30 December 2022 Afternoon Session Analysis

Euro rose, but remained under pressure over looming recession.

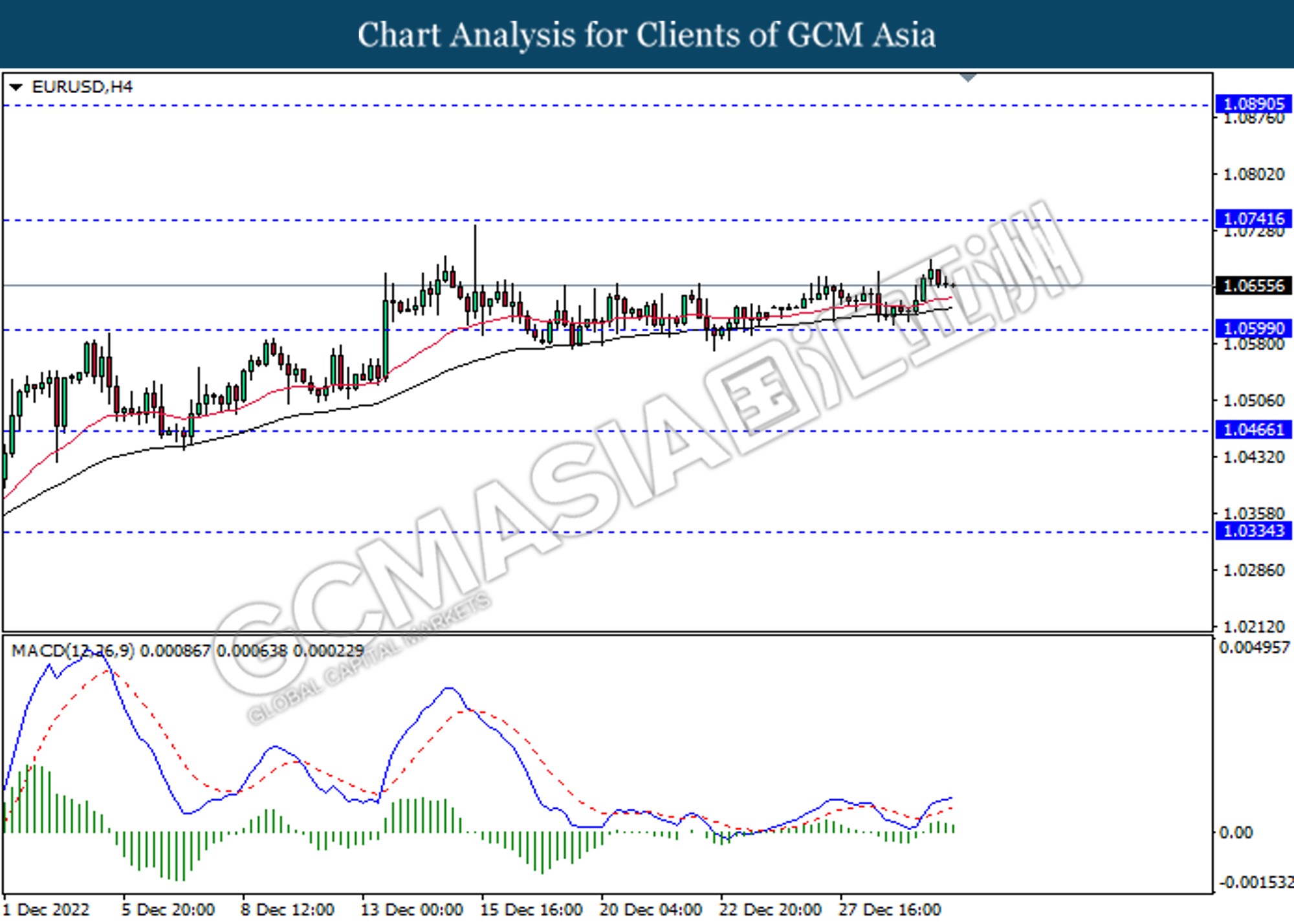

The EUR/USD, which well known by investors around the world rebounded on yesterday over the depreciation of US Dollar, which driven by the rising of US jobless claims. Though, the gains experienced by the Euro was limited amid the background of pessimistic economic outlook in Eurozone. According to Reuters, German exports was anticipated to face challenges in 2023 following the rising Covid-19 infections in China. In fact, China was the major trading partner for Germany, and the deteriorating pandemic would likely to bring negative prospects toward economic progression in China. With that, German economy might be implicated in it. Besides that, the lending rate in Eurozone companies slowed in November, as the rising interest rate by ECB has sparked a possible recession. Nonetheless, it is noteworthy that the ECB has reiterated that the pace of rate hike might be carried forward in order to tame inflation. As of writing, the EUR/USD edged up by 1.0661.

