30 May 2022 Afternoon Session Analysis

Upbeat retail sales spurred the bullish trend in Australian dollar.

The Australian dollar, which is widely traded by the global investors, surged following the release of upbeat economic data from the region. Prior to that, the pair of AUD/USD managed to recoup part of its losses as the possibility of pause in the US rate hike dragged the appeal of dollar index. The bullish momentum of AUD/USD has been extended further after Australian Bureau of Statistics (ABS) released its retail sales data. According to the institution, the Australian retail sales data jumped to another record level in April, where the data came in at 0.9%, similar to the expectation of consensus. Upbeat economic data underscored the recovery of consumer spending in Australia in the post-pandemic period. At this juncture, majority of the investors are eyeing on the upcoming crucial data such as GDP to gauge the further direction of Australian dollar. As of writing, the pair of AUD/USD rose 0.22% to 0.7175.

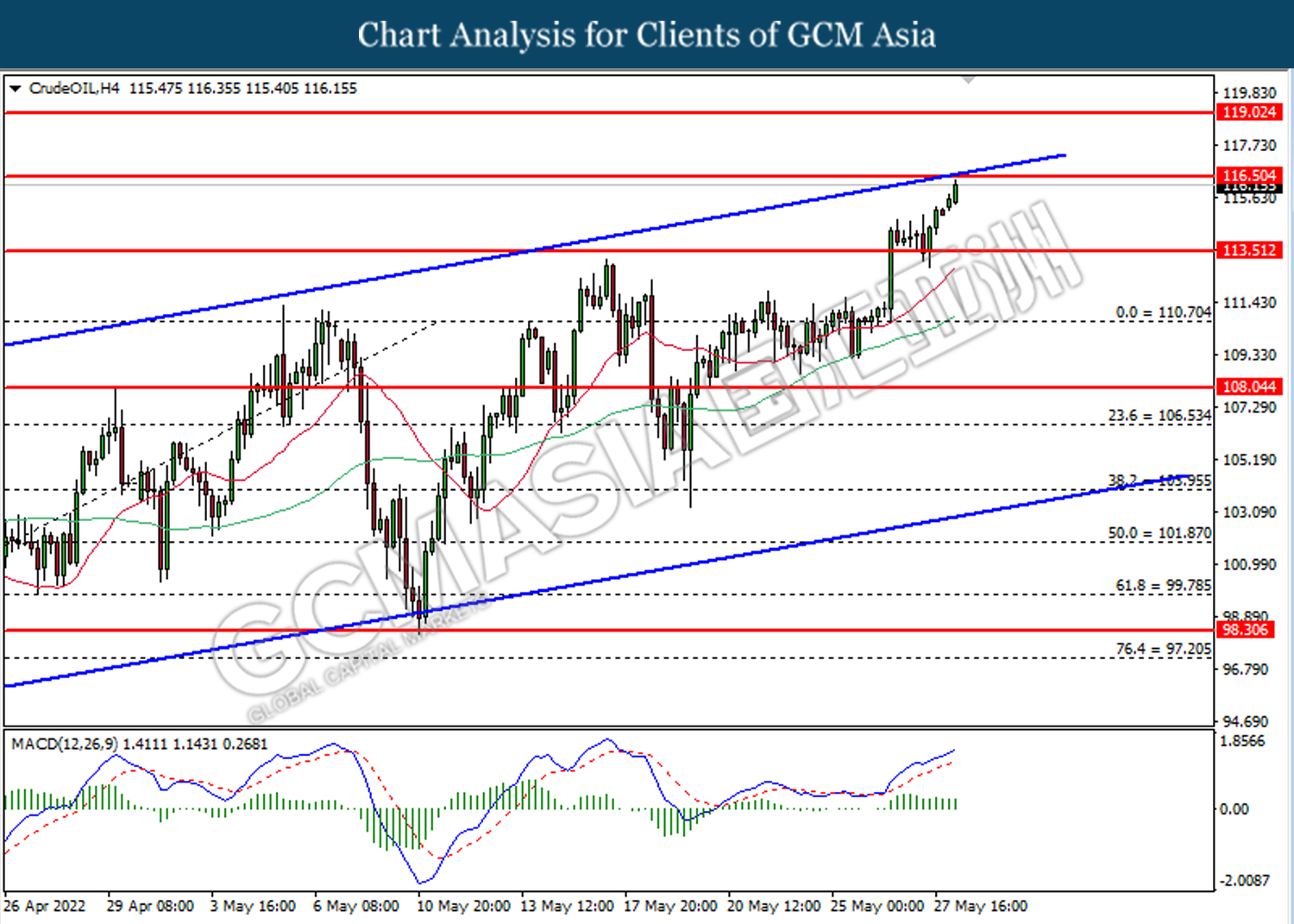

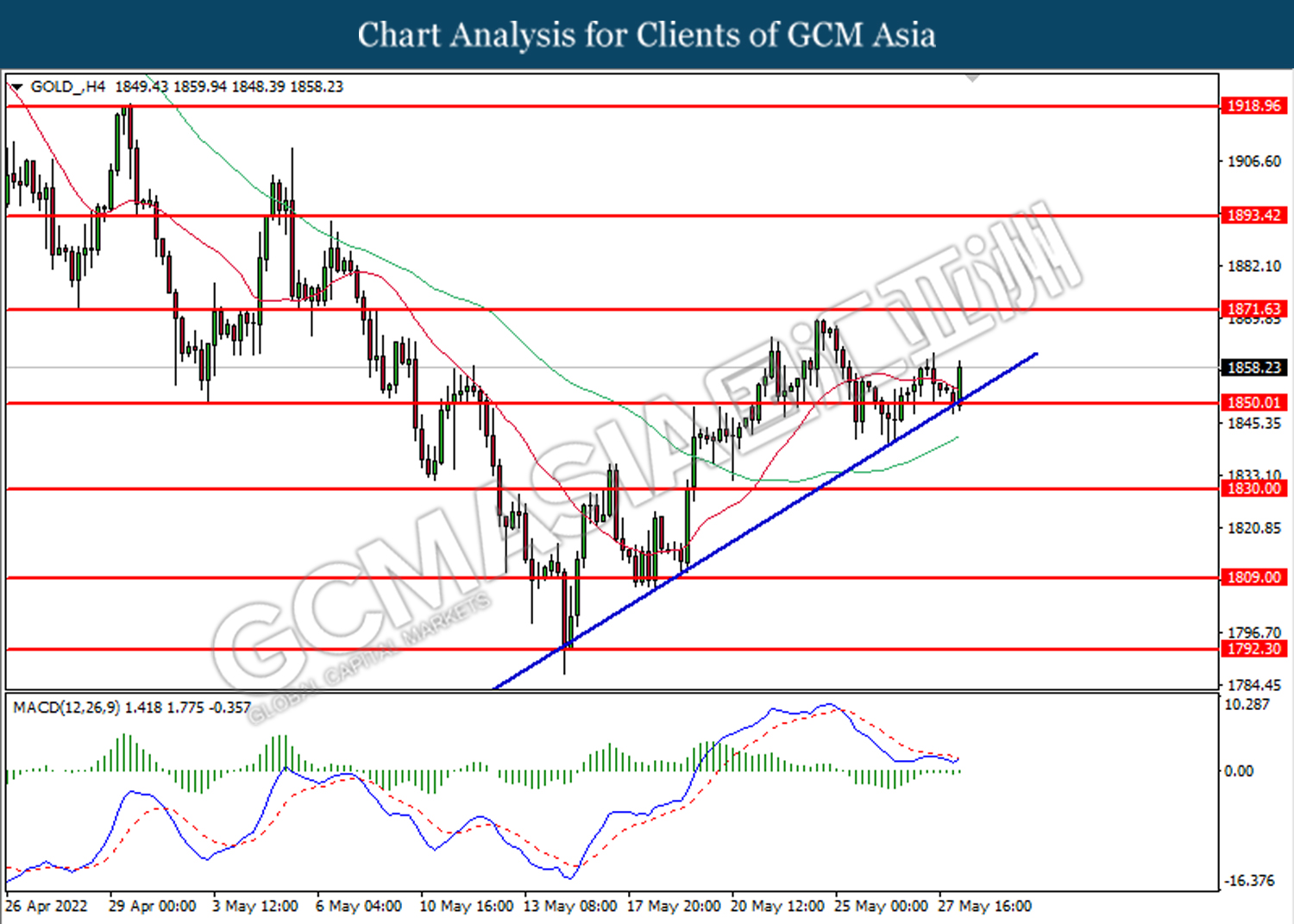

In the commodities market, crude oil prices are up by 0.83% to $116.15 per barrel as of writing as the start of driving season in the United States is expected to boost the overall demand for the oil products. Besides, gold price up 0.23% to $1,858.90 per troy ounce amid the weakness of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Memorial Day

