28 April 2023 Afternoon Session Analysis

The yen slipped after the BoJ maintained its policy.

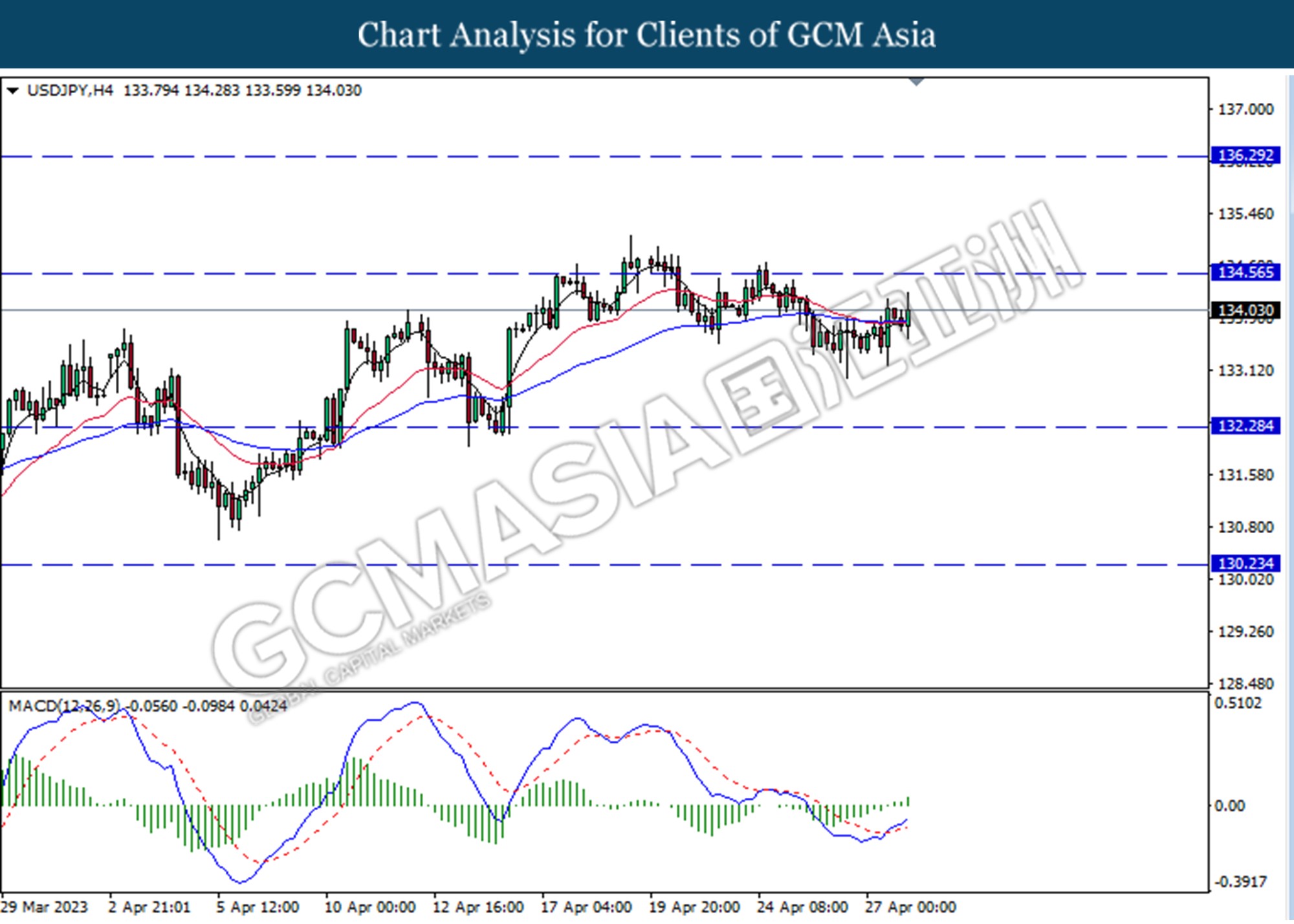

The Japanese Yen the third most commonly traded currency in the world slipped amid the Bank of Japan (BoJ) maintained its ultra-loosen monetary policy. Kazuo Ueda, the new governor of the Bank of Japan, kept interest rates at -0.1%, and the 10-year government bond yield remained near zero, in line with market consensus. As a result, the pair of USDJPY soar up as the Japanese Yen experienced a massive sell-off by global investors. However, the recent optimistic economic data released was unable to save the Yen from falling. The Bureau of Statistics of Japan showed that the Tokyo Consumer Price Index grew to 3.5% from 3.2%, above the market estimation of 3.2%. The board revised its core consumer inflation afterward, to 1.8% from 1.6% under previous projections made in January and 2.0% in the following year. Besides, the retail sales data rose to 7.2%, upbeat the market expectation of 5.8%. The series of optimistic economic data lost its luster after the BoJ monetary easing. As of writing, the pair of USD/JPY soars up 0.82% to $135.03.

