29 June 2023 Afternoon Session Analysis

The euro fell despite the European Central Bank’s hawkish stance against inflation.

The euro fell against the dollar against the dollar despite hawkish comments from the European Central Bank (ECB) president. At yesterday’s European Central Bank Forum, the world’s top central bank reiterated that since inflation in significant countries remains high, many countries need to tighten monetary policy further to combat inflation. These include the Federal Reserve, the Bank of England and the European Central Bank. Before that, ECB President Christine Lagarde promised more tightening measures to curb inflation to the 2% target. She said that the euro area will enter a new phase of high inflation, and the second phase of the inflation process is now starting to get stronger. The gap between wages and production has widened as nominal wages have risen, but productivity growth in manufacturing and services has remained weak. Against this background, many companies will face input cost increase pressure. Therefore, further tightening moves are required by the ECB central bank. However, the recent economic data in the eurozone, especially German was entering into a recession phase. The euro was sold by investors as further tightening measures would plunge the eurozone economy into recession. As of writing, the EURUSD slipped by -0.14% to 1.0896.

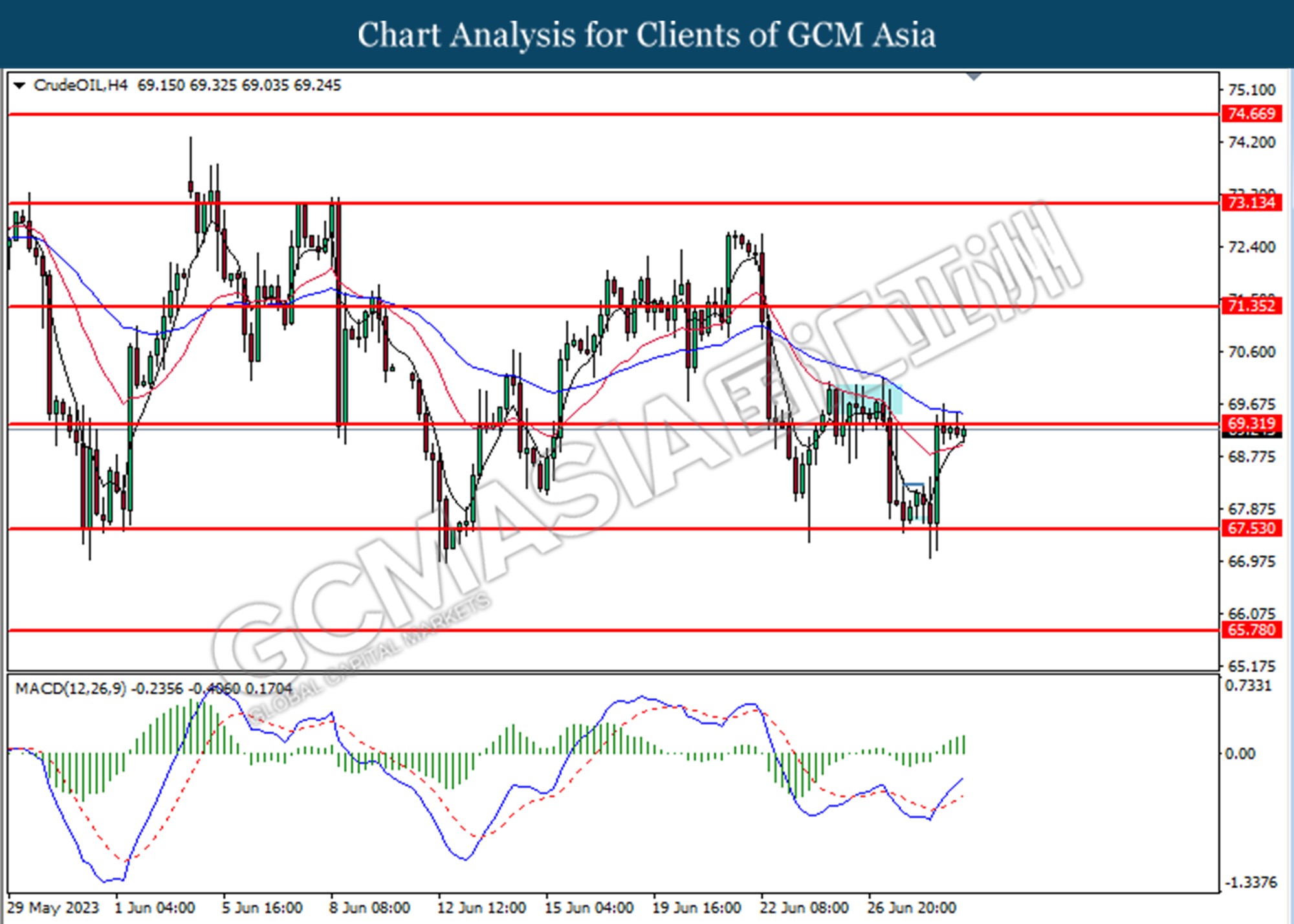

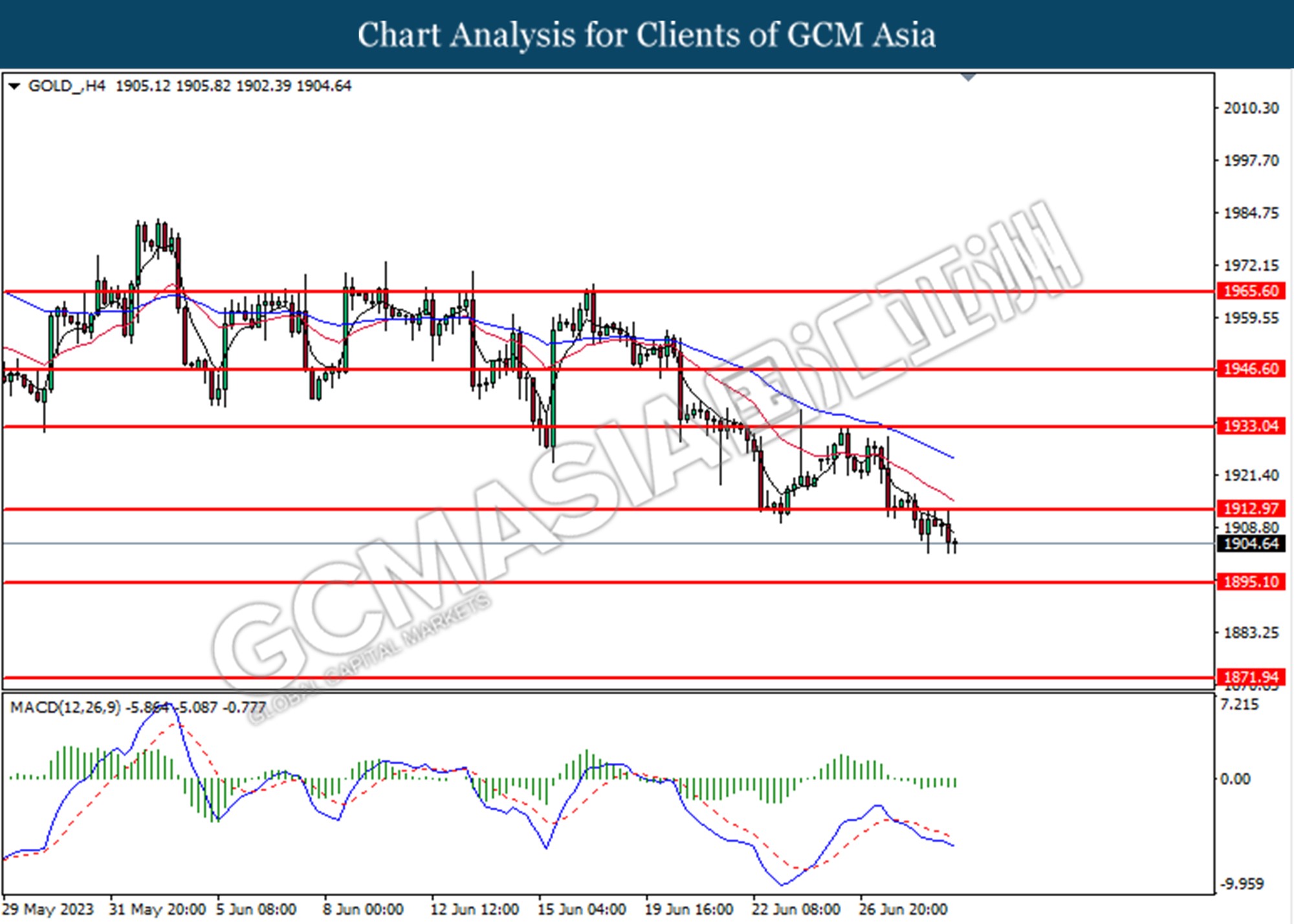

In the commodities market, crude oil prices traded down by -0.37% to $69.30 per barrel as the previous session crude oil price rose after EIA crude inventory showed in deficit amount. Besides, the gold prices were reduced by -0.16% to $1904.37 per troy ounce as the Fed hints more tightening moves will implement to curb inflation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:30 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | EUR – German CPI (MoM) (Jun) | -0.1% | 0.2% | – |

