28 December 2022 Morning Session Analysis

Dollar flat as China eased its lockdown curb.

The index, which used to measure US dollar strength or weakness compared to a basket of six major currencies, lingered near the level of 104.00 as the reopening border of China tampered the market risk-off sentiment. According to the latest news, the China’s National Health Commission has announced that they will stop forcing the inbound travelers to go into quarantine starting from 8th January 2023. As a further step of easing the Covid-19 curb, the China will also downgrade the management of Covid-19 from the current top level of Category A to the less stricter Category B as the disease has found to become less virulent and will evolve to a common type of respiratory infection gradually. With such a backdrop, the China economy is expected to recover strongly after been battered by the frequent lockdown measures since the resurgence of Covid-19, sparkling the market risk-on sentiment. On the other side, the likelihood of aggressive rate hike continues to drop alongside the inflationary pressures showed further sign of easing. Hence, the market failed to see a strong revival in the dollar index at the moment. As of writing, the dollar index dropped -0.14% to 104.15.

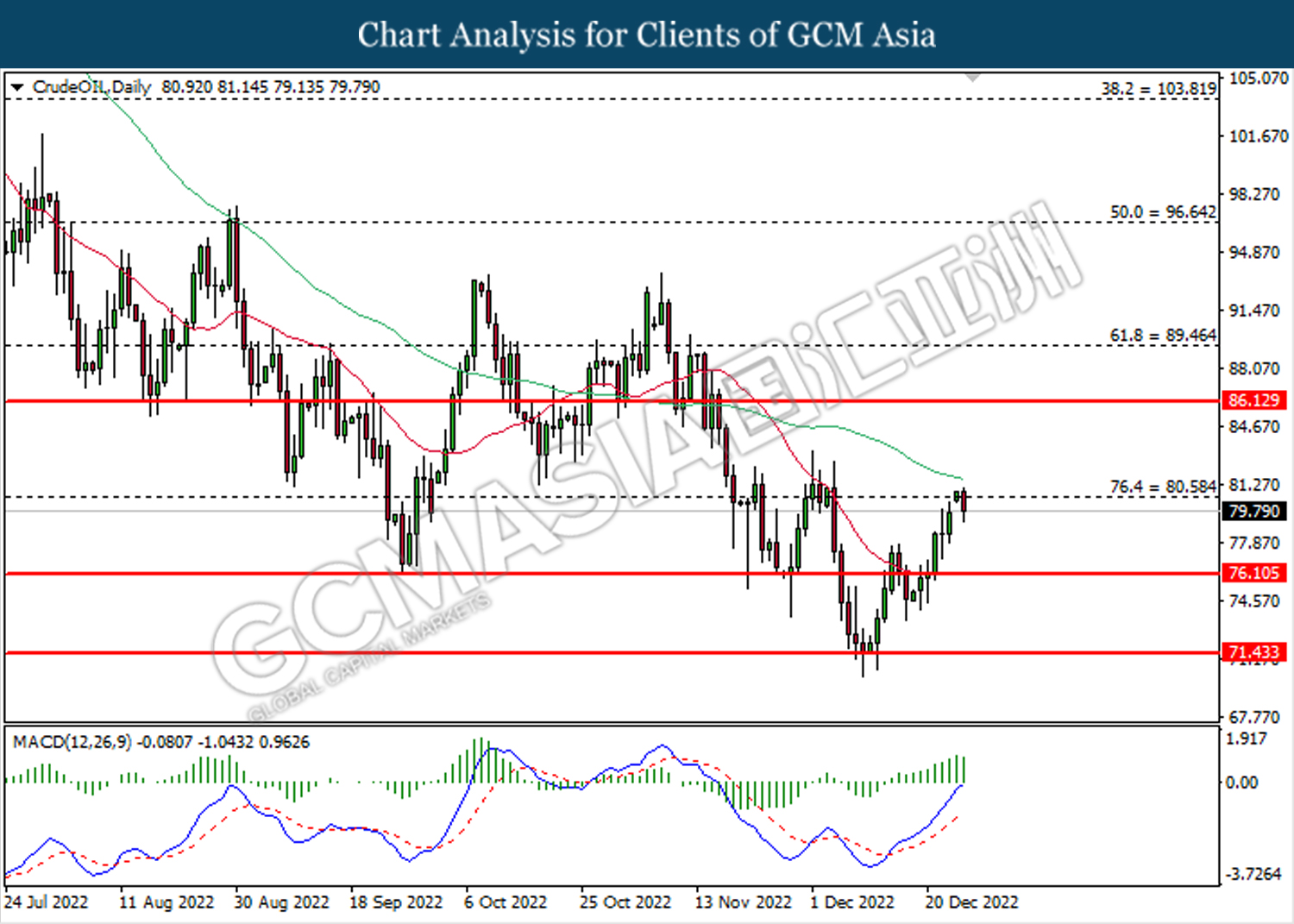

In the commodities market, crude oil prices up by 1.66% to $80.75 per barrel as China decided to loosen its Covid-19 restrictions starting from 8th January, boosting the market hopes of a demand recovery in the near-term future. Besides, gold prices appreciated by 0.85% to $1813.65 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – Pending Home Sales (MoM) (Nov) | -4.6% | -0.8% | – |

