28 September 2022 Afternoon Session Analysis

Pound slumped amid worsening budget deficit.

The Pound Sterling extends its losses following the UK-denominated bond experienced a worst selloff in decades, with UK corporate bonds losing a stunning 27% this year. Earlier, the UK denominated bond slumped following the UK Prime Minister Liz Truss’s new government rolled out policy for large-scale tax cuts in order to boost up the economic momentum. Such policy had spurred further tensions toward the government’s already sizable budget deficit, which further dragging down the appeal for the Pound Sterling. On the other hand, the pair of EUR/USD received significant bearish momentum yesterday as market participants concerned that the shutdown of Nord Stream pipeline would likely to jeopardize the economic development in European region. According to Reuters, European Commission chief Ursula von der Leyen on Tuesday claimed that the leaks of the Nord Stream pipelines were caused by sabotage, deepening uncertainty about European energy security as soaring prices and fears of running short of fuel over the winter. As of writing, GBP/USD depreciated by 0.68% to 1.0655 while EUR/USD slumped 0.30% to 0.9560.

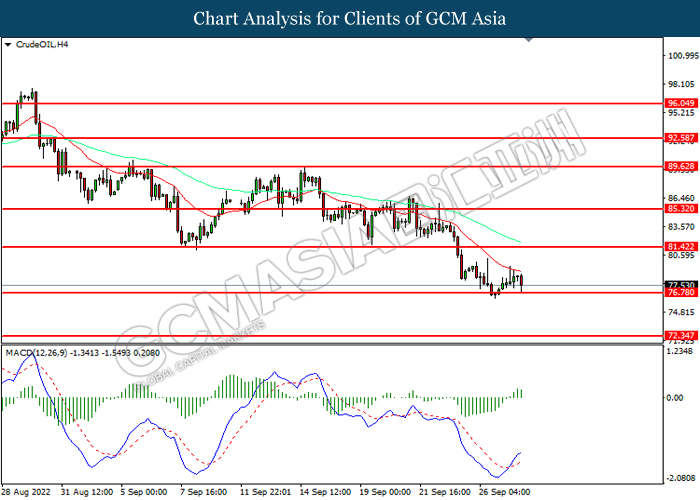

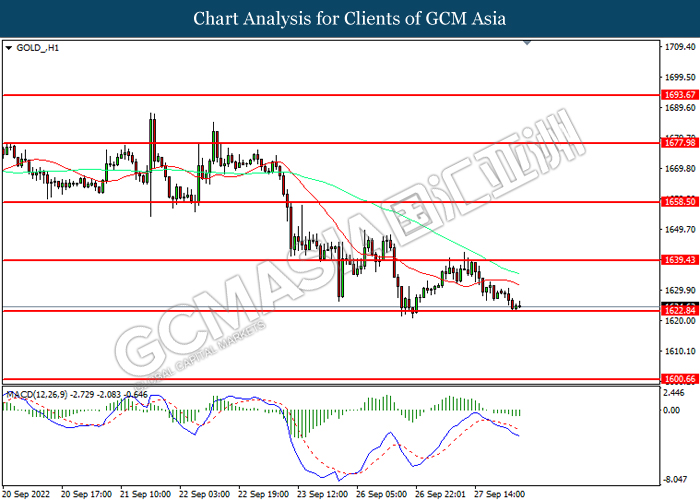

In the commodities market, the crude oil price depreciated by 0.54% to $77.55 per barrel as of writing amid downbeat economic prospect would likely to weigh down the market demand on this black-commodity. On the other hand, the gold price slumped 0.25% to $1624.95 per troy ounces as of writing following the United States released a string of positive economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:15 EUR ECB President Lagarde Speaks

22:15 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Pending Home Sales (MoM) (Aug) | -1.0% | -1.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.142M | – | – |

Technical Analysis

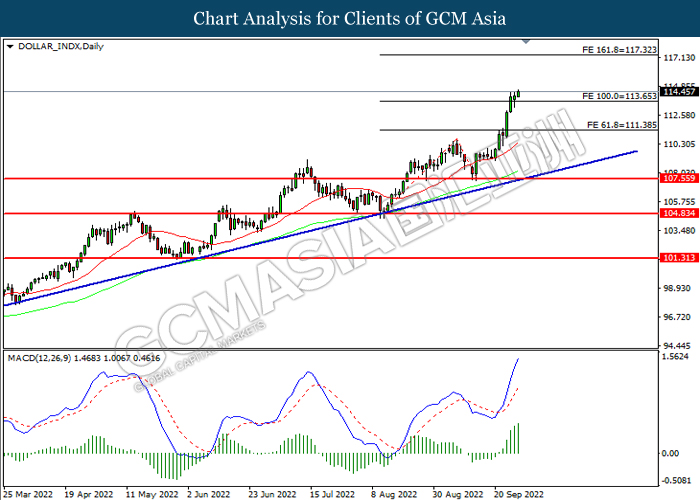

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 117.30, 120.00

Support level: 113.65, 111.40

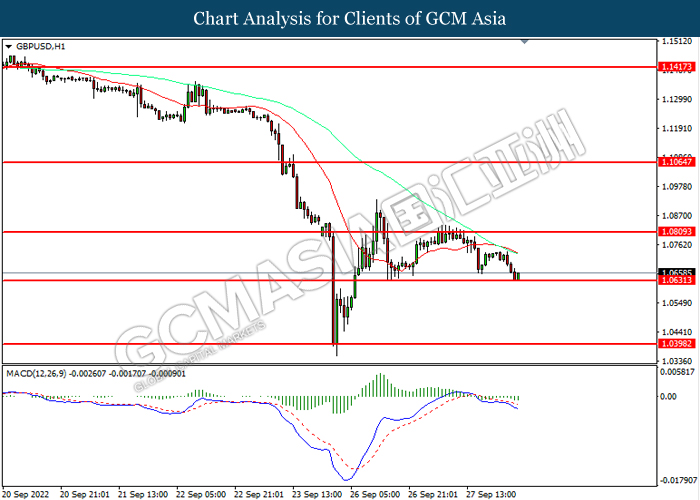

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout the support level.

