29 December 2022 Morning Session Analysis

Greenback notched up amid risk aversion.

The dollar index, which traded against a basket of mainstream currencies, managed to hold its ground and it regained its luster over the past trading session amid the market risk aversion ahead of the kickoff of year 2023. Prior to that, the market is hyped with the risk-on mood as investors were focused on China restarting its economy and bet on the path of future rate hikes by the Federal Reserve. However, the yield on benchmark U.S. 10-year Treasuries surged significantly and even hit the highest level in nearly 7 weeks as investors eyed 2023 with caution. On top of that, the Greenback received some buy-in momentum after latest minutes from the Bank of Japan suggested its accommodative monetary stance is likely to remain in place. With that, it hit the Japanese Yen as the suggested continuation of ultra-accommodative policy are against with the strategy of the other central bank. Besides, the downbeat result which printed by the Pending Home Sales data limited the gains of dollar index. The data came in at -4.0%, missing the consensus forecast at -0.8%, reflecting the housing sector was hit hard following a series of rate hikes decision by the Federal Reserve. As of writing, the dollar index rose 0.27% to 104.45.

In the commodities market, crude oil price edged down -1.46% to $78.80 per barrel on fears that surging virus cases would hinder a demand uptick in China. Besides, gold prices depreciated by -0.08% to $1805.75 per troy ounce following the rebound in US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 216K | 225K | – |

Technical Analysis

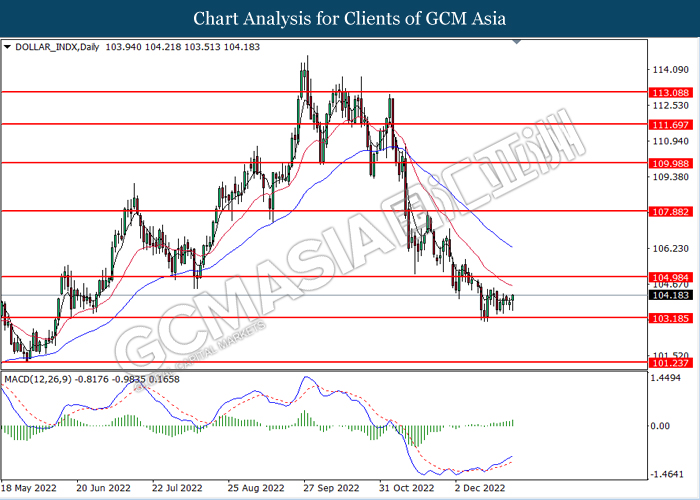

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.20, 101.25

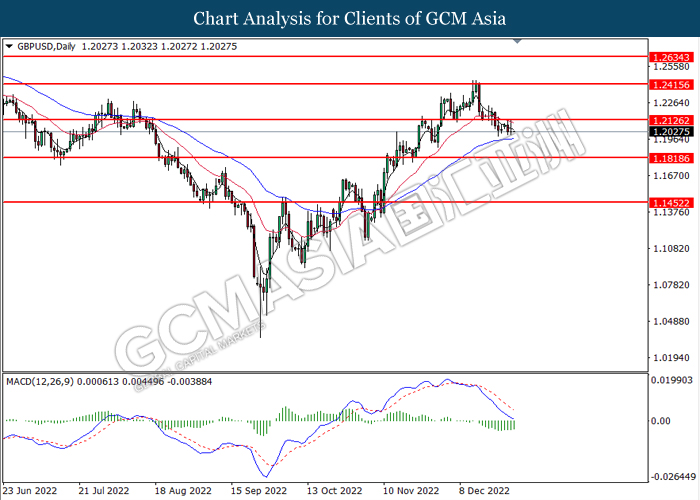

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2125. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1820.

Resistance level: 1.2125, 1.2415

Support level: 1.1820, 1.1450

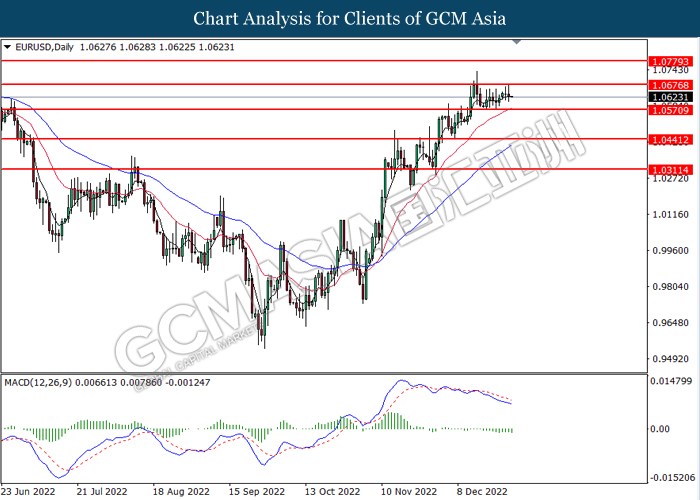

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0570. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0675, 1.0780

