27 June 2023 Morning Session Analysis

US dollar flat ahead of a slew of economic data.

The dollar index, which was traded against a basket of six major currencies, lingered near the similar level throughout the previous trading session amid quiet trading ahead of a series of crucial economic data later today. Yesterday, a comment from the Japan’s top currency diplomat has spurred a relatively large movement in the Japanese Yen market. According to the Japan’s Top FX Diplomat Kanda statement, he mentioned that the Japan government will respond to foreign exchange moves if moves become excessive, while emphasized that the currency should fluctuate steadily based on their fundamentals. With that, it hyped the market expectation that the Japanese government would likely interrupt the exchange rate if the currency value continues to depreciate further. However, it did not resulted any significant movement in the dollar market. At this point in time, the investors are not only eyeing on the economic data later today, also they are focusing on the updates over the weekend munity that appeared to pose a major threat to Russia President Putin. Although the mutiny is over, it derived the stress on Putin’s system of rule and questions swirled about his grip on power. As of writing, the dollar index dropped -0.14% to 102.75.

In the commodities market, crude oil prices were down by -0.12% to $69.30 per barrel after Russian munity was aborted. Besides, the gold prices edged up by 0.02% to $1923.40 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | USD – Building Permits | 1.417M | 1.491M | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (May) | -0.2% | -0.2% | – |

| 22:00 | USD – CB Consumer Confidence (Jun) | 102.3 | 103.7 | – |

| 22:00 | USD – New Home Sales (May) | 683K | 670K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 103.00.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

