30 August 2022 Morning Session Analysis

US dollar lost its ground after hitting the new high in 20 years.

The dollar index, which gauges its value against a basket of six major currencies, retreated after hitting the highest level in 20 years amid the profit taking activities in the dollar market. Prior to that, the greenback received huge buying momentum on Friday, when the Federal Reserve Chairman Jerome Powell told the Jackson Hole central banking conference in Wyoming that the Fed would increases the cash rate as high as needed to cool down the overheating economy, and keep them there for a certain period of time in order to lower inflation running at more than three times the Fed’s 2% goal. Shifting the focus to the other currency market, the Europe zone’s single currency jumped as ECB policymakers made the case on Saturday a sharp rise in interest rates next month as inflation remains at a sky-high level while the public is losing trust in the bank’s ability to fight inflation. Following a rate hike of 50 basis points last month, ECB is expected to have a similar or larger move on 8th September meeting. Looking ahead, investors will put their attention over the upcoming crucial data, such as the CB Consumer Confidence, to have a gauge on the consumer spending in the near future. As of writing, the dollar index dropped -0.05% to 108.75.

In the commodities market, the crude oil price was down by -0.26% to $96.72 a barrel as potential OPEC+ output cuts outweigh the consequence of strong US dollar and dire global economic outlook. Besides, the gold prices edged up by 0.04% to $1736.90 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – CB Consumer Confidence (Aug) | 95.7 | 97.9 | – |

| 22:00 | USD – JOLTs Job Openings (Jul) | 10.698M | 10.475M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 108.50. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