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

N/A

Technical Analysis

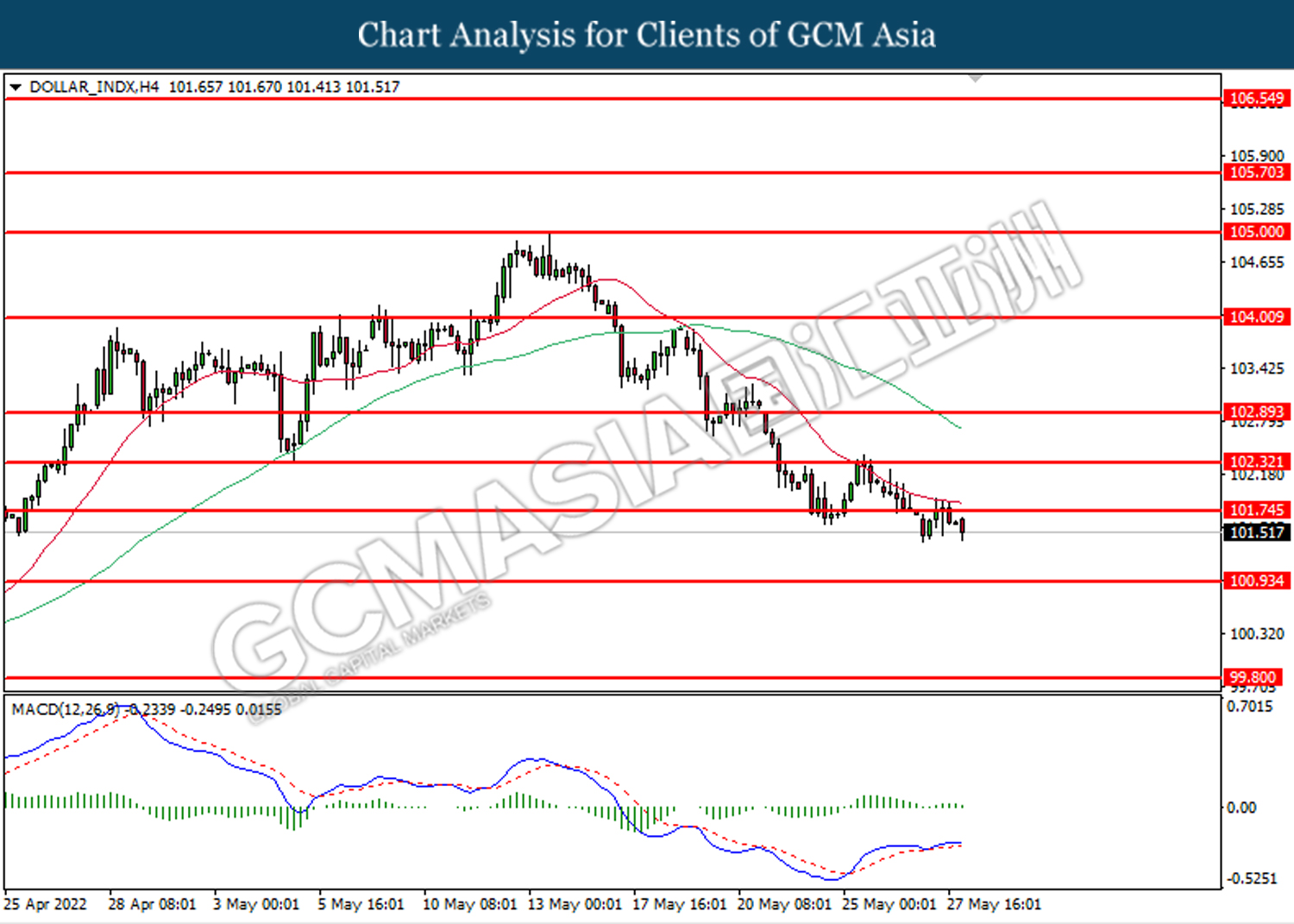

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the index to be traded lower toward a lower level.

