270423 Afternoon Session Analysis

27 April 2023 Afternoon Session Analysis

Yen buoyed as US banking sector fears.

The Japanese Yen is the third most commonly traded currency in the world buoyed by US banking sector fears. The dollar fell against the yen after the yen outperformed after the panic in the US banking sector. The dollar’s decline came as First Republic Bank (RFC)’s decline accelerated after its earnings report, with the company’s stock price plummeting 66% in 3 days. As a result, investors have turned funds into traditional safe-haven assets such as the yen. However, the outlook for the yen is in mixed conditions as the Yen was under selling pressure following the inauguration of Kazuo Ueda as the new Bank of Japan Governor. The New BoJ governor reiterated to maintain its ultra-loosen policy to achieve BoJ’s 2% inflation target. The yen depreciated after BoJ gave a dovish outlook following the comments, as the value fell as the money supply in the market increased. Meanwhile, the Japanese Yen struggled as investors continued to eye on the BoJ monetary meeting on Friday. At this point in time, the majority of investors expect that the new BoJ Governor Ueda will likely maintain the bank’s monetary easing decision in the meeting. As of writing, the USD/JPY traded lower by 0.01% to $133.64.

In the commodities market, crude oil prices rebounded by 0.26% to $74.49 per barrel after heavy losses on US banking sector jitters. On the other hand, gold prices edged up by 0.53% to $1999.80 per troy ounce amid the US dollar weakening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | 2.6% | 2.0% | – |

| 20:30 | USD – Initial Jobless Claims | 245K | 248K | – |

| 22:00 | USD – Pending Home Sales (MoM) (Mar) | 0.8% | 0.5% | – |

Technical Analysis

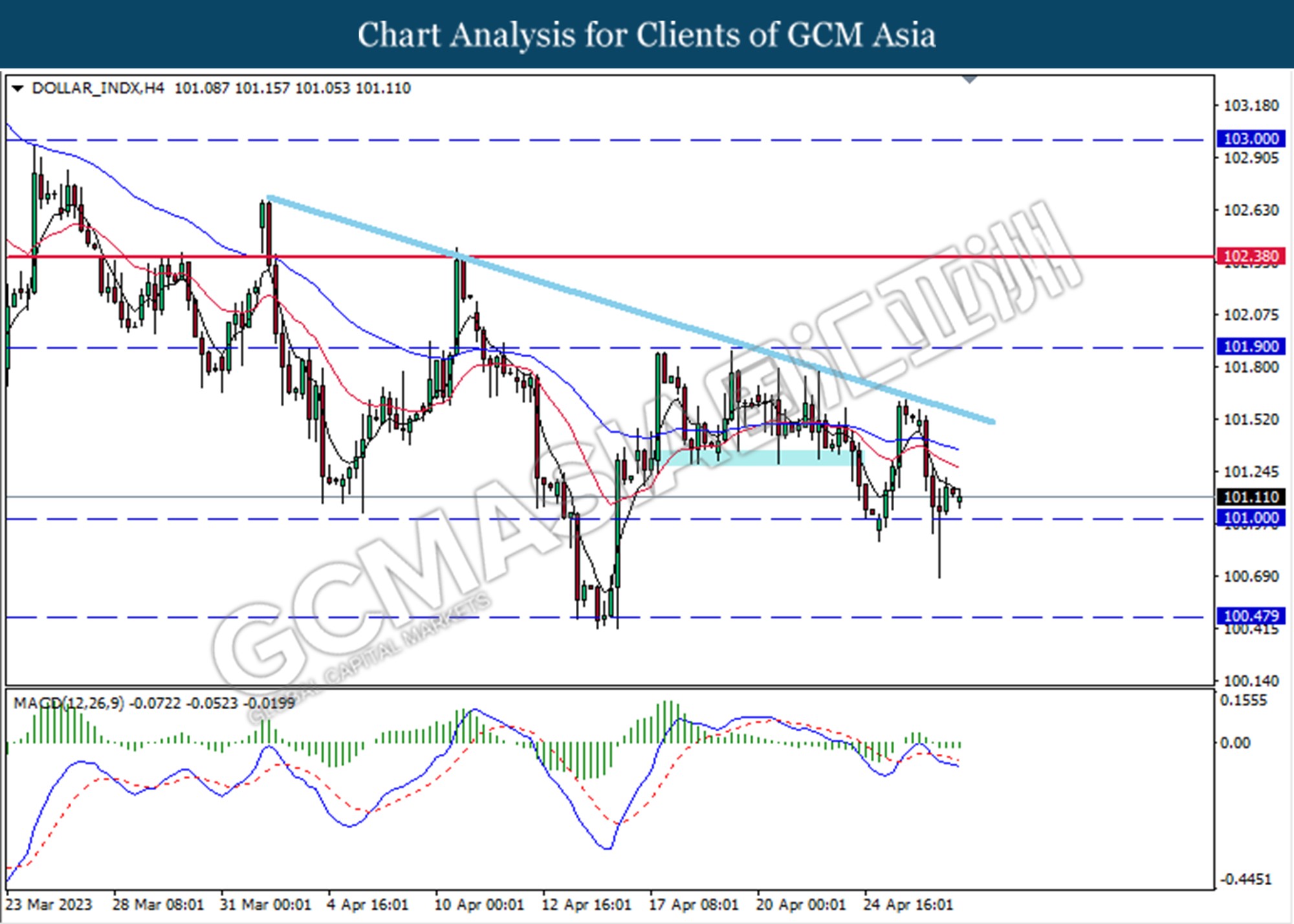

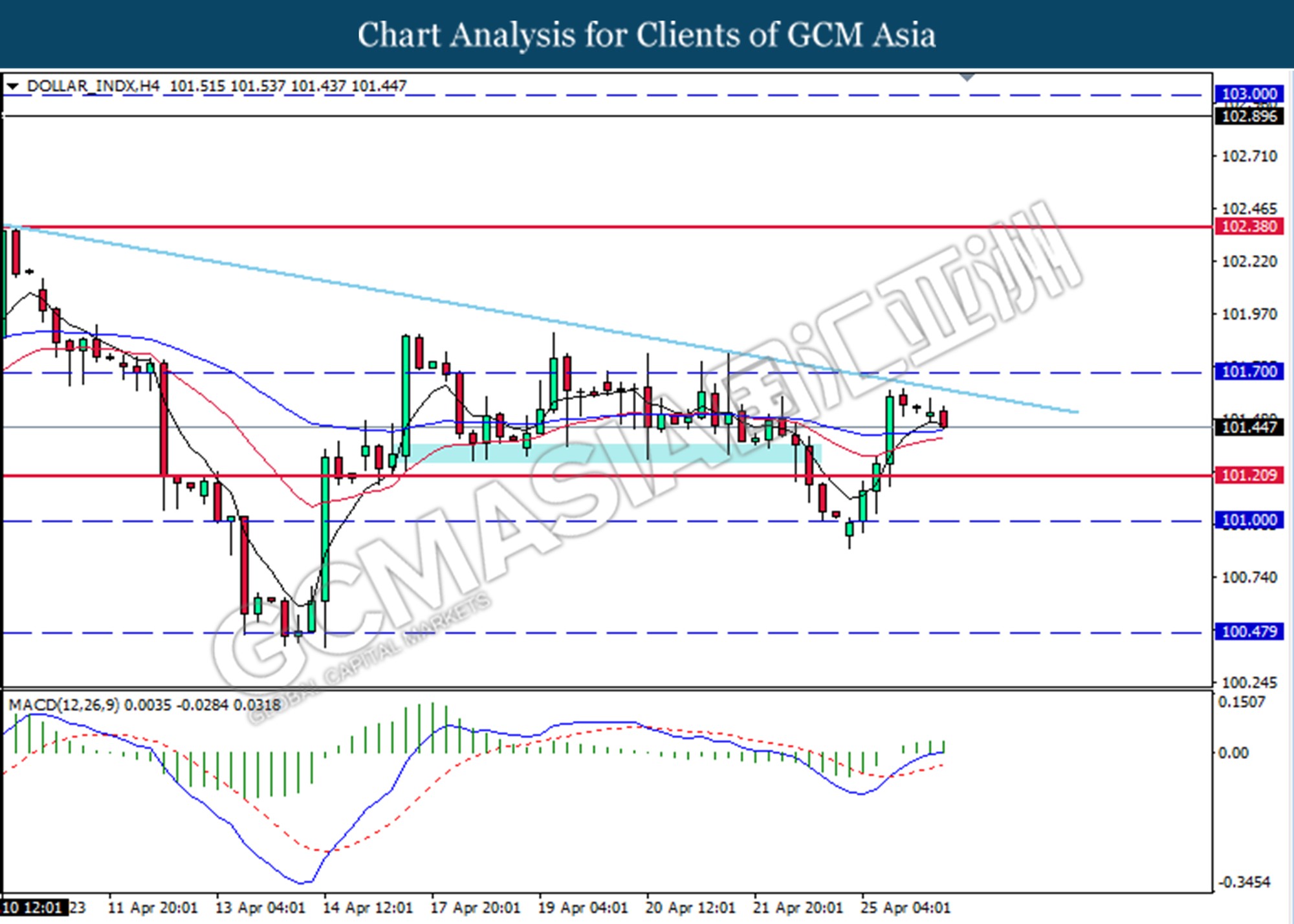

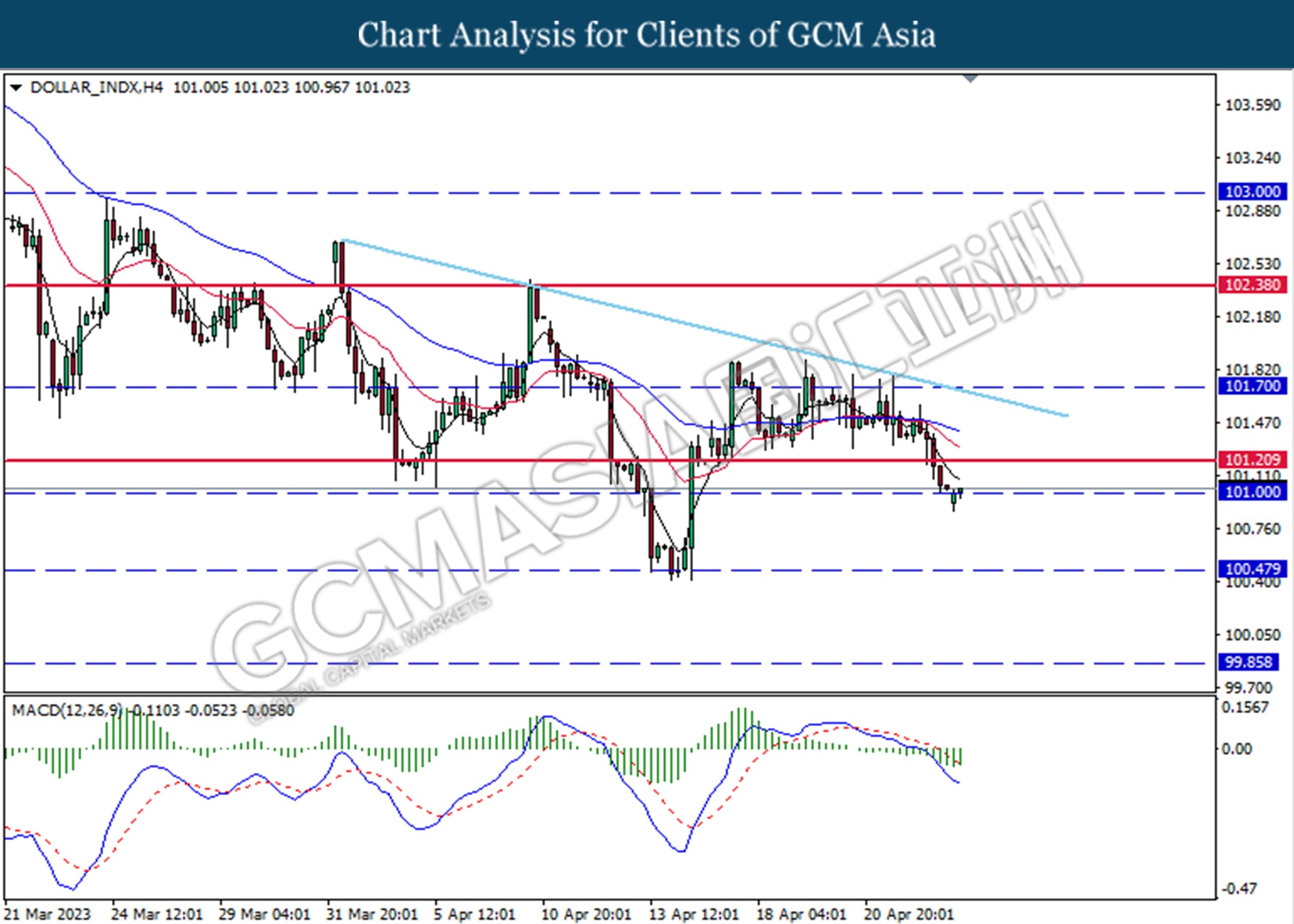

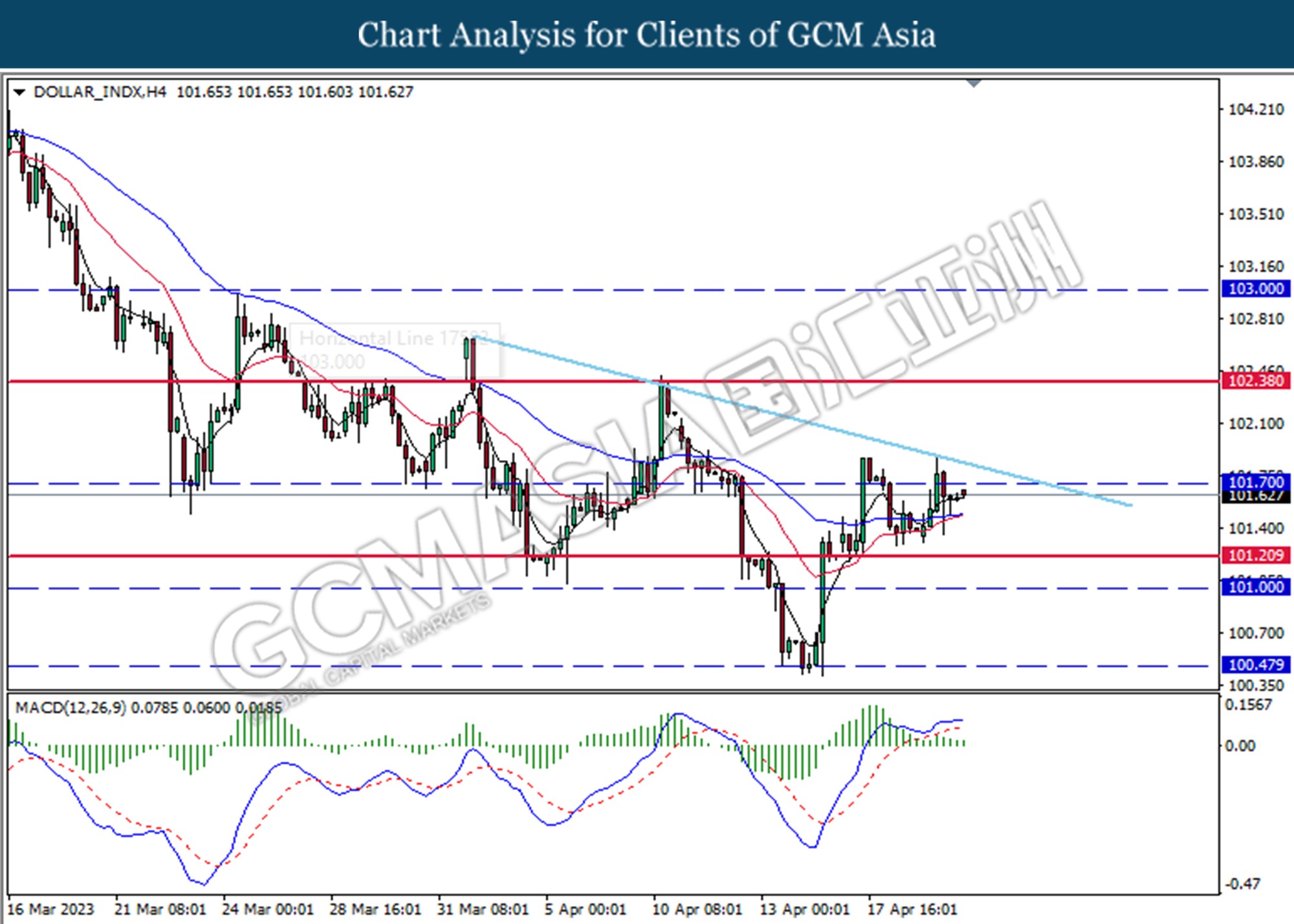

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 101.00. MACD which illustrated diminishing bullish momentum suggests the index extended its losses after it successfully breakout below the support level.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

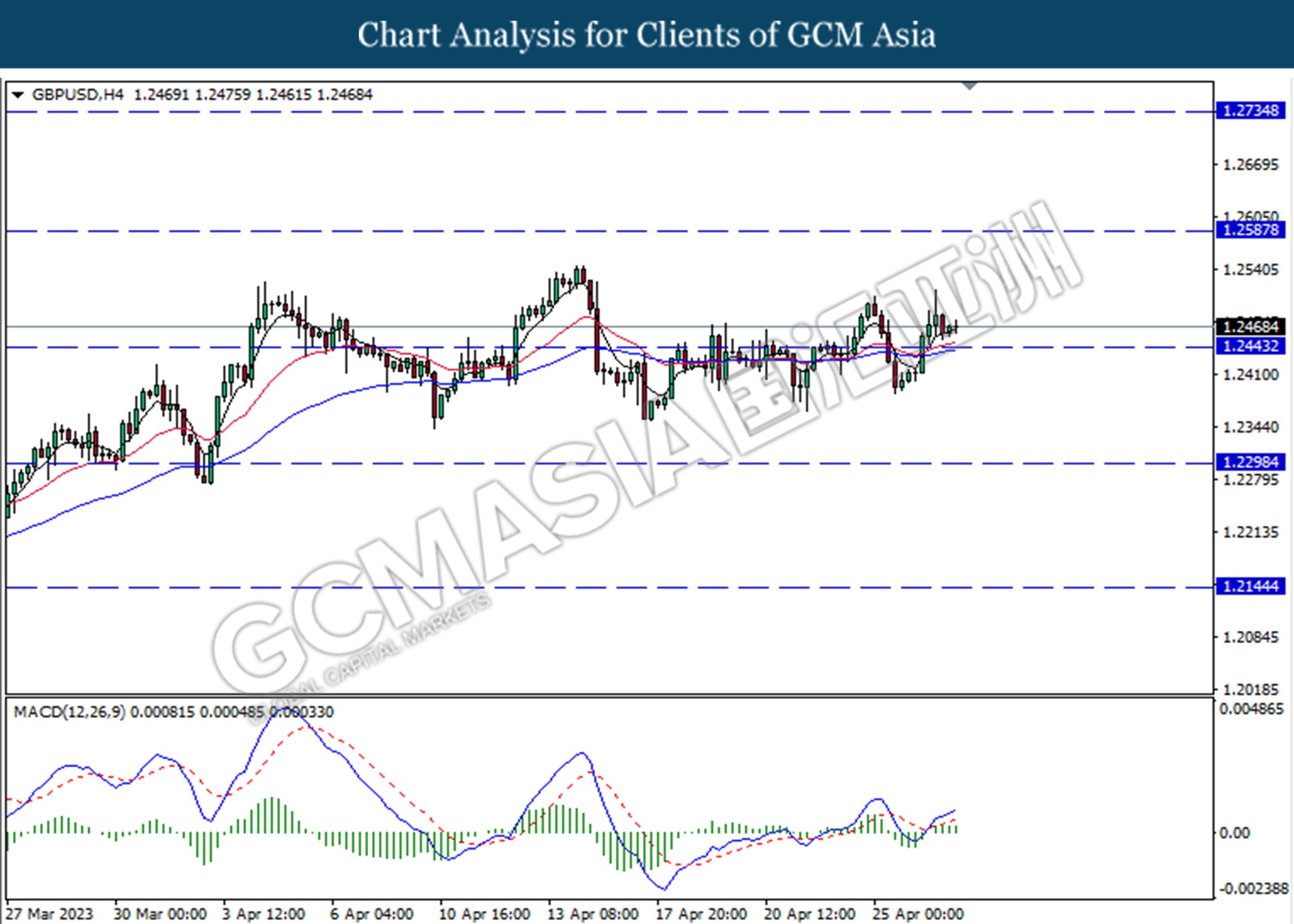

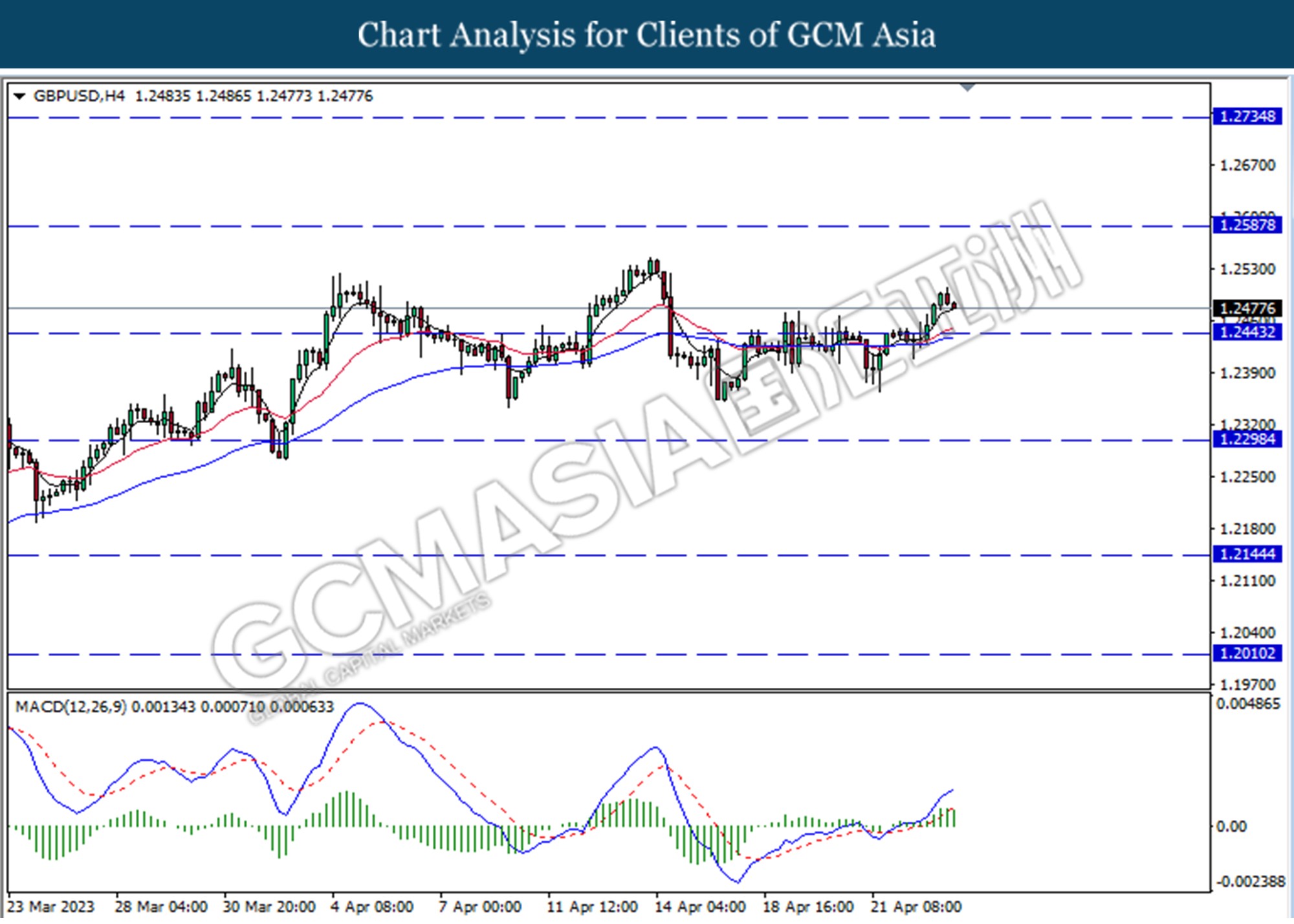

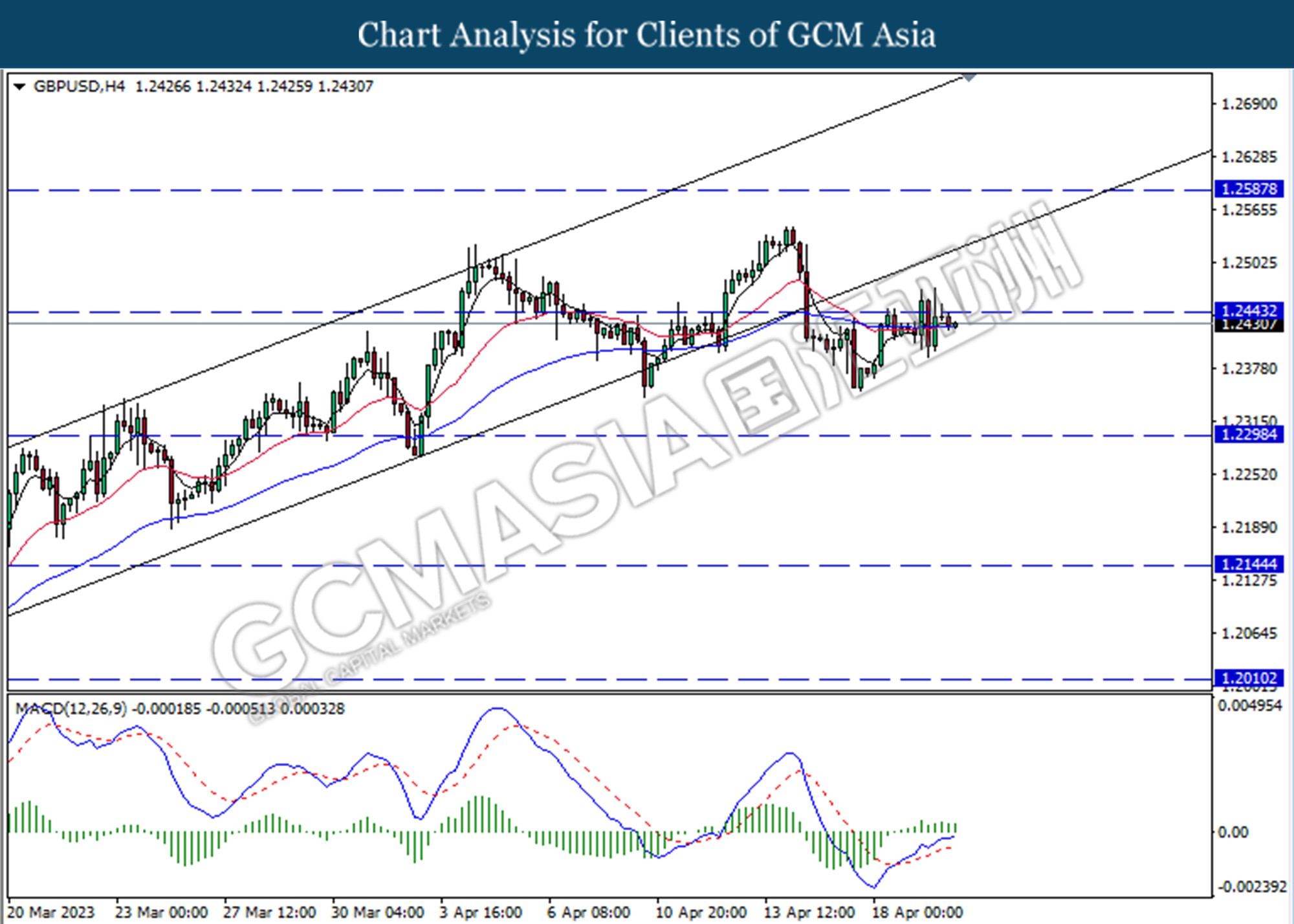

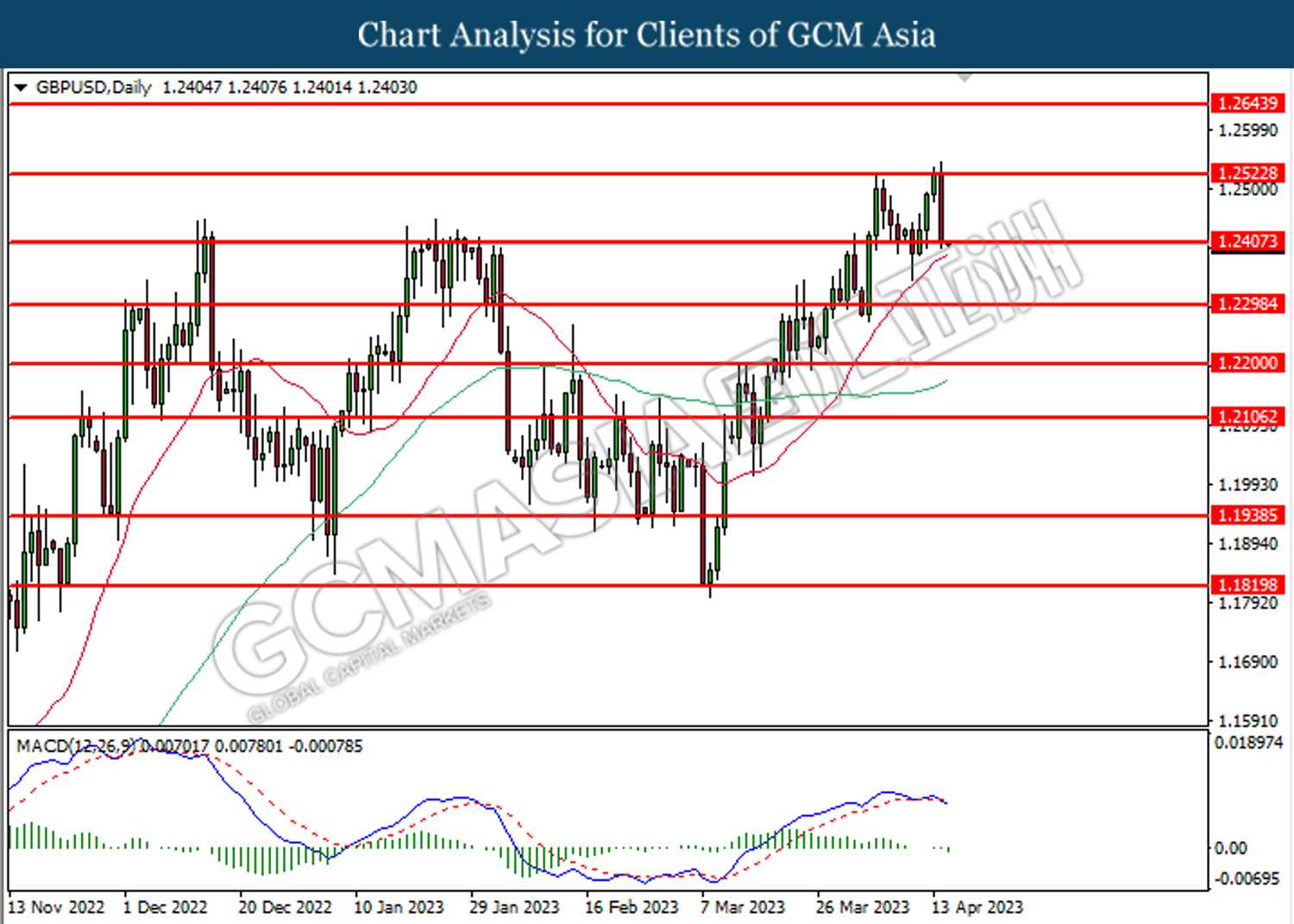

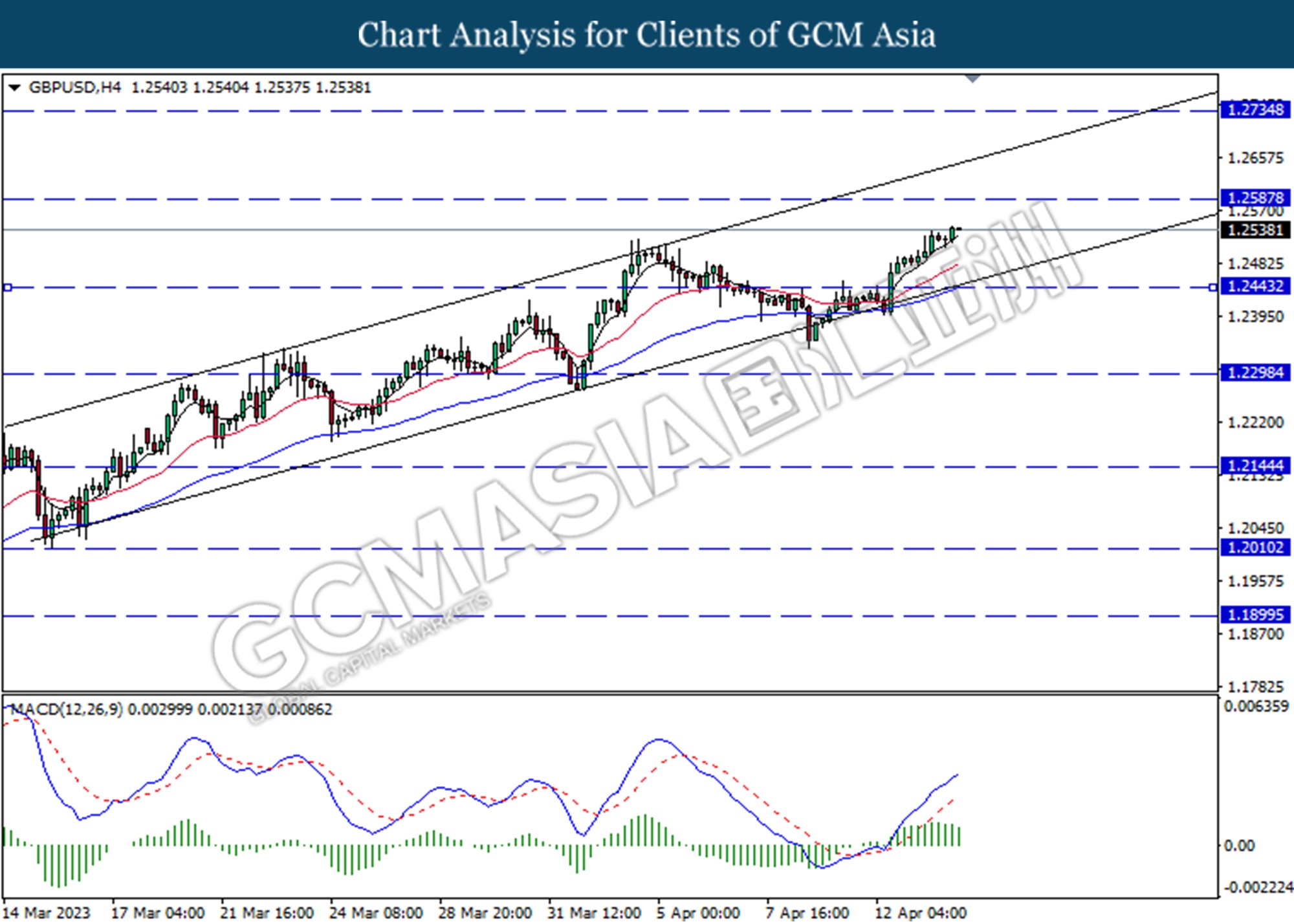

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.2590.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