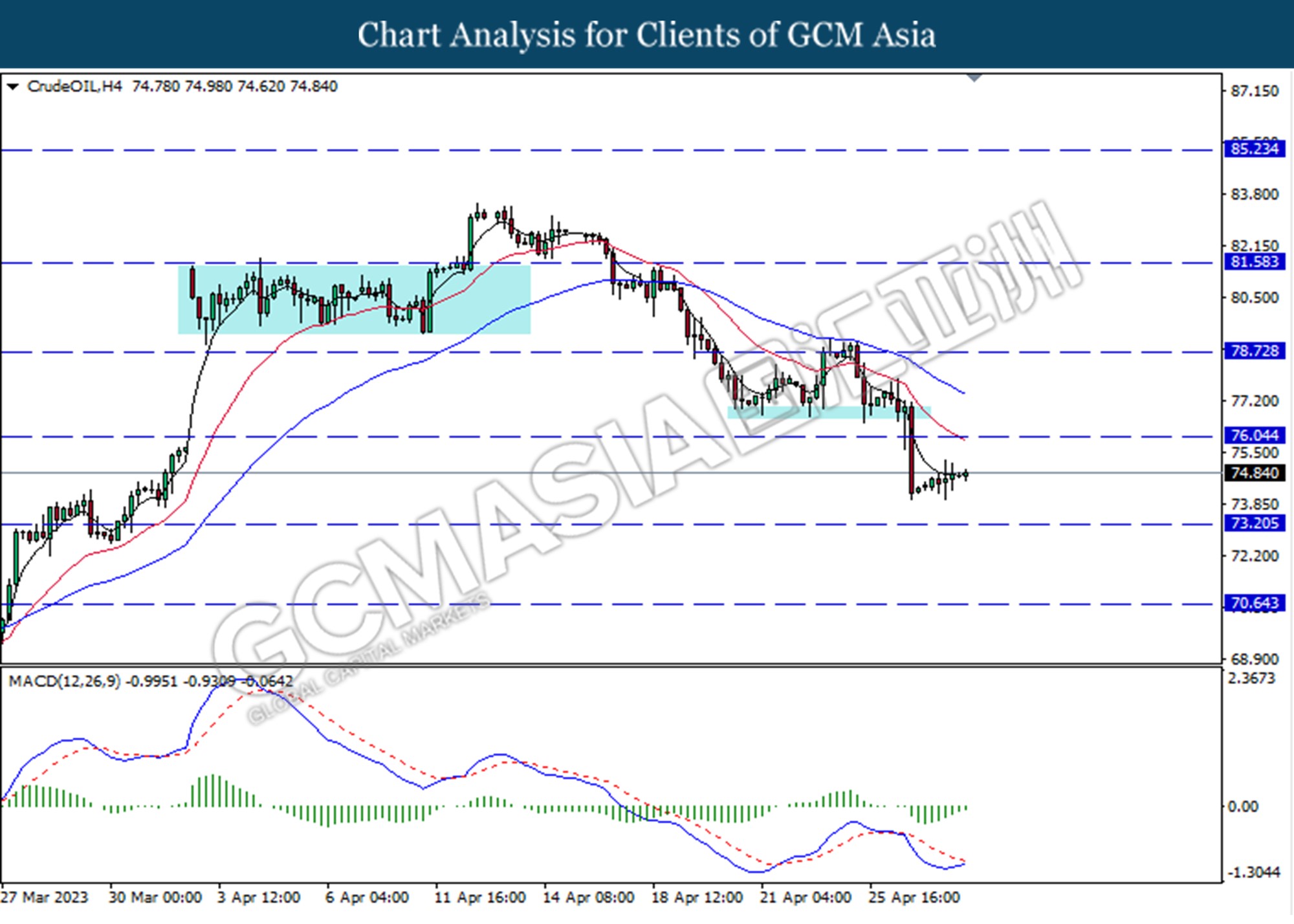

In the commodities market, crude oil prices edged up by 0.49% to $75.12 per barrel following a prior sharp decline in price after the recession risk increased. Besides, gold prices dipped down by -0.14% to $1985.09 per troy ounce as strong inflation and labor data in the US

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q1) | 0.9% | 0.3% | – |

| 20:00 | EUR – German CPI (MoM) (Apr) | 0.8% | 0.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Mar) | 0.3% | 0.3% | – |

| 20:30 | CAD – GDP (MoM) (Feb) | 0.5% | 0.2% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Apr) | 63.5 | 63.5 | – |

