28 February 2022 Afternoon Session Analysis

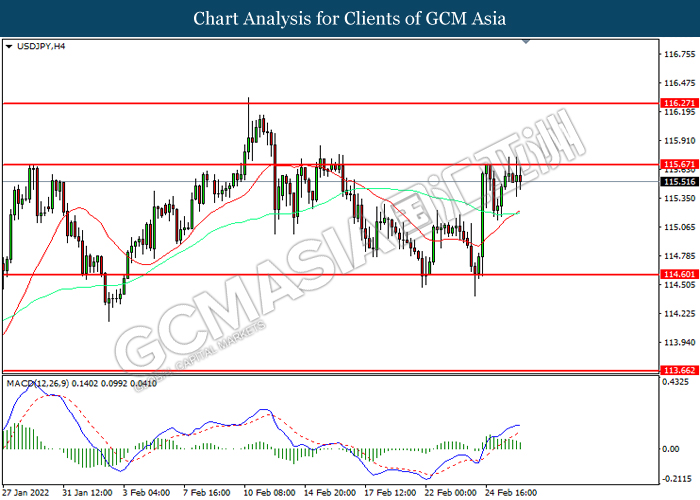

Escalating tensions Russia-Ukraine, spurring demand on safe-haven Japanese Yen.

The rising tensions between Russia-Ukraine recently had spurred further risk-off sentiment in the global financial market, which prompting investors to shift their portfolio toward safe-haven asset while insinuating bullish momentum on the Japanese Yen. According to Reuters, the most recent sanctions from European countries will ban Russian lenders from using the global SWIFT messaging system, while raising concerns upon the ability for Central Bank of the Russian Federation ability to stabilize the Russian financial system. Nonetheless, Russian and Ukraine officials will meet at the border with Belarus, but Ukrainian President Volodymyr Zelenskiy remained sceptical about the talks between both countries. Though, as of writing investors would continue to scrutinize the latest updates with regards of war prospect between Russia-Ukraine to receive further trading signal. As of writing, USD/JPY depreciated by 0.05% to 115.45.

In the commodities market, the crude oil price appreciated by 4.41% to $97.55 per barrel as of writing. The crude oil price jumped significantly amid escalating sanctions against Russia over its invasion of Ukraine had increased concerns upon the supply disruption in future. On the other hand, the gold price appreciated by 1.08% to $1909.65 per troy ounces as of writing amid diminishing risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

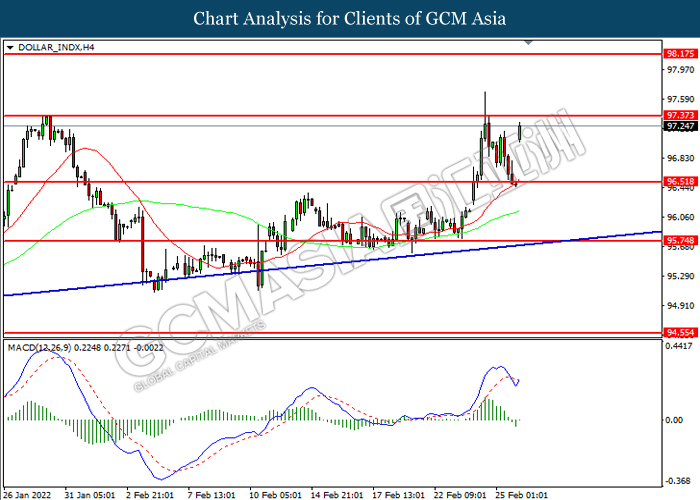

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 97.35. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 97.35, 98.20

Support level: 96.50, 95.75

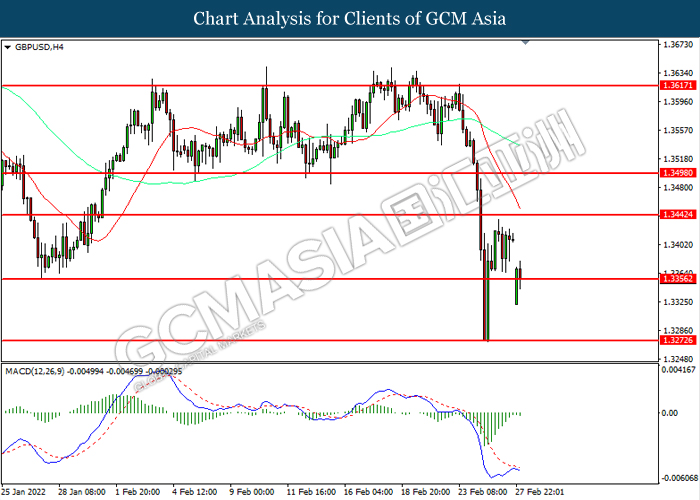

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.3355. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3440, 1.3500

Support level: 1.3355, 1.3275

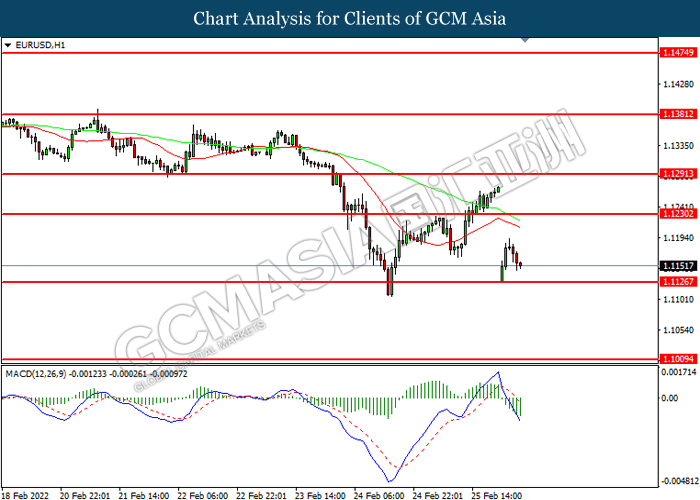

EURUSD, H1: EURUSD was traded lower while currently near the support level at 1.1125. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1230, 1.1290