Resistance level: 101.75, 102.30

Support level: 100.95, 99.80

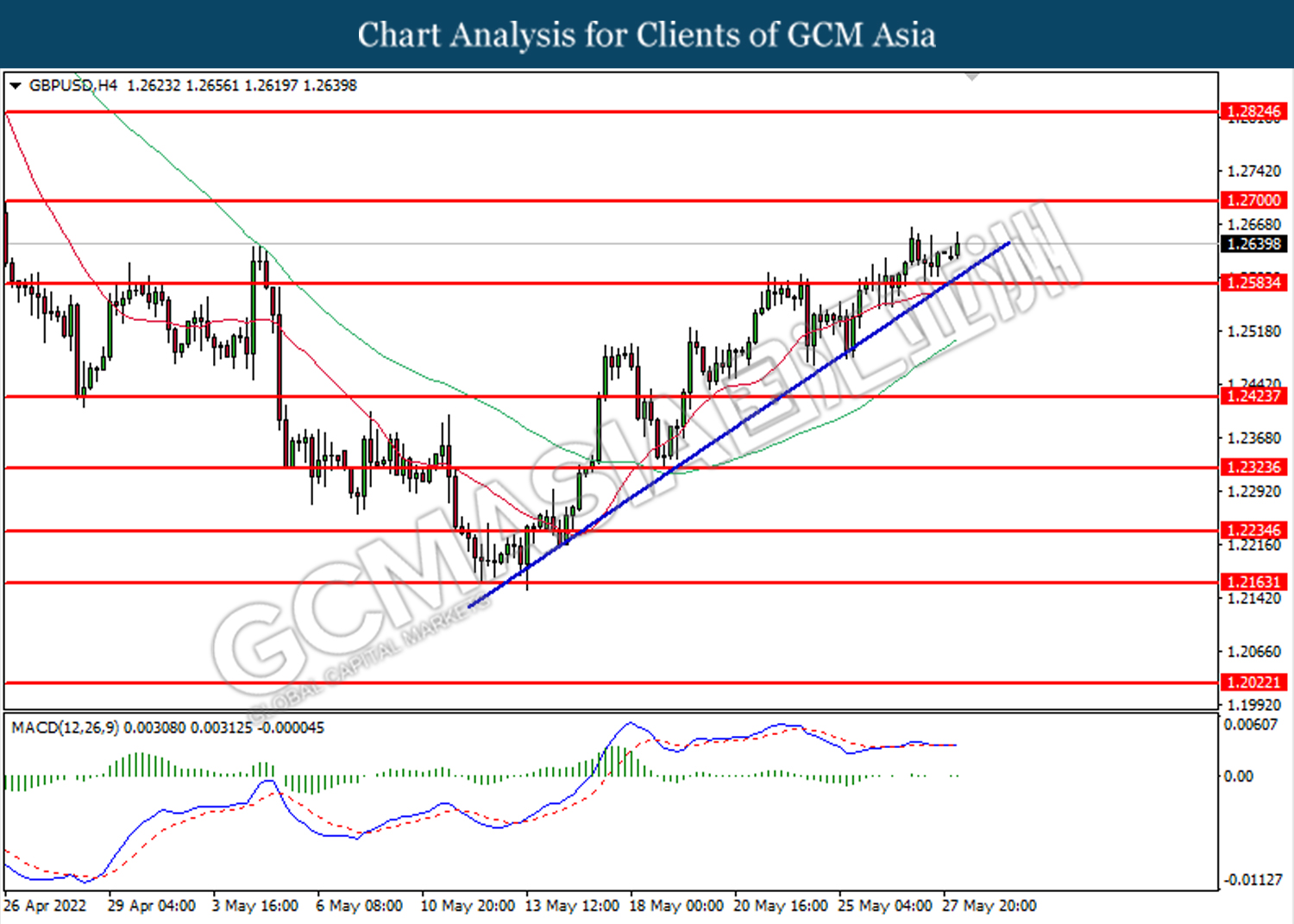

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2585. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.2700.