Technical Analysis

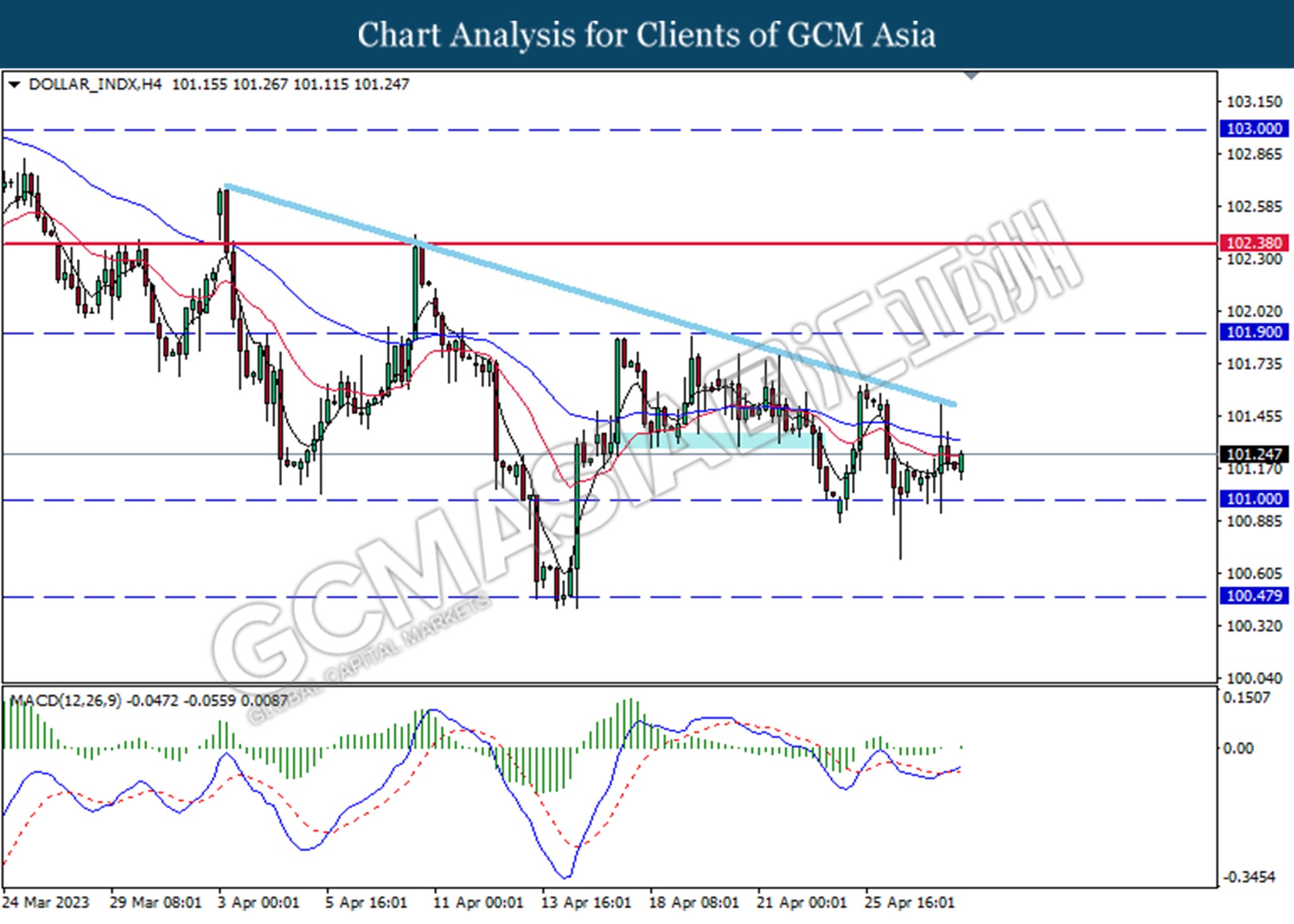

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the support level at 101.00. MACD which illustrated increasing bullish momentum suggests the index extended its gains towards the resistance level.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

