140323 Afternoon Session Report

14 March 2023 Afternoon Session Analysis

Aussie weakened amid RBA’s dovish move.

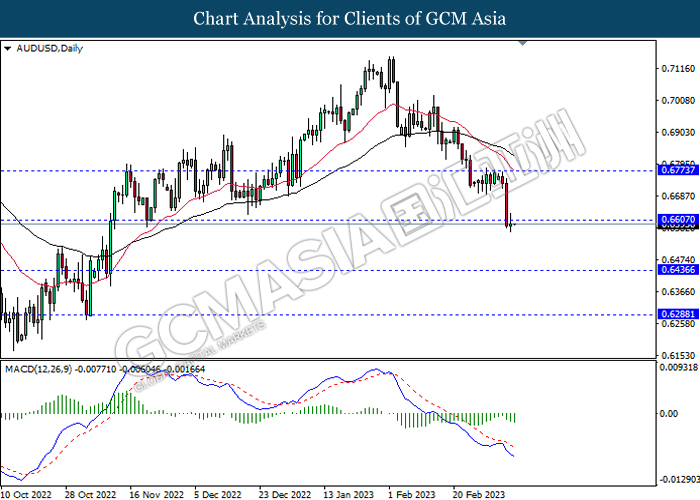

The Aussie dollar, which is traded as one of the mainstream currencies edged down after the Reserve Bank of Australia’s dovish communique. The RBA Government Lowe announced a higher chance of policy pause on Wednesday after the RBA delivered a 25bp hike last Tuesday. According to the cash rate futures, it implied a 59% chance of an official rate pause in April, but that has now increased to 89% due to SVB (Silicon Valley Bank) crisis. Whilst investors embraced full panic mode regards to SVB, it does increase the odds that the Fed will step back from their tightening monetary policy, and that would likely further increase the odds of same move by RBA in April. Besides, Australian household spending plunged 14.8% in January, according to the Australian Bureau of Statistics (ABS) report. As the RBA is closely monitoring household spending, it can be taken as another factor to cease the RBA from rising its interest rate further. Investors now are keeping an eye on the Monthly Labor Force Report from the ABS. As of writing, the AUD/USD pair plunged -0.14% to $0.6656.

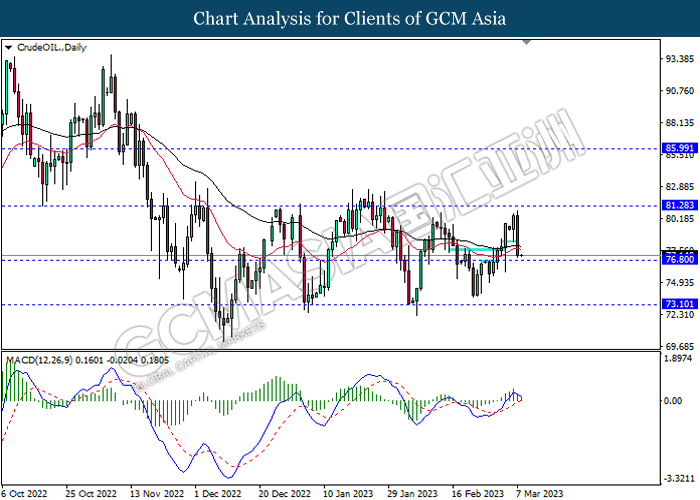

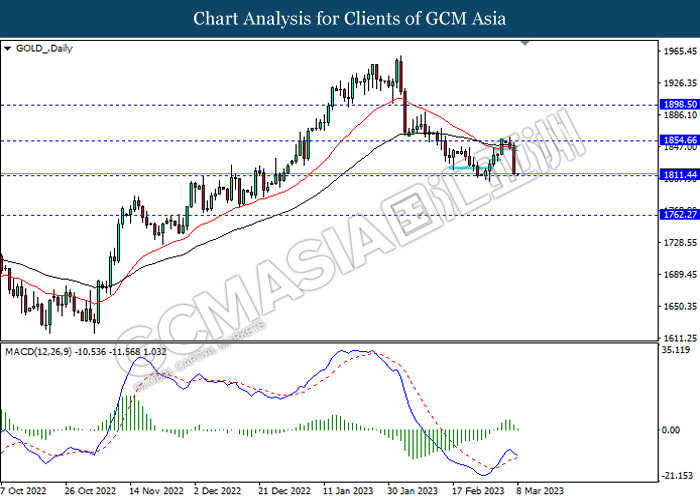

In the commodity market, the crude oil price edged down by -1.13% to $79.86 per barrel as of writing amid heightening of investors’ fears over the risk of global economic recession, which prompted investors to shy away from oil market temporarily. On the other hand, the gold price slipped by -0.37% to $1909.55 per troy ounce as of writing as investors are waiting for more signal from the CPI report.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Feb) | 0.40% | 0.40% | – |

