29 March 2022 Morning Session Analysis

US Dollar surged as rising US yield.

The Dollar Index which traded against a basket of six major currencies hovered in recent high amid market participants continue to speculate the rate hike expectation from Federal Reserve, sending the US Treasury yields soared to new multi-year highs. According to Reuters, US 10-year Treasury yield surged above 2.5% to three-year highs, with the expectation that the Federal Reserve would likely to implement a 50 basis-point interest rate rise in May in order to stabilize the spiking numbers of inflation rate. Nonetheless, the overall trend for the US Dollar for yesterday remained stable as investors are currently still waiting for the crucial jobs data from the United States on Friday. Meanwhile, investors would continue to scrutinize the latest updates of the monetary policy decision as well as further economic data to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index appreciated by 0.34% to 99.15.

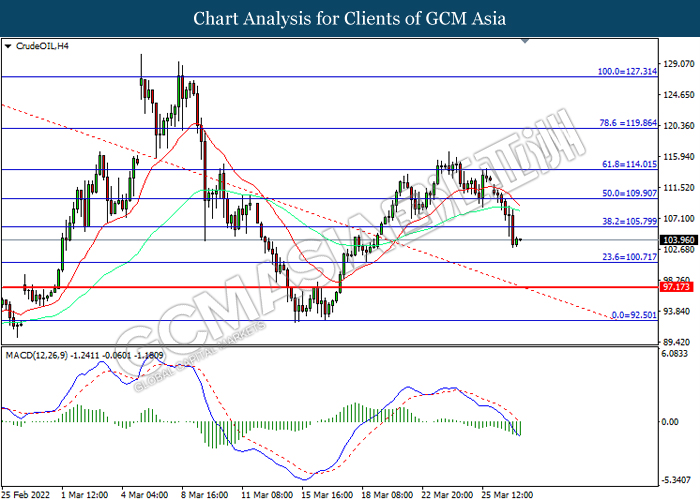

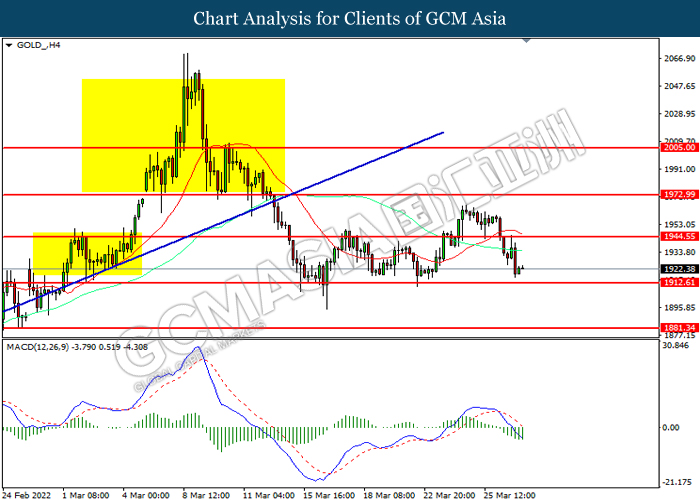

In the commodities market, the crude oil price appreciated by 0.43% to $105.36 per barrel as of writing amid technical correction. Though, the overall trend for the crude oil price remained bearish as the fears of demand disruption following the implementation of lock-down in China continue to weigh down the appeal for this black-commodity. On the other hand, the gold price depreciated by $1923.80 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Mar) | 110.5 | 107 | – |

| 22:00 | USD – JOLTs Job Openings (Feb) | 11.263M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level at 97.80. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

