140423 Morning Session Analysis

14 April 2023 Morning Session Analysis

US Dollar plunged amid the easing price background.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday after the economic data showed the inflationary risk in the US was easing. According to the US Bureau of Labor Statistics, the US Producer Price Index (PPI) MoM in March notched down from the previous reading of 0.0% to -0.5%, missing the consensus expectation of 0.1%. Prior to that, the CPI data that released on Wednesday slipped significantly, which indicated the Fed is really making good progress in its fight against inflation, and the decline in PPI adds to that. Thus, it increased the bets that the US interest rate would likely to reach its peak, whereas Fed could step back from its aggressive tightening policy. On the other hand, the fragile labor market in the US had also extended the losses of Dollar Index. The US Initial Jobless Claims unexpectedly rose to 239K from the prior 228K, signaling the number of unemployment raised in the past week. Consequences, it restricted the room for further rate hike by Fed. By now, the next vital US economic data release will be retails sales data, which will be analyzed for how inflation is affecting consumer spending. As of writing, the Dollar Index depreciated by 0.49% to 100.68.

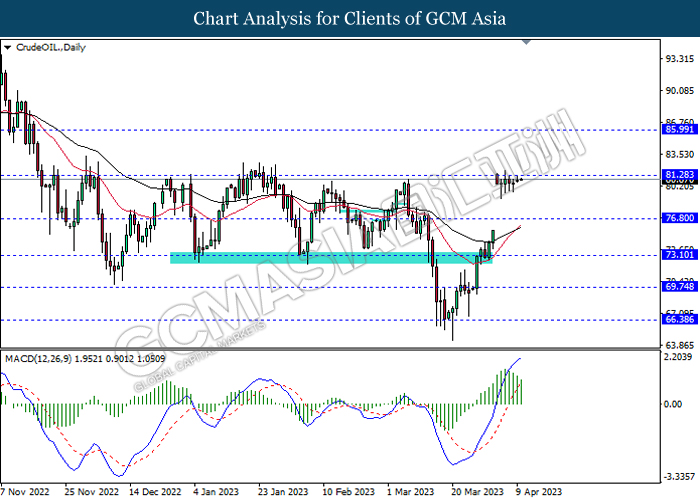

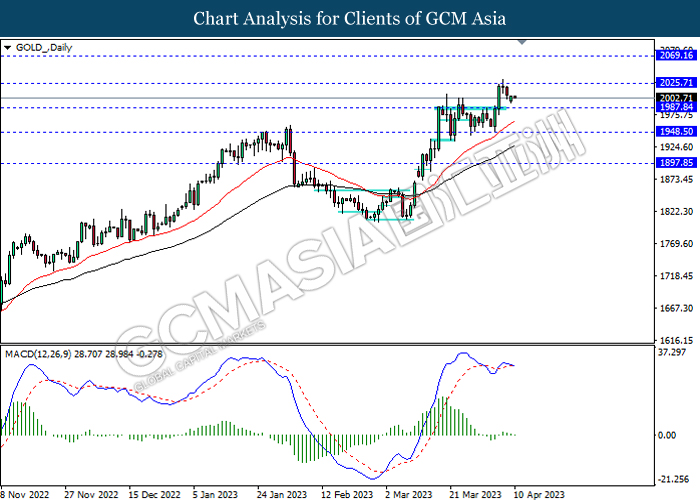

In the commodity market, the crude oil price rose by 0.21% to $82.33 per barrel as of writing following the easing inflation risk in the US had dialed up the demand for oil. In addition, the gold price dropped by 0.05% to $2039.12 per troy ounce as of writing over the slightly rebound of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Mar) | -0.10% | -0.30% | – |