| 20:30 | USD – CPI (MoM) (Feb) | 0.50% | 0.40% | – |

| 20:30 | USD – CPI (YoY) (Feb) | 6.40% | 6.00% | – |

Technical Analysis

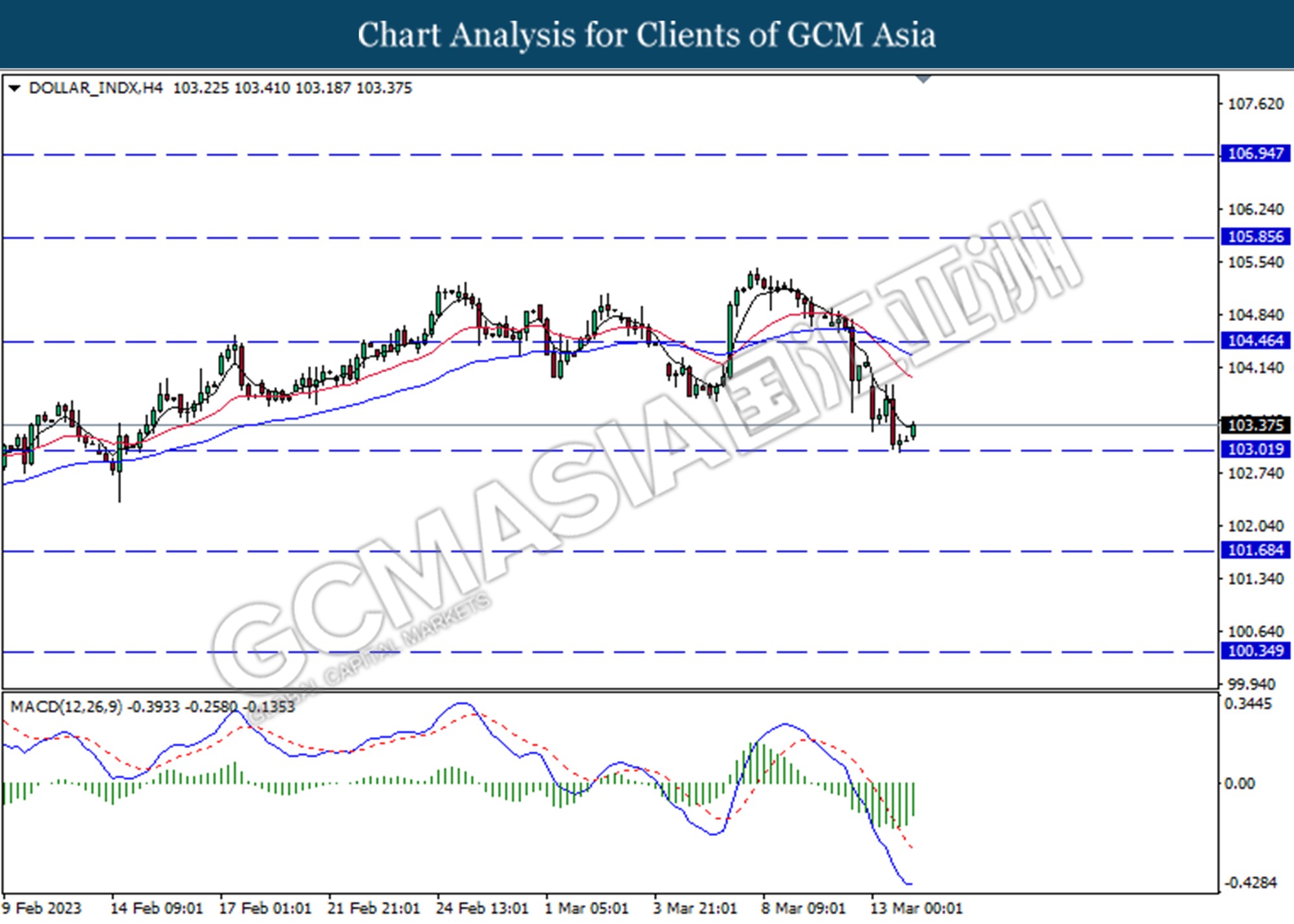

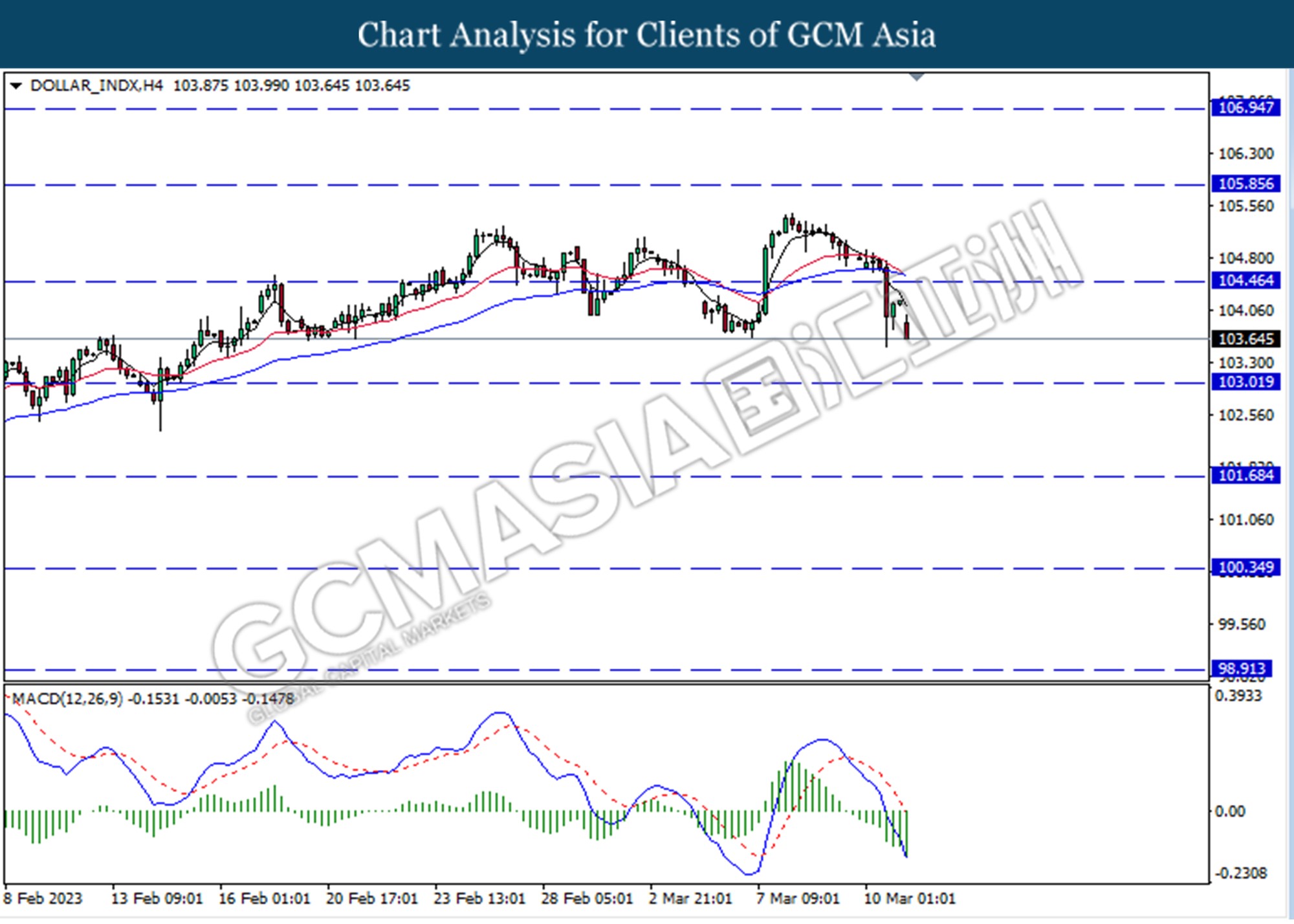

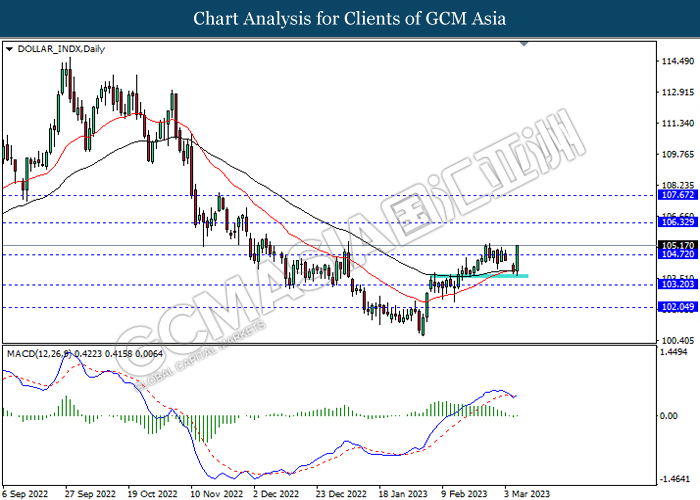

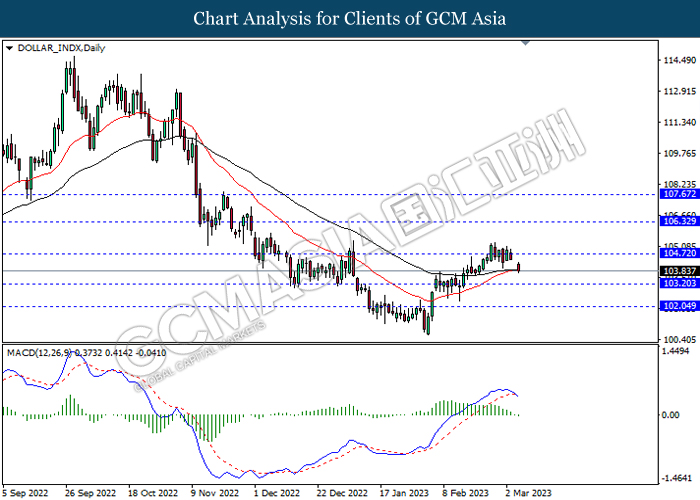

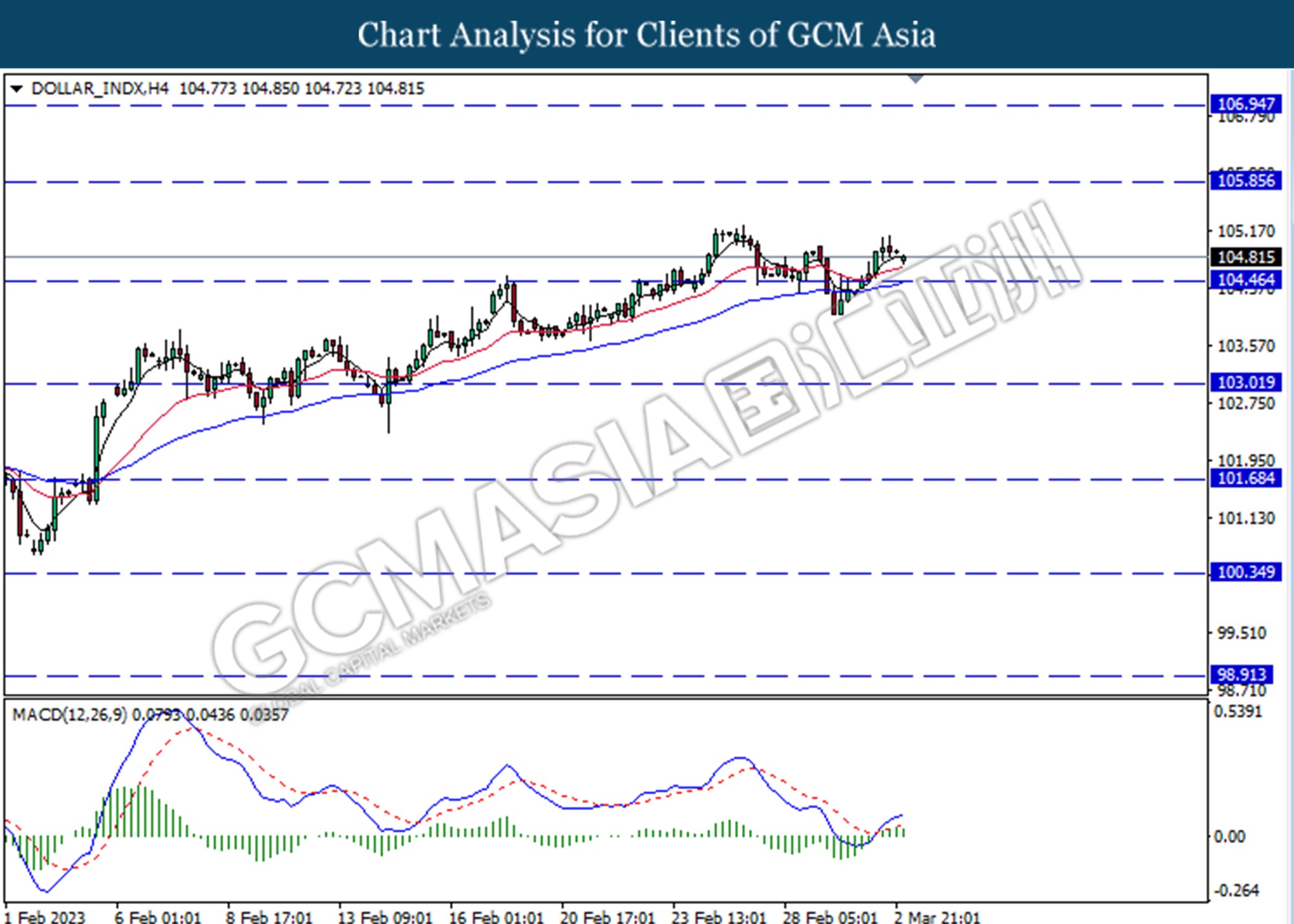

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the support level at 103.00. MACD which illustrated decreasing bearish momentum suggests the index to extend its gains toward the resistance level.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

