29 December 2022 Afternoon Session Analysis

Euro plunged as the Eurozone economy headwinds continued.

The EUR/USD, which well known by investors around the world dropped significantly on yesterday as the Eurozone still facing economic headwinds. According to Reuters, the European Central Bank (ECB) Vice President Luis de Guindos claimed on Wednesday that the euro area undergo a difficult economic situation which threatening household as well as businesses. The sky-high inflation, slower economic growth in the European countries has weighed down the market confident on Euro currency, whereas shifting their capitals to flee into safe-haven assets such as US Dollar. Besides that, another negative speech from ECB member has put further pressure on the Euro. ECB Governing Council Gediminas Simkus appeared a speech on yesterday that the Eurozone inflation has not reach its peak, as it showed a half-year lag to that of Lithuania. With that, he emphasized that the energy crisis would likely to be exacerbated if they are unable to access affordable energy. As of writing, the EUR/USD raised by 0.12% to 1.0620.

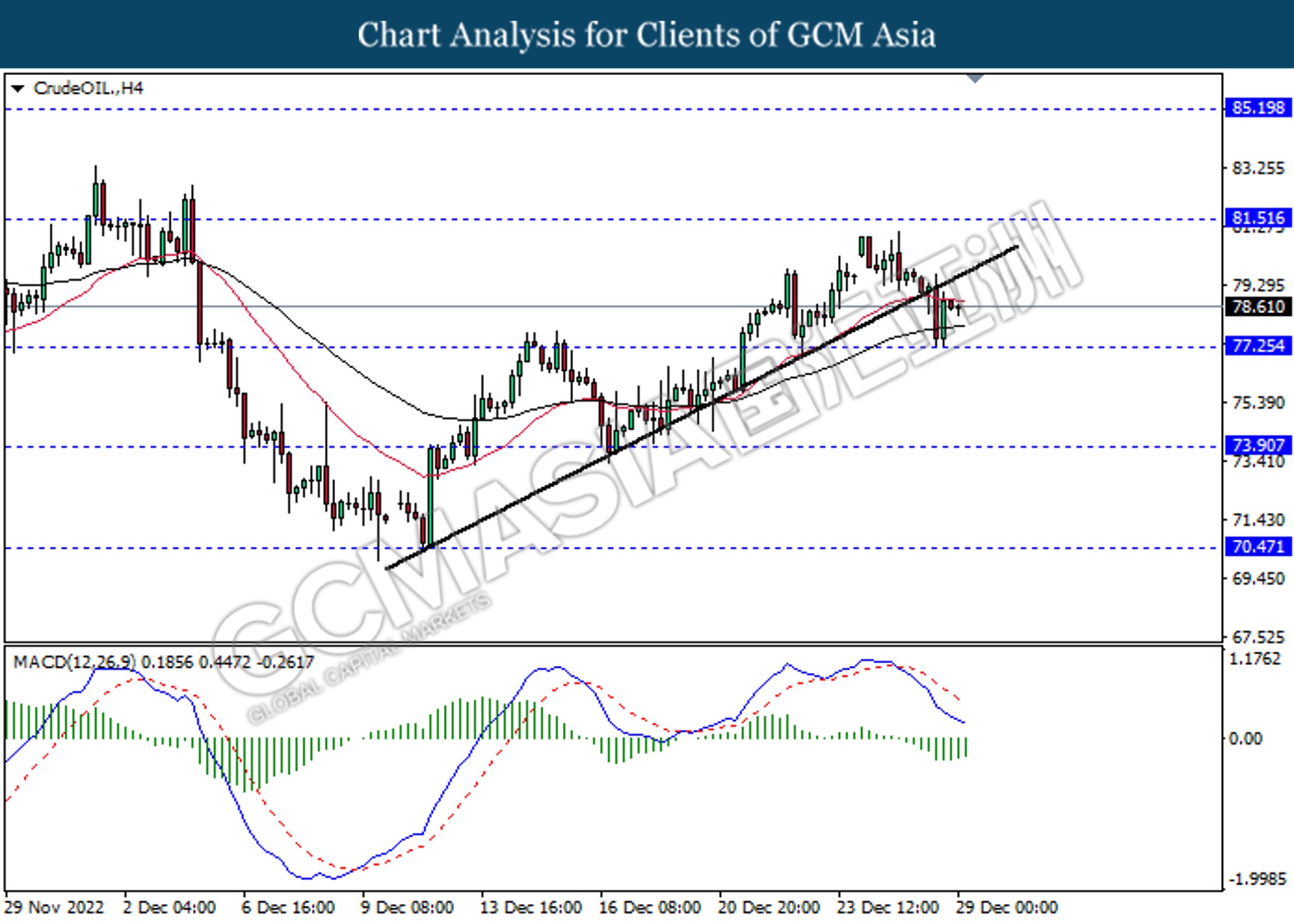

In the commodities market, the crude oil price plunged by 0.41% to $78.63 per barrel as of writing. However, the oil price has rebounded from its recent low as the API Weekly Crude Oil Stock shown a decreasing circulation. On the other hand, the gold price eased by 0.10% to $1807.31 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 216K | 225K | – |

