28 February 2022 Morning Session Analysis

Will Russia use nuclear weapon?

Investors were being shaken with latest developments from Russian and Ukrainian war as the former contemplates to use nuclear weapon. According to Reuters, Russian President Vladimir Putin has ordered its nuclear deterrence force to stay on high alert as the war escalates to the next level. His latest order has received wide condemnation from leaders in the West, citing the call will bring the world to witness yet another nuclear war if it is being used. Likewise, investors are currently speculating more sanctions being introduced towards Russia as previously announced sanctions failed to deter Russia from advancing further into attacking Ukraine. The announcement has also sparked risk aversion in the market, prompting higher demand for safe-haven assets in the financial market. As of writing, the dollar index was up 0.15% to 96.60.

In the commodities market, crude oil price was up 5.02% to $97.13 per barrel following rising tensions in between Russia and Ukraine. On the other hand, gold price was up 0.79% to $1,905.00 a troy ounce due to risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

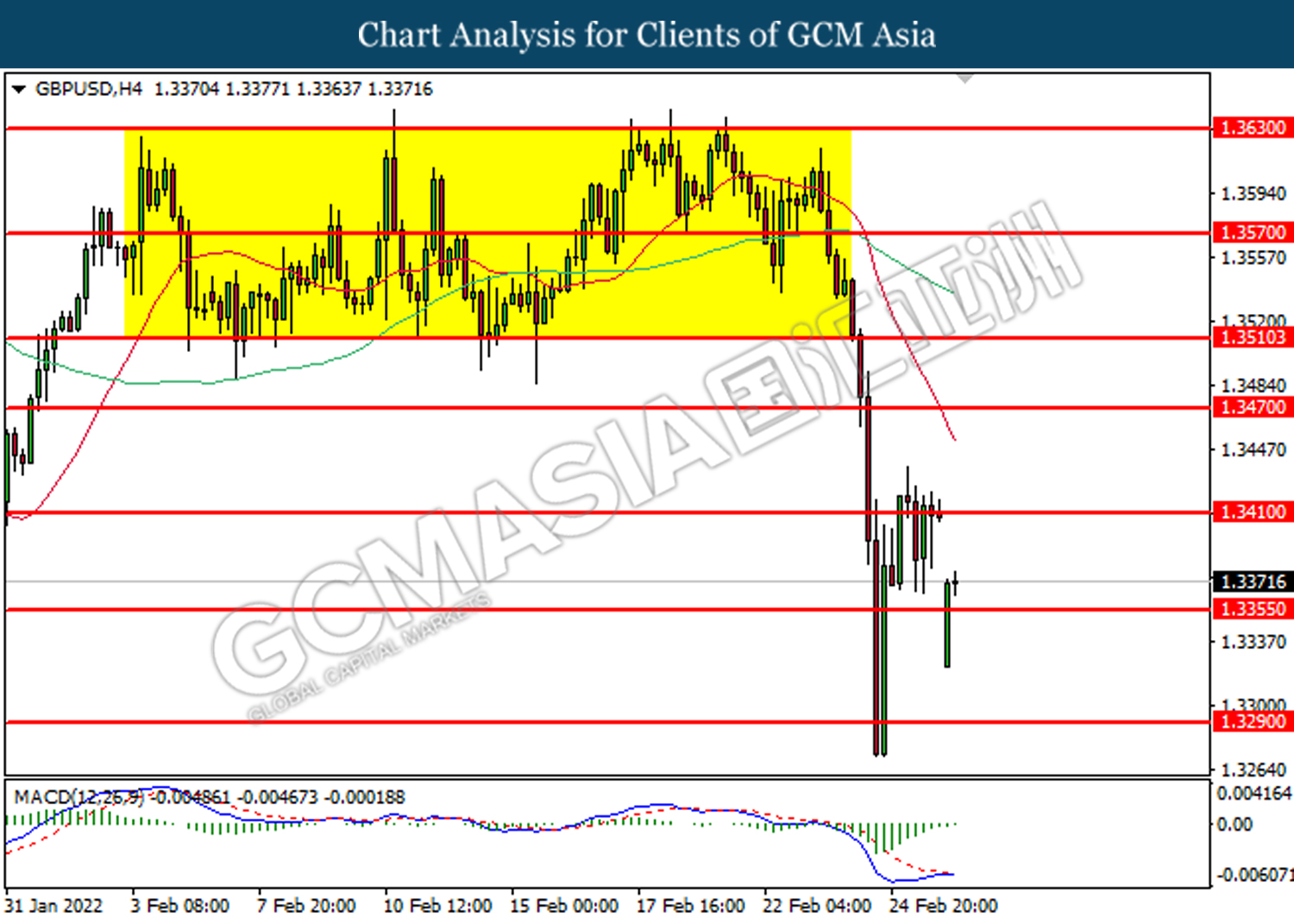

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3410, 1.3470

Support level: 1.3355, 1.3290

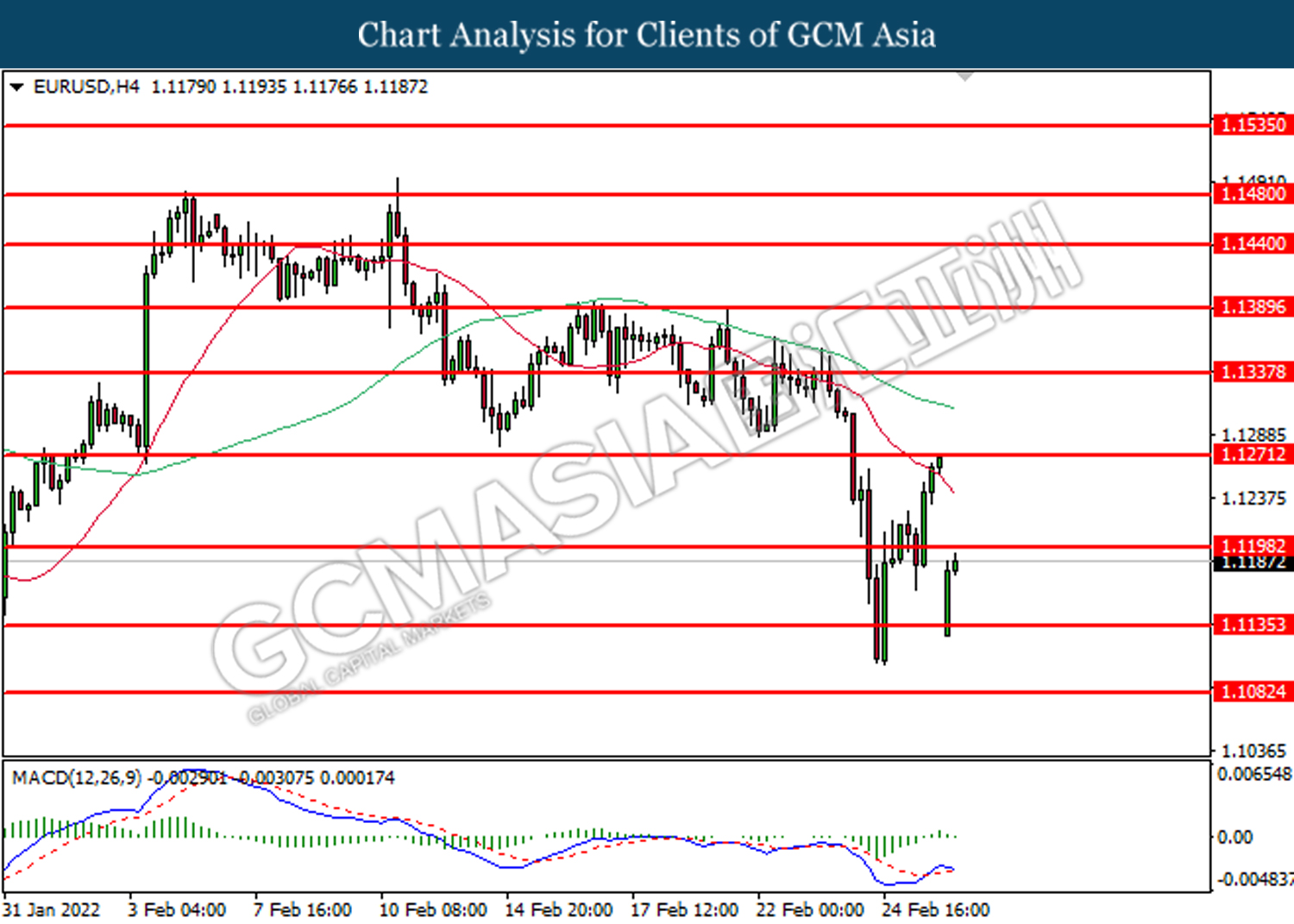

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lowr in short-term.

