30 March 2022 Morning Session Analysis

De-escalating tensions upon Russia-Ukraine, safe-haven dipped.

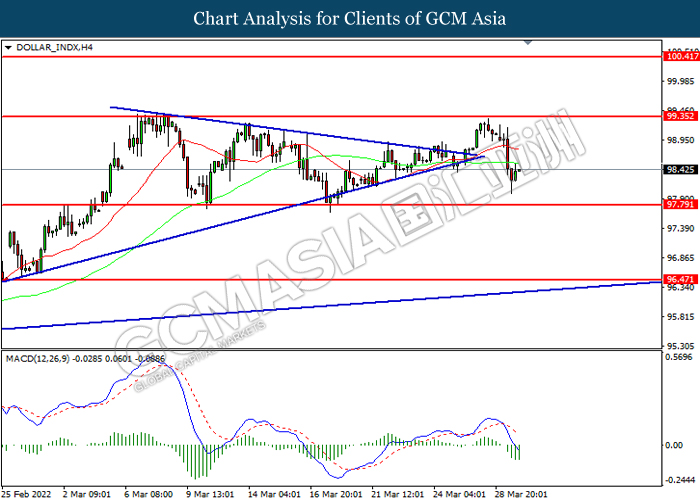

The Dollar Index which traded against a basket of six major currencies slumped significantly yesterday amid the easing tensions from Russia-Ukraine had stoked a shift in sentiment toward other riskier asset, dragging down the appeal for the safe-haven Dollar. According to the Guardian, Russia has pledged to drastically reduce its military activity in northern Ukraine to help advance peace talks. Russia’s deputy defence minister, Alexander Fomin, said after the talks in Istanbul on Tuesday that Russia wanted to increase mutual trust, create the right conditions for future negotiations and reach the final aim of signing a peace deal with Ukraine”. Besides, Ukraine President Volodymyr Zelenskiy claimed that the signals from the talks are still remained positive. Nonetheless, Russian Top negotiator Medinsky claimed that the de-escalation does not mean both parties would ceasefire, while reiterated that it still required further talks to enhance the relationship between Russia-Ukraine. As of writing, the Dollar Index depreciated by 0.69% to 98.40.

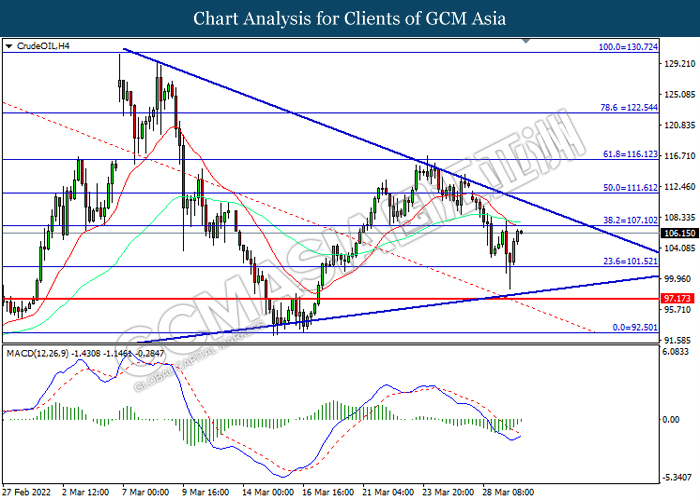

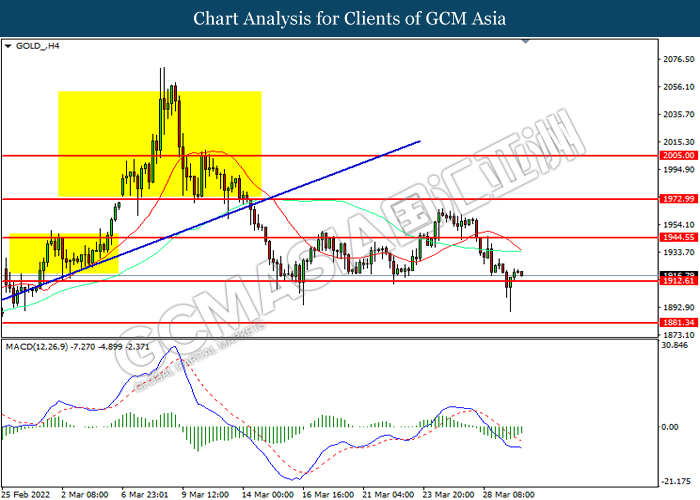

In the commodities market, the crude oil price retreated 0.05% to $107.00 per barrel as of writing. The oil market edged lower yesterday amid the hopes upon the resolution of Russia-Ukraine war had sparked positive prospect toward the oil supply disruption issues. On the other hand, the gold price depreciated by 0.08% to $1917.95 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Mar) | 475K | 438K | – |

| 20:30 | USD – GDP (QoQ) (Q4) | 2.30% | 7.10% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -2.508M | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

