27 May 2022 Morning Session Analysis

Downbeat economic data unleashed, US Dollar slumped.

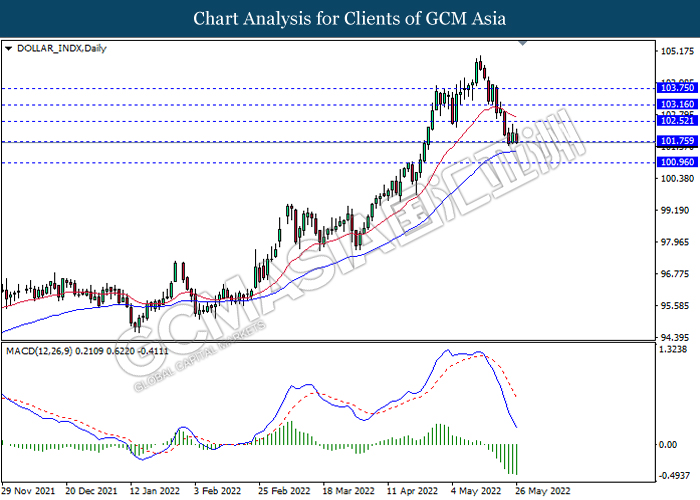

The Dollar Index which traded against a basket of six major currencies eased on Thursday after the downbeat economic data was unleashed. According to Bureau of Economic Analysis, the US Gross Domestic Product (GDP) QoQ notched down from the previous reading of -1.4% to -1.5%, which lower than the market forecast of -1.3%. Besides, the US Pending Home Sales MoM came in at the reading of -3.9%, missing the market forecast of -2.0%, according to National Association of Realtors. Both data which lower than expected reading indicated that the economy recession in the US region, which dialed down the market optimism toward the economic progression in the US. Furthermore, the Dollar Index extended its losses over the slowing rate hike consideration from Federal Reserve. According to Reuters, markets are expecting whether the Federal Reserve might slow or even pause its tightening cycle in the second half of the year, which would weaken the allure of the safe-haven Dollar. As of writing, the Dollar Index depreciated by 0.30% to 101.77.

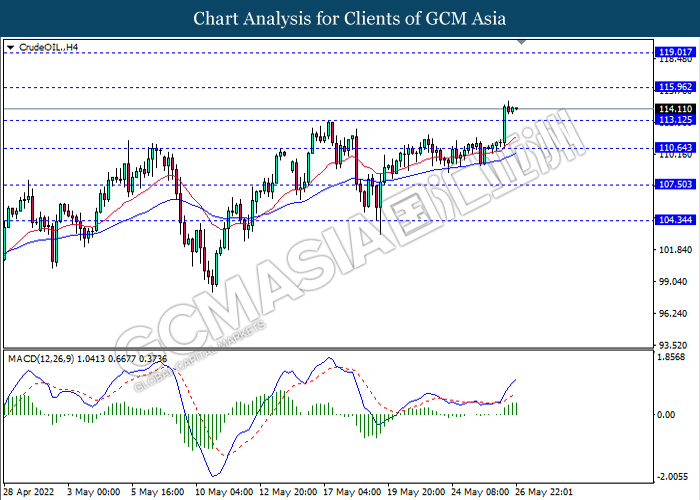

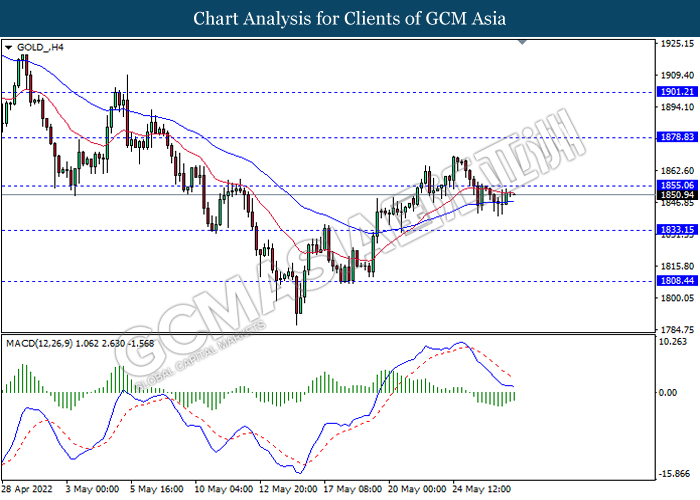

In the commodities market, crude oil price surged by 0.18% to $114.30 per barrel as of writing on signs of tight supply ahead of the US summer driving season, as the European Union wrangled with Hungary over plans to ban crude imports from Russia over its invasion of Ukraine. On the other hand, gold price appreciated by 0.20% to $1851.21 per troy ounce as of writing following the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core PCE Price Index (MoM) (Apr) | 0.3% | 0.3% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

