28 April 2022 Morning Session Analysis

US Dollar surged amid hawkish bet on Fed.

The Dollar Index which traded against a basket of six major currencies surged to its highest level since the pandemic began as hawkish expectation from Federal Reserve continue to linger in the financial market. Investor bet on an aggressive path of contractionary monetary policy from Fed following the Fed Chairman Jerome Powell confirmed that the central bank would be increasing their interest rates by 50 basis points in May. Besides, the recent hawkish tone from Fed members have stoked speculation on whether the central bank will hint a much larger 75 basis point to combat the spiking inflation risk. In addition, the US Dollar extend its gains as risk-off sentiment in global financial market following Russia’s Gazprom halted gas supplies to Poland and Bulgaria on Wednesday over their failure to pay in rubles, sparked higher stagflation risk in future. As of writing, the Dollar Index appreciated by 0.67% to 102.99.

In the commodities market, the crude oil price surged 0.03% to $102.45 per barrel as of writing over the backdrop of bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at 0.692M, lesser than the market forecast at 2.000M. On the other hand, the gold price depreciated by 0.02% to $1885.95 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative JPY BoJ Monetary Policy Statement

Tentative JPY BoJ Outlook Report (YoY)

Tentative JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | 6.90% | 1.10% | – |

| 20:30 | USD – Initial Jobless Claims | 184K | 180K | – |

Technical Analysis

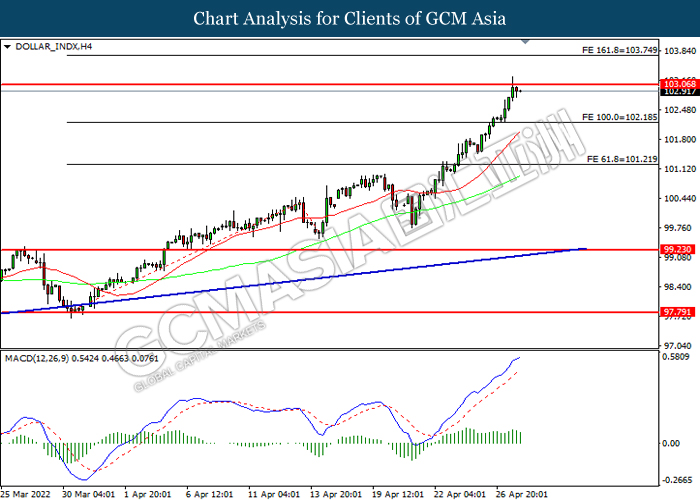

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded l lower as technical correction.

