31 October 2022 Morning Session Analysis

Greenback standstill ahead of Fed meeting’s week.

The dollar index, which traded against a basket of six major currencies, managed to hold its ground in the early trading session as the market participants are preparing for a ‘busy’ week ahead. Last Friday, the Bureau of Economic Analysis released the US Core PCE Price Index data. The data came in at 0.5%, in line with the consensus forecast, showing that the inflation stayed strong in September. With that, the greenback was pushed up following the release of the data, while the market participant has started to shift their attention to the upcoming data. In the next few trading days, the greenback is expected to have large movement as the Federal Reserve will hold its meeting during 2nd Nov – 3rd Nov, whereby the rate hike plan of the Federal Reserve would be critical to the market participants. The central bank is expected to raise rates by 75 basis points for the fourth-straight time before “pivoting” to a slower pace of rate hikes, which the market has begun pricing in. Besides, investors will also eyes on the Friday’s NonFarm Payroll data and Unemployment data to gauge the current situation of the labor market. As of writing, the dollar index dropped -0.02% to 110.75.

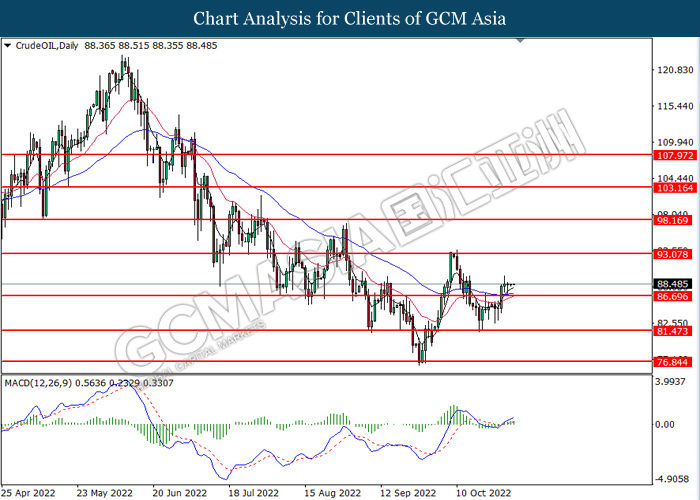

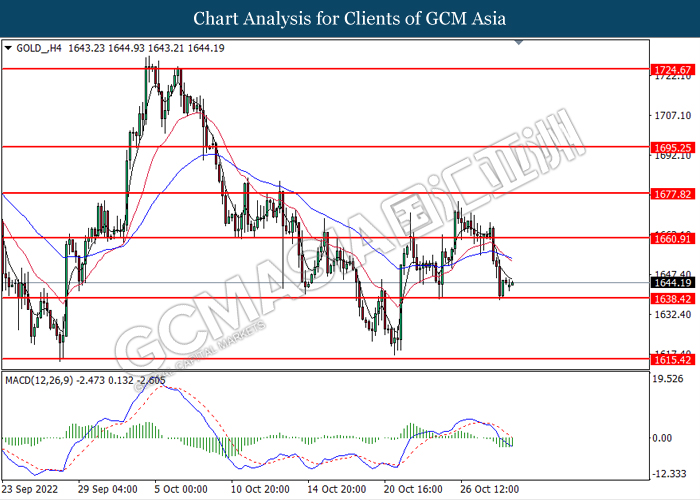

In the commodities market, crude oil prices edged down by -0.17% to $89.05 per barrel as China widen Covid curbs. Besides, gold prices appreciated by 0.11% to $1644.85 per troy ounce following the slight fall in dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Oct) | 9.9% | 10.2% | – |

Technical Analysis

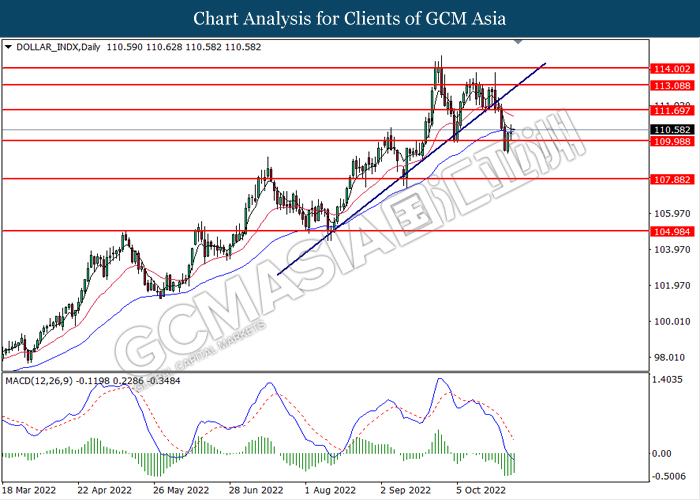

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 110.00. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains toward the resistance level at 111.70.

Resistance level: 111.70, 114.00

Support level: 110.00, 107.90

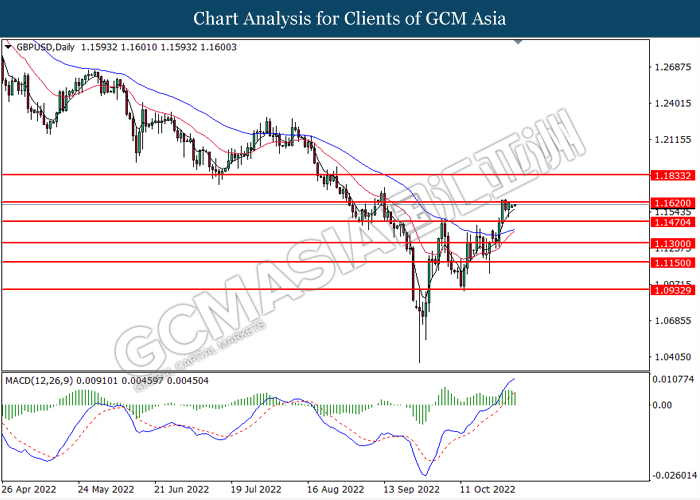

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1620. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1620, 1.1835