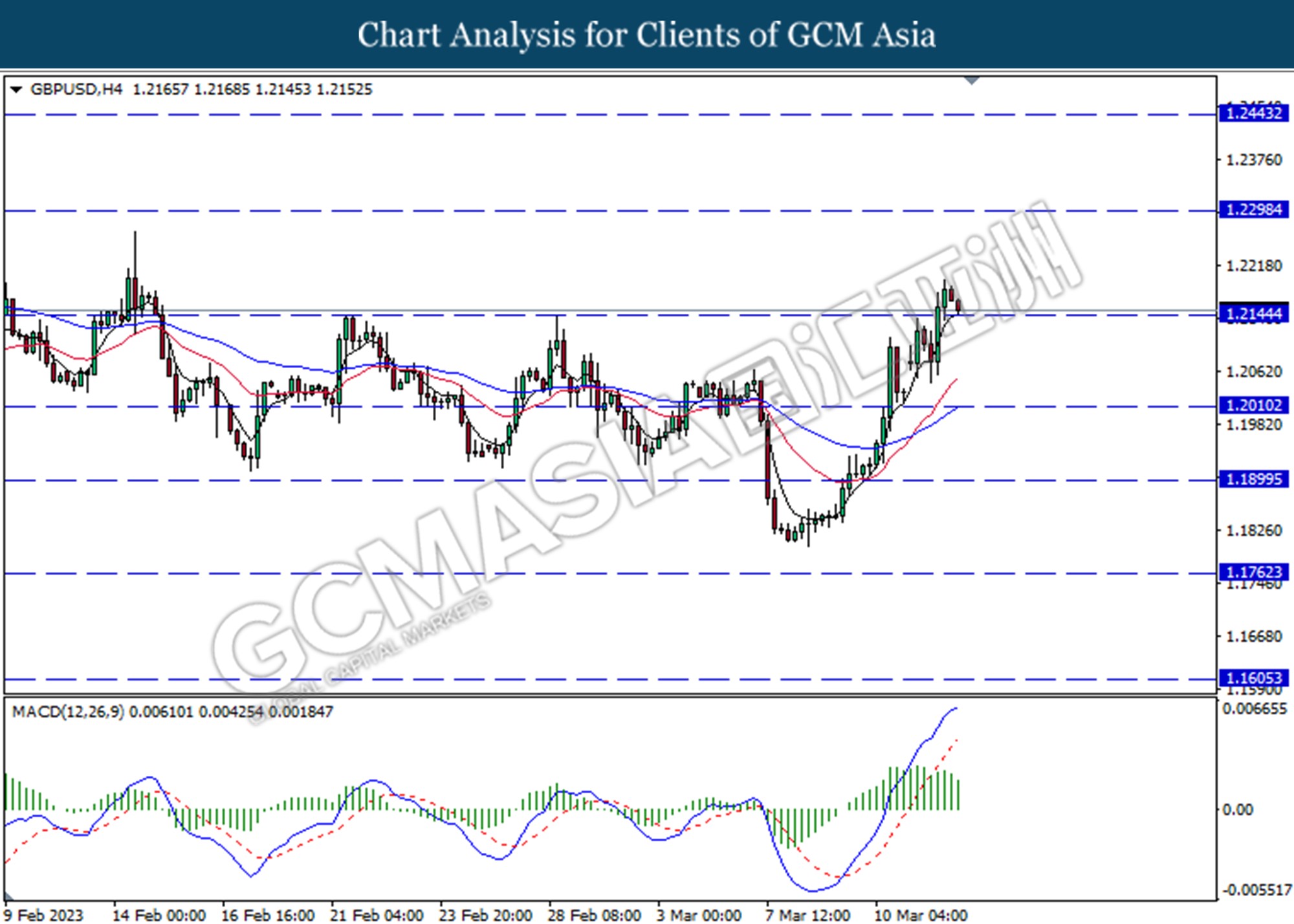

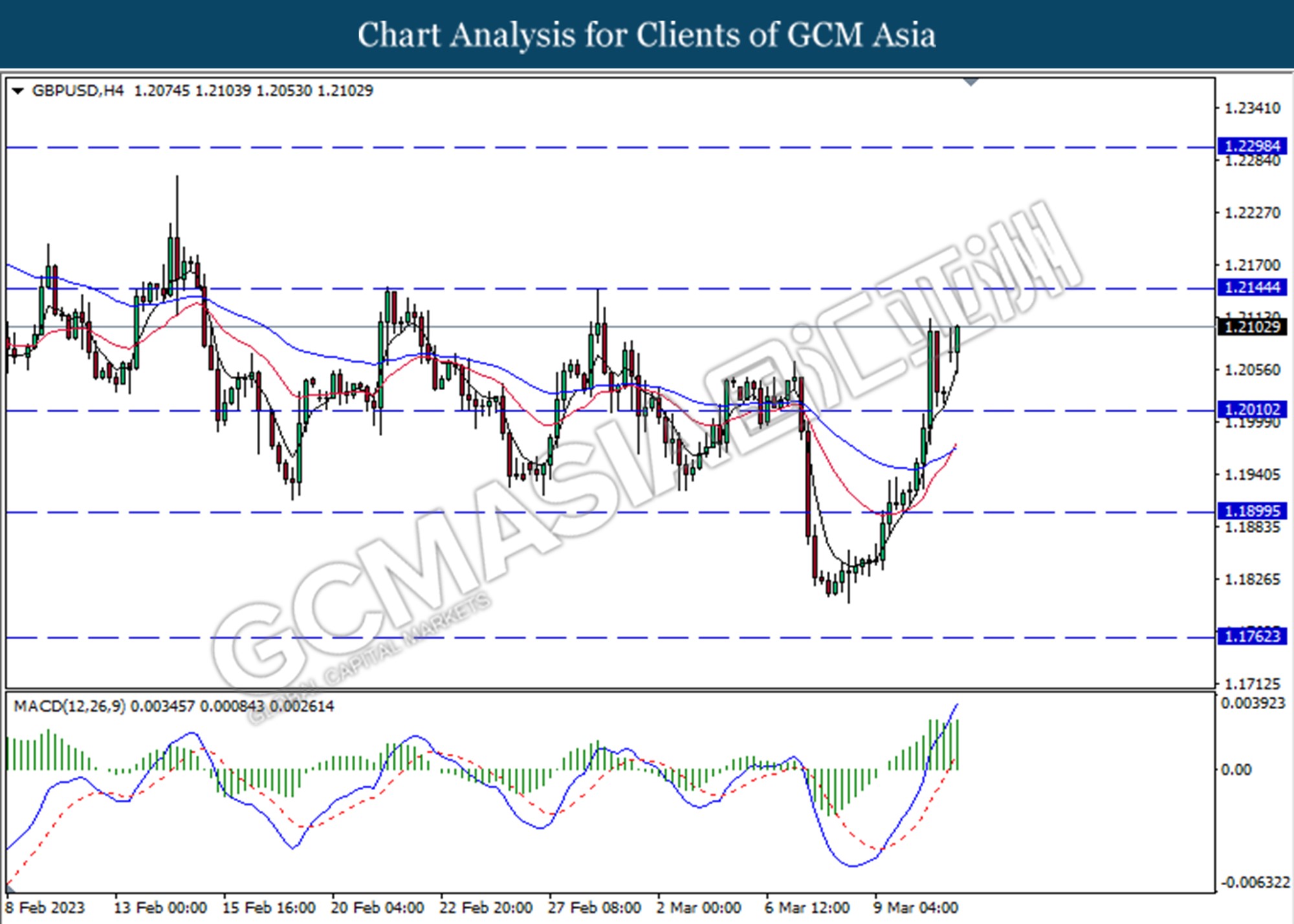

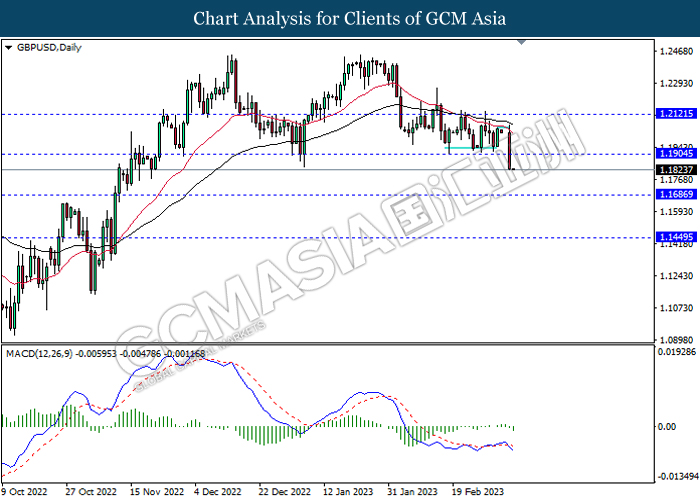

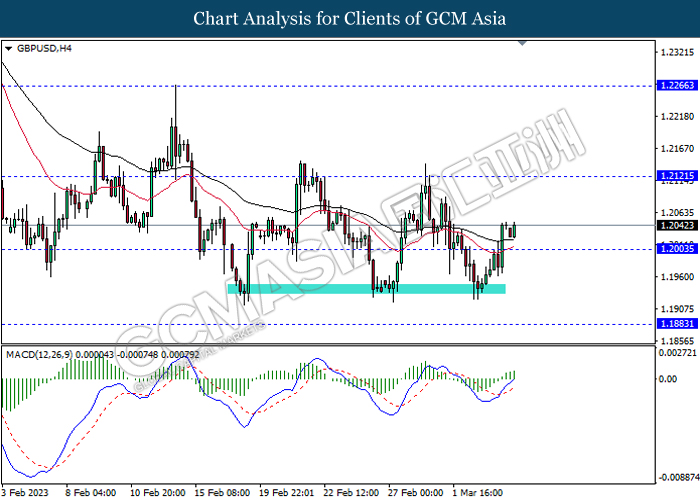

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2145. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses if successfully breaks below the support level.

