29 June 2021 Afternoon Session Analysis

Pound slips following virus concerns.

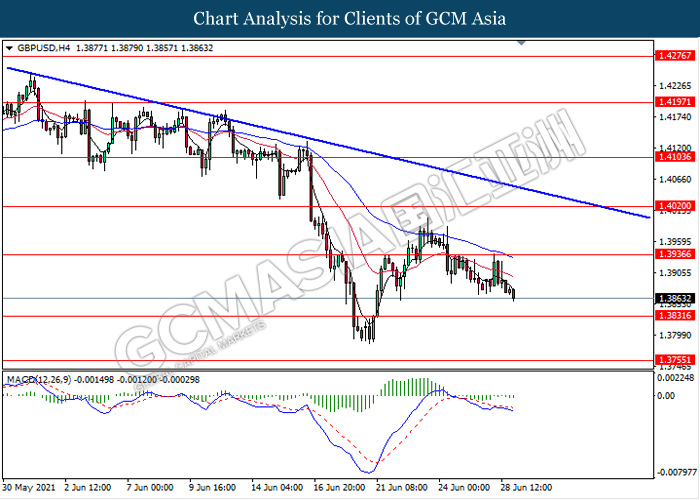

The pound sterling which traded against the dollar and other currency pairs have fell amid rising concerns over new coronavirus cases in the UK. According to the latest official figure on Monday, UK reported the highest daily infection since January 30, adding 22,868 cases to the total of 4,755,078. The latest surge in virus cases which include delta variants have causing several countries such as German and Hong Kong to signal ban over U.K flights and travelers. While U.K health minister Sajid Javid remain confident on July 19 deadline to unlock U.K, the rising new COVID-19 may dent market confidence towards U.K economic recovery. At the time of writing, GBP/USD fell 0.11% to 1.3868.

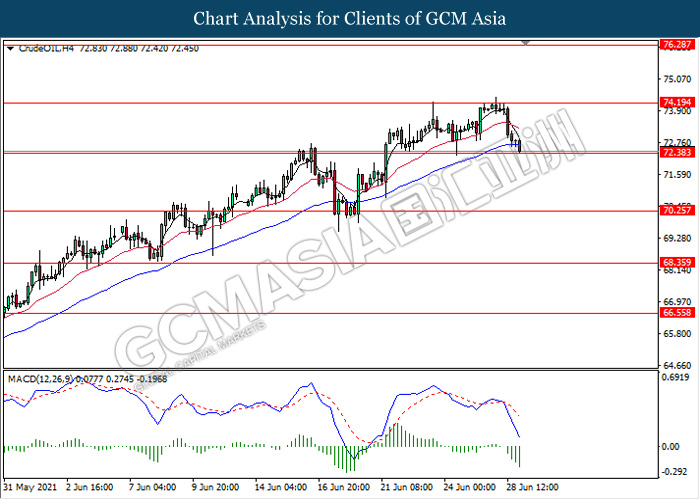

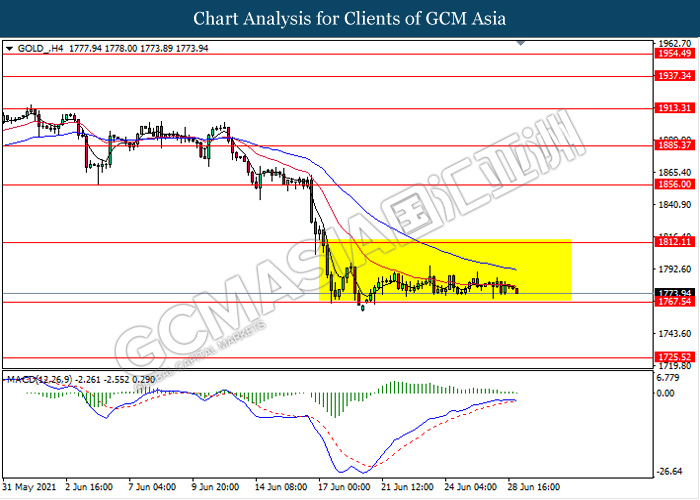

In the commodities market, crude oil price extends losses and fell 0.27% to $72.88 per barrel as of writing following virus outbreak concerns which affect demand. U.K. reported the highest daily rise in COVID-19 cases on Monday since January 30. Hong Kong, Spain, and Portugal banned all passenger flights from the nation to curb the spread of the Delta variant of COVID-19. Besides that, Australia is seeing a spike in the number of COVID-19 cases, with 110 cases of Delta variant in Sydney. On the other hand, gold price slips 0.16% to $1775.62 a troy ounce at the time of writing following dollar rebound.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Jun) | 117.2 | 119.0 | – |

