27 June 2023 Afternoon Session Analysis

Euro rises despite cloudy outlook over the German economy.

The EUR which traded against the dollar index rise despite the cloudy outlook over the German economy. German business continues to worsen for the second consecutive month as the Business Climate index fall from 91.5 in May to 88.5 in June, while the analysts polled by Reuters estimated a drop to 90.7. Economists were less optimistic about the eurozone as a decline in German Ifo together with the drop in the PMI. The reading suggests that the German economy higher probability of a longer recession. The weaker-than-hoped-for China reopening and ongoing monetary policy tightening seem to be weighing on German business activity, the head of IFO surveys told Reuters in an interview on Monday. The Bundesbank, however, remains optimistic about the German economy’s outlook as private consumption should bottom out due to strong wages rising in the real disposable incomes of private households. The German central bank added that German, the euro zone’s biggest economy ability to cope with continued decline in demand due to lower energy prices, easing supply bottlenecks and full order books would underpin growth in the second quarter GDP. As of writing, the EUR/USD lifted by 0.20% to 1.0926.

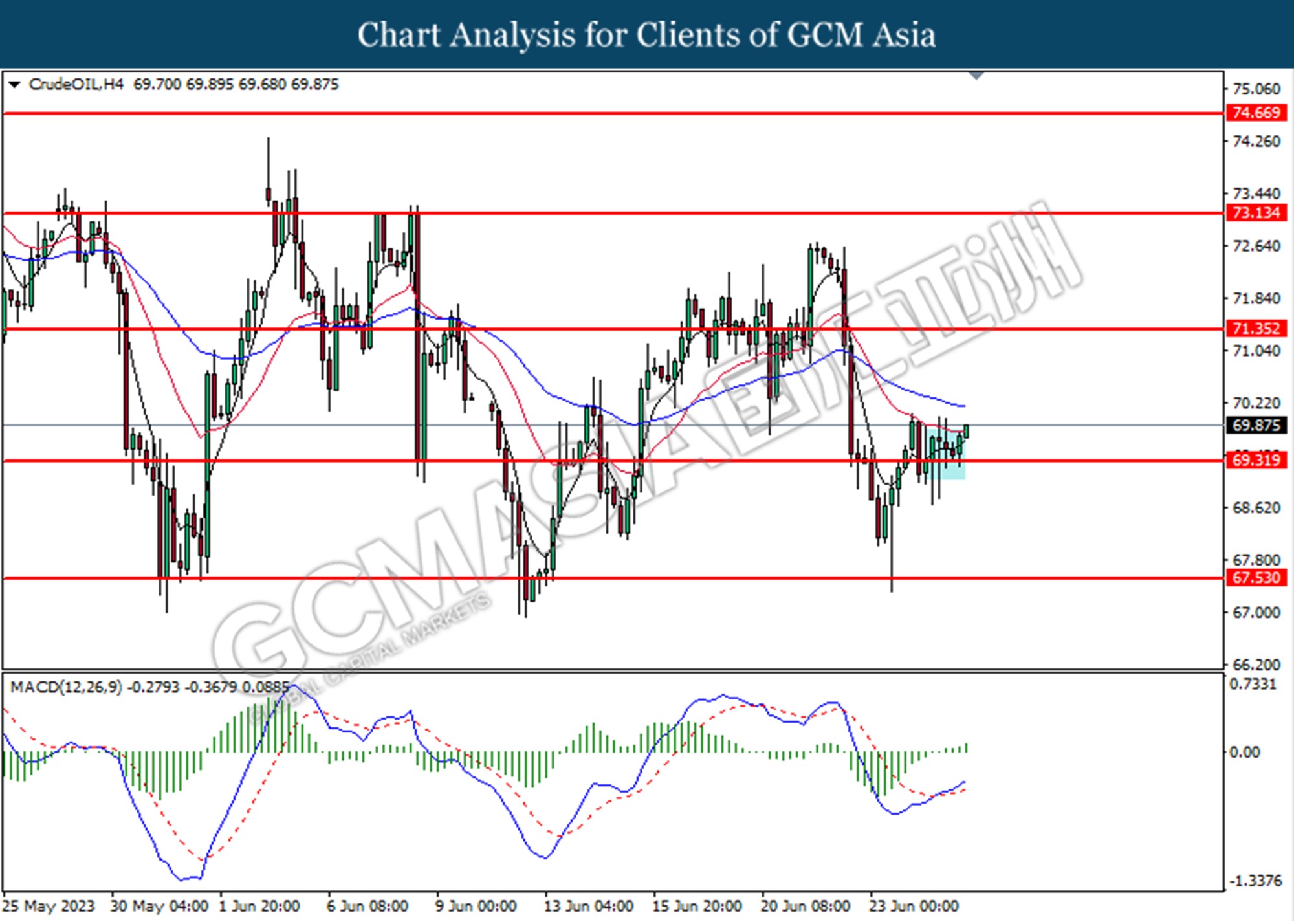

In the commodities market, crude oil prices traded up by 0.58% to $69.77 per barrel as Saudi Aramco commented on a good second-half oil outlook on demand from China, and India. Besides, the gold prices rebounded by 0.32% to $1929.38 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | USD – Building Permits | 1.417M | 1.491M | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (May) | -0.2% | -0.2% | – |