Support level: 1.1125, 1.1010

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 115.65. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

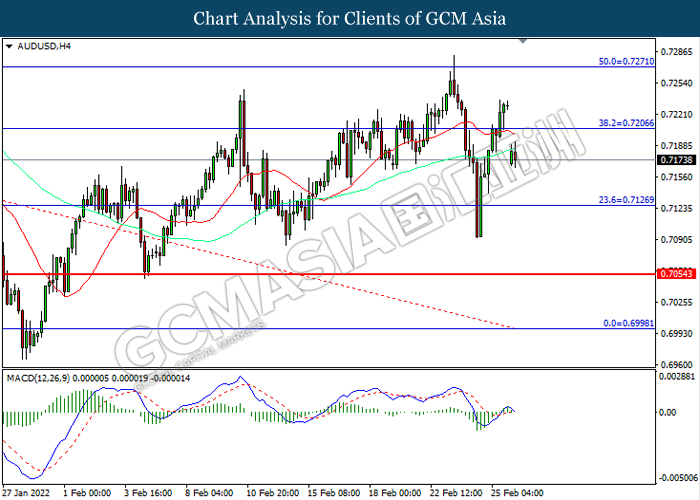

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level at 0.7205. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.7125.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7055

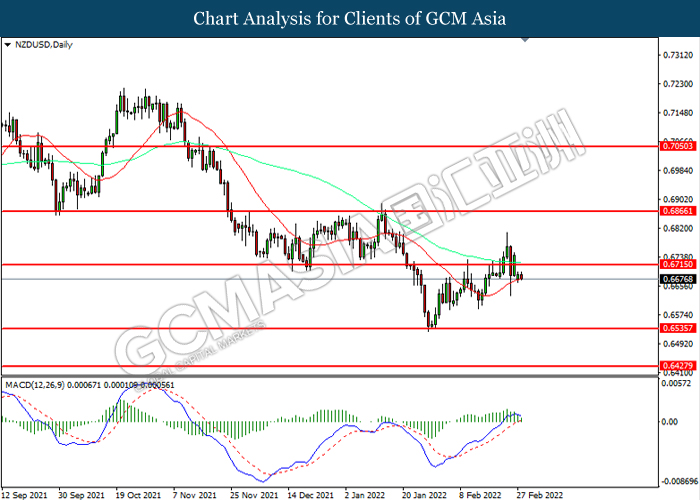

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6715. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6535.

Resistance level: 0.6715, 0.6865

Support level: 0.6535, 0.6430

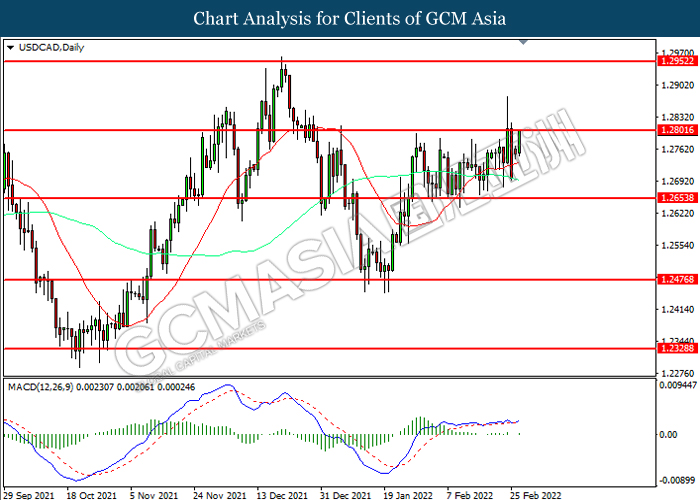

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2800. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2800, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded lower while currently near the support level at 95.45. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 98.05, 100.15

Support level: 95.45, 93.05

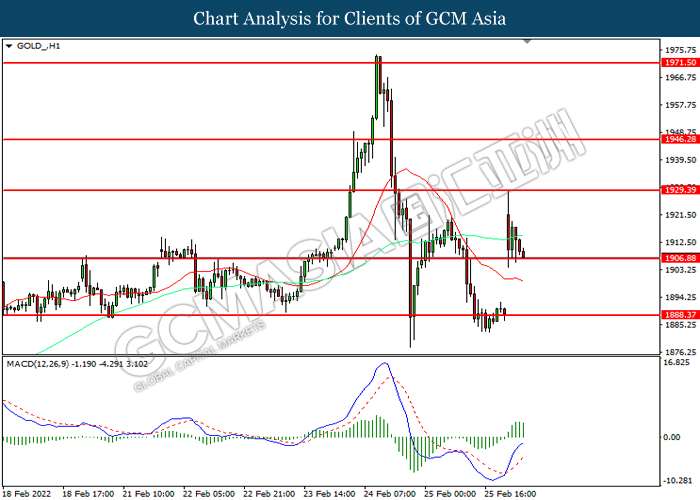

GOLD_, H1: Gold price was traded lower while currently testing the support level at 1906.90. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1929.40, 1946.30

Support level: 1906.90, 1888.35