Resistance level: 1.2300, 1.2445

Support level: 1.2145, 1.2010

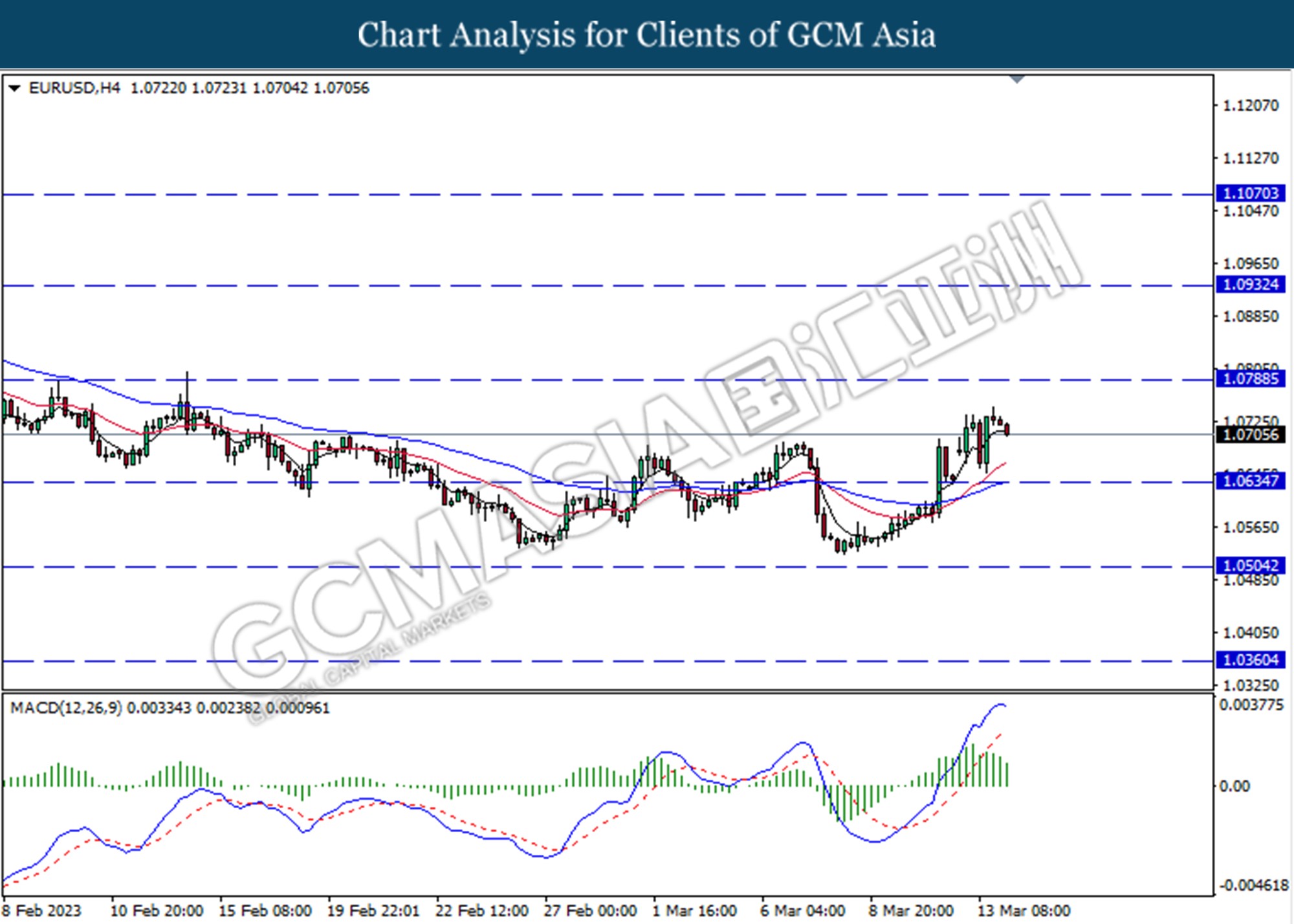

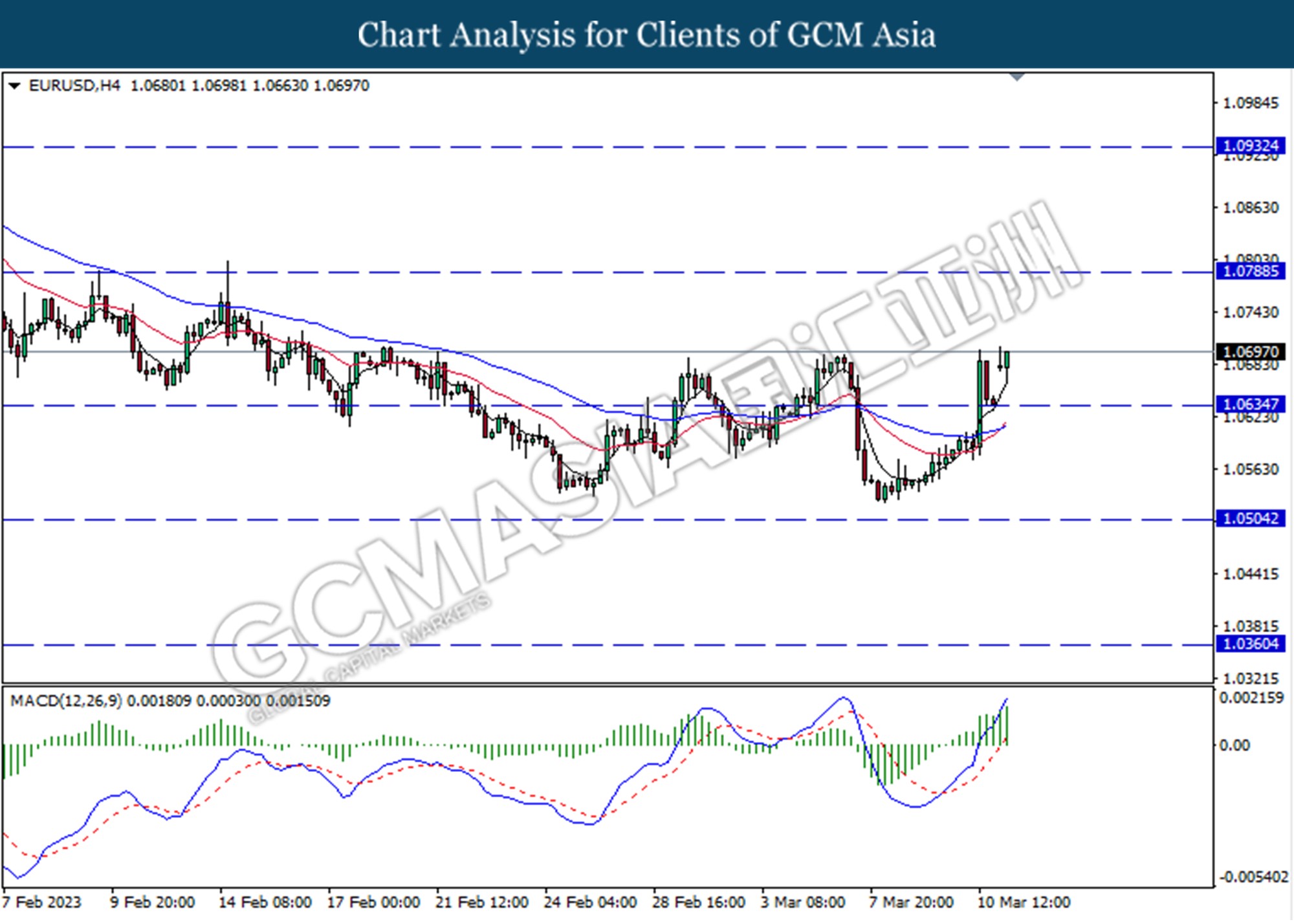

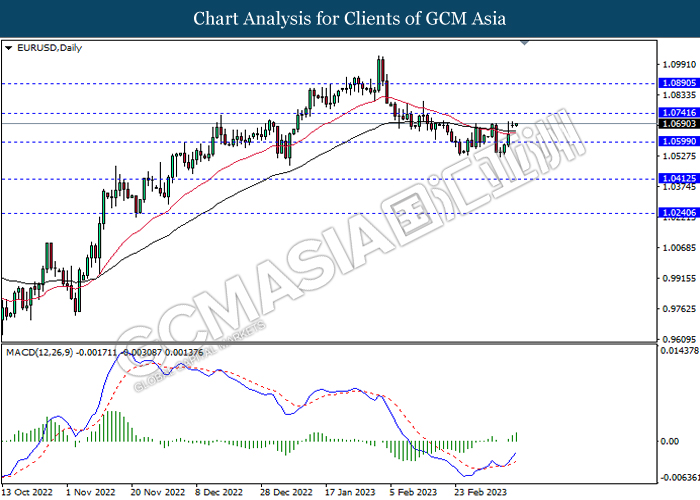

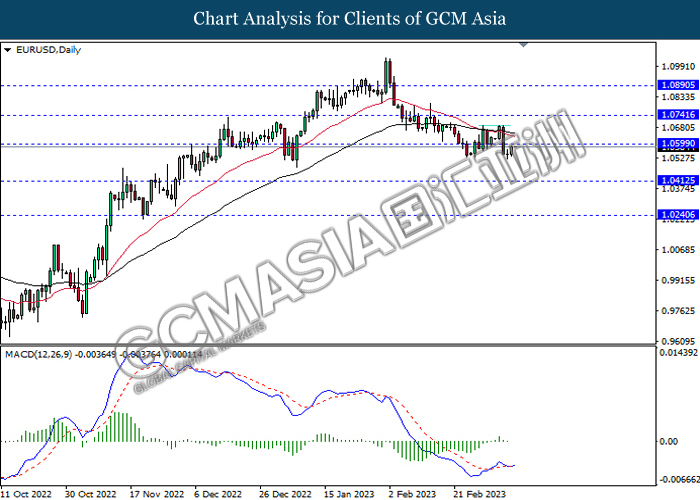

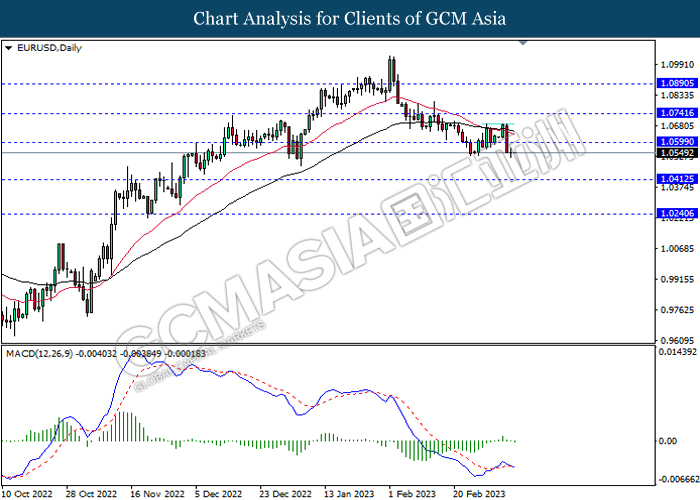

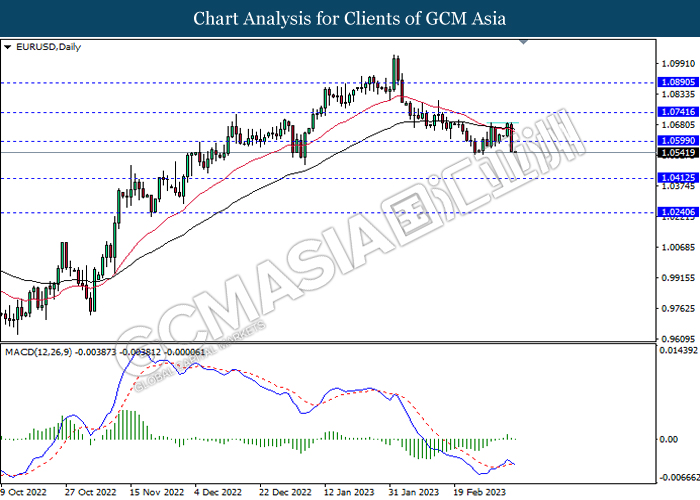

