29 August 2019 Afternoon Session Analysis

Antipodeans crashes due to ongoing trade war.

New Zealand dollar extended its losses during Asian trading session following the release of bearish economic data from the region. For the month of August, ANZ reported that Business Confidence in New Zealand slumped to -52.3, significantly lower than previous month’s reading of -44.3. Deteriorating business confidence is largely contributed by ongoing trade dispute in between US and China which may drag global economic momentum if it persists for a longer period of time. As New Zealand mainly exports to Australia whom also economically dependent on China, recent escalation in trade war has dialed down market sentiment towards both Antipodean currencies. As of writing, pair of NZD/USD slumped 0.28% to 0.6319. On the other hand, safe-have currencies such as Japanese Yen regained its demand in the FX market following higher risk aversion among traders. Extended recessive risks while coupled with political jitters in the UK has sparked a shift in portfolio into safe-havens. For the time being, investors will keep an eye on tonight’s US GDP data in order to gauge the economic performance of one of the world’s largest economy. Pair of USD/JPY was down 0.21% to 105.89.

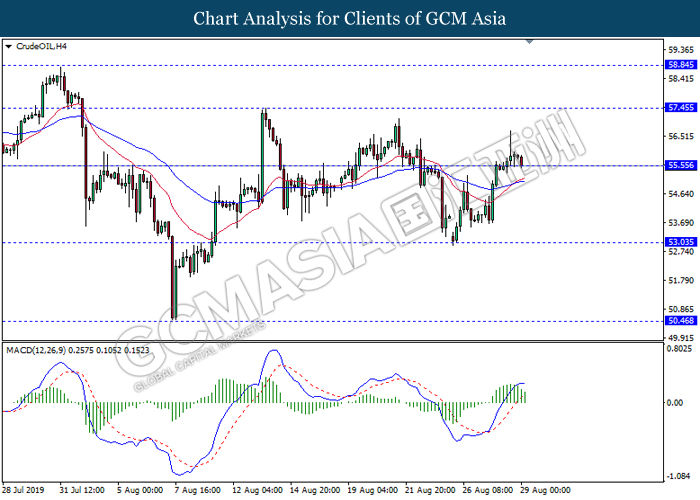

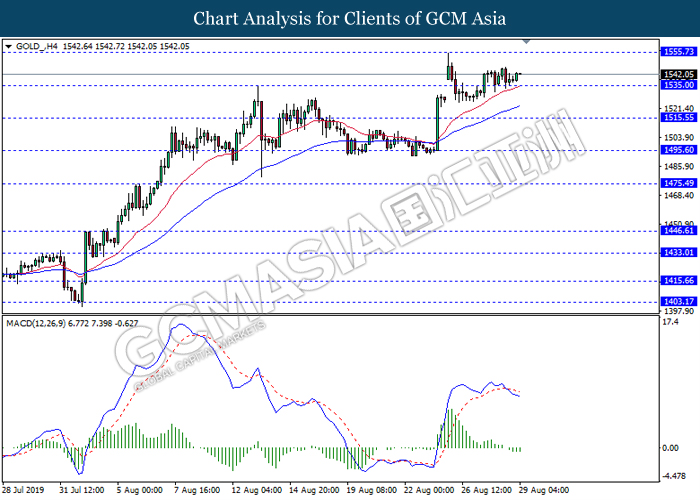

As for commodities market, crude oil price slumped 0.59% to $55.62 per barrel. Bearish momentum overtakes oil futures due to lingering trade war risk in between US and China that sees no end. Otherwise, gold price extended gains by 0.13% to $1,541.13 a troy ounce due to higher risk aversion in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (Aug) | 1K | 4K | – |

| 20:30 | USD – GDP (QoQ) (Q2) | 2.1% | 2.0% | – |

| 20:30 | USD – Initial Jobless Claims | 209K | 215K | – |

| 22:00 | USD – Pending Home Sales (MoM) (Jul) | 2.8% | 0.1% | – |

Technical Analysis

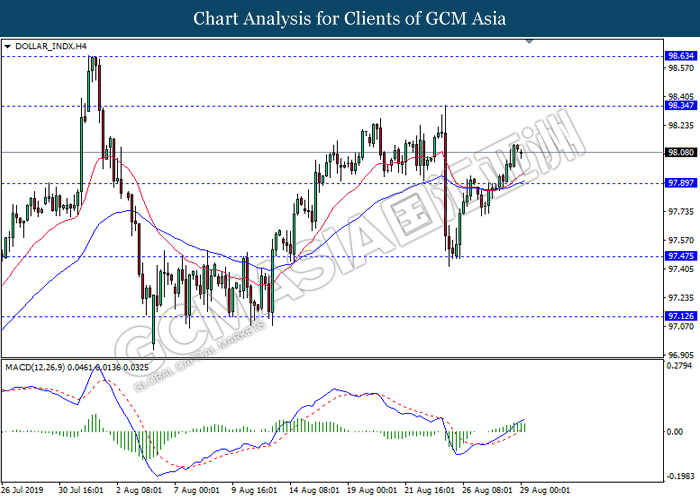

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level 97.90. MACD which illustrate bullish momentum signal suggest the dollar to extend its gains towards the resistance level 98.35.

