29 June 2023 Morning Session Analysis

Greenback climbed amid Powell’s hawkish comment.

The dollar index, which was traded against a basket of six major currencies, managed to extend its rally yesterday as his hawkish comment with regards the monetary policy path spurred the sentiment of the dollar index. In the ECB Economic Forum, Federal Reserve Chairman Jerome Powell struck a hawkish tone on inflation, saying that he expects multiple rate hikes in the future, and probably at an aggressive pace. Besides, Jerome Powell also revealed that there were strong majority in Fed committee wanted two or more rate hikes till the end of 2023. The reason behind was that they could not see the inflation coming down to the Fed’s 2% long term target until the year of 2025. Hence, the monetary policy is needed to be restrictive enough and sustained for a sufficiently long time. With the higher likelihood of further rate hikes in the upcoming meeting, the appeal of the dollar index spiked as the outlook of the currency turned brighter. As of writing, the dollar index rose 0.47% to 102.95.

In the commodities market, crude oil prices appreciated by 2.21% to $69.40 per barrel as the EIA reported a huge draw from US crude stockpiles. Besides, the gold prices ticked down by -0.02% to $1909.00 per troy ounce as the dollar strengthened amid Powell’s hawkish speech.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:30 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:00 | EUR – German CPI (MoM) (Jun) | -0.1% | 0.2% | – |