Technical Analysis

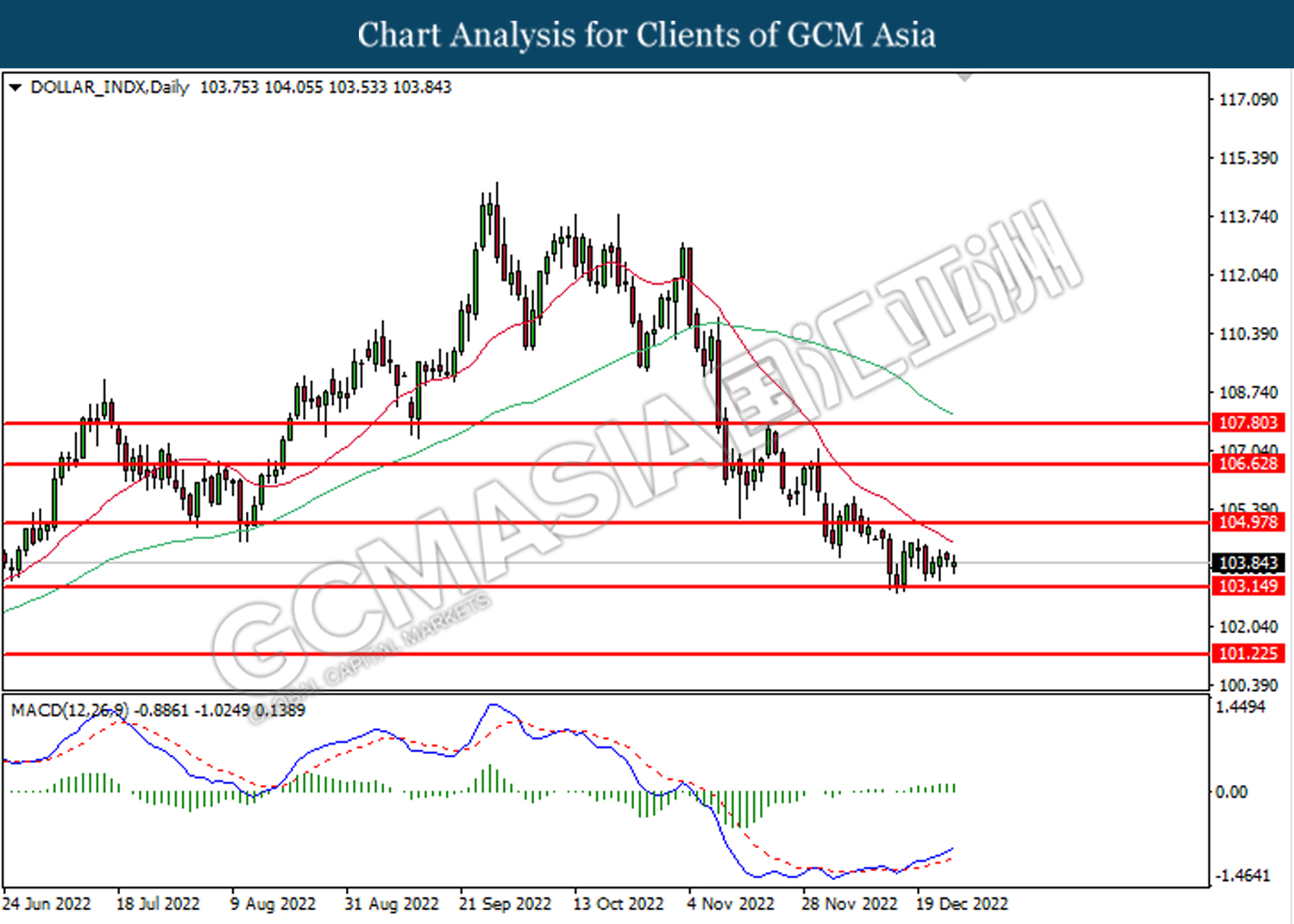

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

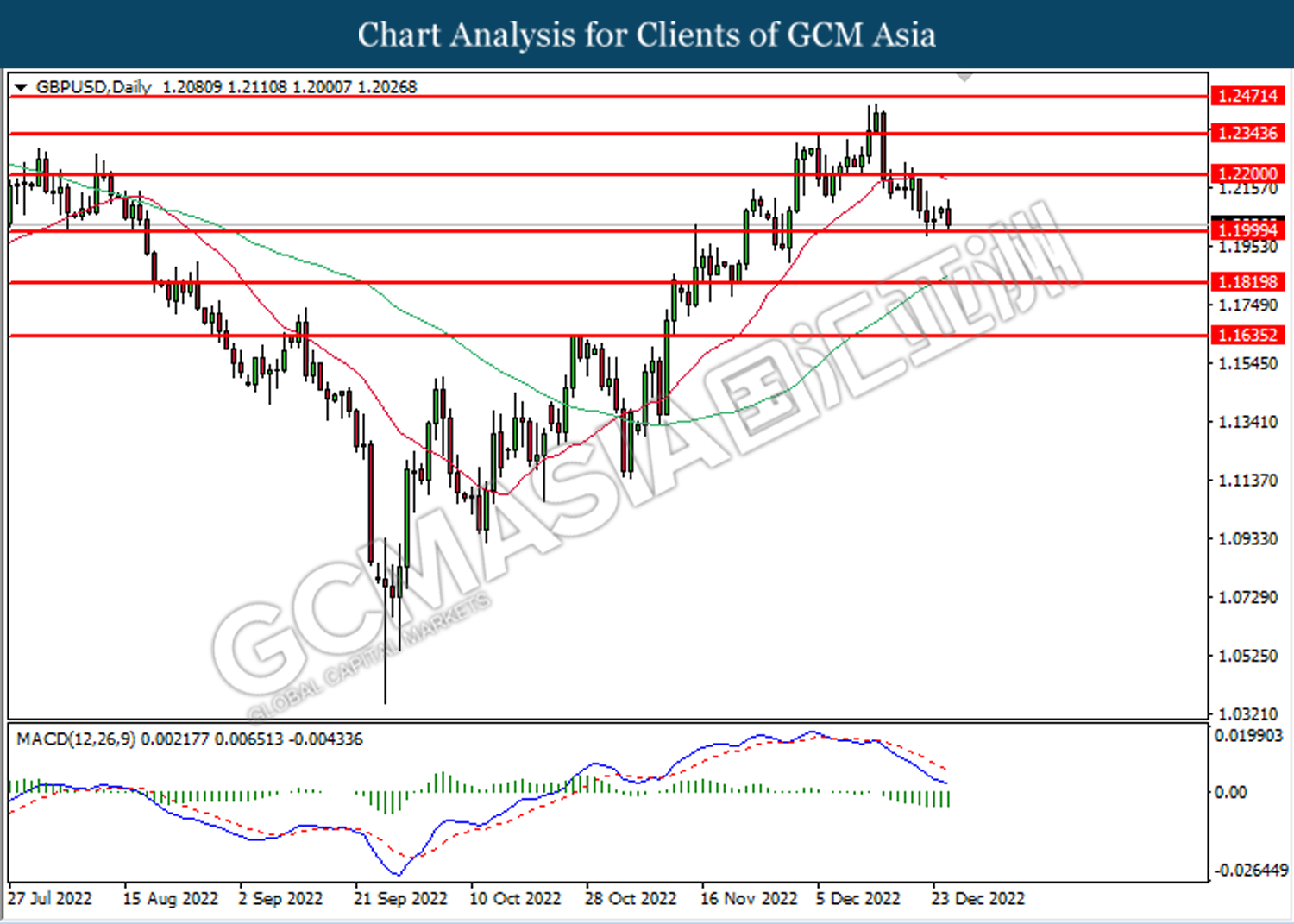