| 20:30 | USD – Retail Sales (MoM) (Mar) | -0.40% | -0.40% | – |

Technical Analysis

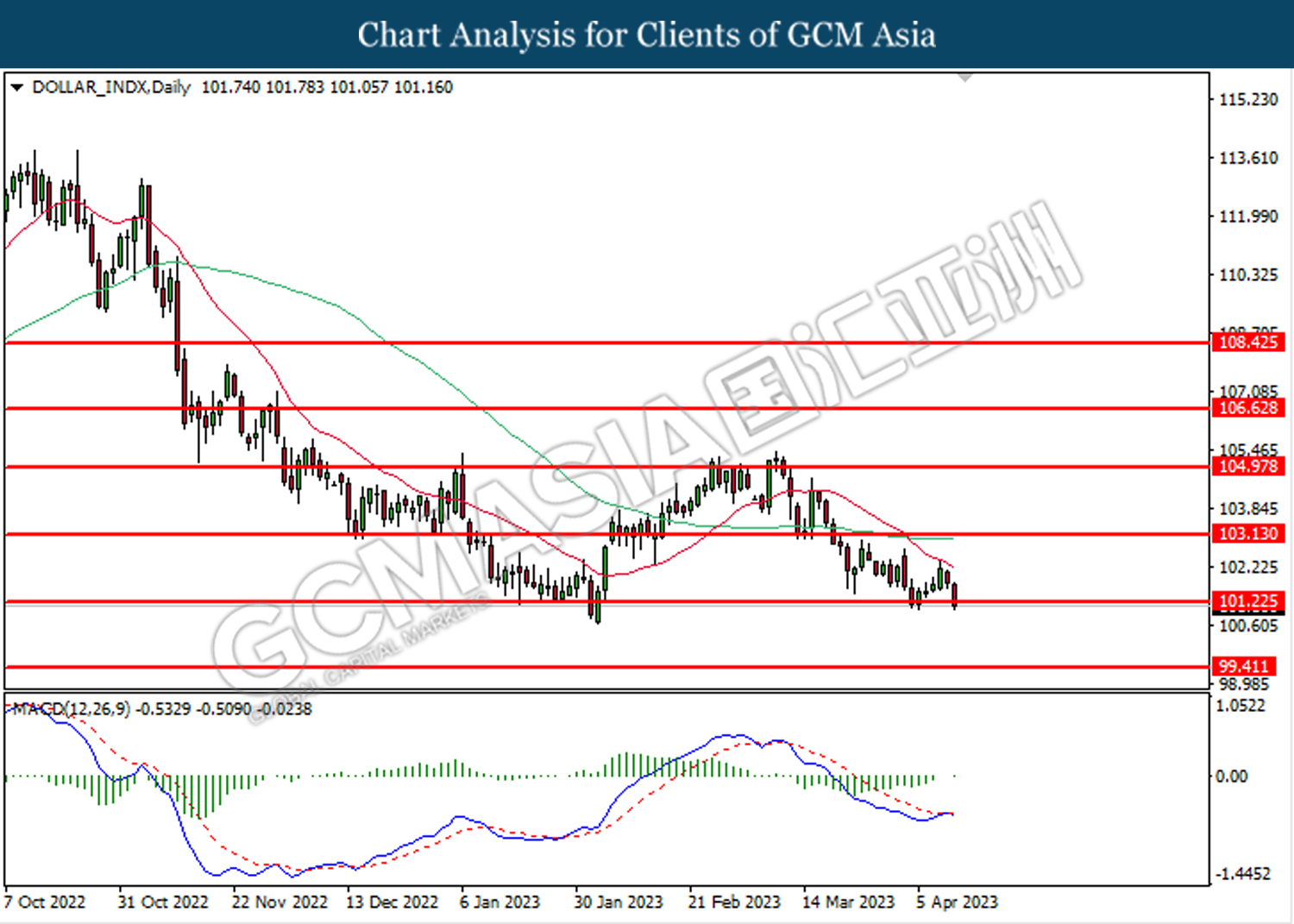

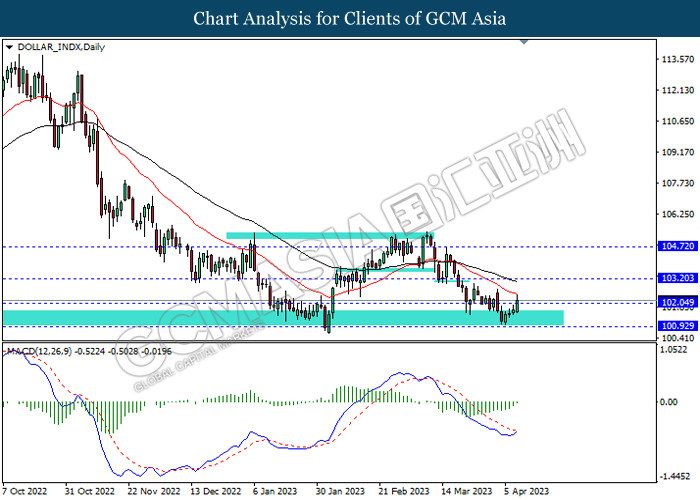

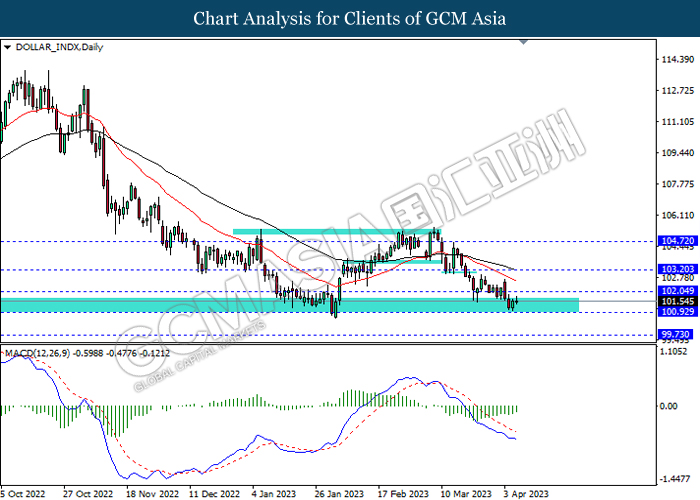

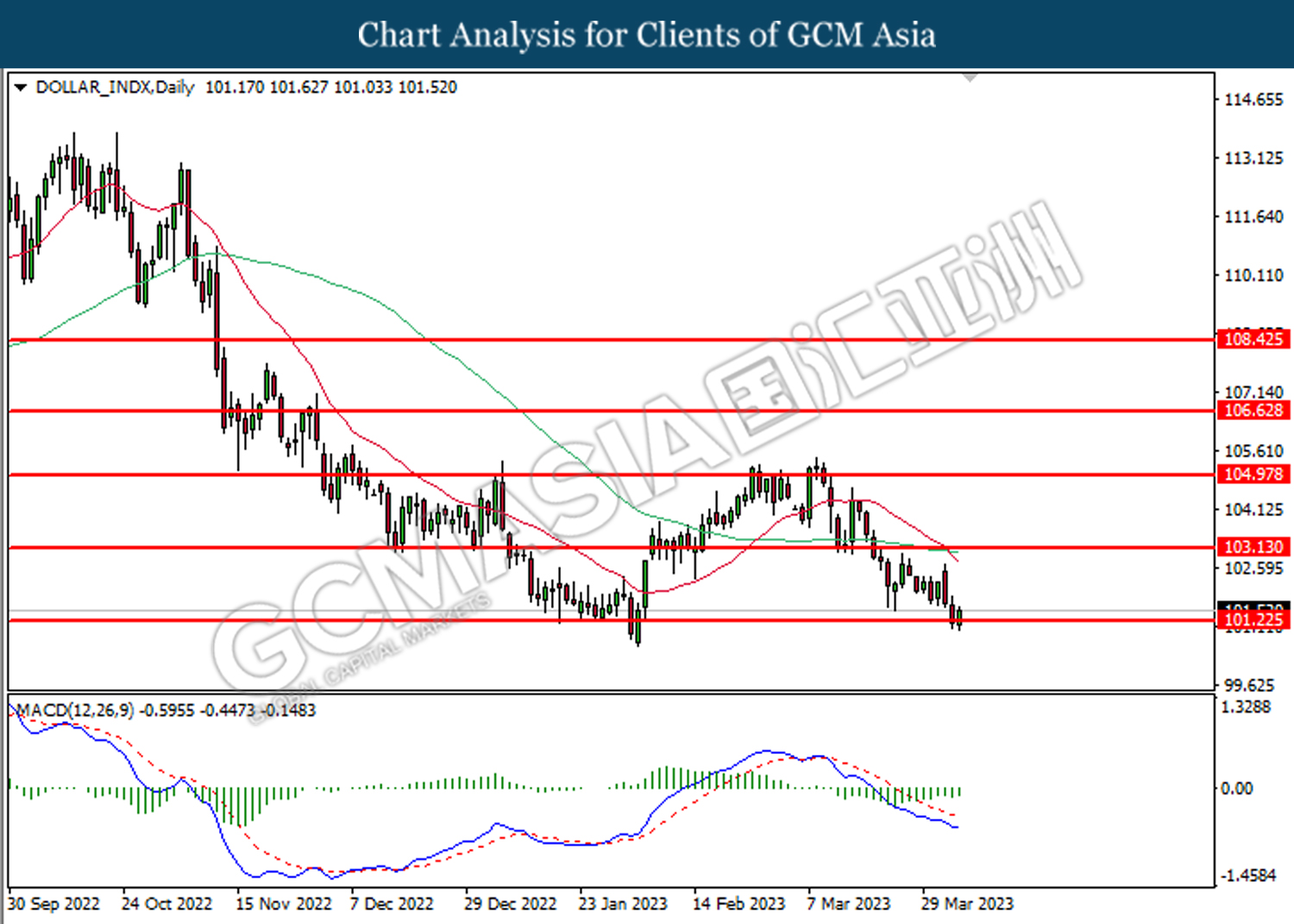

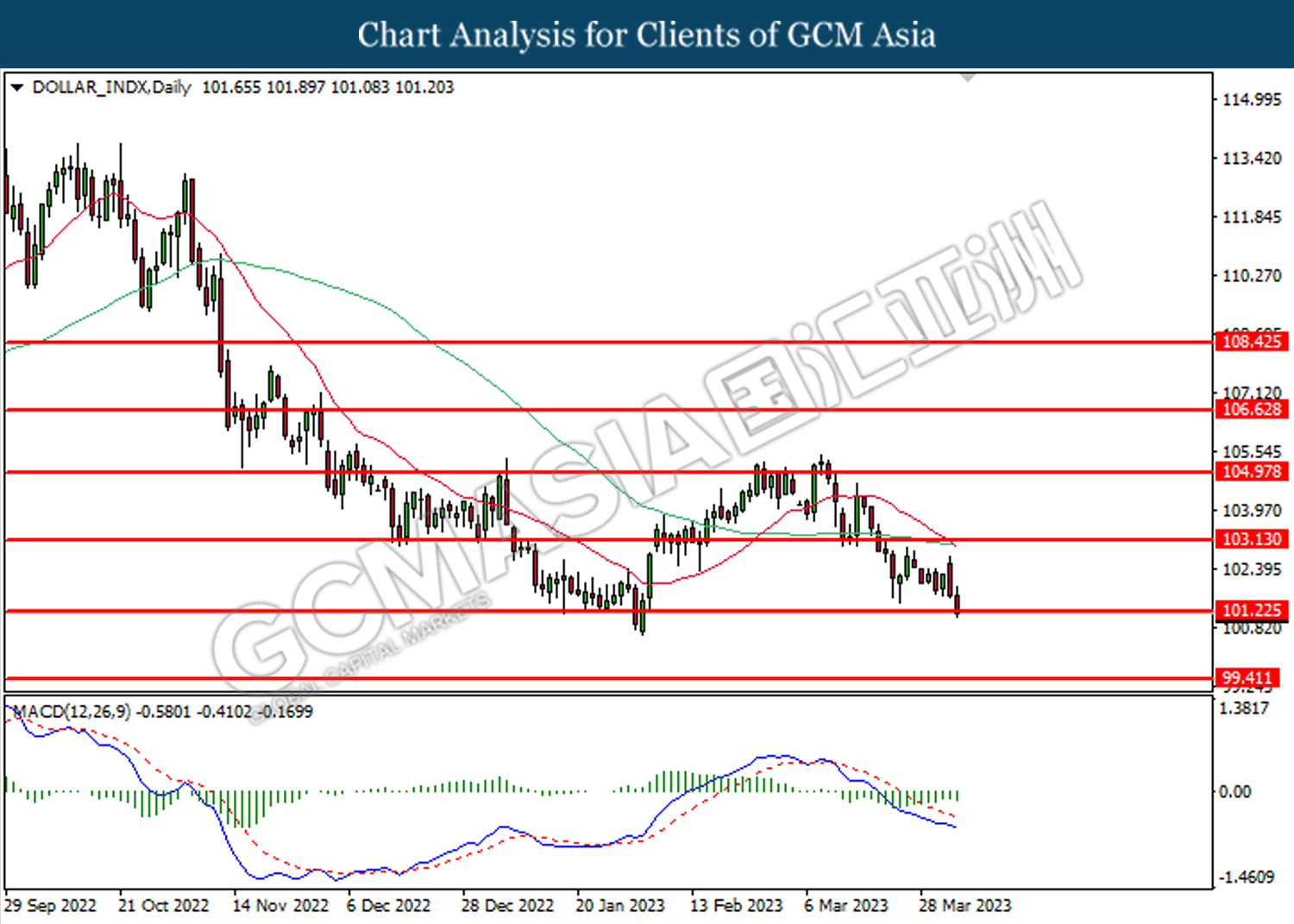

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 100.90, 102.05

Support level: 99.75, 98.35

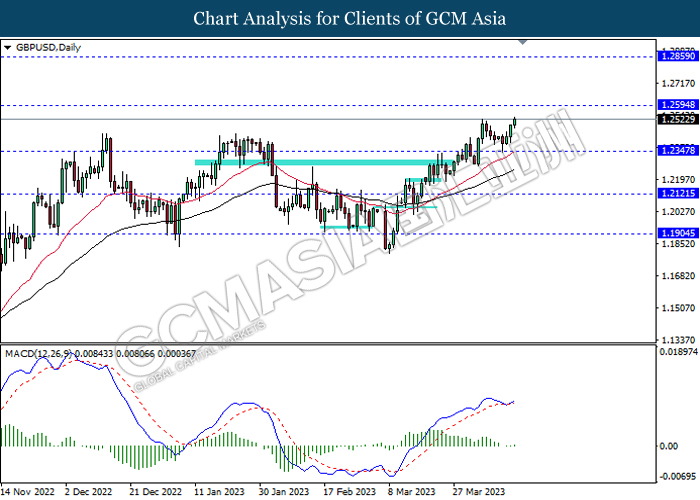

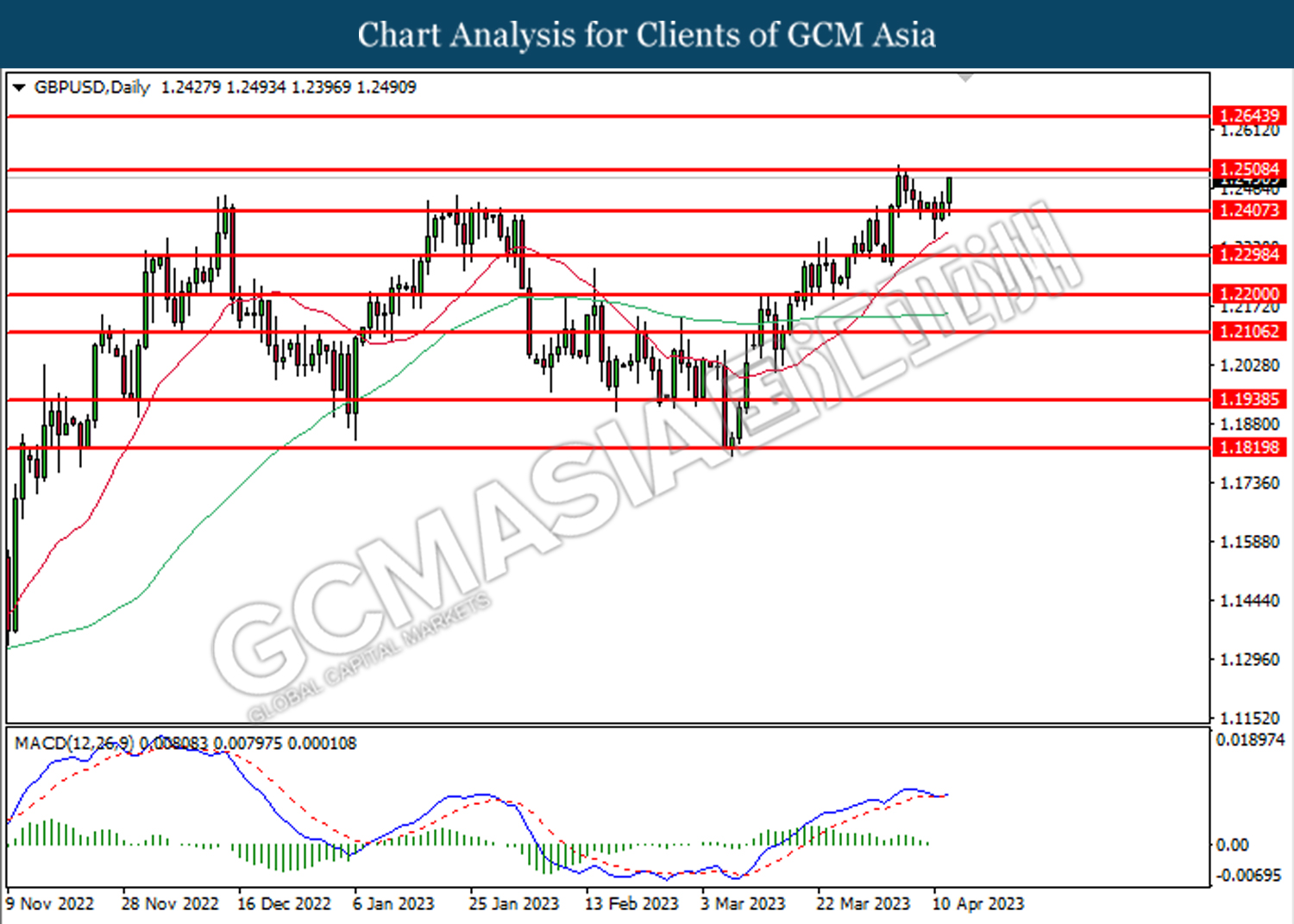

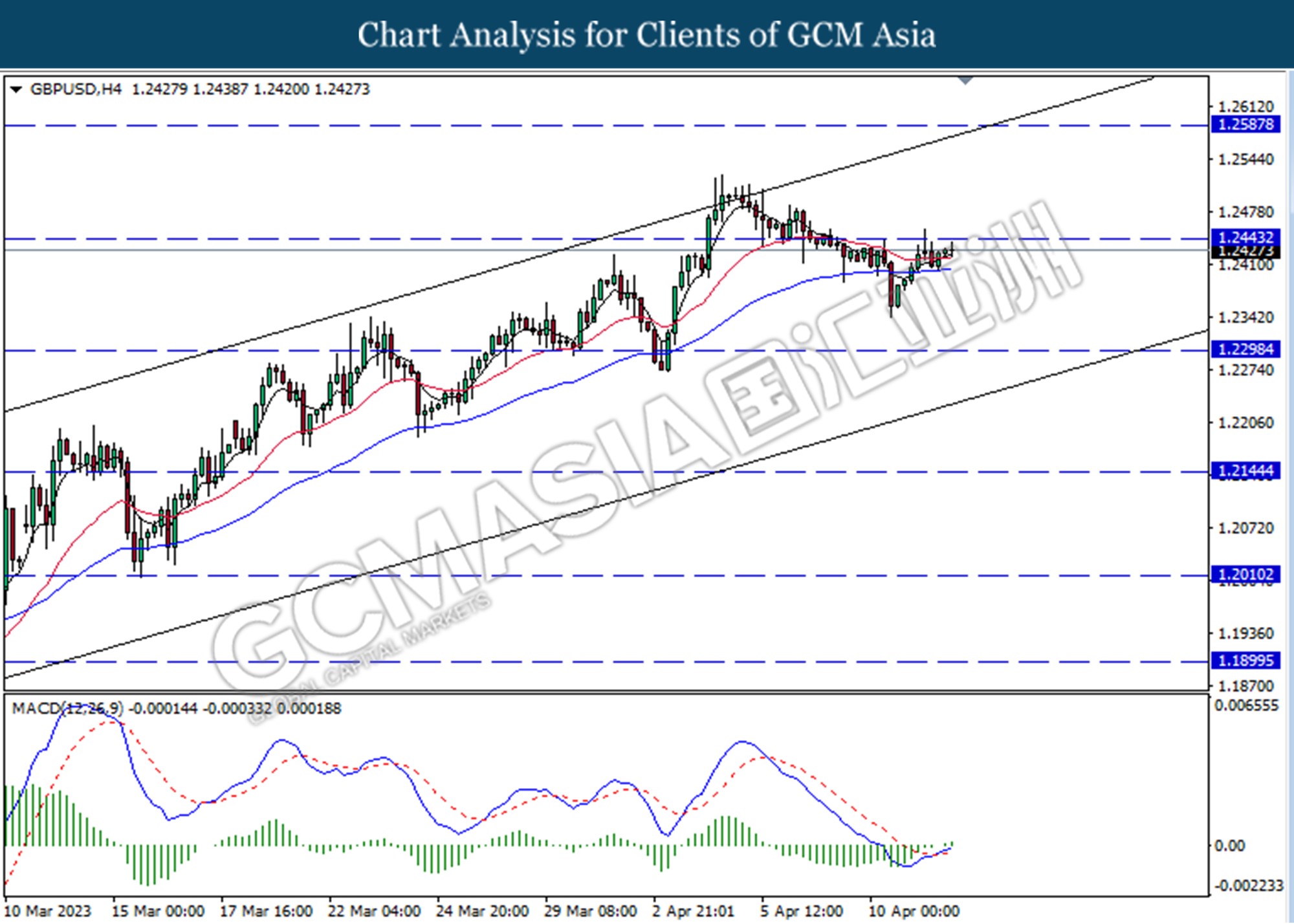

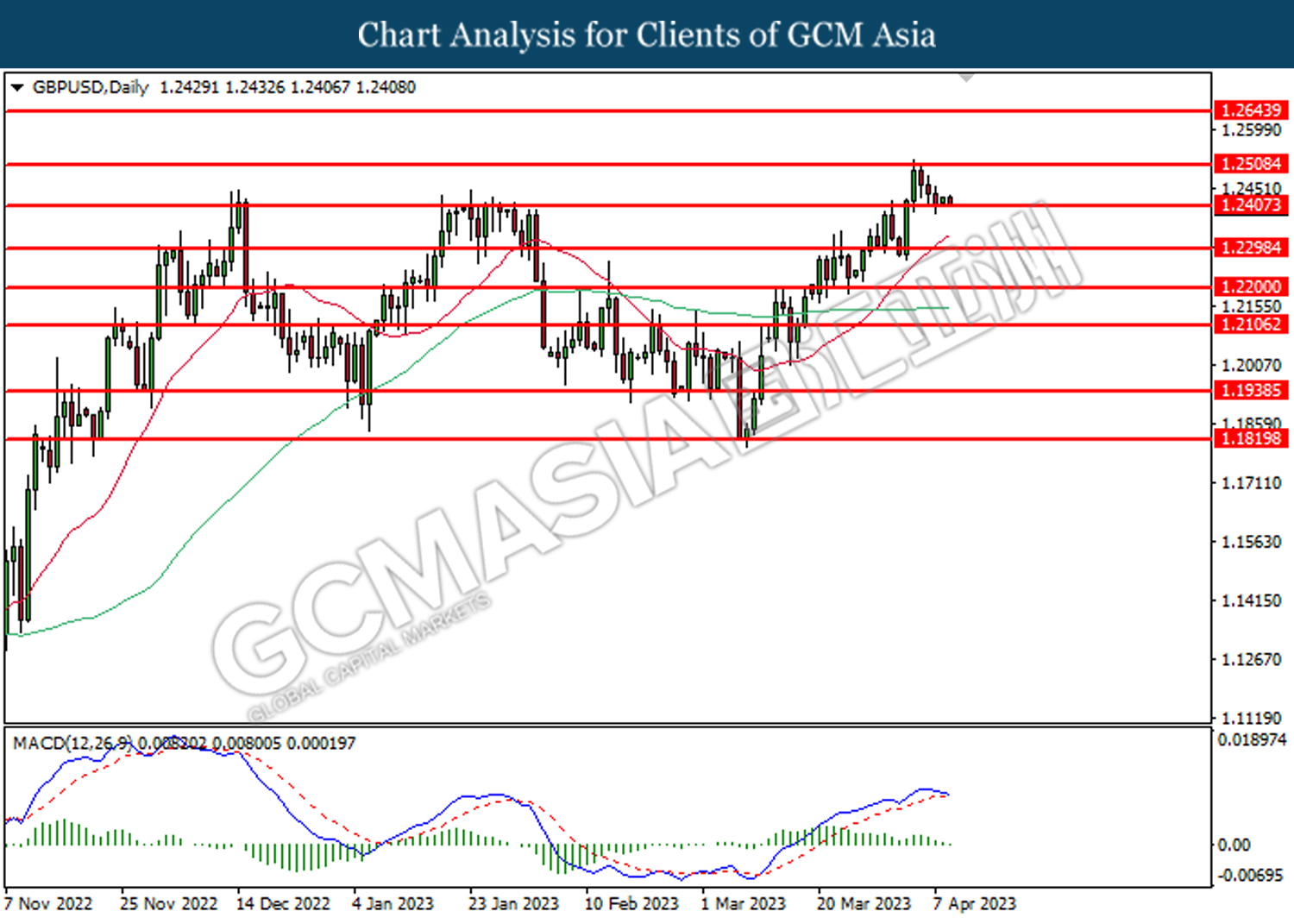

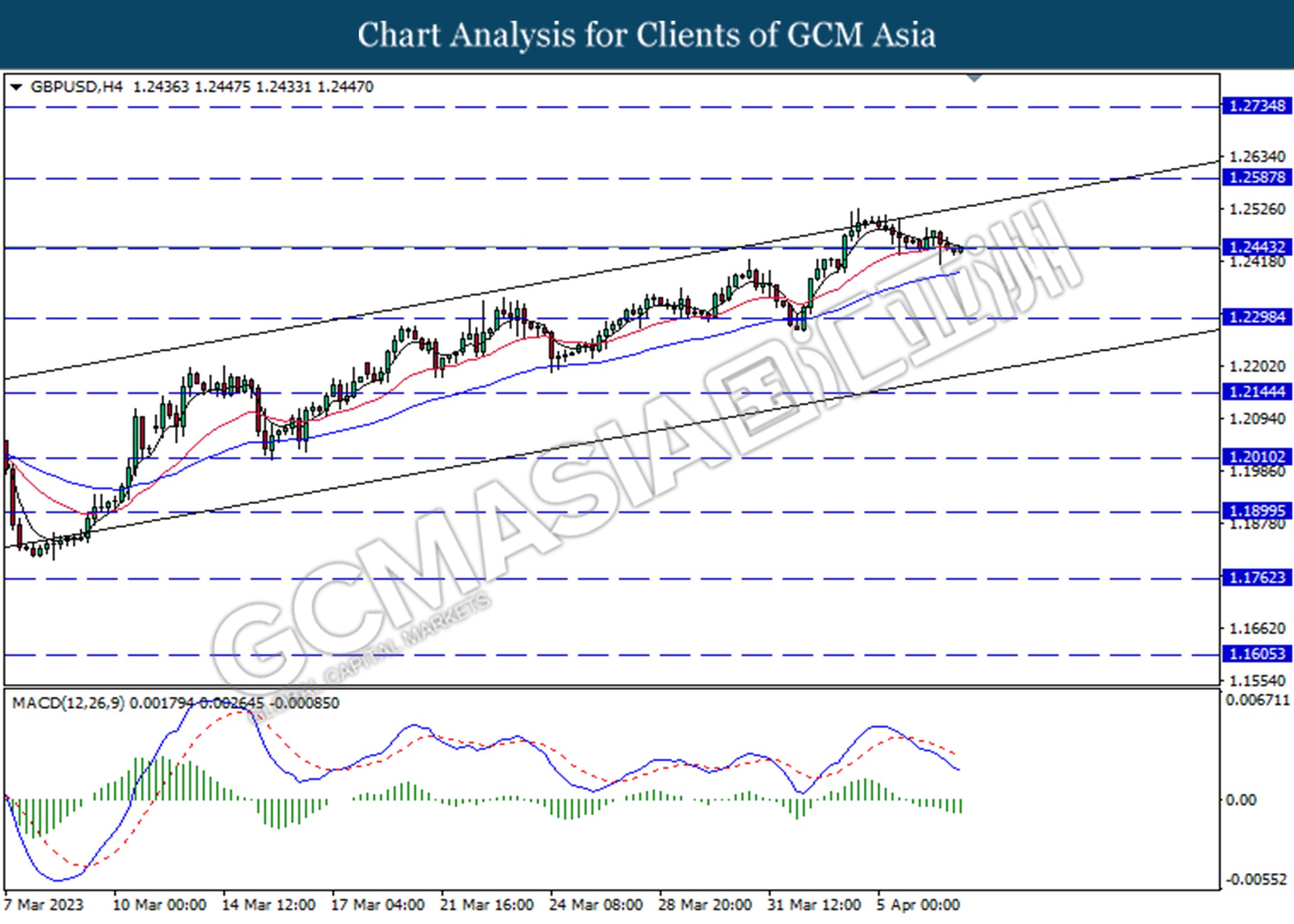

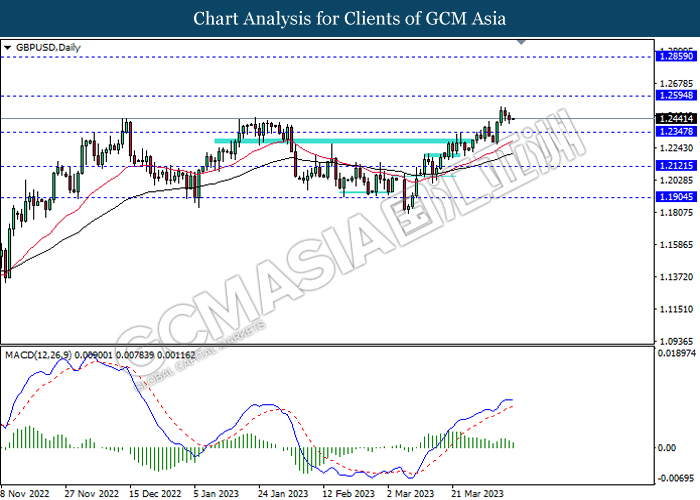

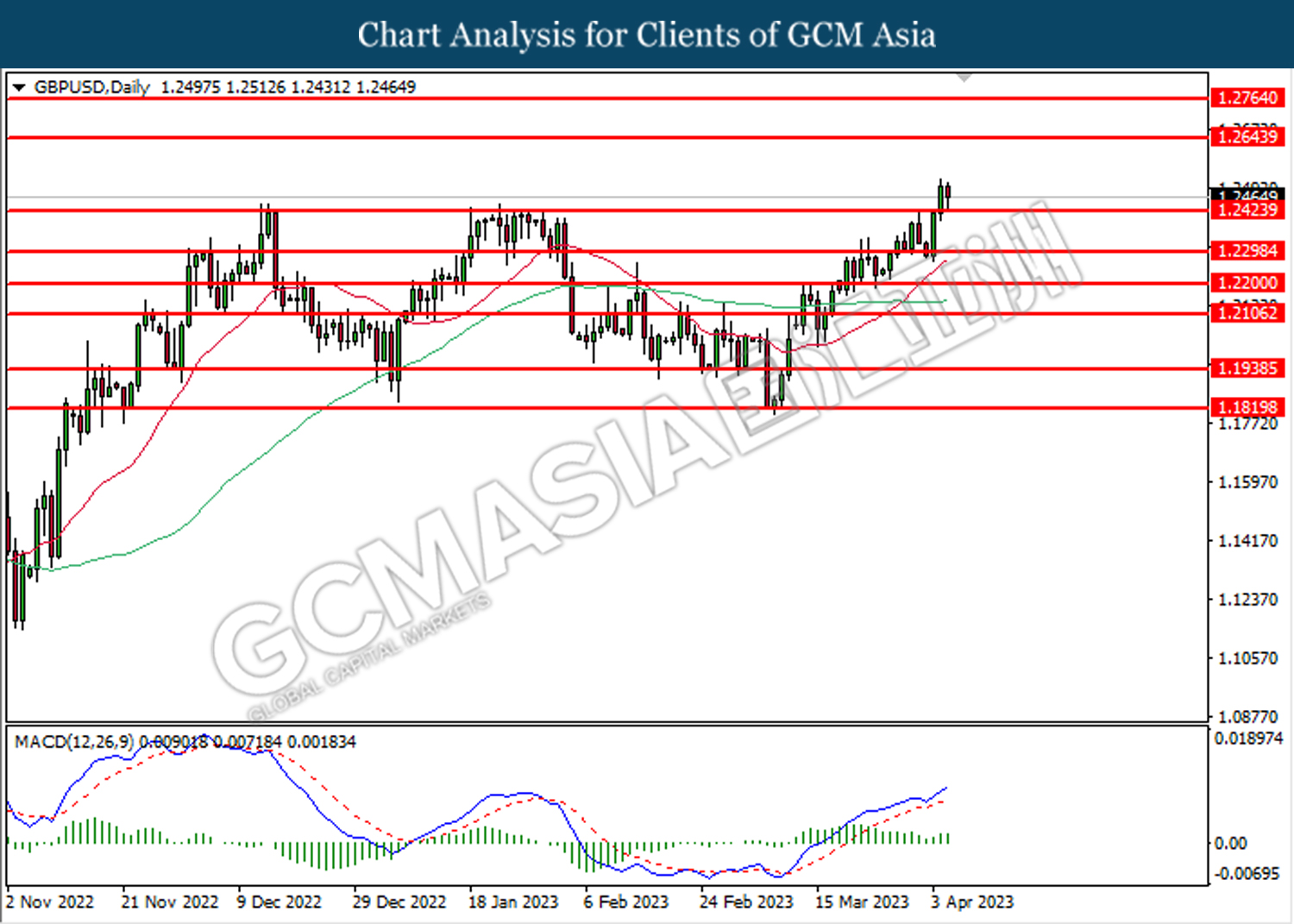

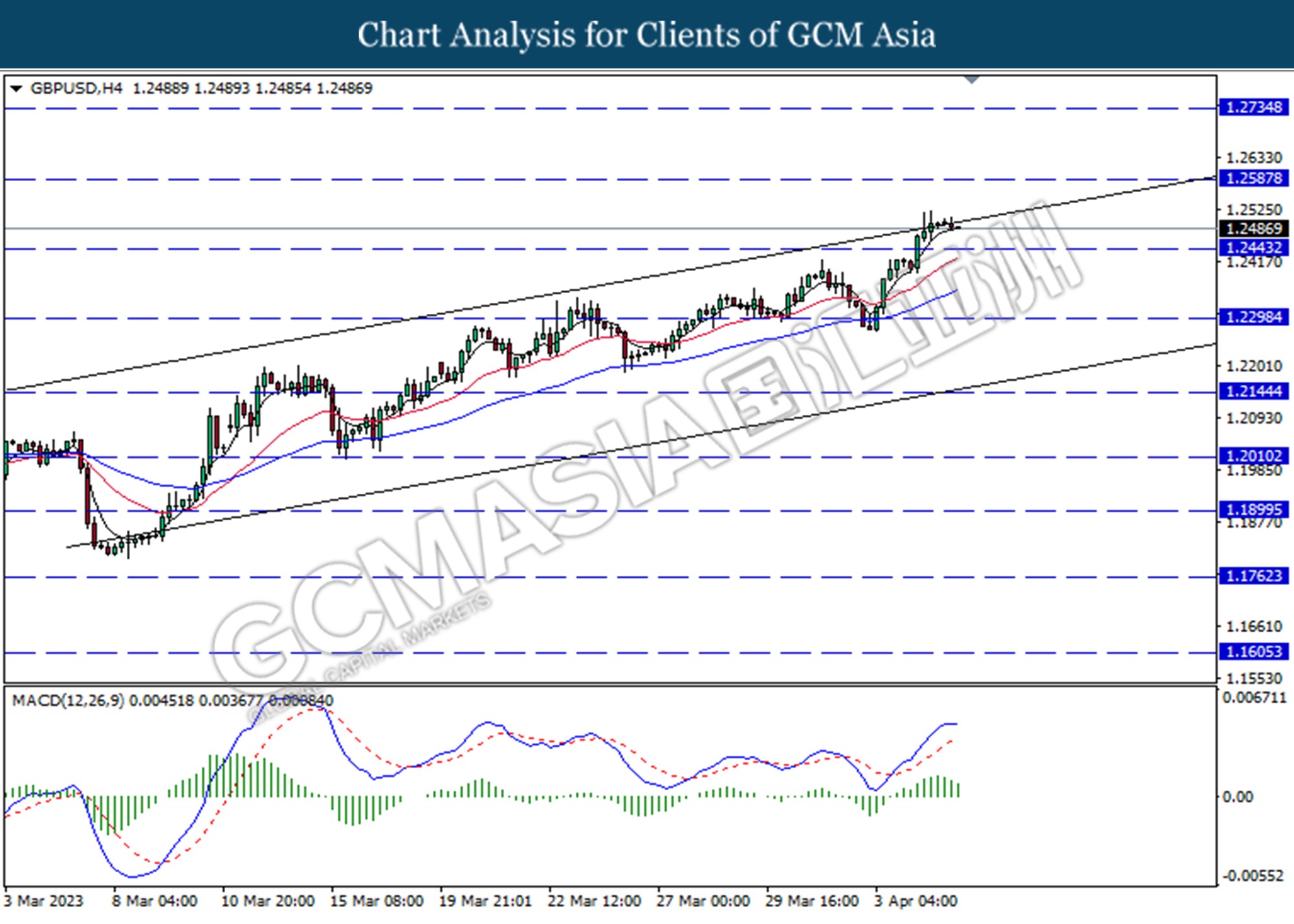

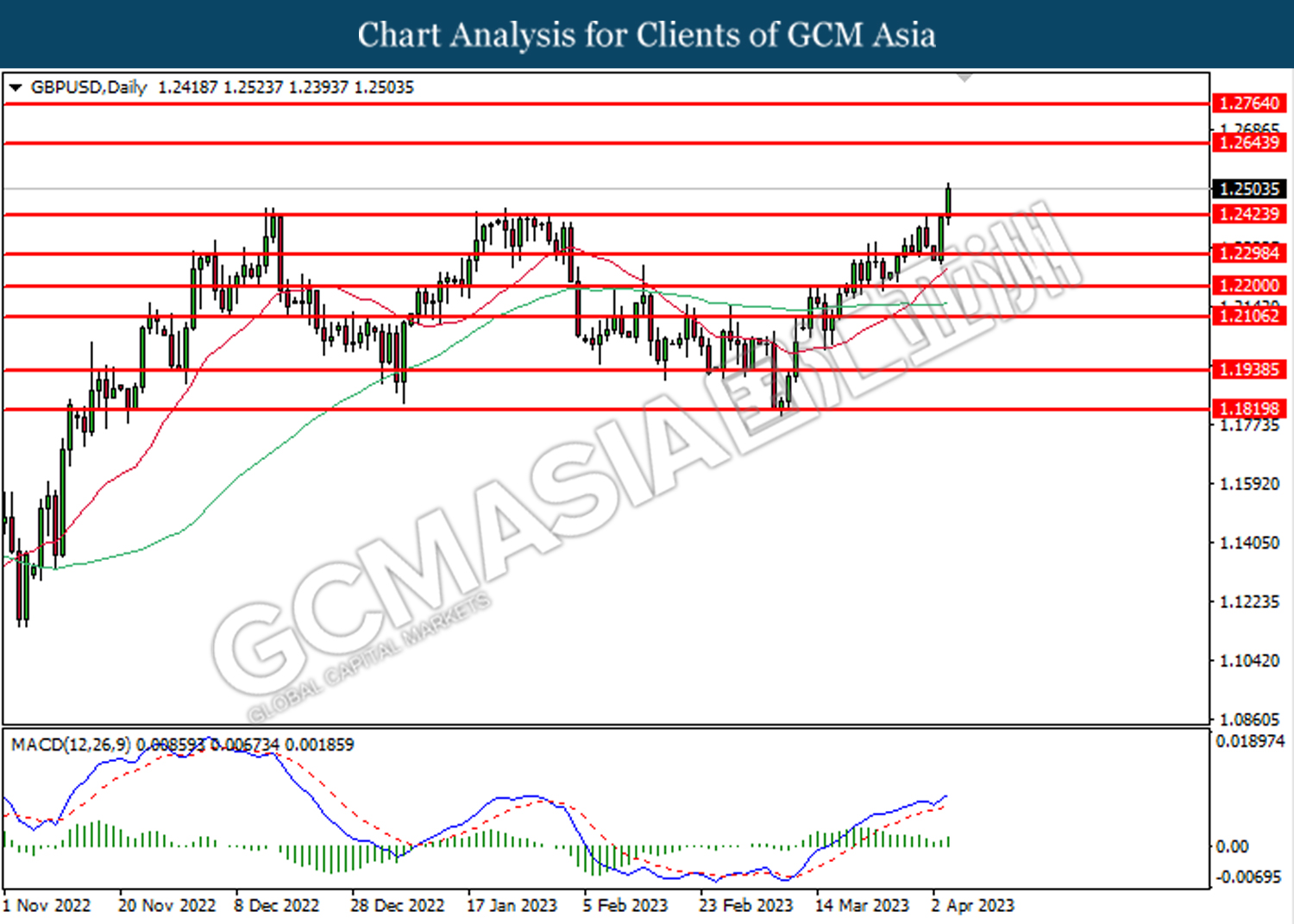

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

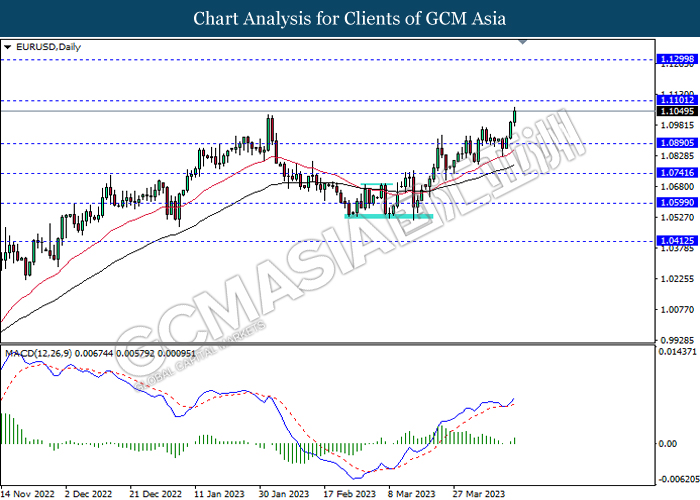

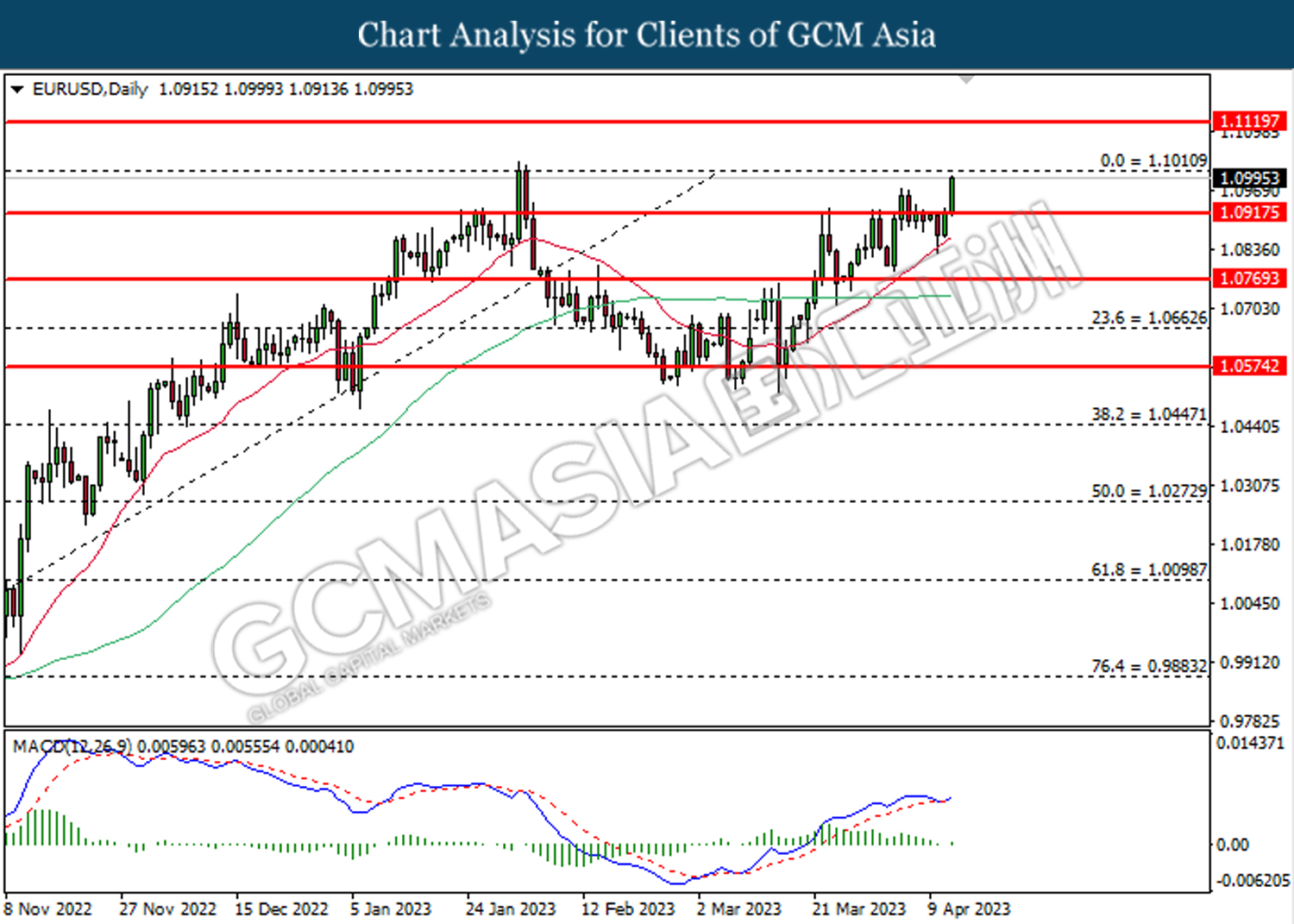

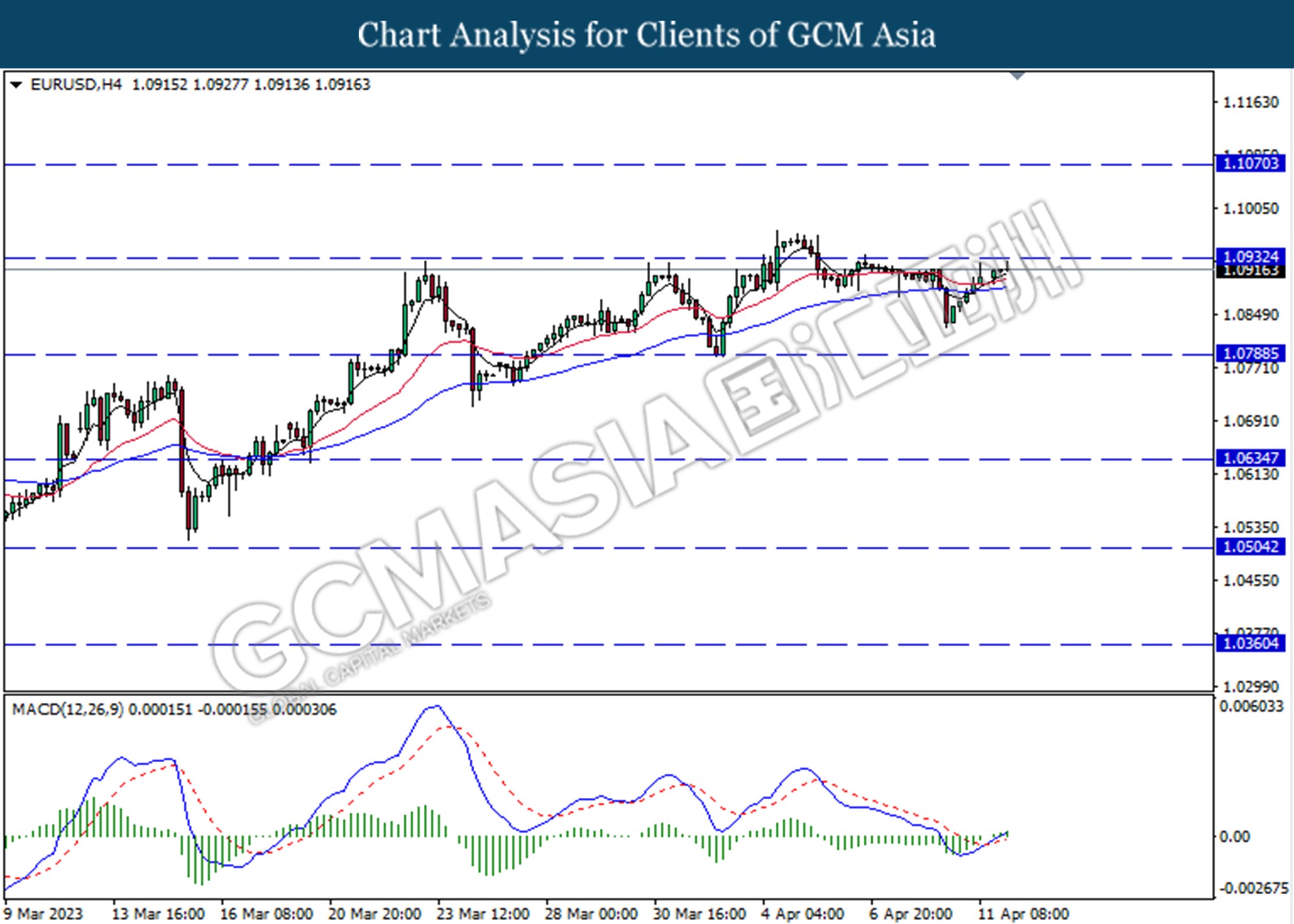

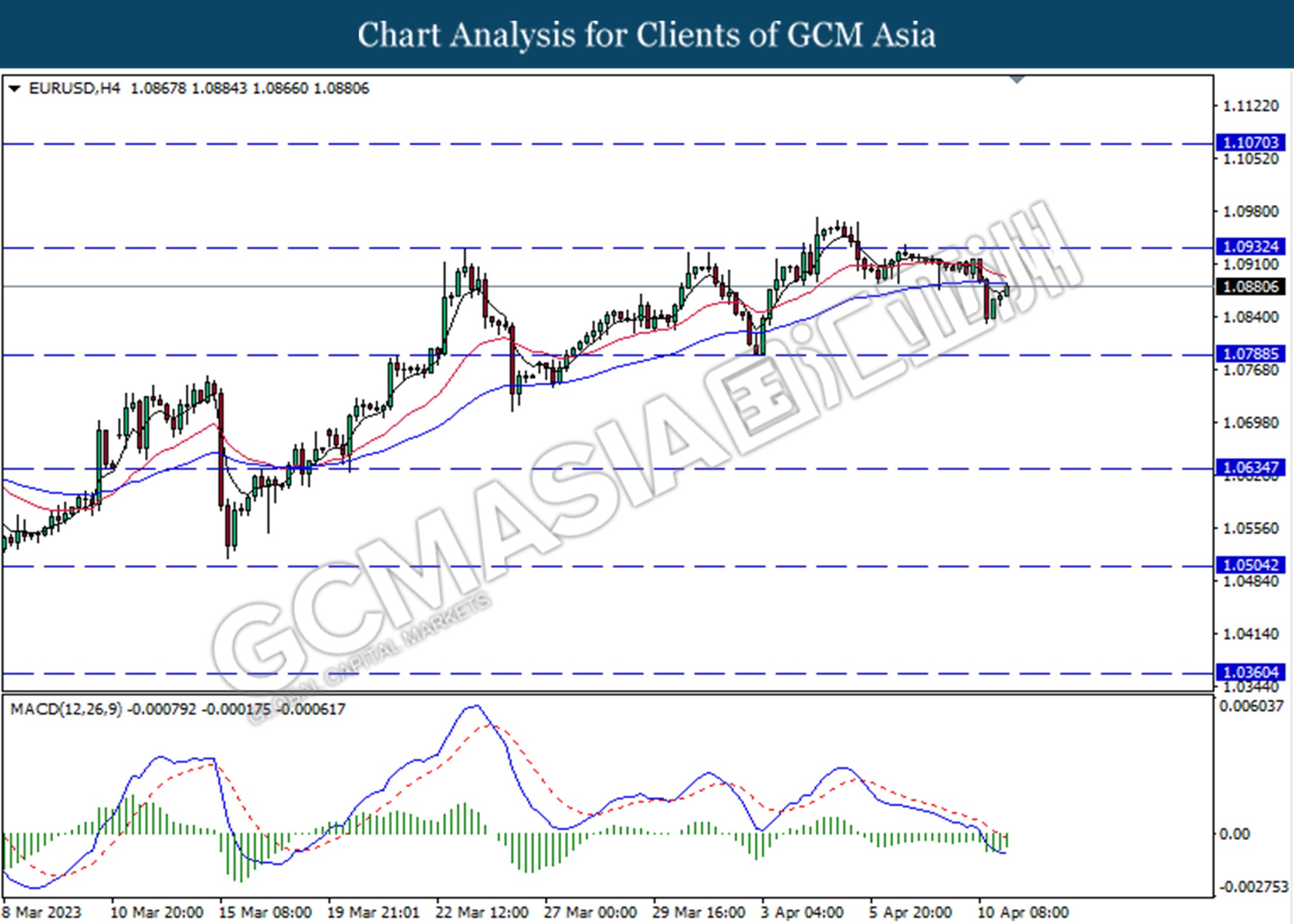

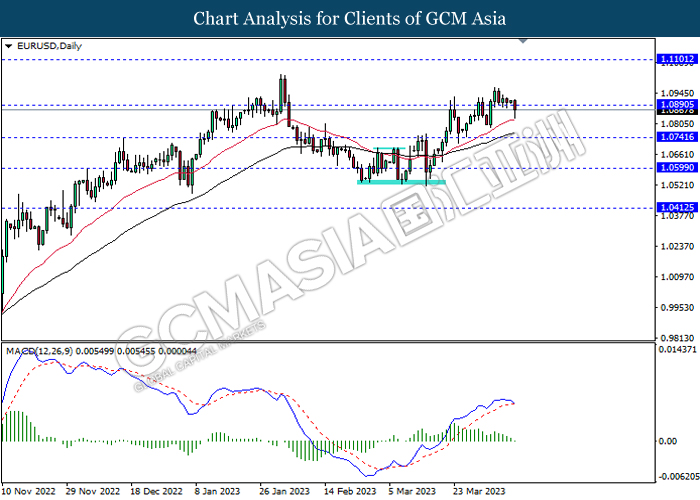

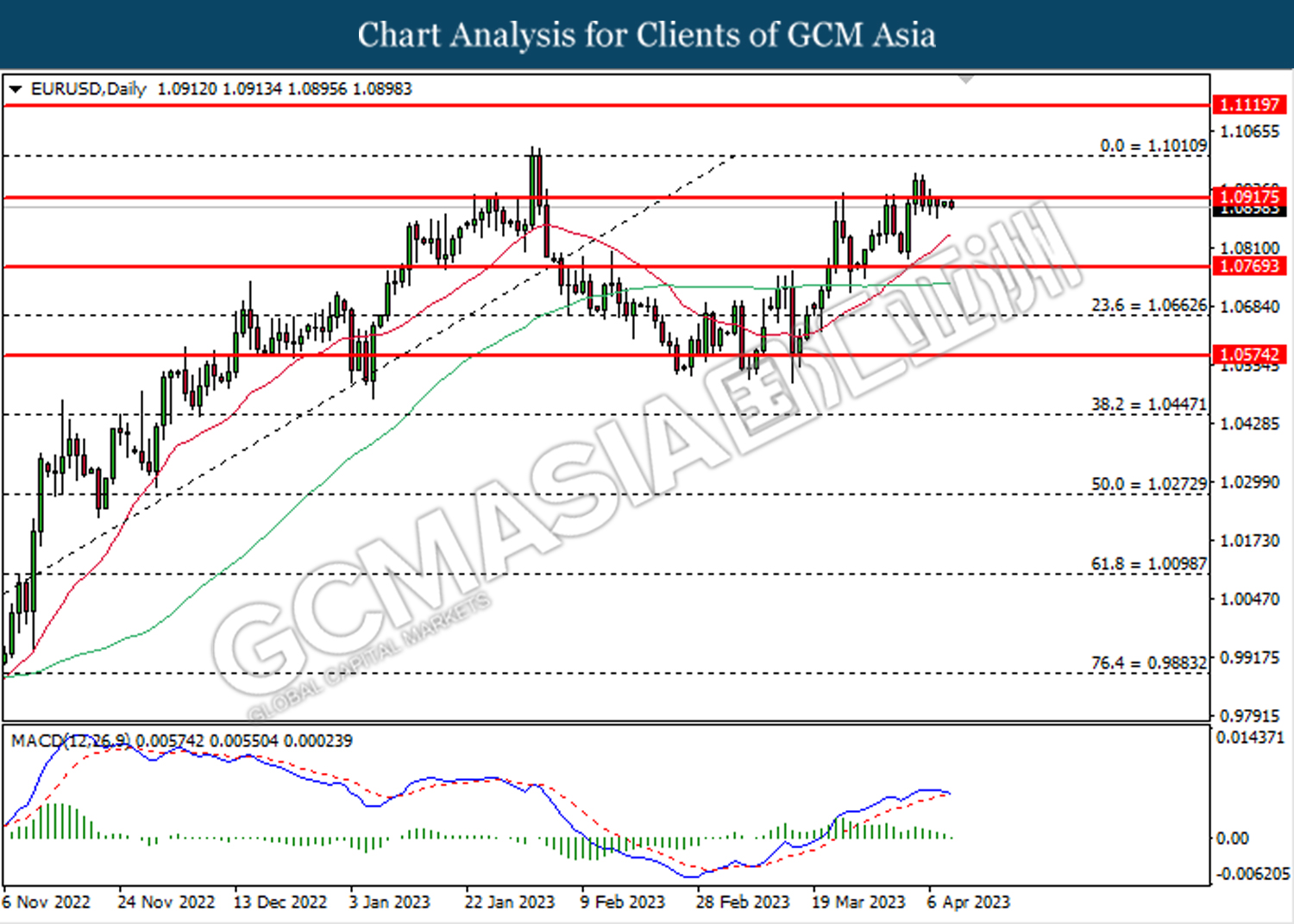