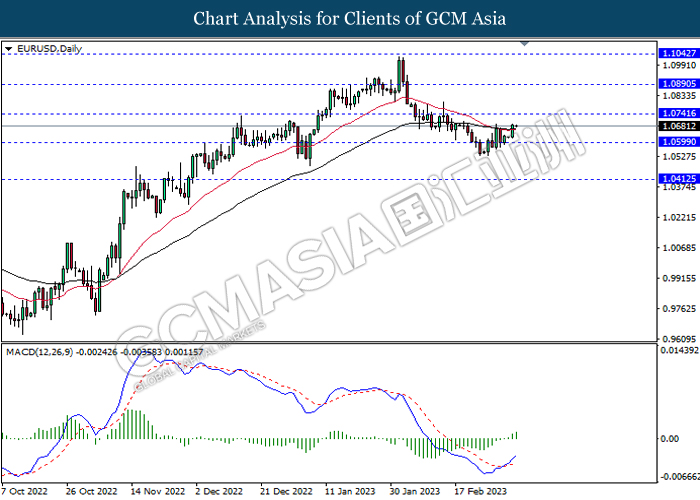

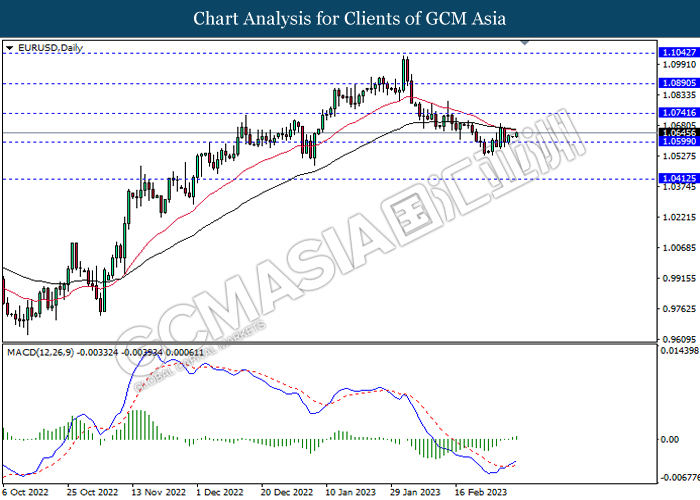

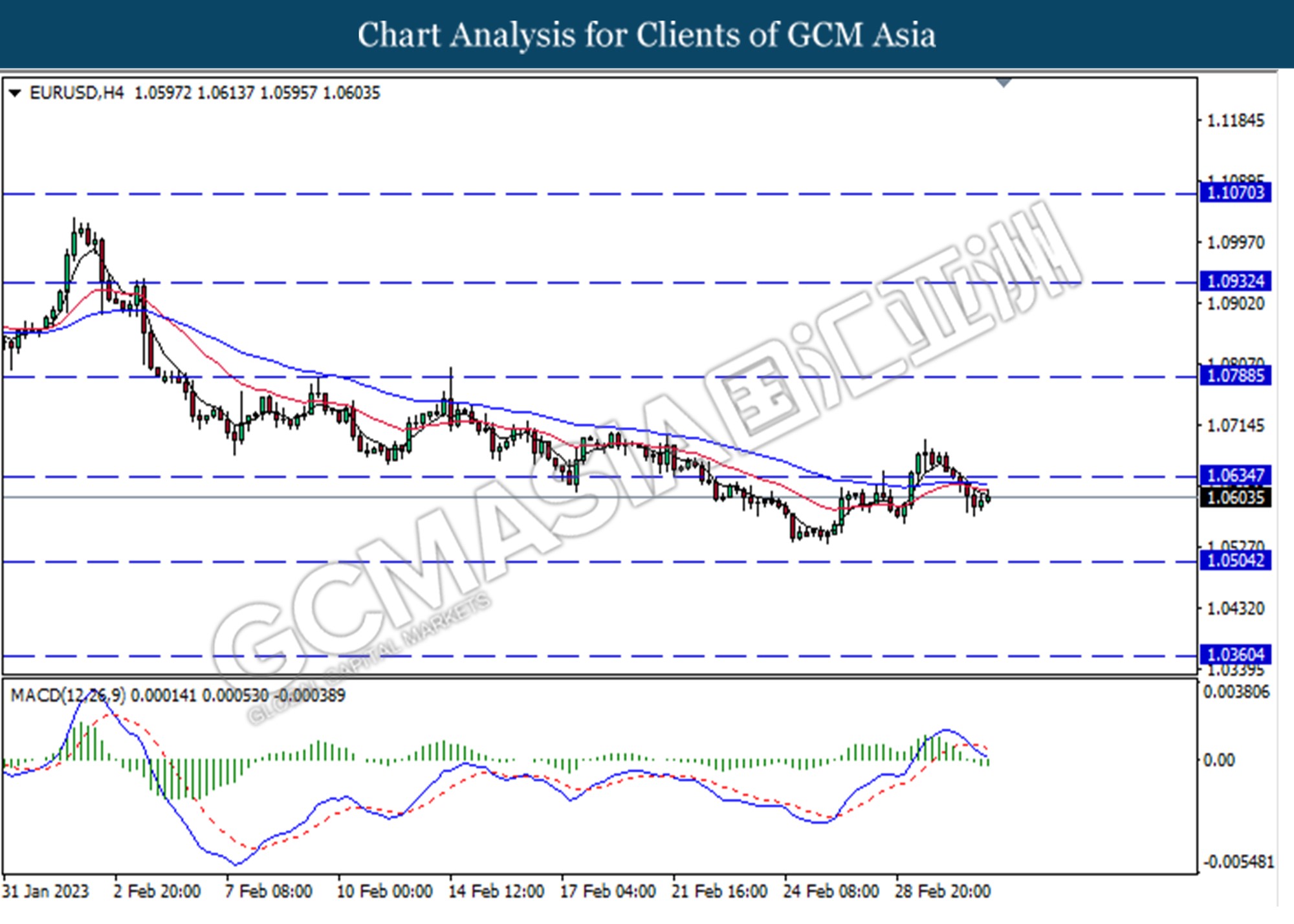

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 1.0635

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

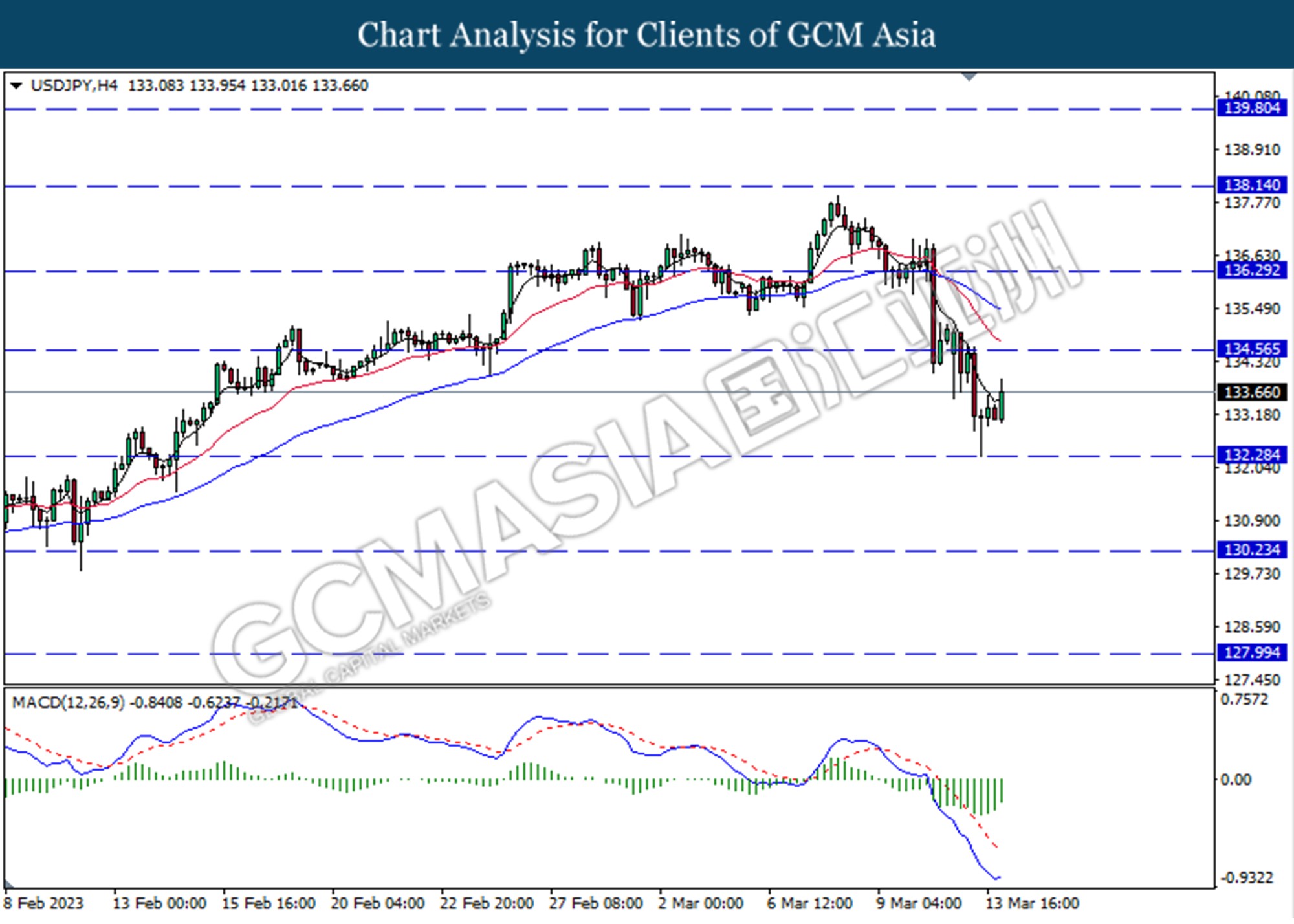

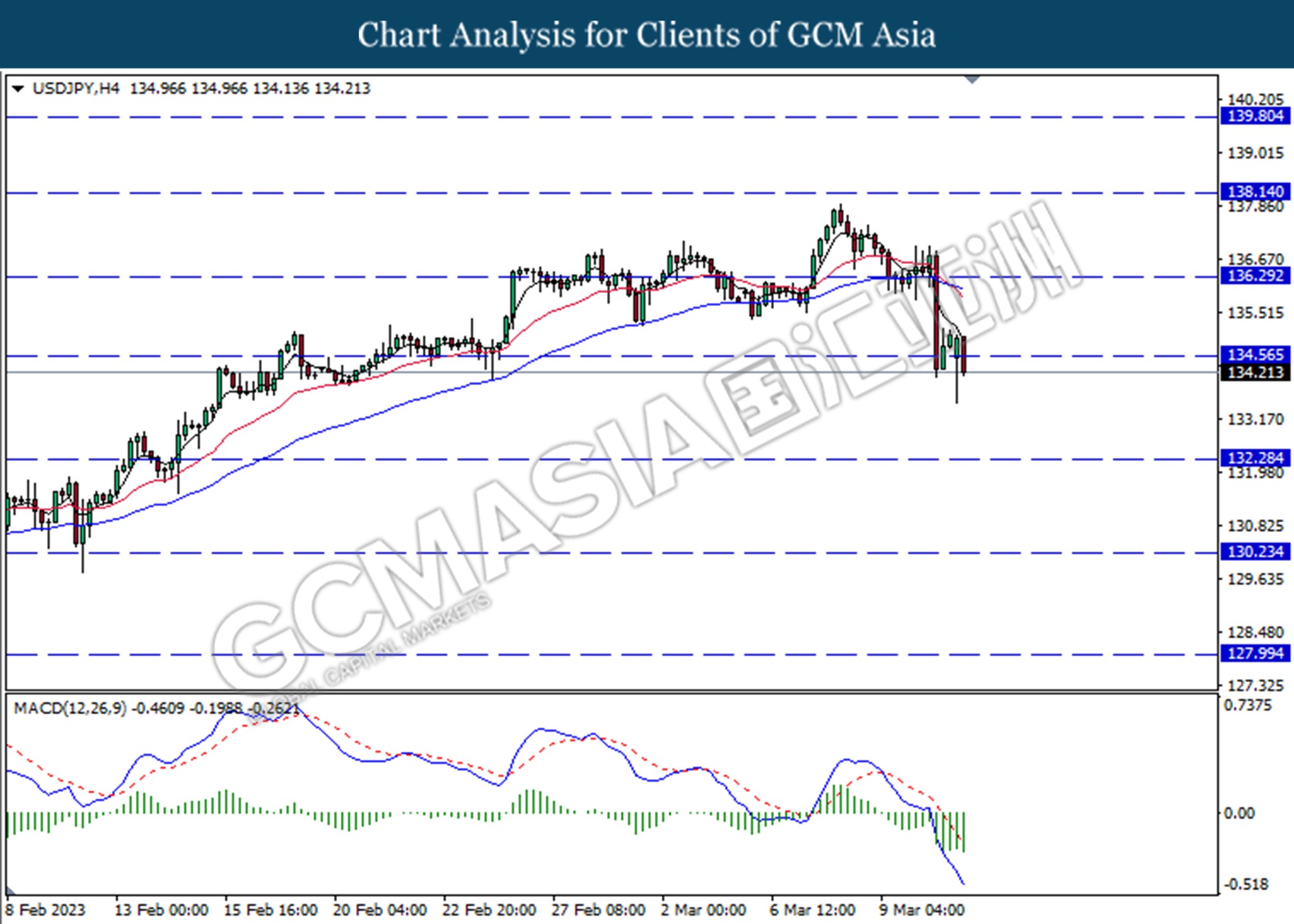

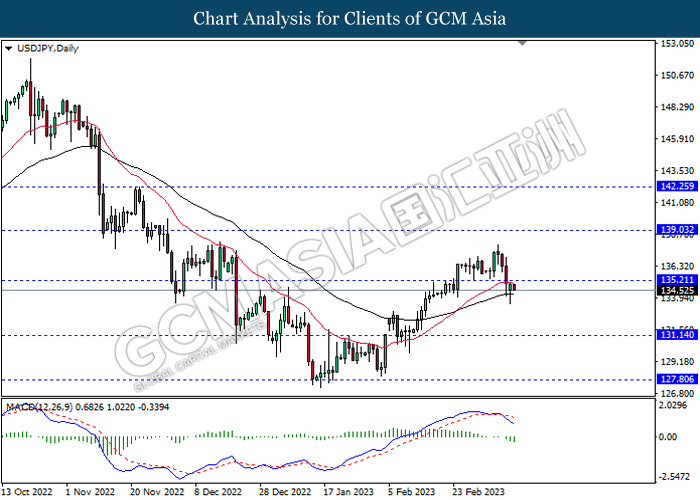

