28 October 2022 Afternoon Session Analysis

Euro slumped despite jumbo rate hike from ECB.

The EUR/USD, which traded by majority of investors dropped significantly on yesterday although European Central Bank (ECB) hiked its interest rate. Yesterday, ECB increased its interest rate by 75 basis point to 2.00%, the highest level since 2009, which met with the consensus forecast. Nonetheless, the Euro retraced from the level around 1.0095 upon the rate differential between Fed and ECB. In the earlier moment, Fed has raised its rate to 3.25%, as well as 0.75% rate hike might be implemented again in the meeting which scheduled on next week. In the perspective of investors, they are more willing to shift their capital toward US currency market to earn higher return, which spurred bearish momentum on the Euro. Though, the losses experienced by EUR/USD was limited over the hawkish statement from ECB. According to Reuters, the ECB claimed on Thursday that the rate hike path would be continued to restore price stability, and the size of rate increase is going to be discussed. As of writing, the EUR/USD rose by 0.26% to 0.9988.

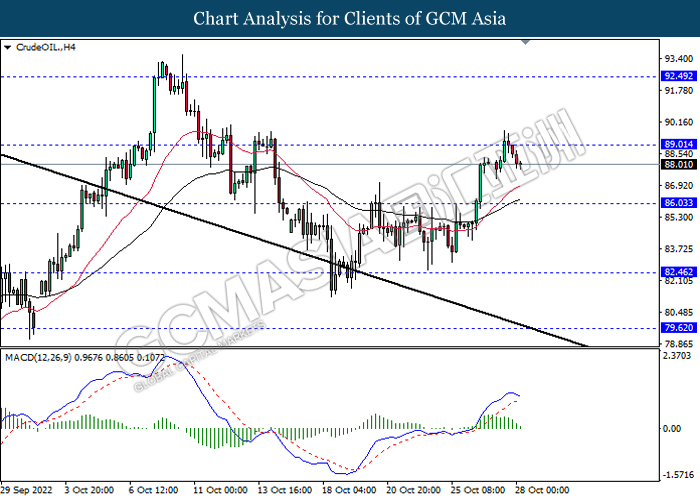

In the commodities market, the crude oil price eased by 1.15% to $88.06 per barrel as of writing as the Covid-19 issue in China keep threatening the demand of oil. On the other hand, the gold price appreciated by 0.12% to $1663.97 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q3) | 0.1% | -0.2% | – |

| 20:00 | EUR – German CPI (YoY) (Oct) | 10.0% | 10.1% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Sep) | 0.6% | 0.5% | – |

| 20:30 | CAD – GDP (MoM) (Aug) | 0.1% | 0.1% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Sep) | -2.0% | -5.0% | – |