| 22:00 | USD – CB Consumer Confidence (Jun) | 102.3 | 103.7 | – |

| 22:00 | USD – New Home Sales (May) | 683K | 670K | – |

Technical Analysis

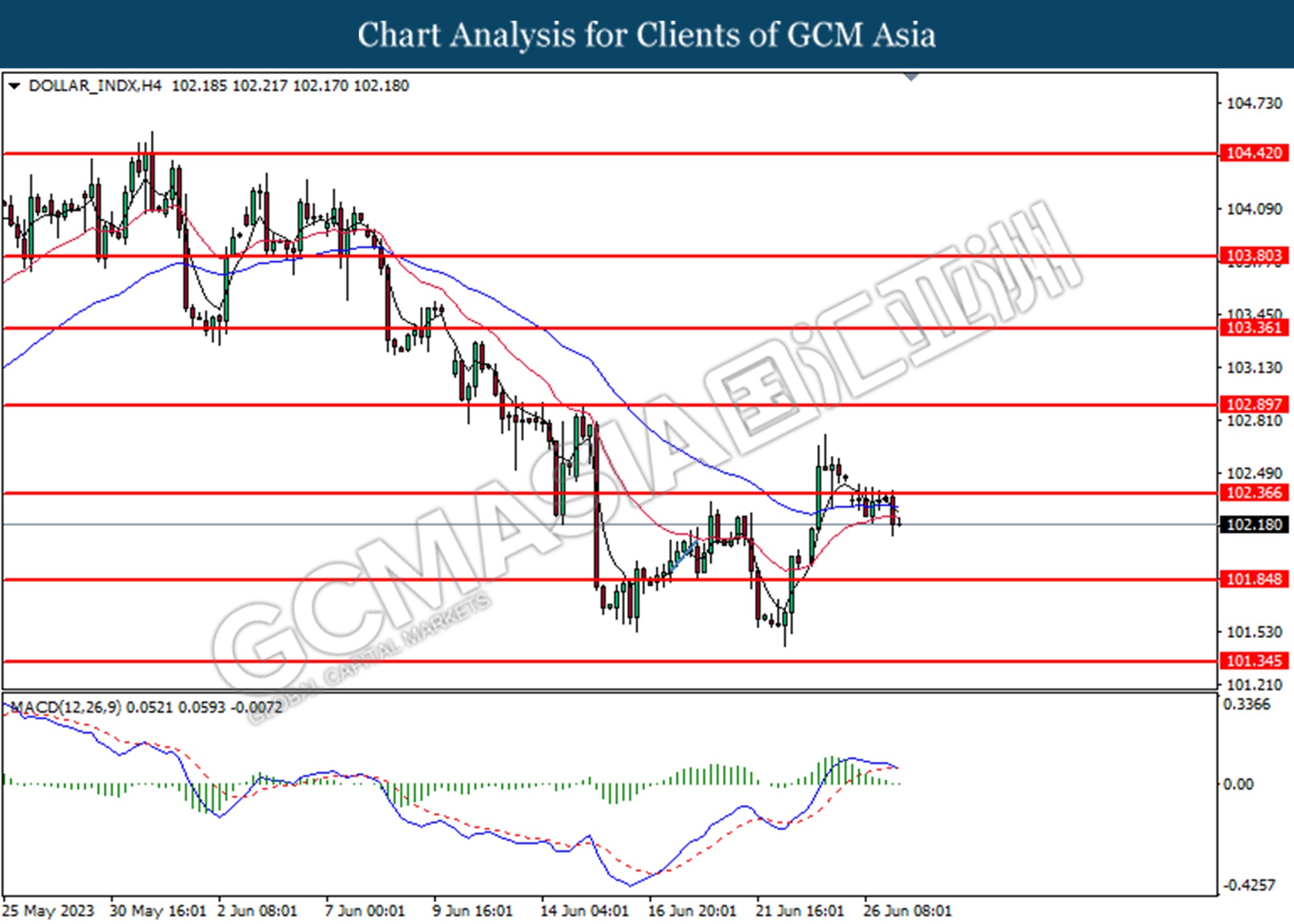

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement below from the prior support level at 102.35. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level.

