27 December 2018 Afternoon Session Analysis

Dollar firmed amid U.S – China tension ease.

Dollar index held its gains against its basket of six major currency pairs as markets cheered on reports on easing tension of US-Sino. According to reports, a trade team from the U.S will be sent to Beijing to hold talks with Chinese officials on January 7. With the ongoing trade war between the two biggest economy powerhouses, the news has ease fears among investors and boost confidence around the outlook of the dollar. Besides that, the dollar has been further strengthened with the data showing U.S 2018 holiday sales has rose 5.1 percent which is the strongest gain in six years, illustrating a growing economy outlook. Dollar index rose 0.03 to 96.30 as of writing. Meanwhile, AUDUSD slips 0.17% to 0.7055 at the time of writing amid a slowdown in China economy. According to data, China’s industrial profits for December has fell for the first time three years with the reading of -1.8% against forecasted reading 3.6% and economist has expected earnings will continue to worsen next year. As China is the biggest trading partner with Australia, thus it is highly sensitive towards China’s data and also economy outlook.

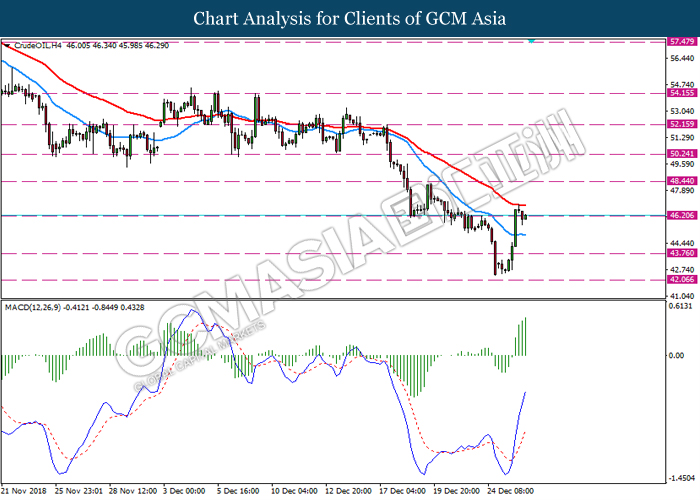

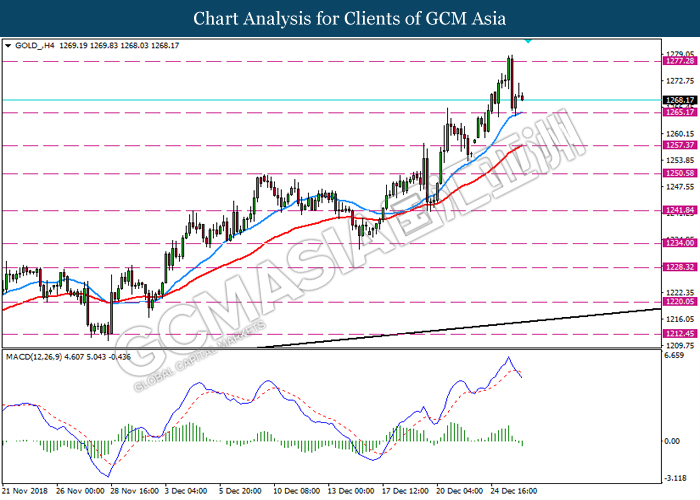

As for commodities market, crude oil price remains sluggish and slips 0.62% to $46.28 per barrel as of writing as concerns over a glut in supply remains a major pressure in the market. Despite OPEC and its allies have agreed to cut supply, investors remain skeptical and fear that the supply cut would not be enough to balance the supply and demand in the market. On the other hand, gold price slumped 0.16% to $1268.50 at the time of writing amid dollar regaining its confidence which supported by US – Sino tension ease.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 214K | 217K | – |

| 23:00 | USD – CB Consumer Confidence (Dec) | 135.7 | 133.7 | – |

| 23:00 | USD – New Home Sales (Nov) | 544K | 560K | – |

Technical Analysis

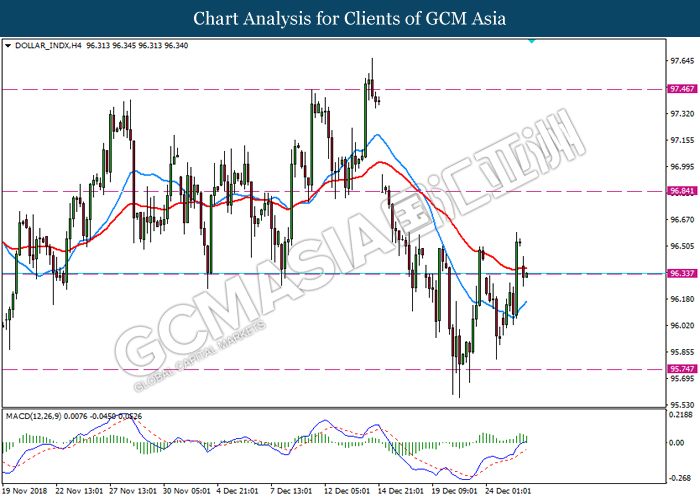

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 96.35. MACD which illustrate bearish momentum suggest the pair to extend its losses after it breaks below the support level 96.35.

