28 October 2022 Morning Session Analysis

Greenback revived as the economic data turned positive.

The dollar index, which traded against a basket of six major currencies, managed to find its ground as the U.S. data showed that the world’s biggest economy rebounded more than expected in the third quarter. According to the Bureau of Economic Analysis, the US GDP came in at 2.6% QoQ, higher than the consensus forecast at 2.4%, revealing a more upbeat snapshot of the economy even as high inflation is still the major challenge of the nation, just like any other country in the world. In fact, the GDP growth ticked upward because of a narrowing trade deficit in recent months. On top of that, the gains also occurred because of growth in consumer spending, government spending, and non-residential fixed investment. Despite the fact that the nation’s economic outlook remains clouded as the effect of rising interest rates is expected to come in soon, where exports will fade, and domestic demand is getting crushed. On the other side, the US Initial Jobless Claims data came in at 217K, lower than the consensus forecast at 220K, mirroring that the US labor market remains resilient. As of writing, the dollar index rose 0.78% to 110.55.

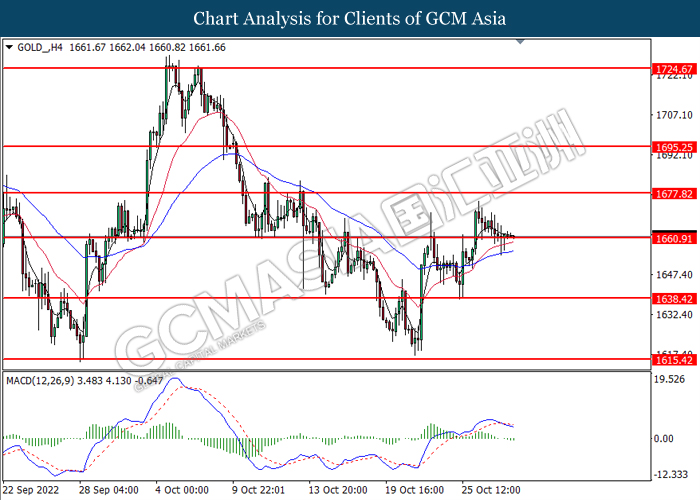

In the commodities market, crude oil prices edged up by 0.05% to $88.55 per barrel as the US GDP data showed a higher-than-expected reading, which boosted the market optimism toward the outlook of the oil demand. Besides, gold prices depreciated by -0.09% to $1661.85 per troy ounce following the rebound of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q3) | 0.1% | -0.2% | – |

| 20:00 | EUR – German CPI (YoY) (Oct) | 10.0% | 10.1% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Sep) | 0.6% | 0.5% | – |

| 20:30 | CAD – GDP (MoM) (Aug) | 0.1% | 0.1% | – |

| 22:00 | USD – Pending Home Sales (MoM) (Sep) | -2.0% | -5.0% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 110.00. However, MACD which illustrated bearish bias momentum suggest the index to undergo technical correction in short term.

Resistance level: 110.00, 111.70

Support level: 107.90, 105.00

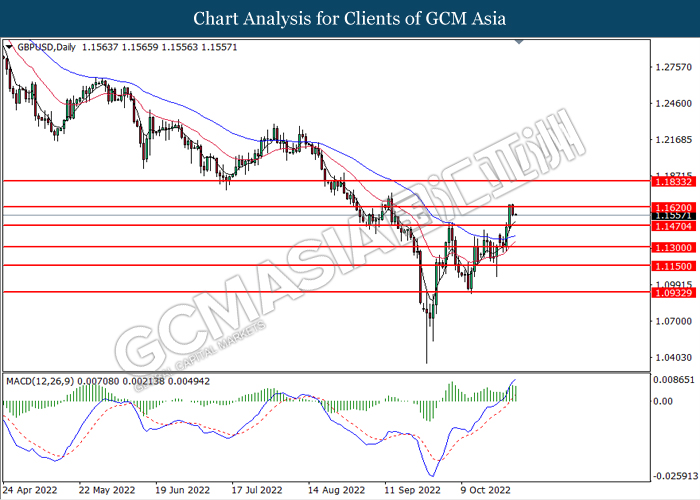

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1620, 1.1835

Support level: 1.1470, 1.1300

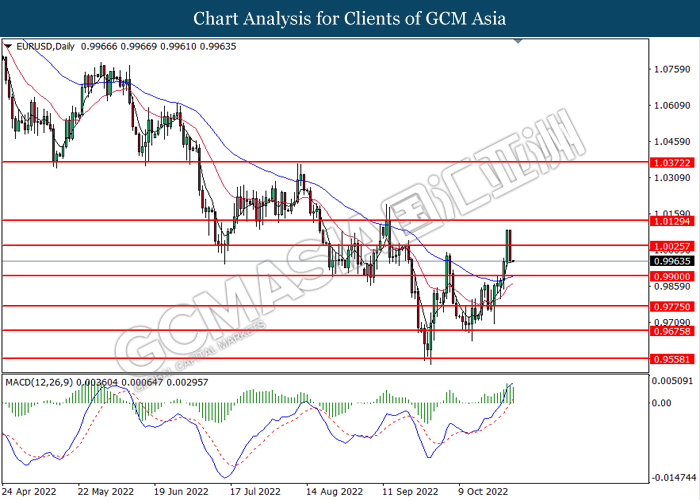

EURUSD, Daily: EURUSD was traded lower following prior retracement near the resistance level at 1.0025. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9900.

