30 December 2022 Morning Session Analysis

Dollar slid amid China reopening plan and upbeat US job data.

The index, which used to measure US dollar strength or weakness compared to a basket of six major currencies, edged down during the previous trading session as the optimism of the China reopening plan diminished the market demand against the safe haven currency. Earlier this week, Beijing announced that they will reopen the border where the inbound travelers are not mandatory to quarantine starting from 8th January 2023. The step of loosening the curb of Covid-19 in China is expected to drive the growth of global economy, where investors finally could see the light at the end of the tunnel. Besides, a downbeat data from the United States has driven away the investors from the Greenback market. According to the Labor Department, the number of Americans who filed for jobless claims rose from the prior reading’s 216K to 225K this week. The rise in the Initial Jobless Claims data raised the market worries over the resiliency of the US labor market. As of writing, the dollar index dropped by -0.47% to 103.95.

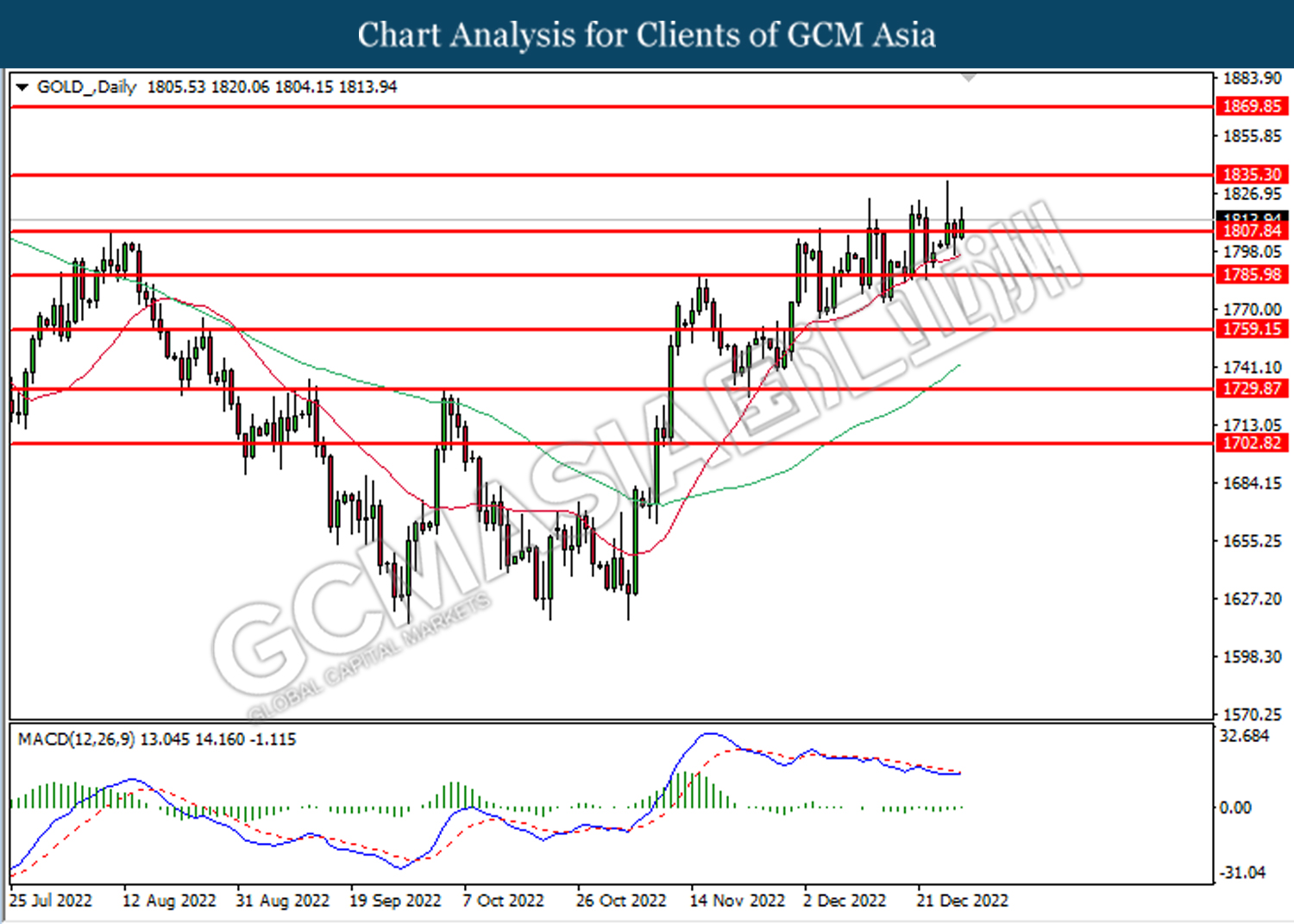

In the commodities market, crude oil prices fell by -0.15% to $78.80 per barrel as the spike in China Covid-19 cases dampened the demand outlook. Besides, gold prices appreciated by 0.59% to $1814.95 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