Resistance level: 102.35,102.90

Support level: 101.85, 101.35

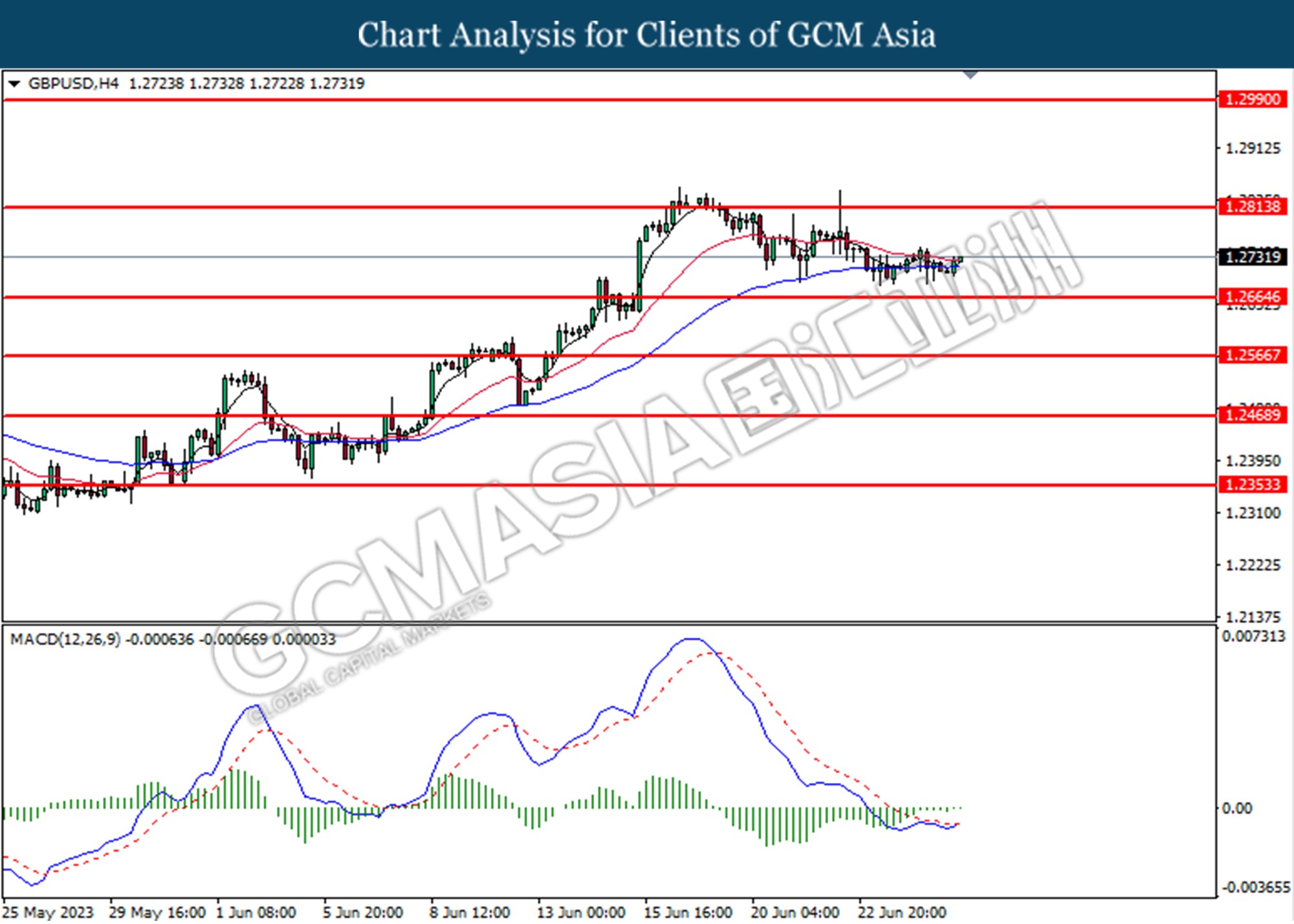

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.2815.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

