28 March 2022 Morning Session Analysis

US Dollar surged amid US latest Fiscal plan.

The Dollar Index which traded against a basket of six major currencies extend its gains following US President Joe Biden propose a minimum tax on billionaires as part of the fiscal policy for the year of 2023. Further details are expected to be unveiled on Monday, according to White House. The fiscal policy plan would set at 20% minimum tax rate on households who worth more than $100 million, targeting the United State’s billionaires. According to US authorities, the plan would authorize those wealthy household to pay the minimum tax of 20% on all their incoming including unrealized investment income. The contractionary fiscal policy will help to reduce the current budget deficit by about $360 billion in the next decade, protecting the economic growth for the Unites States. As of writing, the Dollar Index appreciated by 0.02% to 98.81.

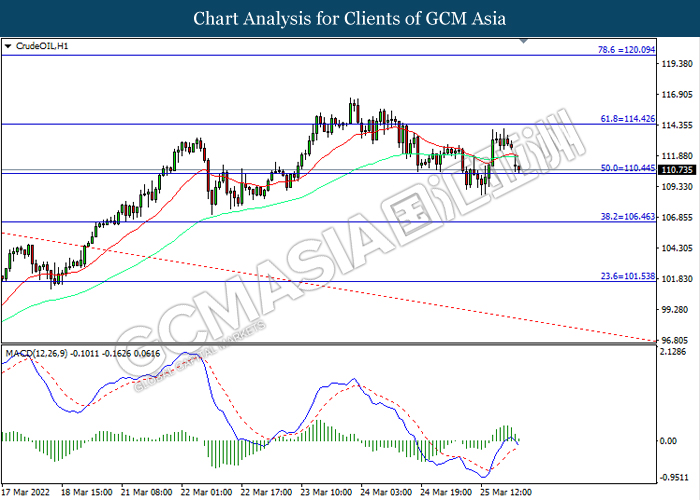

In the commodities market, the crude oil price extends its gains by 1.18% to 114.45 per barrel as of writing. The oil market continues to edge higher amid traders reconciled the impact of missile attack on an oil facility in Saudi Arabia. Yemen’s Houthis claimed that they launched attacks on Saudi energy facilities on Friday. On the other hand, the gold price appreciated by 0.02% to $1958.20 as of writing amid rising tensions between Russia-Ukraine continue to spark higher inflation risk in future.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

