28 December 2022 Afternoon Session Analysis

Yen remained weak upon the negative factory production.

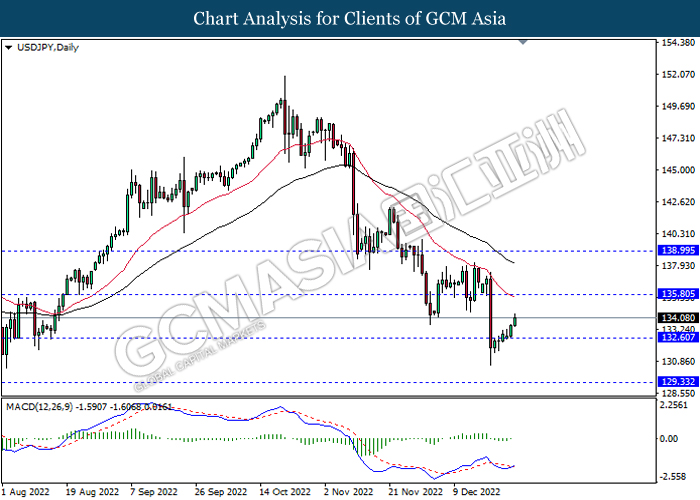

The USD/JPY, which widely traded by global investors surged during early trading session after the downbeat economic data has been released. The Japan Industrial Production has dropped for a third consecutive month in November, which recorded a -0.1% contraction. In the previous months, the factory output has lowered by 3.2% and 1.7% in October and September respectively. With such backdrop, the market optimism has been dialed down by the deteriorating economy outlook in Japan, which prompting investors to shift their capitals toward safe-haven Dollar. On the other hand, the losses of Japanese Yen was extended following the Bank of Japan (BoJ) was anticipated to remain its ultra-loose monetary policy. According to Reuters, BoJ Governor Haruhiko Kuroda has dismissed the chance of a near-term rate hike, although the core consumer inflation has reached a four-decade high of 3.7%. He deemed on the view price rises were driven by raw material costs, rather than strong demand. As of writing, the USDJPY appreciated by 0.61% to 134.29.

In the commodities market, the crude oil price rose by 0.15% to $79.65 per barrel as of writing following the Russia was expected to retaliate against a price cap on its oil imposed by Western countries. In addition, the gold price depreciated by 0.30% to $1810.23 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – Pending Home Sales (MoM) (Nov) | -4.6% | -0.8% | – |

