28 July 2022 Afternoon Session Analysis

Aussie seesawed after softer-than-expected retail sales was released.

The Australian dollar, which widely known as Aussie, slipped after Australia posted a downbeat data at home. According to Australian Bureau of Statistic, Australia retail sales data dropped from 0.9% to 0.2%, missing the consensus forecast of 0.5%, citing the heightening risk of economic slowdown in Australia. Despite the downbeat data, the pair of AUD/USD did not experience huge tumble as the dollar index continue to support the upward trend of the currency pair. Early today, the Fed Interest Rate Decision has been unleashed, where the FOMC members adjusted the rate upward from 1.75% to 2.50%, hitting the market analyst expectation. Prior to that, the market participants were in a midst of either a 75-basis point rate hike or a 100-basis point of that. As the rate hike amplitude was not as big as market expects, hence it triggered a huge sell-off pressure in dollar market, while prompting the investors to shift their capital toward other markets such as Pound, Aussie and etc. As of writing, the pair of AUD/USD down 0.11% to 0.6985.

In the commodities market, the crude oil price up 0.46% to $98.70 a barrel as the appreciation of the US dollar caused the cost of oil became slightly cheap for the non-US buyers, while huge crude oil inventories drew further support the black commodity price. Besides, the gold prices jumped 0.06% to $1735.25 per troy ounce following a smaller-than-expected rate hike during the overnight FOMC meeting.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q2) | -1.60% | 0.40% | – |