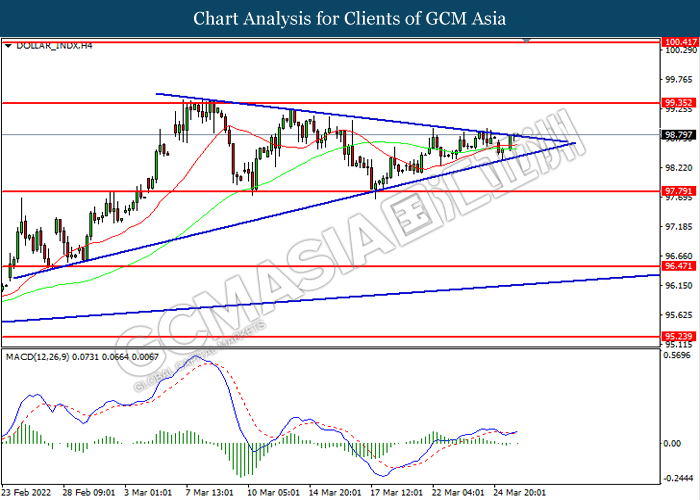

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3195, 1.3285

Support level: 1.3125, 1.3010

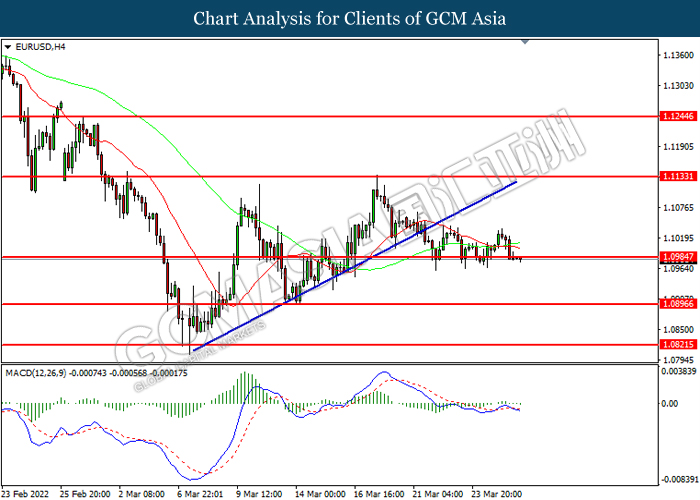

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0985. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0820

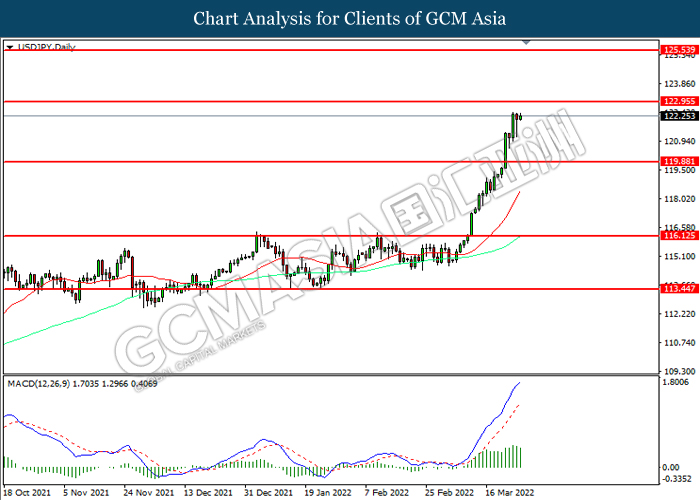

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 122.95. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 122.95, 125.55