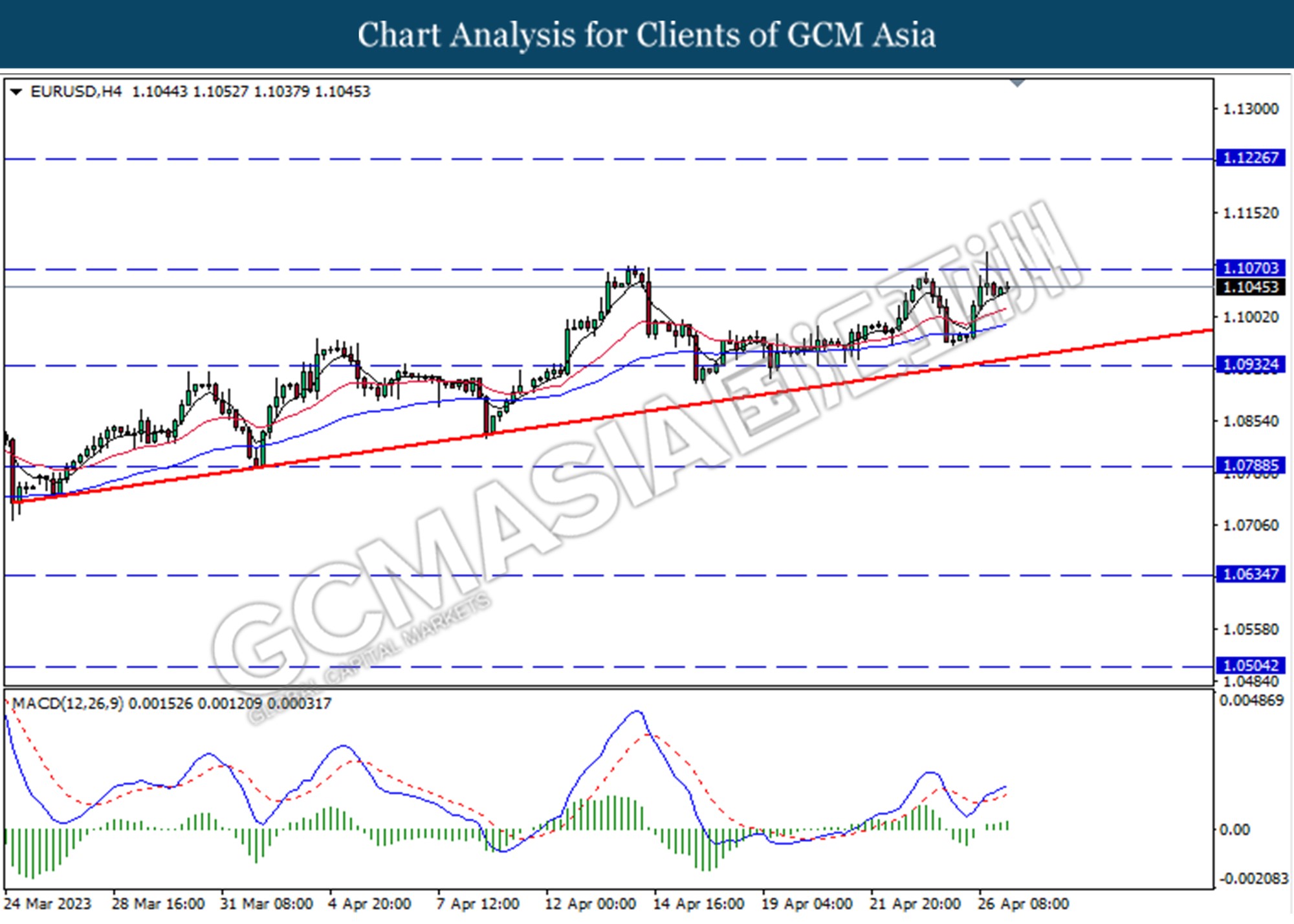

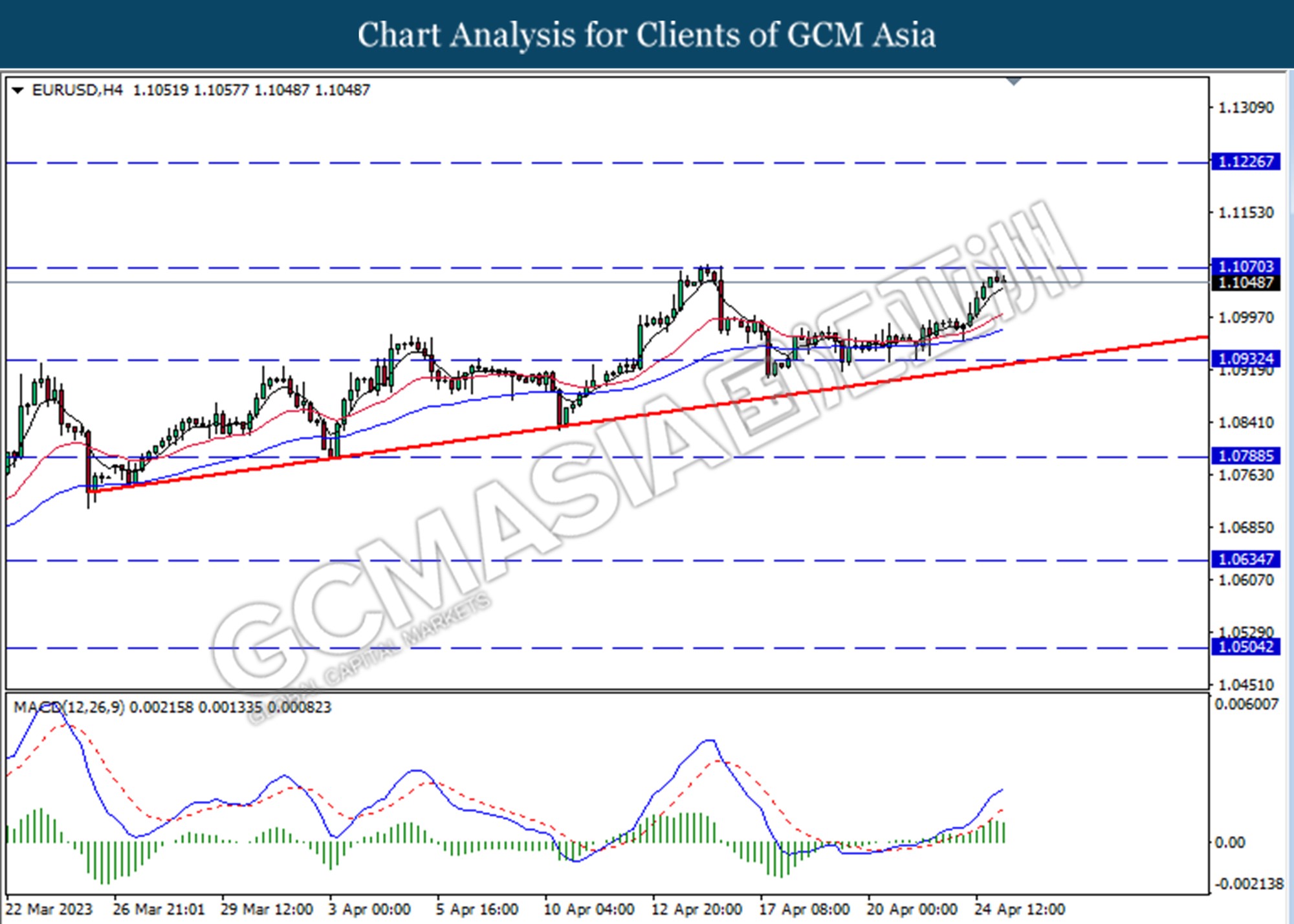

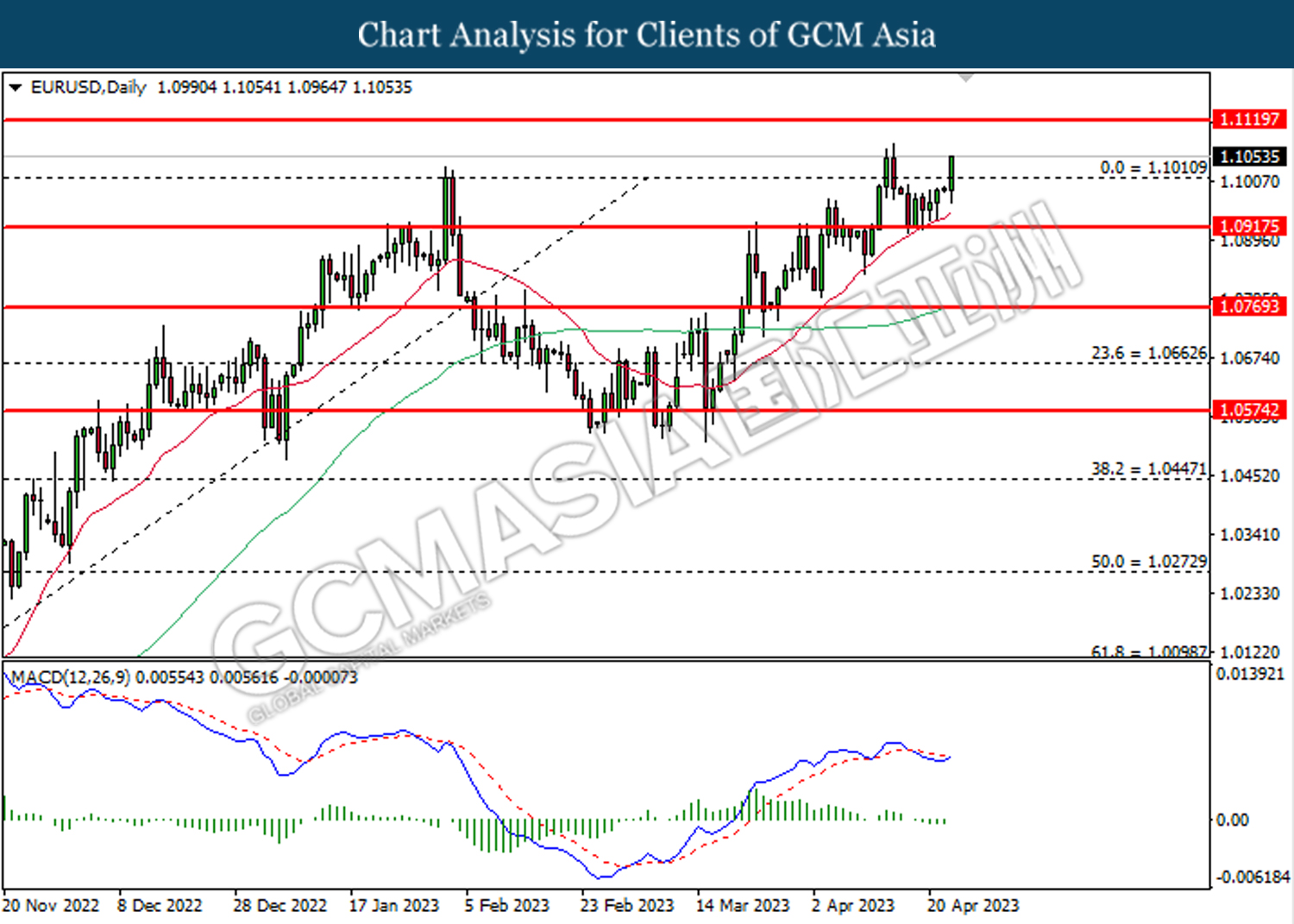

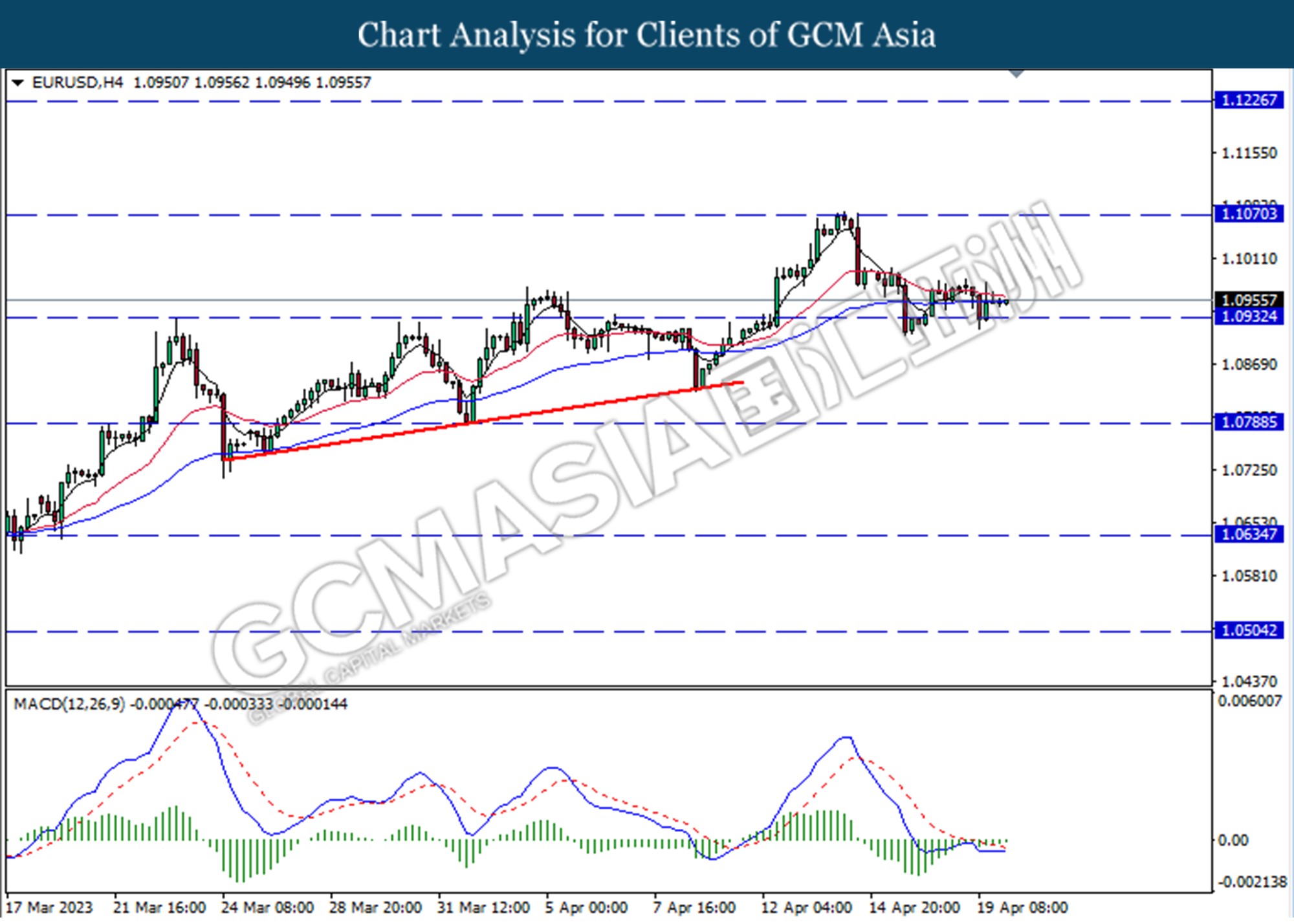

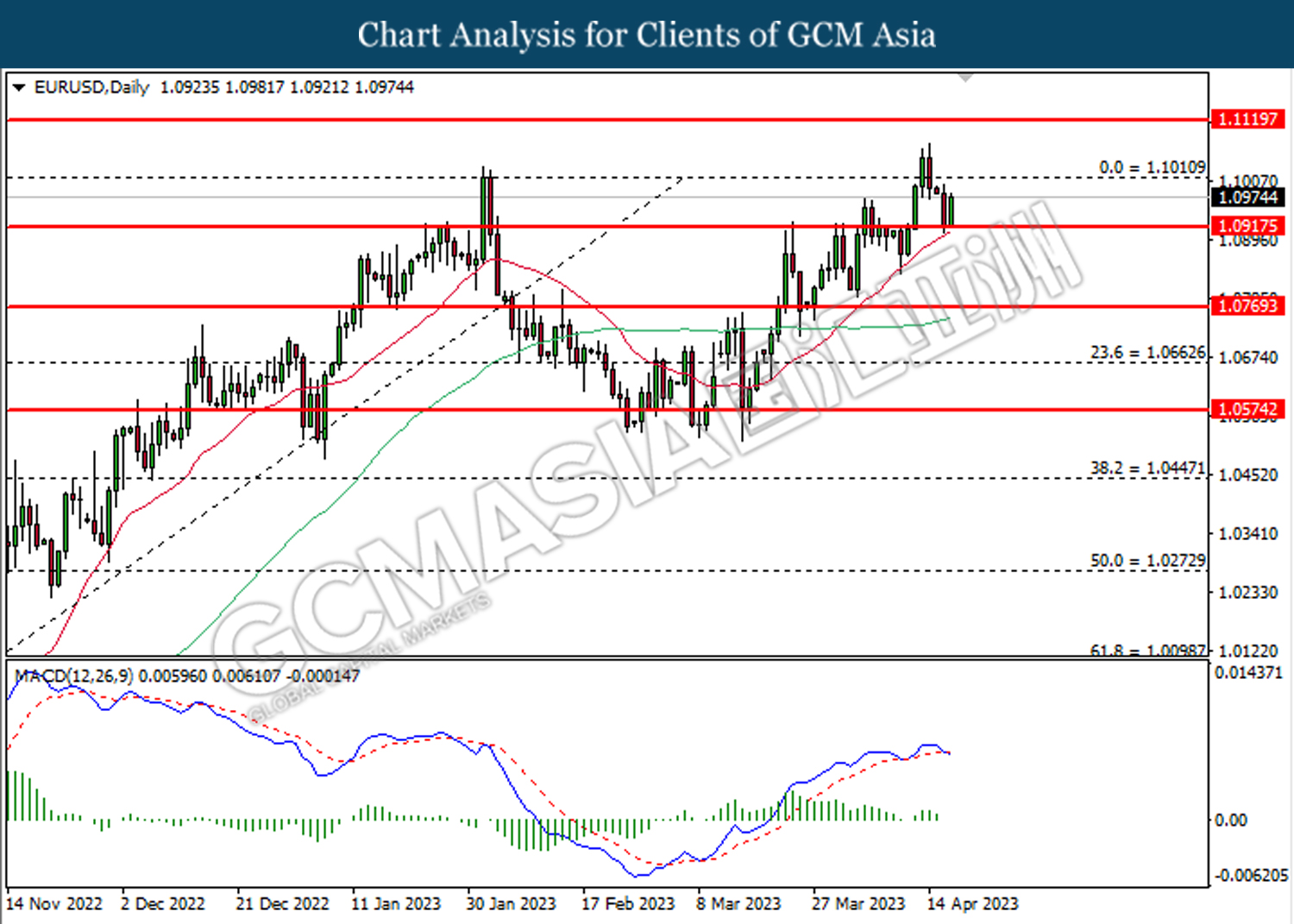

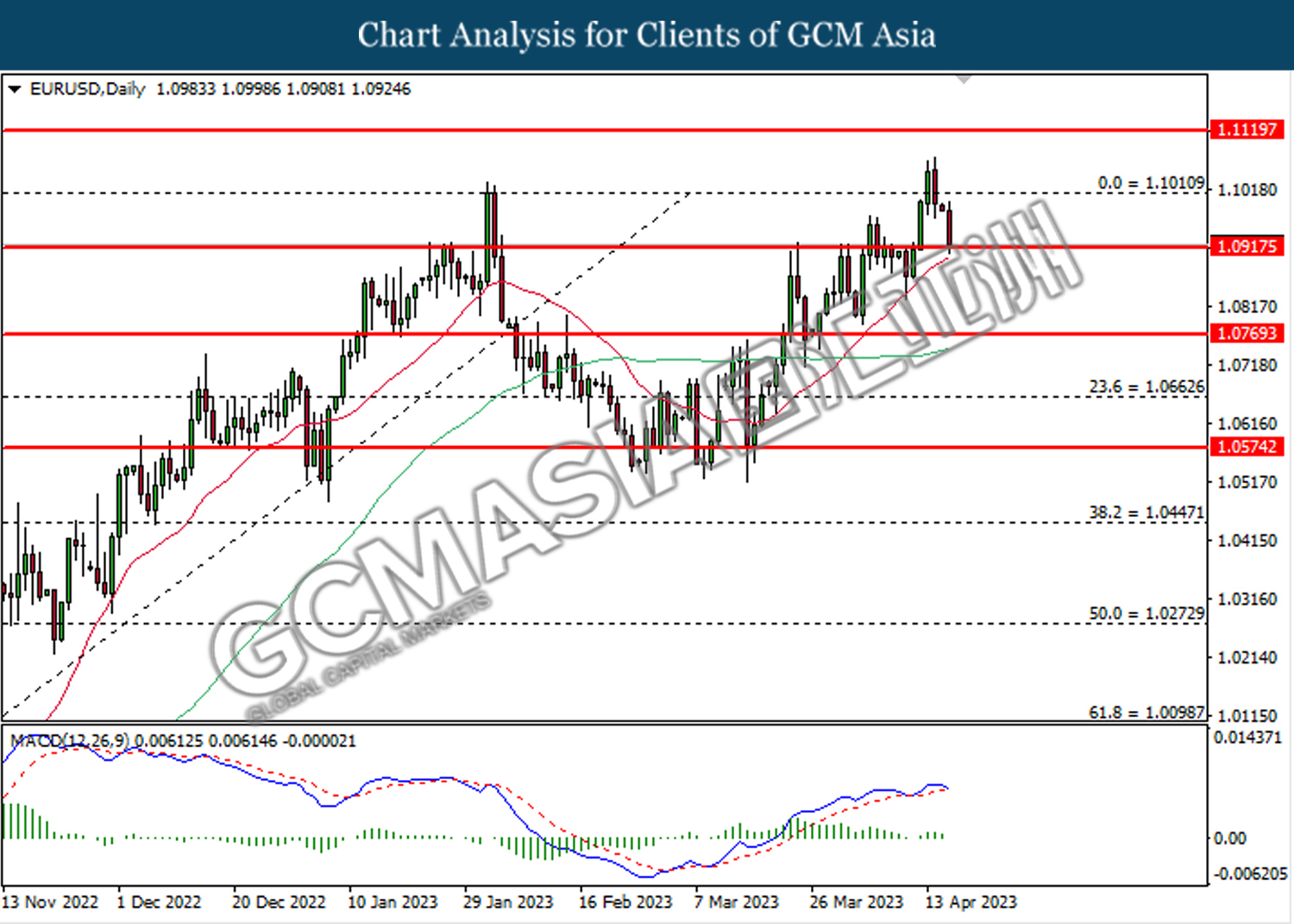

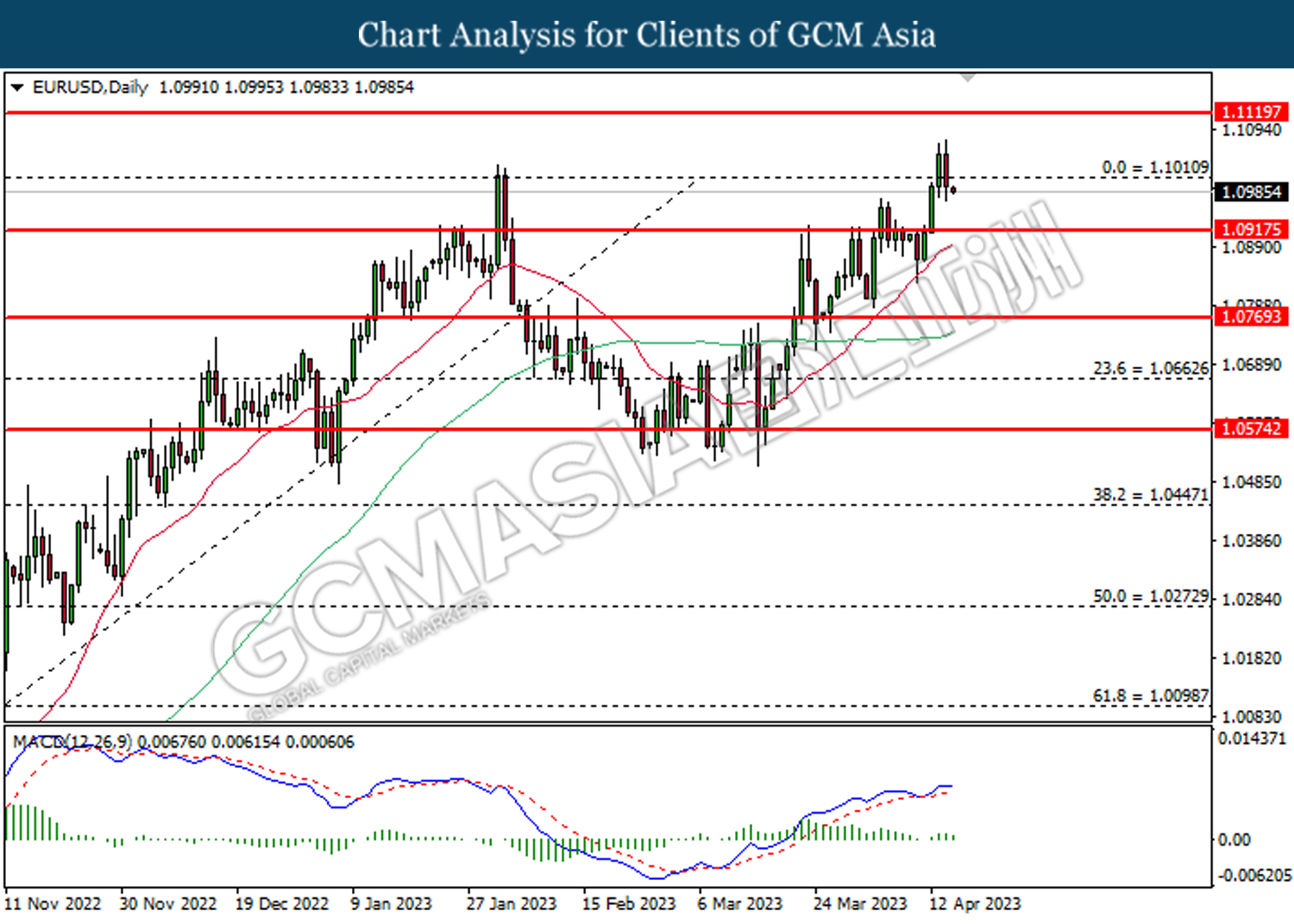

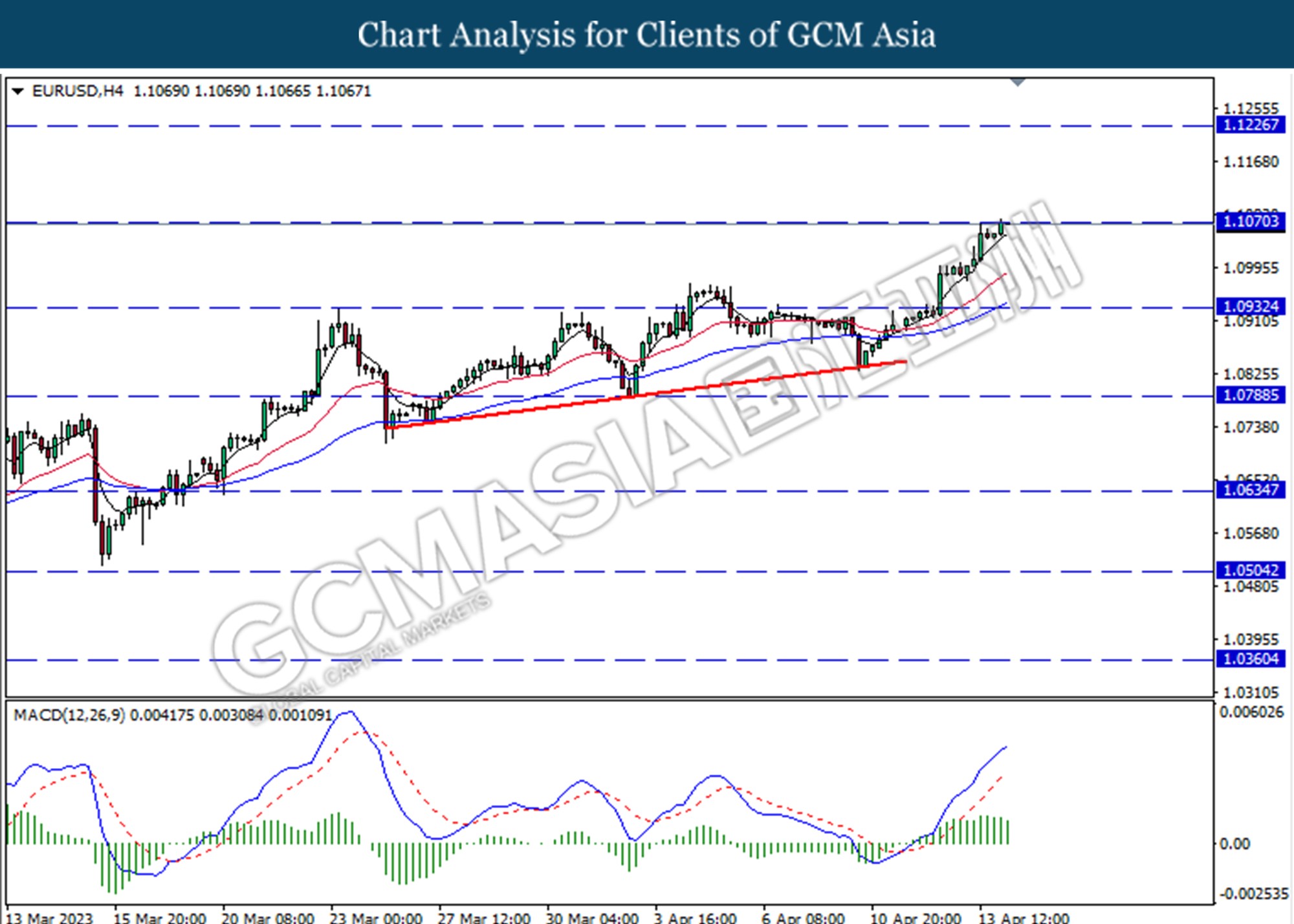

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1070. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully breakout above the resistance level.

Resistance level: 1.1070, 1.1225

Support level: 1.0.930, 1.0790

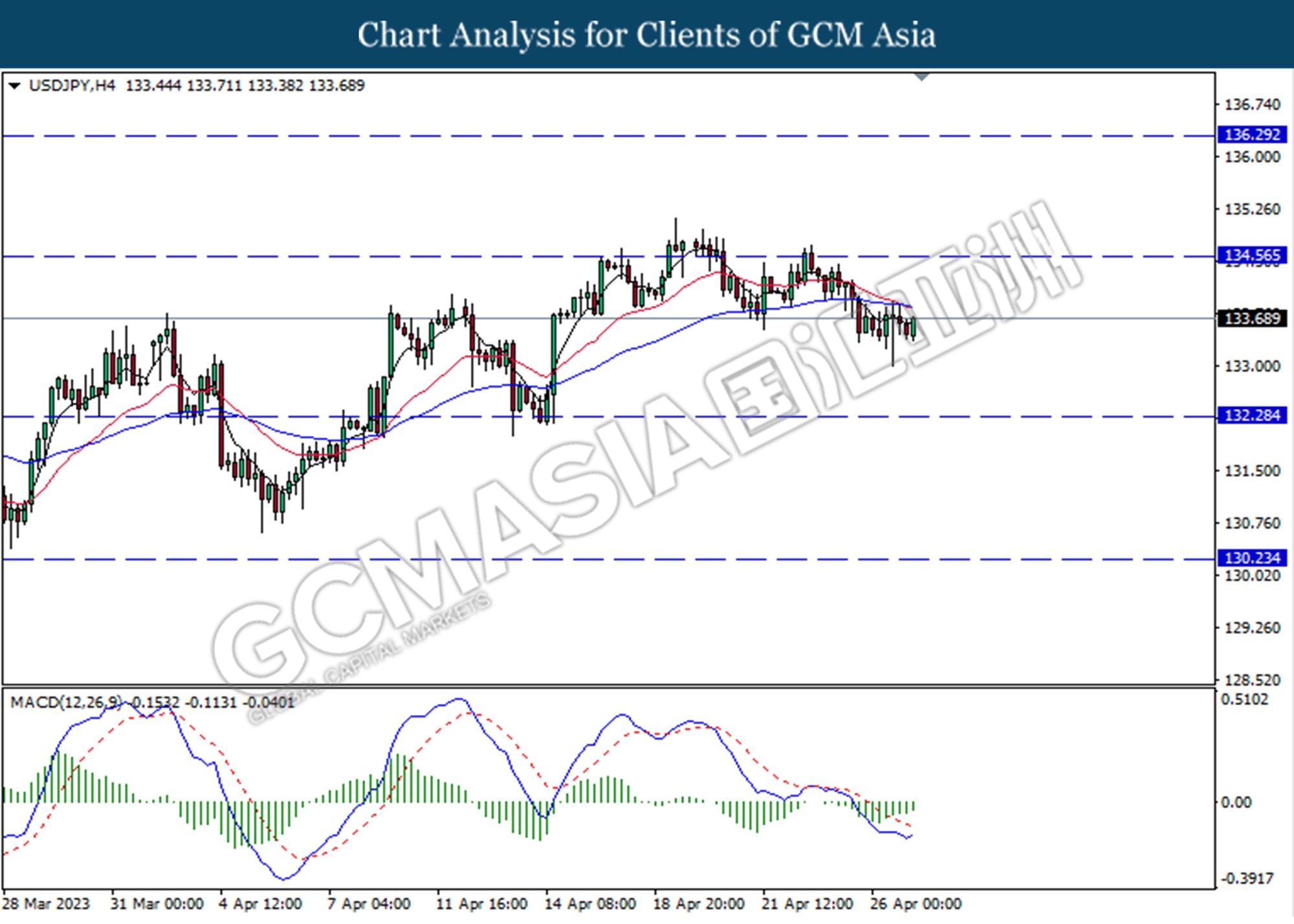

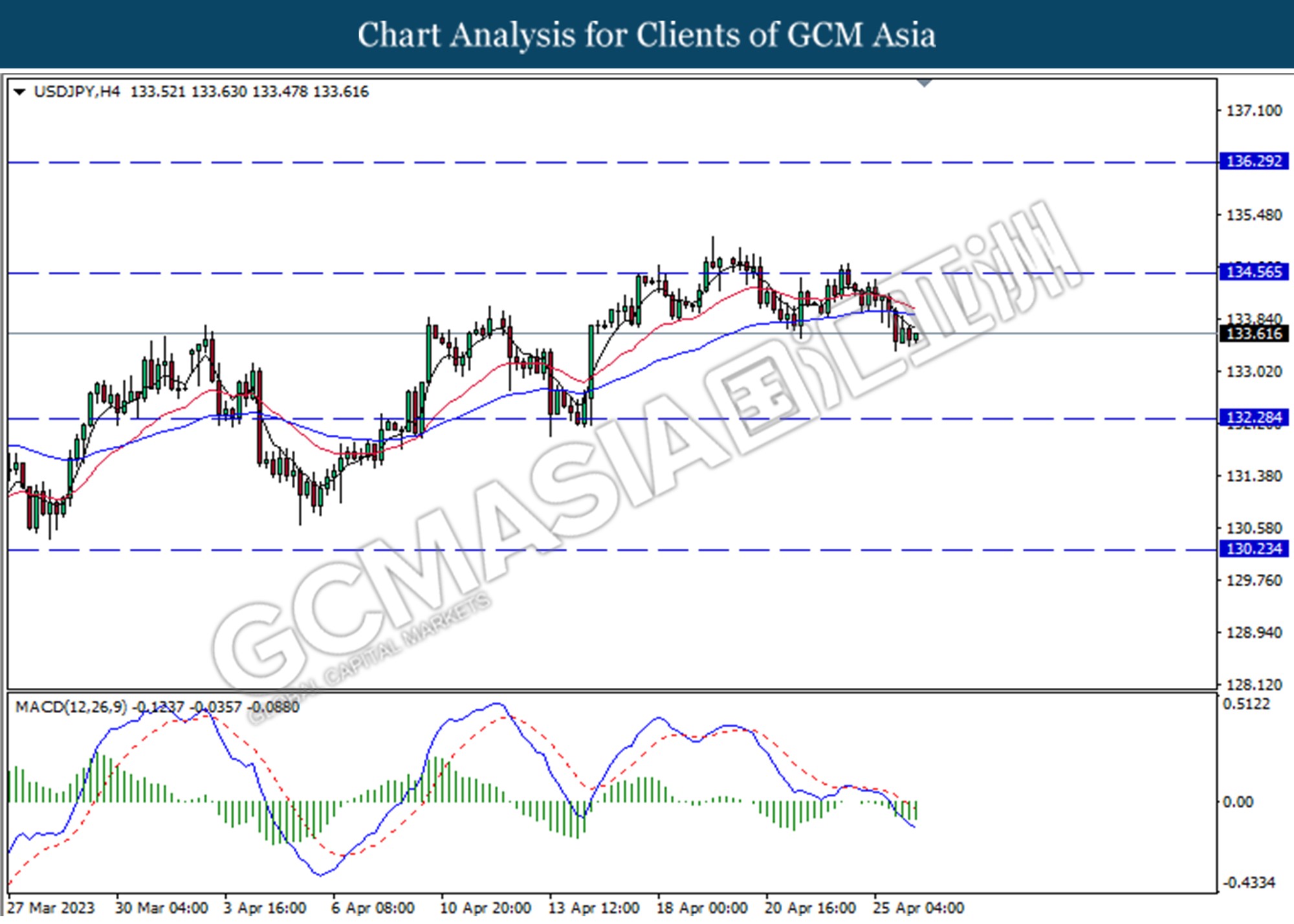

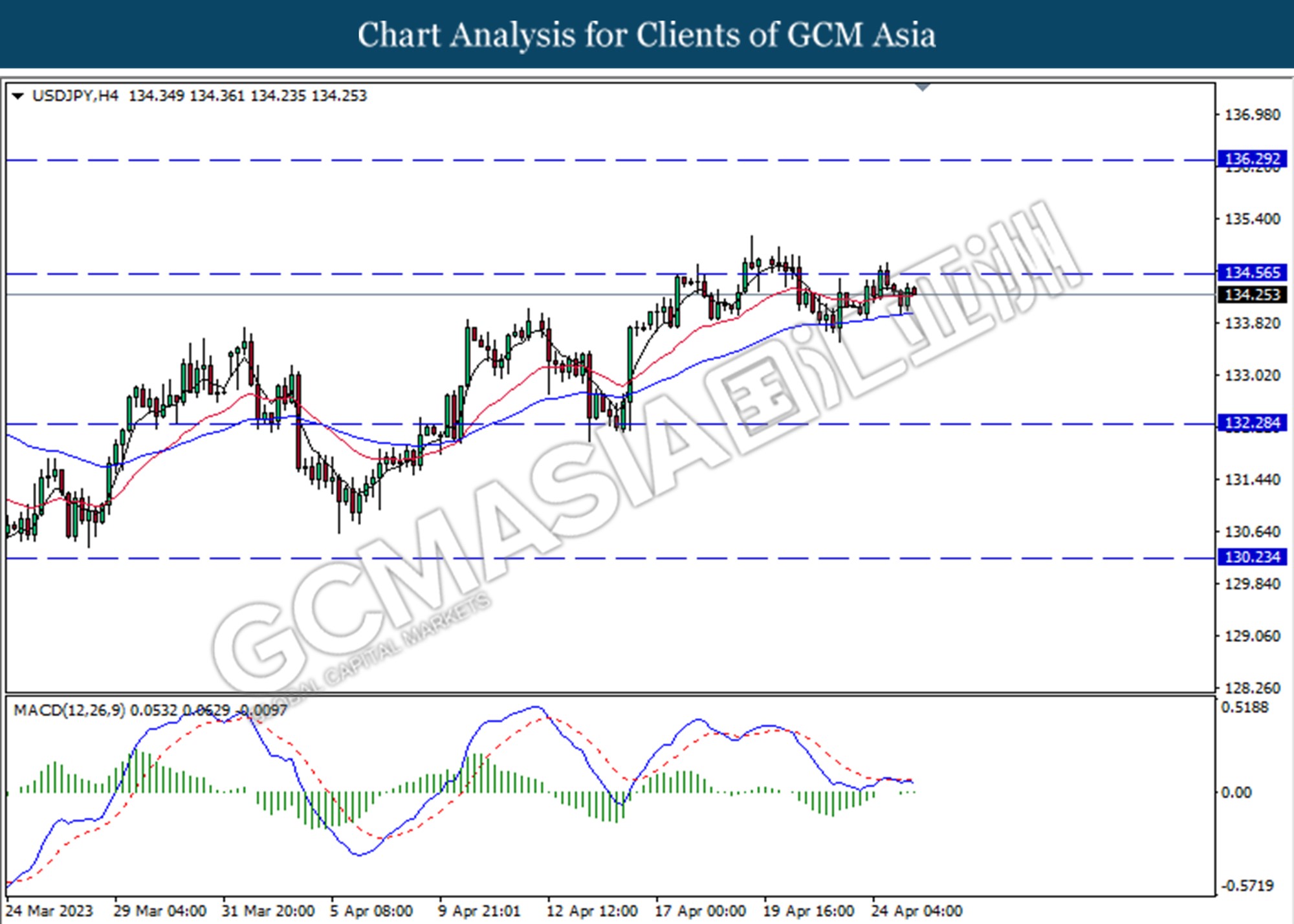

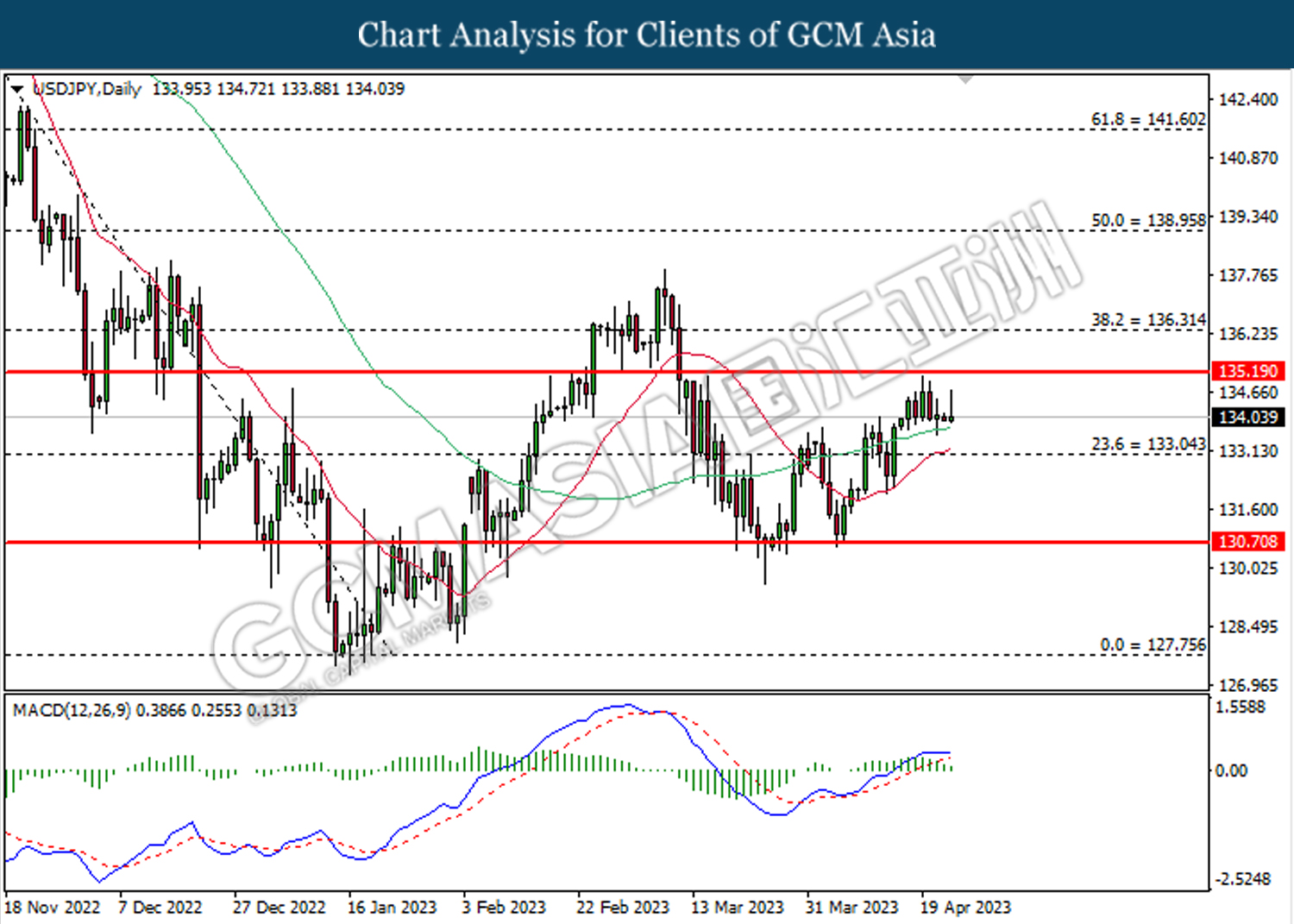

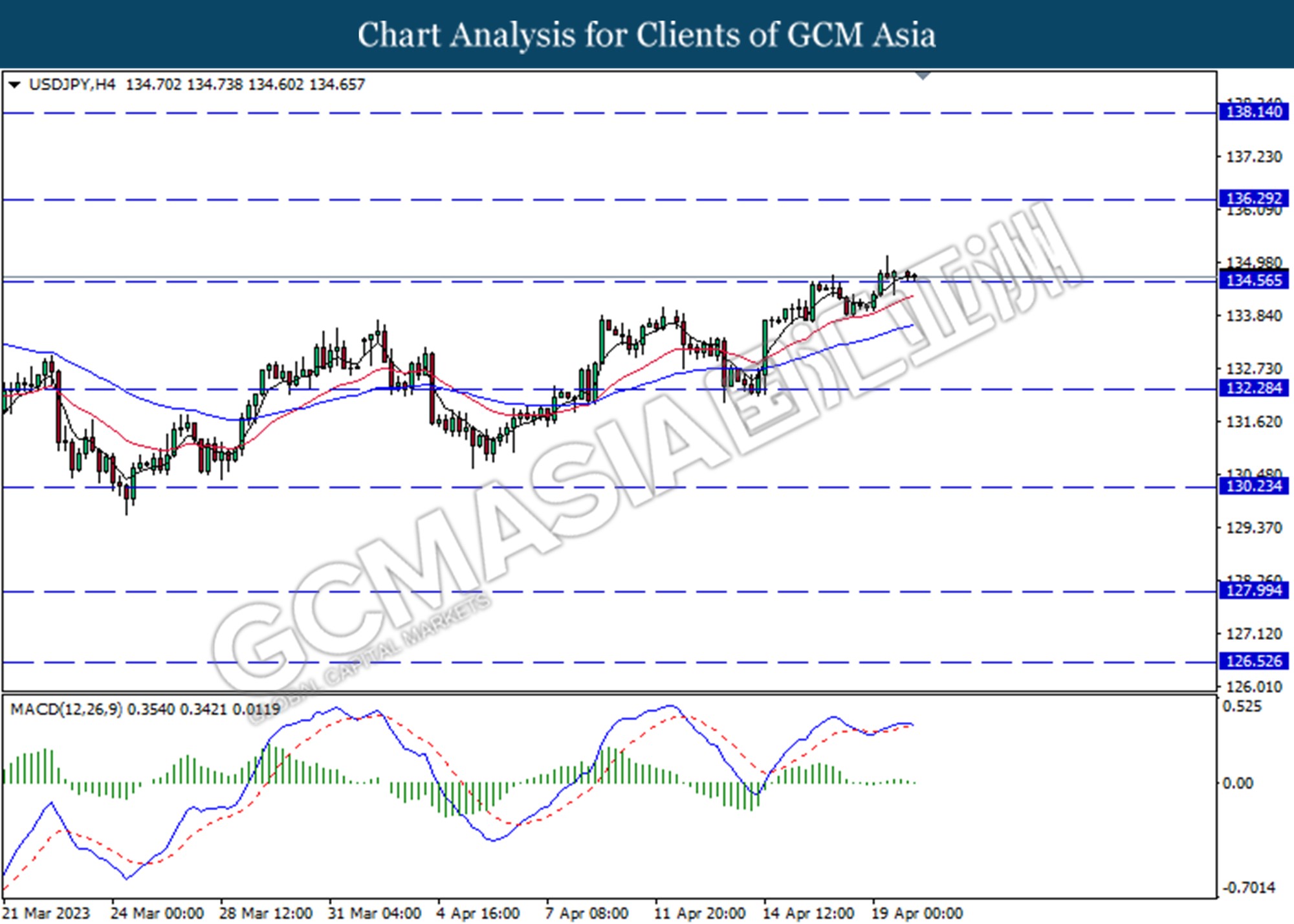

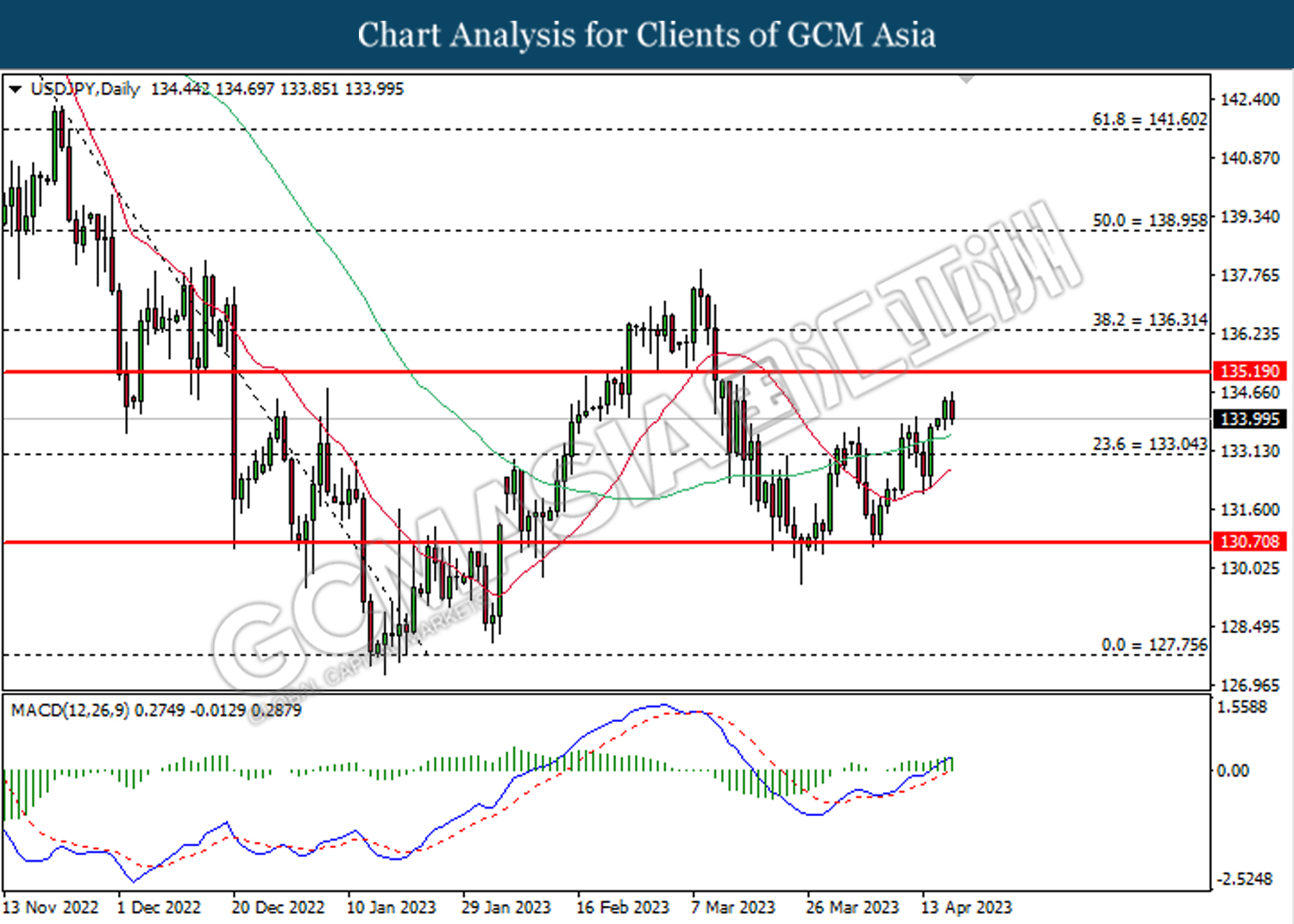

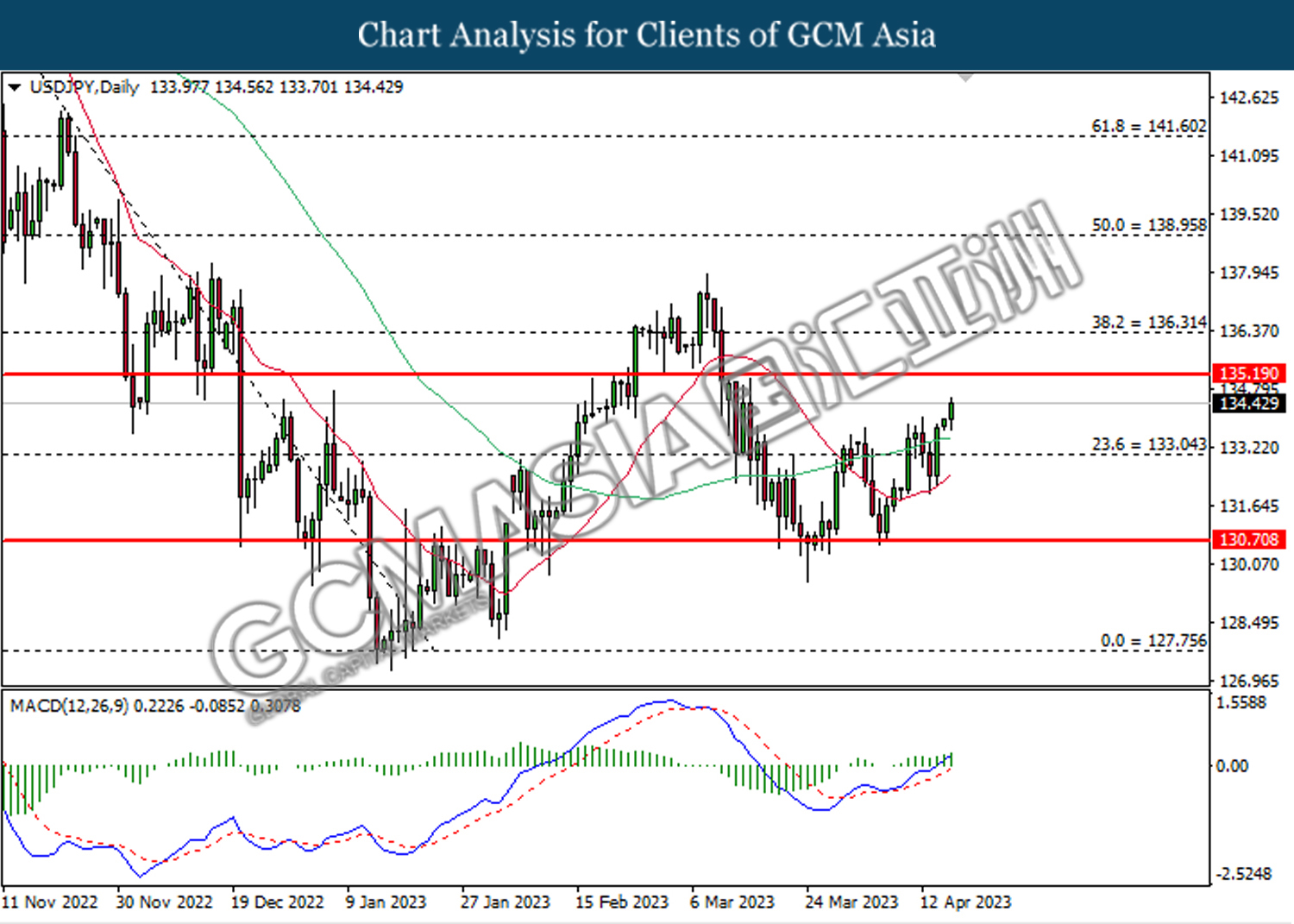

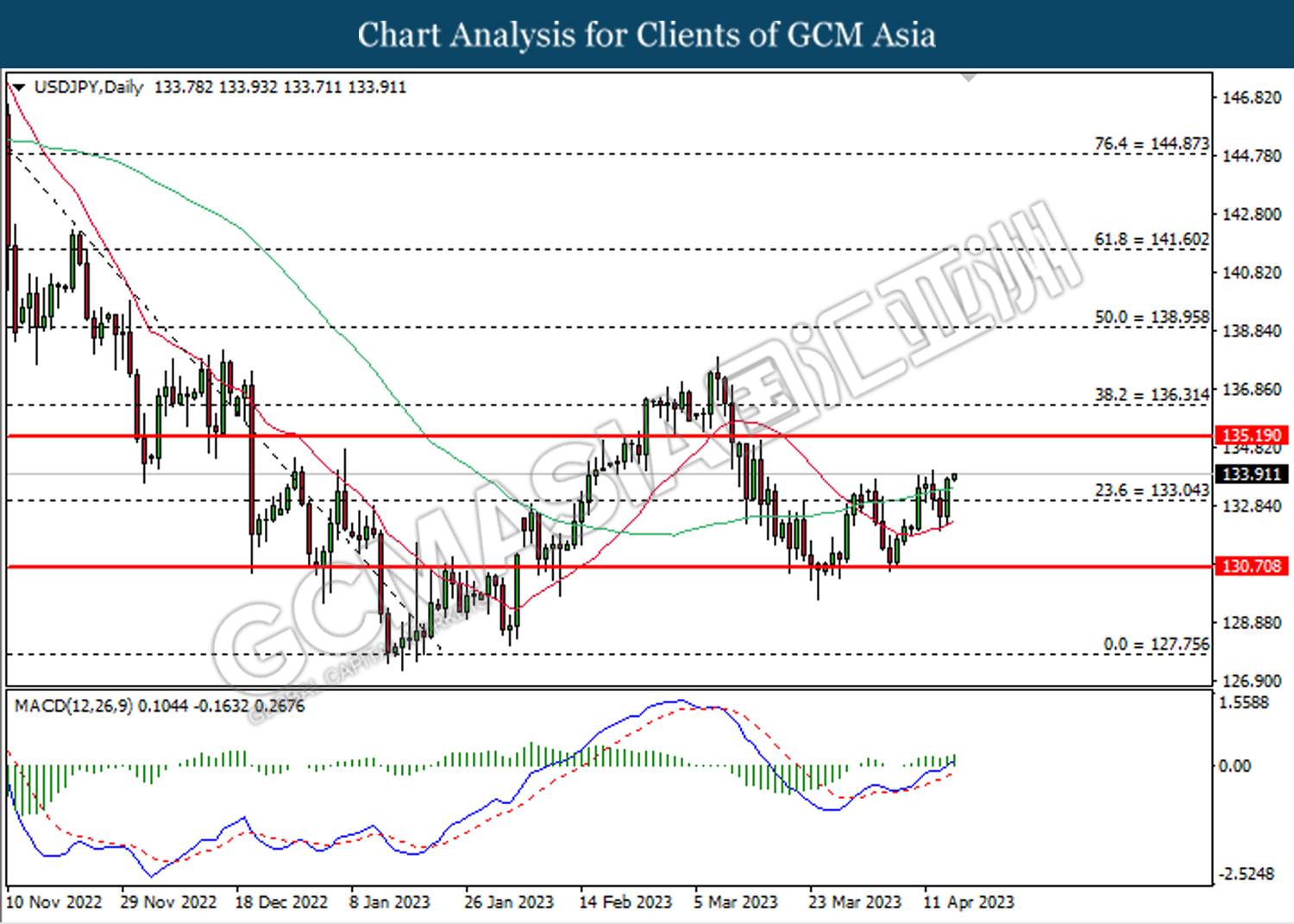

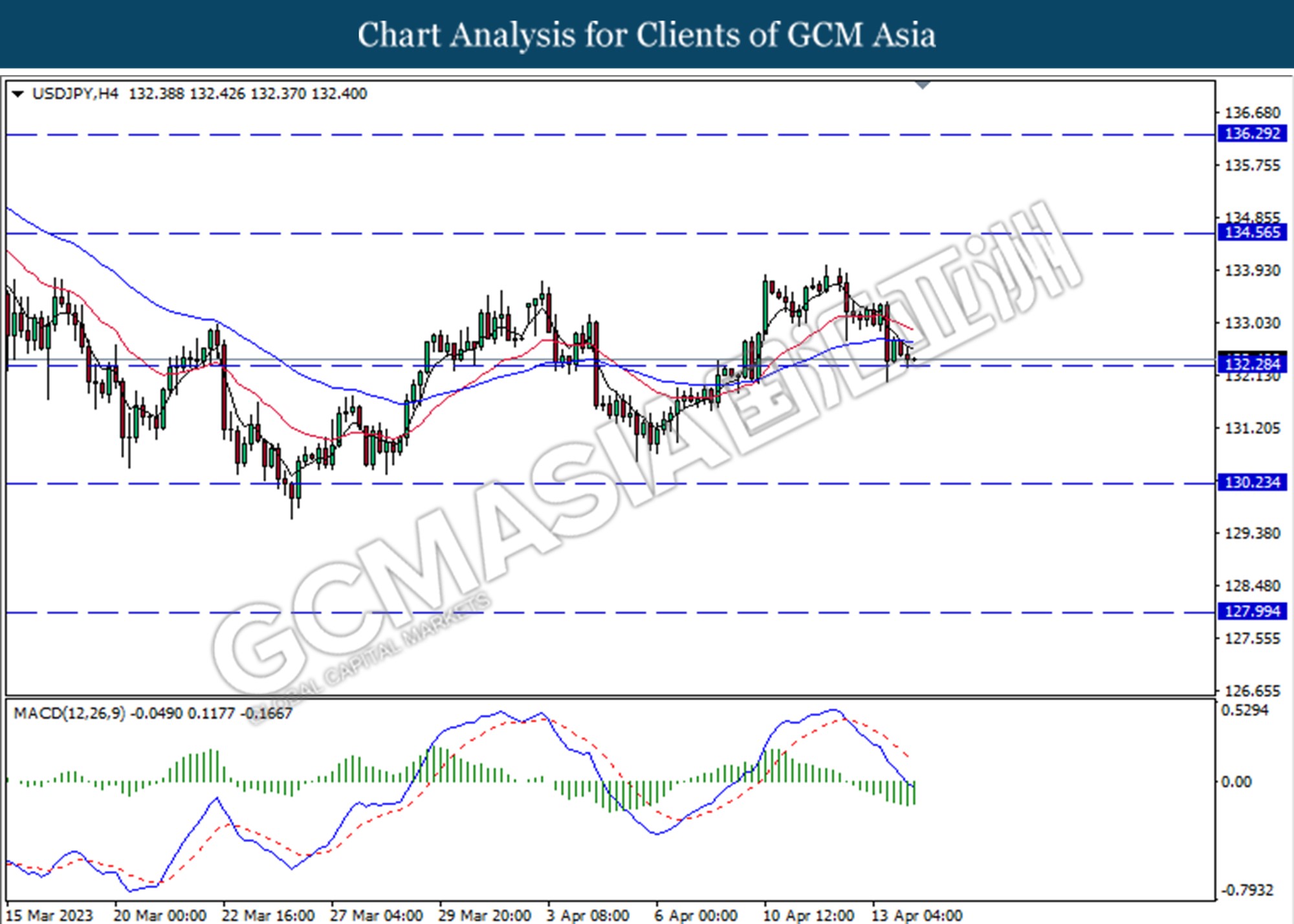

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 134.55.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