| 20:30 | USD – Initial Jobless Claims | 251K | 253K | – |

Technical Analysis

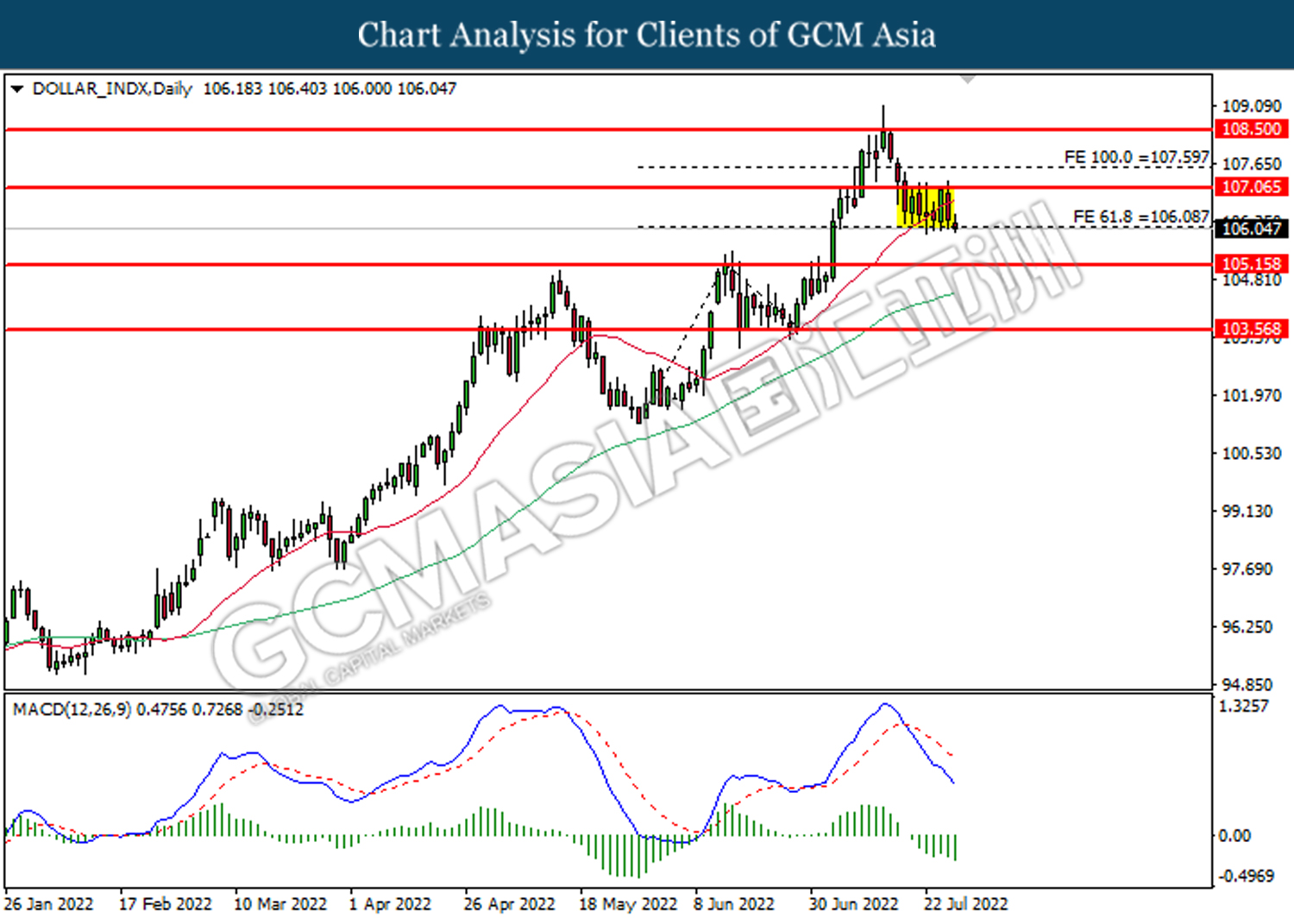

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 106.10. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 107.60, 108.50