Support level: 119.90, 116.15

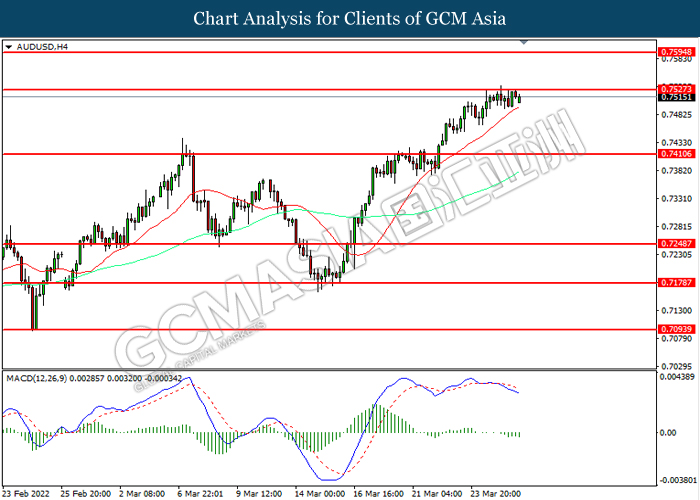

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

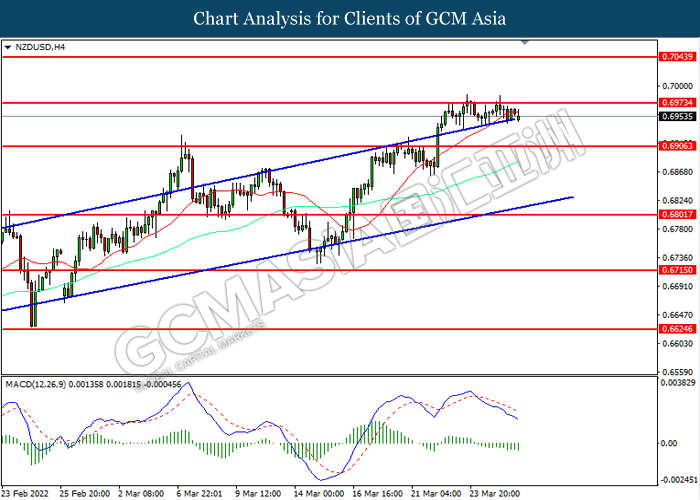

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6965, 0.7045

Support level: 0.6905, 0.6800

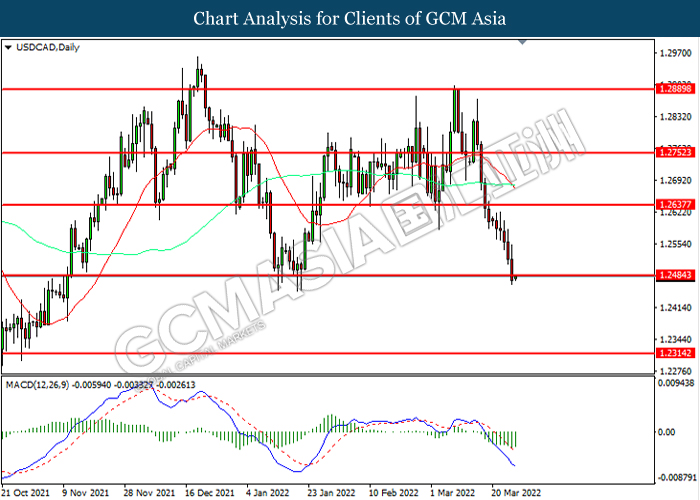

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

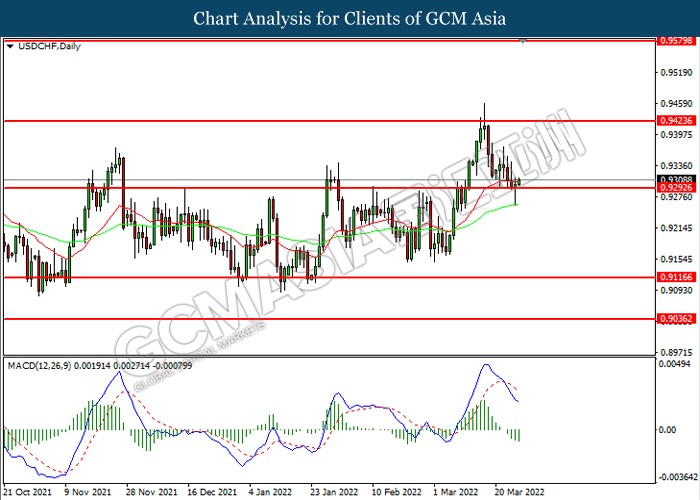

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9425, 0.9580

Support level: 0.9295, 0.9115

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 114.45, 120.10

Support level: 110.45, 106.45

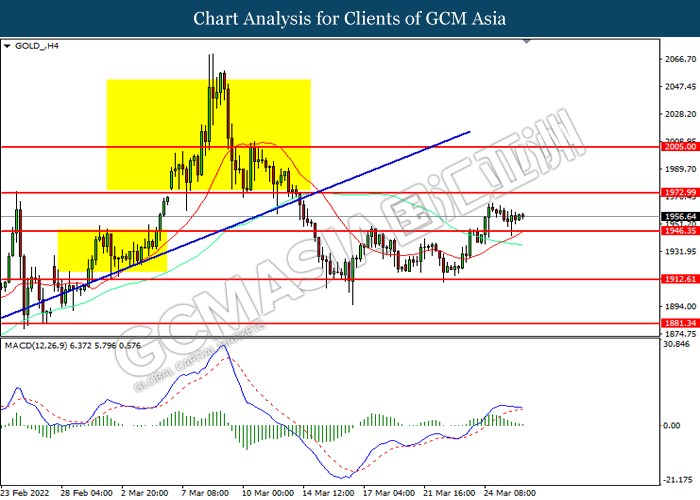

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1973.00, 2005.00

Support level: 1946.35, 1912.60