Early close GBP New Year’s Day

Early close NZD New Year’s Day

Early close AUD New Year’s Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

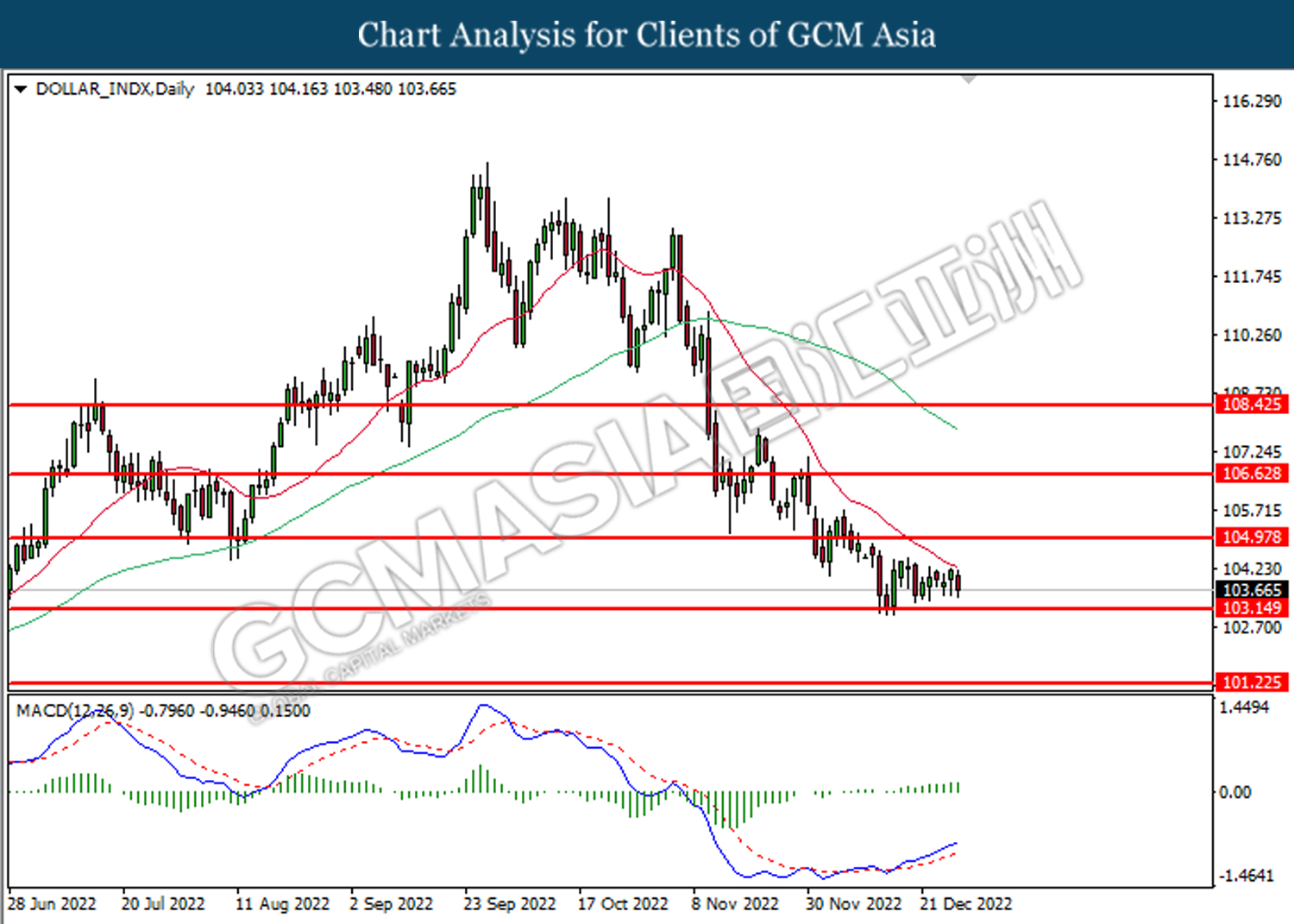

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound near the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