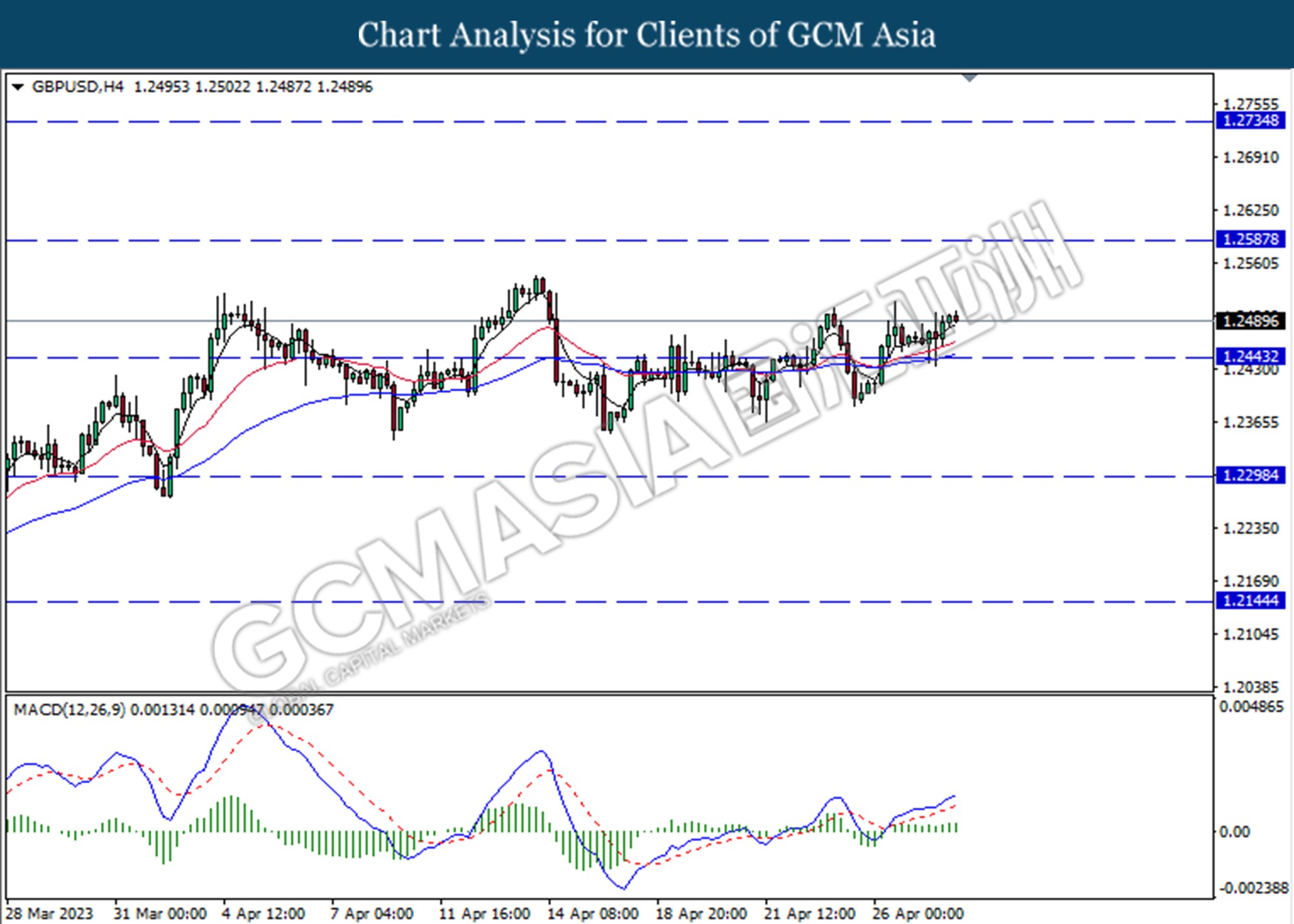

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2445. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.2590.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