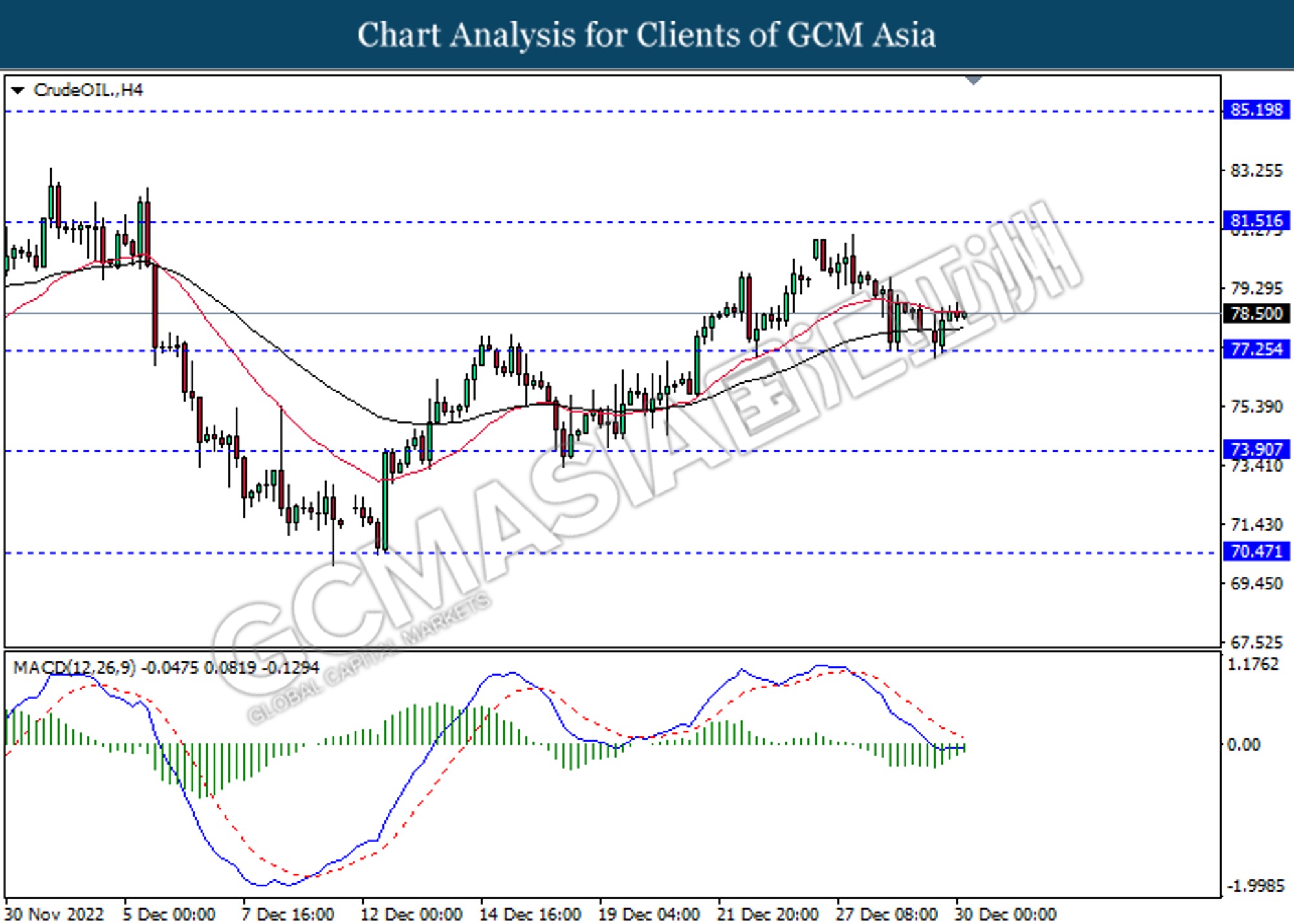

In the commodities market, the crude oil price dropped by 0.05% to $78.36 per barrel as of writing following the increasing of oil inventories. According to EIA, the US Crude Oil Inventories of the week added by 0.718M barrels, which exceeding the market forecast. On the other hand, the gold price depreciated by 0.09% to $1817.27 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