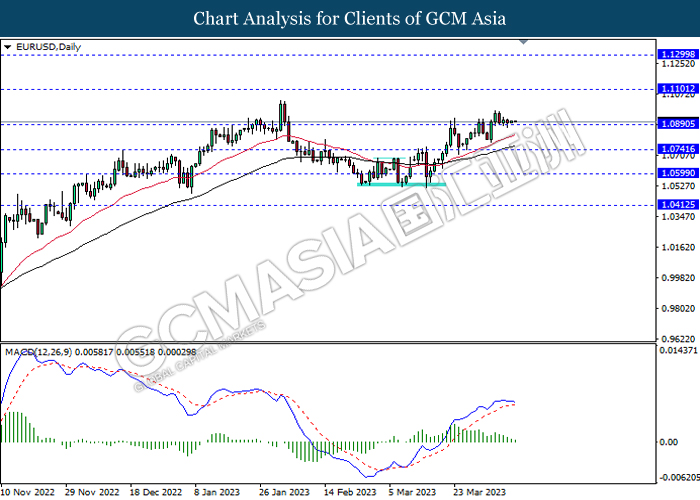

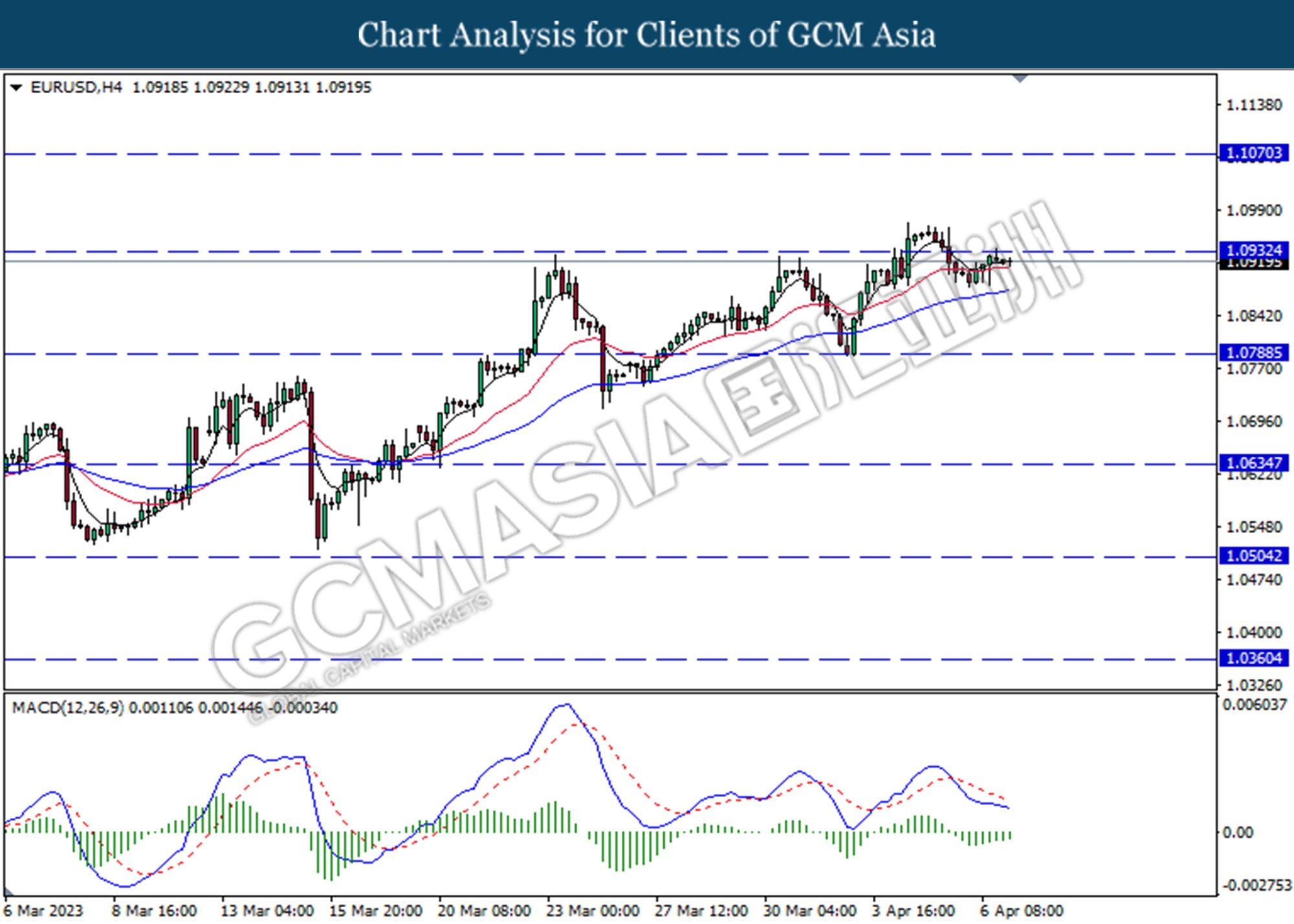

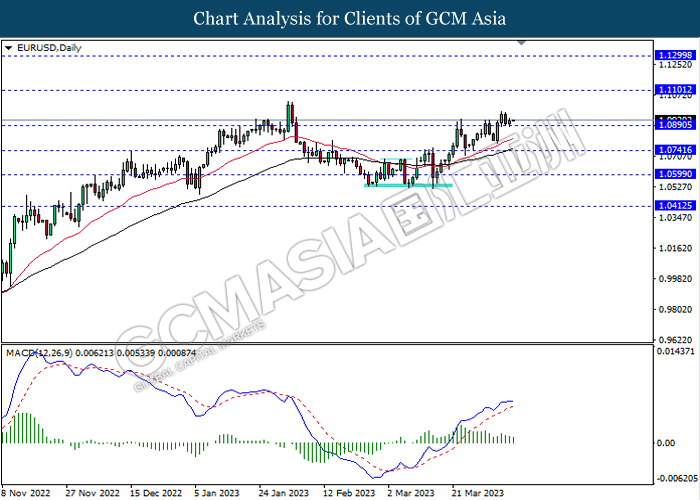

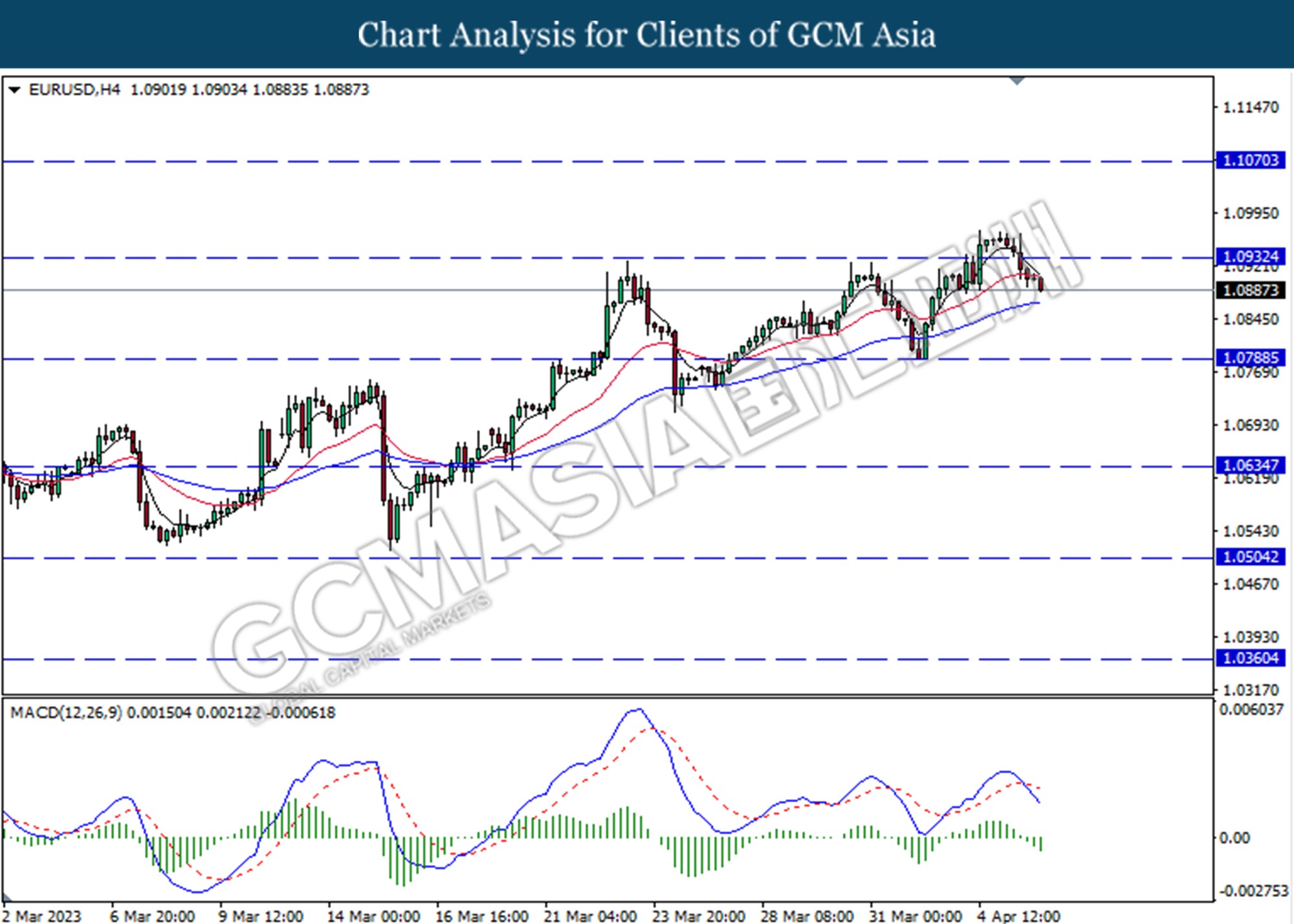

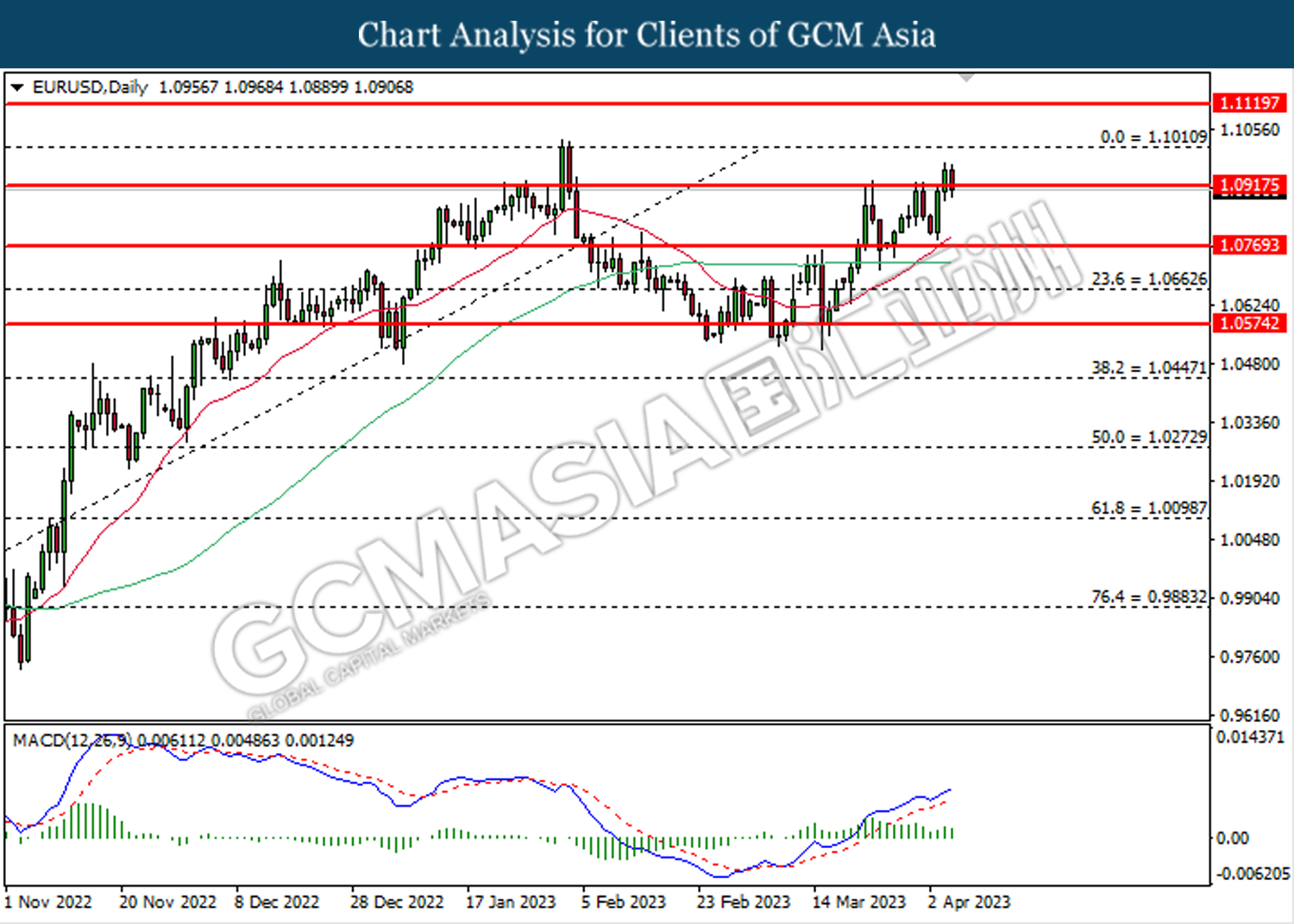

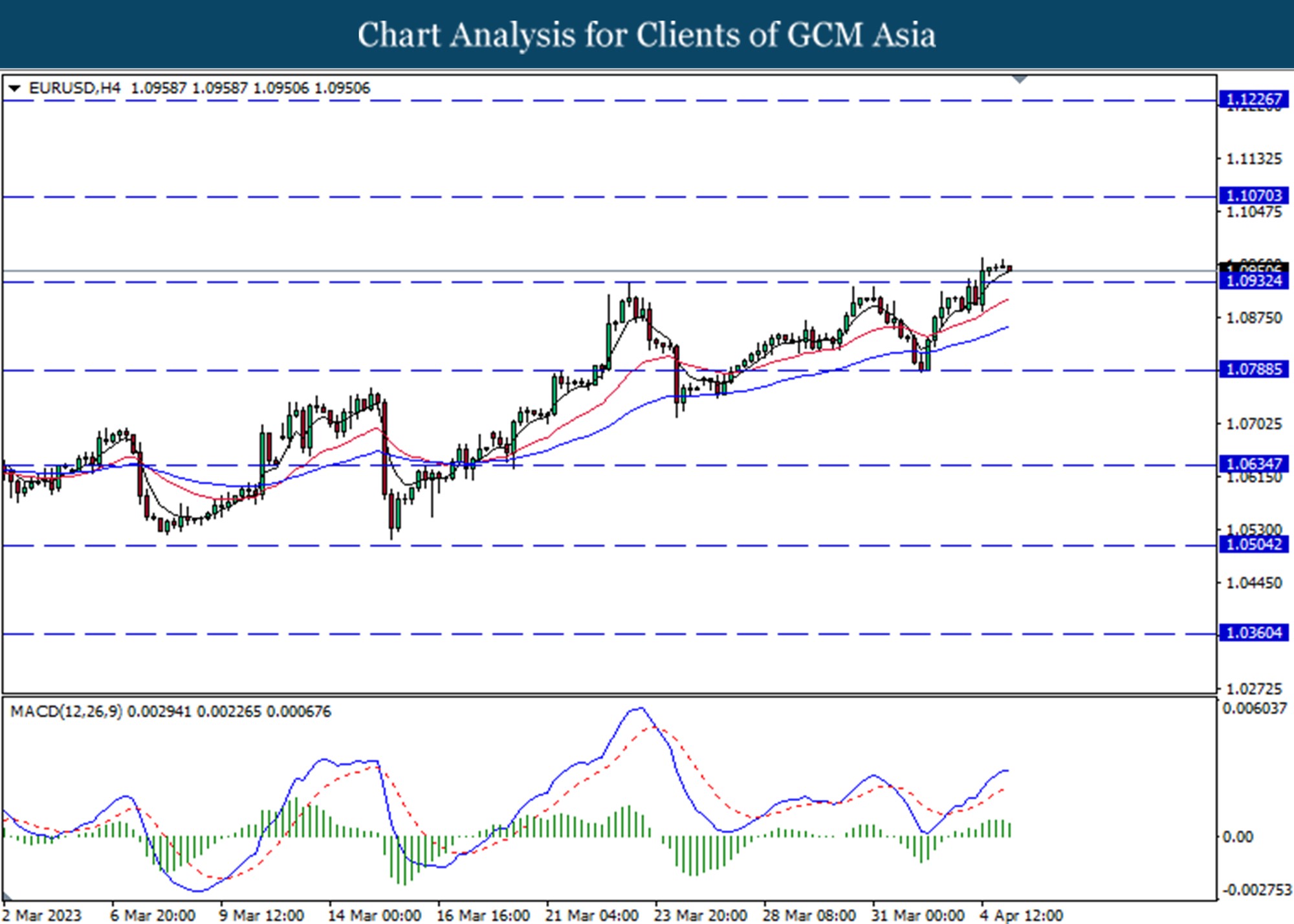

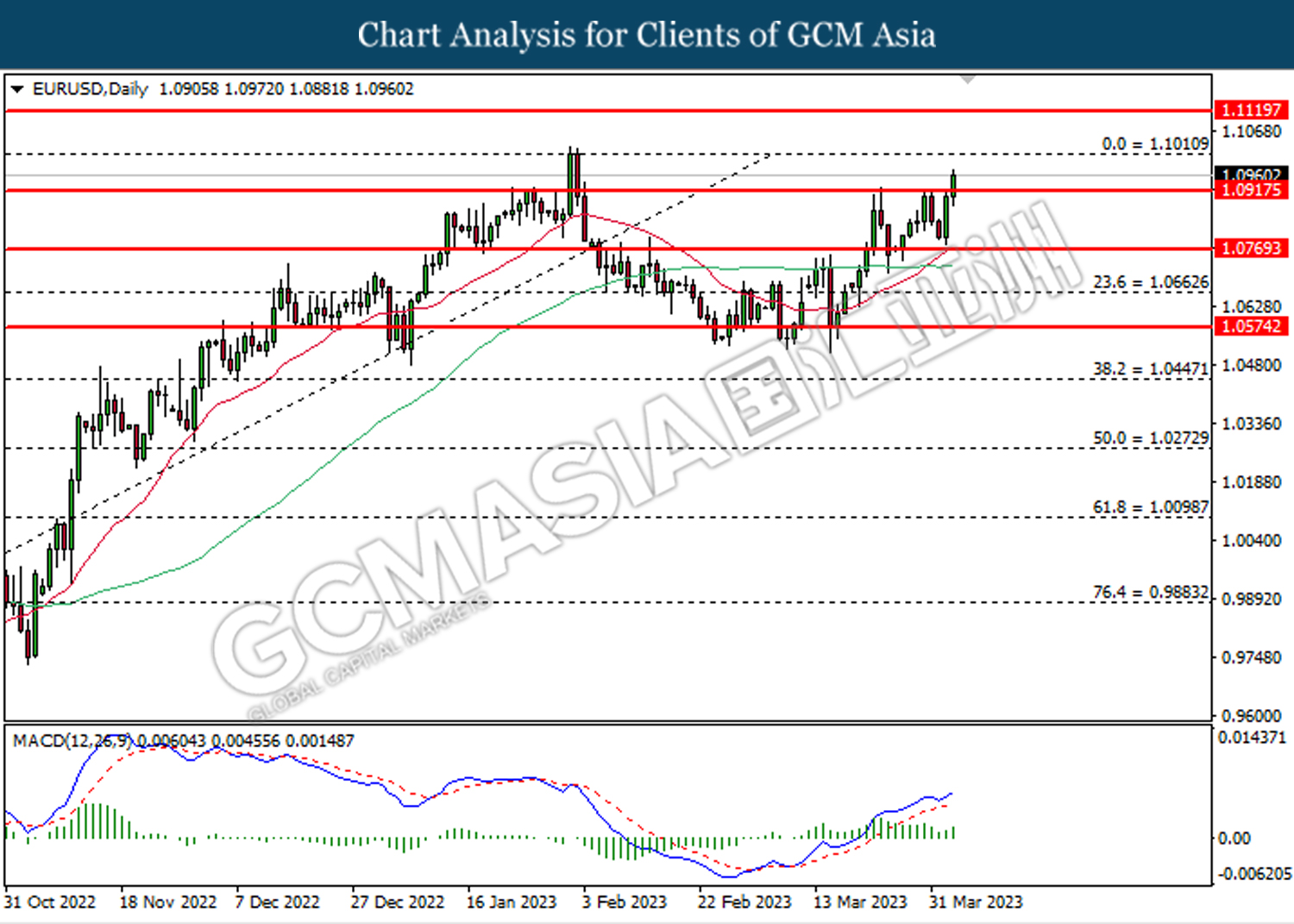

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

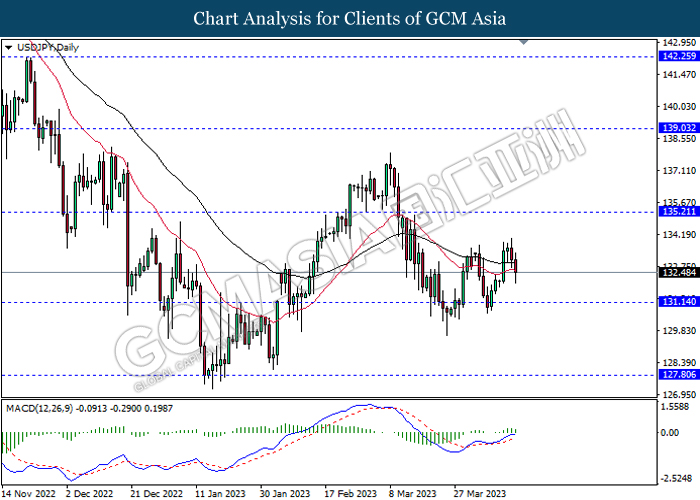

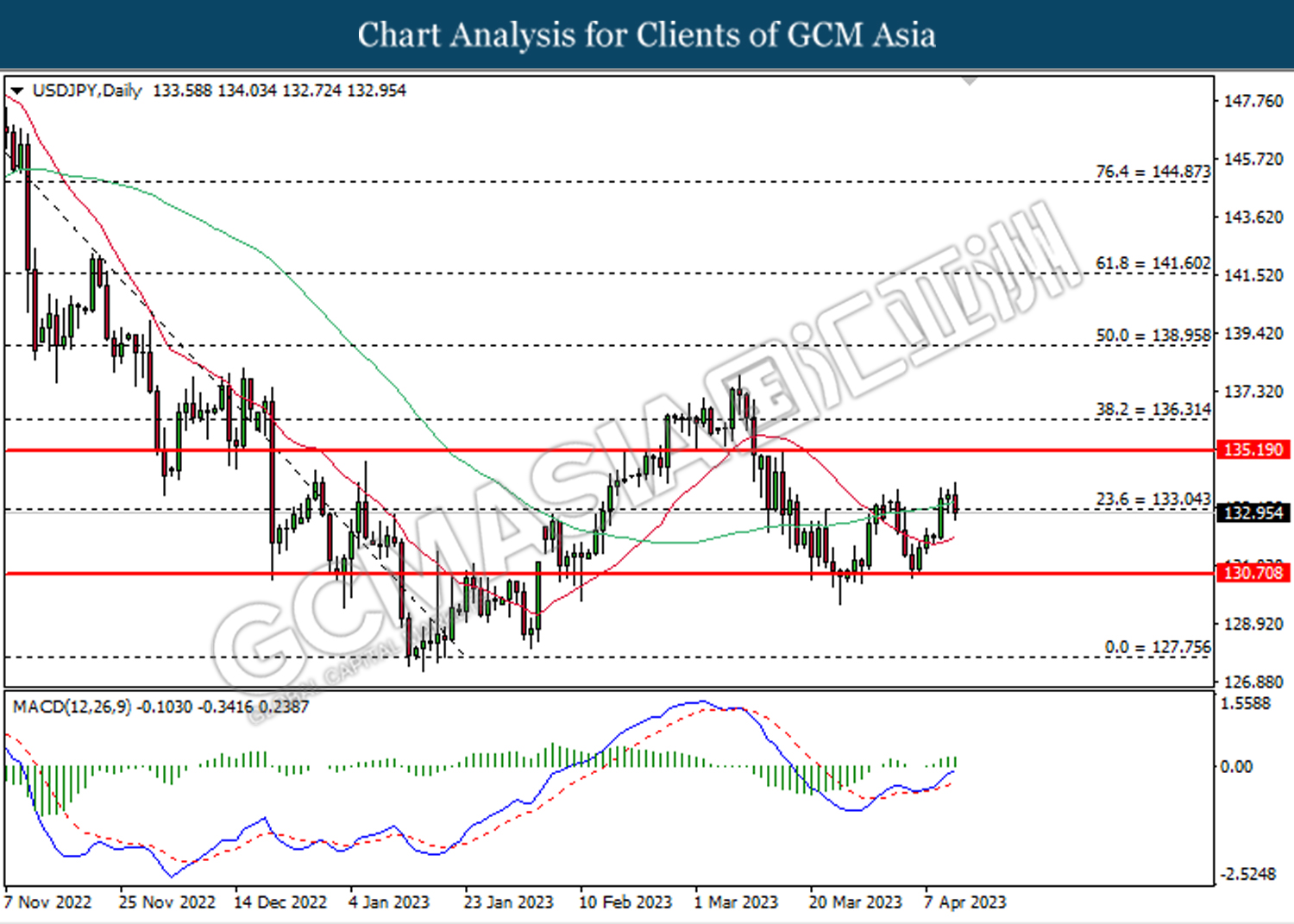

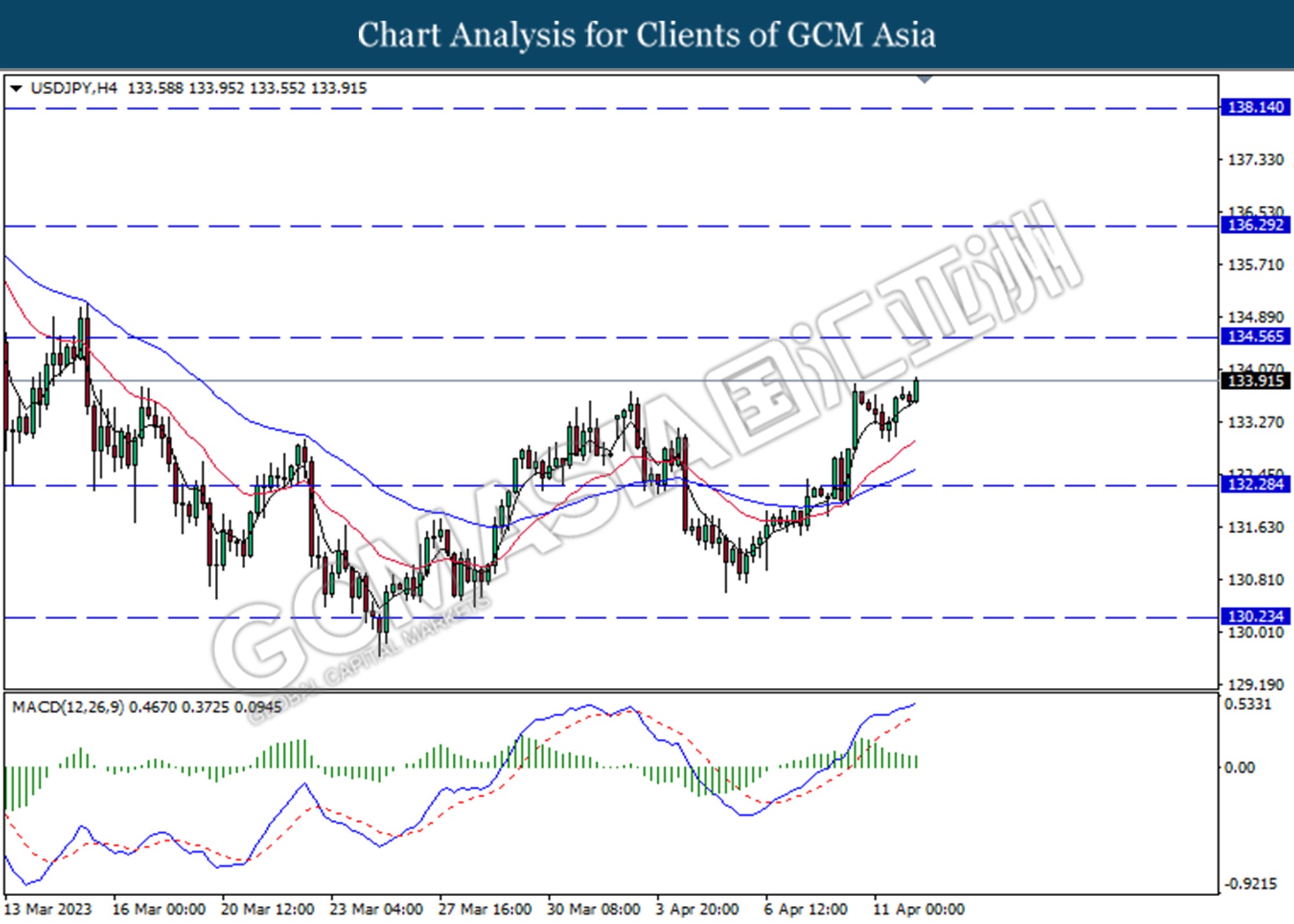

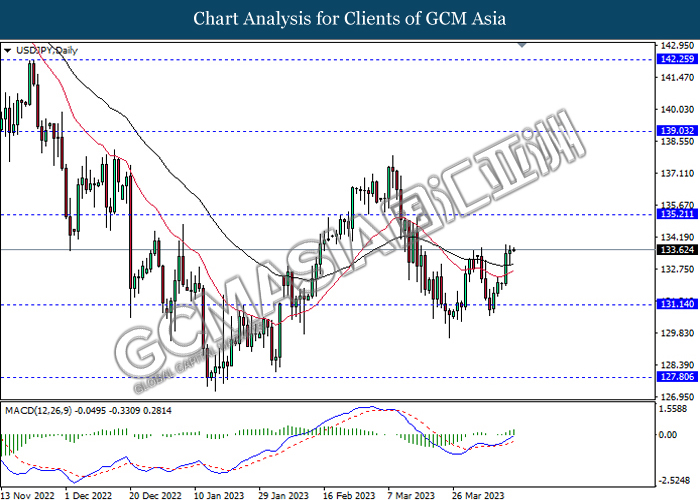

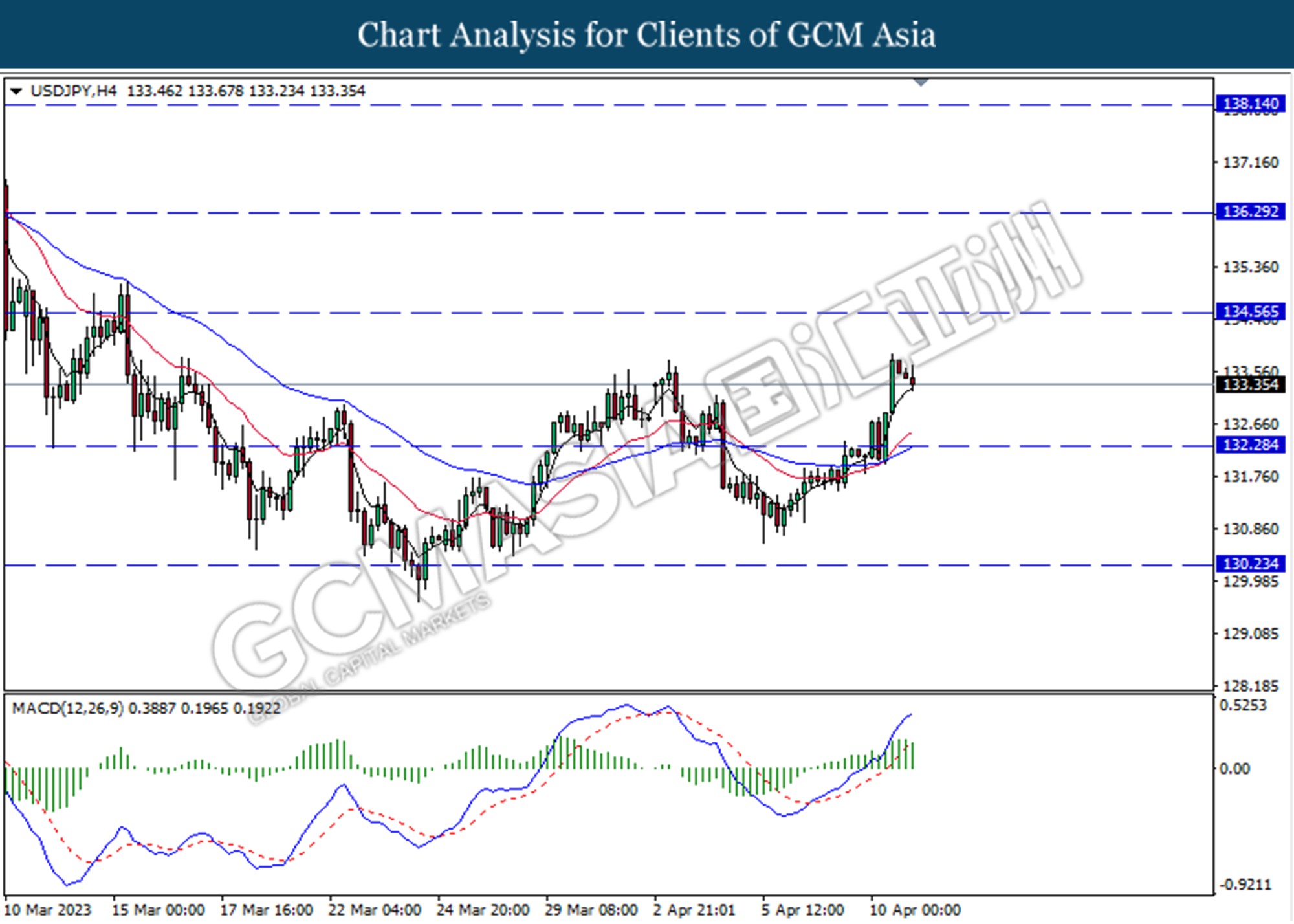

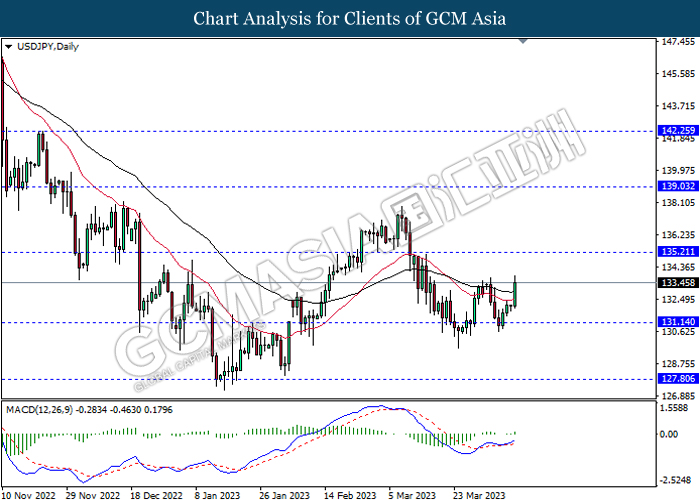

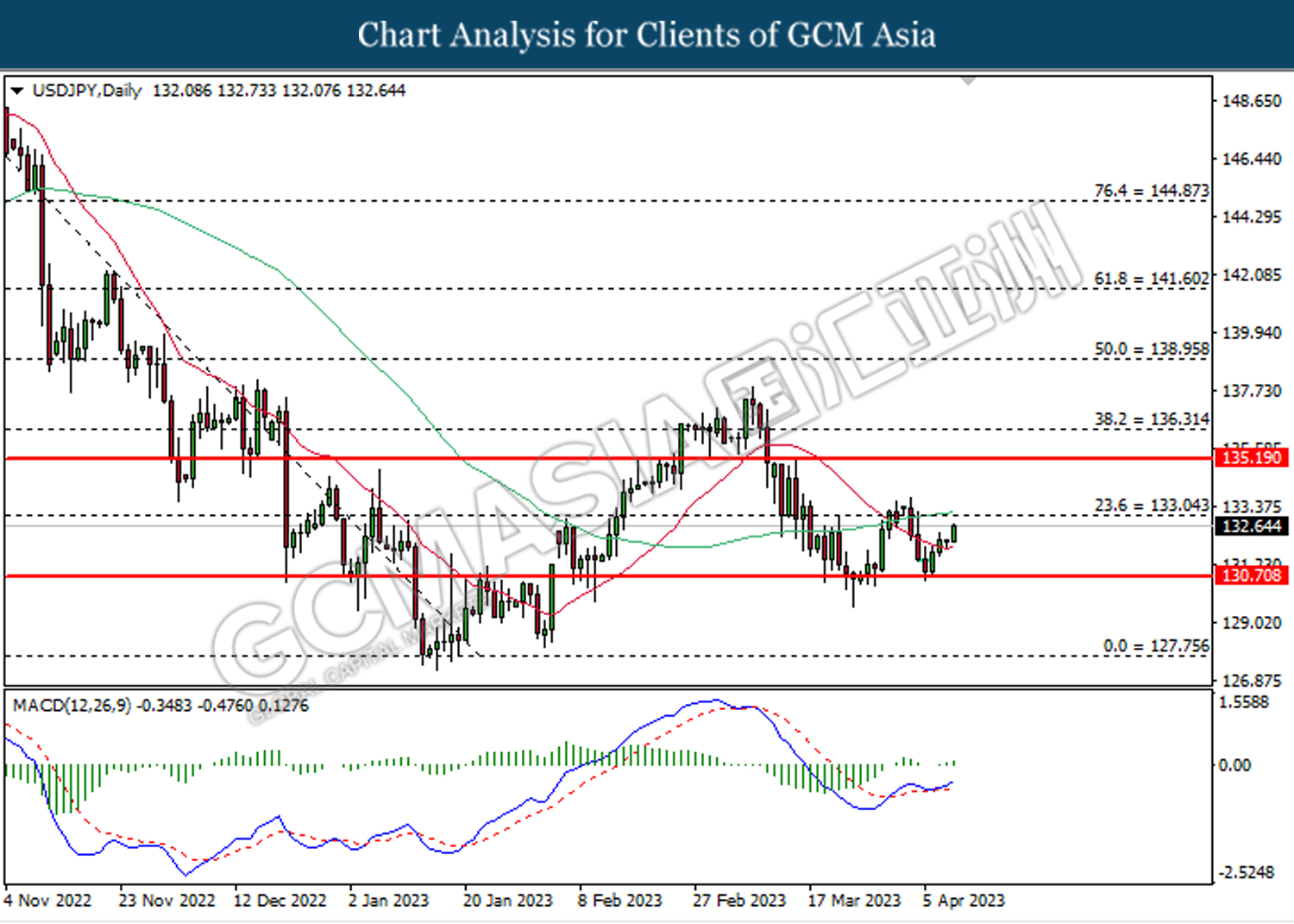

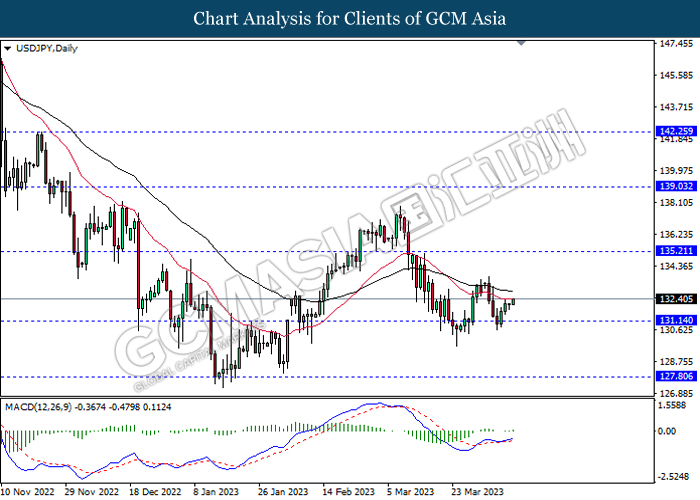

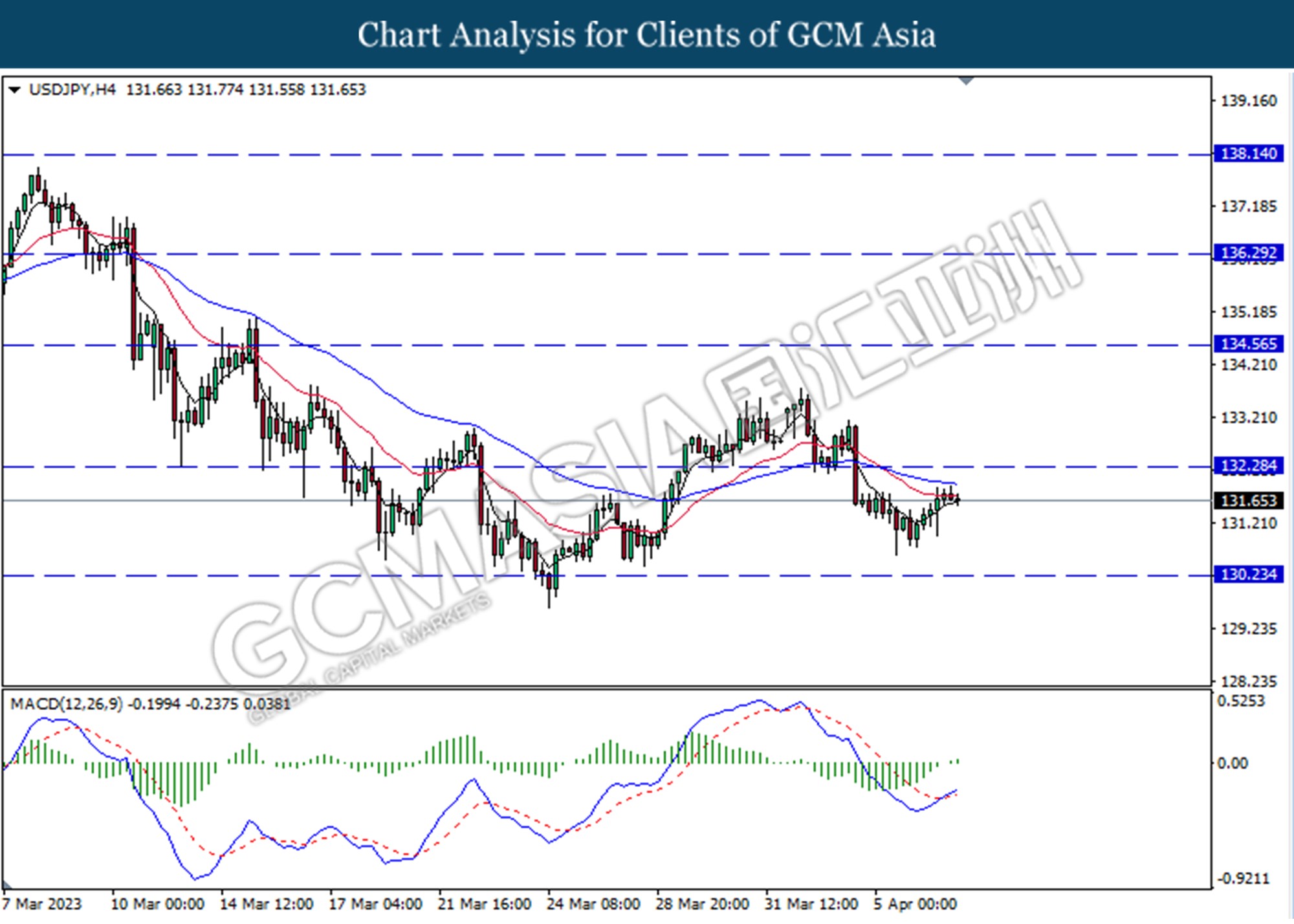

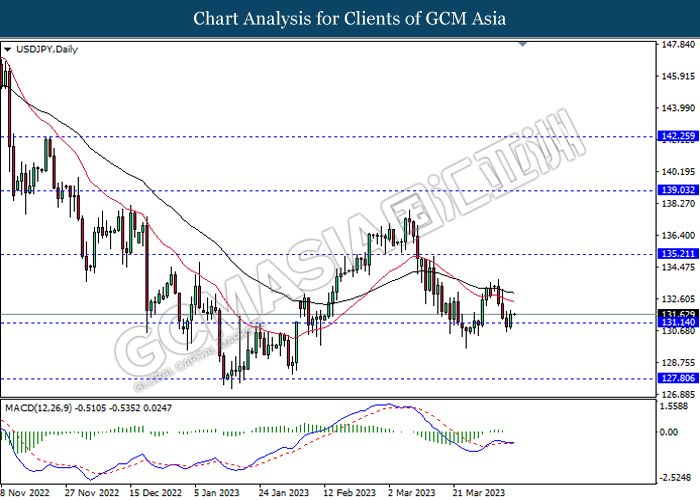

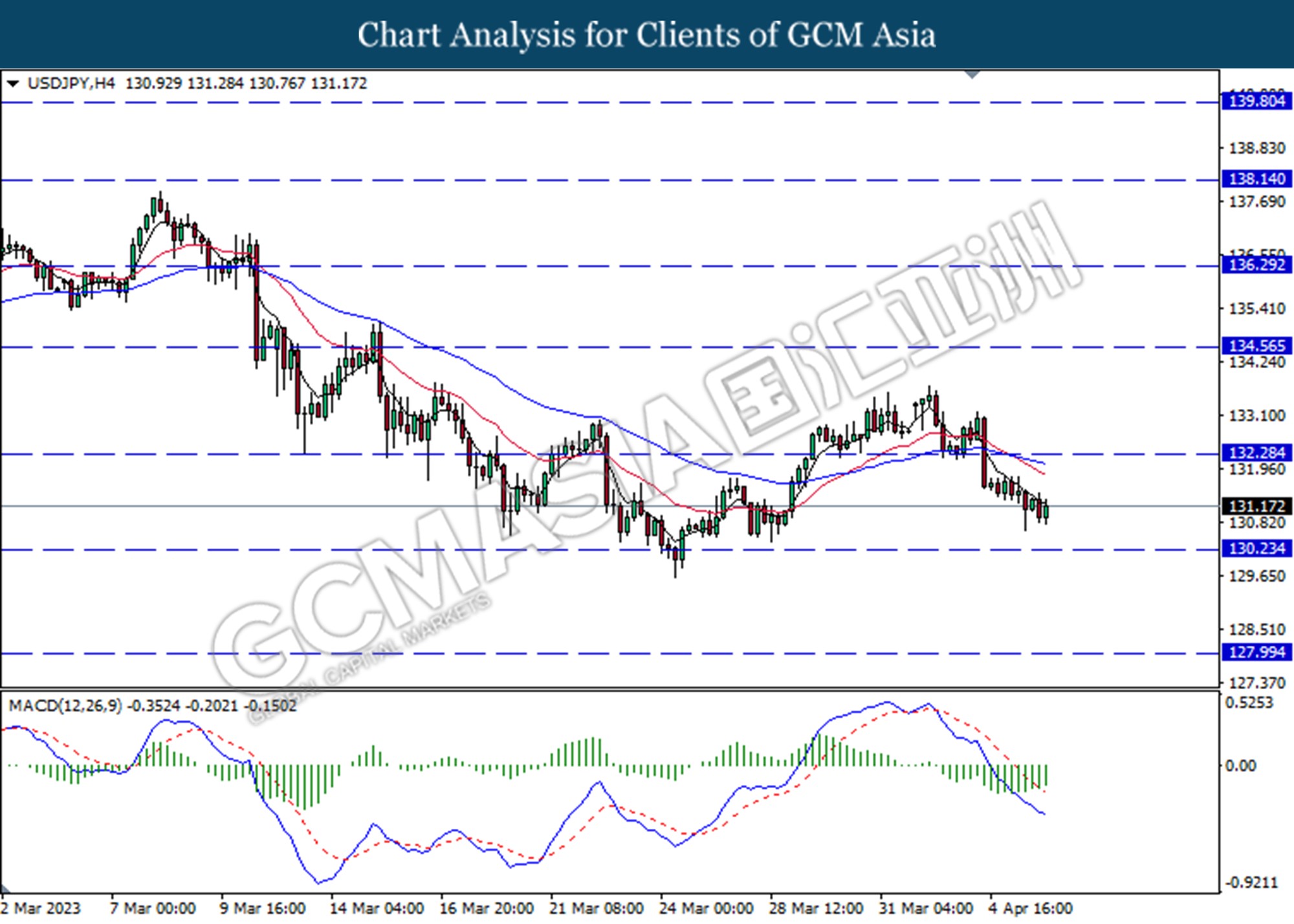

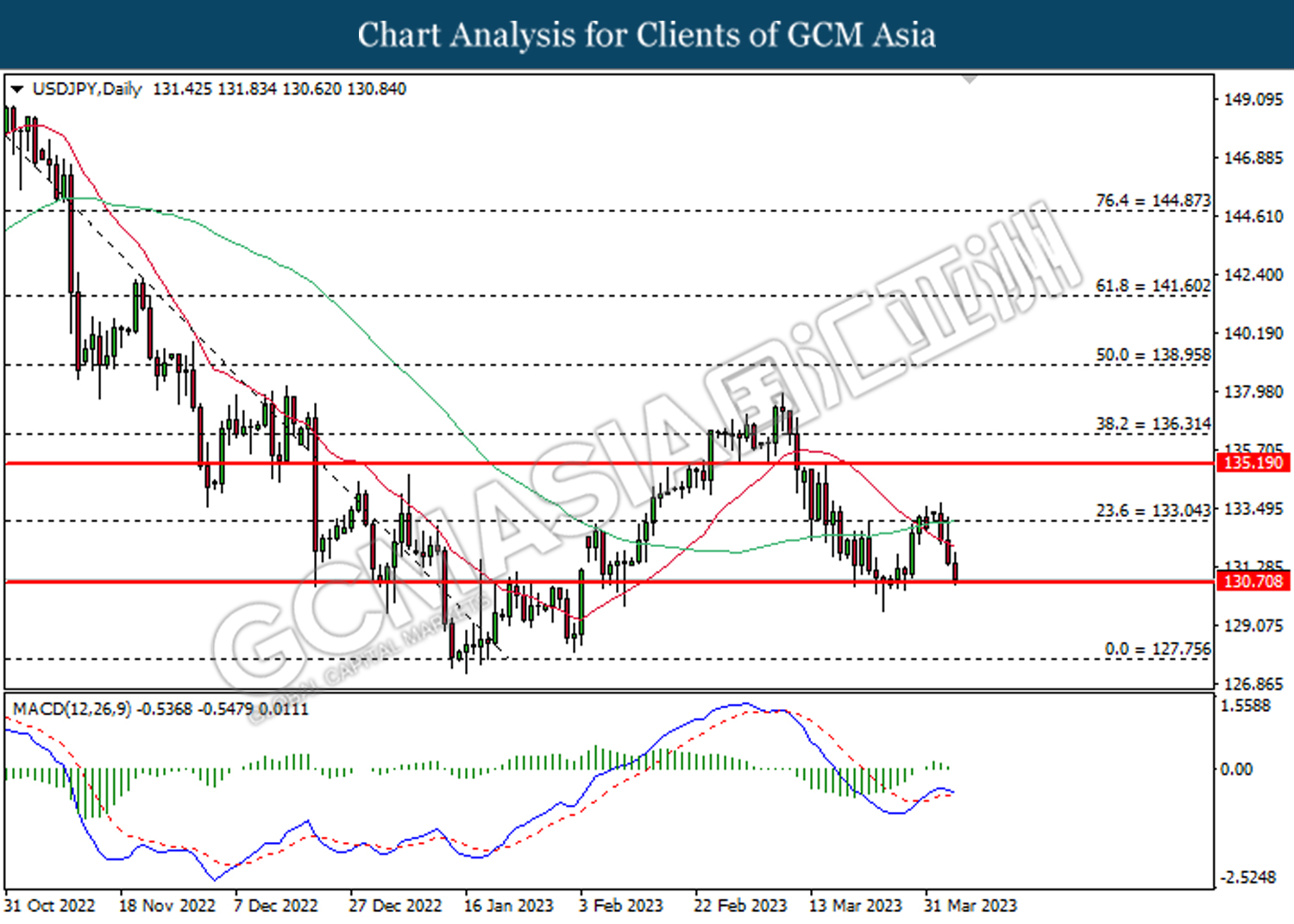

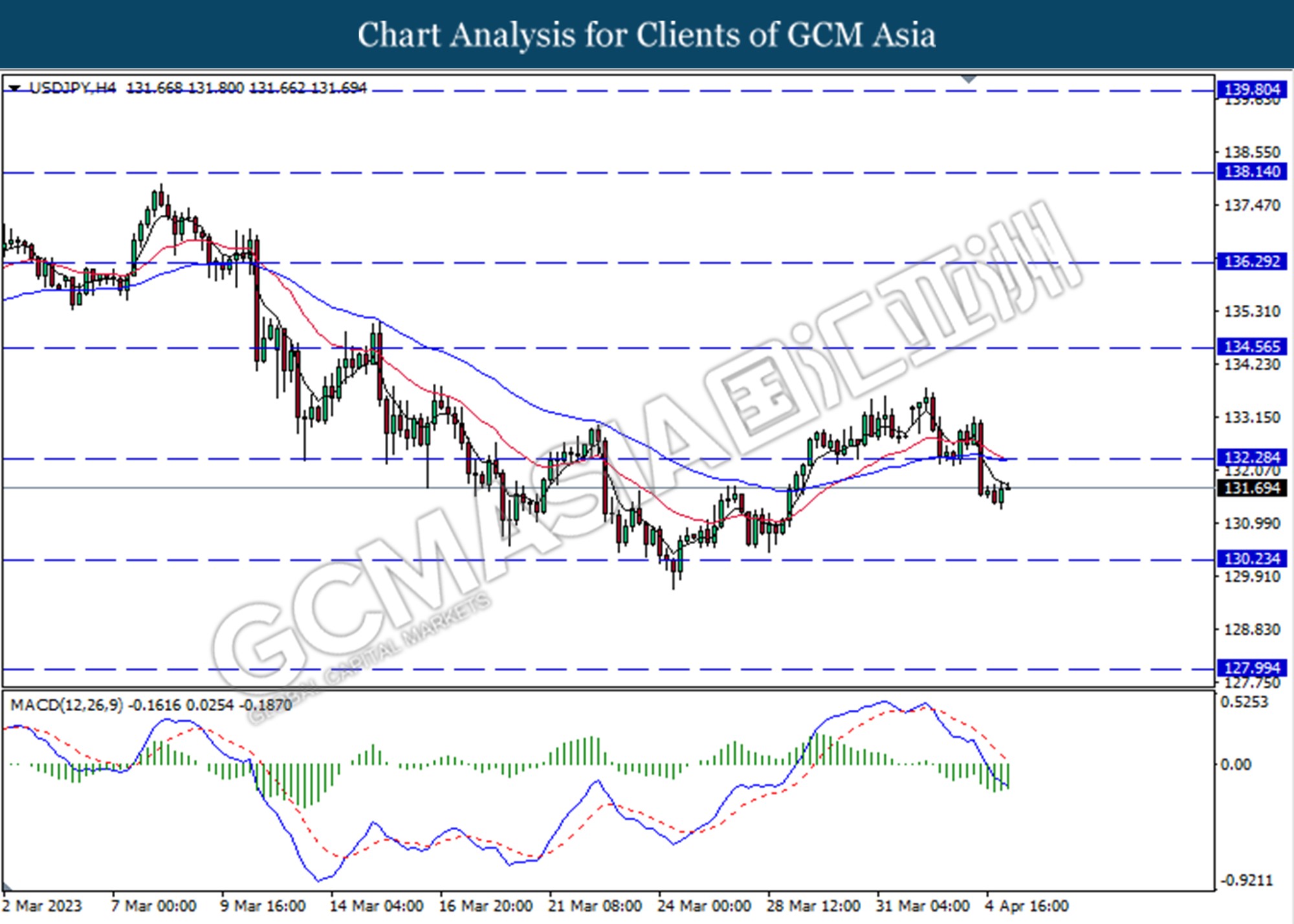

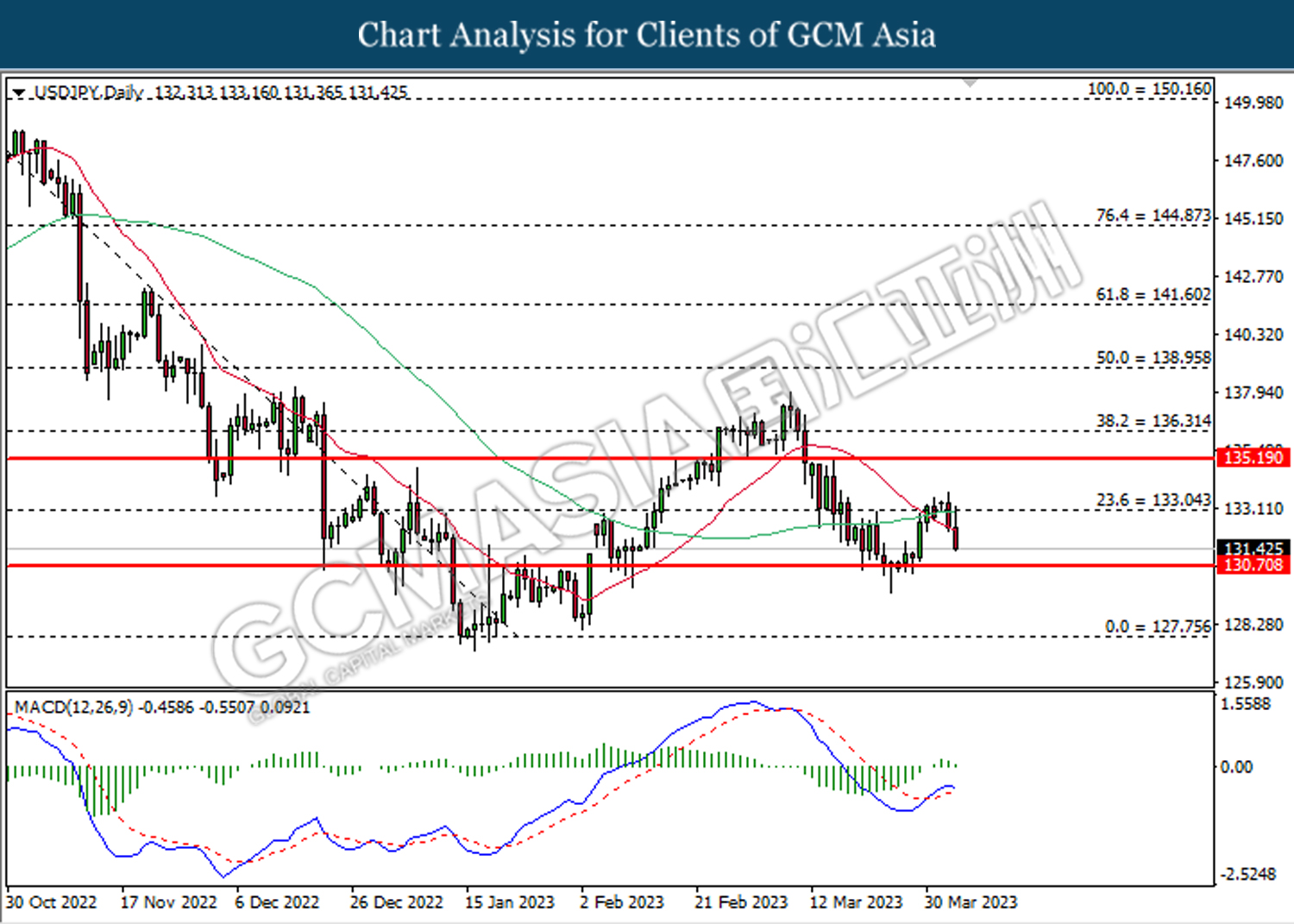

USDJPY, Daily: USDJPY was traded lower following prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

