27 December 2022 Morning Session Analysis

FX Market slowed amid Christmas Holiday.

The dollar index, which traded against a basket of six major currencies, slid last Friday as the economic data signaled that the U.S. economy is cooling down, hyping the market expectation of slower rate hike in the future as inflation eased. According to the Bureau of Economic Analysis, excluding the volatile food and energy components, the PCE index up 0.2% after increasing 0.3% in October, in line with the market consensus. The inflation data showed that it is moving in the right direction, whereby it is in the gradual pace of easing while the US economic growth has not been hindered significantly. At this juncture, the Fed is expected to raise the interest rate by 25 basis points in the next meeting, which is scheduled to be held in the month of February. However, due to the Christmas Holiday, the trading condition in the FX market remains subdued and thinned as the market participants stayed calm.

In the commodities market, crude oil price rose by 1.30% to $80.67 per barrel after Russia said it could cut crude output in response to the G7 price cap on Russian exports Besides, gold prices appreciated by 0.14% to $1800.70 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day GBP Christmas

All Day NZD Christmas

All Day AUD Christmas

All Day CAD Christmas

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

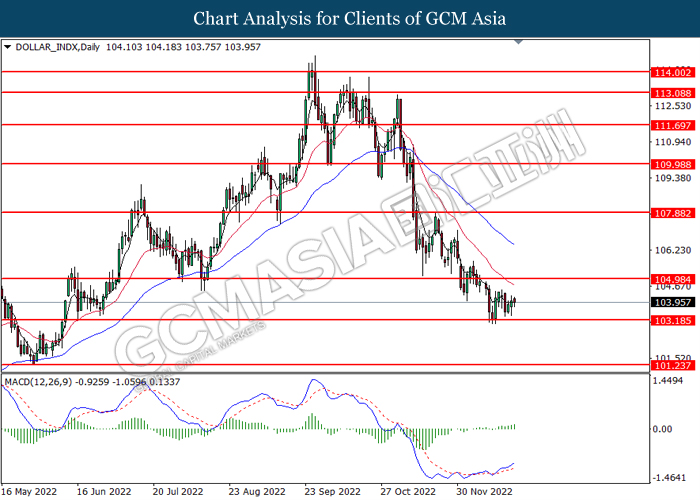

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.20, 101.25

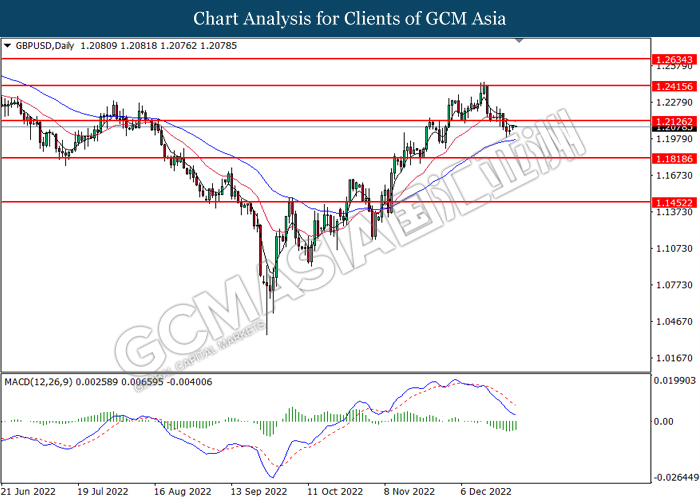

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2125. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1820.

Resistance level: 1.2125, 1.2415

Support level: 1.1820, 1.1450

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0570. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0675, 1.0780

Support level: 1.0570, 1.0440

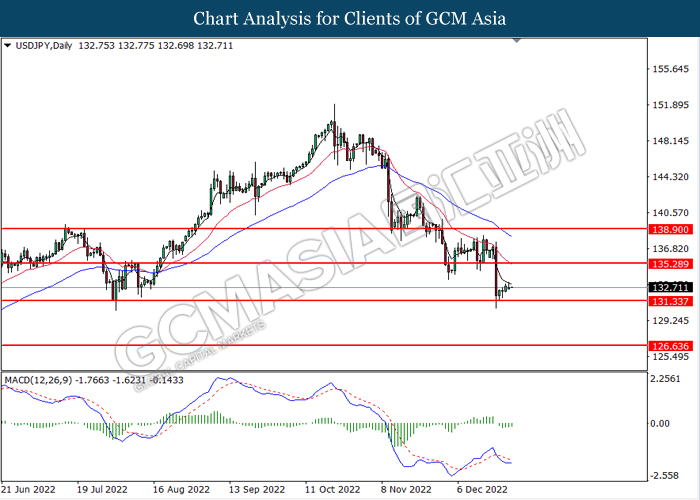

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.35. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 135.30, 138.90

Support level: 131.35, 126.65

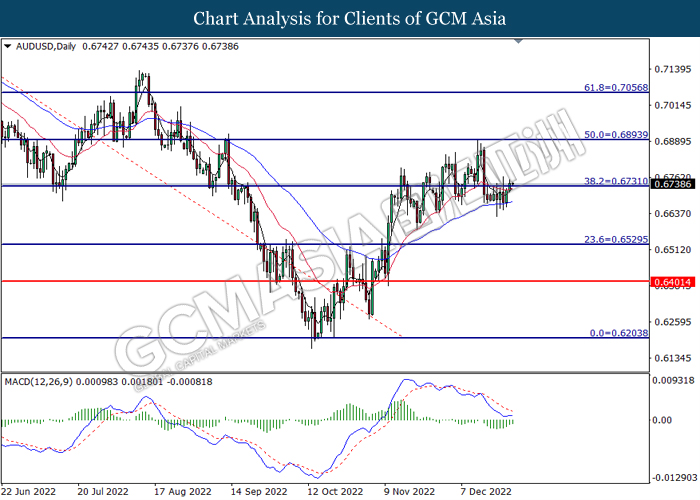

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance at 0.6730. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6730, 0.6895

