28 April 2022 Afternoon Session Analysis

Euro beaten down amid gas cut-off from Russia.

Euro eased to its recent low since yesterday following the gas cut-off from Russia to Europe. According to Reuters, Ukraine appeared a speech that Europe should stop depending on Russia for trade after Moscow halted gas supplies to Bulgaria and Poland for not paying in roubles, as the shutoff exposed the continent’s weaknesses and divisions on Wednesday. Gazprom, Russia’s gas export monopoly, suspended gas supplies “due to absence of payments in roubles”, as stipulated in a decree from Russian President Vladimir Putin that aims to soften the impact of sanctions. As Europe was the largest dependent on the Russia commodities, the diminishing commodities such as natural gas would drag down the economic activities in Europe region, leading to the disruption of domestic productivity. It dialed down the market optimism toward economic progression in Europe, prompting investors to selloff Euro. Besides, the hawkish tone from Federal Reserve would likely reduce the US Dollar circulation in the market, sparkling the appeal for the US Dollar and spurring further bearish momentum on the Euro. As of writing, EURUSD depreciated by 0.19% to 1.0534.

In commodities market, crude oil price slumped by 1.52% to $100.50 per barrel as of writing amid Some of Europe’s largest energy companies are making arrangements to comply with a new payment system for Russian gas sought by the Kremlin, which may lead to the surge of oil supply. On the other hand, gold price depreciated by 0.47% to $1880.00 per troy ounces as of writing over the rally of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative JPY BoJ Monetary Policy Statement

Tentative JPY BoJ Outlook Report (YoY)

Tentative JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | 6.90% | 1.10% | – |