Technical Analysis

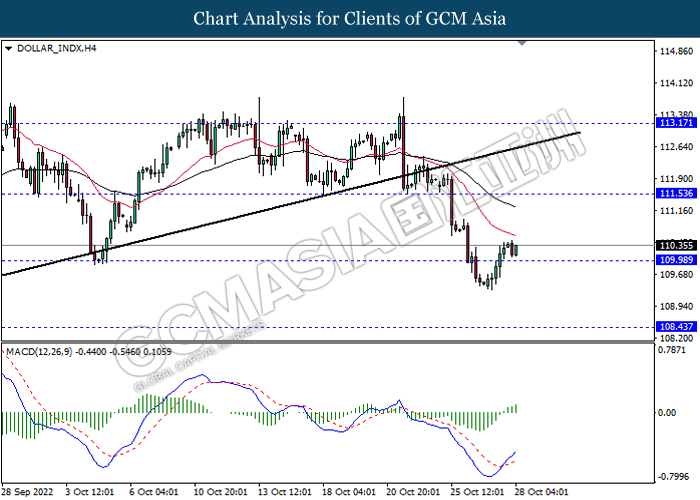

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

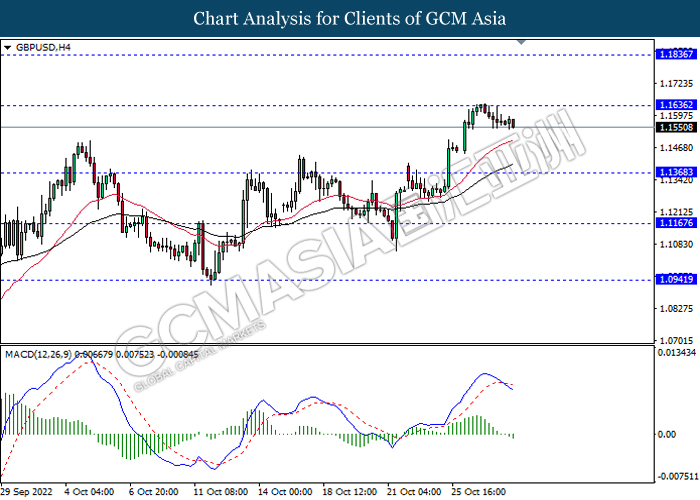

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9990, 1.0095

Support level: 0.9905, 0.9810

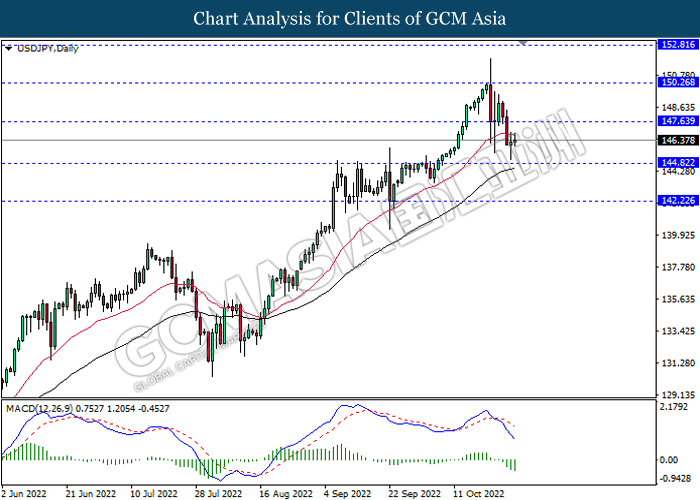

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

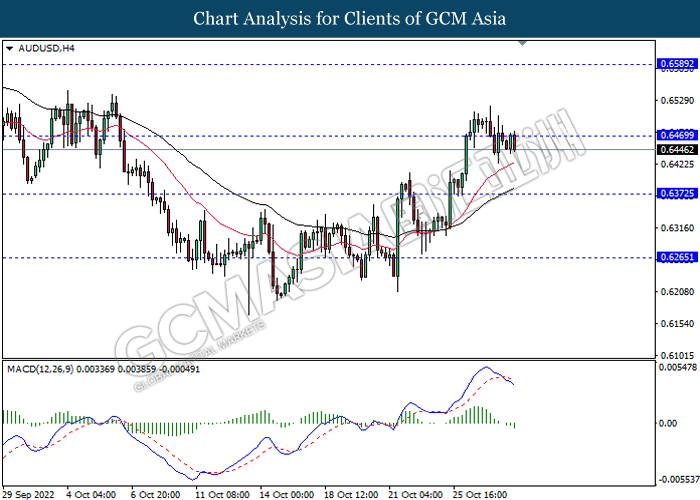

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

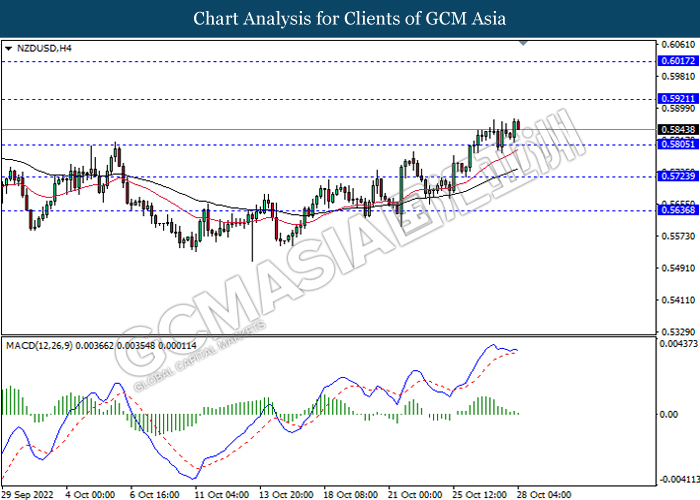

