29 August 2022 Afternoon Session Analysis

Euro dived despite hawkish statement from ECB.

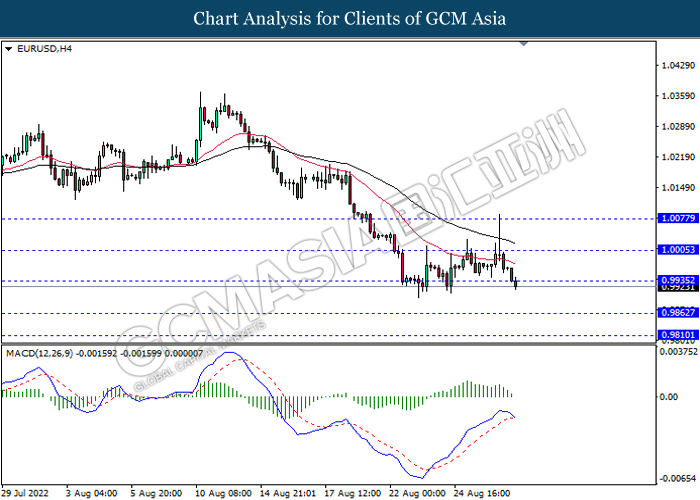

The EUR/USD, which traded by majority of investors dropped significantly although the ECB members released their hawkish speech. According to Reuters, European Central Bank (ECB) board member Isabel Schnabel claimed on Saturday that the central banks would raise its interest rate forcefully to tamp down the inflation back to 2%, even the economy was in recession. Besides, ECB policymaker Martins Kazaks also unleashed his point of view that both 50 and 75 basis point rate hike should be on the table. Nonetheless, the EUR/USD retraced from the 1.0000 level following the hawkish statement from Federal Reserve Chairman Jerome Powell. As of now, investors would continue to scrutinize the Eurozone CPI data which will be announced on Wednesday in order to anticipate the interest rate decision from ECB. Currently, the economist expected that the Eurozone CPI would increase from the prior figure of 8.9% to 9.0%. As of writing, EUR/USD depreciated by 0.35% to 0.9926.

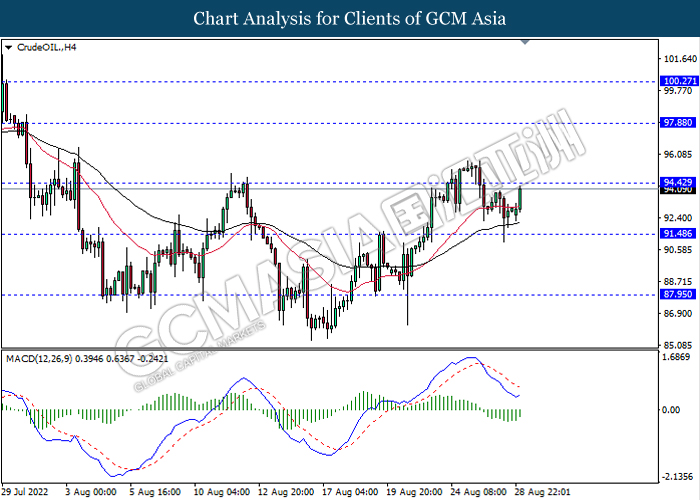

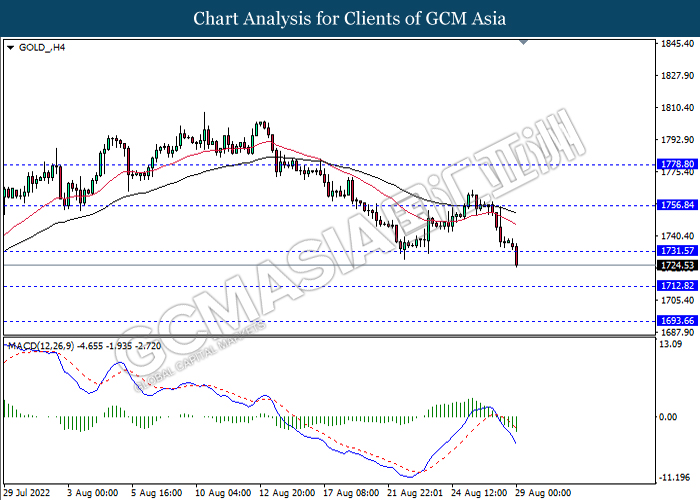

In the commodities market, the crude oil price rose by 1.18% to $94.17 per barrel as of writing over the hopes of a supply cut by the OPEC. On the other hand, the gold price eased by 0.68% to $1726.45 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