Support level: 106.10, 105.15

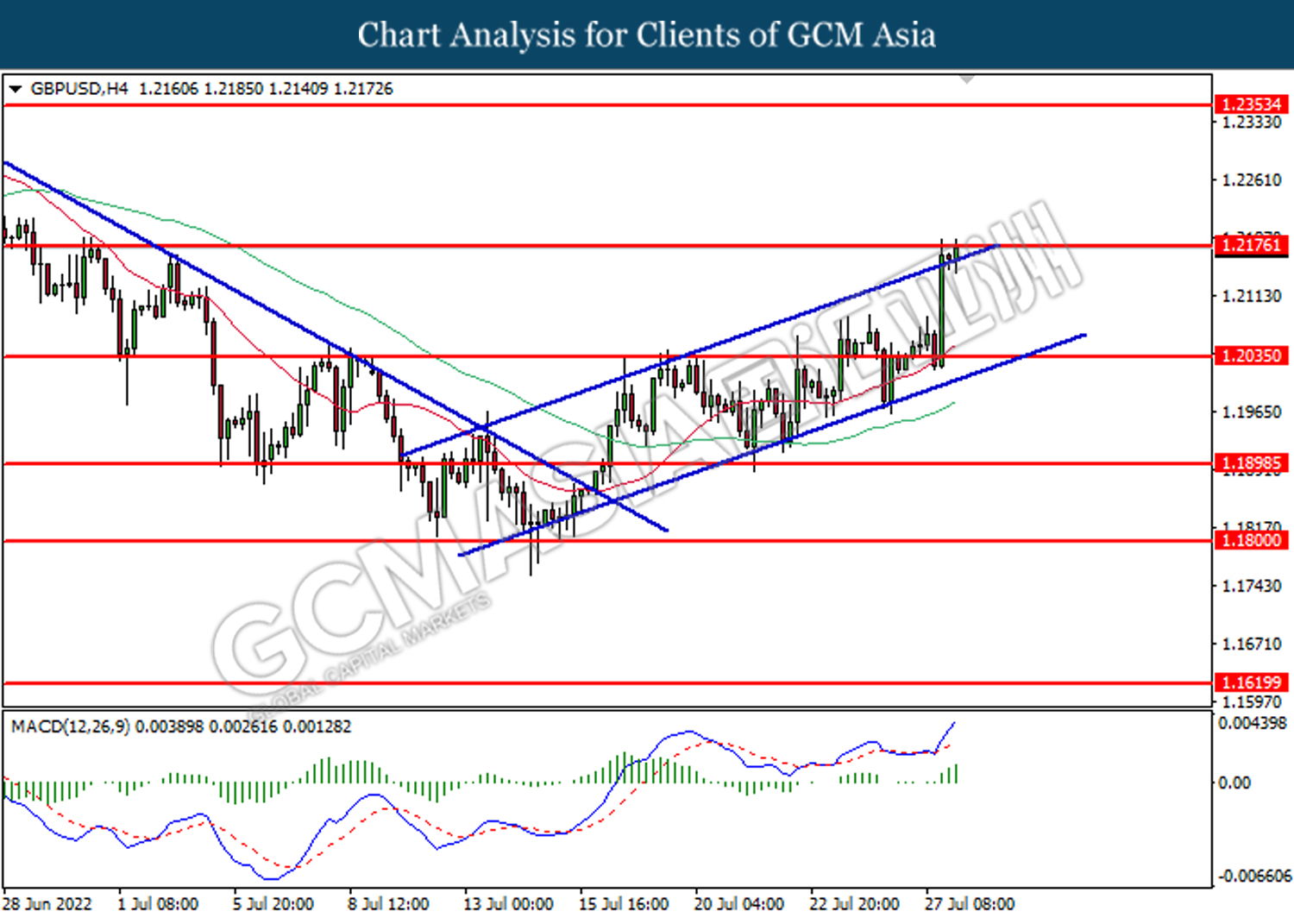

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

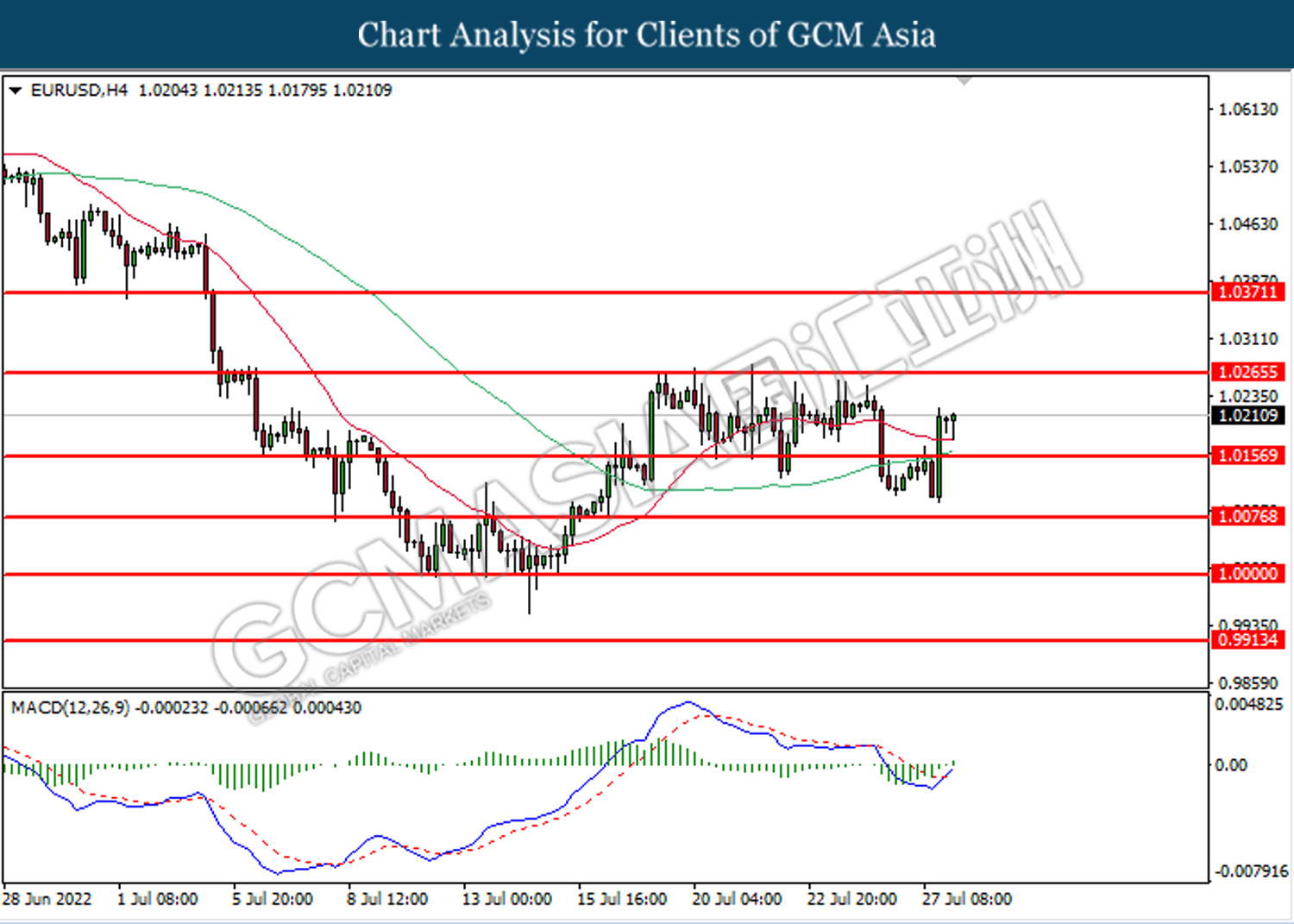

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

