27 October 2022 Morning Session Analysis

Greenback slumped as the possibility of an aggressive rate hike was reduced.

The dollar index, which traded against a basket of six major currencies, sank more than 1%, as weakening economic data reaffirmed the market views that the Federal Reserve may slow the pace of its rate hiking cycle, while sending the euro back above parity with the greenback for the first time in a month. The dollar’s decline came as the benchmark 10-year U.S. Treasury yield continued its descent from last week’s multi-year high of 4.338%, and was last down four basis points at 4.0317%. However, the market participants are waiting for other crucial economic data to further scrutinize whether the Federal Reserve would slow down its pace of rate hike in the upcoming meeting. Some other data would be the US GDP and US Initial Jobless Claims, which scheduled to be announced later today. On the other side, the appointment of new prime minister in UK also boosted the investor’s optimism in pound market, while dragging the value of the dollar index to a lower level. As of writing, the dollar index slumped -1.09% to 108.75.

In the commodities market, crude oil prices edged down by -0.06% to $89.15 per barrel despite the EIA Crude Oil inventories data shows some stockpile over the week. In the matter of fact, the jump in crude oil price was attributable to the weakening of dollar index. Besides, gold prices appreciated 0.04% to $1665.40 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Oct) | 0.75% | 1.50% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 1.50% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (Oct) | 1.25% | 2.00% | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Sep) | 0.3% | 0.2% | – |

| 20:30 | USD – GDP (QoQ) (Q3) | -0.6% | 2.4% | – |

| 20:30 | USD – Initial Jobless Claims | 214K | 220K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 110.00. MACD which illustrated bearish bias momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 111.70, 113.10

Support level: 110.00, 107.90

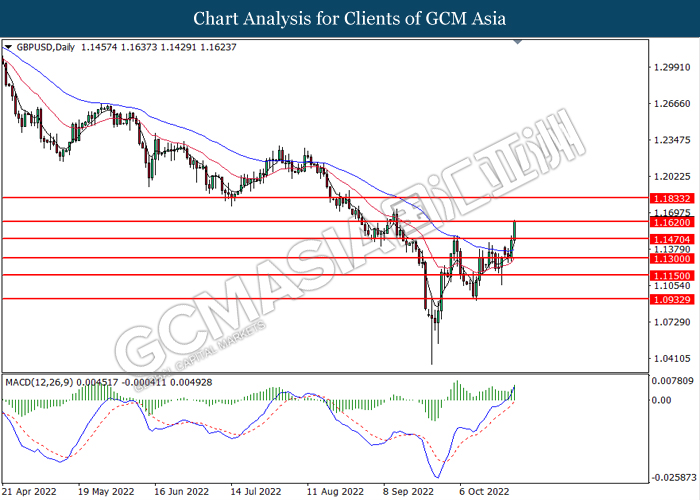

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1620, 1.1835

Support level: 1.1470, 1.1300

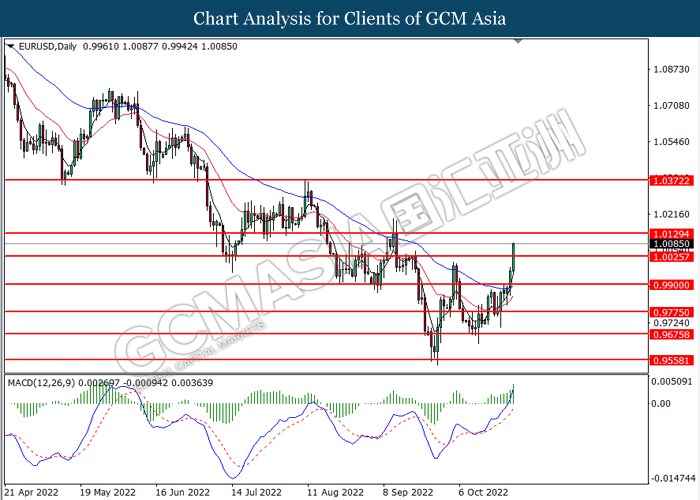

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0025. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0130.