Technical Analysis

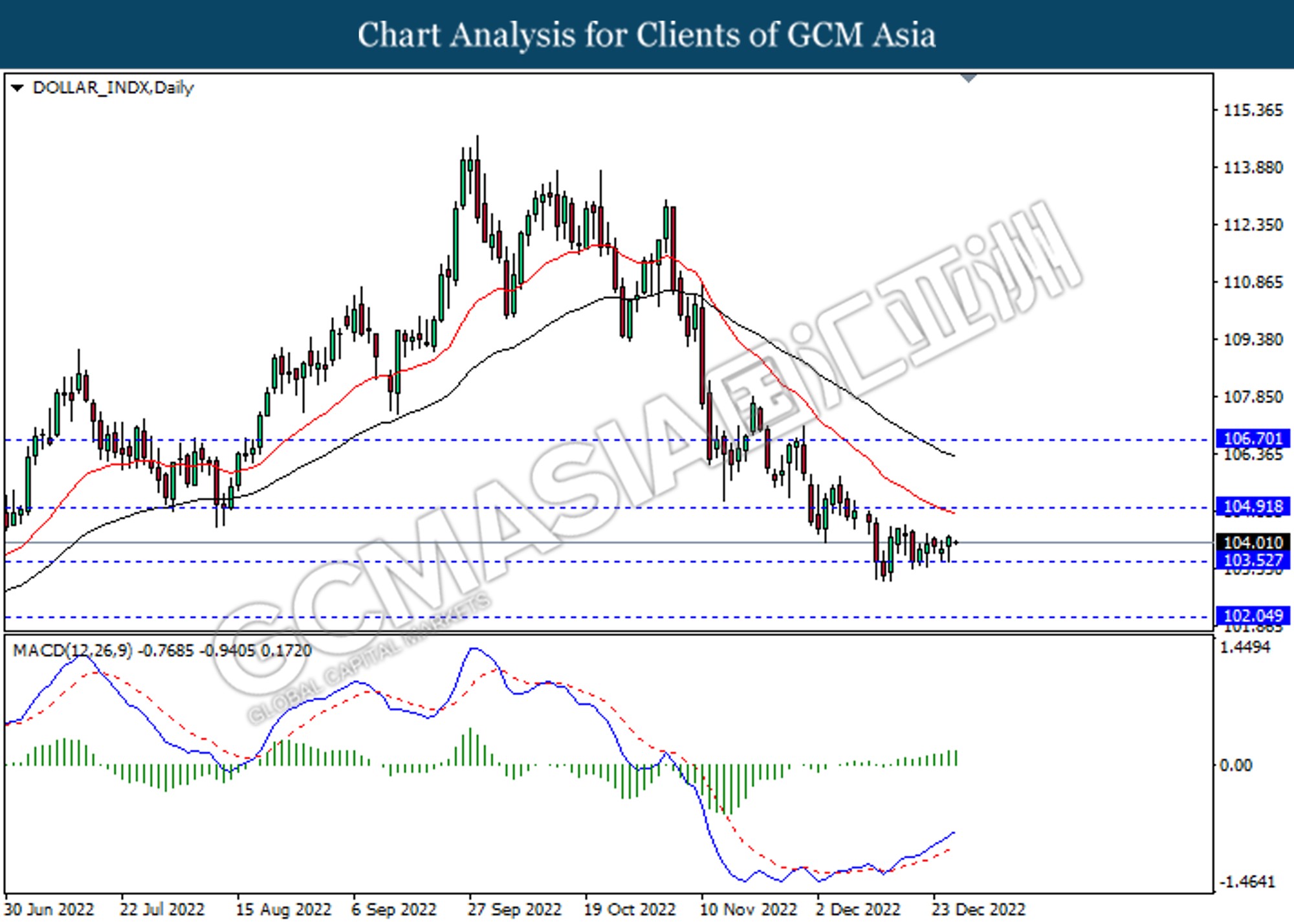

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