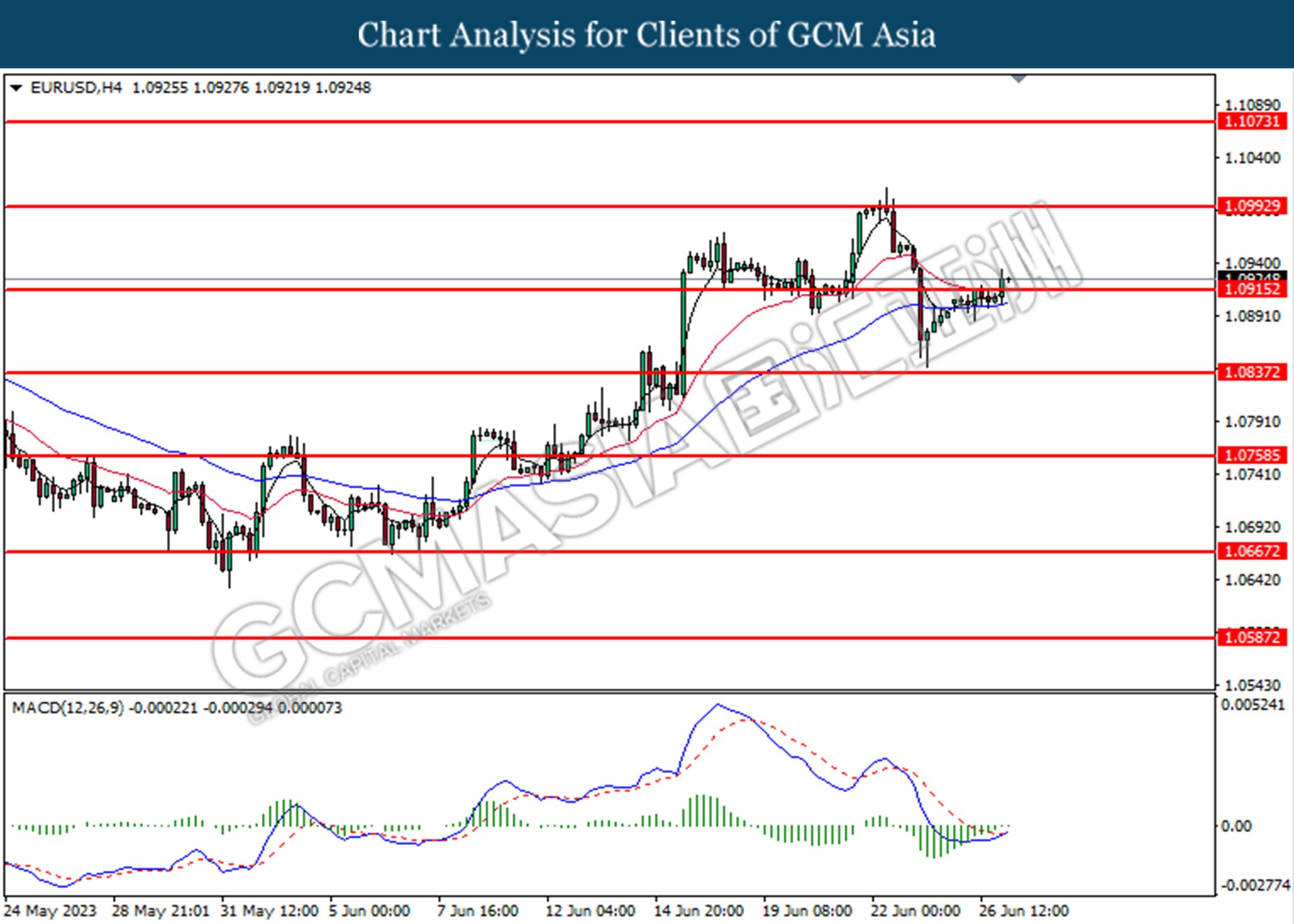

EURUSD, H4: EURUSD was traded higher following the prior breaks above the previous resistance level at 1.0915. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.0990.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