Early close GBP New Year’s Day

Early close NZD New Year’s Day

Early close AUD New Year’s Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

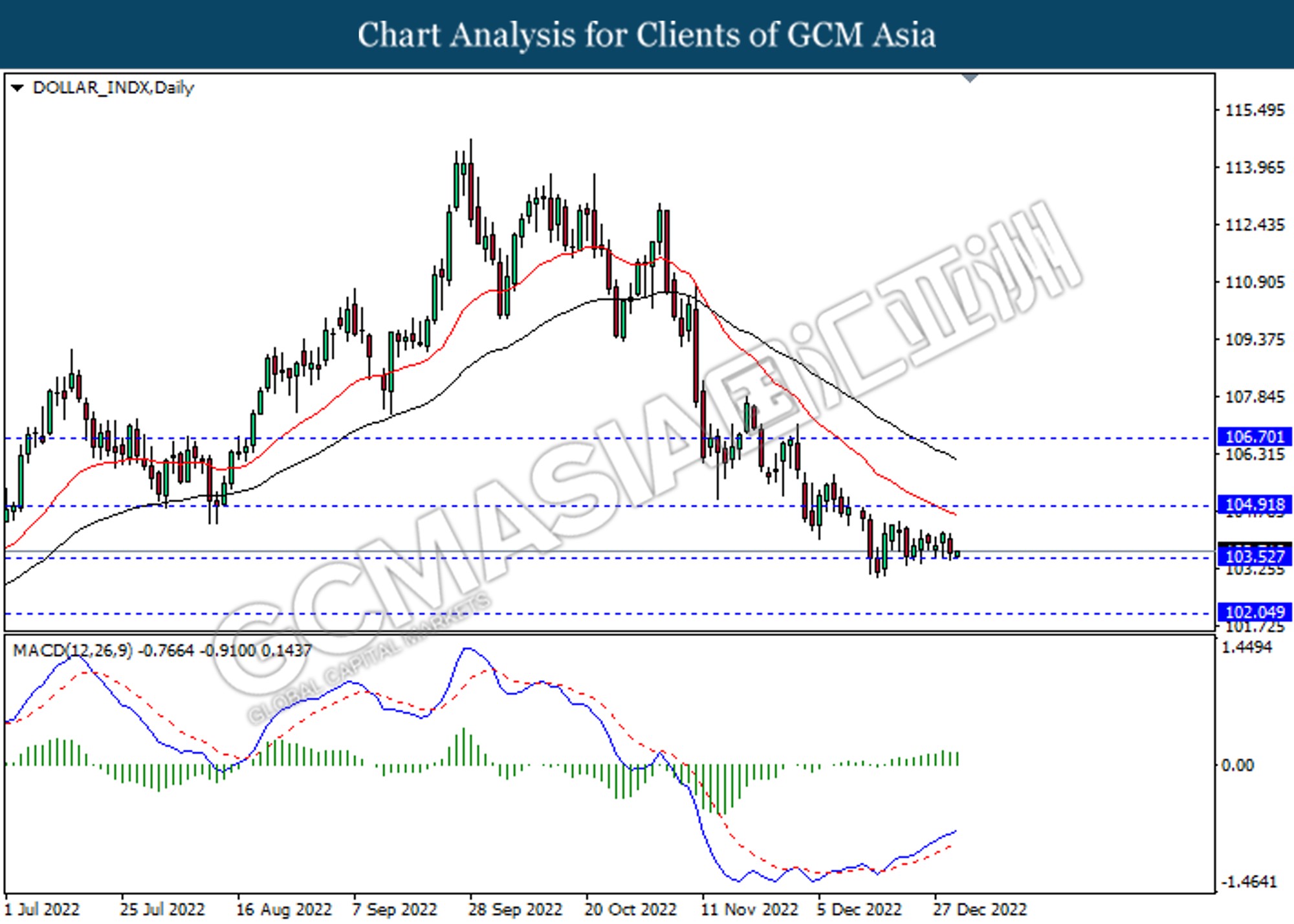

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

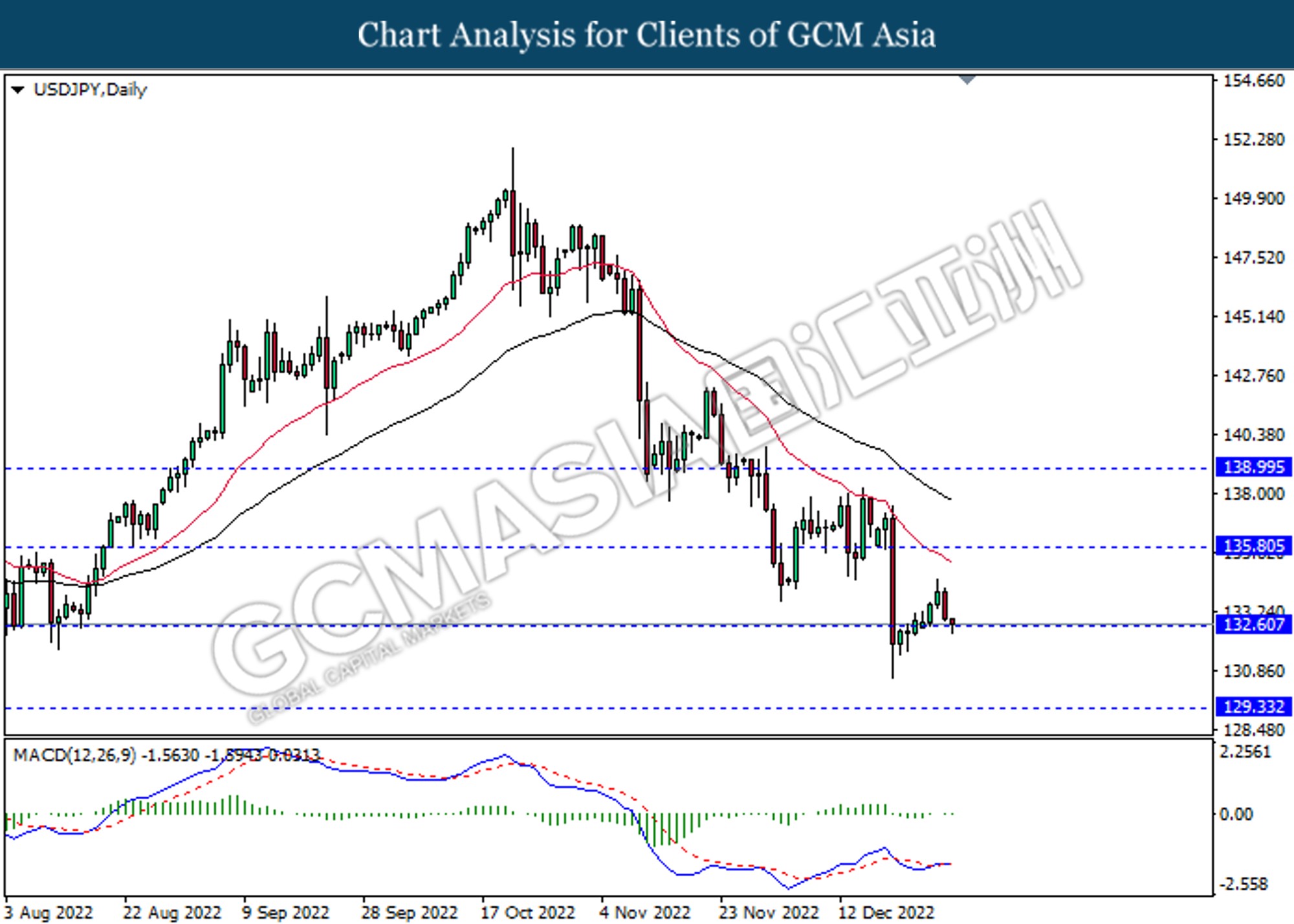