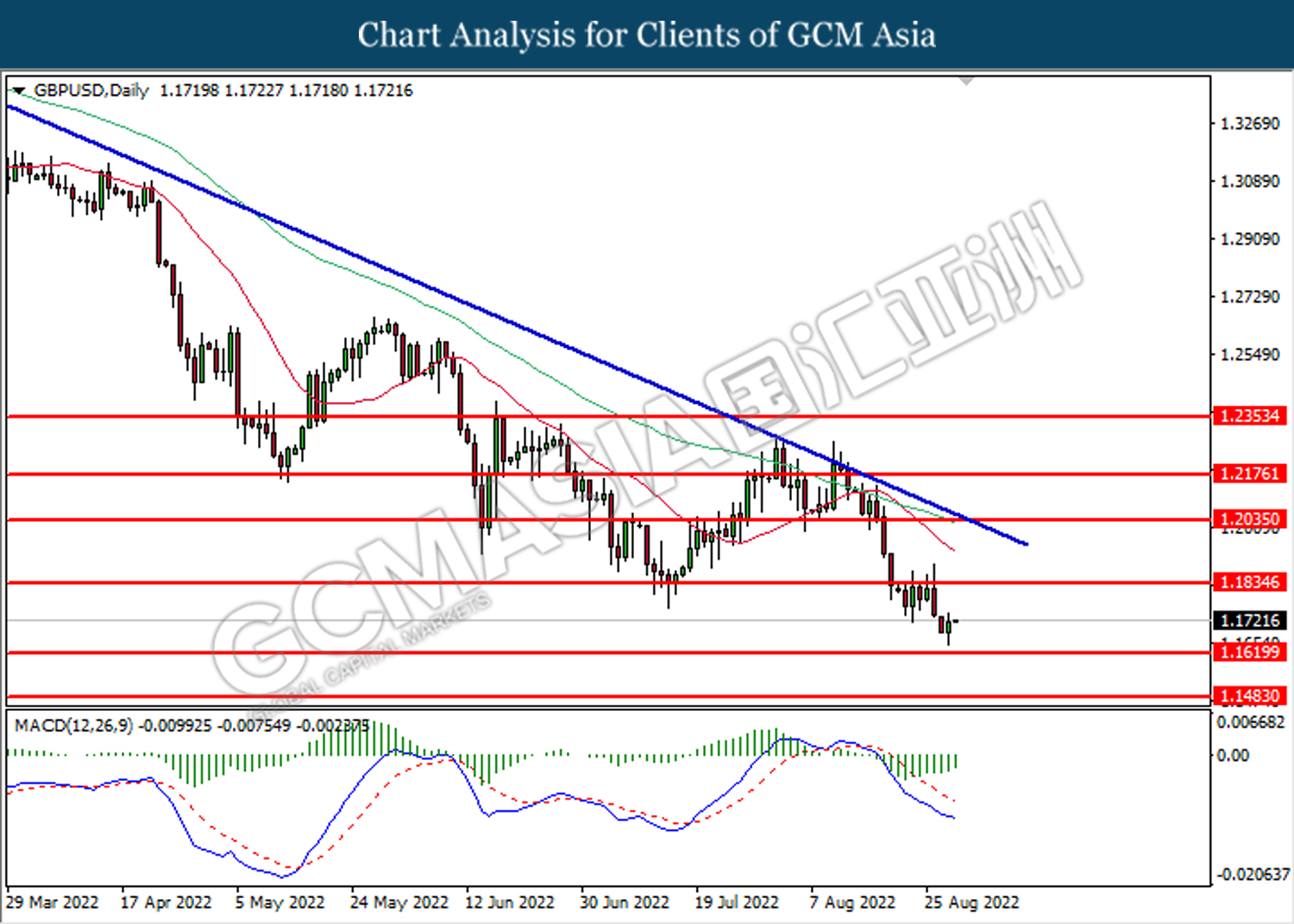

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1835. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the next support level.

Resistance level: 1.1835, 1.2035

Support level: 1.1620, 1.1485

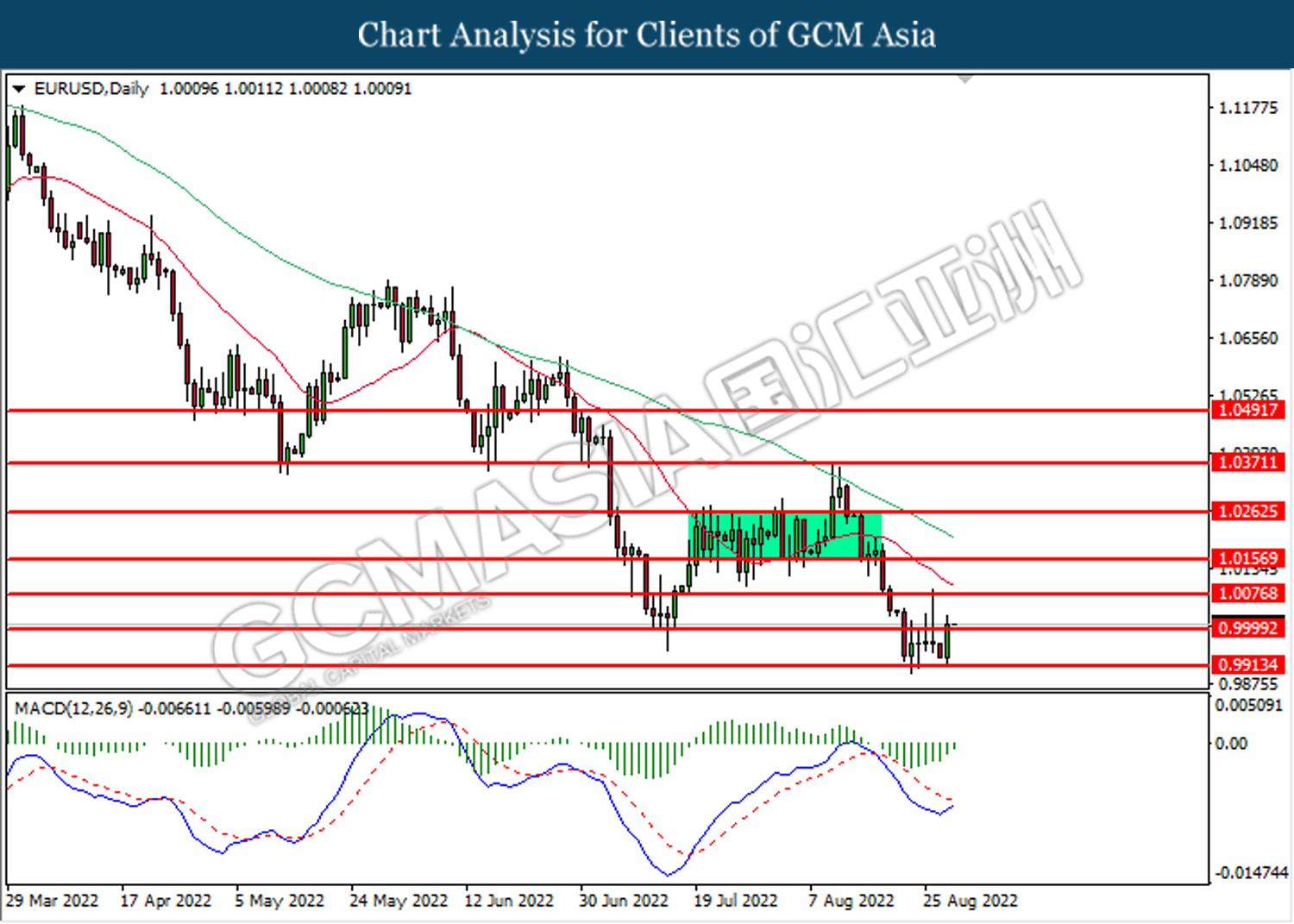

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0000. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9815

