29 September 2022 Afternoon Session Analysis

Dollar’s bull, turn its head down following downbeat data was released.

The Dollar Index which traded against a basket of six major currencies retreated from its highest level over the backdrop of the downbeat economic data. According to National Association of Realtor, US Pending Home Sales for last month notched down significantly from the preliminary reading of -0.6% to -2.0%, missing the market forecast at -1.4%. The contracts to purchase US home fell for a third straight month in August, weighed down by the spiking interest rate and inflation risk, which diminishing the affordability. As for now, investors would continue to scrutinize the crucial economic data from United States region tonight to gauge the likelihood movement for the US Dollar. On the other hand, the US Dollar extend its losses following the Bank of England claimed to purchase long-term bond in order to sustain the economic development, which prompting investors to sell off the US Dollar while shifting into UK market. As of writing, the Dollar Index appreciated by 0.62% to 113.30.

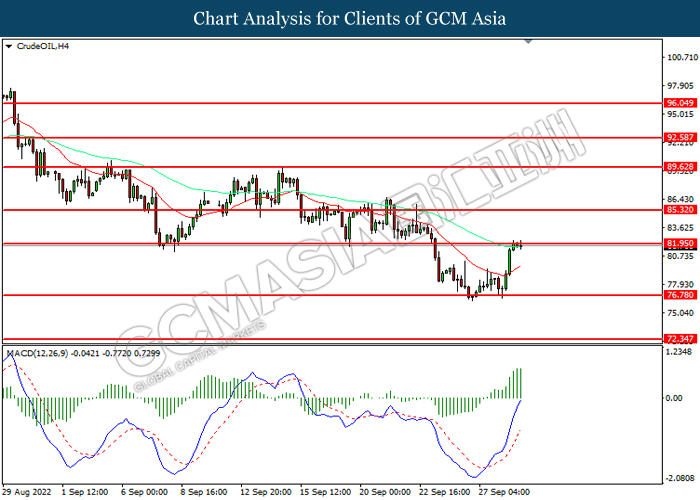

In the commodities market, the crude oil price appreciated by 0.01% to $81.75 per barrel as of writing. The crude oil price rebounded from its lower level as the precautionary shutdowns in production on the Gulf of Mexico by Chevron and BP, which diminishing the oil supply. On the other hand, the gold price surged 0.01% to $1653.50 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q2) | 9.0% | 8.9% | – |

