31 March 2022 Morning Session Analysis

US Dollar retreated following US GDP growth revised lower.

The Dollar Index which traded against a basket of six major currencies extend its losses over the backdrop of downbeat economic data yesterday. The United States economy ended 2021 by expanding at a 6.9% annual pace from October through December, according to Bureau of Economic Analysis. Nonetheless, the overall reading is still slight downgrade from its previous estimation. Economist predicted that the growth in future is likely to slow sharply in the year of 2022 as spiking numbers of inflation rate prompted by the earlier aggressive expansionary monetary policy would likely to weigh down on consumer spending. On top of that, the US Home Sales have fallen following the Federal Reserve has started the implementation of rate hike, leading to a sharp increase in borrowing costs. Exports may weaken as overseas economies are disrupted by Russia’s invasion of Ukraine. As of writing, the Dollar Index depreciated by 0.57% to 97.98.

In the commodities market, the crude oil price surged 0.08% to $108.95 per barrel as of writing following the released of the bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at -3.449M, better than the market forecast at -1.022M. On the other hand, the gold price surged 0.02% to $1932.95 per troy ounces as of writing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (QoQ) (Q4) | 1.10% | 1.00% | – |

| 14:00 | GBP – GDP (YoY) (Q4) | 6.50% | 6.50% | – |

| 15:55 | EUR – German Unemployment Change (Mar) | -33K | -20K | – |

| 20:30 | USD – Initial Jobless Claims | 187K | 200K | |

| 20:30 | CAD – GDP (MoM) (Jan) | 0.00% | 0.20% |

Technical Analysis

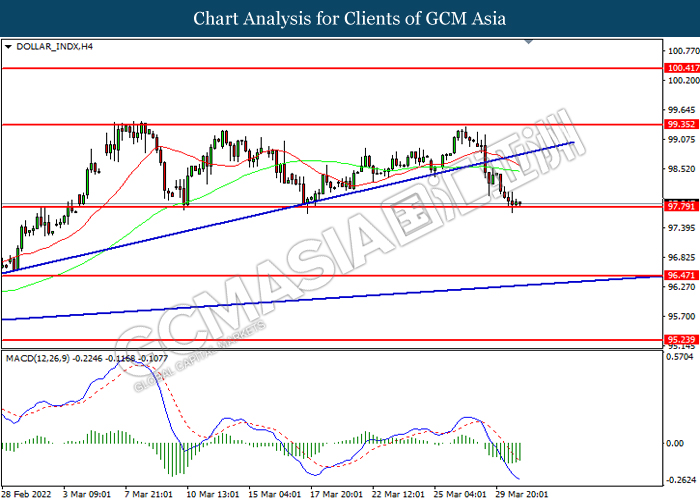

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

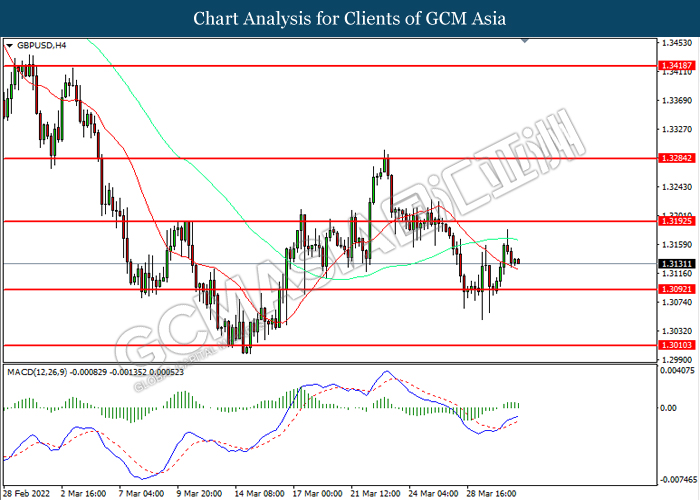

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1245, 1.1370

Support level: 1.1135, 1.0980

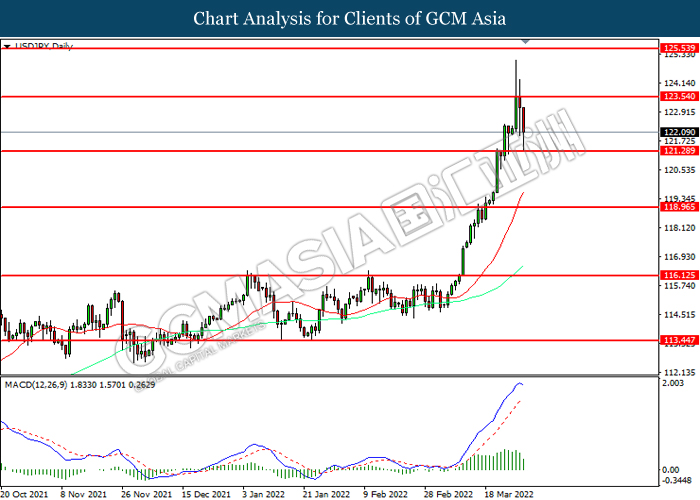

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

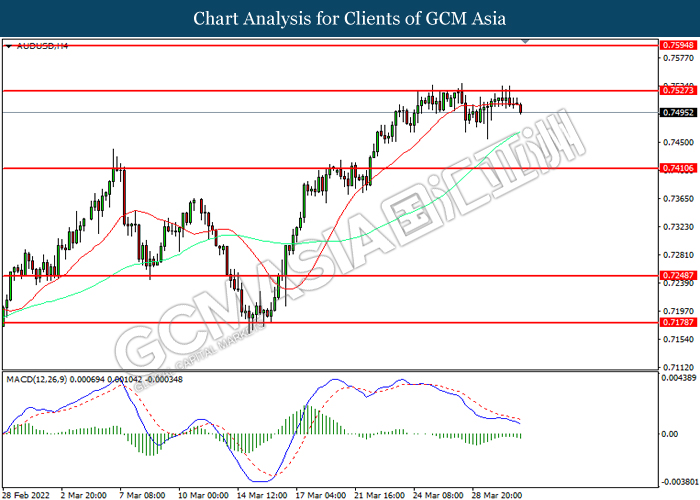

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6975, 0.7045

Support level: 0.6890, 0.6800

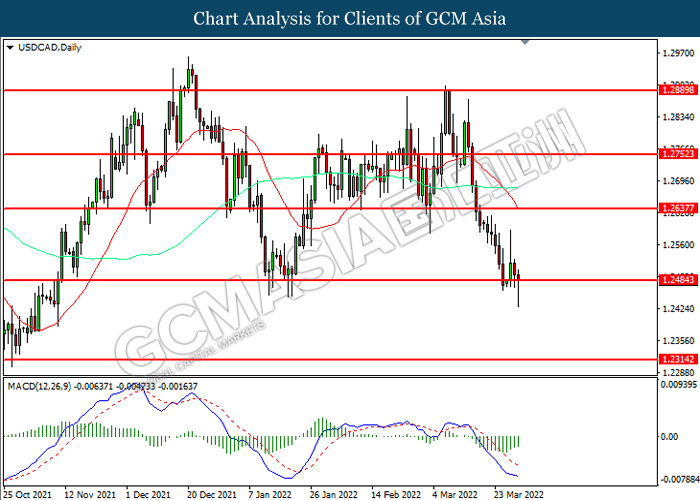

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

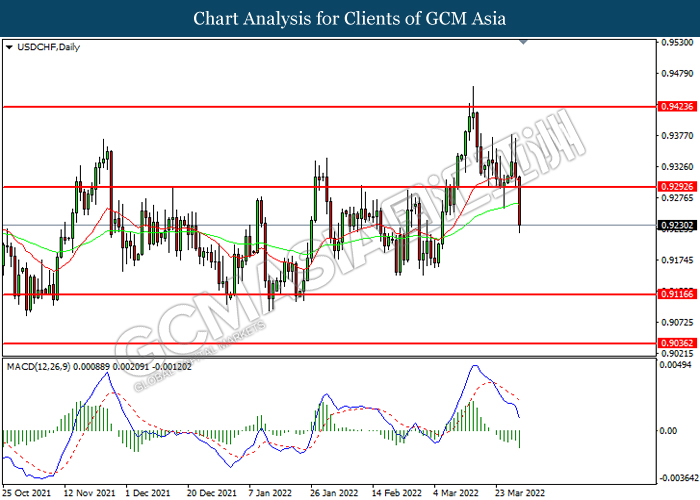

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9295. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

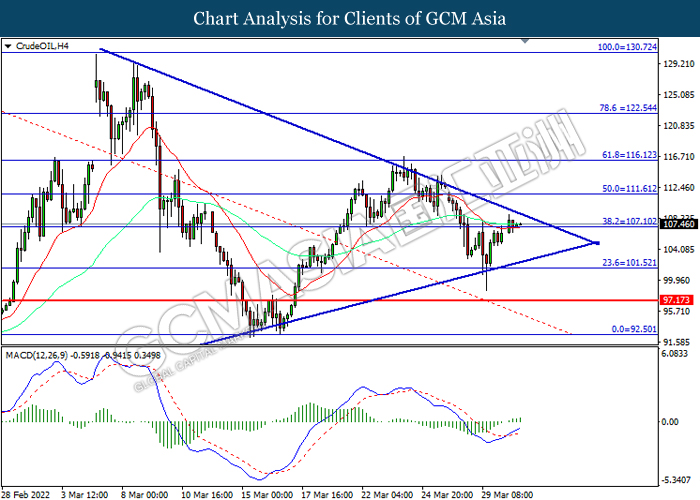

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.15

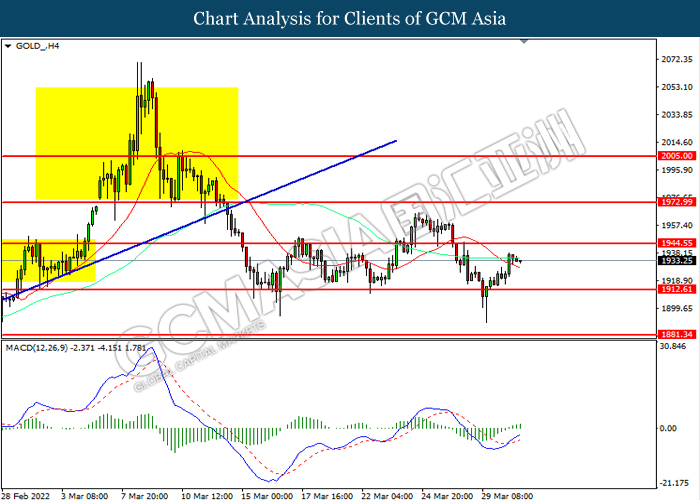

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1912.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35