| 20:30 | USD – GDP (QoQ) (Q1) | 1.3% | 1.4% | – |

| 20:30 | USD – Initial Jobless Claims | 264k | 266K | – |

| 22:00 | USD – Pending Home Sales (MoM) (May) | 0.0% | 0.2% | – |

Technical Analysis

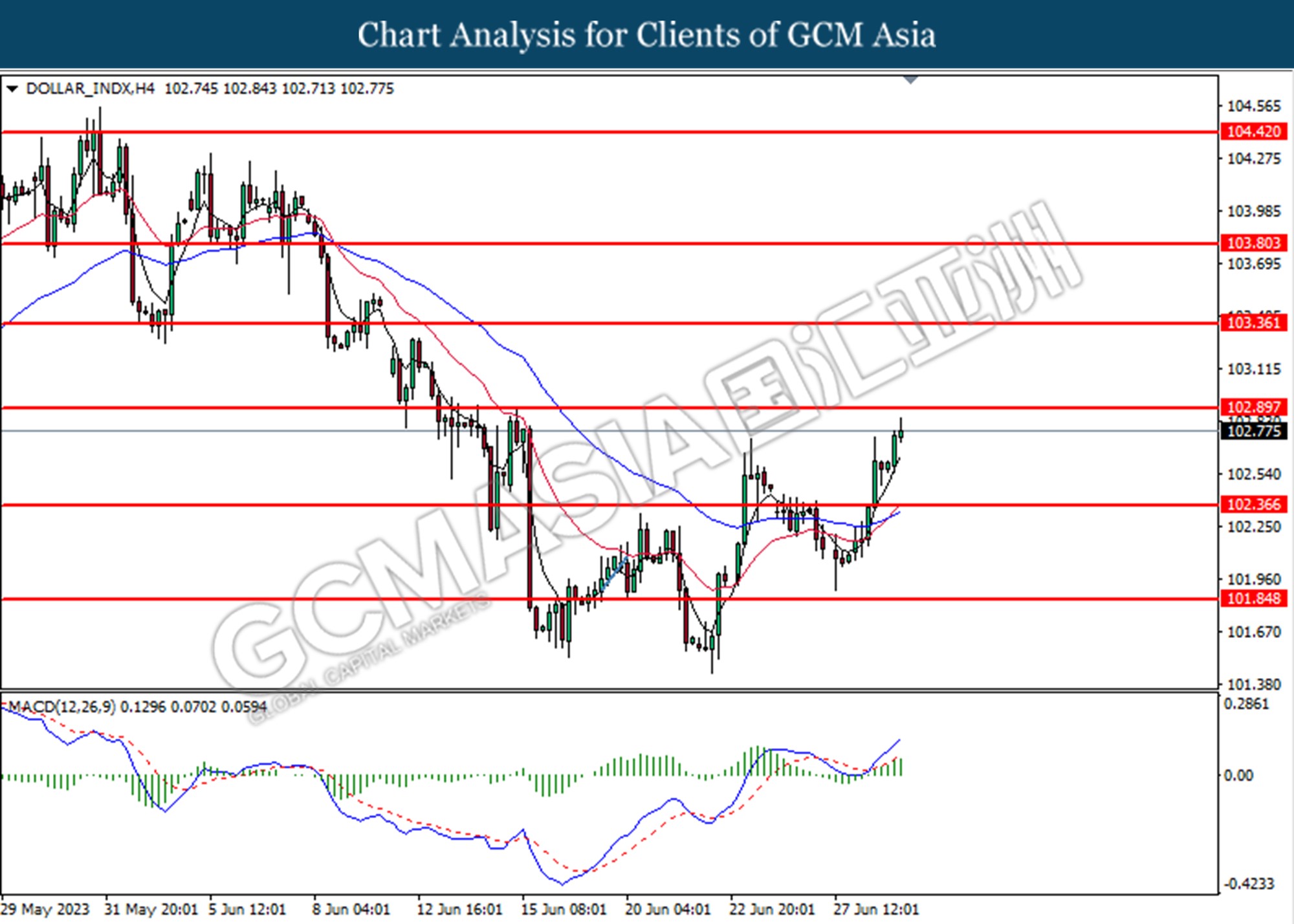

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the index extended its gains toward the resistance level at 102.90.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