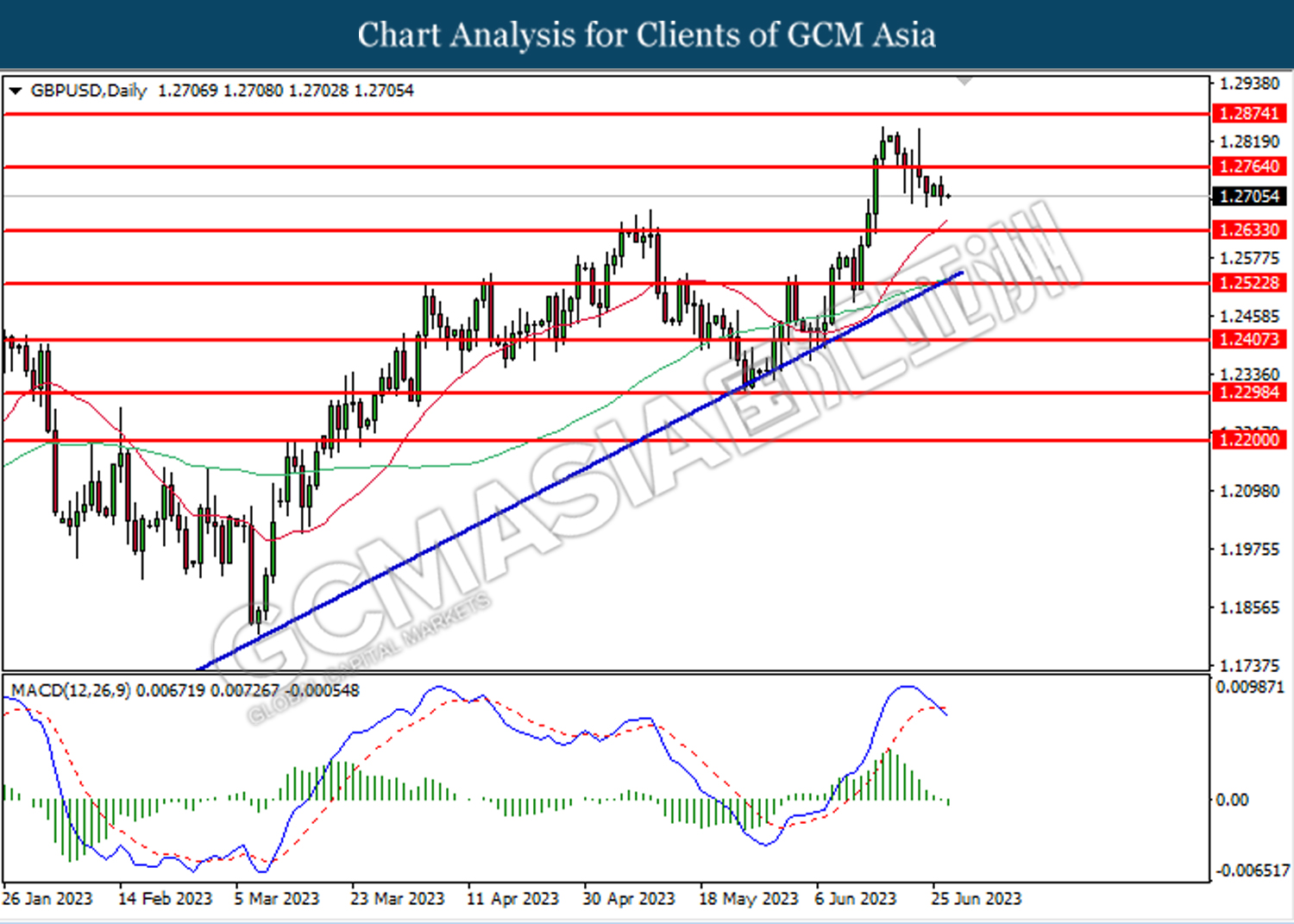

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2765. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

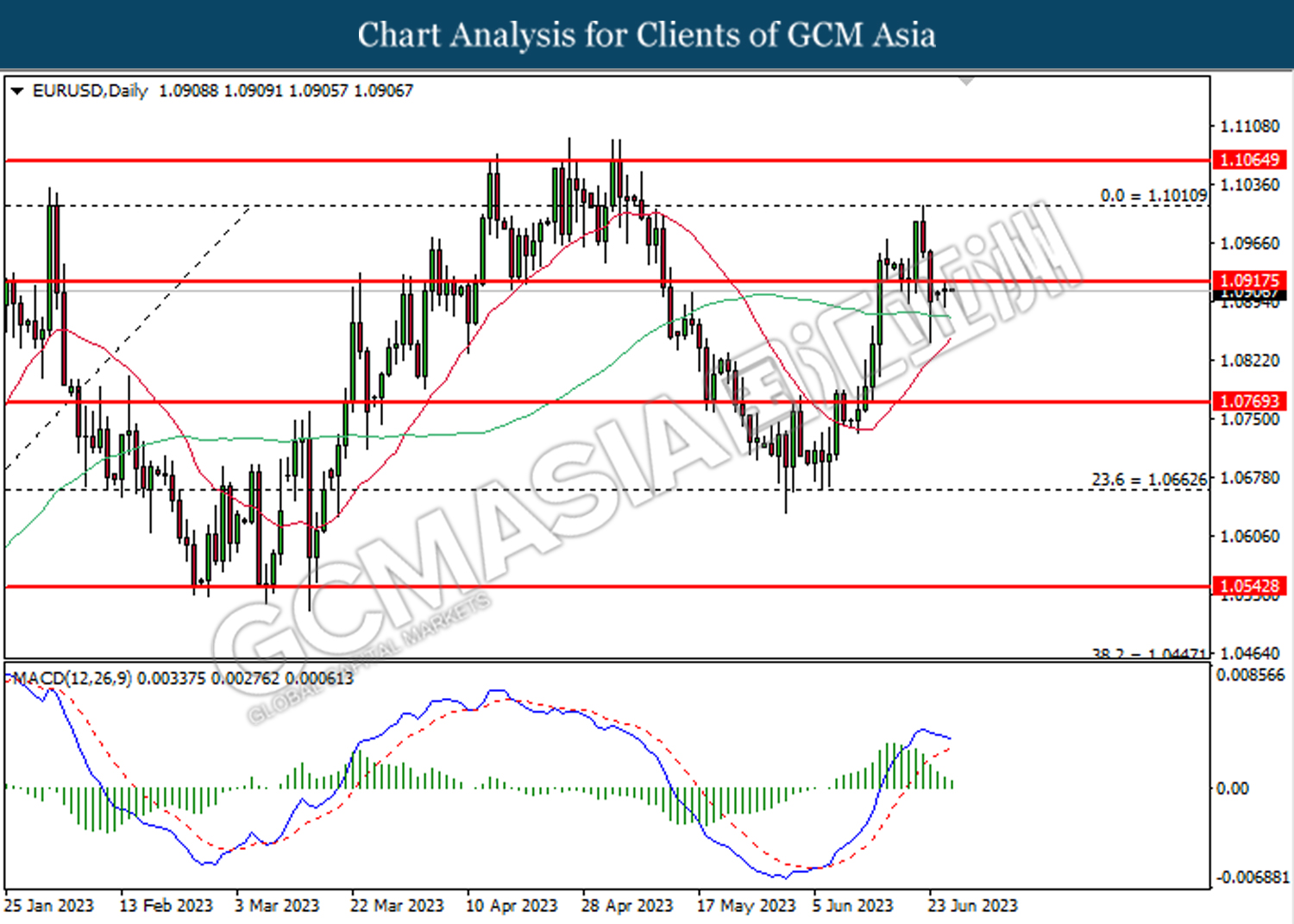

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0835.