Support level: 1.0570, 1.0440

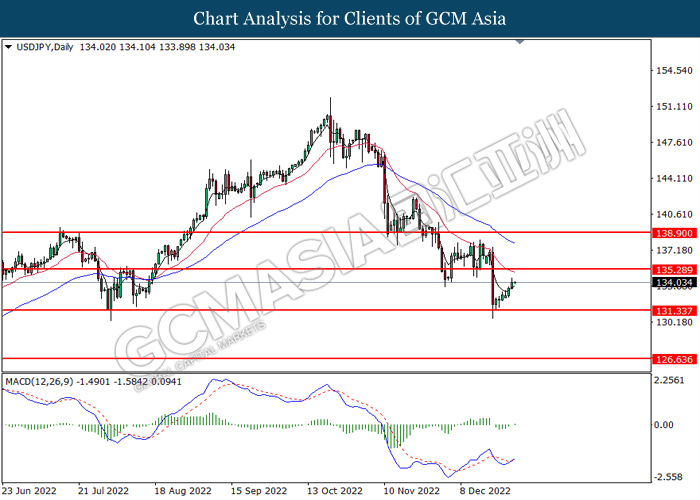

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.35. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 135.30, 138.90

Support level: 131.35, 126.65

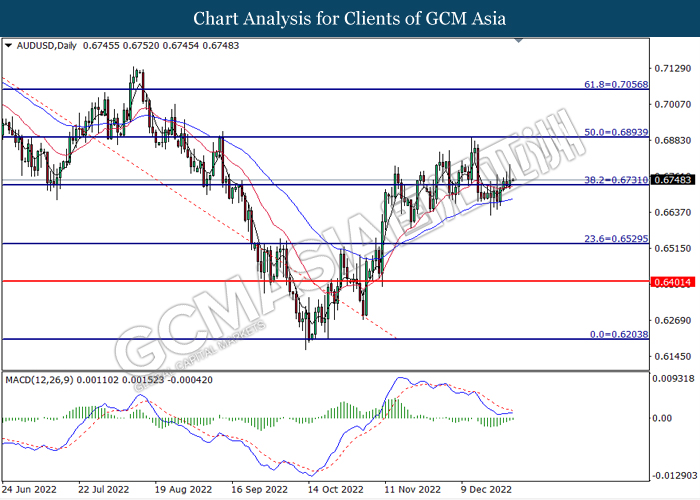

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6730. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6895.

Resistance level: 0.6895, 0.7055

Support level: 0.6730, 0.6530

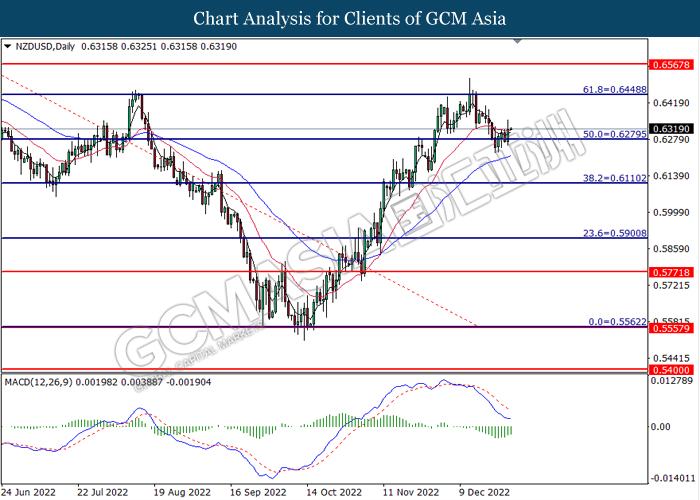

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6280. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6450.