Resistance level: 1.2700, 1.2825

Support level: 1.2585, 1.2425

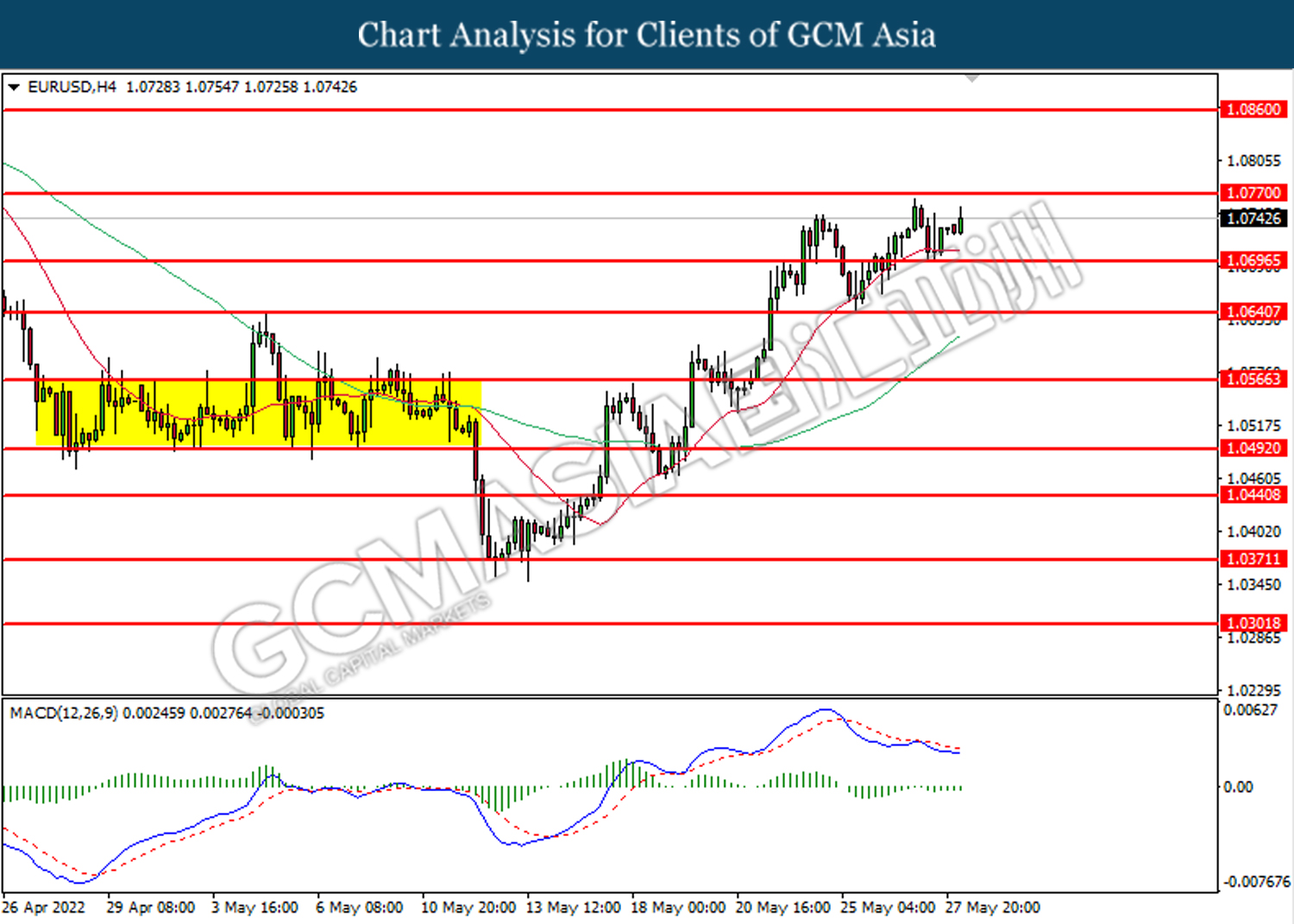

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0660

Support level: 1.0695, 1.0640

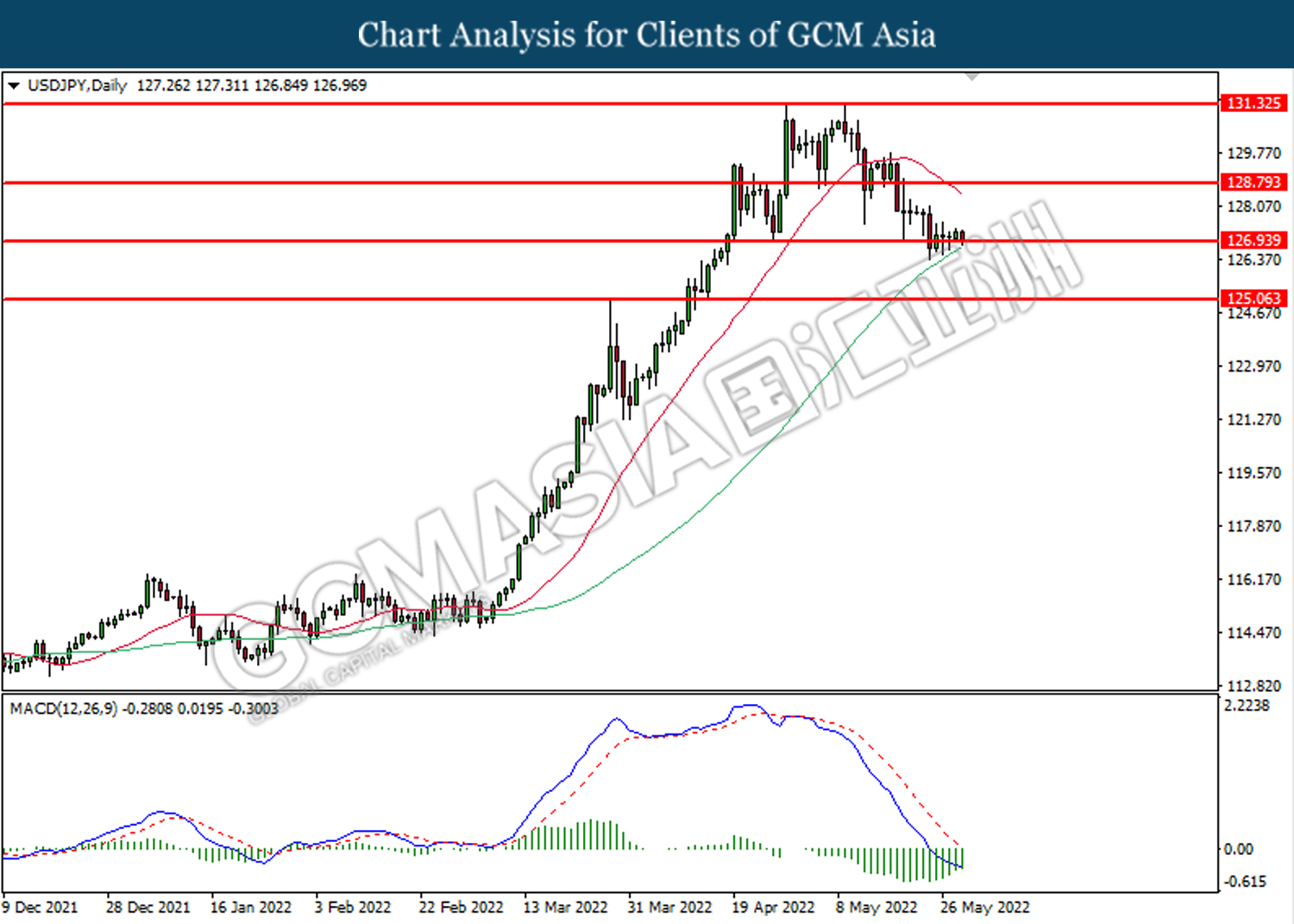

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be extend its gains toward the resistance level at 128.80.