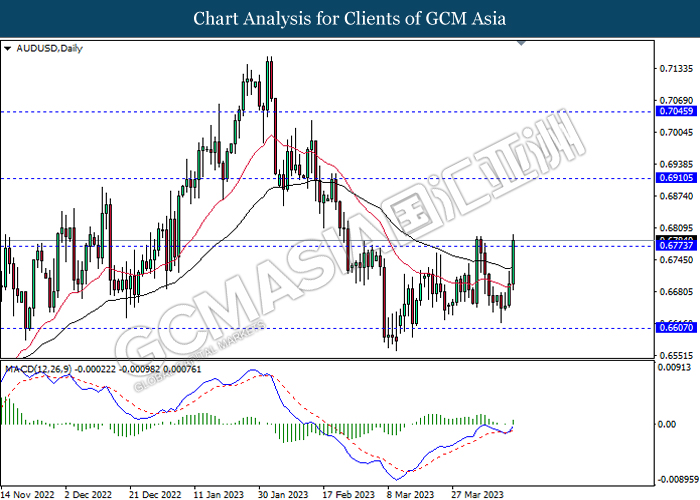

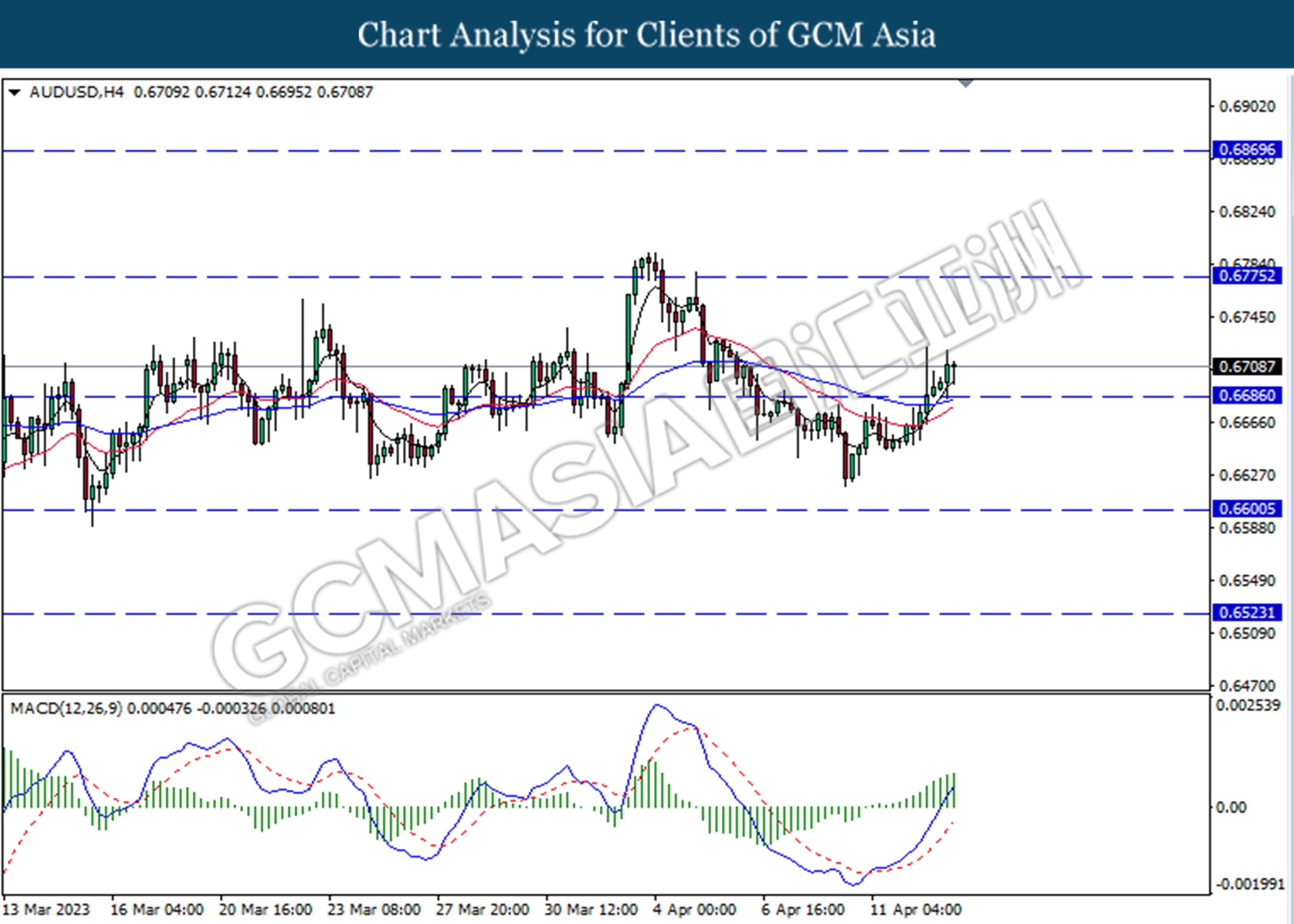

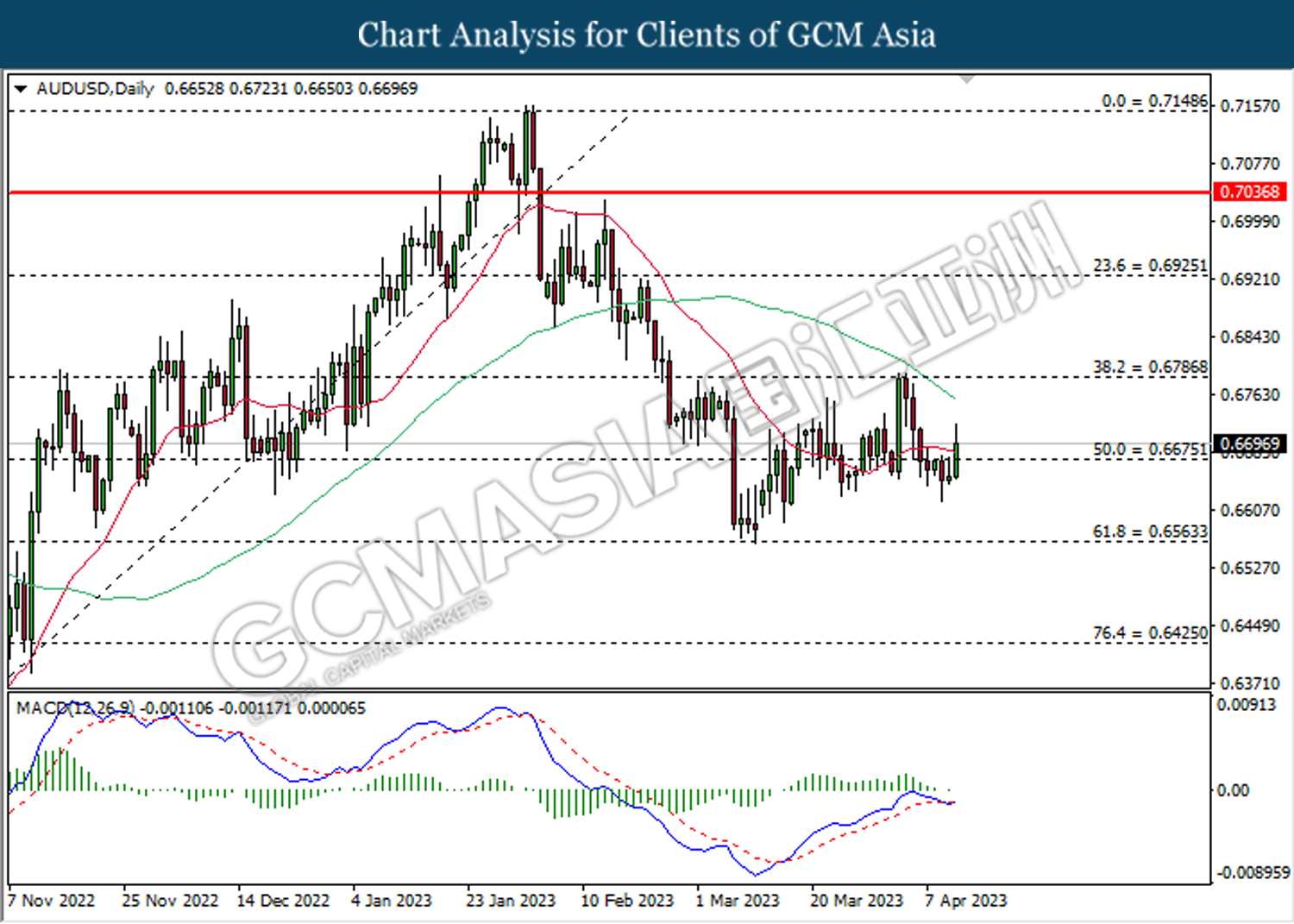

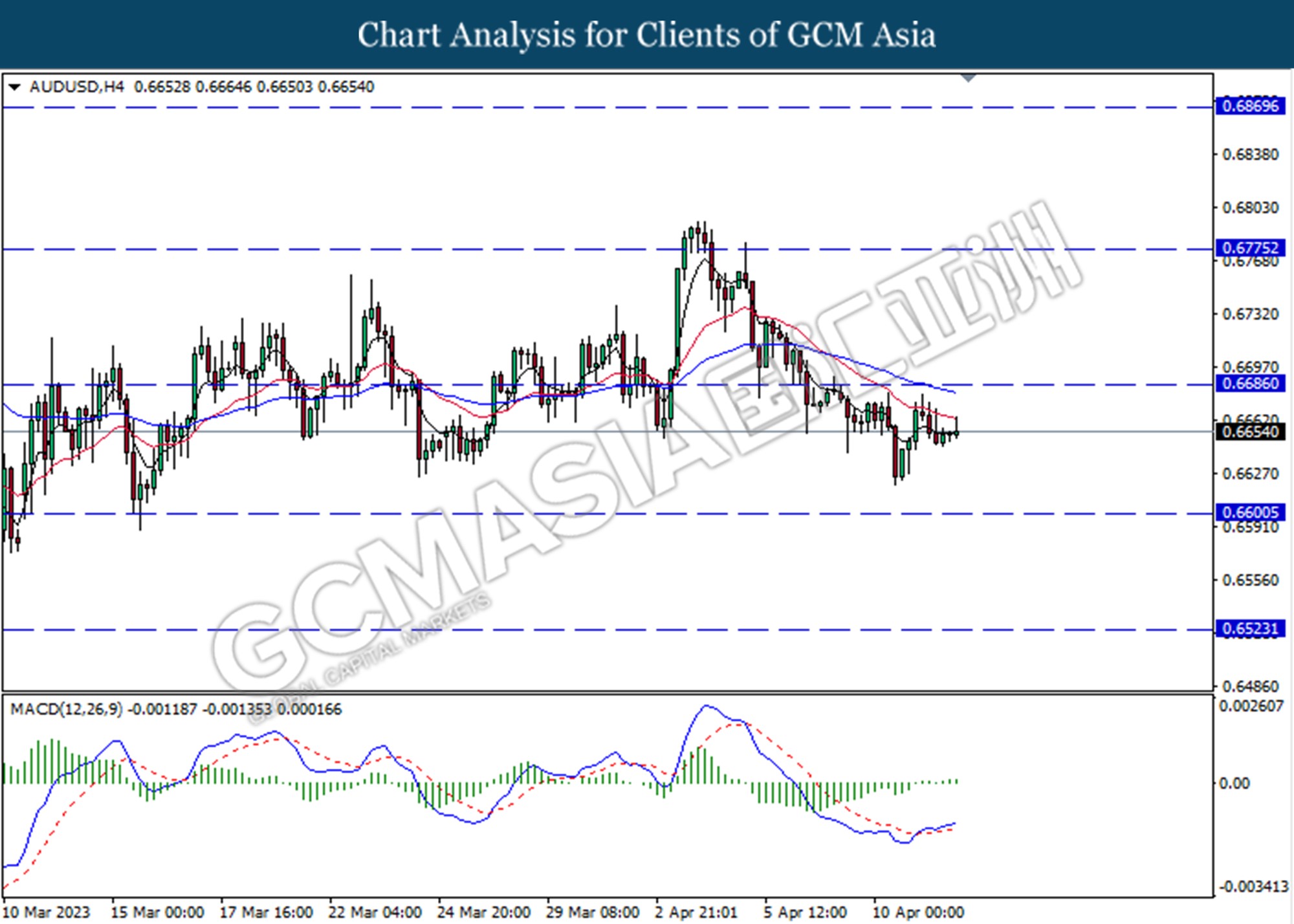

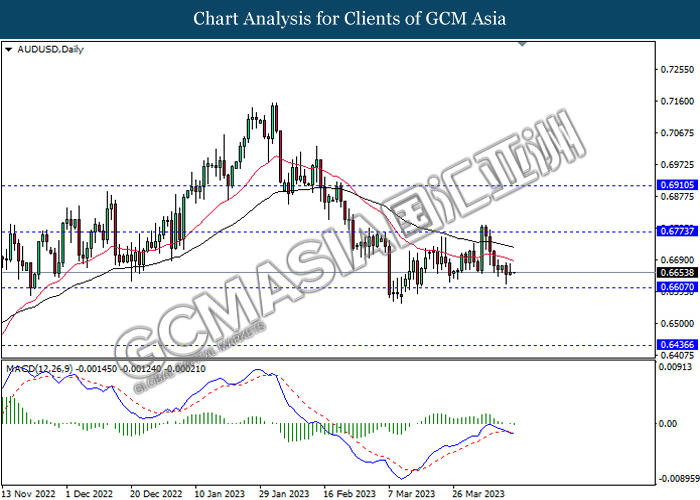

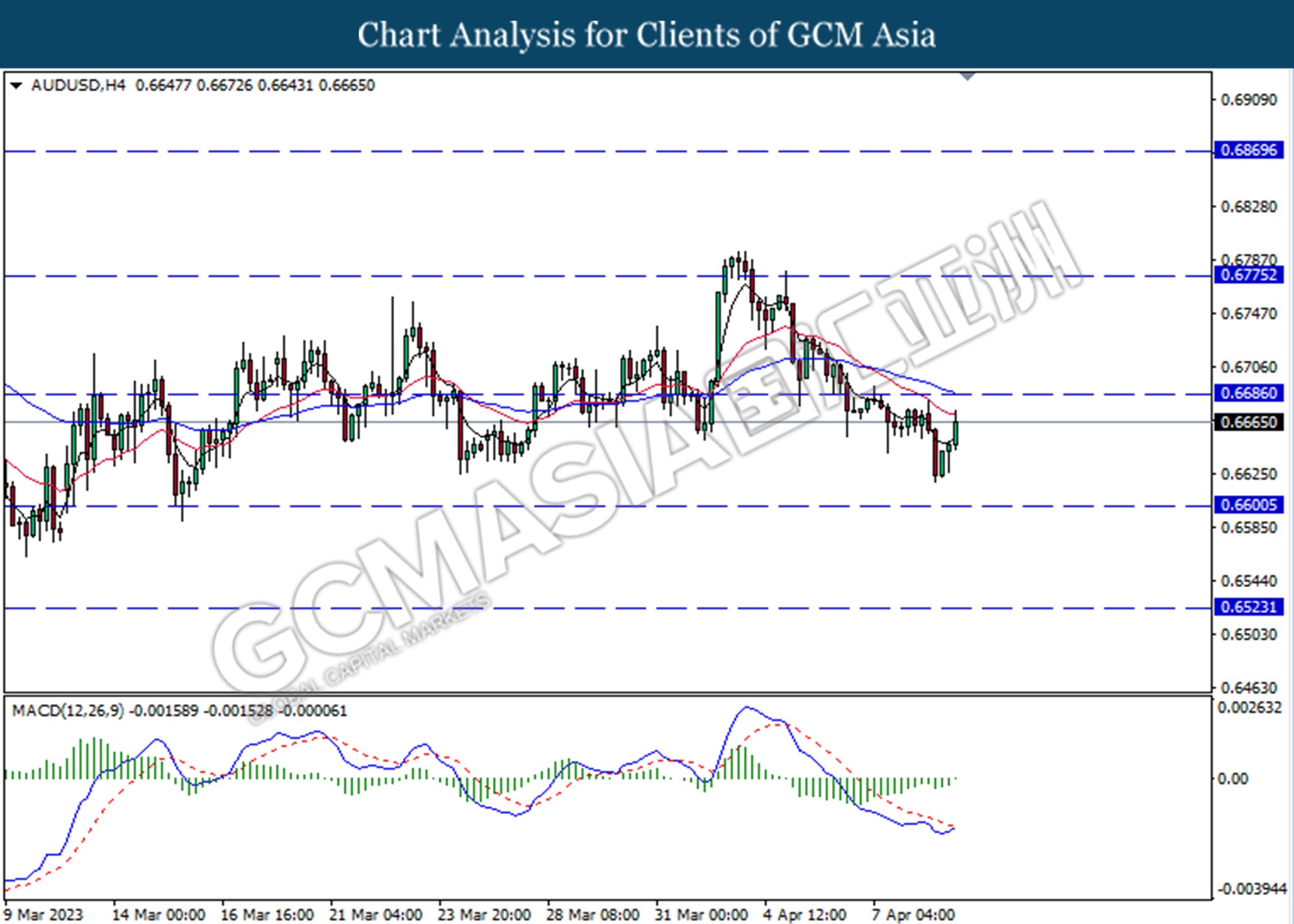

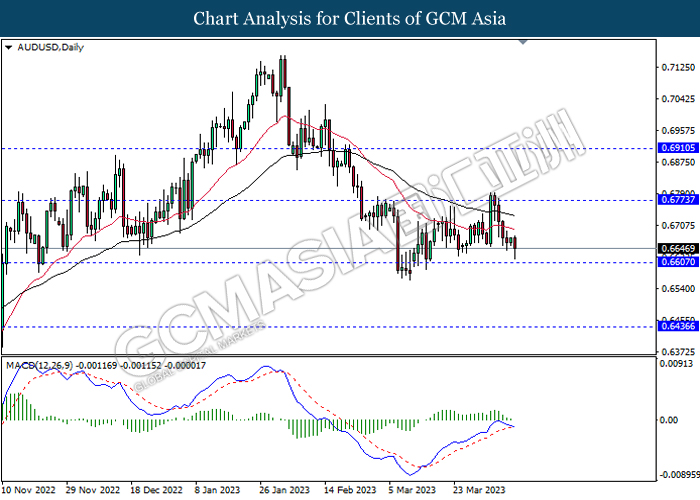

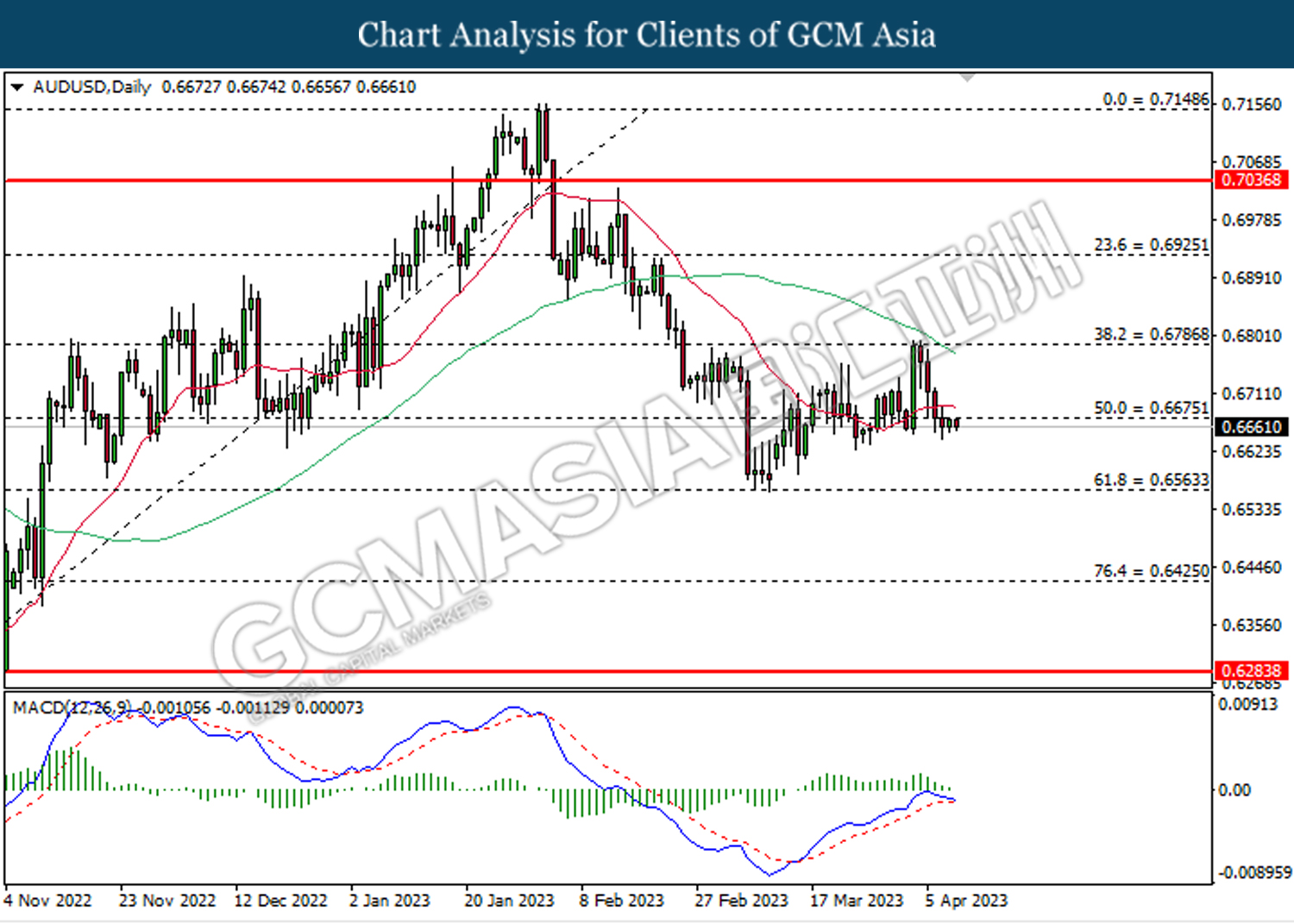

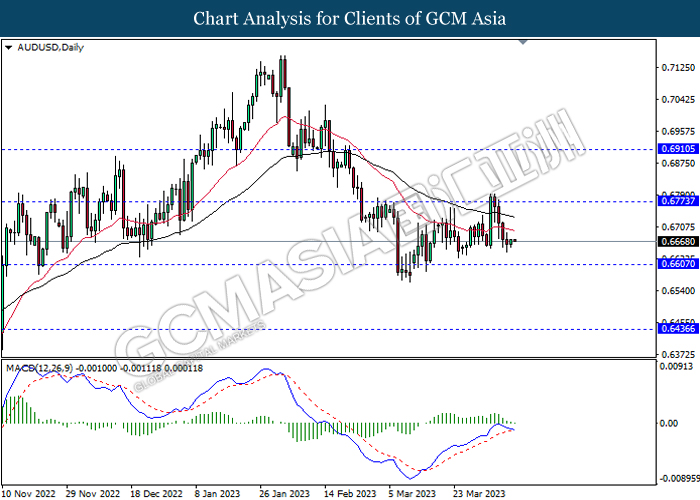

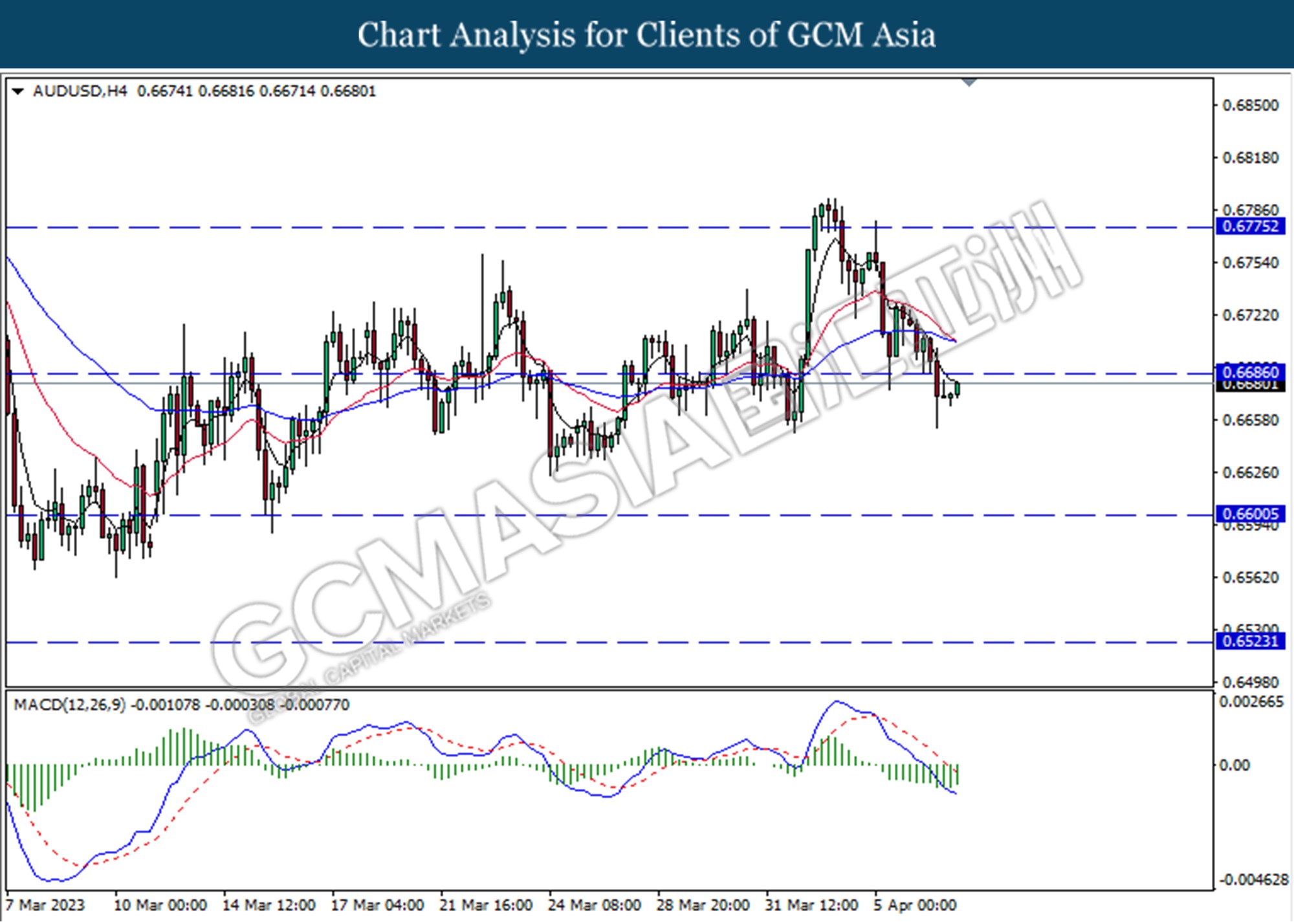

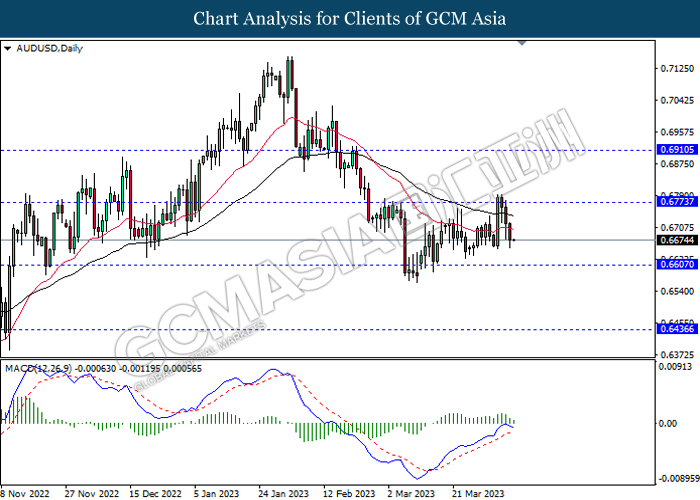

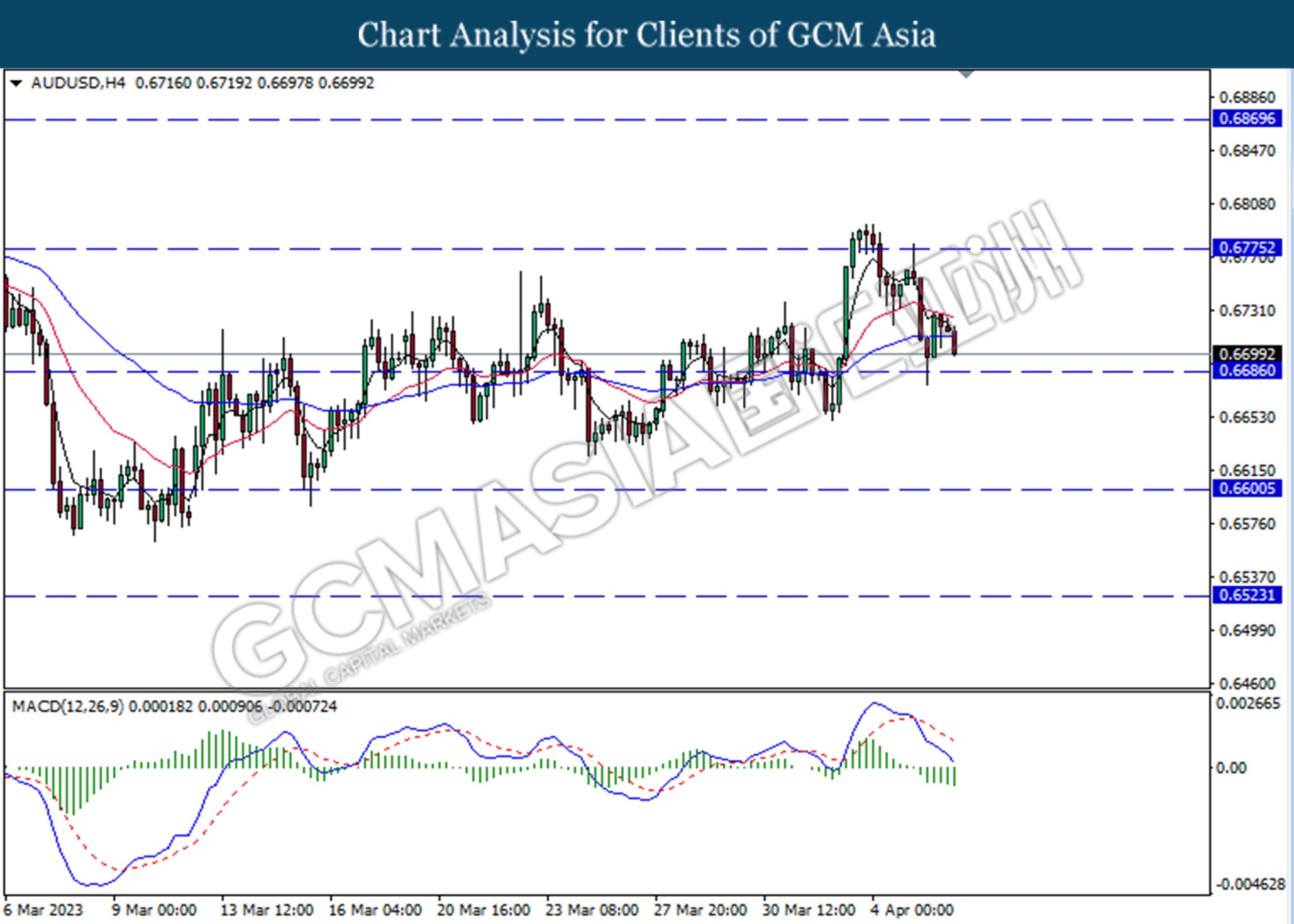

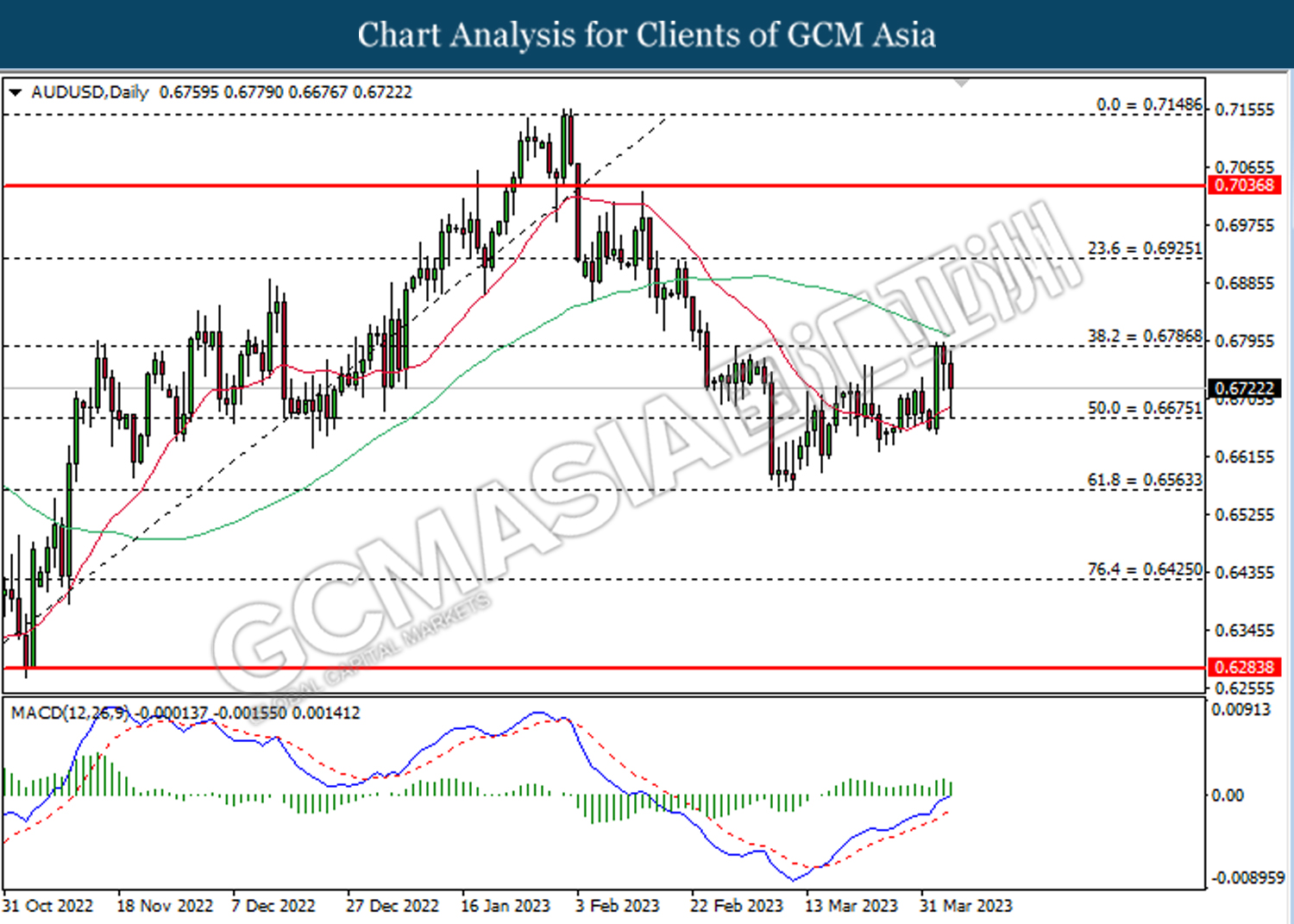

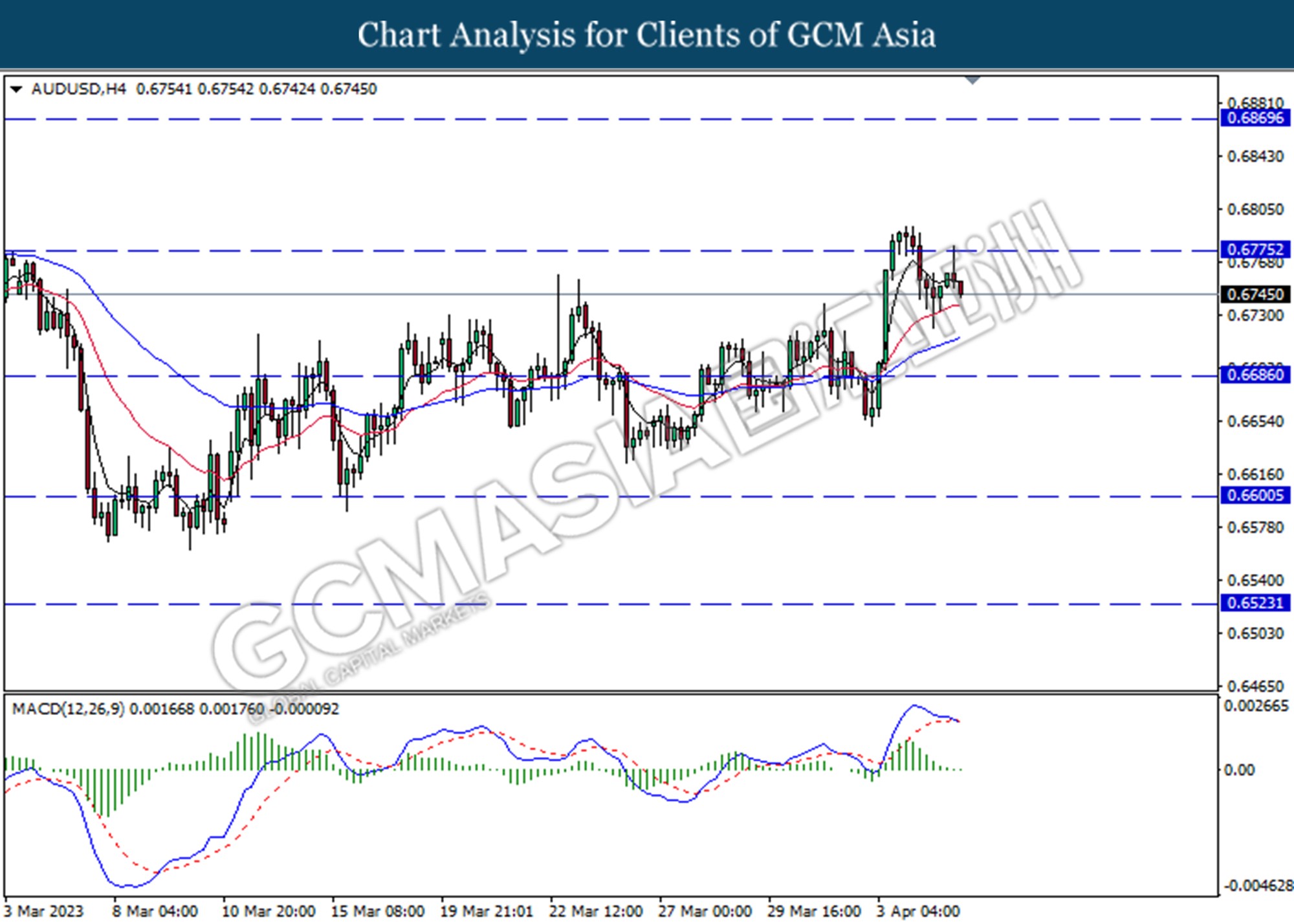

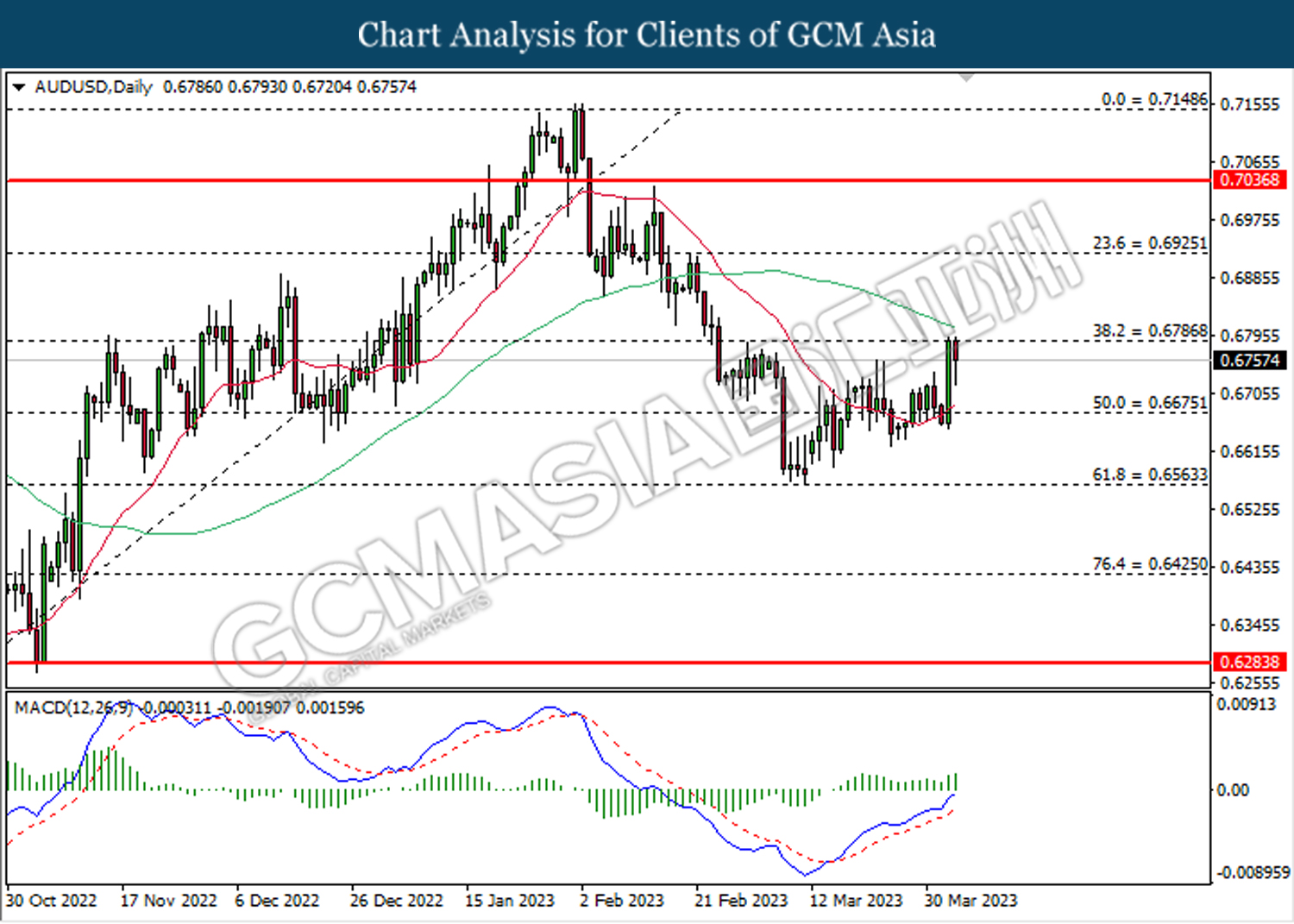

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6910, 0.7045

Support level: 0.6775, 0.6605

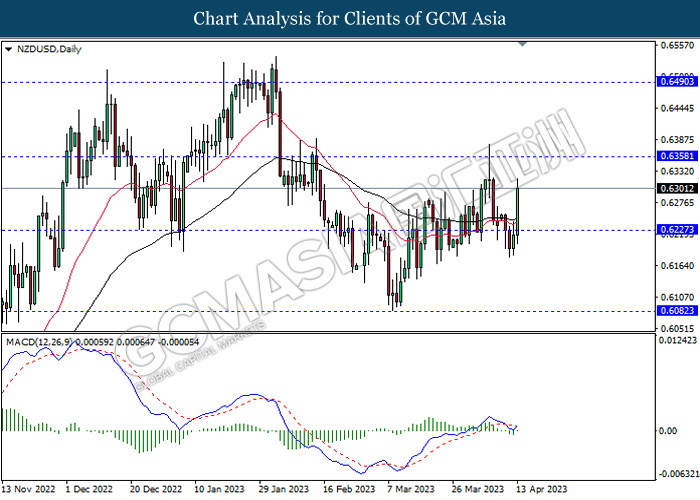

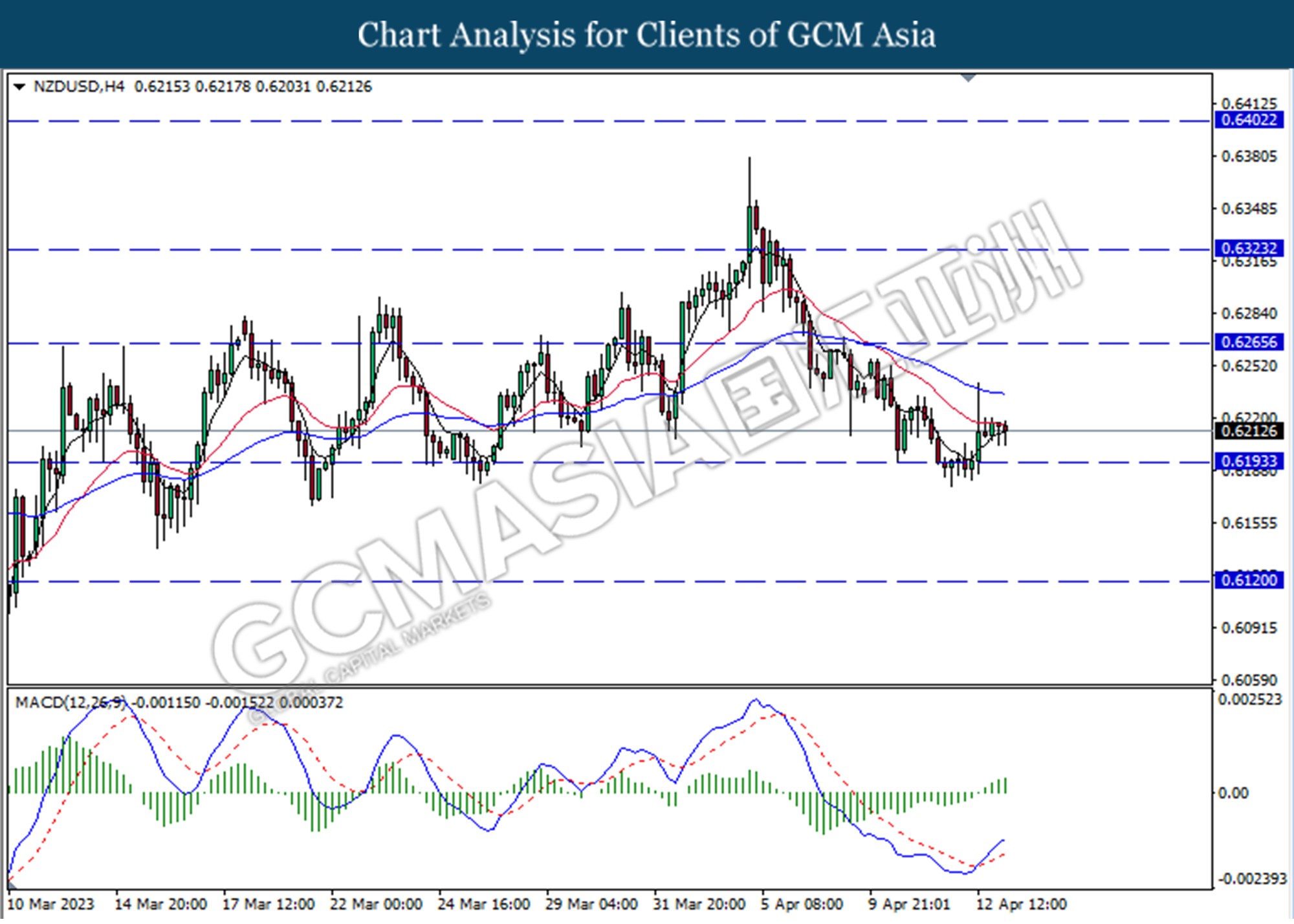

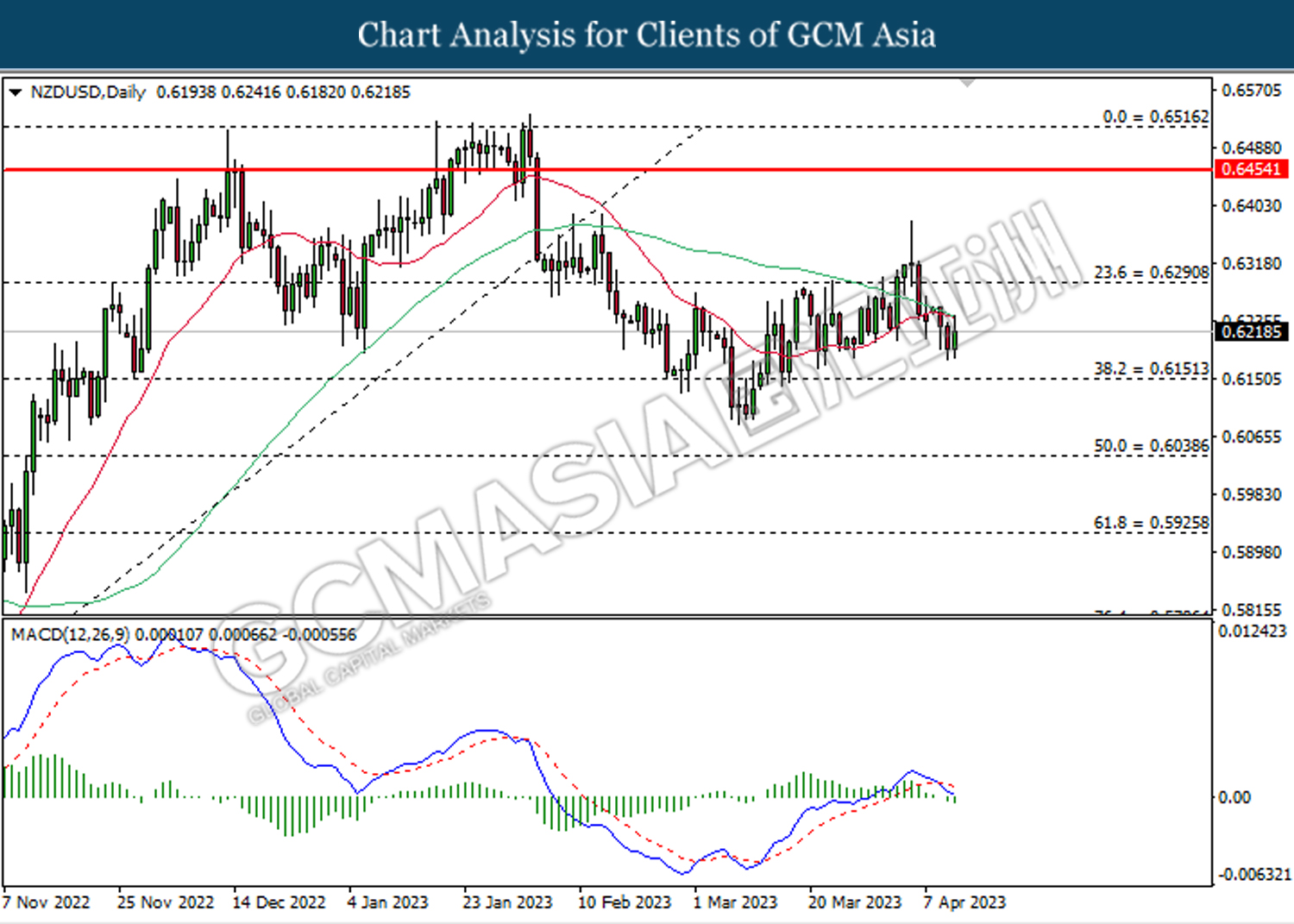

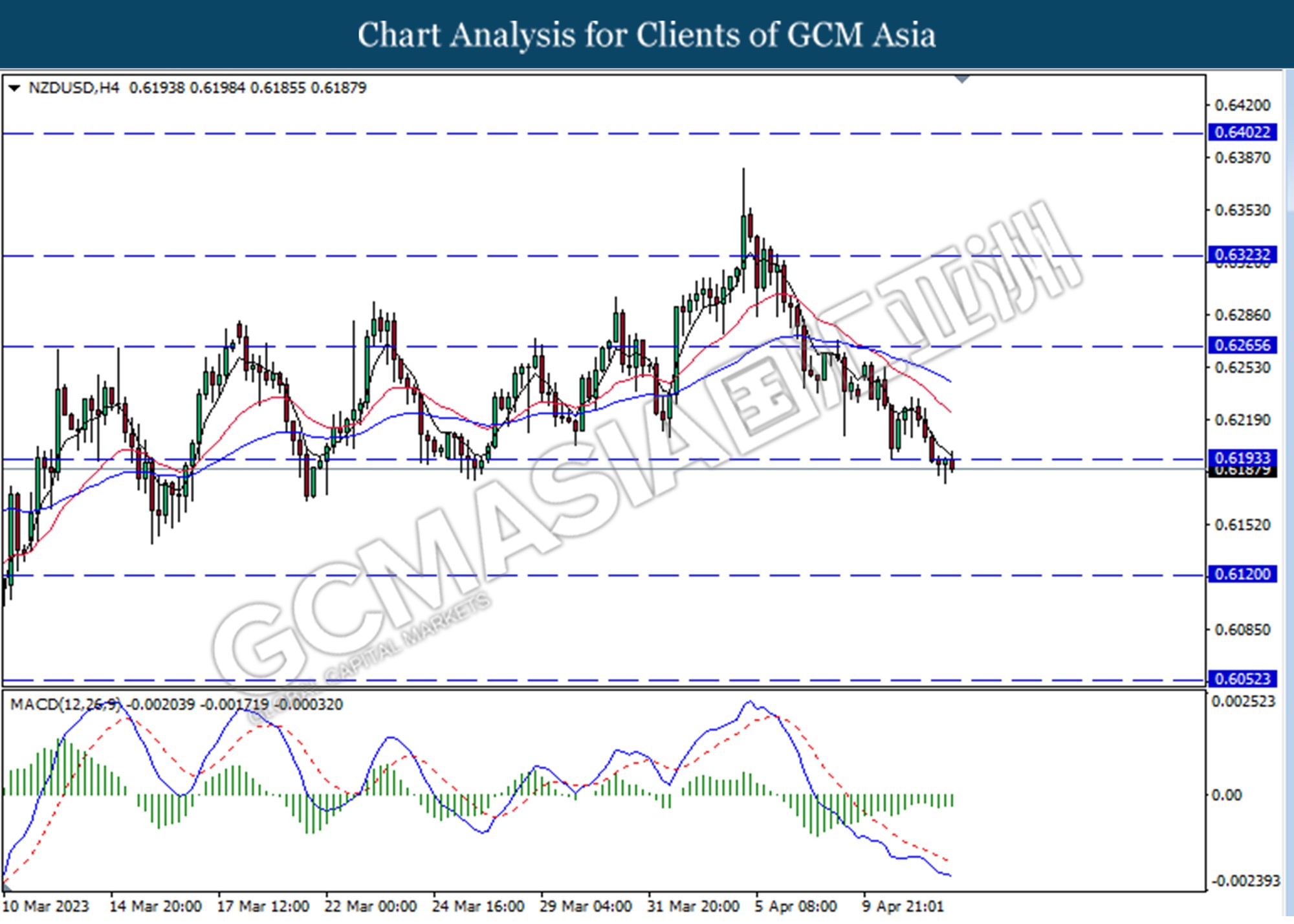

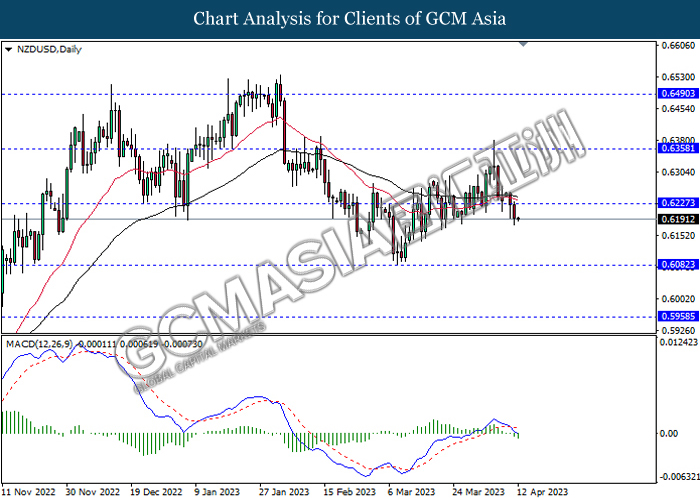

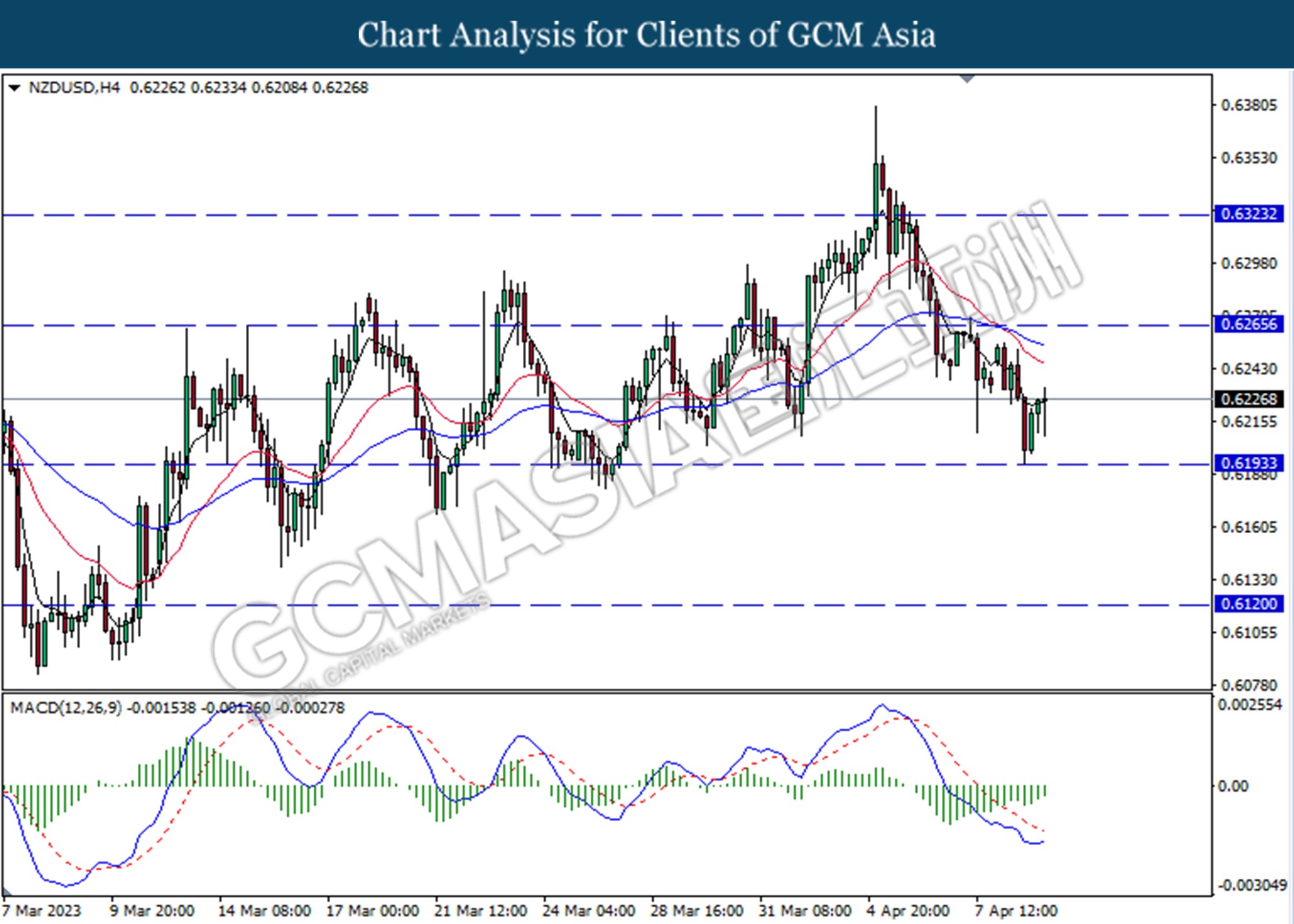

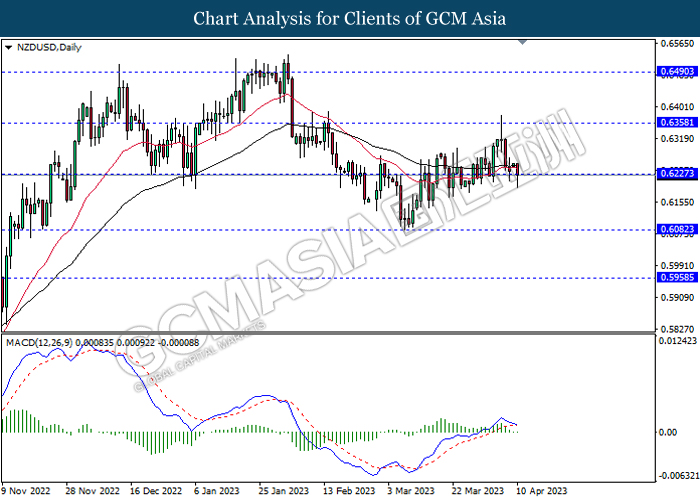

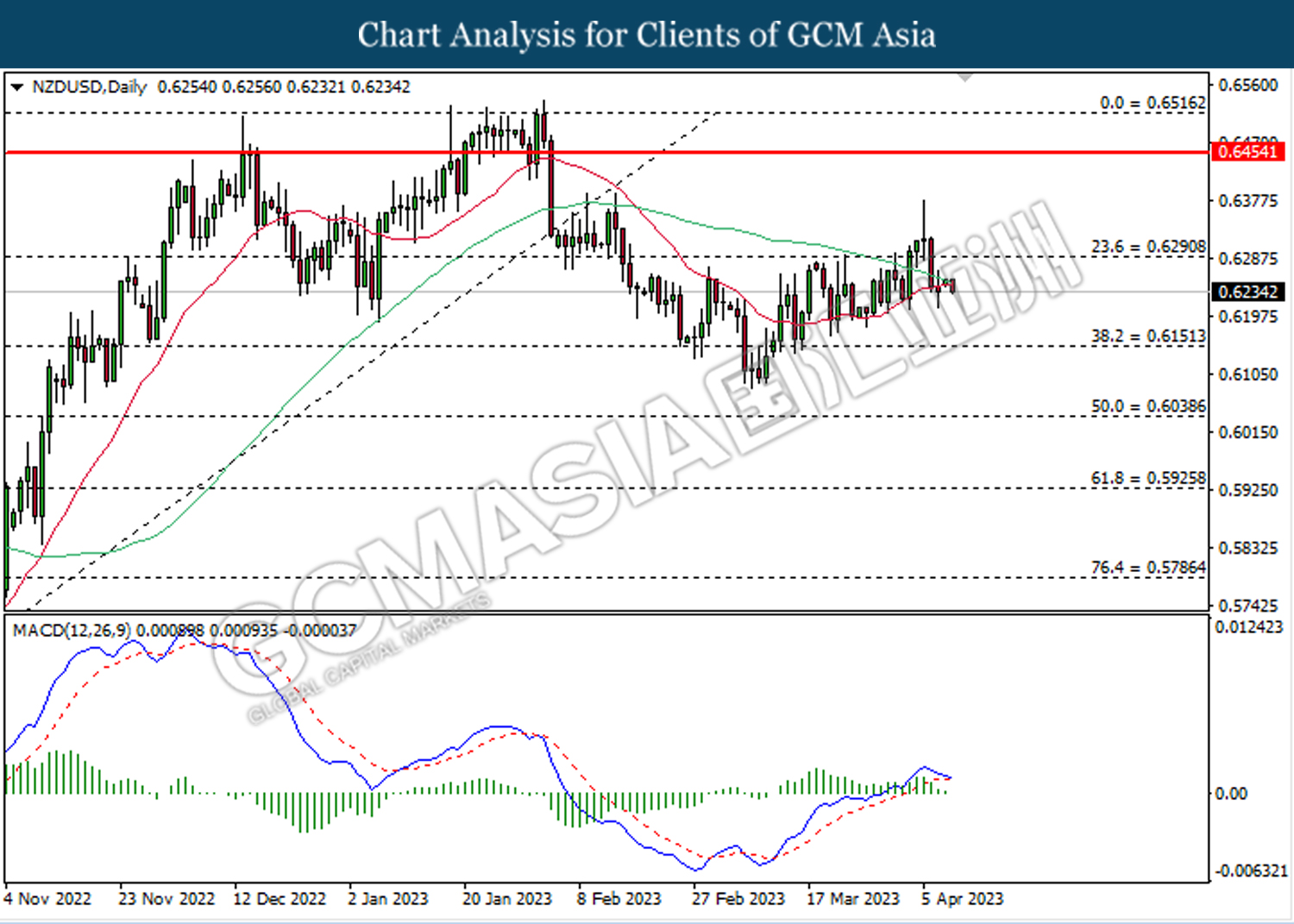

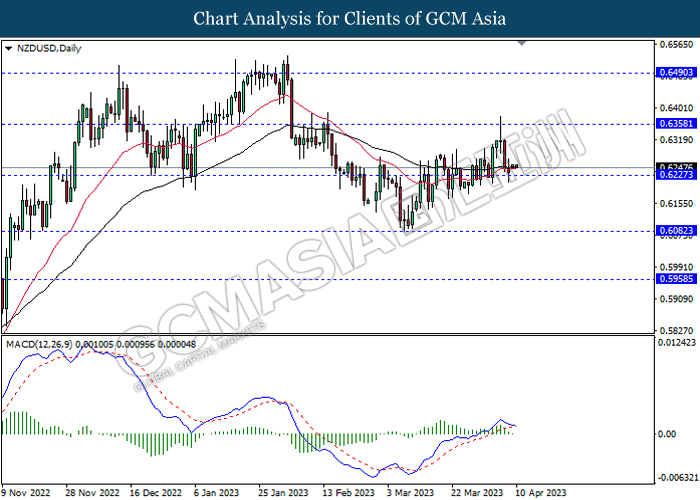

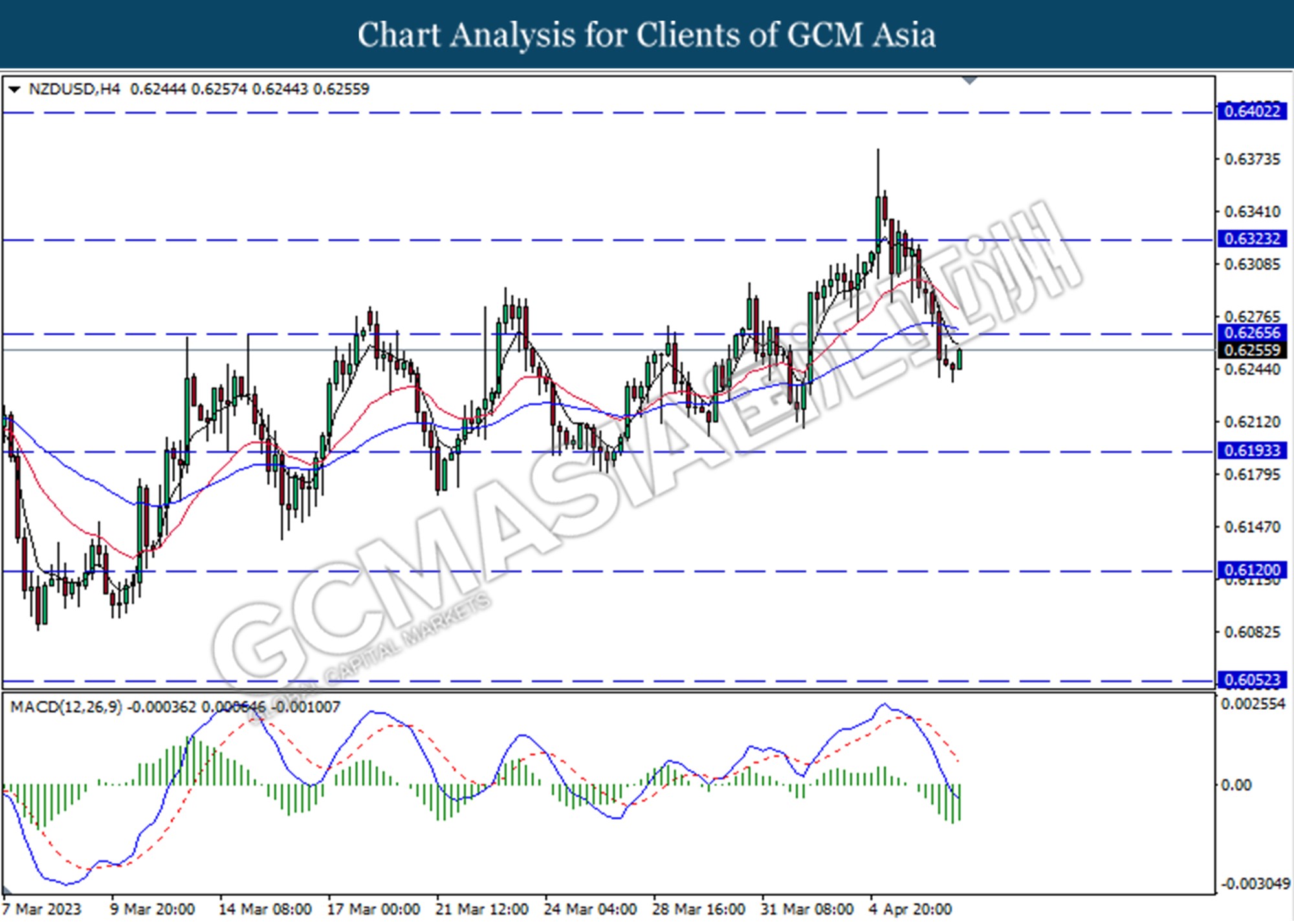

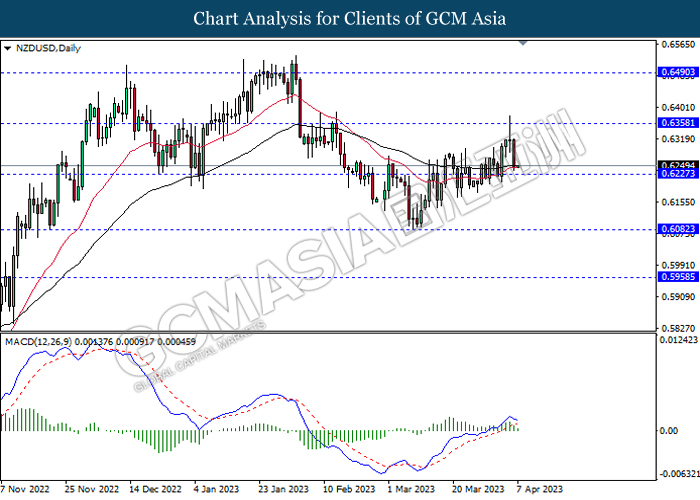

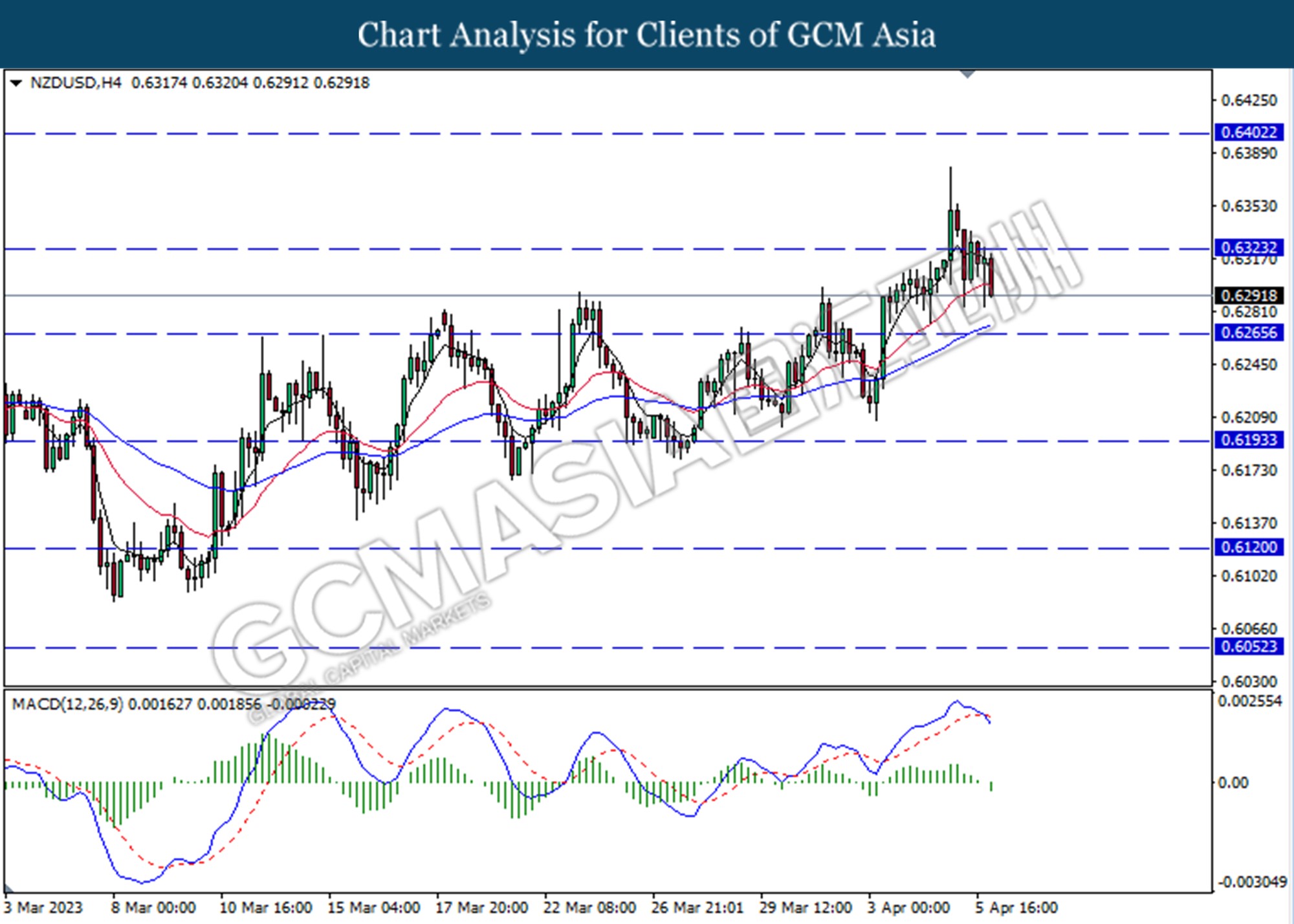

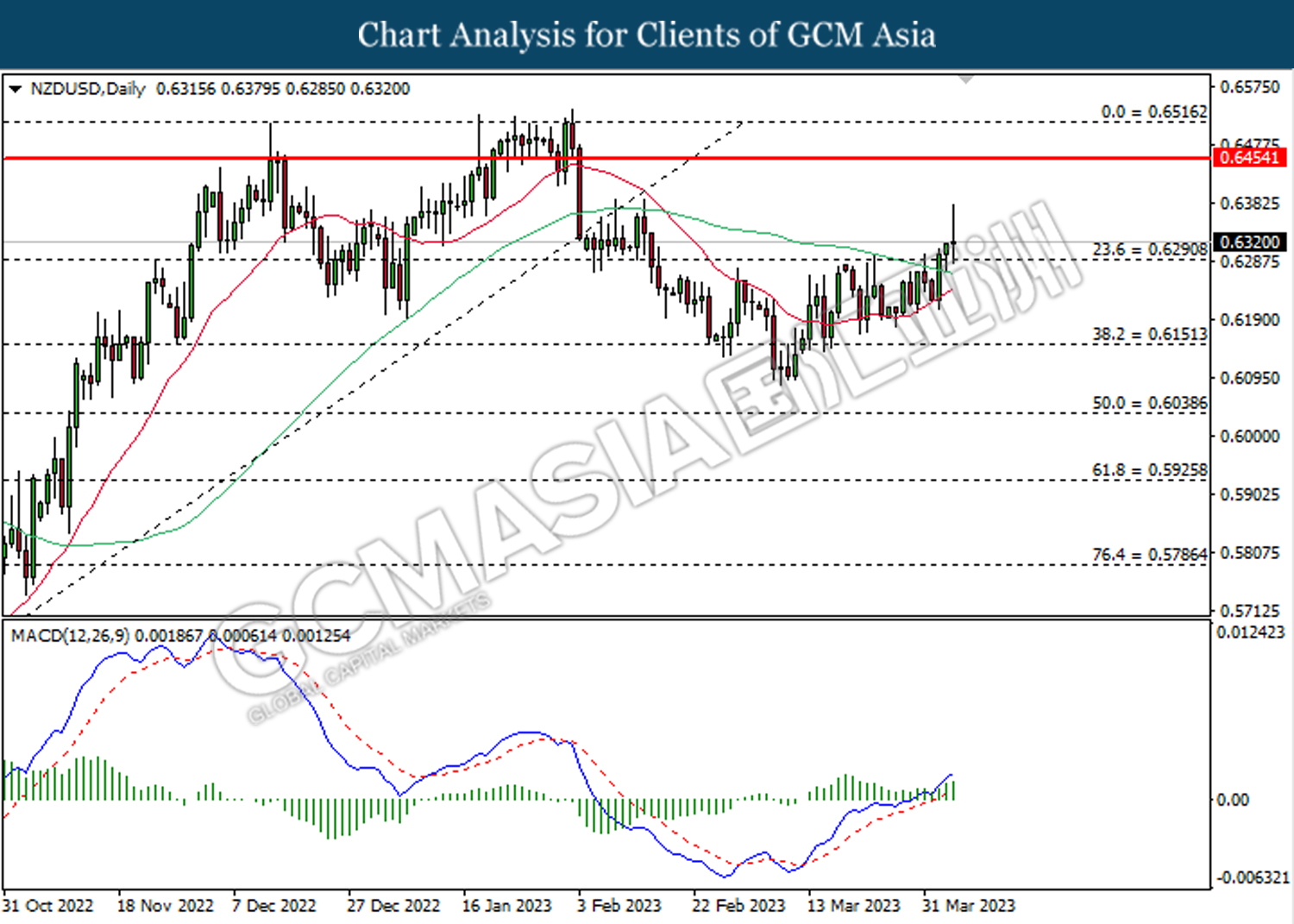

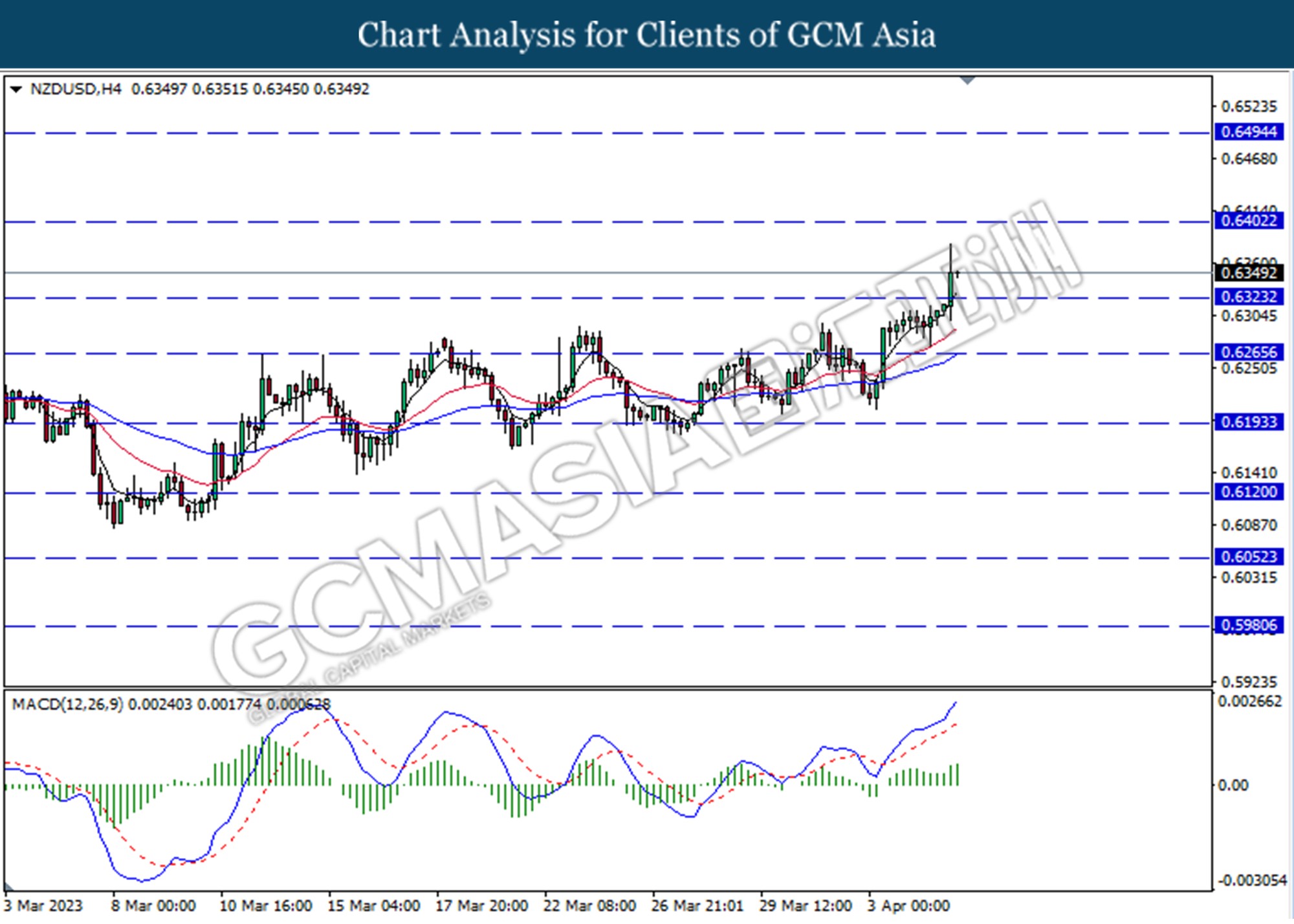