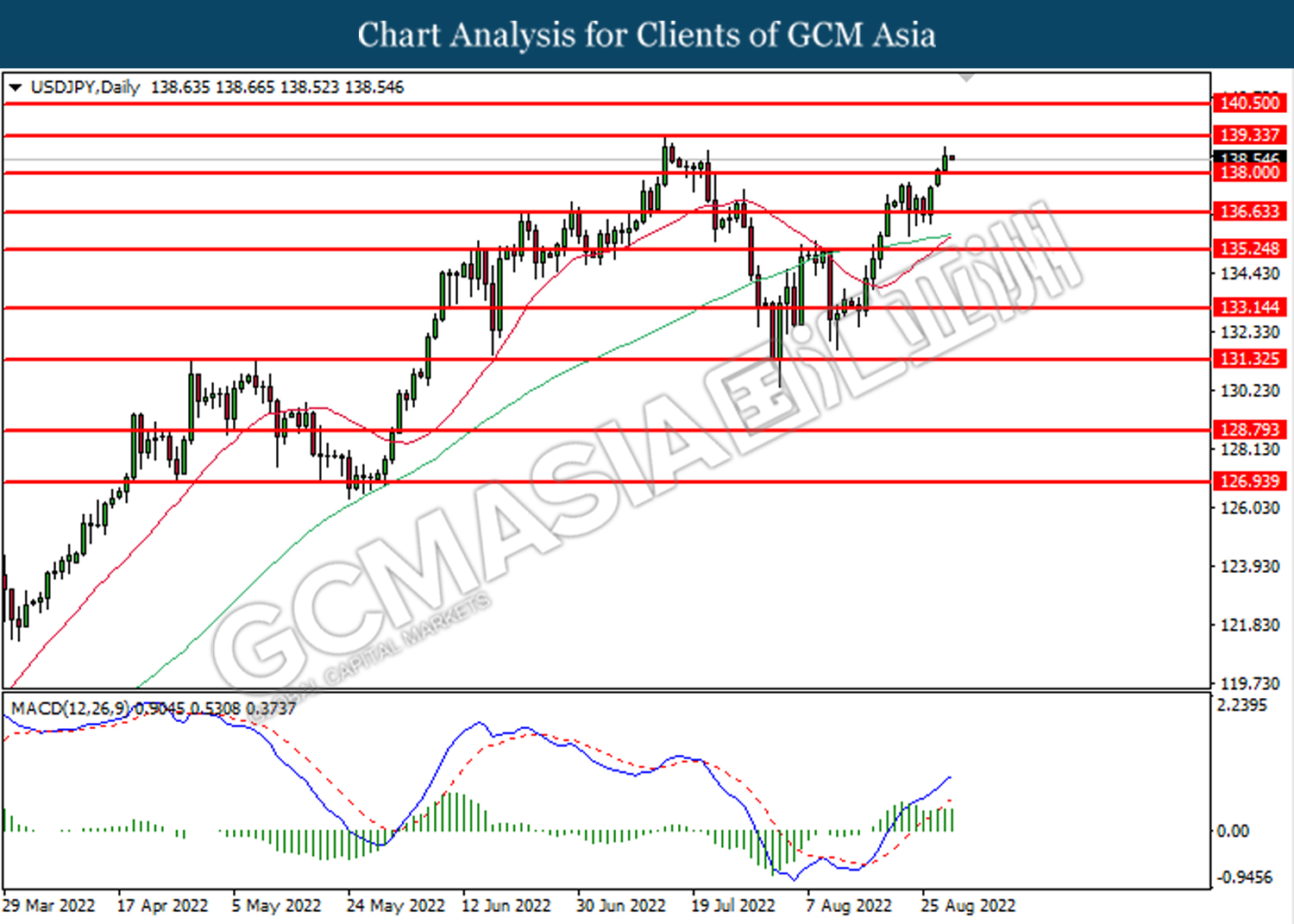

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 138.00. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 139.35.

