31 January 2019 Morning Session Analysis

Dollar plunges to 3-weeks low amid FOMC Statement.

Dollar index was traded lower against a basket of six major currency pairs following the release of the Federal Open Market Committee (FOMC) statement regarding Fed’s decision on federal funds rate. During yesterday’s statement, the committee stated that they will remain patient while determining suitable adjustments to the target range for funds rate to tackle current economic slowdown condition. The dovish statement lowered investors’ confidence for gradual rate hike this year while causing the dollar to undergo large sell-off. Besides that, prior to the FOMC statement was the release of higher than expected ADP Nonfarm Employment Change and also the Pending Home Sales data. Although the job data with a reading of 213K against 180K helped push the dollar higher, the gains were limited by a poor Pending Home Sales data with an actual reading of -2.2% compared to 0.8%. Dollar index slumped 0.03% to 94.96 as of writing. In other news, pair of EUR/USD was up by 0.09% to 1.1485 supported by the major fall in dollar and also higher than expected German CPI. The CPI came in at -0.8% compared to -0.9%, indicating a higher spending rate while also lifting the poor sentiment which haunted the euro market for the past week. Although overall growth for Euro Zone remains slow, inflation data like the CPI would provide good support for the market.

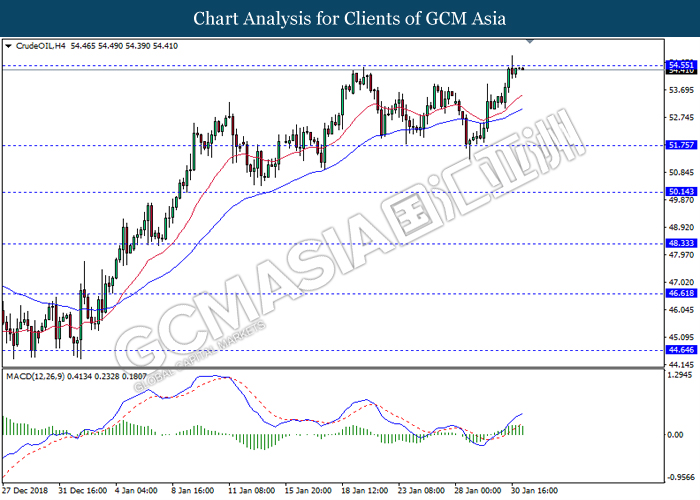

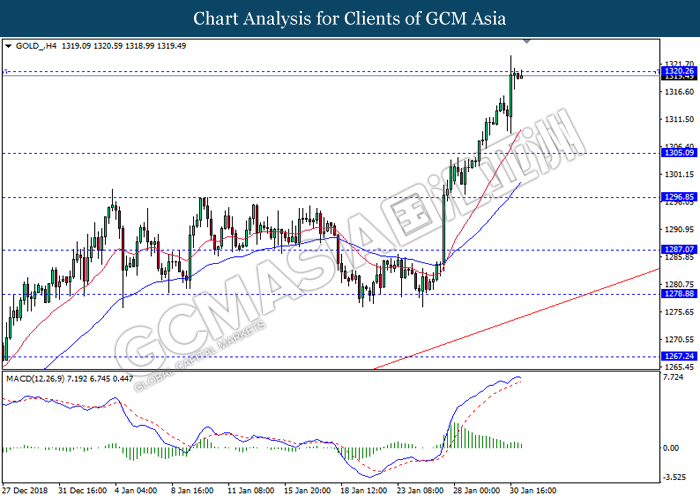

In the commodities market, crude oil price increased by 0.31% to $54.40 per barrel amid the release of pro-inventory data. According to the US Energy Information Administration, crude oil inventories was down by more than 1 million barrels to 0.919M. Besides that, oil sentiment continues to be supported by recent sanction on Venezuelans oil export and also OPEC production cut. Current outlook for oil market remained positive as investors awaits future news regarding the increase of OPEC’s production cut. On the other hand, gold price falls 0.11% to $1317.90 after exceeding recent highs amid FOMC dovish statement which sends investors flocking into safe-haven assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Jan) | -14K | -11K | – |