Resistance level: 1.0025, 1.0130

Support level: 0.9900, 0.9775

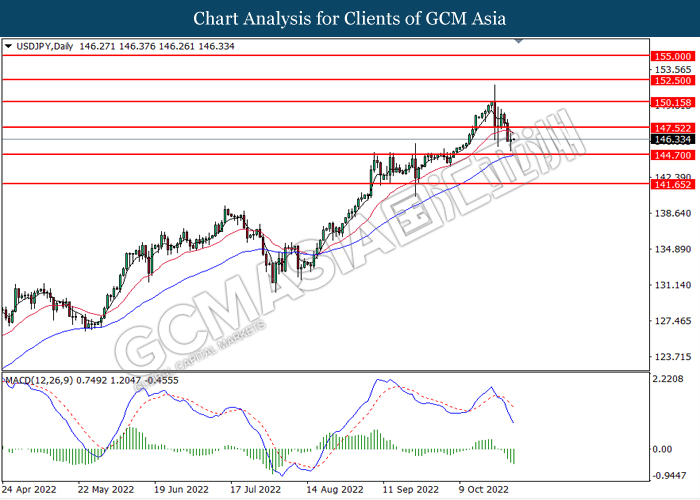

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 147.50. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 144.70.

Resistance level: 147.50, 150.15

Support level: 144.70, 141.65

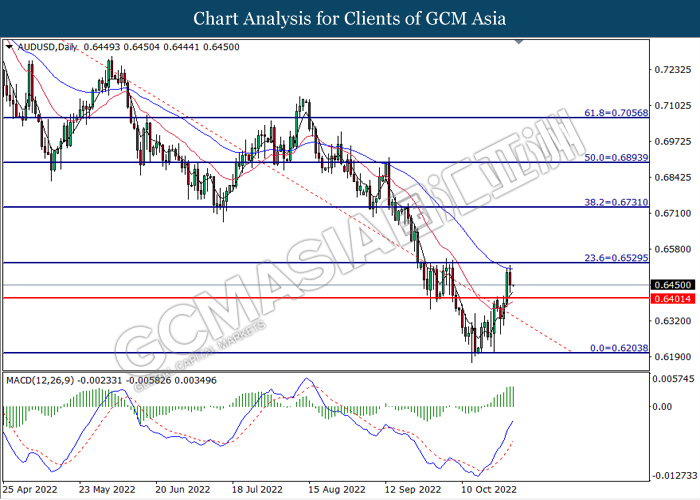

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6530. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6400.

Resistance level: 0.6530, 0.6730

Support level: 0.6400, 0.6205

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.5770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.5950.

Resistance level: 0.5950, 0.6105

Support level: 0.5770, 0.5560

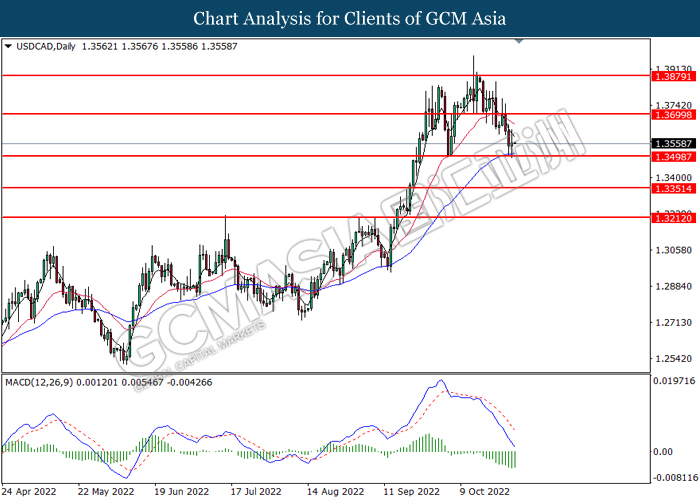

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3700. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3500.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

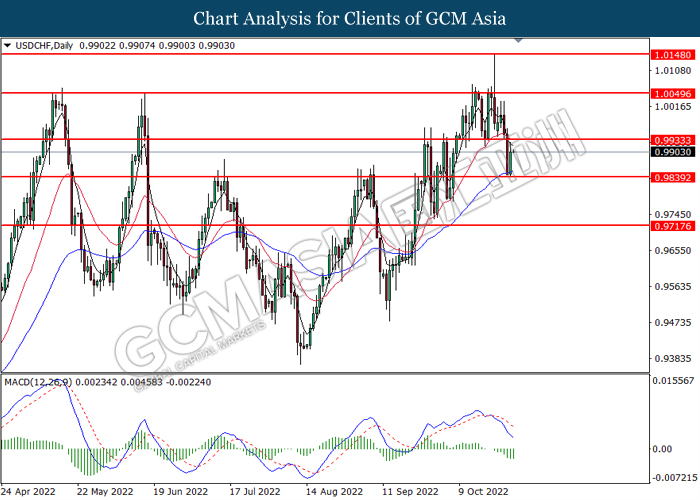

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9840. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9935, 1.0050

Support level: 0.9840, 0.9720

CrudeOIL, Daily: Crude oil price was traded higher following prio breakout above the previous resistance level at 86.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 93.10.

Resistance level: 93.10, 98.15

Support level: 87.70, 81.45

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1660.90. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1677.80, 1695.25

Support level: 1660.90, 1638.40