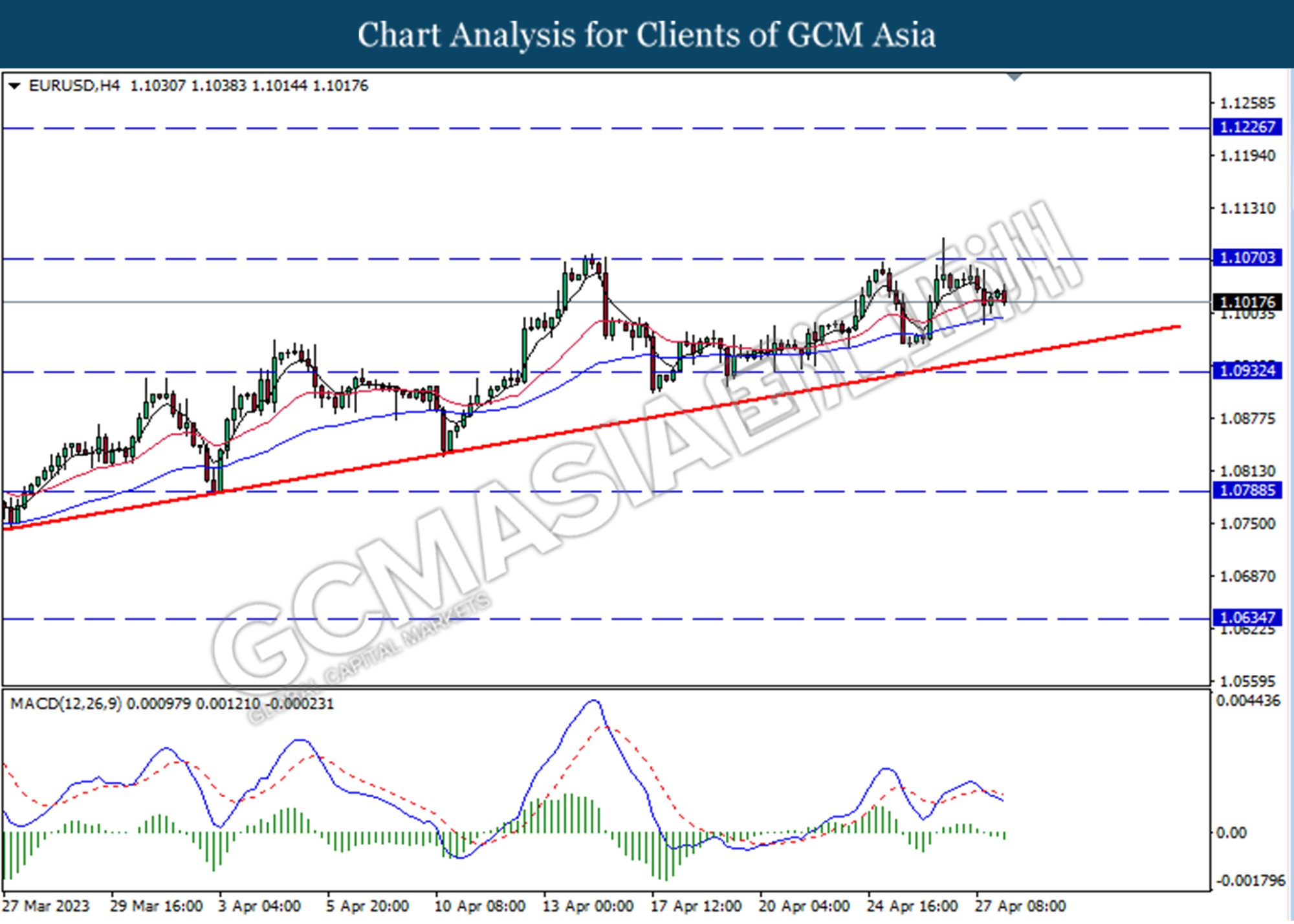

EURUSD, H4: EURUSD was traded lower following a prior retracement from a higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.0930.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 134.55.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