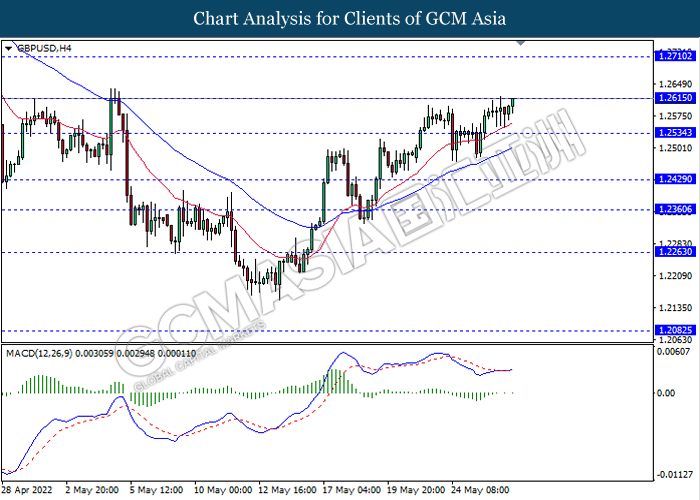

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

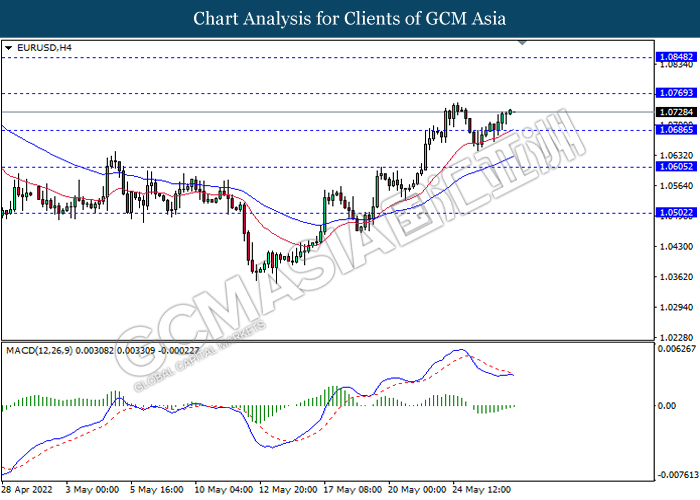

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

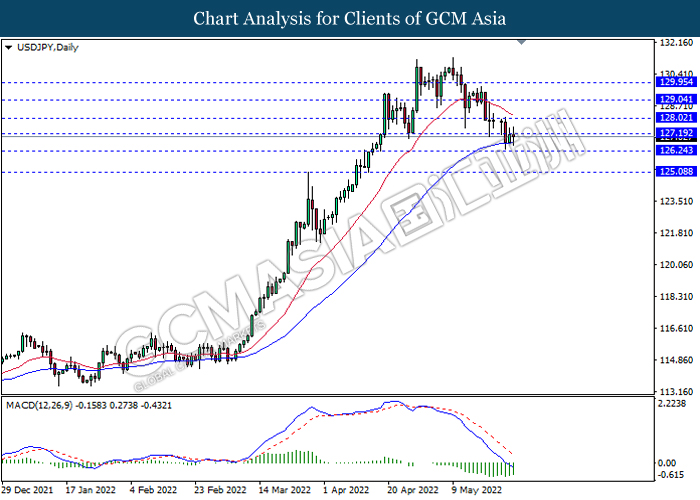

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains id successfully breakout the resistance level.