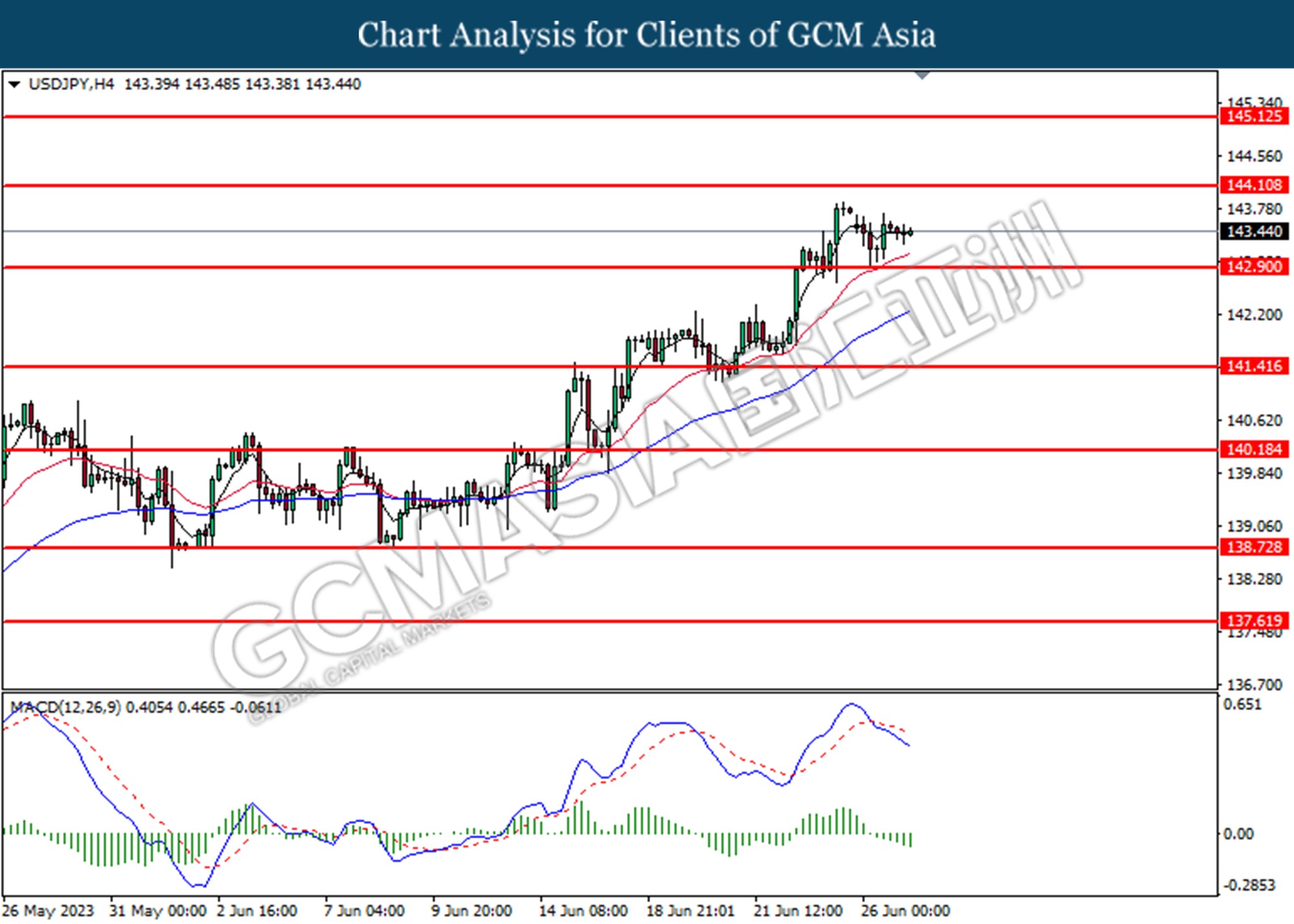

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 142.90.

