29 September 2022 Morning Session Analysis

Pound jumped as BoE intervened the gilt market.

The GBP/USD, which traded by majority of investors surged on yesterday amid the intervention of UK central bank. According to CNBC, the Bank of England (BoE) would start buying long-dated bonds in order to restore market functioning and reduce any risks contagion to credit conditions for UK household and businesses. The monthly rise of yields of UK government bonds has spiked to a high level since 1957 as the market participants had flee away from the UK fixed income market, after the fiscal policy has been announced. The bond purchase started from 28 September and the central bank will stop purchasing it on 14 October. Besides, the bank’s Financial Policy Committee had acknowledged that the dysfunction in the gilt market caused a material risk to the country’s financial stability. Thus, they decided to take action immediately. The move from BoE would stimulate the nation spending in short-term period, which brought positive prospects toward economic progression in UK. As of writing, GBP/USD eased by 0.43% to 1.0845.

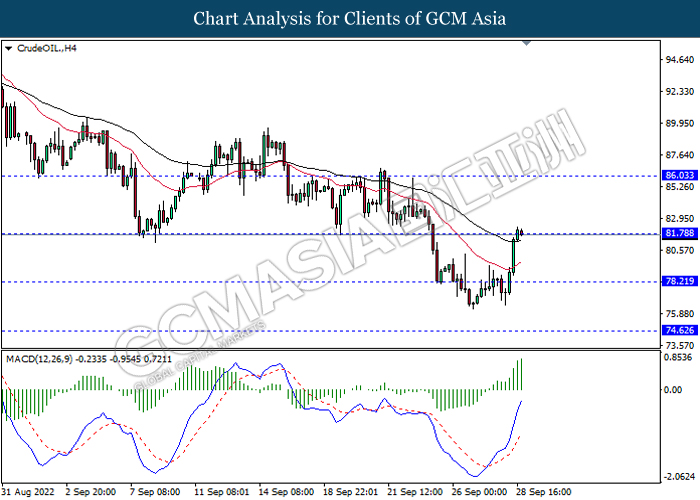

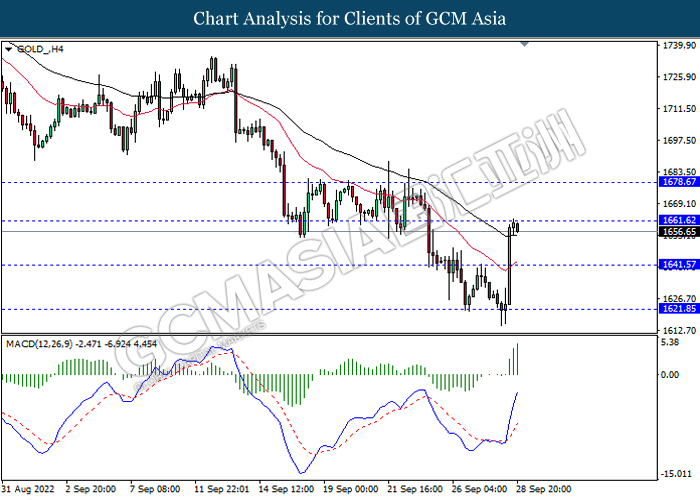

In the commodities market, the crude oil price dropped by 0.50% to $81.74 per barrel as of writing. However, the oil price rose significantly on yesterday following the crude oil inventories decreased by 0.215M barrel, missing the market expectation of 0.443M increase. In addition, the gold price depreciated by 0.23% to $1657.34 per troy ounce as of writing. Yesterday, the gold price spiked over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q2) | 9.0% | 8.9% | – |

| 20:30 | USD – Initial Jobless Claims | 213K | 215K | – |

| 20:30 | CAD – GDP (MoM) (Jul) | 0.1% | -0.1% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 113.00, 114.10