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 135.80, 139.00

Support level: 132.60, 129.35

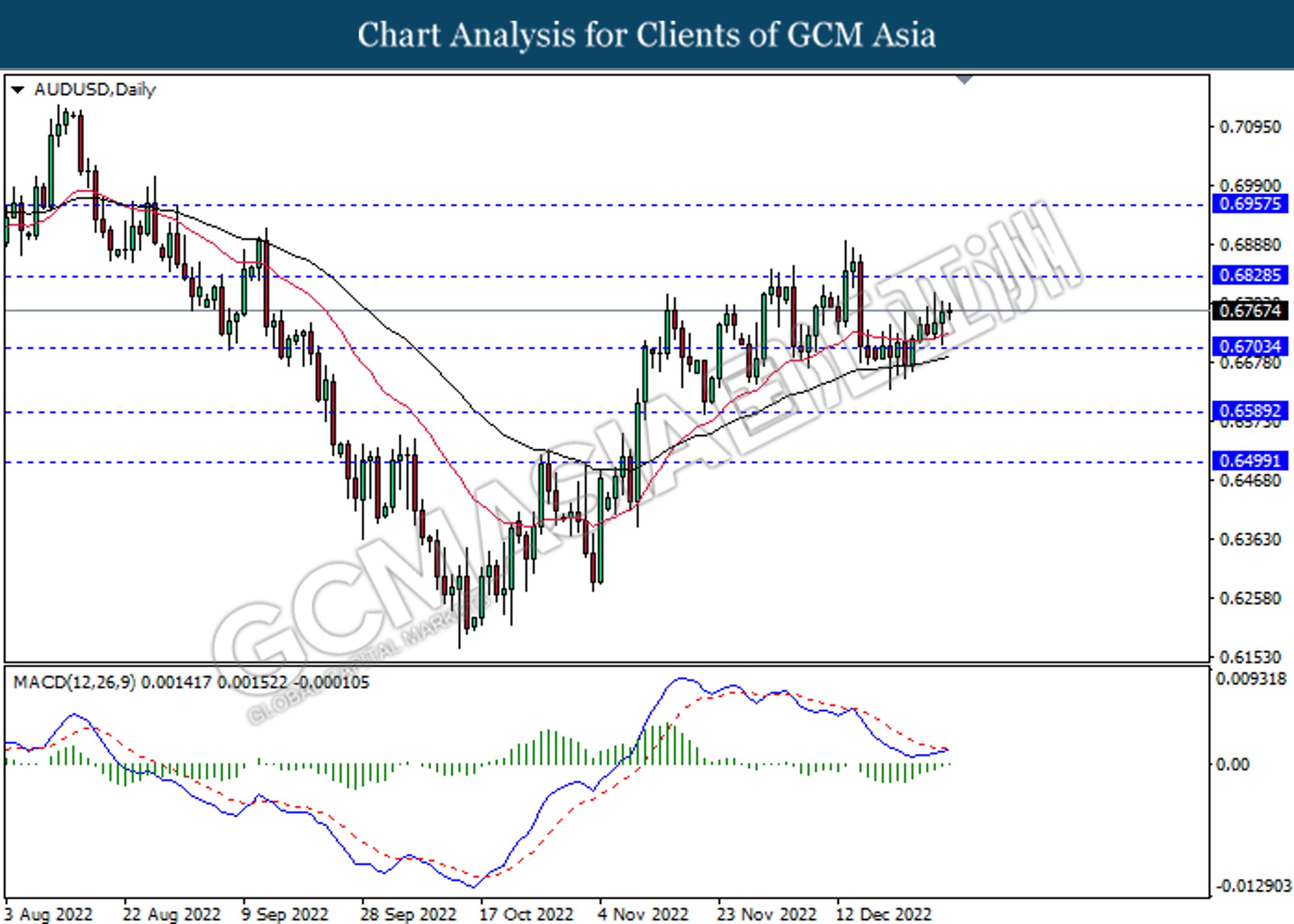

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

