29 July 2022 Afternoon Session Analysis

Euro surged ahead of the all-eyed CPI data.

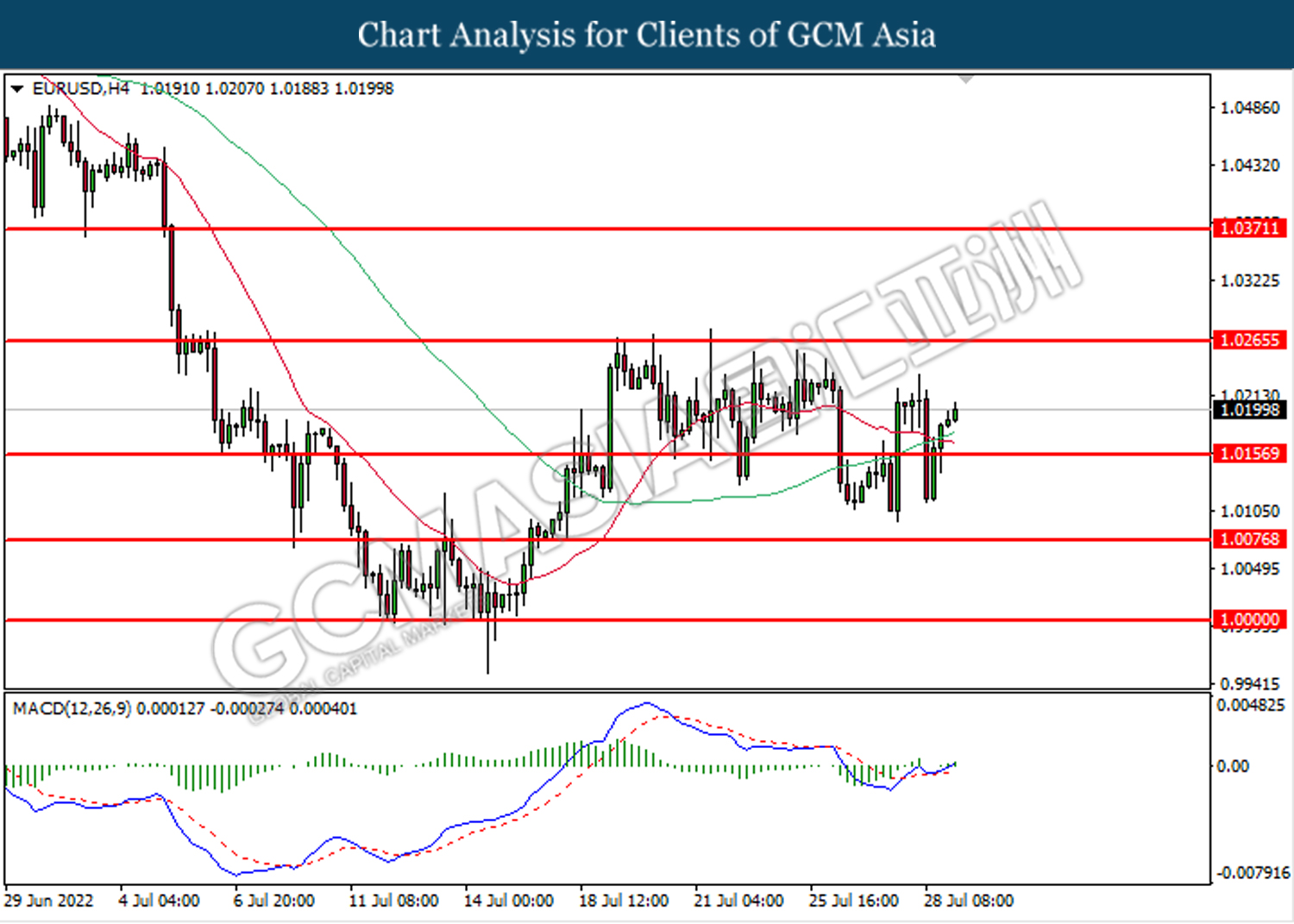

The Euro, which is majorly traded by global investors, surged ahead of the release of the inflation data in the Eurozone. Recently, the single currency had been thrown off by the market participants as the tensions between the Eurozone and Russia heightened. The Russian natural gas giant has reduced its gas flow through the Nord Stream 1, where the company claimed that there were some technical issues noticed. The disruption of gas flow has led to the increase of market fears over the recession in the Eurozone. At the same time, the EU has also achieved a consensus to lower its natural gas reliance on Russia by 15% in the next 9 months. Nonetheless, the pair of EUR/USD managed to stay above the level of 1.0100 as the weakening of the dollar index continued to limit the losses of the currency pair. Yesterday, a series of downbeat data, including the US GDP and Initial Jobless Claims, heralded dark clouds for the US economy at this juncture. As of writing, the pair of EUR/USD is up 0.04% to 1.0200.