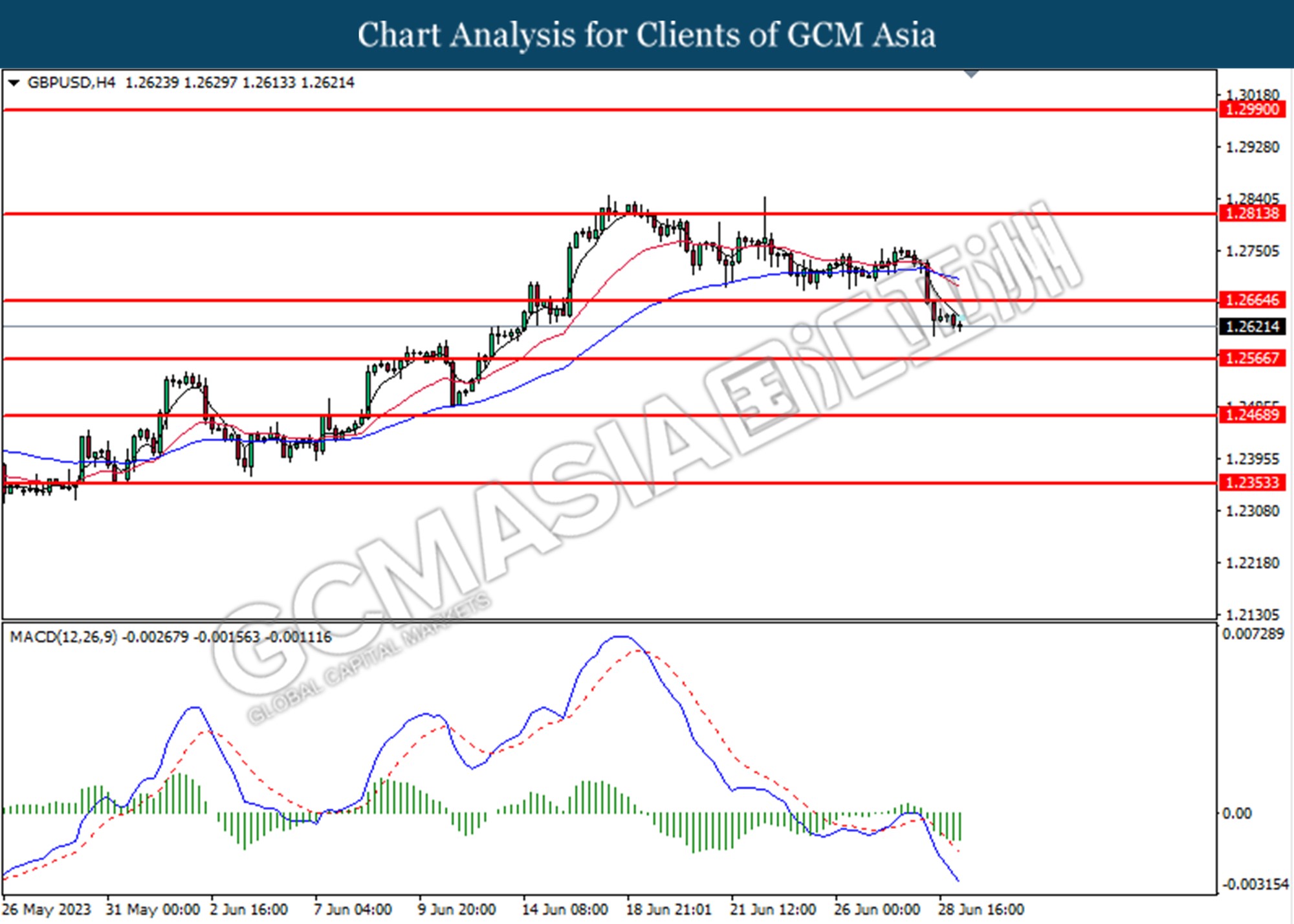

GBPUSD, H4: GBPUSD was traded lower following the prior breaks below the previous support level at 1.2665. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.2565.

Resistance level: 1.2665, 1.2815

Support level: 1.2565, 1.2470

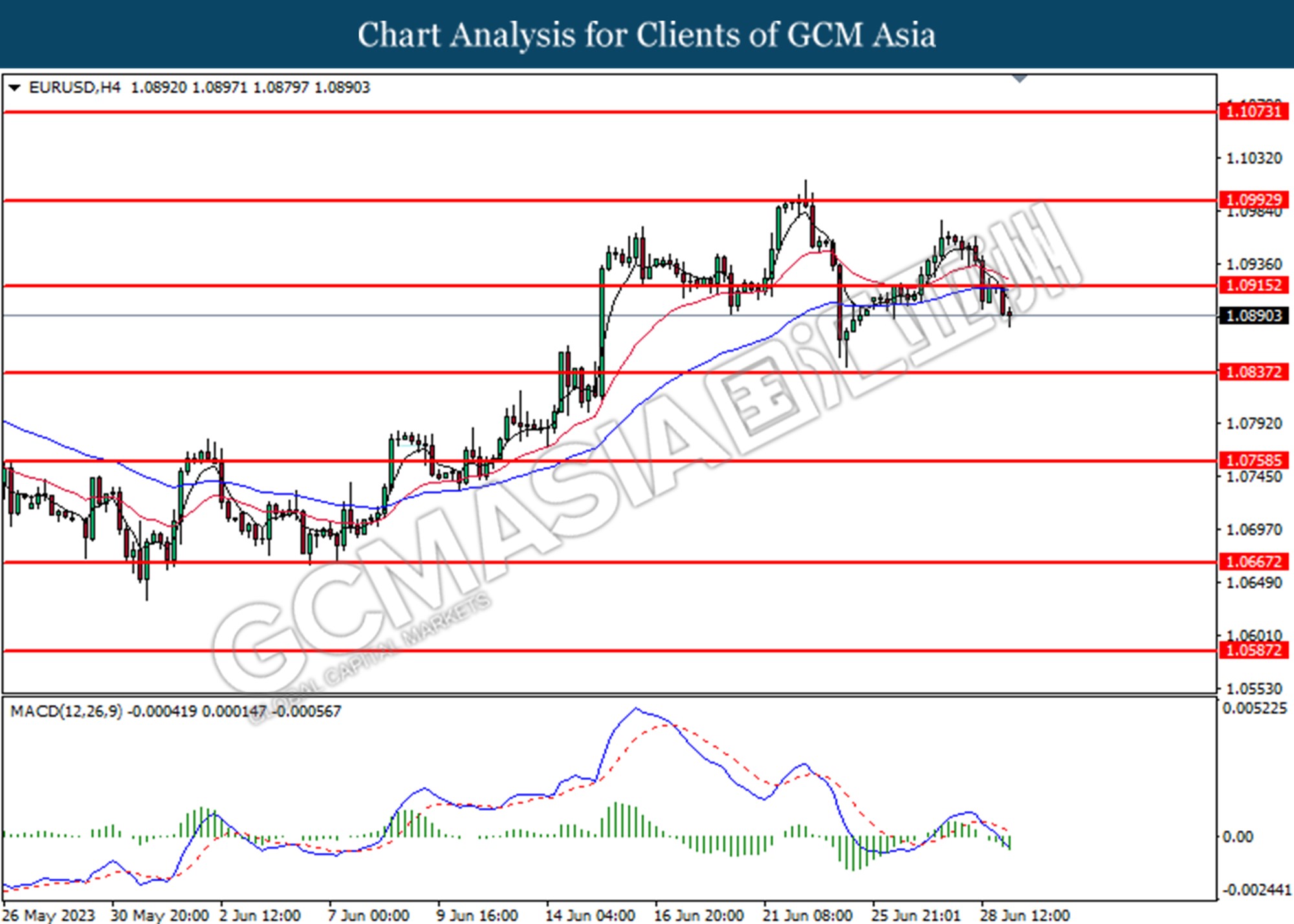

EURUSD, H4: EURUSD was traded lower following the prior breaks below the previous support level at 1.0915. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

