30 June 2023 Afternoon Session Analysis

Euro slipped despite the German CPI rising.

The euro fell against the dollar despite the German CPI rising. Germany’s annual consumer price index (CPI) rose to 6.4% from 6.1%, beating market expectations of 6.3%, according to the German Federal Statistical Office. According to an official statement, German CPI continues to rise as food price rise above the average rate of 13.7% compared to the same month last year. Due to the Russian-Ukraine war, the energy price has risen, which has led to an increase in food prices compared with the previous year’s reading. Also, measures of the third relief package of the German government, reflected in lower energy prices and caused the food price increase. The EUR/USD index strengthened after German consumer price inflation came in higher than expected. However, a massive downturn revision of the EURUSD after the US announced a series of optimistic economic data. The dollar index lifted after employment jobless claims reduced to 239k versus 266k expectations and upbeat quarter 1 GDP. Meanwhile, investors’ eyes on eurozone CPI to get a clue of market direction. As of writing the EURUSD edged up by 0.08% to 1.0873.

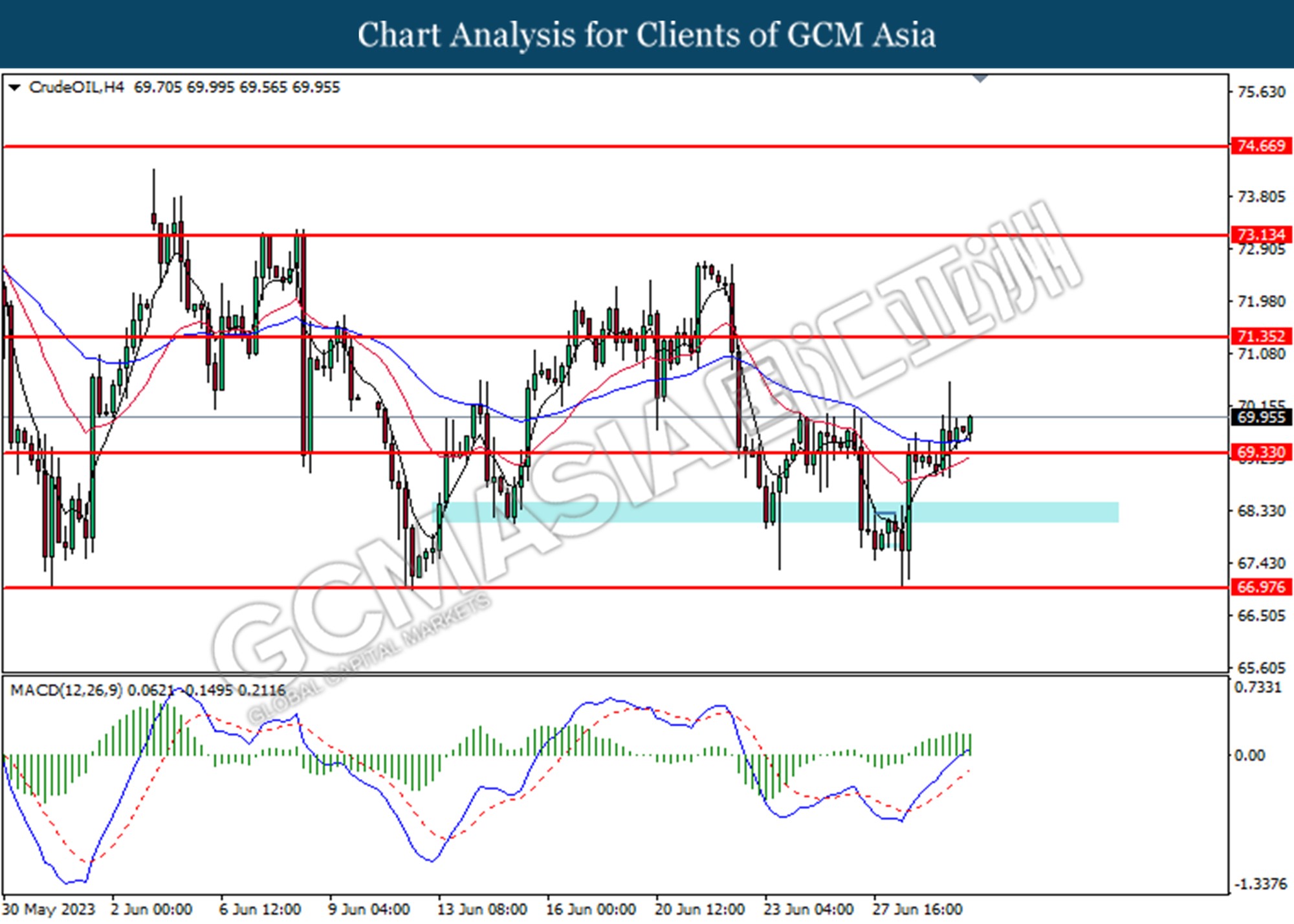

In the commodities market, crude oil prices rose by 0.20% to $70.00 per barrel as Nigeria’s supply concerns lifted the crude prices. Besides, the gold prices were range bound by adding 0.03% to $1908.87 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (YoY) (Q1) | 0.2% | 0.6% | – |

| 17:00 | EUR – CPI (YoY) (Jun) | 6.1% | 5.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (May) | 0.4% | 0.4% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Jun) | 59.2 | 63.9 | – |