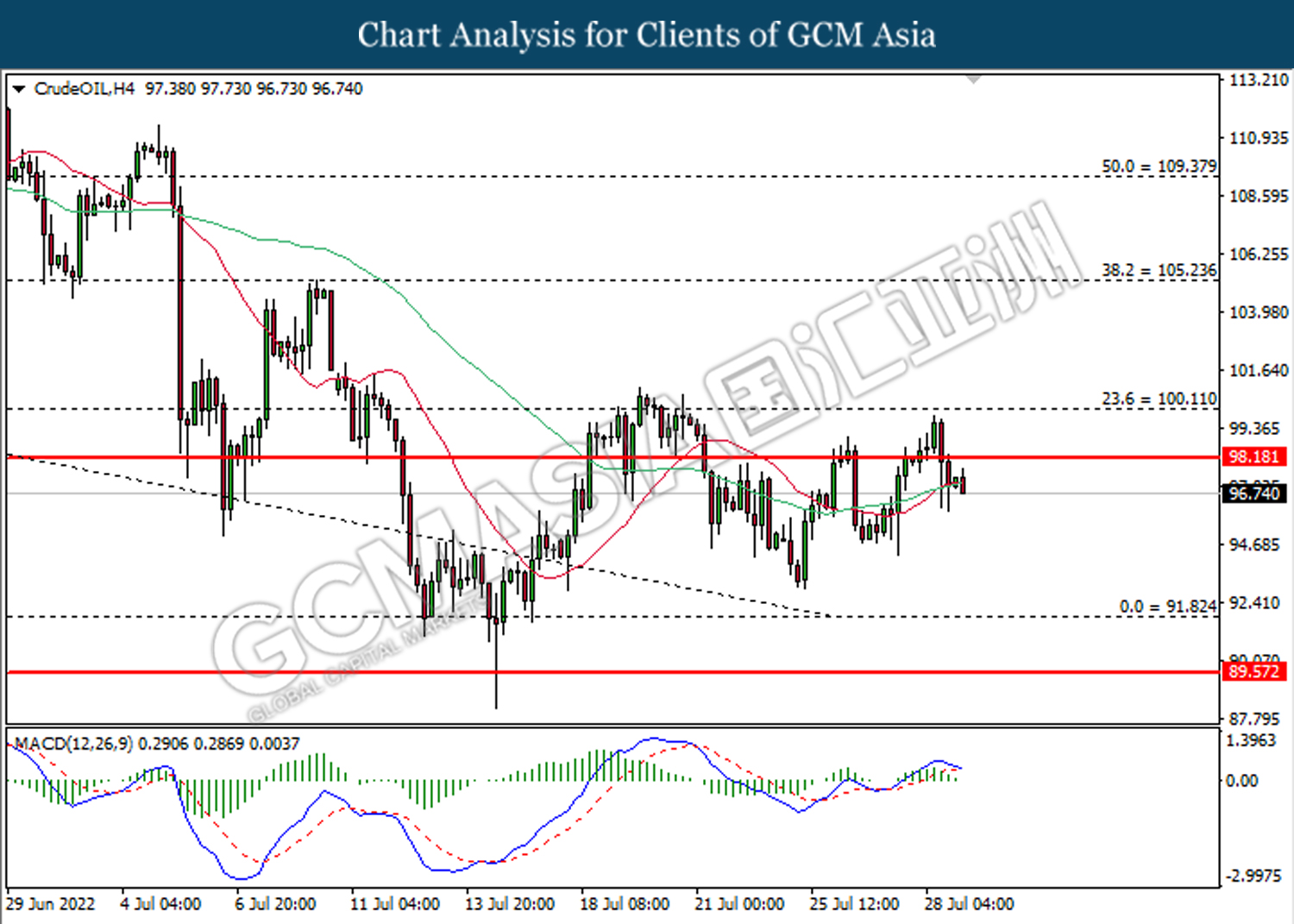

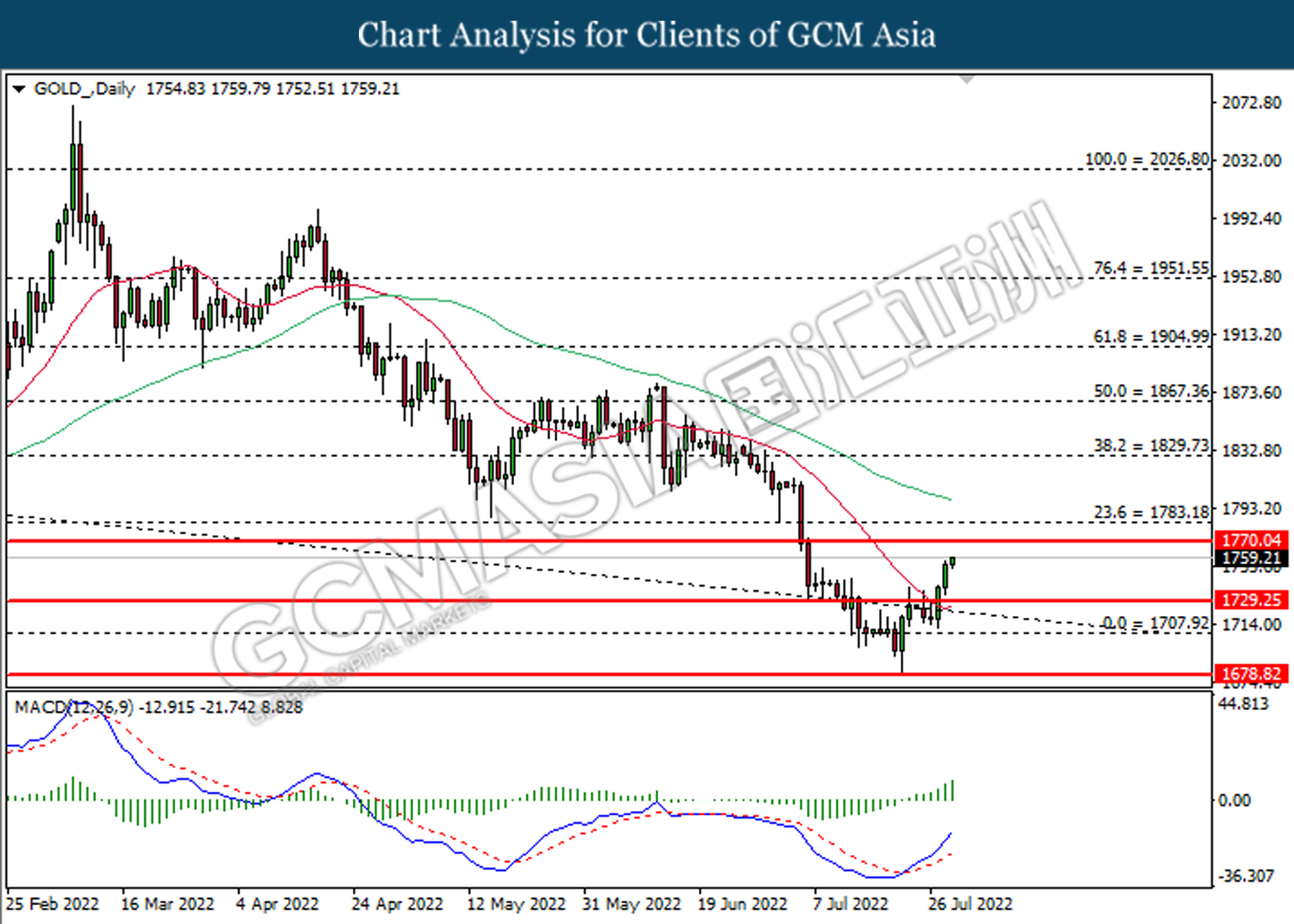

In the commodities market, the crude oil price was down 0.58% to $96.77 a barrel as the recession risk loomed after a weaker-than-expected GDP was released from the US. Besides, the gold prices appreciated by 0.10% to $1758.10 per troy ounce following the release of the downbeat GDP.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (Jul) | 133K | 15K | – |