| 20:30 | USD – Initial Jobless Claims | 213K | 215K | – |

| 20:30 | CAD – GDP (MoM) (Jul) | 0.1% | -0.1% | – |

Technical Analysis

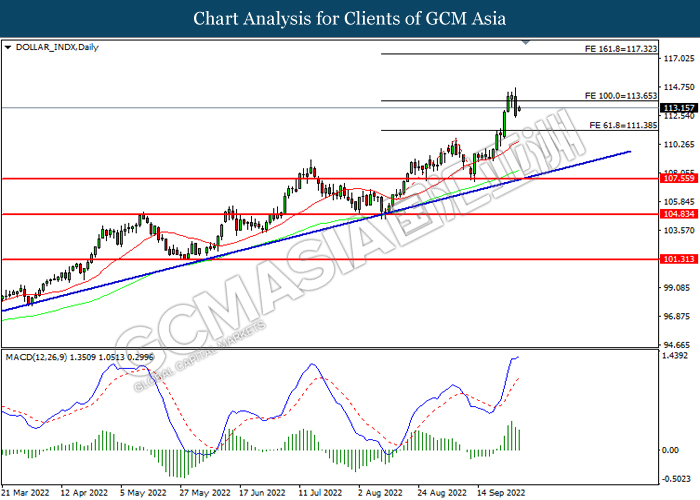

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 113.65, 117.30

Support level: 107.55, 107.55

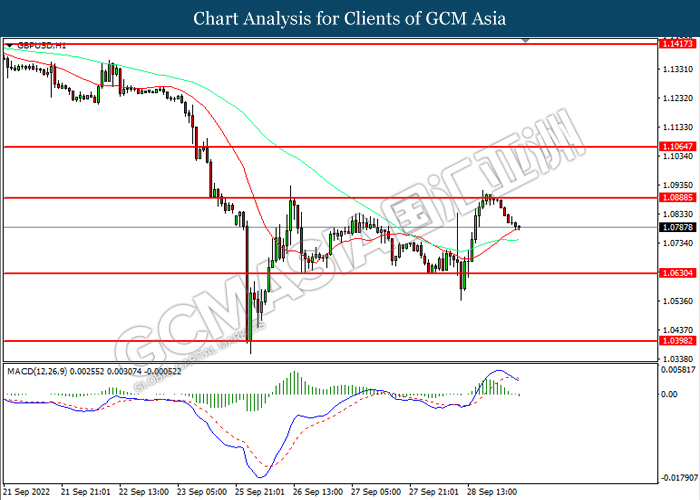

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.0890, 1.1065

Support level: 1.0630, 1.0400

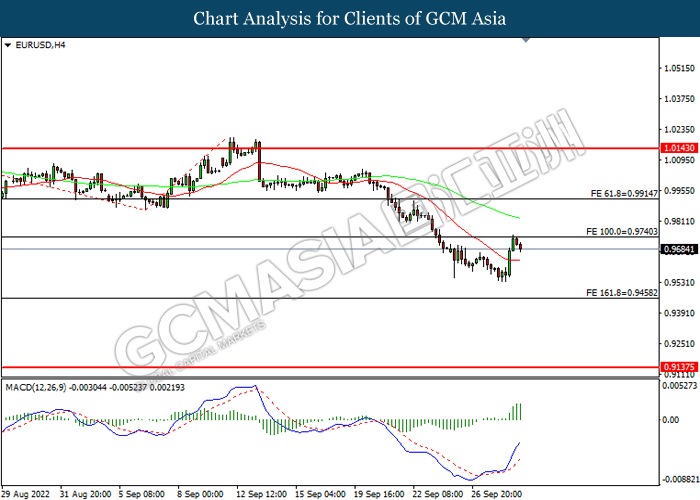

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout the resistance level.