Resistance level: 144.10, 145.10

Support level: 142.90, 141.40

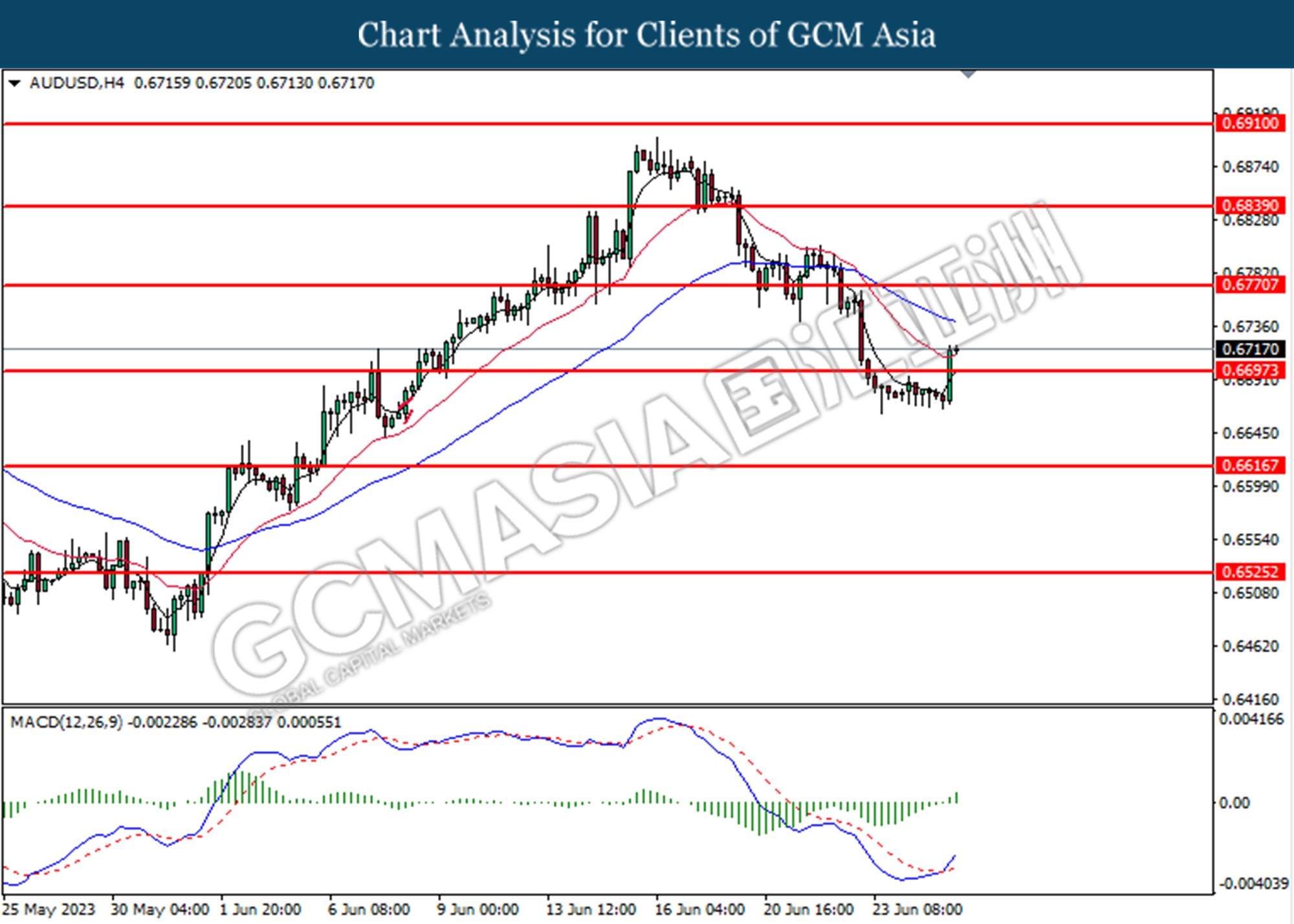

AUDUSD, H4: AUDUSD was traded higher following the prior breaks above from the previous resistance level at 0.6700. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the next resistance level at 0.6770.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