| 20:30 | USD – GDP (QoQ) (Q1) | 1.3% | 1.4% | – |

| 20:30 | USD – Initial Jobless Claims | 264k | 266K | – |

| 22:00 | USD – Pending Home Sales (MoM) (May) | 0.0% | 0.2% | – |

Technical Analysis

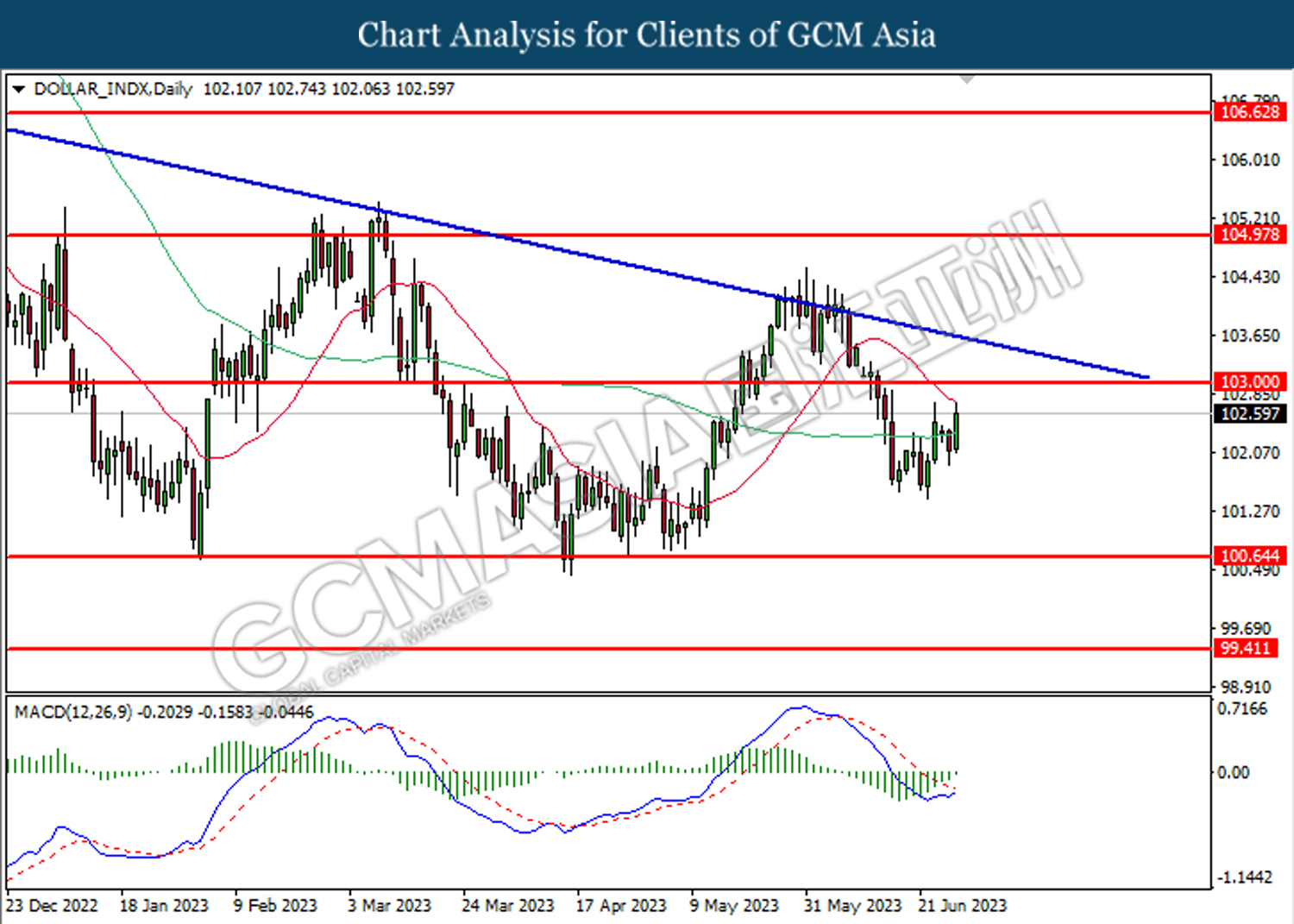

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 103.00.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2635. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