Technical Analysis

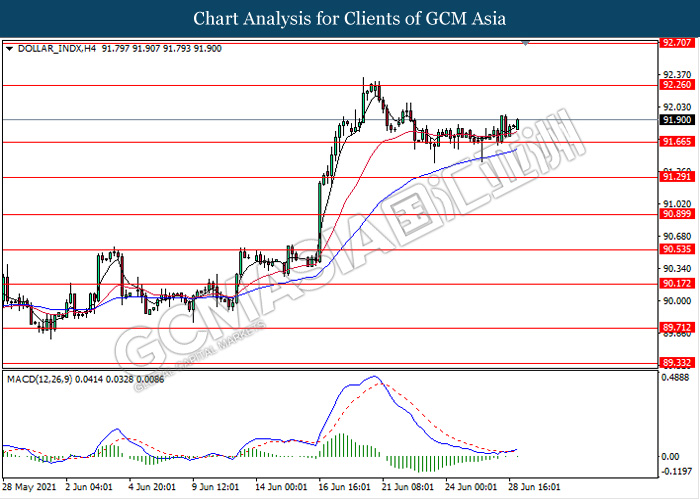

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level 91.65. MACD which illustrate bullish bias signal with the formation of golden cross suggest the dollar to extend its rebound towards the resistance level 92.25.

Resistance level: 92.25, 92.70

Support level: 91.65, 91.30

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level 1.3935. MACD which illustrate bearish momentum signal suggest the pair to extend its retracement towards the support level 1.3830.

Resistance level: 1.3935, 1.4020

Support level: 1.3830, 1.3755

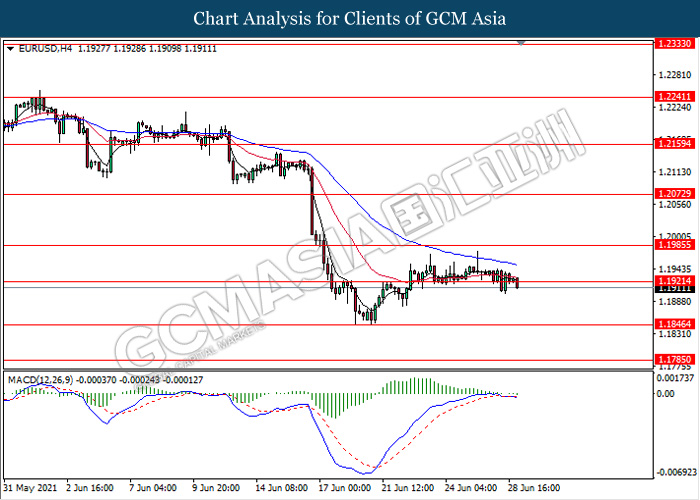

EURUSD, H4: EURUSD was traded lower while currently testing the support level 1.1920. MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.1985, 1.2070

Support level: 1.1920, 1.1845

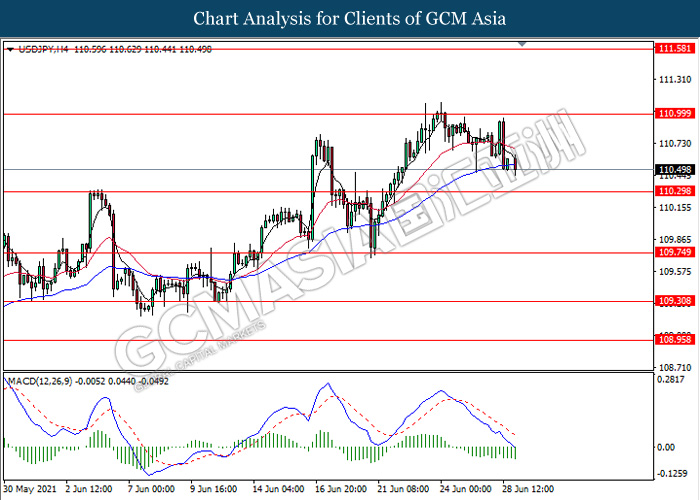

USDJPY, H4: USDJPY was traded lower while currently testing near the support level 110.30. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 111.00, 111.60

Support level: 110.30, 109.75

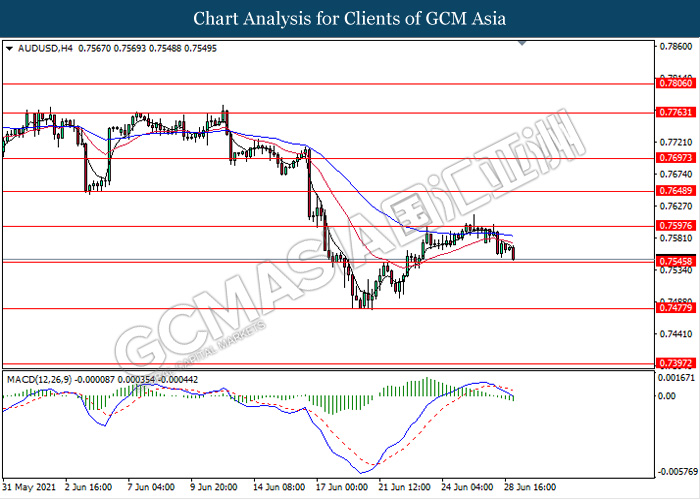

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level 0.7545. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.7595, 0.7650

