30 October 2017 Weekly Analysis

GCMAsia Weekly Report: October 30 – November 3

Market Review (Forex): October 23 – 27

U.S. Dollar

Greenback pared some gains against other major peers on Friday after touching three months high over the backdrop of better-than-expected economic report for the third quarter. The index which measured greenback’s strength against a basket of six major currencies rose only 0.18% while closing the week at 94.72. For the week, US dollar has recorded its largest weekly gains with 1.33%.

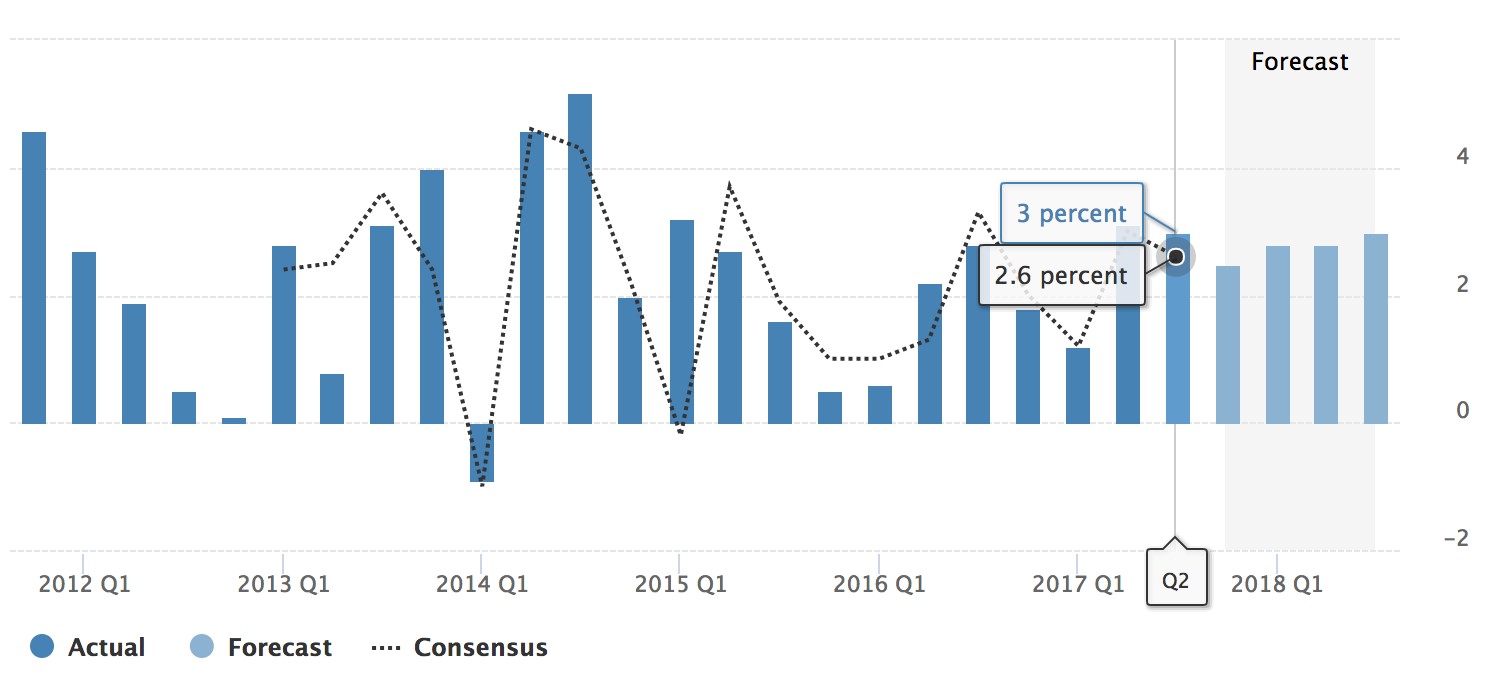

Referring to the report released by the US Commerce Department, Gross Domestic Product (GDP) grew at an annual rate of 3% in the third quarter, beating economist consensus for only 2.6%. The strong-than-expected data has further cemented the course for the Fed to raise their interest rate at a faster pace due to onset higher inflationary pressure and robust labor market.

However, the greenback was unable to sustain its bullish momentum following a report on US President Donald Trump whom favors to nominate Federal Reserve Governor Jerome Powell as the next Fed Chair. His move was seen to be bearish as Powell is deemed less hawkish than Stanford University economist John Taylor over respective views on the current economic prospect and sentiment.

US Gross Domestic Product

US Gross Domestic Product for third quarter grew at a faster pace with 3.0% vs 2.6%.

USD/JPY

Pair of USD/JPY was down by 0.25% to 113.62, off from prior three-months high at 114.43.

