28 March 2022 Afternoon Session Analysis

Euro slumped amid downbeat data.

The Euro slumped over the backdrop of bearish economic data last week. According to Ifo Institute for Economic Research, Germany Ifo Business Climate Index notched down significantly from the previous reading of 98.5 to 90.8, missing the market forecast at 94.2. The downbeat reading indicated that the market expectations toward the business outlook in the European region is extremely uncertain due to the rising tensions between Russia-Ukraine recently. Besides that, the Euro extend its losses amid escalating tensions between Russia-Ukraine during the weekend. According to Reuters, the war tensions between Russia-Ukraine remained high following the rockets missiles continue to strike the western Uranian city of LVIV on Saturday, signalling a new potential new front in Moscow’s invasions. Meanwhile, United States and NATO claimed that they will continue to support Ukraine with military and humanitarian assistance while imposing significant economic sanctions upon Russia. As of writing, the EURUSD depreciated by 0.26% to 1.0953.

In the commodities market, the crude oil price slumped 1.85% to $112.25 per barrel as of writing. The oil market edged lower following the implementation of China lockdown in order to combat the spiking numbers of Covid-19 cases, weighing down the prospect for the oil demand in future. On the other hand, the gold price depreciated by 0.55% to $1947.15 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

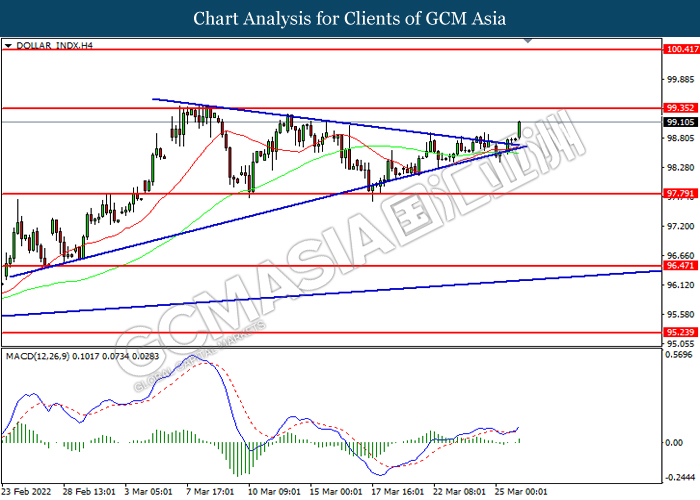

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

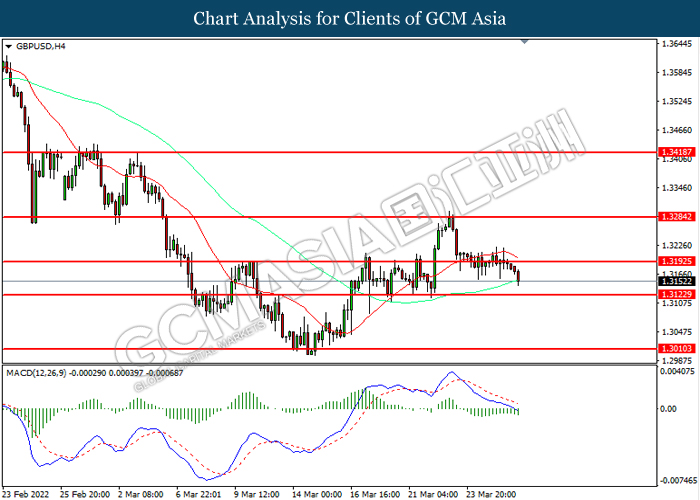

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3195, 1.3285

Support level: 1.3125, 1.3010

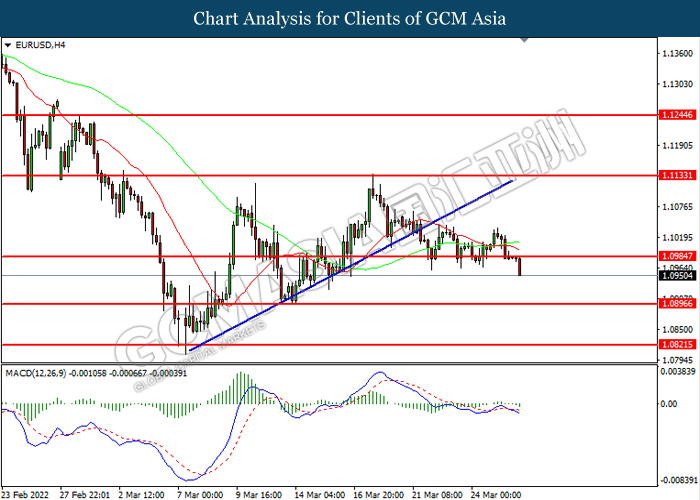

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0985, 1.1135

Support level: 1.0895, 1.0820

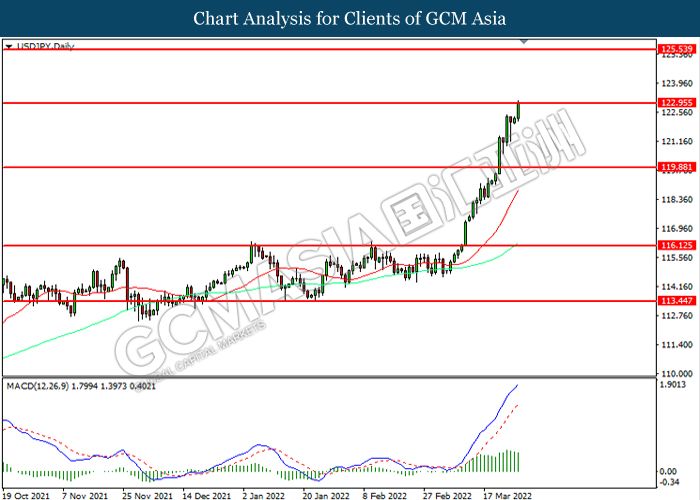

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 122.95. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