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the previous resistance level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2000.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

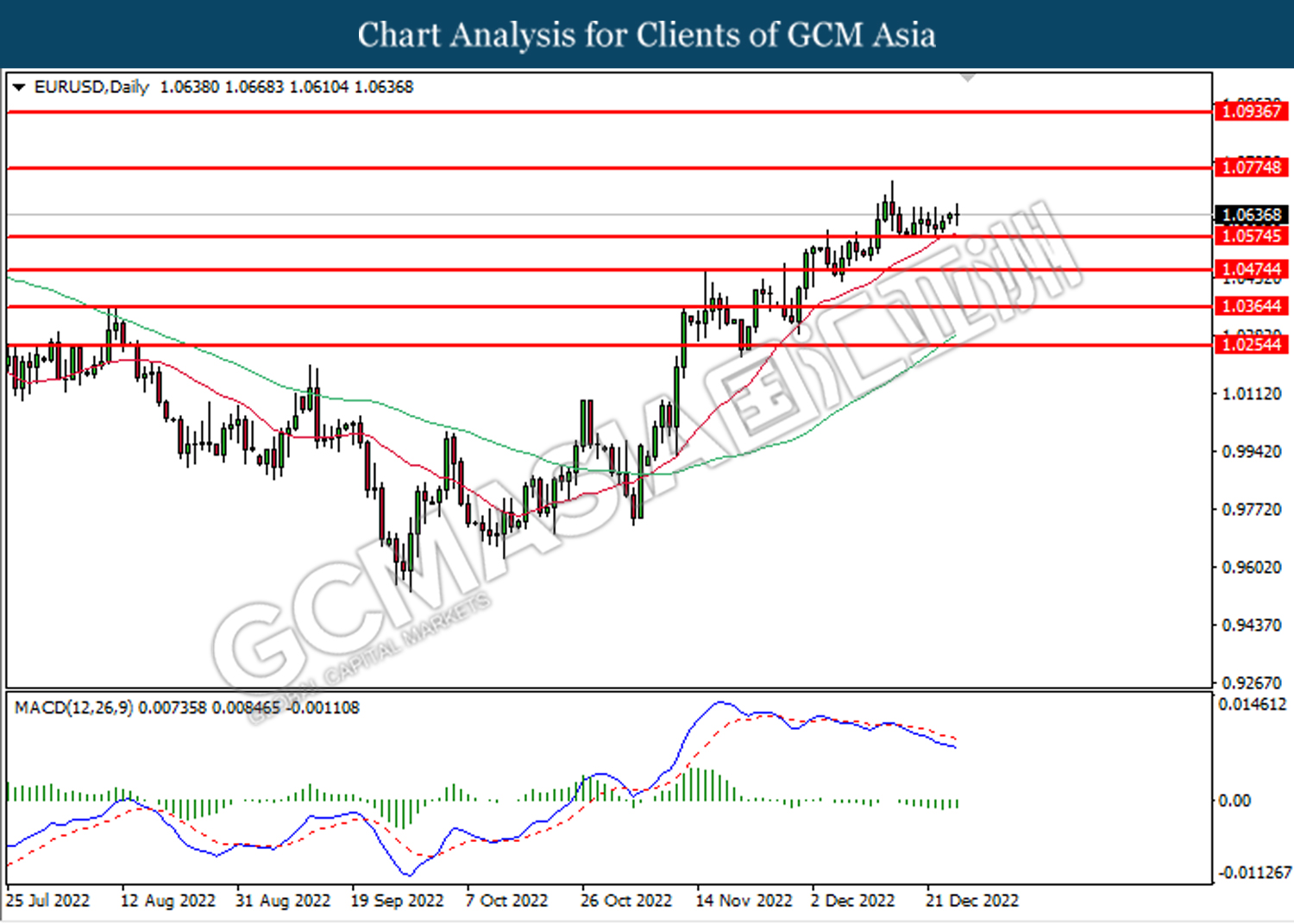

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0575. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0575, 1.0475