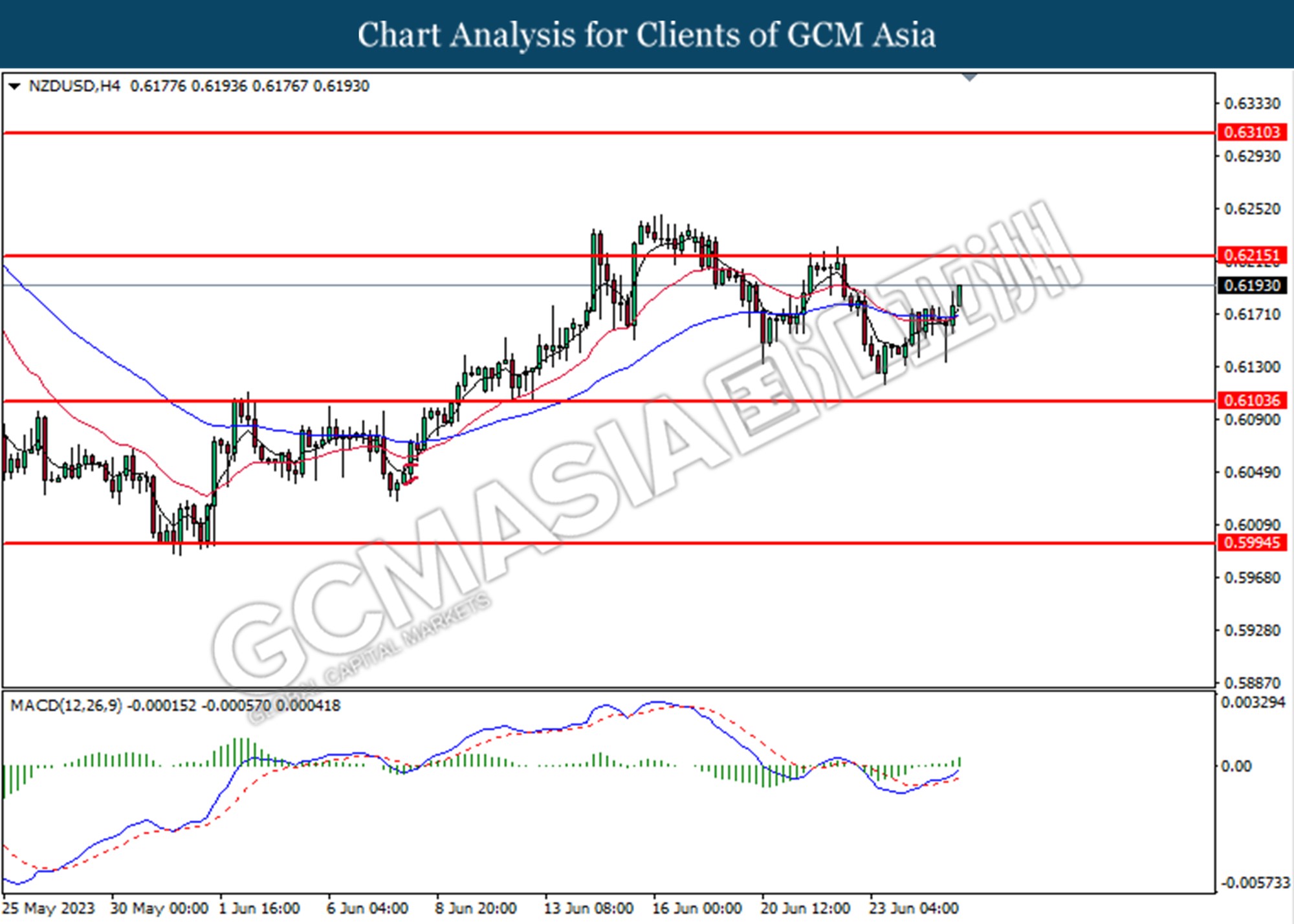

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6215.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

USDCAD, H4: USDCAD was traded lower following the prior breaks below the previous support level at 1.3140. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.3140, 1.3240

Support level: 1.3040, 1.2940

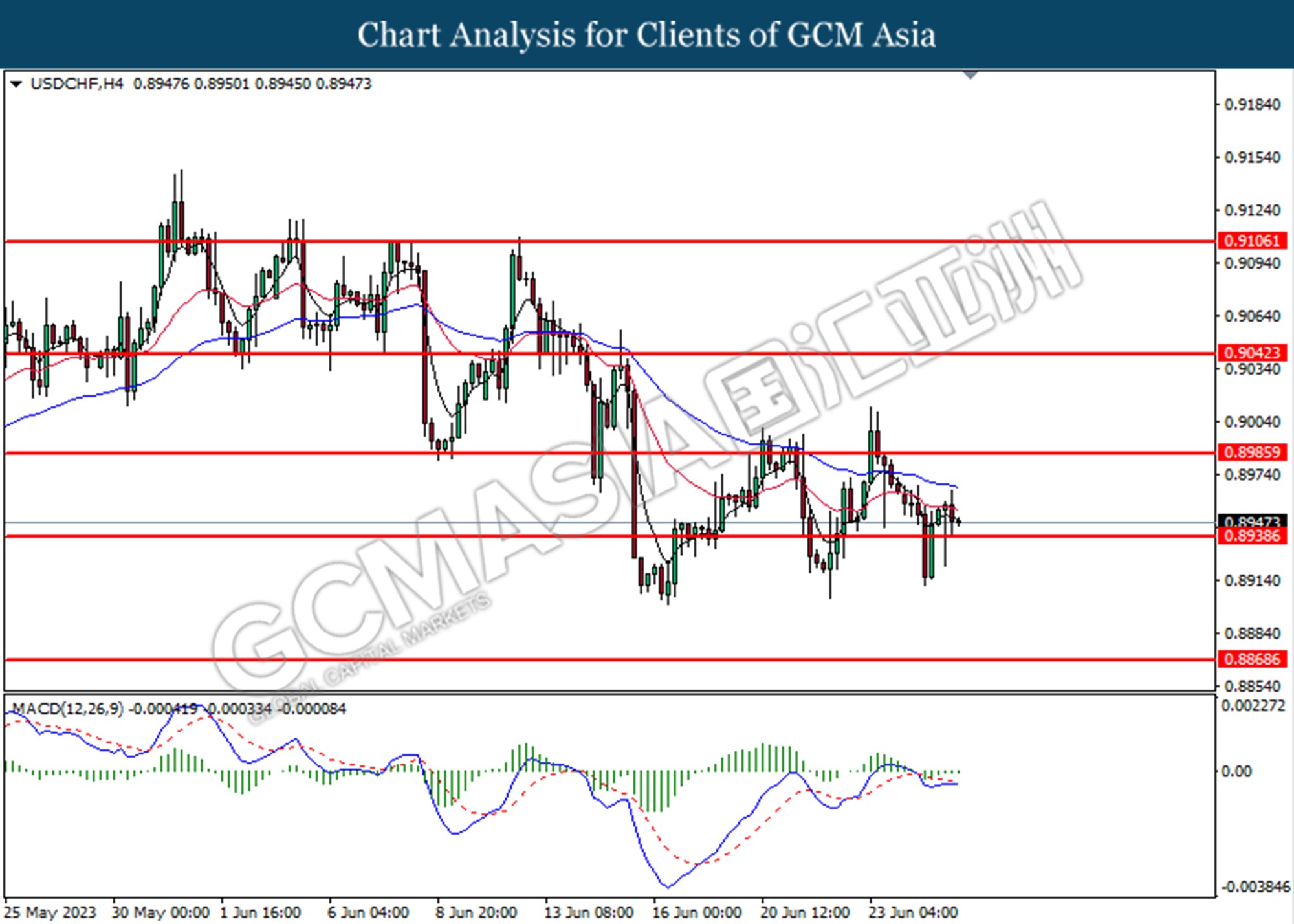

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 69.30. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the next resistance level.