| 20:30 | USD – Initial Jobless Claims | 184K | 180K | – |

Technical Analysis

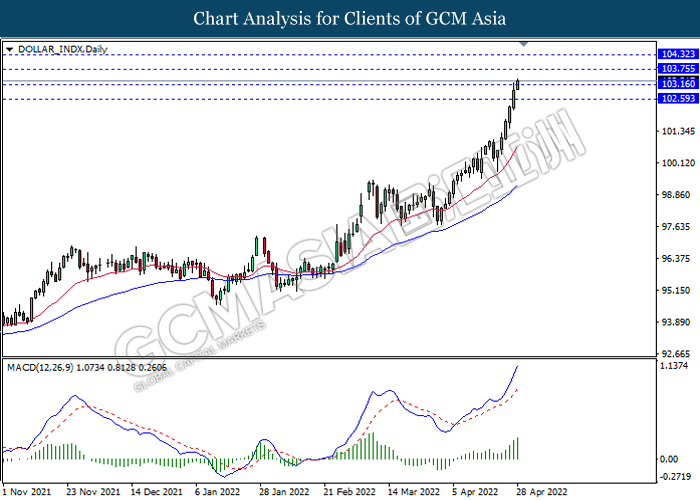

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 103.75, 104.30

Support level: 103.15, 102.60

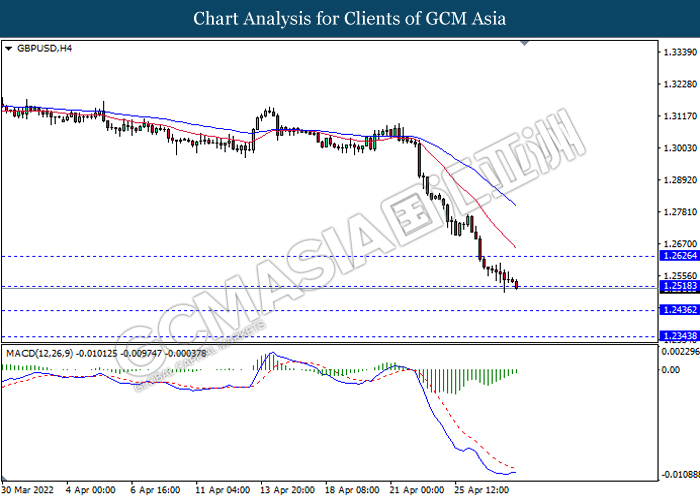

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2520, 1.2625

Support level: 1.2435, 1.2345

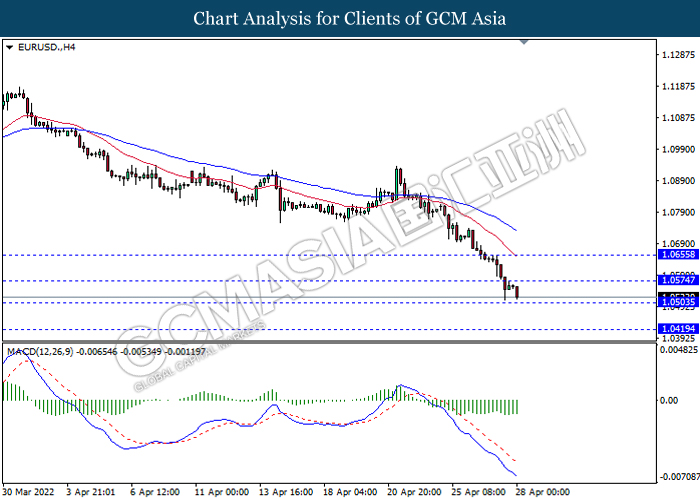

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

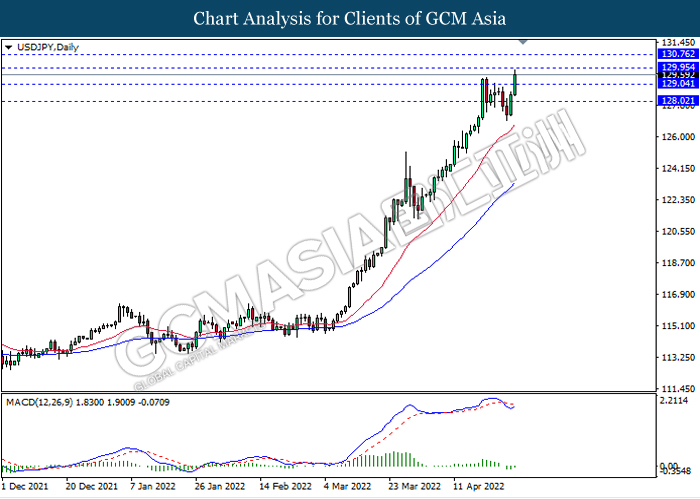

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 129.95, 130.75

Support level: 129.05, 128.00

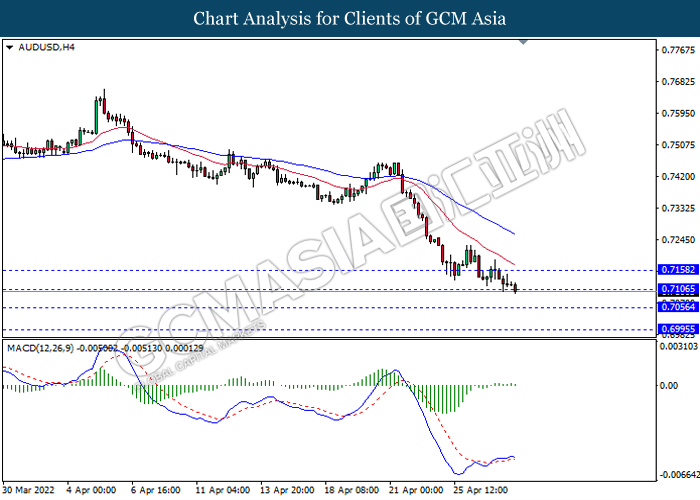

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7105, 0.7160