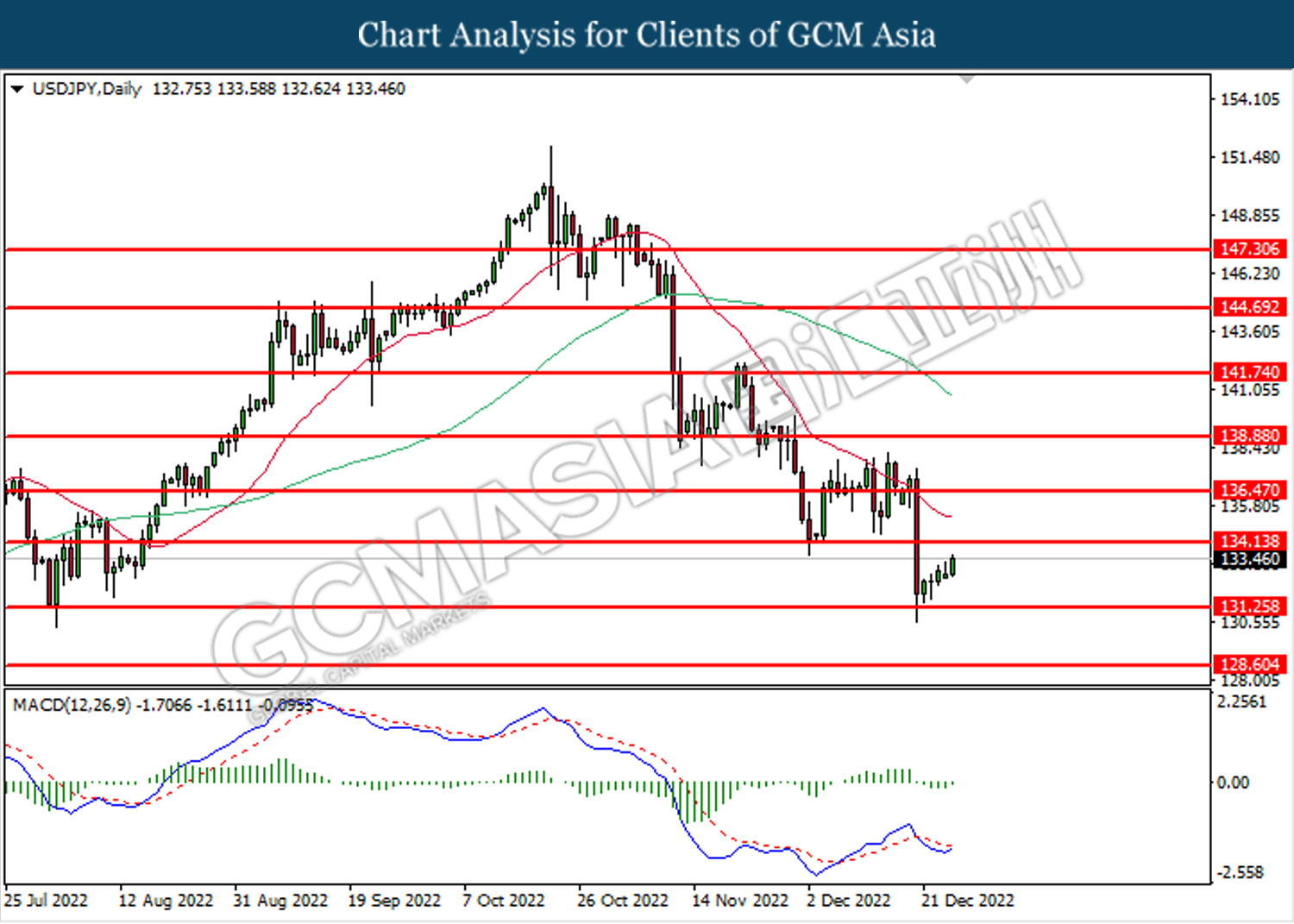

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 134.15.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