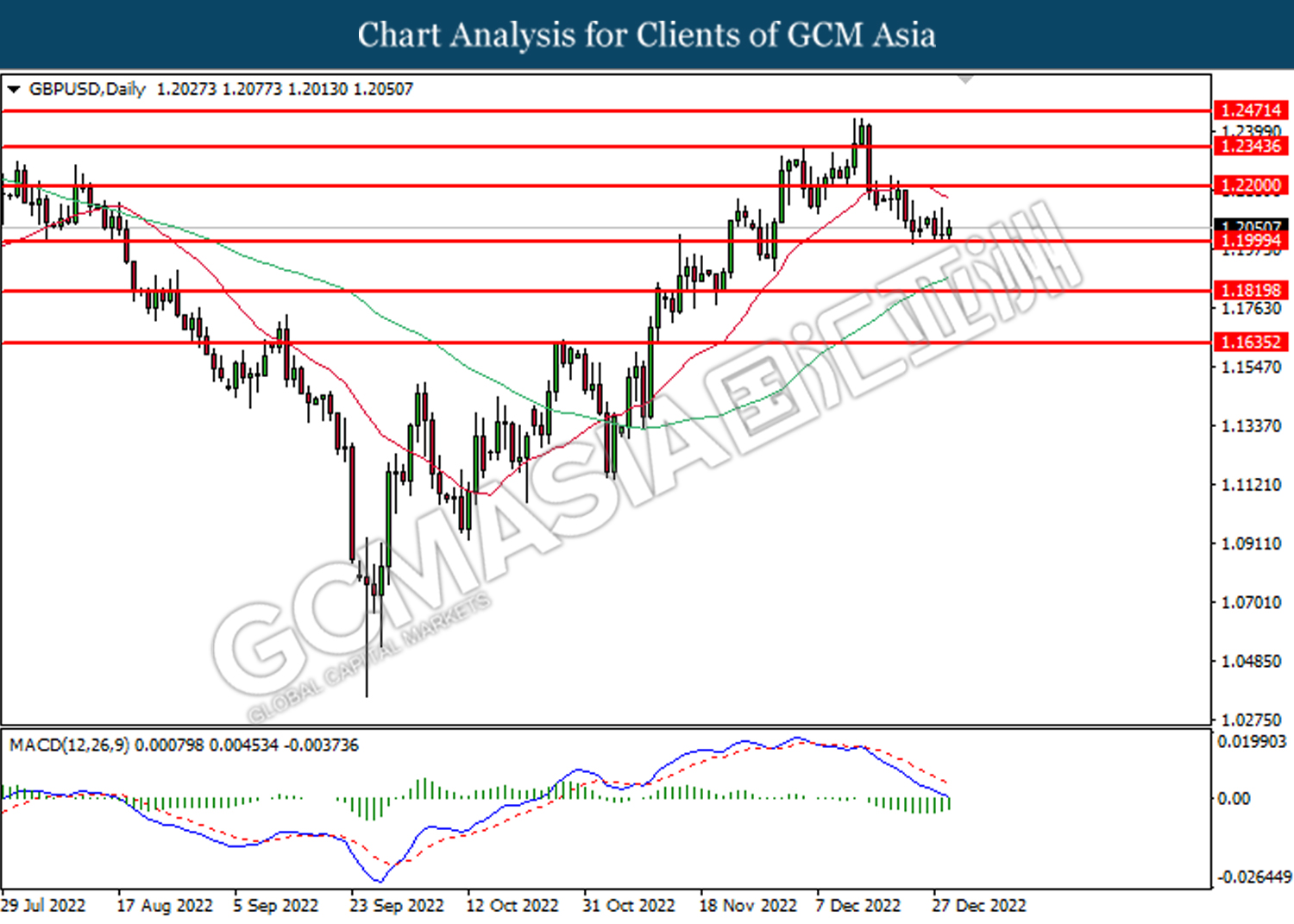

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the previous resistance level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2000.