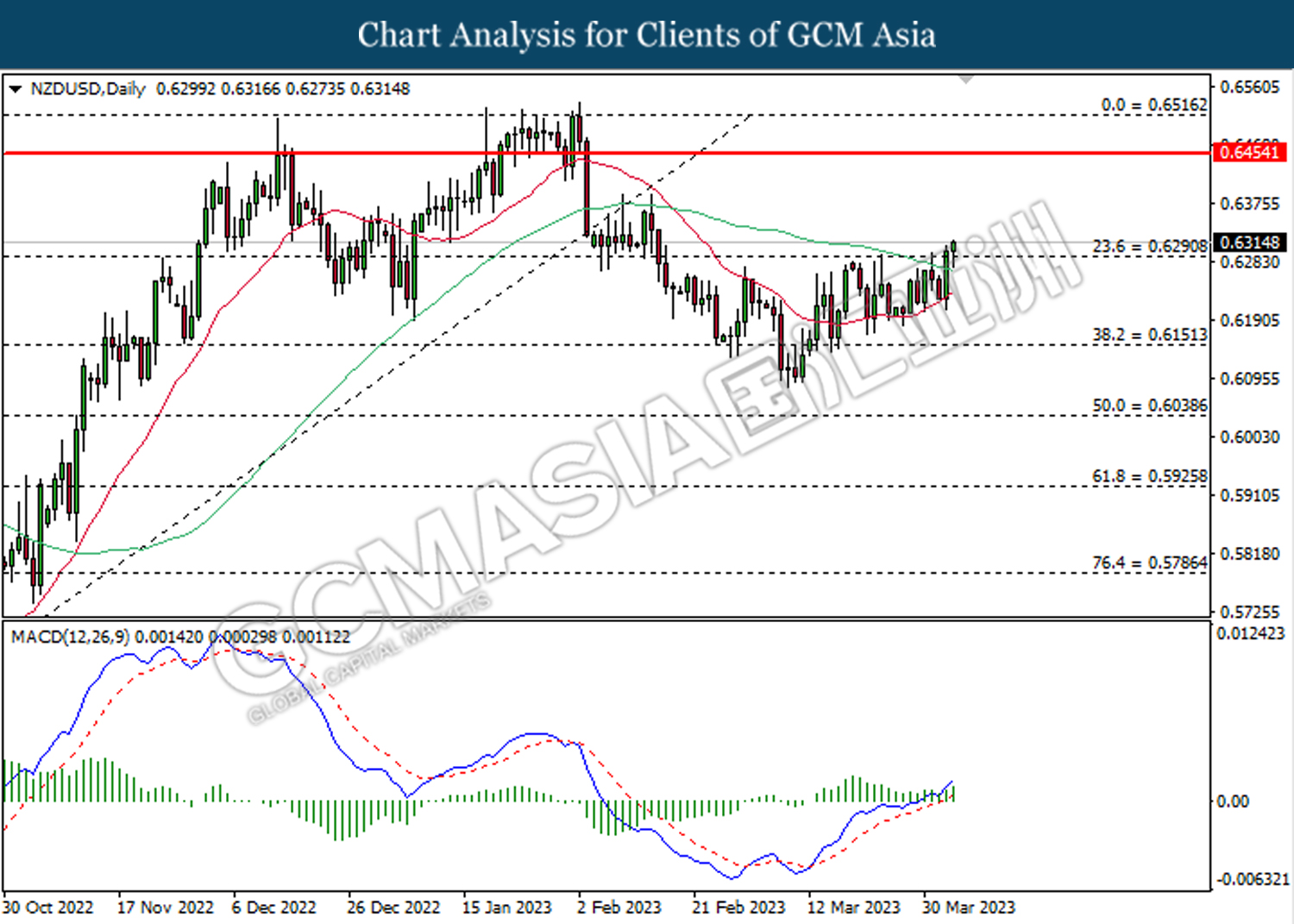

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

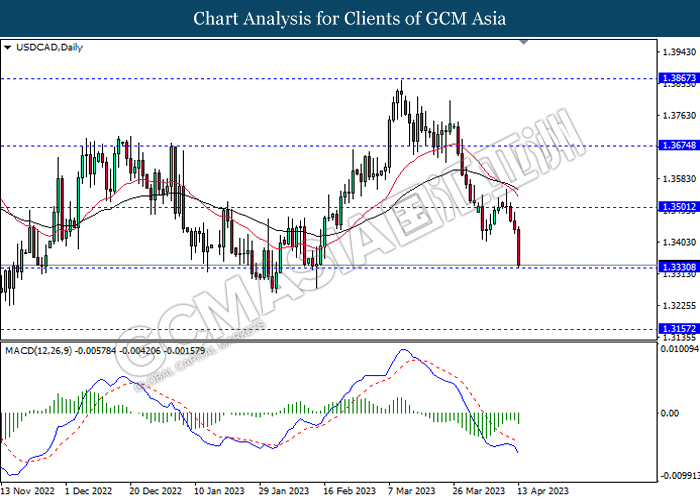

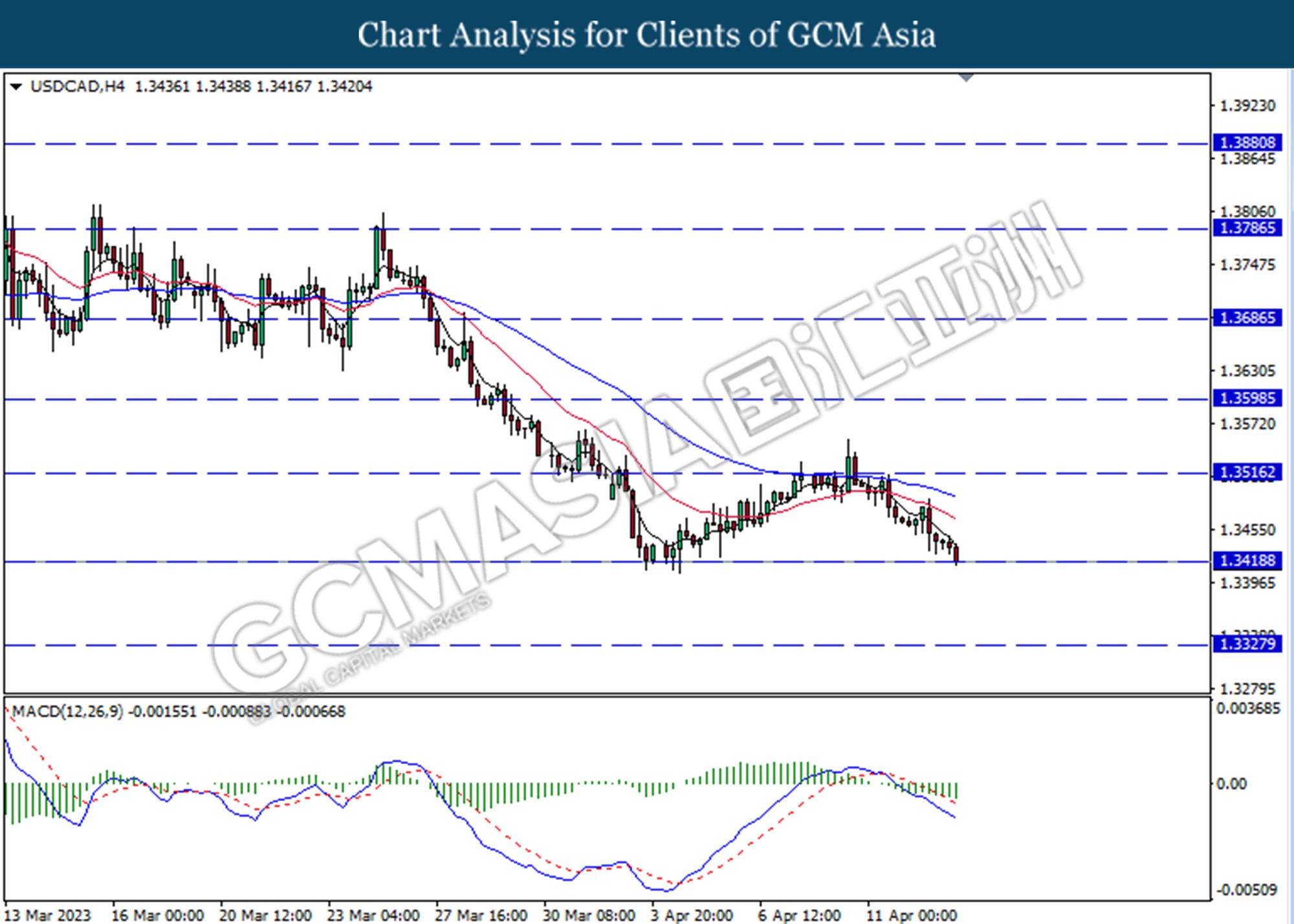

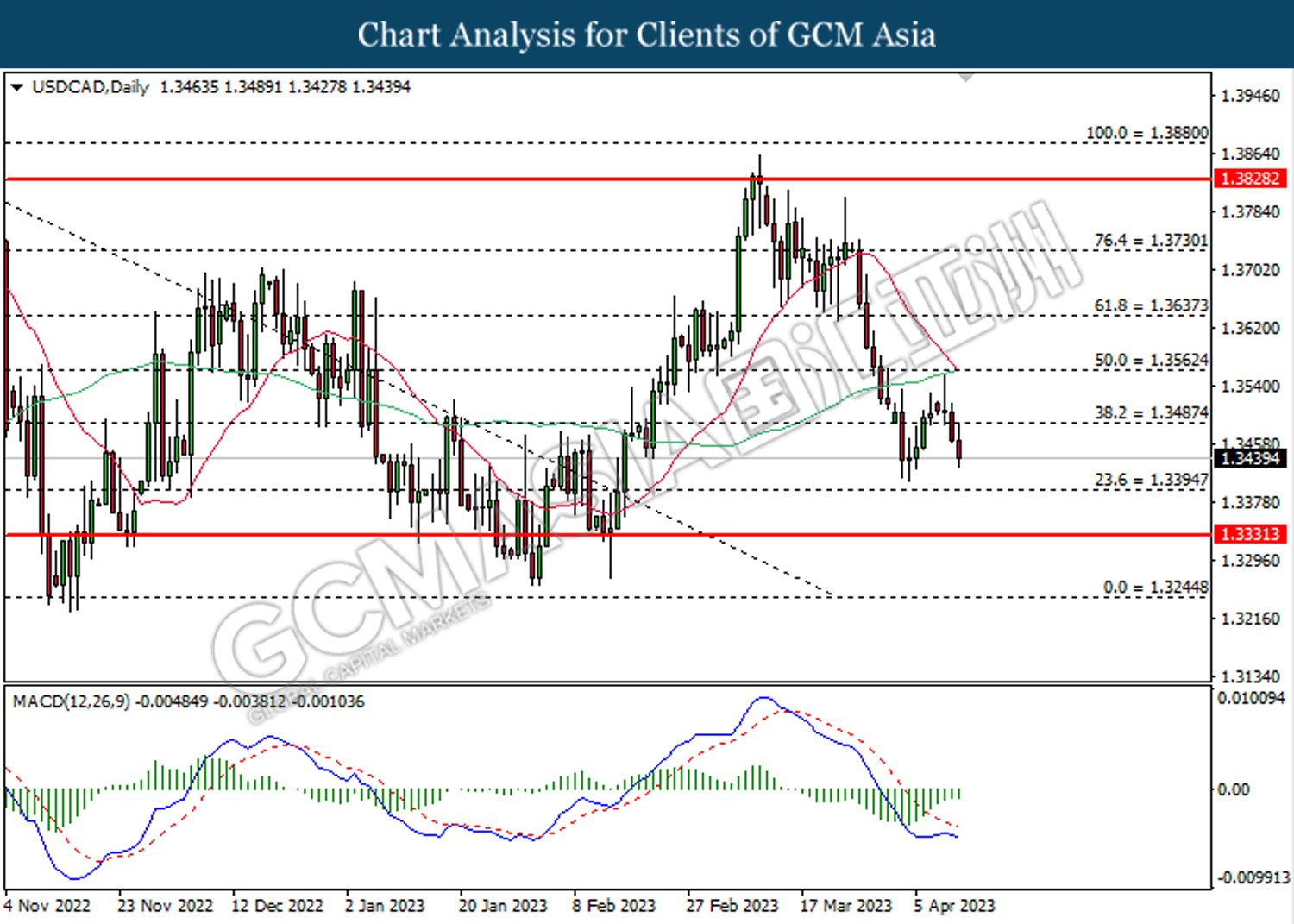

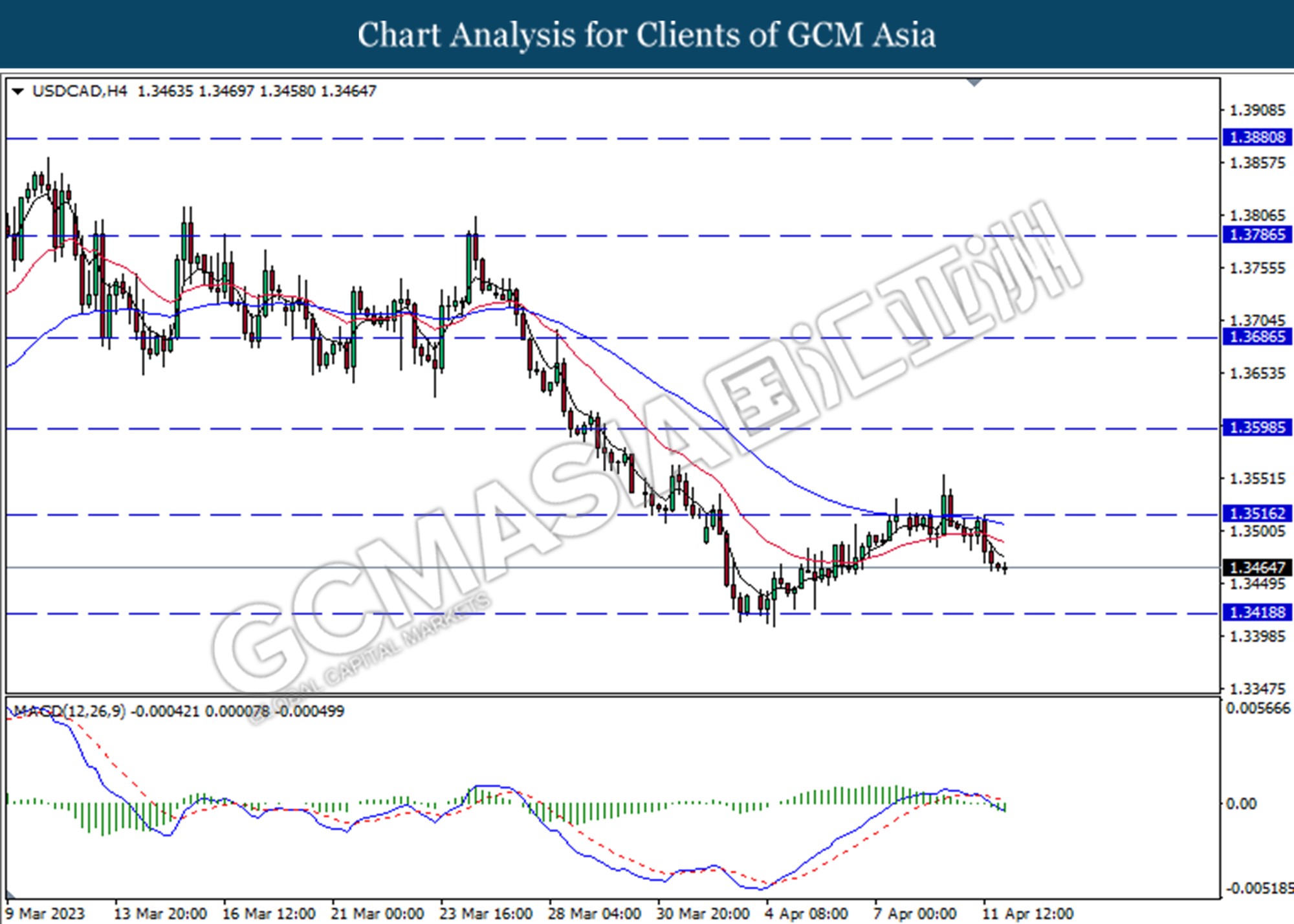

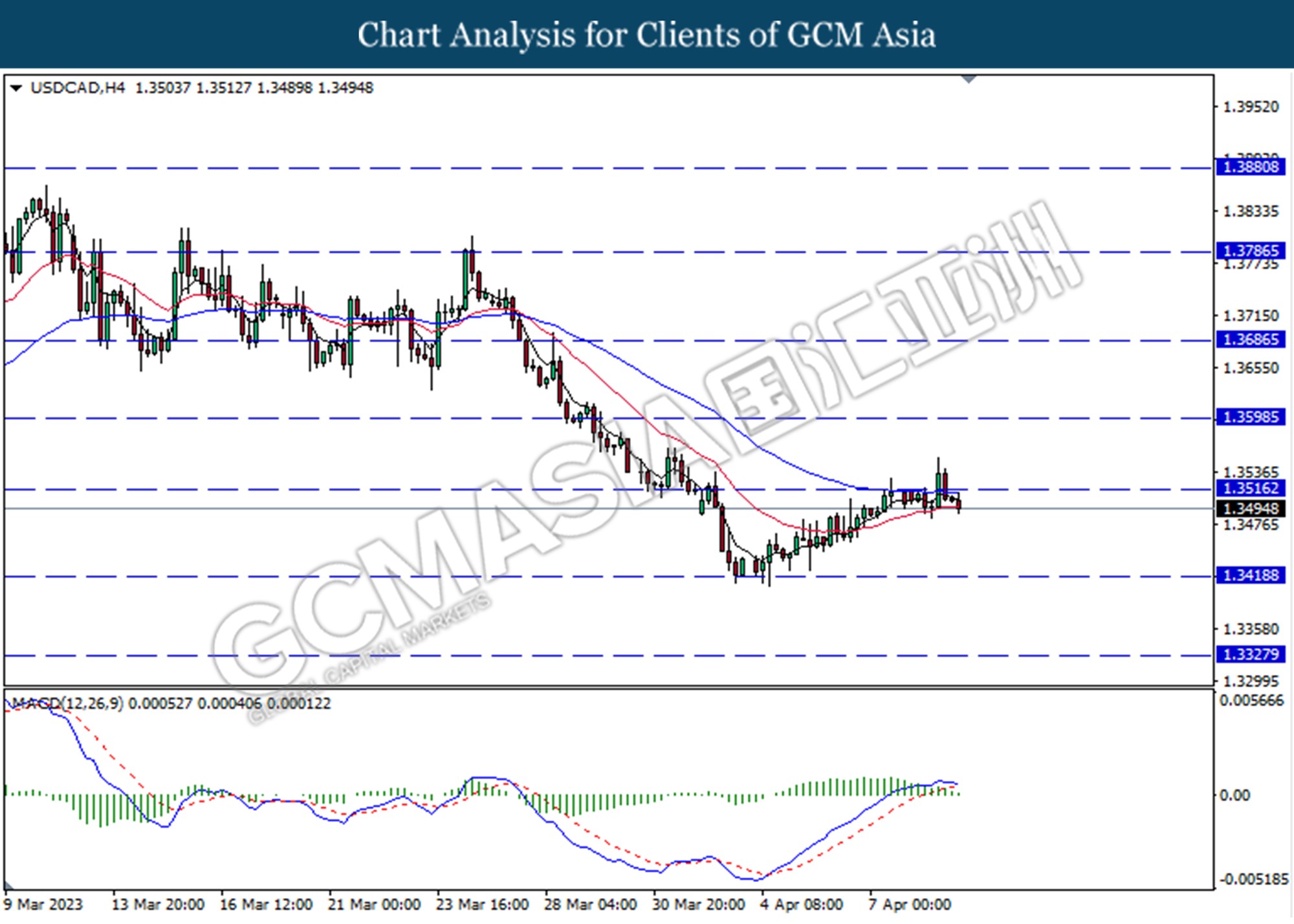

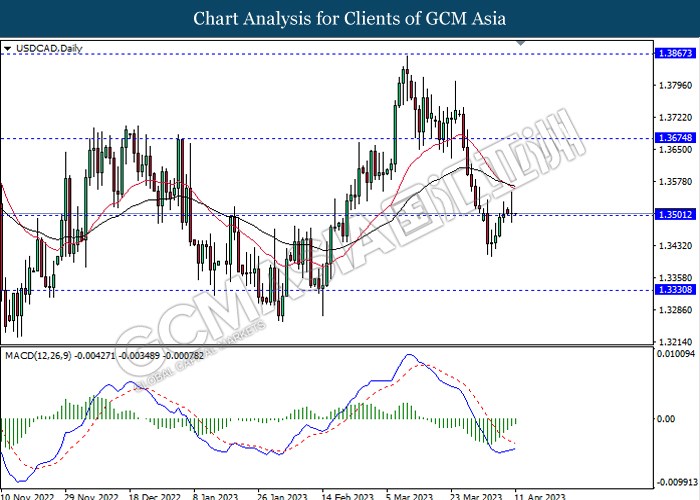

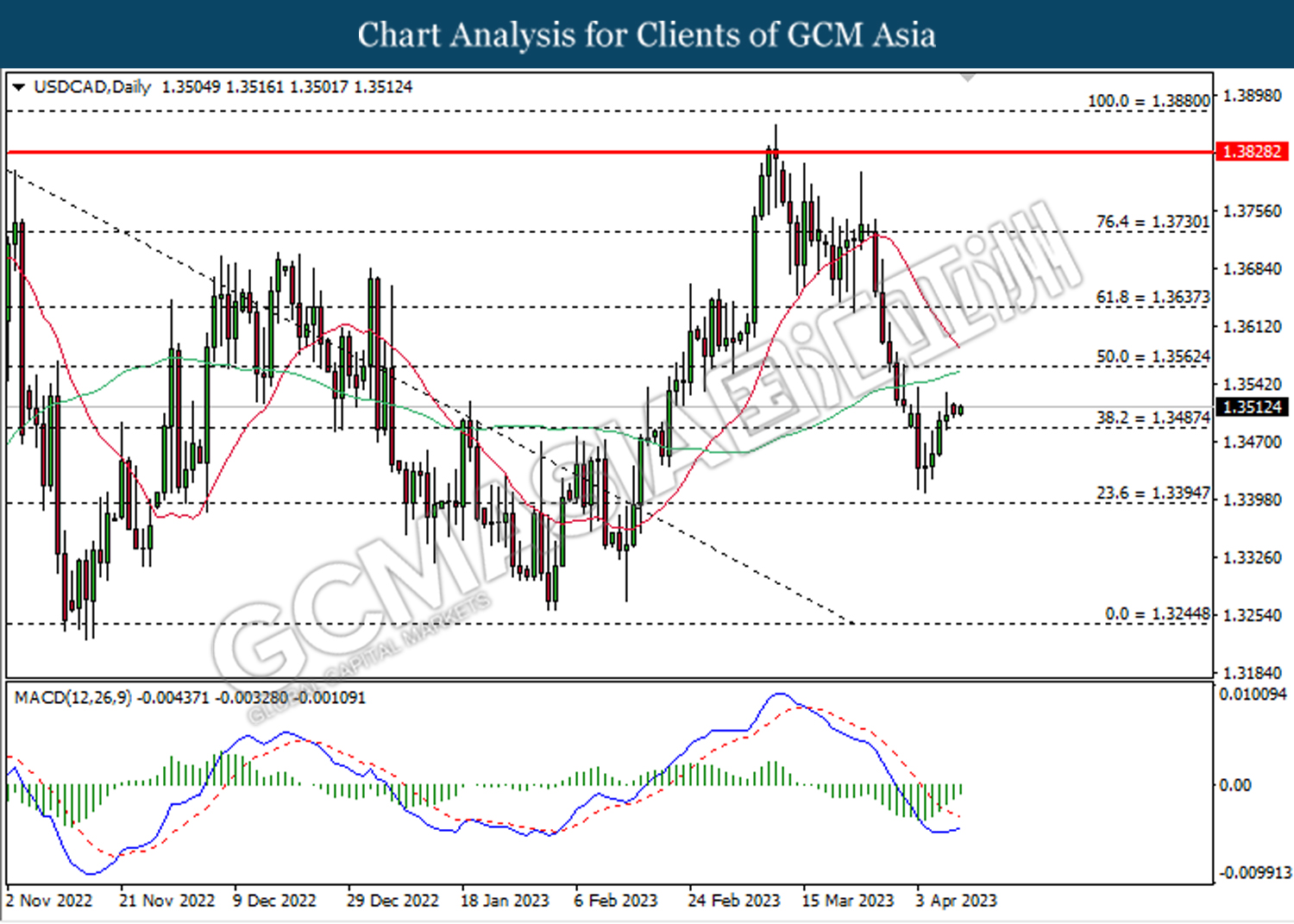

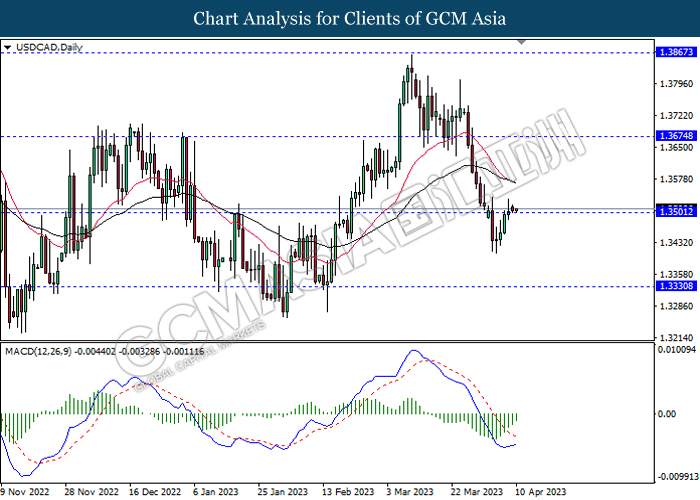

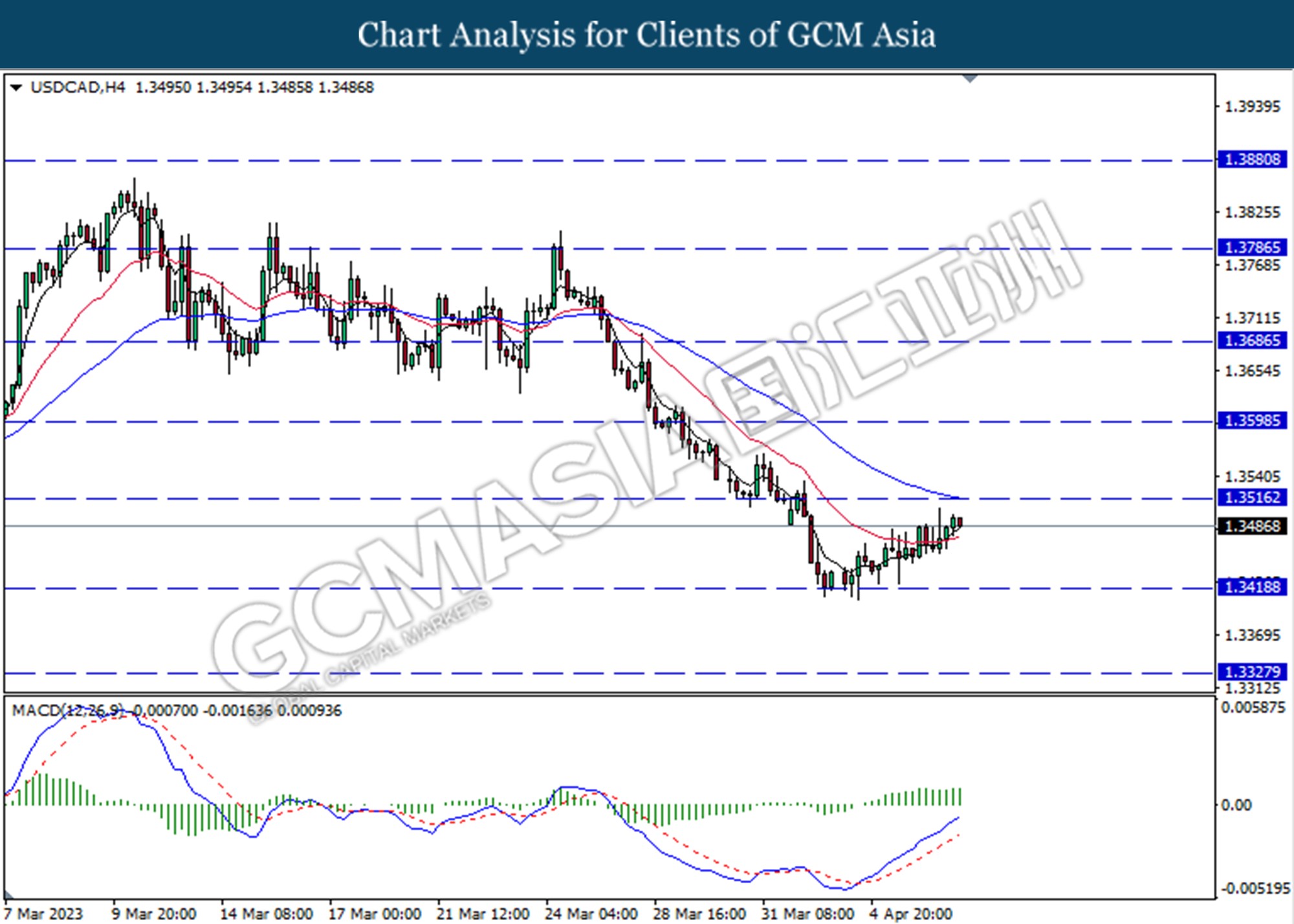

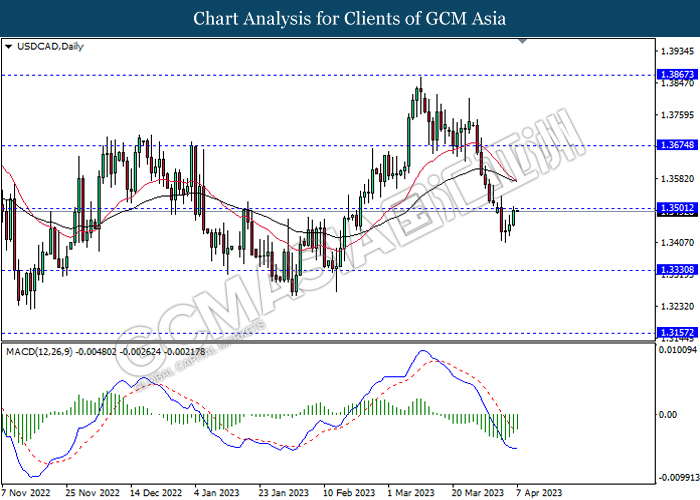

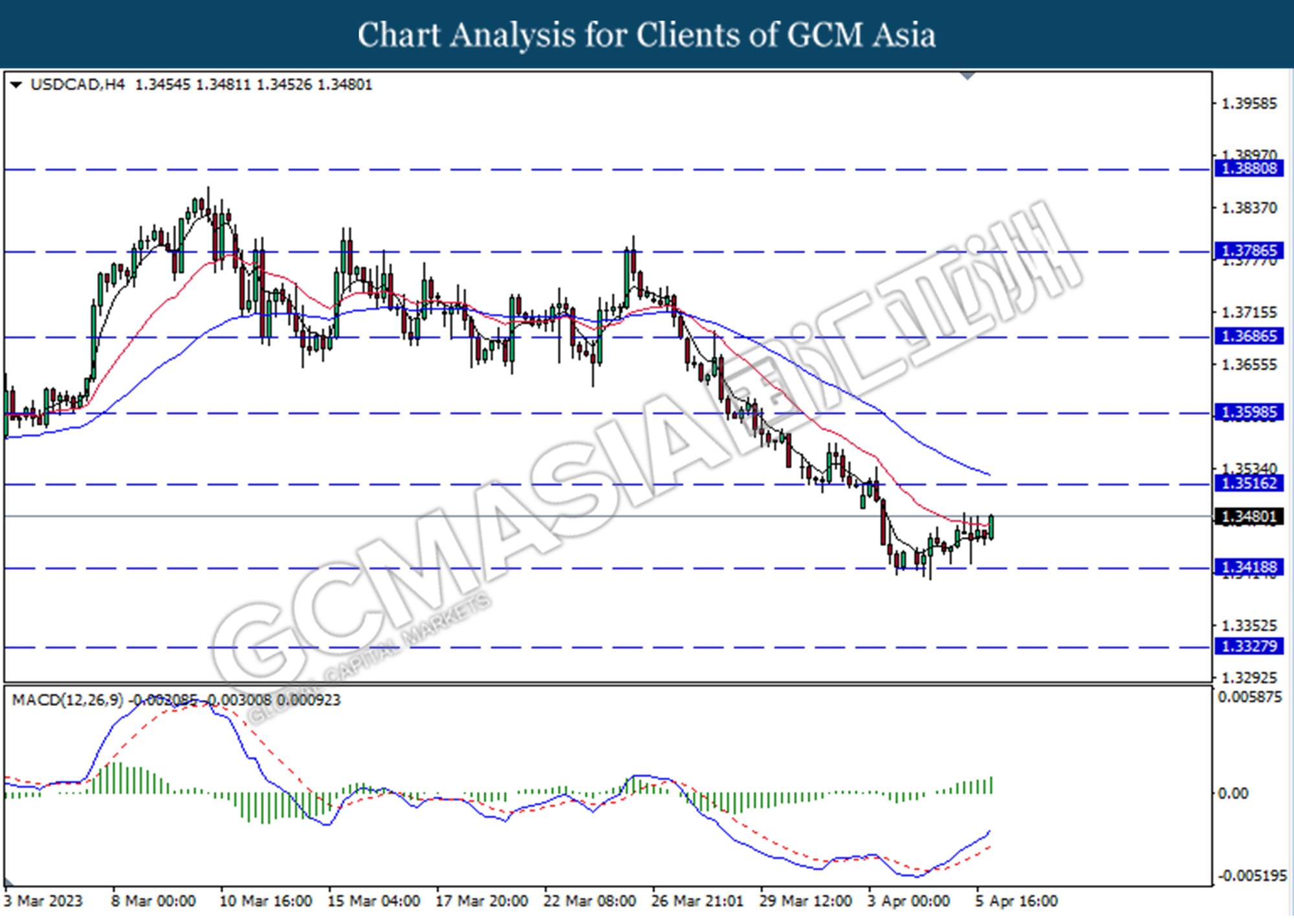

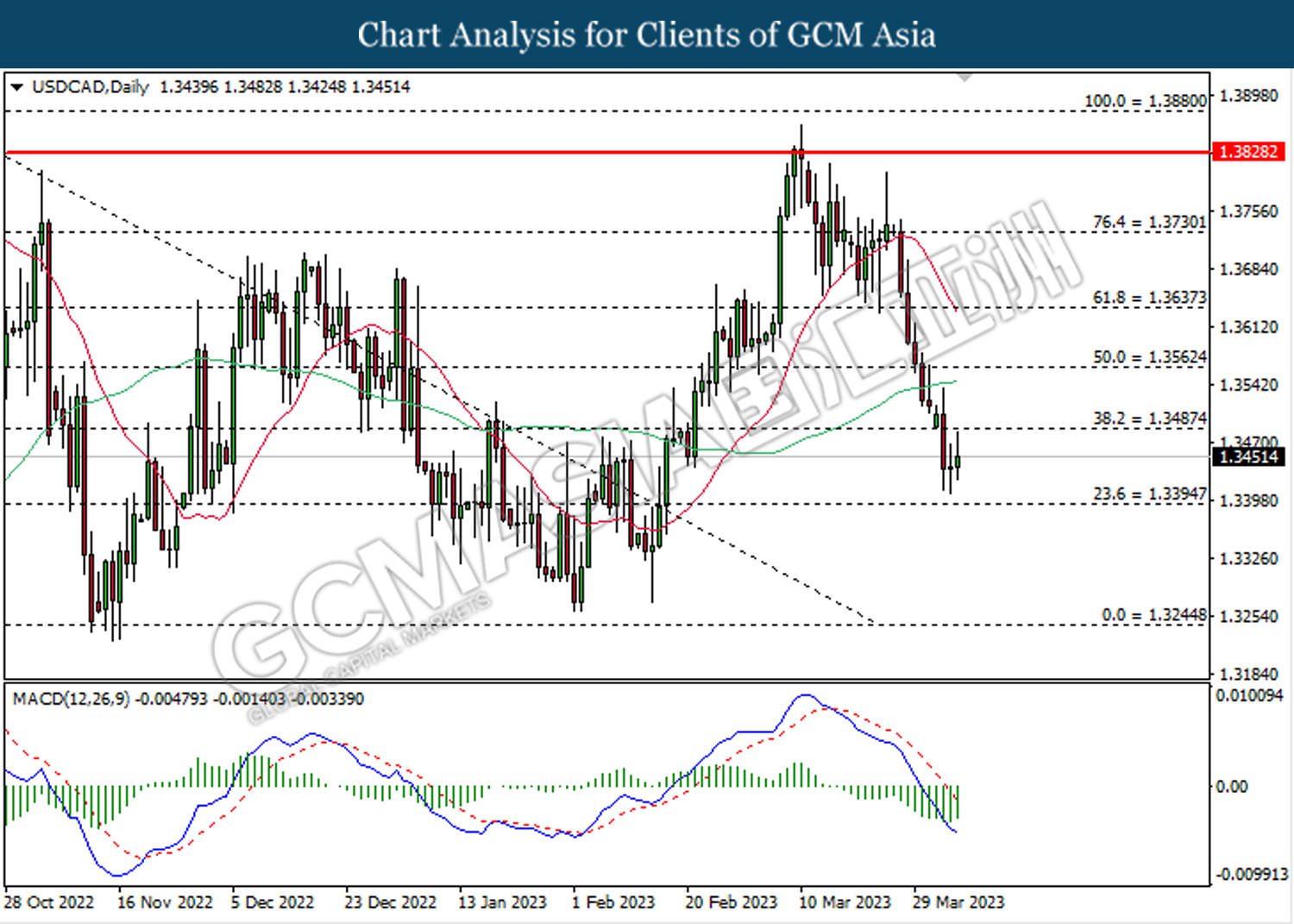

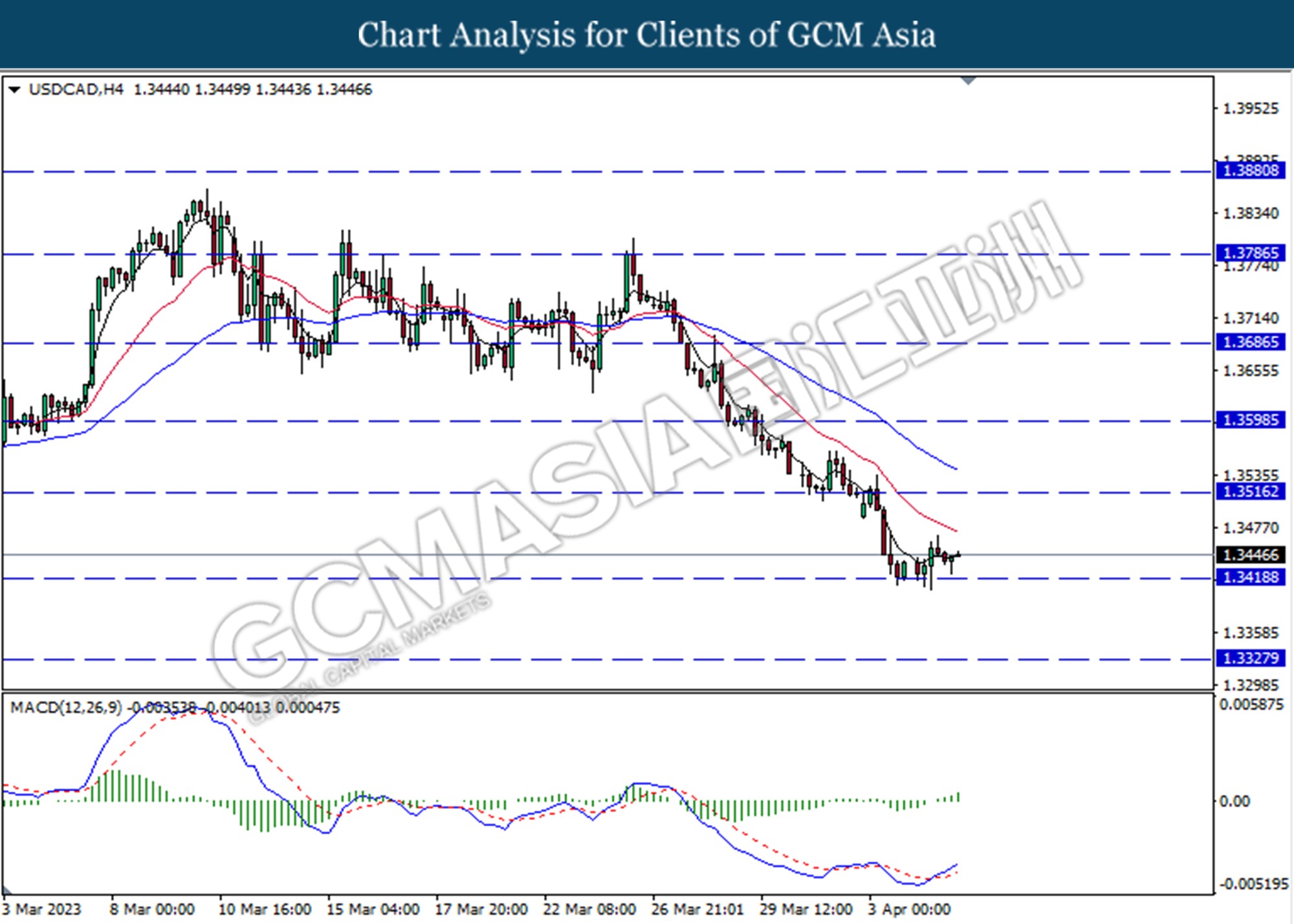

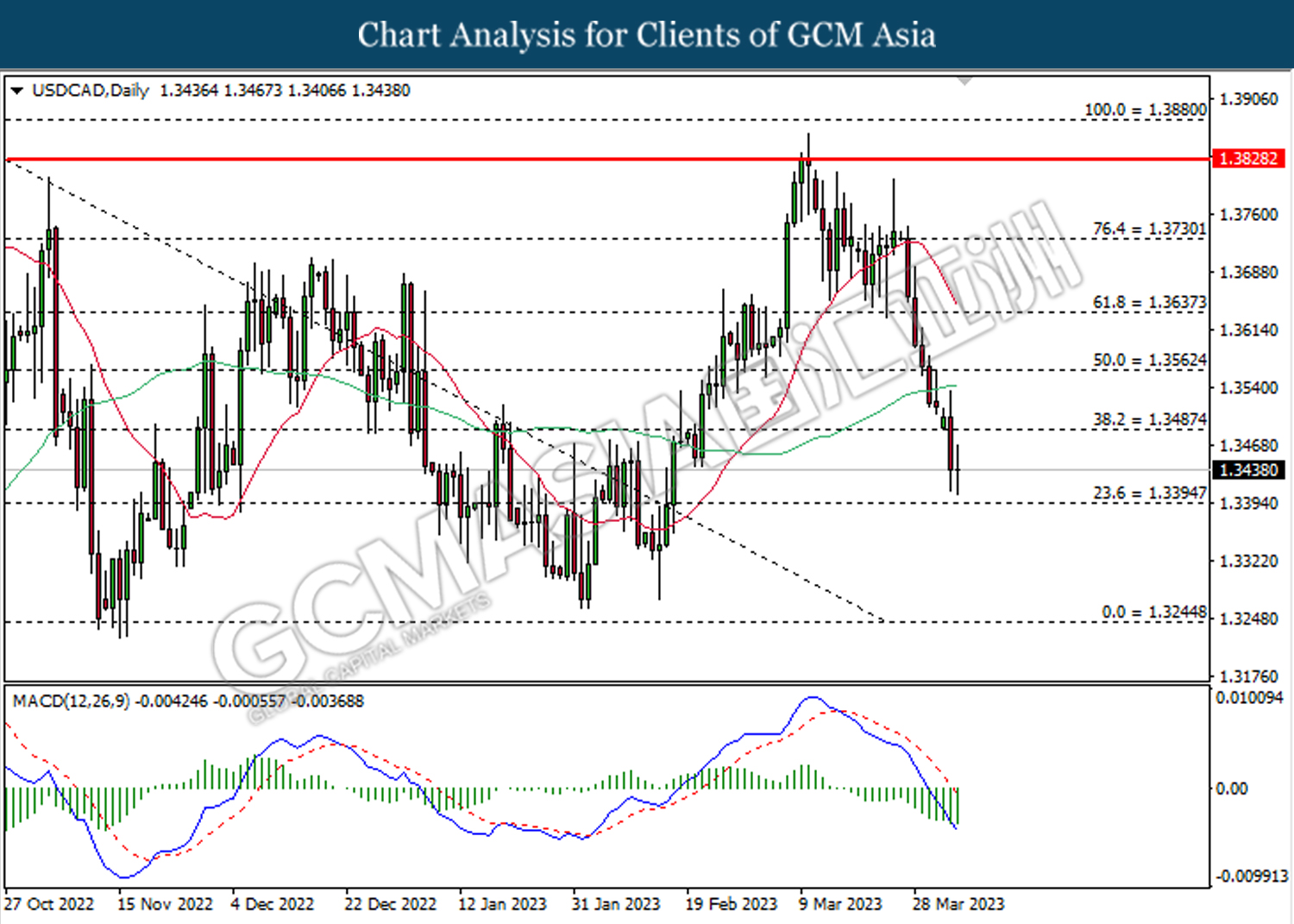

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

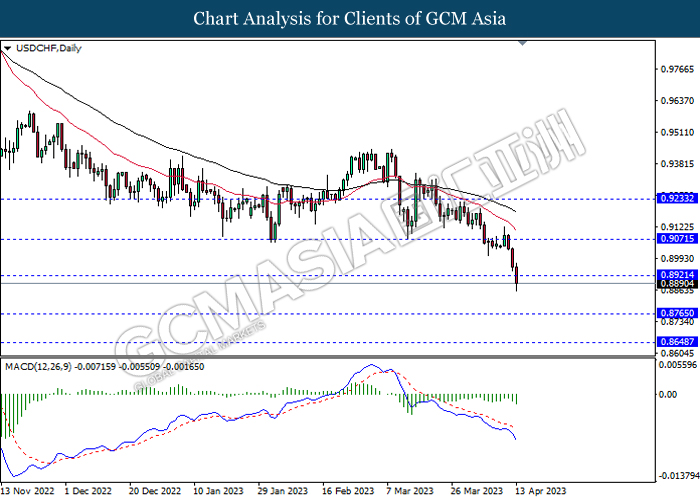

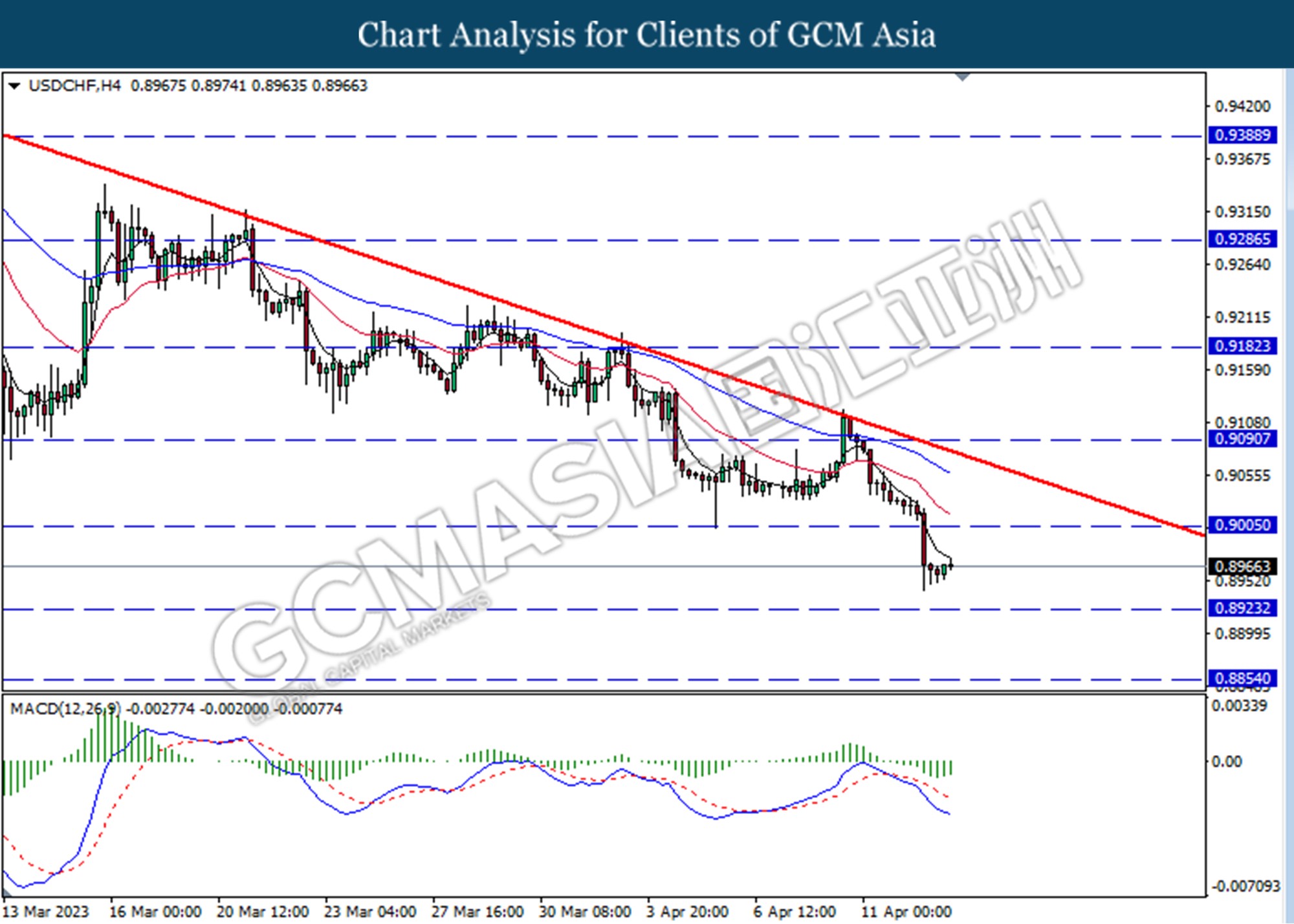

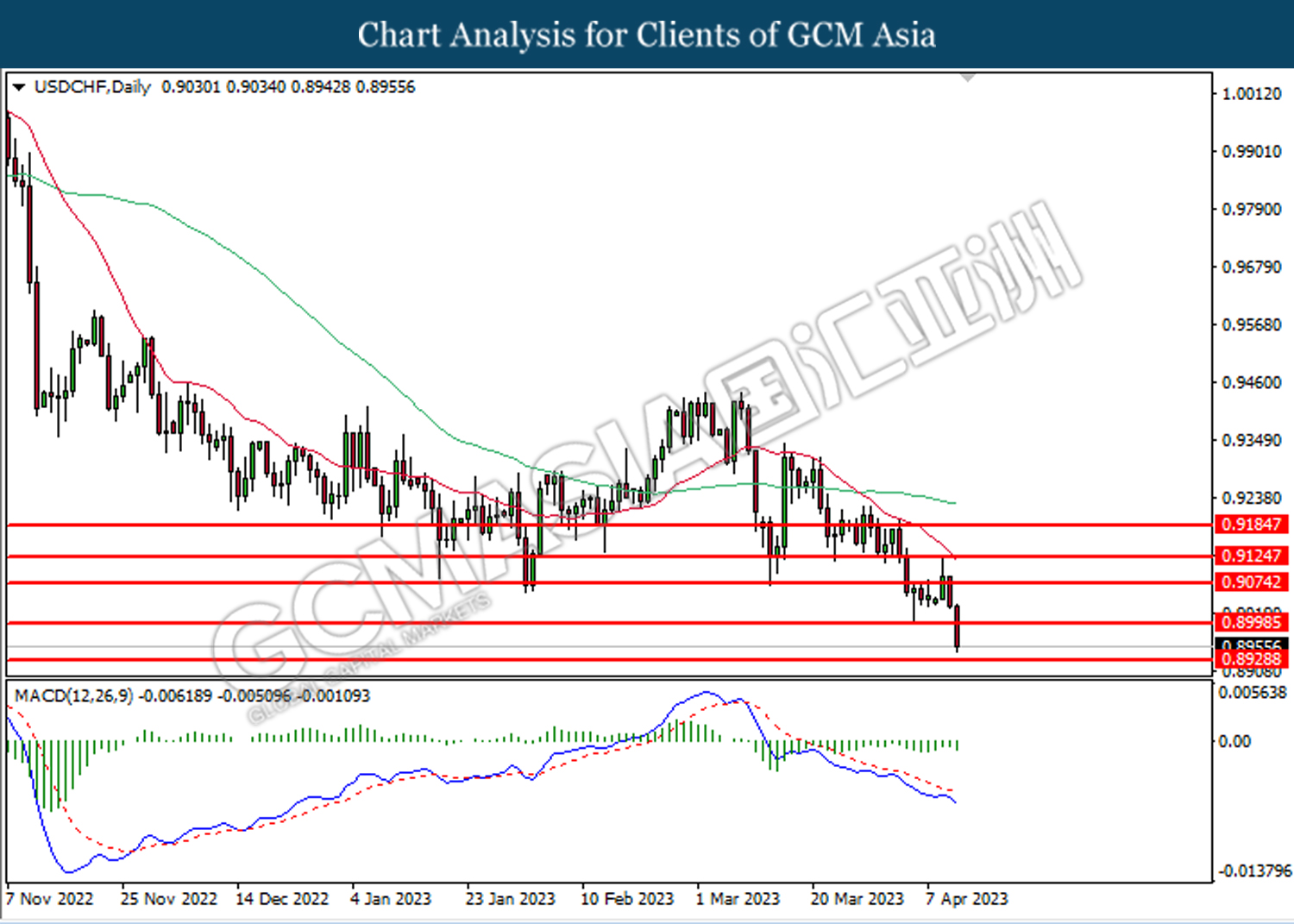

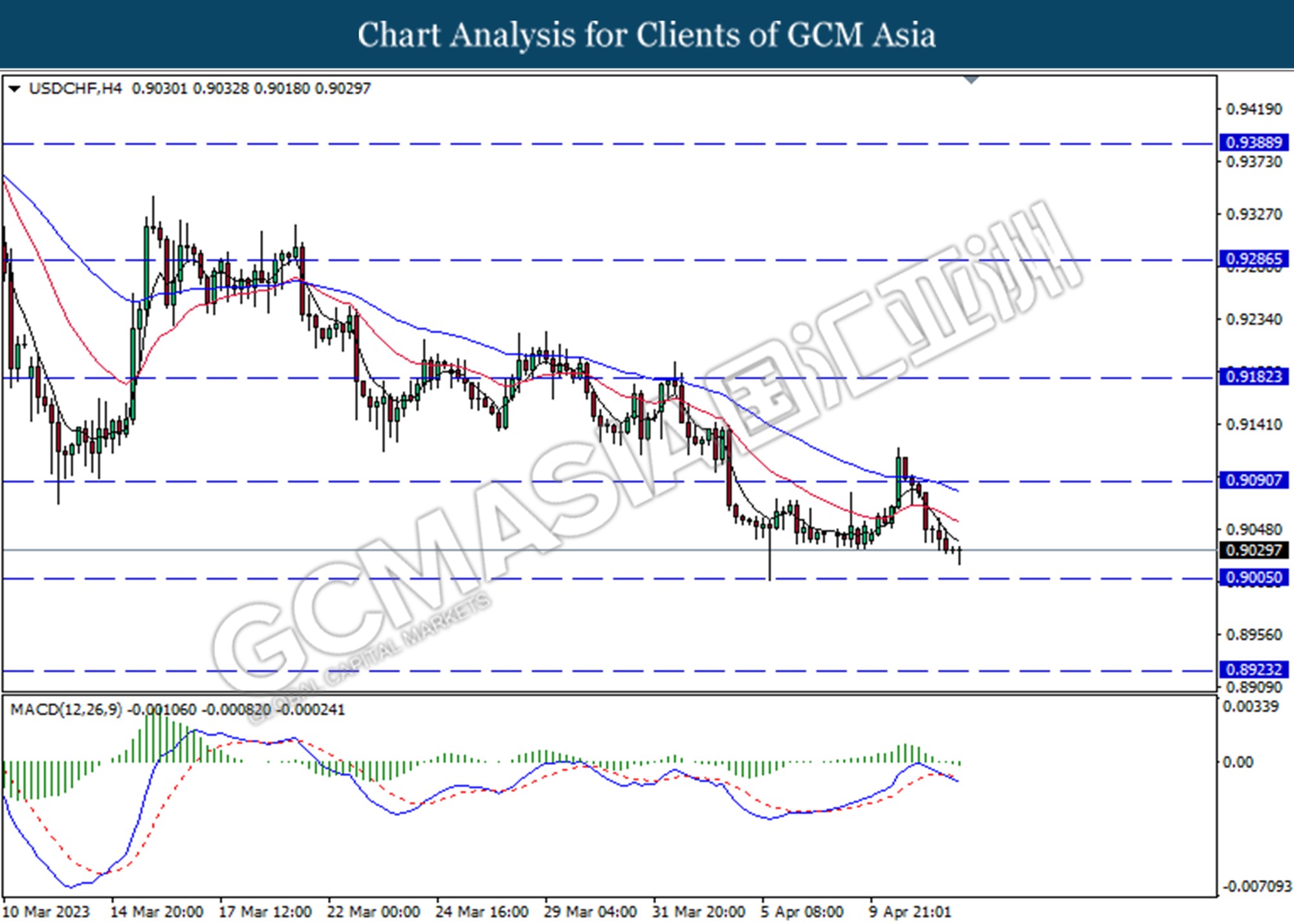

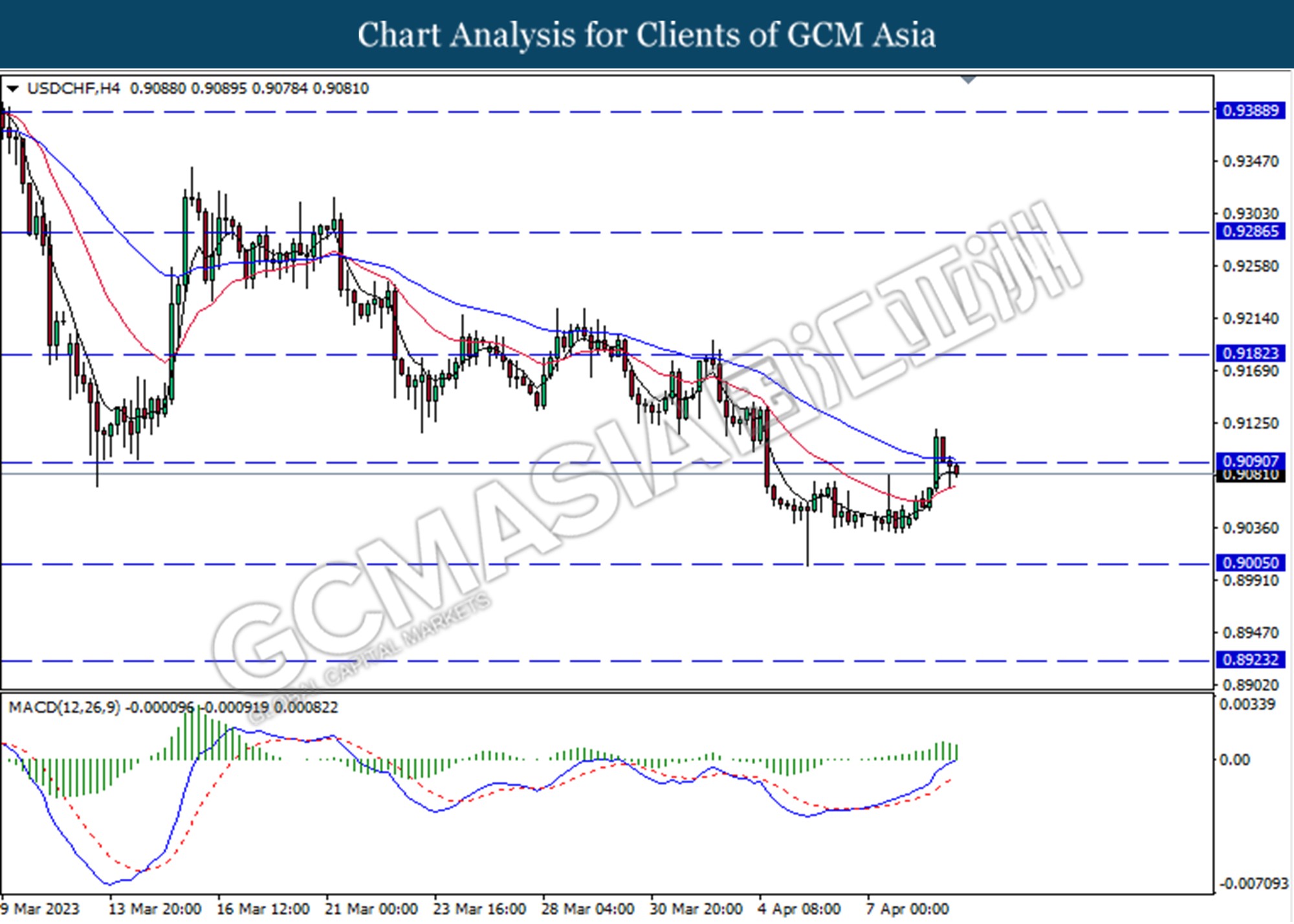

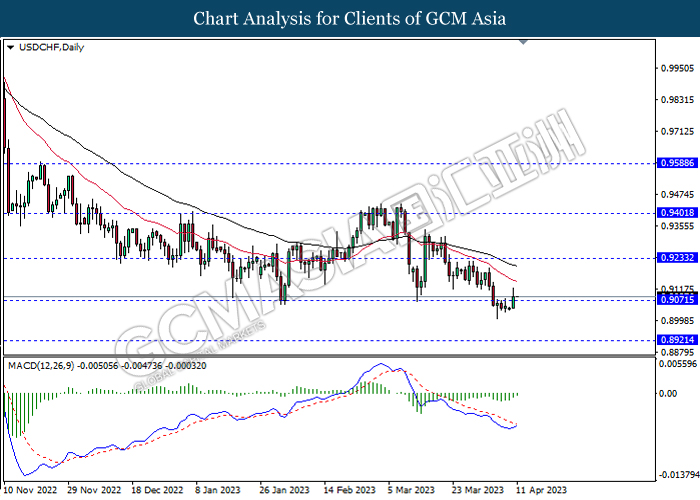

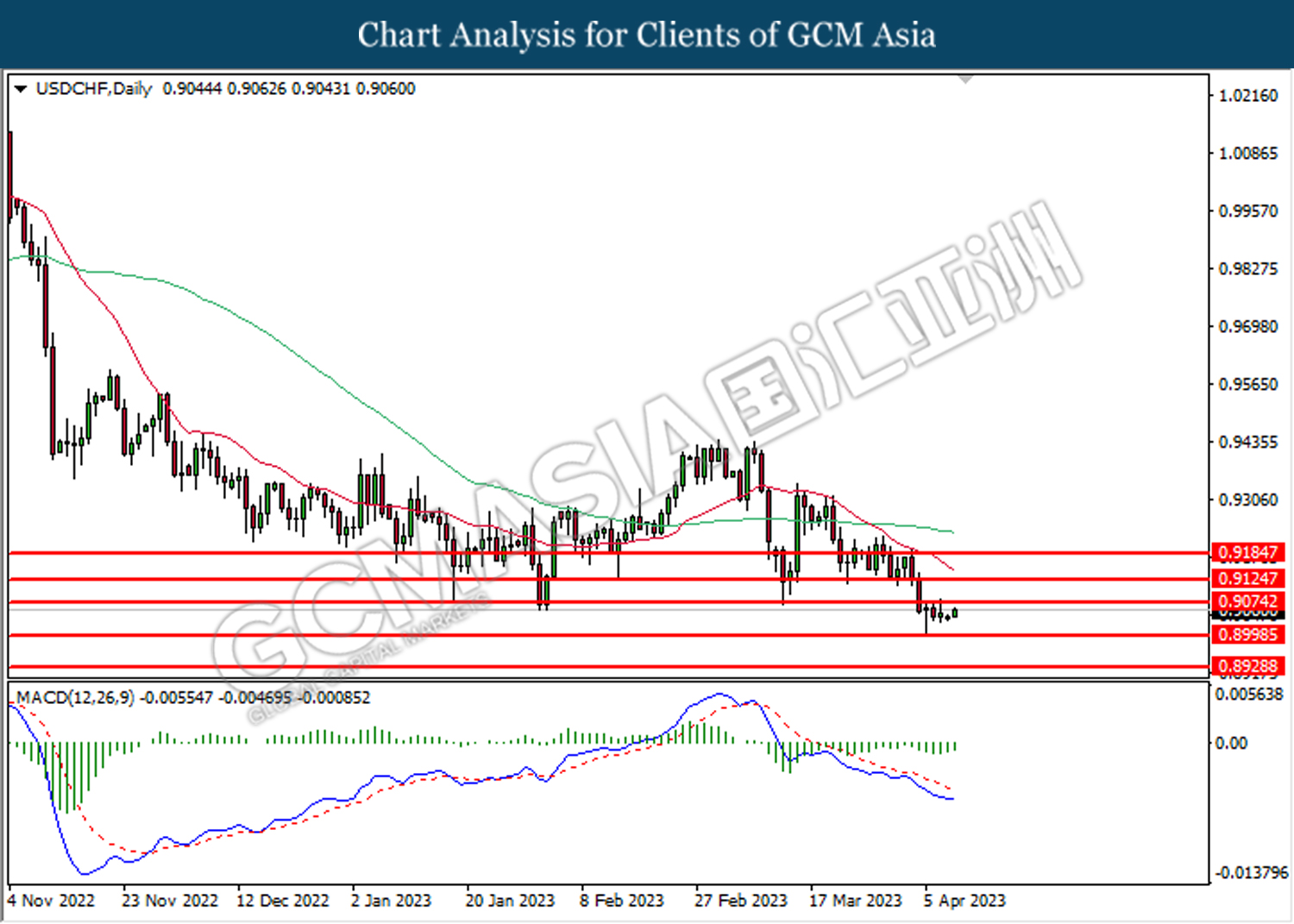

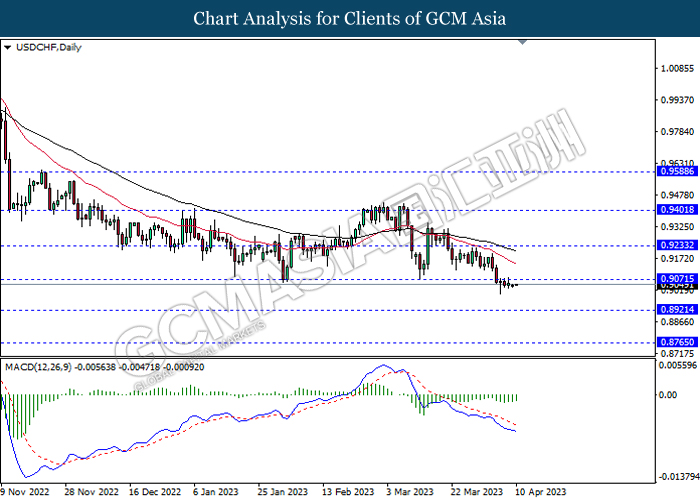

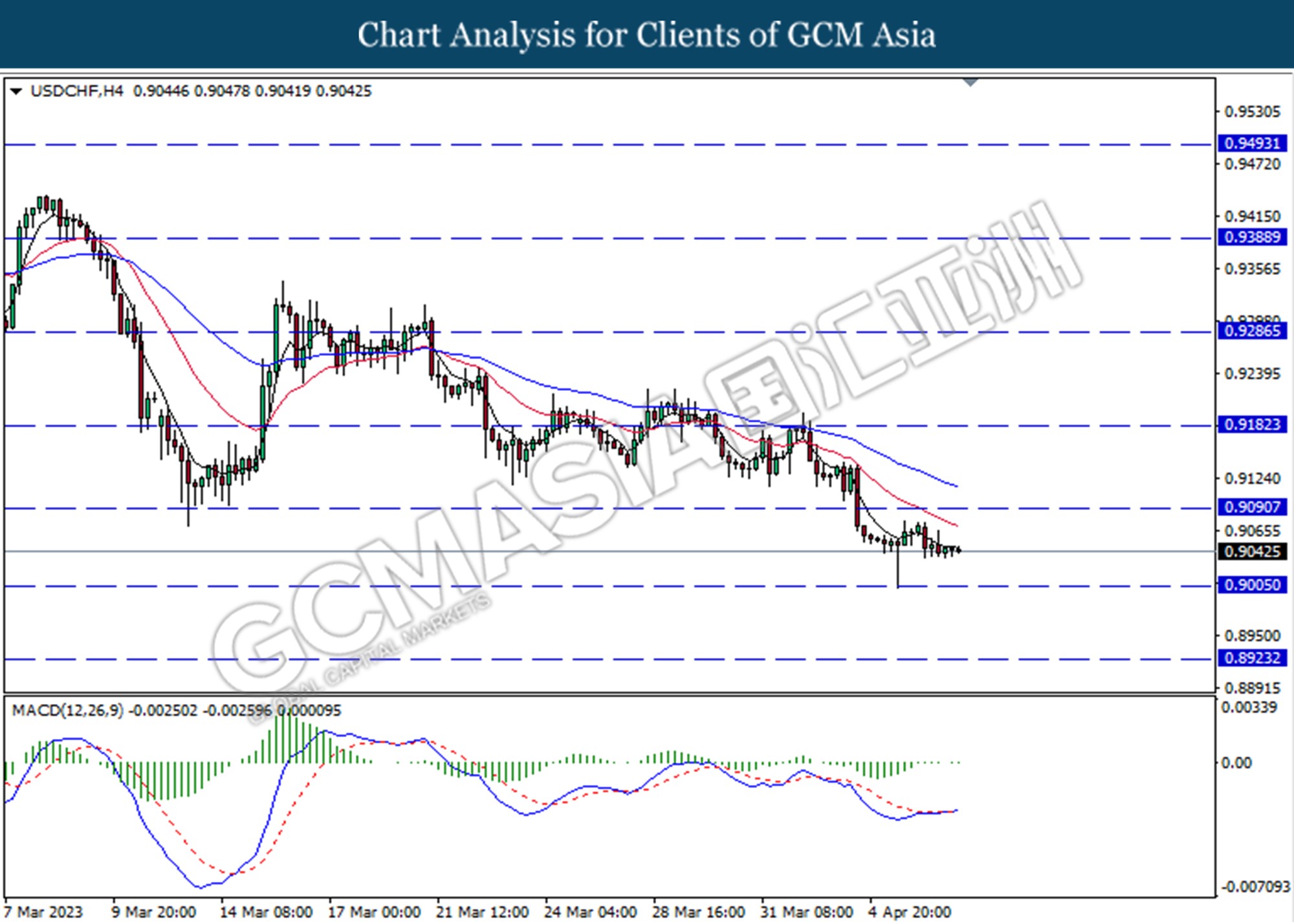

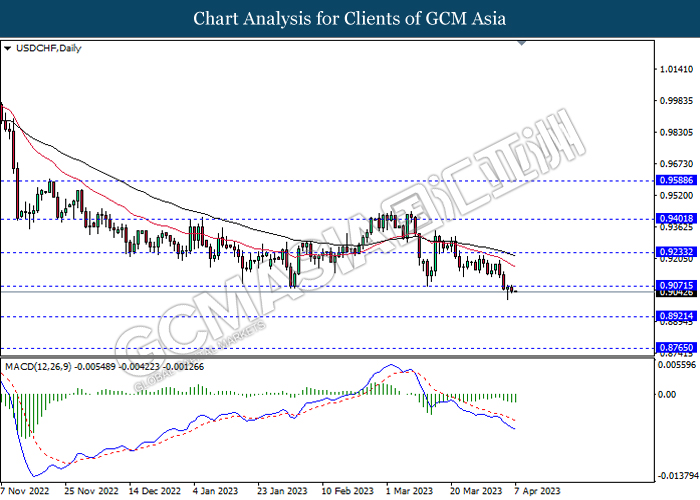

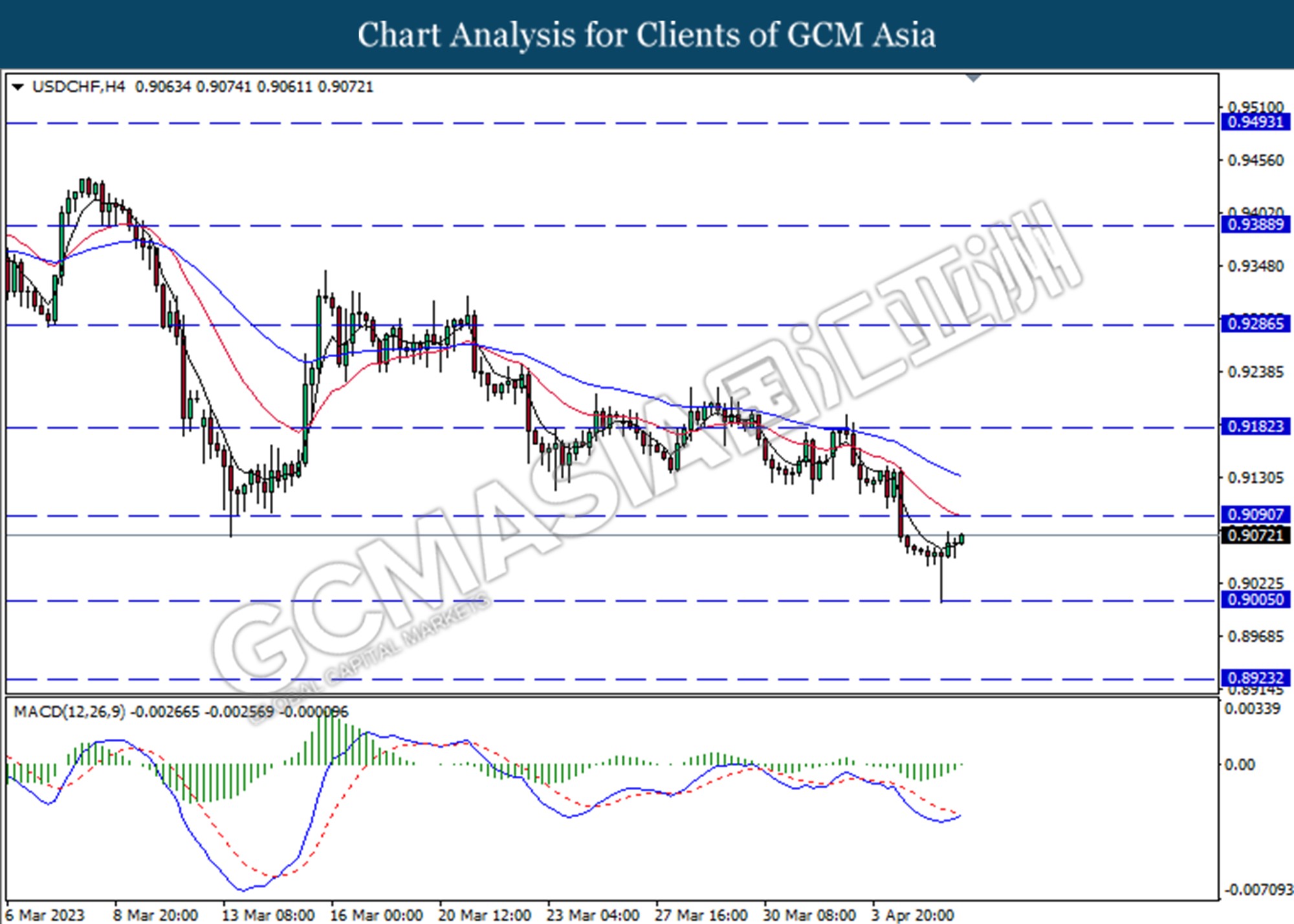

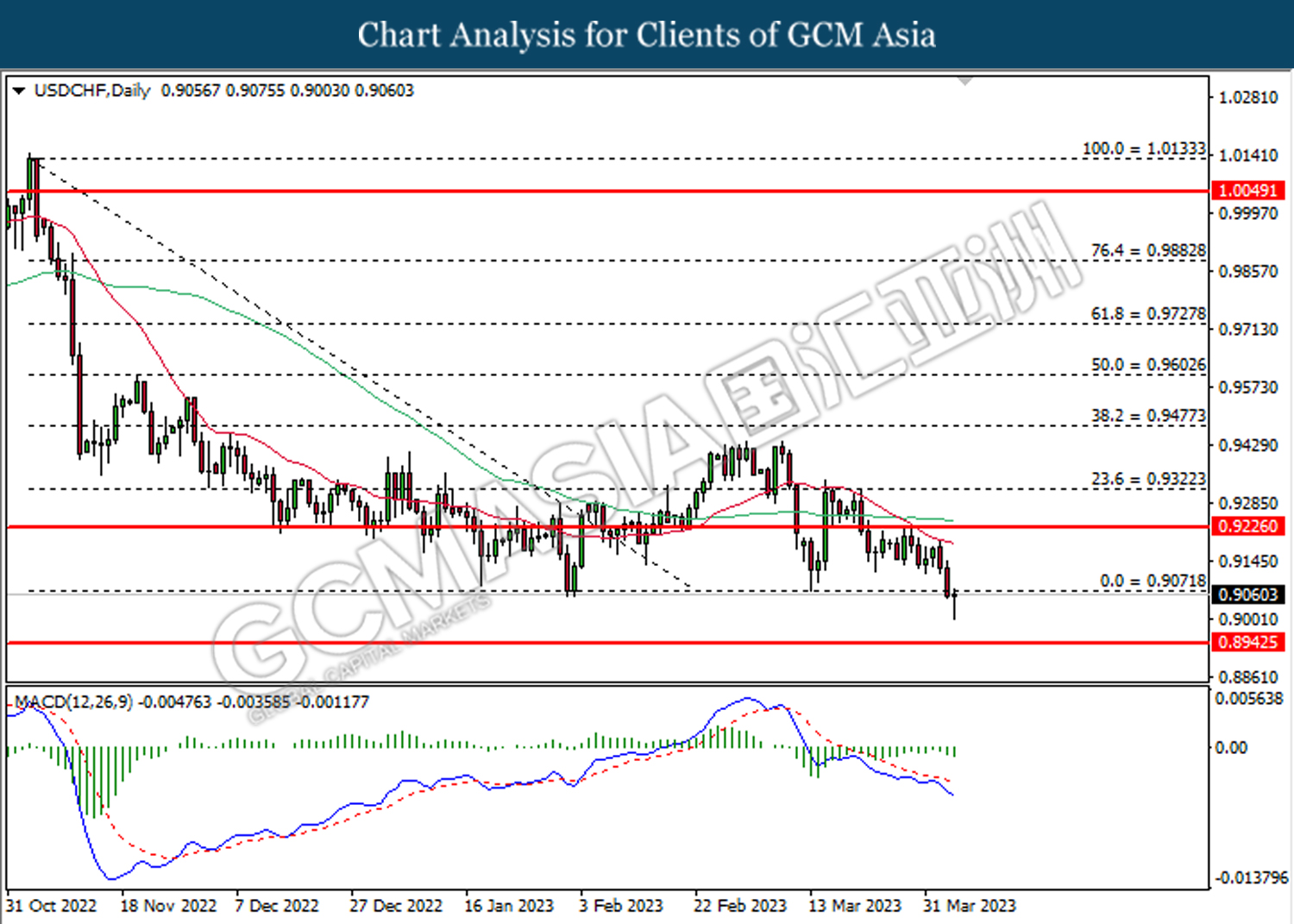

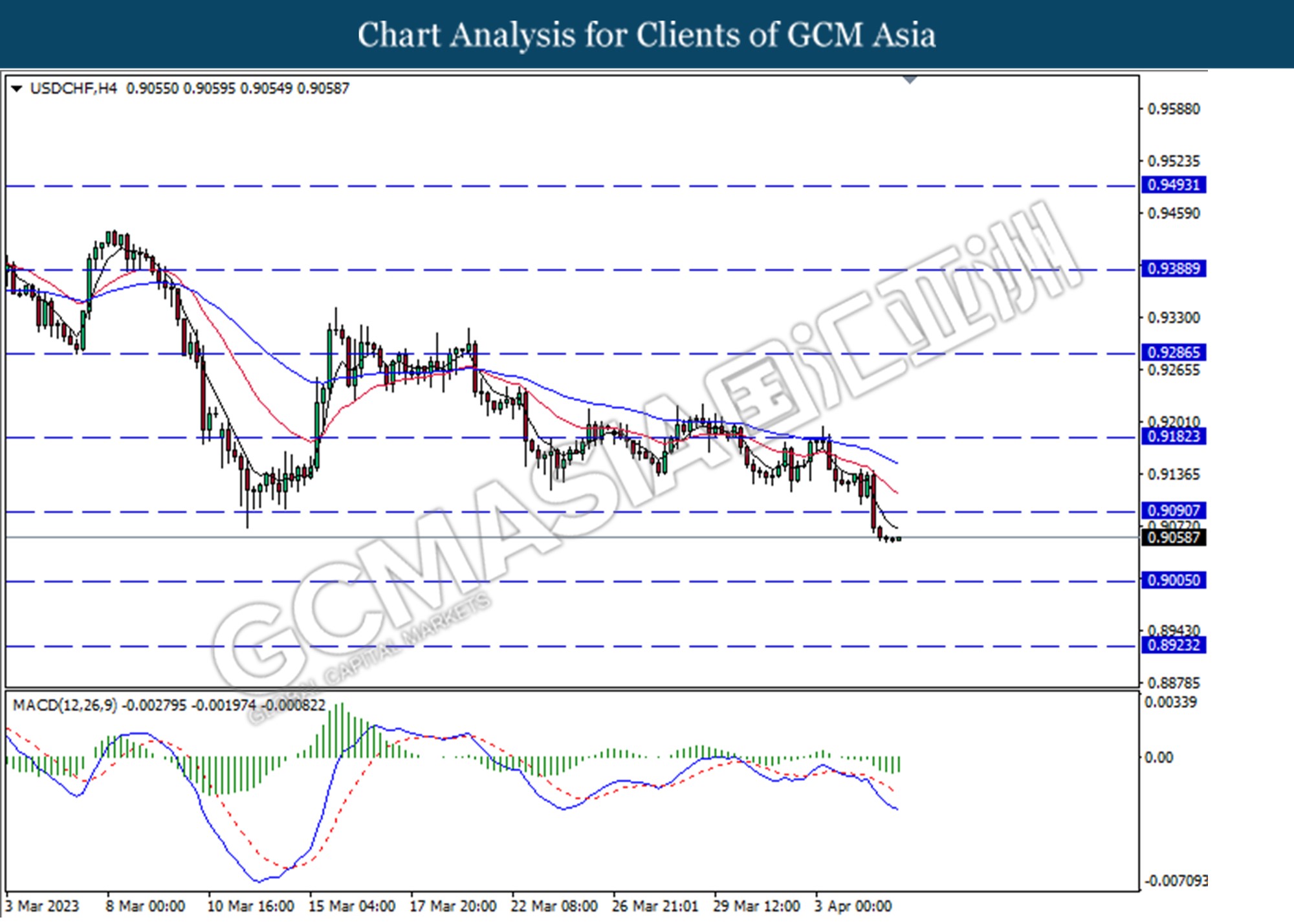

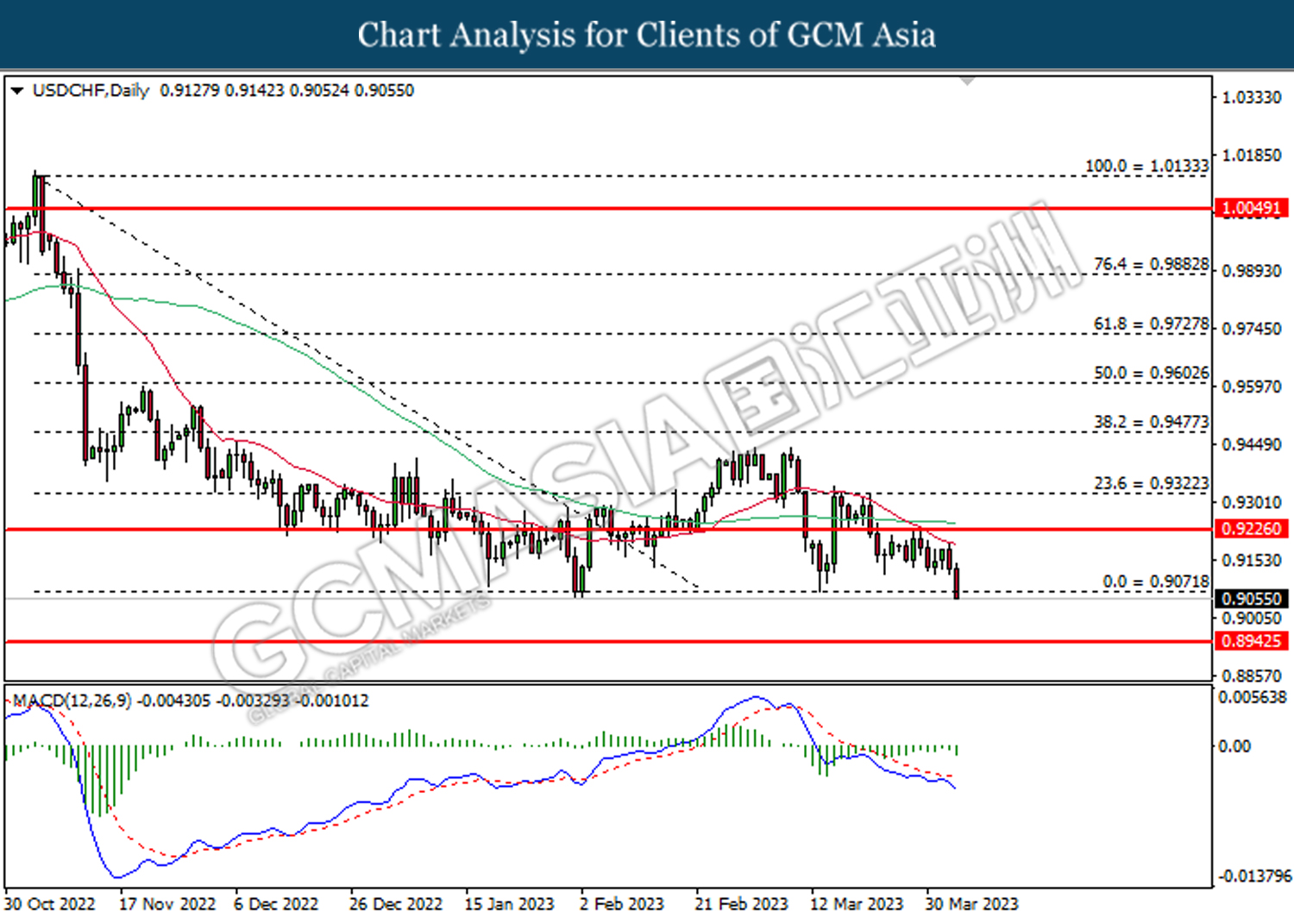