Support level: 0.7055, 0.6995

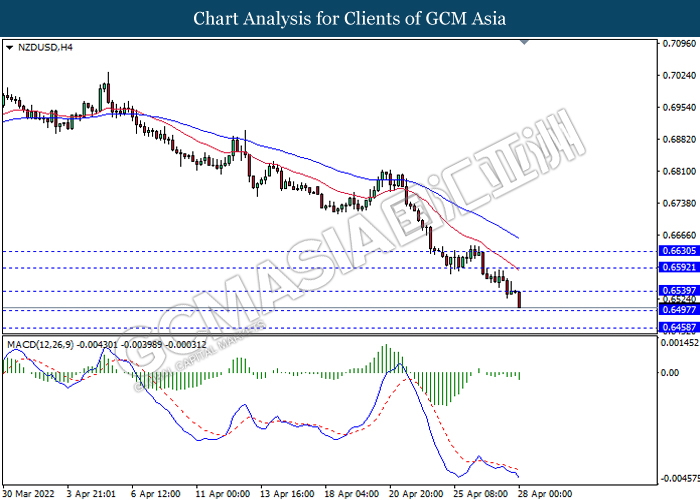

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6540, 0.6590

Support level: 0.6495, 0.6460

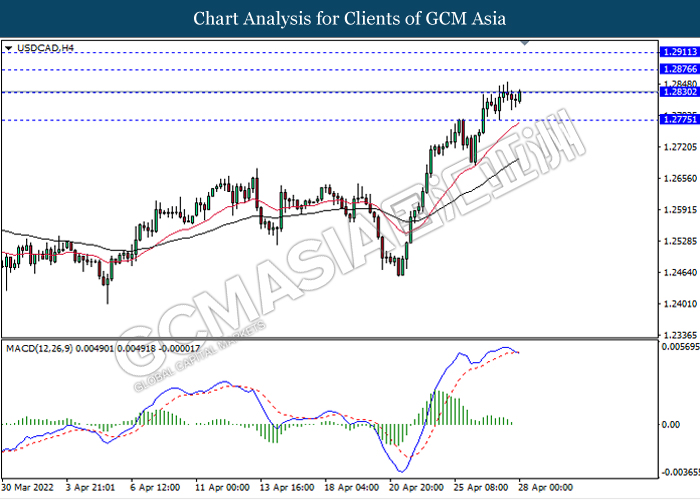

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2875, 1.2910

Support level: 1.2830, 1.2775

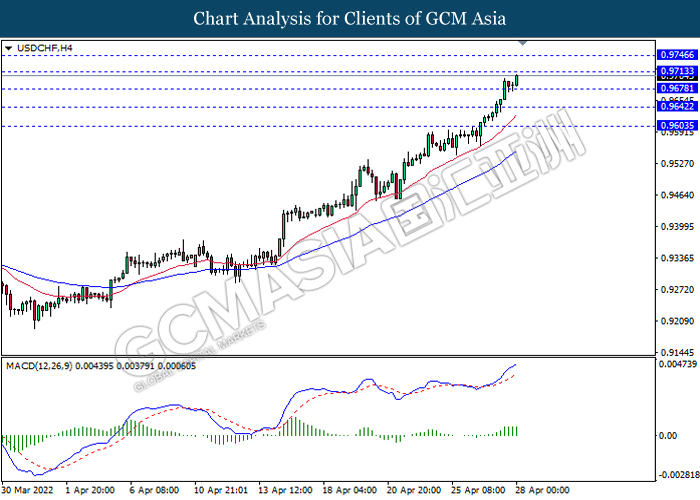

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9715, 0.9745

Support level: 0.9680, 0.9640

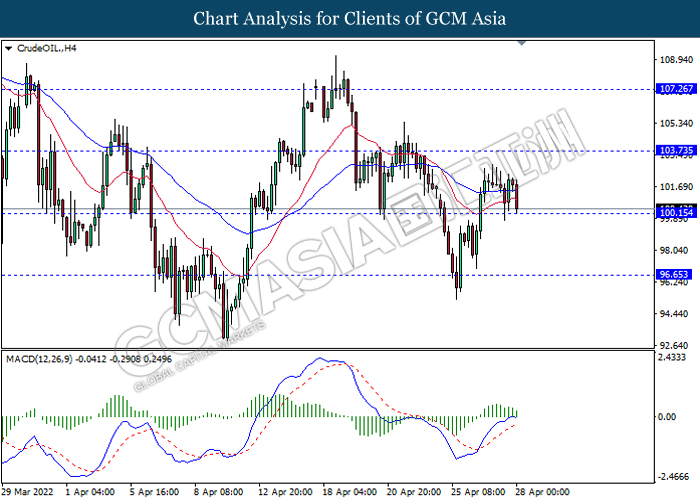

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 103.75, 107.25

Support level: 100.15, 96.65

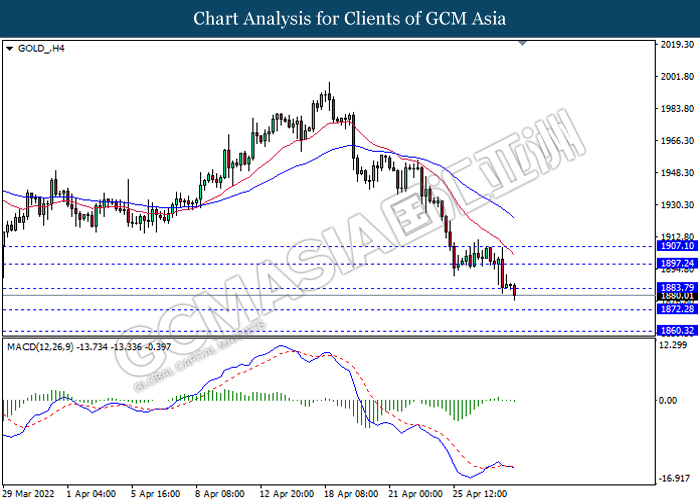

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1883.80, 1897.25

Support level: 1872.30, 1860.30