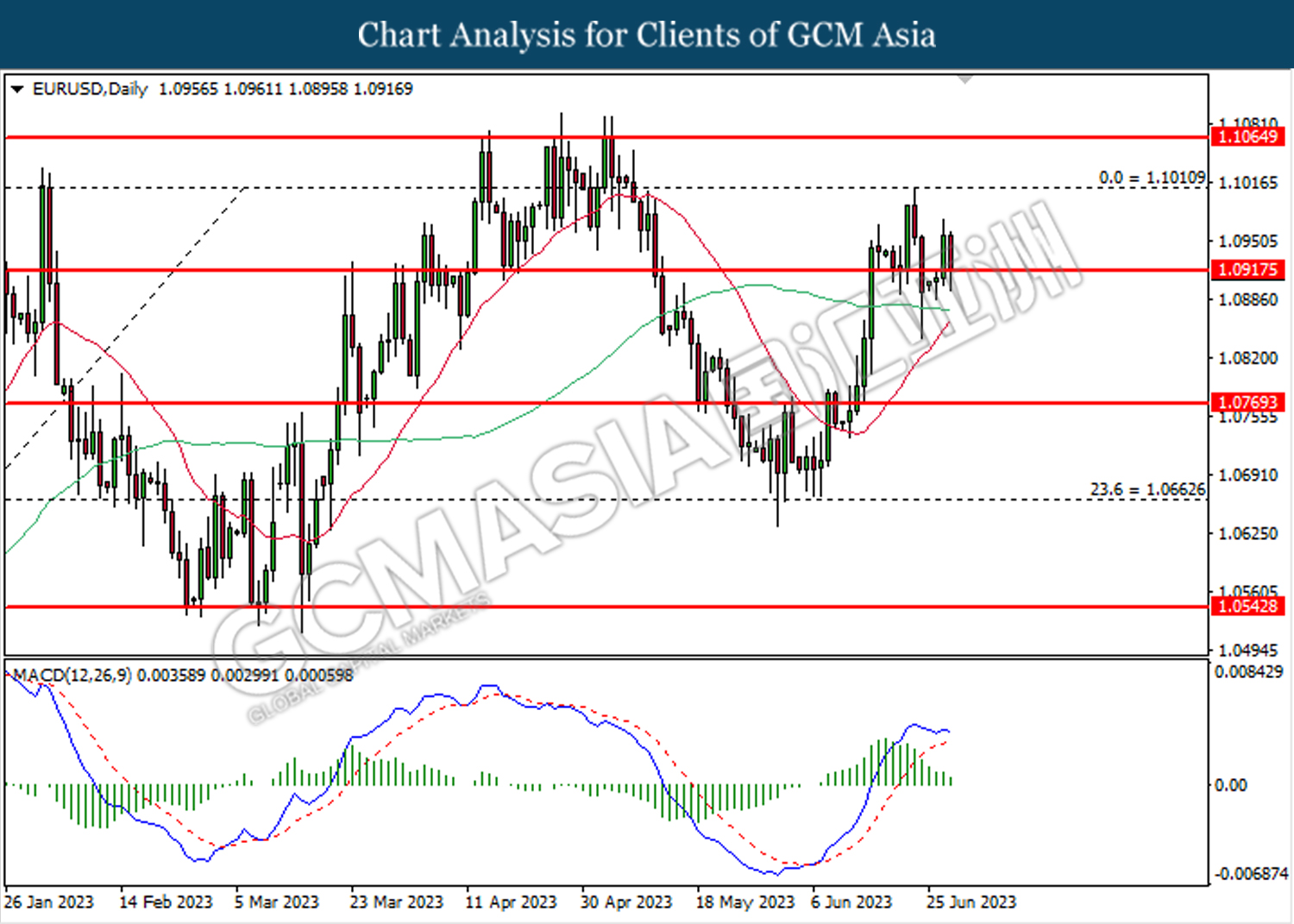

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

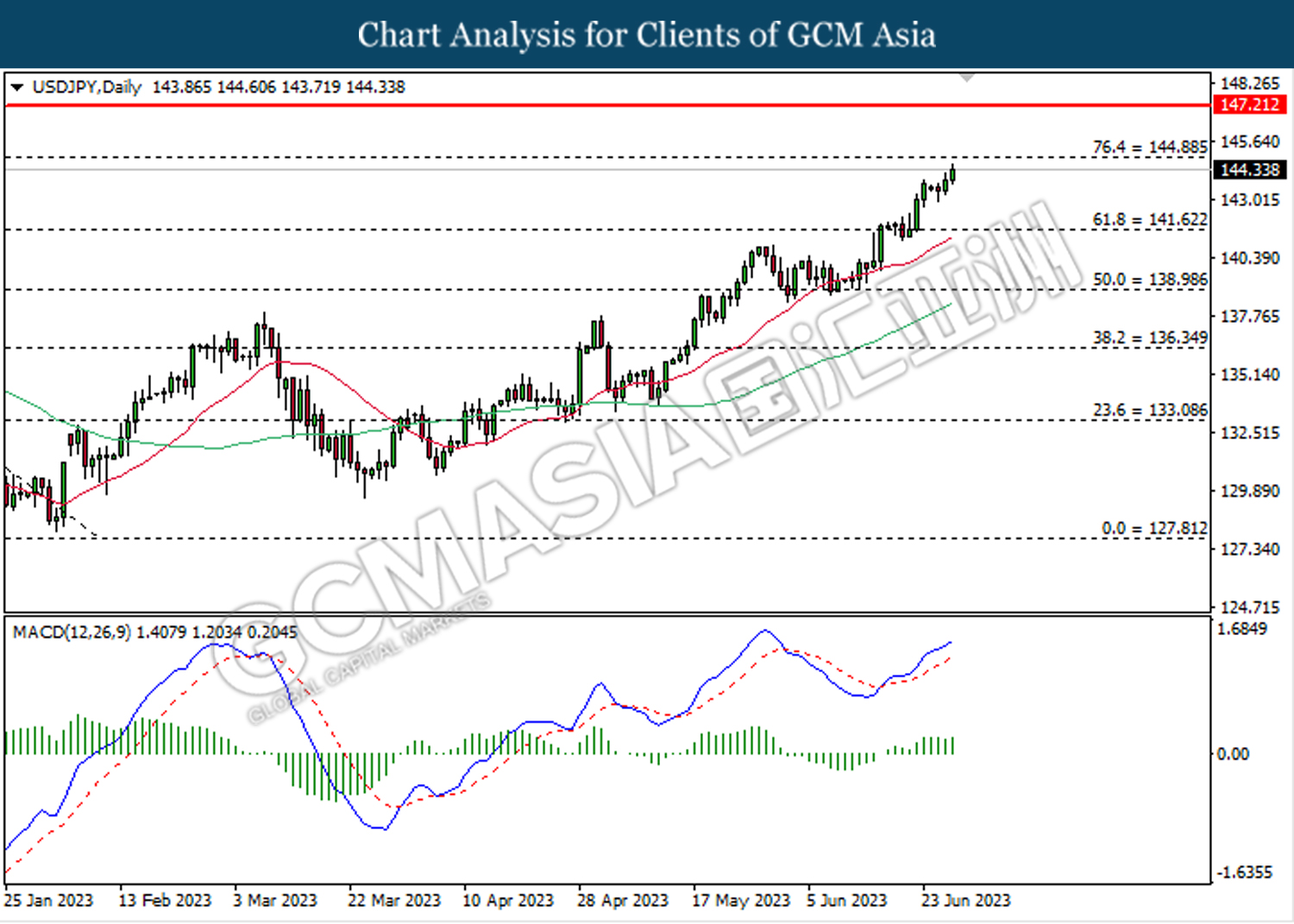

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 141.65. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