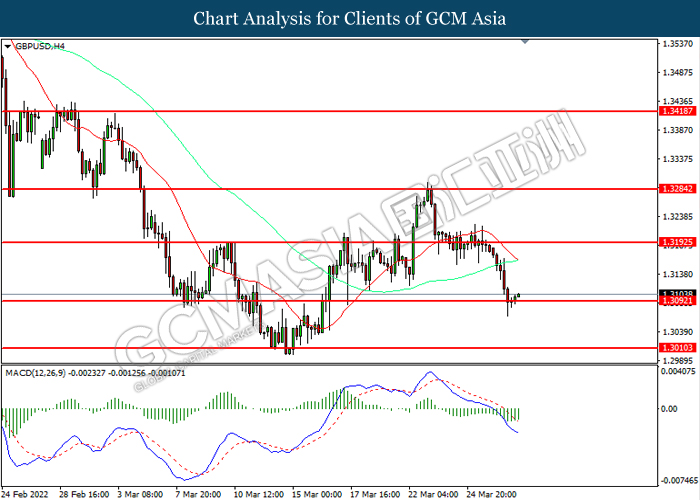

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

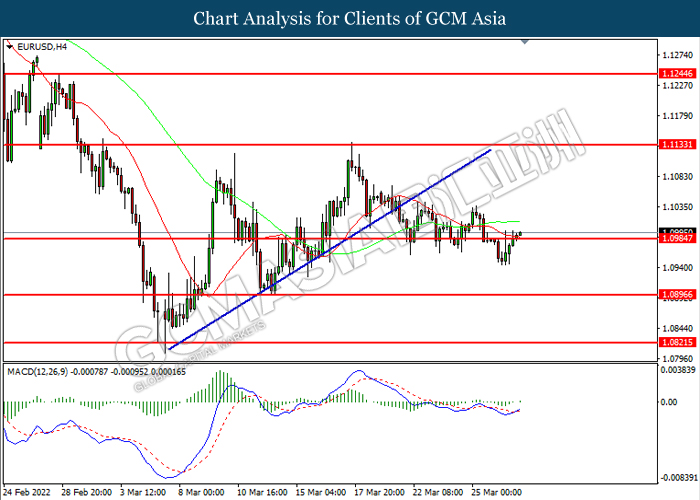

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1135, 1.1245

Support level: 1.0985, 1.0895

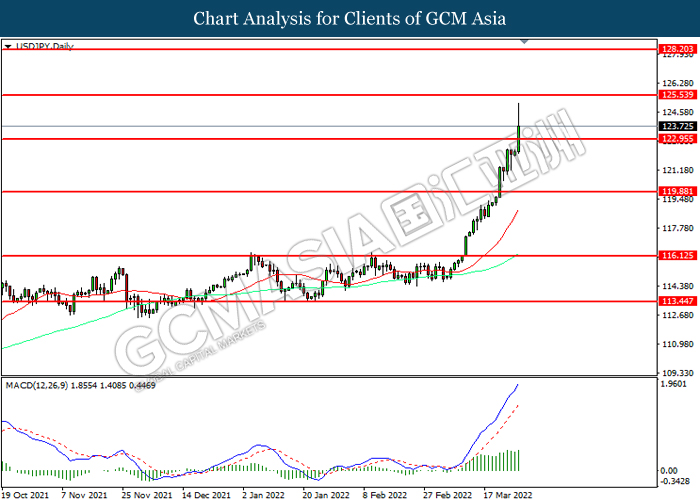

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 125.55, 128.20

Support level: 122.95, 119.90

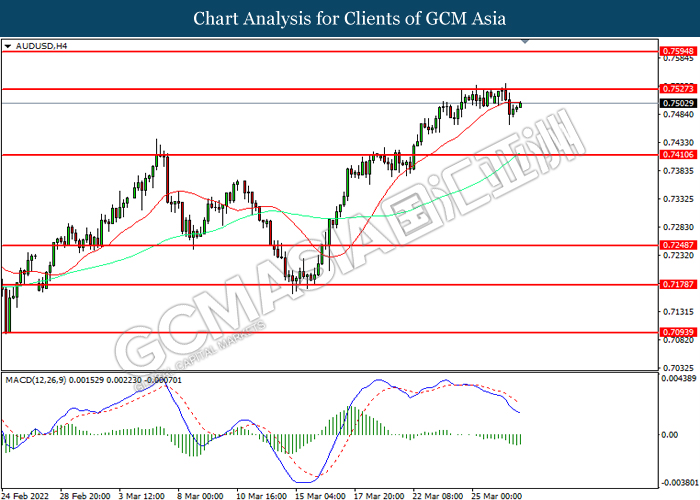

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6975, 0.7045

Support level: 0.6890, 0.6800

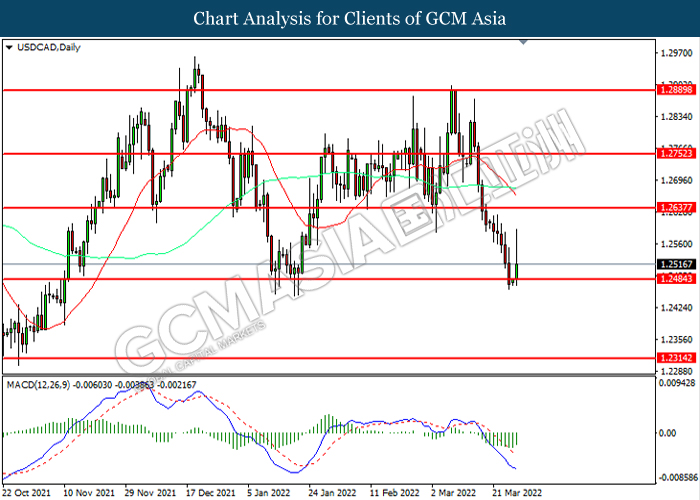

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

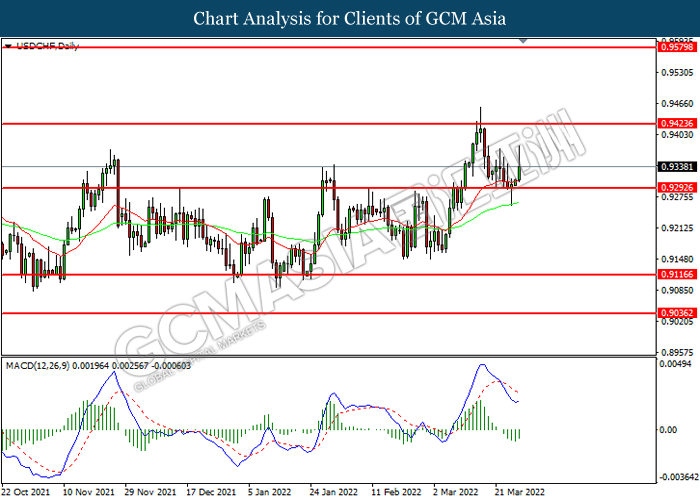

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9295, 0.9115

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 105.80, 109.90

Support level: 100.70, 97.15

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1912.60. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35