Resistance level: 96.85, 97.45

Support level: 96.35, 95.75

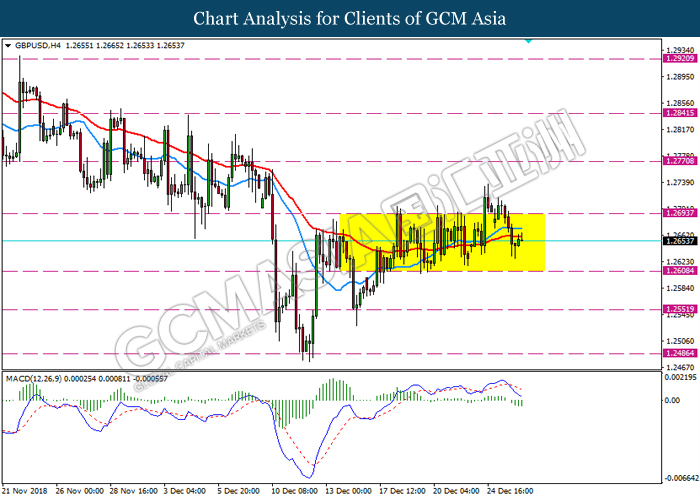

GBPUSD, H4: GBPUSD remains traded in a sideway channel following prior retracement from the resistance level 1.2695. MACD which illustrate bearish momentum with the formation of death cross suggest the pair to be traded lower towards the support level 1.2610.

Resistance level: 1.2695, 1.2770

Support level: 1.2610, 1.2550

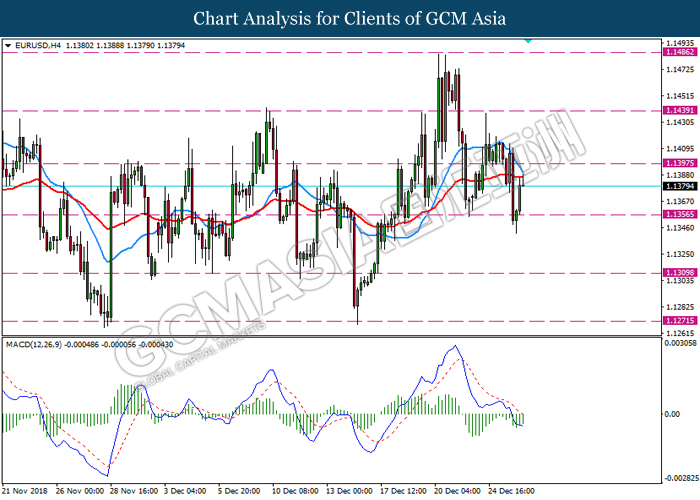

EURUSD, H4: EURUSD was trading higher following recent rebound from the support level 1.1355. MACD which illustrate bullish momentum suggest the pair to extend its rebound towards the resistance level 1.1395.

Resistance level: 1.1395, 1.1440

Support level: 1.1355, 1.1310

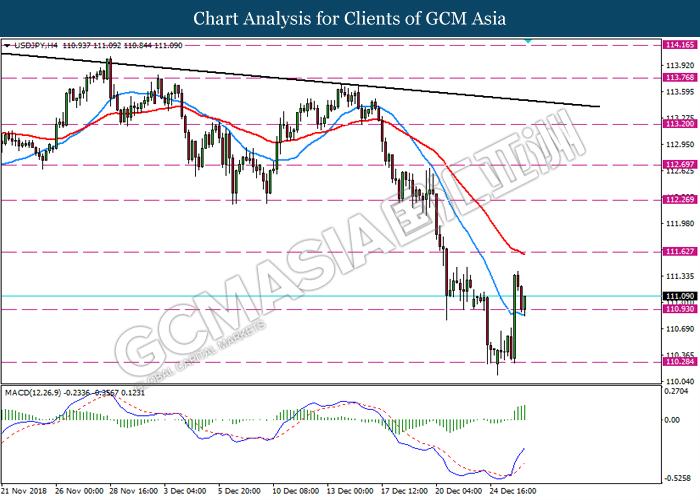

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 110.95. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 111.60.

Resistance level: 111.60, 112.25

Support level: 110.95, 110.30

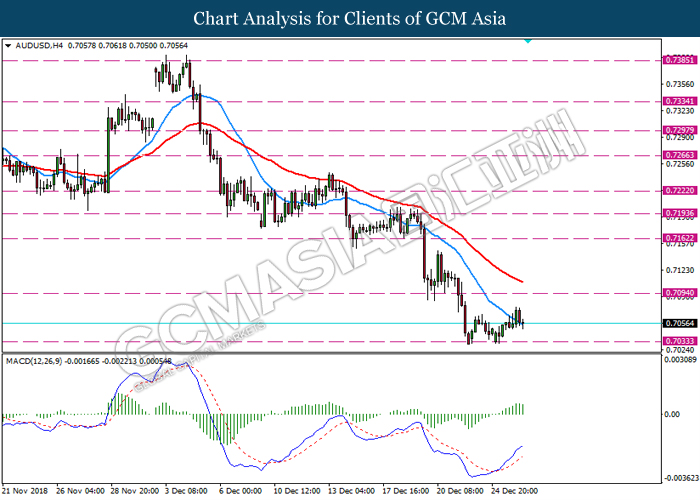

AUDUSD, H4: AUDUSD remain traded in a sideway channel following prior retracement from its recent highs. MACD which illustrate diminishing bullish momentum suggest the pear to undergo a technical correction towards the support level 0.7035.