| 16:00 | EUR – German GDP (QoQ) (Q2) | 0.20% | 0.10% | – |

| 17:00 | EUR – CPI (YoY) (Jul) | 8.60% | 8.70% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Jun) | 0.30% | 0.50% | – |

| 20:30 | CAD – GDP (MoM) (May) | 0.30% | -0.20% | – |

Technical Analysis

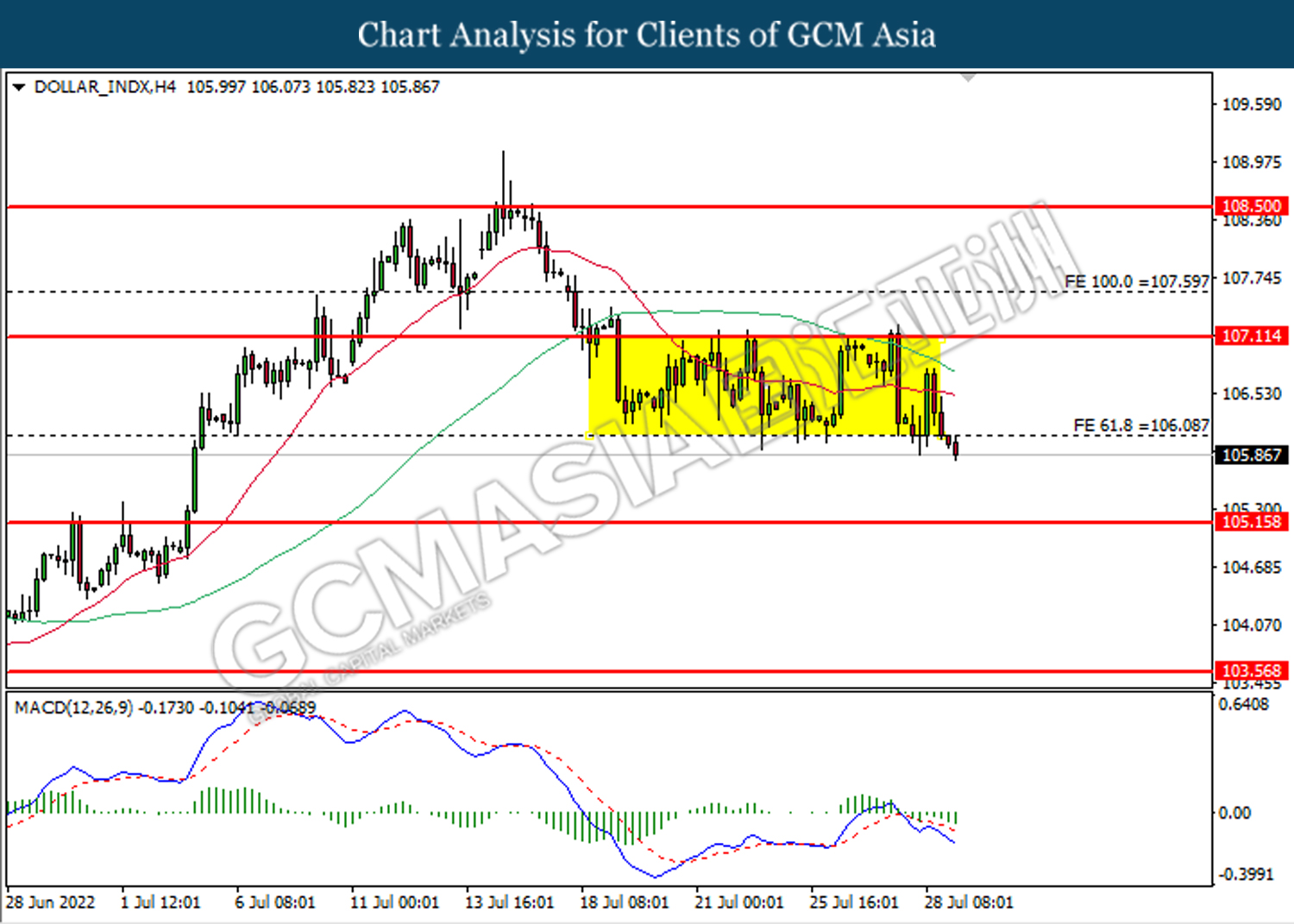

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 106.10. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 105.15.