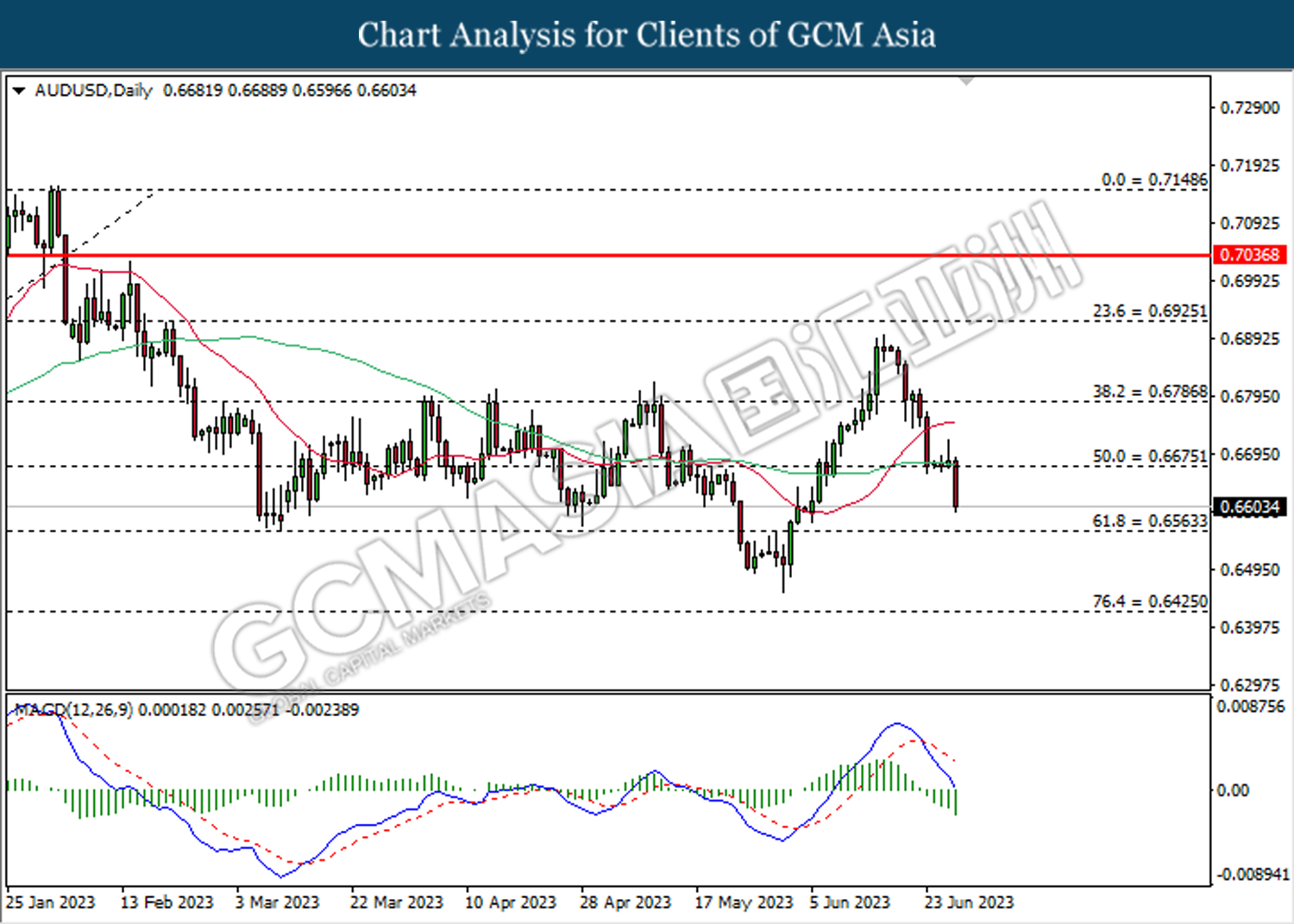

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

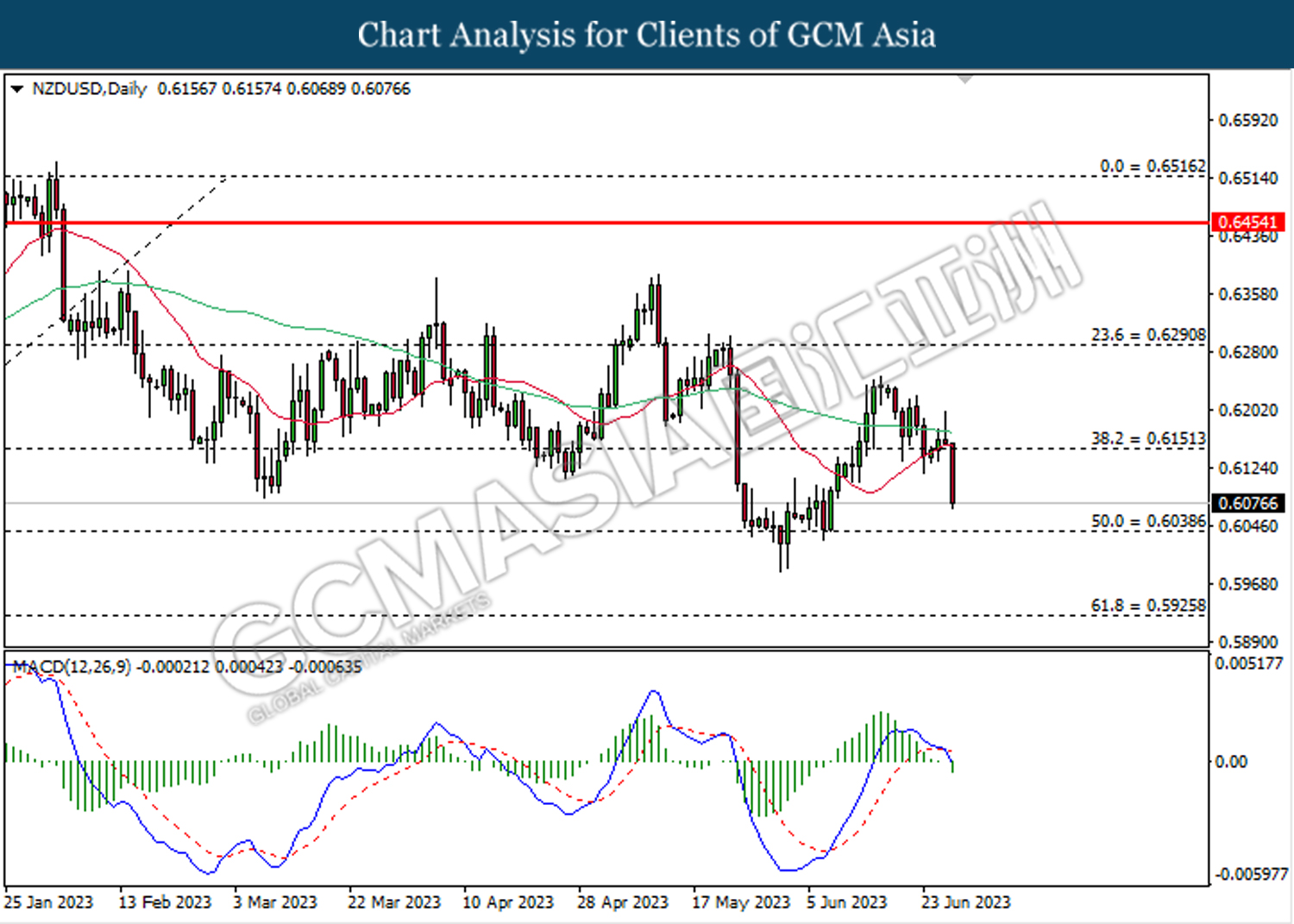

