31 March 2022 Afternoon Session Analysis

Euro surged following additional oil form Biden.

The Euro extend its gains on Wednesday over the backdrop of surging oil supply from President Joe Biden. According to Reuters, The Biden administration is weighing a draw of oil from emergency reserves of up to 180 million barrels over several months, two U.S. sources said on Wednesday. The move is an attempt to control oil prices that have shot over $100 a barrel on Russia’s invasion of Ukraine and on high global demand. The rising tensions of Russia-Ukraine conflict would likely to cause inflation risk to surge, as the economic activities was restricted, leading to the spike of commodities price such as crude oil. The move attempted by Biden would pump additional oil circulation into commodities market and the companies in Europe region was benefited as the impost cost was diminished. It dialed up the market optimism toward economic progression in Europe region, leading investors to purchase Euro which having better future prospects, spurring further bullish momentum on the pair. As of writing, Euro appreciated by 0.10% to 1.1167.

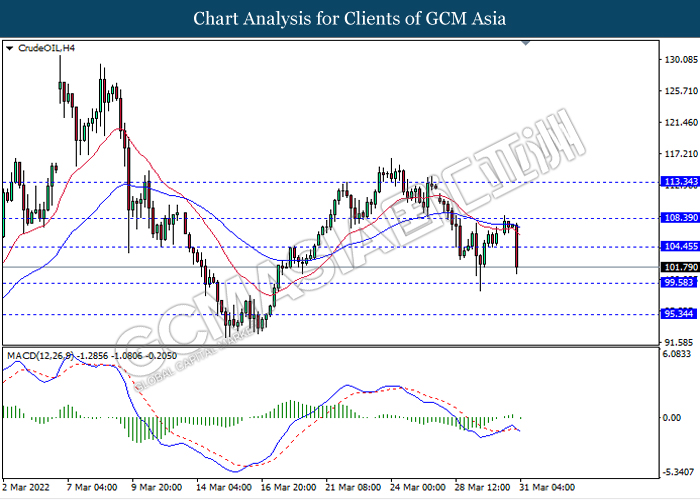

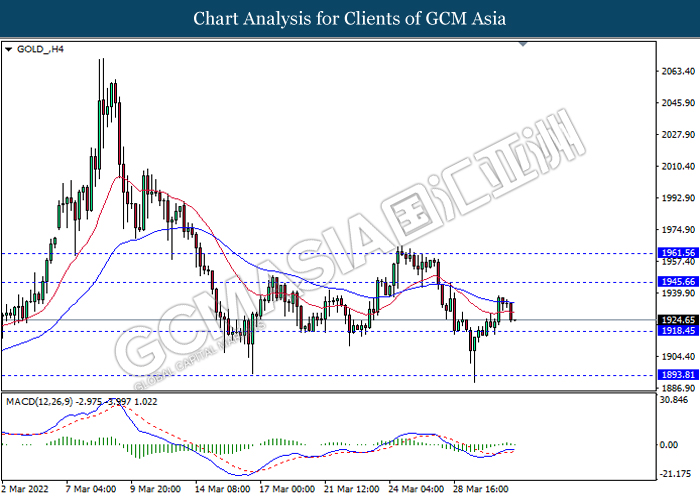

In commodities market, crude oil price depreciated by 5.69% to $101.69 per barrel as of writing following President Biden decided to release oil from emergency reserve. Besides, gold depreciated by 0.47% to $1924.50 per troy ounces as of writing amid the backdrop of diminishing of inflation risk had drag down the inflation-hedging commodities.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (QoQ) (Q4) | 1.10% | 1.00% | – |