Technical Analysis

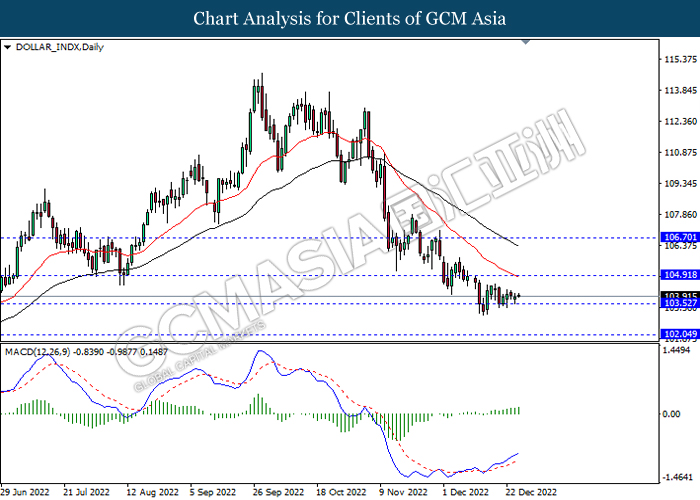

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

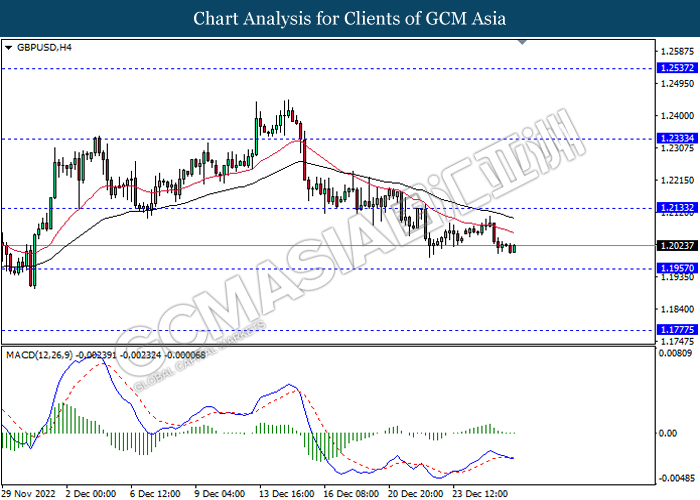

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

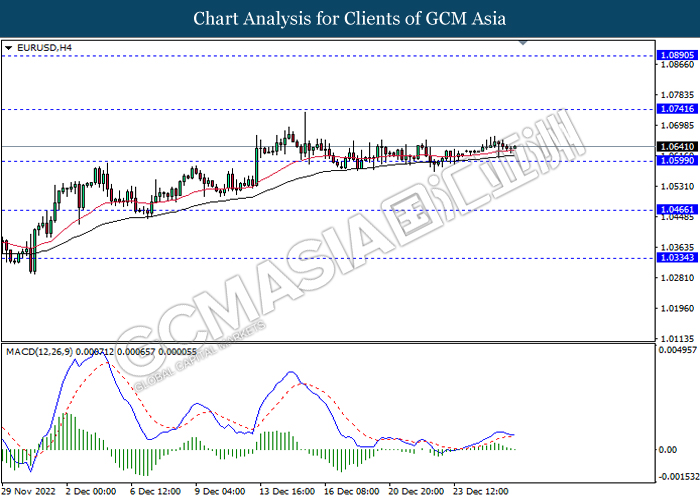

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.80, 139.00

Support level: 132.60, 129.35

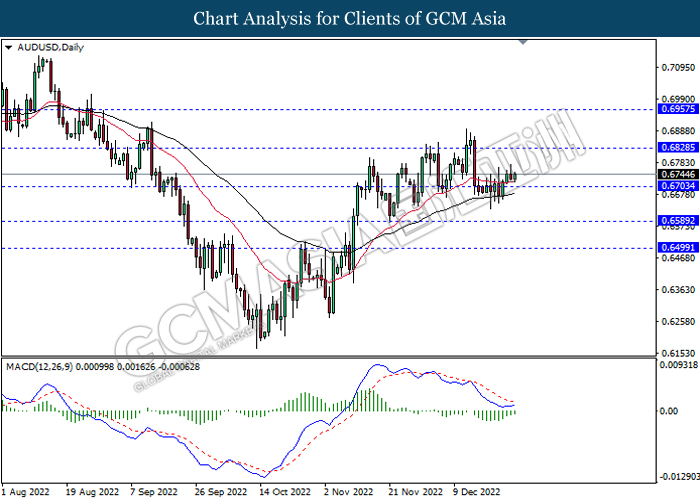

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

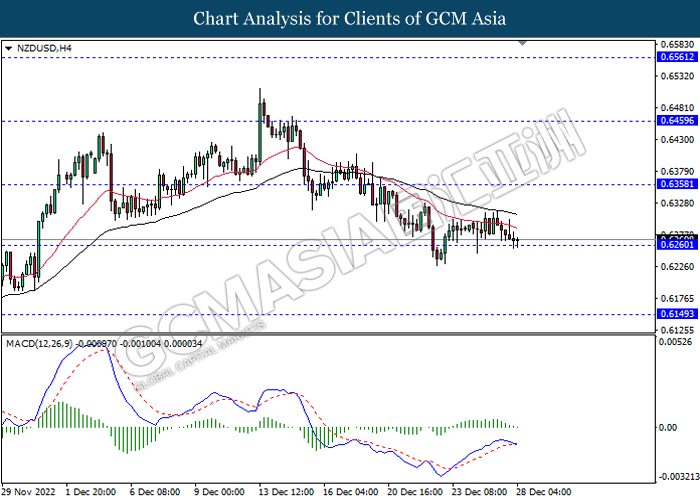