Resistance level: 128.80, 131.35

Support level: 126.95, 125.05

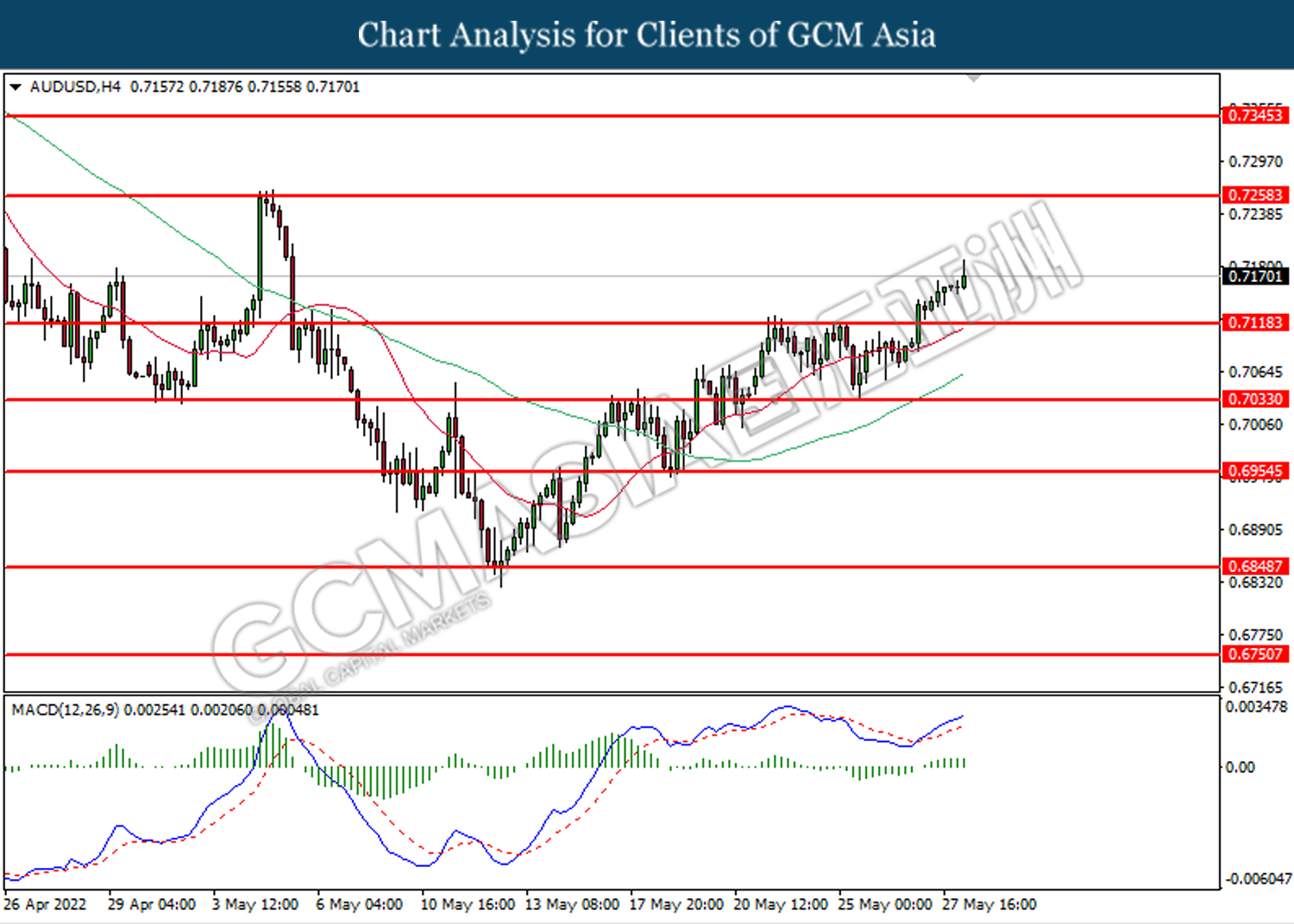

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7120. However, MACD which illustrated bullish momentum suggest the pair to extend its gains toward the resistance level at 0.7260.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