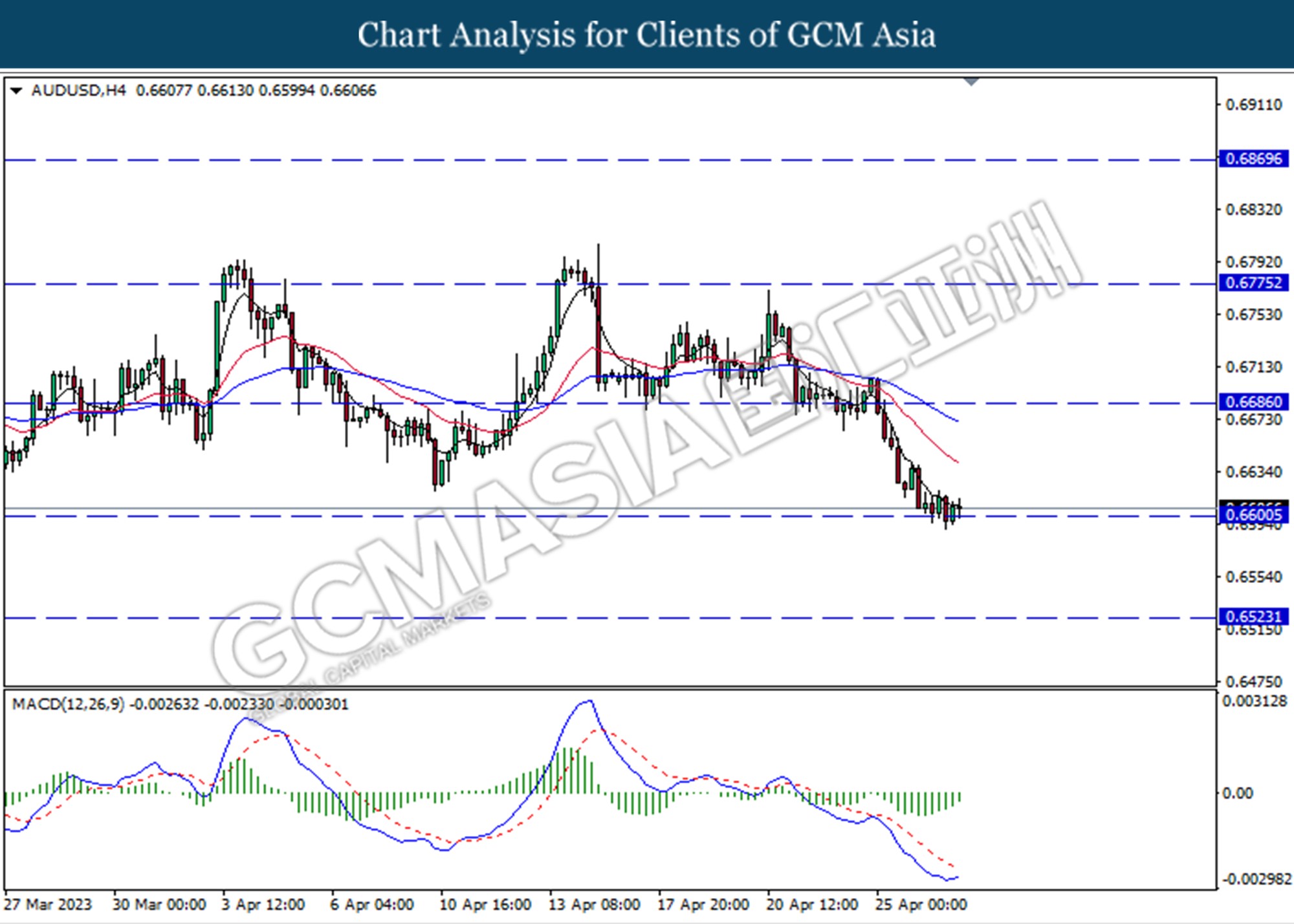

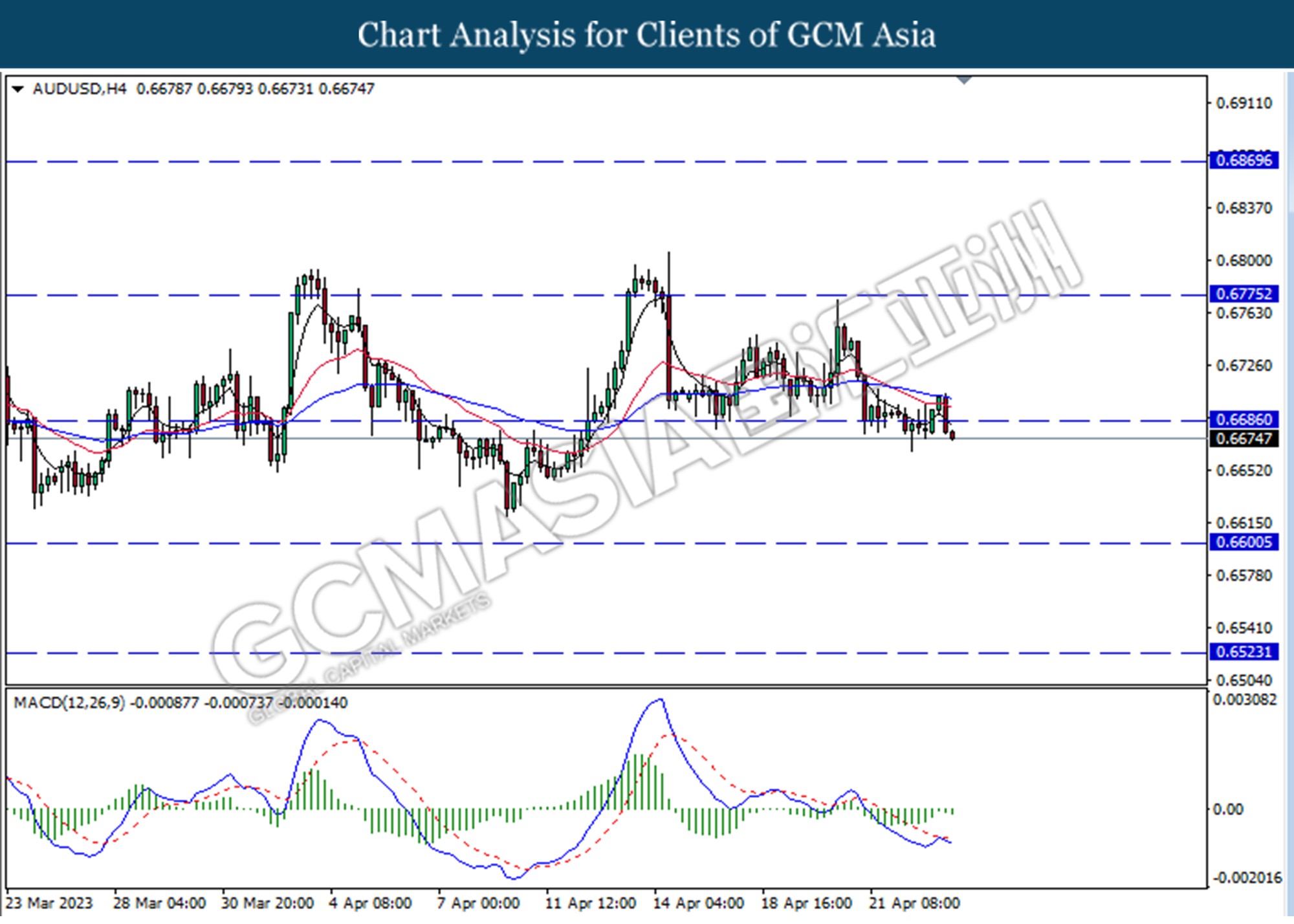

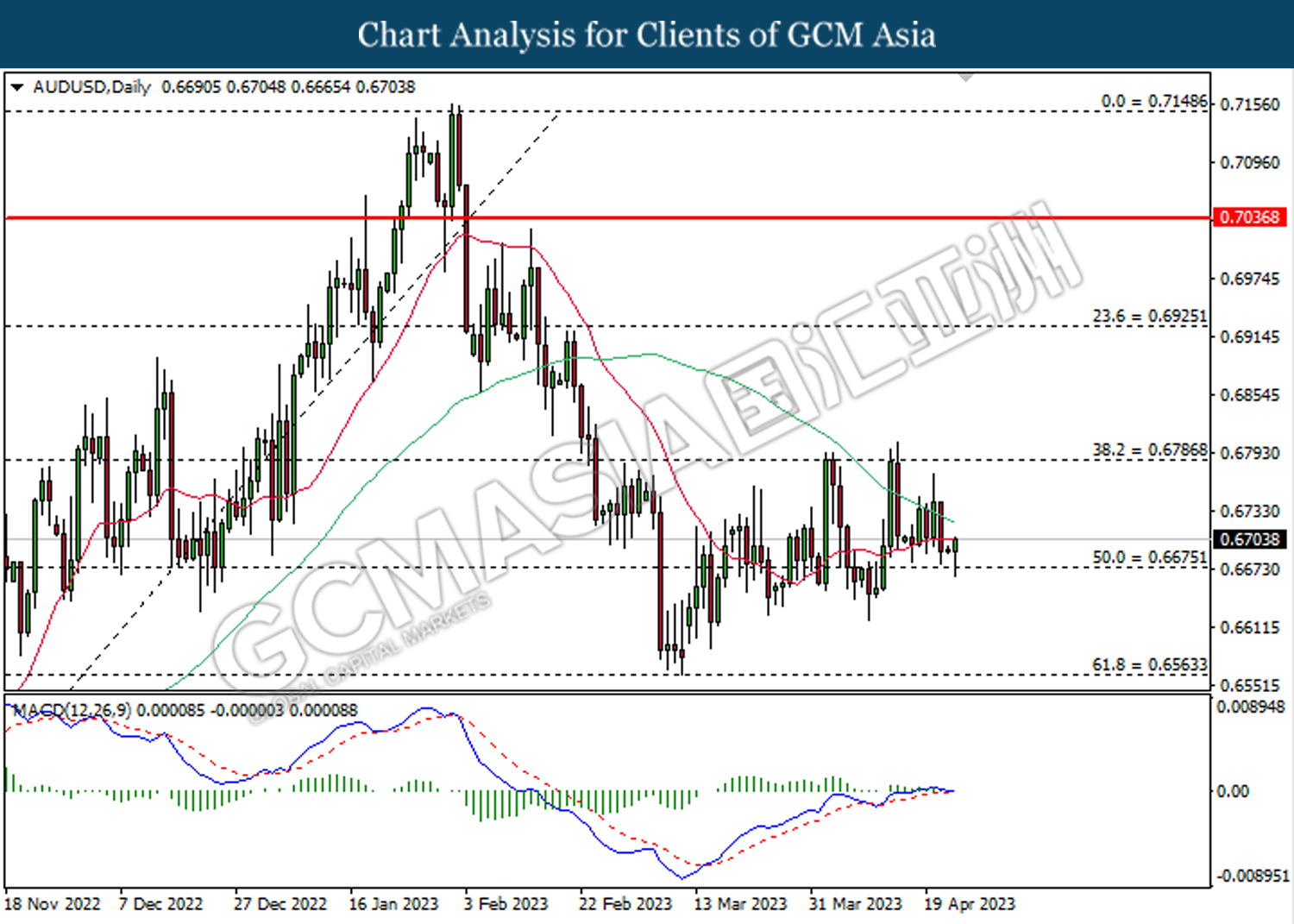

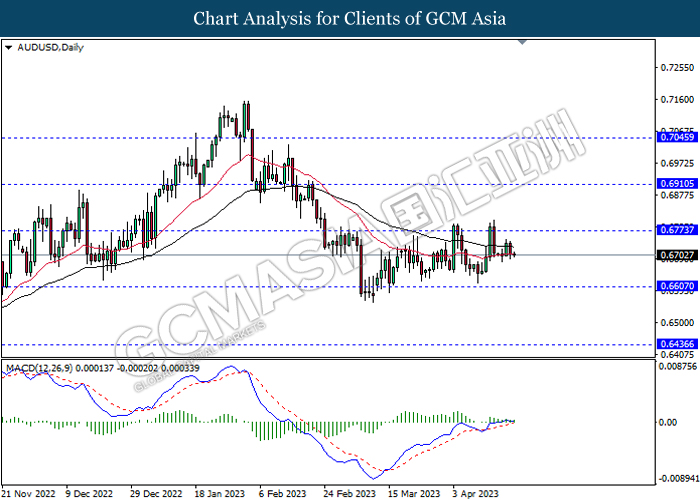

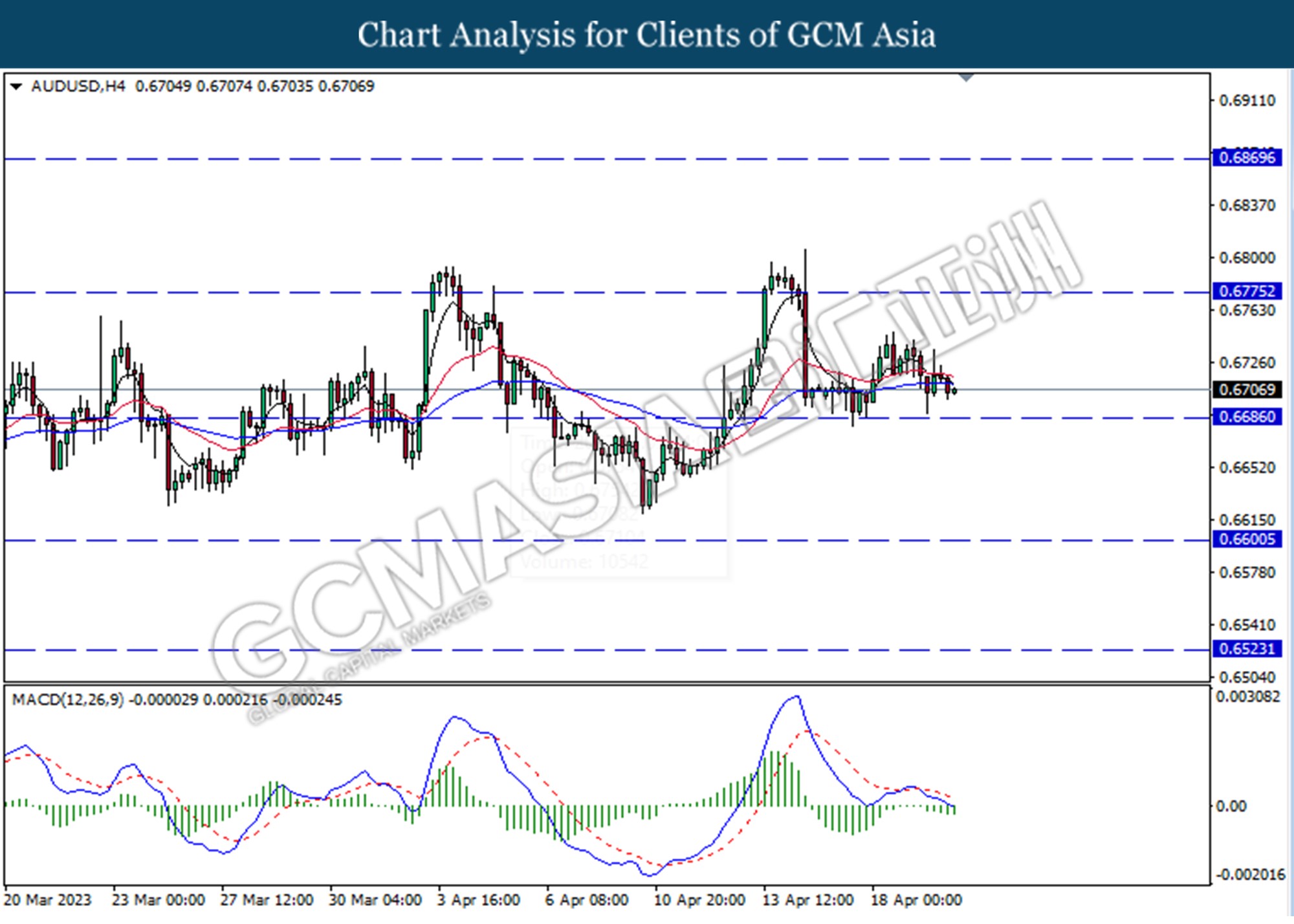

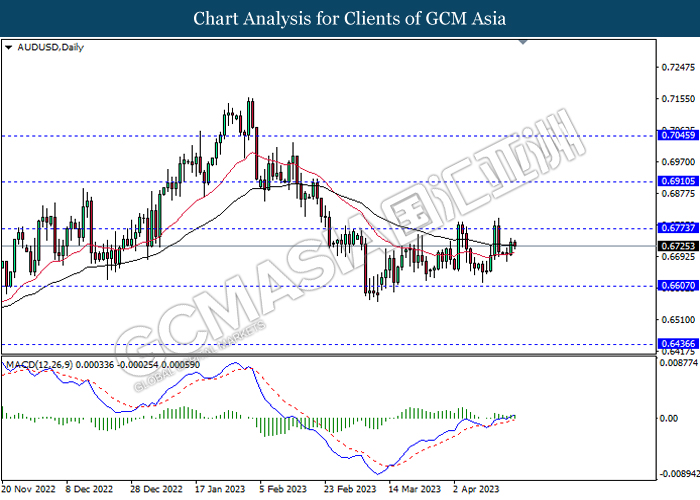

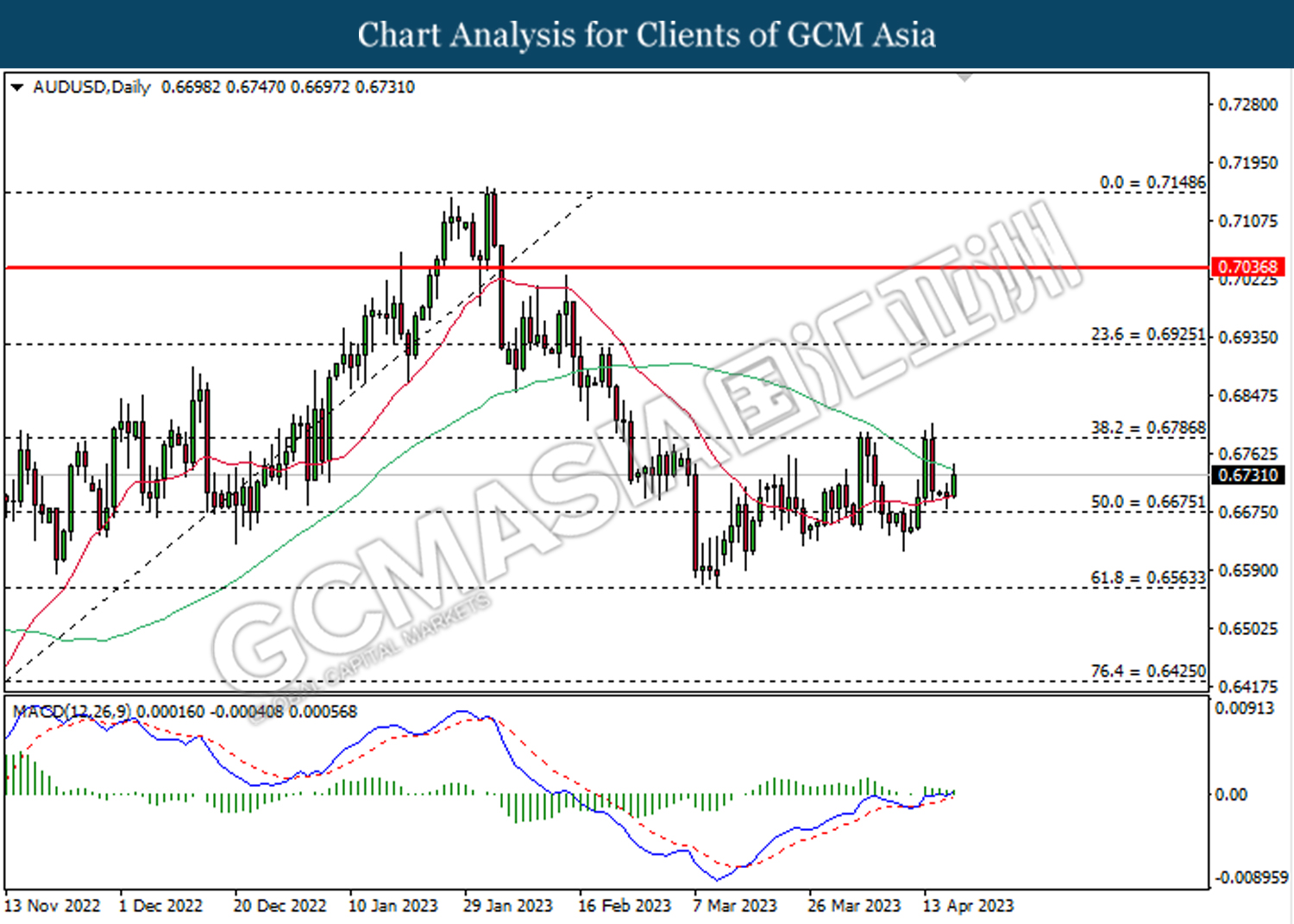

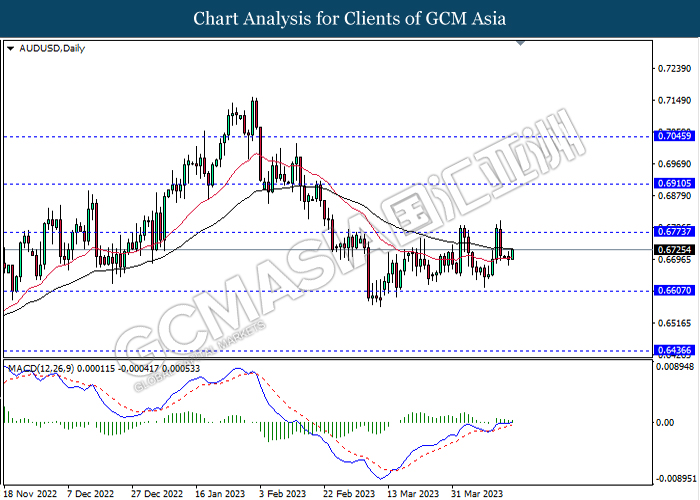

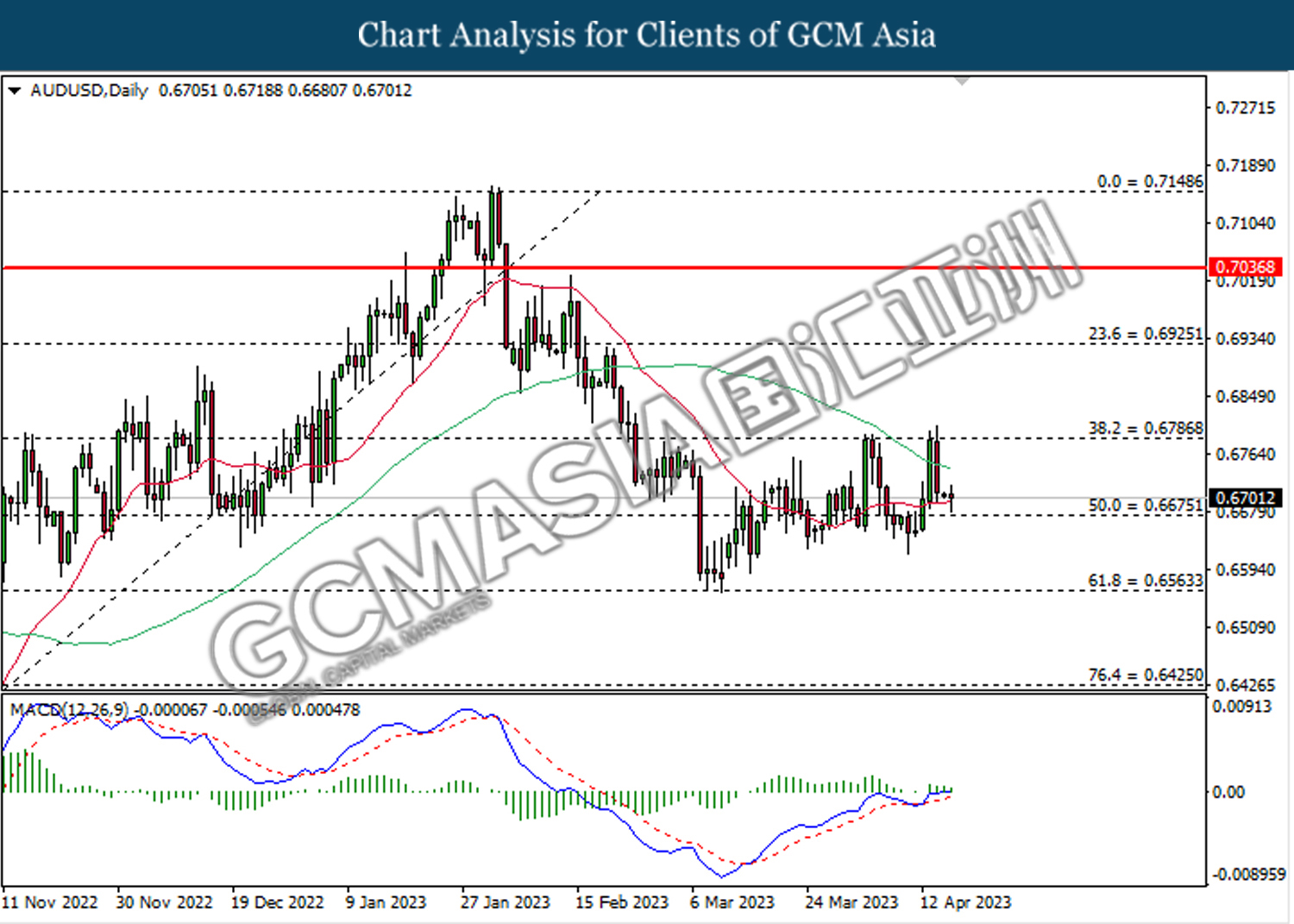

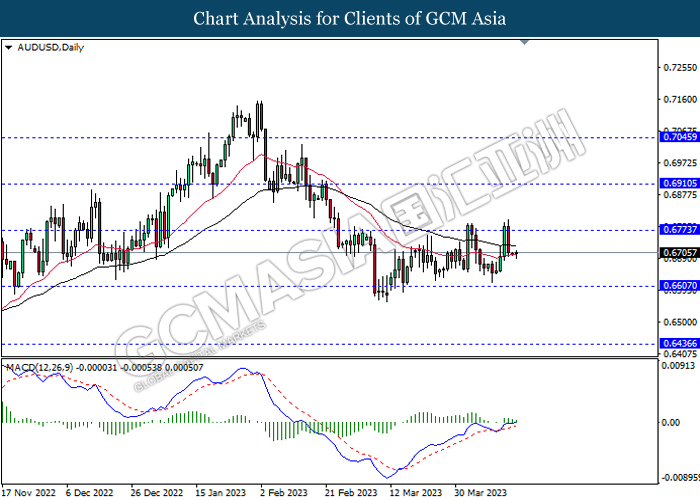

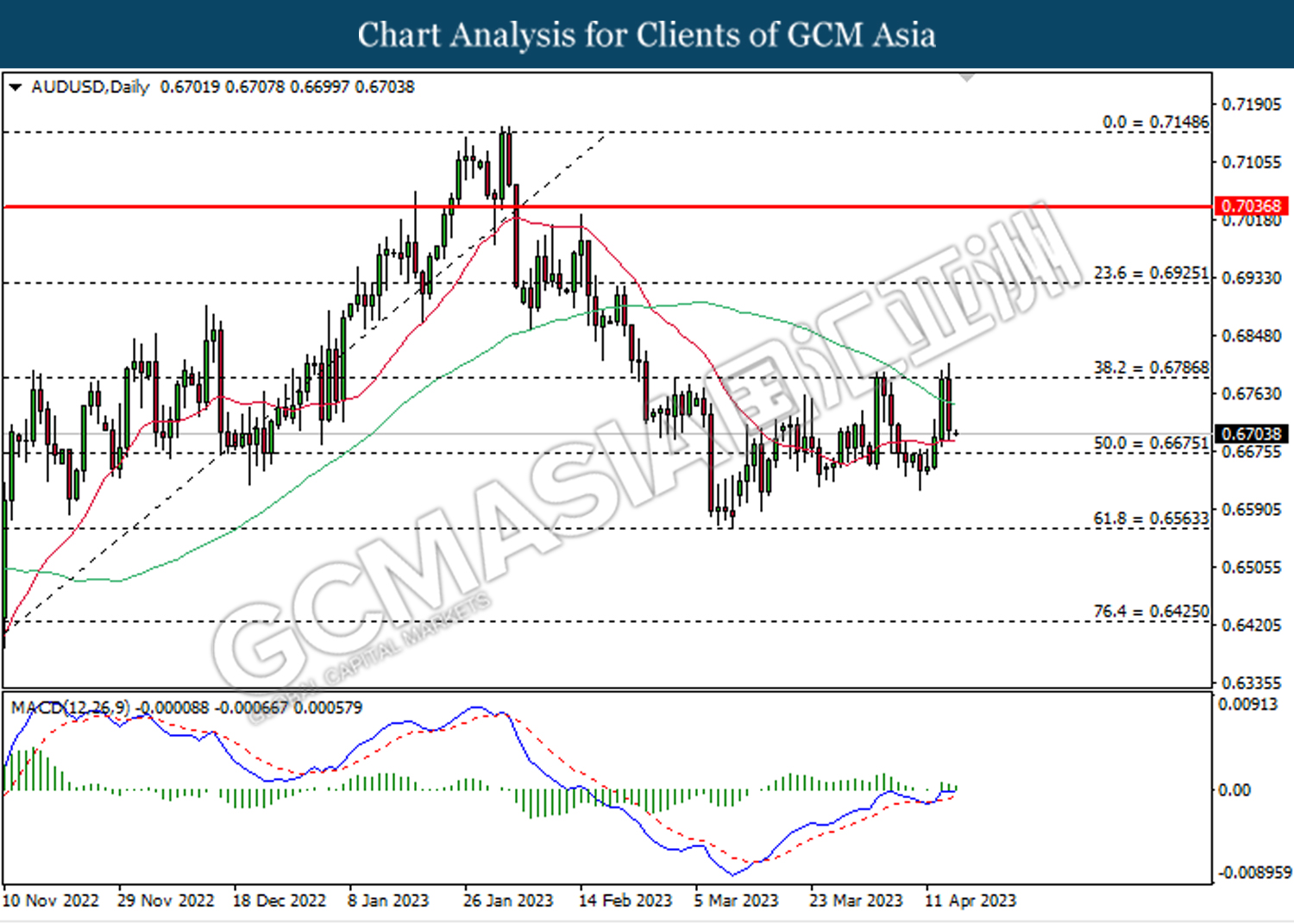

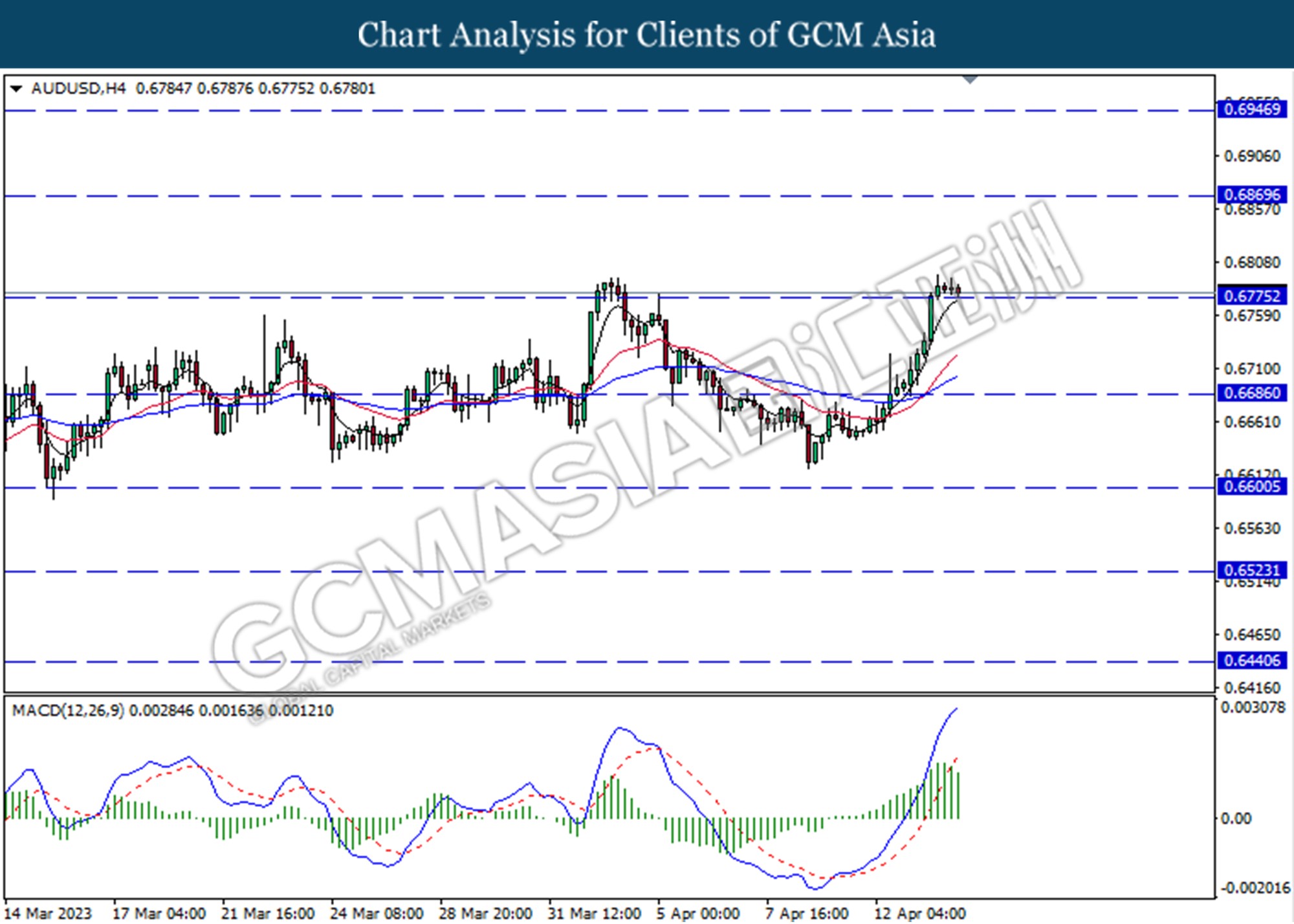

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6600. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

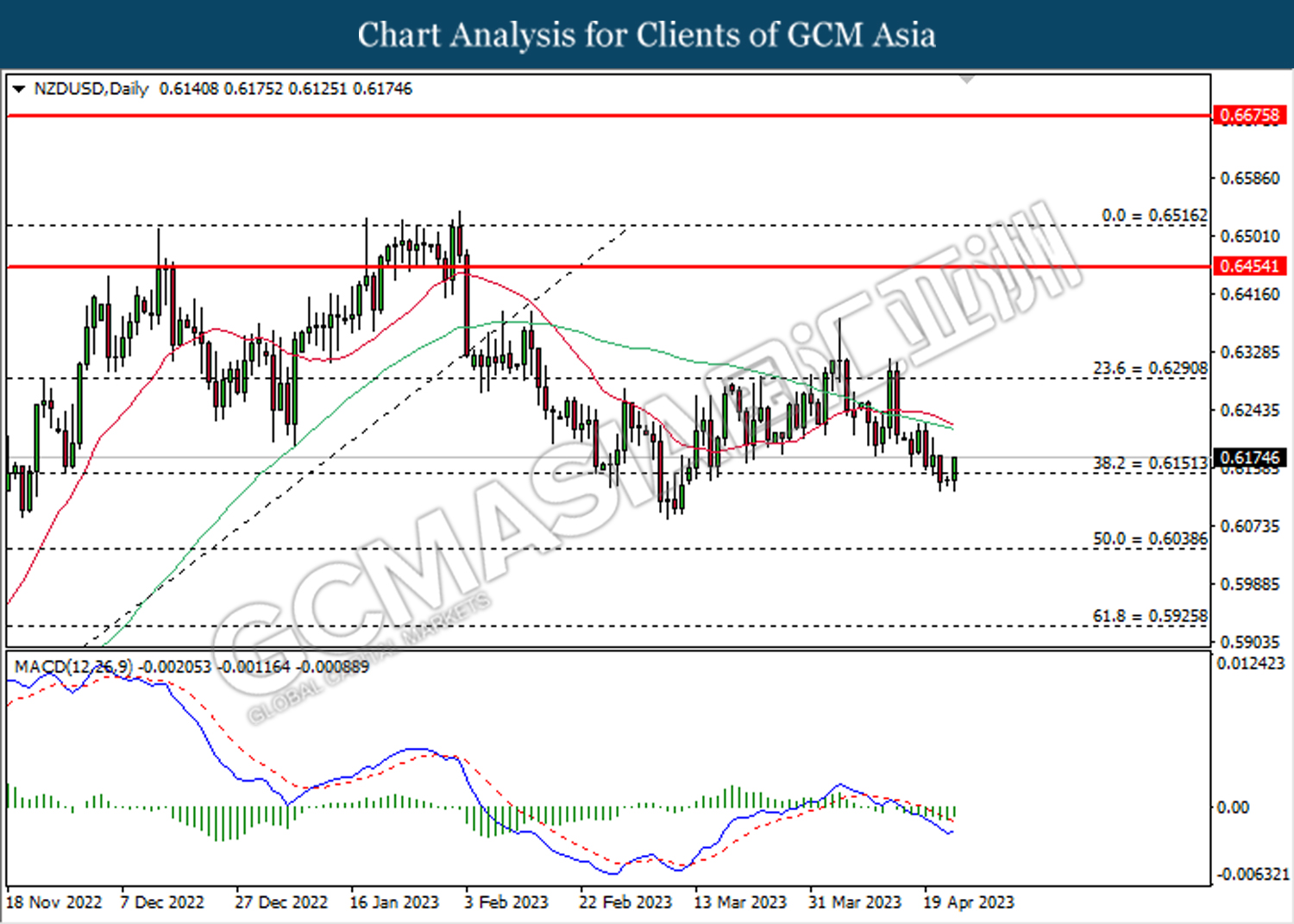

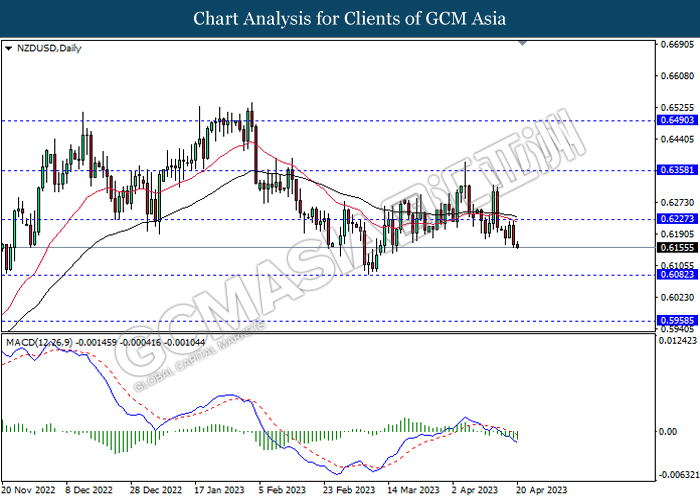

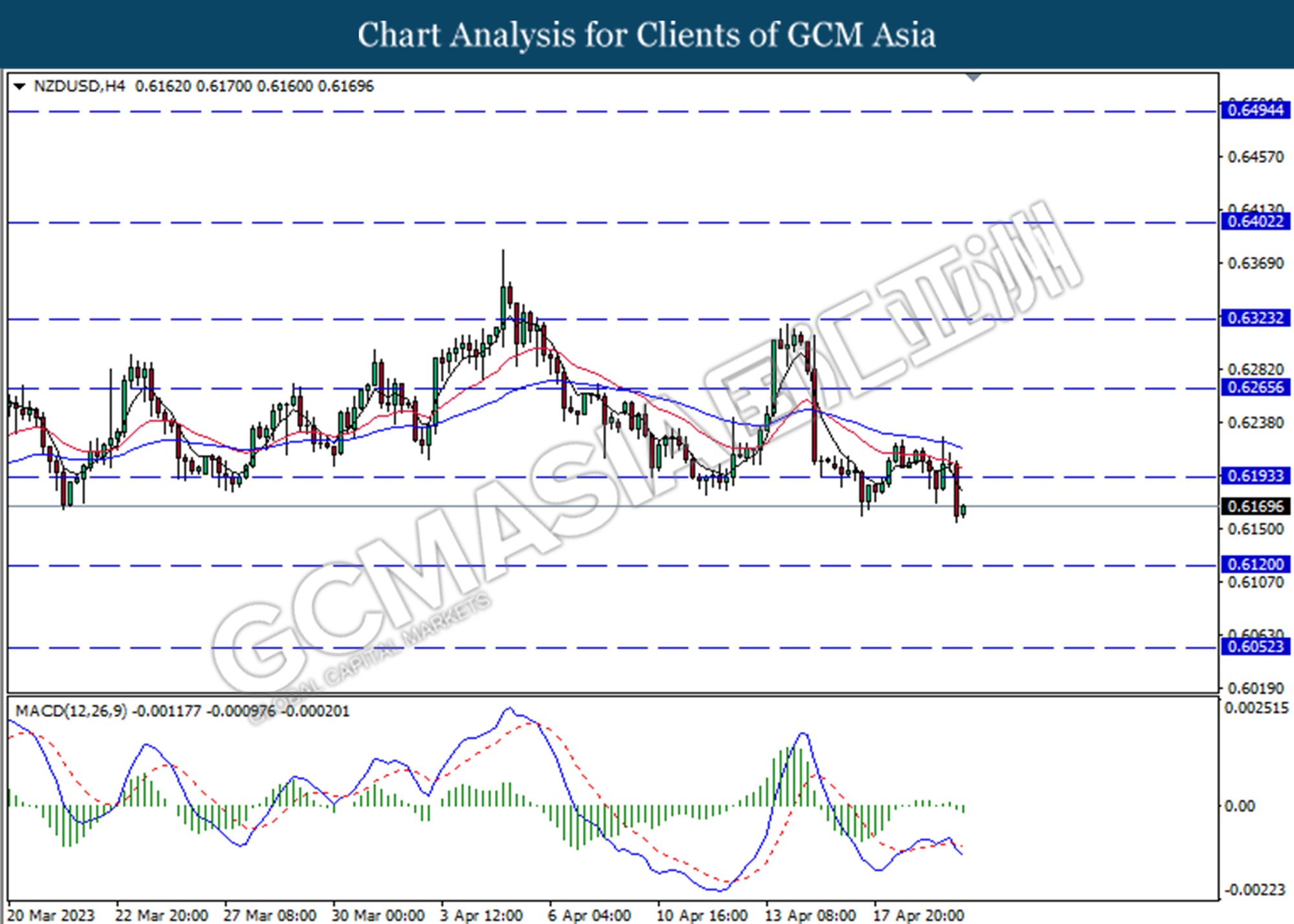

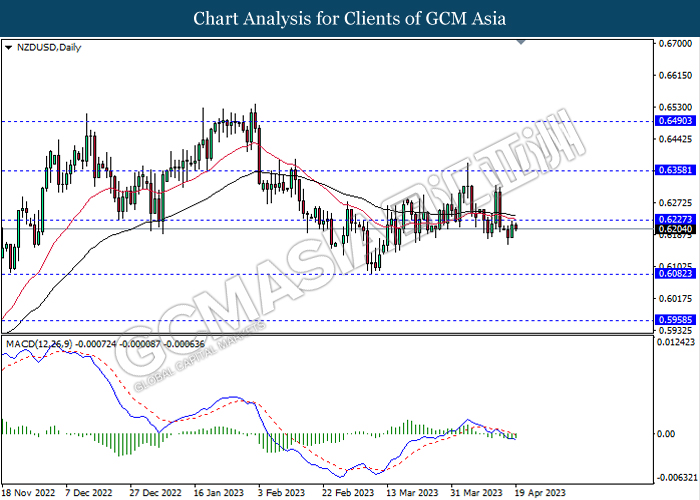

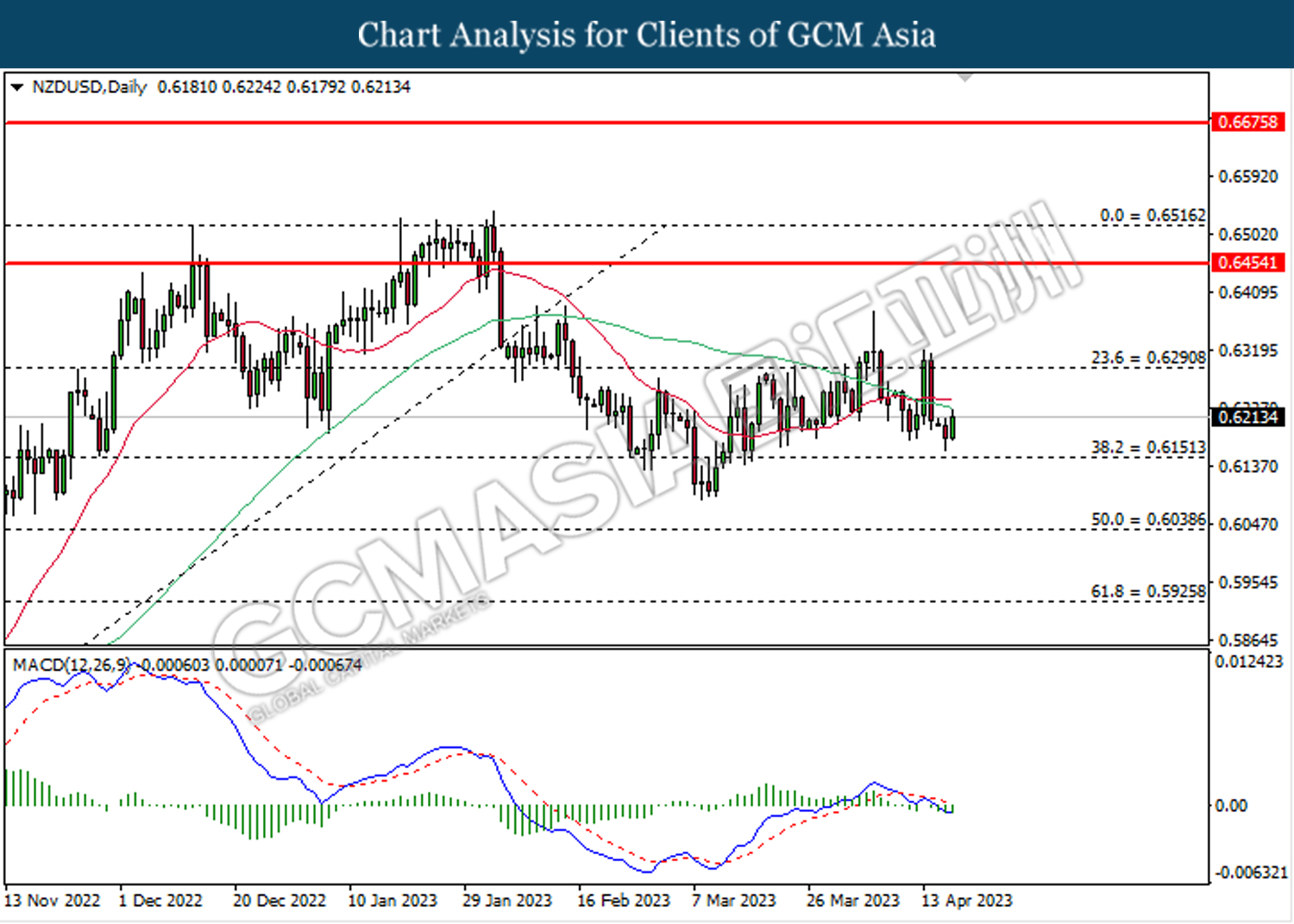

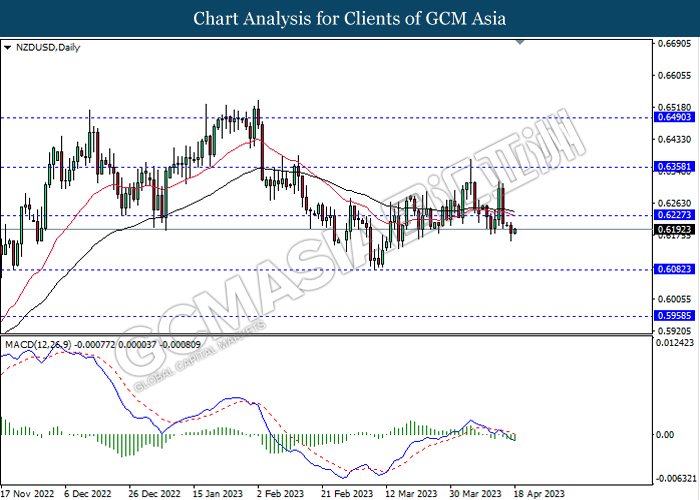

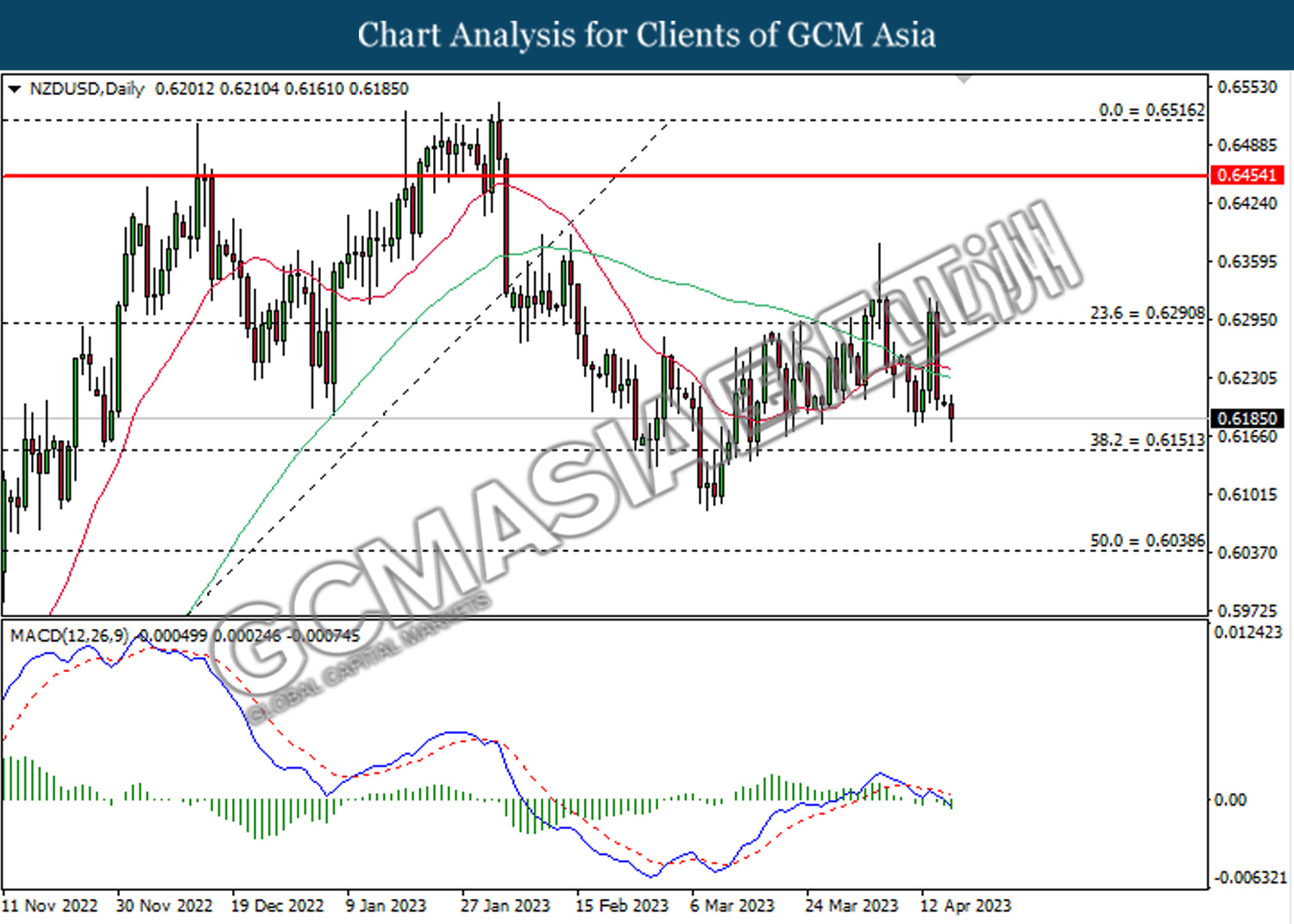

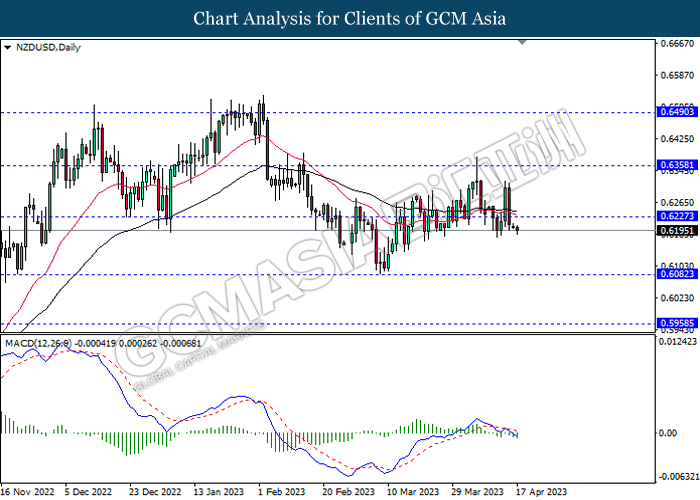

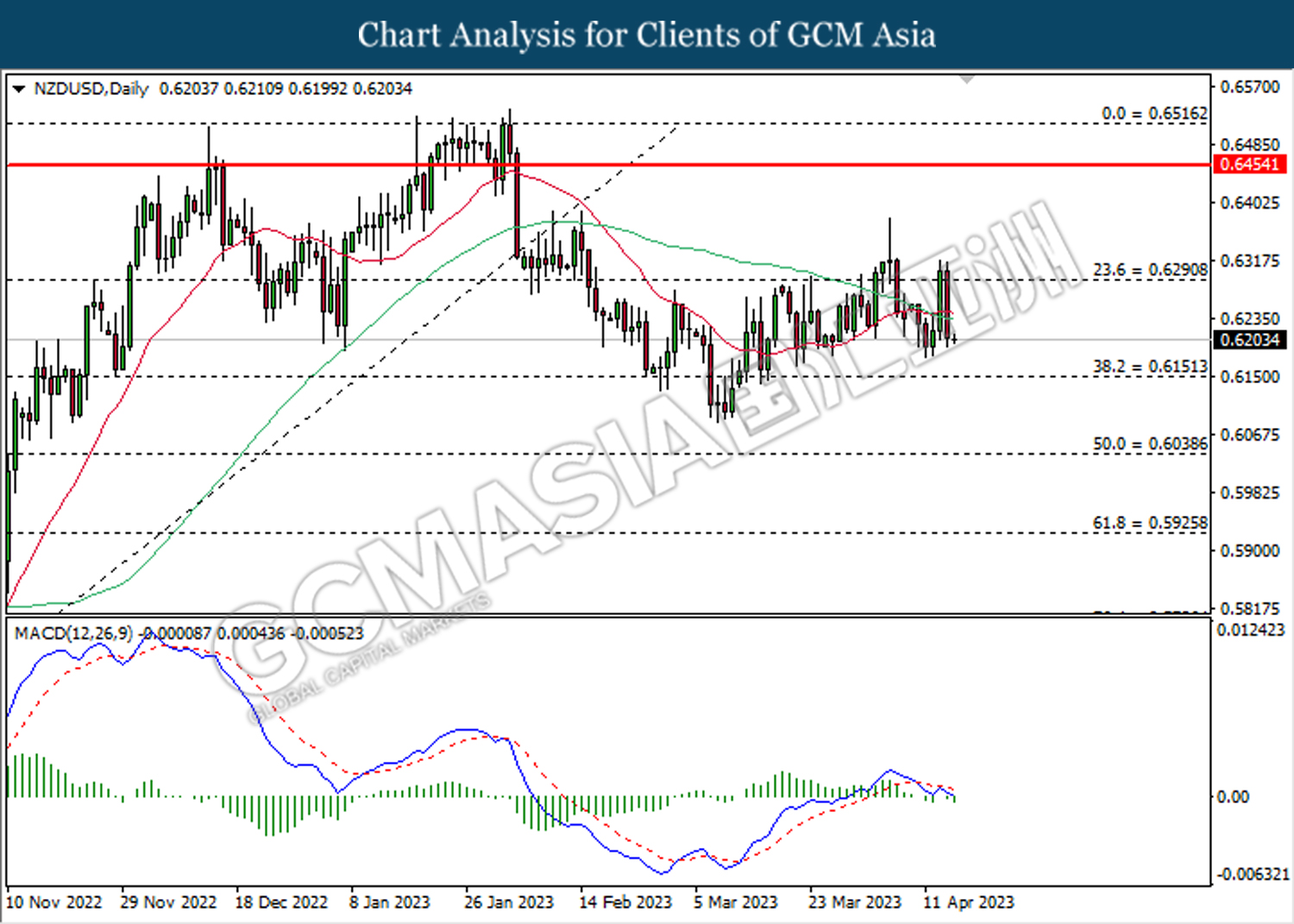

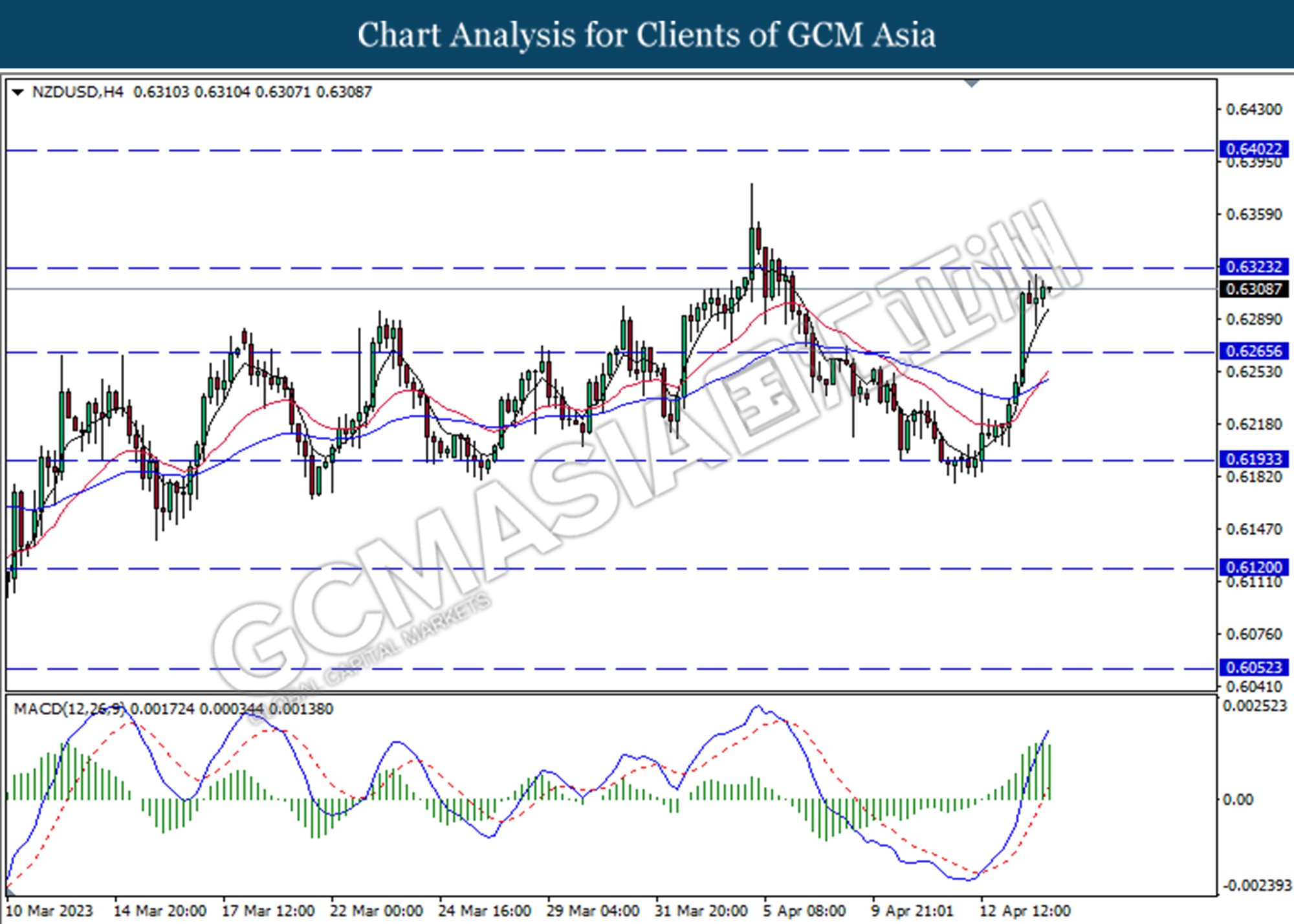

NZDUSD, H4: NZDUSD was traded higher following a prior break above the prior resistance level at 0.6120. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6195.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