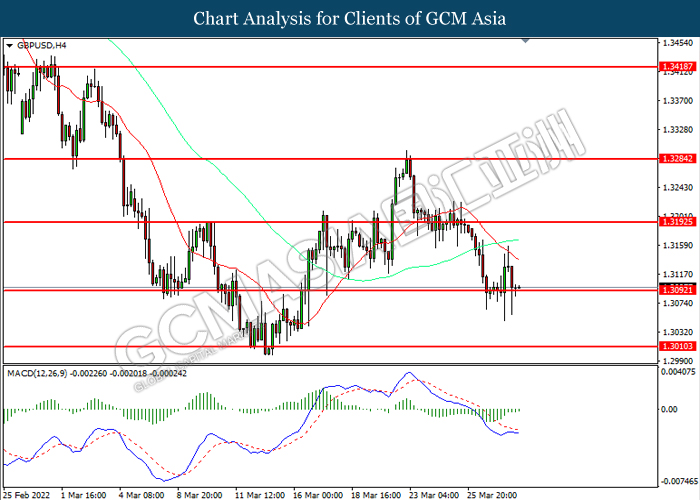

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

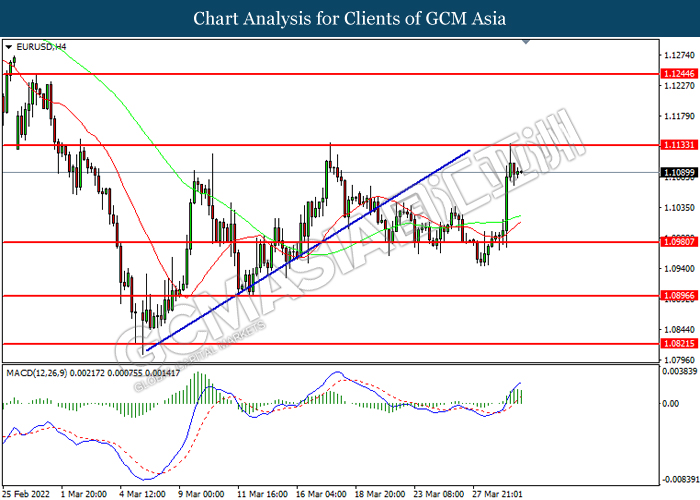

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.1135, 1.1245

Support level: 1.0985, 1.0895

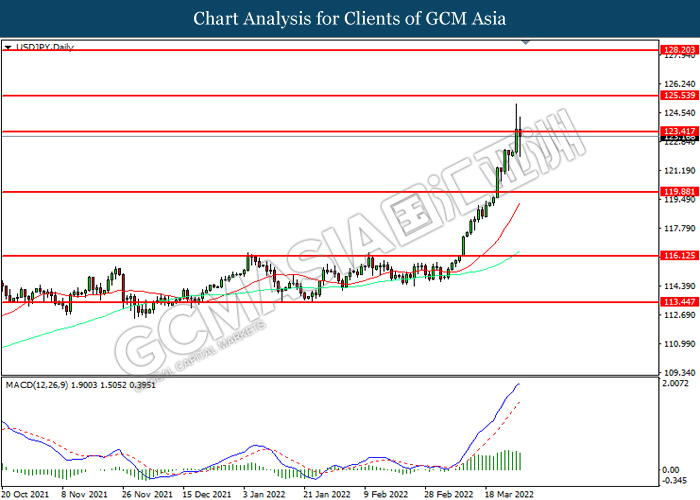

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.40, 125.55

Support level: 119.90, 116.15

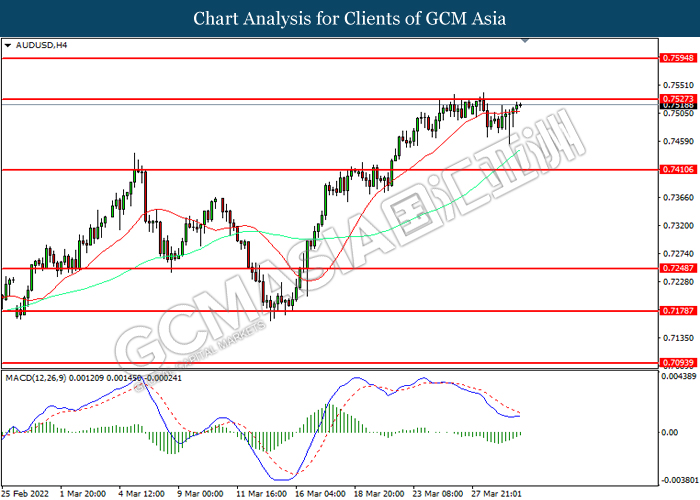

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after successfully breakout.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

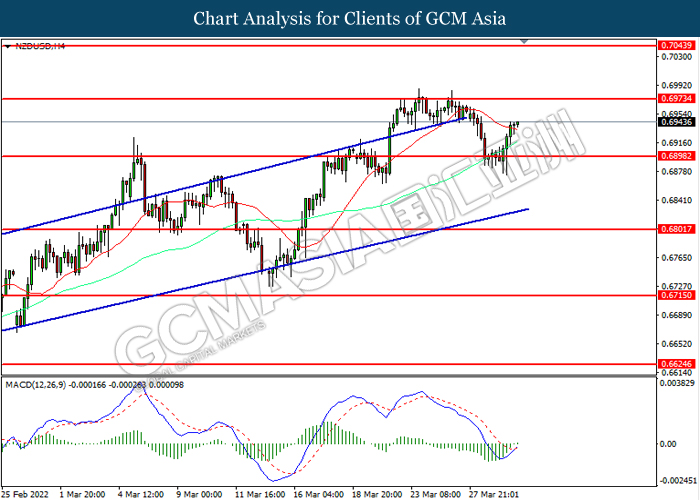

NZDUSD, H4: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6975.