Resistance level: 103.05, 103.75

Support level: 102.20, 101.20

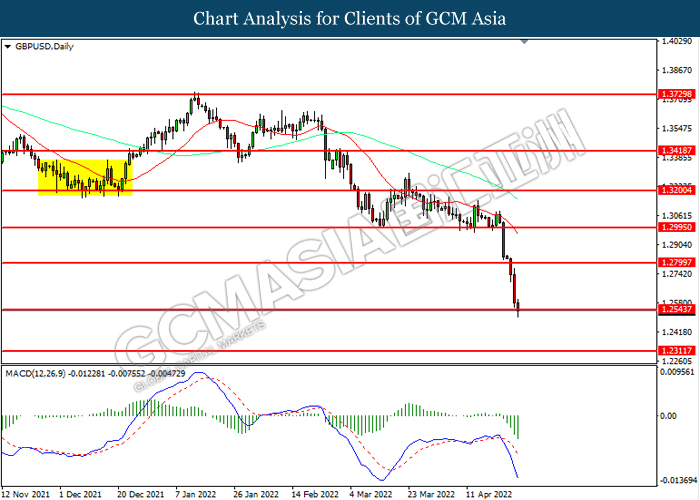

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2800, 1.2995

Support level: 1.2545, 1.2310

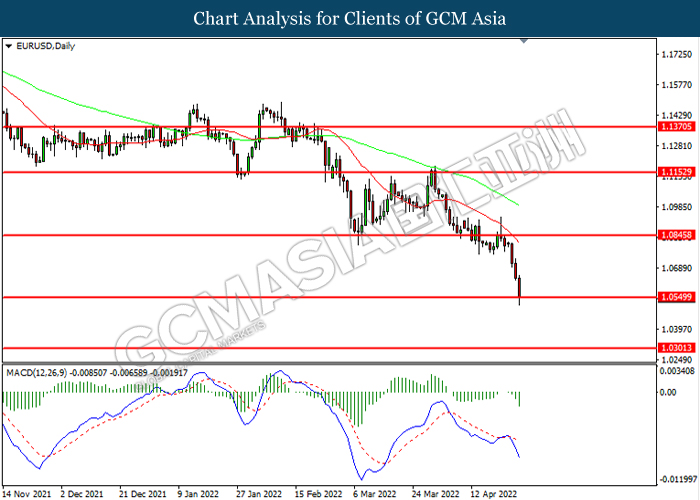

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0845, 1.1155

Support level: 1.0550, 1.0300

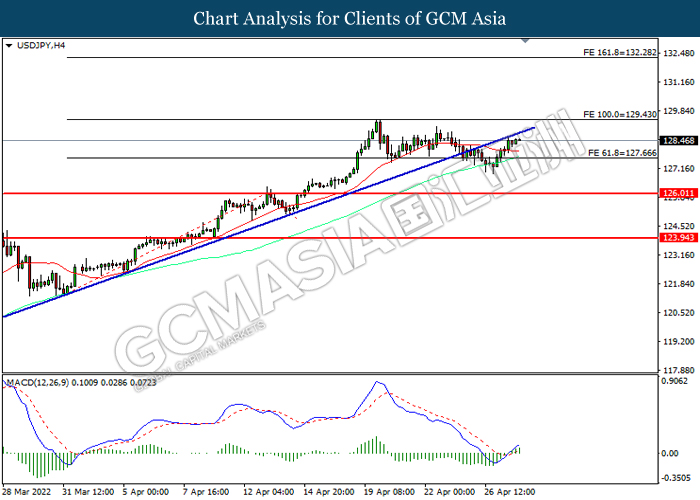

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 129.45, 132.30

Support level: 127.65, 126.00

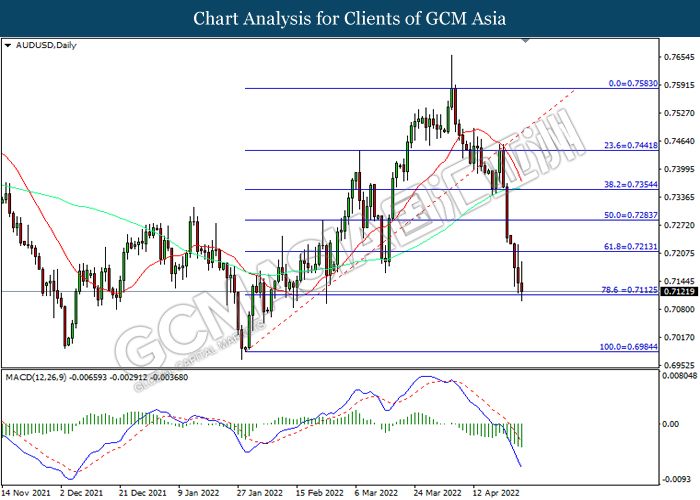

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7215, 0.7385

Support level: 0.7115, 0.6985

