30 May 2022 Morning Session Analysis

US Dollar dropped as US Treasury yields slumped.

The Dollar Index which traded against a basket of six major currencies edged down on Friday amid the easing of US Treasury yields. According to CNBC, the US 10-Years Treasury yields slide down to 2.743% on Friday, as fears over the Federal Reserve’s plans to aggressively hike interest rates appeared to ease and a key inflation reading showed a slowing rise in prices. The reducing treasury yields would likely to diminish the risk-off return of investors, which dragged down the appeal of US Dollar. Besides, although inflation continued to increase in April, it rose less than in recent months, according to the data showed on Friday. The Personal Consumption Expenditures (PCE) price index rose 0.2%, the smallest gain since November 2020, after shooting up 0.9% in March. For the 12 months through April, the PCE price index advanced 6.3% after jumping 6.6% in March. As the inflation might reach its peak, Federal Reserve would less likely to implement aggressive rate hike in order to combat the easing inflation, which prompted investors to shift their capitals toward risk-appetite assets. As of writing, the Dollar Index appreciated by 0.01% to 101.71.

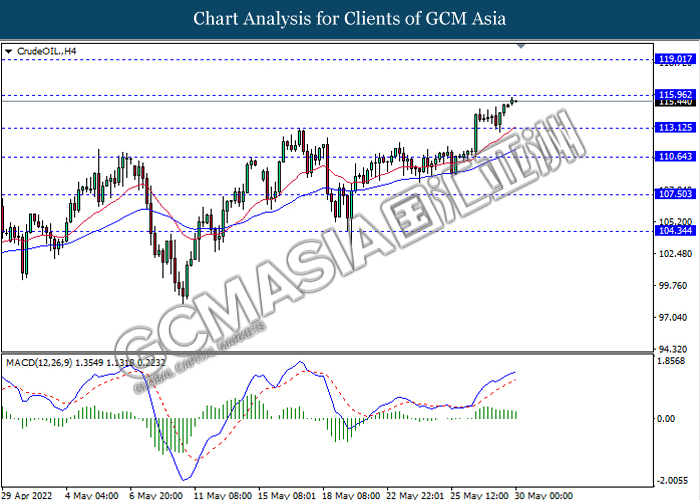

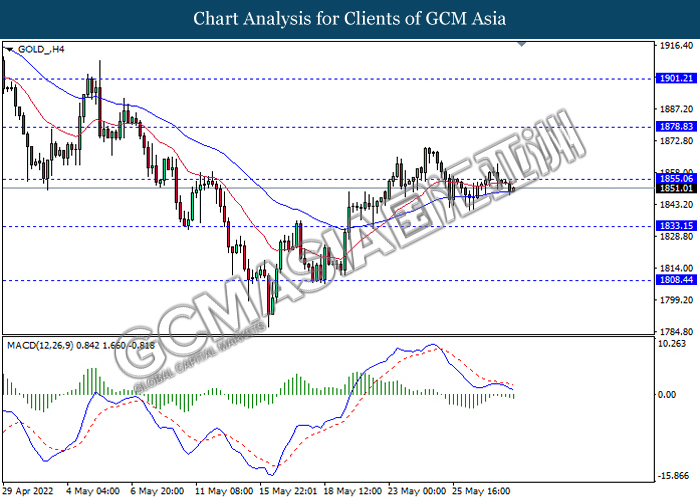

In the commodities market, crude oil price appreciated by 0.57% to $115.72 per barrel as of writing ahead of the US driving season which led to the increasing demand on oil. On the other hand, gold price depreciated by 0.25% to $1846.68 per troy ounce as of writing following the shift sentiment on the risk-appetite assets.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Memorial Day

