28 September 2022 Morning Session Analysis

Optimistic economic data supported US Dollar to rise.

The Dollar Index which traded against a basket of six major currencies rose significantly amid the background of upbeat economic data. According to Conference Board, the US CB Consumer Confidence in September notched up from the previous reading of 103.6 to 108.0, exceeding the market forecast of 104.5. Besides, the US New Home Sales had also increased from the prior figure of 532K to 685K, far higher that consensus expectation of 500K. A series of bullish data had indicated that the US economy is beginning to show signs of improvement, which dialed up the market optimism toward economy progression in the US. In addition, the US Dollar received further bullish momentum over the hawkish stand of Fed members. Chicago Fed President Charles Evans claimed on Tuesday that the US central bank would need to hike its interest rate to a range between 4.50% and 4.75%. He also reiterated the importance of rate hike path which is continuing, even the rate hike would lead to an economy recession. Such hawkish speech has sparked the appeal of US Dollar. As of writing, the Dollar Index appreciated by 0.07% to 114.10.

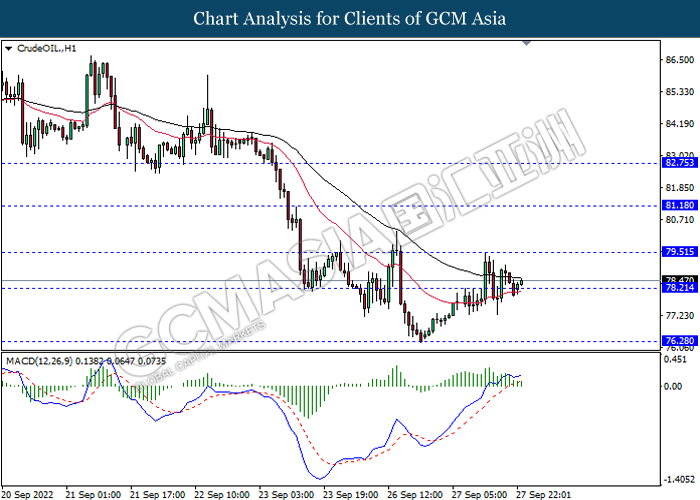

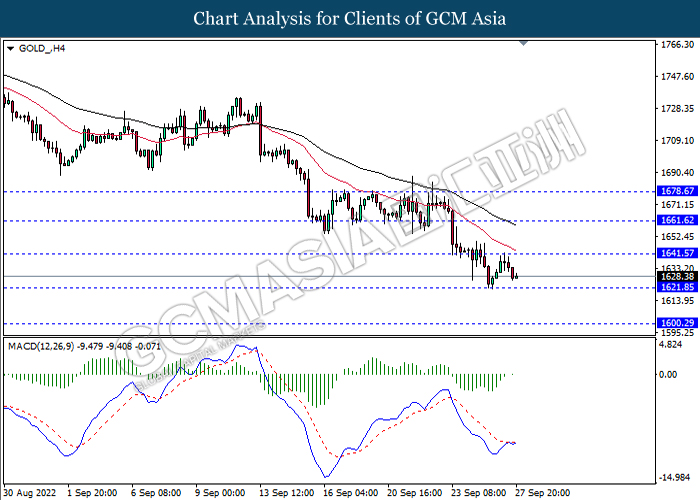

In the commodities market, the crude oil price dropped by 0.13% to $78.41 per barrel as of writing. Nonetheless, the oil price surged throughout yesterday trading session over the likelihood of reduced supply from Hurricane Ian. On the other hand, the gold price edged down by 0.02% to $1628.58 per troy ounce as of writing following the strengthened US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:15 EUR ECB President Lagarde Speaks

22:15 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Pending Home Sales (MoM) (Aug) | -1.0% | -1.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 1.142M | – | – |