Resistance level: 0.9740, 0.9915

Support level: 0.9460, 0.9135

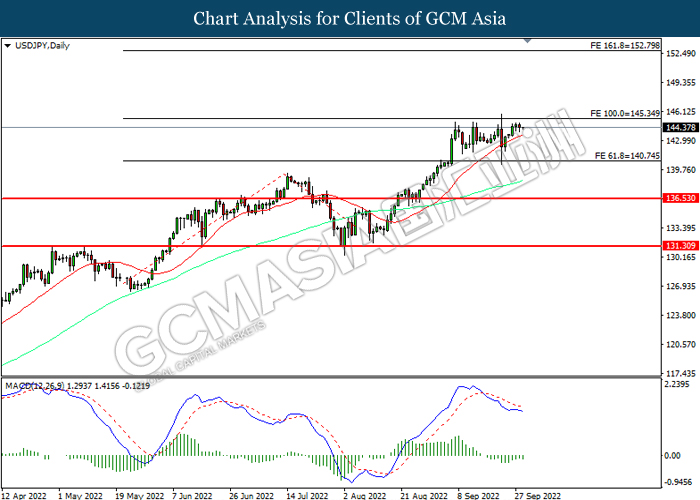

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

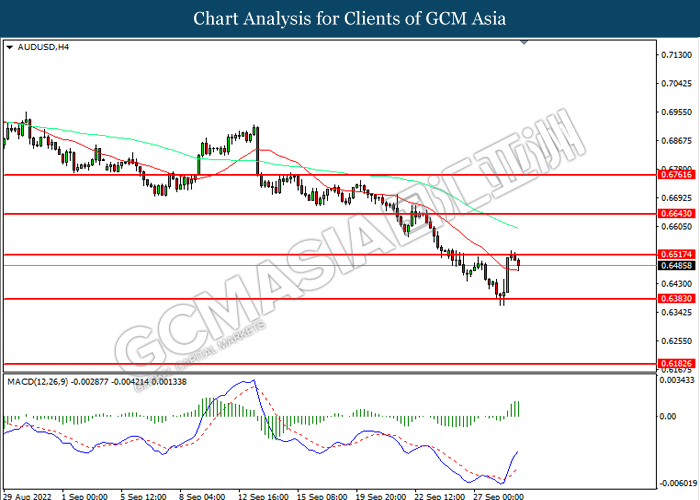

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6515, 0.6645

Support level: 0.6385, 0.6185

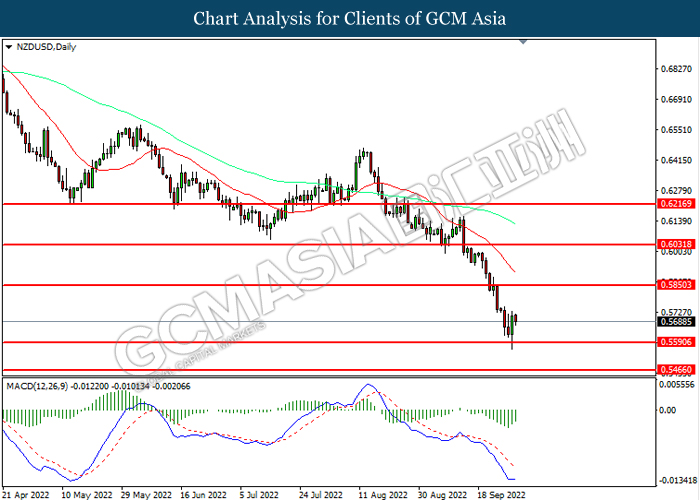

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

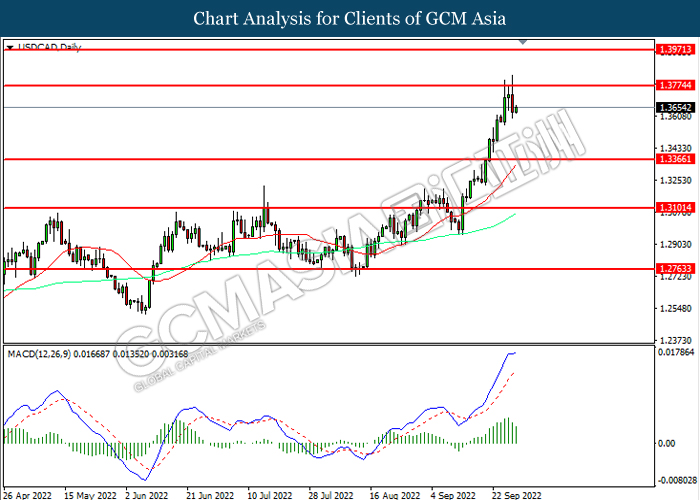

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3775, 1.3970

Support level: 1.3365, 1.3100

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9855, 0.9965

Support level: 0.9640, 0.9515

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 81.95, 85.30

Support level: 76.80, 72.35

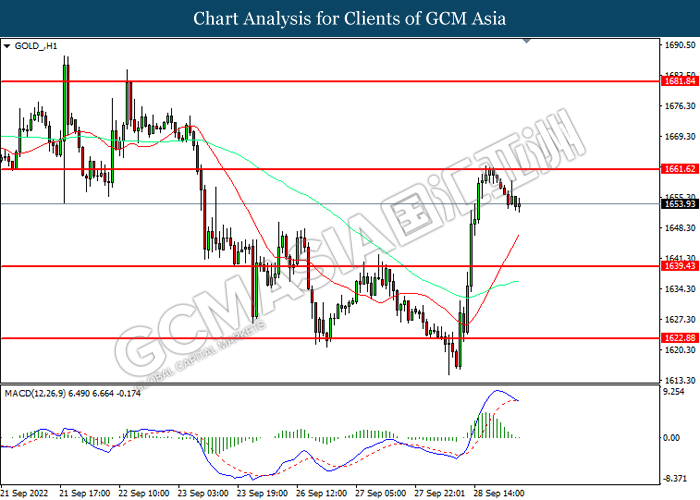

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1661.60, 1681.85

Support level: 1639.45, 1622.90