EUR/USD

Euro edged lower against the US dollar, down 1.48% for the week while closing in at $1.1608 following Catalonia’s parliament announcement for independence from Madrid, raising overall political risk in the economic bloc.

GBP/USD

Pound sterling was down by 0.21% to $1.3133, pressured by the prospect of a dovish rate hike which will not be followed by subsequent rate rise in for the time being.

Market Review (Commodities): October 23 – 27

GOLD

Gold price pared some losses on Friday following higher political risk in the EU zone due to ongoing geopolitical escalation arising from Spain. Its prices settled up 0.51% to $1,276.06 albeit recording a weekly loss of 0.68%. Catalonia parliament on Friday declared their independence from Madrid, adding more fears over instability in the EU.

The move has prompted Spain prime minister to sack the Catalan government and call for elections next month. The bullion is often used as safe haven asset in times of higher economic and political uncertainty while risk assets are generally being sold off.

Crude Oil

Crude oil price rallied on Friday, lifting the US benchmark WTI to its highest close in eight months while sending global crude benchmark above $60 a barrel for the first time in more than two years following higher expectation that major global producers will extend its production cut plan beyond its expiry date next year.

Its prices rose more than $1.26 or 2.4% while ended the week at $53.90 a barrel after touching its best level since March 1st at $54.20. For the week, its prices have recorded third consecutive weekly gains with up to $2.06 for last week.

Overall uncertainty which shrouds the oil market ahead of OPEC’s next policy meeting was lifted after Saudi Arabia and Russia declared their support to extend a global deal to cut oil supplies for another nine months, as announced by OPEC’s secretary general last Friday.

Under the original terms, OPEC and 10 other non-OPEC members led by Russia has agreed to cut daily production up to 1.8 million barrels for six months, while it has also been extended to March 2018 next year in a bid to further stabilized global oil prices.

Weekly Outlook: October 30 – November 3

For the week ahead, investors will be focusing on Wednesday’s Fed meeting for further clues regarding next rate hike and their prospect for future monetary policy path. Likewise, Friday’s US jobs report for October will be widely anticipated in order to gauge the timing of next rate hike which is highly speculated to be done by year end.

In the Europe region, investors will be looking forward for Bank of England’s policy meeting as well as EU zone growth and inflation data due this Tuesday.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: October 30 – November 3

| Monday, October 30 |

Data JPY – Retail Sales (YoY) (Sep) EUR – German Retail Sales (MoM) (Sep) GBP – Net Lending to Individuals USD – Core PCE Price Index (MoM) (Sep) USD – Personal Income (MoM) (Sep) USD – Personal Spending (MoM) (Sep)

Events N/A

|

| Tuesday, October 31 |

Data NZD – ANZ Business Confidence (Oct) CNY – Manufacturing PMI (Oct) JPY – BoJ Interest Rate Decision EUR – CPI (YoY) (Oct) EUR – GDP (QoQ) (Q3) EUR – Unemployment Rate (Sep) USD – Employment Cost Index (QoQ) (Q3) CAD – GDP (MoM) (Sep) USD – CB Consumer Confidence (Oct)

Events JPY – BoJ Monetary Policy Statement JPY – BoJ Outlook Report (YoY) JPY – BoJ Press Conference CAD – BoC Gov Poloz Speaks

|

| Wednesday, November 1 |

Data CrudeOIL – API Weekly Crude Oil Stock NZD – Employment Change (QoQ) (Q3) CNY – Caixin Manufacturing PMI (Oct) GBP – Manufacturing PMI (Oct) USD – ADP Nonfarm Employment Change (Oct) USD – ISM Manufacturing Employment (Oct) USD – ISM Manufacturing PMI (Oct) CrudeOIL – Crude Oil Inventories USD – Fed Interest Rate Decision

Events USD – FOMC Statement CAD – BoC Gov Poloz Speaks

|

| Thursday, November 2 |

Data AUD – Building Approvals (MoM) (Sep) AUD – Trade Balance (Sep) EUR – German Manufacturing PMI (Oct) EUR – German Unemployment Change (Oct) GBP – Construction PMI (Oct) GBP – BoE Interest Rate Decision (Oct) USD – Initial Jobless Claims USD – Unit Labor Costs (QoQ) (Q3)

Events GBP – BoE Inflation Report GBP – BoE MPC Meeting Minutes GBP – BoE Gov Carney Speaks USD – FOMC Member Powell Speaks USD – FOMC Member Dudley Speaks USD – FOMC Member Bostic Speaks

|

|

Friday, November 3

|

Data AUD – Retail Sales (MoM) (Sep) CNY – Caixin Services PMI (Oct) GBP – Services PMI (Oct) USD – Average Hourly Earnings (MoM) (Oct) USD – Nonfarm Payrolls (Oct) USD – Unemployment Rate (Oct) CAD – Employment Change (Oct) CAD – Unemployment Rate (Oct) USD – Factory Orders (MoM) (Sep) USD – ISM Non-Manufacturing Employment (Oct) USD – ISM Non-Manufacturing PMI (Oct) CrudeOIL – US Baker Hughes Oil Rig Count