Support level: 0.6530, 0.6400

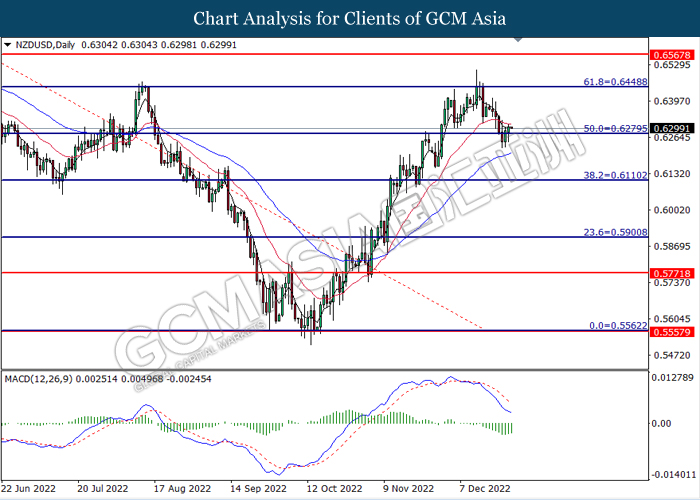

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6280. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6450.

Resistance level: 0.6450, 0.6570

Support level: 0.6280, 0.6110

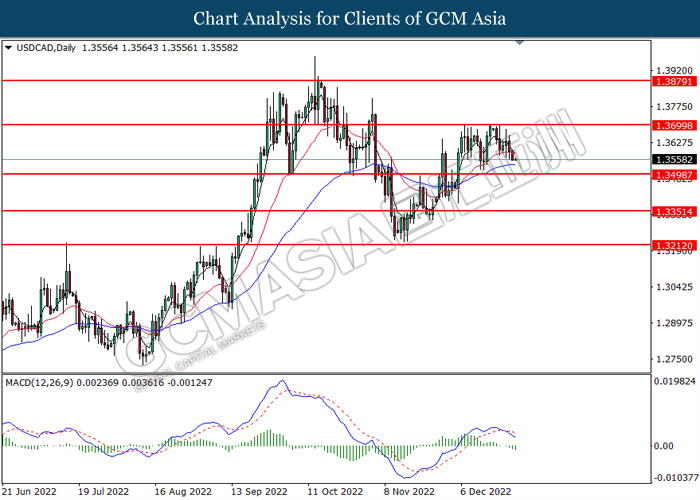

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3700. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3500.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

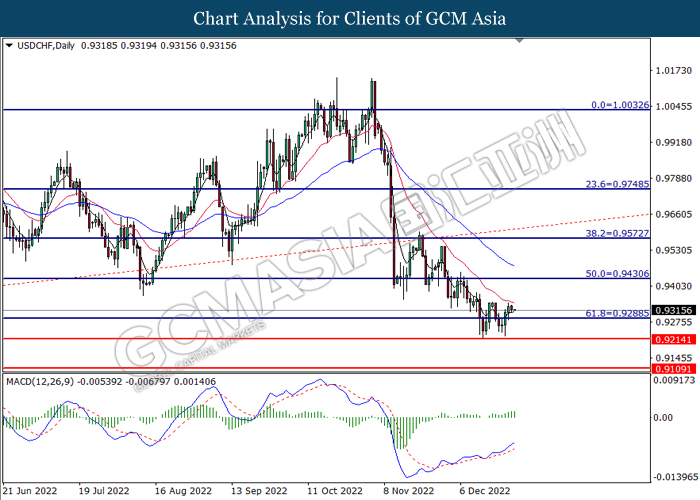

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9430.

Resistance level: 0.9430, 0.9575

Support level: 0.9290, 0.9215

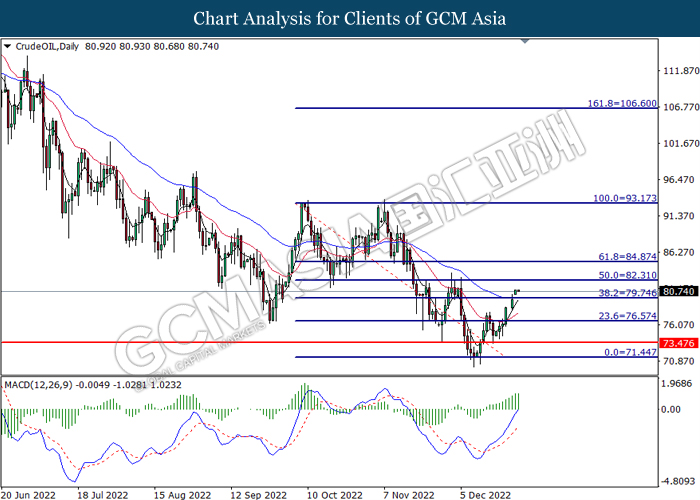

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 79.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 82.30.

Resistance level: 82.30, 84.85

Support level: 79.75, 76.55

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1808.85. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 1765.95.

Resistance level: 1808.85, 1835.00

Support level: 1765.95, 1726.25