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

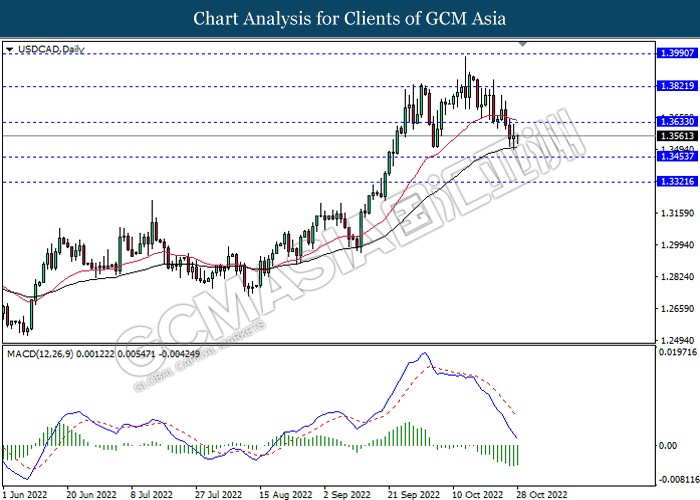

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

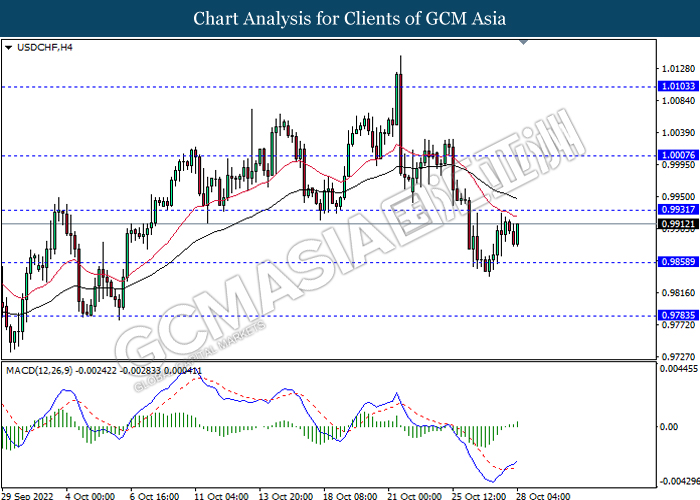

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9930, 1.0005

Support level: 0.9860, 0.9785

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

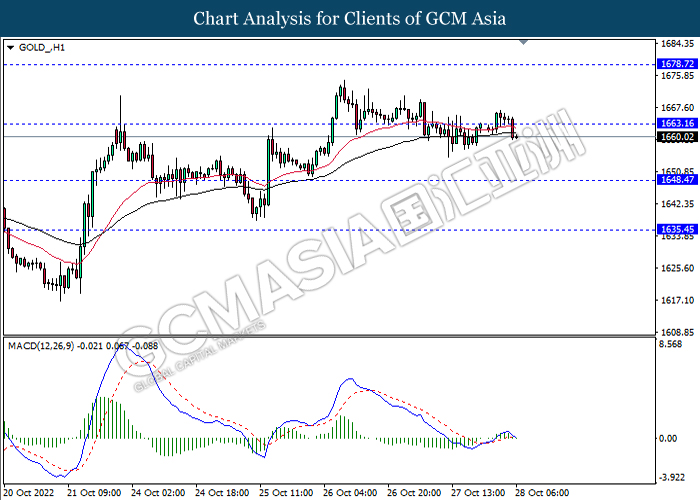

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1663.15, 1678.70

Support level: 1648.45, 1635.45