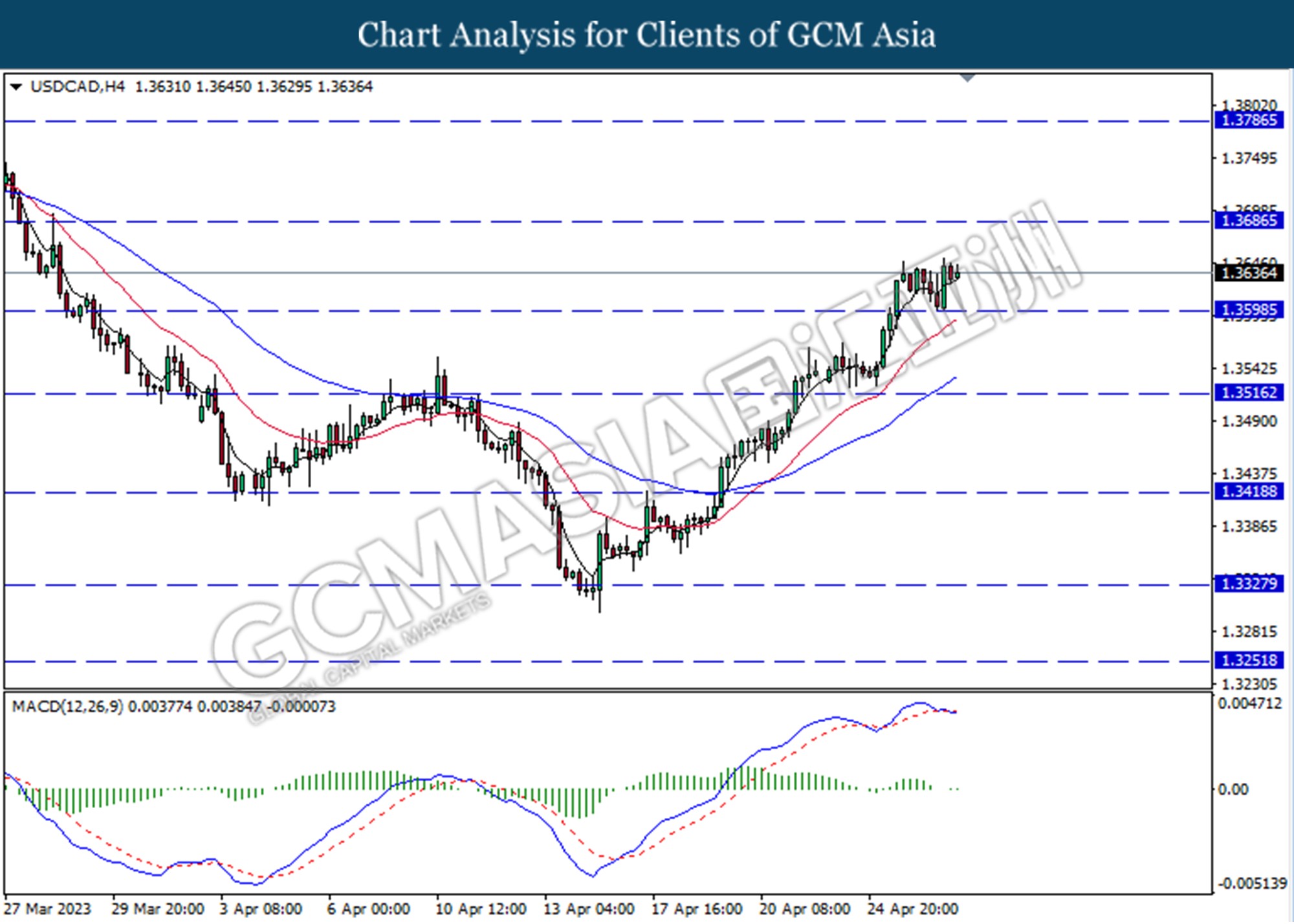

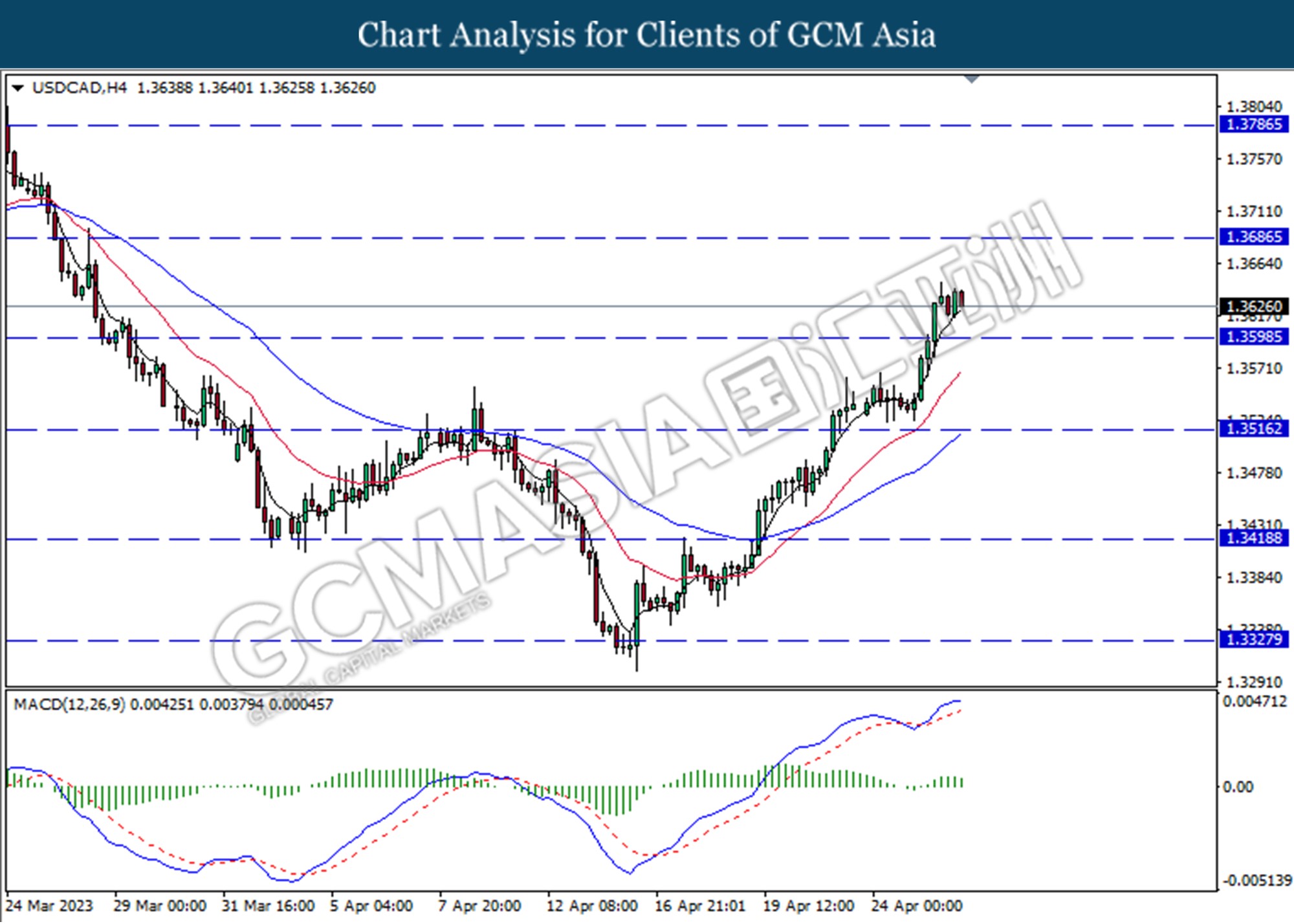

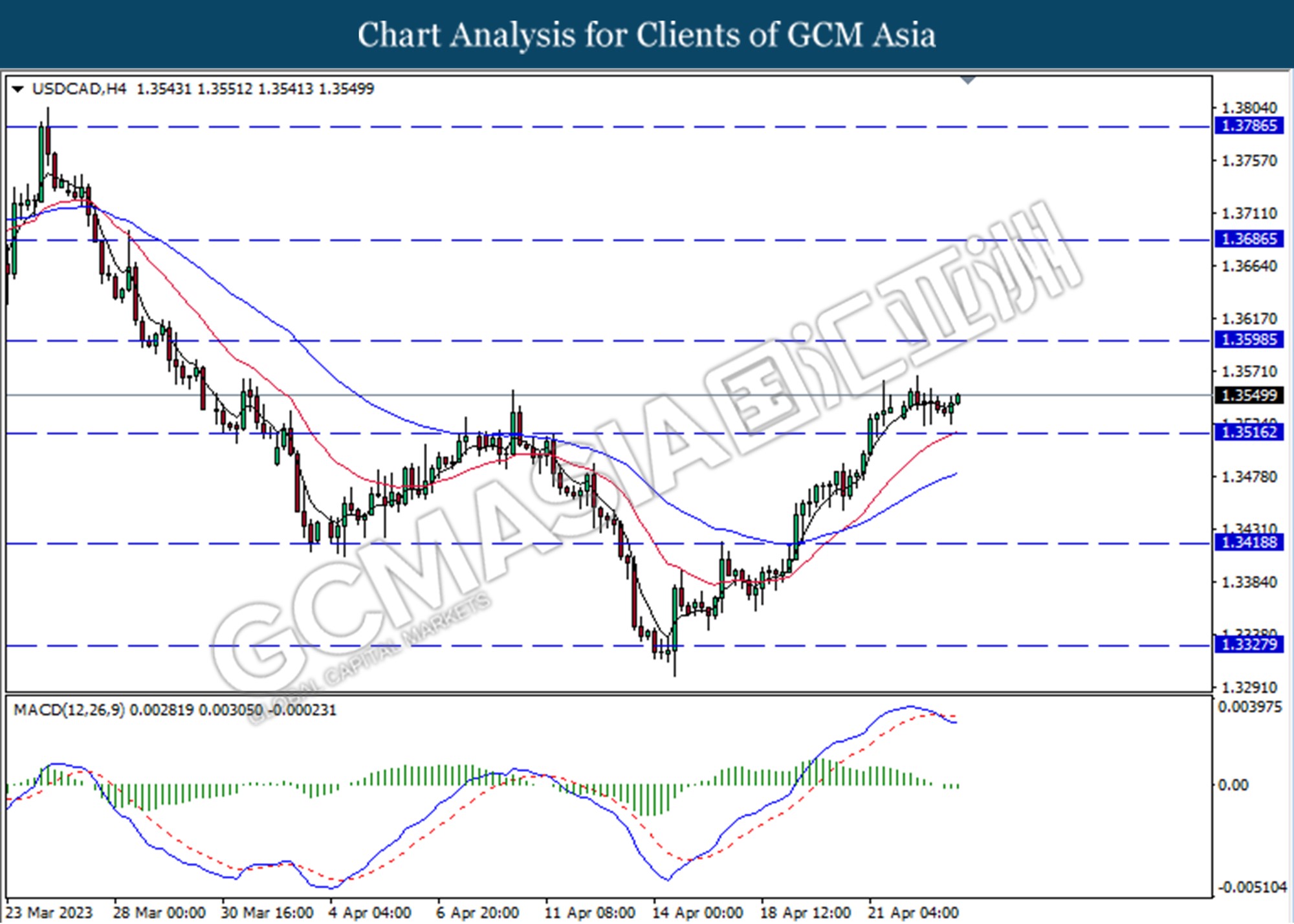

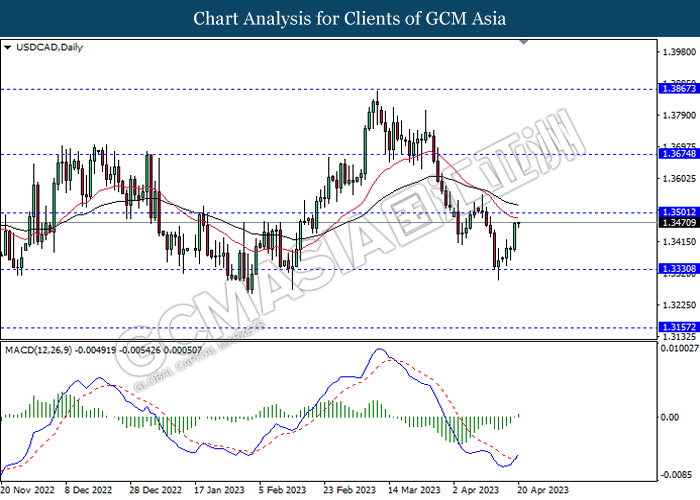

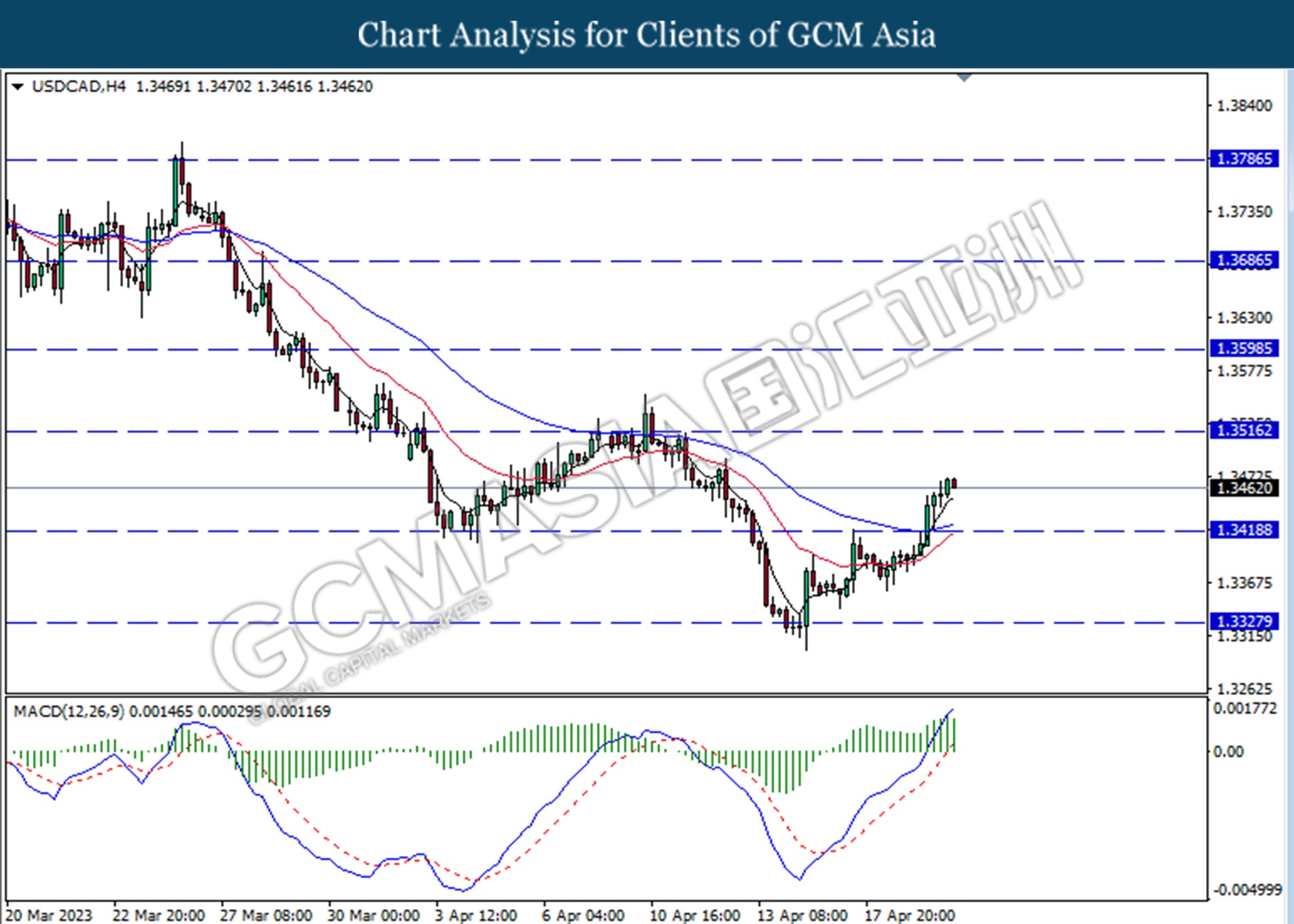

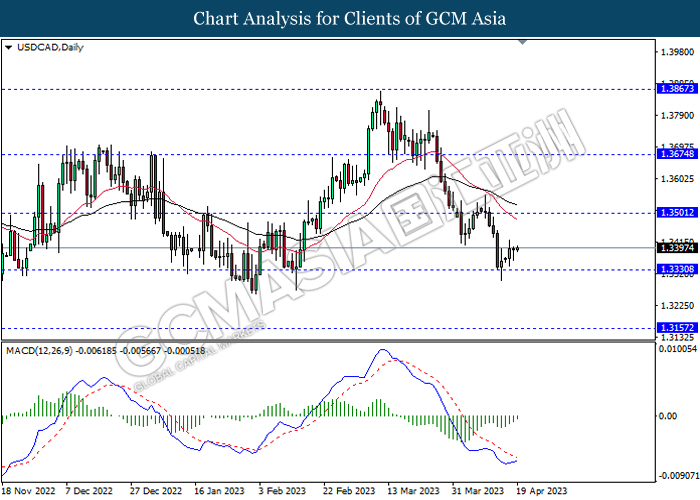

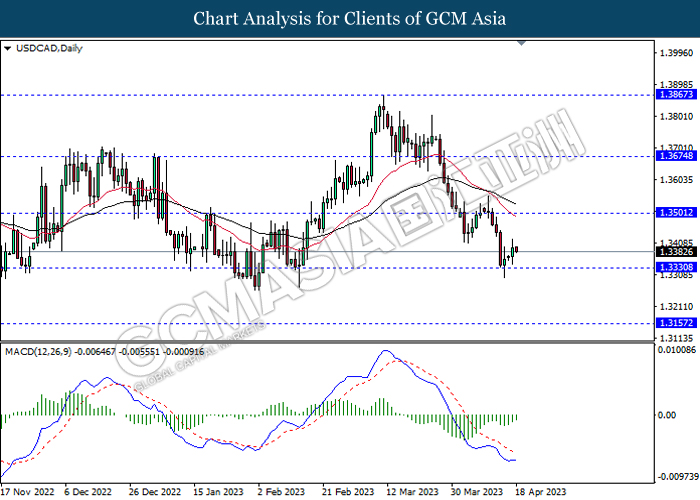

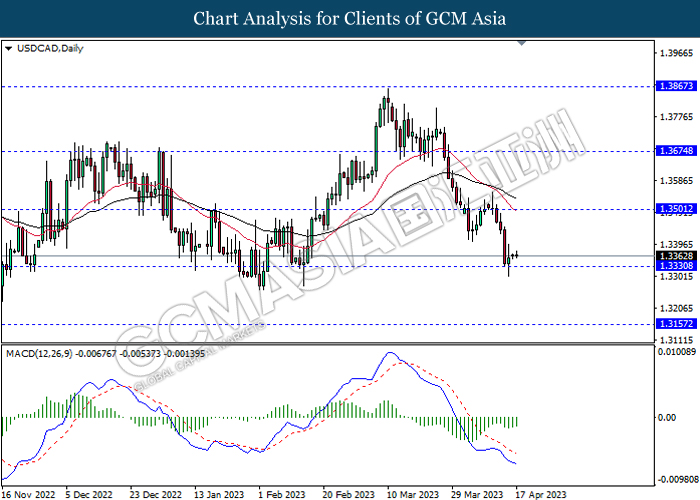

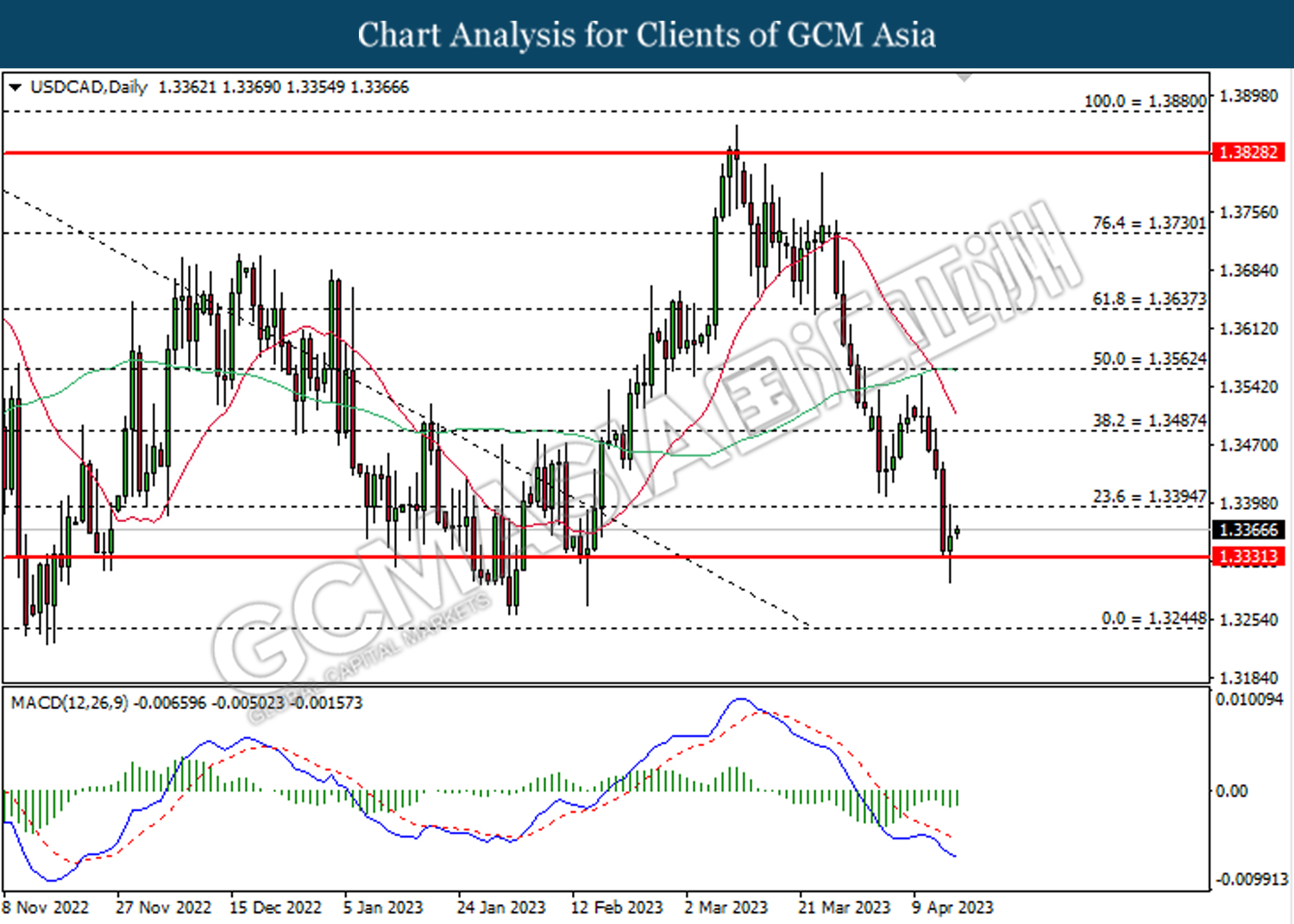

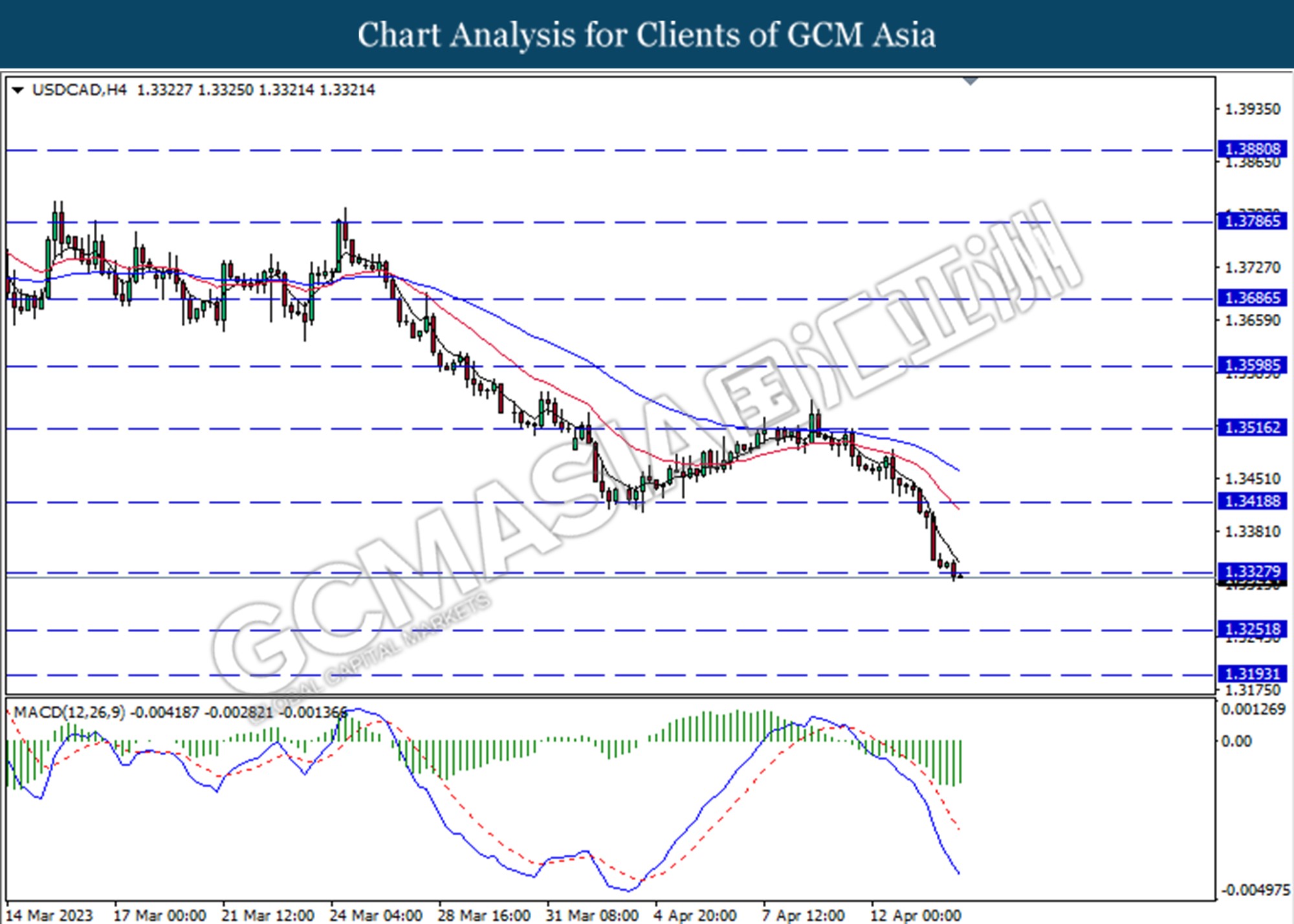

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3600. However, MACD which illustrated diminishing bullish momentum suggests the pair to traded lower as a technical correction.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

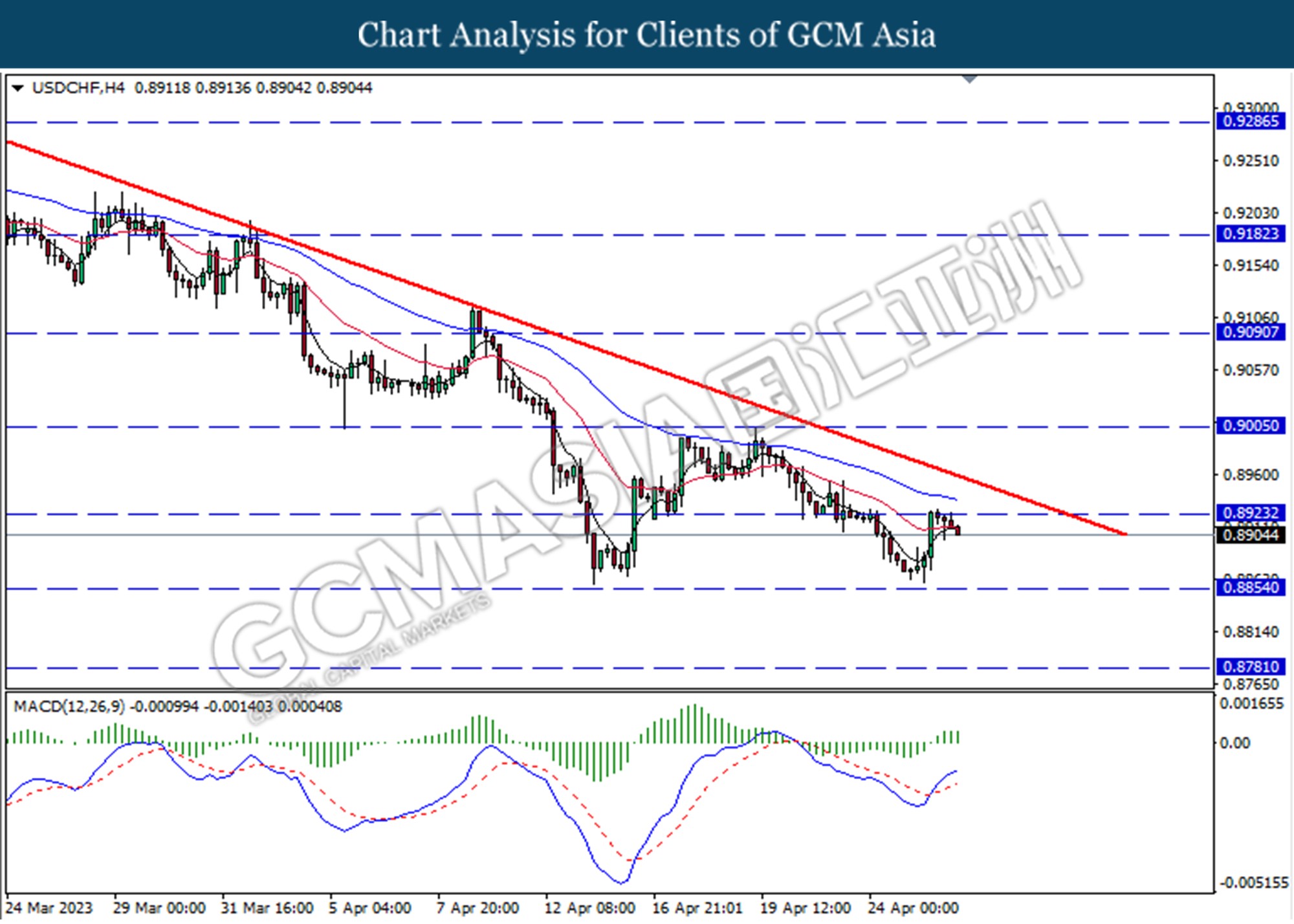

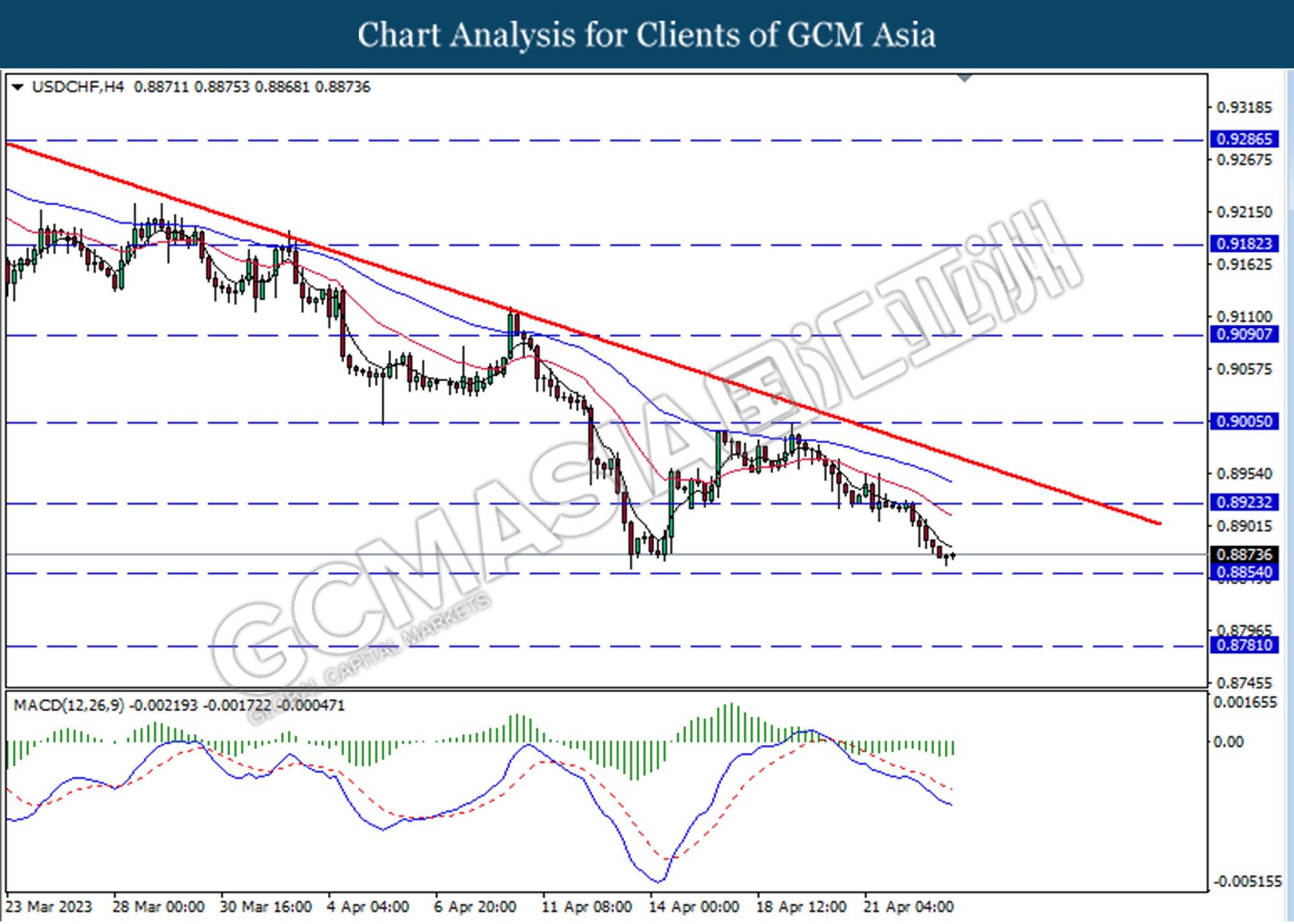

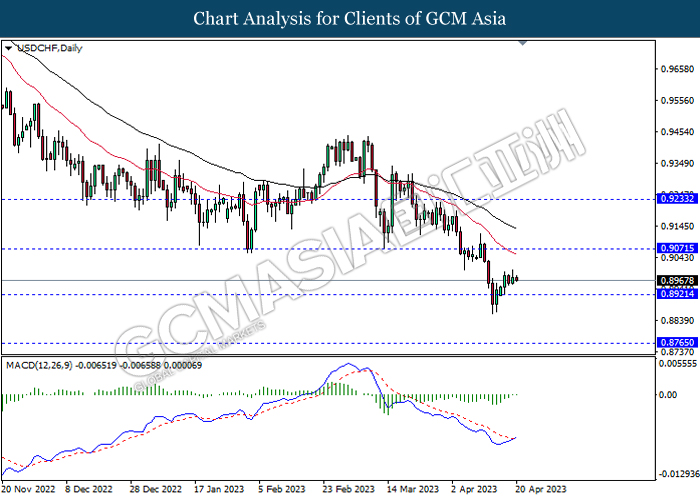

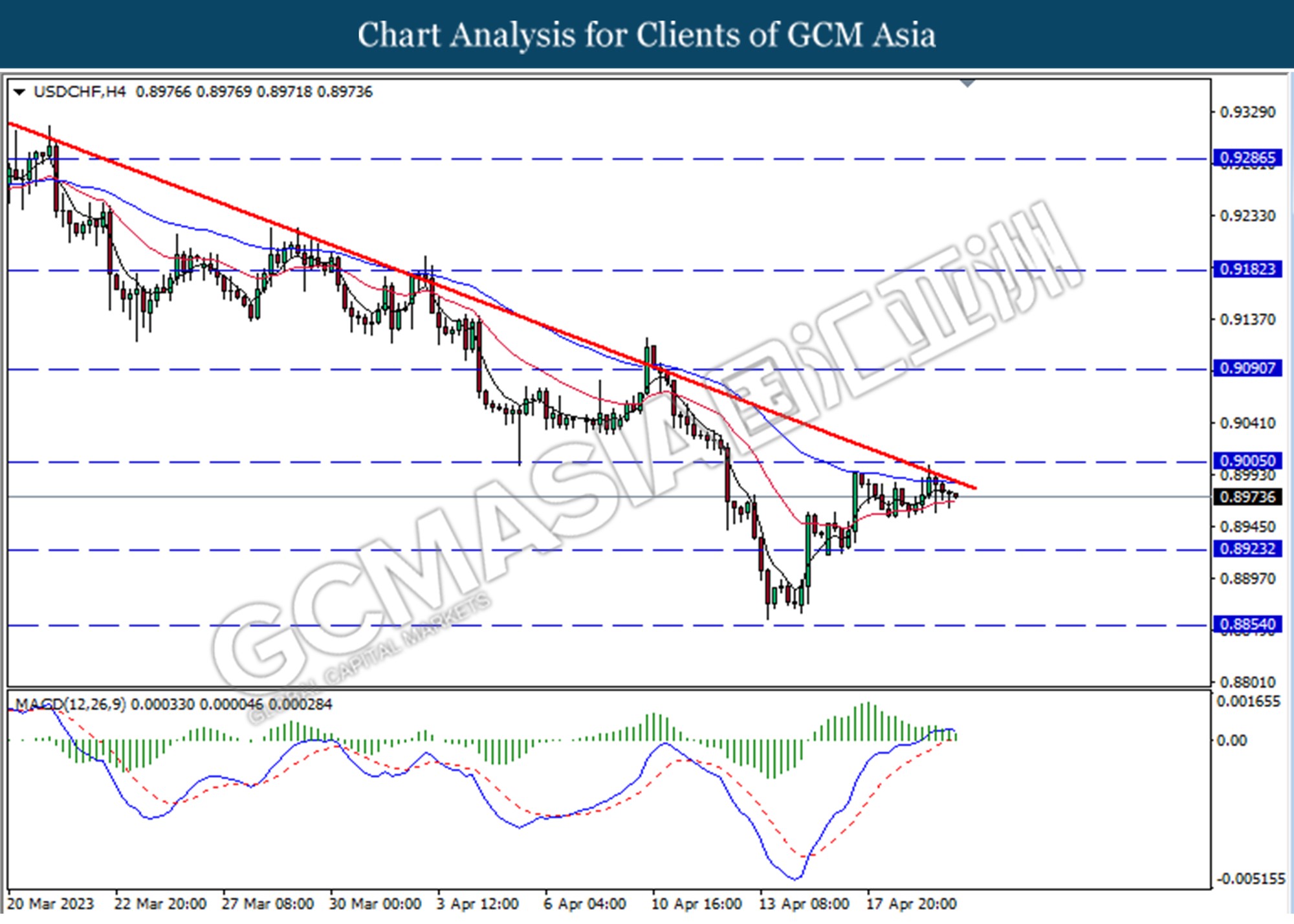

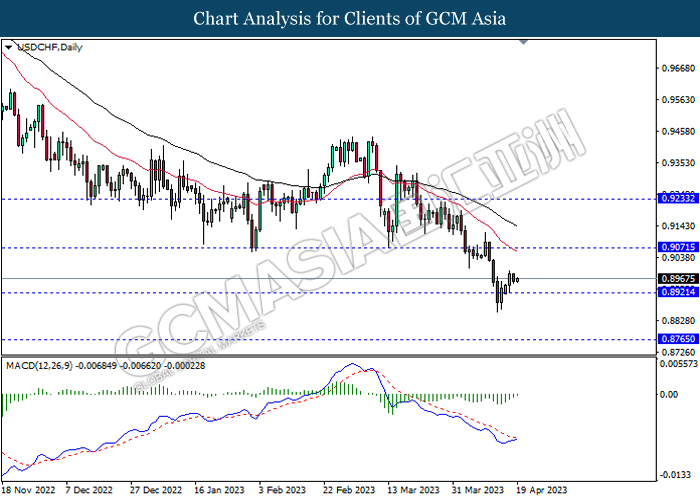

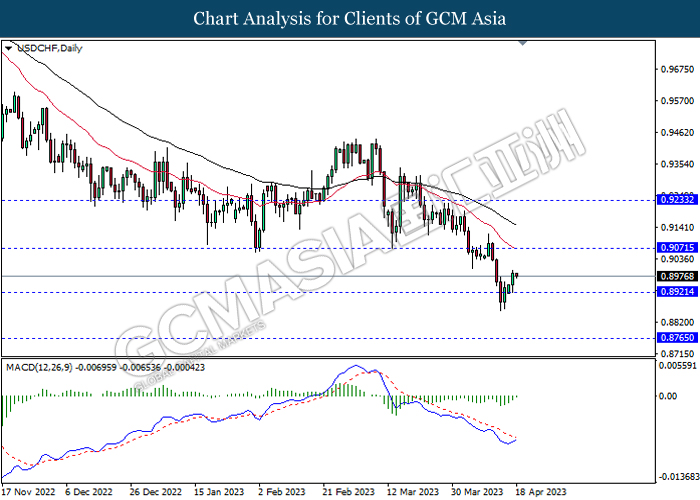

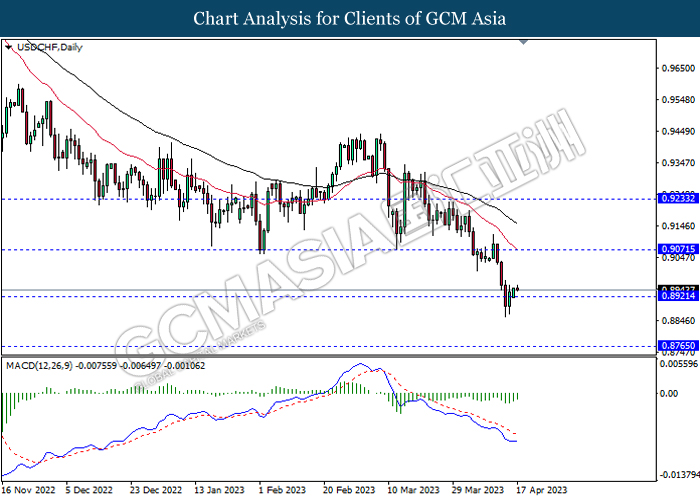

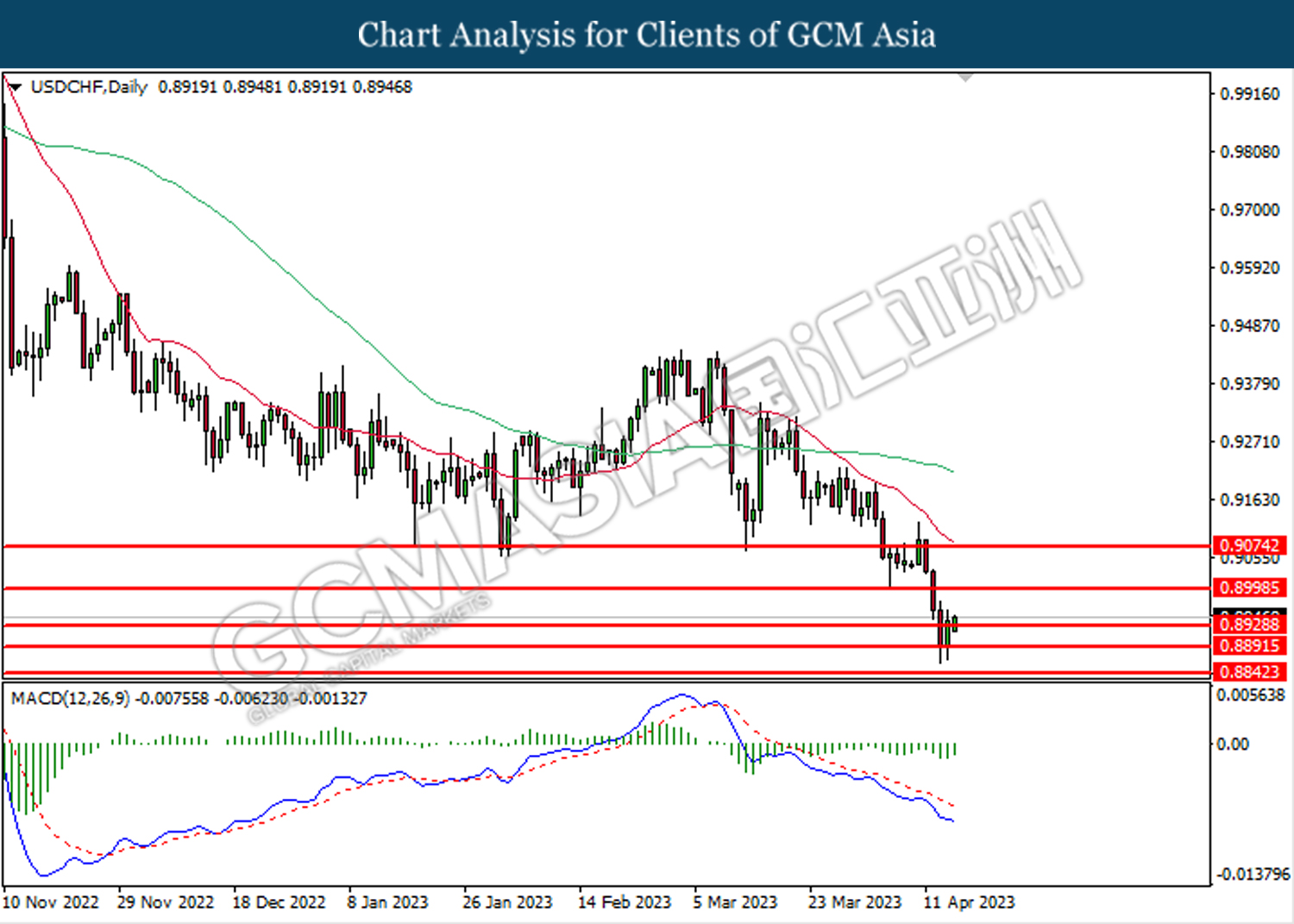

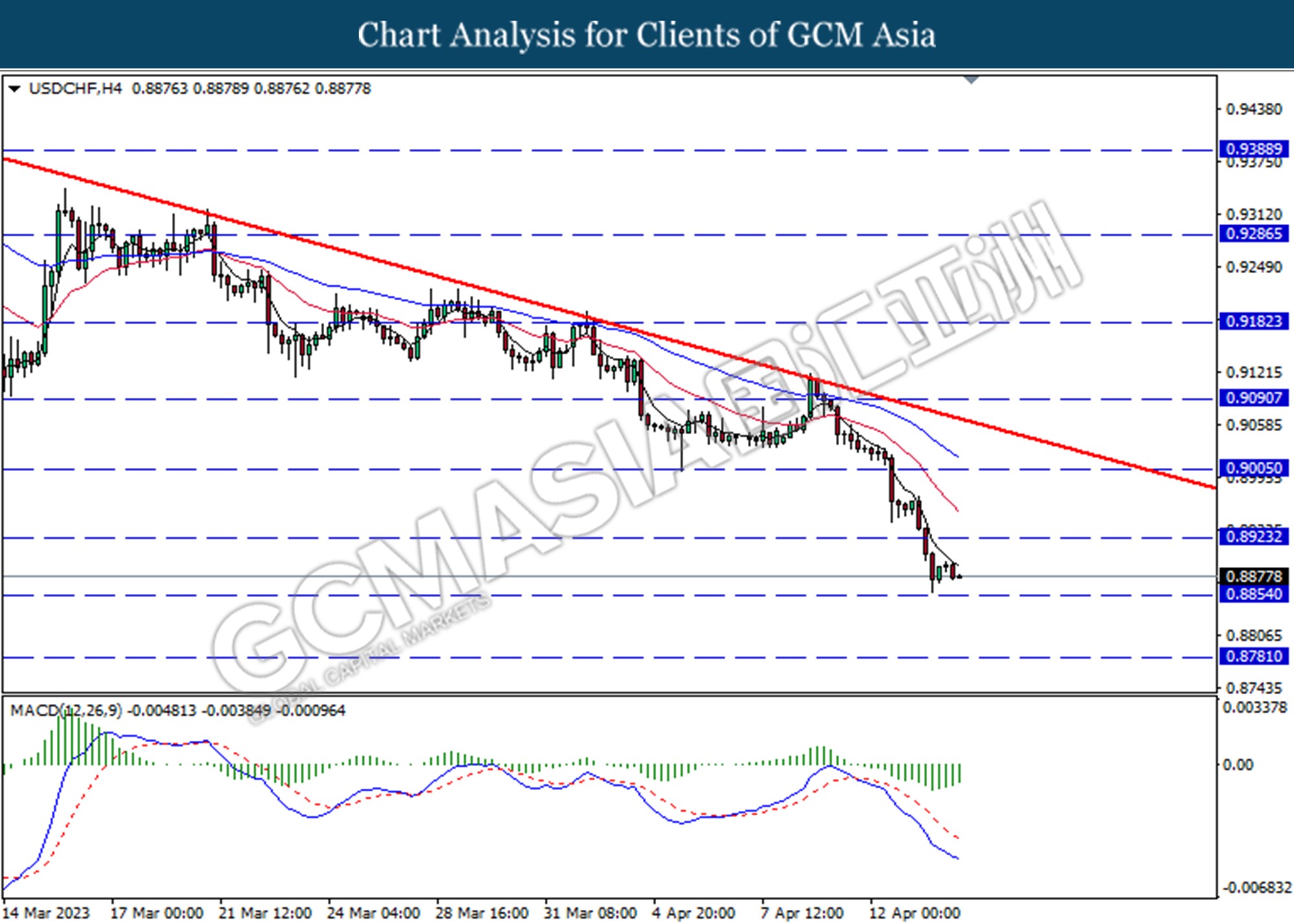

USDCHF, H4: USDCHF was traded higher following a prior rebound from the support level at 0.8855. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.8925