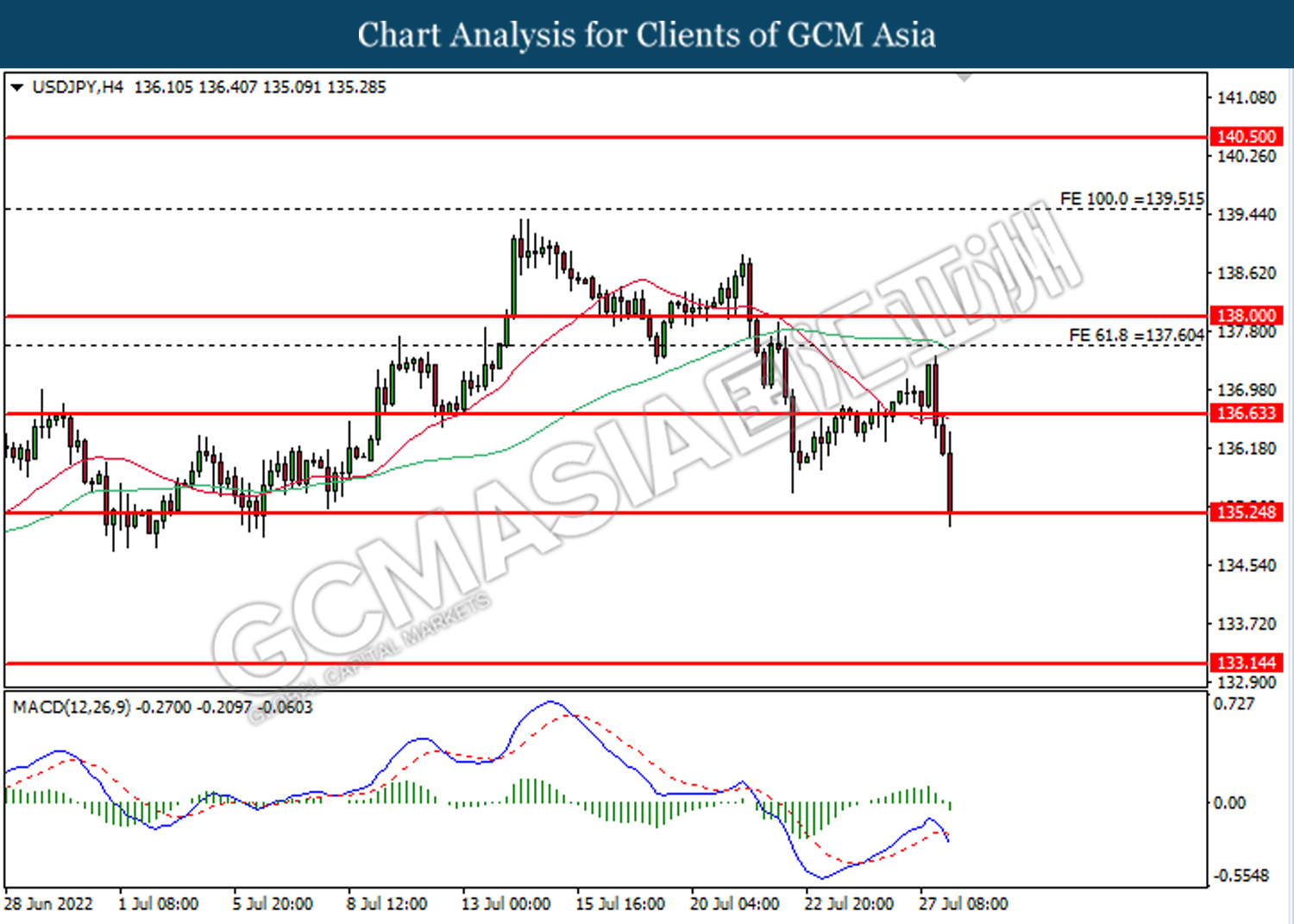

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 135.25. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 136.65, 138.00