Resistance level: 139.35, 140.50

Support level: 138.00, 136.65

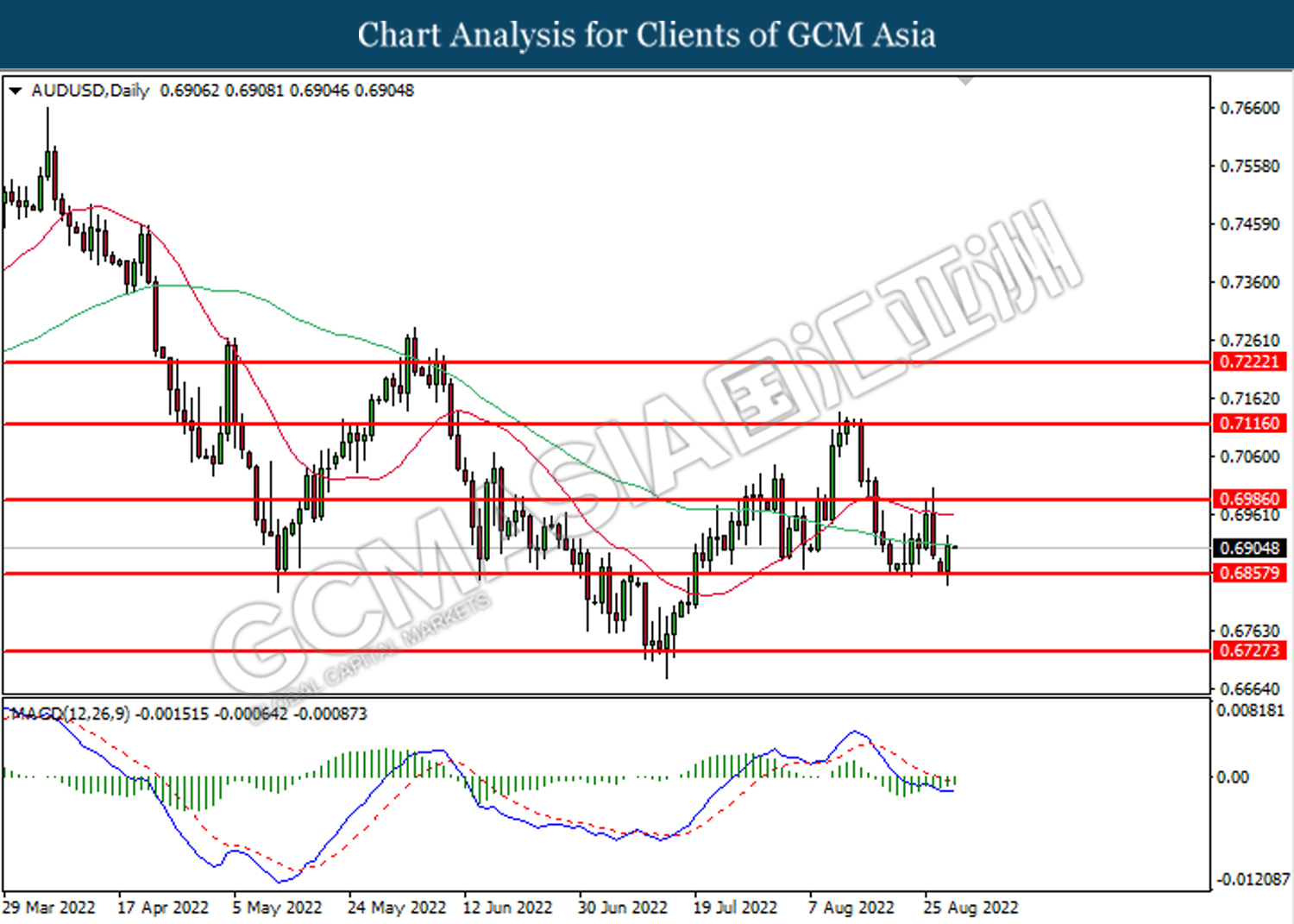

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish momentum suggest the pair to extend its to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7115