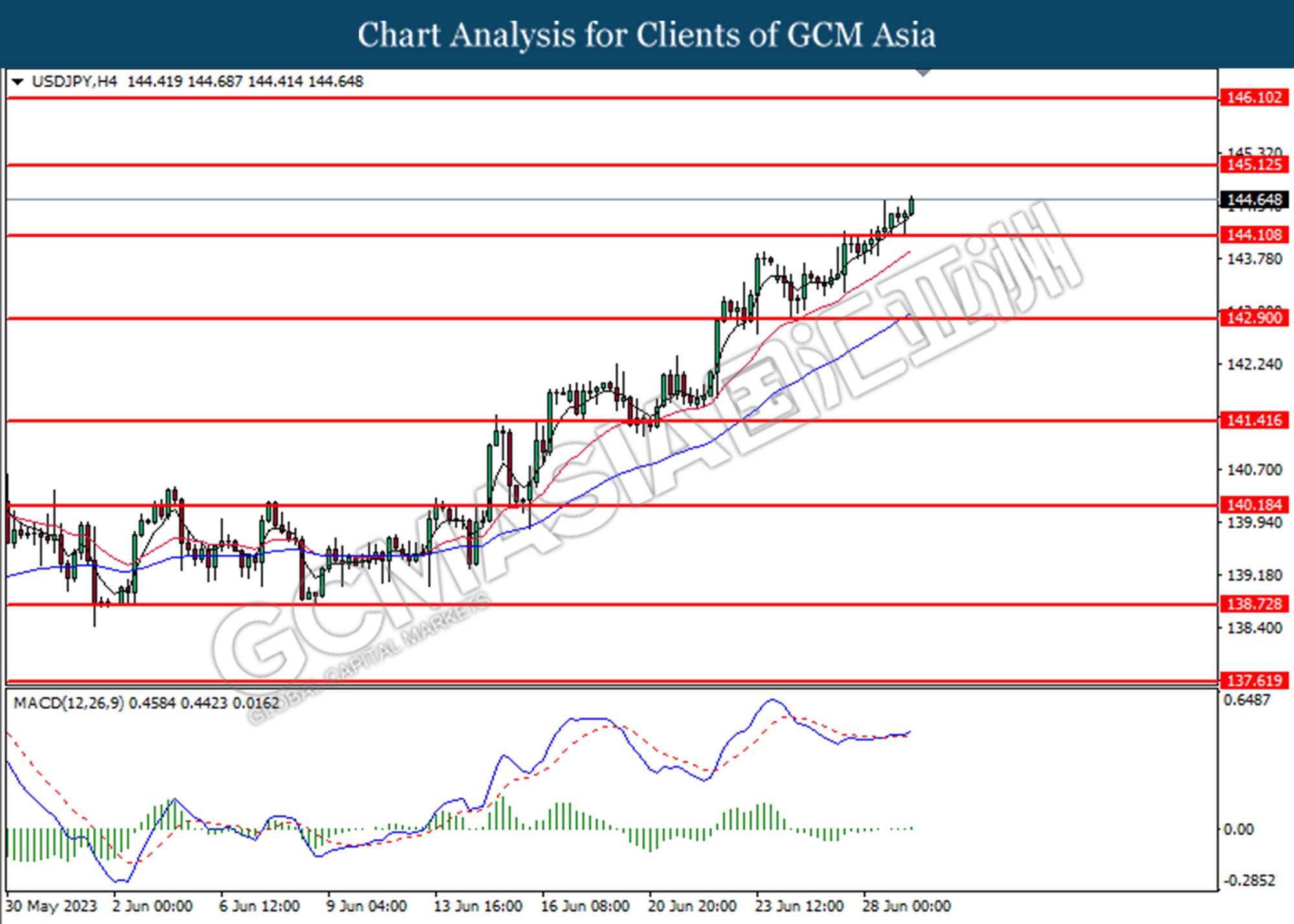

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 144.10. MACD which illustrated increasing bullish momentum suggests the pair extended its gain toward the resistance level at 145.10.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