| 14:00 | GBP – GDP (YoY) (Q4) | 6.50% | 6.50% | – |

| 15:55 | EUR – German Unemployment Change (Mar) | -33K | -20K | – |

| 20:30 | USD – Initial Jobless Claims | 187K | 200K | |

| 20:30 | CAD – GDP (MoM) (Jan) | 0.00% | 0.20% |

Technical Analysis

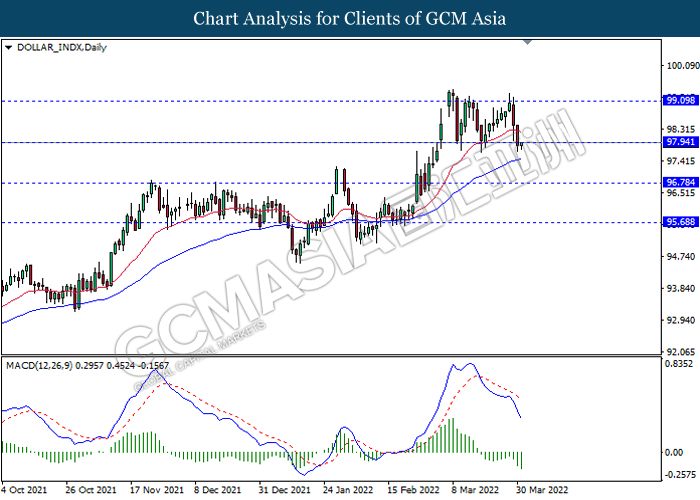

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 97.95, 99.10

Support level: 96.80, 95.70

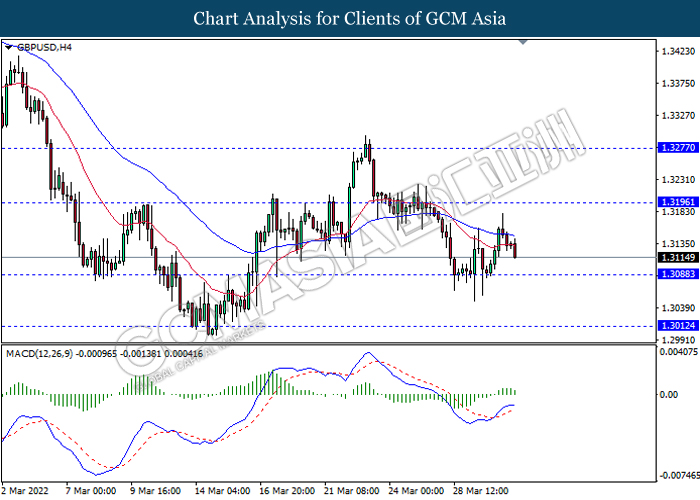

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1230, 1.1315

Support level: 1.1110, 1.1025

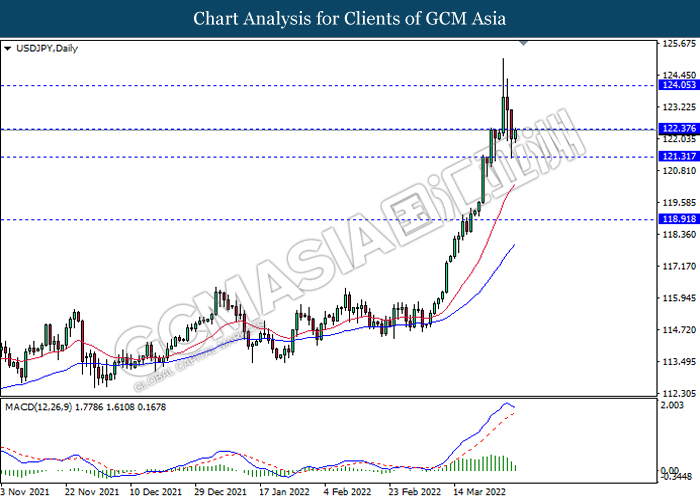

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 122.35, 124.05

Support level: 121.30, 118.90

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7485, 0.7545

Support level: 0.7420, 0.7365

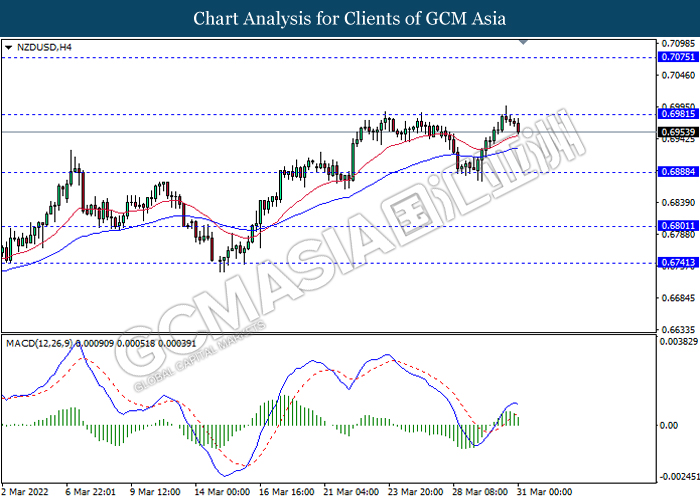

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

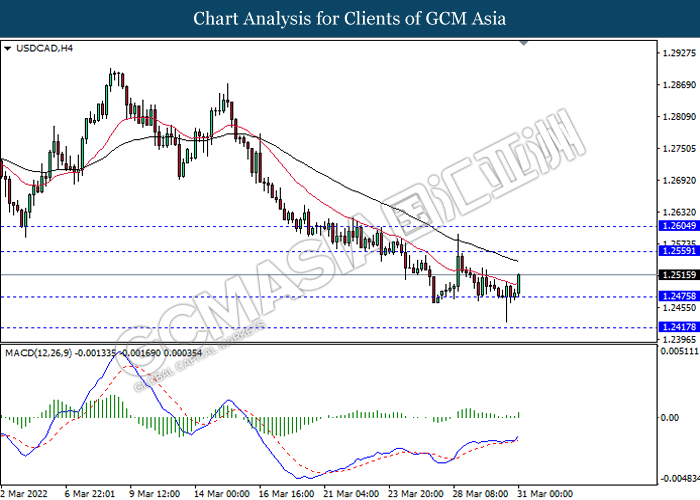

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

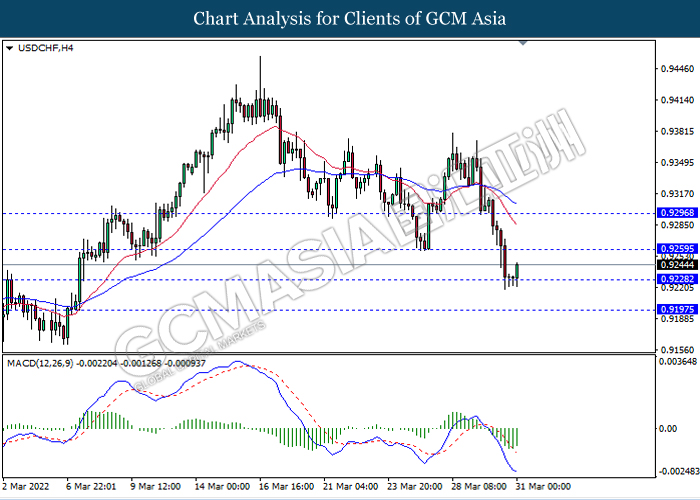

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9260, 0.9295

Support level: 0.9230, 0.9195

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 104.45, 108.40

Support level: 99.60, 95.35

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1945.65, 1961.55

Support level: 1918.45, 1893.81