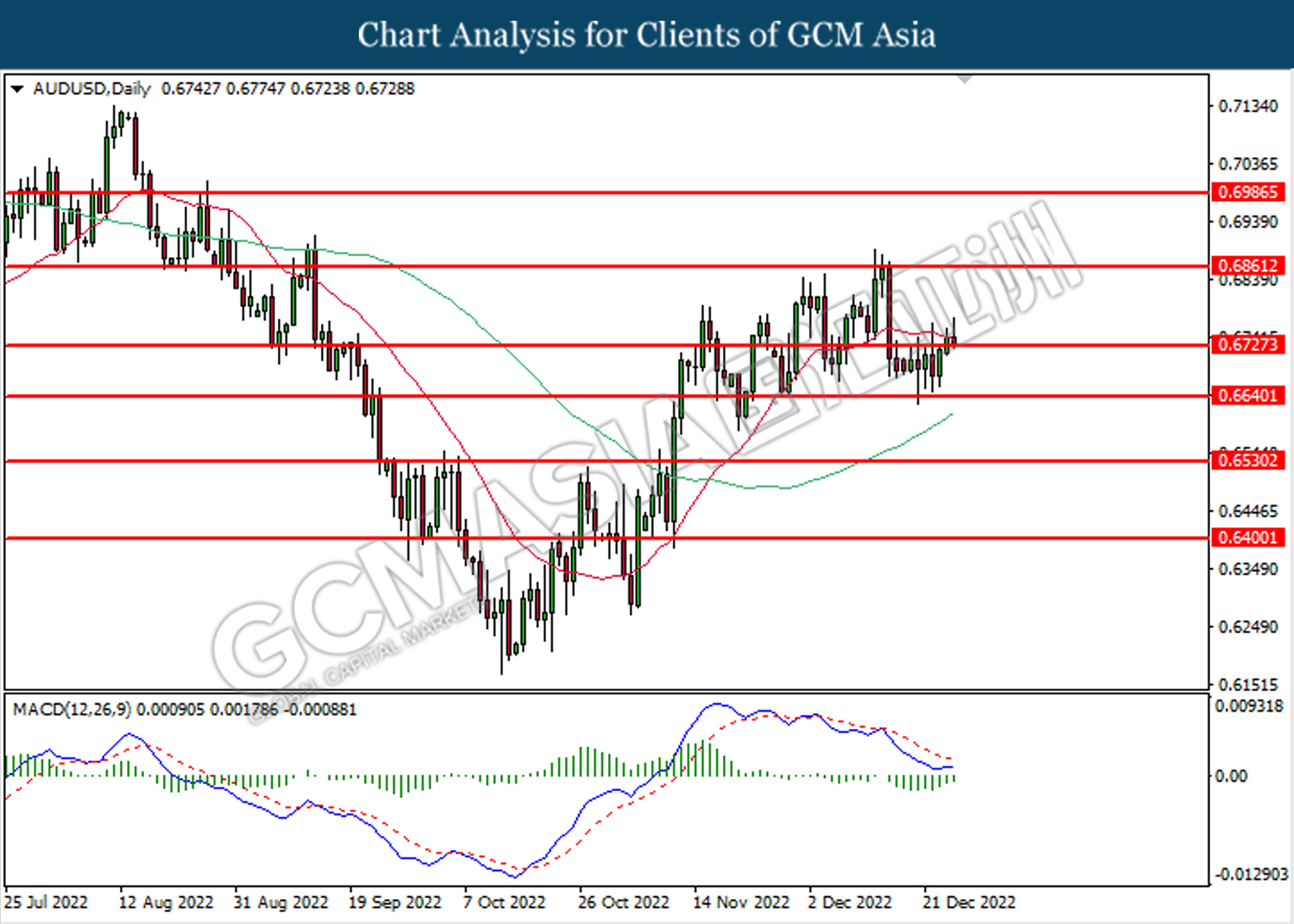

AUDUSD, Daily: AUDUSD was traded lower while currently retesting the support level at 0.6725. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