Support level: 0.6860, 0.6725

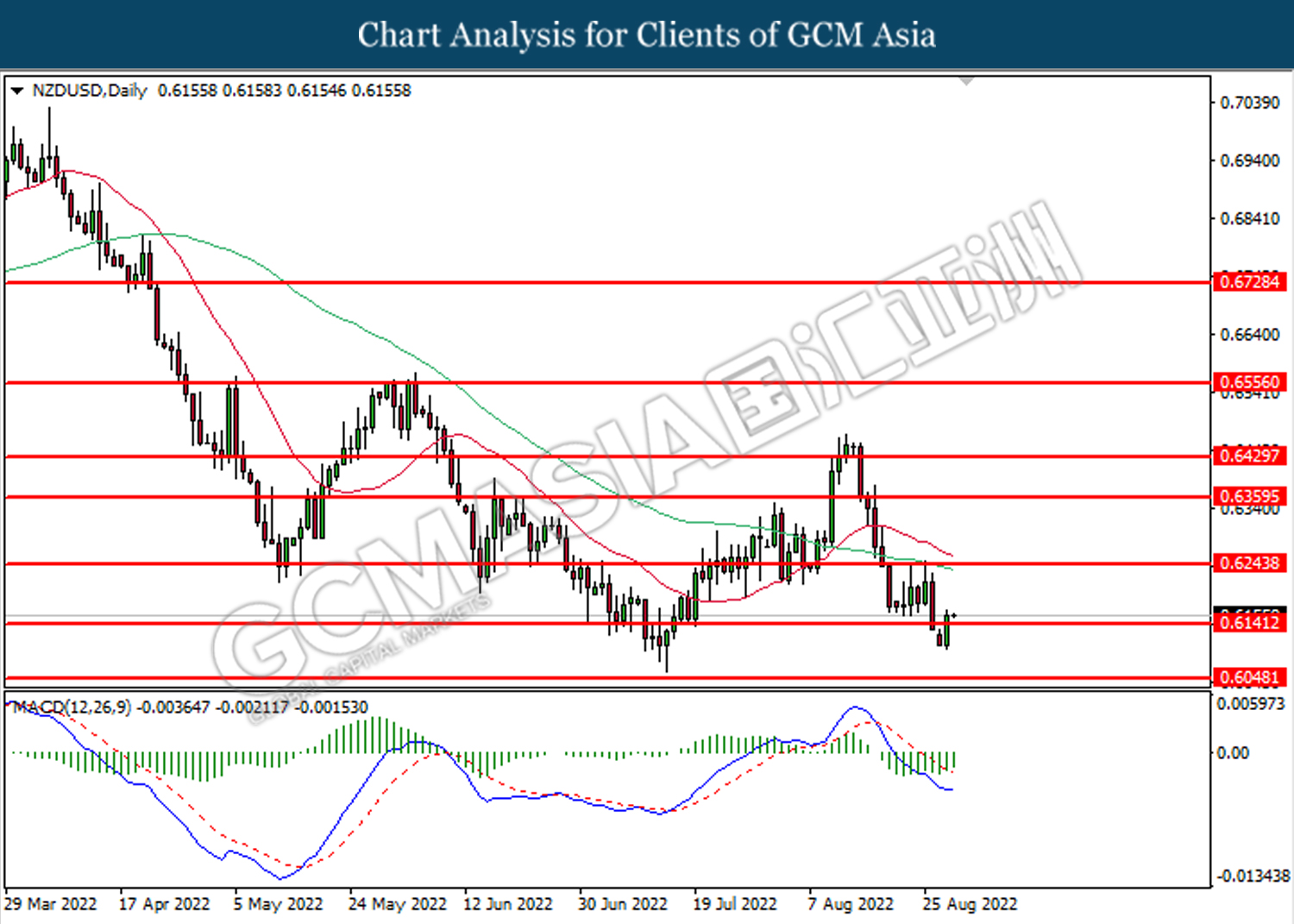

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6140. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6245.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