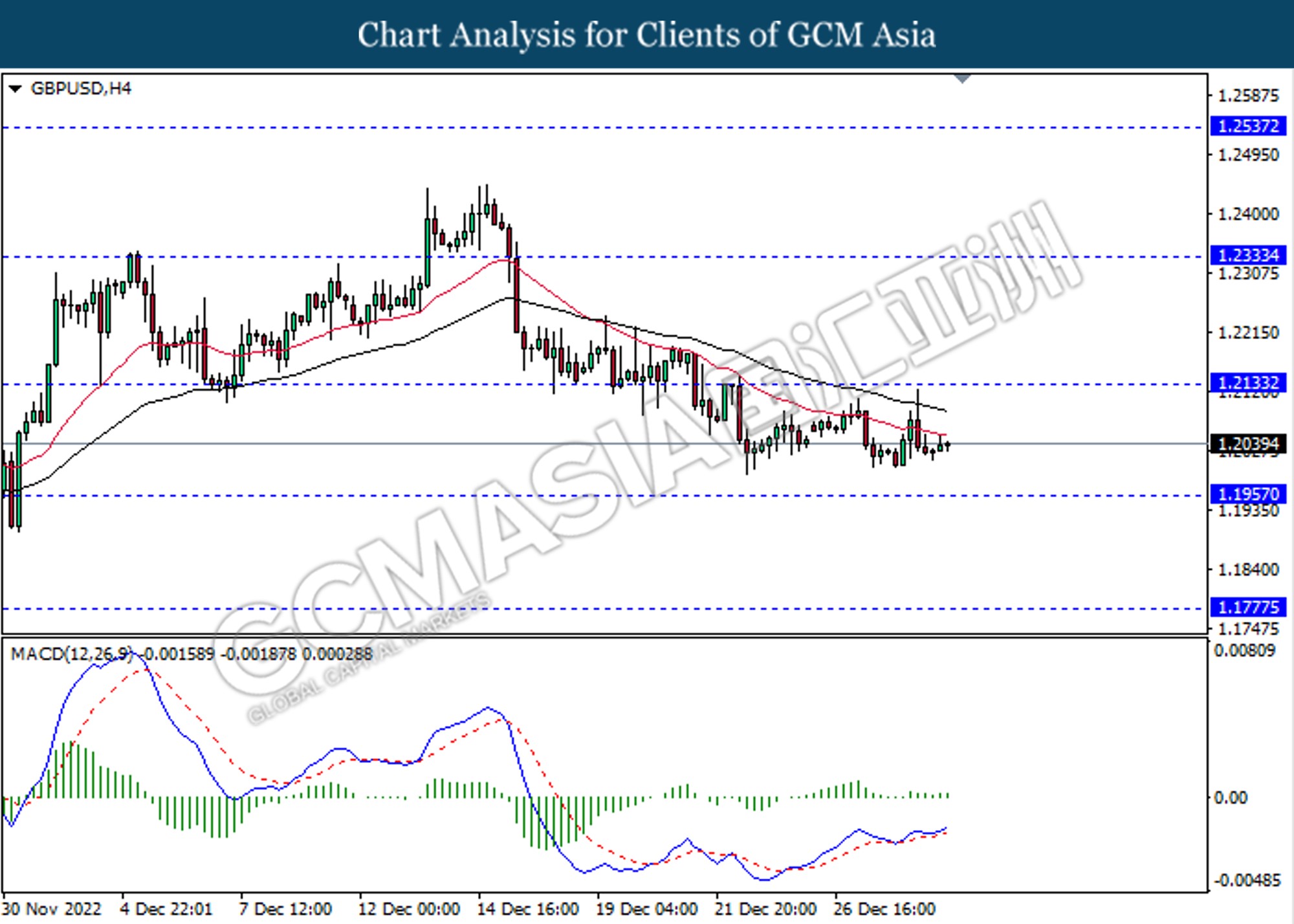

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