Resistance level: 98.35, 98.65

Support level: 97.90, 97.45

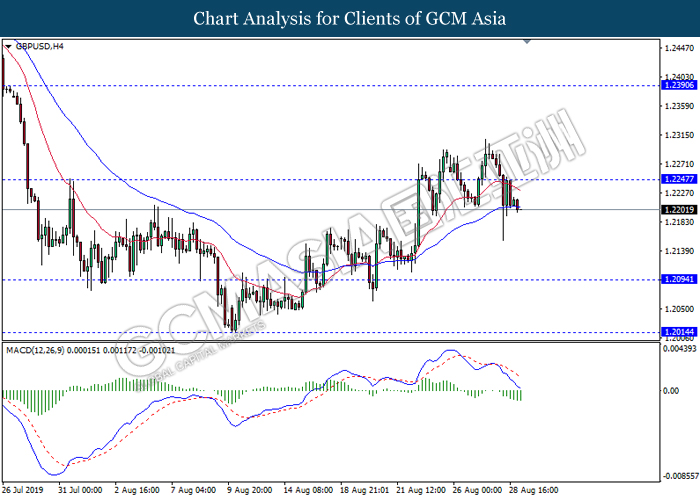

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level 1.2245. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its losses towards the support level 1.2095.

Resistance level: 1.2245, 1.2390

Support level: 1.2095, 1.2015

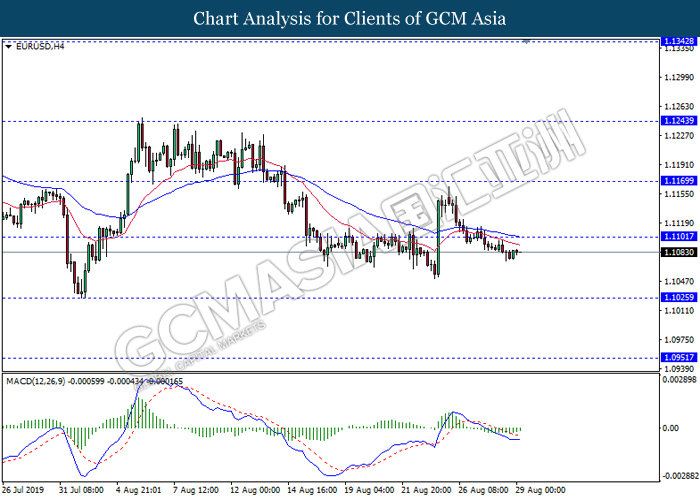

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level 1.1100. MACD which illustrate persistent bearish bias signal suggest the pair to extend its losses towards the support level 1.1025.

Resistance level: 1.1100, 1.1170

Support level: 1.1025, 1.0950

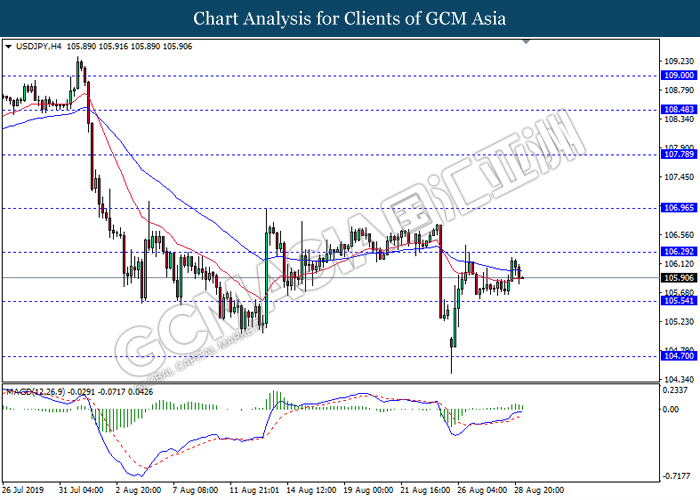

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level 106.30. MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracement towards the support level 105.55.

Resistance level: 106.30, 106.95

Support level: 105.55, 104.70

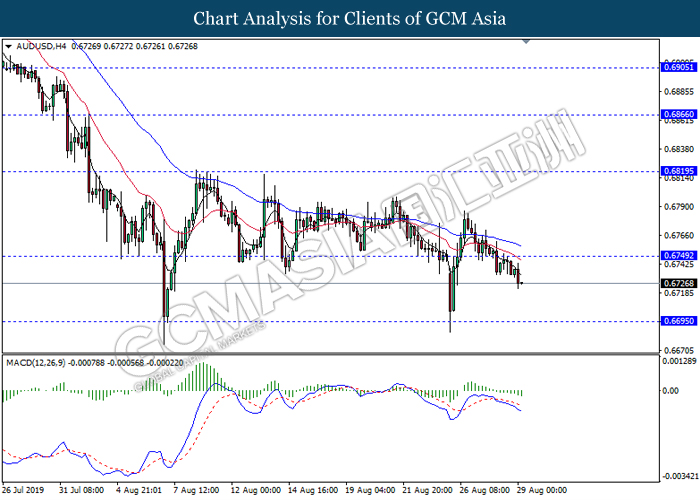

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level 0.6750. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its losses towards the support level 0.6695.