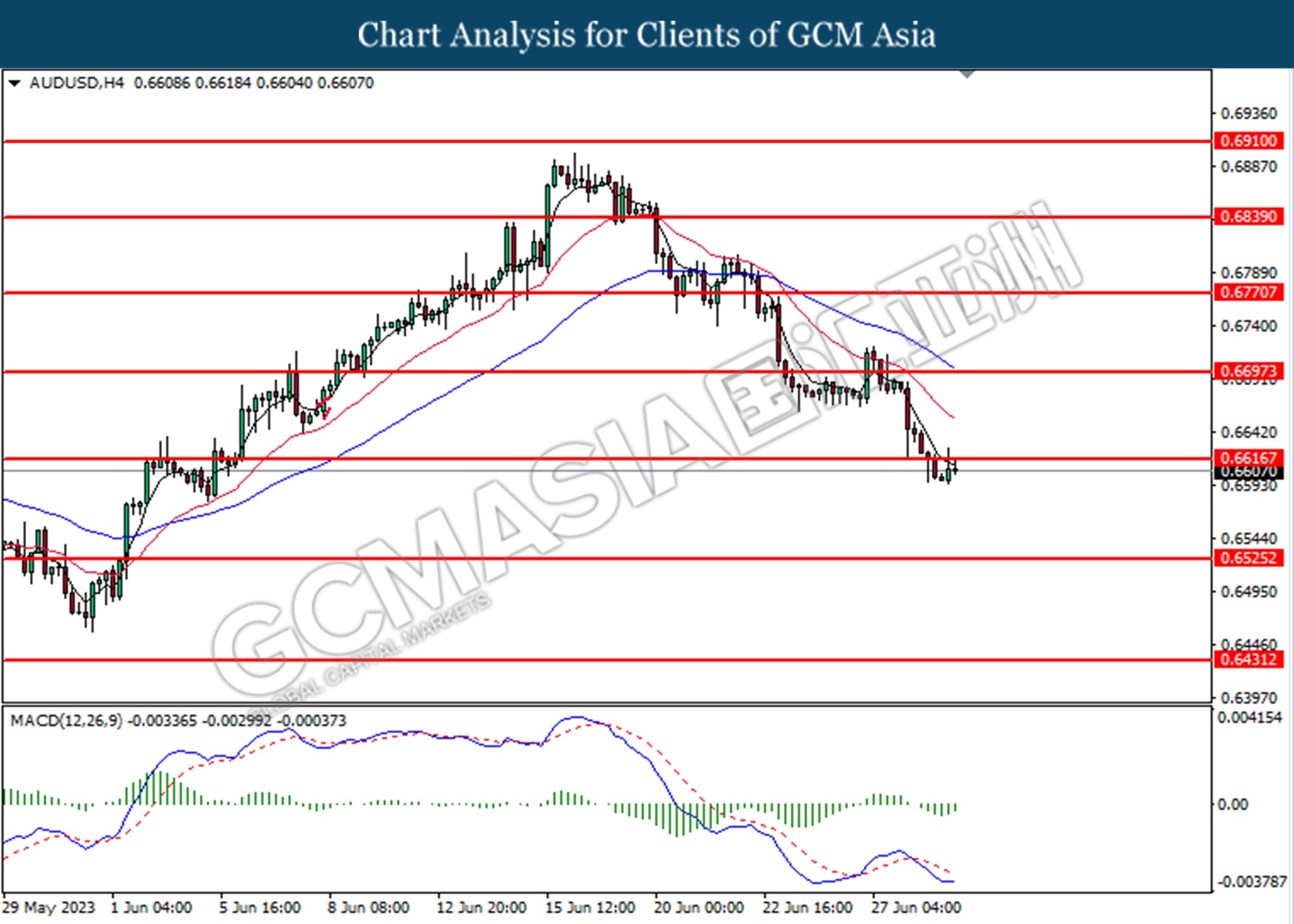

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6615. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6615, 0.6700