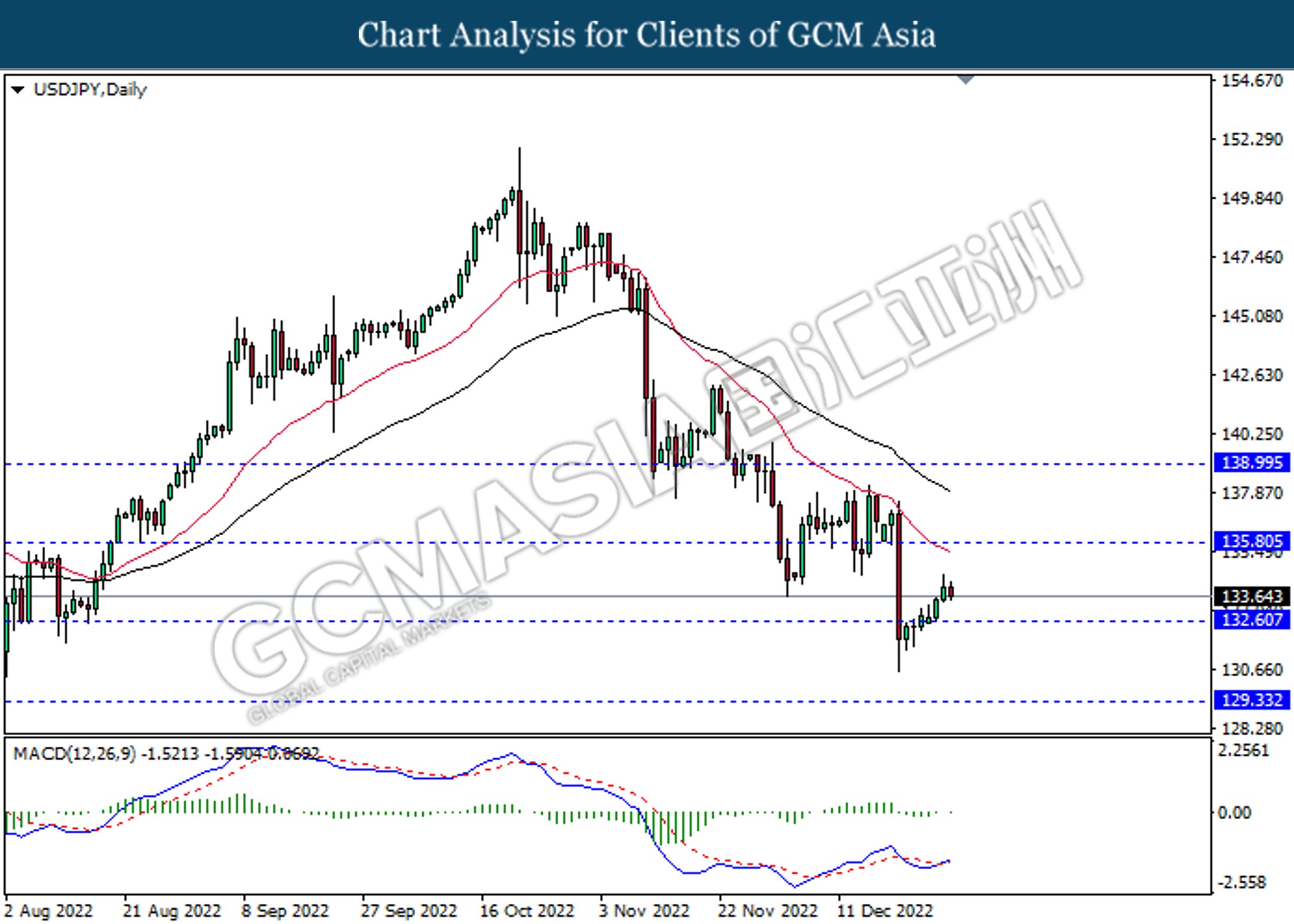

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.80, 139.00