Technical Analysis

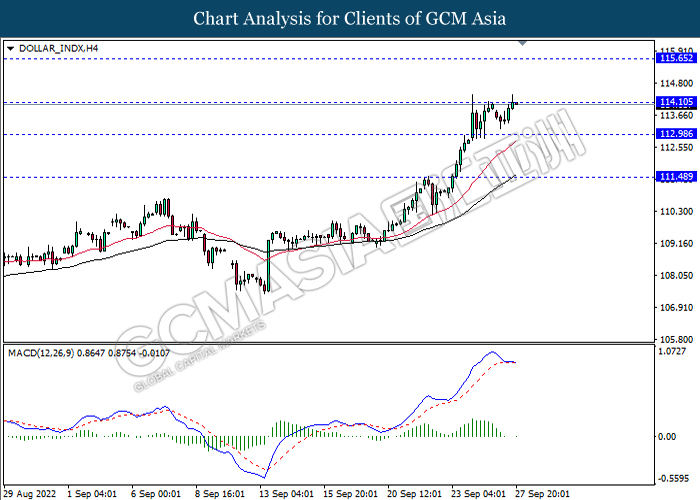

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 114.10, 115.65

Support level: 113.00, 111.50

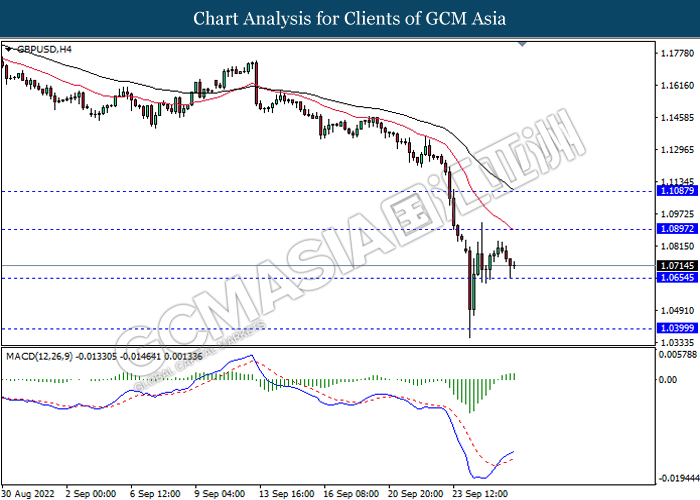

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0895, 1.1085

Support level: 1.0655, 1.0400

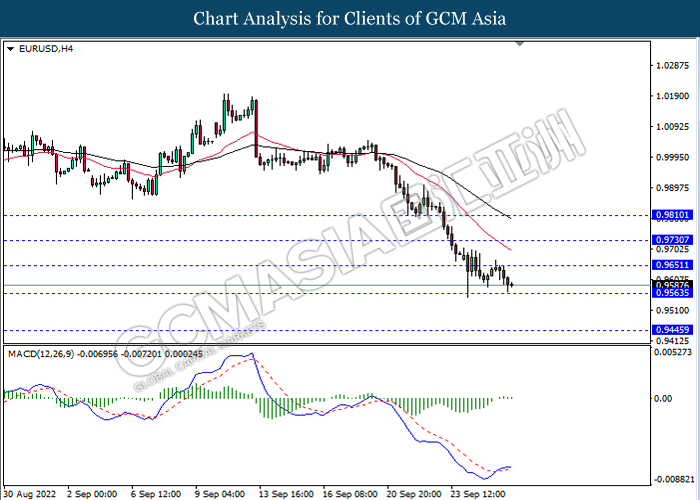

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9650, 0.9730

Support level: 0.9565, 0.9445

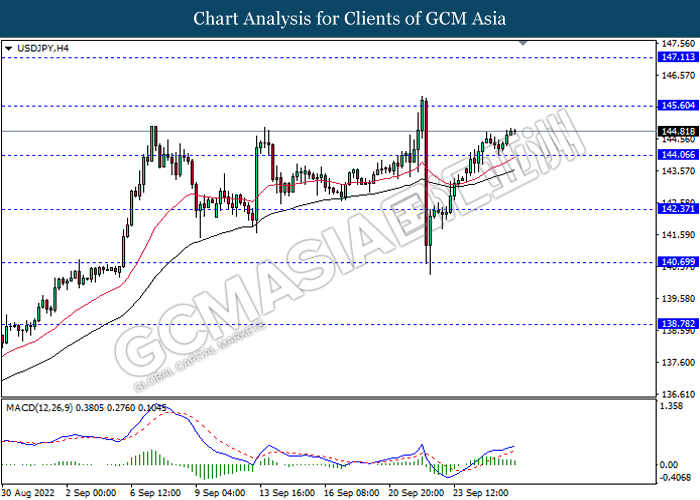

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

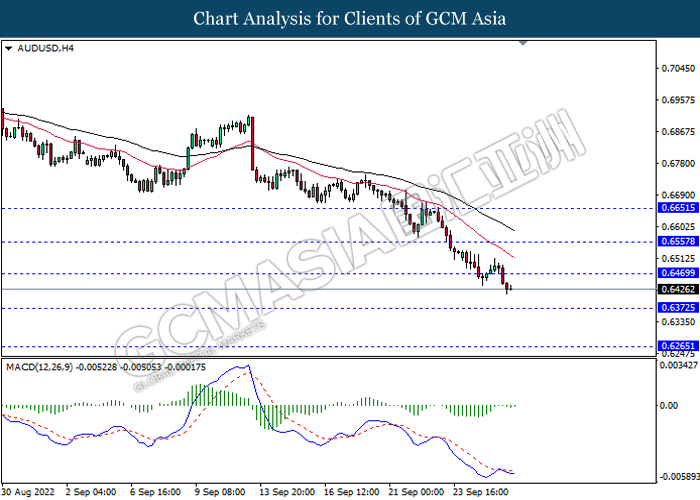

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6470, 0.6555