Resistance level: 0.6750, 0.6820

Support level: 0.6695, 0.6600

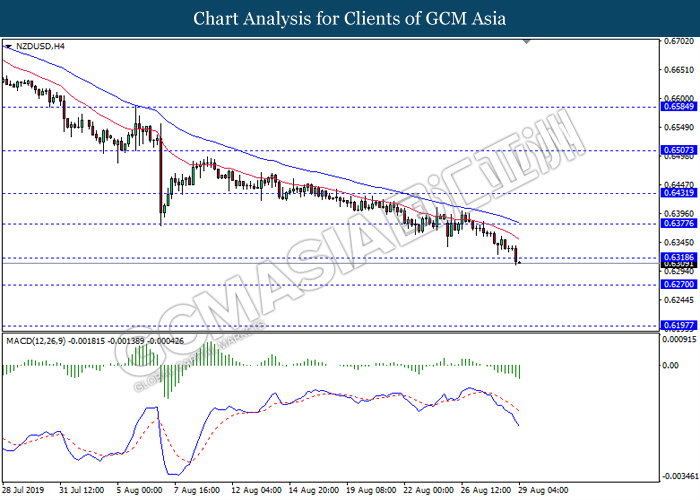

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the support level 0.6320. MACD which illustrate persistent bearish bias signal suggest the pair to extend its losses towards the support level 0.6270.

Resistance level: 0.6320, 0.6375

Support level: 0.6270, 0.6195

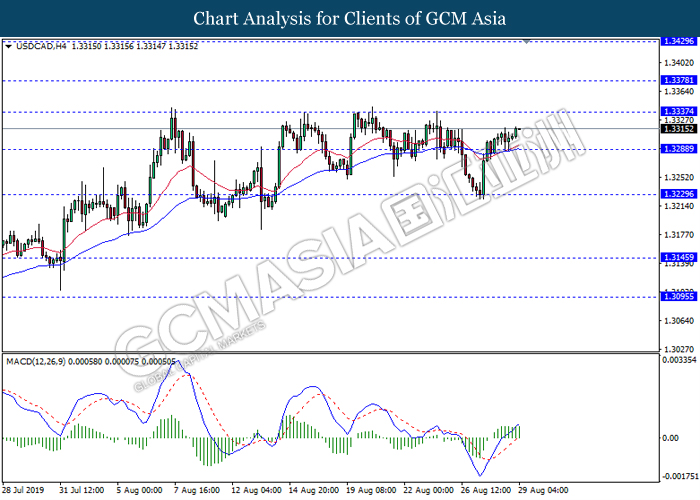

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level 1.3335. MACD which illustrate persistent bullish momentum signal suggest the pair to extend its gains towards the resistance level 1.3335.

Resistance level: 1.3335, 1.3380

Support level: 1.3290, 1.3230

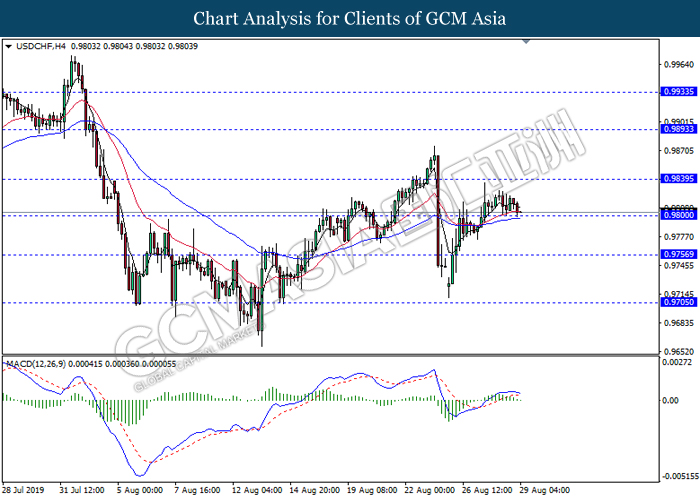

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.9800. MACD which illustrate bearish momentum signal suggest the pair to extend its gains after it breaks below the support level 0.9800.

Resistance level: 0.9840, 0.9895

Support level: 0.9800, 0.9755

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level 55.55. MACD which illustrate diminishing bullish momentum suggest the commodity to extend its losses after it breaks below the support level 55.55.

Resistance level: 57.45, 58.85

Support level: 55.55, 53.05

GOLD_, H4: Gold price was traded flat near the support level 1535.00. However, MACD which illustrate bearish bias signal with the formation of death cross suggest the commodity to extend its losses after it breaks below the support level 1535.00.

Resistance level: 1555.75, 1575.00

Support level: 1535.00, 1515.55