Support level: 132.60, 129.35

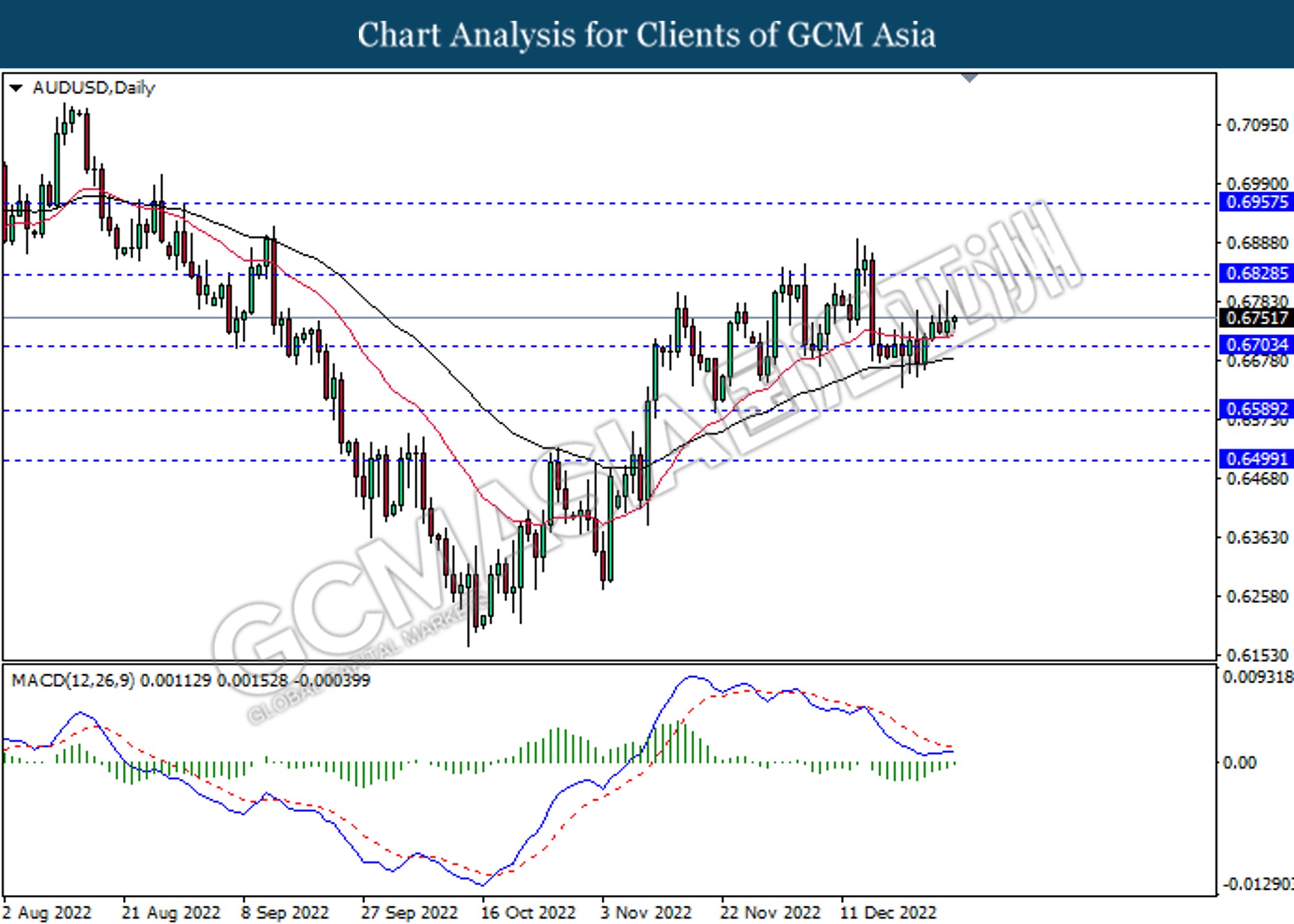

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