Resistance level: 1.0130, 1.0370

Support le vel: 1.0025, 0.9900

vel: 1.0025, 0.9900

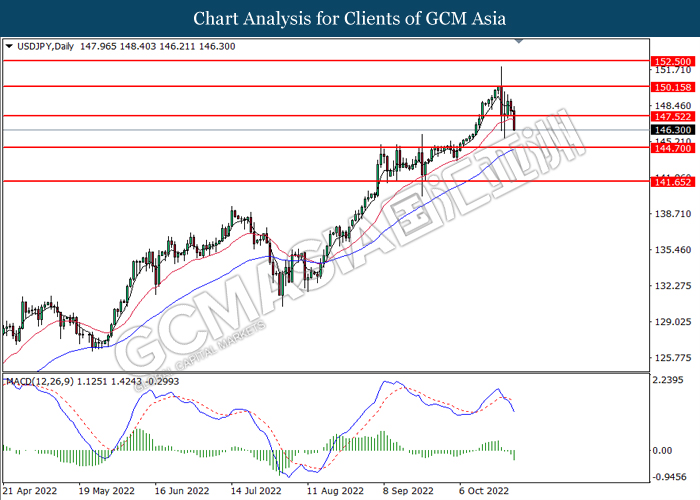

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 147.50. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 150.15, 152.50

Support level: 147.50, 144.70

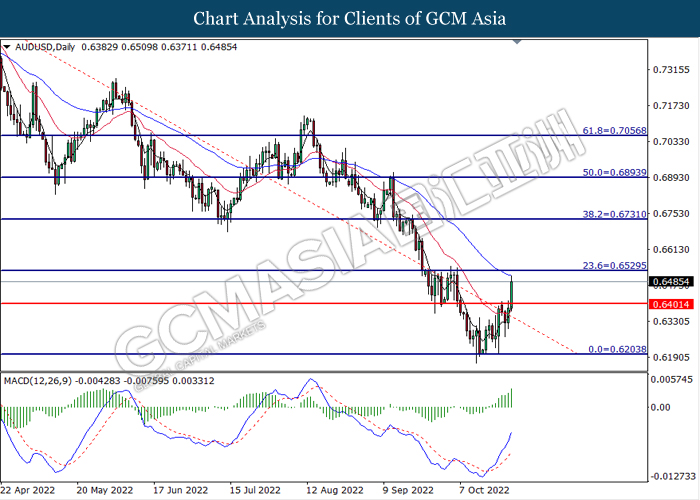

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6400. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6400, 0.6530

Support level: 0.6205, 0.5990

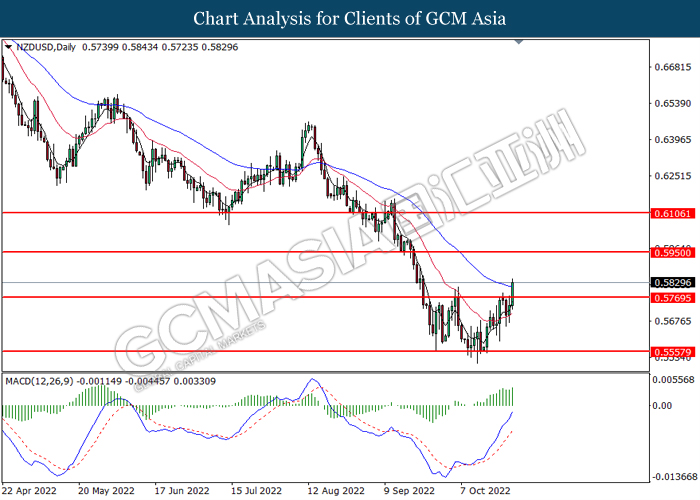

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.5770, 0.5950

Support level: 0.5560, 0.5400

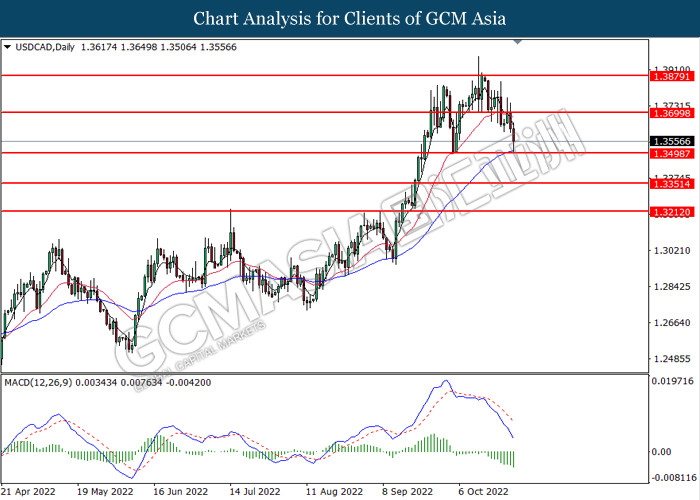

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3700. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3500.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9935. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0050, 1.0150

Support level: 0.9935, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 86.70. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level at 86.70.

Resistance level: 86.70, 93.10

Support level: 81.45, 76.85

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1660.90. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo short term technical correction.

Resistance level: 1677.80, 1695.25

Support level: 1660.90, 1638.40