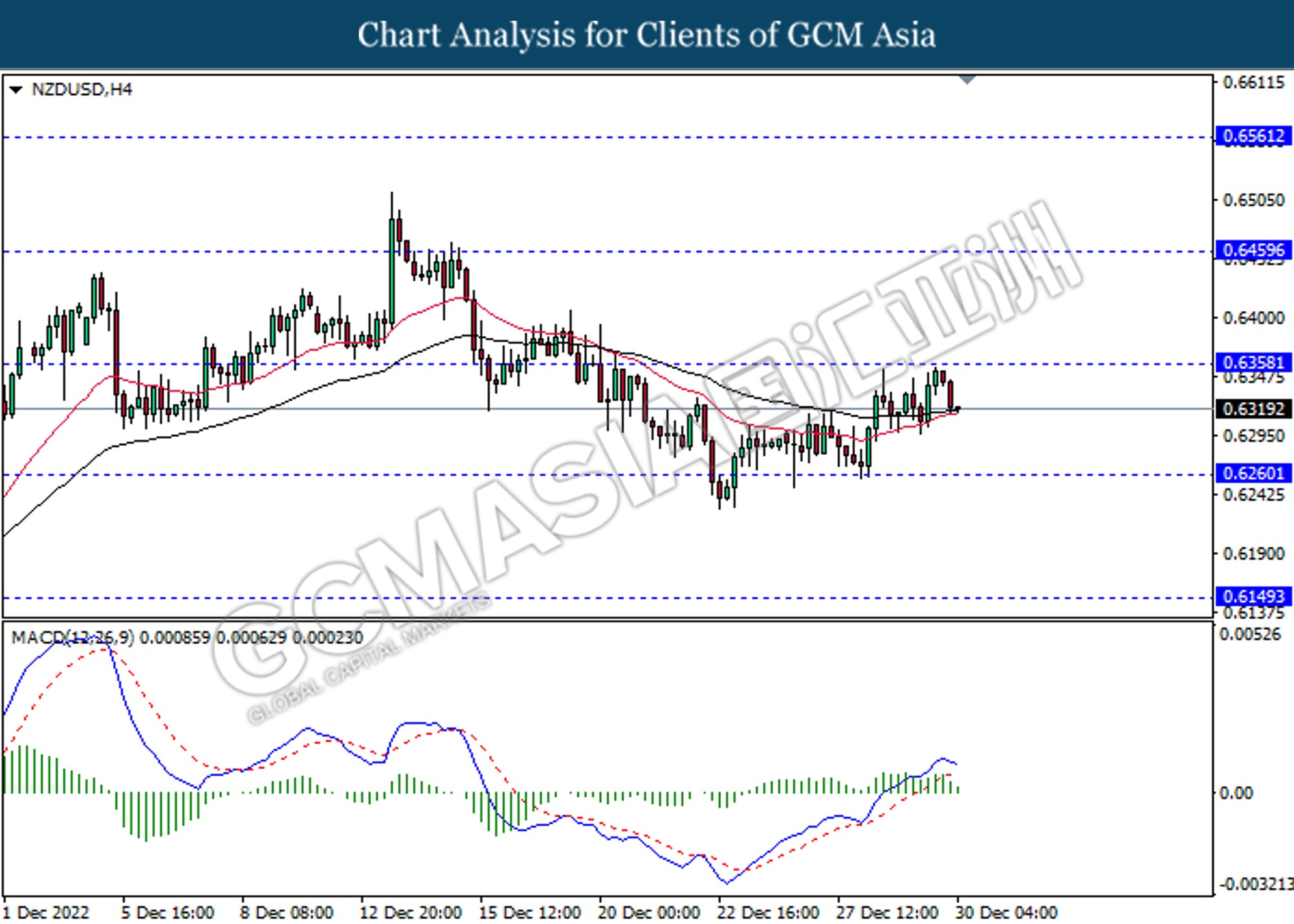

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

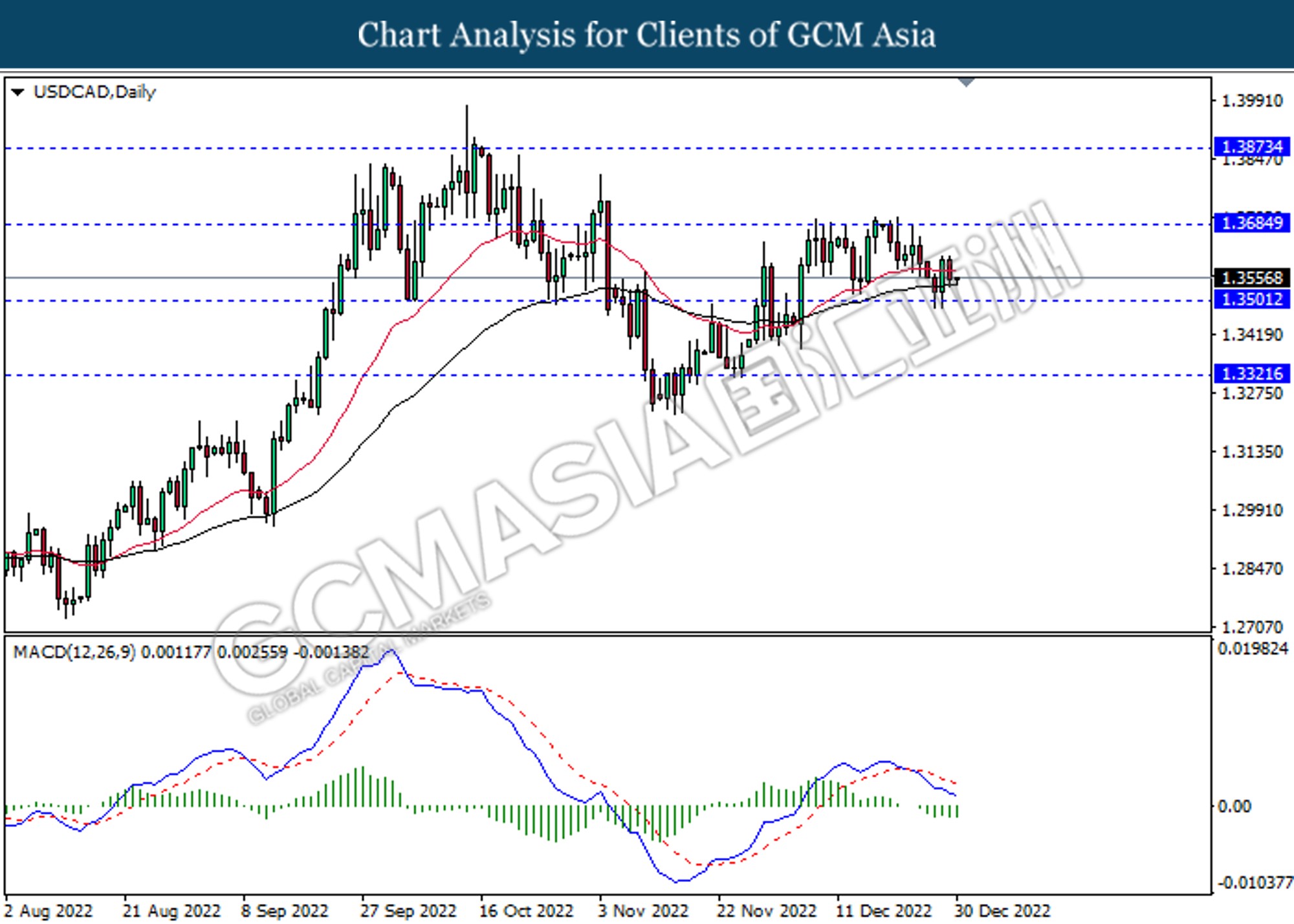