Resistance level: 1.0810, 1.1065

Support level: 1.0630, 1.0400

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9740, 0.9915

Support level: 0.9460, 0.9135

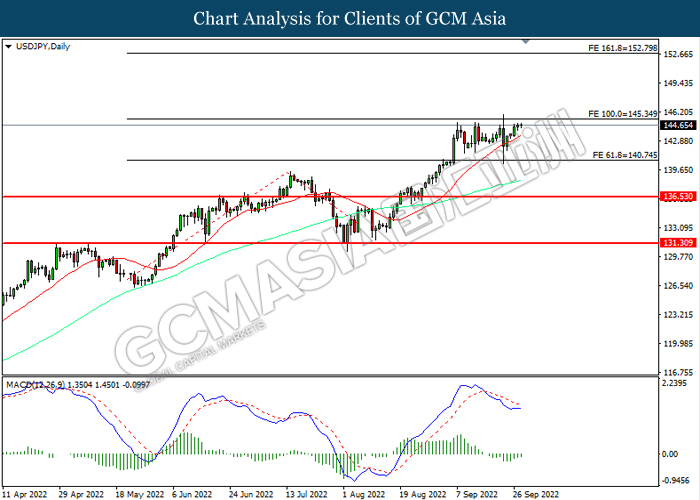

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

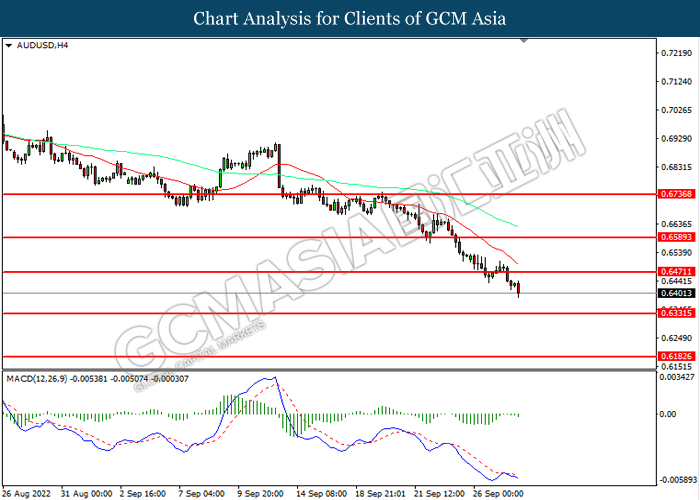

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6470, 0.6590

Support level: 0.6330, 0.6185

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

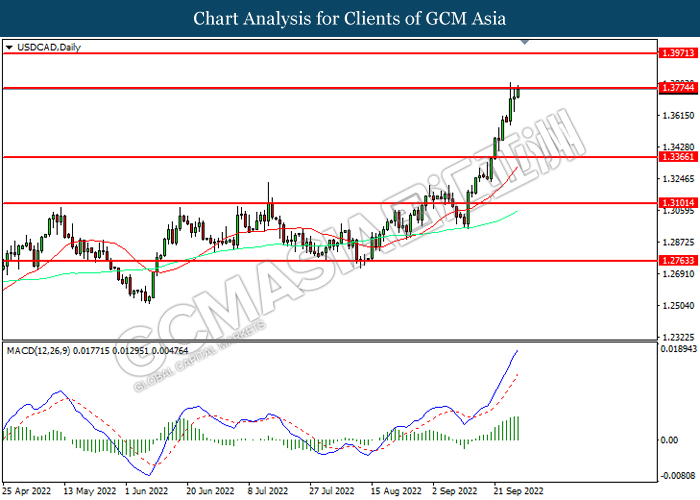

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3775, 1.3970

Support level: 1.3365, 1.3100

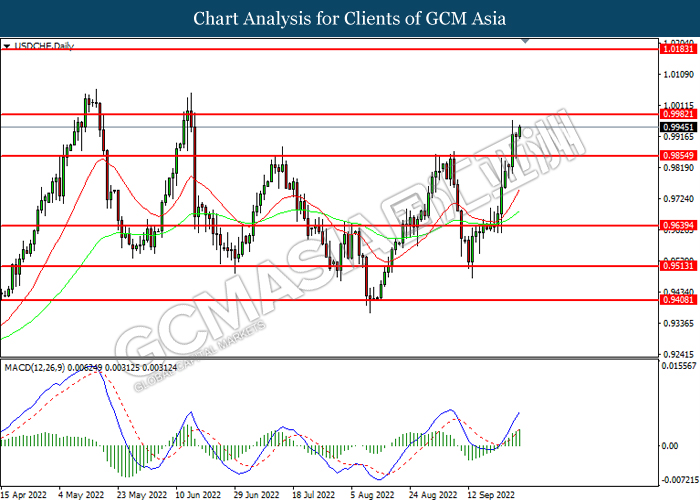

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9980, 1.0185

Support level: 0.9855, 0.9640

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 81.40, 85.30

Support level: 76.80, 72.35

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1639.45, 1658.50

Support level: 1622.85, 1600.65