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

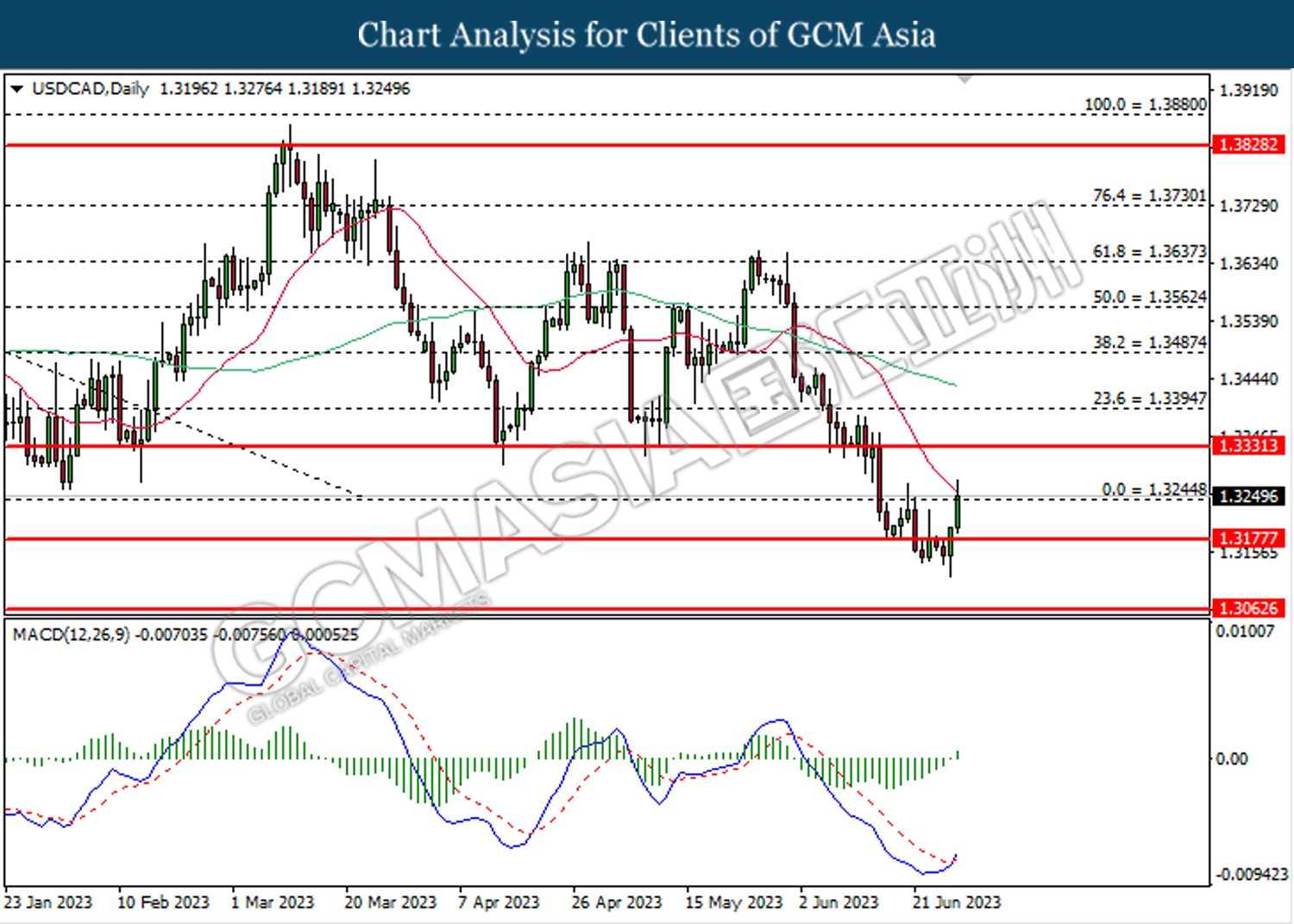

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