| 18:00 | EUR – GDP (QoQ) | 0.2% | 0.2% | – |

| 18:00 | EUR – Unemployment Rate (Dec) | 7.9% | 7.9% | – |

| 21:30 | USD – Initial Jobless Claims | 199K | 215K | – |

| 21:30 | CAD – GDP (MoM) (Nov) | 0.3% | -0.1% | – |

| 23:00 | USD – New Home Sales (Nov) | 544K | 560K | – |

Technical Analysis

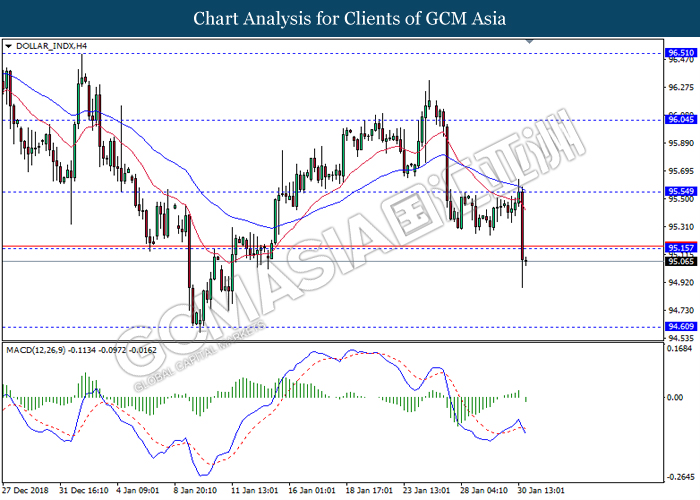

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level 95.15. MACD which illustrate bearish momentum signal with the formation of death cross suggest the dollar to extend its losses towards the support level 94.60.

Resistance level: 95.15, 95.55

Support level: 94.60, 94.30

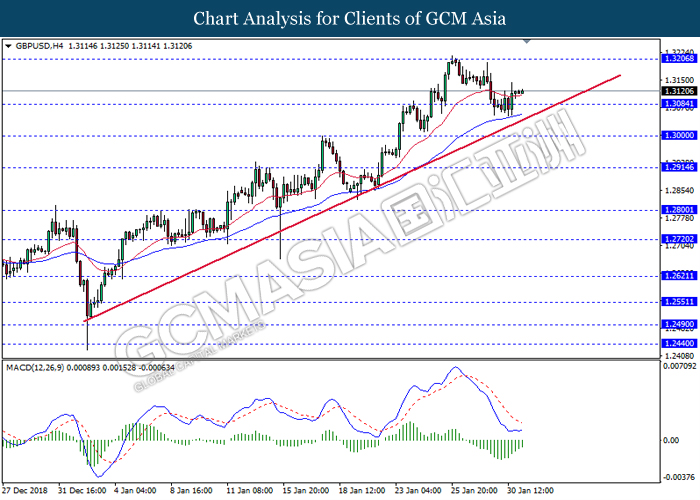

GBPUSD, H4: GBPUSD was traded higher following recent breakout above the previous resistance level 1.3085. MACD which illustrate bullish bias signal suggest the pair to extend its gains towards the resistance level 1.3205.