Support level: 135.25, 133.15

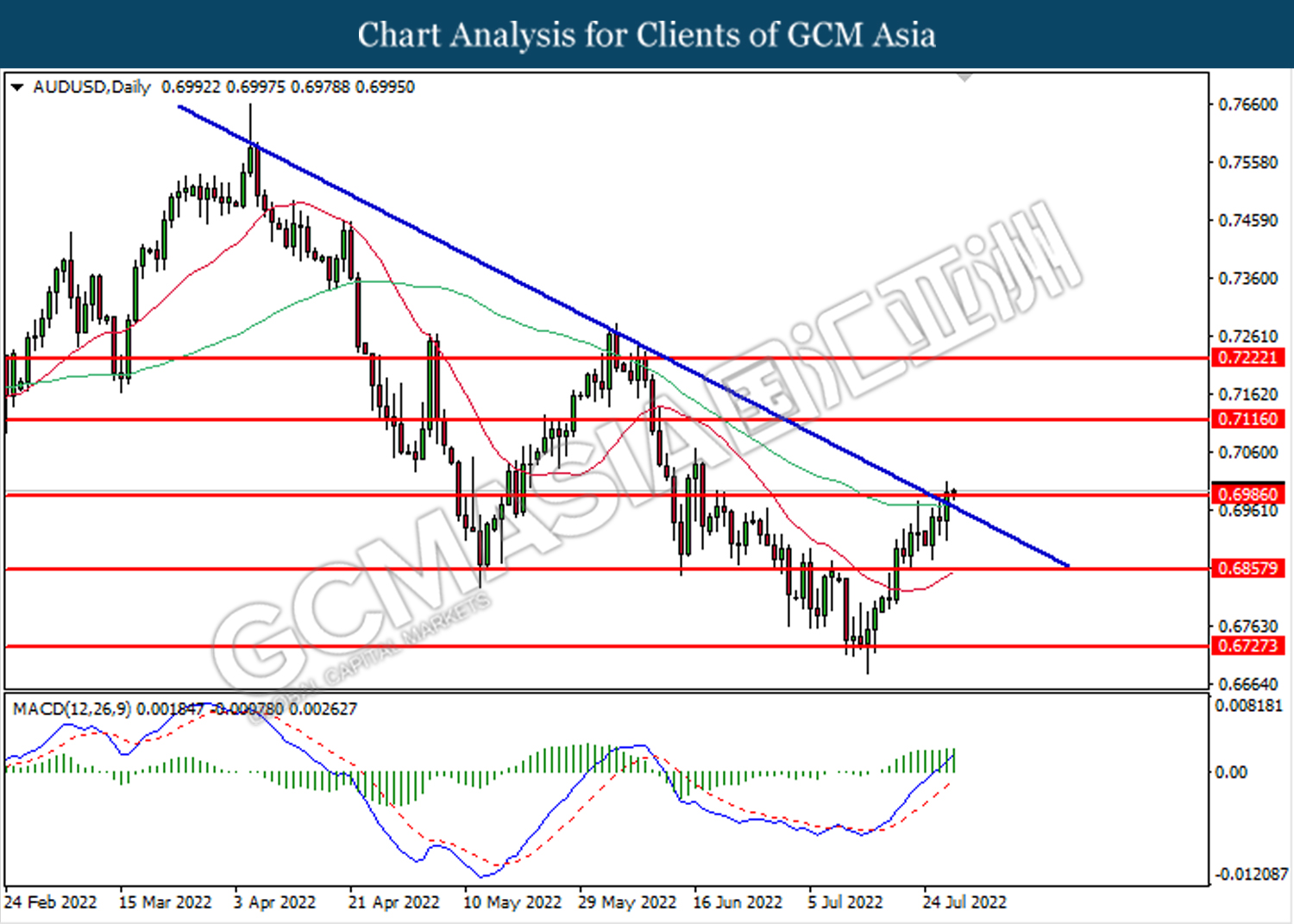

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

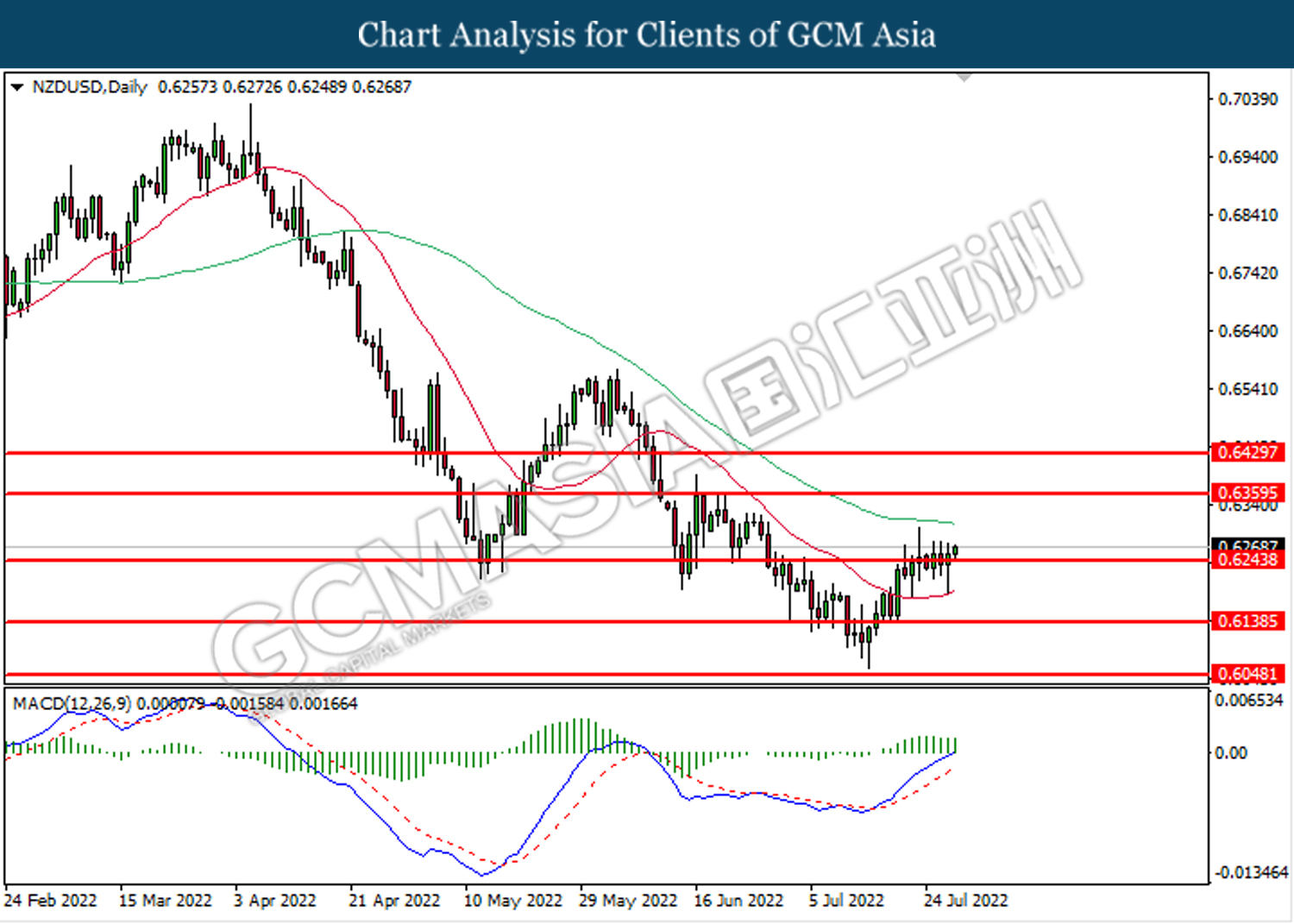

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

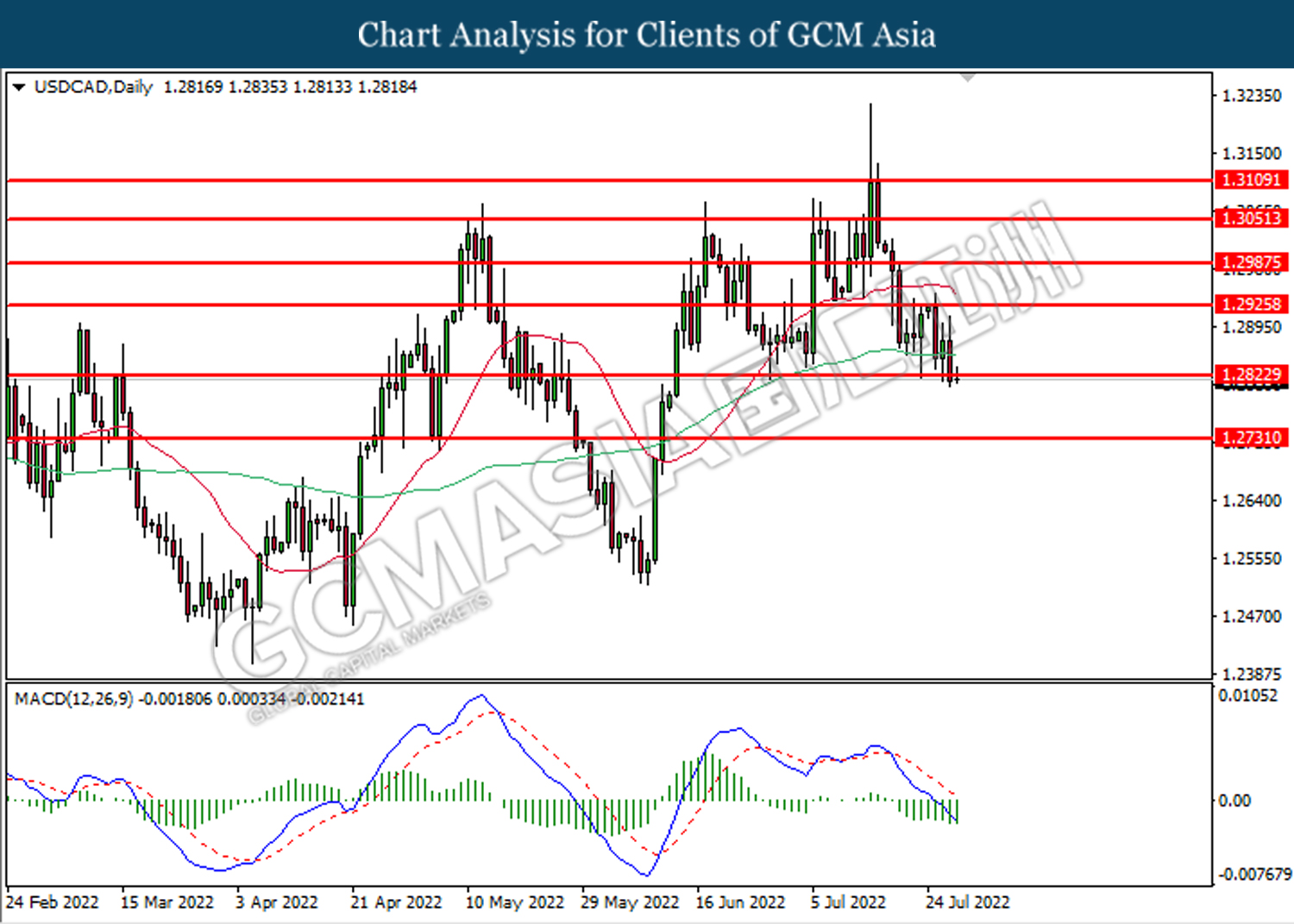

USDCAD, Daily: USDCAD was traded lower while currently testing near the support level at 1.2825. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2925, 1.2985

Support level: 1.2825, 1.2755

USDCHF, Daily: USDCHF was traded lower following prior breakout below the prior support level at 0.9590. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9520.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