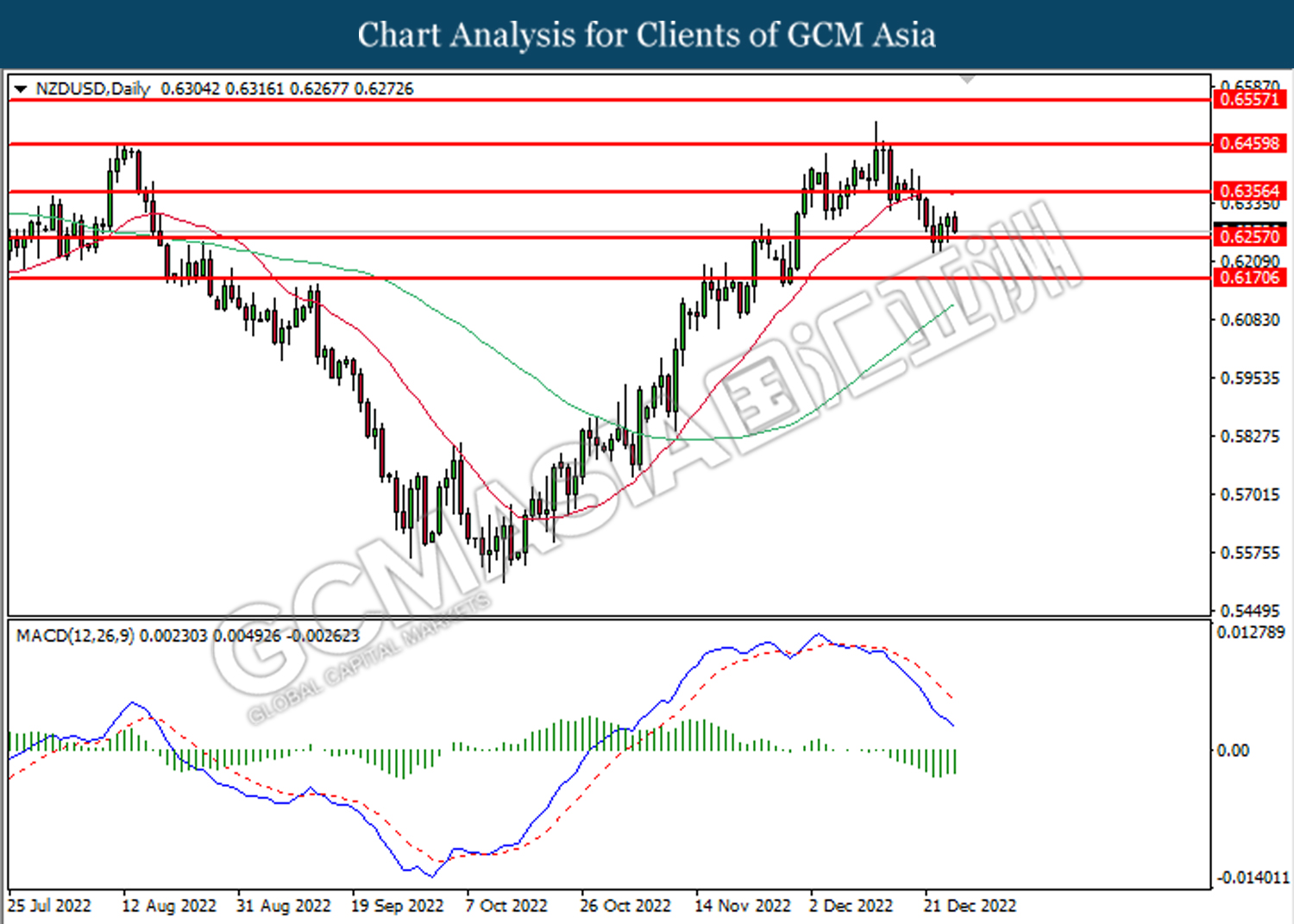

NZDUSD, Daily: NZDUSD was traded lower while currently retesting the support level at 0.6255. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3505. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

