27 October 2022 Afternoon Session Analysis

Euro surged upon aggressive rate hike expectations.

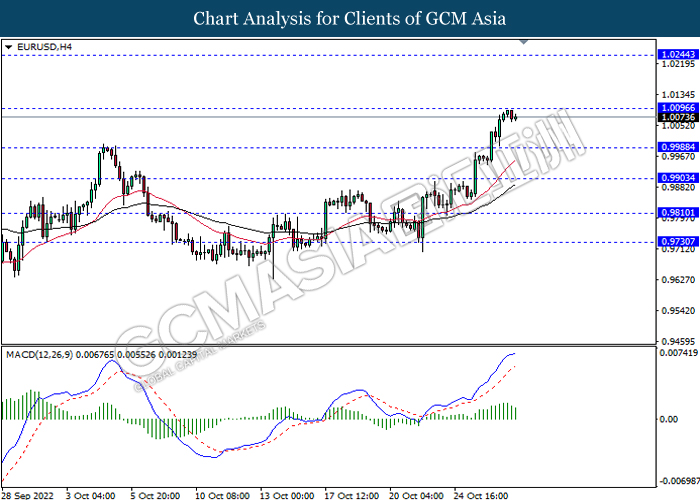

The EUR/USD, which traded by majority of investors rose significantly on yesterday amid the rate hike expectation from European Central Bank (ECB). According to Reuters, the ECB was anticipated to hike its interest rate by today in order to stabilize the sky-high inflationary risk, which 75 basis point rate increase would likely to be implemented in the meeting tonight. Fearing that spiking price is becoming worse, the ECB has raised its rates at the fastest pace on record as well as the rate hike path could take it well into next year or beyond. Besides, ECB also hinted that the process of tightening monetary policy is not yet done, and the size of subsequent moves still on the table. Such hawkish stance had sparked the appeal of Euro. As of now, investors would highly eye on the announcement of ECB interest rate decision to gauge the likelihood movement of Euro. On the other hand, the EUR/USD pairing extended its gains over the depreciation of US Dollar, which led by diminishing expectation of aggressive rate hike from Fed. As of writing, EUR/USD edged down by 0.06% to 1.0071.

In the commodities market, the crude oil price appreciated by 0.27% to $88.17 per barrel as of writing as record-high US crude exports suggested that global oil demand remained robust despite recent economic headwinds. In addition, the gold price eased by 0.01% to $1664.74 per troy ounce as of writing following the value of US Dollar heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Oct) | 0.75% | 1.50% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 1.50% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (Oct) | 1.25% | 2.00% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Sep) | 0.3% | 0.2% | – |