Resistance level: 0.7095, 0.7160

Support level: 0.7035, 0.6975

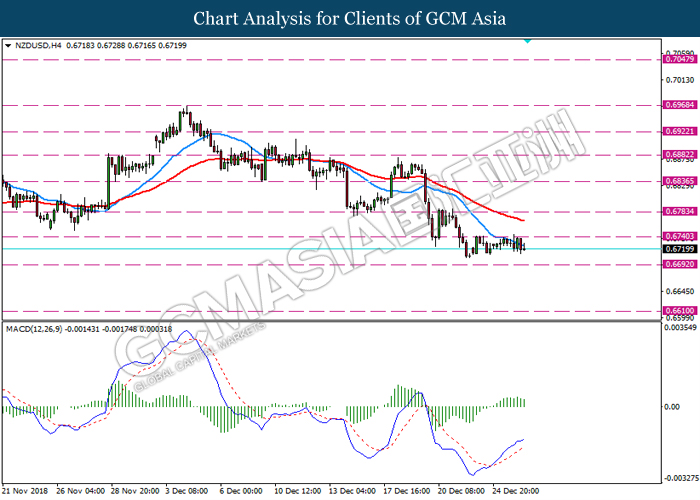

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level 0.6740. MACD which illustrate bearish momentum suggest the pair to extend its retracement towards the support level 0.6690.

Resistance level: 0.6740, 0.6785

Support level: 0.6690, 0.6610

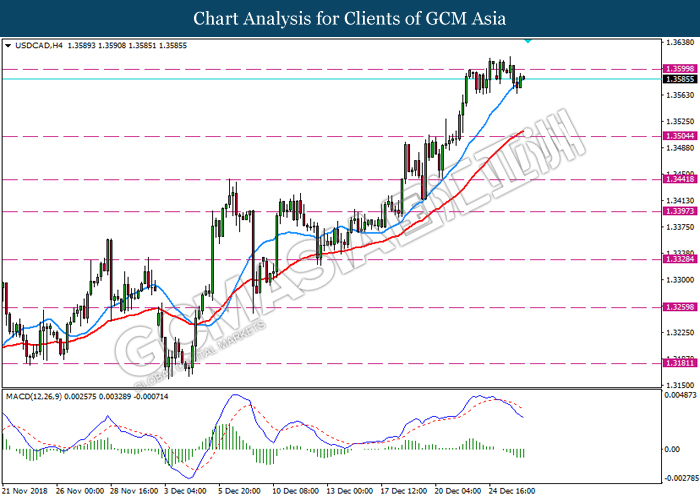

USDCAD, H4: USDCAD was traded lower following recent retracement from the resistance level 1.3600. MACD which display bearish bias signal with the formation of death cross suggest the pair to extend its retracement towards the support level 1.3505.

Resistance level: 1.3600, 1.3650

Support level: 1.3505, 1.3440

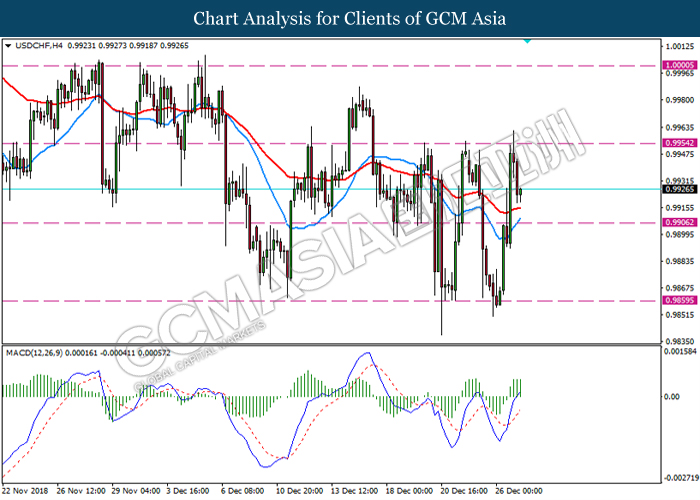

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level 0.9955. MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracement towards the support level 0.9905.

Resistance level: 0.9955, 1.0000

Support level: 0.9905, 0.9860

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level 46.20. MACD which illustrate bullish momentum with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level 46.20.

Resistance level: 46.20, 48.45

Support level: 43.75, 42.05

GOLD_, H4: Gold was traded lower following prior retracement from the resistance level 1277.30. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its retracement towards the support level 1246.15.

Resistance level: 1277.30, 1283.90

Support level: 1265.15, 1257.35