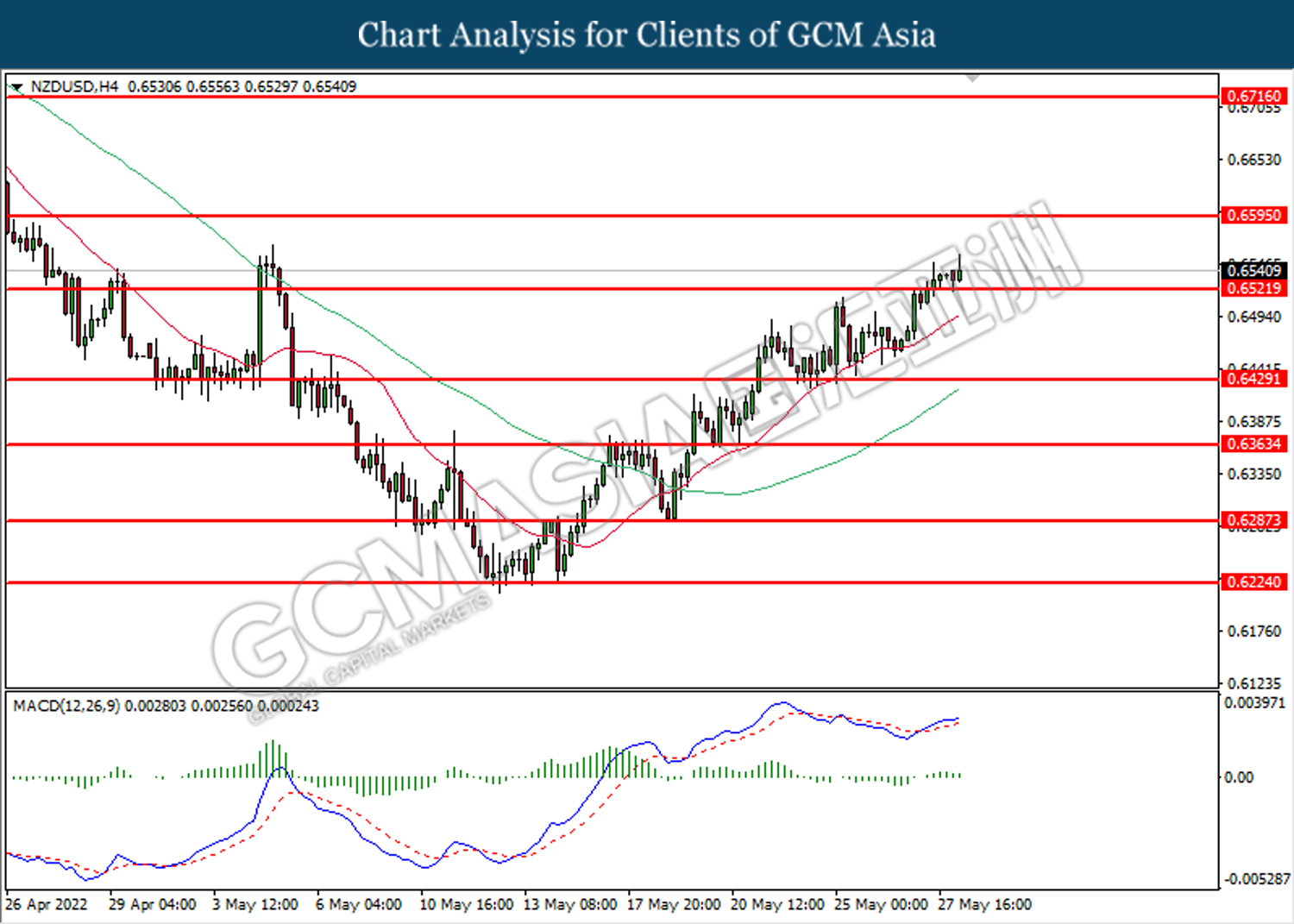

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6520. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6595.