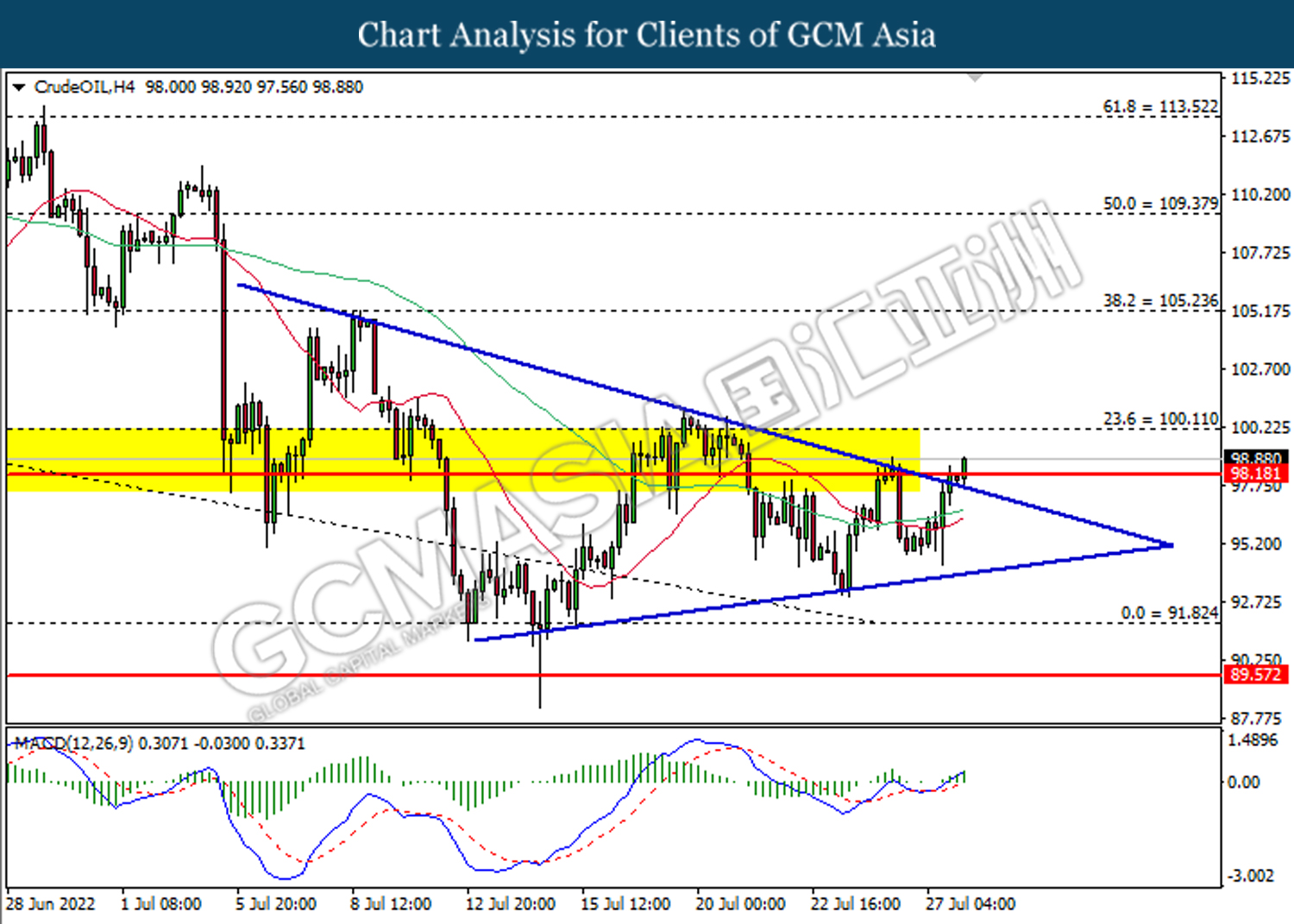

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 98.20. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after its candle successfully close above the resistance level.