Resistance level: 106.10, 107.10

Support level: 105.15, 103.55

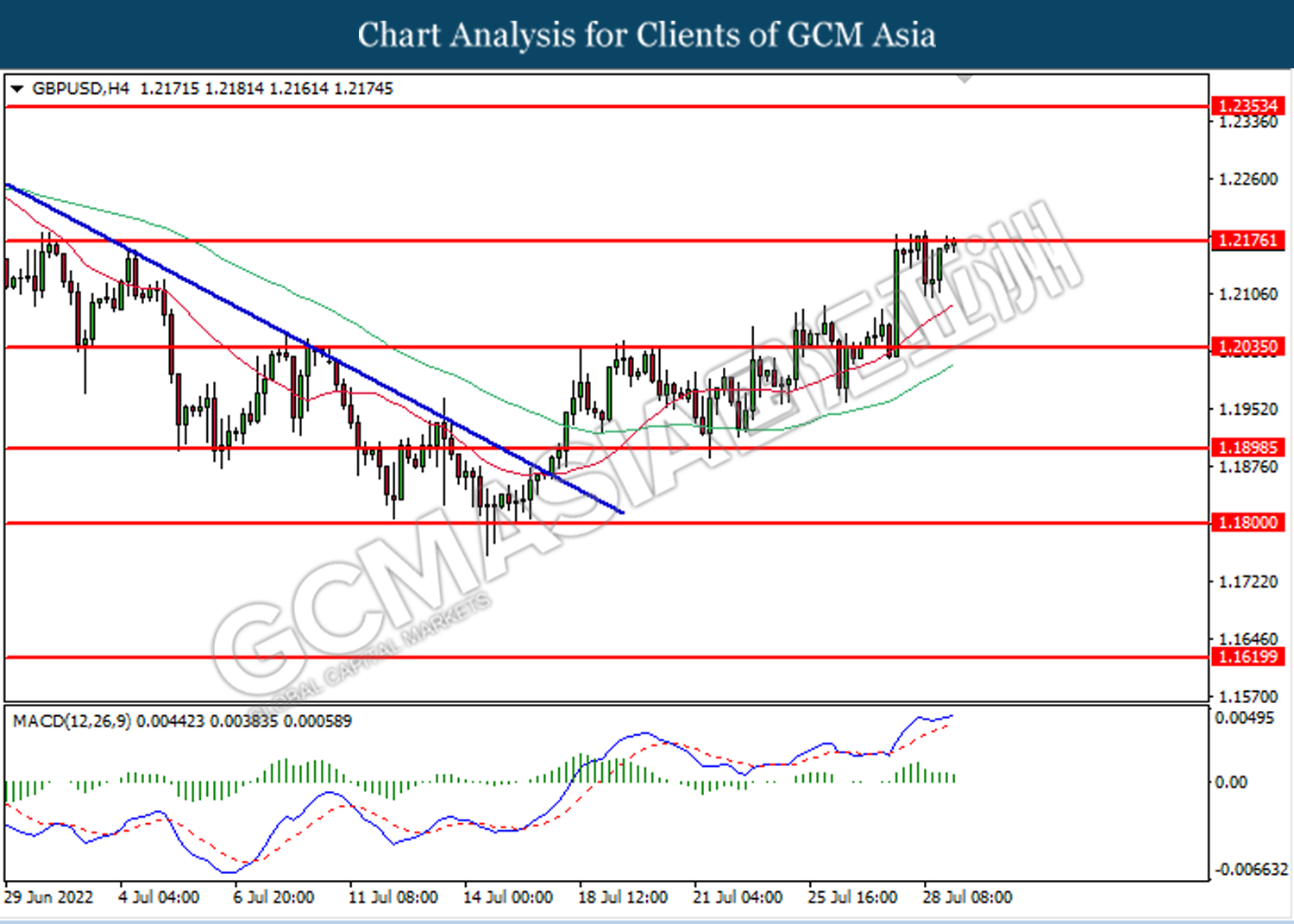

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

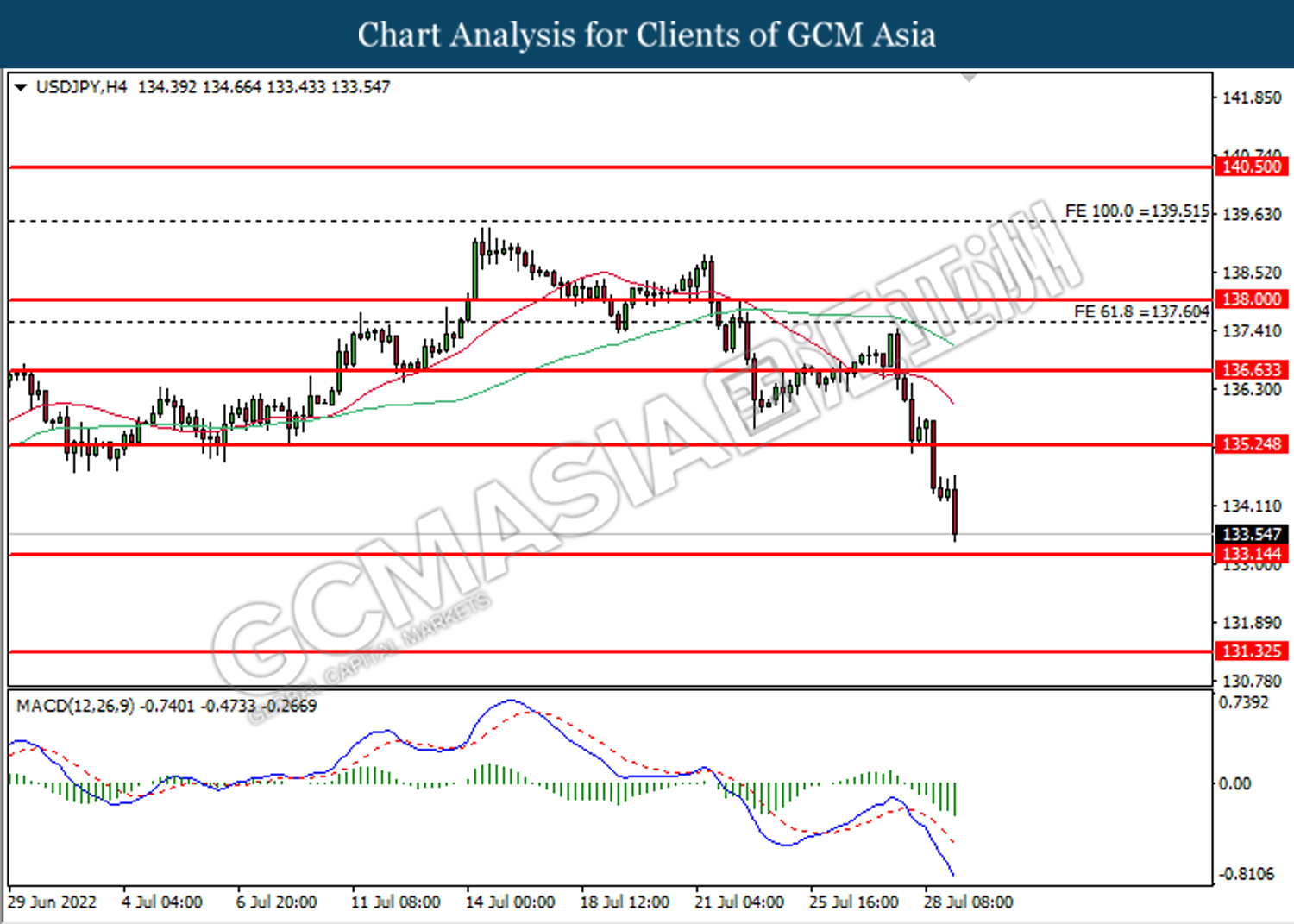

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 135.25. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 133.15.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