Support level: 0.6525, 0.6430

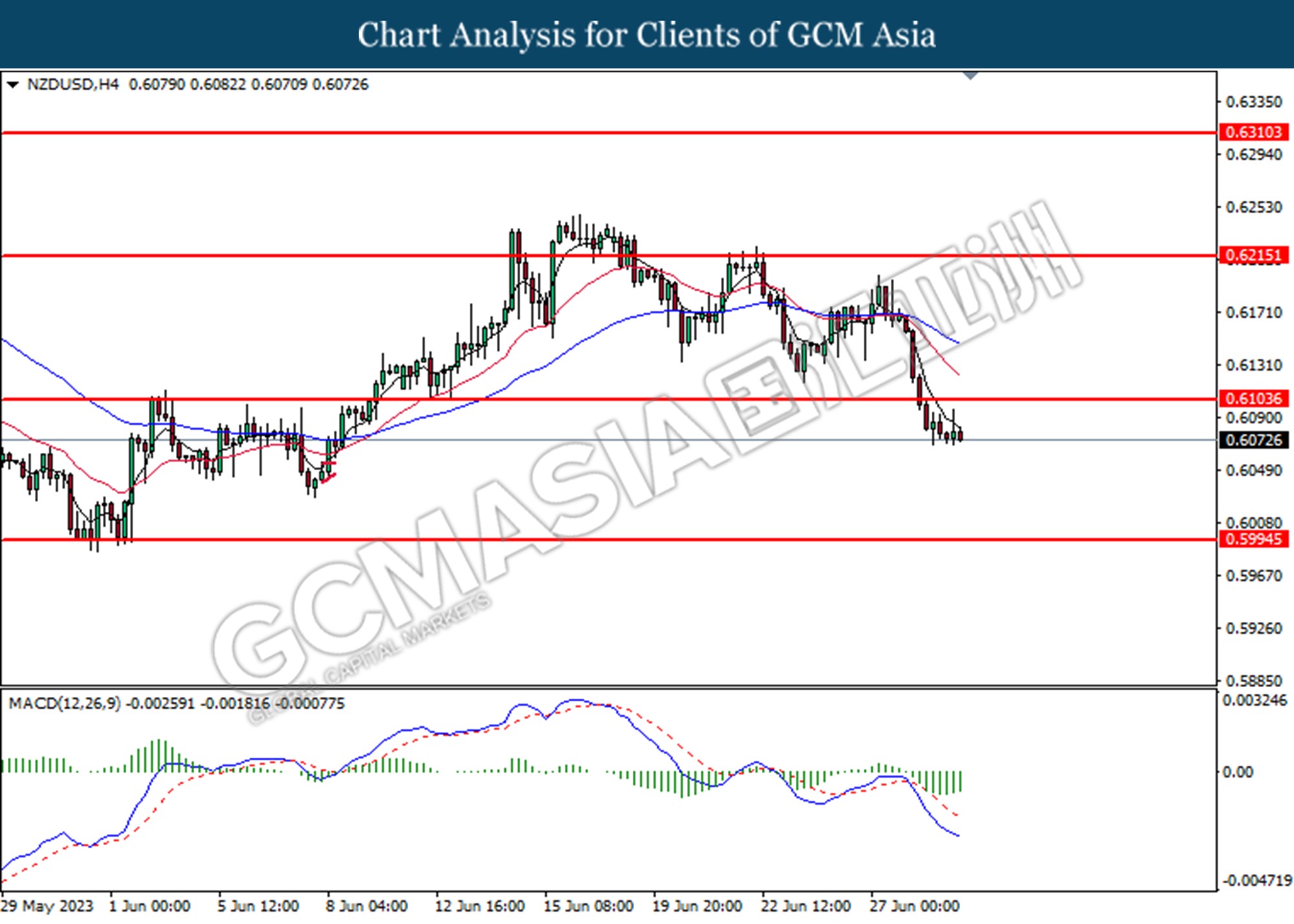

NZDUSD, H4: NZDUSD was traded lower following the prior breaks below from the previous support level at 0.6105. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6105, 0.6215