Support level: 0.6370, 0.6265

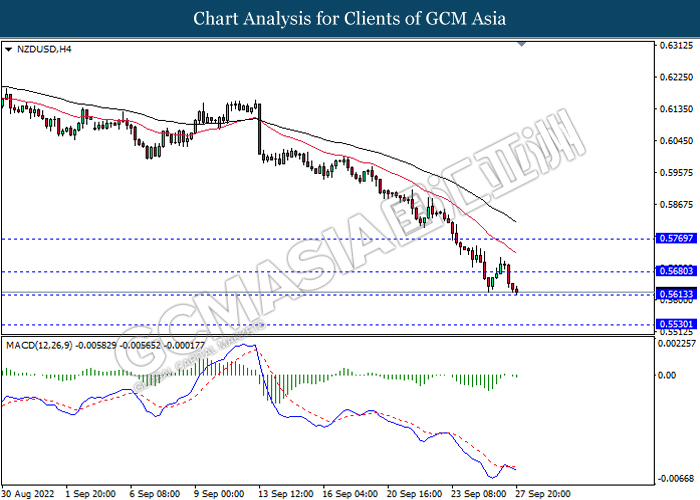

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.5680, 0.5770

Support level: 0.5615, 0.5530

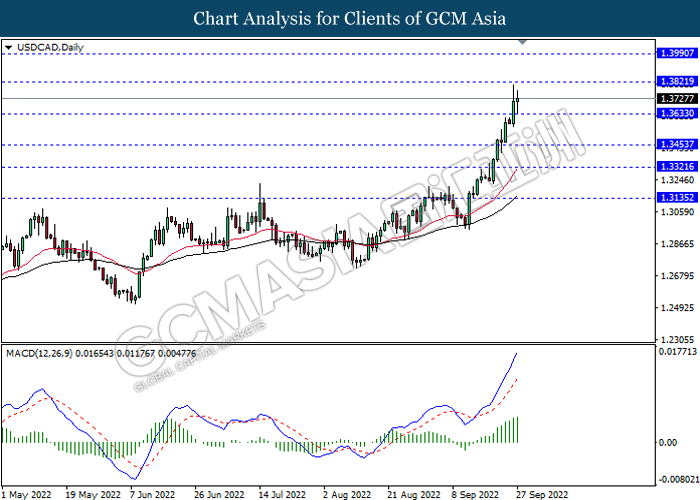

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

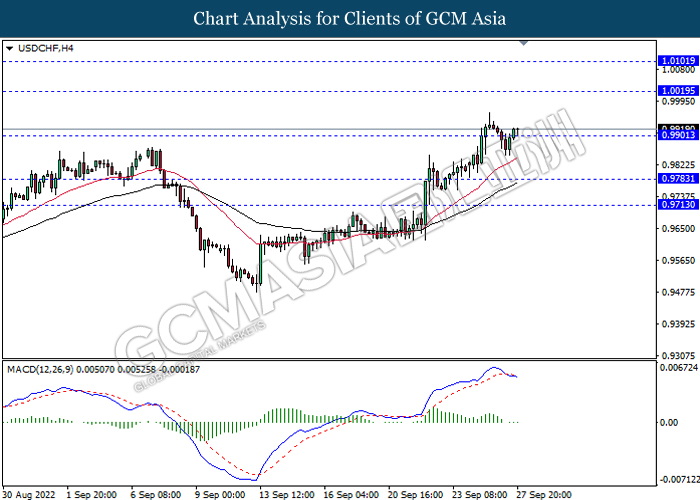

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0020, 1.0100

Support level: 0.9900, 0.9785

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 79.50, 81.20

Support level: 78.20, 76.30

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1641.55, 1661.60

Support level: 1621.85, 1600.30