Resistance level: 0.6450, 0.6570

Support level: 0.6280, 0.6110

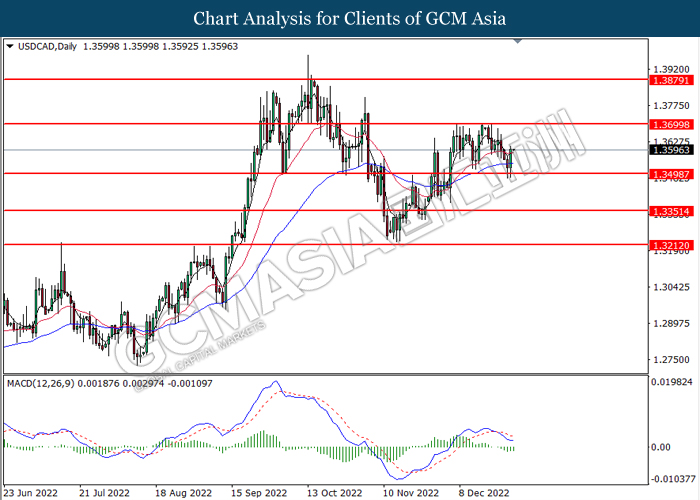

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3500. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3700.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

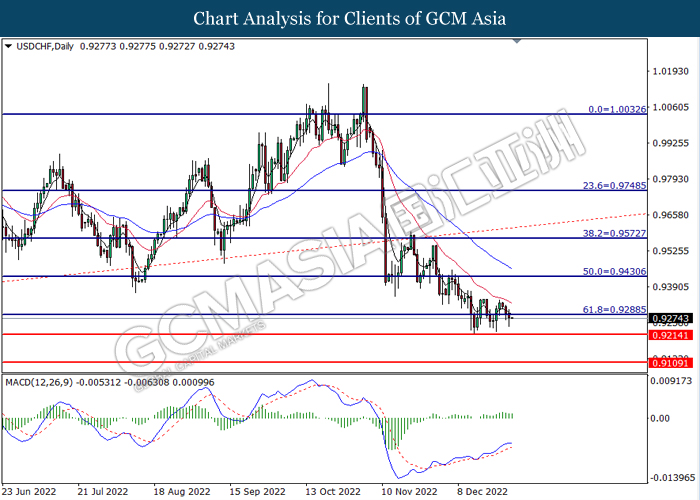

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9215.

Resistance level: 0.9290, 0.9430

Support level: 0.9215, 0.9110

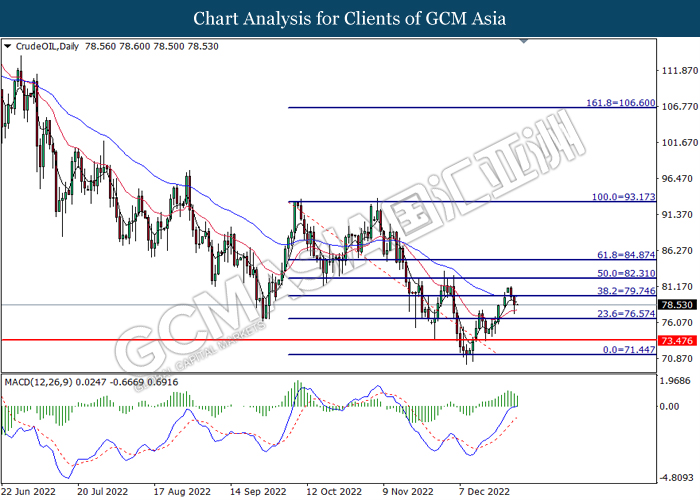

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 79.75. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.55.

Resistance level: 79.75, 82.30

Support level: 76.55, 73.45

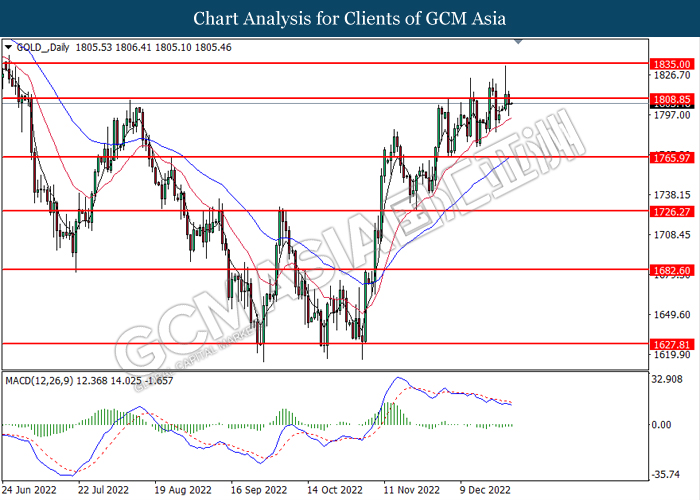

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1808.85. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 1765.95.

Resistance level: 1808.85, 1835.00

Support level: 1765.95, 1726.25