Support level: 0.5995, 0.5880

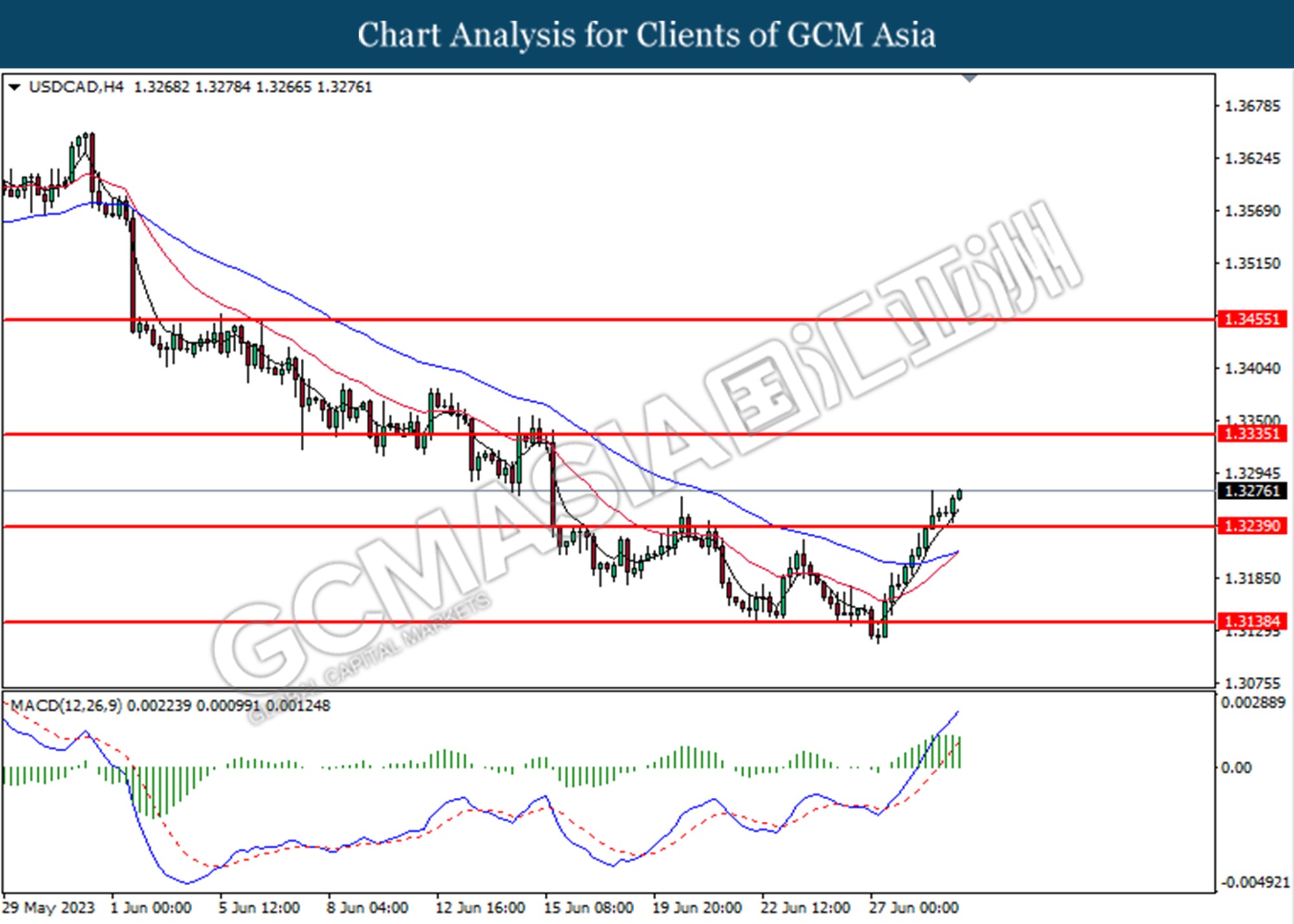

USDCAD, H4: USDCAD was traded higher following the prior breaks above the previous resistance level at 1.3240. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

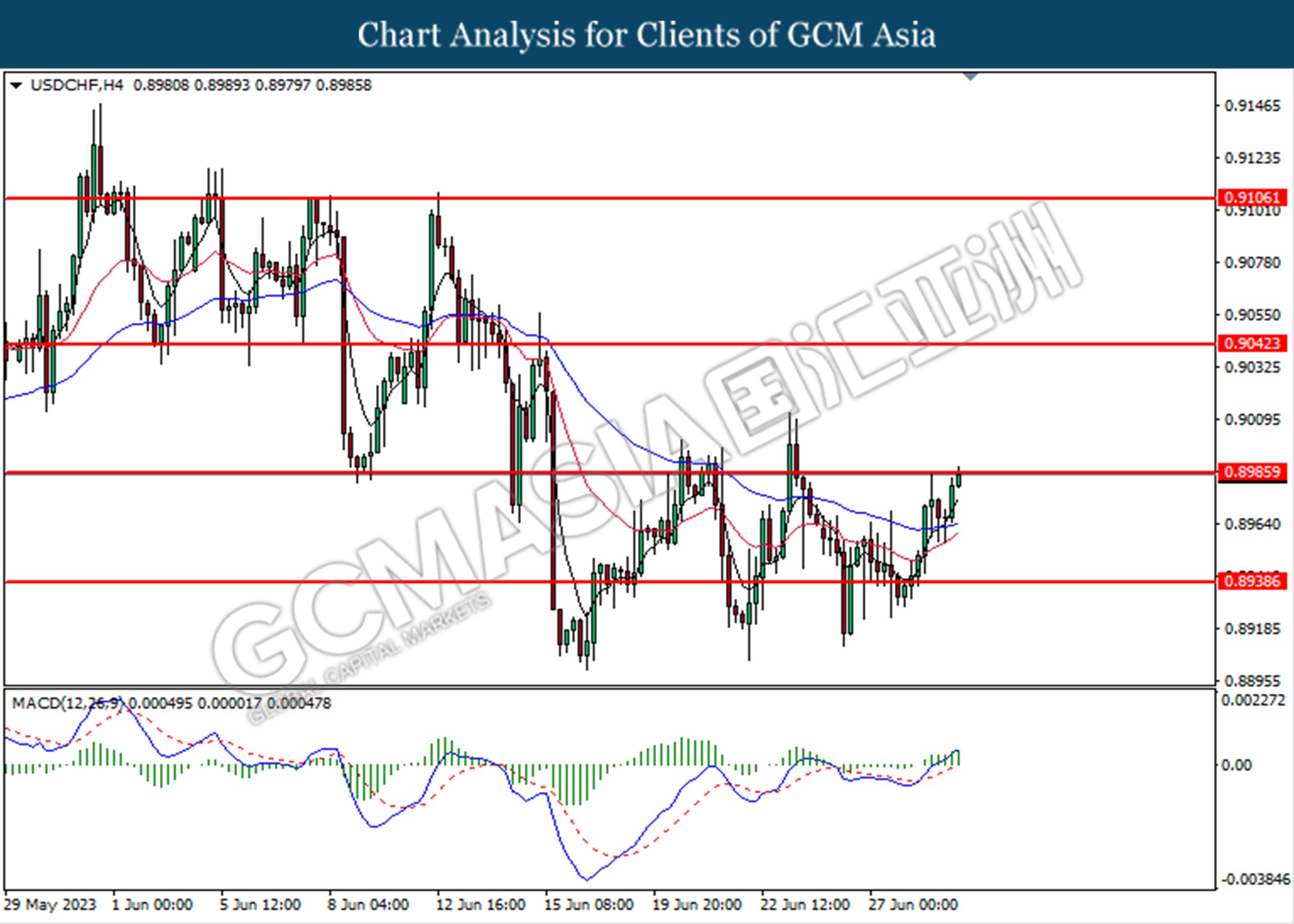

USDCHF, H4: USDCHF was traded higher while currently testing for the resistance level at 0.8985. MACD which illustrated increasing bullish momentum suggests the pair extended its gains if successfully breaks above the resistance level.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the resistance level at 69.30. However, MACD which illustrated increasing bullish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 69.30, 71.35

Support level: 67.55, 65.80

GOLD_, H4: Gold price was traded lower following the prior retracement from the resistance level at 1913.00. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level at 1895.10

Resistance level: 1913.00, 1933.00

Support level: 1895.10, 1871.95