30 August 2022 Afternoon Session Analysis

Euro jumped as ECB tend to bring down skyrocketed inflation.

The EUR/USD, which traded by majority of investors, surged on yesterday trading session amid the hawkish statement from European Central Bank (ECB). According to Bloomberg, the ECB has prepared to rate hike at least half-percentage in upcoming meeting. Besides, a larger move would be considered if the inflationary pressure keep rising. The aggressive tightening monetary policy would likely to increase the risk-free return of investors, which prompting investors to shift their capitals toward Euro market. Though, the gains experienced by Euro was limited amid the raising fears of energy shortage threat in European. Currently, the US would cooperate with European to alleviate that potential threat as well as European Union (EU) would hold an emergency meeting with energy ministers on 9th September in order to deal with spiking commodities prices. On the data front, investors would eye on Eurozone CPI data which scheduled tomorrow. As of writing, EUR/USD eased by 0.03% to 0.9992.

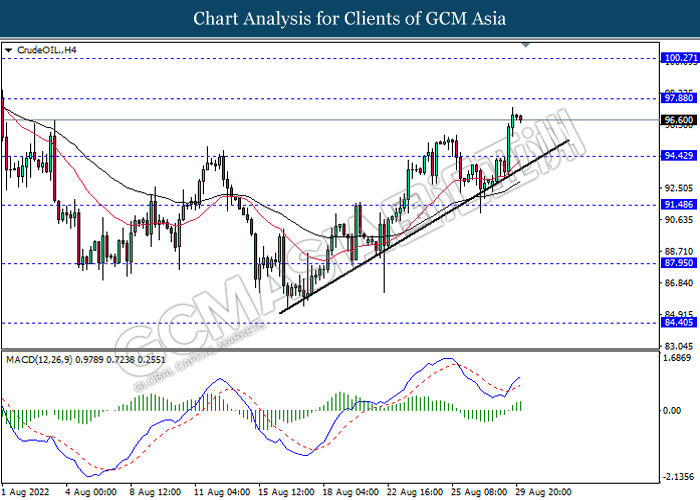

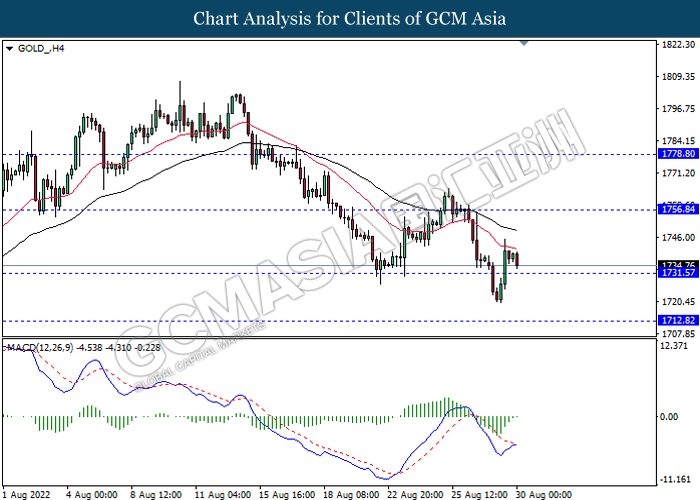

In the commodities market, the crude oil price depreciated by 0.38% to $96.64 per barrel as of writing as the global inflation diminished market demand on oil. On the other side, the gold price dropped by 0.11% to $1735.59 per troy ounce as of writing amid the value of US Dollar heightened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Aug) | 95.7 | 97.9 | – |