Technical Analysis

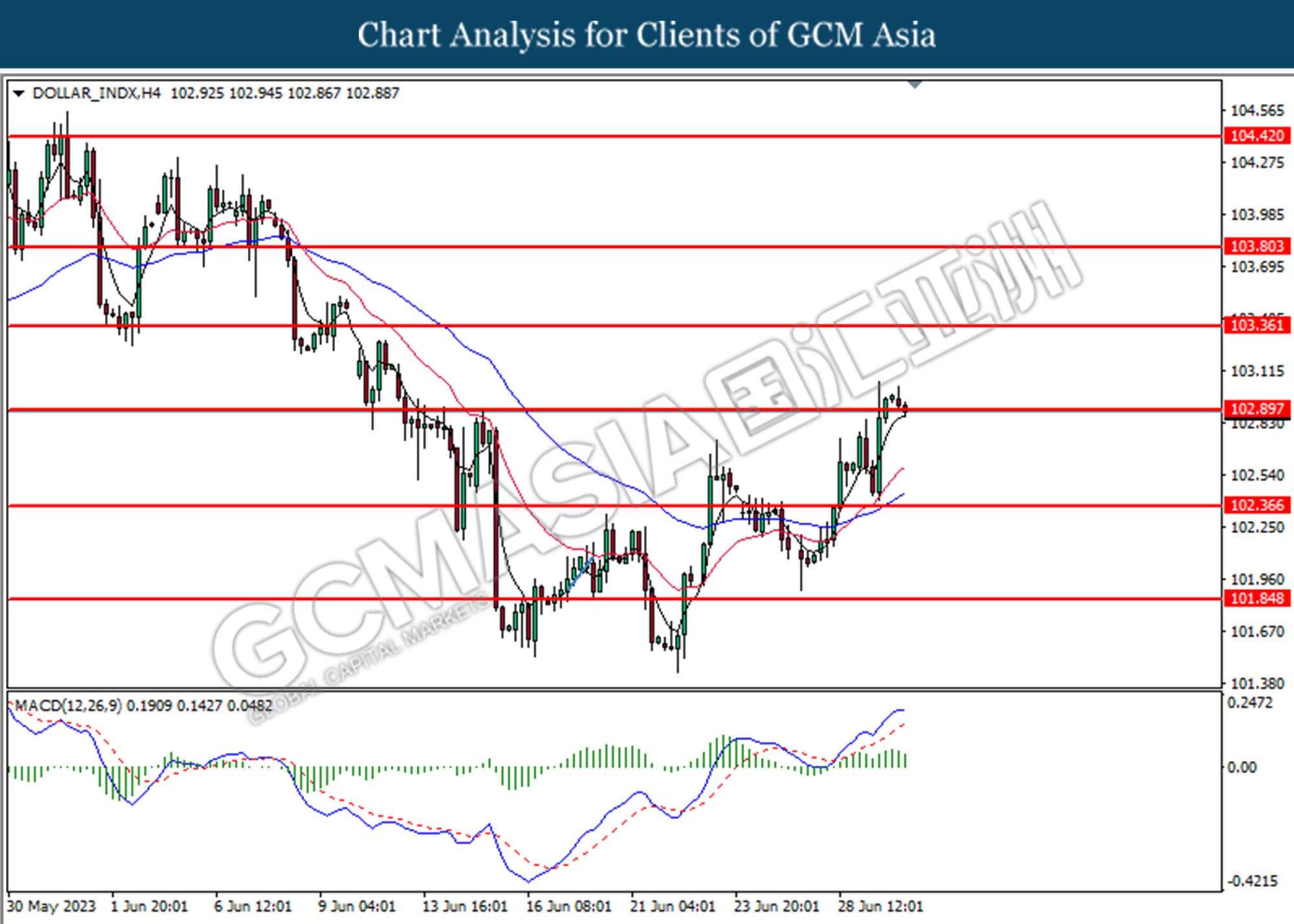

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for the support level at 102.90. MACD which illustrated diminishing bullish momentum suggests the index extended its losses if successfully breaks below the resistance level.