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

N/A

Technical Analysis

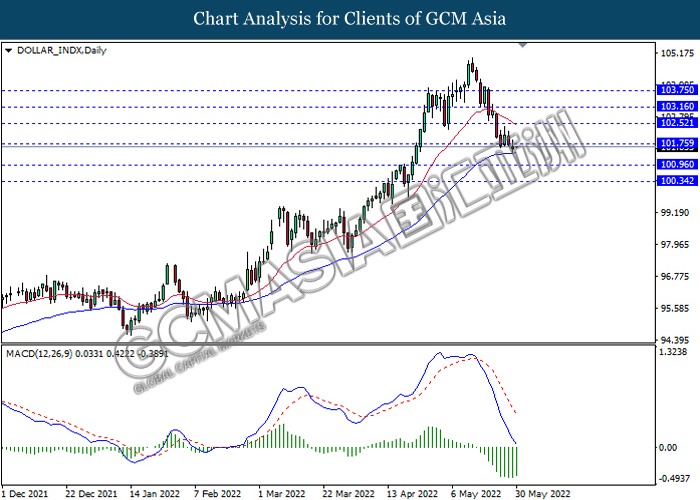

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 101.75, 102.50

Support level: 100.95, 100.35

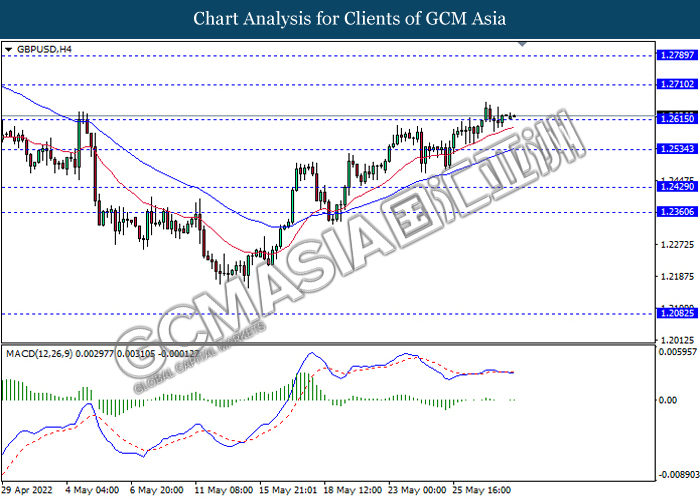

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2710, 1.2790

Support level: 1.2615, 1.2535

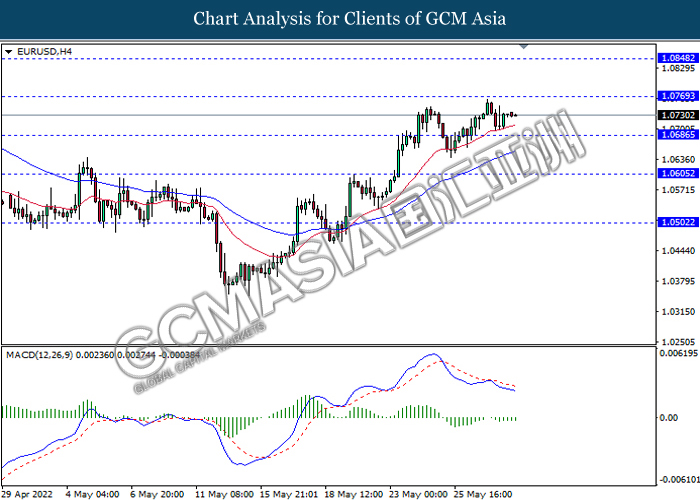

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

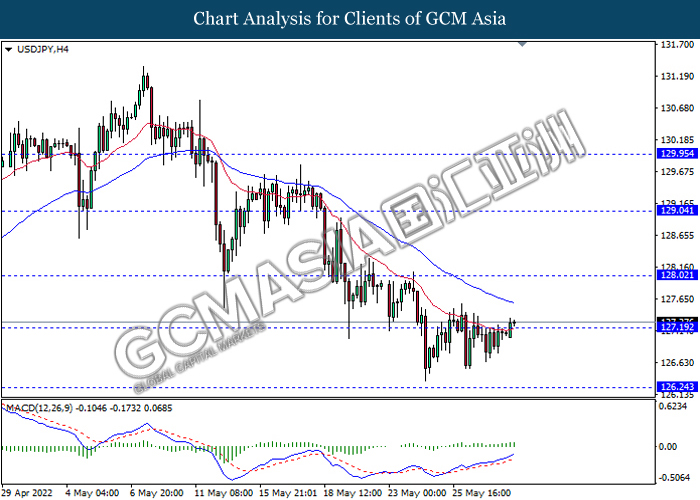

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to be extend its gains.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

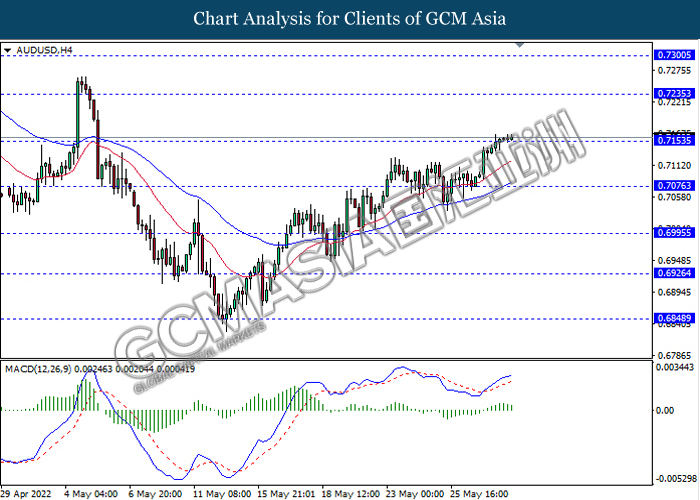

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7235, 0.7300

Support level: 0.7155, 0.7075

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6595, 0.6675

Support level: 0.6500, 0.6425

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2520

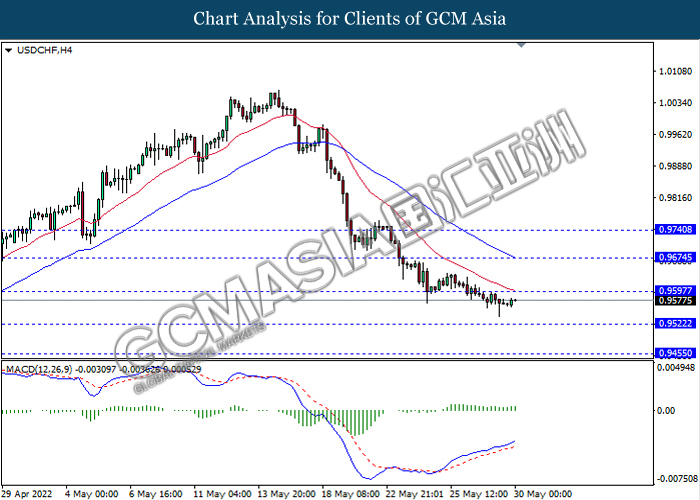

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 115.95, 119.00

Support level: 113.10, 110.65

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45