Resistance level: 127.20, 128.00

Support level: 126.25, 125.10

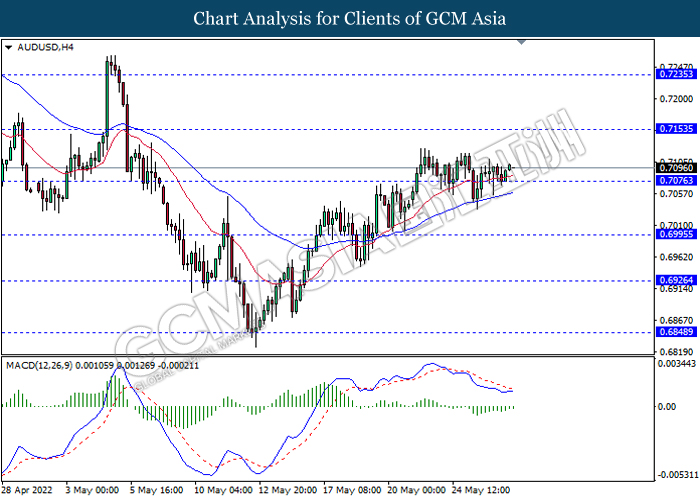

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7155, 0.7235

Support level: 0.7075, 0.6995

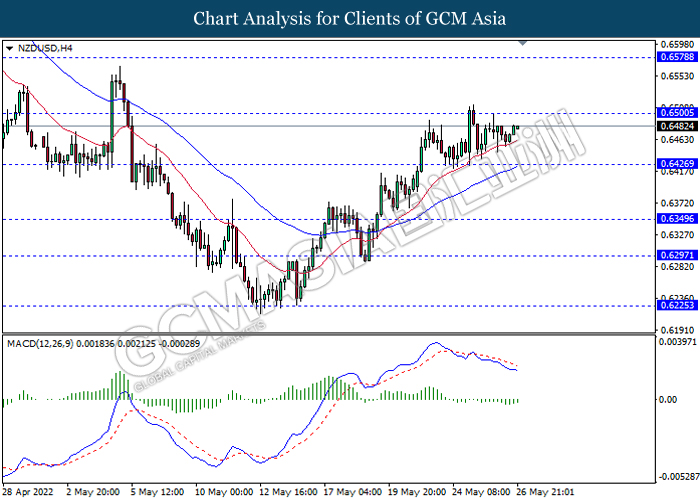

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6500, 0.6580

Support level: 0.6425, 0.6350

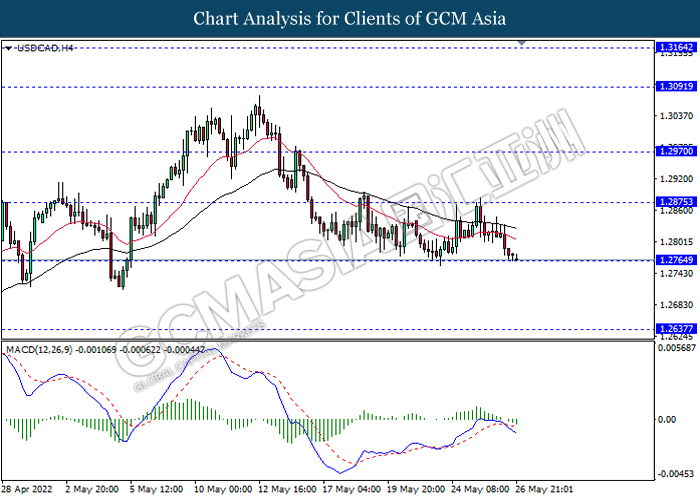

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

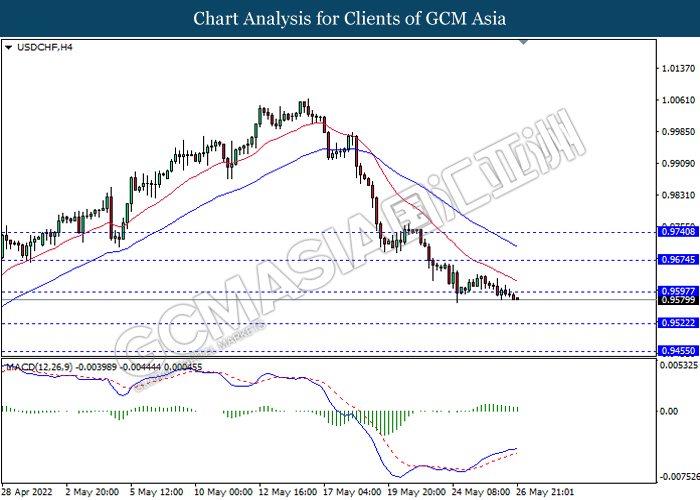

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 115.95, 119.00

Support level: 113.10, 110.65

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45