Resistance level: 1.0915, 1.0995

Support level: 1.0770, 1.0665

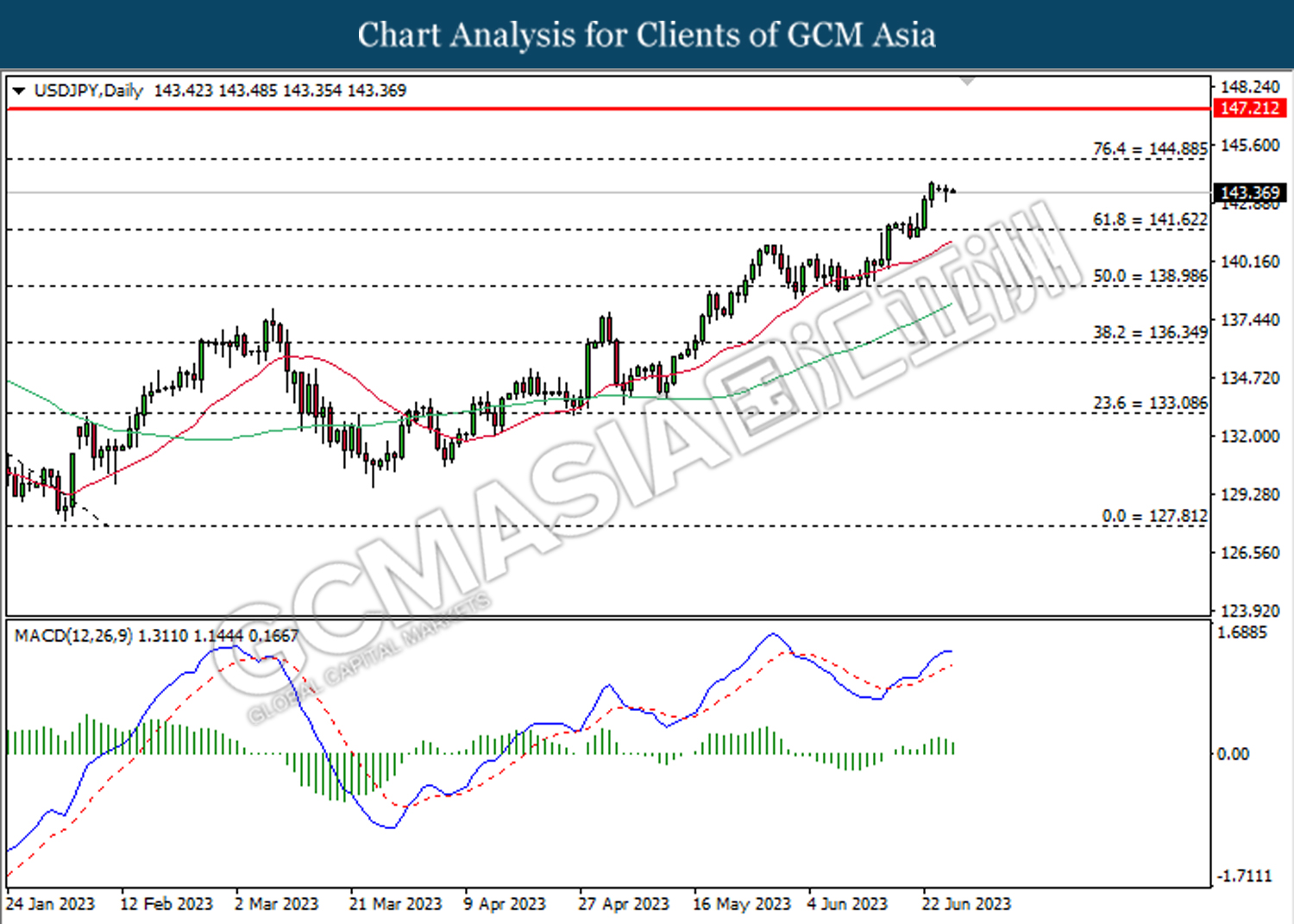

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 141.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