Resistance level: 71.35, 73.15

Support level: 69.30, 67.55

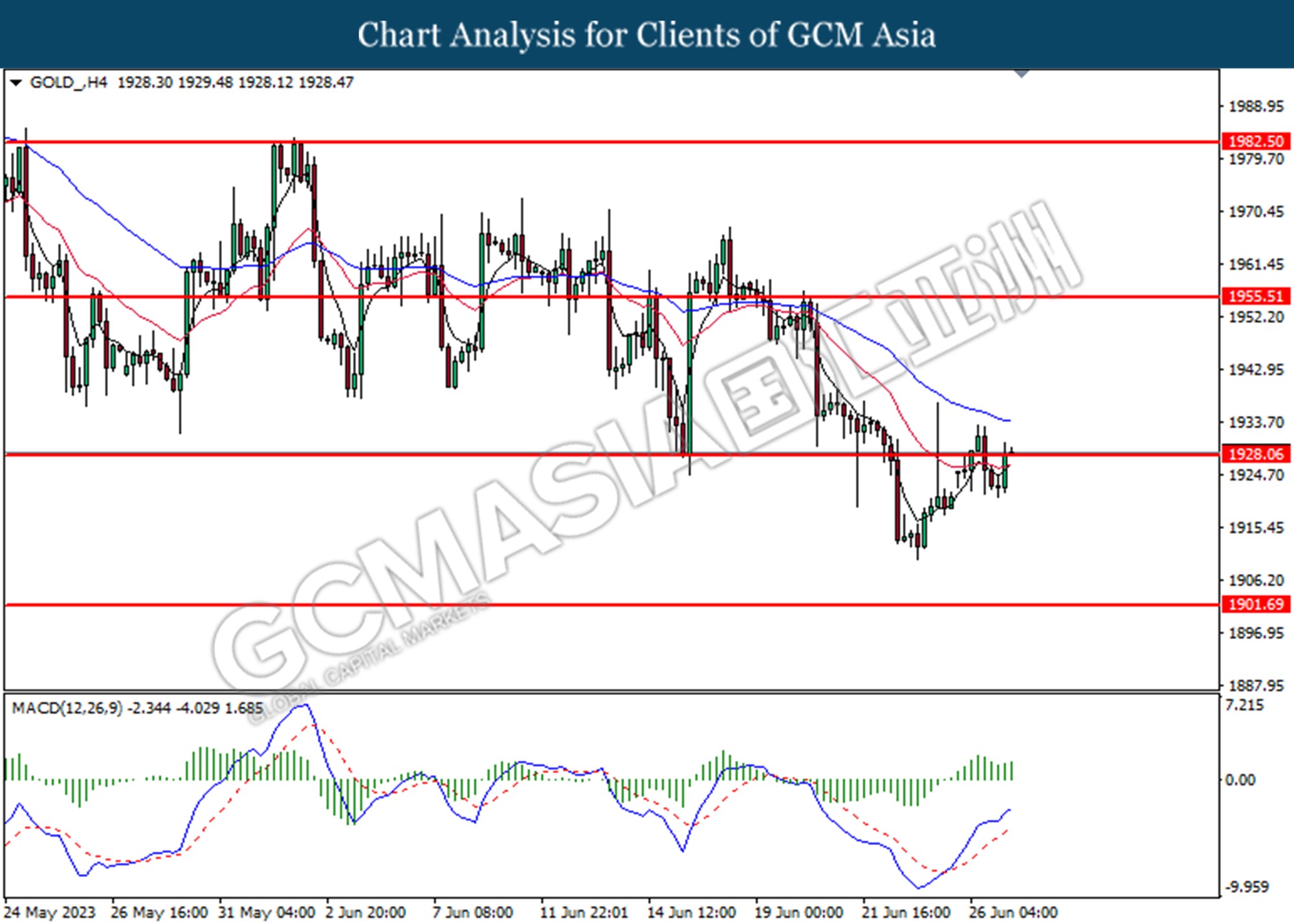

GOLD_, H4: Gold price was traded lower while currently testing for the support level at 1928.05. However, MACD which illustrated increasing bullish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 1955.50, 1982.50

Support level: 1931.45, 1901.70