Resistance level: 0.6595, 0.6715

Support level: 0.6520, 0.6430

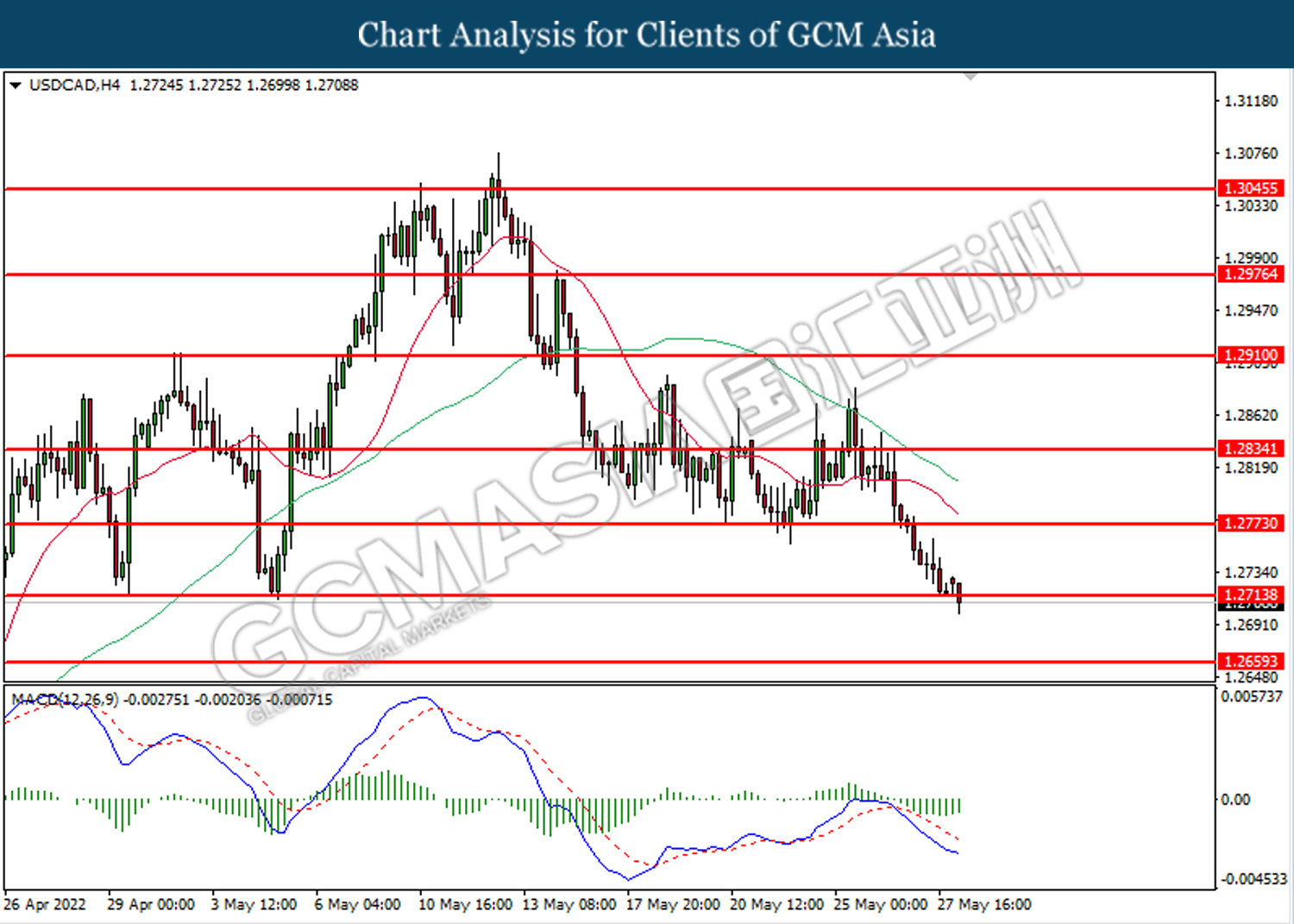

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2715. However, MACD which illustrated decreasing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2775, 1.2835

Support level: 1.2715, 1.2660

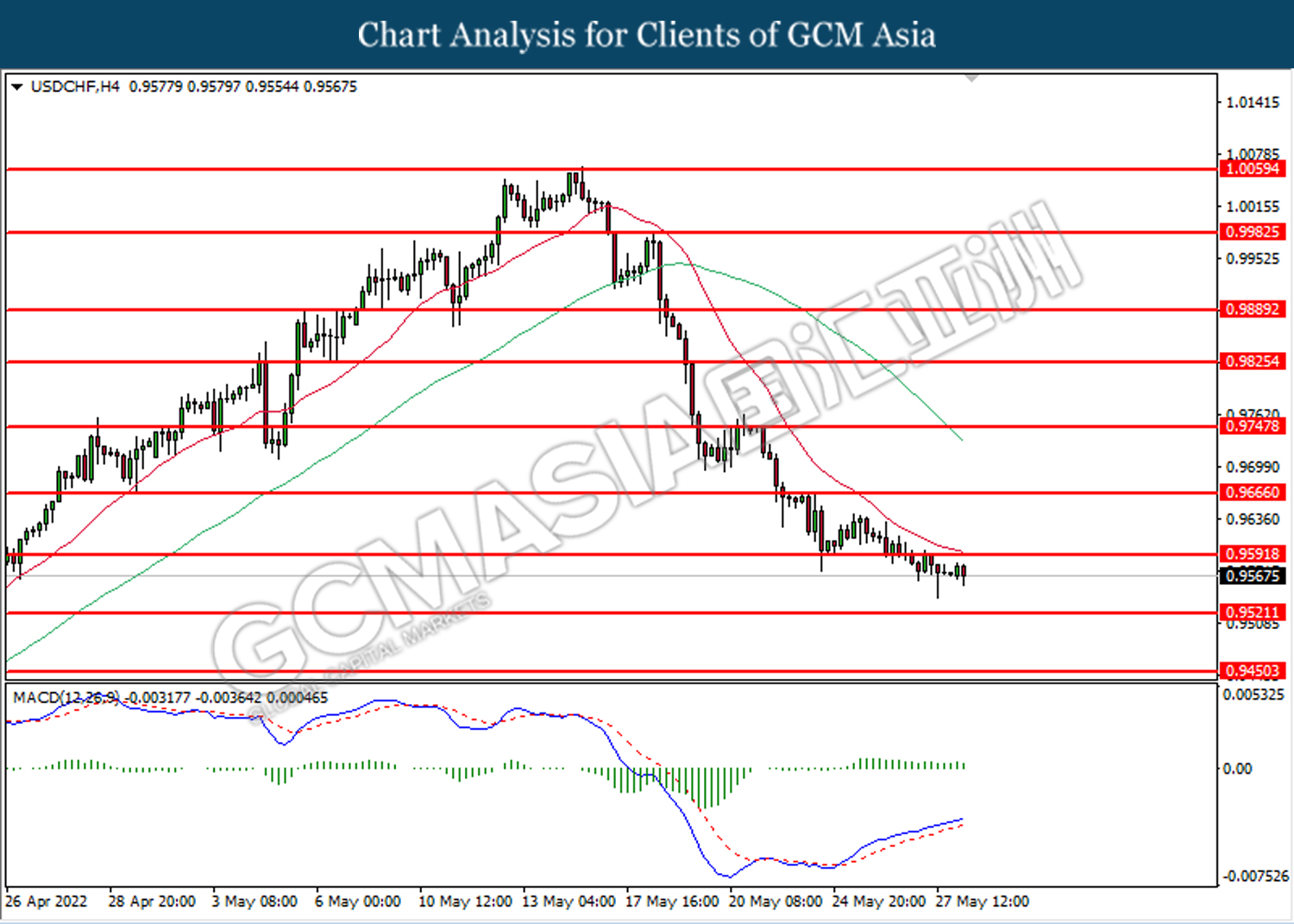

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9590. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9520.

Resistance level: 0.9590, 0.9665

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 116.50. MACD which illustrated bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level at 116.50.

Resistance level: 116.50, 119.00

Support level: 113.50, 110.70

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1850.00. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1871.65.

Resistance level: 1871.65, 1893.40

Support level: 1850.00, 1830.00