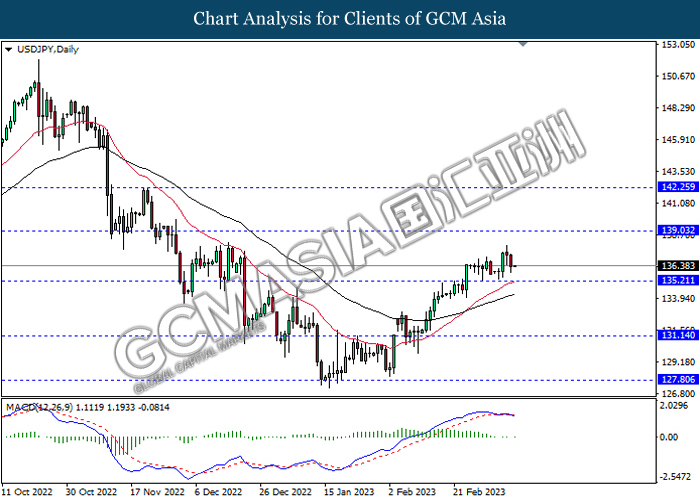

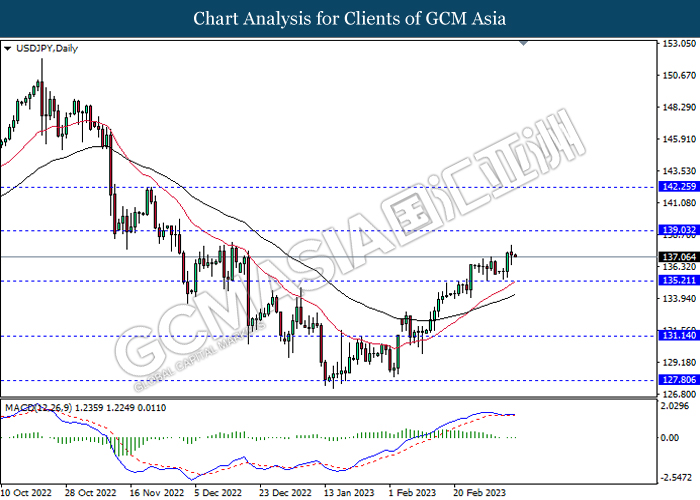

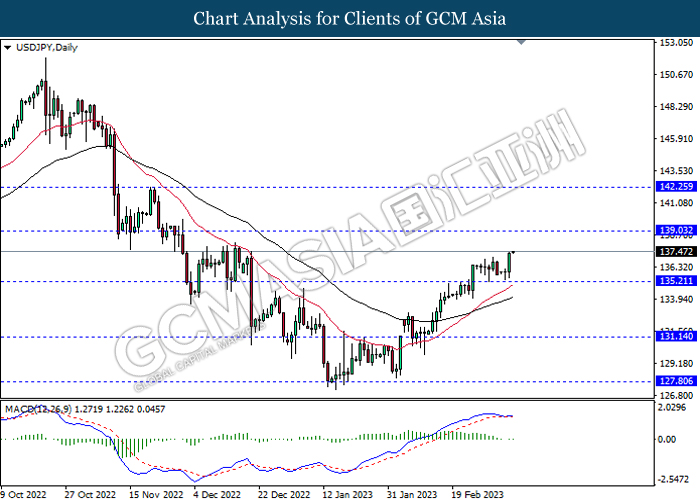

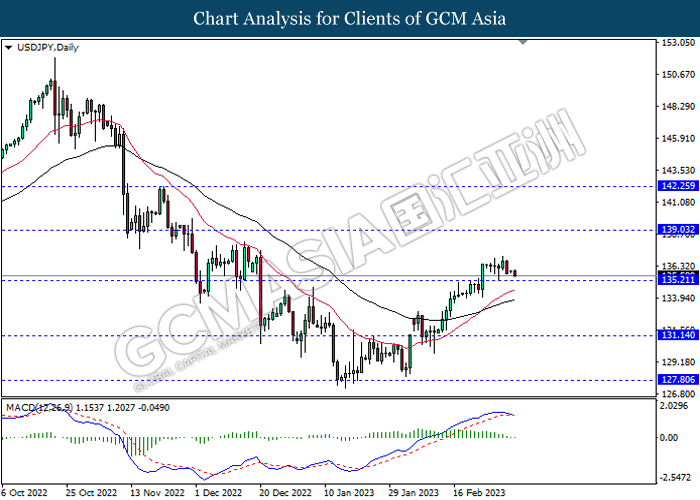

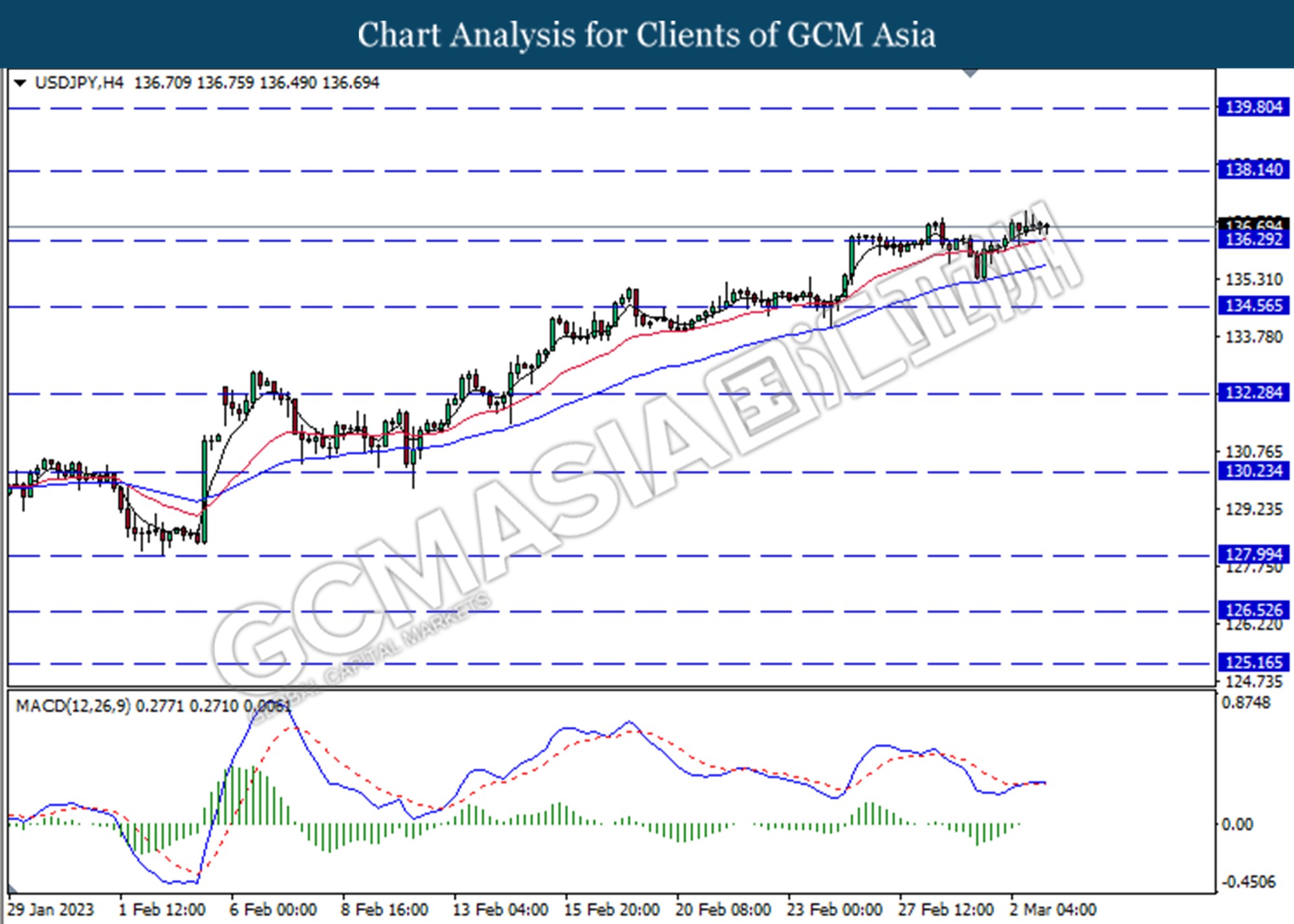

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 134.55.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