Resistance level: 1.3205, 1.3350

Support level: 1.3085, 1.3000

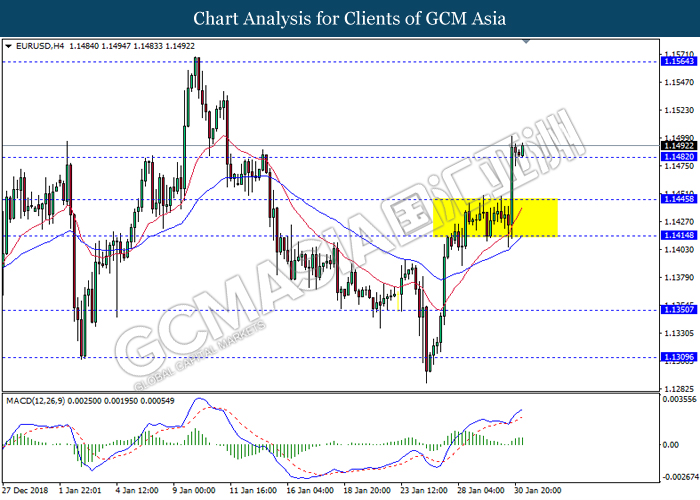

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level 1.1480. MACD which illustrate bullish momentum suggest the pair to extend its gains towards the resistance level 1.1565.

Resistance level: 1.1565, 1.1615

Support level: 1.1480, 1.1445

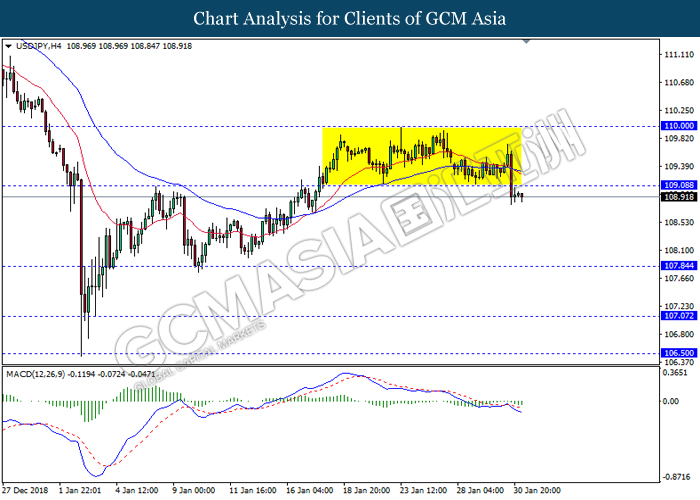

USDJPY, H4: USDJPY was traded lower following recent breakout below the previous support level 109.10. MACD which illustrate bearish momentum suggest the pair to extend its losses towards the support level 107.85.

Resistance level: 109.10, 110.00

Support level: 107.85, 107.05

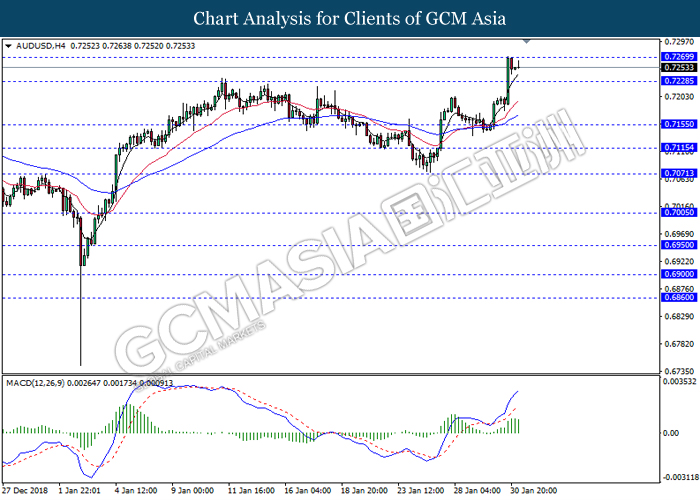

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7270. MACD which display diminishing bullish momentum suggest the pair to extend its retracement towards the support level 0.7230.