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

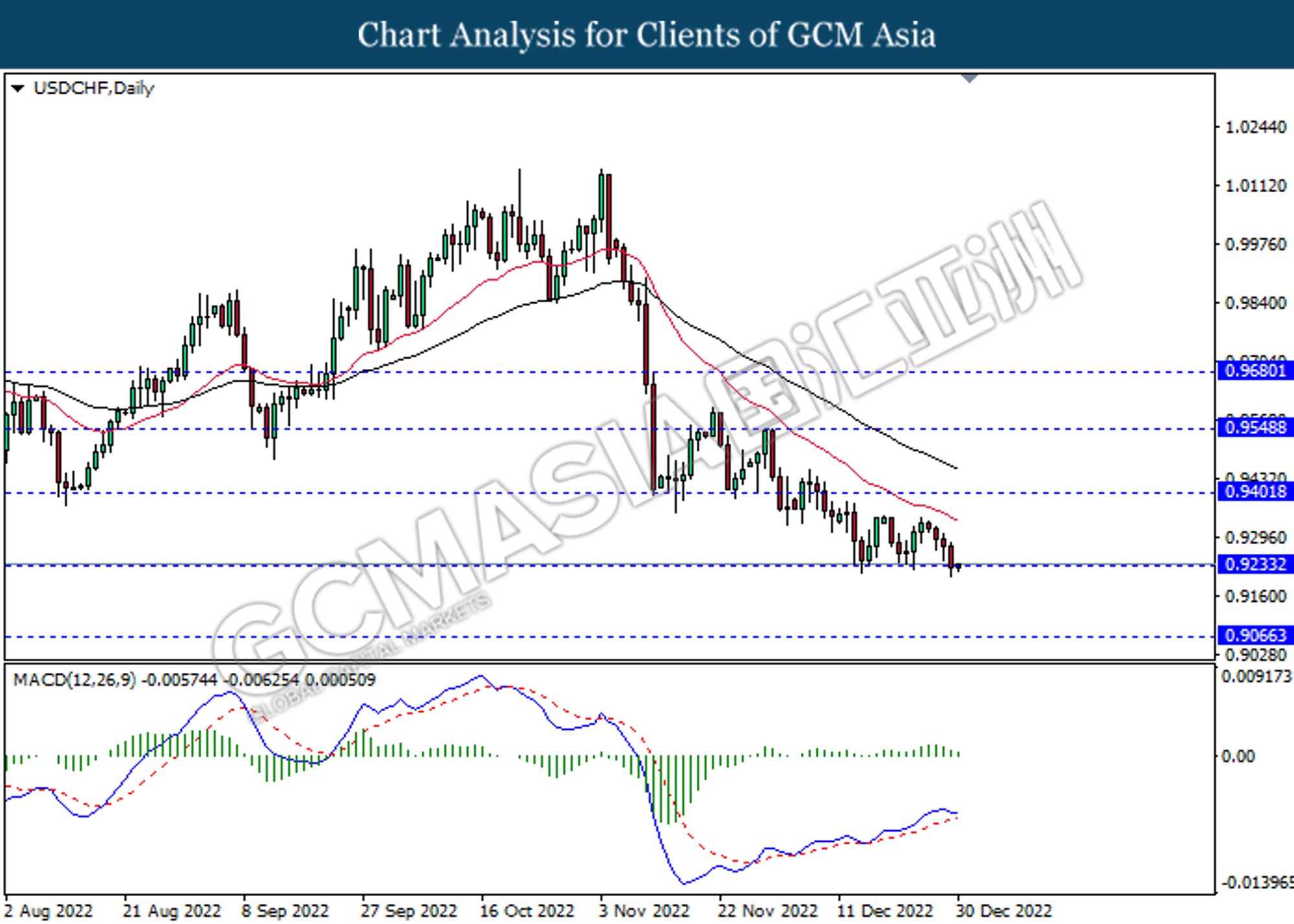

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