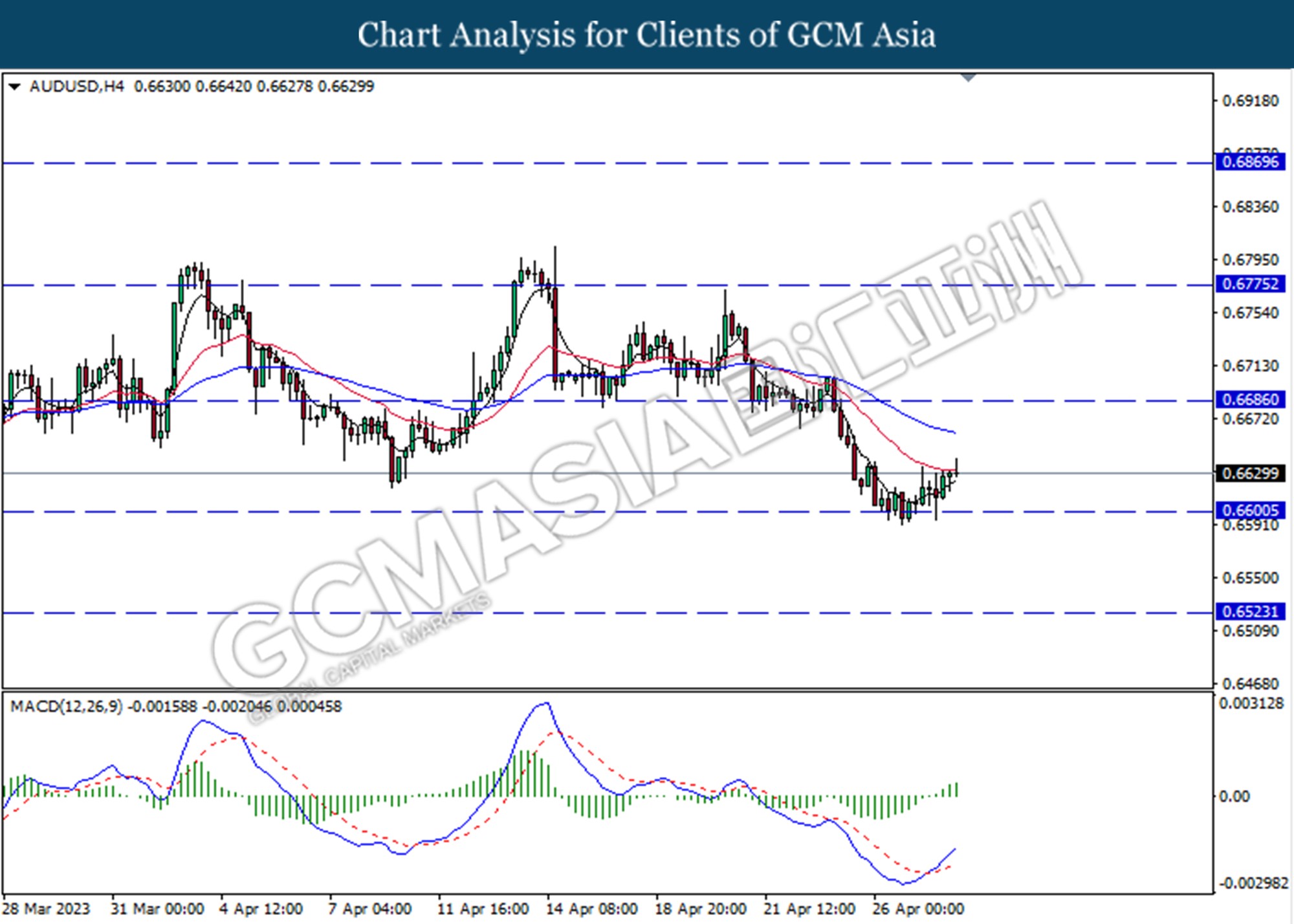

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6600. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6120. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6195.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