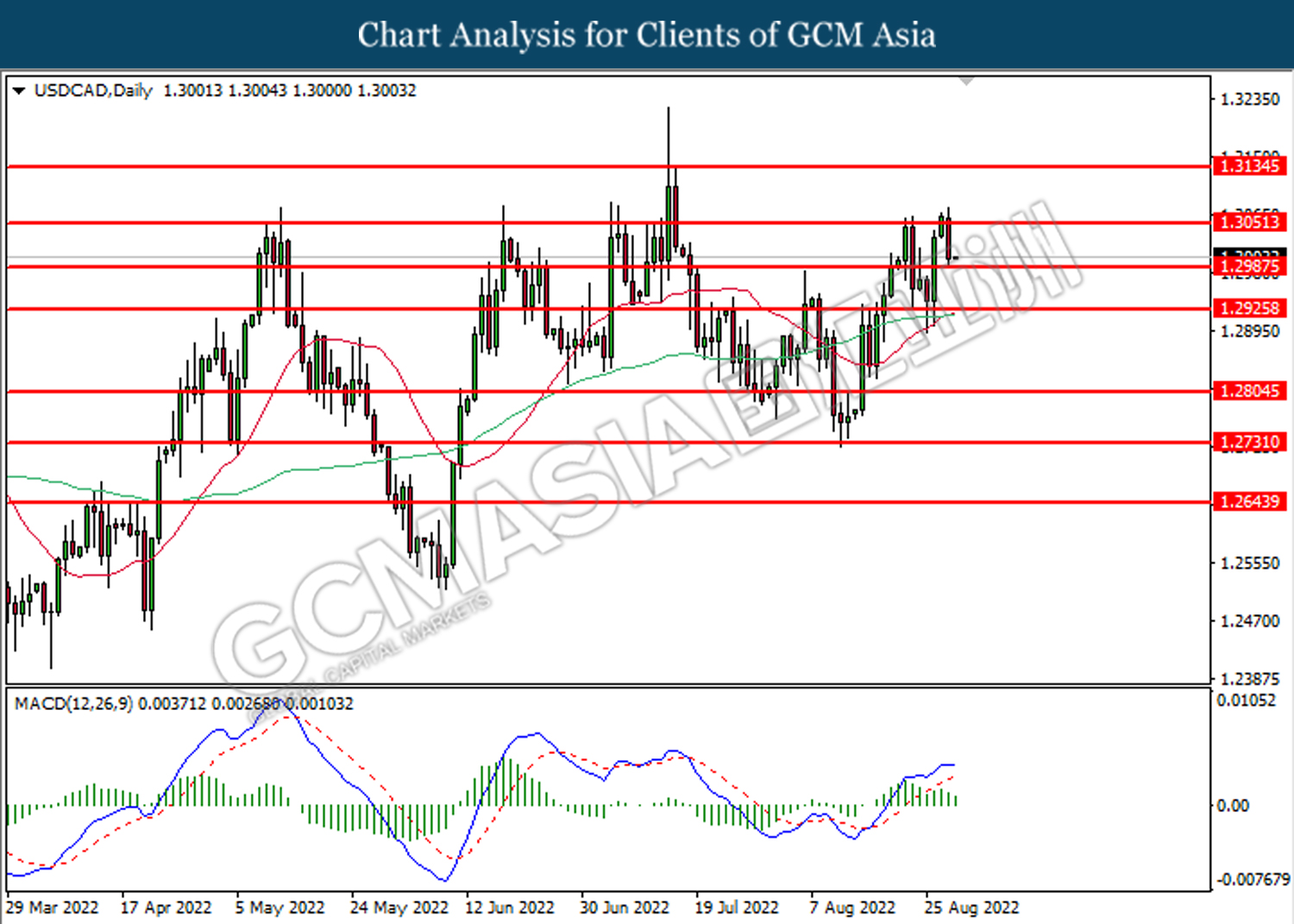

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2985. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3050, 1.3135