Resistance level: 0.7270, 0.7335

Support level: 0.7230, 0.7155

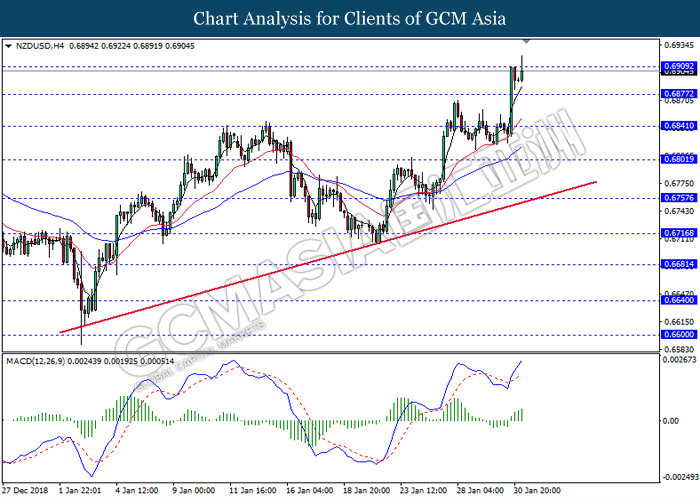

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6910. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.6910, 0.6965

Support level: 0.6875, 0.6840

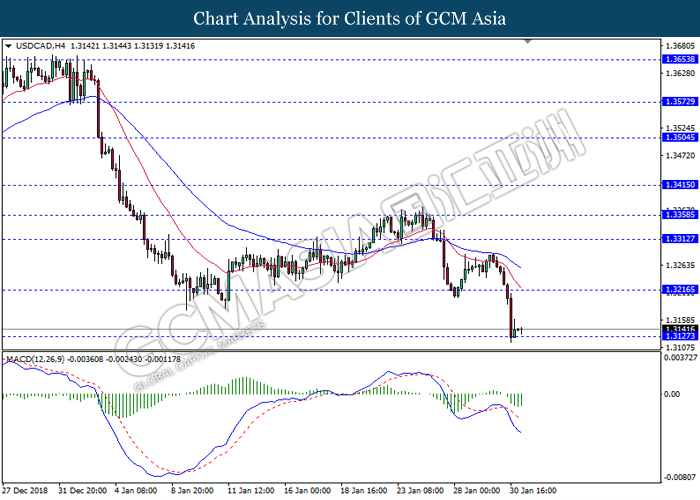

USDCAD, H4: USDCAD was traded higher following rebound from the support level 1.3125. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.3215.

Resistance level: 1.3215, 1.3310

Support level: 1.3125, 1.3060

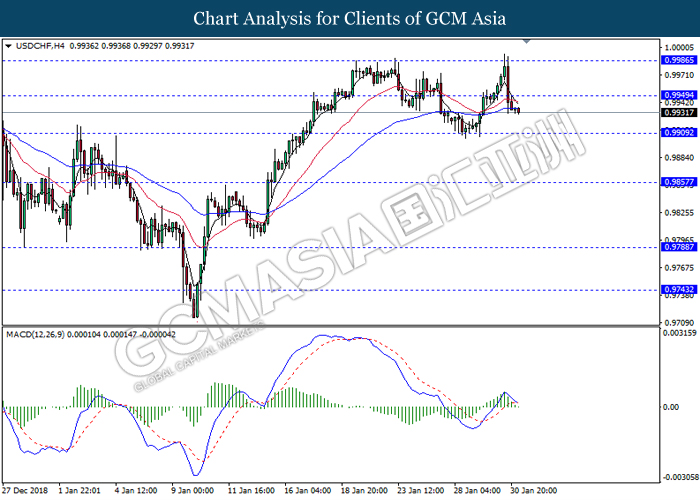

USDCHF, H4: USDCHF was traded lower following recent breakout below the previous support level 0.9950. MACD which illustrate bearish momentum with the starting formation of death cross suggest the pair to extend it losses towards the support level 0.9910.

Resistance level: 0.9950, 0.9985

Support level: 0.9910, 0.9855

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level 54.55. However, MACD which illustrate diminishing bullish momentum suggest the pair to undergo a technical correction in short term towards the support level 51.75.

Resistance level: 54.55, 57.80

Support level: 51.75, 48.35

GOLD_, H4: Gold price was traded higher while currently testing the resistance level 1320.25. However, MACD which display diminishing bullish momentum suggest the commodity to experience a technical correction in short term towards the support level 1305.10.

Resistance level: 1320.25, 1329.15

Support level: 1305.10, 1296.85