Resistance level: 103.35, 103.80

Support level: 102.90, 102.35

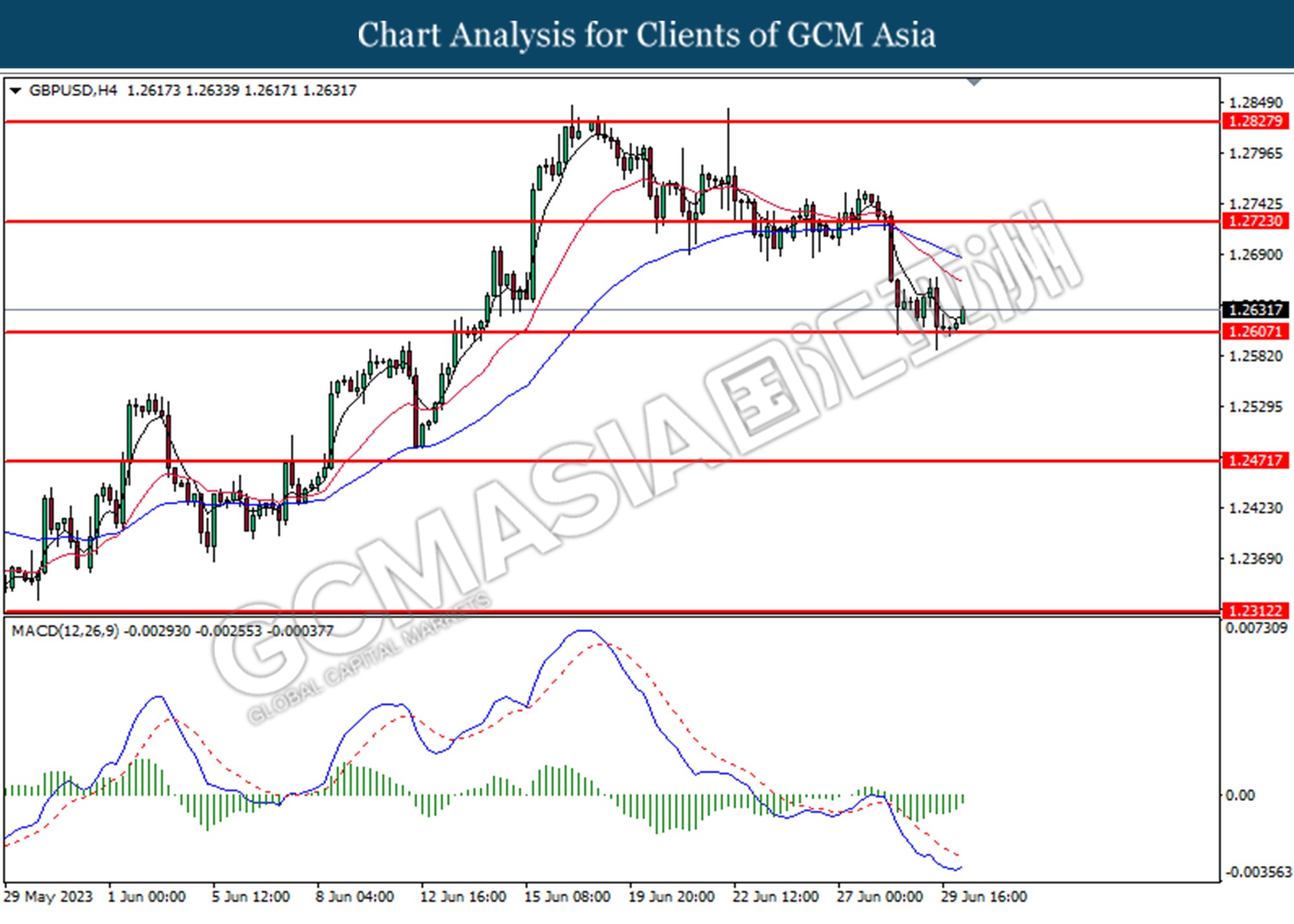

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2610. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2725, 1.2830