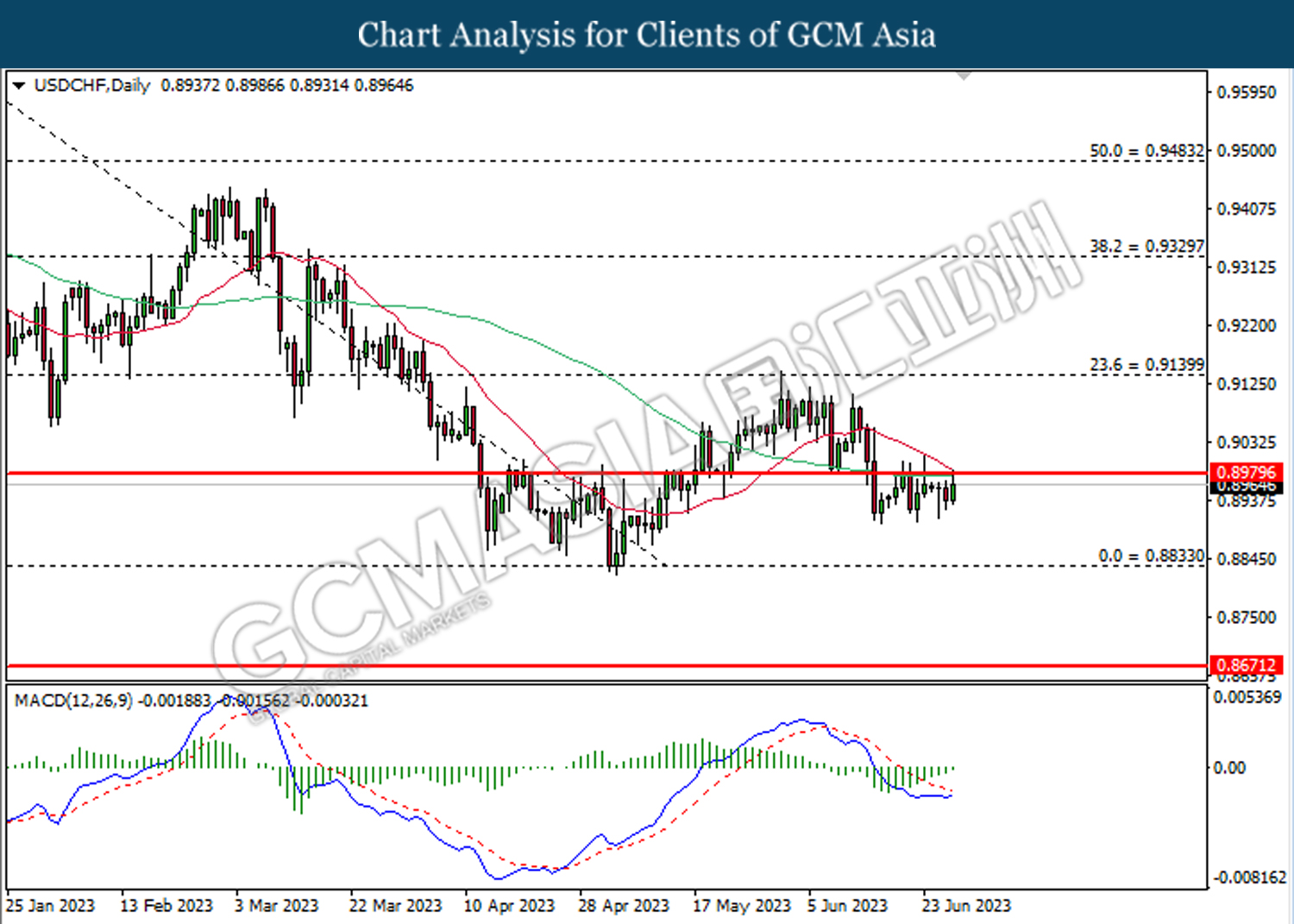

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

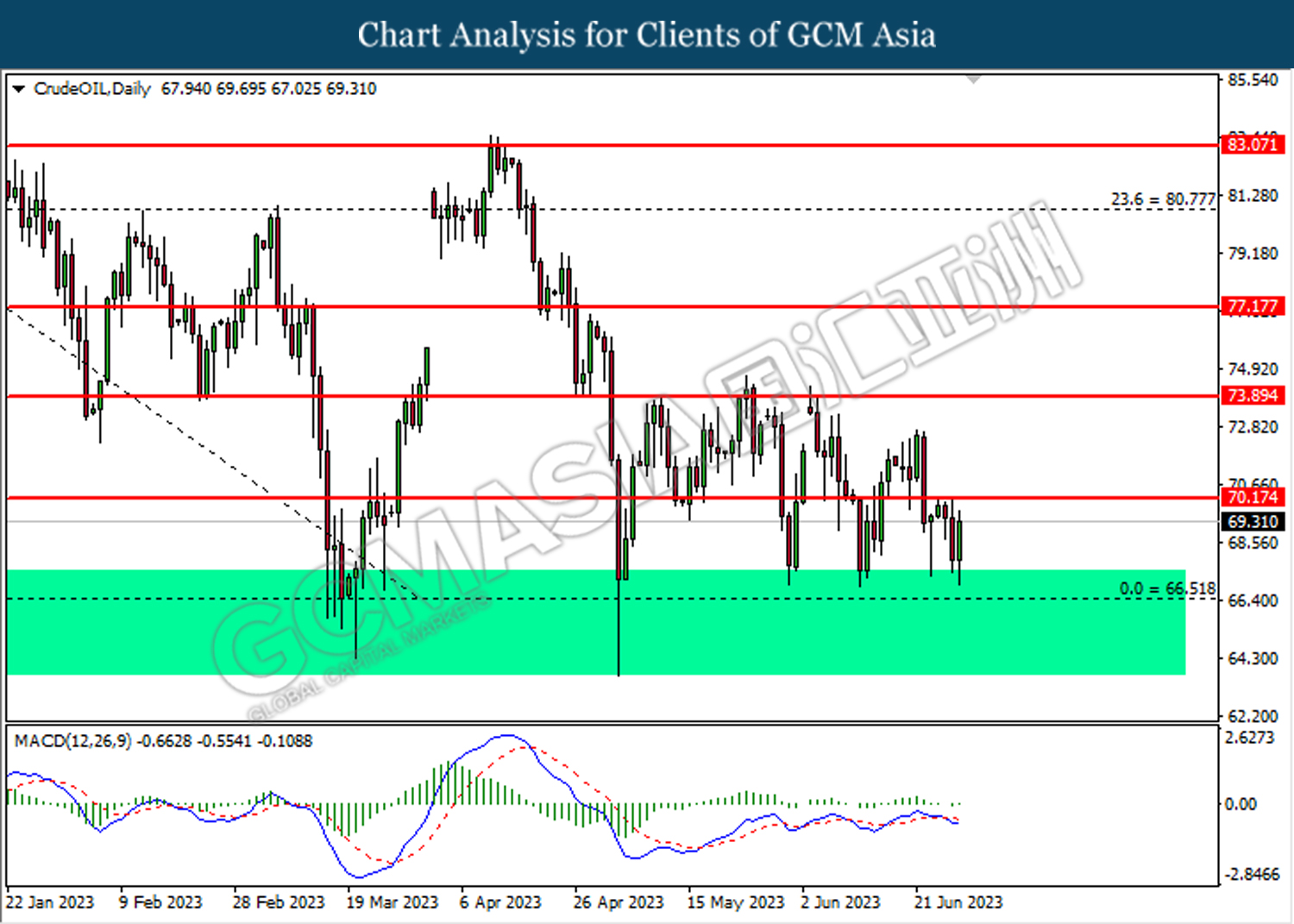

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support zone. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 70.15.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

