27 August 2018 Weekly Analysis

GCMAsia Weekly Report: August 27 – 31

Market Review (Forex): August 20 – August 24

US Dollar

The US Dollar remained pressured by the bears after a dovish note on Fed Chairman in his speech last Friday. The dollar index has slipped 0.52% while closing the price at 95.04 last Friday.

During the central bank’s annual gathering Jackson Hole Economic Symposium at the Jackson Hole last Friday, Federal Reserve Chairman Jerome Powell has emphasized in his speech that gradual interest rate hikes would be conditioned on the continued strength of the U.S. economy and labor market. With his speech, he has identified two risk which is “moving too fast and needlessly shortening the expansion, versus moving too slowly and risking a destabilizing overheating”. Investors took Powell’s speech as a more dovish stance, which it seemed to rule out the need for a more aggressive tightening as he suggested a lack of inflationary pressure and put the caveat for further gradual increases in interest rates on a continuation of current economic strength and a strong labor market. Thus, boosting further selling pressure and extending its losses.

Overall, the dollar strength remains weak against it basket of six major rivals as the attractiveness for the dollar has been weaken with the ongoing intensified trade war between US and China and the recent dovish stance from Federal Reserve Chairman Jerome Powell in rate hike which already proved successful to soften investors’ confidence.

USD/JPY

USDJPY pair slipped 0.03% to 111.22 during late Friday trading session.

EUR/USD

EURUSD has rose 0.72% to 1.1622 during last week Friday session.

GBP/USD

GBPUSD has gained 0.27% to 1.2844 during late Friday New York session. Despite with the ongoing uncertainty in Brexit, pound sterling has obtained some relief after the dollar weakness after Powell’s speech last Friday. However, investors remain focused as fears of no deal Brexit continues to weigh in.

Market Review (Commodities): August 20 – August 24

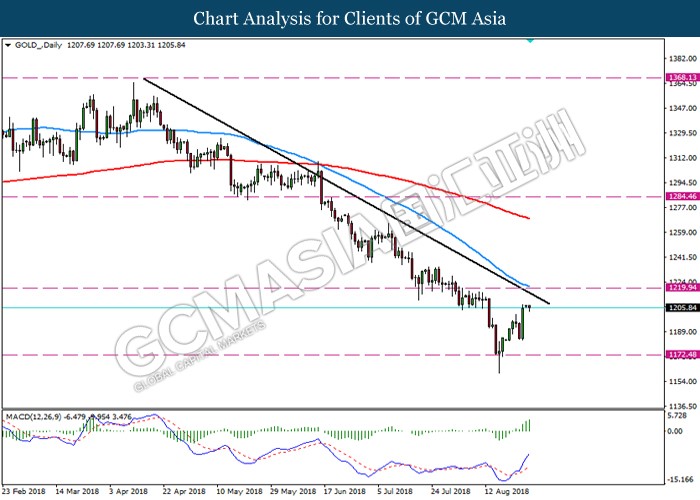

GOLD

Gold price surge amid dollar has extended its losses amid Fed Chairman Jerome Powell’s dovish note from his speech in the annual Economic Symposium last Friday. The yellow metal has closed the market last week by gaining 1.75% to 1205.80 a troy ounce.

The gold price has surged amid dollar strength last week which recently weaken significantly by Powell’s speech which is more towards dovish stance. With Powell highlighting the risk and condition for rate hike, the stance has prompted some aggressive USD selling in the past hour or so after the speech.

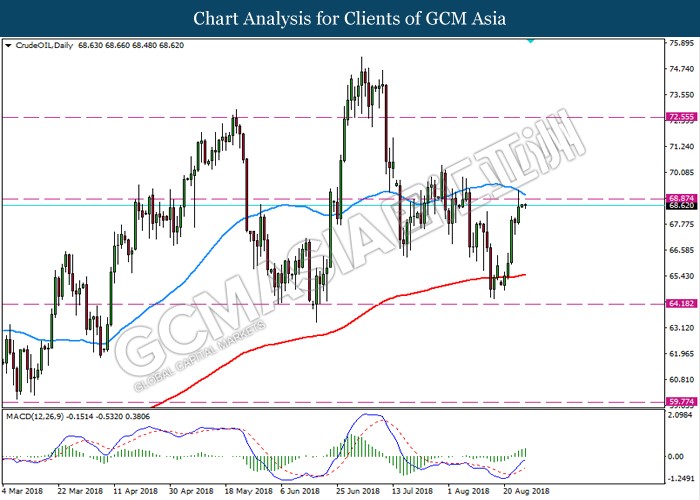

Crude Oil

The price of crude oil continues to rise on Friday despite the weaker release of Baker Hughes Oil Rig report release last week. The commodity price has surged 0.95% to $ 68.36 a barrel during last Friday’s session.

According to the data released by Bakers Hughes which measure the drilling activity in the US, the number of oil rigs are has decreased from previous data with the reading of 860 against previous reading 869. However, the price of the commodity remains driven higher as overall sentiment still subjected toward demand for oil outstrips supply and upcoming U.S. sanctions against Iran have also continue supported the price.

Overall, crude oil risk sentiment remains solid as overall risk appetite for the commodity continue towards the possibility of demand which could exceed supply following the recent fundamentals in crude oil.