Resistance level: 1.1200, 1.1270

Support level: 1.1135, 1.1080

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which diminished illustrate bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

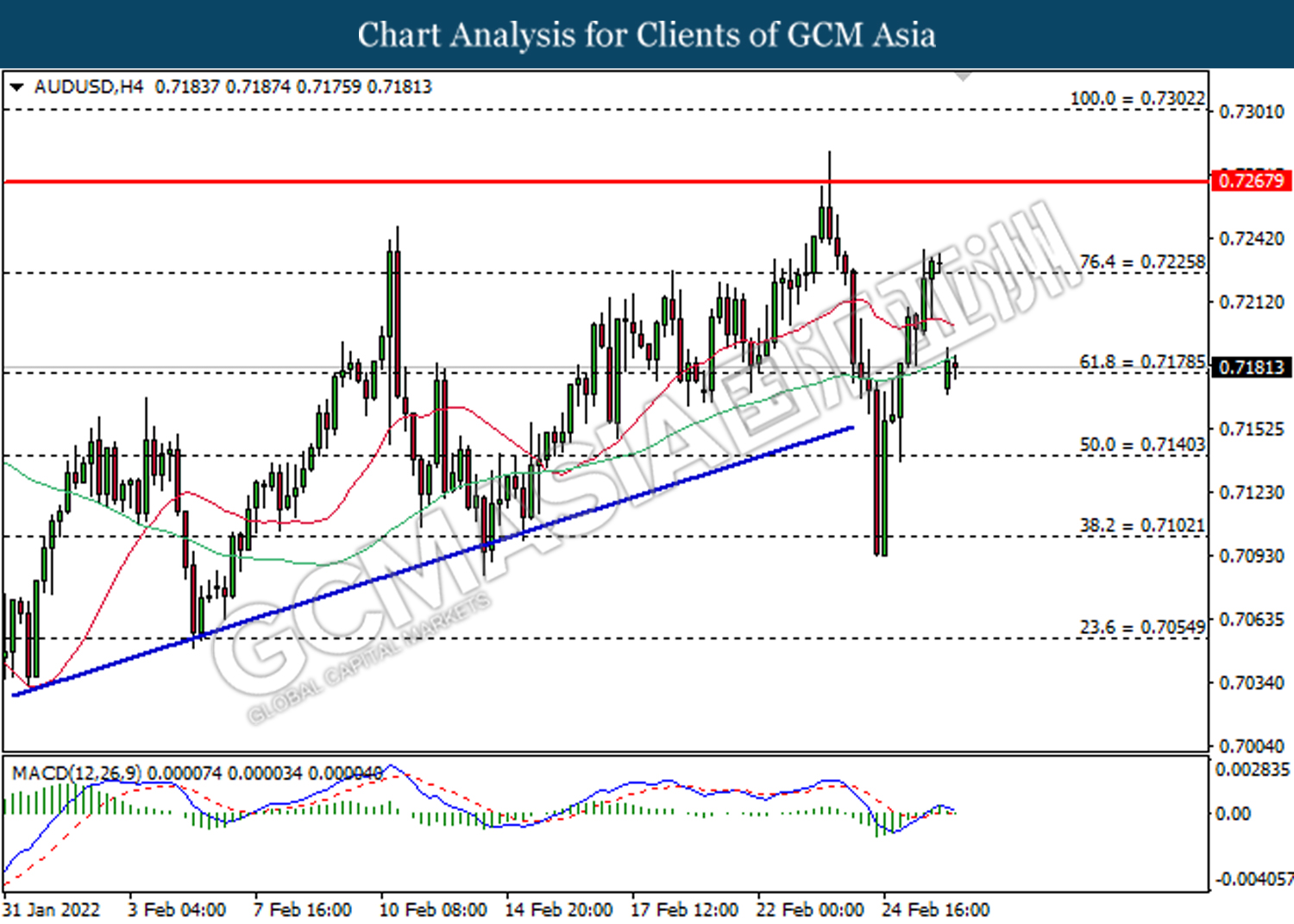

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7225, 0.7270

Support level: 0.7180, 0.7140

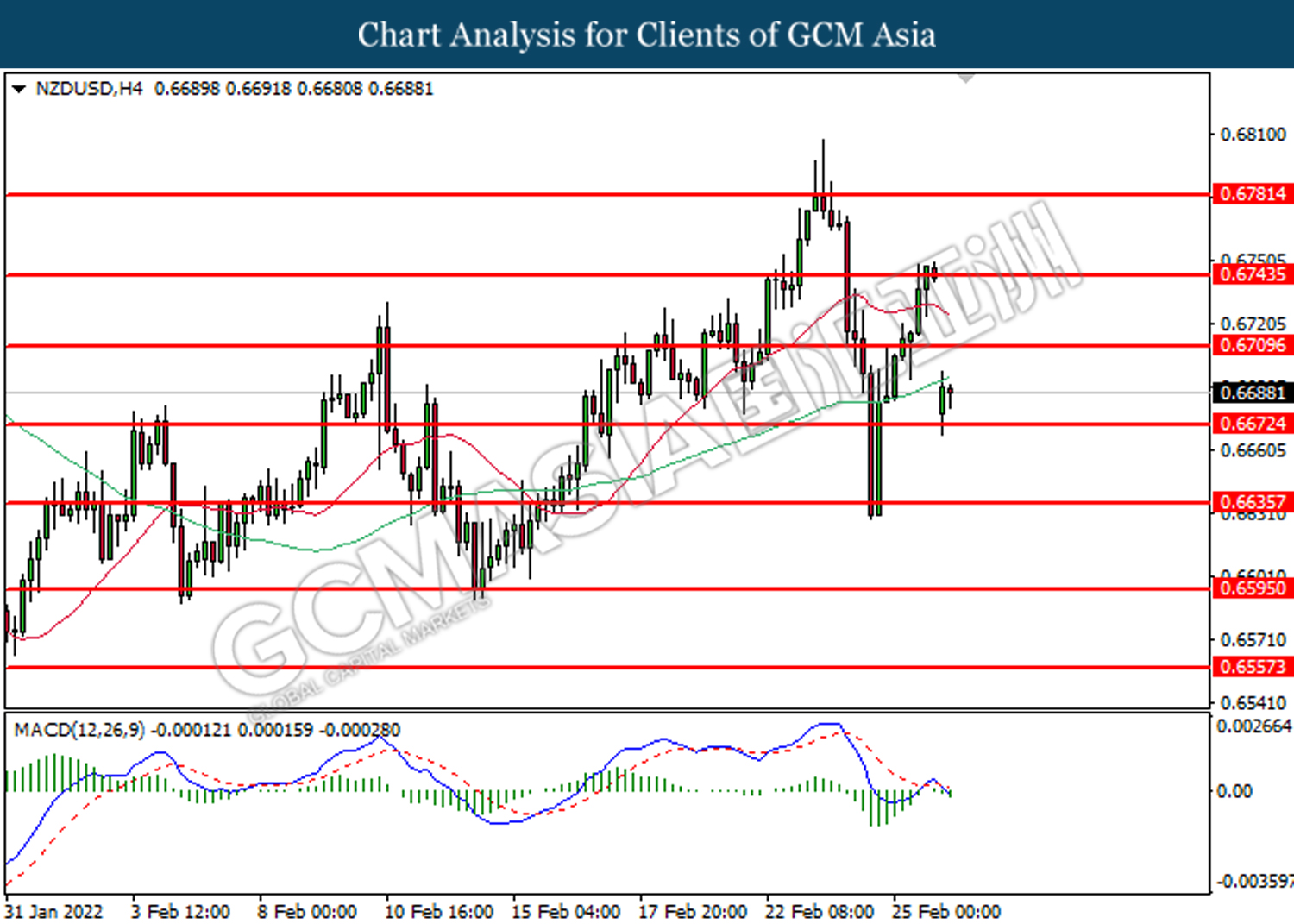