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8780

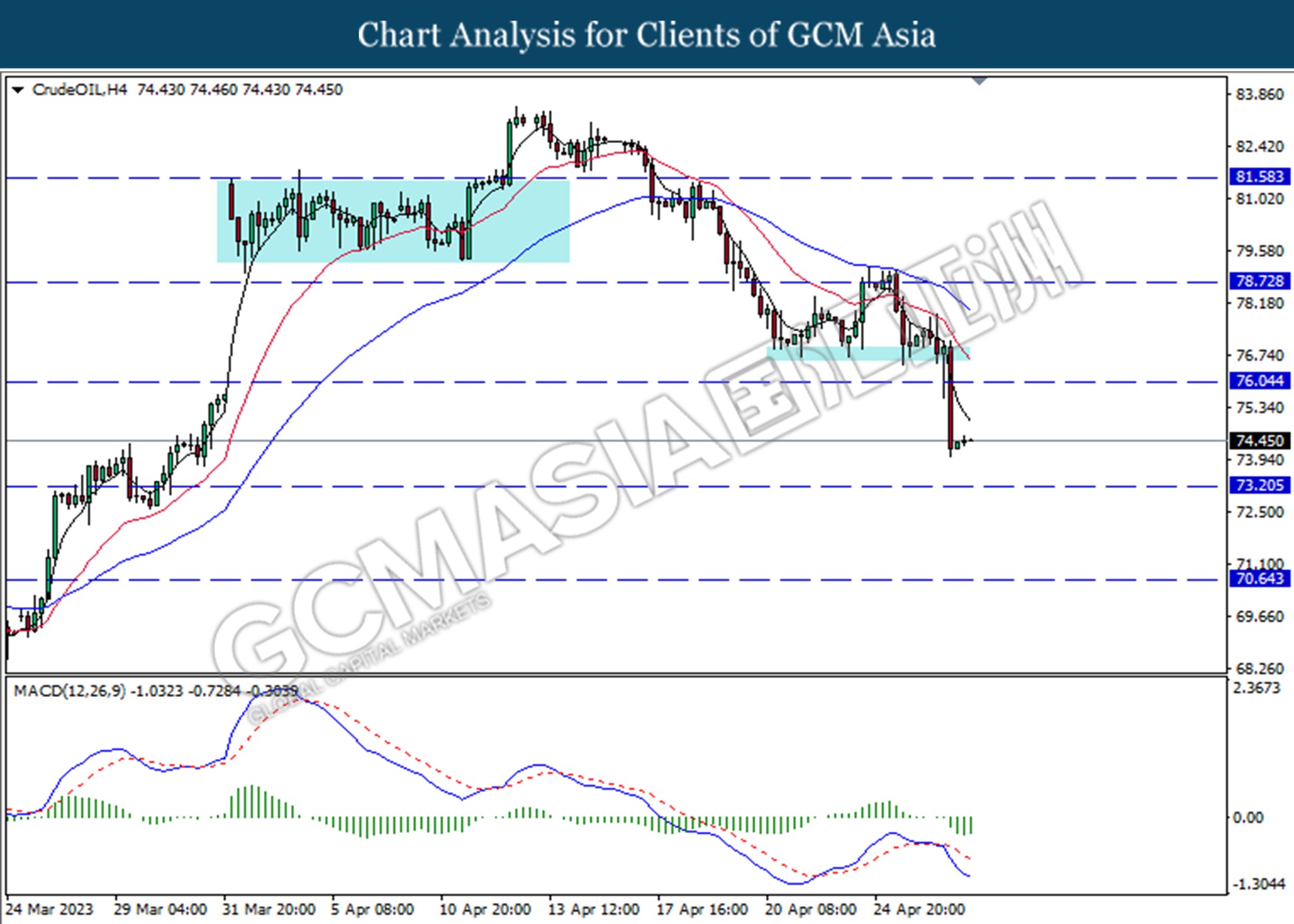

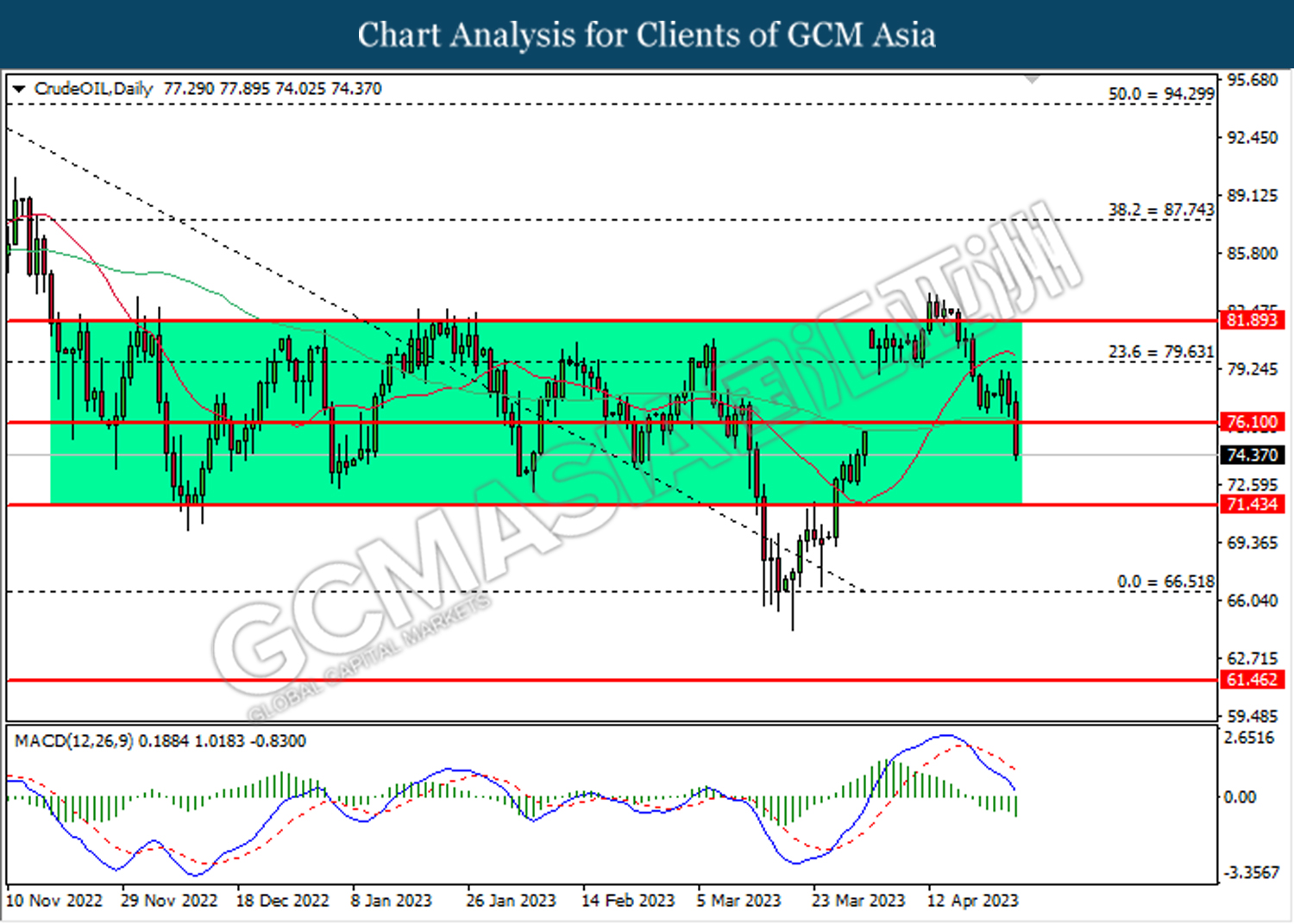

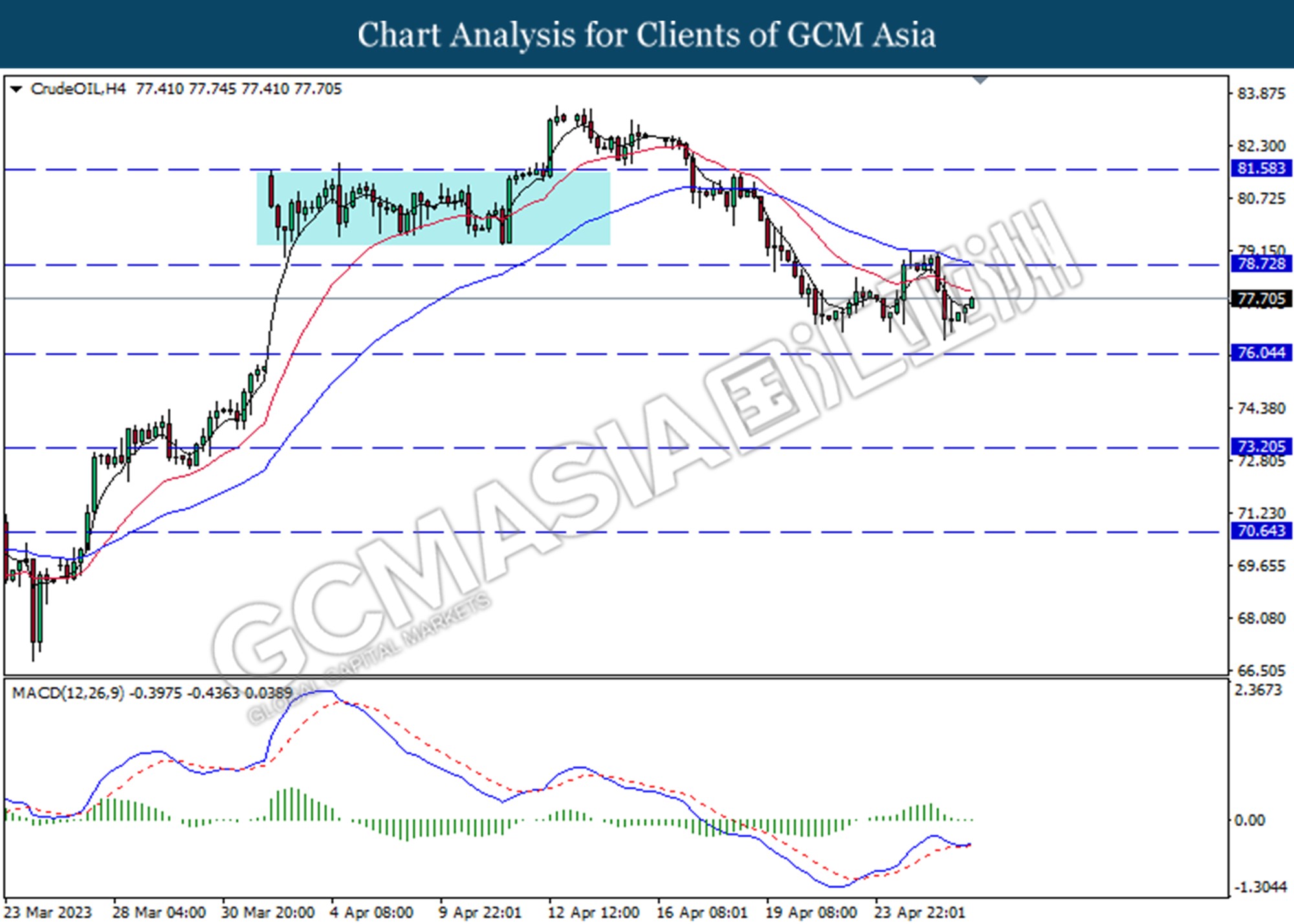

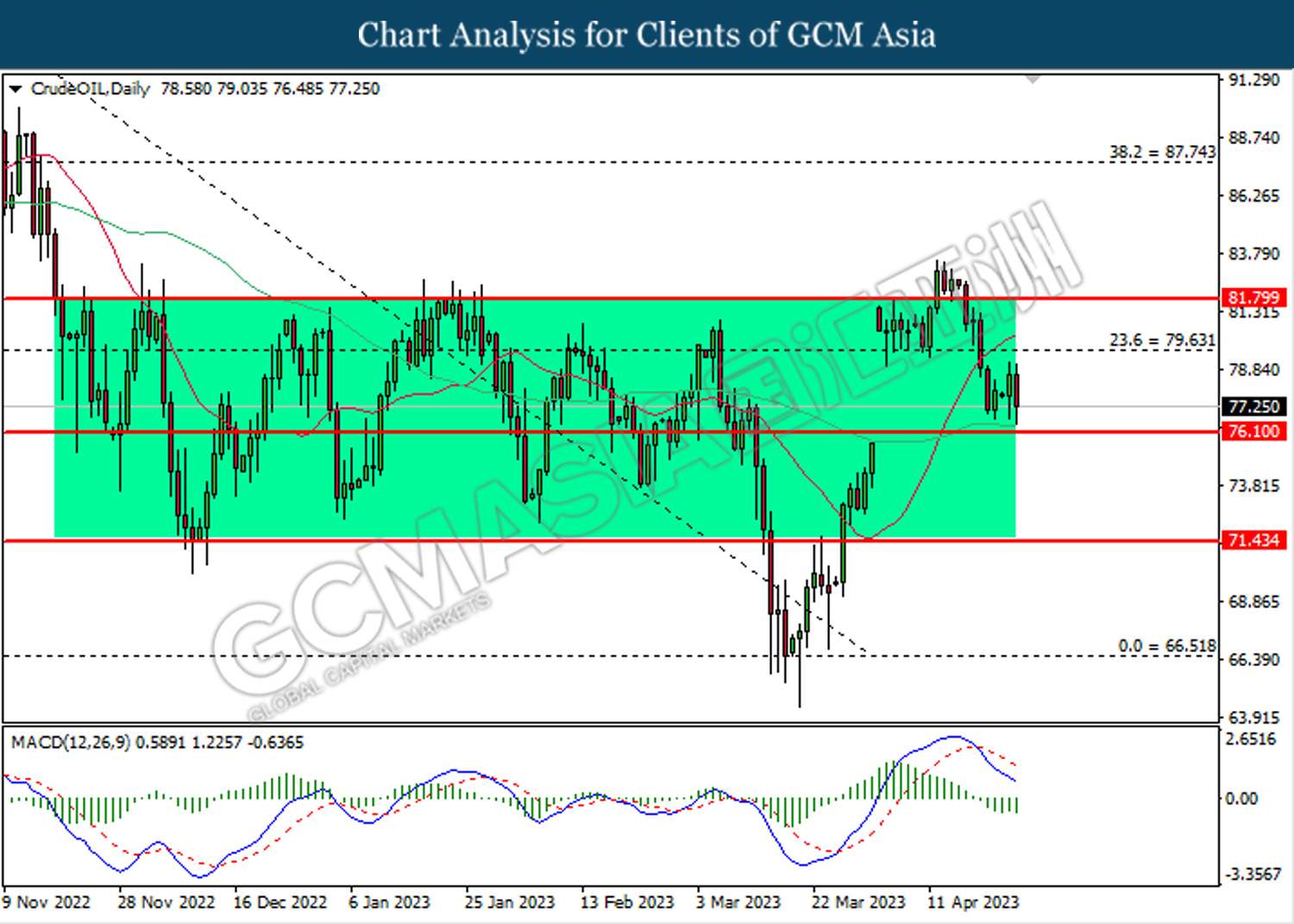

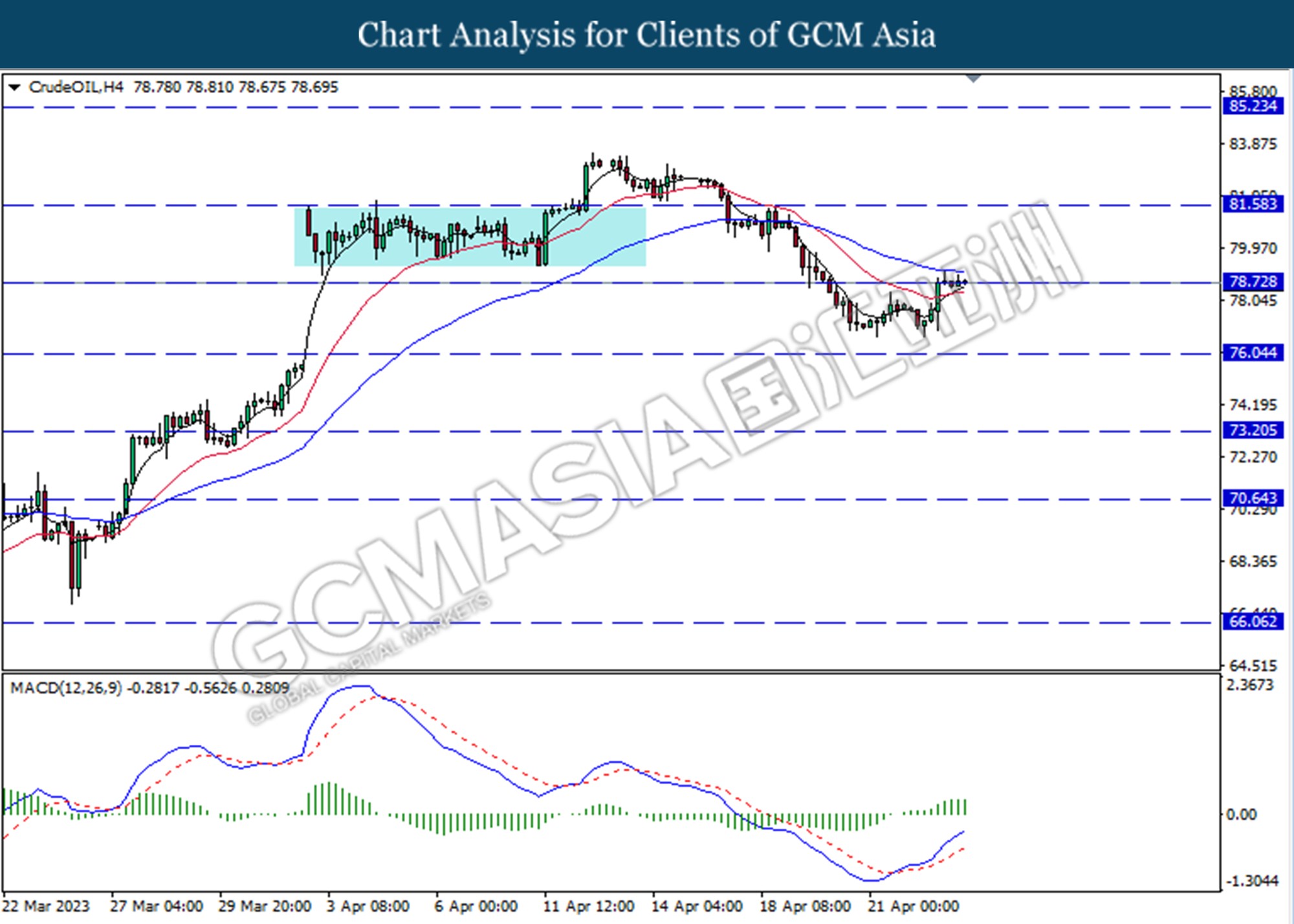

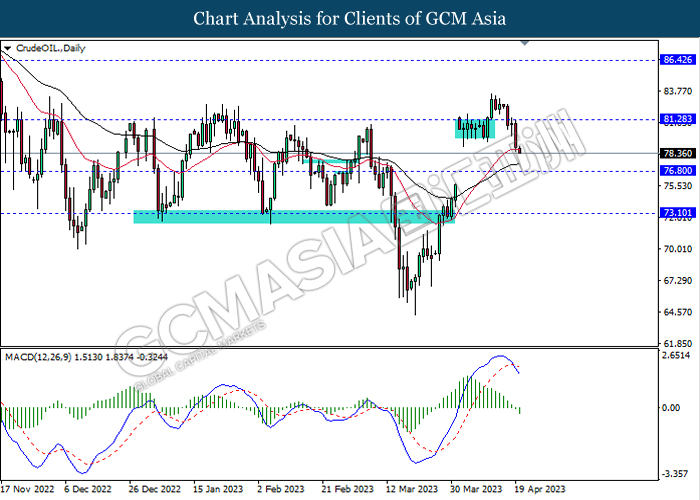

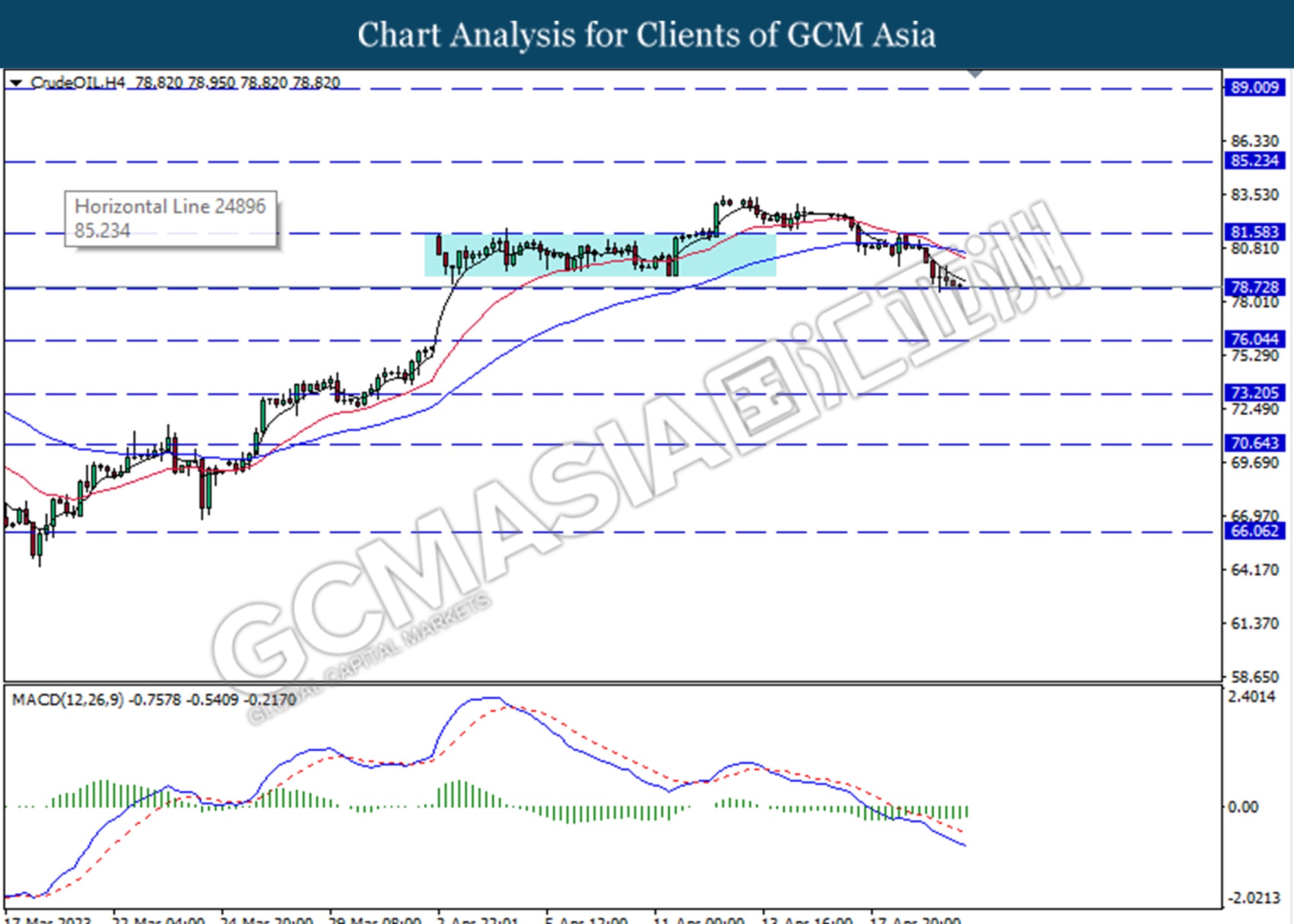

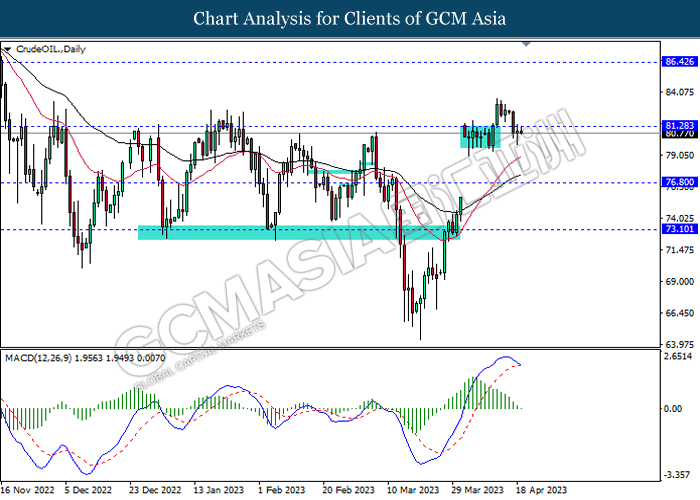

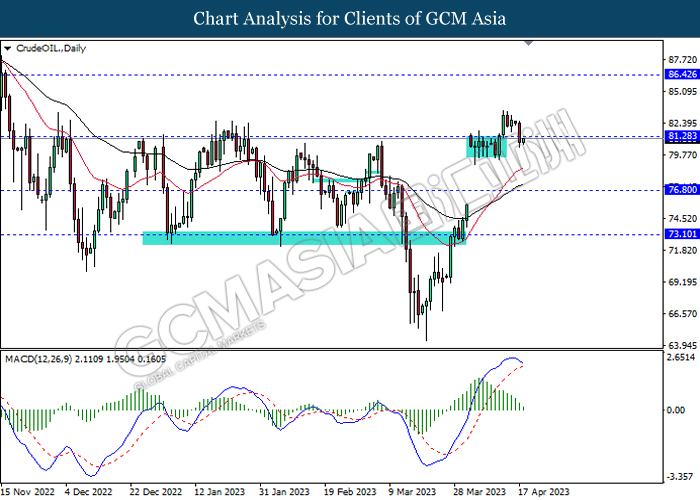

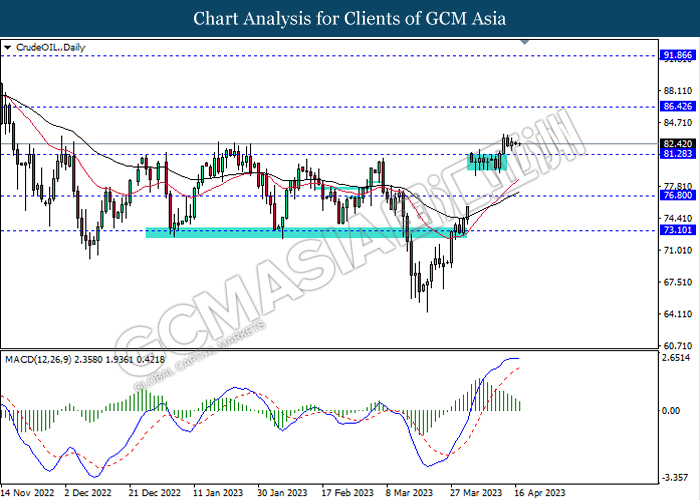

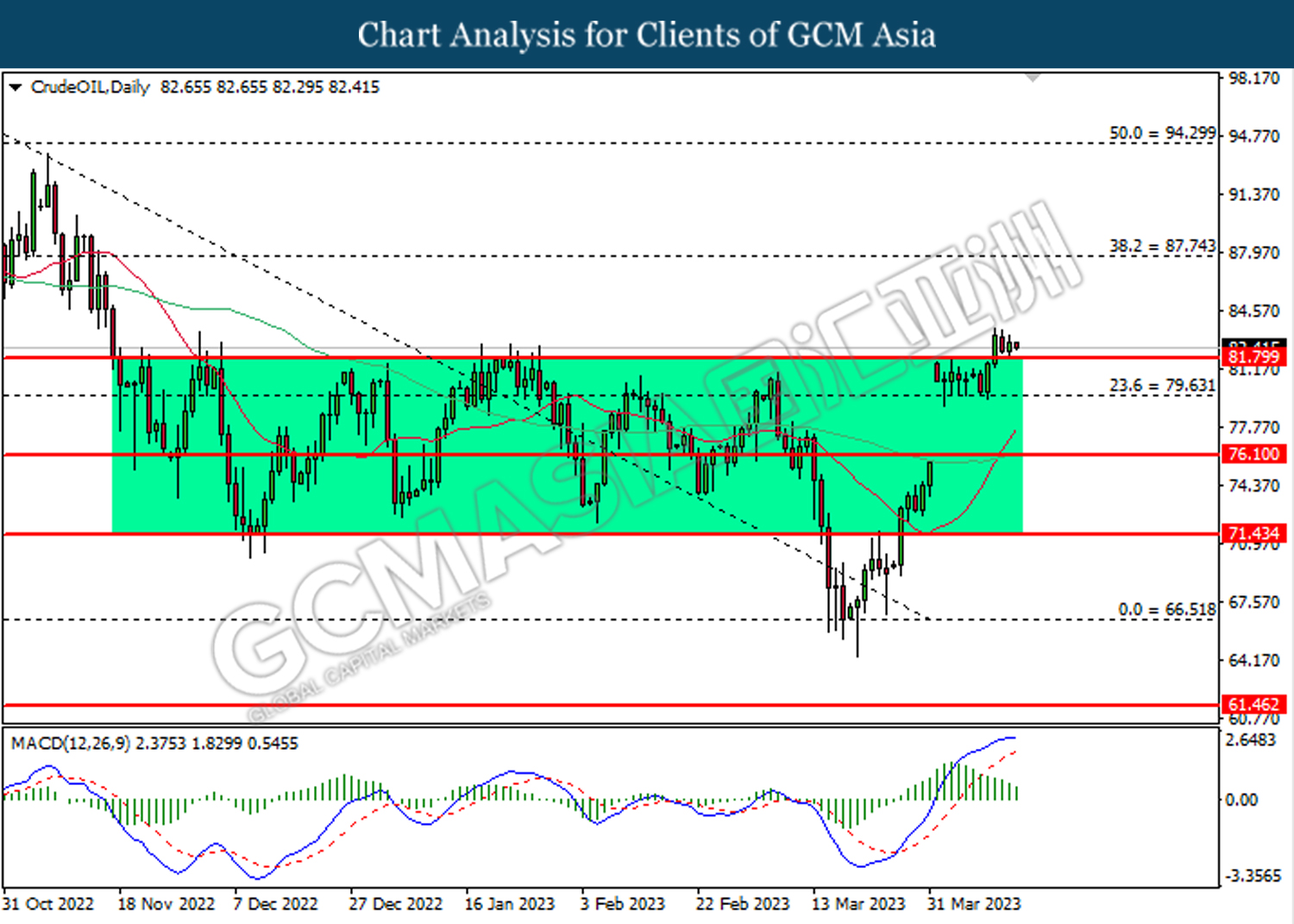

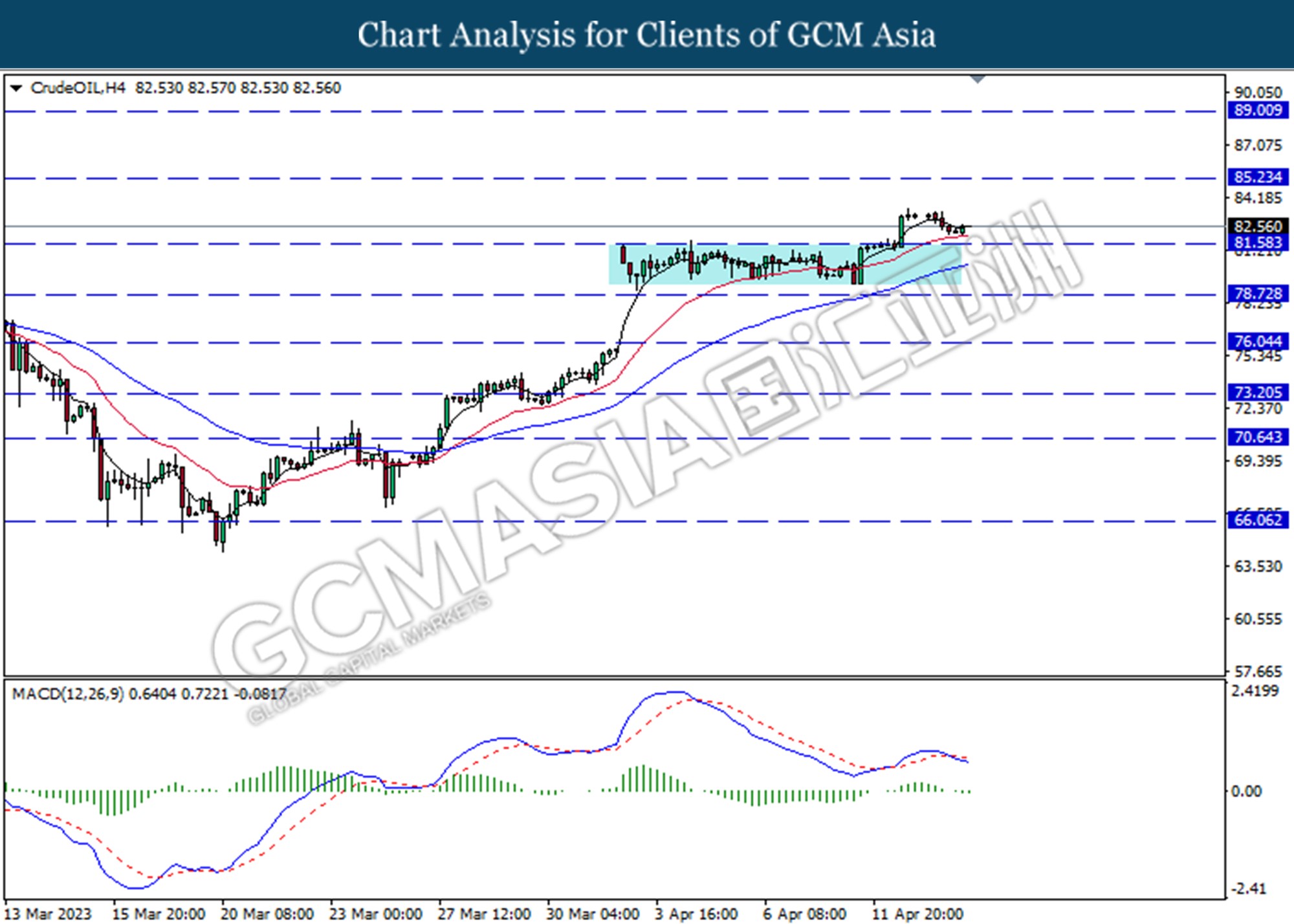

CrudeOIL, H4: Crude oil price was traded lower following a prior break below the previous support level at 76.05. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level at 73.20.

Resistance level: 76.05, 81.60

Support level: 73.20, 70.65

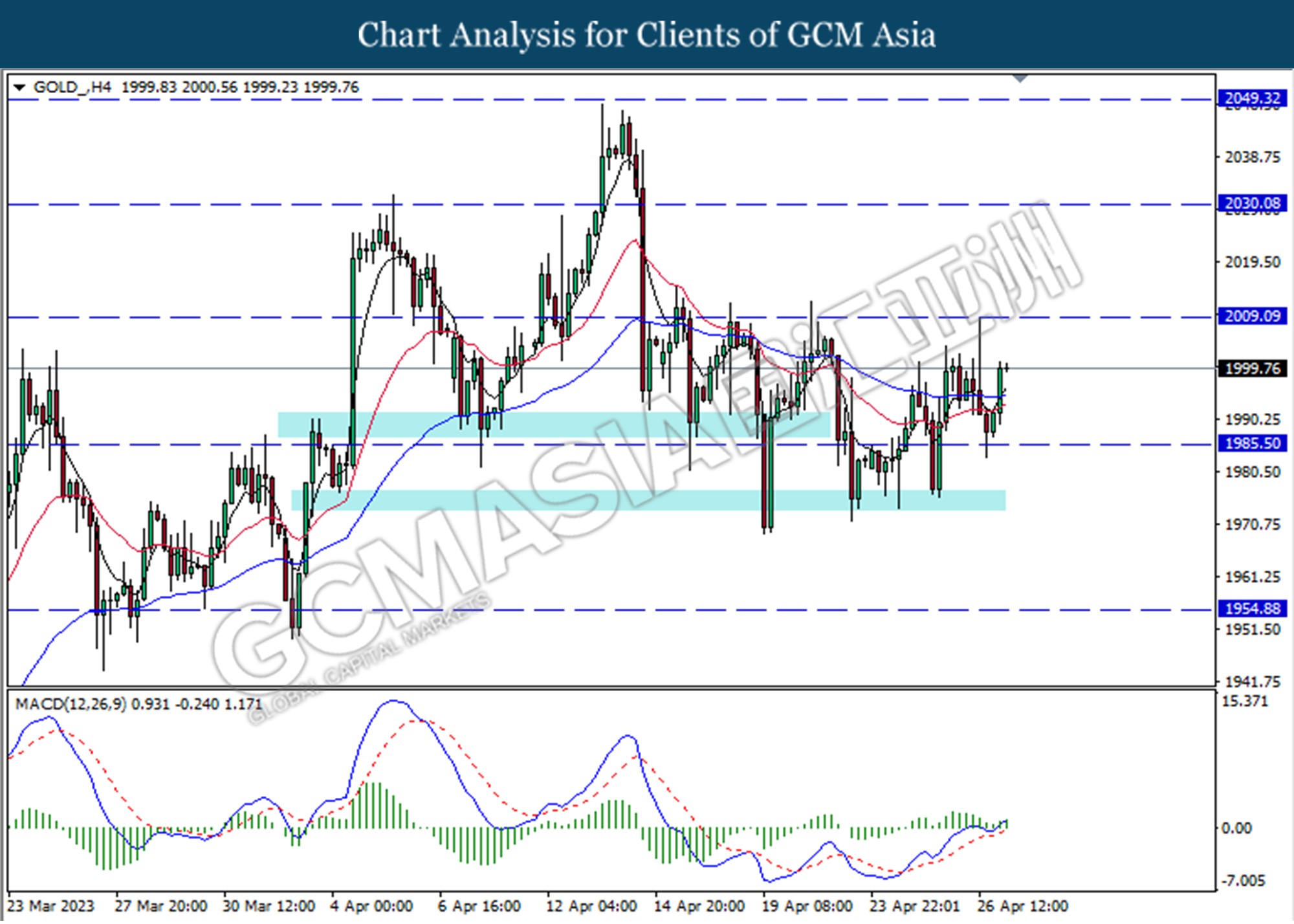

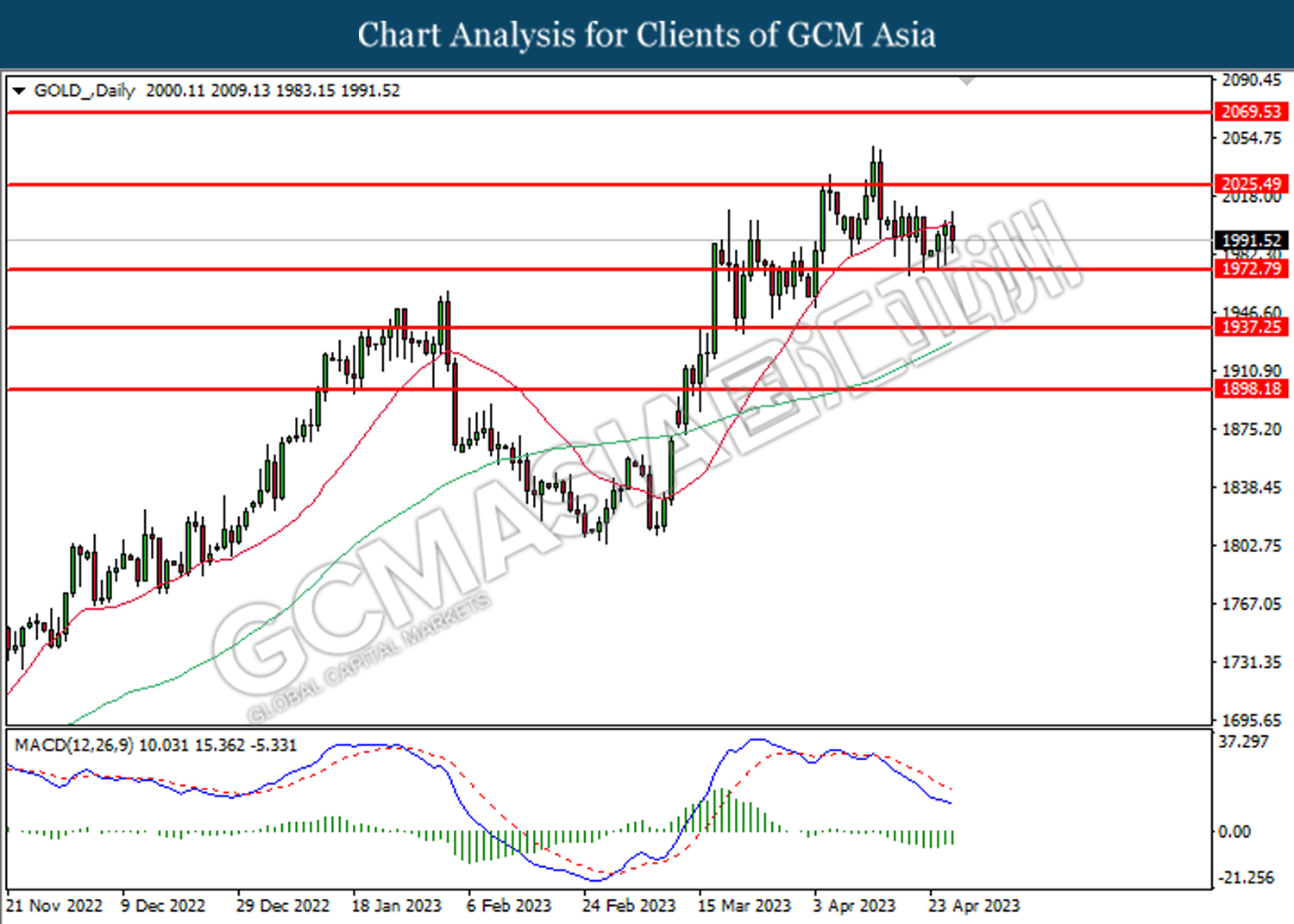

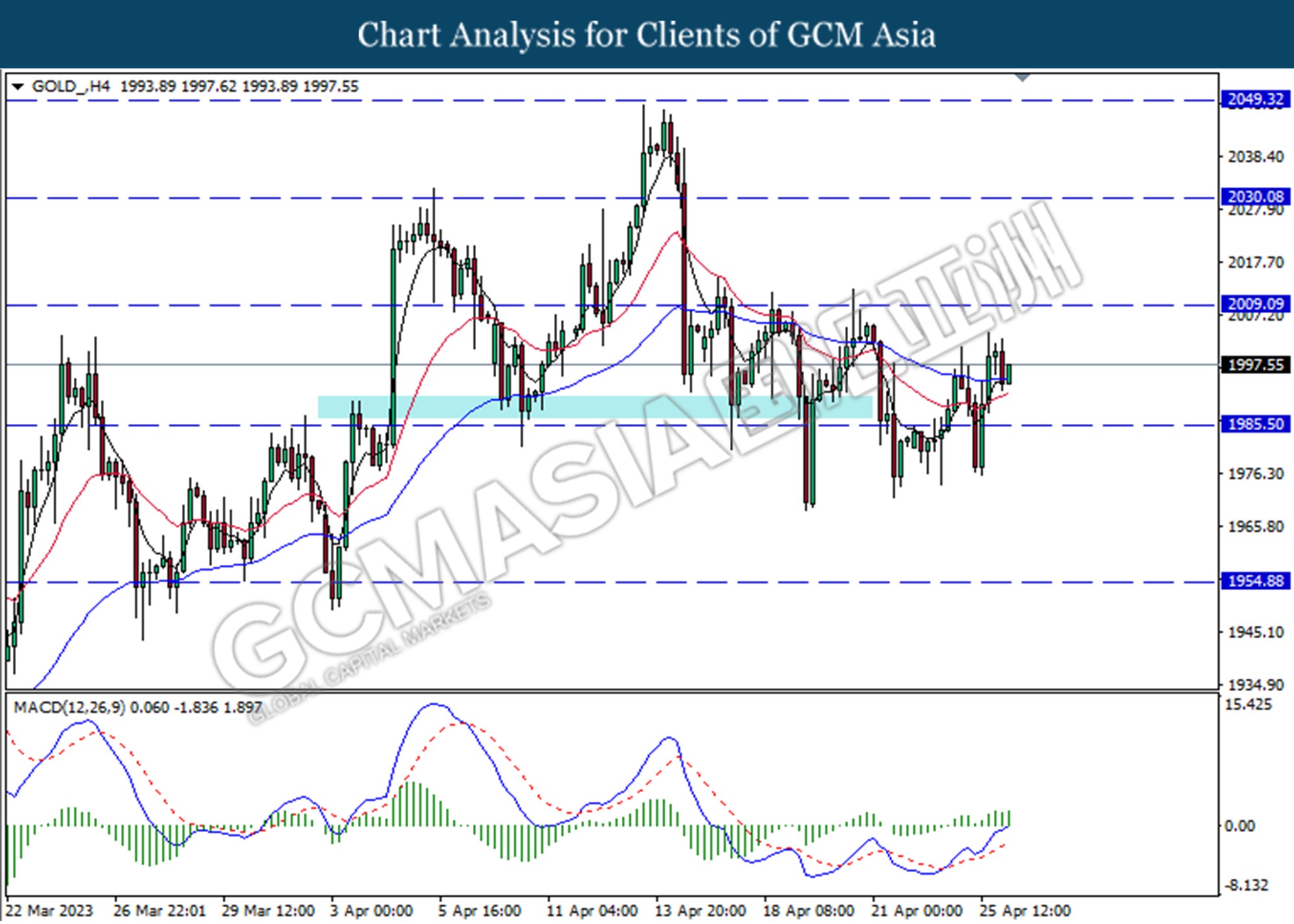

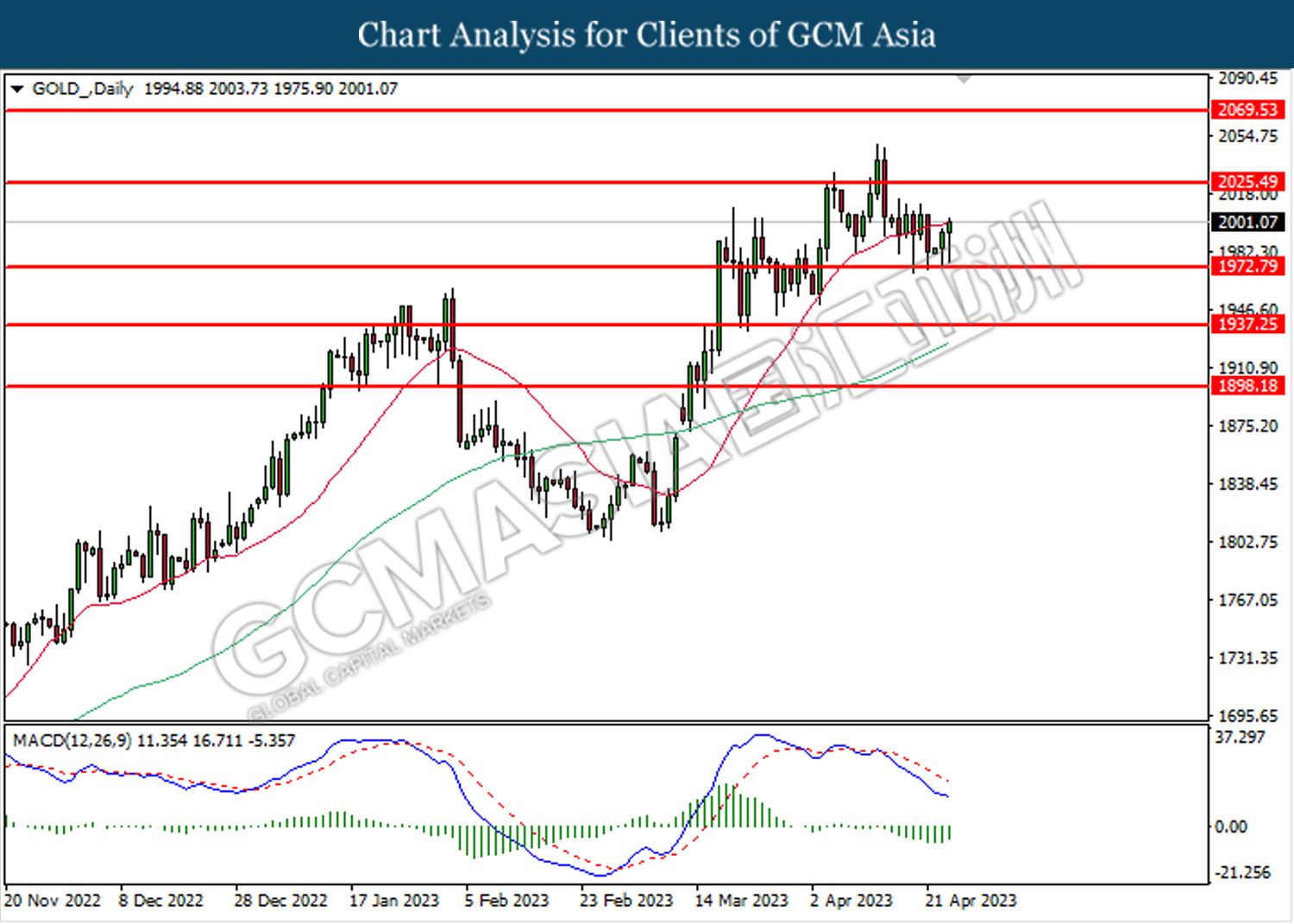

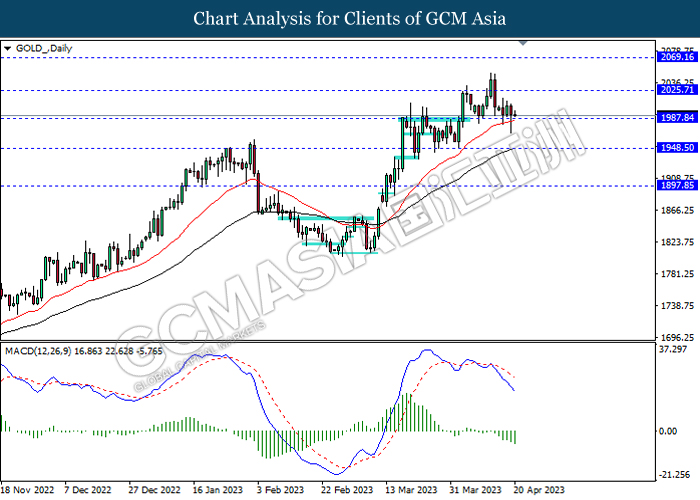

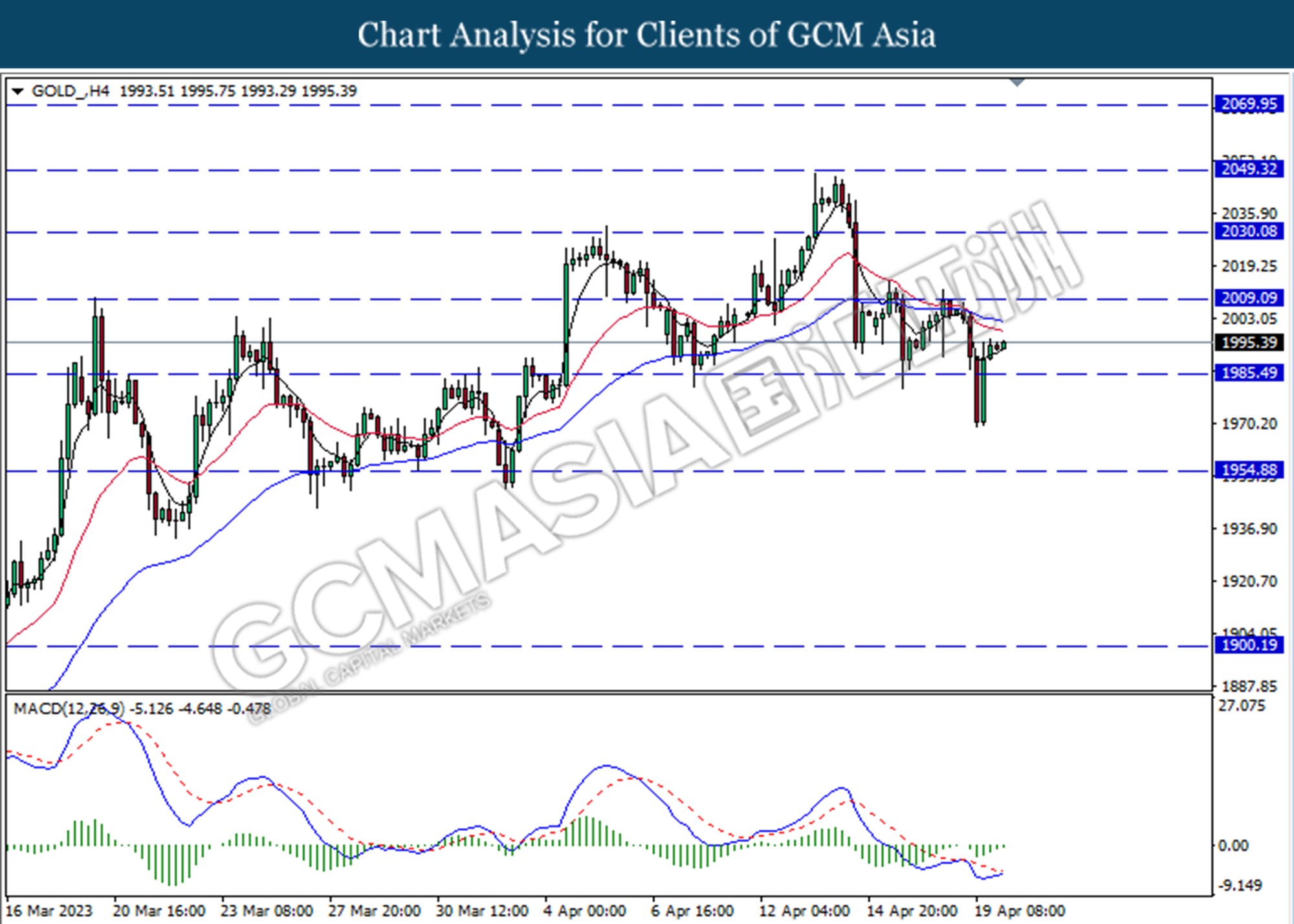

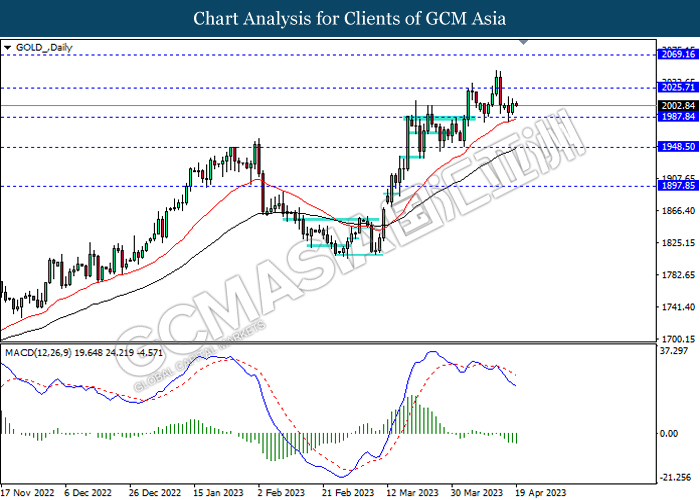

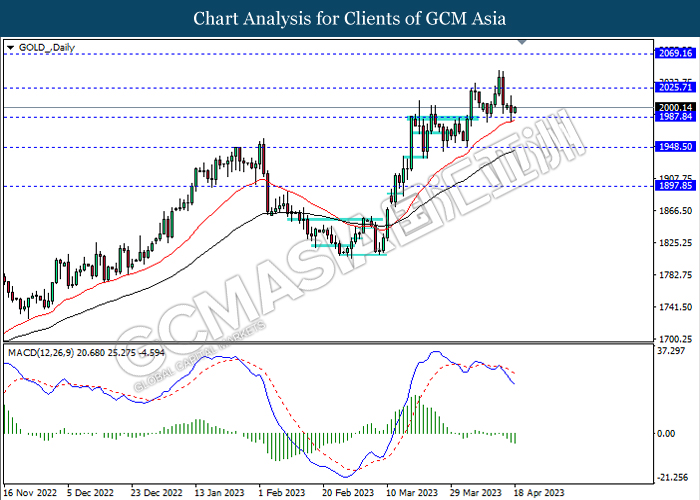

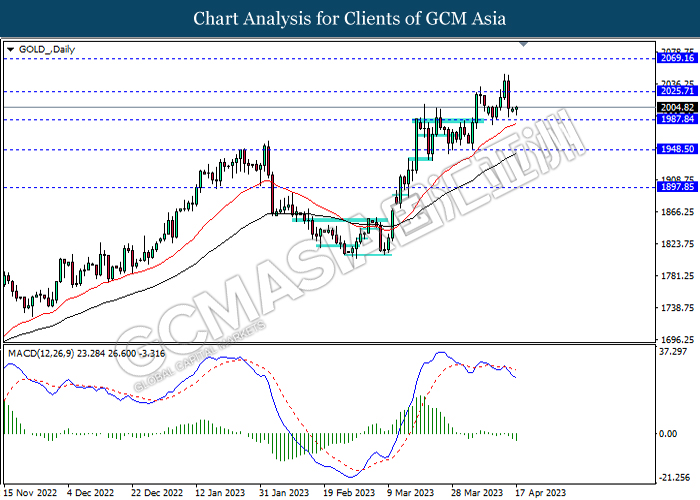

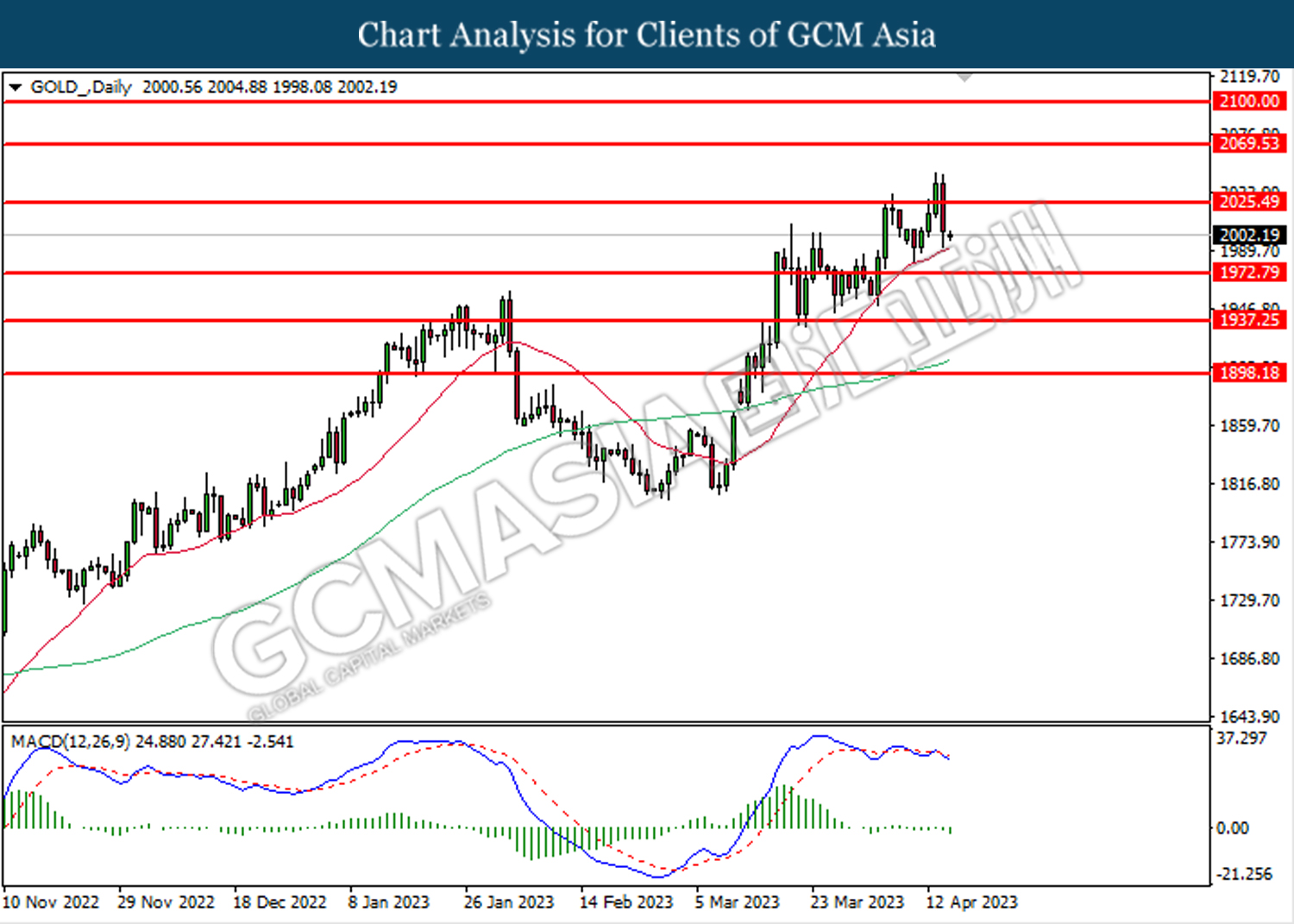

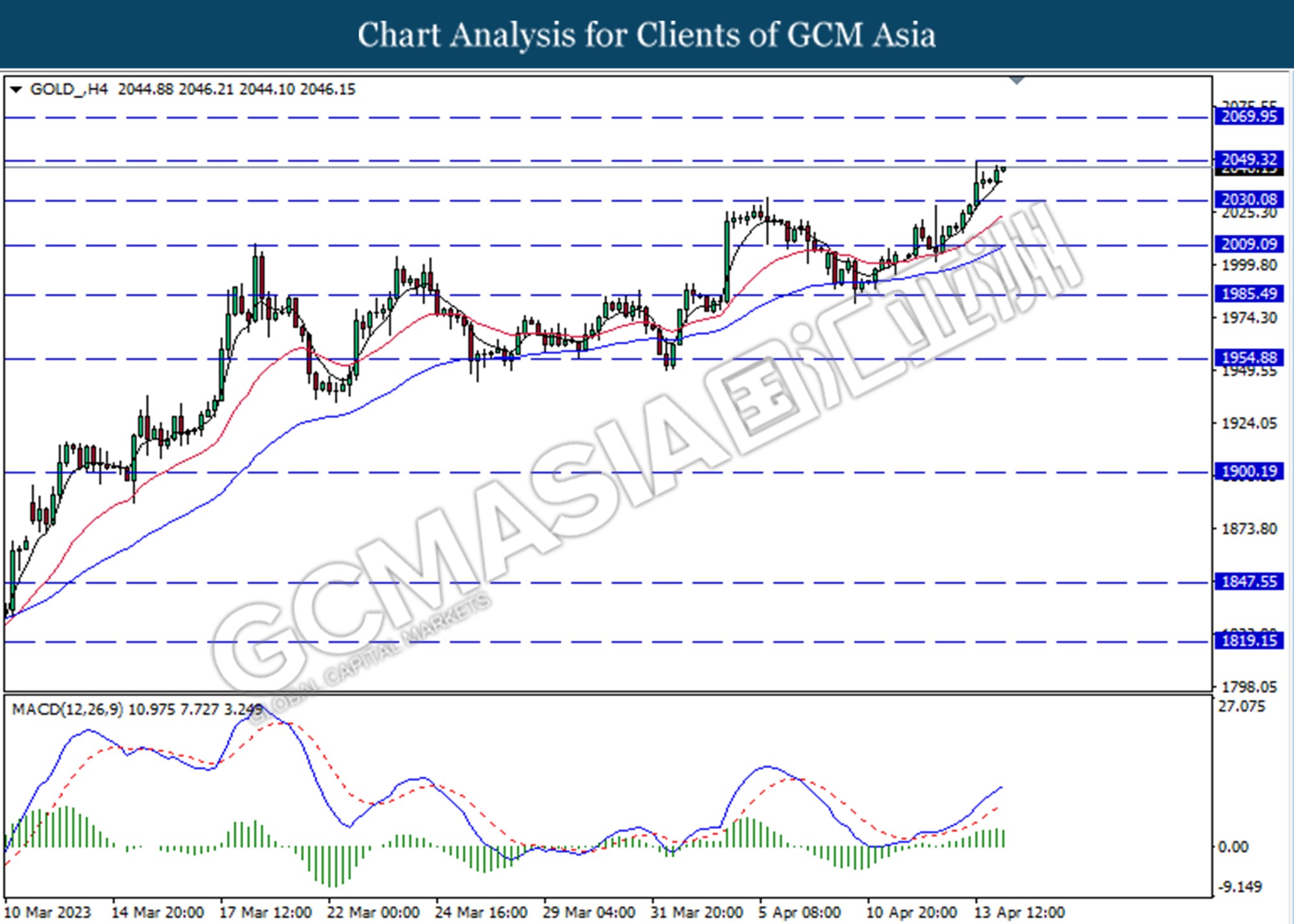

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1985.50. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 2009.10.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90

270423 Morning Session Analysis

27 April 2023 Morning Session Analysis

Greenback tumbled as banking jitters remained.

The dollar index, which was traded against a basket of six major currencies, lost its ground yesterday amid the market concern over the banking jitters overshadowed the announcement of positive data in the US. In the US trading session, the First Republic Bank share price plummeted to new all-time low at $5.69 following a report showed that the Federal government and the banking giants are reluctant to lend a hand to First Republic at this point in time. According to the Bloomberg’s report, U.S. bank regulators are considering lowering their private assessment of First Republic, which could result in it facing potential limits on borrowing from the Federal Reserve. Additionally, without the government support, the other banks do not see a way forward if they choose to buy over some of the asset from First Republic Bank. Prior to that, the renewed worries of banking crisis was initiated after First Republic Bank reported deposit outflows of more than $100 billion in the first quarter, or a total of 40%. With the heightening risk of banking crisis in the US, the stronger-than-expected Core Durable Goods data failed to reignite the sentiment in US dollar market. As of writing, the dollar index dropped -0.39% to 101.45.