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

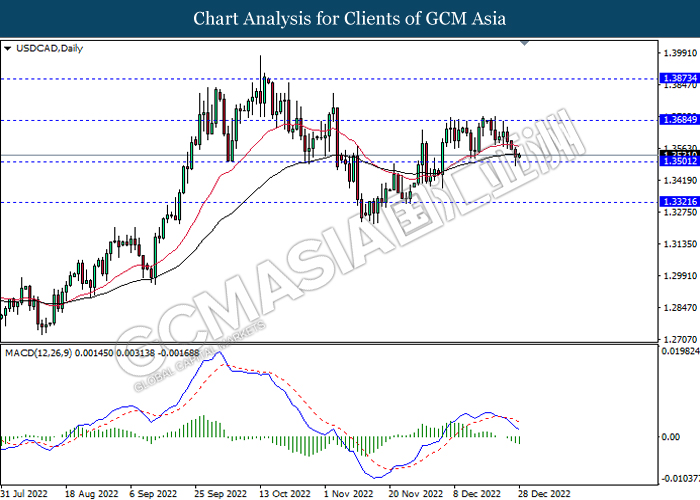

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

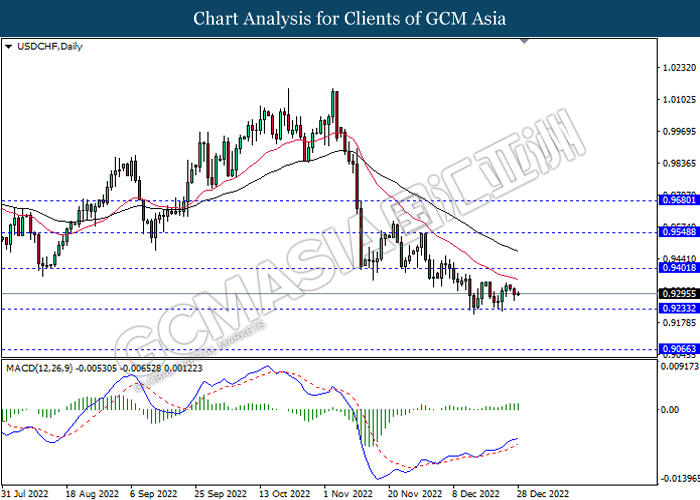

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

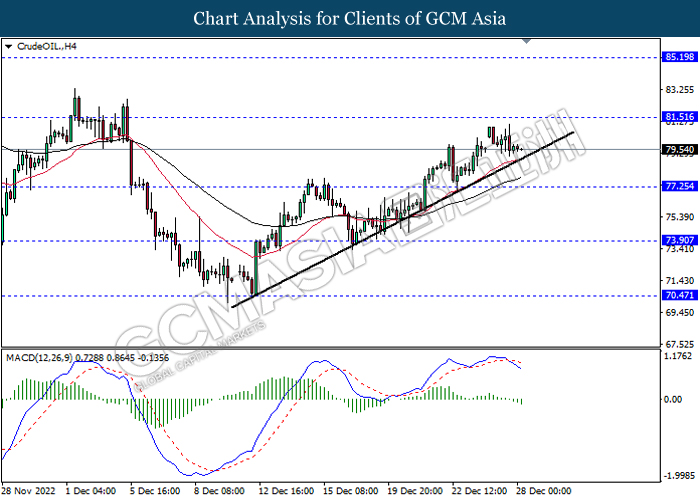

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

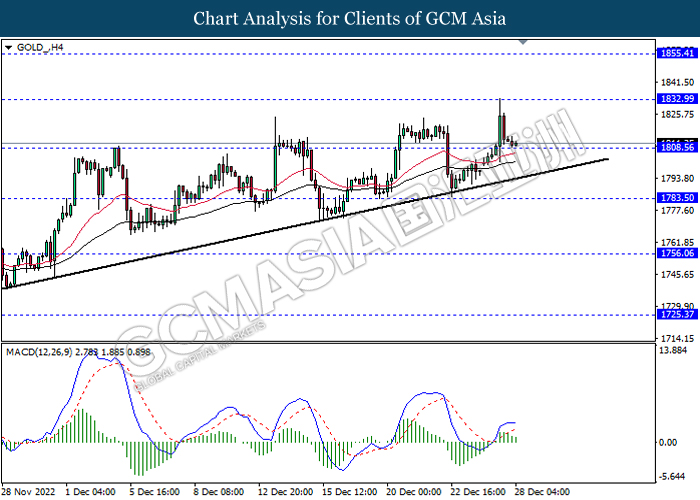

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1833.00, 1855.40

Support level: 1808.55, 1783.50