Support level: 1.1470, 1.1300

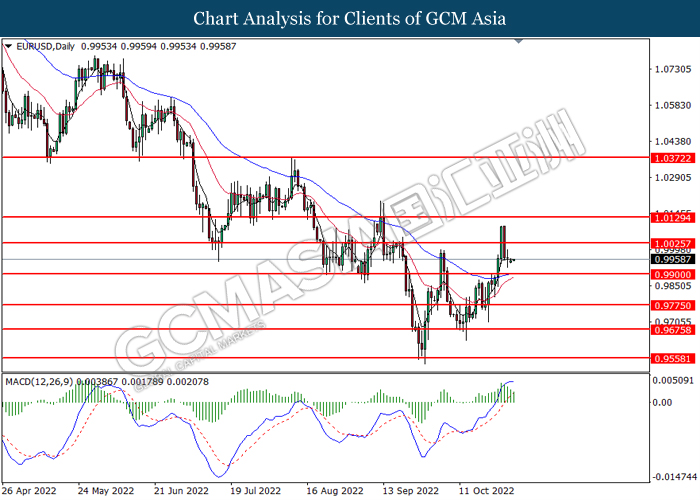

EURUSD, Daily: EURUSD was traded lower following prior retracement near the resistance level at 1.0025. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9900.

Resistance level: 1.0025, 1.0130

Support level: 0.9900, 0.9775

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.50. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 150.15.

Resistance level: 150.15, 152.50

Support level: 147.50, 144.70

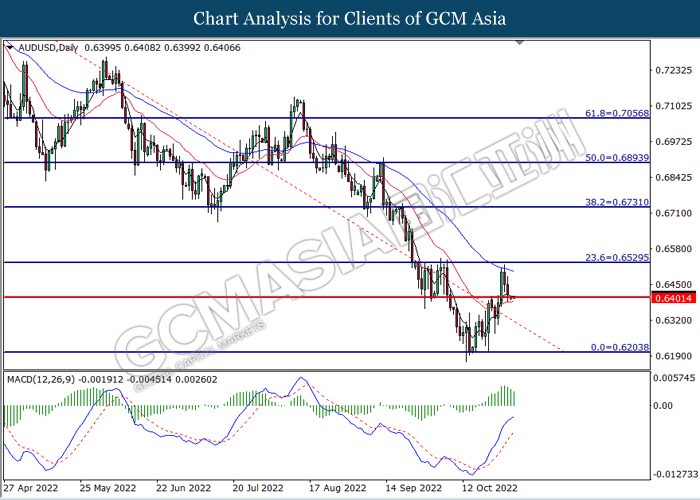

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6530, 0.6730

Support level: 0.6400, 0.6205

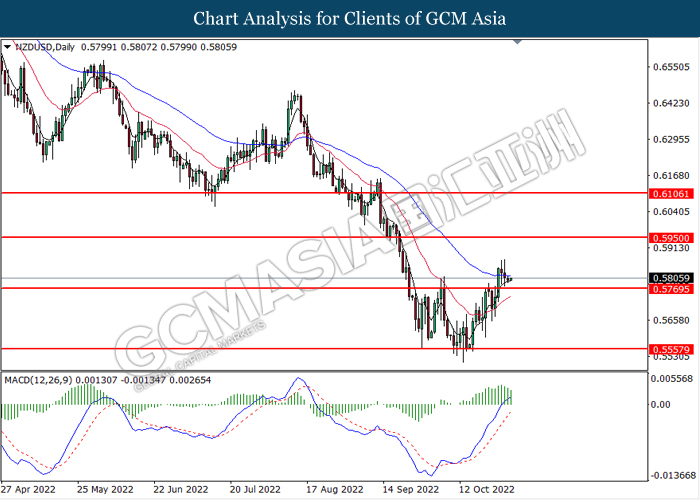

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.5770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.5950.

Resistance level: 0.5950, 0.6105

Support level: 0.5770, 0.5560

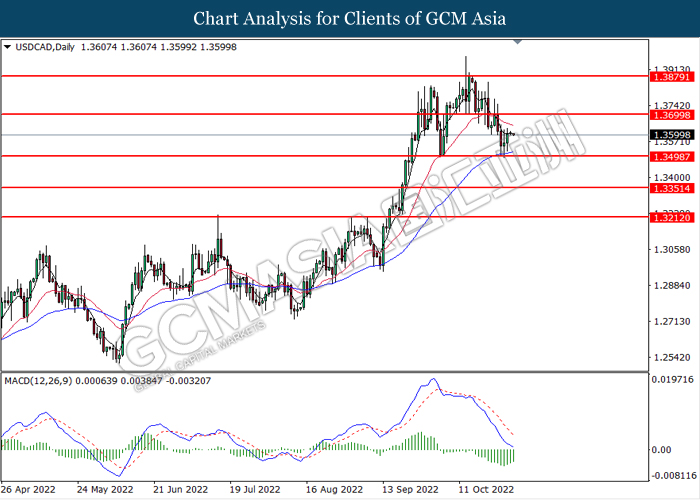

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3500. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.3700.

Resistance level: 1.3700, 1.3880

Support level: 1.3500, 1.3350

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9935. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0050.

Resistance level: 1.0050, 1.0150

Support level: 0.9935, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 86.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 93.10.

Resistance level: 93.10, 98.15

Support level: 87.70, 81.45

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1638.40. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1660.90.

Resistance level: 1660.90, 1677.80

Support level: 1638.40, 1615.40