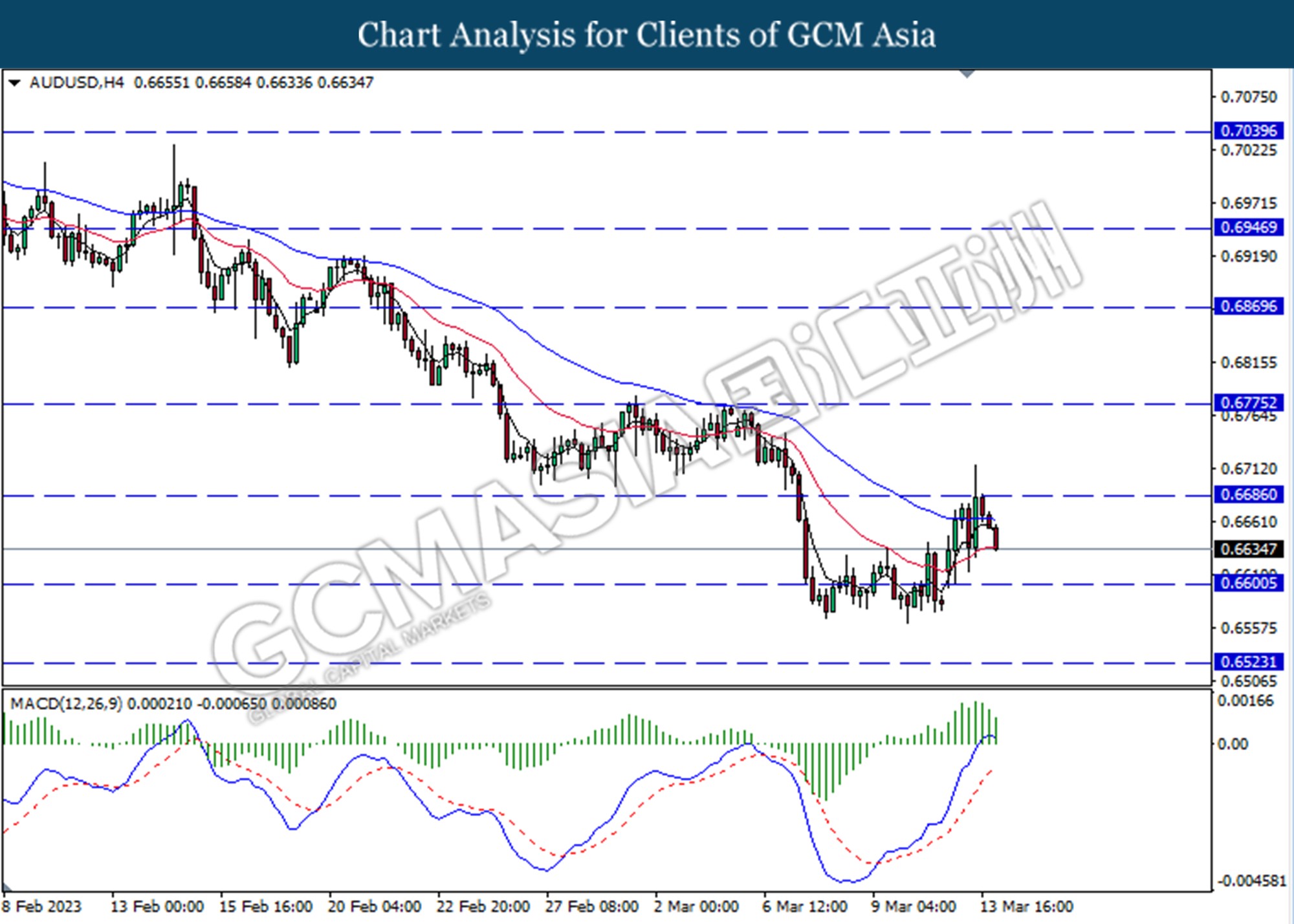

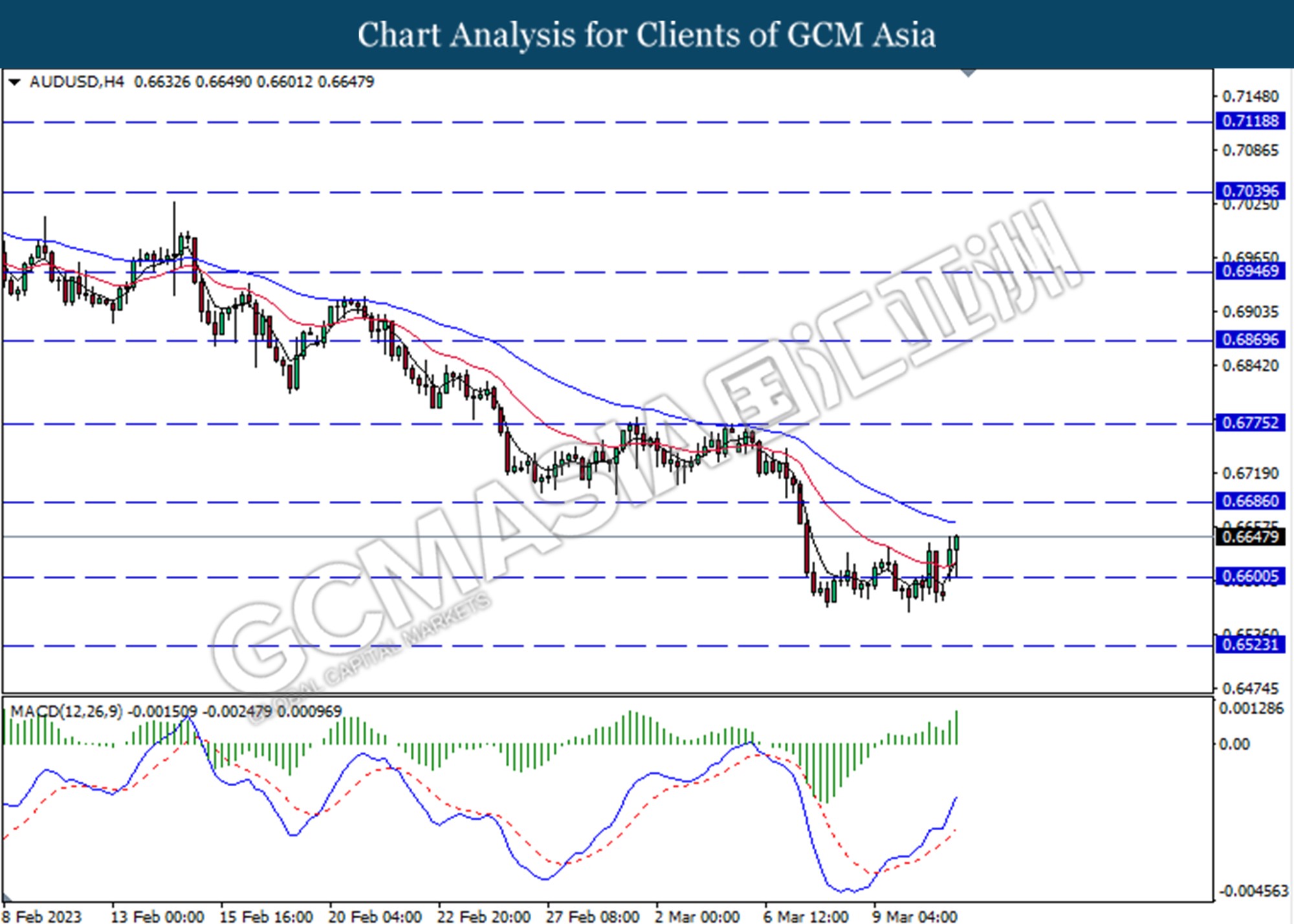

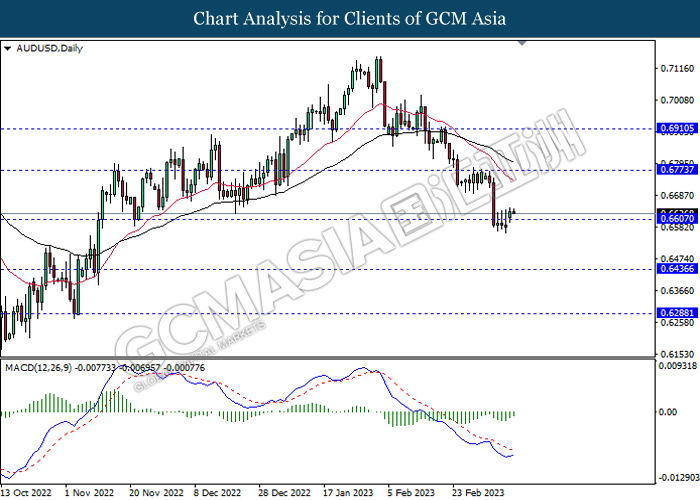