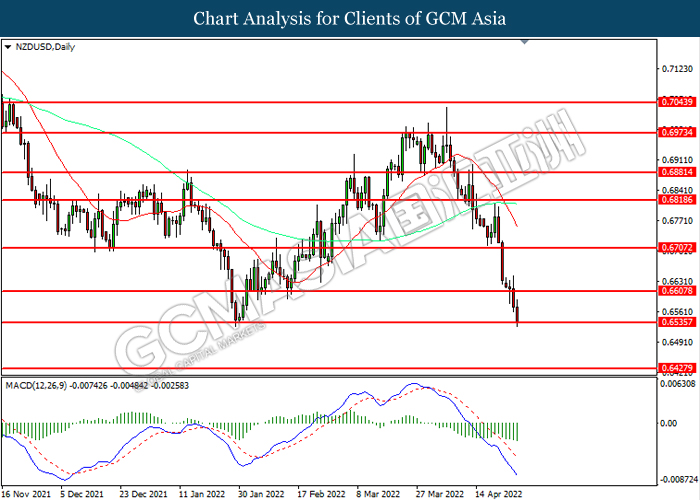

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6605, 0.6705

Support level: 0.6535, 0.6430

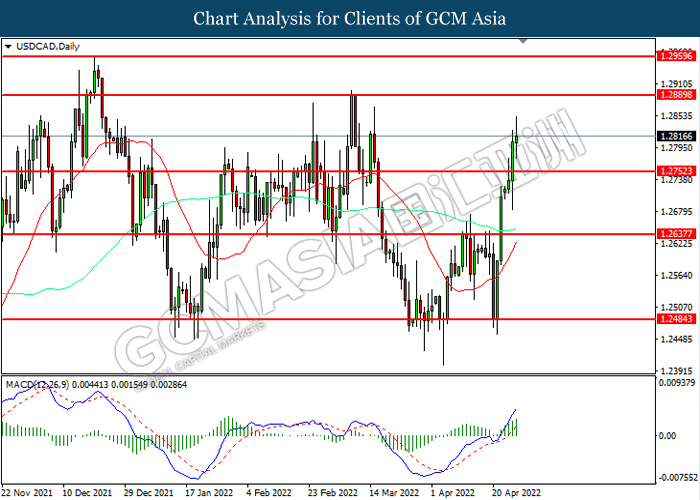

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2890, 1.2960

Support level: 1.2750, 1.2635

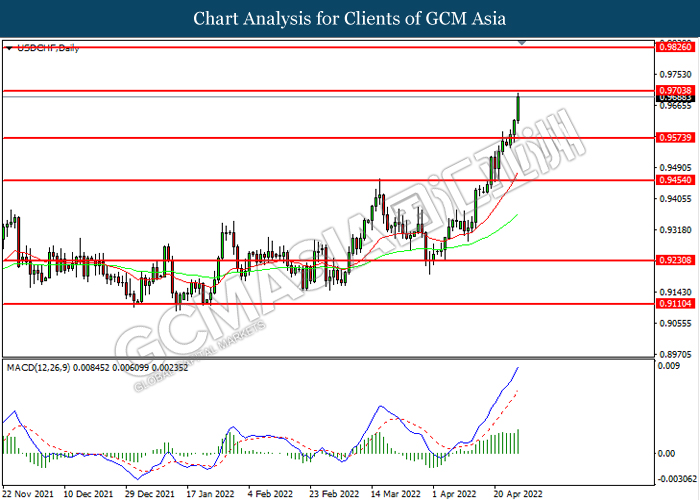

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9705, 0.9825

Support level: 0.9575, 0.9455

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 102.95, 105.50

Support level: 100.40, 97.85

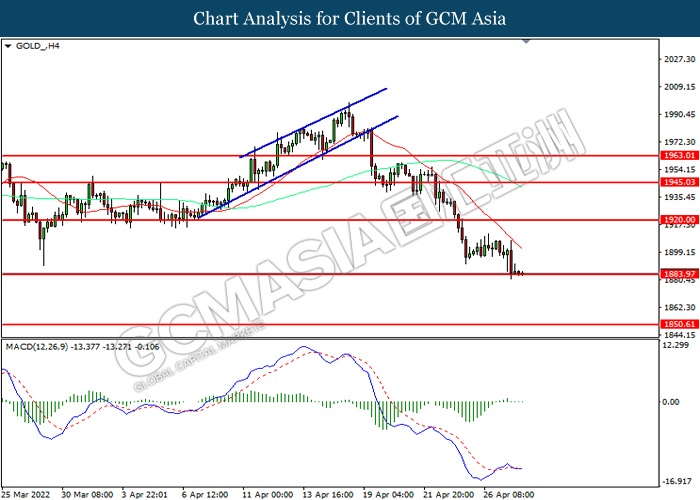

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1920.00, 1945.05

Support level: 1883.95, 1850.60