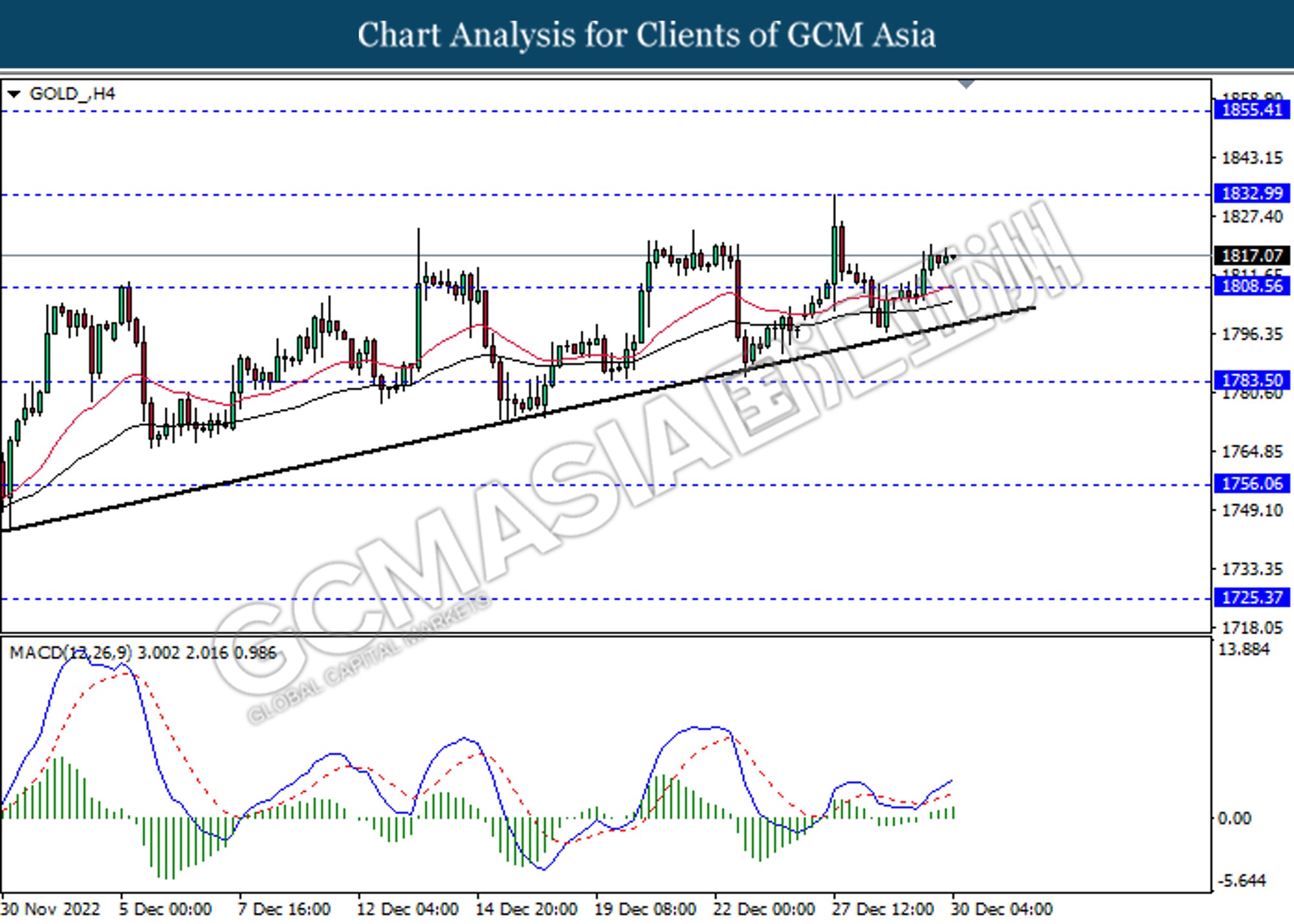

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1833.00, 1855.40

Support level: 1808.55, 1783.50