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.8920, 0.9070

Support level: 0.8765, 0.8650

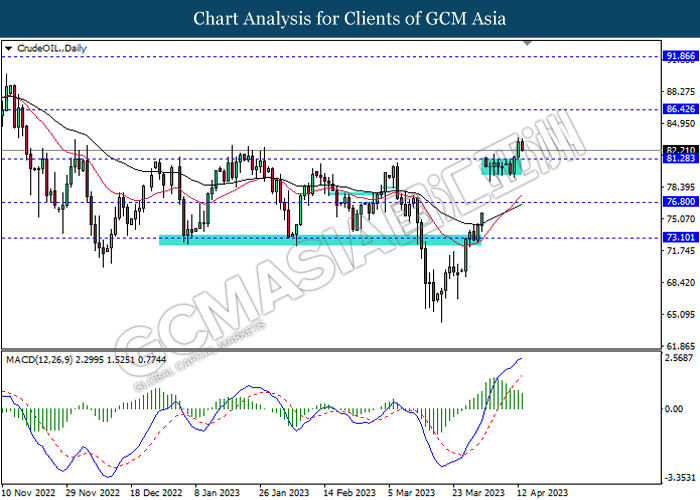

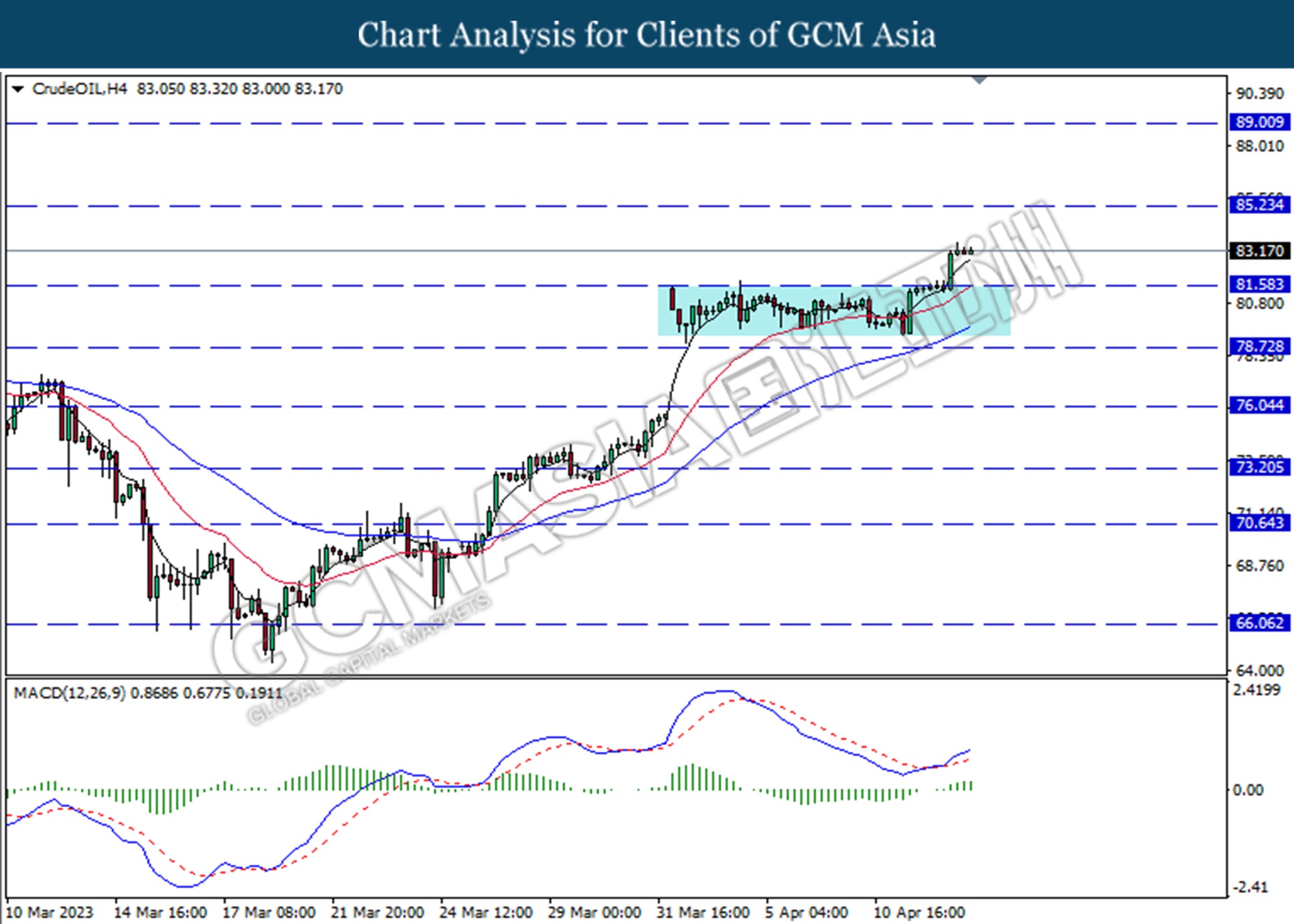

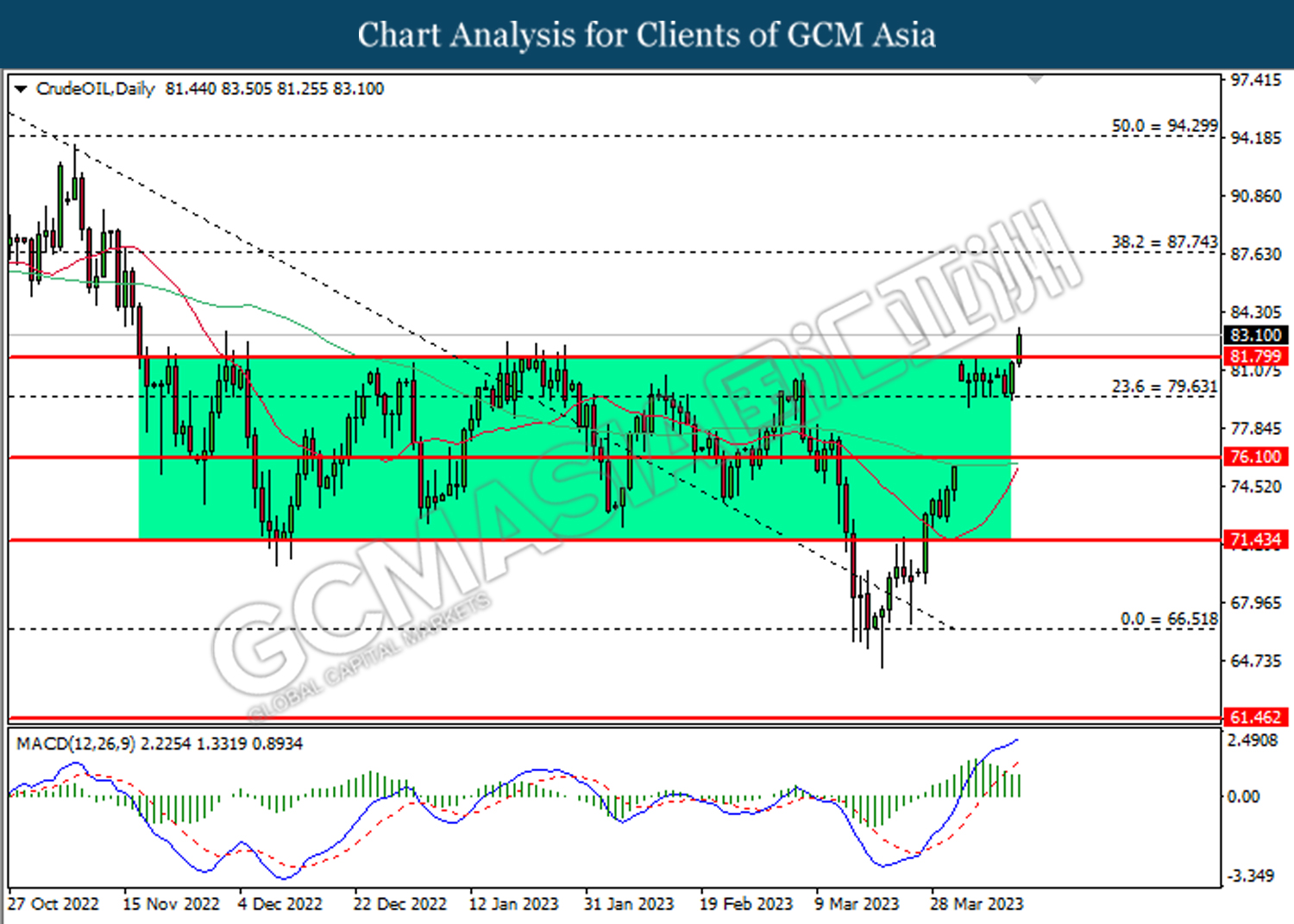

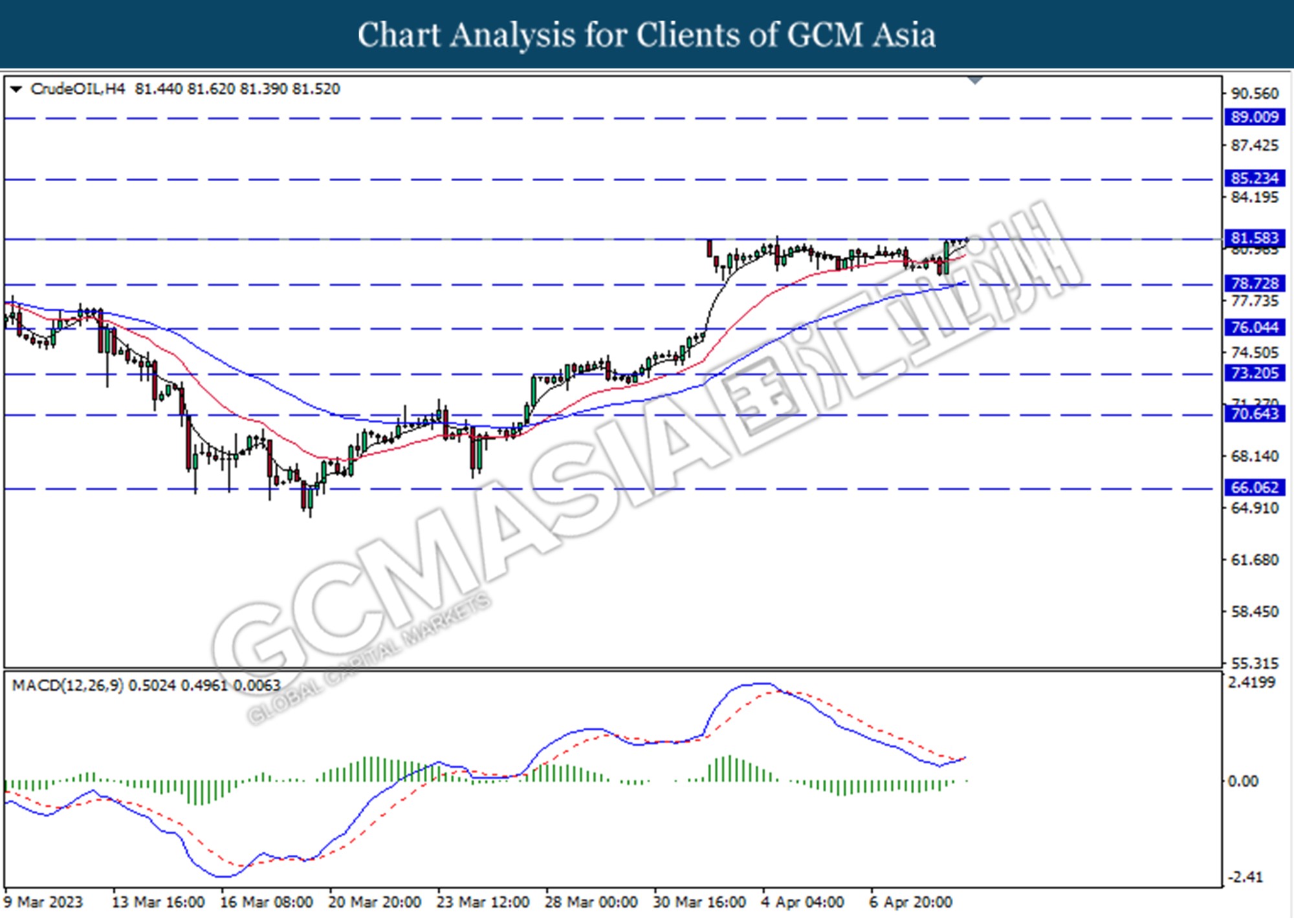

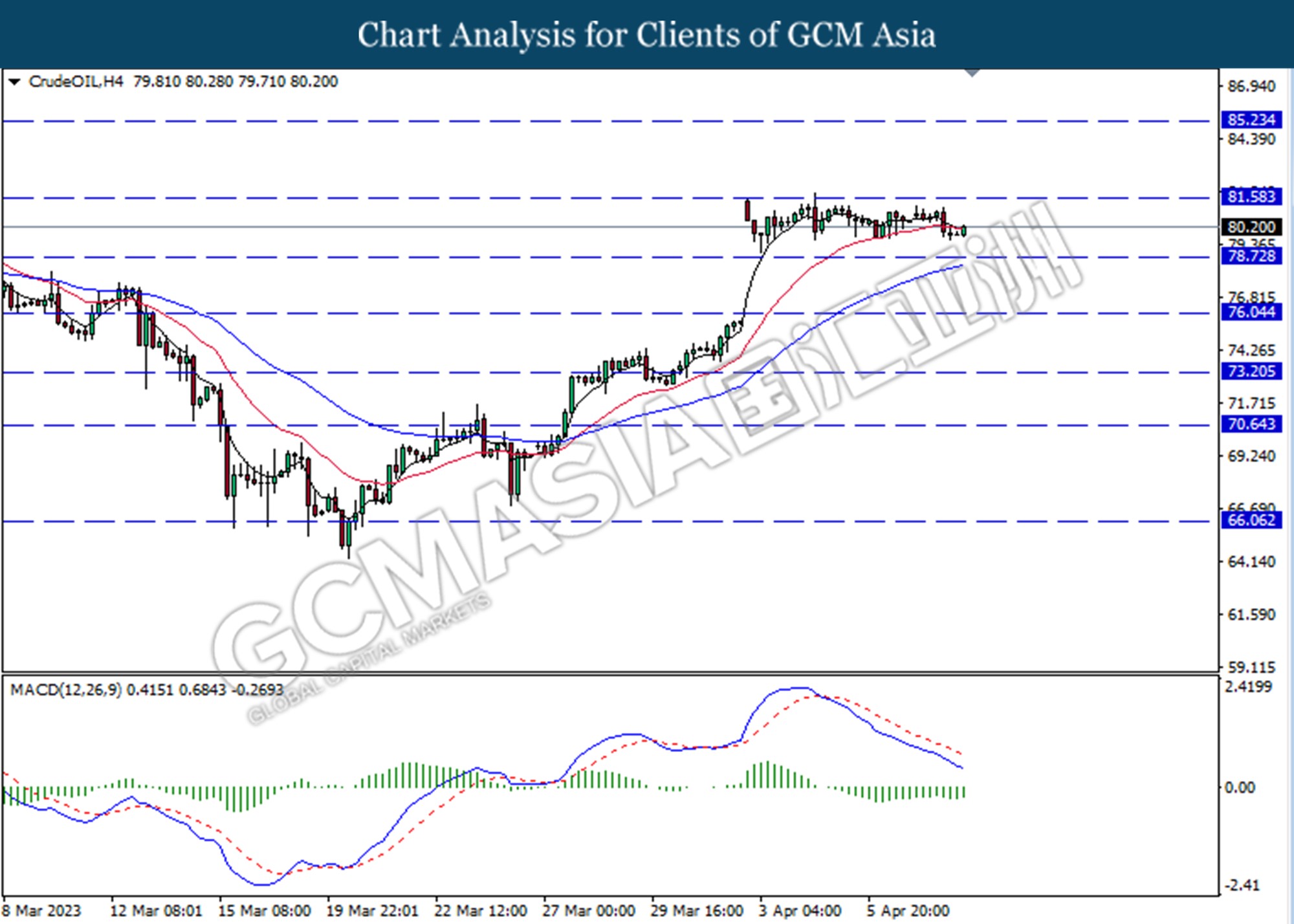

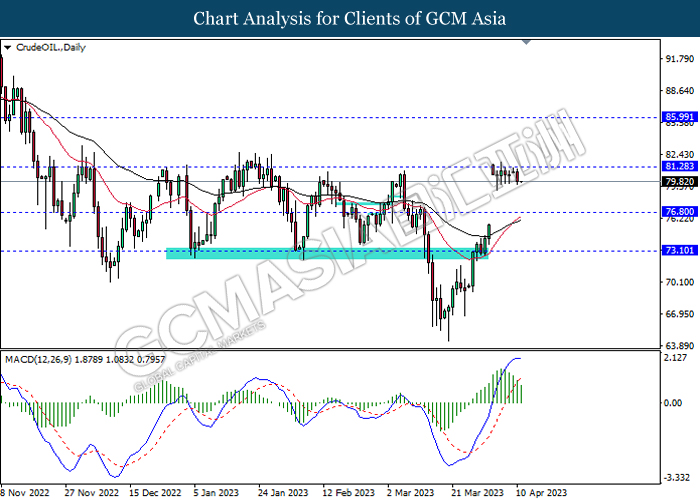

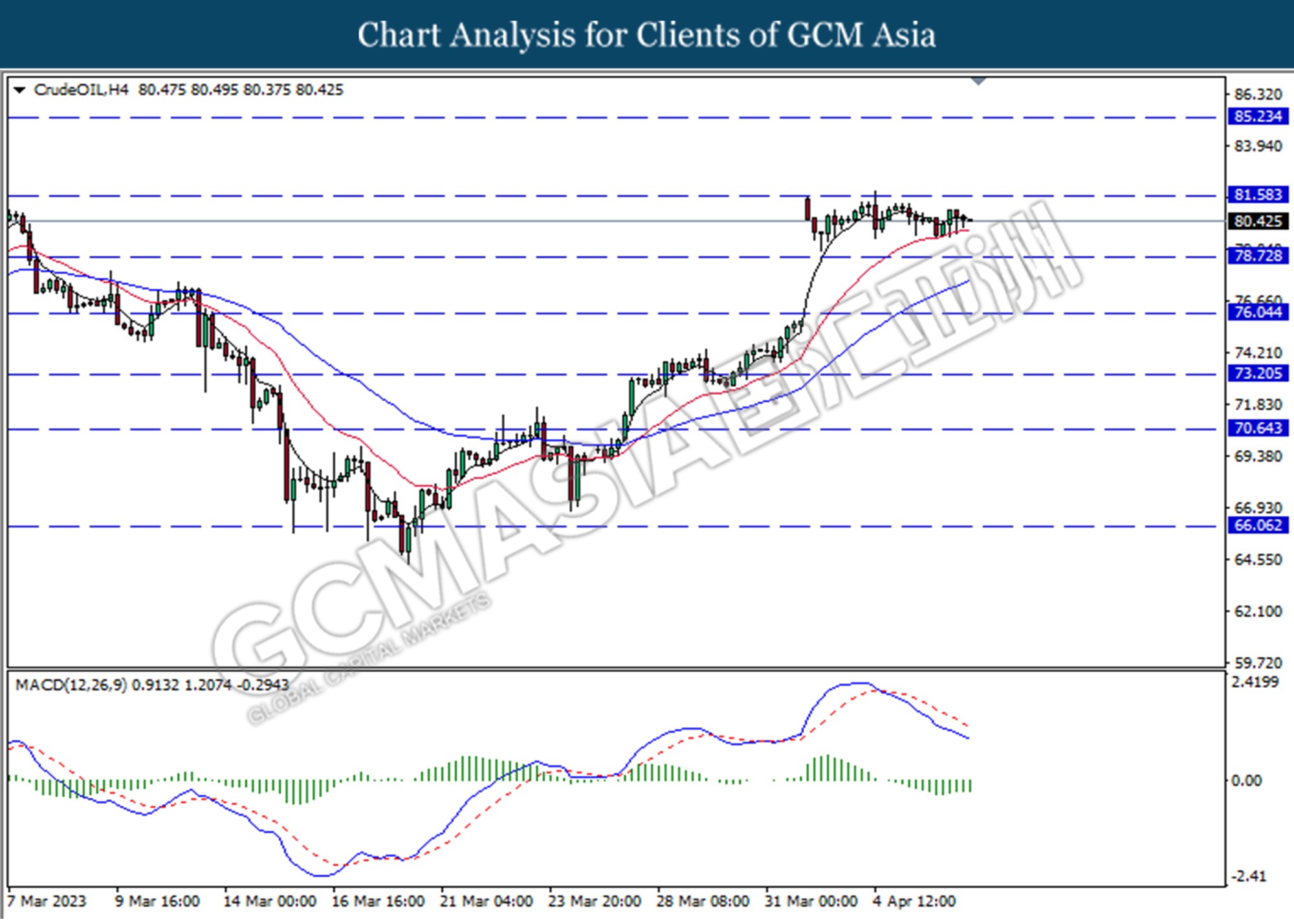

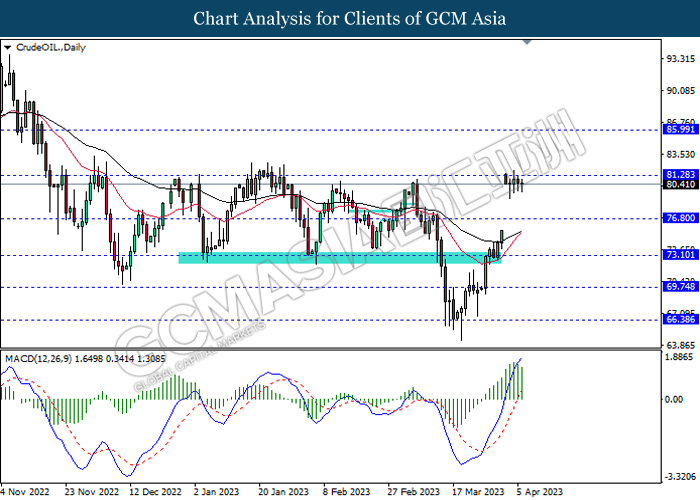

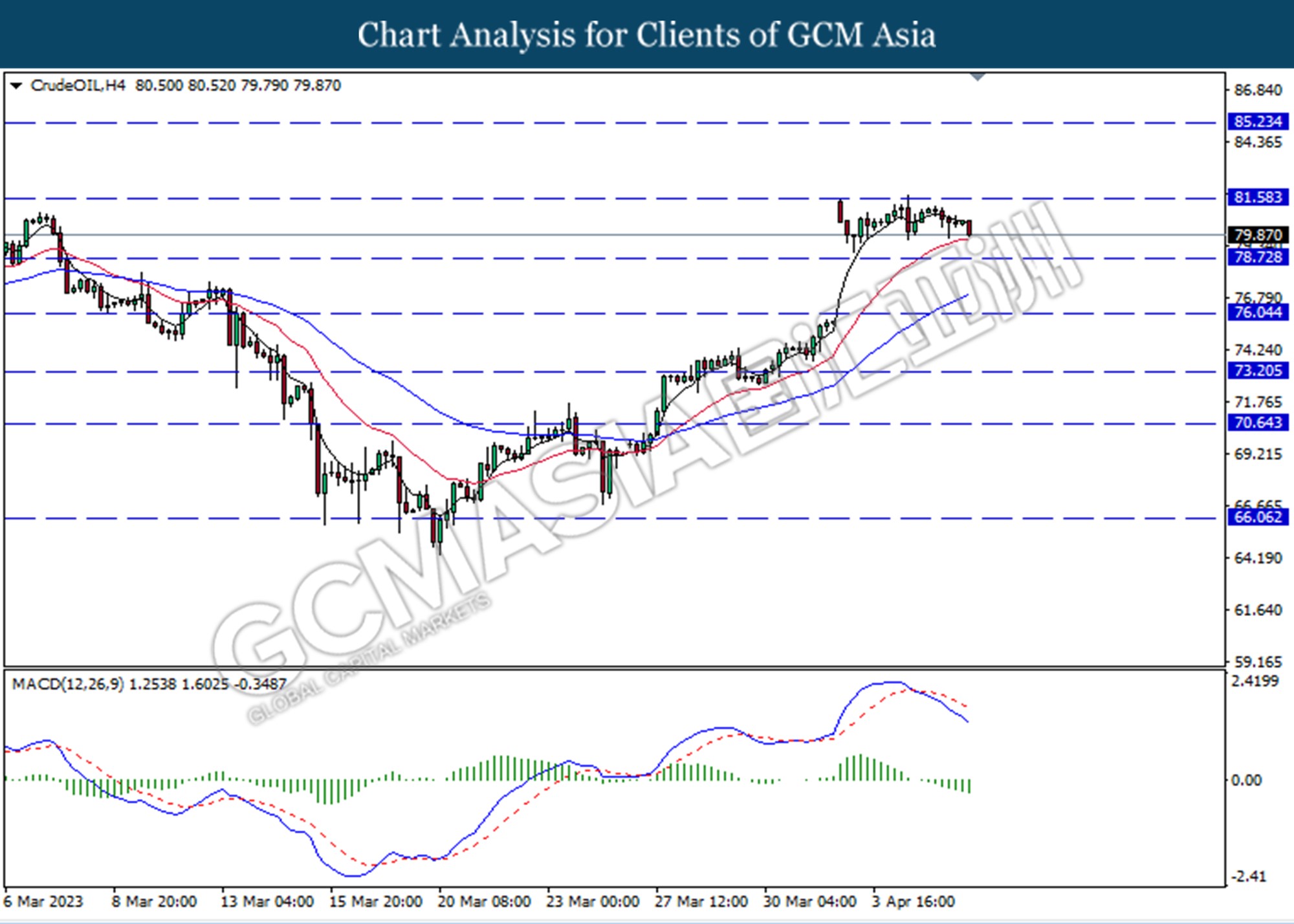

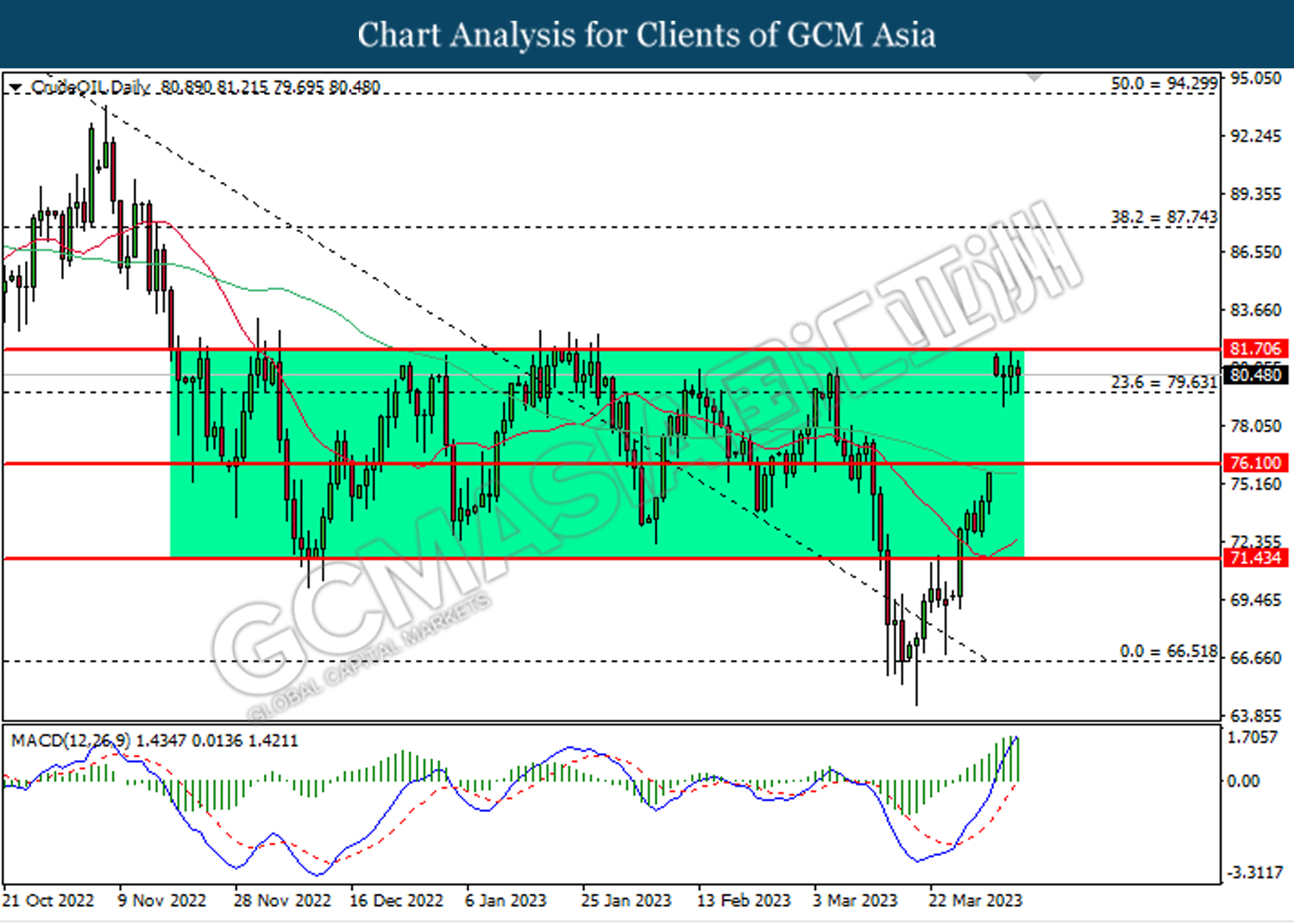

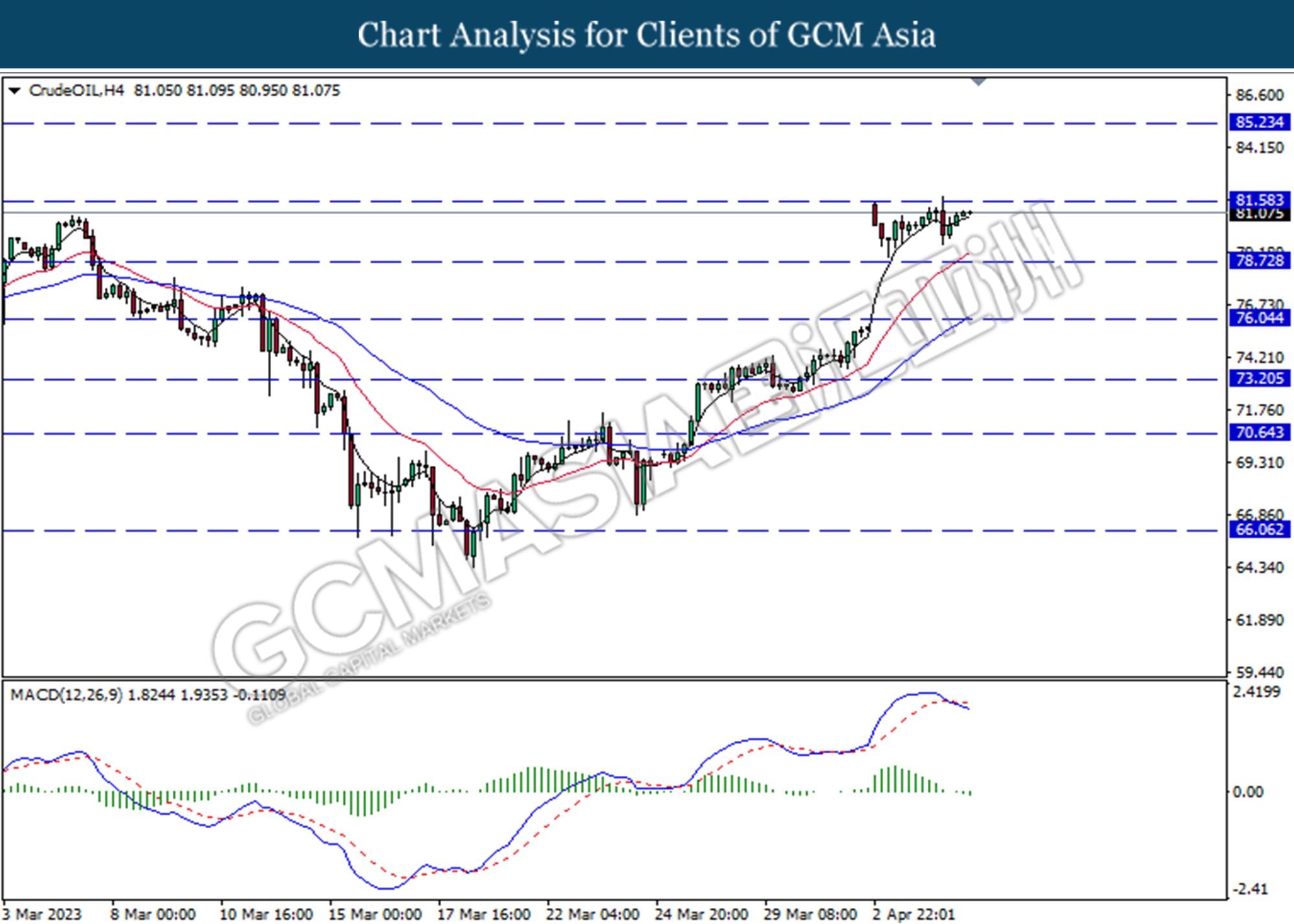

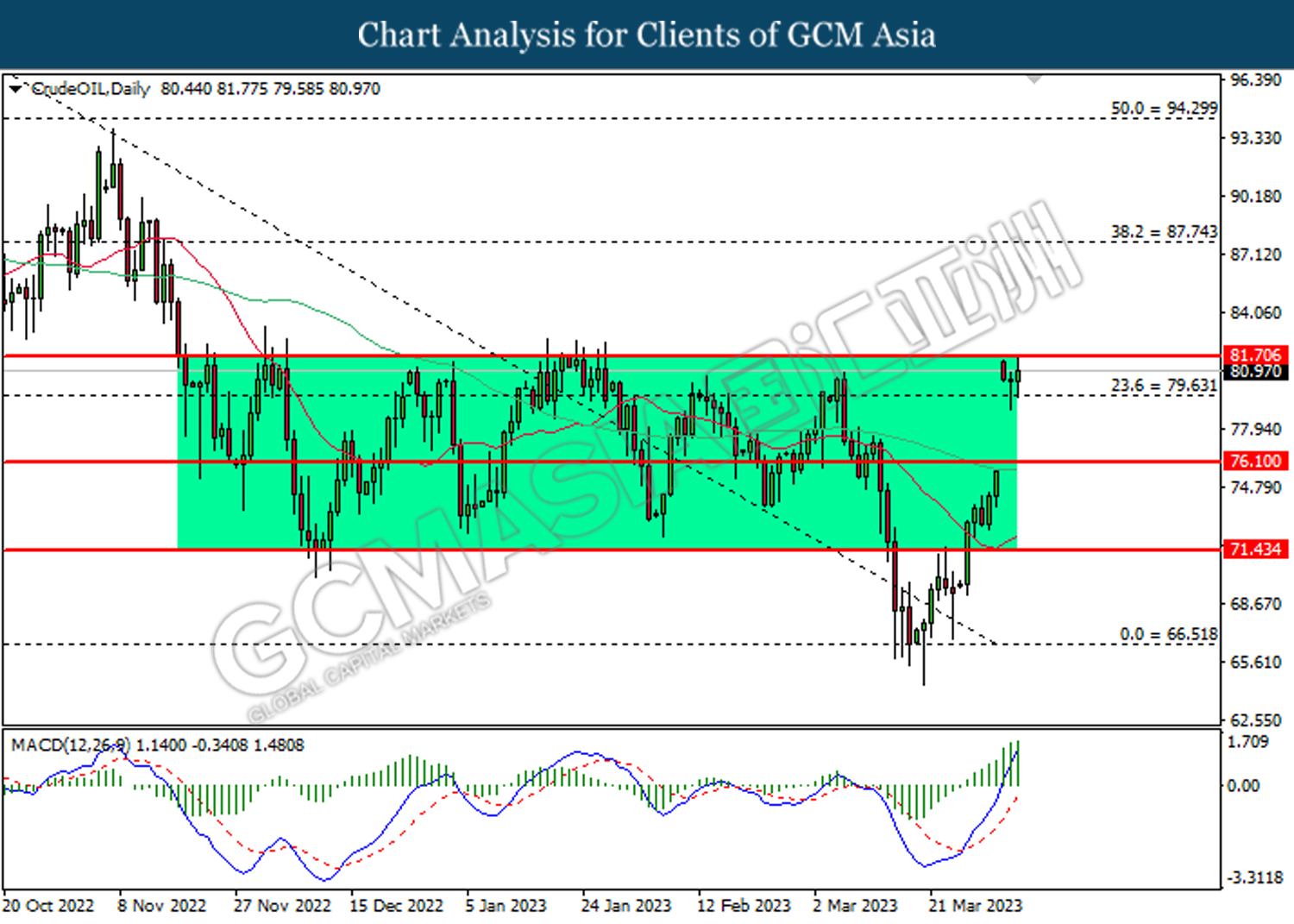

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 86.40, 91.85

Support level: 81.30, 76.80

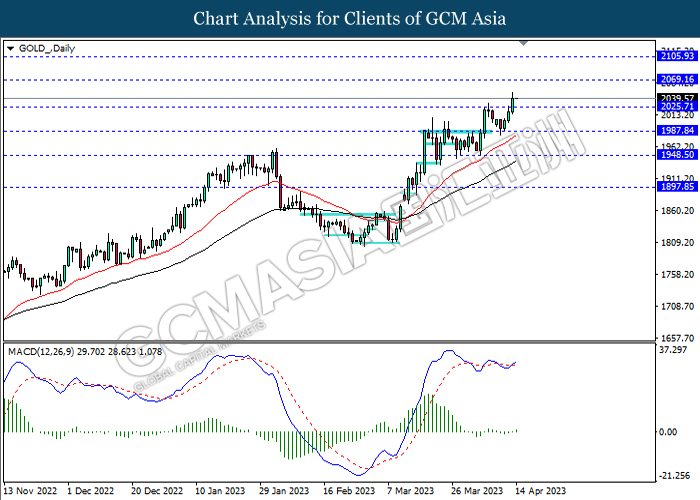

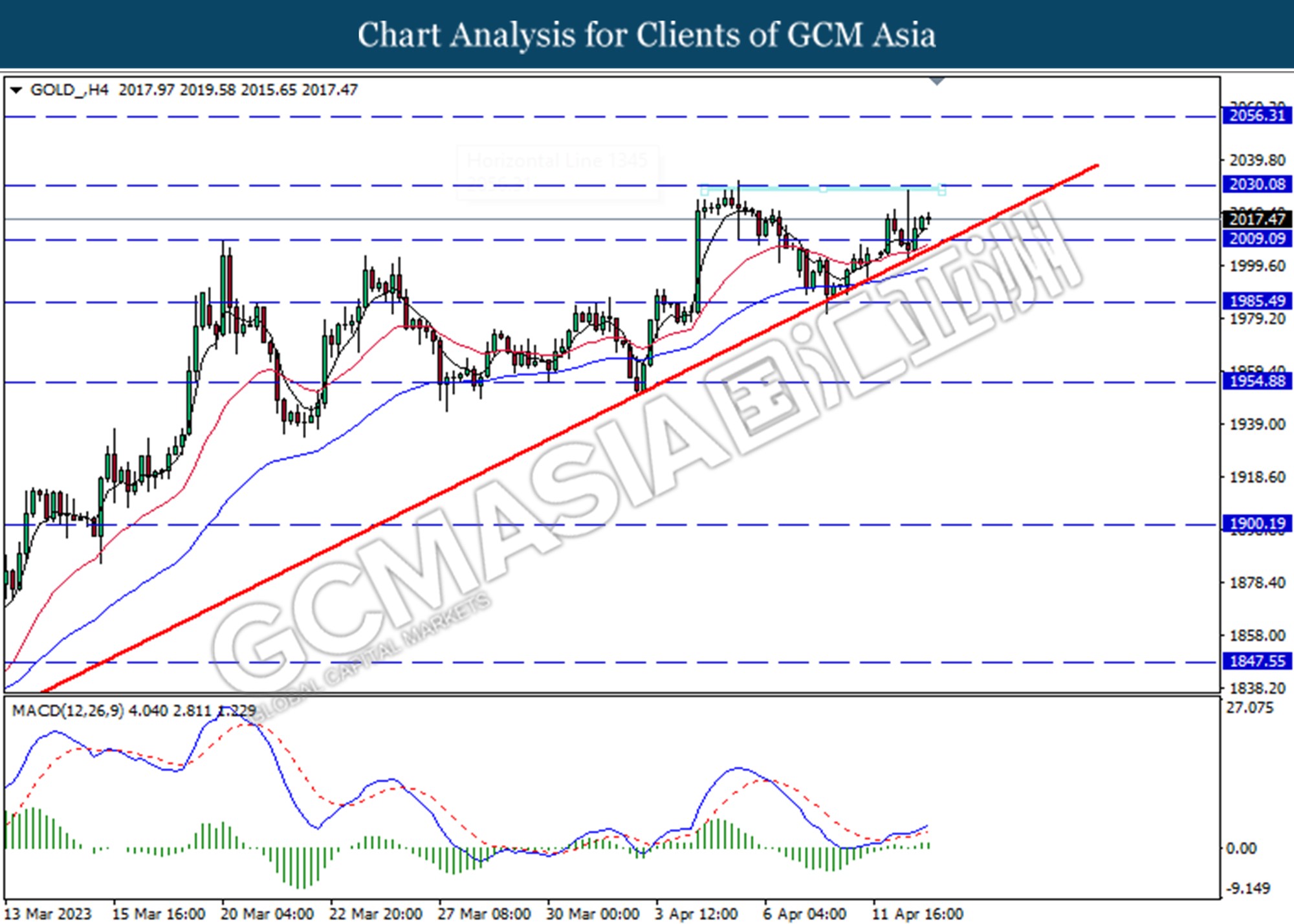

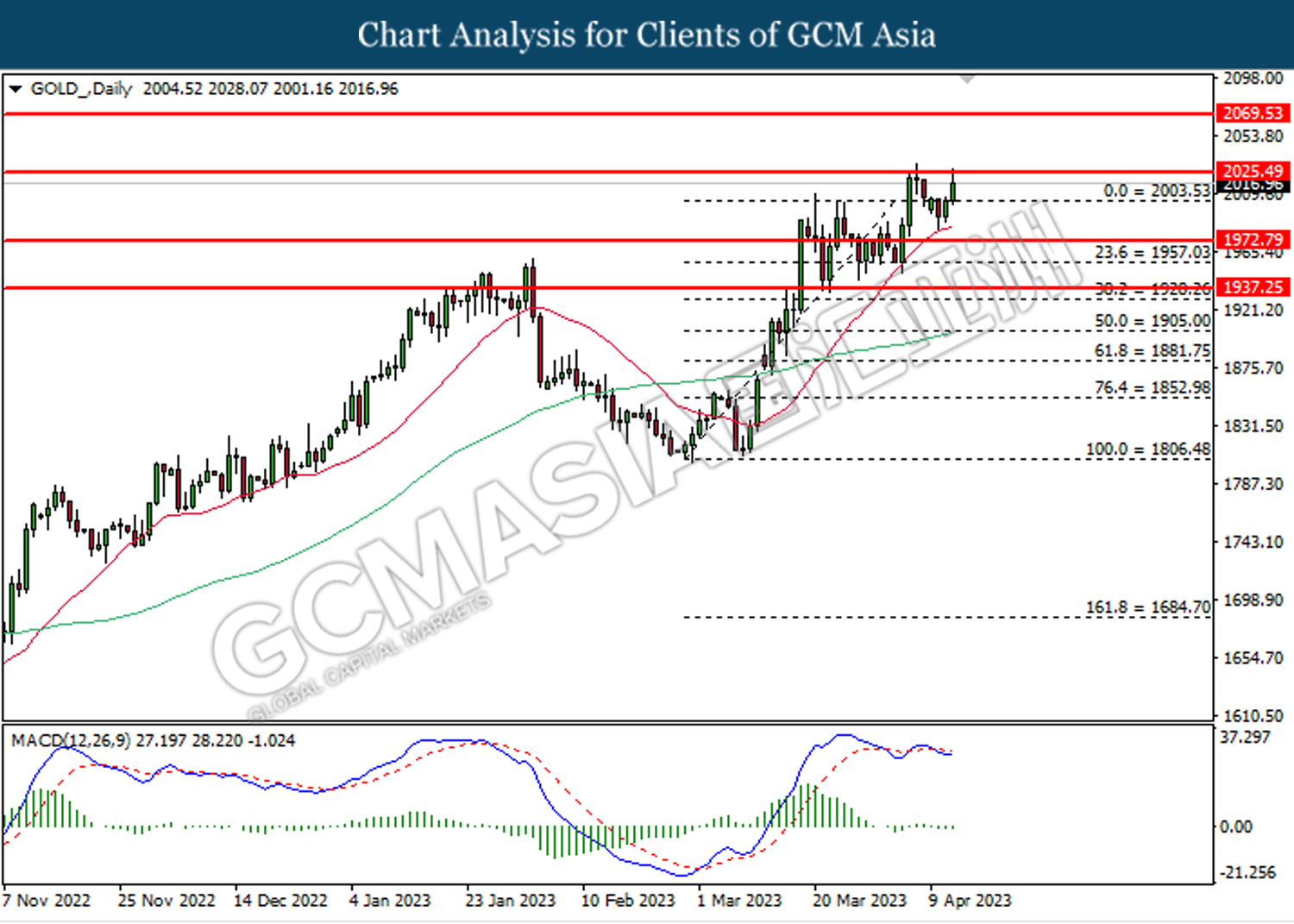

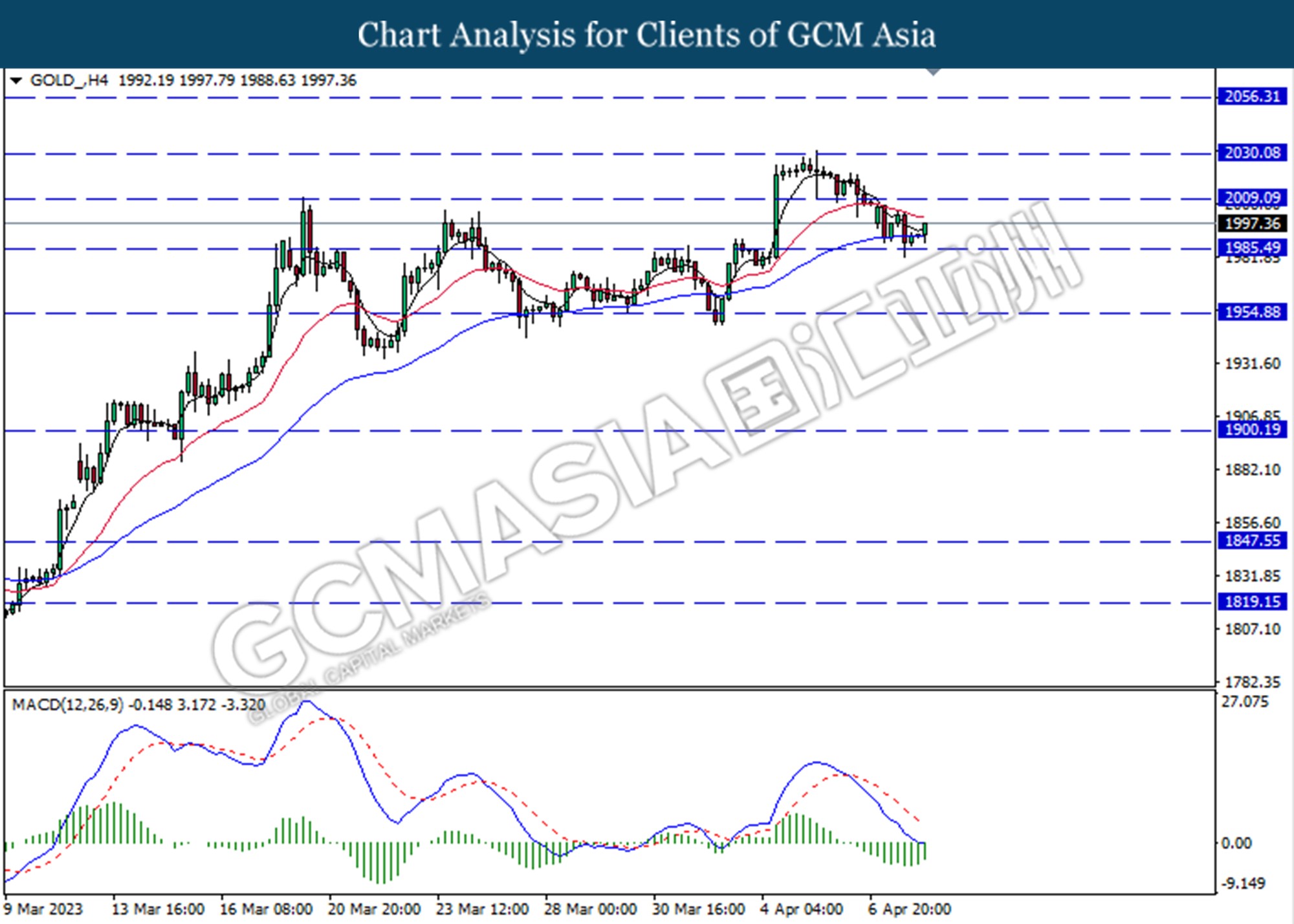

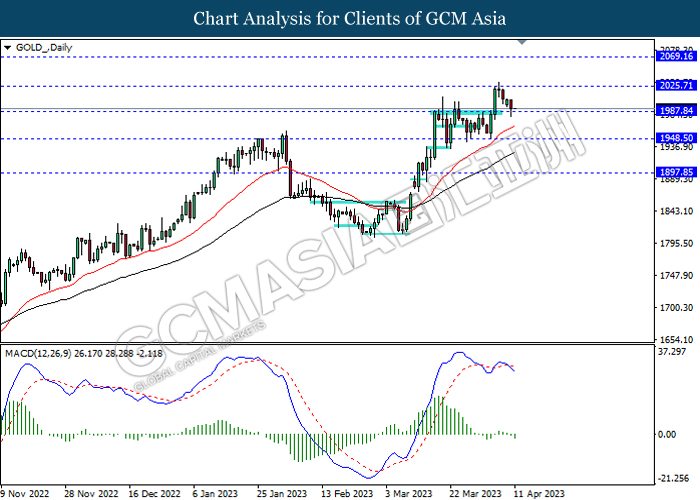

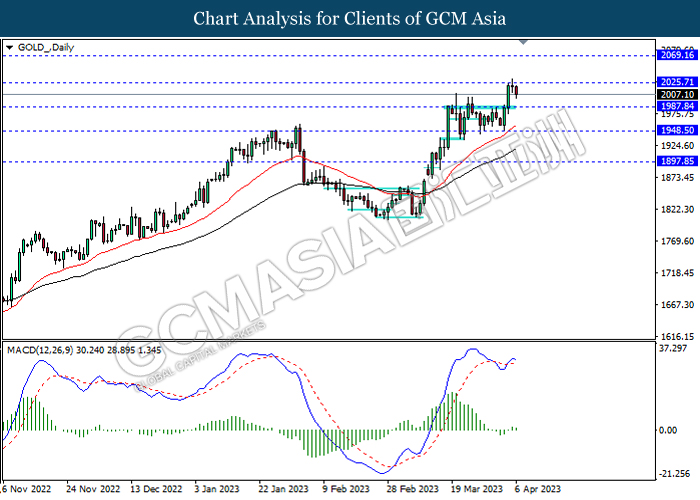

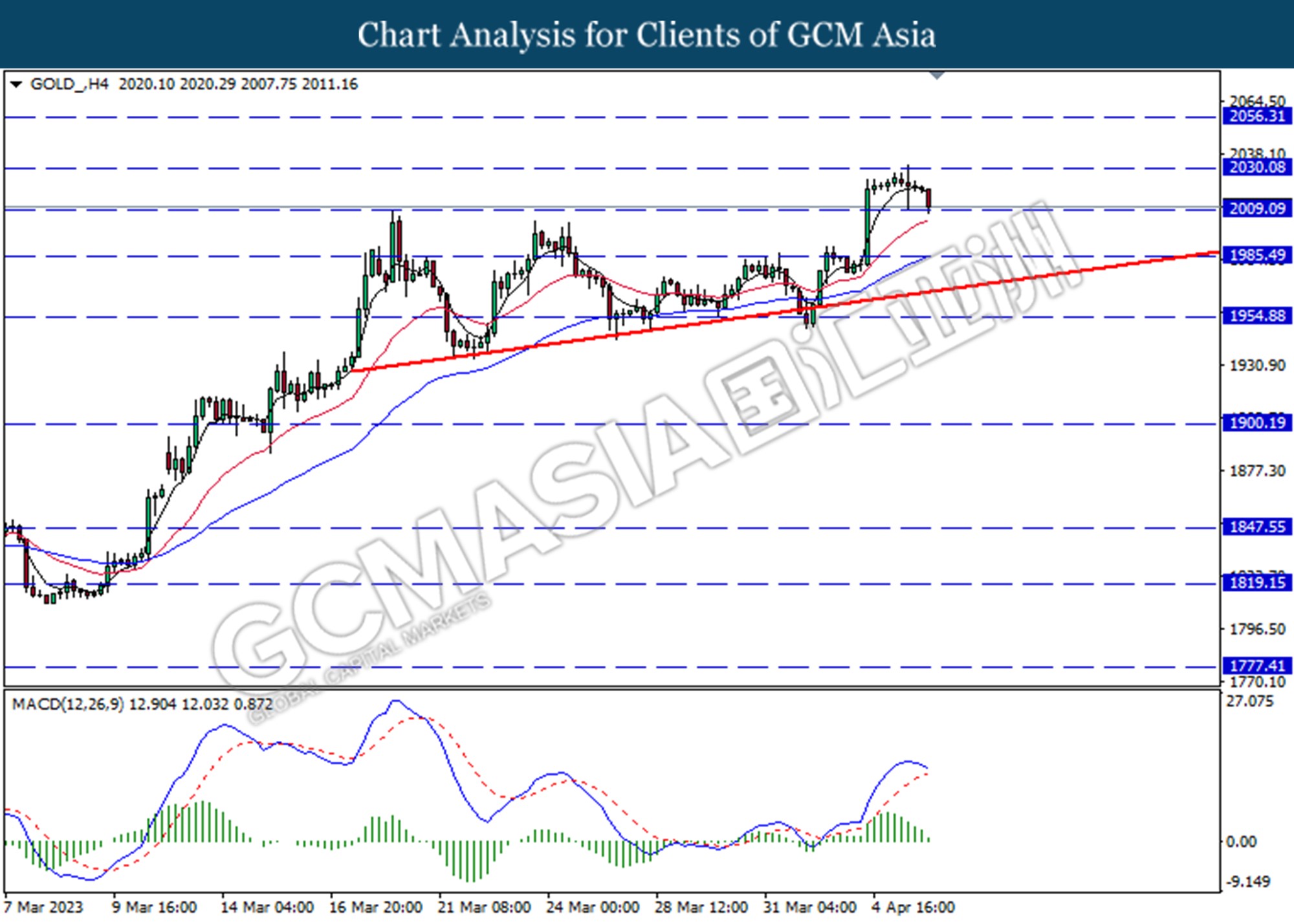

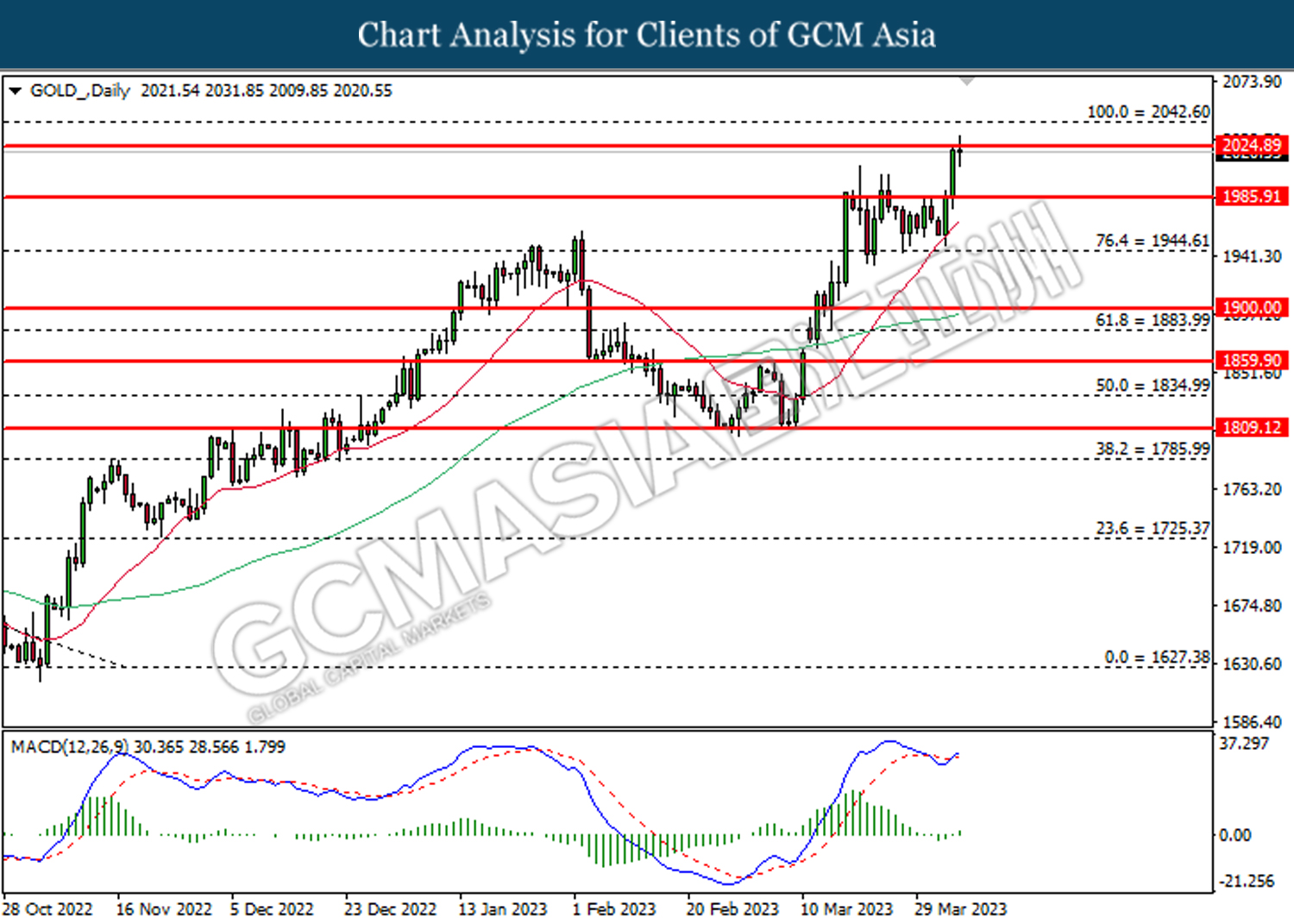

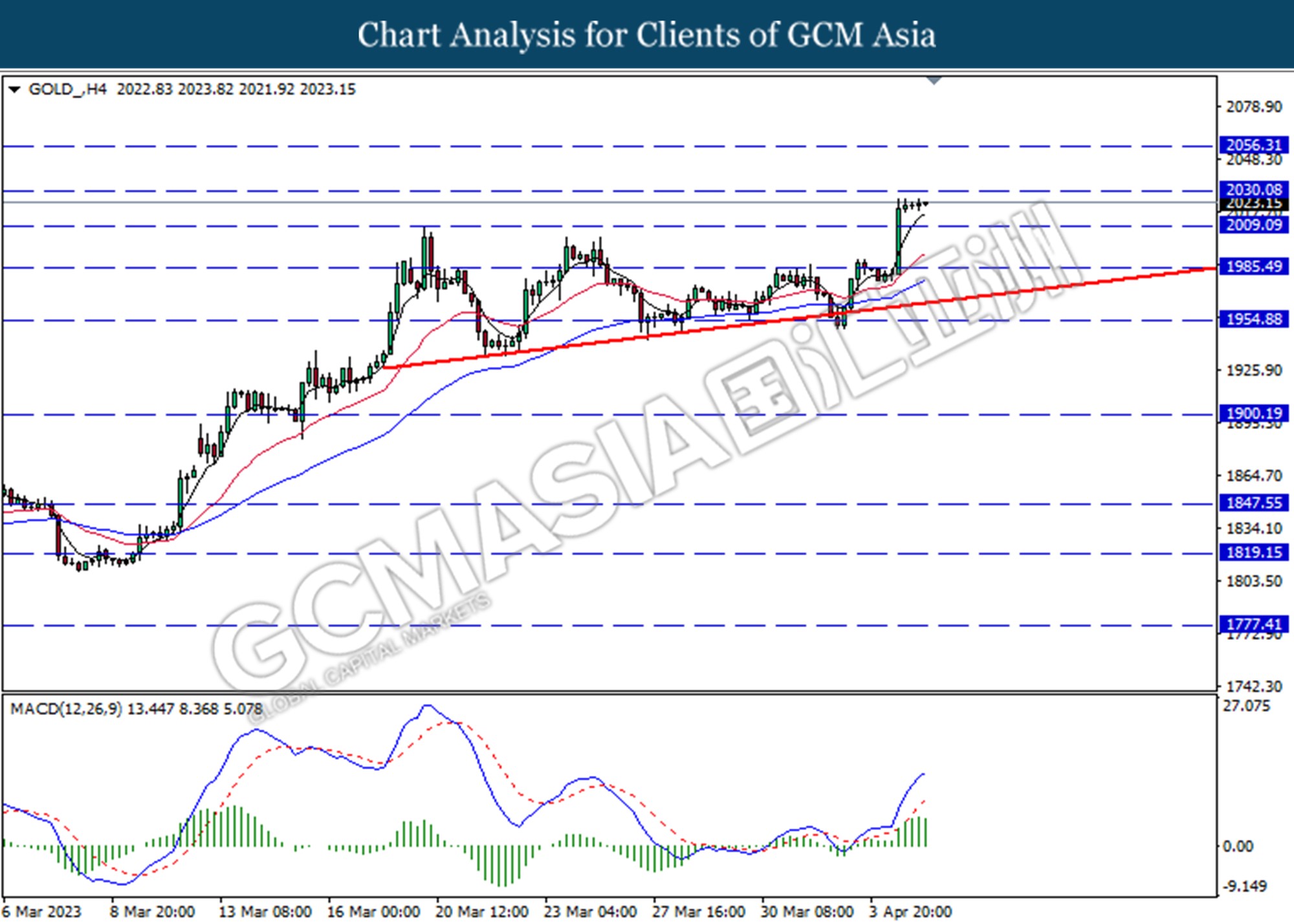

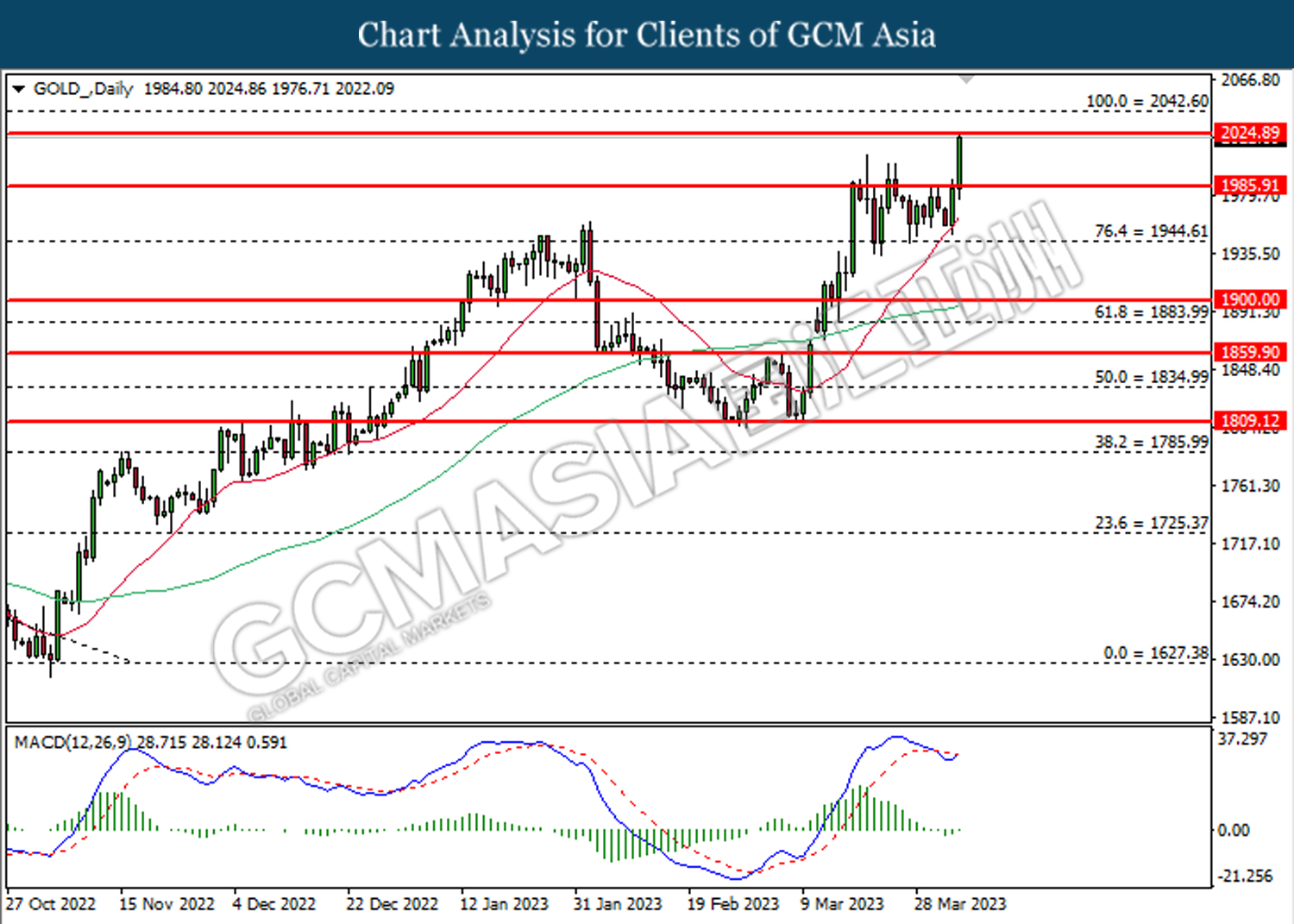

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 2069.15, 2105.95

Support level: 2025.70, 1987.85

130423 Afternoon Session Analysis

13 April 2023 Afternoon Session Analysis

Loonie lifted after BAC kept the interest rate steady.

The Canadian dollar rose for a fifth straight day, despite the Bank of Canada (BAC) keeping interest rates at a 15-year high of 4.5%. The central bank’s move was widely expected by economists after it had signaled a pause in raising rates after eight hikes since March 2022. One of the reasons the BAC paused its rates is that the effects of its previous rate hikes are starting to filter through the economy. The BAC paused rate hike was also supported by inflation data after falling for the fourth consecutive month, falling to 5.2% from 5.9% in February. Besides, Investors also increase the expectation that the inflation data for March, due next week, is expected to show that inflation has cooled. The BAC mentioned that the bank is confident of keeping rates on hold amid mounting evidence that inflation data has cooled. Besides, USD/CAD weakened further as yesterday’s US CPI data showed cooling. The U.S. Bureau of Labor Statistics data showed that the CPI data fell from 6.0% to 5.0%, higher than market expectations of 5.2%, further weighing on the dollar. It also prompted investors to think the Fed might pause its tightening efforts. As a result, the dollar faced a massive sell-off after the market raised the possibility of a pause in Fed tightening. As of writing, the USD/CAD edged down -0.055 to $1.3432.