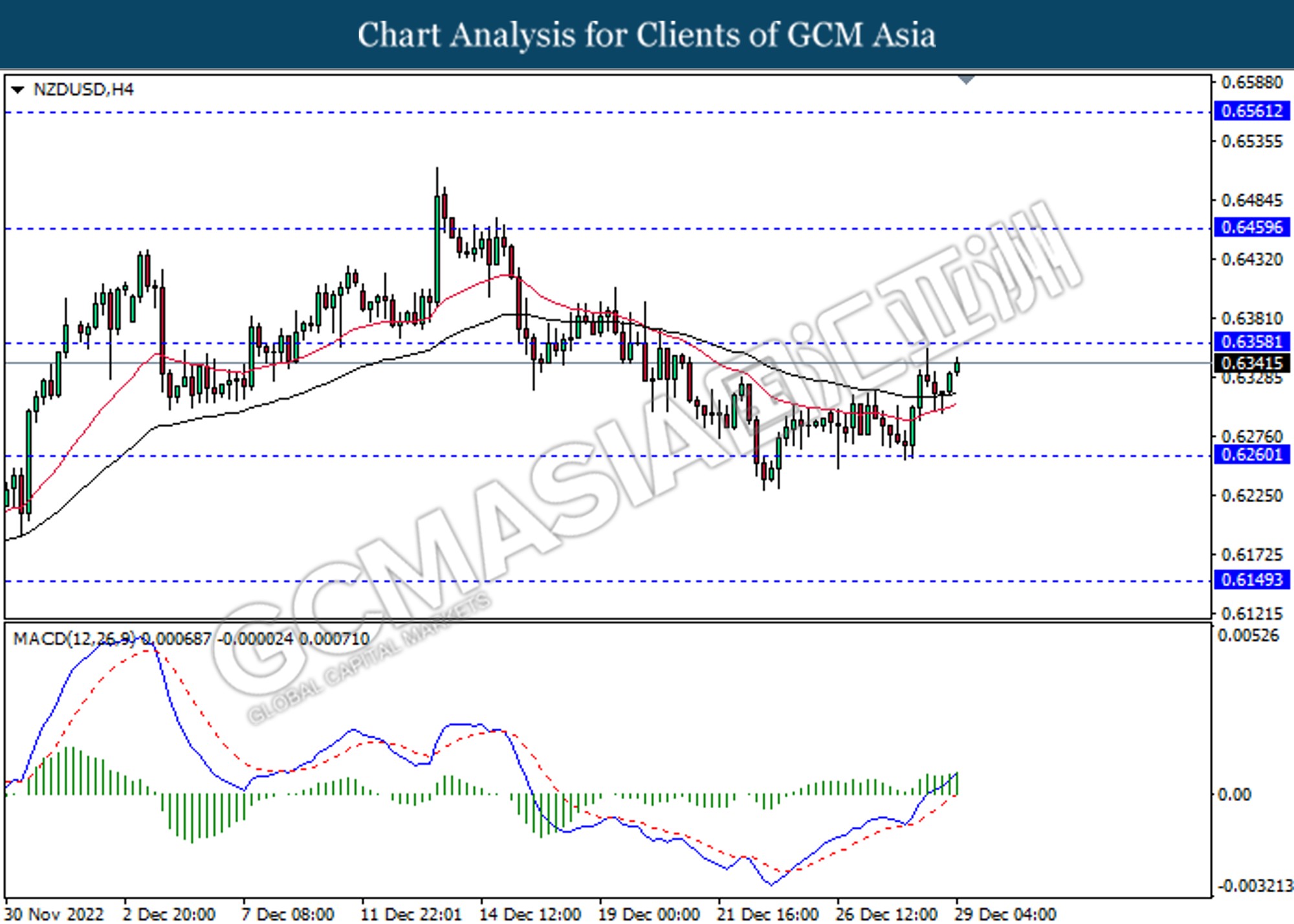

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