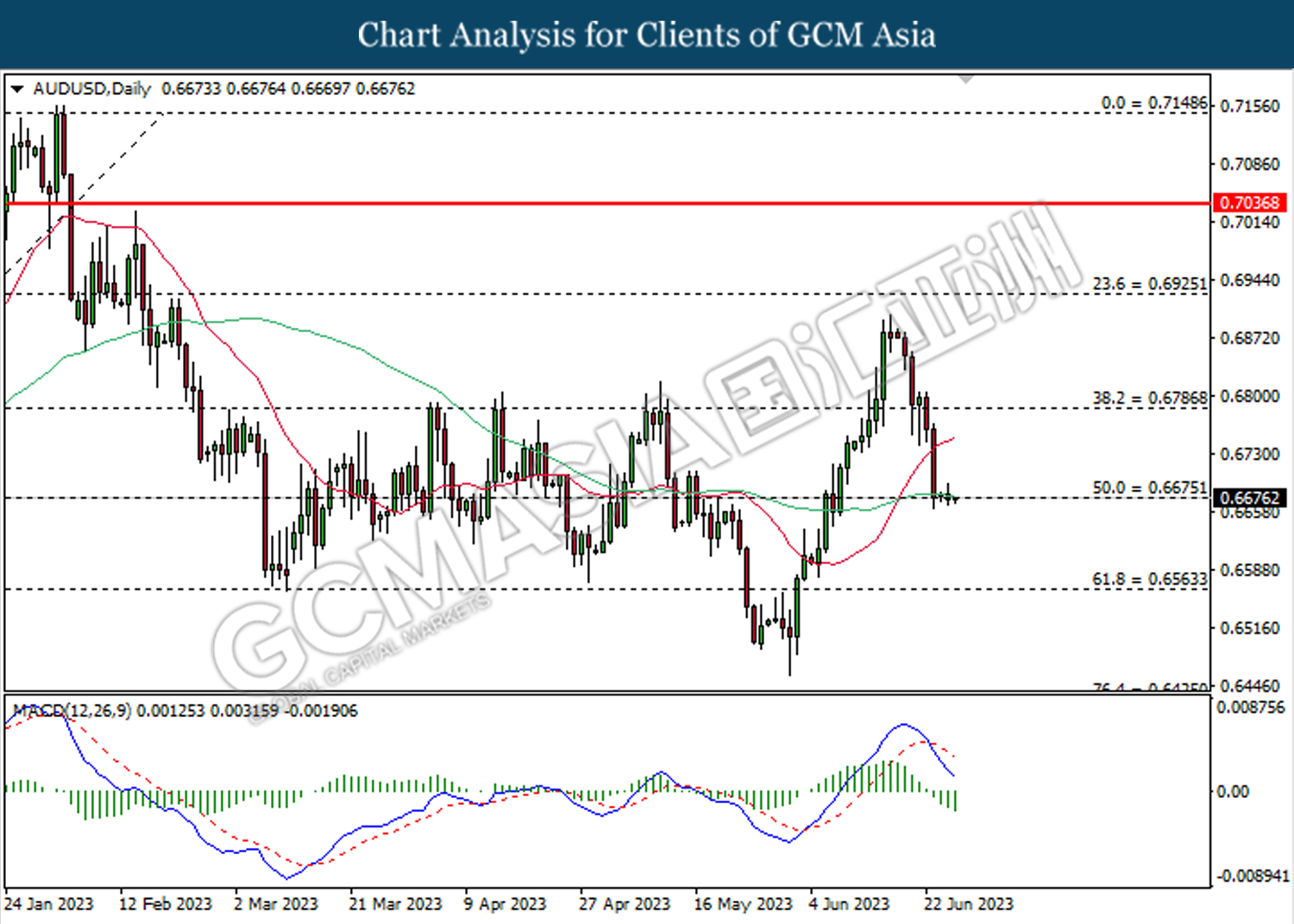

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

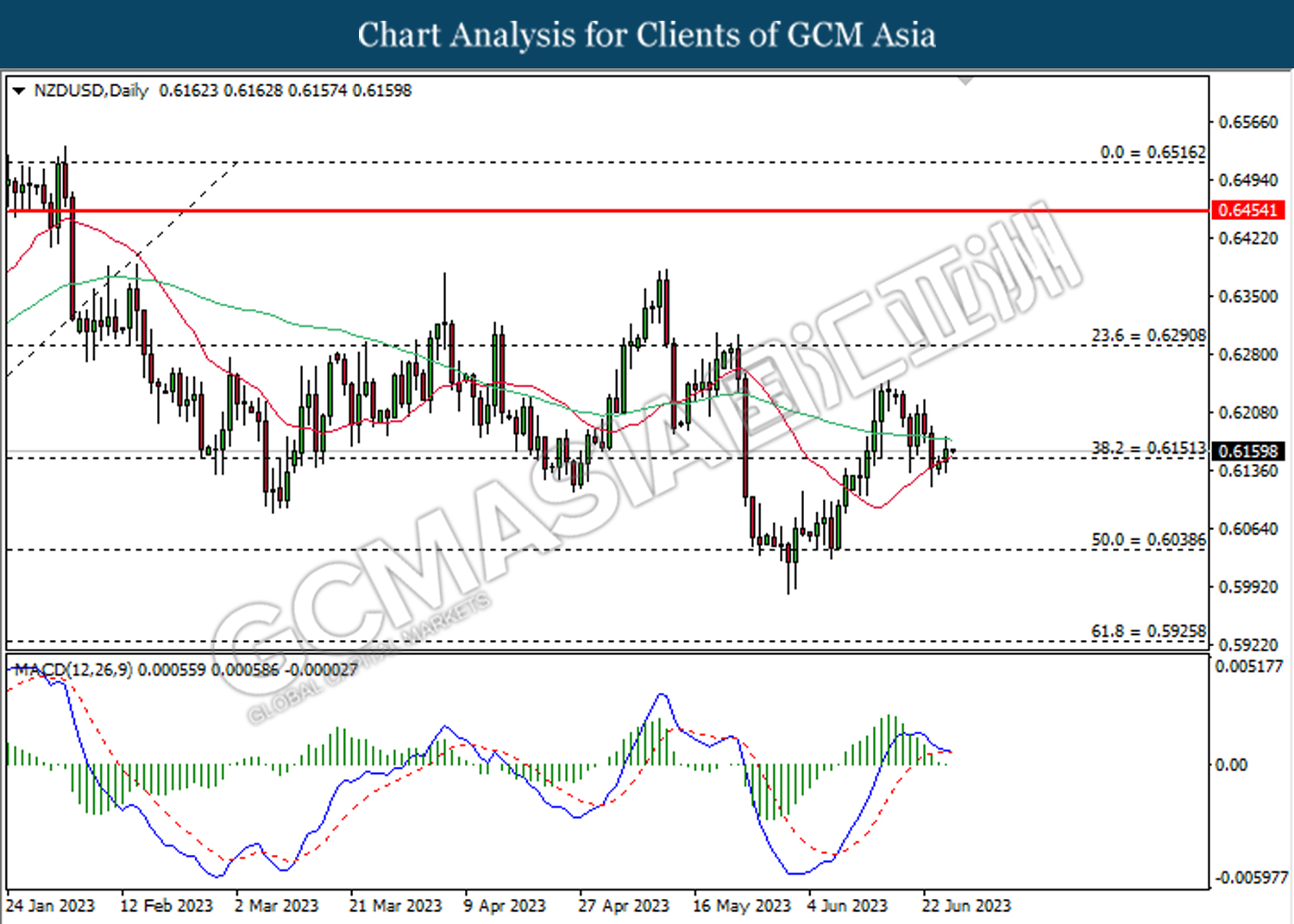

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