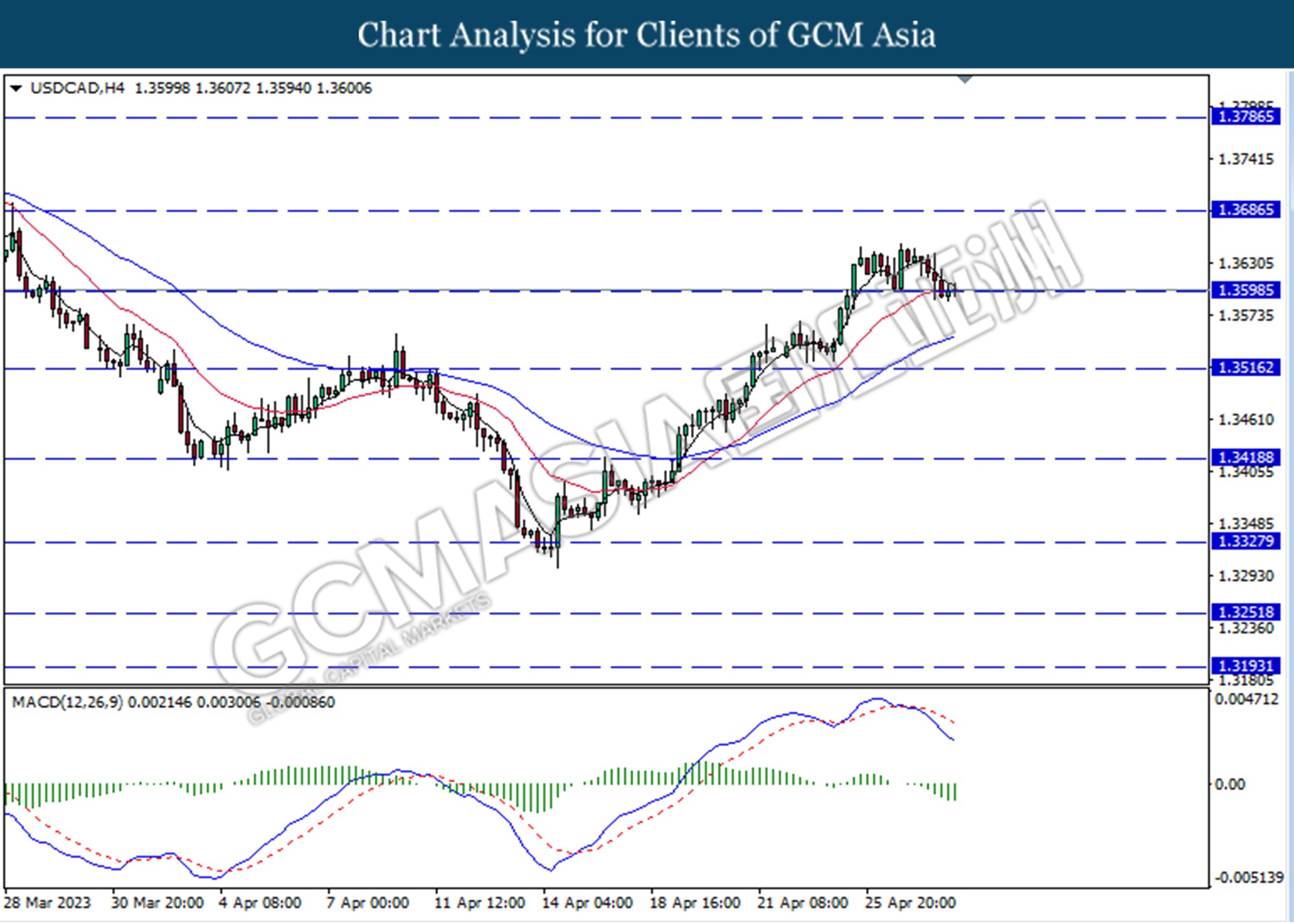

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3600. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses if successfully breaks below the support level.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

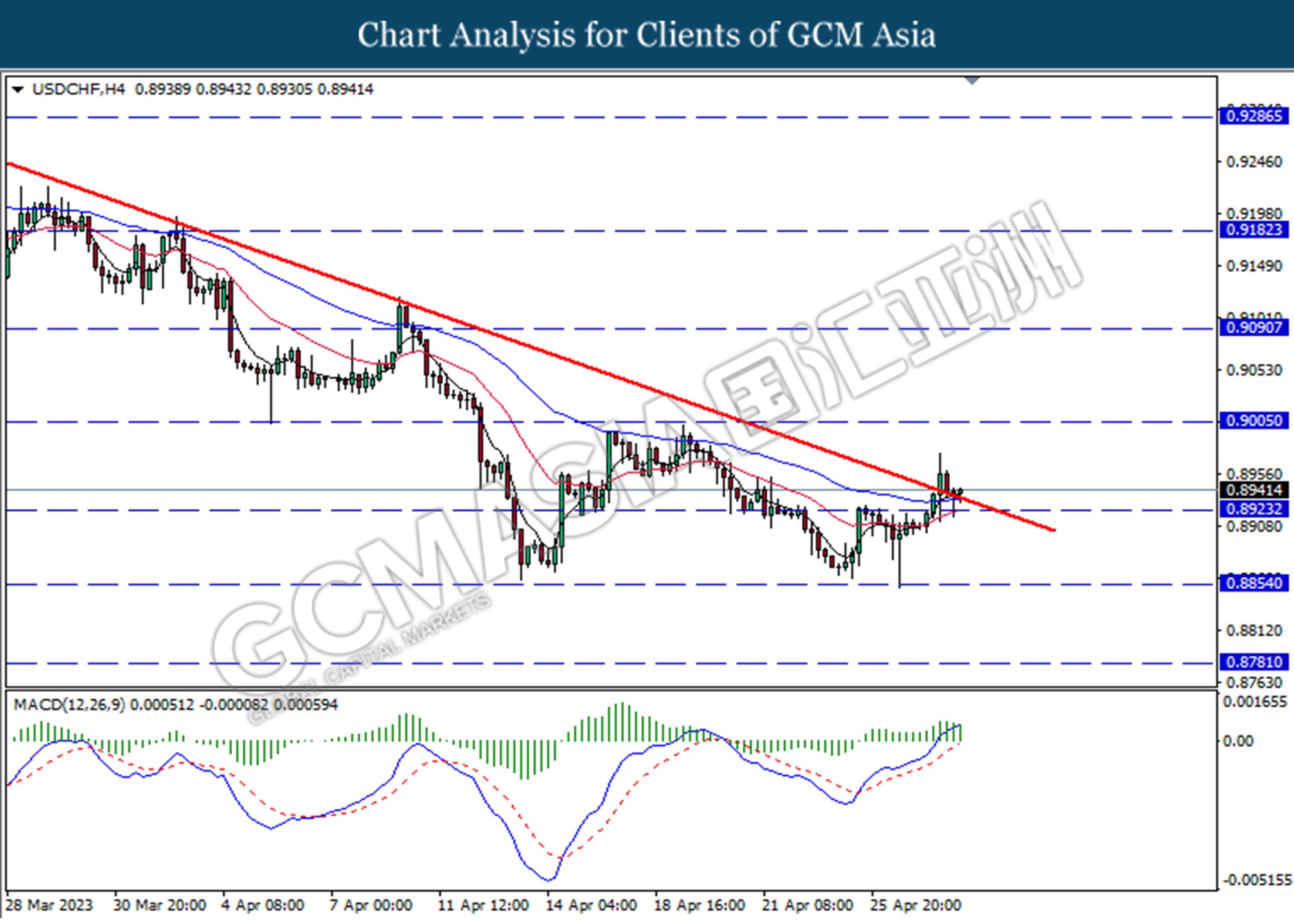

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.8925. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 76.05.