Resistance level: 0.6975, 0.7045

Support level: 0.6890, 0.6800

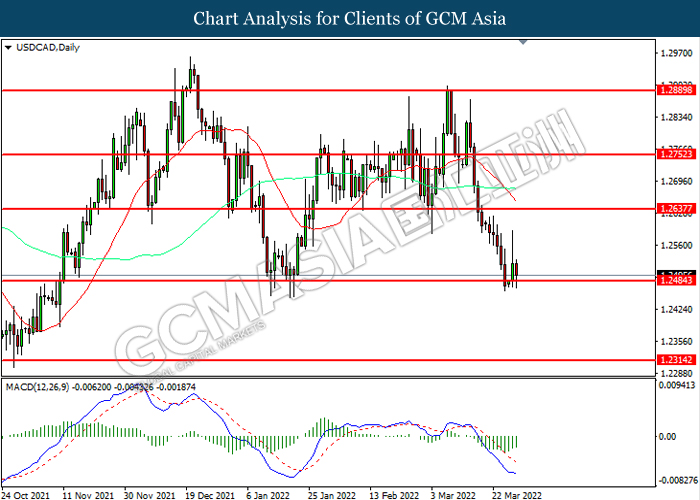

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

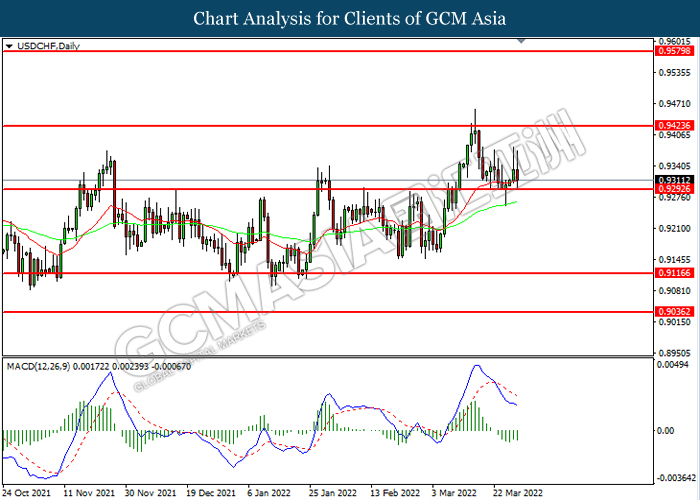

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9295. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after successfully breakout.

Resistance level: 0.9425, 0.9580

Support level: 0.9295, 0.9115

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 107.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.15

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1912.60. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35