Support level: 111.50, 110.50

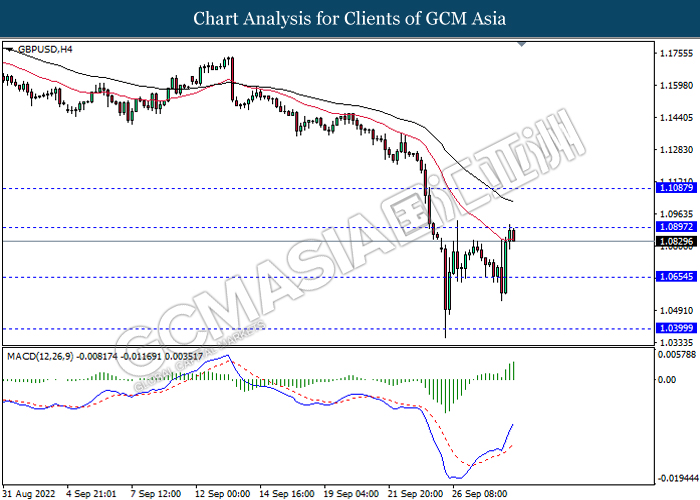

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0895, 1.1085

Support level: 1.0655, 1.0400

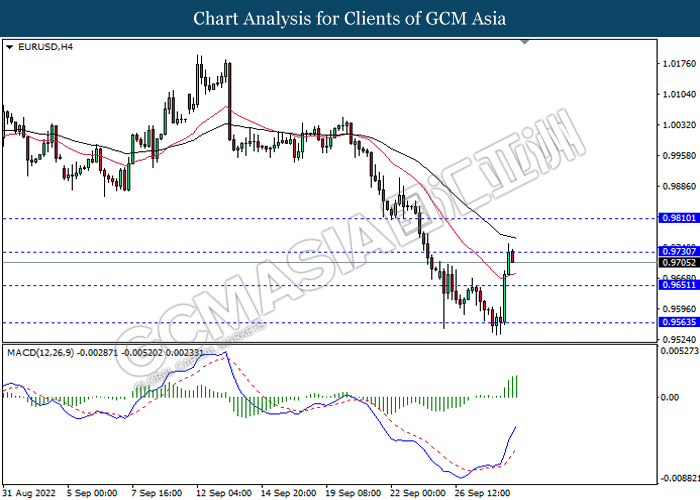

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9730, 0.9810

Support level: 0.9650, 0.9565

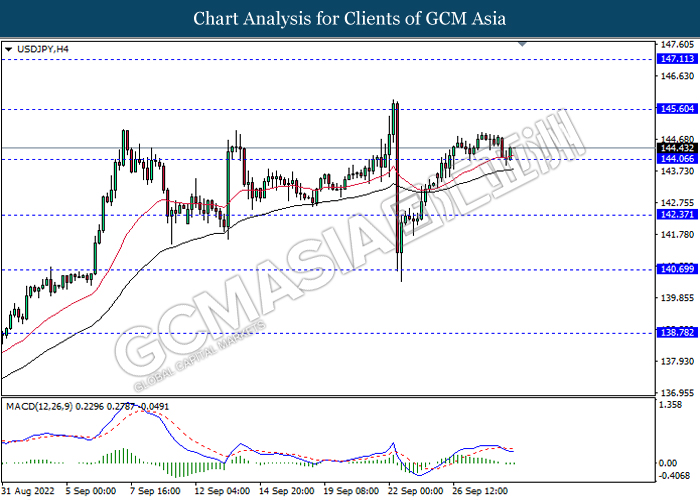

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

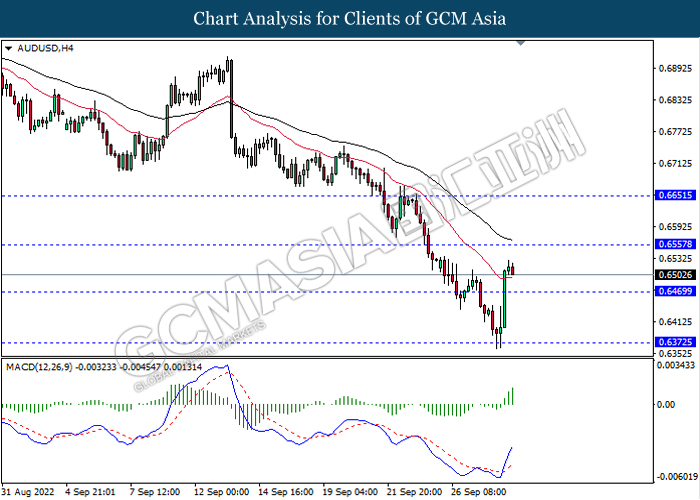

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6555, 0.6650

Support level: 0.6470, 0.6370

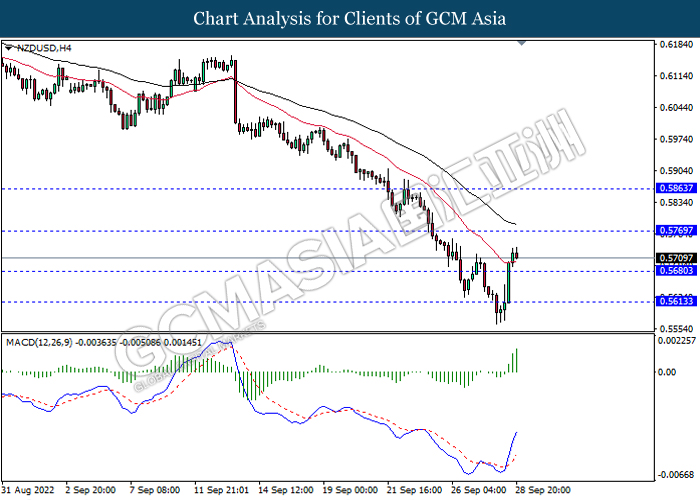

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5770, 0.5865

Support level: 0.5680, 0.5615

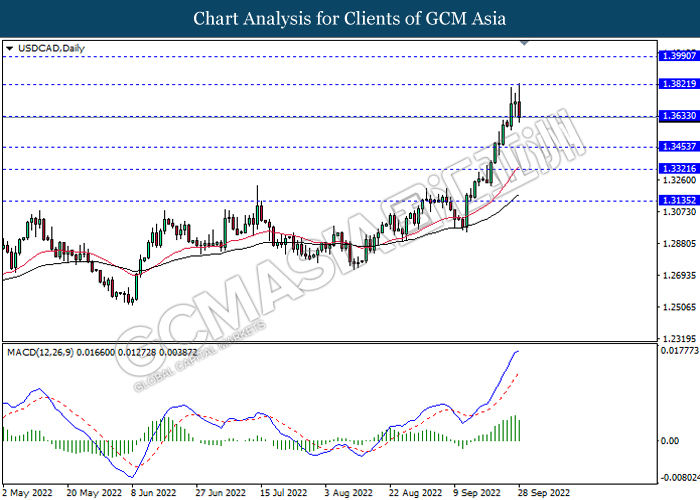

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9785, 0.9865

Support level: 0.9715, 0.9635

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 81.80, 86.05

Support level: 78.20, 74.60

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1661.60, 1678.65

Support level: 1641.55, 1621.85