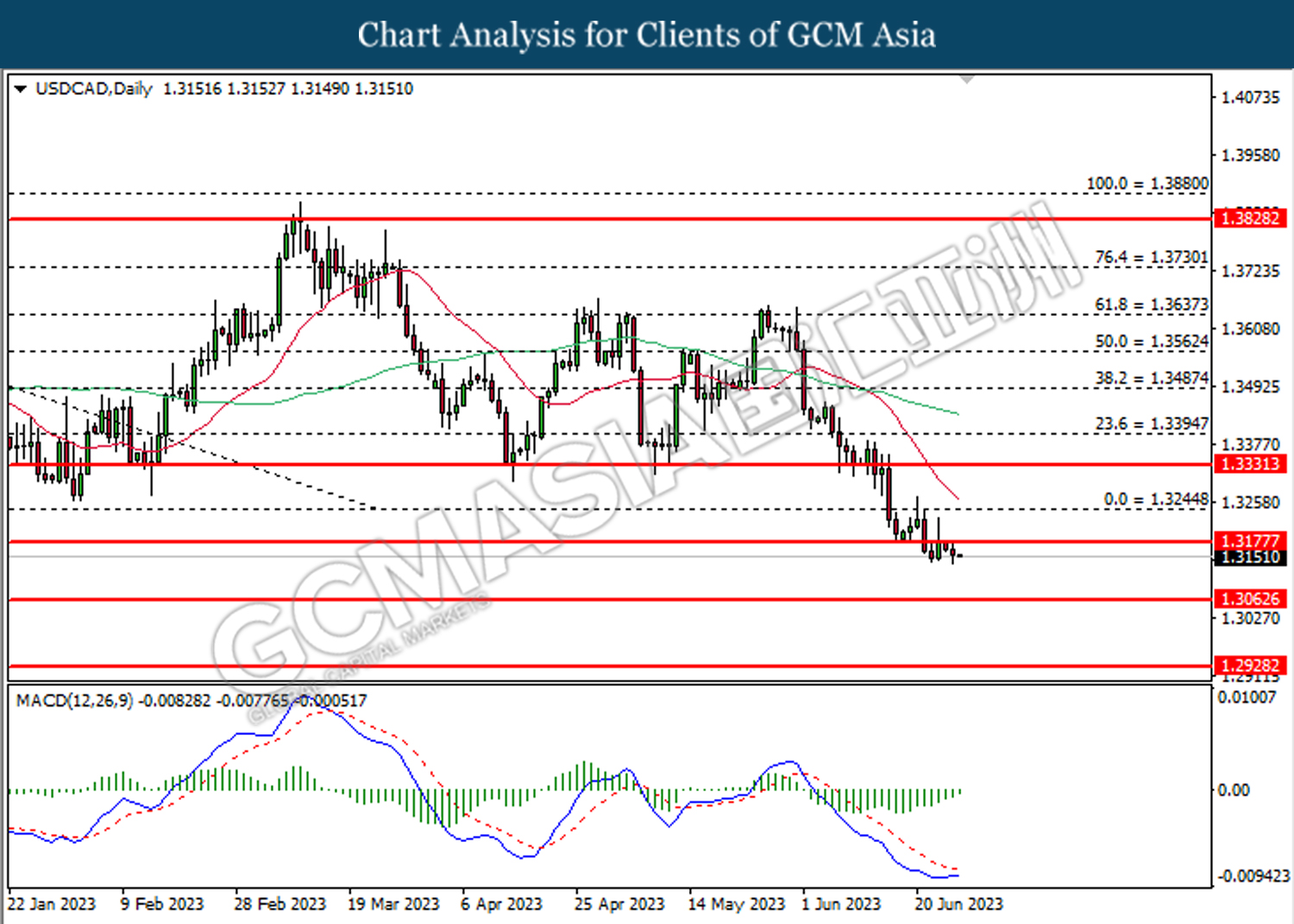

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3175. However, MACD which illustrated diminishing bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3175, 1.3245