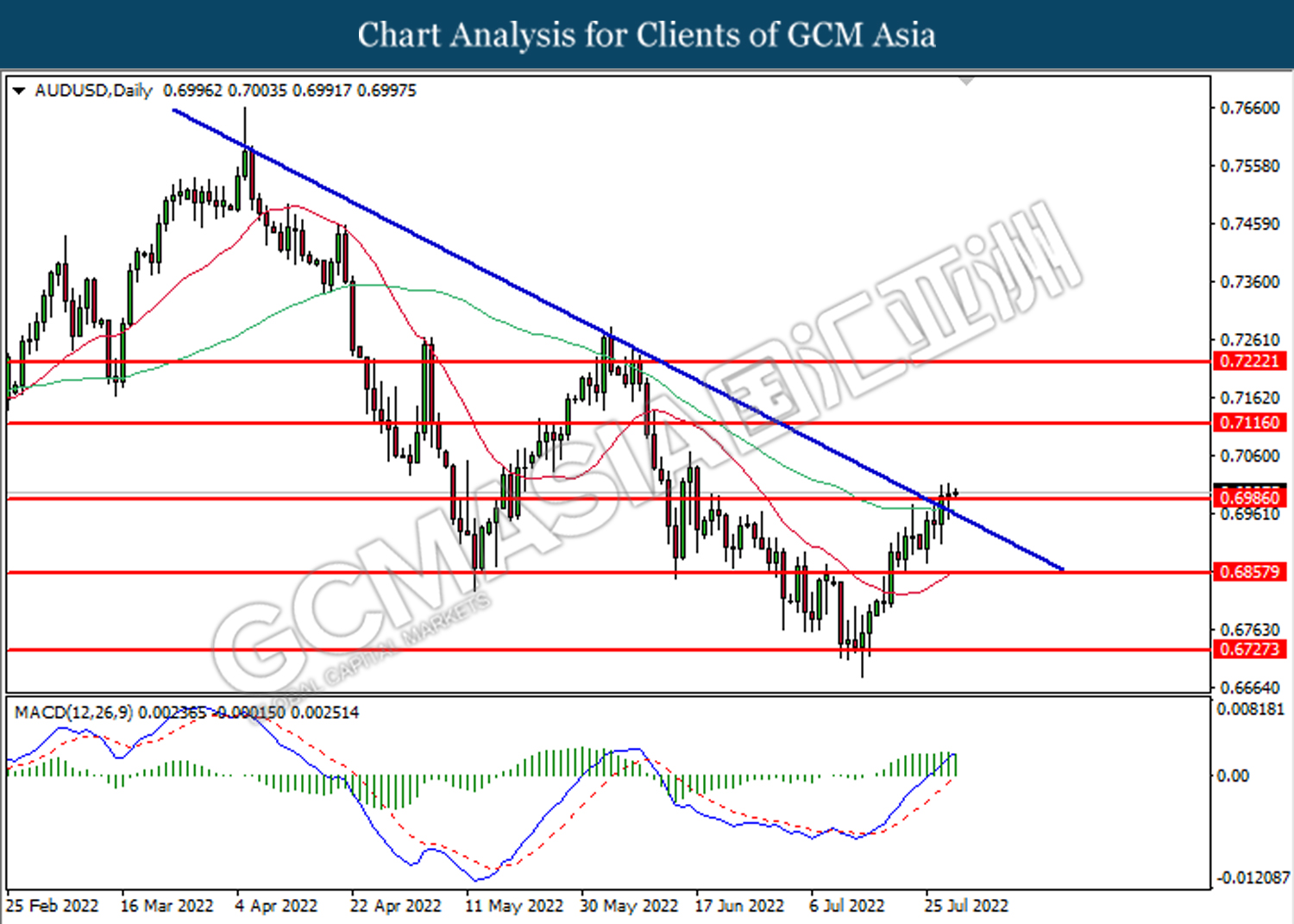

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7115.