Support level: 0.7545, 0.7475

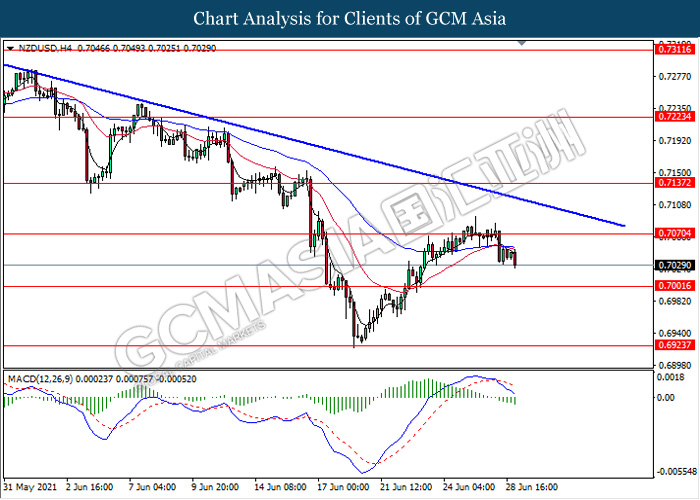

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level 0.7070. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 0.7000.

Resistance level: 0.7070, 0.7135

Support level: 0.7000, 0.6925

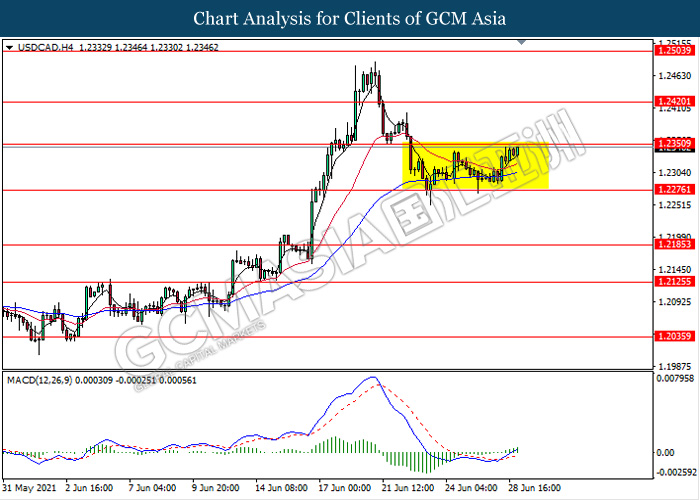

USDCAD, H4: USDCAD remain traded in a sideway channel while currently testing the resistance level 1.2350. However, MACD which illustrate bullish momentum signal with the recent formation of golden cross suggest the pair to be traded higher after it breaks above the resistance level.

Resistance level: 1.2350, 1.2420

Support level: 1.2275, 1.2185

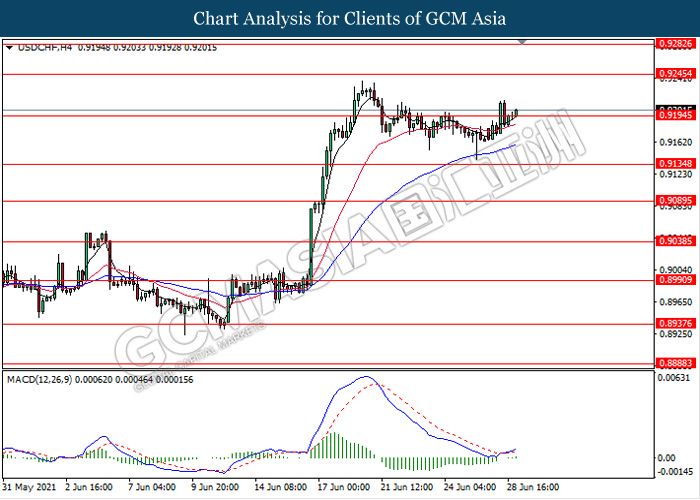

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level 0.9195. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.9245.

Resistance level: 0.9245, 0.9280

Support level: 0.9195, 0.9135

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level 72.40. MACD which illustrate bearish momentum signal suggest the commodity to extend its losses after it breaks blow the support level.

Resistance level: 74.20, 76.30

Support level: 72.40, 70.25

GOLD_, H4: Gold price remain traded flat in a sideway channel while currently testing near the support level 1767.55. However, MACD which illustrate diminishing bullish momentum signal suggest the commodity to be traded lower after it breaks below the support level.

Resistance level: 1812.10, 1856.00

Support level: 1767.55, 1725.50