Support level: 1.3065, 1.2930

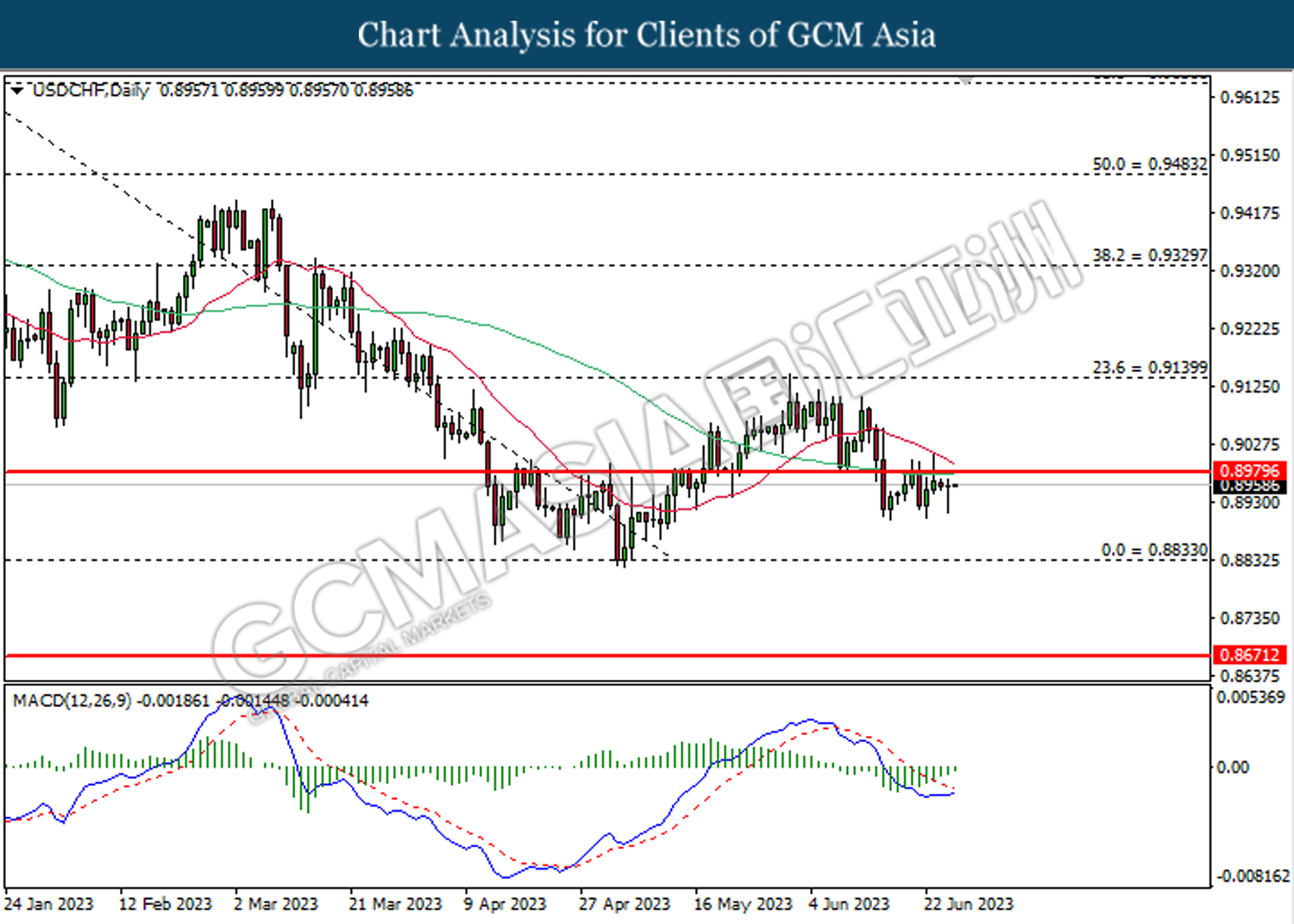

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