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

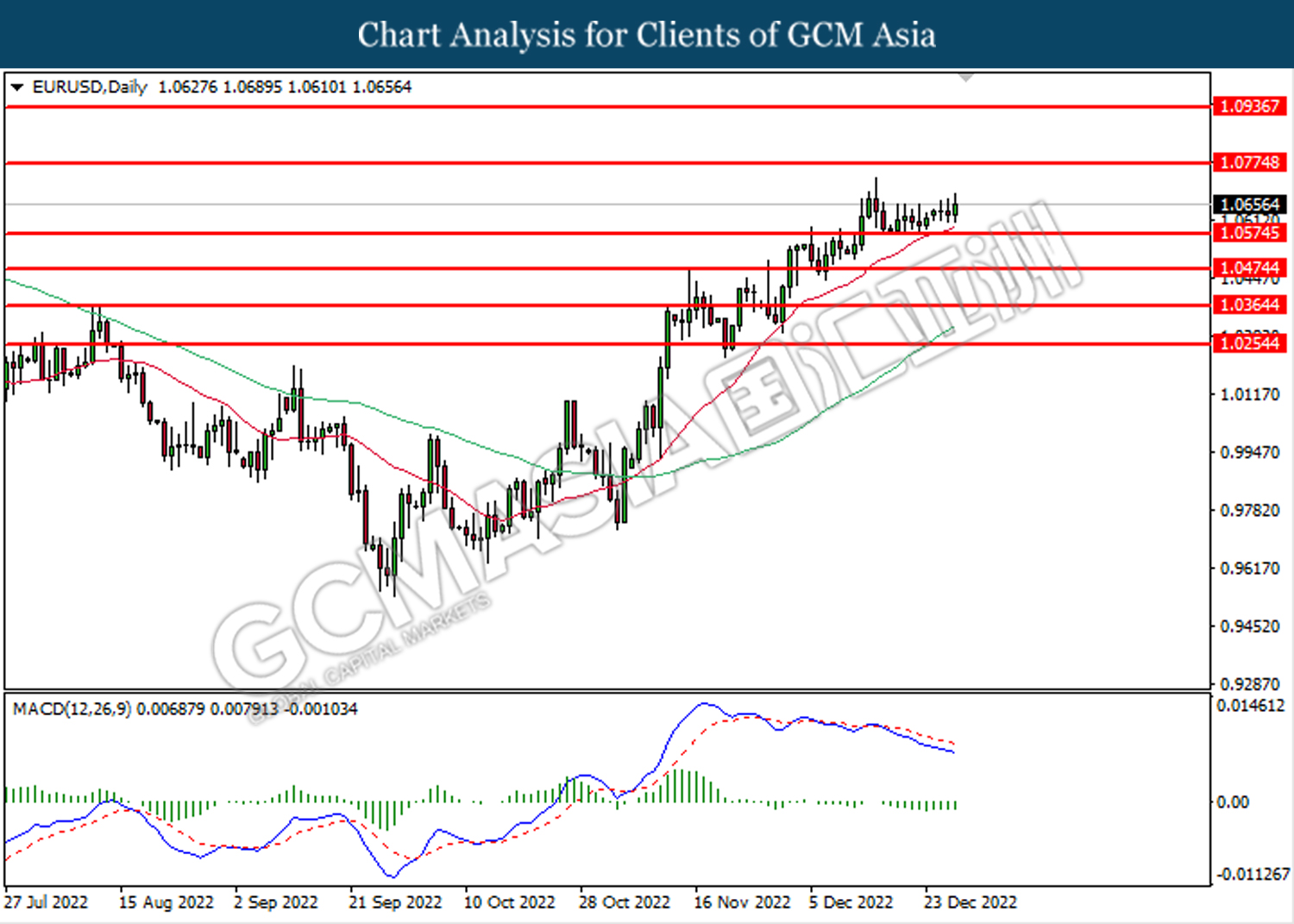

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0575. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0575, 1.0475