Support level: 1.2610, 1.2470

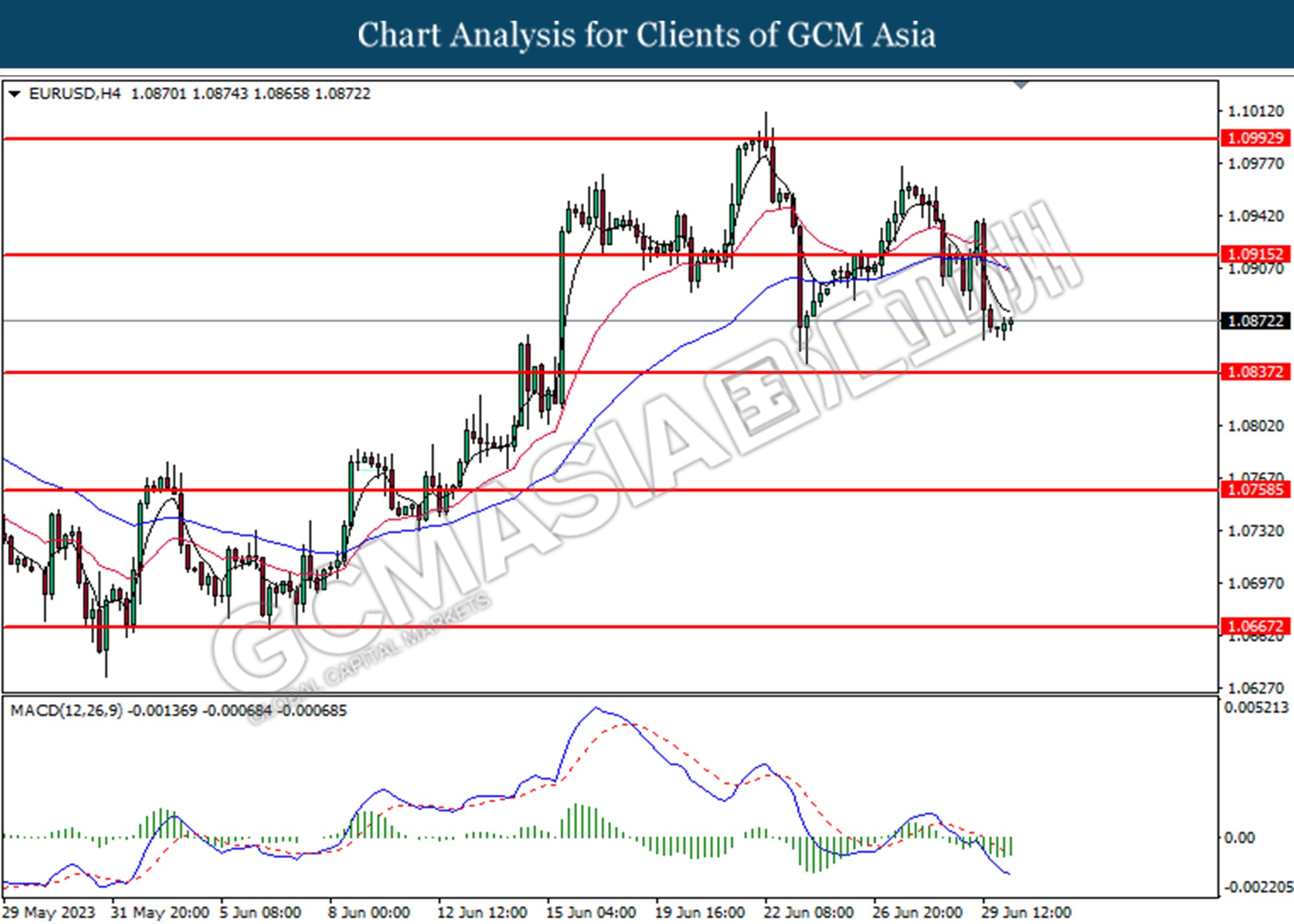

EURUSD, H4: EURUSD was traded higher following the rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