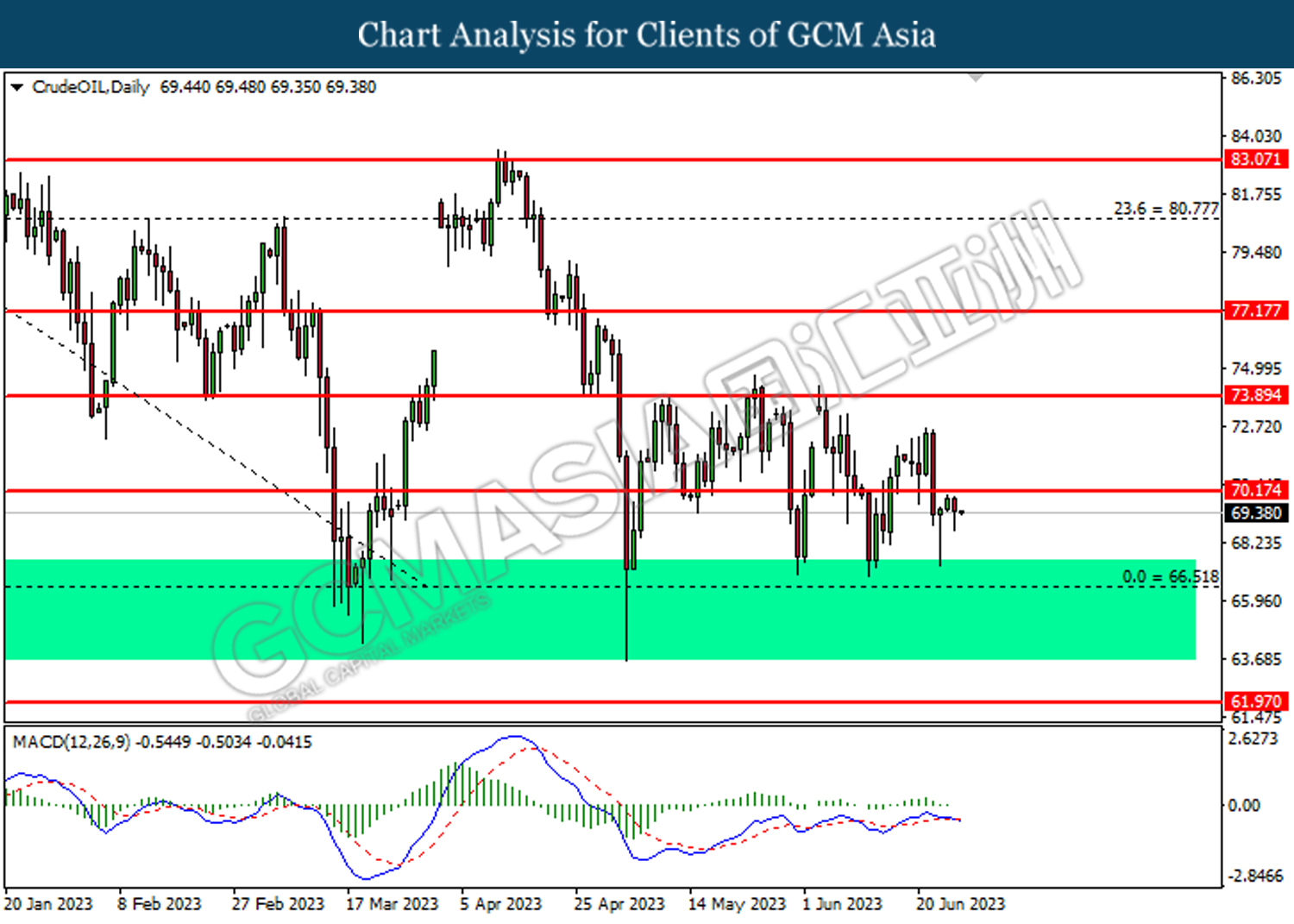

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 70.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