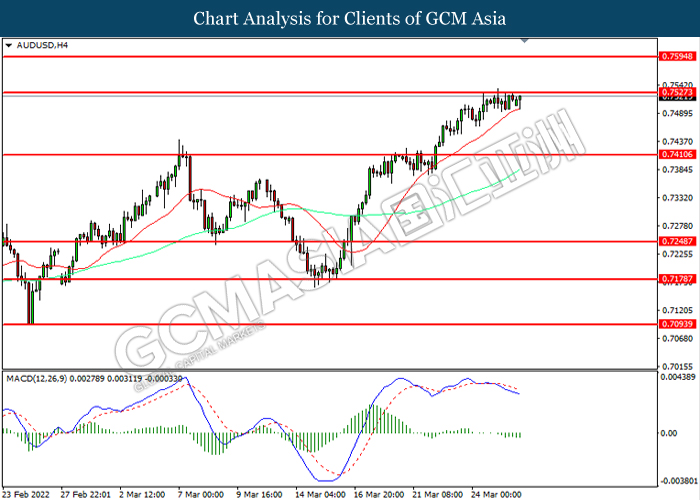

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

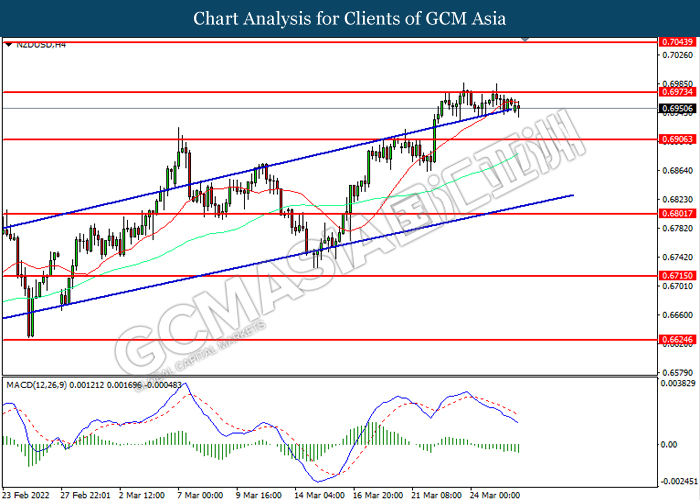

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

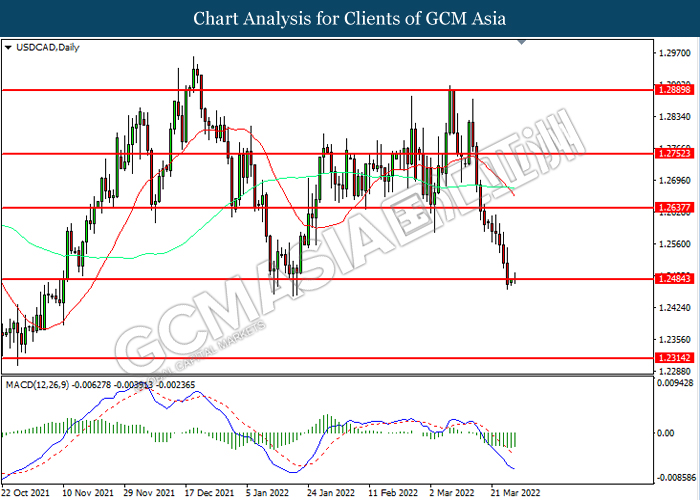

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

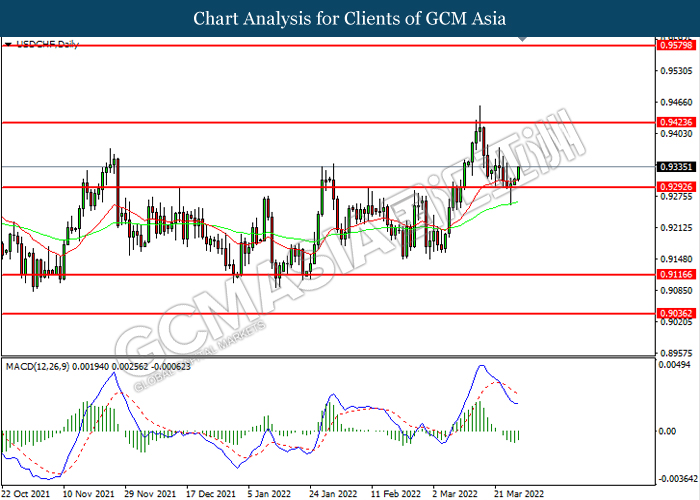

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9295, 0.9115