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

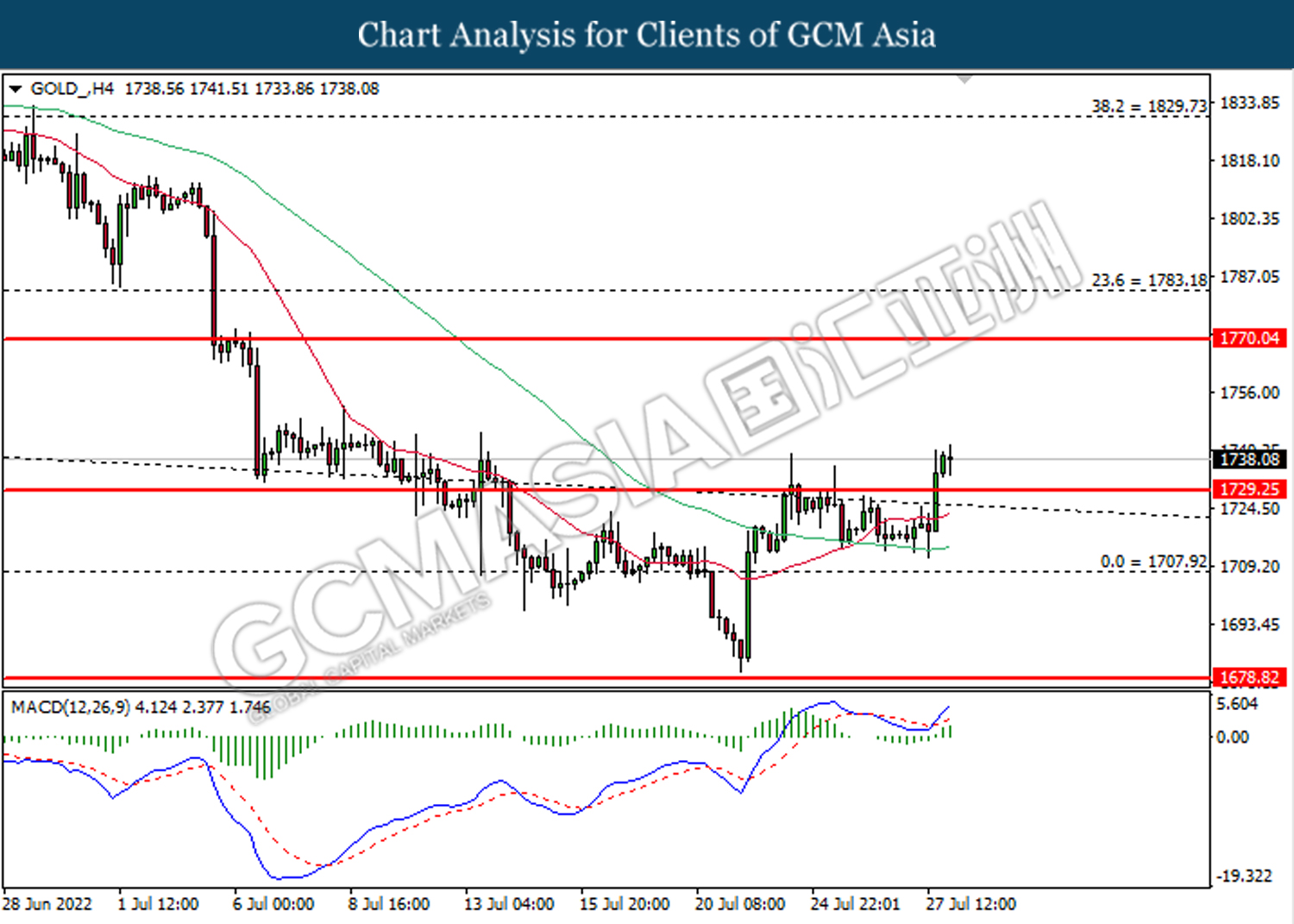

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistnace level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90