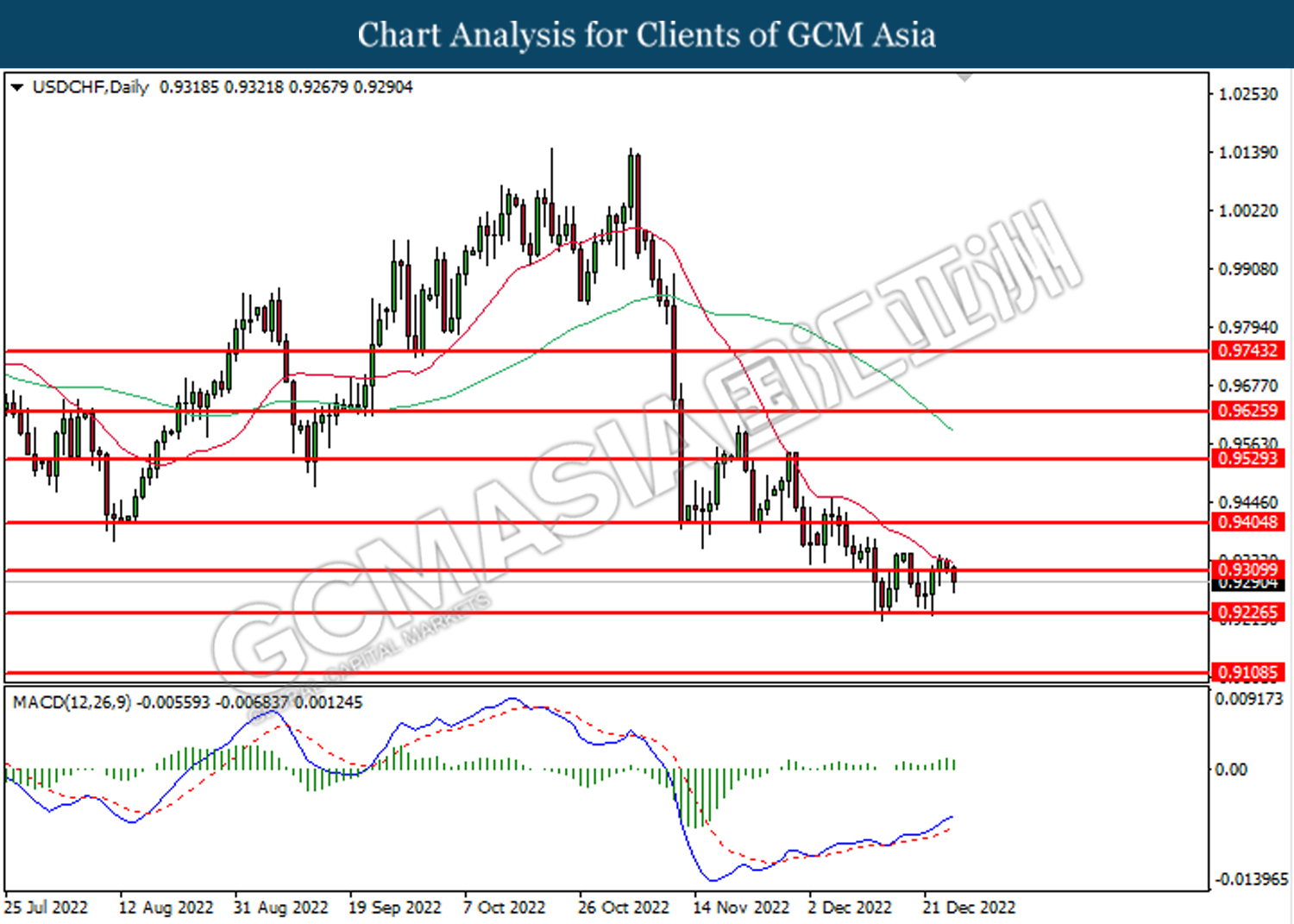

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9310.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 80.60. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1807.85. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1835.30.

Resistance level: 1835.30, 1869.85

Support level: 1807.85, 1786.00