Support level: 1.2985, 1.2925

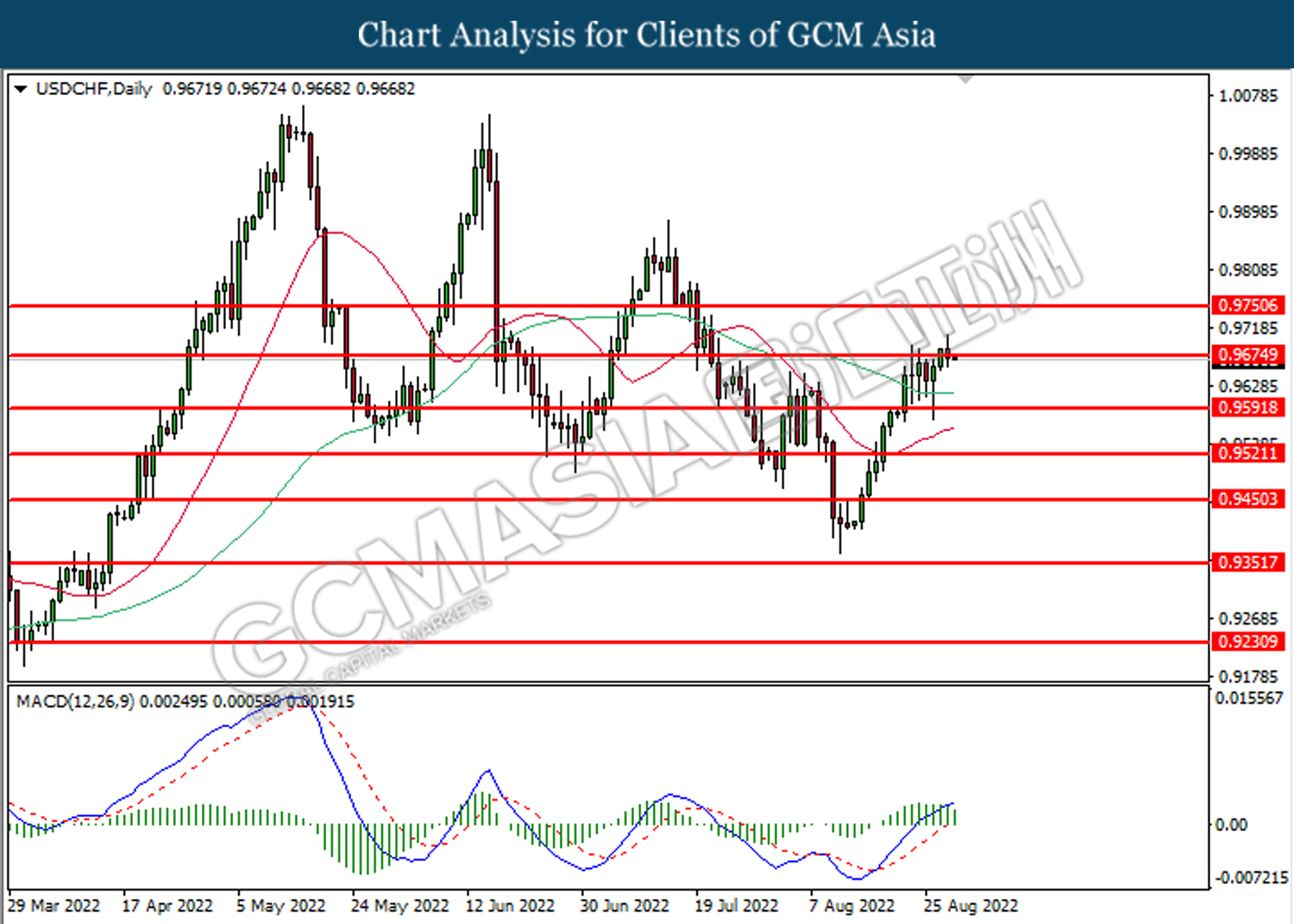

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9675, 0.9750

Support level: 0.9590, 0.9520

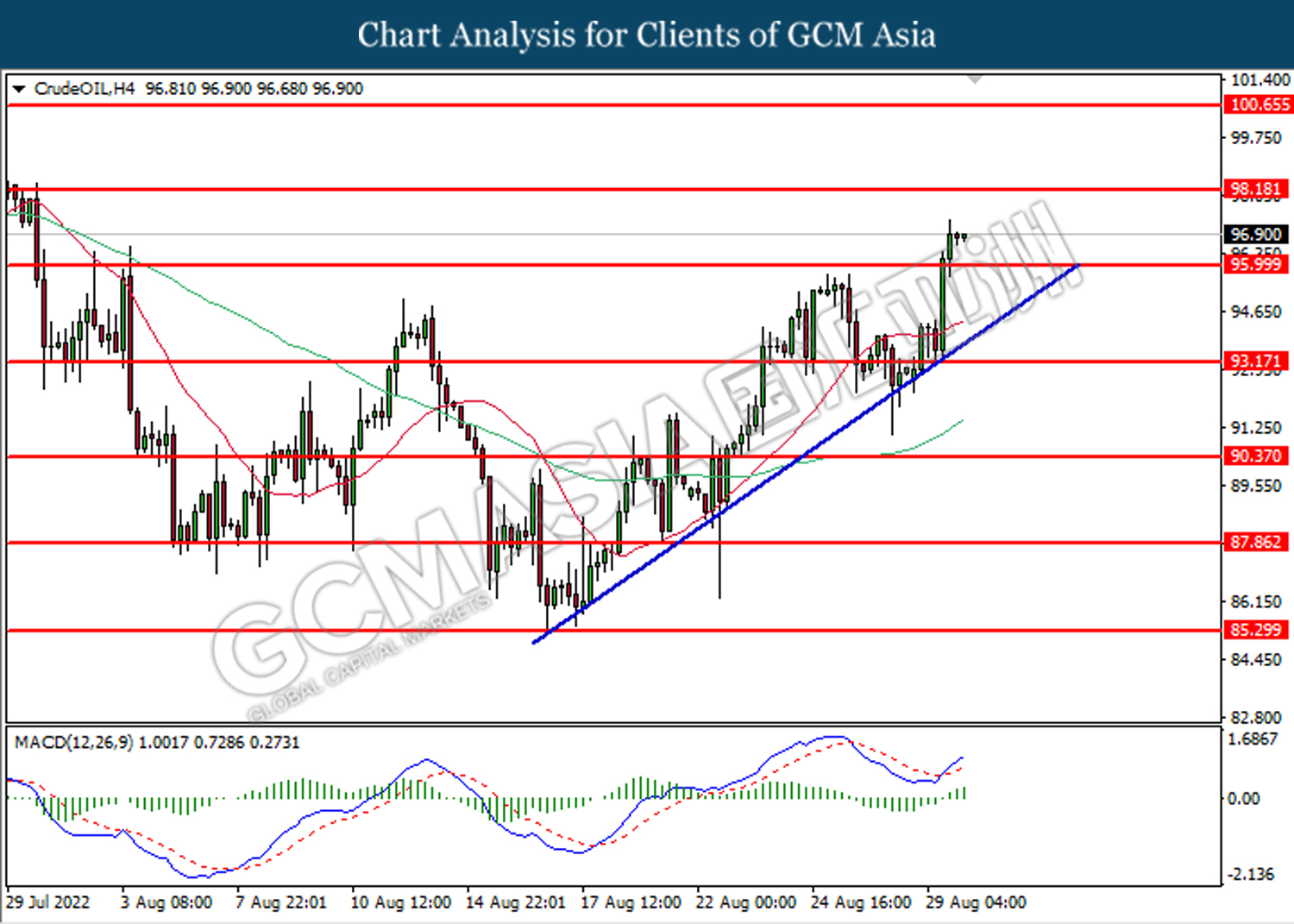

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 96.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 98.20.