| 20:30 | USD – GDP (QoQ) (Q3) | -0.6% | 2.4% | – |

| 20:30 | USD – Initial Jobless Claims | 214K | 220K | – |

Technical Analysis

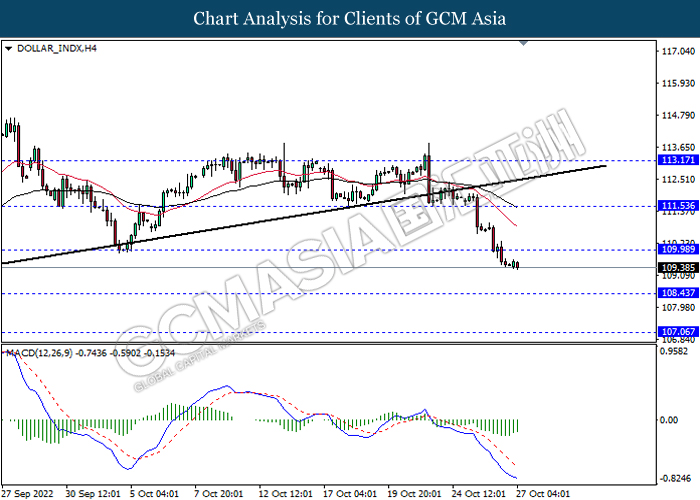

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 109.95, 111.55

Support level: 108.45, 107.05

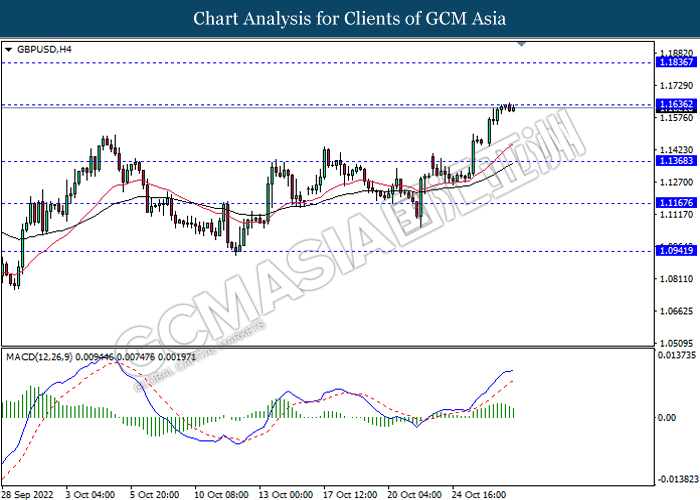

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0095, 1.0245

Support level: 0.9990, 0.9905

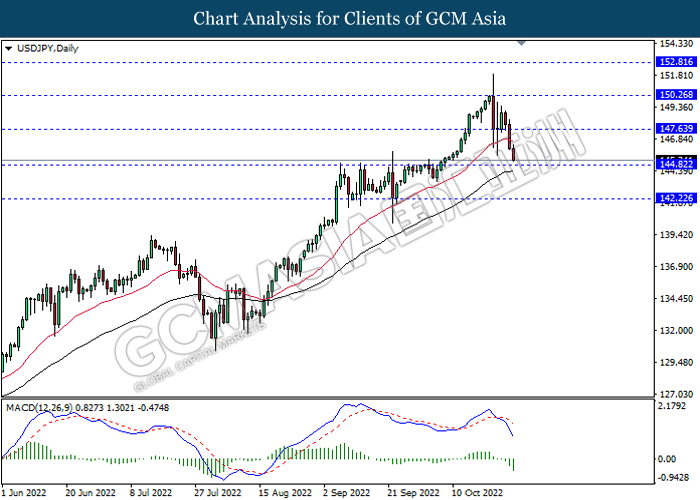

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

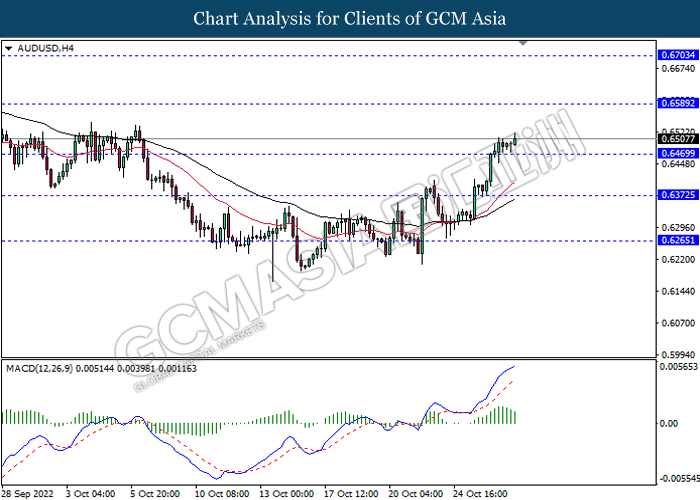

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6590, 0.6705