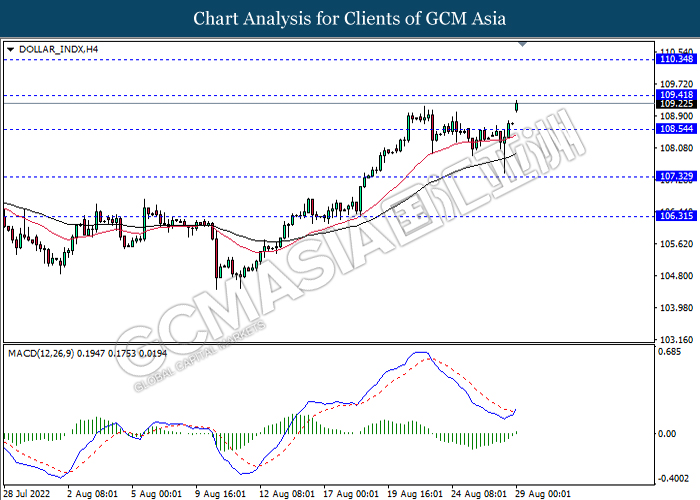

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

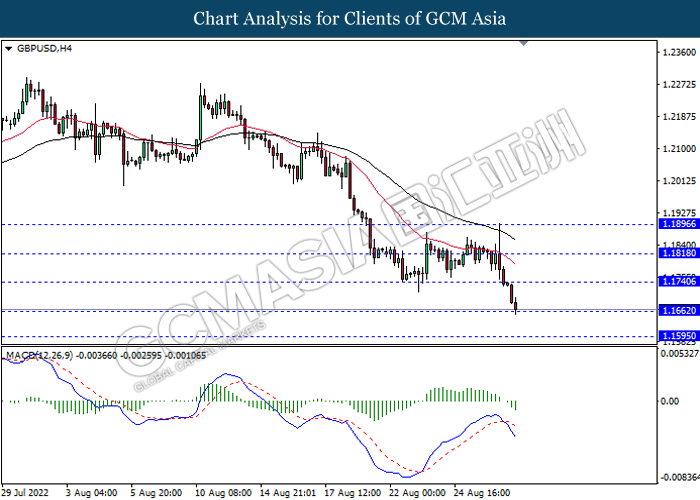

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1740, 1.1820

Support level: 1.1660, 1.1595

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9935, 1.0005

Support level: 0.9860, 0.9810

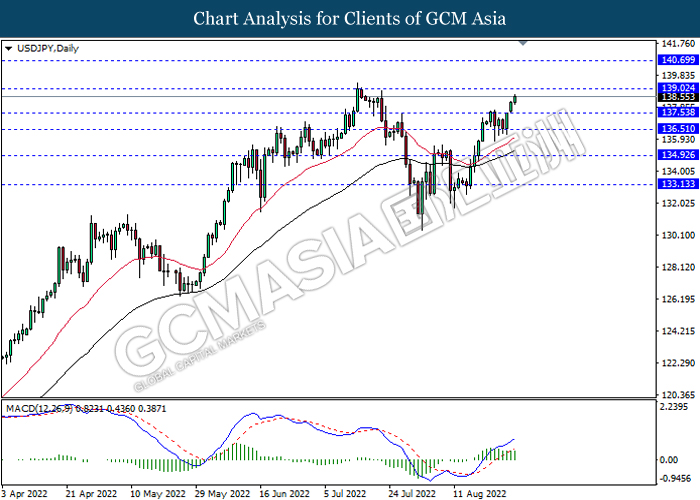

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 139.00, 140.70

Support level: 137.55, 136.50

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

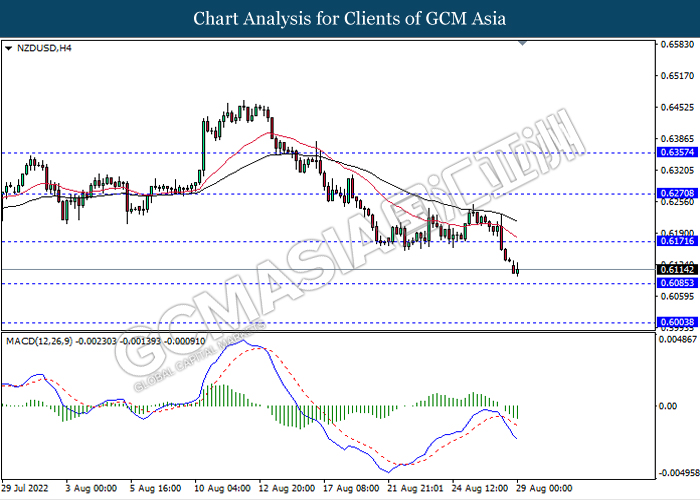

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

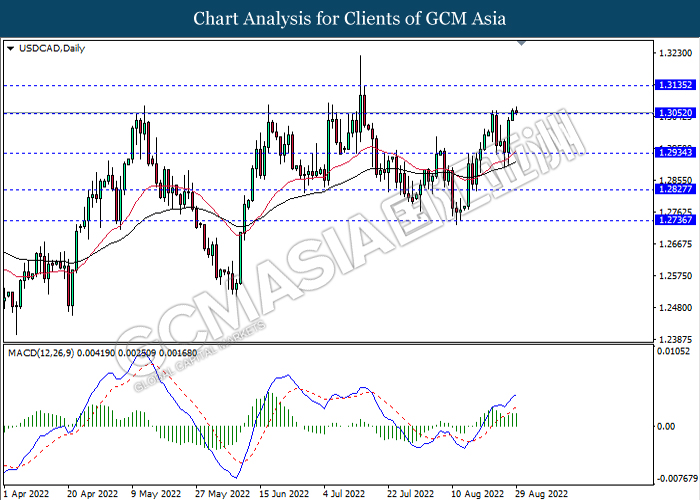

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9755, 0.9840

Support level: 0.9680, 0.9595

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 94.40, 97.90

Support level: 91.50, 87.95

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1731.55, 1756.85

Support level: 1712.80, 1693.65