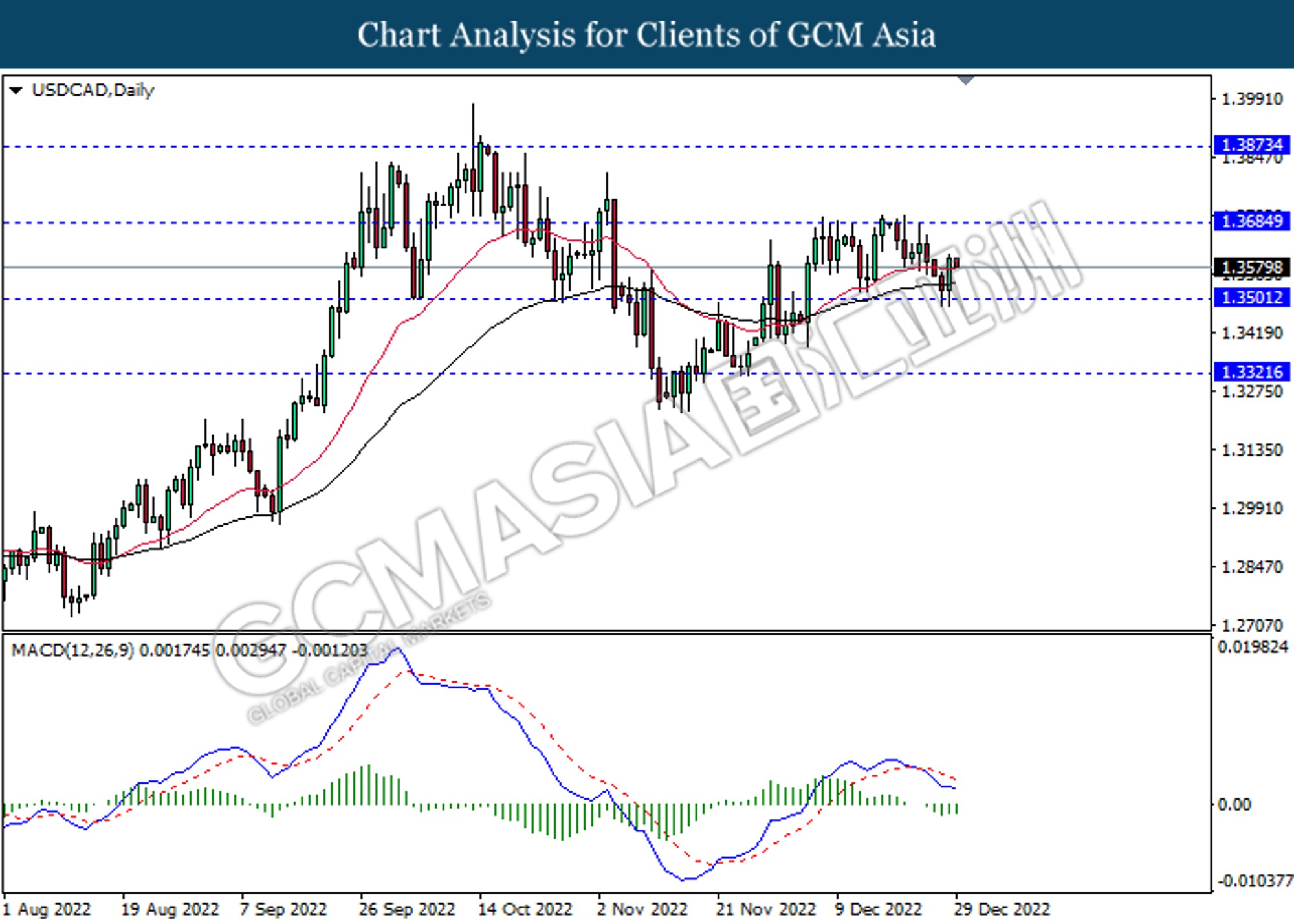

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