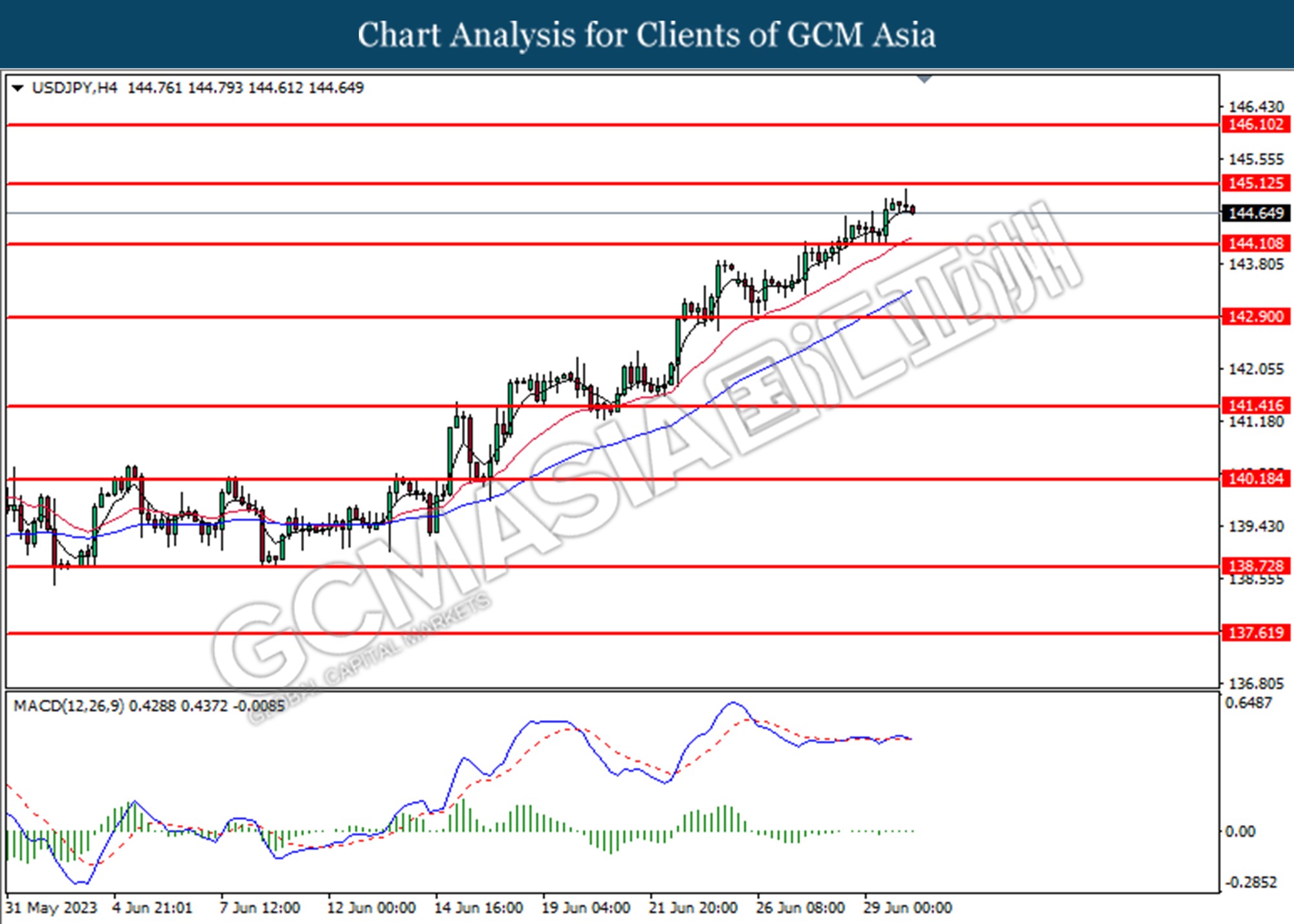

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 145.10. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