| 22:00 | USD – JOLTs Job Openings (Jul) | 10.698M | 10.475M | – |

Technical Analysis

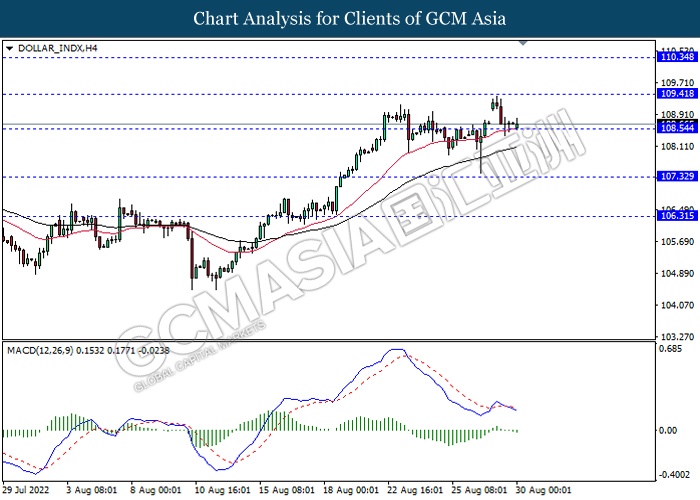

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

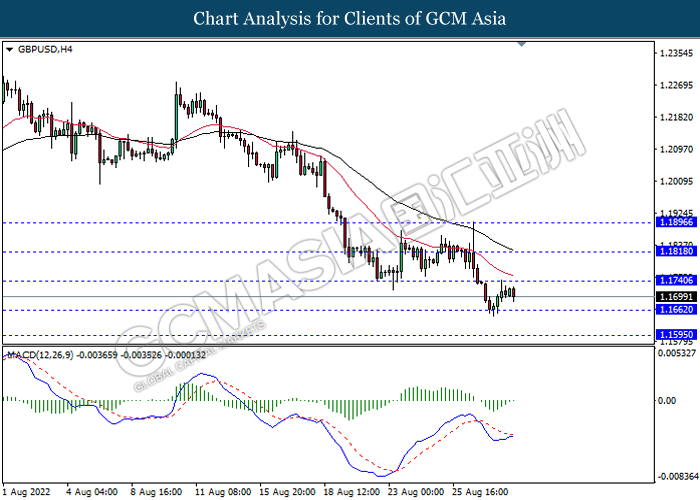

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1740, 1.1820

Support level: 1.1660, 1.1595

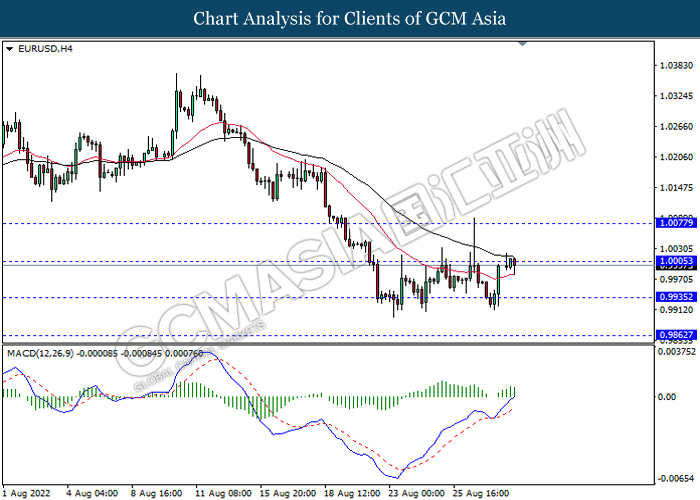

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

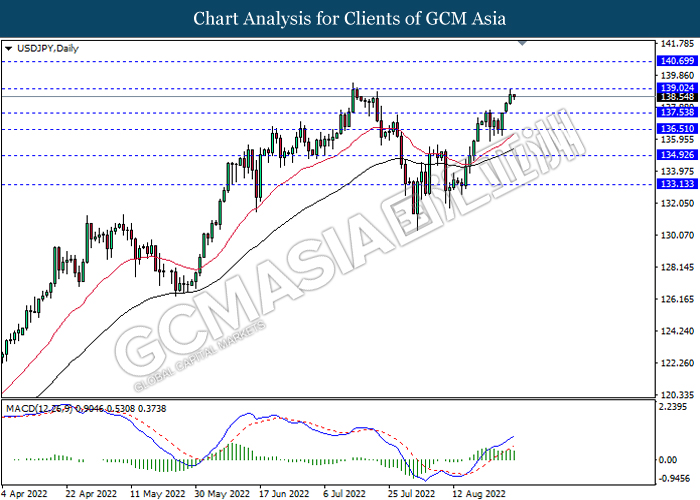

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.00, 140.70

Support level: 137.55, 136.50

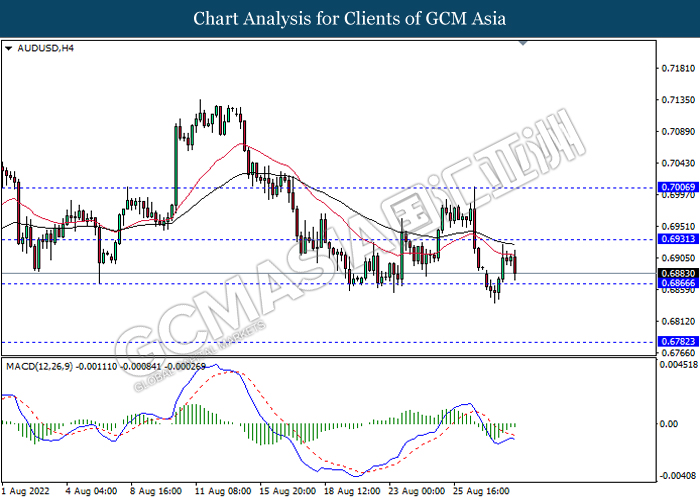

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6930, 0.7005

Support level: 0.6865, 0.6780

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3050, 1.3135

Support level: 1.2935, 1.2825

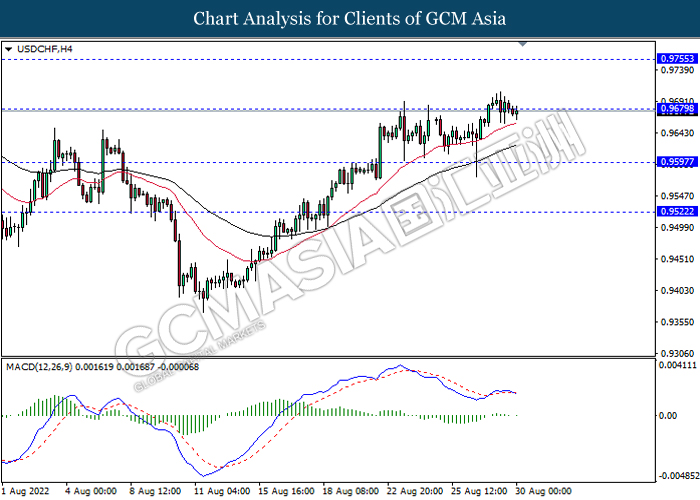

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9680, 0.9755

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 97.90, 100.25

Support level: 94.40, 91.50

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1756.85, 1778.80

Support level: 1731.55, 1712.80