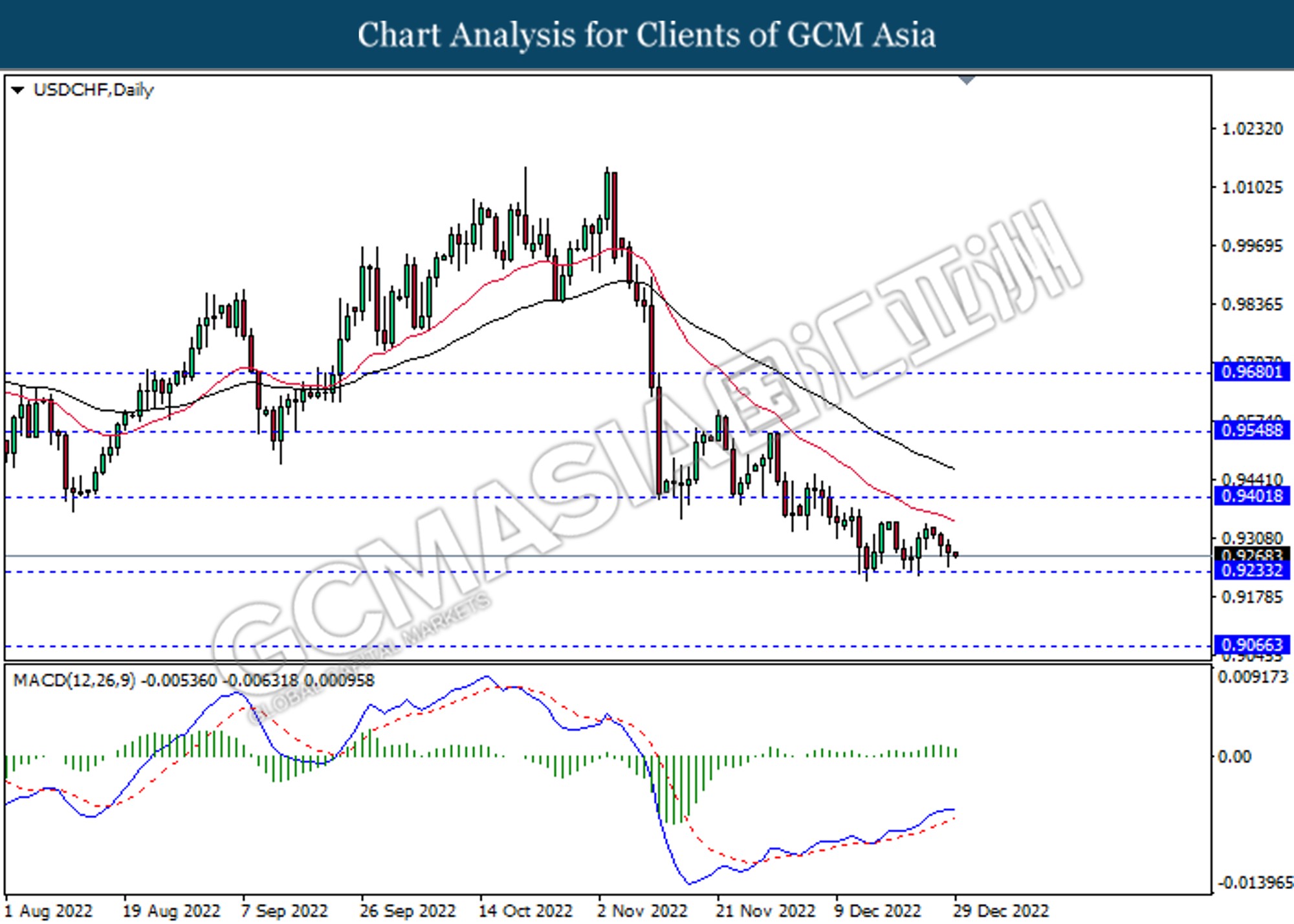

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05