In the commodities market, crude oil prices were down by -0.04% to $74.40 per barrel as the renewed banking fears continued to weigh on the prospect of this black commodity. Besides, gold prices edged up by 0.05% to $1990.30 per troy ounce amid the rising of safe haven demand.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | 2.6% | 2.0% | – |

| 20:30 | USD – Initial Jobless Claims | 245K | 248K | – |

| 22:00 | USD – Pending Home Sales (MoM) (Mar) | 0.8% | 0.5% | – |

Technical Analysis

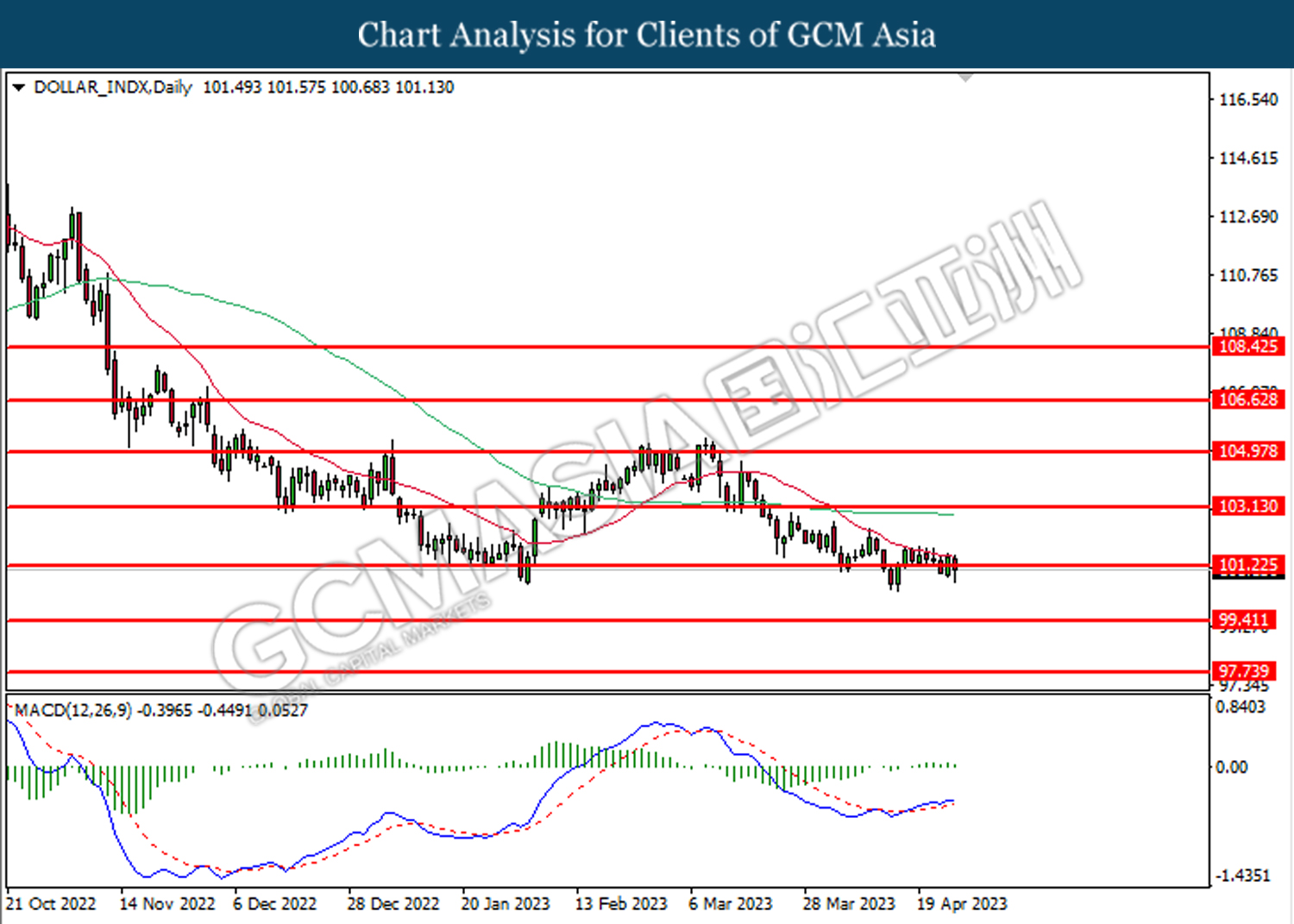

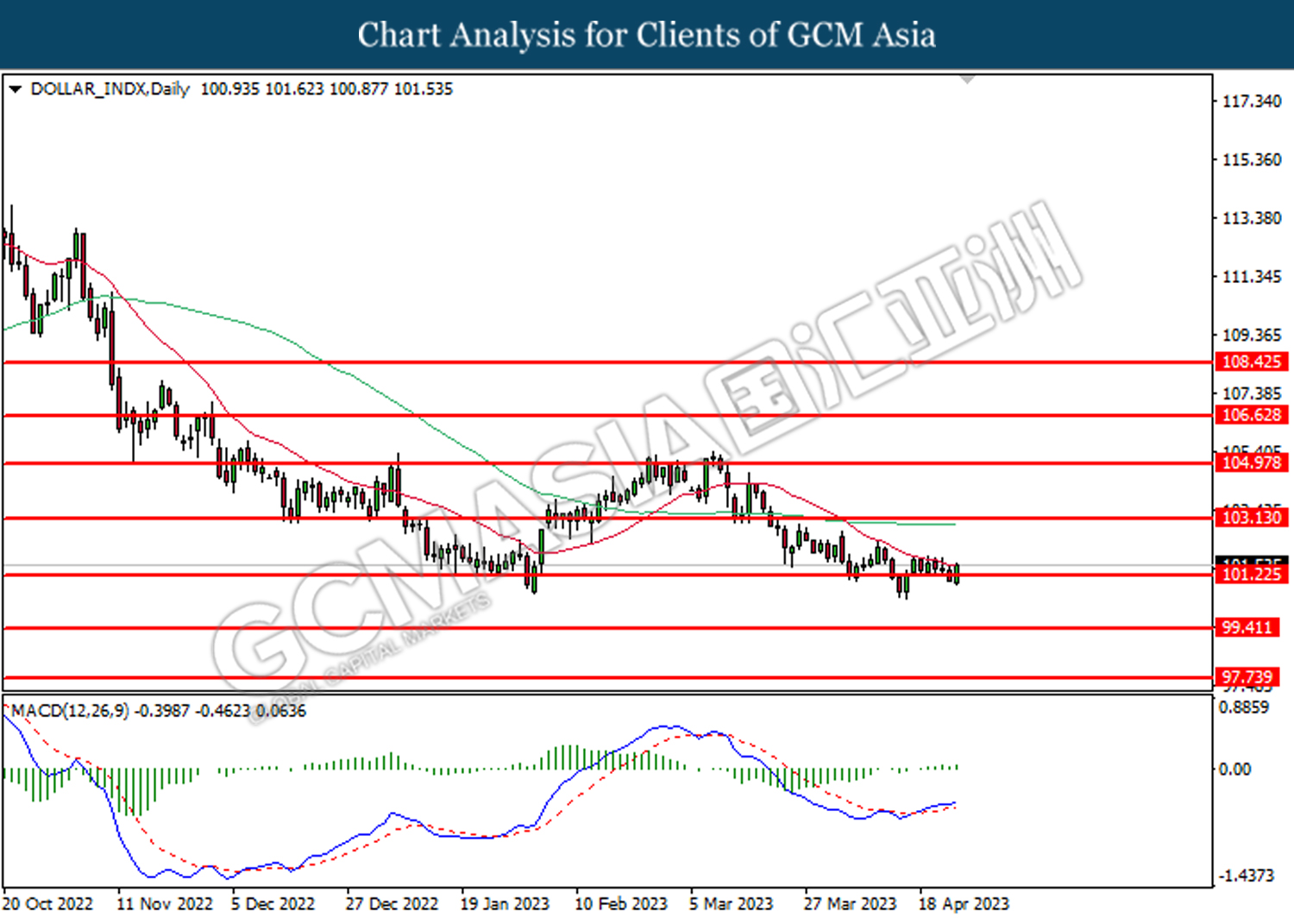

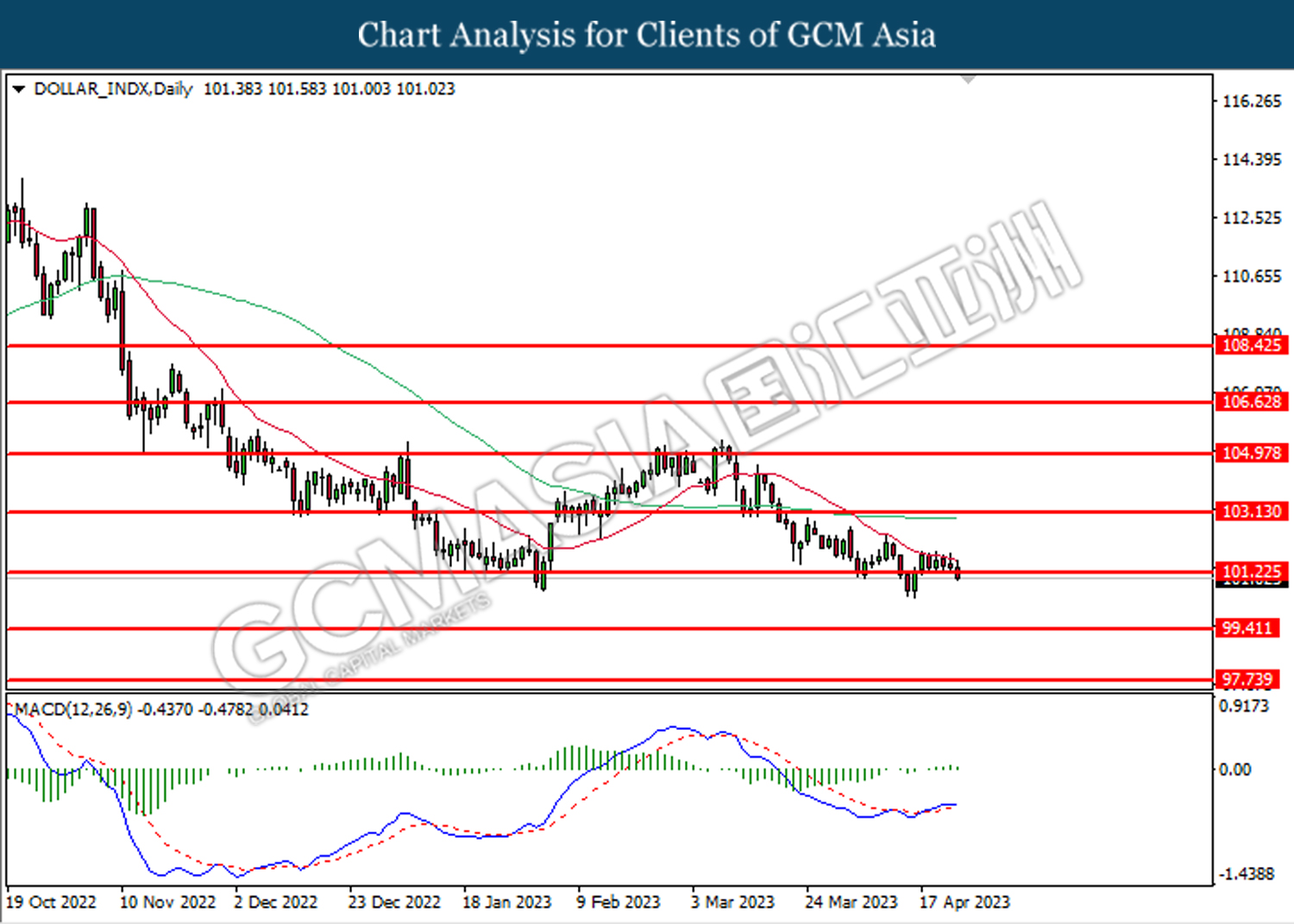

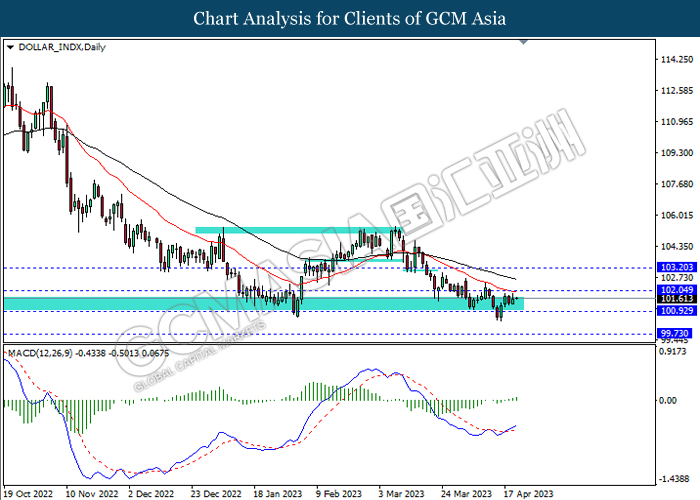

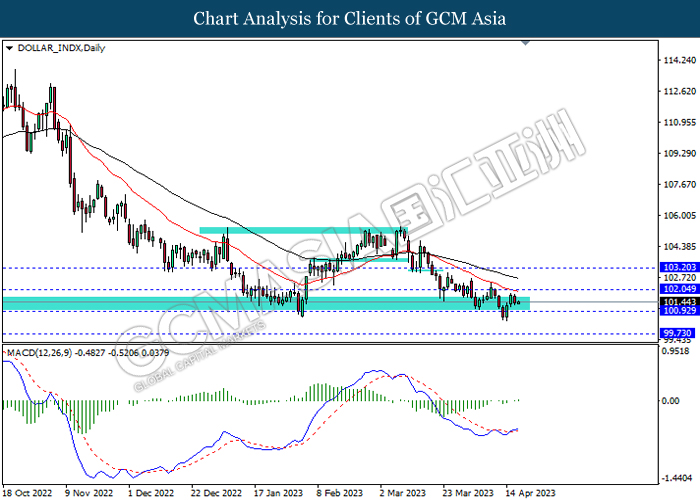

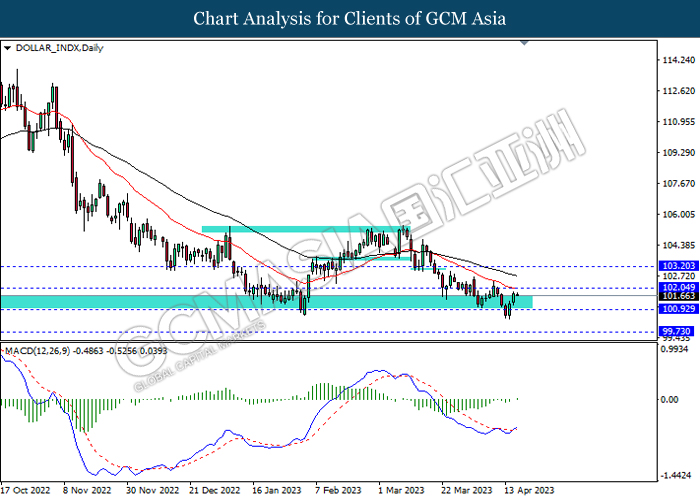

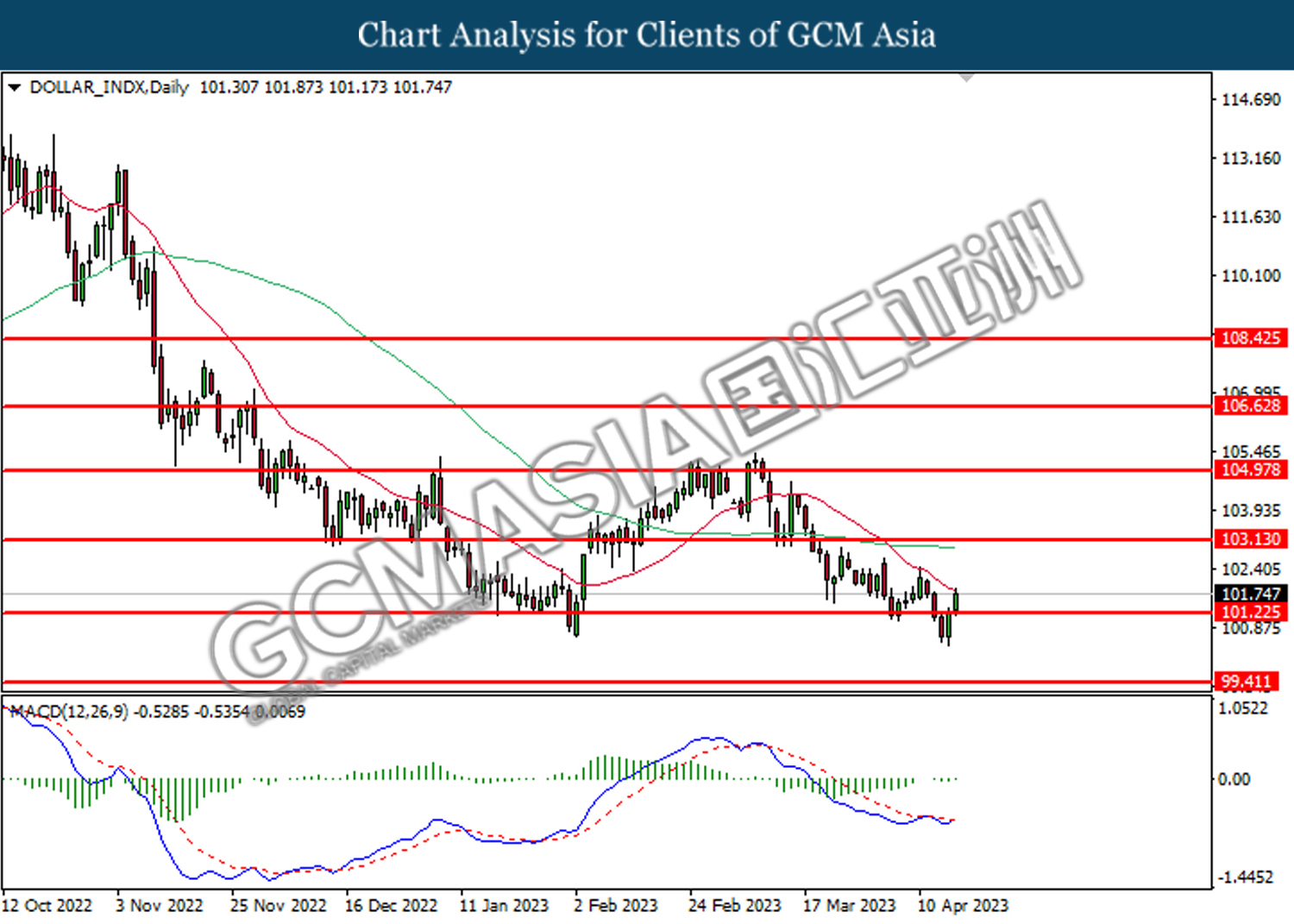

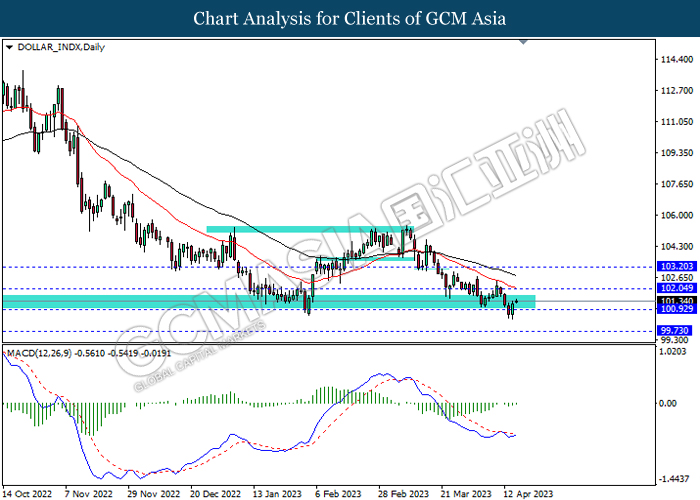

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

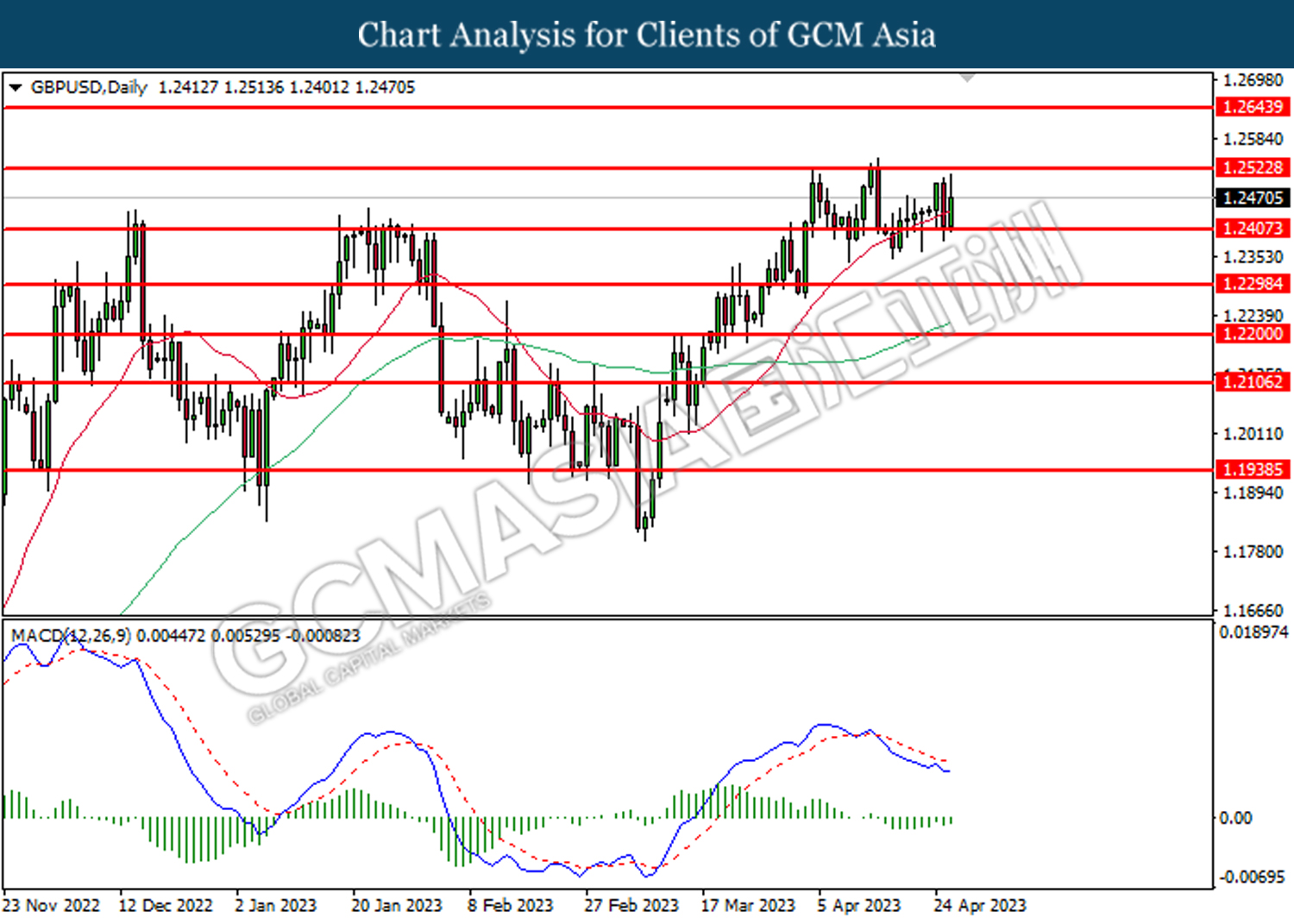

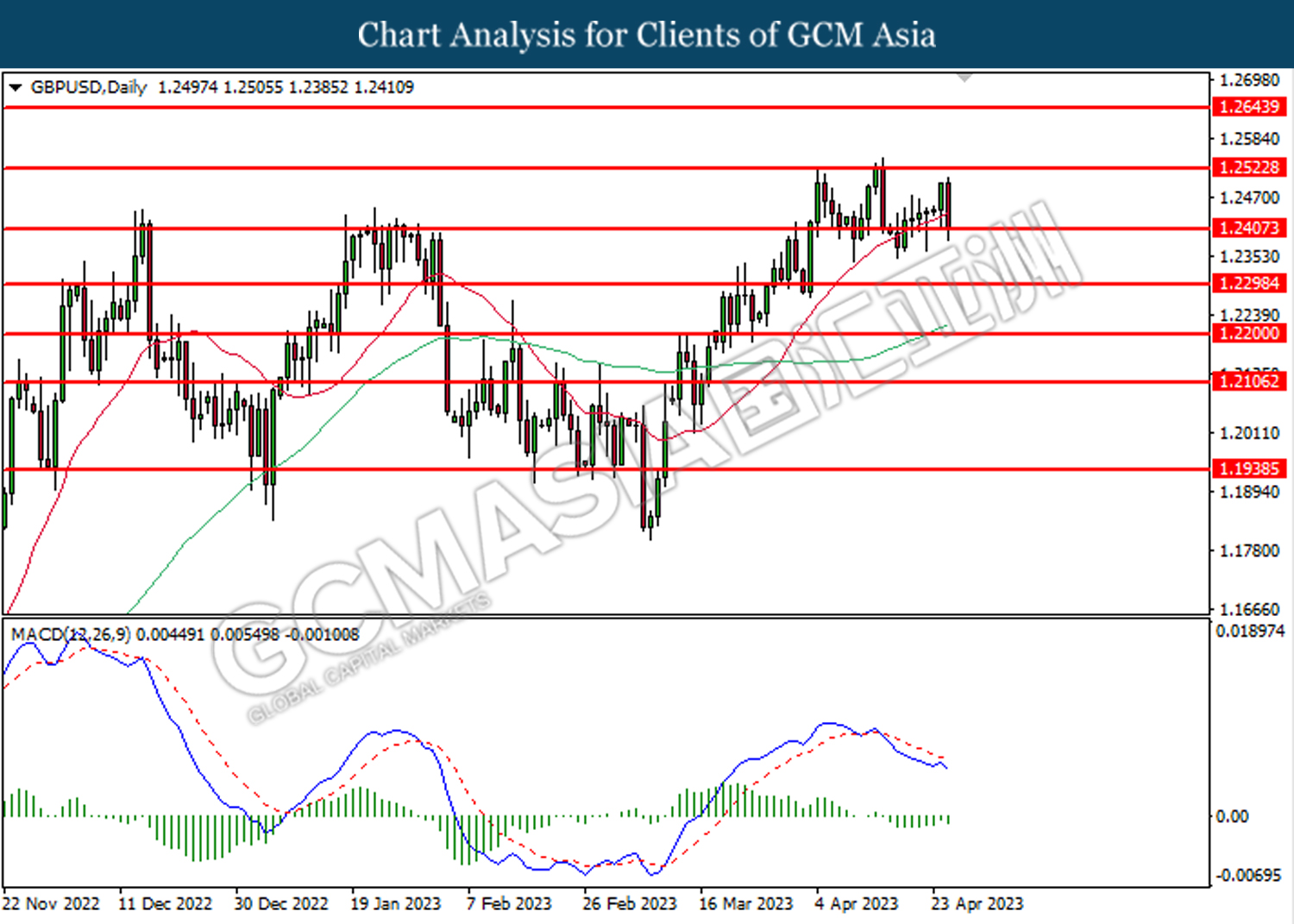

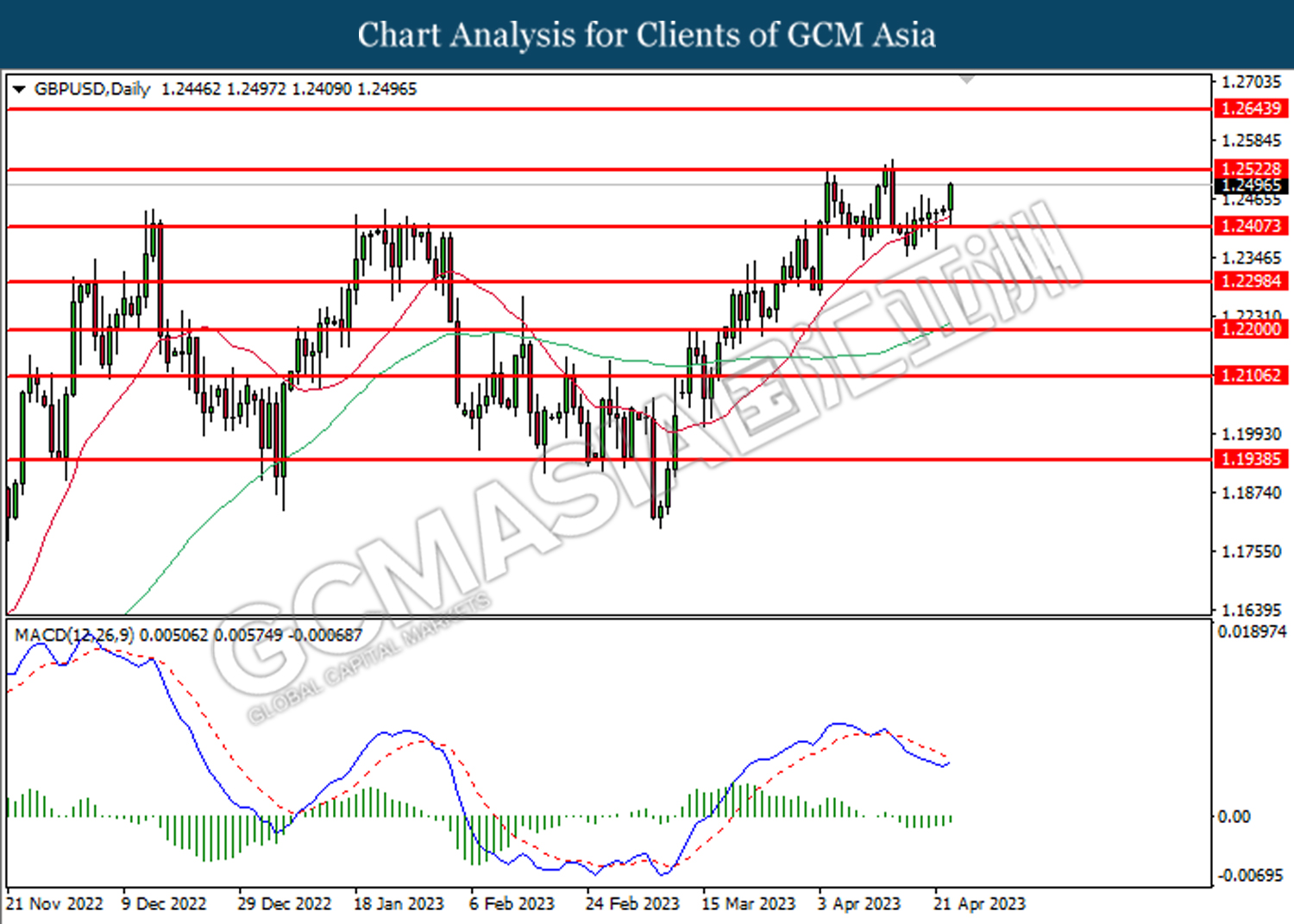

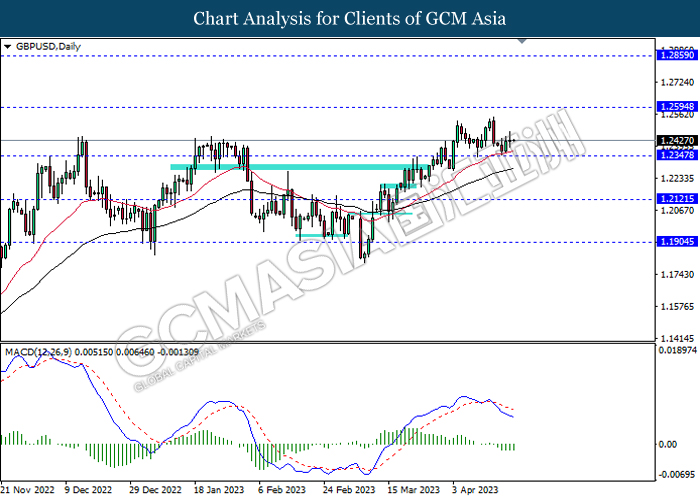

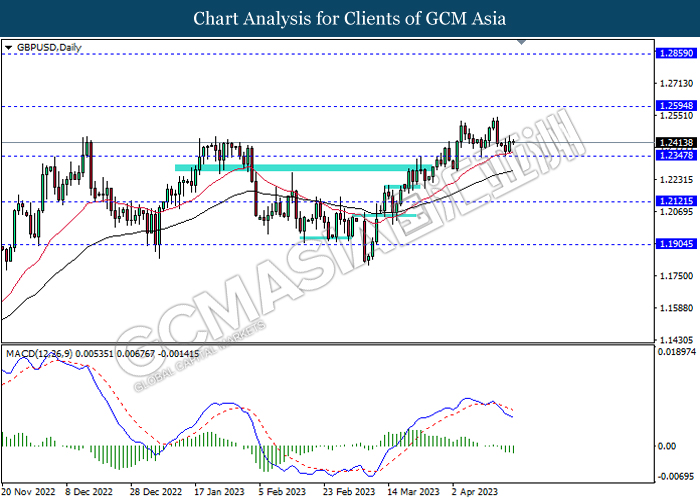

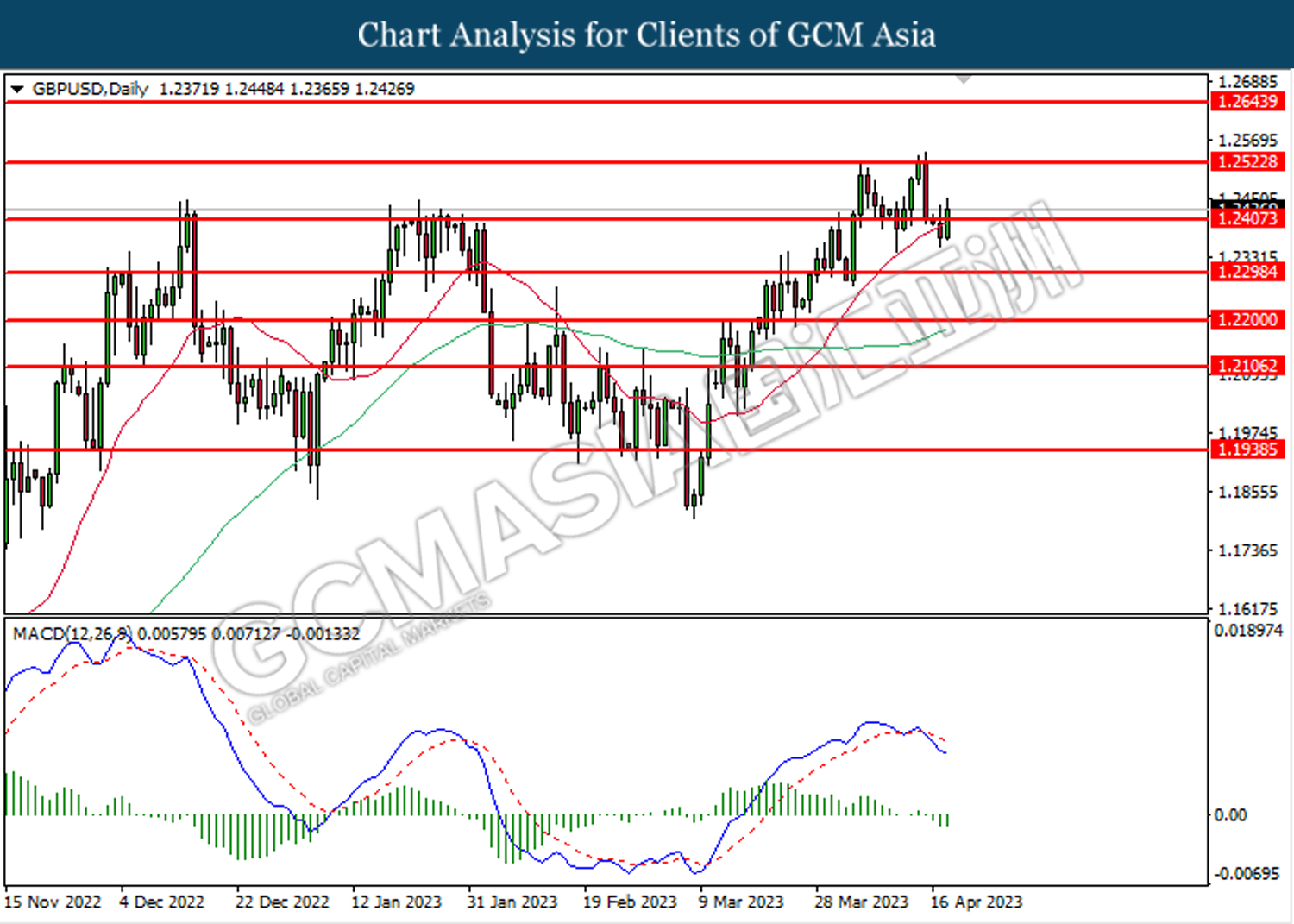

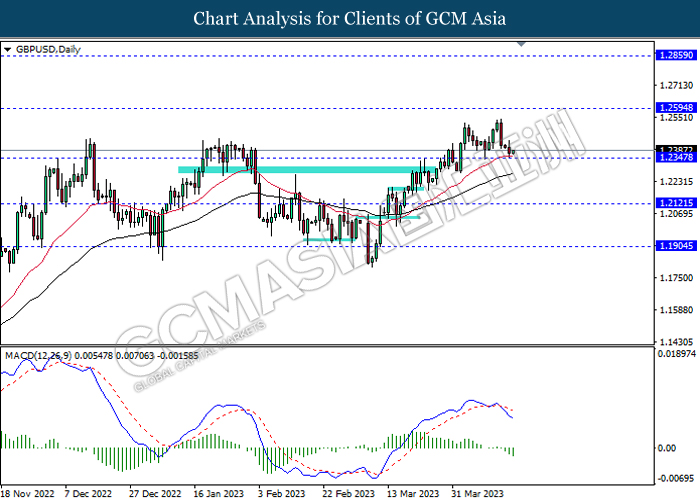

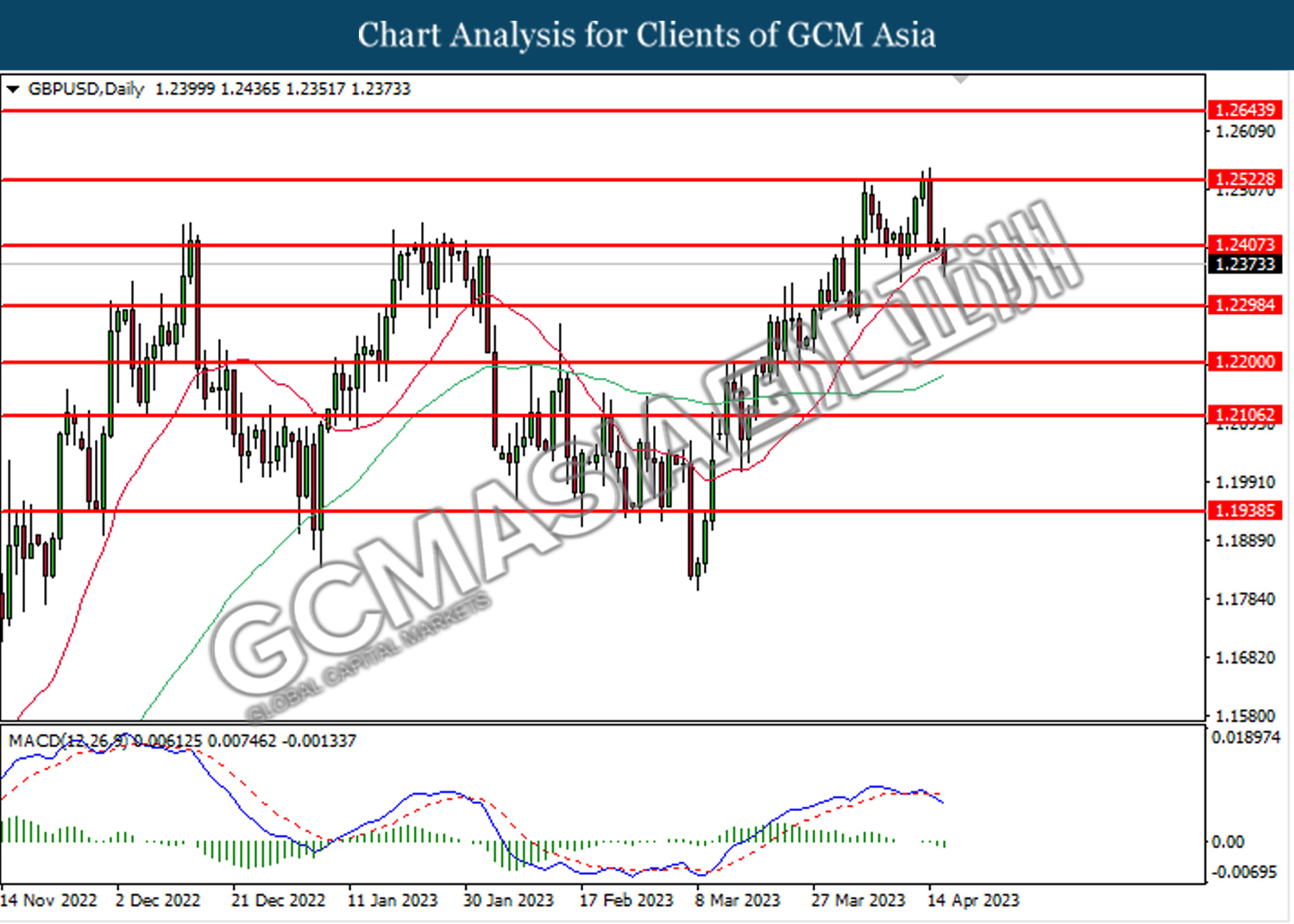

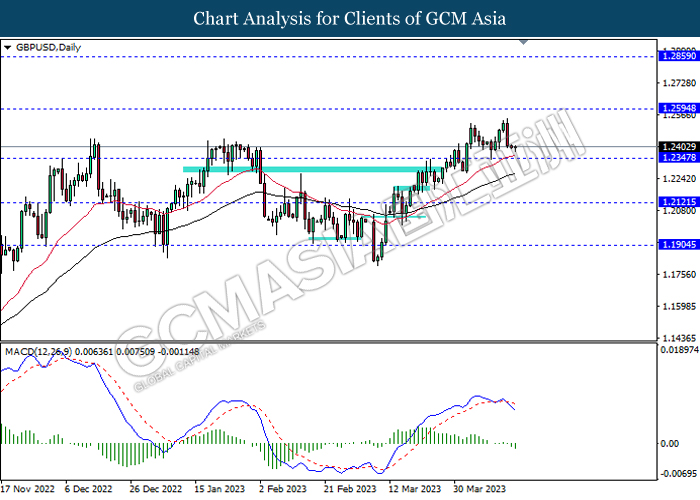

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2525.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

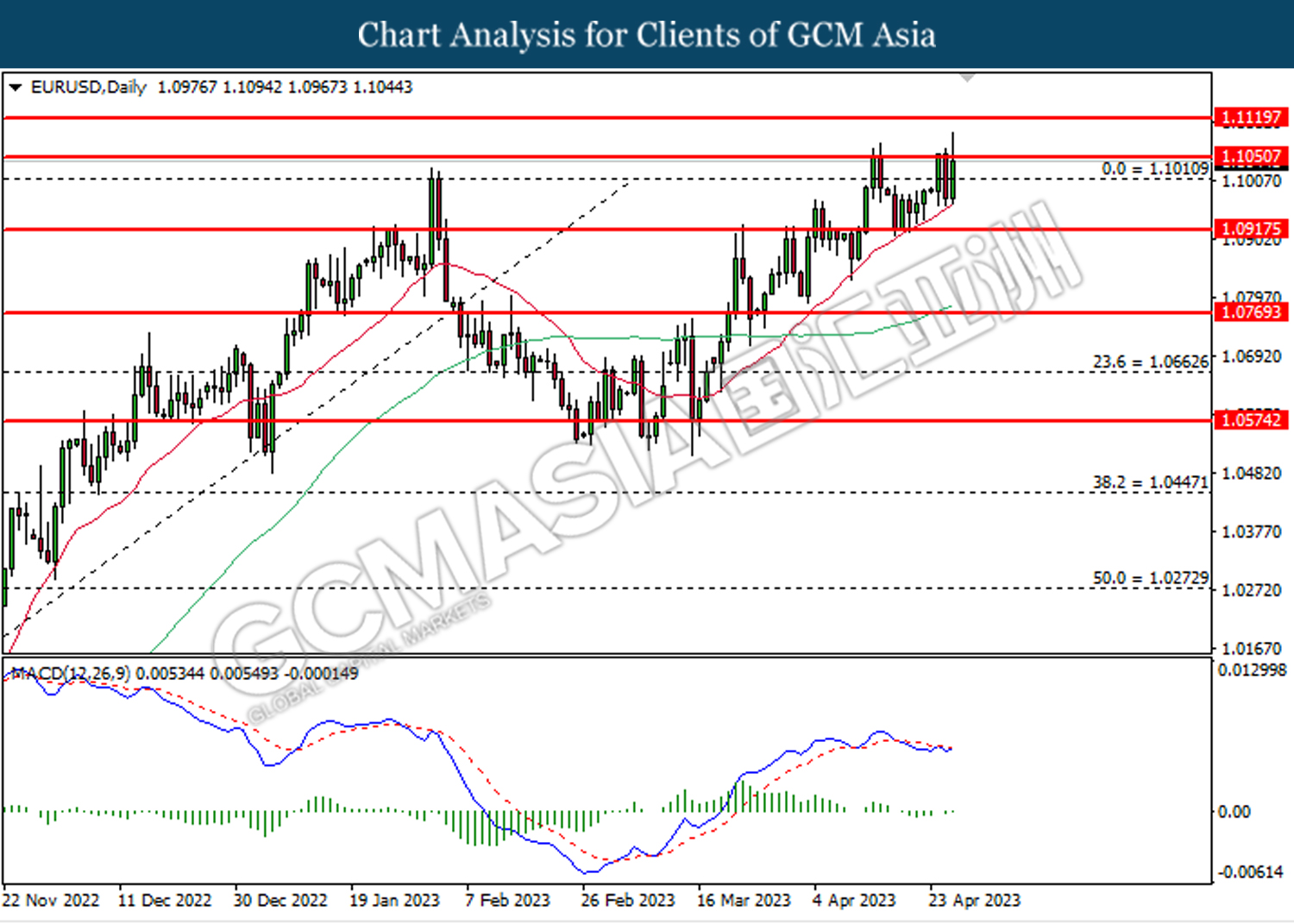

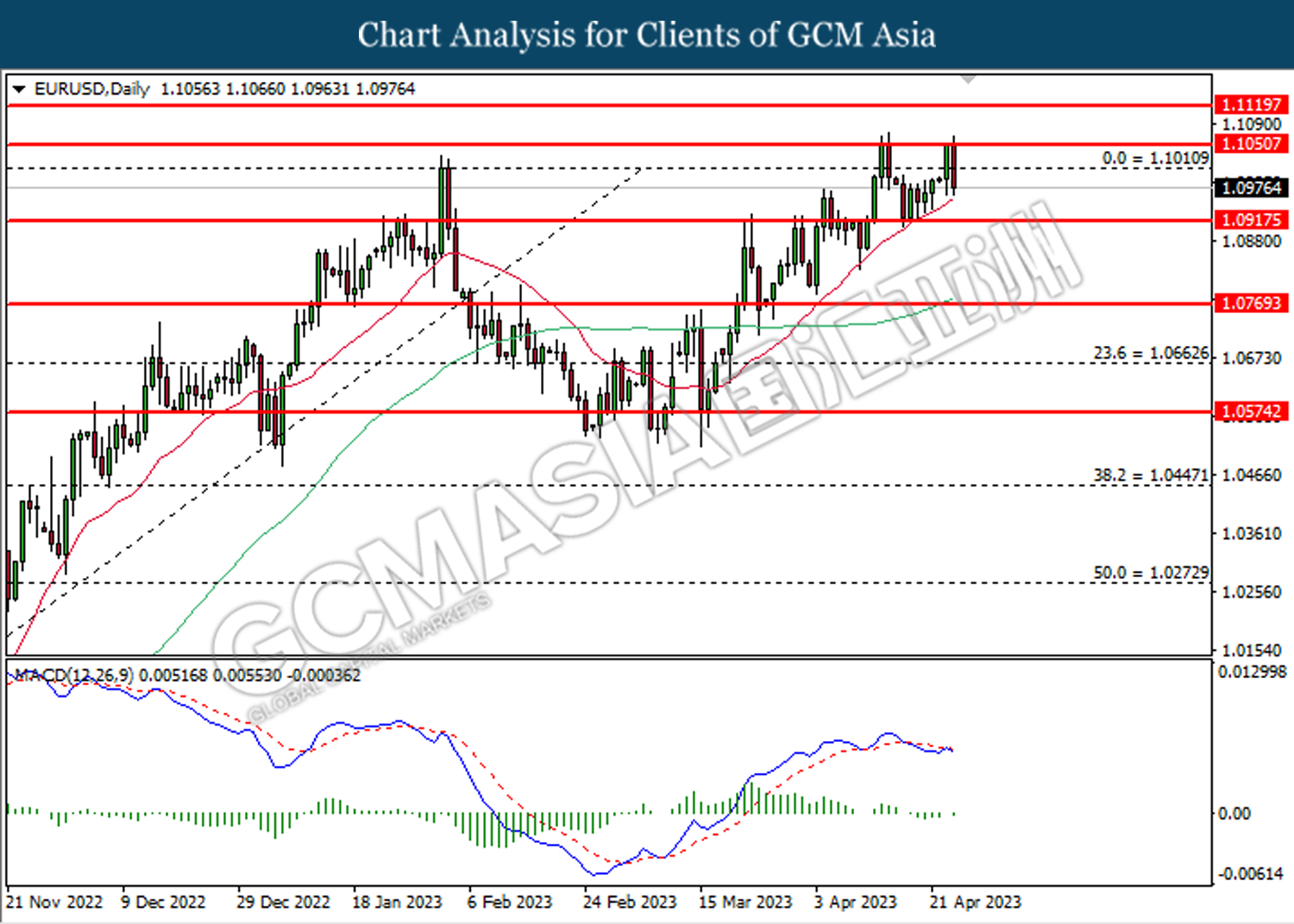

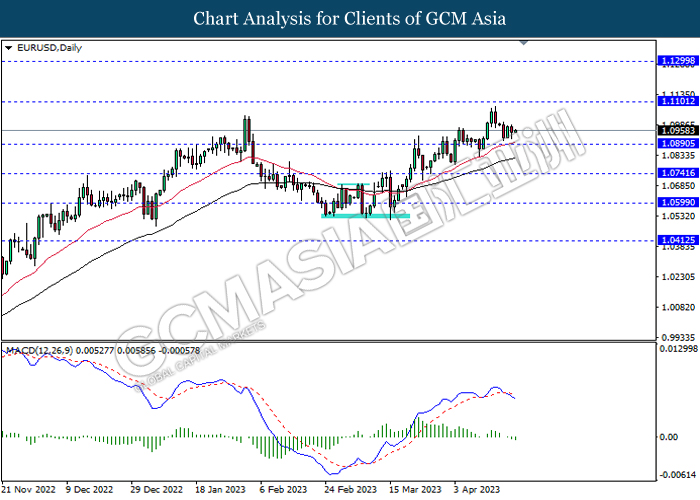

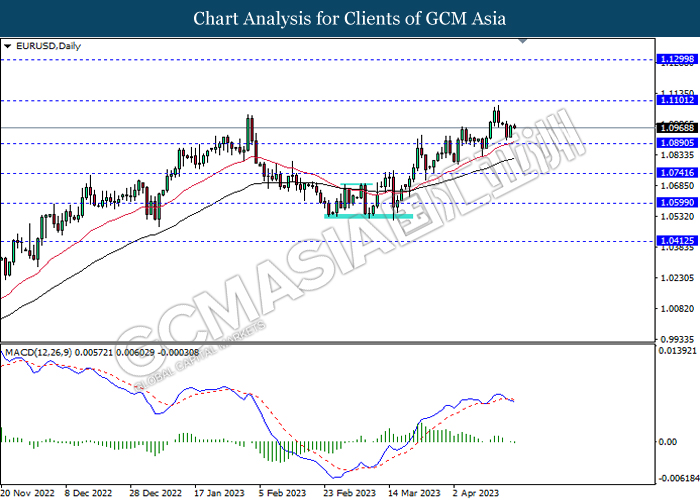

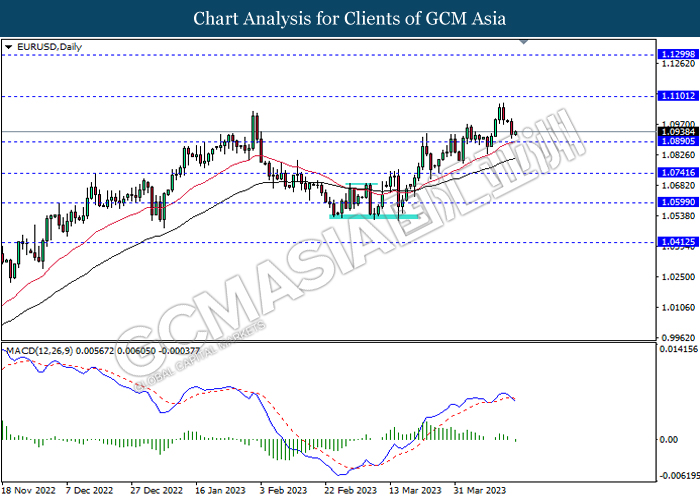

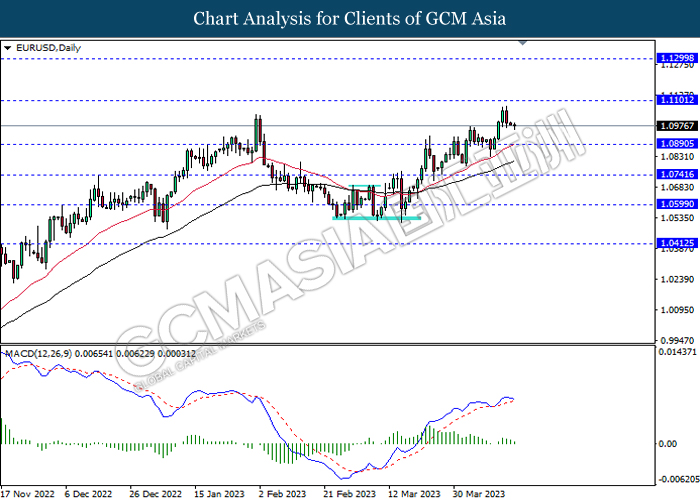

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1050. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