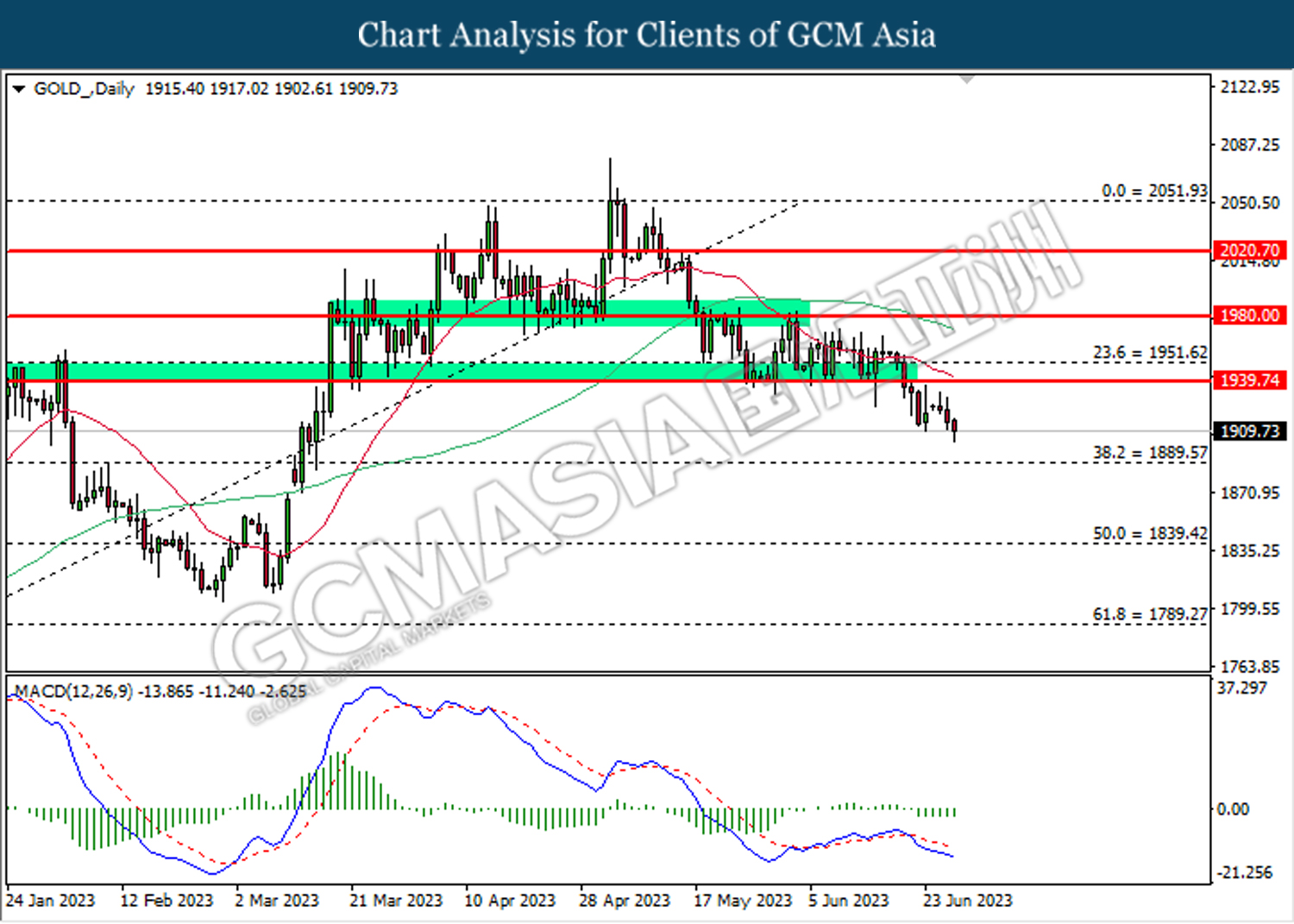

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1939.75. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40