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6710, 0.6745

Support level: 0.6670, 0.6635

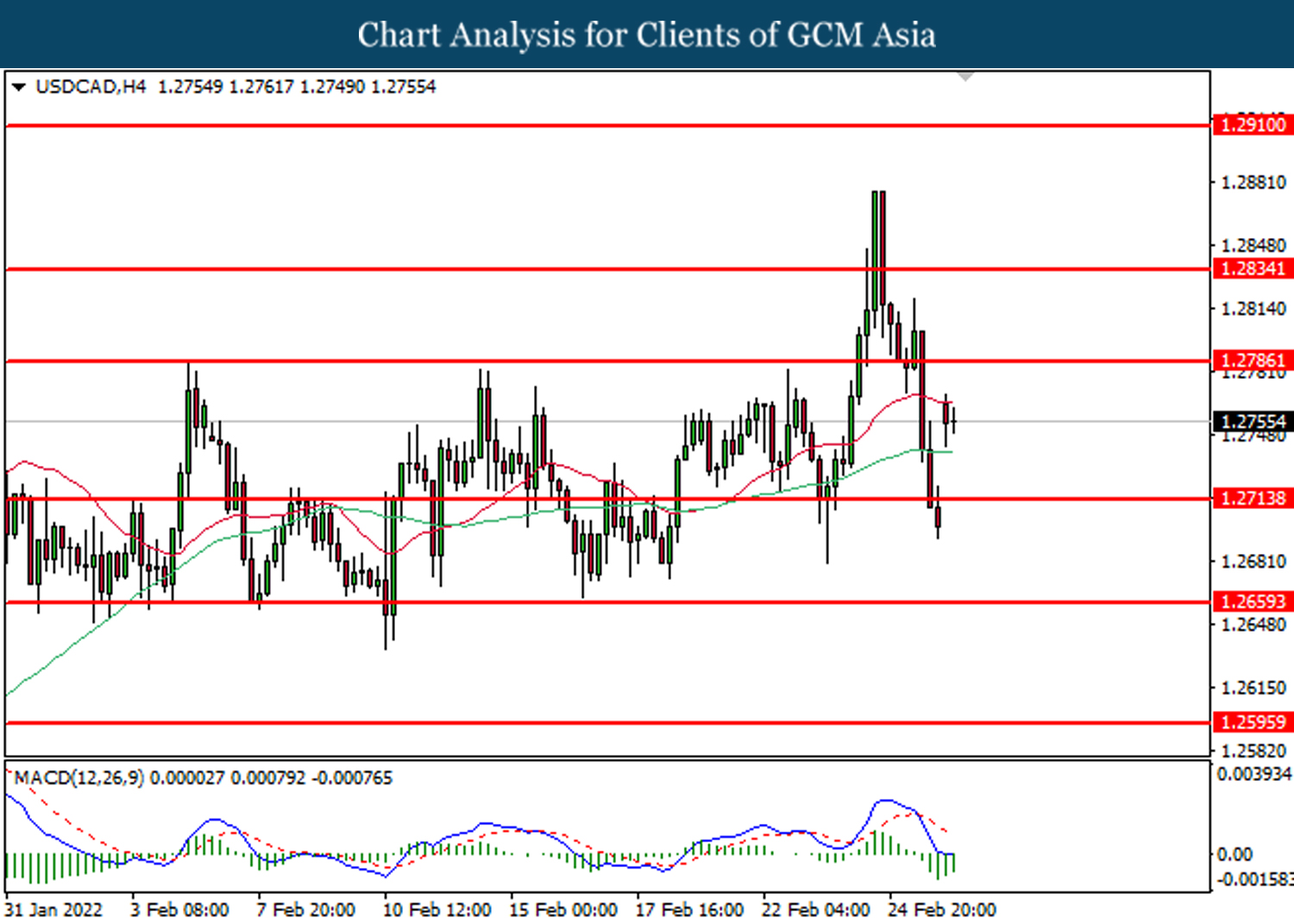

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

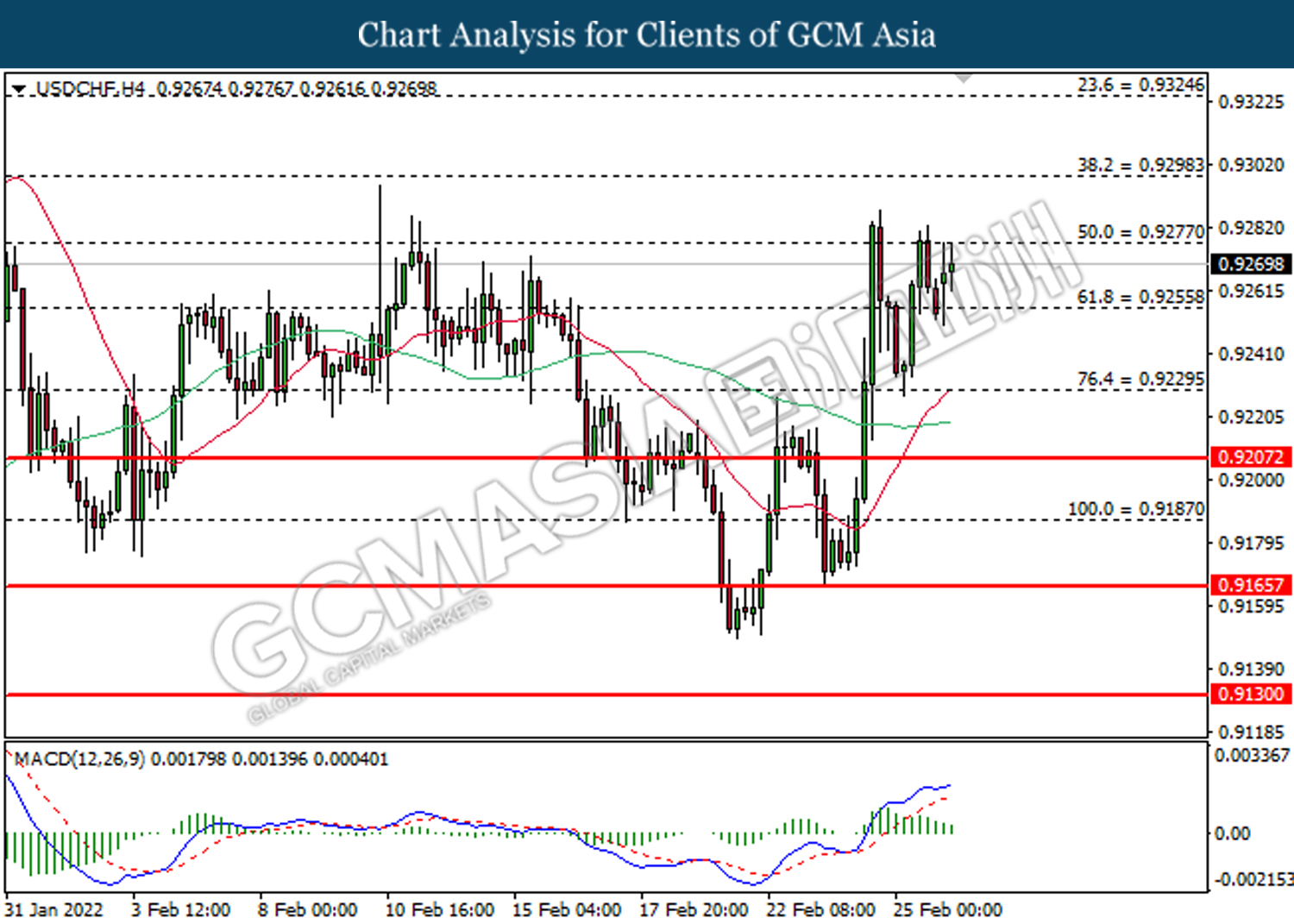