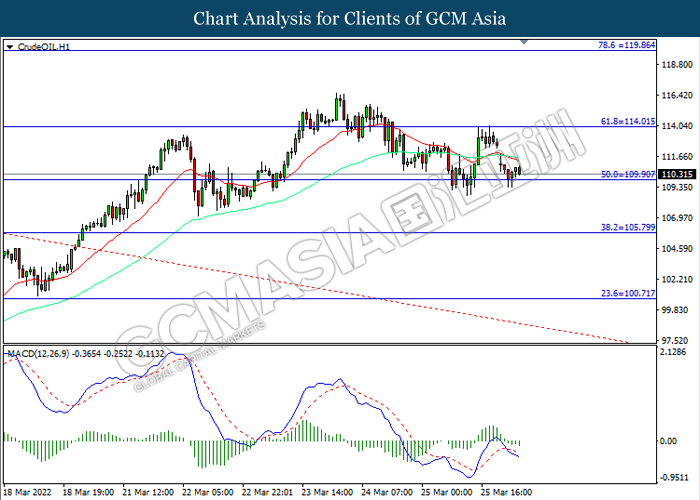

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 114.00, 119.85

Support level: 109.90, 105.80

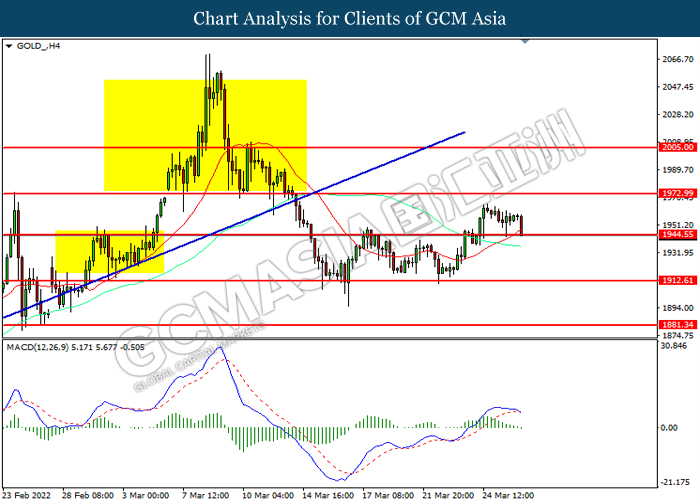

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1944.55. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1973.00, 2005.00

Support level: 1944.55, 1912.60