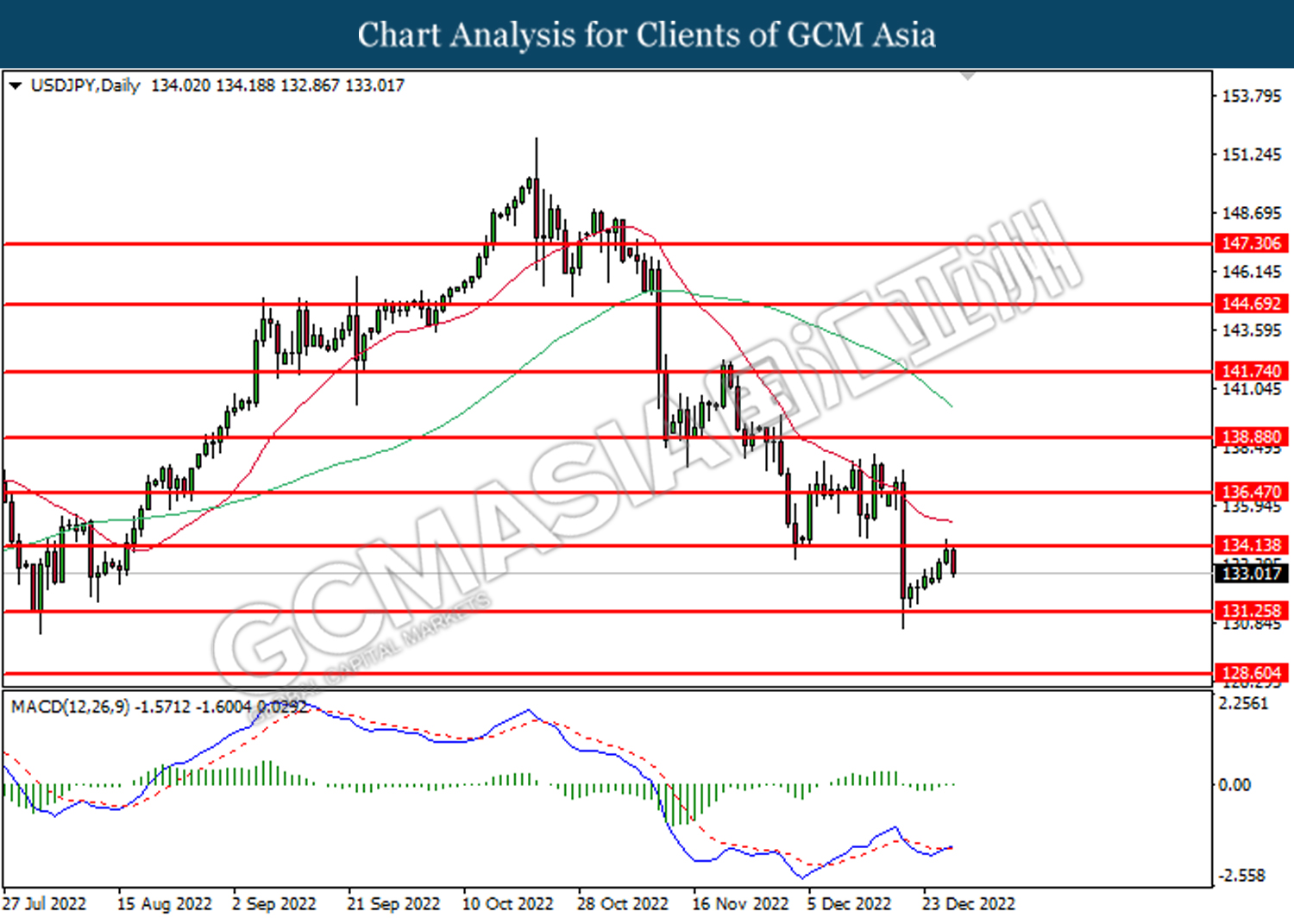

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level at 134.15. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term toward the higher level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