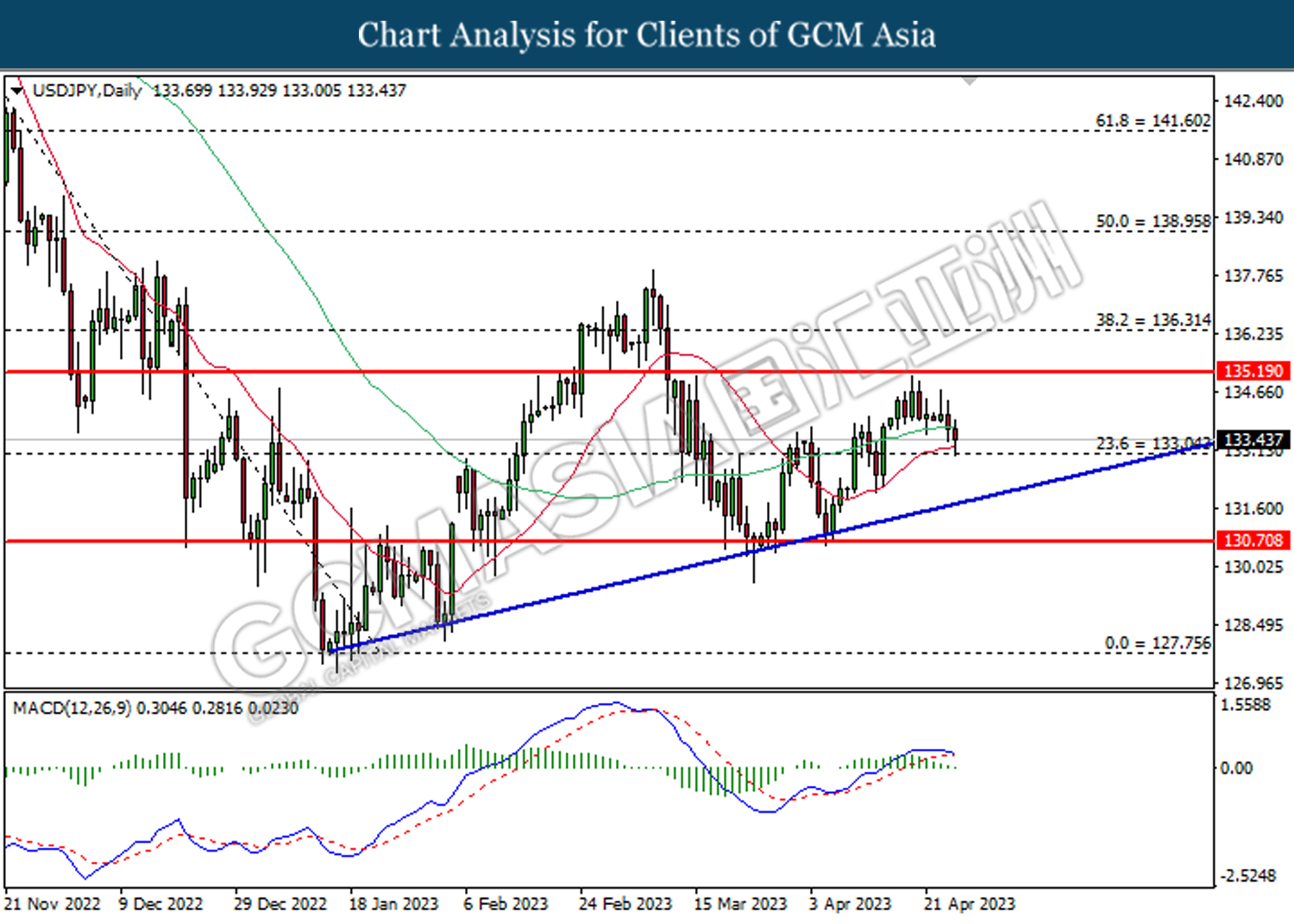

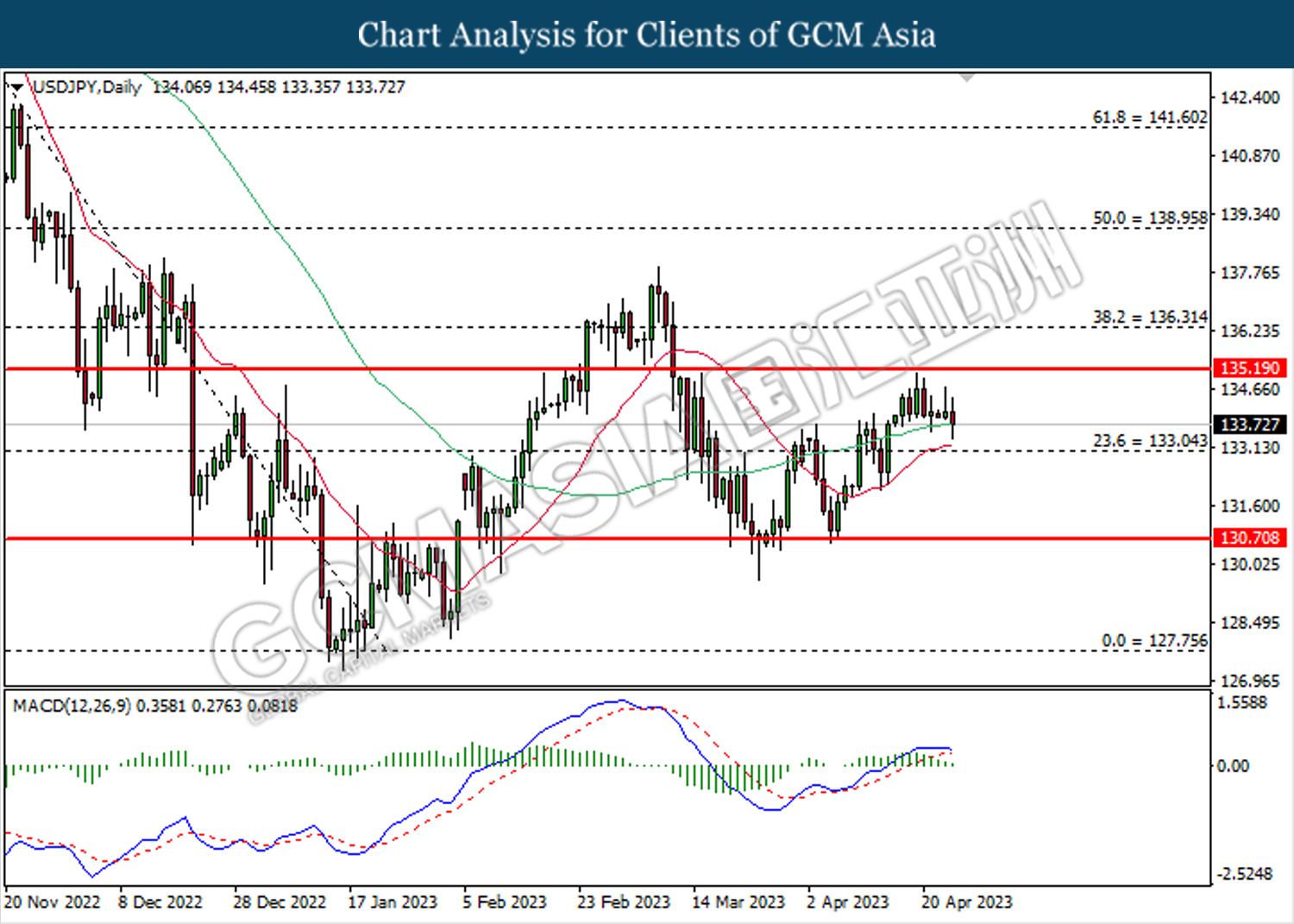

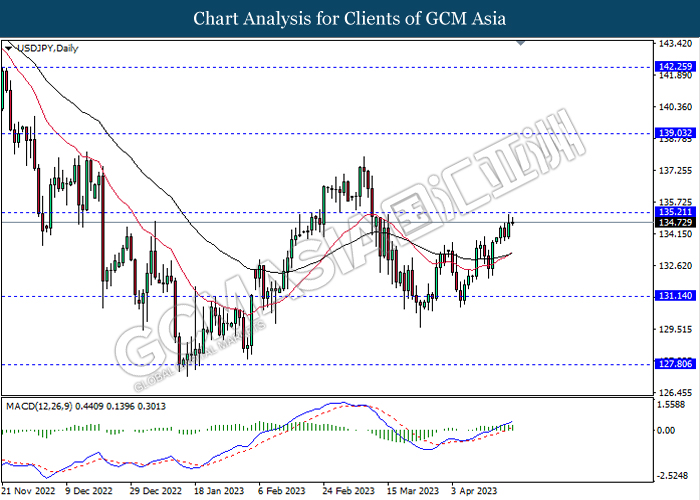

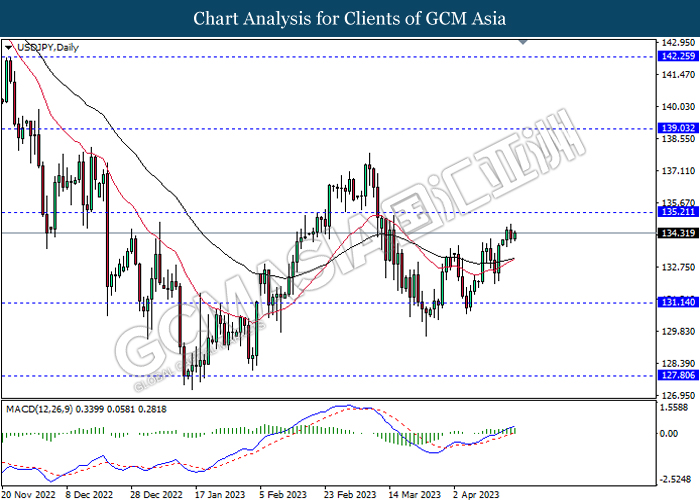

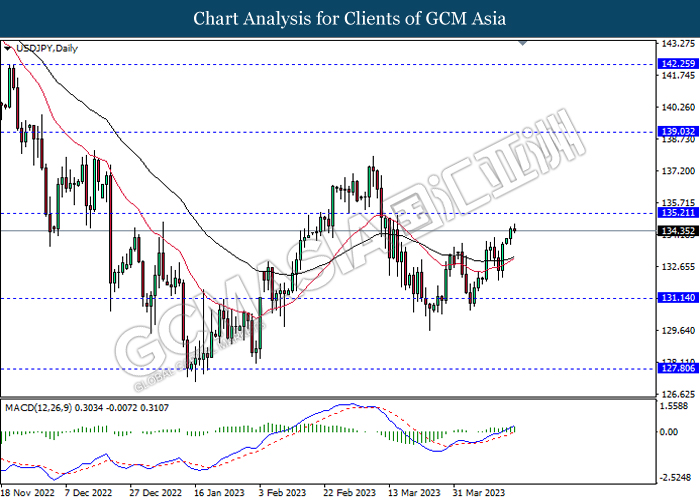

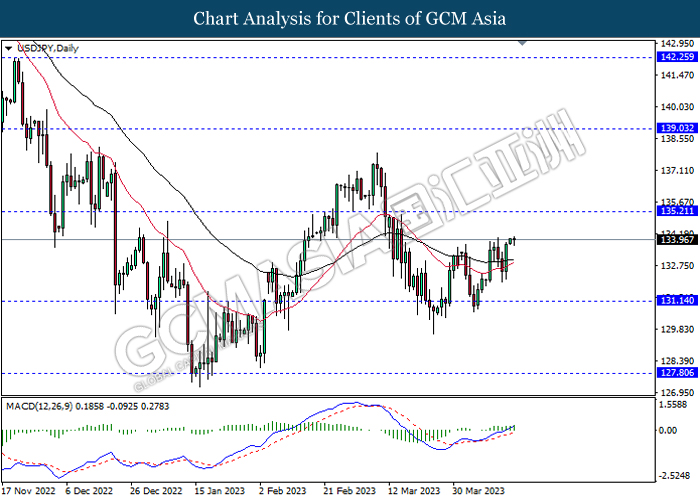

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 135.20. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

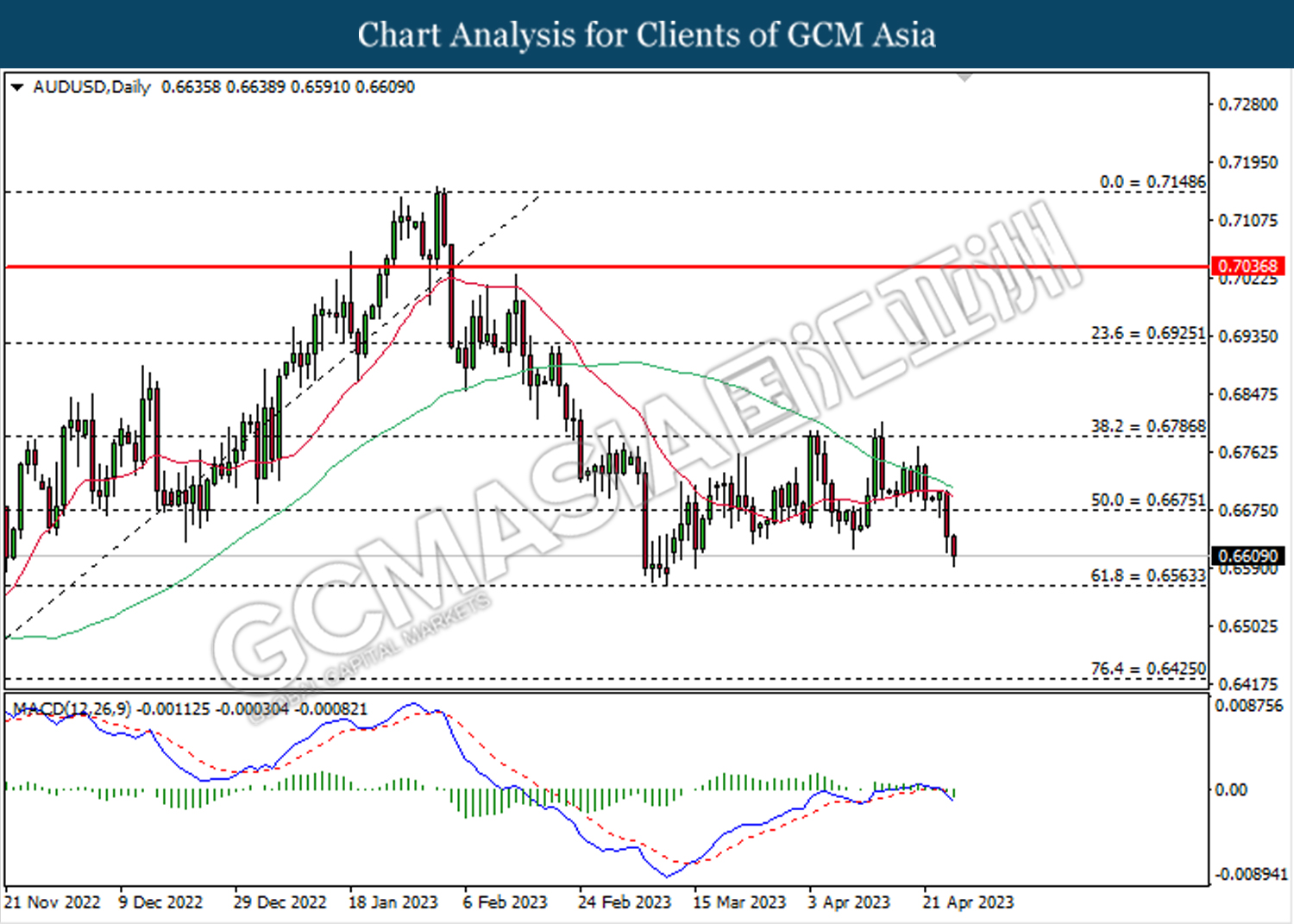

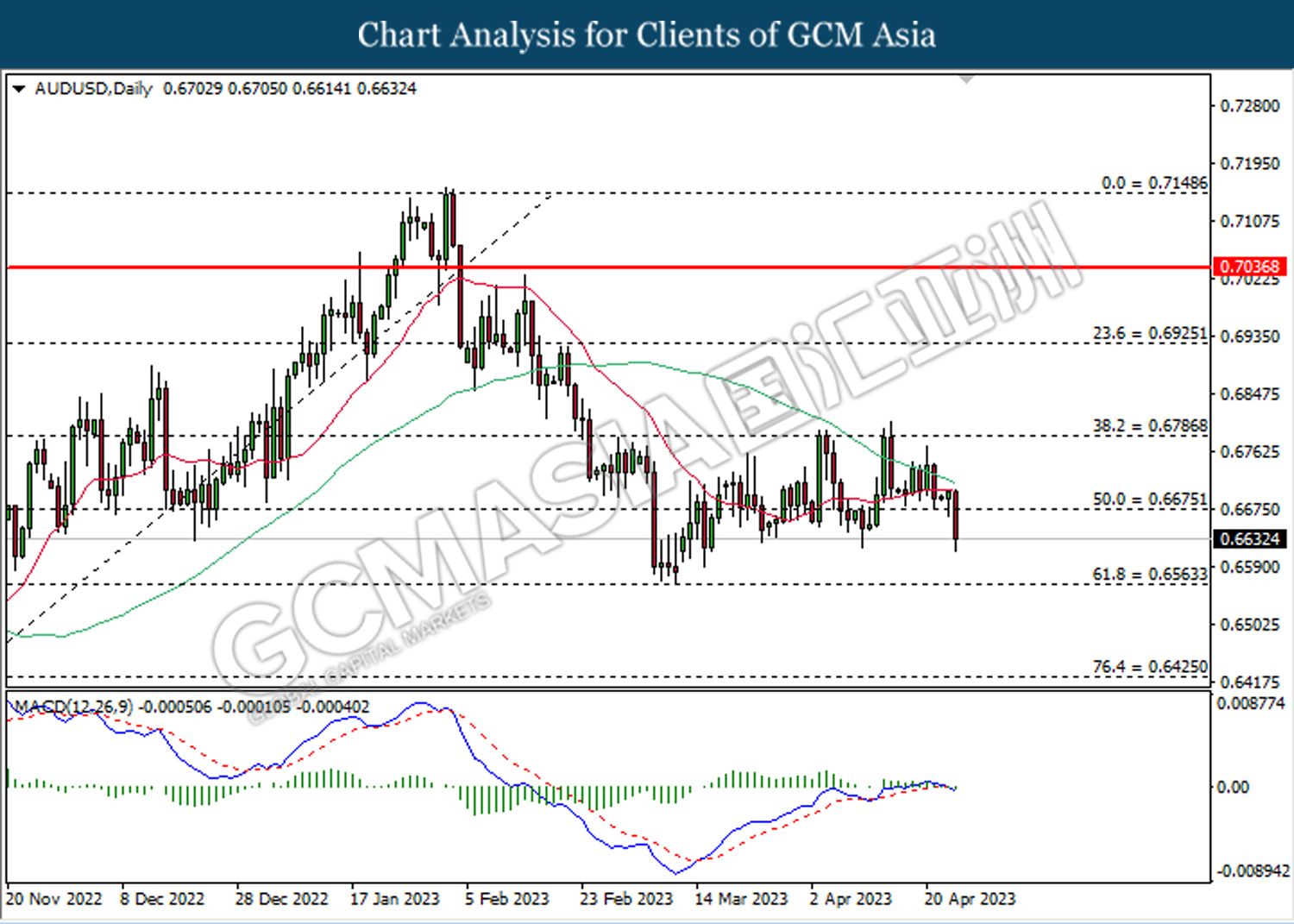

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

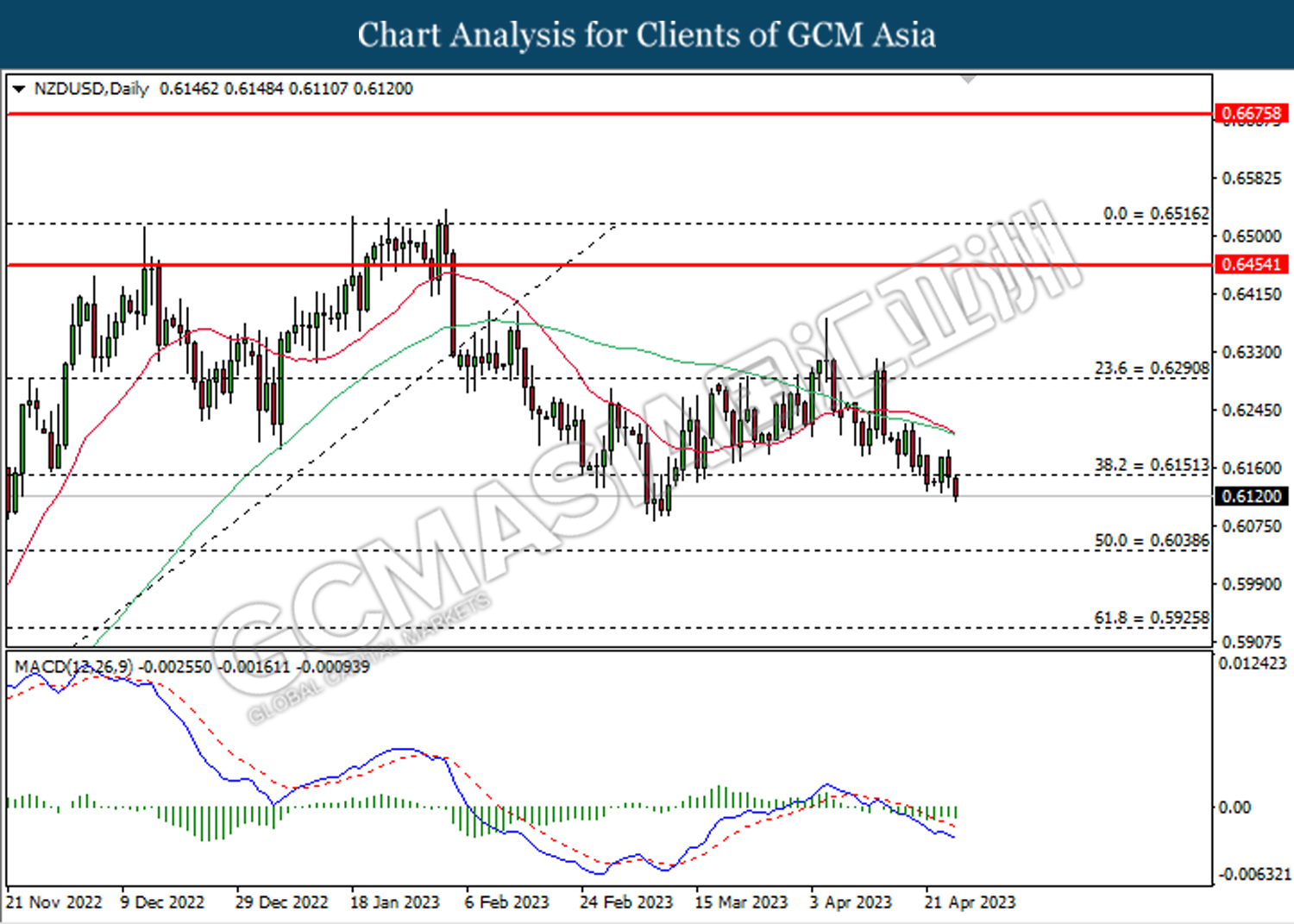

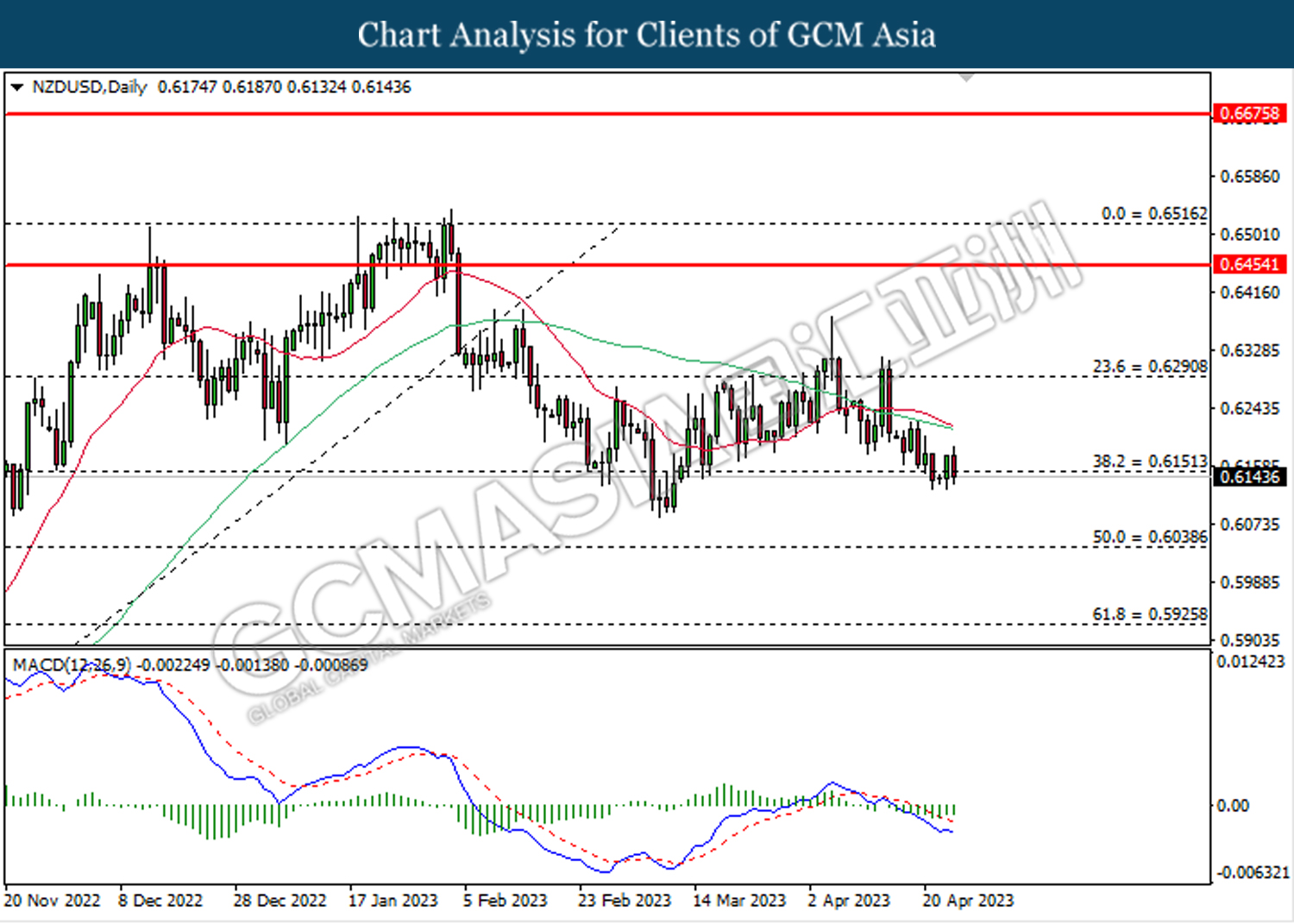

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

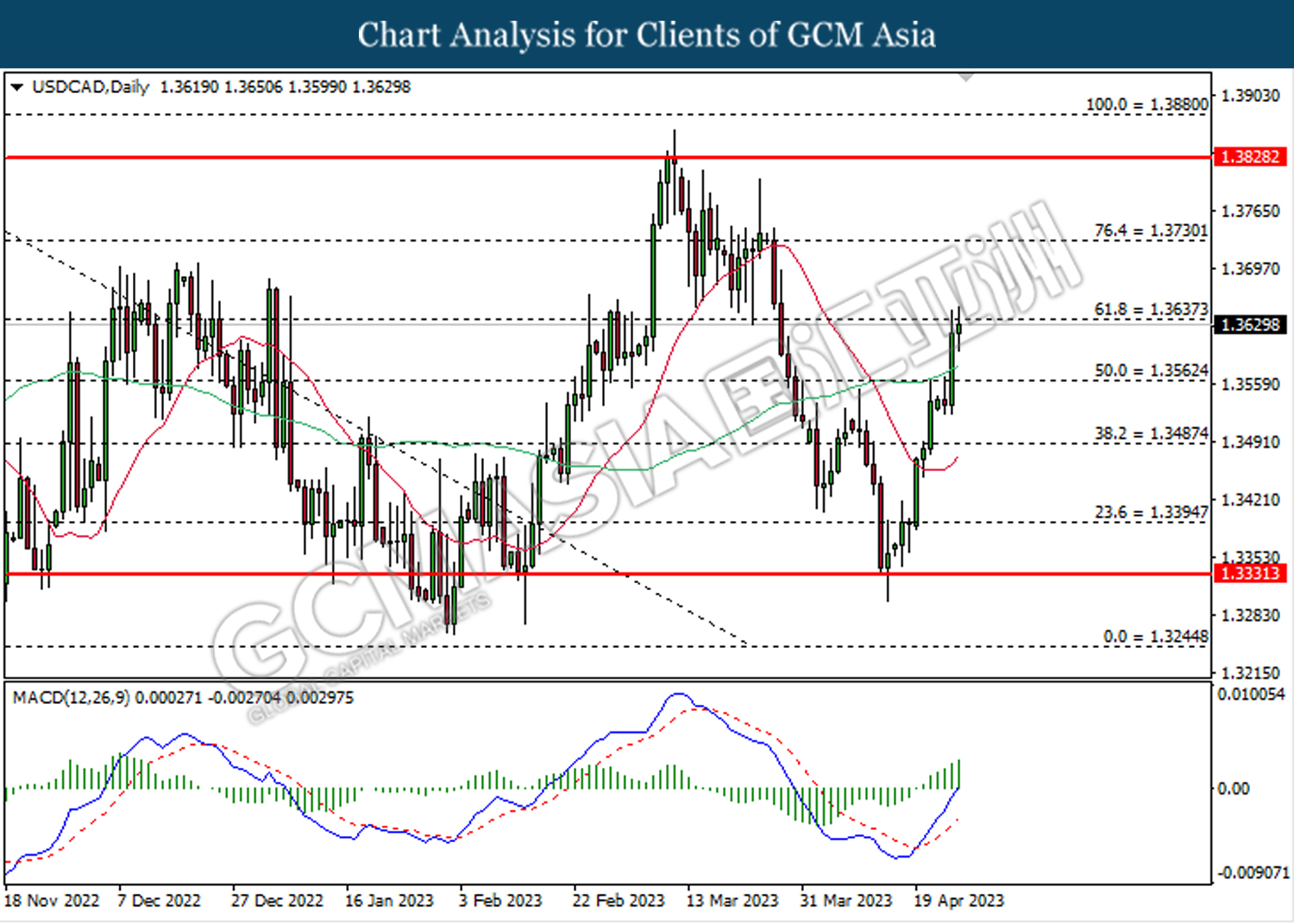

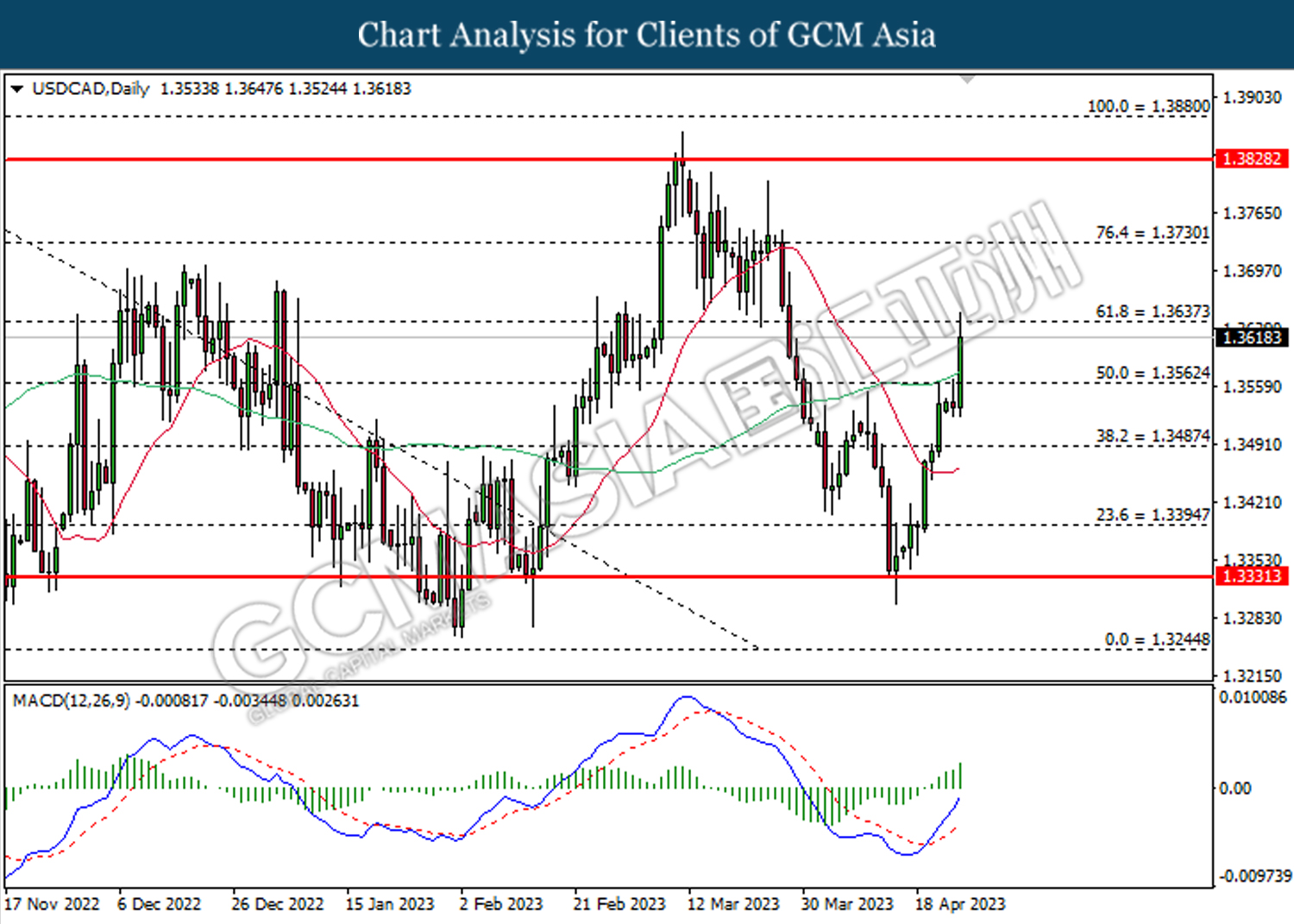

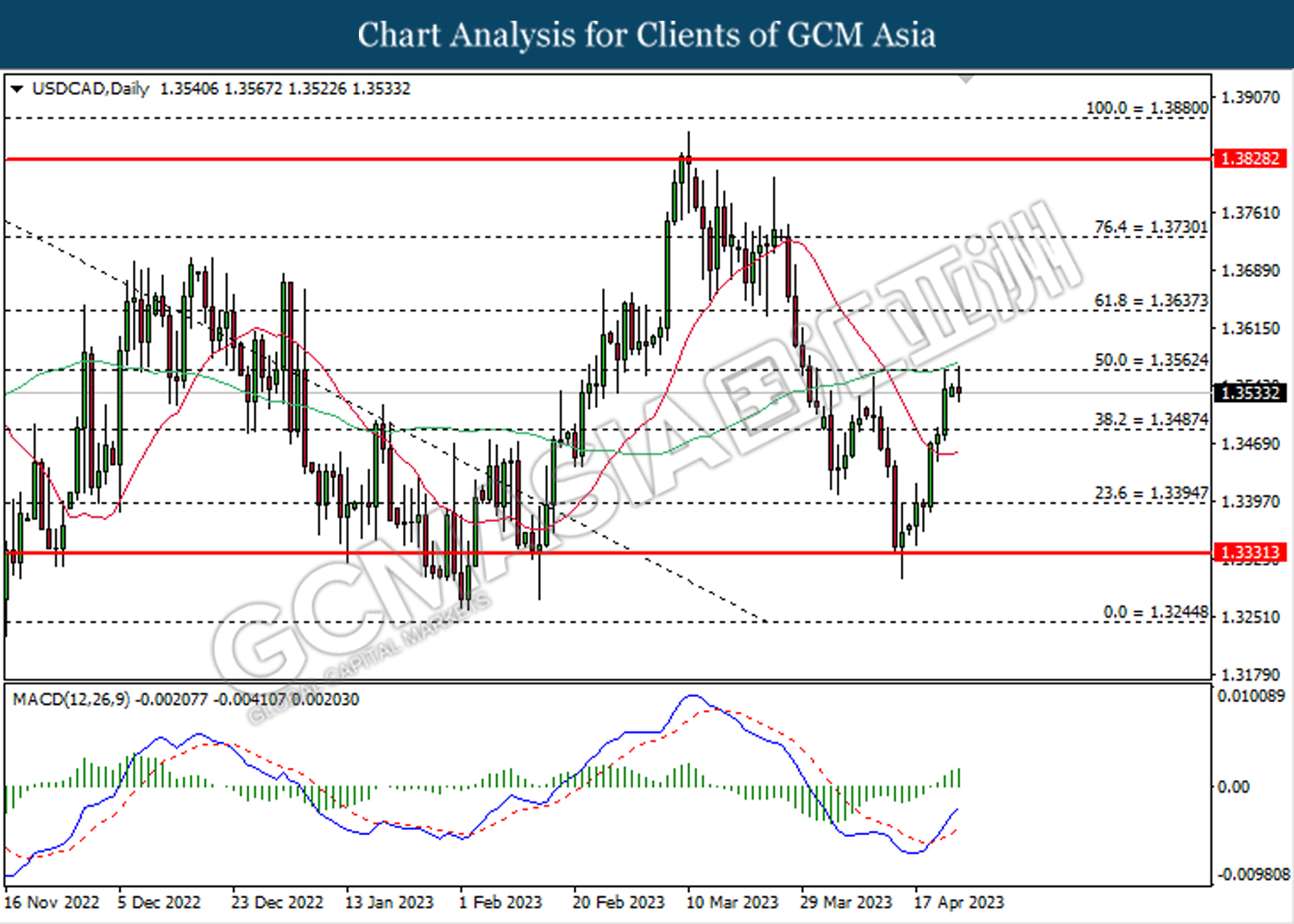

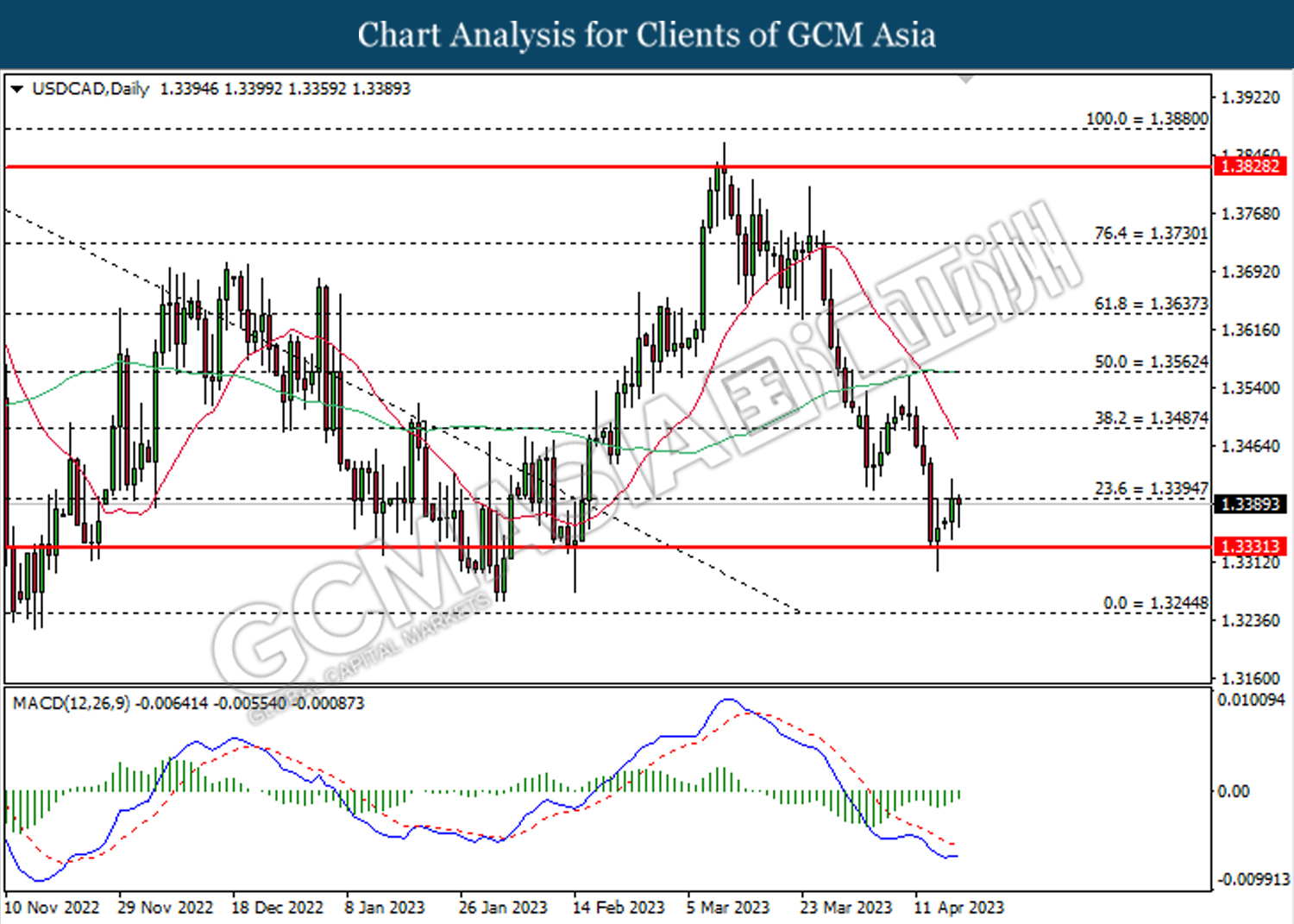

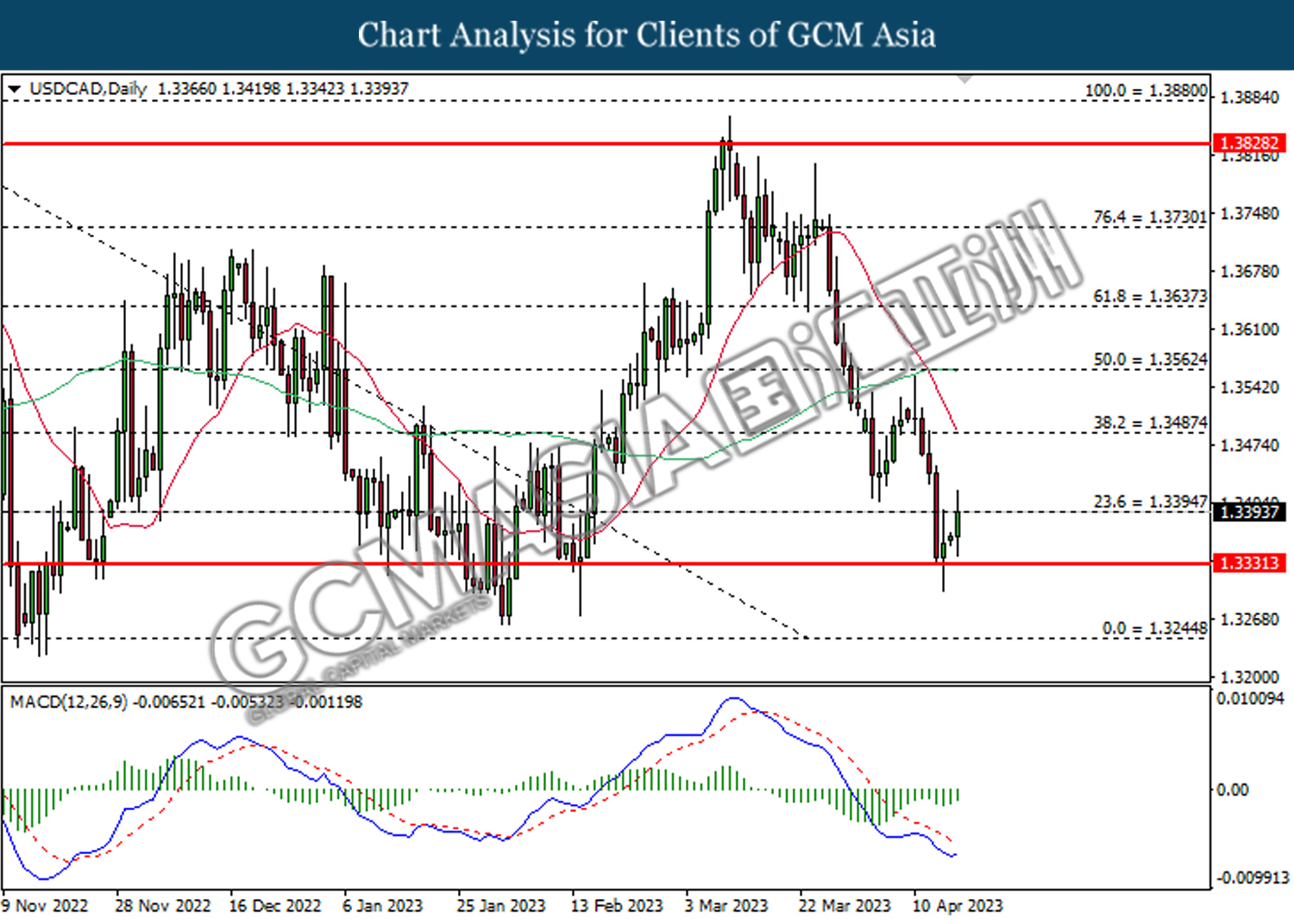

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3635. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