Resistance level: 98.20, 100.65

Support level: 96.00, 93.15

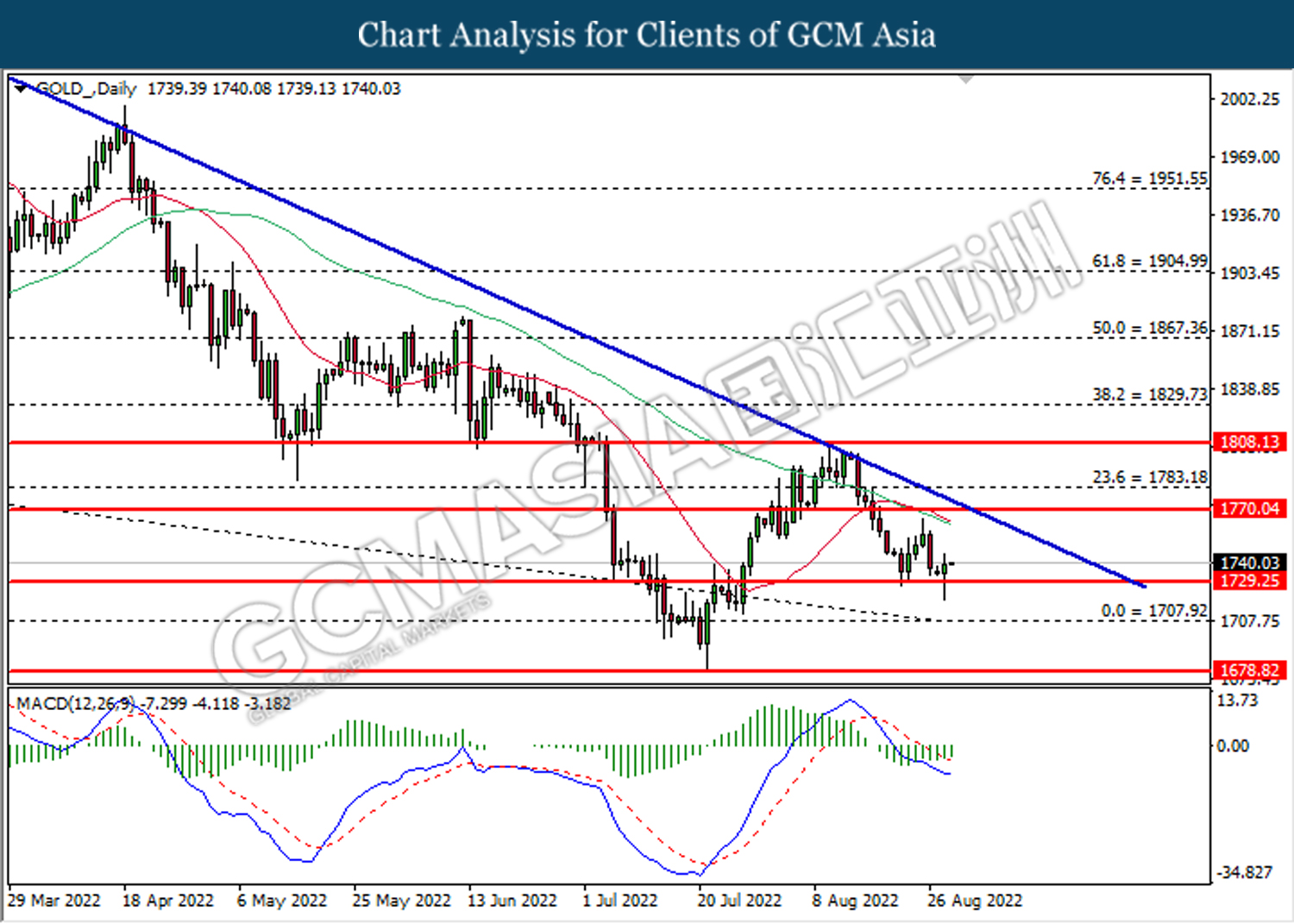

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1729.25. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90