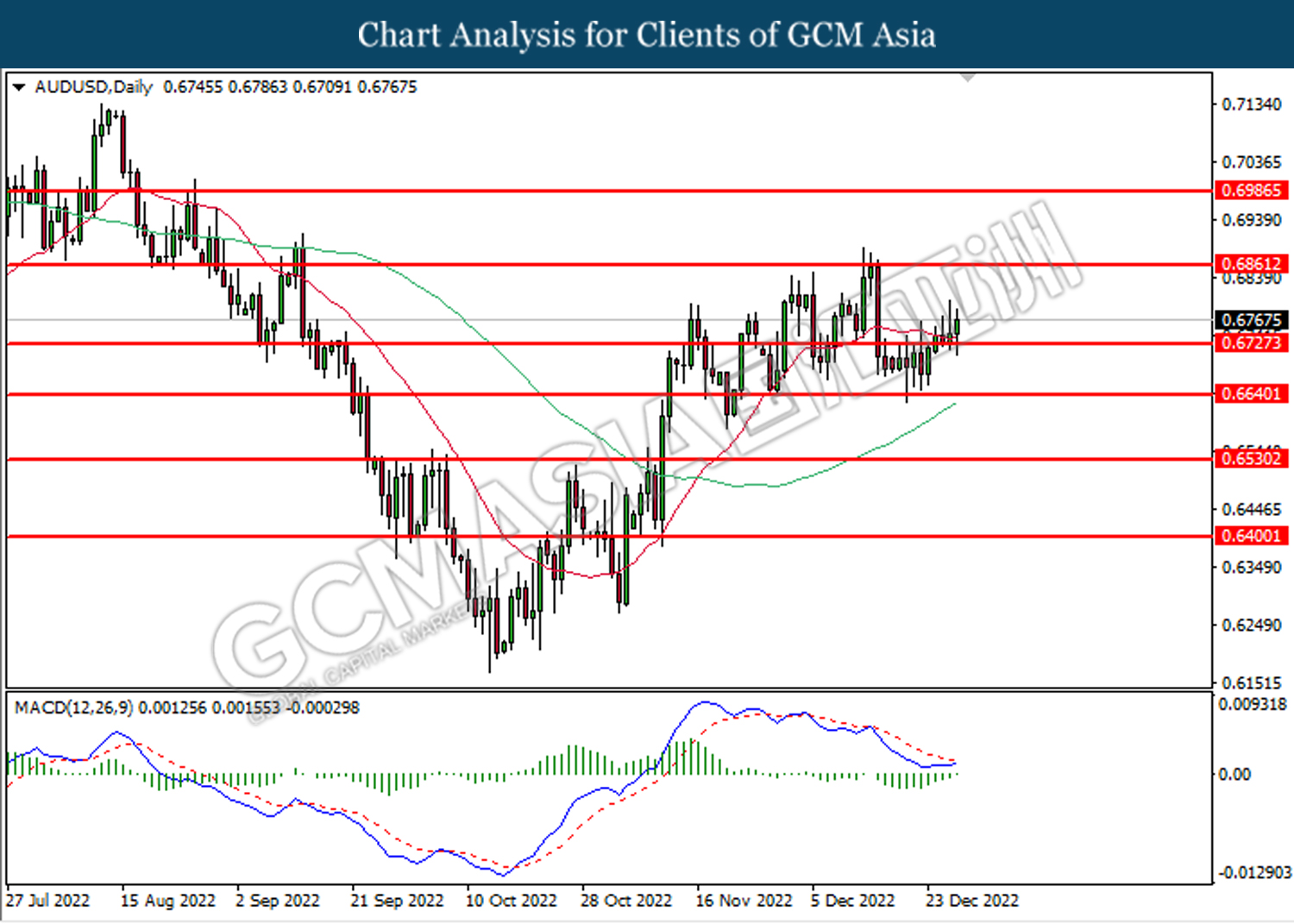

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

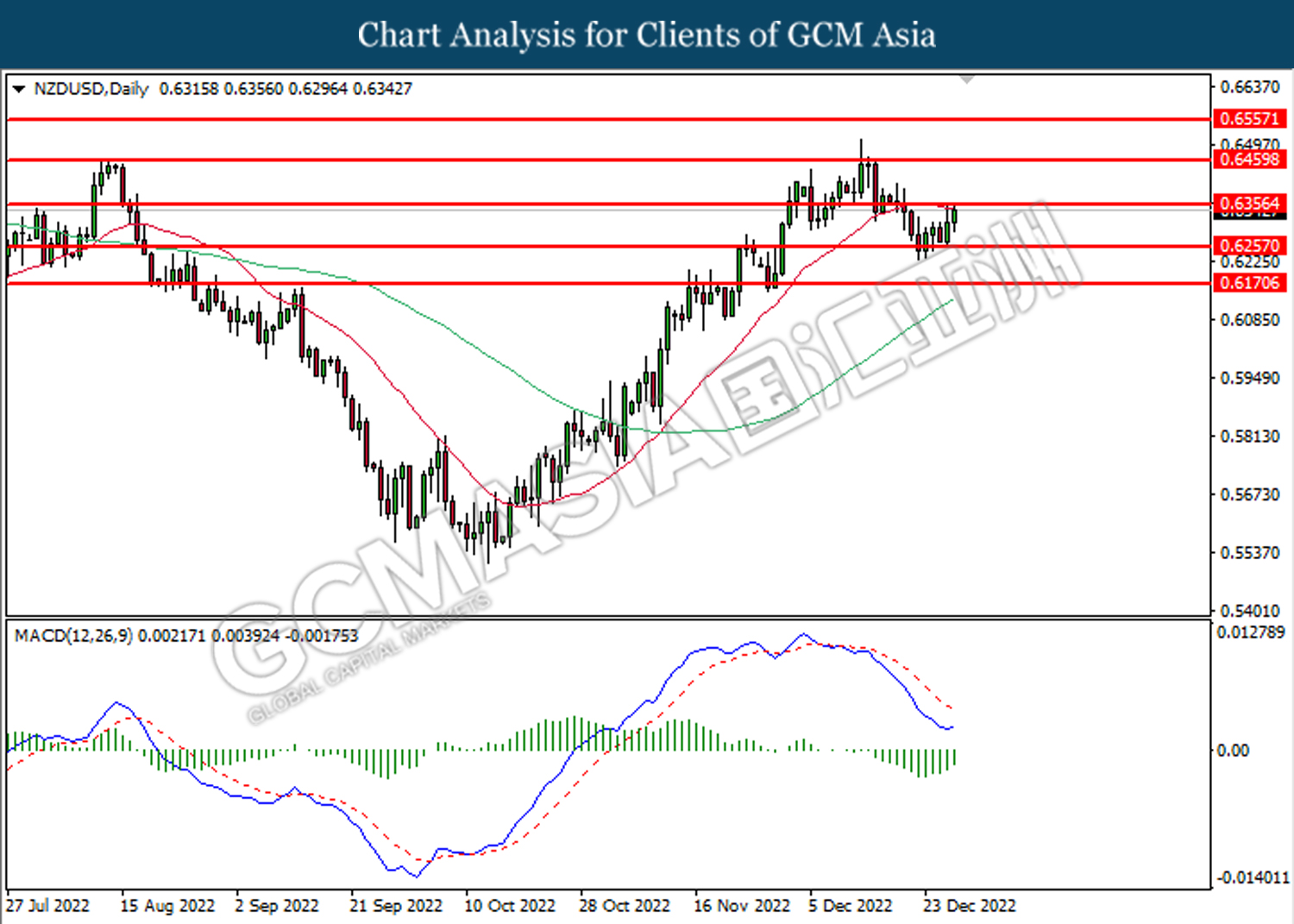

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3600. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