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9280, 0.9300

Support level: 0.9255, 0.9230

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 100.00, 103.20

Support level: 96.30, 93.15

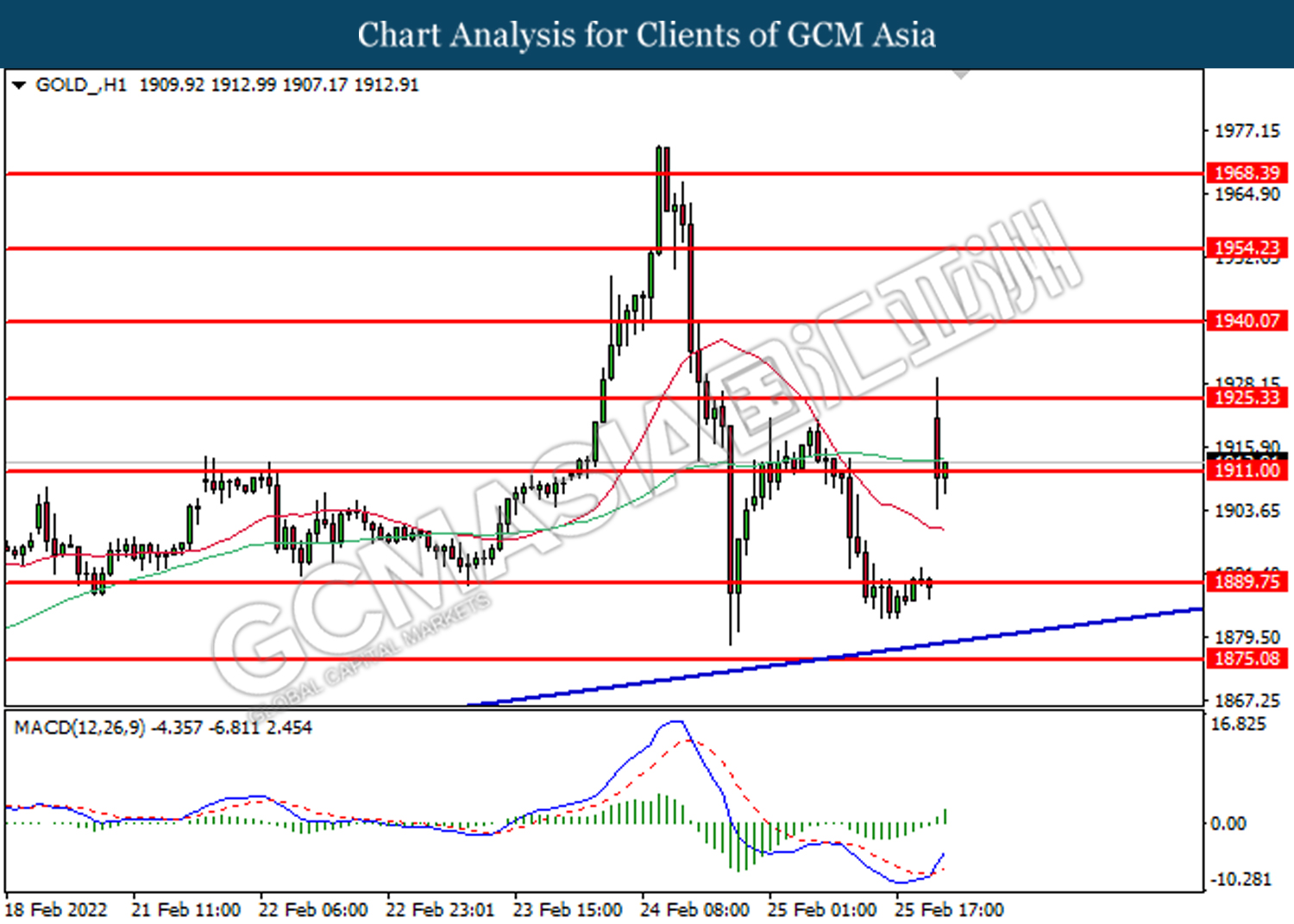

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after closing above its resistance level.

Resistance level: 1911.00, 1925.35

Support level: 1889.75, 1875.10