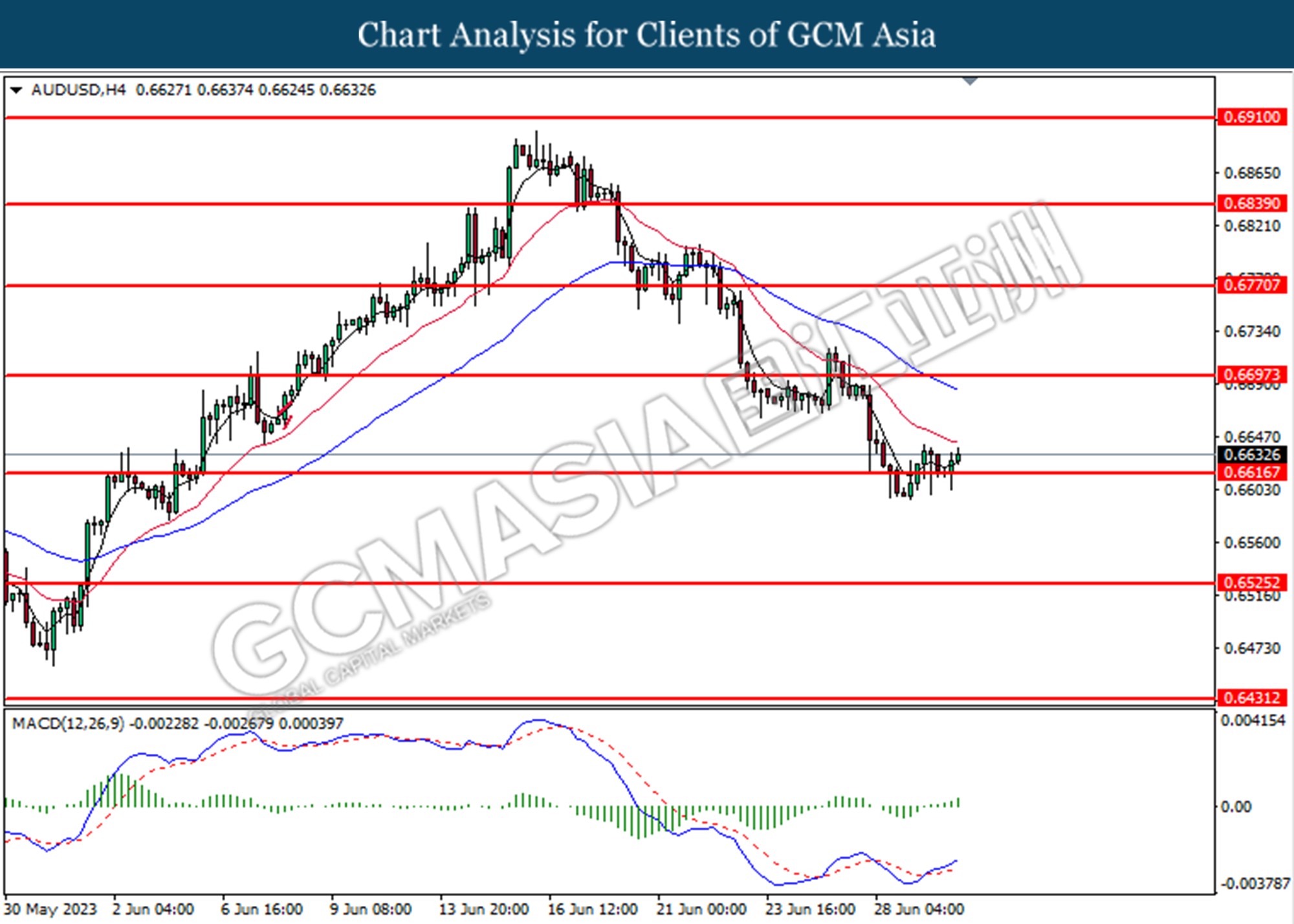

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6615. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