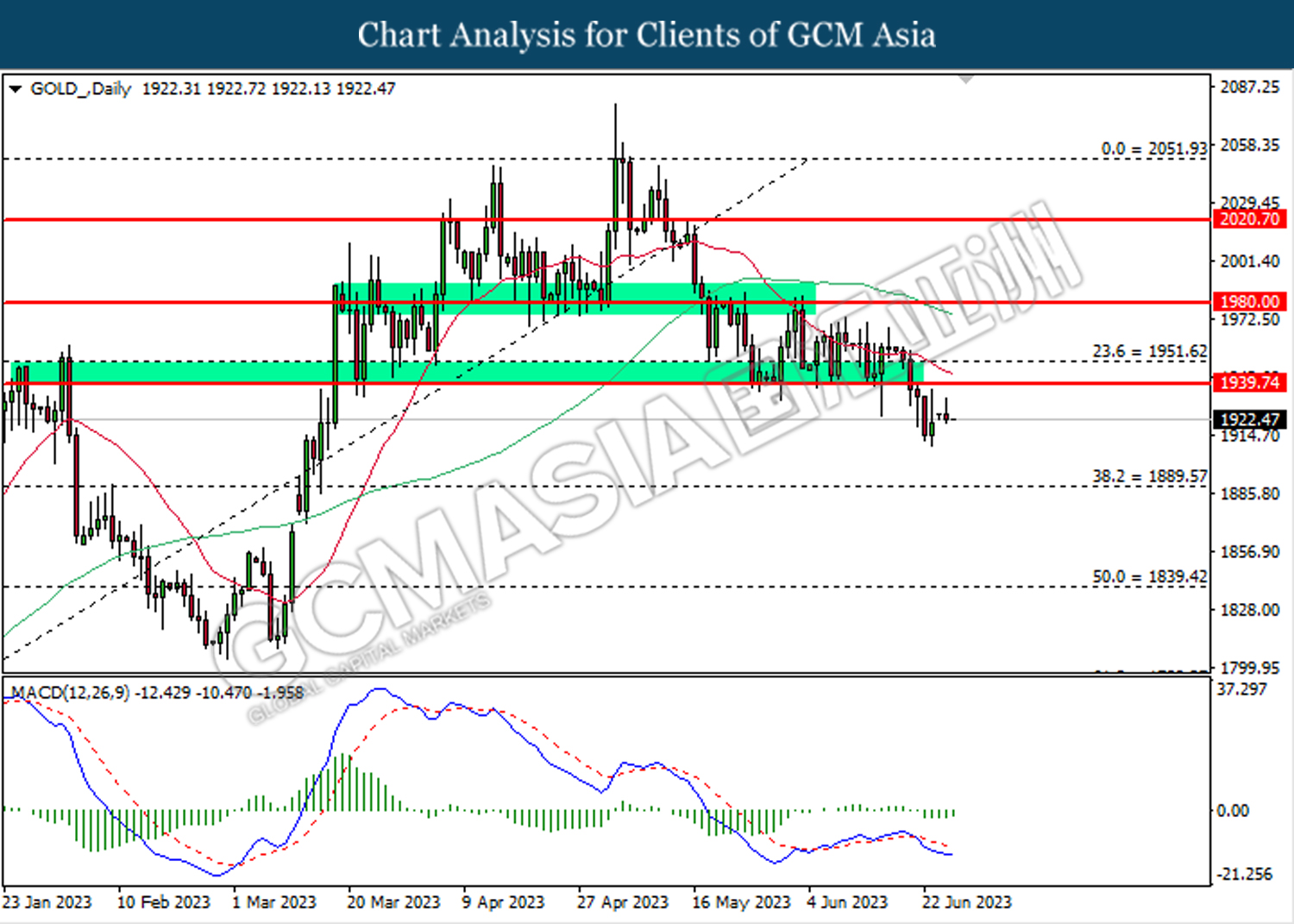

GOLD_, Daily: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40