31 October 2022 Afternoon Session Analysis

Pound Sterling rose upon budget plan from UK Prime Minister.

The GBP/USD, which widely traded by global investors rebounded from recent low on last Friday after the new UK Prime Minister announced his first budget plan. According to Reuters, Rishi Sunak, who started his tenure as UK Prime Minister on last week has claimed on 28 October that he was considering to postpone the country’s foreign aid budget for an additional two years to 2026 – 2027. Earlier, Rishi Sunak was inclined to reduce government spending, and the plan was the first step to achieve the goal. Besides, the tax cuts cancellation was also under consideration of UK government in order to stabilize the spiking inflationary pressures, which sparking the appeal of Pound Sterling. As of now, investors would continue to scrutinize the latest updates with regards of budget plans from Rishi Sunak government. In addition, the interest rate decision from Bank of England which scheduled on Thursday would also be closely watched by investors. As of writing, GBP/USD edged down by 0.03% to 1.1609.

In the commodities market, the crude oil price dropped by 0.46% to $87.50 per barrel as of writing following the downbeat economic data had weigh down the demand on this black commodity. The China Manufacturing Purchasing Managers Index (PMI) has notched down from the previous reading of 50.1 to 49.2, missing the market forecast of 50.0. On the other hand, the gold price appreciated by 0.14% to $1643.98 per troy ounce as of writing over the depreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Oct) | 9.9% | 10.2% | – |

Technical Analysis

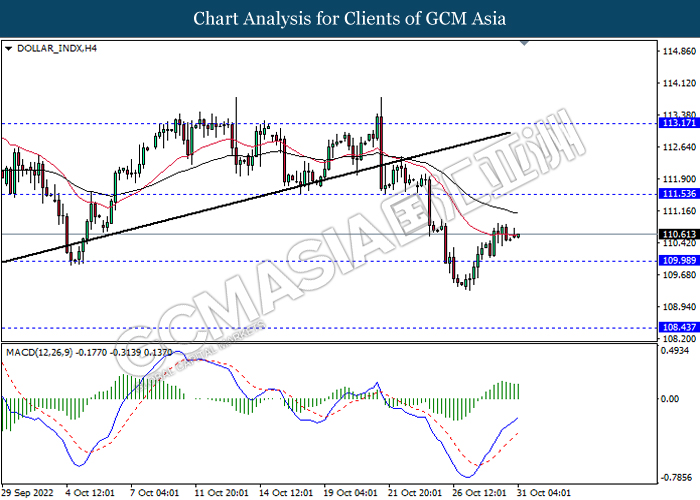

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9990, 1.0095

Support level: 0.9905, 0.9810

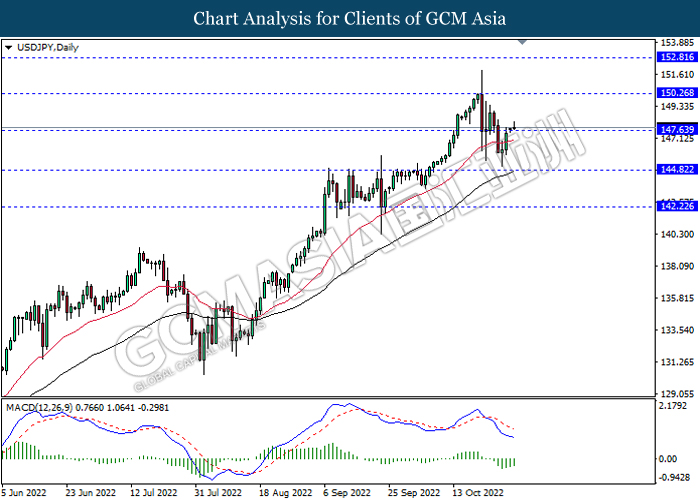

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

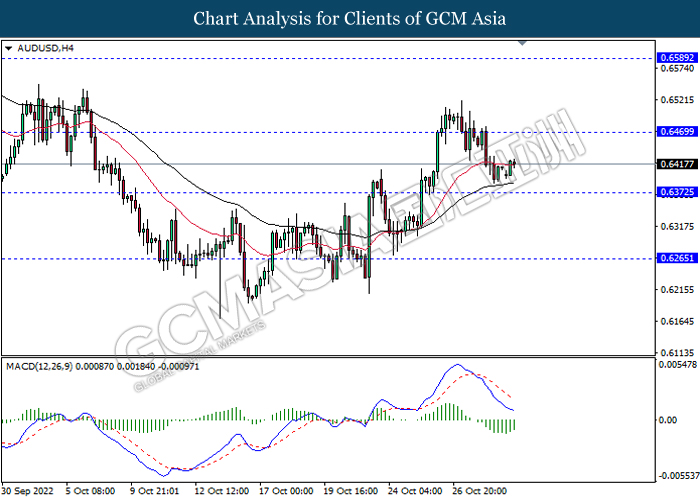

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

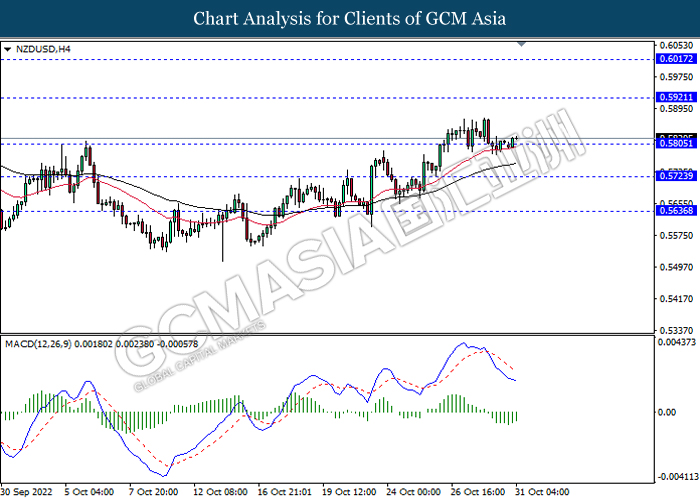

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

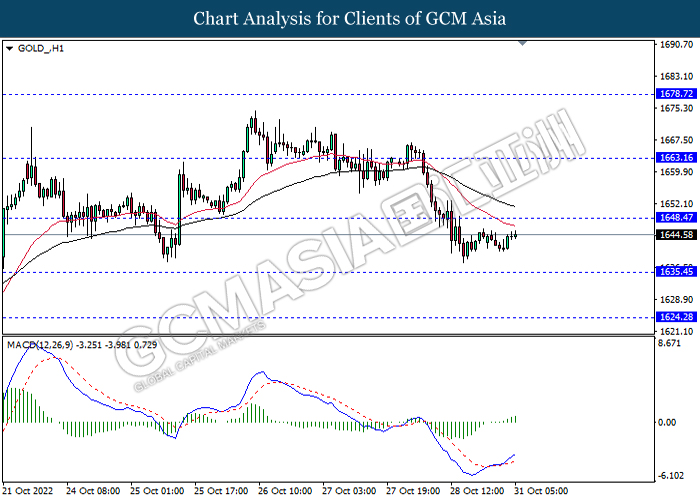

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1648.45, 1663.15

Support level: 1635.45, 1624.30