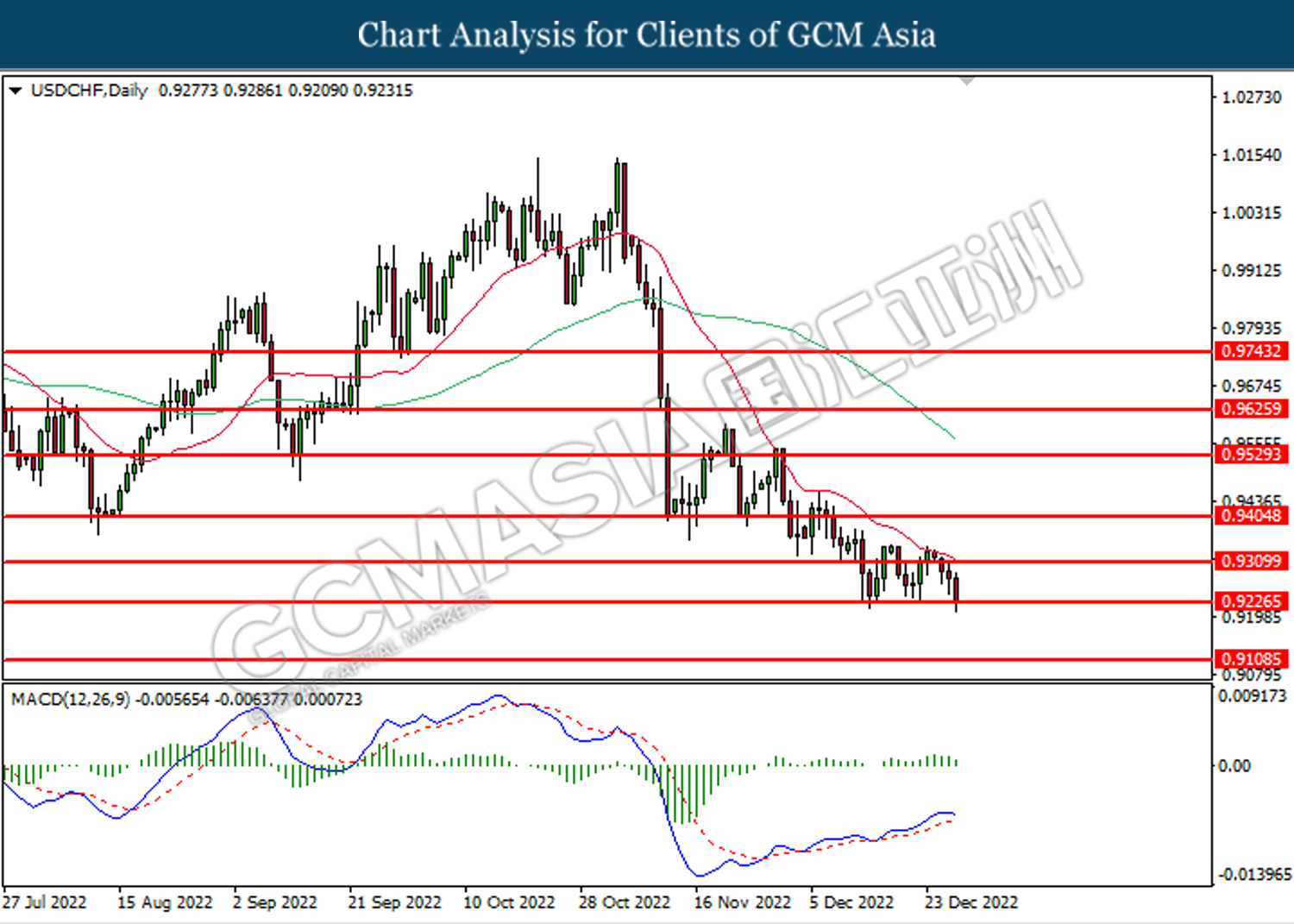

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 80.60. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1807.85. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1835.30.

Resistance level: 1835.30, 1869.85

Support level: 1807.85, 1786.00