Resistance level: 0.7115, 0.7220

Support level: 0.6985, 0.6860

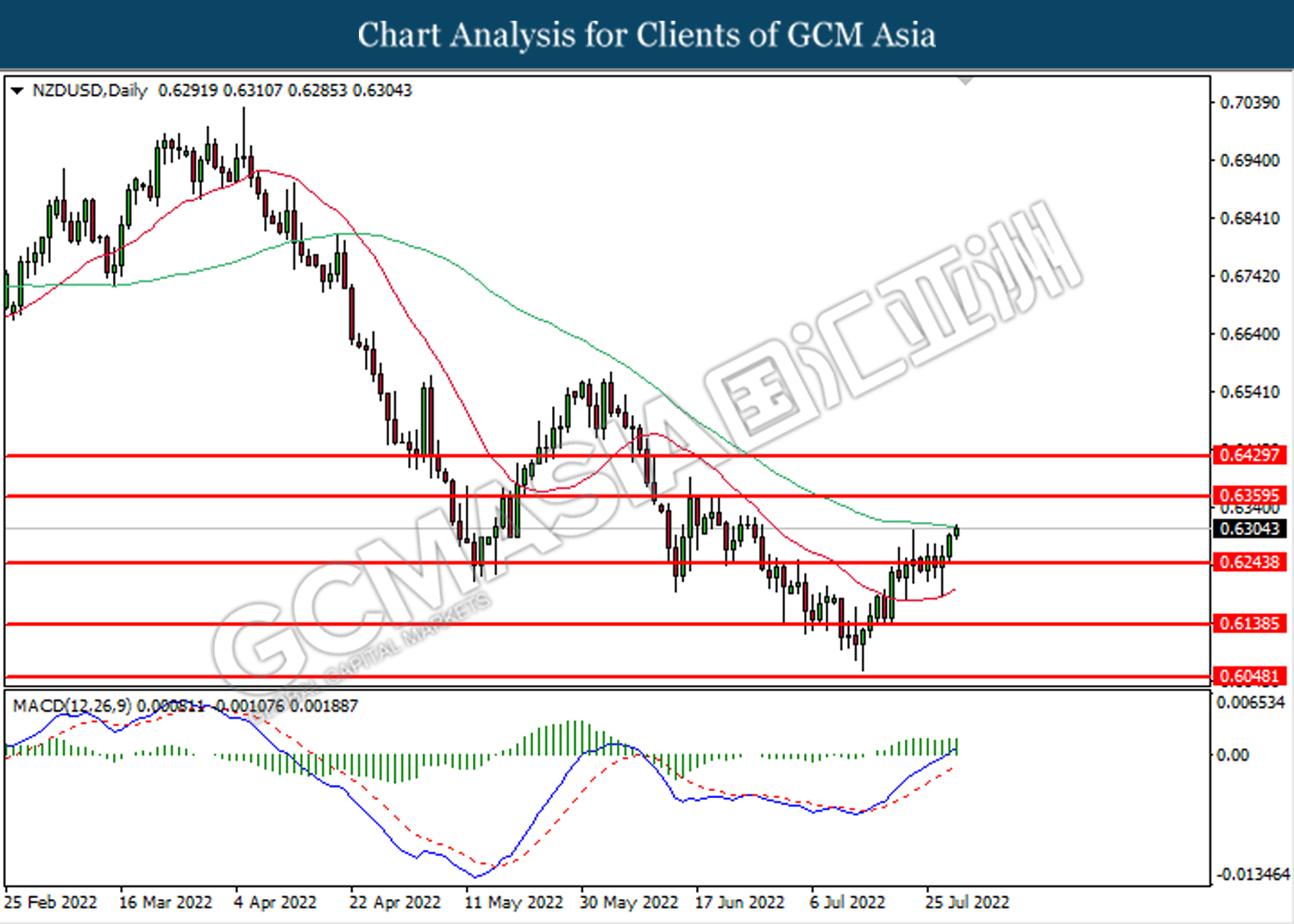

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2825. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2730.

Resistance level: 1.2825, 1.2925

Support level: 1.2730, 1.2645

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 98.20. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 91.80.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistnace level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90