In the commodities market, crude oil prices traded down by -0.35% to $82.97 per barrel after rising concern about recession fears. Besides, gold prices were appreciated by 0.22% to $2019.12 per troy ounce as the inflation eased and recession fears rise.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 228K | 232K | – |

| 20:30 | USD – PPI (MoM) (Mar) | -0.1% | 0.1% | – |

Technical Analysis

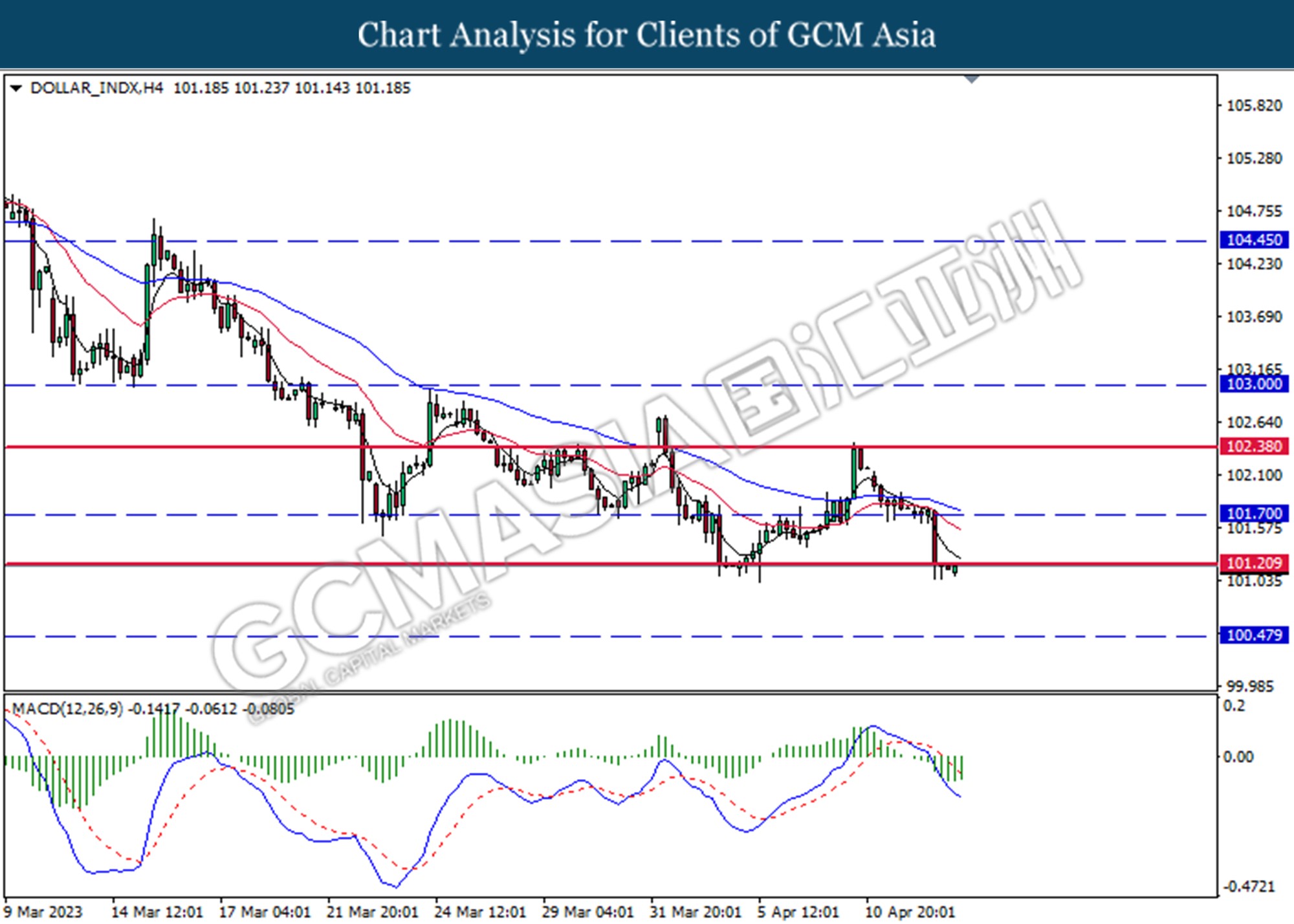

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 101.20. MACD which illustrated decreasing bearish momentum suggests the index extended its gains after it successfully breakout above the resistance level.

Resistance level: 101.70, 102.40

Support level: 101.20, 100.50

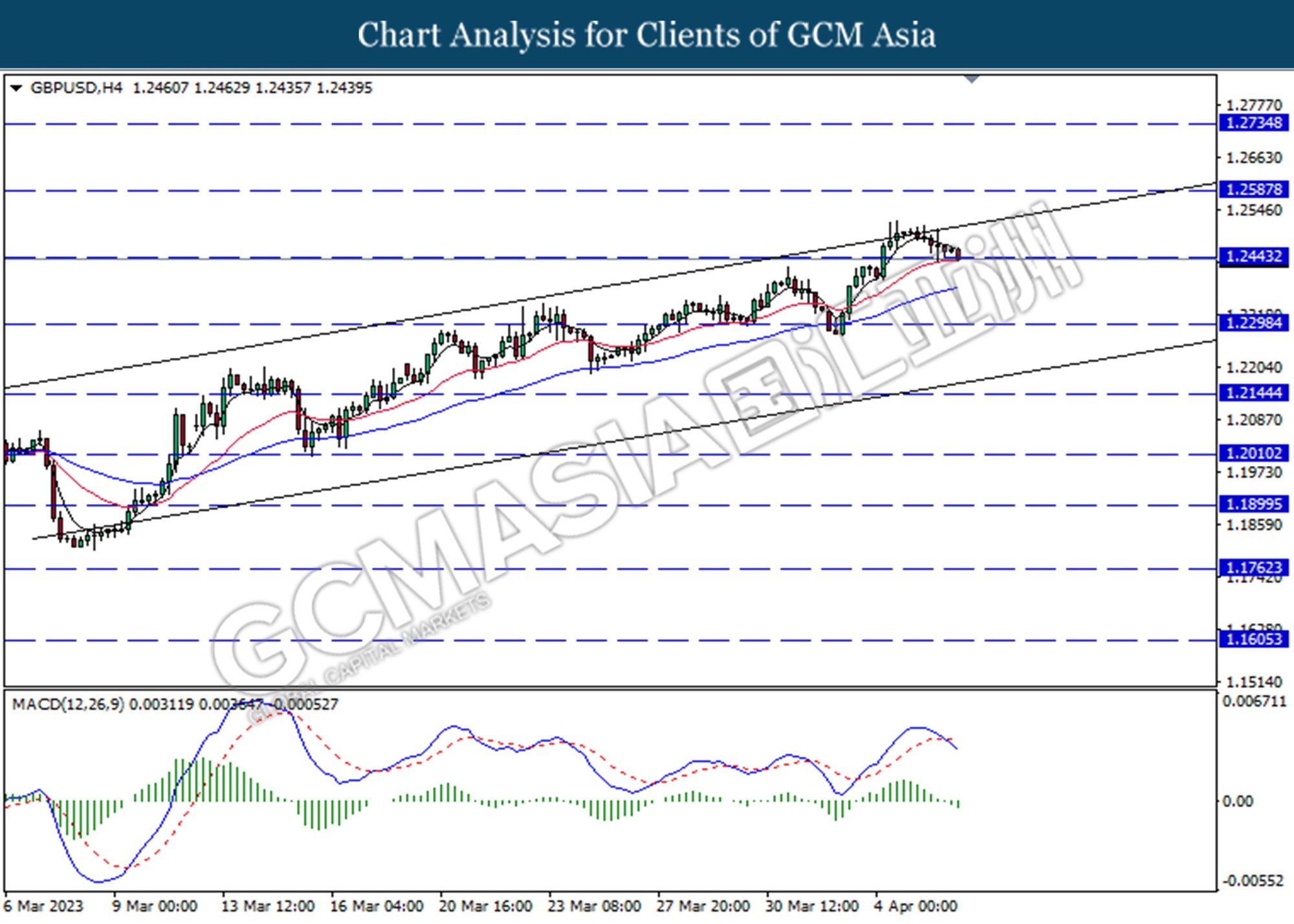

GBPUSD, H4: GBPUSD was traded higher following the prior break above the previous resistance level at 1.2445. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 1.2590.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

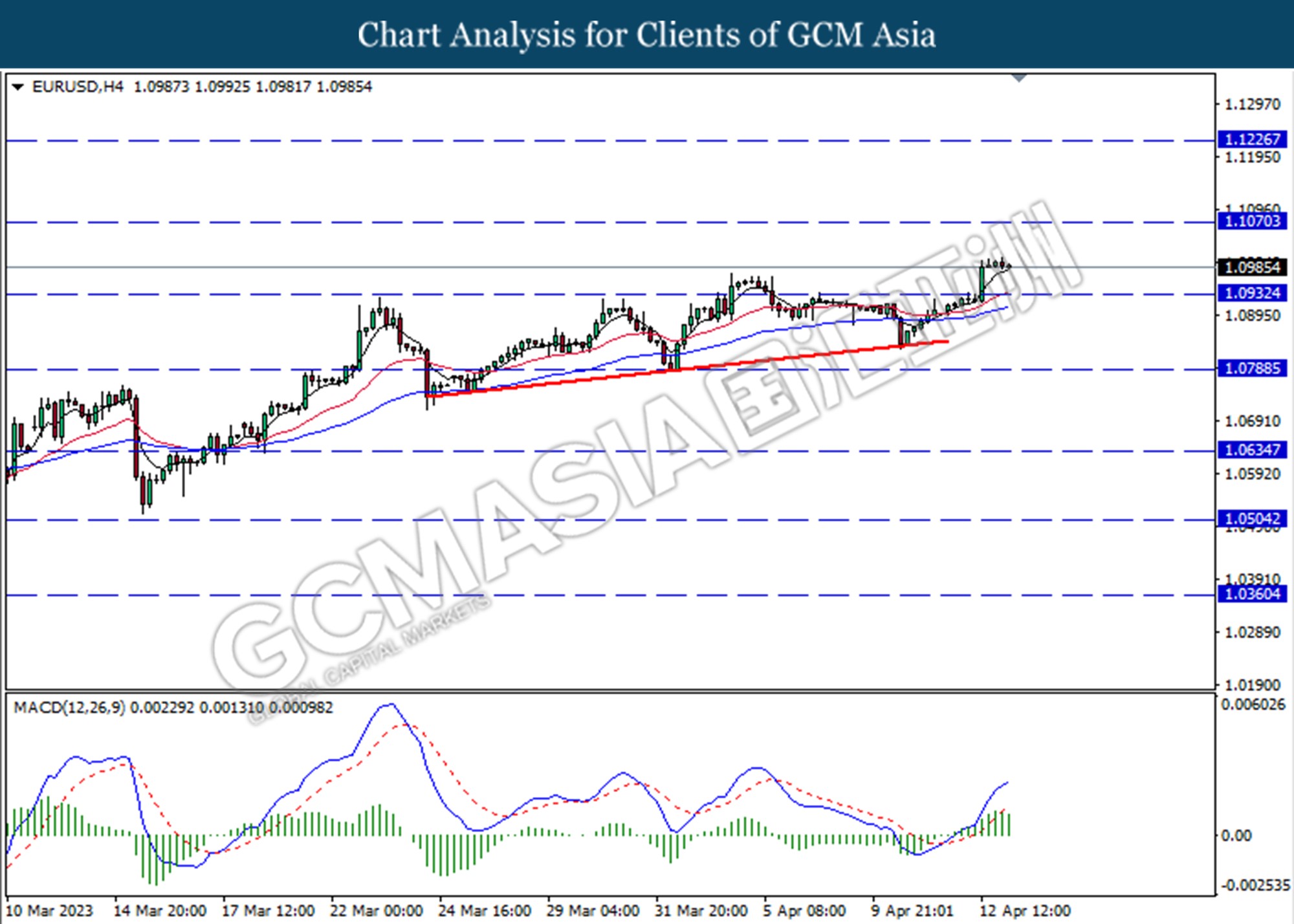

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated decreasing bullish bias momentum suggests the pair extended its losses toward the support level at 1.0930.

Resistance level: 1.1070, 1.1230

Support level: 1.0930, 1.0790

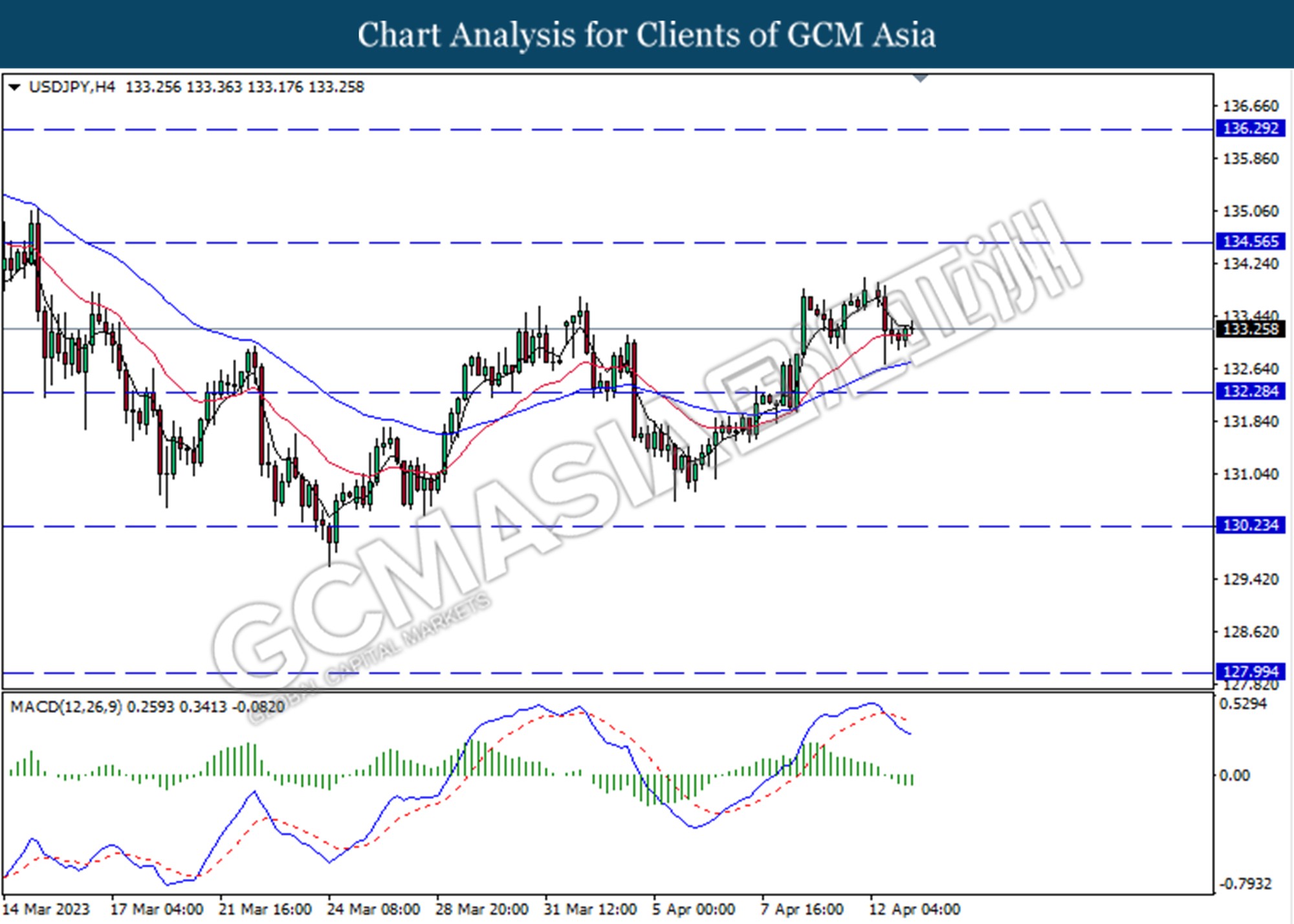

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6685. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0. 6775.

Resistance level: 0.6775, 0.6870

Support level: 0.66685, 0.6605

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6195. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3420. MACD which illustrated increasing bearish momentum suggests the pair extended its losses if successfully break below the support level.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.9005.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded higher following a prior break above the previous resistance level at 81.60. MACD which increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 85.25.

Resistance level: 85.25, 89.00

Support level: 81.60, 78.70

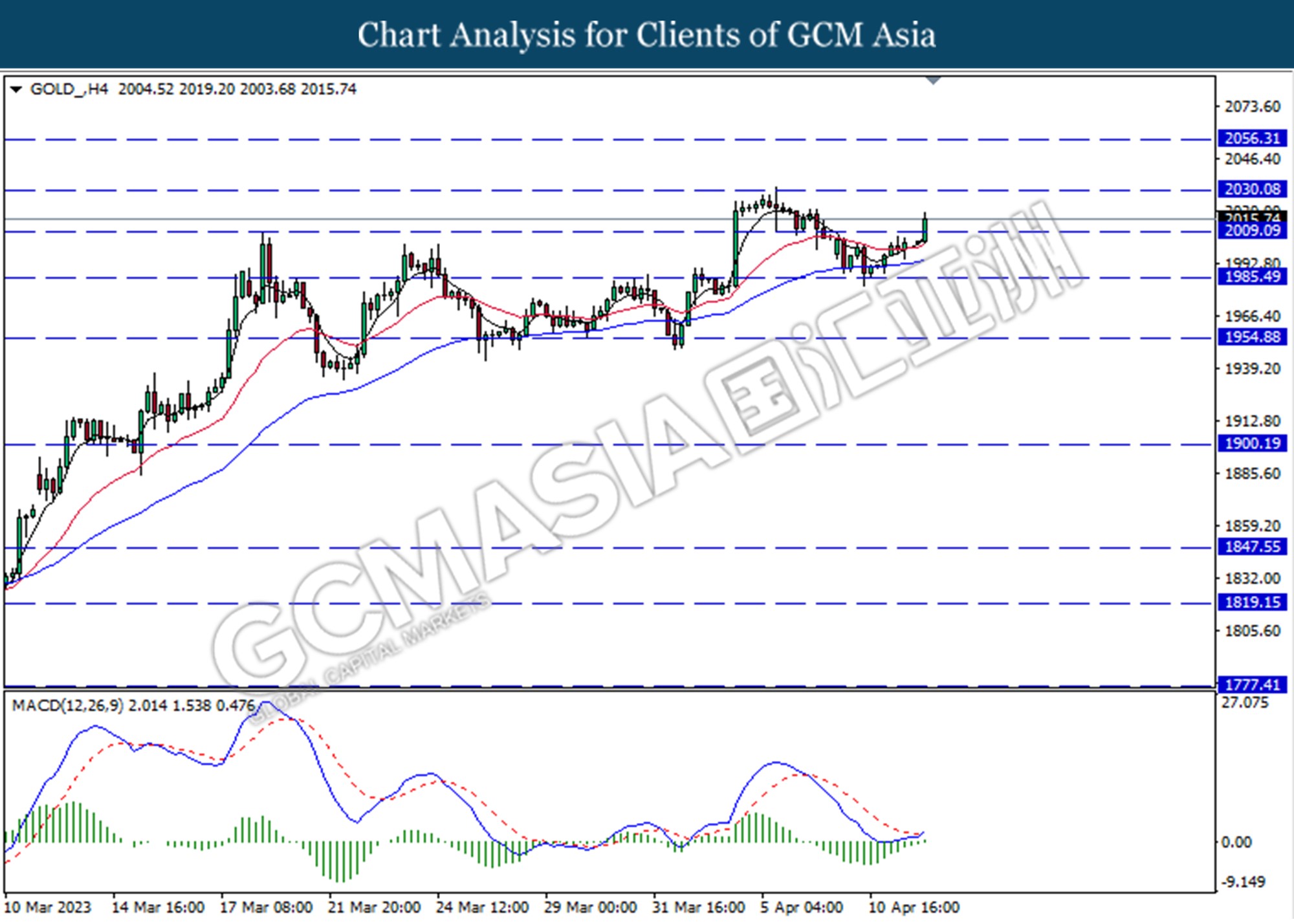

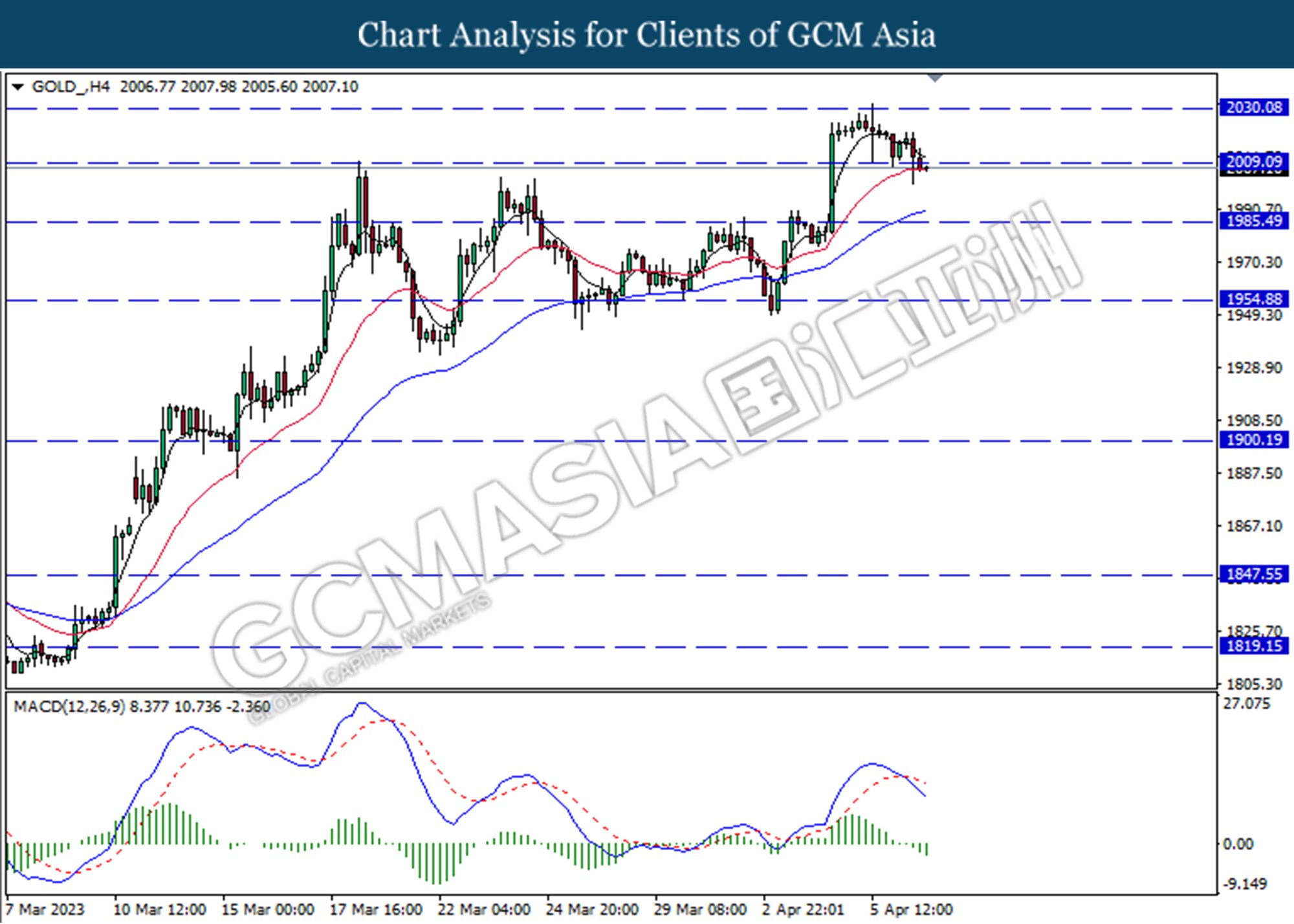

GOLD_, H4: Gold price was traded higher following a prior break above the previous resistance level at 2009.10. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 2030.10.

Resistance level: 2030.10, 2056.30

Support level: 2009.10, 1985.50

130423 Morning Session Analysis

13 April 2023 Morning Session Analysis

US dollar plunged amid inflation continued to ease.

The dollar index, which is traded against a basket of six mainstream currencies, lost its ground as the inflation data showed a sign of further cooling in March. Yesterday, the US Labor Department released the long-waited inflation data, Consumer Price Index (CPI). The data came in at 5.0%, significantly lower than the prior reading at 6.0%, while beating the consensus forecast at 5.2%, mirroring that the rate hikes plan successfully cooled down the inflationary pressures in the US. Besides, the core CPI, which excludes volatile items such as food and energy, increased by 0.4%, as widely expected. Since almost a year ago, the Fed has been implementing its rate hikes plan at an aggressive pace, a total of 9 times rate hikes that bring the benchmark interest rate to 4.75% as of last month’s central bank meeting. Notably, despite the sharp drop in March’s CPI figure, the US policymakers still target inflation around 2% as a healthy and sustainable growth level. Hence, the chances of one more rate hike in the upcoming meeting do not rule out from the table of the Fed. On top of that, the Fed meeting minutes released early today showed that the office of the Fed was considering pausing its rate hike due to their concerns about the contagion of recent banking turmoil. Besides, the financial chaos also led the members to forecast that the US economy might fall into a mild recession later this year. As of writing, the dollar index dropped -0.66% to 101.55.

In the commodities market, crude oil prices edged down by -0.24% to $83.00 per barrel after rising sharply amid the dollar weakening, which has prompted non-US oil buyers to rush into the oil market. Besides, gold prices were traded up by 0.05% to $2015.00 per troy ounce as the CPI data showed further signs of cooling inflation.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) (Feb) | 0.3% | 0.1% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Feb) | -0.4% | 0.2% | – |

| 14:00 | EUR – German CPI (MoM) (Mar) | 0.8% | 0.8% | – |

| 20:30 | USD – Initial Jobless Claims | 228K | 232K | – |

| 20:30 | USD – PPI (MoM) (Mar) | -0.1% | 0.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2405. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2510, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0915. MACD which illustrated bullish bias momentum suggest the pair to extend its extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.05. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6290. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3485. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3395.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8995. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully close below the support level.

Resistance level: 0.9075, 0.9125

Support level: 0.9000, 0.8930

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.80. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 81.80, 87.75

Support level: 79.65, 76.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2025.50. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2025.50, 2069.55

Support level: 2003.55, 1972.80

120423 Afternoon Session Analysis

12 April 2023 Afternoon Session Analysis

Loonie steady ahead of Bank of Canada interest rate decision.

The Canadian dollar strengthened against the greenback ahead of the Bank of Canada (BAC) interest rate decision. The BAC meeting on Wednesday is expected to pause, leaving the cash rate unchanged at a 15-year high of 4.50%. According to Governor Macklem’s speech, the BAC is highly like to “conditional pause” on the rate hike following the battle against inflation is moving in the right direction. The recent data showed CPI data falling from 5.9% to 5.2% in February and the labor market remains robust with the economy adding 34.7k jobs in March. However, a rate hike would hurt the consumer and businesses which are struggling under the high-interest rates. The Lonnie rises despite central bank no rate hike expectations. The Loonie appreciation was largely attributed to the optimistic outlook for crude oil as crude oil is one of the larger exports of Canada. According to the U.S. Energy Information Administration (EIA) statement, crude oil prices are expected to rise by $2 in the short term due to massive production cuts by OPEC and Russia. Besides, investors are keeping an eye on the US CPI data release today. As of writing, the USDCAD slipped -0.03% to $1.3462

In the commodity market, the crude oil price rose by 0.01% to $81.54 per barrel as of writing after the EIA report showed optimism about the short-term outlook for crude oil. On the other hand, the gold price gained by 0.66% to $2032.15 per troy ounce as of writing following investors awaited for CPI report announces.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 GBP BoE Gov Bailey Speaks

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

2:00 USD FOMC Meeting Minutes (13th April)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Mar) | 0.50% | 0.40% | – |

| 20:30 | USD – CPI (MoM) (Mar) | 0.40% | 0.30% | – |

| 20:30 | USD – CPI (YoY) (Mar) | 6.00% | 5.20% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.739M | -2.329M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for the support level at 101.70. MACD which illustrated decreasing bullish momentum suggests the index extended losses after successfully break below the support level.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.50

GBPUSD, H4: GBPUSD was traded higher while currently testing for the resistance level at 1.2440. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully break above the resistance level.

Resistance level: 1.2440, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded higher while currently testing for the resistance level at 1.0930. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully break above the resistance level.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lower level. However, MACD which illustrated decreasing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following a prior rebound form the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded lower following a prior breakout below the previous support level at 0.6195. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 0.6120.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded lower following a prior retracement from the resistance level at 1.3515. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.3420

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded lower following a prior breakout below the previous support level at 0.9090. MACD which illustrated increasing bearish momentum suggests the pair to extended its losses toward the support level at 0.9005.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded higher while currently testing for the resistance level at 81.60. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains if successfully break above the resistance level.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

GOLD_, H4: Gold price was traded higher following a prior breakout above the prior resistance level at 2009.10. MACD which illustrated decreasing bearish momentum suggests the commodity extended its gains to the resistance level at 2030.10

Resistance level: 2030.10, 2056.30

Support level: 2009.10, 1985.50

120423 Morning Session Analysis

12 April 2023 Morning Session Analysis

US Dollar dived as IMF downgraded its growth estimations.

The Dollar Index which traded against a basket of six major currencies dropped significantly amid the background of reducing global economic growth forecast by International Monetary Fund (IMF). According to CNBC, the IMF anticipated that the global growth for this year would reach 2.8% and 3% for the year of 2024. Nonetheless, the growth rate was slightly lower than the estimation in January by 0.1% for both years. Besides, the IMF also claimed that the prediction released was based on what has happened so far, such as aggressive tightening monetary policy by major banks, collapses of big banks from deteriorating inn financial conditions, the continuation of war between Russia-Ukraine and so on. In the point of view of IMF, the banking crisis would likely to exacerbate and it might lead to a hard landing for global growth, which prompting major banks to reconsider their monetary policy. Investors were once again in the dark about the state of America’s banks, as the IMF indirectly pointed out that their failures were caused by sharp interest rate rises. With that, it might influence Fed to take back its rate hike in the next meeting. Though, it is note-worthy that decision of interest rate would highly depend on today’s CPI data. As of writing, the Dollar Index edged down by 0.01% to 101.83.

In the commodity market, the crude oil price rose by 0.01% to $81.58 per barrel as of writing ahead of announcement of CPI data. On the other hand, the gold price raised by 0.08% to $2005.14 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 GBP BoE Gov Bailey Speaks

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

2:00 USD FOMC Meeting Minutes (13th April)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Mar) | 0.50% | 0.40% | – |

| 20:30 | USD – CPI (MoM) (Mar) | 0.40% | 0.30% | – |

| 20:30 | USD – CPI (YoY) (Mar) | 6.00% | 5.20% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.739M | -2.329M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded lower following prior retracement form the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to traded higher as technical correction.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 86.40, 91.85

Support level: 81.30, 76.80

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50

110423 Afternoon Session Analysis

11 April 2023 Afternoon Session Analysis

Aussie rebounded after upbeat economic data released.

The Aussie dollar rebounded after a series of upbeat economic data released during the Asian trading hours. Australian consumer confidence surged 9.4%, beating market expectation at 1.5%, according to the Westpac Consumer Confidence Statement. The survey was conducted over the four days of April 4 – 6 with about 1200 consumers on the board. Judging by the survey result, the index’s strong recovery was largely attributed to the decision of the Reserve Bank of Australia (RBA) to pause its cash rate increase at the April meeting. Besides, the confidence amongst respondents with a mortgage lifted by 12.2% although it is still below its 14.5% level before RBA tightening cycle began. However, both data still indicated an increase in consumer confidence, boosting consumer spending. Moreover, business confidence continued to show resilience in March, despite the reading remaining 1 index point below the long-run average According to National Australia Bank (NAB) statement, the reading grew higher than the prior reading’s -4 and out beat market expectation at the index level at -2. Importantly, price and cost growth measures showed a sign of easing in March. A series of optimistic data increased the odds of maintaining the central bank stance on tightening monetary policy. Also, the Westpac’s economists are expecting a 25-basis points rate hike at the May board meeting. As of writing, the AUD/USD appreciated by 0.49% to $0.6669.

In the commodity market, the crude oil prices edged up by 0.73% to $80.33 per barrel as of writing, buoyed by China tourism hopes. On the other hand, the gold price was traded up by 0.46% to $2012.95 per troy ounce as of writing amid investors awaited the release of the CPI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the index extended its losses toward the support level at 101.70.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 1.1245.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded lower higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 1.0930.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 132.30.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following a prior rebounded from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following a prior rebounded from the support level at 0.6195. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower following a prior breakout below the previous support level at 1.3515. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses towards the support level at 1.3420.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded lower following a prior breakout below the previous support level at 0.9090. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses towards the support level at 0.9005.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the commodity extended its gains toward the resistance level at 81.60.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

GOLD_, H4: Gold price was traded higher following a prior rebound from the support level at 1985.50. MACD which illustrated decreasing bearish momentum suggests the commodity extended its gains toward the resistance level at 2009.10.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90

110423 Morning Session Analysis

11 April 2023 Morning Session Analysis

US Dollar surged amid the background of weakening Yen.

The Dollar Index which traded against a basket of six major currencies resume its luster on Monday following the depreciation of Japanese Yen. According to Reuters, the Bank of Japan (BoJ) Governor Kazuo Ueda claimed on yesterday that the central bank was not hurry to step back from its ultra-loose monetary policy for stimulating economic growth. Following to that, it led to the larger divergence between Fed and BoJ monetary policy, as the US central bank would likely to raise its interest rate again after the employment data signaled that the US labor market remained hot and resilient. Thus, it prompted investors to flee away from Japan market, as well as shifting their capitals toward US Dollar. Besides, the gains of Dollar Index was extended amid the hawkish statement by Fed official. Federal Reserve Bank of New York President John Williams said on Monday that the aggressive rate hike was not the main issue that driving to the collapse of banks in March. In other words, it was a lapse in the bank’s management of assets and funds, which easing the worries over banking crisis. By now, investors would highly eye on the announcement of CPI data in order to gauge the next step of Fed. As of writing, the Dollar Index rose by 0.50% to 102.23.

In the commodity market, the crude oil price appreciated by 0.14% to $79.85 per barrel as of writing after a sharp decline throughout overnight trading session following the hawkish statement of Fed. On the other hand, the gold price edged up by 0.02% to $1991.72 per troy ounce as of writing over the retracement of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses is successfully breakout the support level.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded lower following prior retracement form the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50

100423 Afternoon Session Analysis

10 April 2023 Afternoon Session Analysis

Euro dipped despite ECB’s Knot hawkish speech.

The single currency in the Eurozone, which is majorly traded by global investors, failed to extend its rally last Friday despite ECB’s Knot hawkish statement. Klaas Knot, the Dutch central bank governor and a leading policy hawk, commented in the NRC newspaper’s interview that the ECB is certainly not done with interest rate hikes at this point in time. It brings a thought that the European Central Bank (ECB) has to continue raising the cash rate to cool down the still-high inflation. He added that the current 3% interest rate is far from the level to bring down the 6% of core inflation, therefore, the upcoming rate hike needs to be 25 basis points or 50 basis points. Besides, he also highlighted that the chance of a rate cut this year is almost impossible, whereby hinted that the cash rate would be stayed at a high level for an extended period of time, possibly until the end of this year. As of writing, the pair of EUR/USD rose 0.03% to 1.0900.

In the commodities market, crude oil prices edged up by 0.32% to $80.60 per barrel as the oil supply remained tight, especially after the extra oil cut plan by OPEC+ last week. Besides, gold prices edged down by -0.92% to $1989.45 per troy ounce as the US unemployment rate dropped below the expectation.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Easter

All Day EUR Germany – Easter

All Day CHF Switzerland – Easter

All Day AUD Australia – Easter

All Day NZD New Zealand – Easter

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 101.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2510, 1.2645

Support level: 1.2405, 1.2300

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0770.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 130.70. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 133.05.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3485. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3565.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9075, 0.9125

Support level: 0.9000, 0.8930

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 81.70, 87.75

Support level: 79.65, 76.10

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 2003.55. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1972.80.

Resistance level: 2003.55, 2021.15

Support level: 1972.80, 1957.00

100423 Morning Session Analysis

10 April 2023 Morning Session Analysis

US Dollar climbed amid upbeat job report.

The Dollar Index which traded against a basket of six major currencies received some spotlight on last Friday following the economic data shown the labor market in the US remained resilient. According to Bureau of Labor Statistics, the US Nonfarm Payrolls for March posted at the reading of 236K, as well as it slid from the previous reading of 326K. Nonetheless, the actual reading of NFP was close to economists’ forecast. Besides, the US Unemployment Rate that released at the same time, notched down from the prior 3.6% to 3.5%, which providing more spaces to Fed for rate hike implementation. Currently, the possibility of 25 basis point hike in May meeting has reached 68.3%, according to CME Fed Watch Tool. However, the gains experienced by the Dollar Index was limited, as the market are anticipating that multiple rate cuts have been factored in by the end of the year. Going back to what the Fed Chairman Jerome Powell said at the March meeting, there would likely to have one more rate hike in this year, and the central bank would pause the process after that. Though, he emphasized that the decision was data-dependent. Consequences, the essential inflation data – CPI that would be announced on this week might be the main key to influent the Fed’s interest rate decisions. As of writing, the Dollar Index edged down by 0.02% to 101.71.

In the commodity market, the crude oil price rose by 0.40% to $81.02 per barrel as of writing following the India’s oil import has reached a new high. On the other hand, the gold price dropped by 0.23% to $2003.21 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Easter

All Day EUR Germany – Easter

All Day CHF Switzerland – Easter

All Day AUD Australia – Easter

All Day NZD New Zealand – Easter

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded lower following prior retracement form the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50

070423 Afternoon Session Analysis

7 April 2023 Afternoon Session Analysis

Canada slips as investors shrug off jobs gain.

The Canadian dollar edged lower against its US counterpart as investors shrugged off jobs gain. According to Statistics Canada, the country added 34.7k jobs to the market upbeat market expectations of 21.8k and prior reading 12k. That suggests that labor conditions are improving as unexpectedly strong job growth typically signals a strong economy. Data also suggests consumer spending in Canada will improve as positive employment changes. However, the Canada unemployment rate remained sticky at 5.0%, same as previous reading, upbeat the market expectations of 5.1%. The Canadian economic activity seemed to expand as Ivey’s PMI rose to 58.2 from 51.6 in February. The main contributions of the PMI in March are from employment and inventory orders climbed. The stronger-than-expected labor data and PMI index will spur the Bank of Canada to resume its rate hike. However, the positive economic data failed to stop the gains of USD/CAD as the greenback rebounded yesterday. The weekly initial jobless claims reduced from 246k to 228k, and it is lower than the reading of 4 weeks average at 237k, which had boosted the dollar rebounded from its recent low. As of writing, the pair of USD/CAD slipped -0.02% to $1.3489.

In the commodity market, the crude oil prices were traded lower by -0.17% to $80.47 per barrel as of writing amid the investor has priced in the impact of OPEC supply cut. Besides, the gold price edged down by -0.57% to $2023.90 per troy ounce as of writing as investors awaits for Non-farm payroll data to release.

Today’s Holiday Market Close

Time Market Event

All Day NZD New Zealand – Good Friday

All Day CAD Canada – Good Friday

All Day GBP United Kingdom – Good Friday

All Day AUD Australia – Good Friday

All Day CHF Switzerland – Good Friday

All Day EUR Germany – Good Friday

All Day USD United States – Good Friday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Mar) | 311K | 238K | – |

| 20:30 | USD – Unemployment Rate (Mar) | 3.6% | 3.6% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggests the index to extended its gains toward the resistance level at 101.70

Resistance level: 101.70, 103.00

Support level: 100.35, 99.35

GBPUSD, H4: GBPUSD was traded higher while currently testing for the resistance level at 1.2445. MACD which illustrated decreasing bearish momentum suggests the extended its gains after it successfully breakout below the resistance level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

EURUSD, H4: EURUSD was traded lower following a prior retracement from the resistance level at 1.0930. However, MACD which illustrated decreasing bearish momentum suggests the pair to be traded higher as technical correction.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded lower following a prior retracement from the resistance level at 1.0930. However, MACD which illustrated increasing bullish momentum suggests the pair to be traded higher as technical correction.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded higher following a prior rebounded from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6605, 0.6525

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher following rebounded from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 1.3515

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded lower following a prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from the higher level. MACD which illustrated bearish momentum suggests the commodity to be traded higher as technical correction.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

GOLD_, H4: Gold price was traded lower following a prior break below from the previous support level at 2009.10. MACD which illustrated increasing bearish momentum suggests the commodity extended its losses toward the support level at 1985.50.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90

070423 Morning Session Analysis

7 April 2023 Morning Session Analysis

US Dollar beaten down by bearish economic data reading.

The Dollar Index which traded against a basket of six major currencies lost its appeal on yesterday after the pessimistic economic data has been unleashed. According to the US Department of Labor, the US Initial Jobless Claims came in at the reading of 228K, exceeding the market expectation of 200K. Not only that, a series of employment data released this week such as JOLTs Job Openings and ADP Nonfarm Employment Change had also disappointed most of investors, while it indicated that the fatigued and weakness of the US labor market. On the other hand, it also signaled that the bankruptcy of big banks which happened last month has brought much negative impacts toward economic progression in the US. As evidence, the weakened economic data such as ISM Non-Manufacturing Purchasing Managers Index bear this out. Consequences, market participants would likely to anticipate a pause on Fed’s rate hike path when the initial jobless claims reports announced. Nonetheless, the losses of Dollar Index was limited following the hawkish statement presented by Fed officials. St. Louis Fed President James Bullard claimed on Thursday that the Fed should keep on raising interest rate as the inflation risk still remained ‘too high’. At this juncture, the announcement of NFP data tonight would gather most attention of investors. As of writing, the Dollar Index appreciated by 0.06% to 101.60.

In the commodity market, the crude oil price dropped by 0.17% to $80.47 per barrel as of writing following the bearish economic data has dialed down the market demand for oil. Besides, the gold price edged up by 0.03% to $2008.01 per troy ounce as of writing over the depreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day NZD New Zealand – Good Friday

All Day CAD Canada – Good Friday

All Day GBP United Kingdom – Good Friday

All Day AUD Australia – Good Friday

All Day CHF Switzerland – Good Friday

All Day EUR Germany – Good Friday

All Day USD United States – Good Friday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Mar) | 311K | 238K | – |

| 20:30 | USD – Unemployment Rate (Mar) | 3.6% | 3.6% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded lower following prior retracement form the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50

060423 Afternoon Session Analysis

06 April 2023 Afternoon Session Analysis

Euro slipped despite the strongest pace of economic growth.

The Eurodollar slipped despite the strongest pace of economic in the Eurozone. Referring to S&P Global, the Eurozone composite PMI grew from 52.0 to 53.7, primarily contributed by Spain’s business activity. Spain’s economic output was the top performing country in March with a 58.2 composite PMI Output index and hit the 16-month high. However, Germany and France, the euro zone’s two largest economies, lagged at 52.6 and 52.7 respectively but still hit the fresh 10-month highs. As result, the eurozone economy rounded off in the first quarter with a third consecutive monthly expansion in the private sector, signaling a marked improvement in the overall economy. Manufacturing activity picked up slightly, but the service sector had the strongest influence in the overall economy. Meanwhile, the eurozone business remains optimistic on the following 12-month outlook with outstanding confidence level. However, the optimistic economic outlook did not support the pair of EUR/USD to spike as the US dollar rebounded yesterday. The US dollar rebounded as investors secured their profit ahead of the Non-Farm Payroll report. As of writing, the EUR/USD slipped by -0.11% to $1.0891.

In the commodities market, crude oil prices depreciated by -0.92% to $79.87 per barrel as of writing amid the weakening economic condition in the US. On the other hand, gold prices slipped by -0.17% to $ 2017.15 per troy ounce as the dollar strengthened

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Mar) | 54.6 | 53.5 | – |

| 20:30 | USD – Initial Jobless Claims | 198K | 200K | – |

| 20:30 | CAD – Employment Change (Mar) | 21.8K | 12.0K | – |

| 22:00 | CAD – Ivey PMI (Mar) | 51.6 | 56.1 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing for the resistance level at 101.70. MACD which increasing bullish momentum suggests the index extended its gains after it successfully breakout below the resistance level.

Resistance level: 101.70, 103.00

Support level: 100.35, 99.35

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2445. MACD which illustrated increasing bearish momentum suggest the pair extended its losses if successfully breaks below the support level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded lower following a prior break below the previous support level at 1.0930. MACD which illustrated increasing bearish momentum suggest the pair extended its losses toward the support level at 1.0790.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair extended its gains toward the resistance level at 132.30.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggest the pair extended it losses toward the support level at 0.6685.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6325. MACD which illustrated increasing bearish momentum suggest the pair extended its losses toward the support level at 0.6265.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

USDCAD, H4: USDCAD was traded higher following the prior rebound from the support level at 1.3420. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3515.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair extended its gains towards the resistance level at 0.9090.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggest the commodity extended its losses toward the support level at 78.70.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

GOLD_, H4: Gold price was traded lower following a prior break below the previous support level at 2009.10. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 1985.50.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90

060423 Morning Session Analysis

06 April 2023 Morning Session Analysis

US dollar survived against the backdrop of downbeat economic data.

The dollar index, which is traded against a basket of six major currencies, managed to hold its ground after hitting the lowest level in two months despite the yesterday’s disappointing economic data. According to the Automatic Data Processing (ADP), the US Nonfarm Employment Change experienced a sharp drop in the past month, where the data reduced from 261K to 145K, weaker than consensus forecast at 200K. The downbeat data has pointed that the US labor market started to moderate after a series of rate hikes by the Federal Reserve. The situation turned even worst after the ISM reported that the US services activity decelerated. According to the Institute for Supply Management (ISM), the US Non-Manufacturing PMI fell to 51.2 in March from 55.1 in February, showing the impact of persistent rate-hike against the sector was obvious and significant. Despite, the dollar index recovered from its low as the investors lightened their short positions to book profits ahead of the all-time crucial labor data, which is the US Nonfarm Payroll. As of writing, the dollar index rose 0.29% to 101.90.

In the commodities market, crude oil prices ticked up by 0.20% to $80.40 per barrel as the past week’s US crude oil inventories fell by a bigger amount compared to the consensus forecast, according to the data from EIA. Besides, gold prices edged down by -0.02% to $2020.30 per troy ounce while the investors are eyeing on the Nonfarm payroll report.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Mar) | 54.6 | 53.5 | – |

| 20:30 | USD – Initial Jobless Claims | 198K | 200K | – |

| 20:30 | CAD – Employment Change (Mar) | 21.8K | 12.0K | – |

| 22:00 | CAD – Ivey PMI (Mar) | 51.6 | 56.1 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2325. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 1.2645.

Resistance level: 1.2645, 1.2765

Support level: 1.2425, 1.2300

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. However, MACD which illustrated bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 130.70. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3485.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3245

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9070. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 81.70, 87.75

Support level: 79.65, 76.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2024.90. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2024.90, 2042.60

Support level: 1985.90, 1944.60

050423 Afternoon Session Analysis

05 April 2023 Afternoon Session Analysis

RBNZ lifted cash rate, kiwi soared up.

The Reserve Bank of New Zealand (RBNZ) unexpectedly life the Official Cash Rate (OCR) by 50 basis points, and the Kiwi soared up. The board member agreed to increase the cash rate by 50 basis points from 4.75% to 5.25% as inflation is high and persistent. The RBNZ’s interest rate decision beat investors’ expectations as investors had been pricing in a 25-basis point hike. The strength of the Kiwi supported the strong buying momentum on the pair of NZDUSD from investors. Before that, goods and services were disrupted as severe storm weather hit the North Island. As a result, inflation in New Zealand will remain high for a long time due to the reduction in supply. In addition, the board recognizes that the labor market is beyond the maximum suitable level as the recent data showed unemployment rate stood at 3.4%. The strong labor market gives the RBNZ more room to raise interest rates sharply, bringing inflation back to its target range of 1% to 3%. As of writing, the NZDUSD appreciated 0.67% to $0.6352.

In the commodities market, crude oil prices edged up by 0.50% to $81.11 per barrel as the US API crude oil inventory signs of shrinking inventory. Besides, gold prices traded up by 0.03% to $2038.90 per troy ounce amid slowing global economic growth fed into safe-haven demand for gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Mar) | 52.2 | 52.2 | – |

| 16:30 | GBP – Services PMI (Mar) | 52.8 | 52.8 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Mar) | 242K | 242K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Mar) | 55.1 | 55.1 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -7.489M | -7.489M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the previous break below the previous support level at 101.70. However, MACD which illustrated diminishing bearish momentum suggests the index to traded higher as technical correction.

Resistance level: 101.70, 103.00

Support level: 100.35, 99.35

GBPUSD, H4: GBPUSD was traded lower following a prior retracement from the higher level . MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.2445.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level . MACD which illustrated diminishing bullish momentum suggests the pair extended its gains toward the support level at 1.0930.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 132.30.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

AUDUSD, H4: AUDUSD was traded lower following retracement from resistance level at 0.6775. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the resistance level at 0.6685.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following breaks above the previous resistance level at 0.6325. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6400.

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6265

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3420. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3515.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded lower following a prior break below from the previous support level at 0.9090. However, MACD which illustrated diminishing bearish momentum suggests the pair to traded higher as technical correction in the short term.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair to traded lower as technical correction in the short term.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

GOLD_, H4: Gold price was traded higher following a prior break above the previous resistance level at 2009.10. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains after it successfully breakout above the resistance level.

Resistance level: 2030.10, 2056.31

Support level: 2009.10, 1985.50

050423 Morning Session Analysis

05 April 2023 Morning Session Analysis

Greenback slumped amid disappointing economic data.

The dollar index, which is traded against a basket of six major currencies, failed to recover from its losses yesterday as downbeat data hyped the market to bet on an earlier-than-expected rate hike pause. According to the Bureau of Labor Statistics, the US JOLTS Job Openings data shrank from the prior month’s reading at 10.563M to 9.931M in February, missing the consensus forecast at 10.400M. The sharp drop in the number of job openings brought the data to the lowest level in nearly two years while signaling that the labor market was moderating following a series of rate hikes since last year. In detail, February’s JOLTS report showed that job creation dropped to 6.1 million from 6.3 million, layoffs shrank to 1.5 million from 1.7 million, and dispositions grew to 4 million from 3.9 million. With such a backdrop, the disappointing labor data triggered huge selling pressures in the dollar market, dragging the dollar index to retest the lowest level since early February now. In overall, the fall in manufacturing activity and poor labor data undermined the greenback, prompting the Federal Reserve a step closer to the end of the rate hike cycle. As of writing, the dollar index edged down -0.51% to 101.57.

In the commodities market, crude oil prices ticked up by 0.01% to $80.86 per barrel as US crude oil inventories fell by a big number, according to the data from API. Besides, gold prices ticked up by 0.02% to $2020.70 per troy ounce amid the sign of moderating in the US labor market appeared.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Mar) | 52.2 | 52.2 | – |

| 16:30 | GBP – Services PMI (Mar) | 52.8 | 52.8 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Mar) | 242K | 242K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Mar) | 55.1 | 55.1 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -7.489M | -7.489M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2425. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2425, 1.2645

Support level: 1.2300, 1.2200

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915 MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 133.05. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 130.70.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3245

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9070. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 81.70, 87.75

Support level: 79.65, 76.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2024.90. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2024.90, 2042.60

Support level: 1985.90, 1944.60