Support level: 0.6470, 0.6370

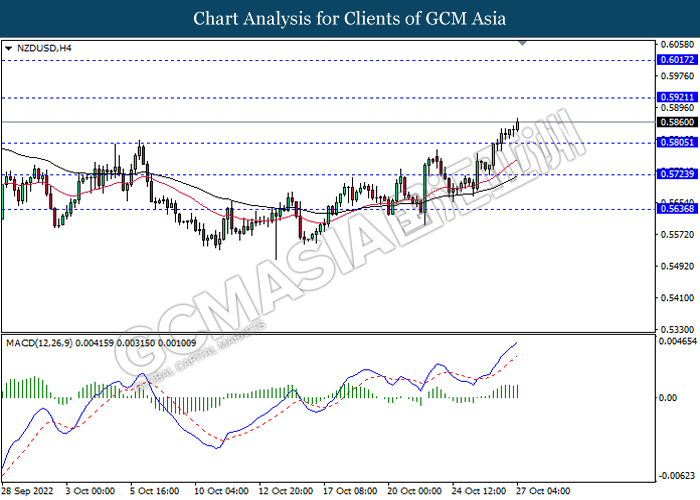

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

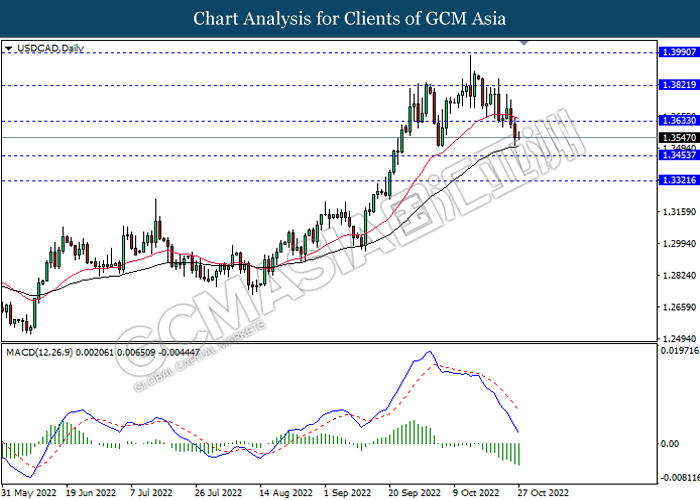

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

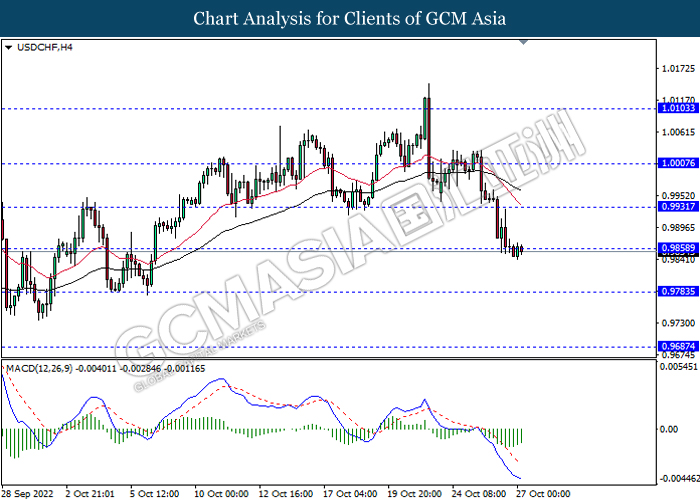

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9860, 0.9930

Support level: 0.9785, 0.9685

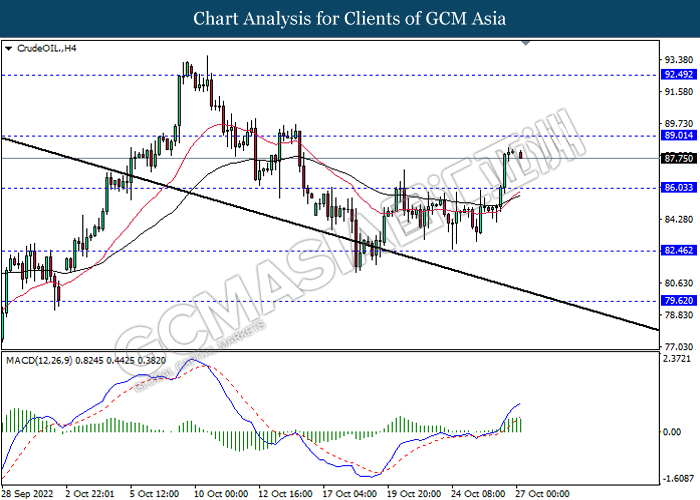

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

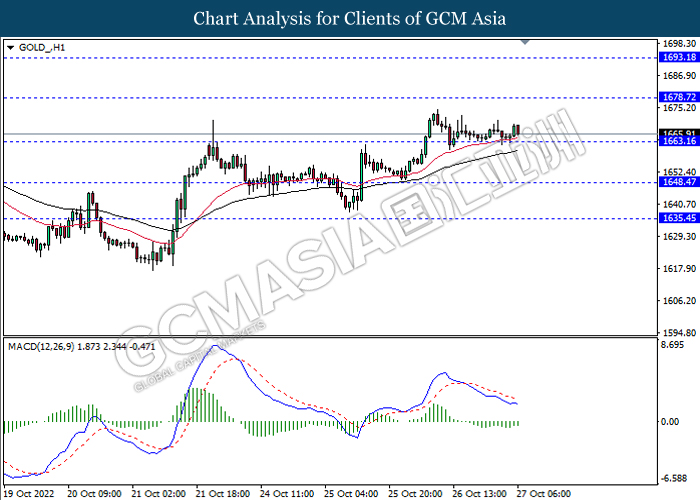

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1678.70, 1693.20

Support level: 1663.15, 1648.45