Resistance level: 76.05, 81.60

Support level: 73.20, 70.65

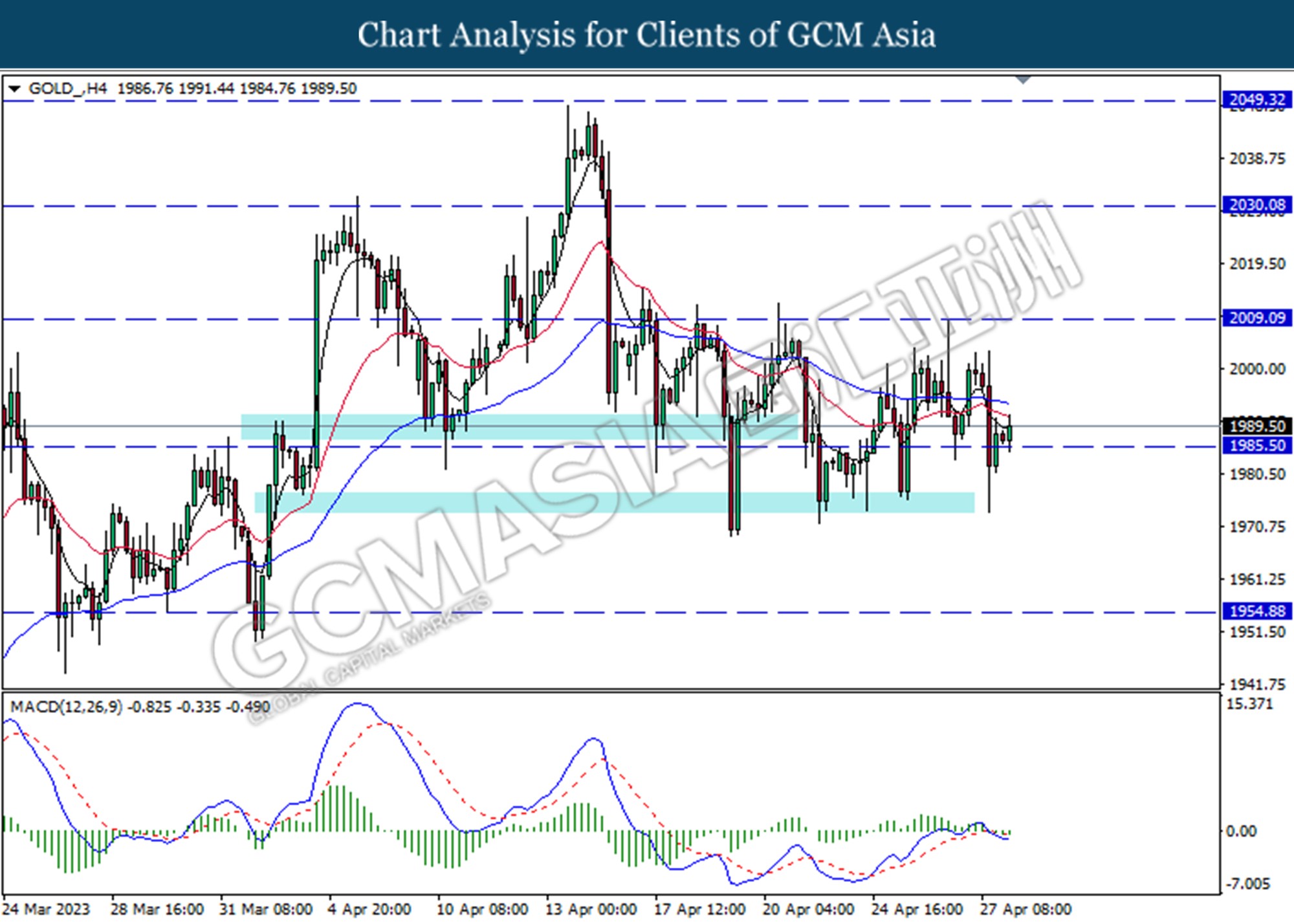

GOLD_, H4: Gold price was traded higher following a prior break above the previous resistance level at 1985.50. However, MACD which illustrated bearish momentum suggests the commodity to trade lower as a technical correction.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90