Events USD – FOMC Member Kashkari Speaks |

Technical weekly outlook: October 30 – November 3

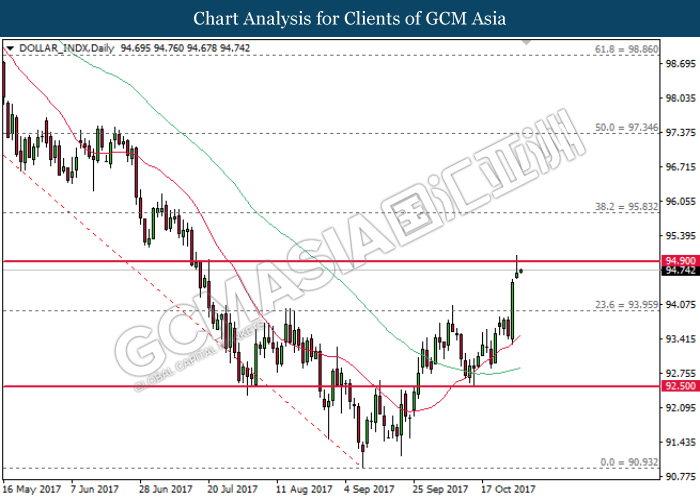

Dollar Index

DOLLAR_INDX, Daily: Dollar index extended its gains while currently testing at one of the minor resistance of 94.90. Both MA line which continues to expand upwards suggest ongoing upside bias, whereby the index is expected to extend its upward momentum after breaking the target of 94.90.

Resistance level: 94.90, 95.85

Support level: 93.95, 92.50

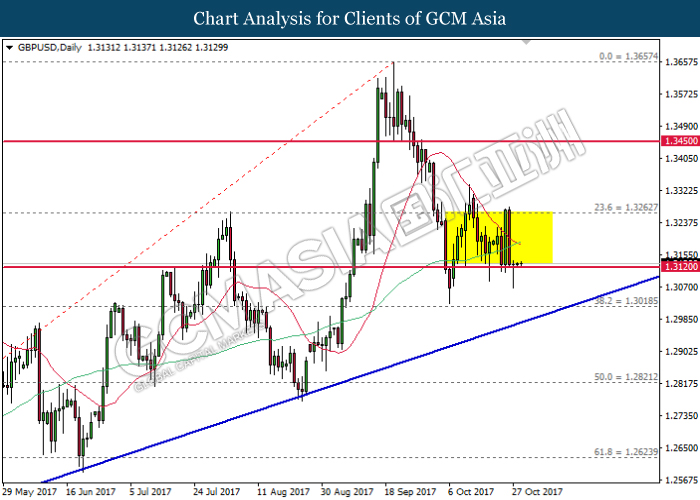

GBPUSD

GBPUSD, Daily: GBPUSD remains traded within a tight range while currently testing at the strong support level near 1.3120. Both MA line has recently formed a death cross, suggesting further downside bias for the pair. Thus, a successful closure below the target of 1.3120 would open further bearish bias thereafter.

Resistance level: 1.3260, 1.3450

Support level: 1.3120, 1.3020

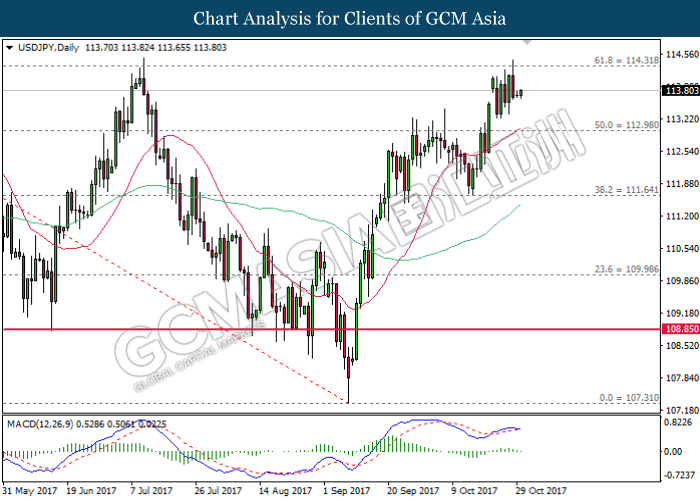

USDJPY

USDJPY, Daily: USDJPY was traded lower following prior retrace from the strong resistance level near 114.30. MACD histogram which begins to illustrate diminishing upward signal suggest USDJPY to experience technical correction and to be traded lower in short-term. First target will be near the 20-MA line (red) of 113.00.