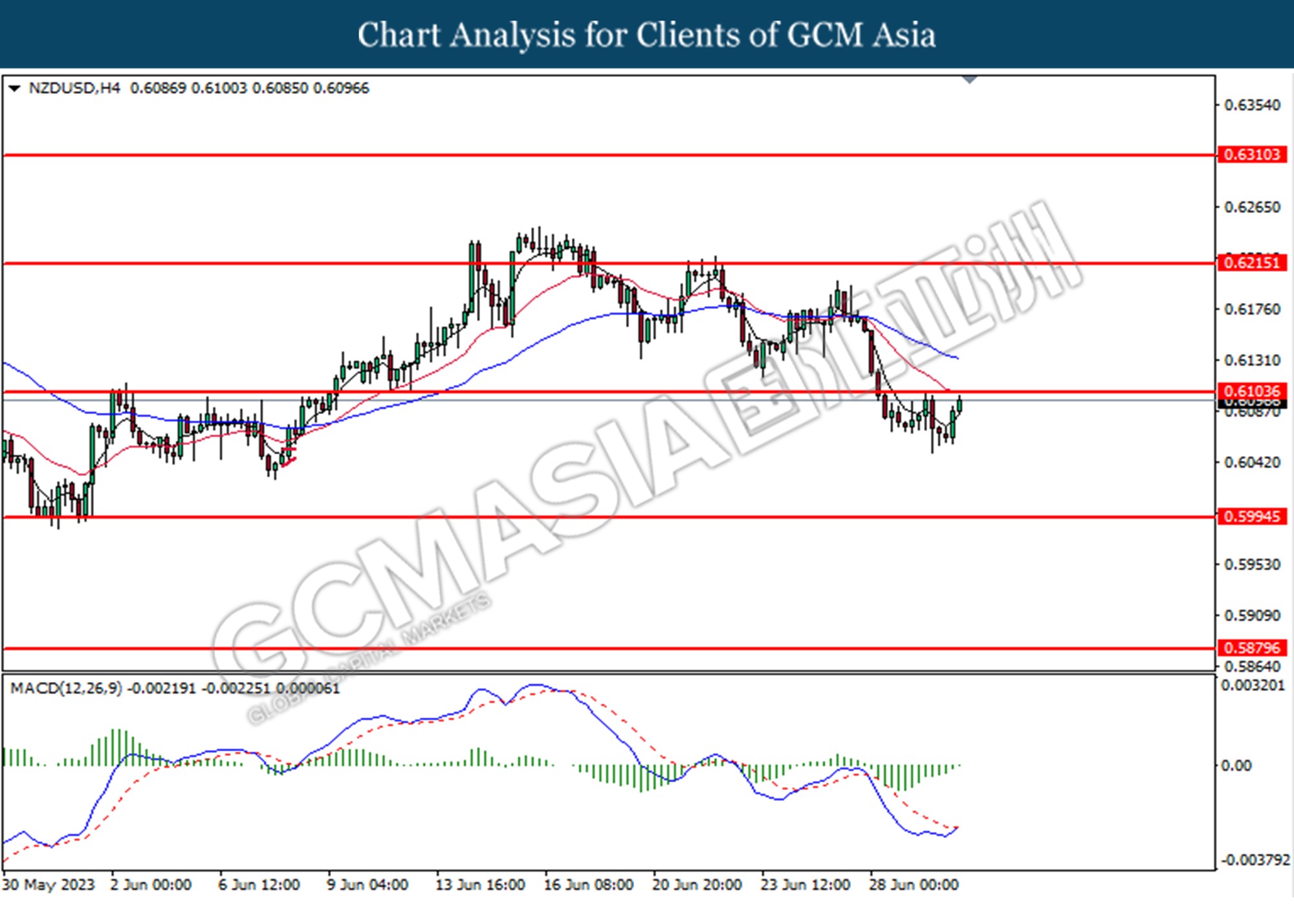

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6105.

Resistance level: 0.6105, 0.6215

Support level: 0.5995, 0.5880

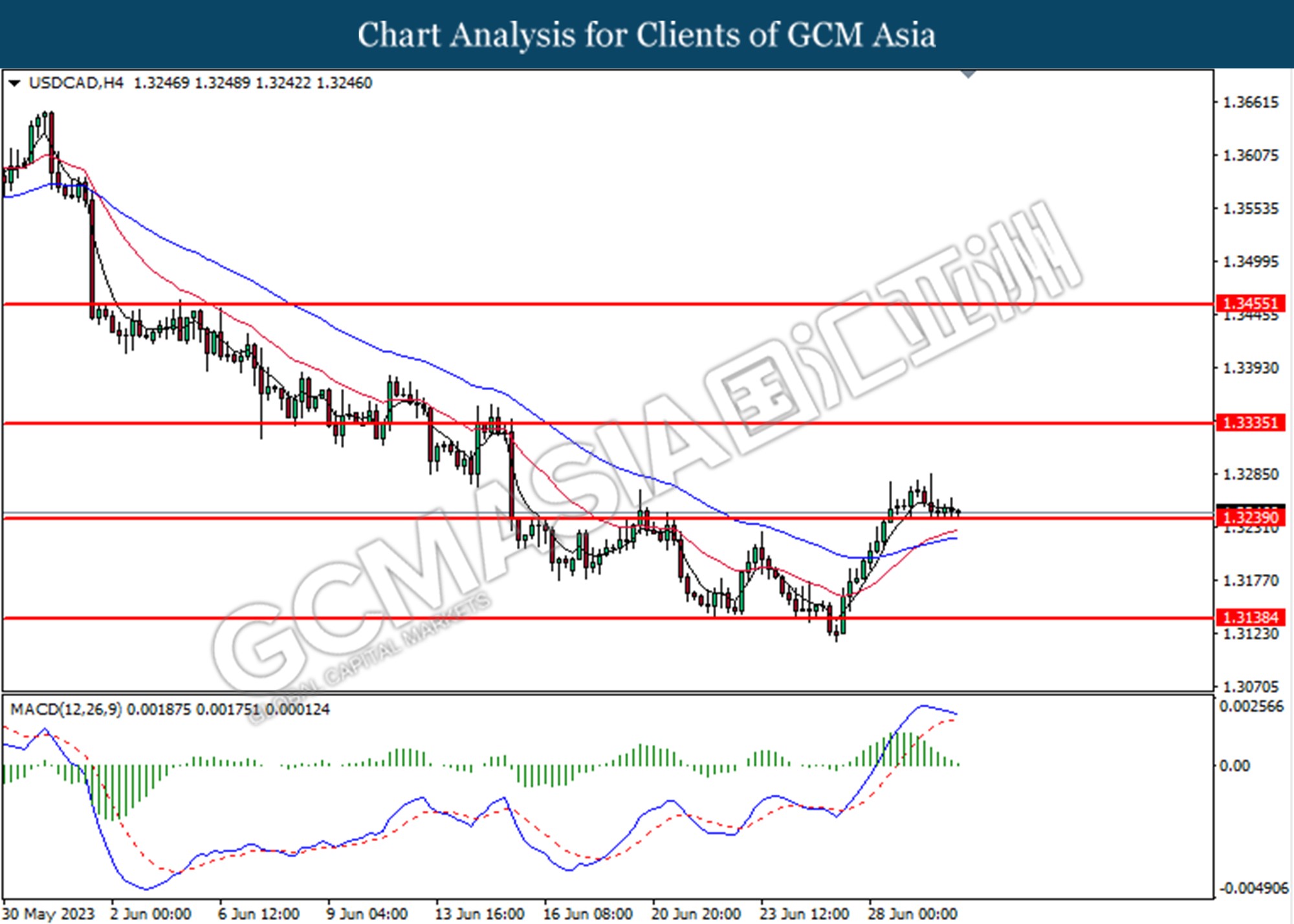

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.3240.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.8985. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior breaks above the previous resistance level at 69.30. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 71.35,73.15