Weekly Outlook: August 27 – 31

For the week ahead, investors will remain focus on the release of various economics data especially US GDP which is scheduled on this week. The data which is an indicator of inflationary pressure that may anticipate interest rates to rise. Thus, investor will keep an eye for the release to attain further signals regards of the dollar momentum.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: August 27 – 31

| Monday, August 27 |

Data EUR – German Ifo Business Climate Index

Events N/A

|

| Tuesday, August 28 |

Data USD – CB Consumers Confidence (Aug) CrudeOIL – API Weekly Crude Oil Stock

Events GBP – Inflation Report Hearings

|

| Wednesday, August 29 |

Data USD – GDP (QoQ) (Q2) USD – Pending Home Sales (MoM) (Jul) CrudeOIL – Crude Oil Inventories

Events N/A

|

| Thursday, August 30 |

Data EUR – German Unemployment Rate (Aug) EUR – German CPI (MoM) (Aug) USD – Initial Jobless Claims USD – Continuous Jobless Claims CAD – GDP (MoM) (Jun)

Events N/A

|

|

Friday, August 3

|

Data CNY – Manufacturing PMI (Aug) EUR – CPI (YoY) (Aug) USD – Michigan Consumer Sentiment (Aug)

Events N/A

|

Technical Weekly Outlook: August 27 – 31

Dollar Index

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level 95.00. Recent price action and MACD which illustrate bearish signal with death cross formation suggest the pair may extend its losses after it breaks below the support level 95.00.

Resistance level: 96.65, 97.50

Support level: 95.00, 93.40

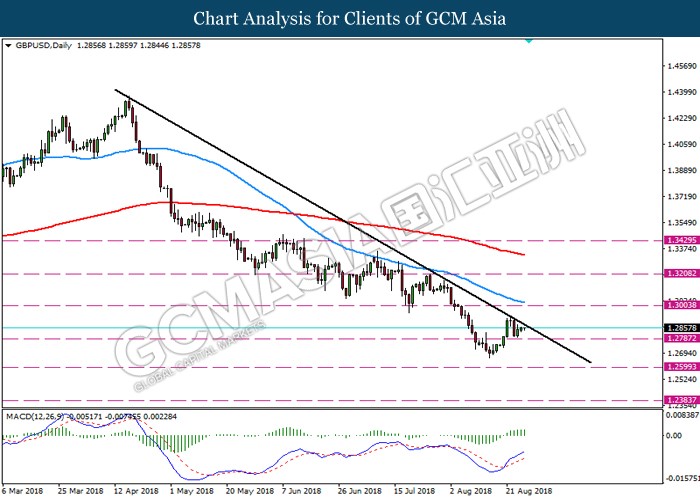

GBPUSD

GBPUSD, Daily: GBPUSD was traded higher while currently testing the descending trend line. Price action and MACD which illustrate bullish momentum with golden cross formation suggest the pair to extend it gains towards the resistance level 1.3005 after it breaks above the trend line.

Resistance level: 1.3005, 1.3210

Support level: 1.2785, 1.2600

USDJPY

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level 110.95. MACD which illustrate bullish signal with golden cross formation suggest the pair may extend its gains towards the resistance level 112.05.

Resistance level: 112.05, 113.05

Support level: 110.95, 109.40

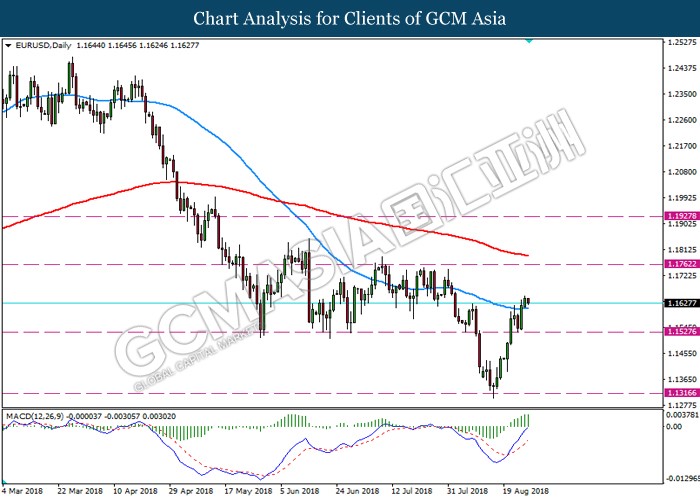

EURUSD

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level 1.1525. Recent price action and MAC which illustrate clear bullish signal with the golden cross formation suggest the pair may extend its gains towards the resistance level 1.1760.

Resistance level: 1.1760, 1.1925

Support level: 1.1525, 1.1315

GOLD

GOLD_, Daily: Gold price was traded higher following recent rebound from the support level 1172.50. Price action and MACD which display bullish bias with the recent formation of golden cross suggest the commodity may extend its gains towards resistance level 1220.00.

Resistance level: 1220.00, 1284.50

Support level: 1172.50, 1123.50

Crude Oil

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level 68.85. Although recent price action and MACD which display bullish momentum with the golden cross formation, a breakout above the resistance level 68.85 is required to attain further confirmation.

Resistance level: 68.85, 72.55

Support level: 64.20, 59.75