Resistance level: 114.30, 115.15

Support level: 113.00, 111.65

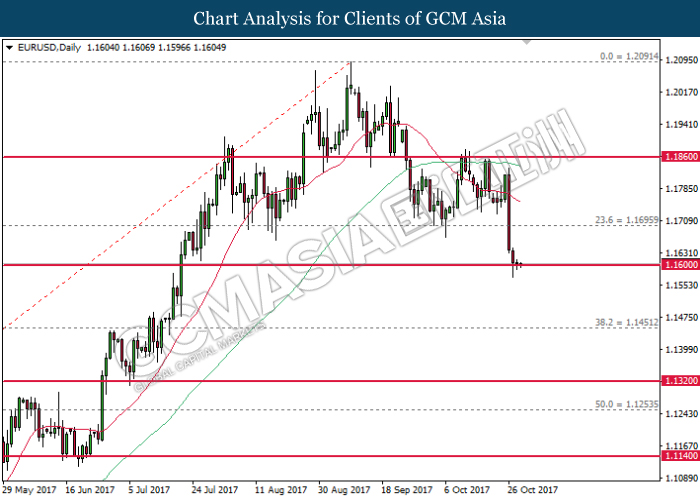

EURUSD

EURUSD, Daily: EURUSD extended its losses following prior breakout from the head and shoulders neckline at 1.1700. Both MA line which continues to expand downwards suggest the pair to move further down after closing below the psychological level of 1.1600.

Resistance level: 1.1700, 1.1860

Support level: 1.1600, 1.1450

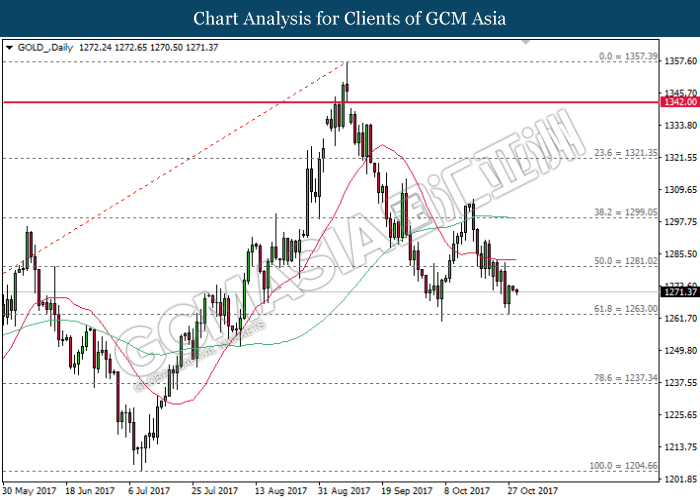

GOLD

GOLD_, Daily: Gold price was traded higher following prior rebound from the strong support level at 1263.00. The rebound has formed a double bottom formation while such price action suggests the commodity to be traded higher in short-term as technical correction with first target at 1281.00.

Resistance level: 1281.00, 1299.05

Support level: 1263.00, 1237.35

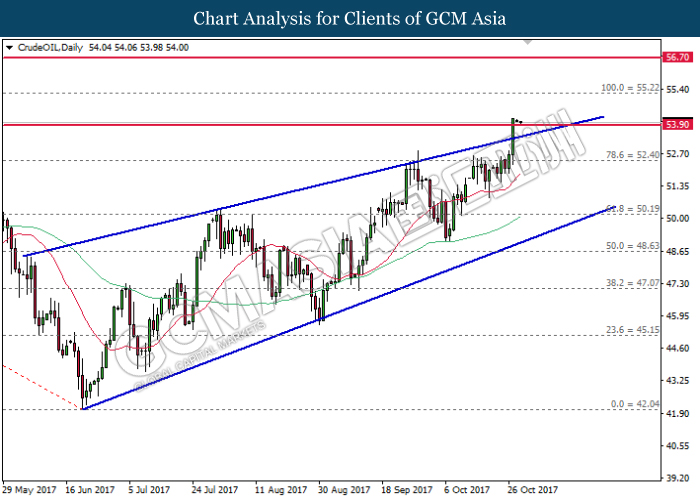

Crude Oil

CrudeOIL, Daily: Crude oil price extended its gains following prior breakout from the top level of rising wedge, signaling a change in trend direction to move further upwards. A successful rebound from the support level of 53.90 would suggest the commodity price to advance further up, towards the strong resistance level at 55.20.

Resistance level: 55.20, 56.70

Support level: 53.90, 52.40