Support level: 69.30, 67.55

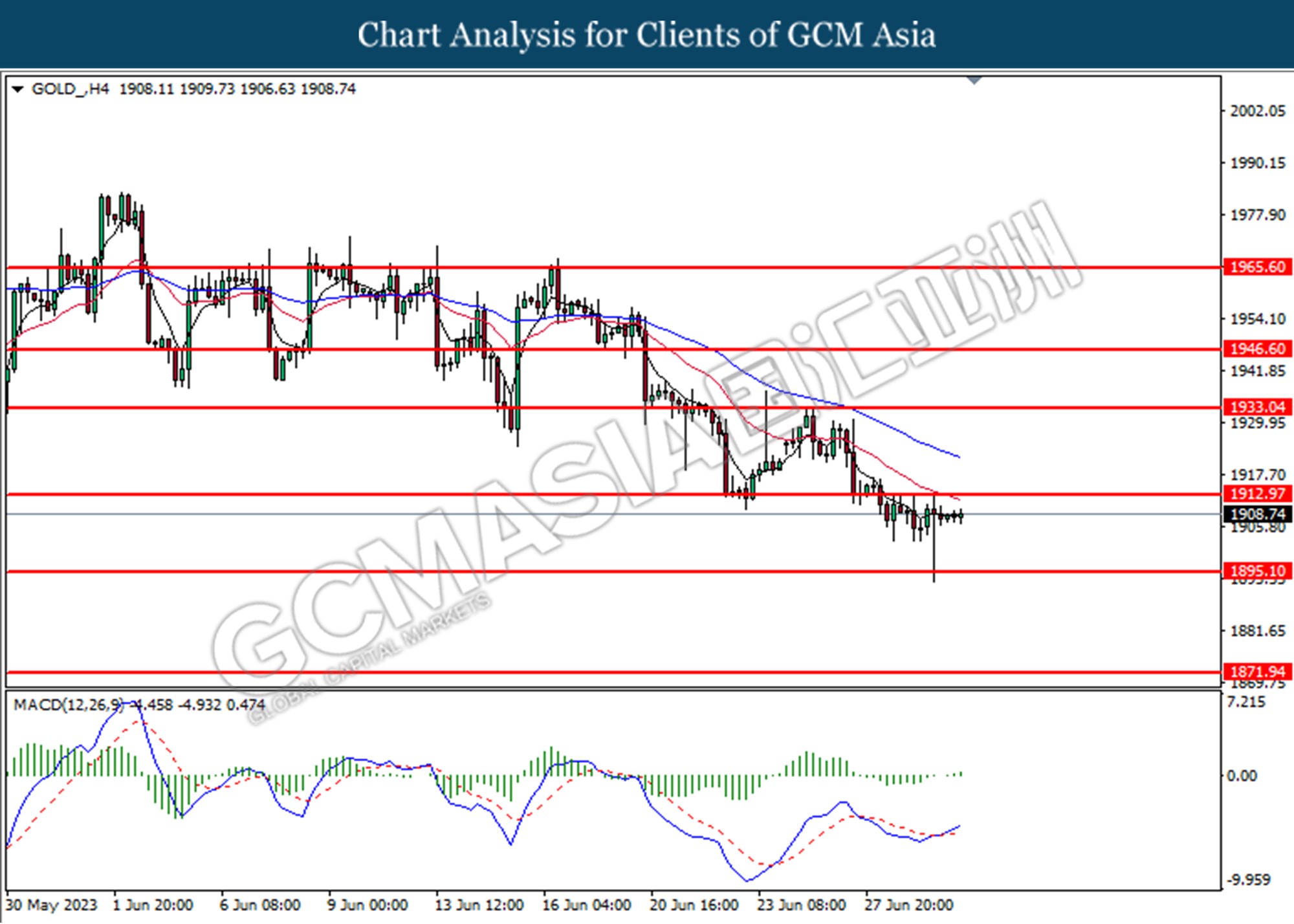

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1895.10. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 1913.00

Resistance level: 1913.00, 1933.00

Support level: 1895.10, 1871.95