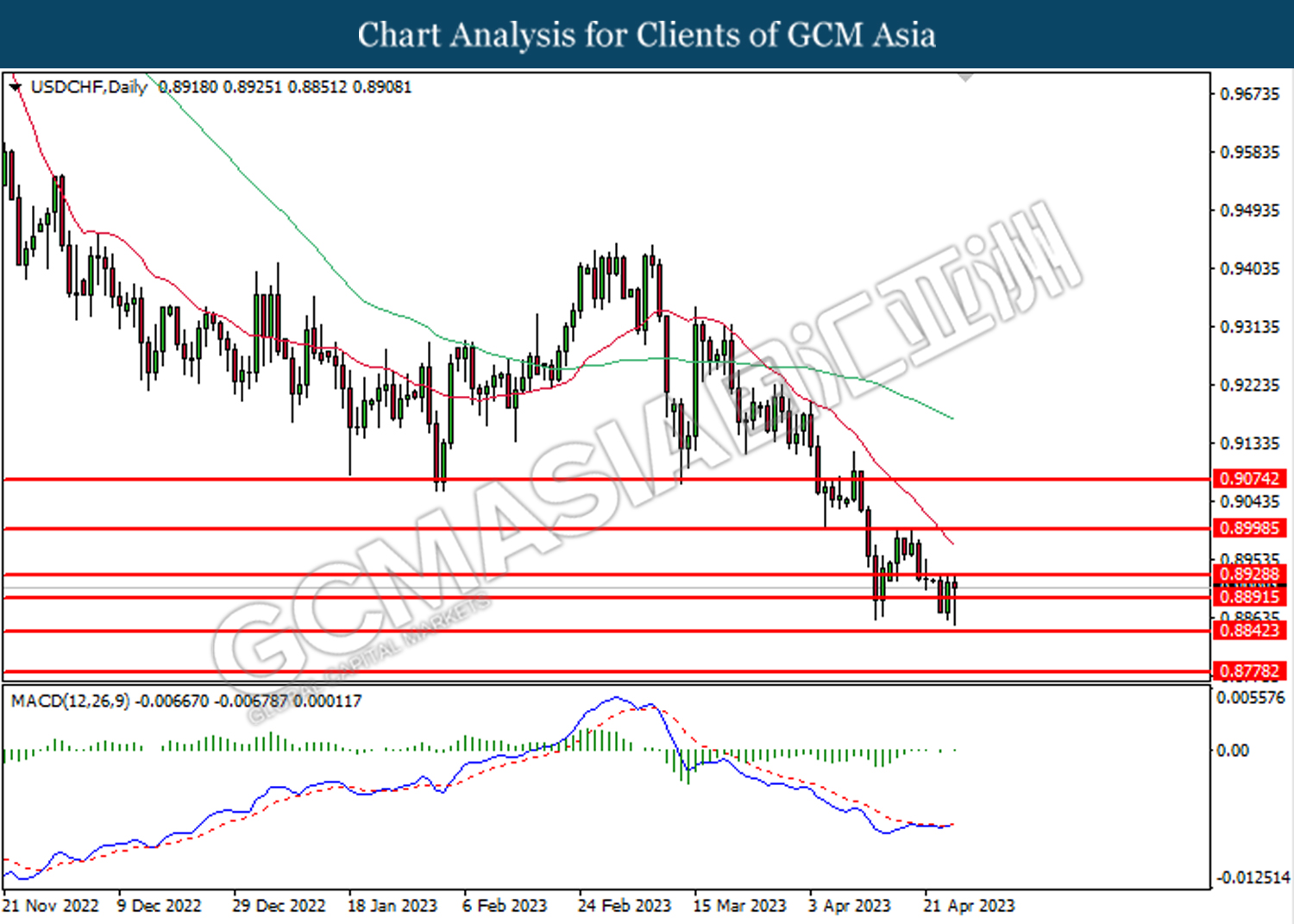

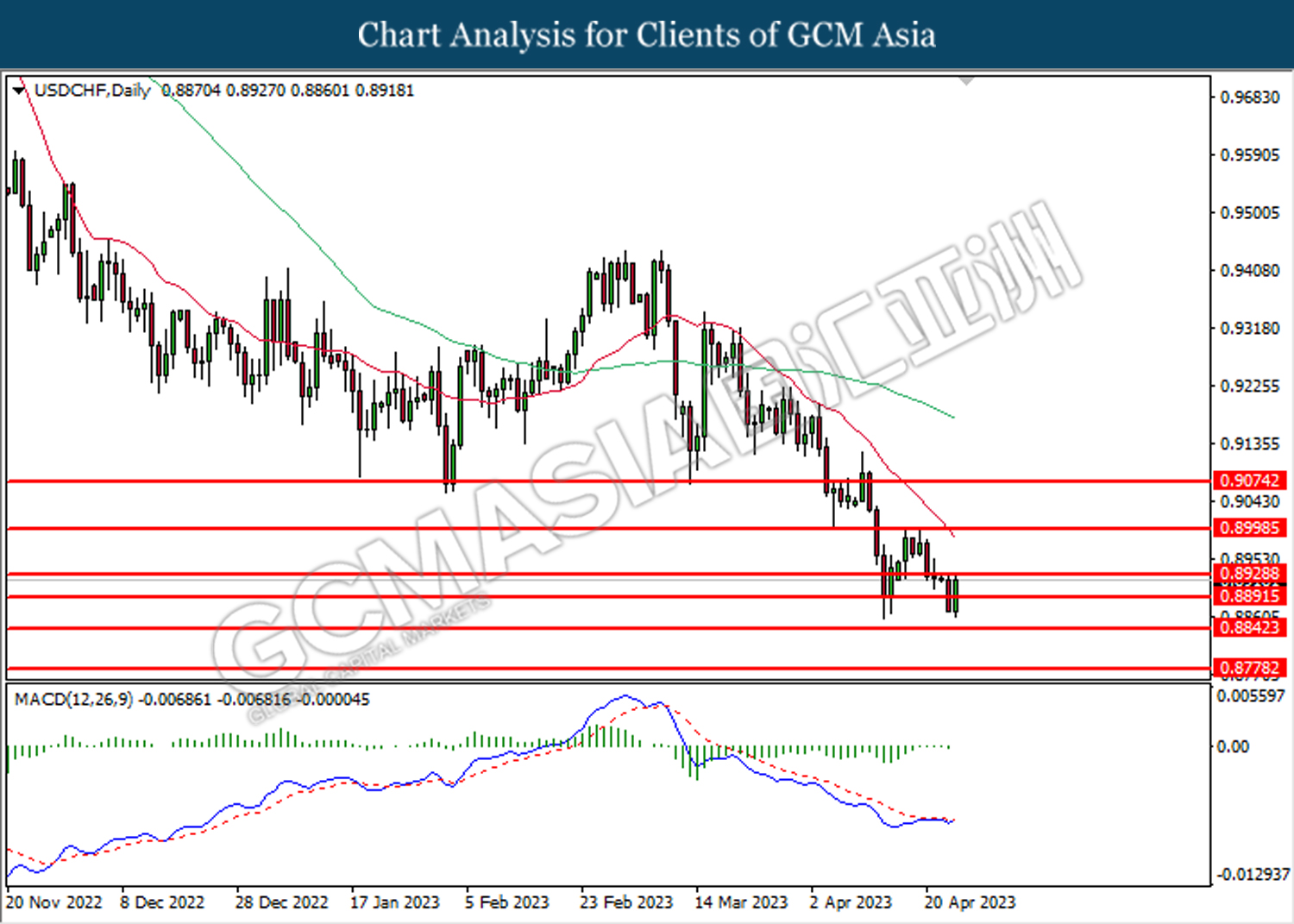

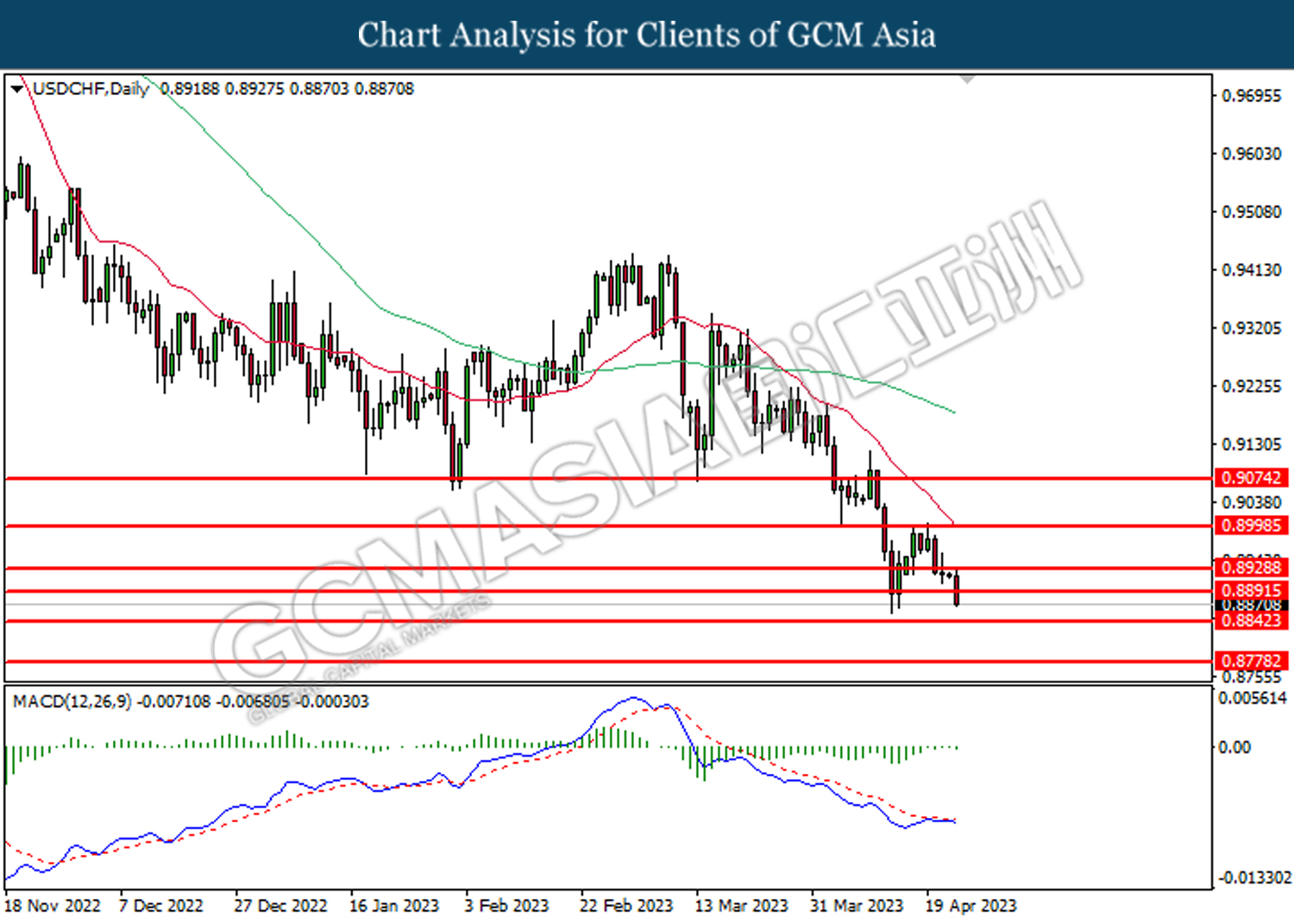

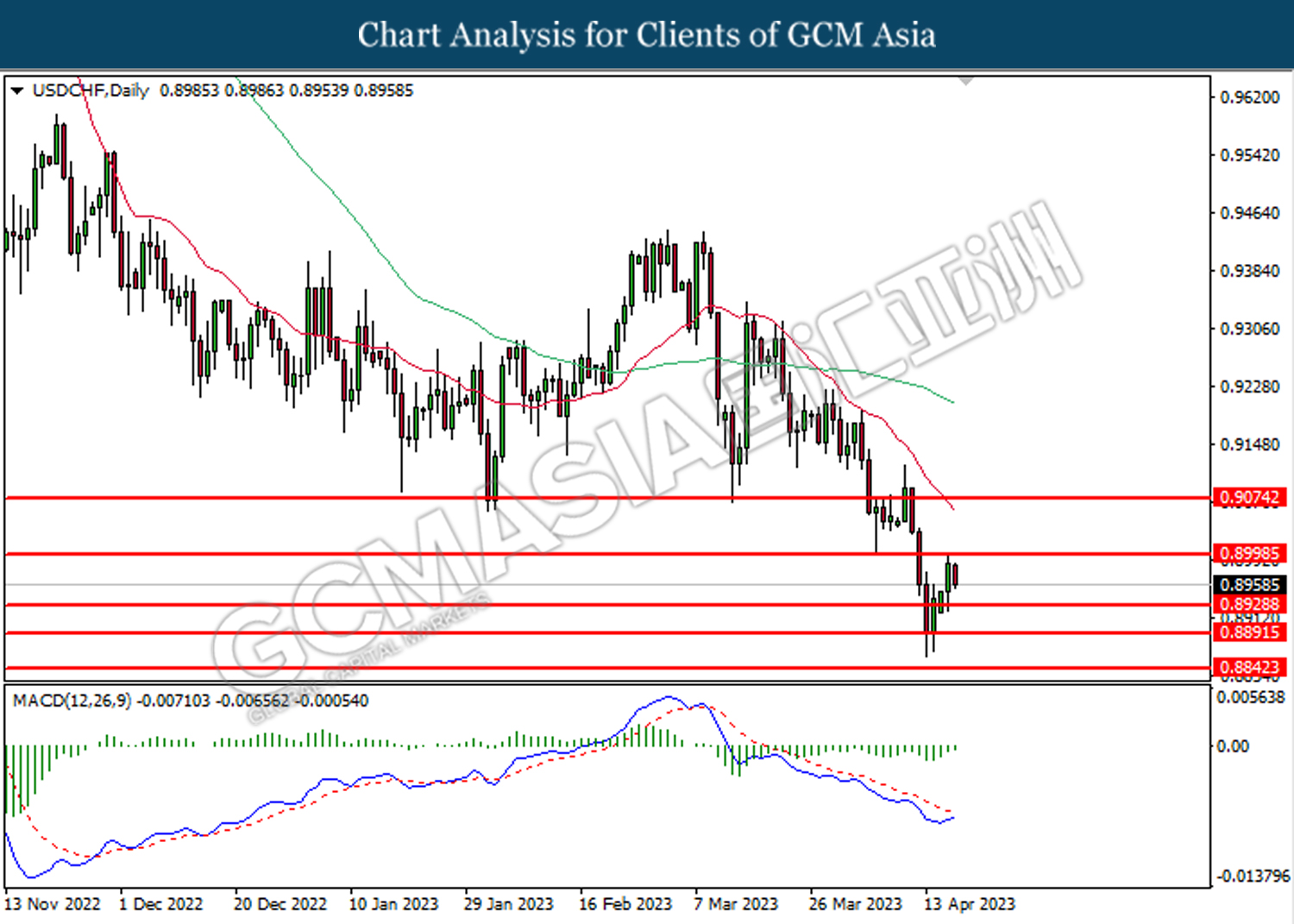

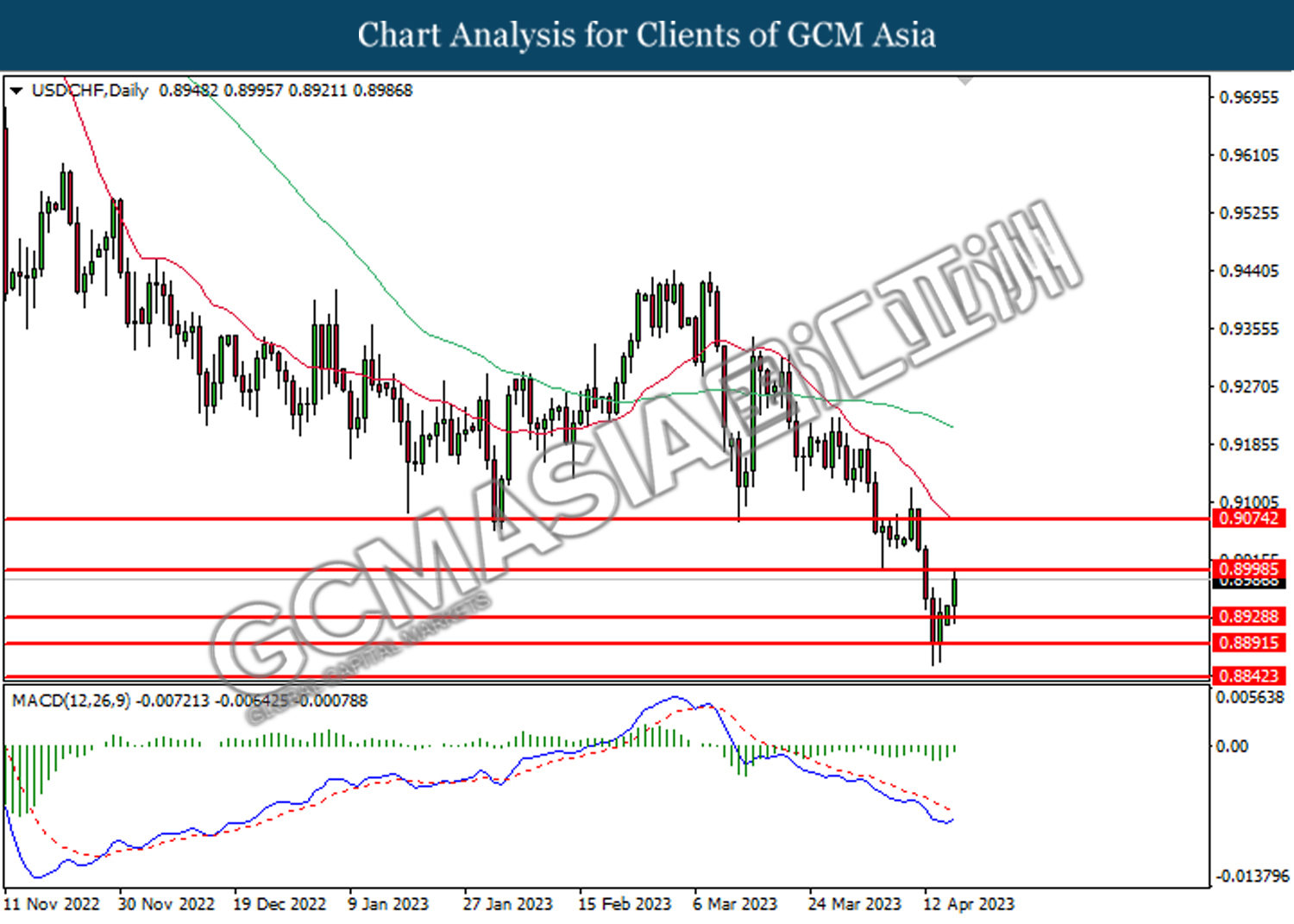

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8930, 0.9000

Support level: 0.8890, 0.8845

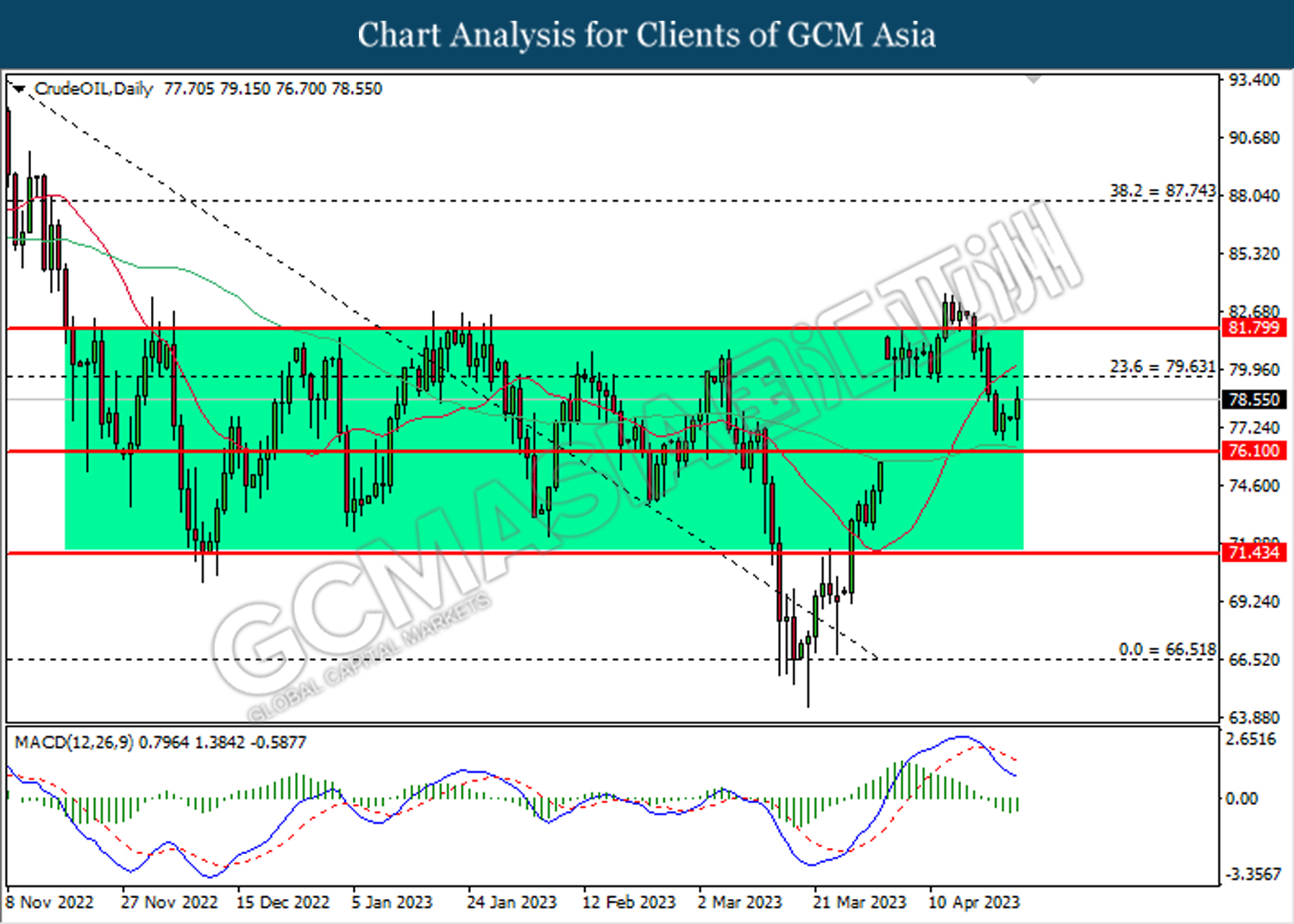

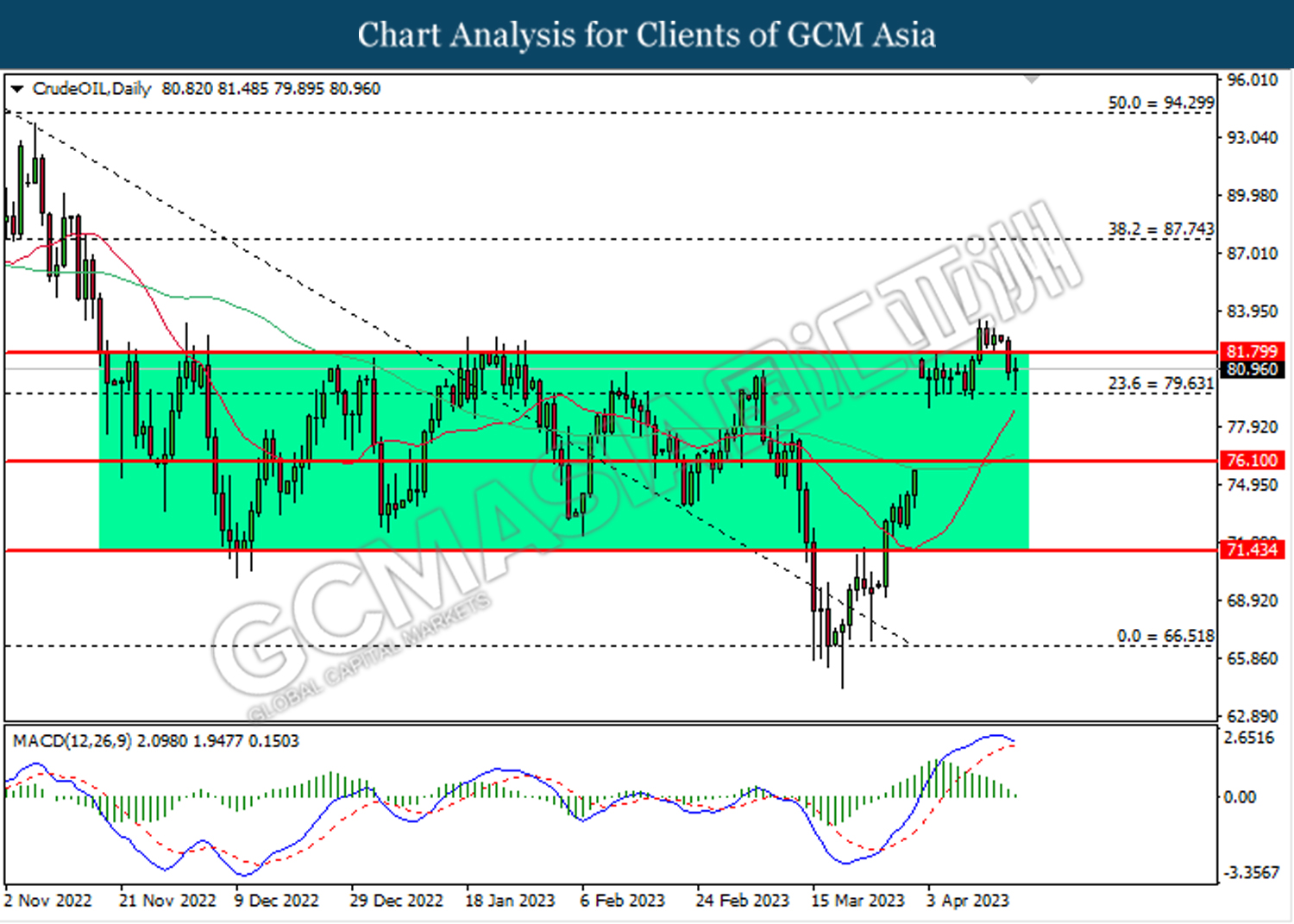

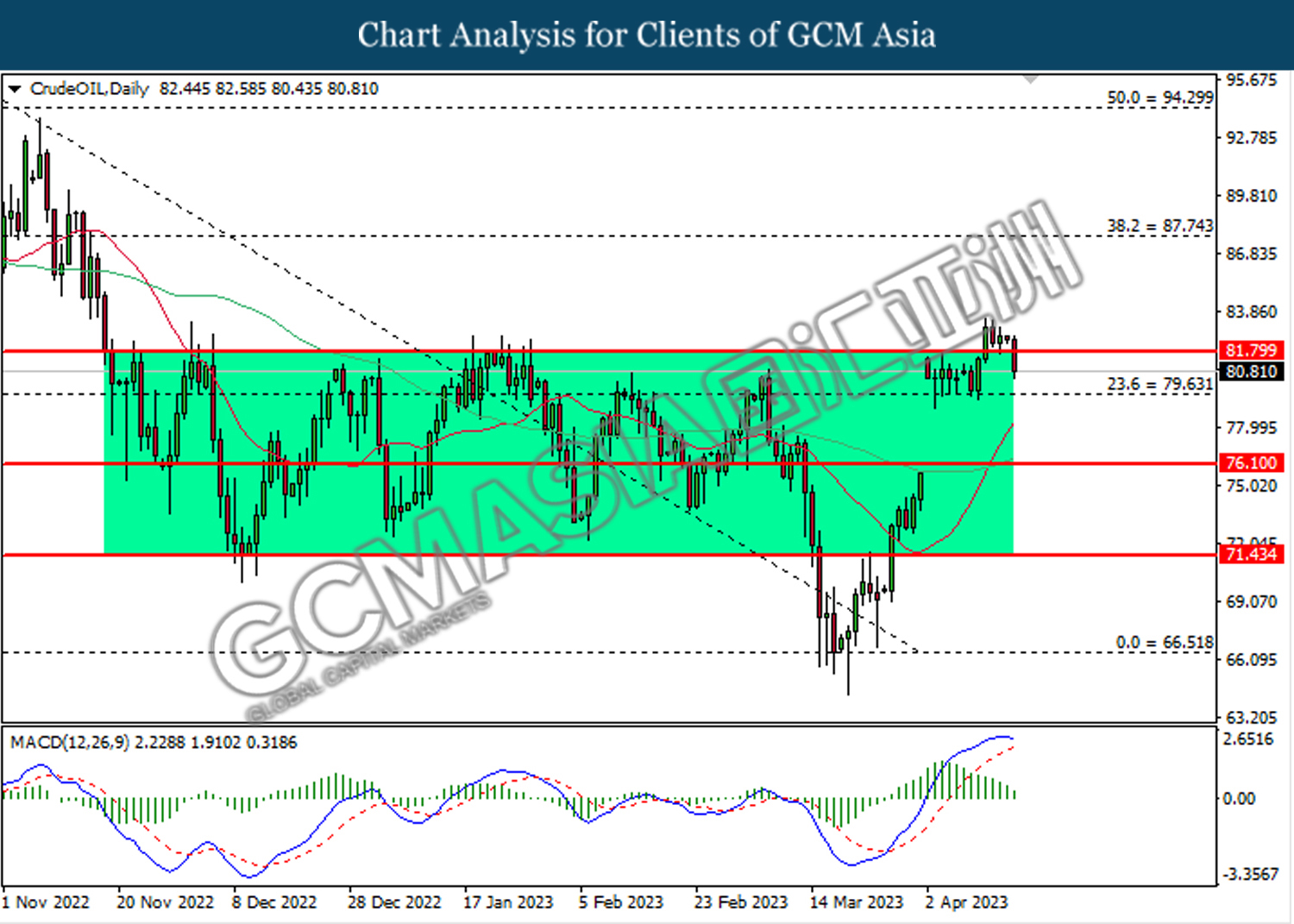

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 79.65, 81.80

Support level: 76.10, 71.45

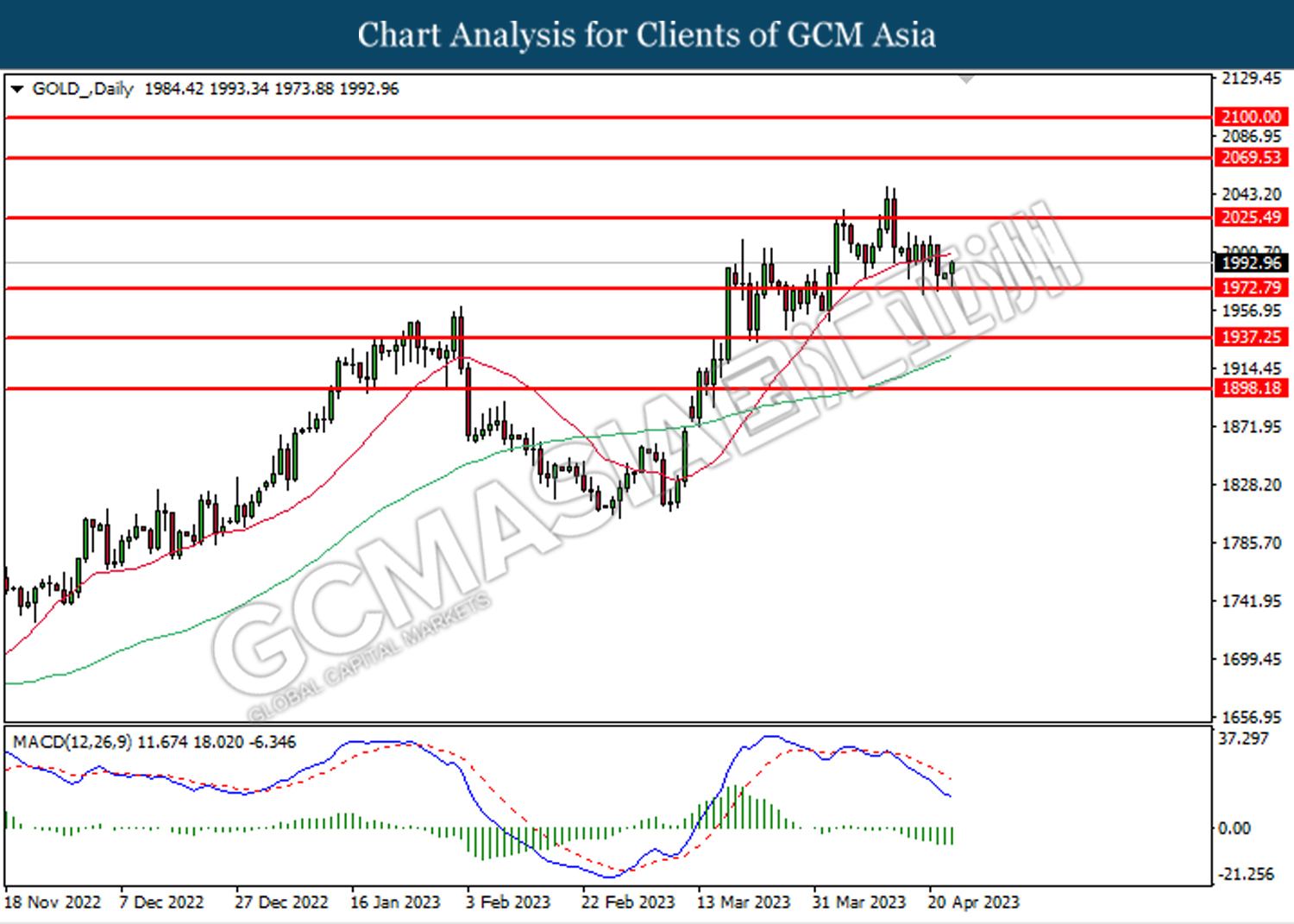

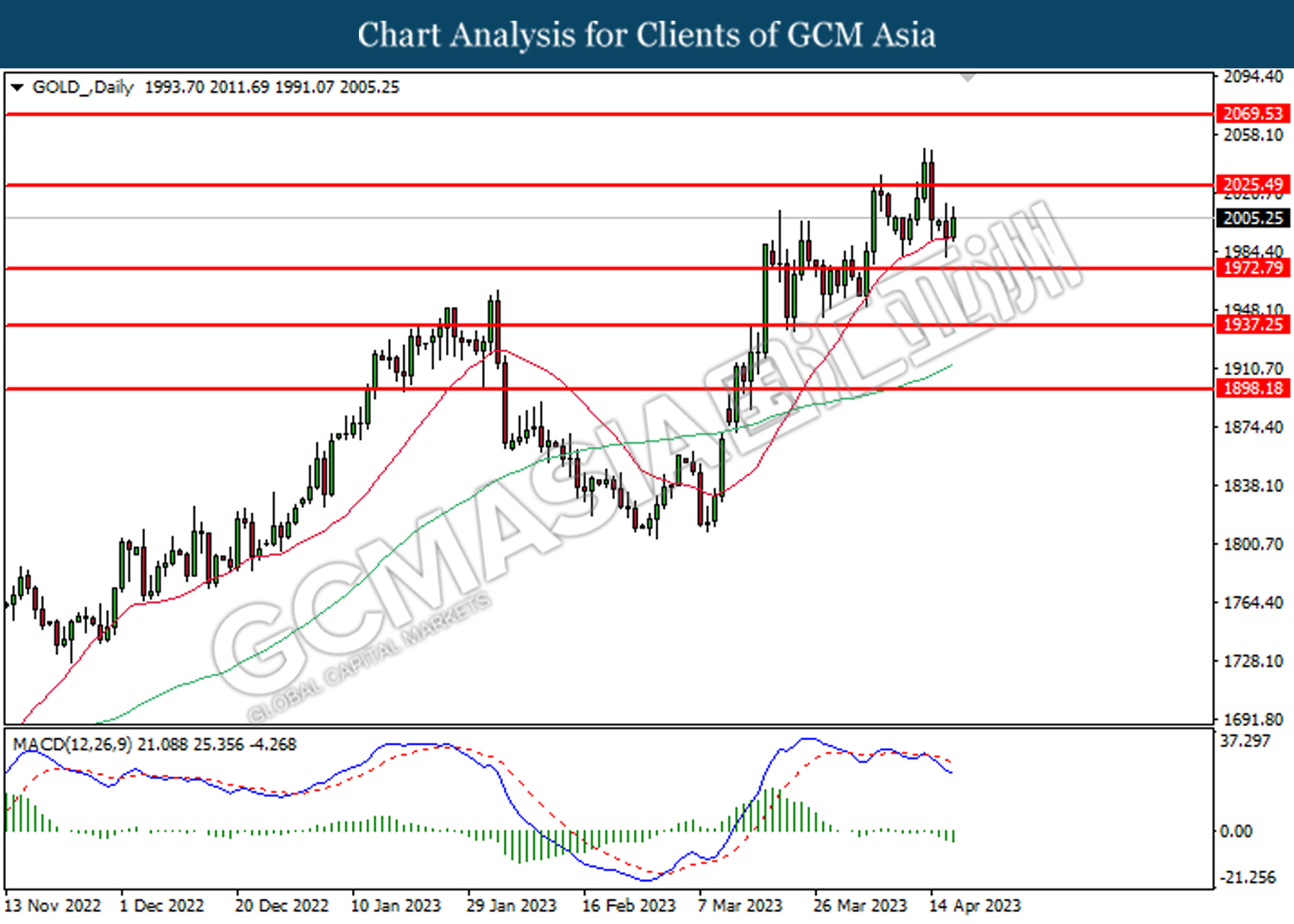

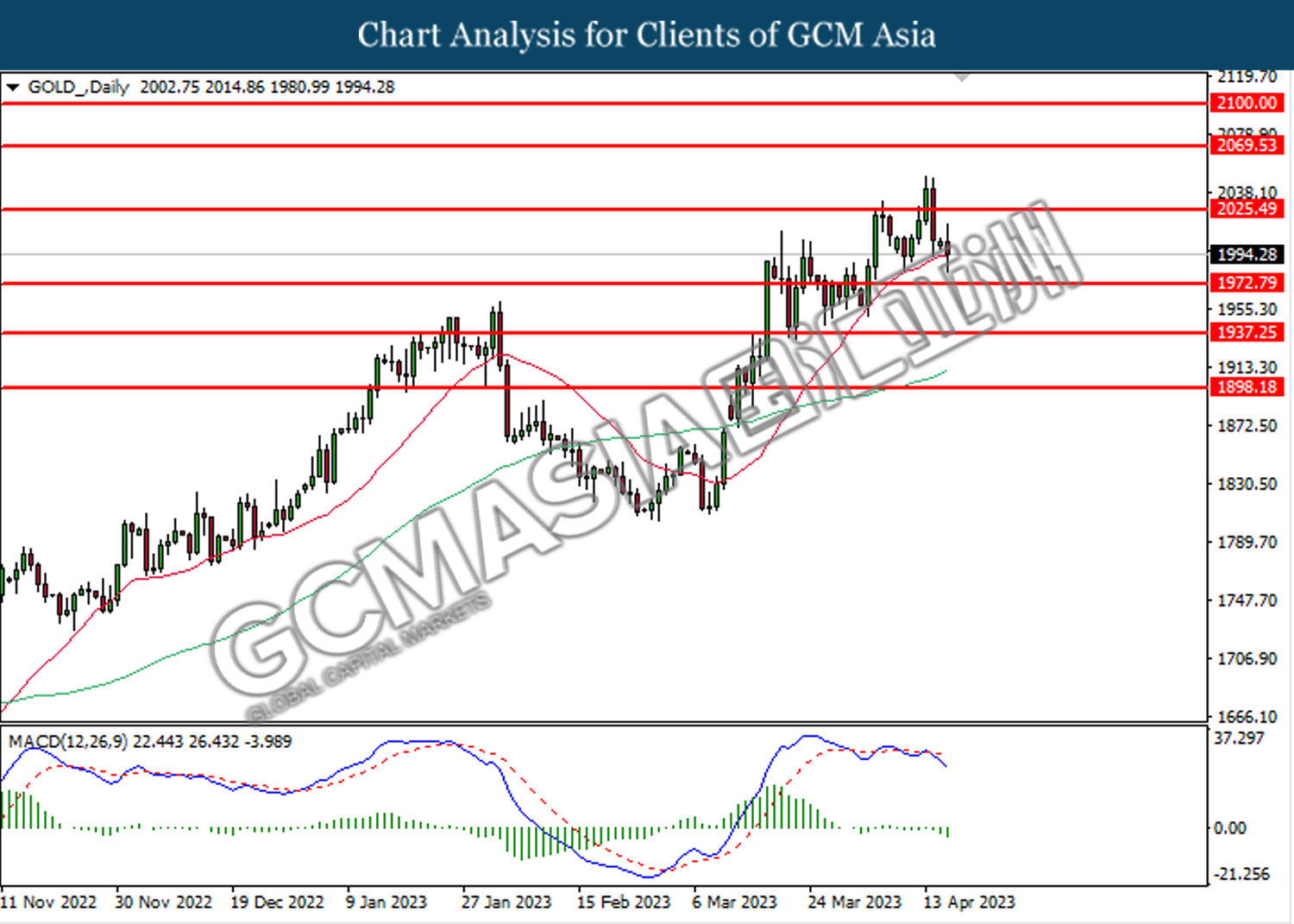

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1972.80. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 2025.50.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25

260423 Afternoon Session Analysis

26 April 2023 Afternoon Session Analysis

The Aussie lost its ground after March CPI was released.

The Australian dollar lost its ground against the US dollar after the March Consumer Price Index (CPI) was released. In the first quarter, the CPI fell from 7.8% to 7.0%, slightly higher than market expectations of 6.9%. At the same time, the RBA lowered the average CPI from 1.7% to 1.2%, the second consecutive decline. However, the data showed persistently high price pressures in Australia. Prior to this, the Reserve Bank of Australia (RBA) left the cash rate unchanged at its last meeting as additional time was needed to gauge the tightening effect of high rates to filter into the economy, but the board members leave the door open for further tightening. With recent inflation still high, the RBA is under increased pressure to reconsider tightening policy further by 25 basis points. Besides, the Australian labor market remains tight at faster than expected pickup in population growth and wage growth giving more space for RBA to further tighten before opting to pause the rate hikes. Meanwhile, Investors are awaiting for upcoming Producer Price Index (PPI) release on Friday to get more clues for the next RBA’s moves. As of writing, the pair of AUD/USD slipped by -0.17% to $0.6615 as the rise of safe-haven demand strengthened the US dollar.

In the commodities market, crude oil prices rebounded by 0.52% to $77.47 per barrel following a prior crude oil price dip of 2% of banking sector jitters and stronger on the US dollar. Besides, gold prices depreciated by -0.12% to $1994.64 per troy ounce as of writing amid the investors locked their profits after the gold price rose yesterday as economic jitters.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Mar) | -0.2% | -0.1% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -4.581M | -1.486M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following from the higher level. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level at 101.20

Resistance level: 101.70, 102.40

Support level: 101.20, 101.00

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 1.2445.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 1.1070.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 134.55. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 132.30.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.6600. MACD which illustrated bearish momentum suggests the pair extended its losses after it successfully breakout below the support level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525.

NZDUSD, H4: NZDUSD was traded lower a prior retracement from the resistance level at 0.6195. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6120

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3600. However, MACD which illustrated diminishing bullish momentum suggests the pair traded lower as a technical correction.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

USDCHF, H4: USDCHF was USDCHF was traded lower following a prior retracement from the resistance level at 0.8925. However, MACD which illustrated bullish momentum suggests the pair traded higher as technical correction.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8780

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair traded lower as technical correction.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded higher following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the commodity traded higher as technical correction.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90

260423 Morning Session Analysis

26 April 2023 Morning Session Analysis

Elevated risk aversion boosted the US dollar.

The dollar index, which was traded against a basket of six major currencies, managed to regain its luster yesterday as the market sentiment turned risk-averse, prompting investors to flock to safe-haven assets. The lower risk appetite around the market was mainly attributed to the investors’ concern over the prospect for the global economy, especially since the inflationary pressures in nation such as the UK and EU were still high. Besides, the US dollar experienced a further rise in value after the mixed economic data were released. Among them, the New Home Sales and Building Permit data out beat the consensus forecast, while the CB Consumer Confidence posted a disappointing result yesterday. According to the Conference Board, the US Consumer Confidence Index fell to 101.3, down from 104.0 in March, but the reading is still above the crucial level of 100. Nevertheless, it is noteworthy to highlight that the lower-than-expected consumer confidence data showed that the consumers became more pessimistic about the outlook for both business conditions and labor markets compared to last month. As of writing, the US dollar rose by 0.49% to 101.85.

In the commodities market, crude oil prices were up by 0.25% to $77.35 per barrel following the slight retracement in the US dollar market despite API weekly Crude Oil Stock data showing a large crude draw. Besides, gold prices edged up by 0.11% to $1999.45 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Mar) | -0.2% | -0.1% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -4.581M | -1.486M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1010. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 135.20. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3635. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8930, 0.9000

Support level: 0.8890, 0.8845

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 79.65.

Resistance level: 79.65, 81.80

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1972.80. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 2025.50.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25

250423 Afternoon Session Analysis

25 April 2023 Afternoon Session Analysis

The pound appreciated after mixed economic data released.

The pound sterling, which is one of the most traded currencies by global investors, was traded higher after mixed economic data were released last Friday. The recent retail and core sales data for March sent the pound into the ground, with actual readings slipping to -0.9% and -1.0%, respectively, below consensus and previous readings. However, the pound sterling rebounded from its downtrend after S&P Global announced upbeat UK Composite PMI data. According to S&P Global, a downbeat manufacturing data showed a contraction in the UK. In March, with a 46.6 reading lower than the market consensus of 48.5 and prior readings of 47.9, Still, the service PMI data outperformed the market estimation with a level of 54.9 higher than the estimations and the prior reading of 49.0 and 49.2 respectively. The composite PMI grew from 52.2 to 53.9, above the upbeat market consensus of 52.6. The S&P Rating Agency upwardly revised the economic outlook on the UK’s AA credit rating from negative to stable as the near-term negative downside risk has been reduced. The stabilization of the data reflects the UK’s stronger-than-expected economic performance. As of writing, the GBP/USD had edged up by 0.03% to $1.2485.

In the commodities market, crude oil prices were traded up by 0.03% to $78.78 per barrel amid OPEC production cuts in May and the weakening dollar. Besides, gold prices appreciated by 0.14% to $1992.91 per troy ounce as investors ponder on the US CB consumer confidence index.

Today’s Holiday Market Close

Time Market Event

All Day AUD ANZAC Day

All Day NZD ANZAC Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits | 1.550M | 1.413M | – |

| 22:00 | USD – CB Consumer Confidence (Apr) | 104.2 | 104.0 | – |

| 22:00 | USD – New Home Sales (Mar) | 640K | 630K | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior break above the previous resistance level at 101.00. However, MACD which illustrated bearish momentum suggests the index to traded lower as a technical correction.

Resistance level: 101.20, 101.70

Support level: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.2445.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2145

EURUSD, H4: EURUSD was traded lower following a prior retracement from the resistance level at 1.1070. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 1.0930.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 134.55.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower following the prior break below from the previous support level at 0.6685. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6600.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525.

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6120.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3515. However, MACD which illustrated diminishing bearish momentum suggests the pair traded lower as technical correction.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following a prior break below from the previous support level at 0.8925. However, MACD which illustrated diminishing bearish momentum suggests the pair traded higher as technical correction.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8780

CrudeOIL, H4: Crude oil price was traded higher while currently testing for the resistance level at 78.70. MACD which illustrated bullish momentum suggests the commodity extended its gains if successfully break above the resistance level.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the commodity traded higher as technical correction.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90

250423 Morning Session Analysis

25 April 2023 Morning Session Analysis

US Dollar teetered near the brink of collapse ahead of busy week.

The dollar index, which was traded against a basket of six major currencies, hovered near the lowest level in one week as the market participants are waiting for the upcoming economic data to gauge whether the Federal Reserve would really hike its interest rate by another 25-basis point in the May’s meeting. Throughout the past week, the US dollar lost its shininess as a series of economic data proved that the nation’s economy was struggling near the edge of recession following the rate hikes a year ago. However, the losses of the greenback were limited by the unexpected upbeat data, which included S&P Global Composite PMI, Manufacturing PMI, and Services PMI. Going forward, the eyes of investors would be placed on the calendar later this week, for example, Gross Domestic Product (GDP), PCE Price Index, and so on. These economic data would likely shed more light on the future path of interest rates by the Fed. Weaker-than-expected data might disrupt the willingness of the Fed’s members to have another round of rate hikes in May’s meeting. As of writing, the dollar index dropped -0.47% to 101.35.

In the commodities market, crude oil prices were up by 0.42% to $78.30 per barrel amid the depreciation of the US dollar spurred the demand for oil products. Besides, gold prices edged up by 0.19% to $1992.95 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

All Day AUD ANZAC Day

All Day NZD ANZAC Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Building Permits | 1.550M | 1.413M | – |

| 22:00 | USD – CB Consumer Confidence (Apr) | 104.2 | 104.0 | – |

| 22:00 | USD – New Home Sales (Mar) | 640K | 630K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2525.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1010. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 133.05. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 135.20.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3565. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8890. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.8890.

Resistance level: 0.8930, 0.9000

Support level: 0.8890, 0.8845

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 79.65.

Resistance level: 79.65, 81.80

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1972.80. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 2025.50.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25

200423 Afternoon Session Analysis

20 April 2023 Afternoon Session Analysis

Pound Sterling boosted following inflation risk heightened.

The GBP/USD, which traded by majority of global investors surged significantly on Wednesday after the inflationary data has been unleashed. According to Office for National Statistics, the UK Consumer Price Index (CPI) YoY for March came in at the reading of 10.1%, exceeding the market forecast of 9.8%. With that, it might lead the UK central bank to raise its rate further in order to cool down the double-digit inflation, which prompting investors to shift their capitals toward UK market. As of now, Deutsche Bank anticipated that there are two more rate hike would be taken by Bank of England (BoE). Besides, other banks such as Morgan Stanley has also provided similar views. Thus, investors would highly eye on the statement from BoE members to gauge the interest rate decisions of the central bank. On the other hand, the gains experienced by Pound Sterling was extended as the Fed claimed in its report yesterday that the price of goods and services was easing. By the way, the Eurostat had also declared its CPI data, but the figures of data did not decreased more than consensus expectation. With such background, it signaled that the inflation was not dampen very well, which driving to the appreciation of EUR/USD. As of writing, the GBP/USD dropped by 0.06% to 1.2428, while the EUR/USD rose by 0.04% to 1.0960.

In the commodities market, the crude oil prices depreciated by 1.07% to $78.39 per barrel as of writing following the oil exports from Russia’s western ports in April would likely to reach a new high since 2019. In addition, the gold price eased by 0.10% to $1992.81 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | Initial Jobless Claims | 239k | 240k | – |

| 20:30 | Philadelphia Fed Manufacturing Index (Apr) | -23.2 | -20.0 | – |

| 22:00 | Existing Home Sales (Mar) | 4.58M | 4.50M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded higher following prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 81.30, 86.40

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50

200423 Morning Session Analysis

20 April 2023 Morning Session Analysis

Dollar regains its position but limited by Fed’s Beige Book.

The dollar index, which is traded against a basket of six major currencies, rebounded after hitting its lowest level since February. The following rebound in the dollar index came from Fed’s James Bullard issued a hawkish statement. In the communique, Bullard was recommended to raise for another half of a percentage point between 5.50% and 5.75% and to discount on recession talk. Bullard’s hawkish statement remarks boosted the 2 years treasury bond yields ticked up 4.5 basis points to 4.2480% and the dollar rebounded aftermath. Besides, the pair of USD/JPY shot above the 135 level after the Bank of Japan (BoJ) stated that it is unlikely to decide to change its curve control program. This means the BoJ is maintaining its ultra-loose monetary policy. Therefore, the Japanese Yen weakened in its position and the dollar strengthened. However, the gains of the dollar were limited after the Fed released the Beige Book report. The Beige Book report highlighted that the overall price levels rose appeared to be slowing and the labor market has become less constrained. With that, an expectation of a rate hike after the May minutes meeting is reduced. As of writing the dollar index edged up 0.19% to $101.645.

In the commodities market, crude oil prices edge lower by -0.45% to $78.88 per barrel as of writing. The crude oil price falls yesterday as recurring fears about Wall Street’s recession. Besides, gold prices depreciated -0.03% to $1994.16 per troy ounce as investors seek clarity on Fed hikes.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:15 | PBoC Loan Prime Rate | 3.65% | 3.655 | – |

| 20:30 | Initial Jobless Claims | 239k | 240k | – |

| 20:30 | Philadelphia Fed Manufacturing Index (Apr) | -23.2 | -20.0 | – |

| 22:00 | Existing Home Sales (Mar) | 4.58M | 4.50M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 101.70 However, MACD which illustrated diminishing bullish momentum suggests the index to traded lower as technical correction.

Resistance level: 101.70, 102.40

Support level: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded lower following a prior break below from the previous support level at 1.2445. However, MACD which illustrated bullish momentum suggests the index to traded higher as technical correction.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was higher following a prior rebound from the support level at 1.0930. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.1070.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded lower while currently testing for the support level at 134.55. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses if successfully break below the support level.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6685.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6195. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 0.6120.

Resistance level: 0.6195, 0.6165

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3420. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3515.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded lower following the prior retracement from the downward trend line. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.8925.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded lower while currently testing for the support level at 78.70. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully break below the support level.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

GOLD_, H4: Gold price was traded higher following the prior break above from the previous resistance level at 1985.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its gains toward the resistance level at 2009.10.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90

190423 Afternoon Session Analysis

19 April 2023 Afternoon Session Analysis

Canadian Dollar dived, Fed’s views remained hawkish.

The USD/CAD, which traded by majority of global investors continued its upward movement on yesterday following the hawkish speech from Fed officials. According to Reuters, the St. Louis Federal Reserve President James Bullard reiterated on Tuesday that Fed should keep on its path on interest rate rise as the recent inflationary data had shown the risk of sky-high price remained persistent. Besides that, he expressed the view that the US labor market is still strong, which increasing the odds of further rate hike after the meeting on May. With that, he favors raising the rates to the range of 5.5% to 5.75%. Another Fed member had echoed the speech of Bullard. Federal Reserve Bank of Atlanta President Raphael Bostic claimed that the rate would likely to be hold above 5% in order to efficiently dampen the inflation. Nonetheless, the gains experienced by USD/CAD was limited over the rising inflation in Canada. The Canada Core Consumer Price Index (CPI) MoM in March had notched up from the previous reading of 0.5% to 0.6%, exceeding the market forecast of 0.4%. Thus, Bank of Canada (BoC) would likely to follow the step of Fed, which sparkling the appeal of Canadian Dollar. As of writing, the USD/CAD appreciated by 0.07% to 1.3396.

In the commodities market, the crude oil prices rose by 0.09% to $80.83 per barrel as of writing following the hawkish statement from Fed had led to the appreciation of US Dollar, prompting the oil price become more expensive. On the other hand, the gold price dropped by 0.04% to $2003.21 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Mar) | 10.4% | 9.8% | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 8.5% | 6.9% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 0.597M | -1.088M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded higher following prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the lower level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 81.30, 86.40

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50

190423 Morning Session Analysis

19 April 2023 Morning Session Analysis

US dollar sank amid upbeat data from China and UK.

The dollar index, which is traded against a basket of six major currencies, lost its ground after hitting the highest level in one week as a series of upbeat economic data from the outside of the US weakened the appeal of the Greenback. Yesterday, the National Bureau of Statistics of China released its first quarter of GDP at 4.5%, far better than the consensus forecast of 4.0%. Prior to that, the China economy was experiencing a growth of just 2.9% in the last quarter of 2022. The stronger-than-expected GDP was mainly attributed to the strong recovery of economic activity across all different sectors after the end of zero-Covid measures late last year. On the other side, the rebound in the pound market also drove the dollar index lower during the pre-trading session of the UK market. Although there was an unexpected rise in the number of unemployed within the UK, the pay growth remained strong, which has been shown by the Average Earnings Index + Bonus data. With such a backdrop, the outstanding performance of the other region diminished the market demand for the dollar index. As of writing, the dollar index dropped -0.37% to 101.70.

In the commodities market, crude oil prices edged up by 0.07% to $81.05 per barrel as the API weekly oil inventories data showed a larger-than-expected draw last week. Besides, gold prices were traded up by 0.01% to $2005.50 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Mar) | 10.4% | 9.8% | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 8.5% | 6.9% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 0.597M | -1.088M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in short term.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2405, 1.2525

Support level: 1.2300, 1.2200

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0915. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 133.05. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 135.20.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3395. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9000. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9000, 0.9075

Support level: 0.8930, 0.8890

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 79.65. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 81.80, 87.75

Support level: 79.65, 76.10

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 2025.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1972.80.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25

180423 Afternoon Session Analysis

18 April 2023 Afternoon Session Analysis

Canada wholesale sales weakened, which sent Canadian Dollar lower.

The USD/CAD, which traded by majority of global investors found its ground on Monday following the bearish Canada economic data has been released. According to Statistics Canada, the Canada Wholesale Sales MoM for February notched down significantly from the previous reading of 6.1% to -1.7%, which is lower than the consensus expectation of -1.6%. The reducing of wholesale was indicated that the slip in consumer spending in Canada, leading the commercial firms to reduce order from wholesalers. Besides, it also cut the spaces for Bank of Canada (BoC) to hike its rate further. Not only that, the upbeat US economic data has also dialed up the market demand for US Dollar. However, it is note-worthy that the BoC official was still discussing another rate hike in the next meeting. Prior to that, the BoC Governor Tiff Macklem emphasized the needs to keep high interest rate for longer time in order to stabilize the price volatility to 2% target. Last week, BoC remained its interest rate at 4.5% for second consecutive time. By now, investors would continue to scrutinize the Canada Core CPI data which would be unleashed tonight to gauge the likelihood movement of Canadian Dollar. As of writing, the USD/CAD appreciated by 0.03% to 1.3396.

In the commodities market, the crude oil prices rose by 0.28% to $81.06 per barrel as of writing following the China’s economy development was stronger than the market expectations, stimulating the demand of oil. On the other hand, the gold price rallied by 0.25% to $2000.16 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Feb) | 5.7% | 5.1% | – |

| 14:00 | GBP – Claimant Count Change (Mar) | -11.2K | 10.2K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Apr) | 13.0 | 15.3 | – |

| 20:30 | USD – Building Permits (Mar) | 1.550M | 1.450M | – |

| 20:30 | CAD – Core CPI (MoM) (Mar) | 0.5% | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded lower following prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 81.30, 86.40

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50

180423 Morning Session Analysis

18 April 2023 Morning Session Analysis

Upbeat manufacturing data spurred the US dollar.

The dollar index, which is traded against a basket of six mainstream currencies, extended its rallies yesterday, mainly buoyed by the upbeat manufacturing data. According to the Federal Reserve Bank of New York, the US New York Empire State Manufacturing Index rose from the prior month’s reading of -24.60 to 10.80 in April, refreshing the highest record since last year’s July. The stronger-than-expected reading showed a strong improvement of business conditions in the New York state despite the recent fallout of the banking sector. Notably, the data also turned to a positive reading for the first time in 5 months, which has further cemented the possibility of further rate hike in the May’s meeting. According to the CME FedWatch Tool, the market expectations for a 25 basis-point hike at the May meeting as of Monday have risen to 86.6%, up from the 78% on Friday, while the possibility of maintaining the interest rate at current level has declined sharply from 22.0% to 13.4%. With the increasing expectation of one more rate hike in the upcoming Fed’s meeting, it exerted further bullish momentum in the dollar market, bringing the index back to the highest level in one week. As of writing, the dollar index rose 0.54% to 102.10.

In the commodities market, crude oil prices edged down by -0.12% to $80.90 per barrel as the strengthening in US dollar diminished the appeal of the black commodity against the non-US oil buyers. Besides, gold prices were traded down by -0.01% to $1994.90 per troy ounce following the release of positive factory activity data in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Feb) | 5.7% | 5.1% | – |

| 14:00 | GBP – Claimant Count Change (Mar) | -11.2K | 10.2K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Apr) | 13.0 | 15.3 | – |

| 20:30 | USD – Building Permits (Mar) | 1.550M | 1.450M | – |

| 20:30 | CAD – Core CPI (MoM) (Mar) | 0.5% | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.25, 103.15

Support level: 99.40, 97.75

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 133.05. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 135.20.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3395. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9000. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8930, 0.8890

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 81.80. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 87.75, 94.30

Support level: 81.80, 79.65

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 2025.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1972.80.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25

170423 Afternoon Session Analysis

17 April 2023 Afternoon Session Analysis

Euro beaten down by dovish speech from ECB.

The EUR/USD, which traded by majority of global investors received significant bearish momentum on last Friday following the dovish statement has been presented by ECB officials. According to Bloomberg, the ECB Governing Council member Mario Centeno claimed on the International Monetary Fund (IMF) Spring Meetings that the central bank was suggested to slow down its rate hike pace due to the stress of high-price in the Eurozone was easing. He said there was no need for further aggressive rate rises, so he thought a rise of 0 or 25 basis points would be appropriate in the May meeting. Besides, another ECB member had also expressed similar views. ECB Governing Council member Francois Villeroy de Galha emphasized that the process of rate hike was coming to an end. With such background, the appeal of Euro was dragged down, while prompting investors to shift their capitals toward other currencies such as US Dollar. Though, it is note-worthy that some of the members still support the central bank to raise its rate by 50 basis point to dampen inflationary risk. Thus, the speech of ECB President Christine Lagarde that would be released today would likely to provide some clues about its interest rate decisions. As of writing, the EUR/USD depreciated by 0.19% to 1.0979.

In the commodities market, the crude oil prices edged up by 0.01% to $82.44 per barrel as of writing following the IEA speculated the oil demand would rebound in the year of 2023. On the other hand, the gold price dropped by 0.01% to $2004.26 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded lower following prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 86.40, 91.85

Support level: 81.30, 76.80

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50

170423 Morning Session Analysis

17 April 2023 Morning Session Analysis

US dollar surged amid hawkish statement from Fed’s Waller.

The dollar index, which is traded against a basket of six mainstream currencies, managed to hold its ground and regained some luster after the Fed’s member revealed his stance of point regarding the tightening policy. Last Friday, Fed’s Board Governor Christopher Waller said that the US cash rate needs to move higher despite a year of aggressive rate hikes to bring down the inflation rate back to 2%. He also highlighted that there is no clear sign of improvement in the underlying inflation, where the inflation is still high from his point of view. With regards to the recent fallout of the banking sector, he commented that it still remains unclear whether bank stress would lead to the further economic slowdown, but the stability of the financial market proved that the Fed was doing right to hike rates in order to cool the inflation rate. The unexpected hawkish statement from Fed’s Waller spurred the dollar index, as a 25 basis point a rate hike is likely to be brought onto the table in the upcoming meeting. Prior to that, the disappointing March retail sales data exerted huge selling pressures in the US dollar market. According to the Census Bureau, the US Retail Sales came in at -1.0%, weaker than the consensus forecast at -0.4%, as the consumers cut back on purchases of cars and other big-ticket items. As of writing, the dollar index rose 0.07% to 101.60.

In the commodities market, crude oil prices edged down by -0.22% to $82.45 per barrel as OPEC monthly report highlighted that the oil demand may be dampened by the challenges of facing rising inventories and global economic growth. Besides, gold prices were traded down by -0.03% to $2003.65 per troy ounce following the Fed’s Waller hawkish statement.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.25, 103.15

Support level: 99.40, 97.75

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated diminishing bullish momentum suggest the pair to extend its extend its losses toward the support level at 1.0915.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 133.05. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 135.20.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3330. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3395.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.8930.

Resistance level: 0.8930, 0.9000

Support level: 0.8890, 0.8845

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 81.80. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the next resistance level at 87.75.

Resistance level: 87.75, 94.30

Support level: 81.80, 79.65

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 2025.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1972.80.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25

140423 Afternoon Session Analysis

14 April 2023 Afternoon Session Analysis

Pound lifted after mixed economic data was released.

The Pound Sterling lifted after a series of mixed economic data was released yesterday. The British economy is steadily at 0.0% less than the previous reading of 0.4% and the market expectation of 0.1%. The slowdown in the economy is primarily attributed to the government’s preparation for another round of brinkmanship with the European Union over the Brexit deal. The UK has drafted legislation to suspend checks on all goods arriving in Northern Ireland, slowing down the process. As a result, industrial and manufacturing sector data published by Office for National Statistics (ONS) showed no growth in February, both data stood at 0.0%. However, the construction sector was the only bright spot that lifted the economy. The data output surged at 2.4%, higher than the prior reading of -1.75, and upbeat the market expectations of 0.9%. The construction output marked as 3 months higher, lifted the economy. On the other hand, the Pound was further supported by the weakening of the dollar after the market increased expectations that the Fed paused its rate hike after an easing in Production Price Index (PPI). As of writing, the GBP/USD edged up by 0.21% to $1.2546.

In the commodity market, the crude oil price rebounded by 0.54% to $82.60 per barrel as of writing following an increasing demand in China helps offset OPEC warning. In addition, the gold price extended gains by 0.22% to $2044.67 per troy ounce as of writing amid softer inflation in US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Mar) | -0.10% | -0.30% | – |

| 20:30 | USD – Retail Sales (MoM) (Mar) | -0.40% | -0.40% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following a prior break below the previous support level at 100.50. However, MACD which illustrated decreasing bearish momentum suggests the index to undergo technical correction in the short term.

Resistance level: 100.50, 101.20

Support level: 99.85, 99.00

GBPUSD, H4: GBPUSD was traded higher following a prior breakout above the previous resistance level at 1.2445. However, MACD which illustrated decreasing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.2600, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded higher while currently testing for the resistance level at 1.1070. However, MACD which illustrated decreasing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.1070, 1.1225

Support level: 1.0935, 1.0790

USDJPY, H4: USDJPY was traded lower while currently testing for the support level at 132.30. However, MACD which illustrated decreasing bearish momentum suggests the pair traded higher as technical correction.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6775. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses after successfully break below the support level.

Resistance level: 0.6870, 0.6945

Support level: 0.6775, 0.6685

NZDUSD, H4: NZDUSD was traded higher following a prior breakout above the previous resistance level at 0.6265. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.6325.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

USDCAD, H4: USDCAD was traded lower following a prior break below the previous support level at 1.3330. However, MACD which illustrated decreasing bearish momentum suggests the pair extended its losses toward the support level at 1.3250.

Resistance level: 1.3330, 1.3420

Support level: 1.3250, 1.3195

USDCHF, H4: USDCHF was traded lower following a prior breakout below the previous support level at 0.8925. However, MACD which illustrated decreasing bearish momentum suggests the pair to traded lower as technical correction.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8780

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity to extend its gains toward the resistance level at 85.25.

Resistance level: 85.25, 89.00

Support level: 81.60, 78.70

GOLD_, H4: Gold price was traded higher while currently testing for the resistance level at 2049.30. However, MACD which illustrated decreasing bullish momentum suggests the commodity traded lower as technical correction.

Resistance level: 2049.30, 2069.95

Support level: 2030.10, 2009.10