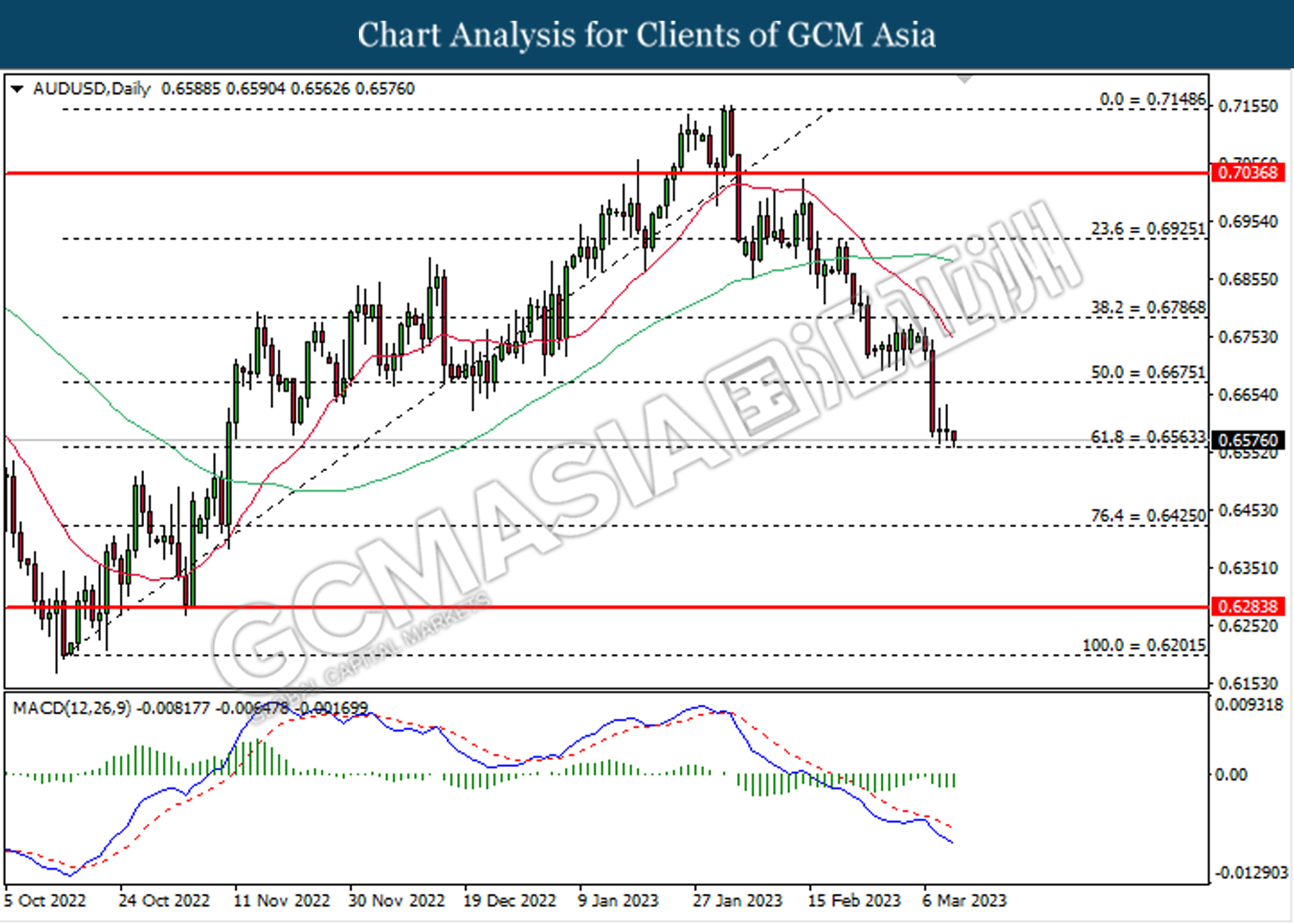

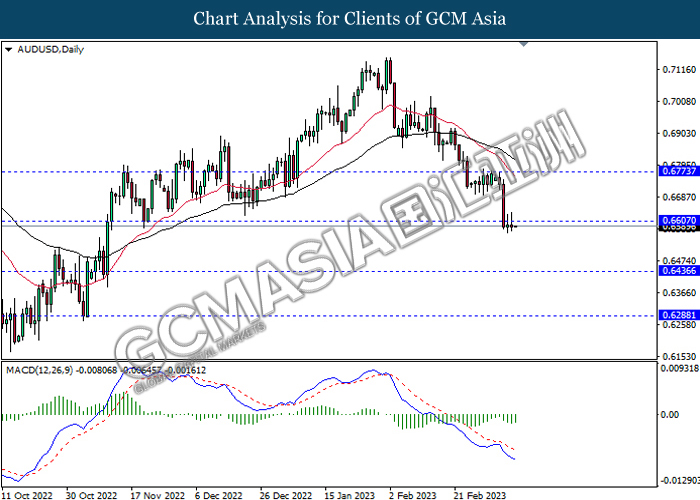

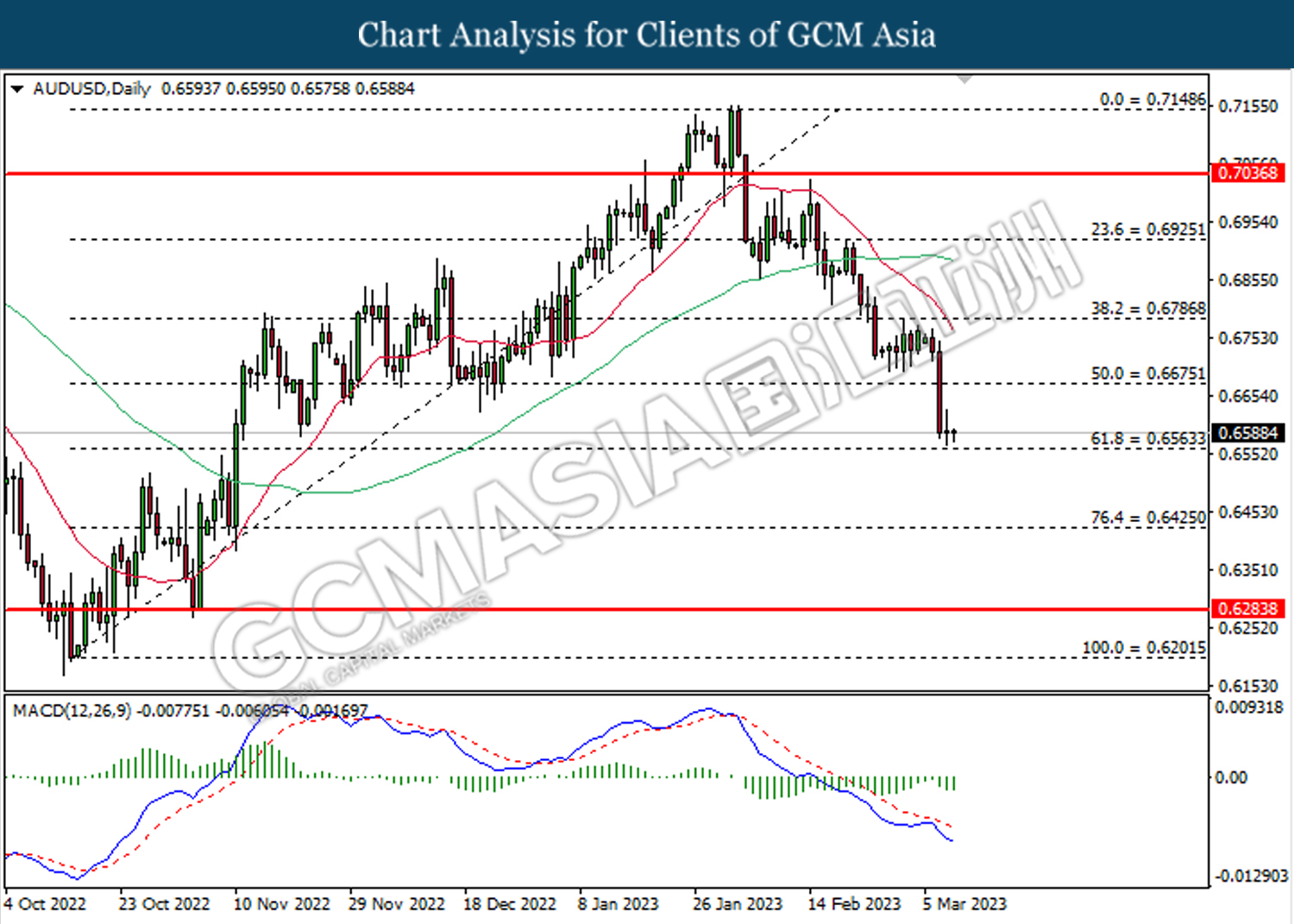

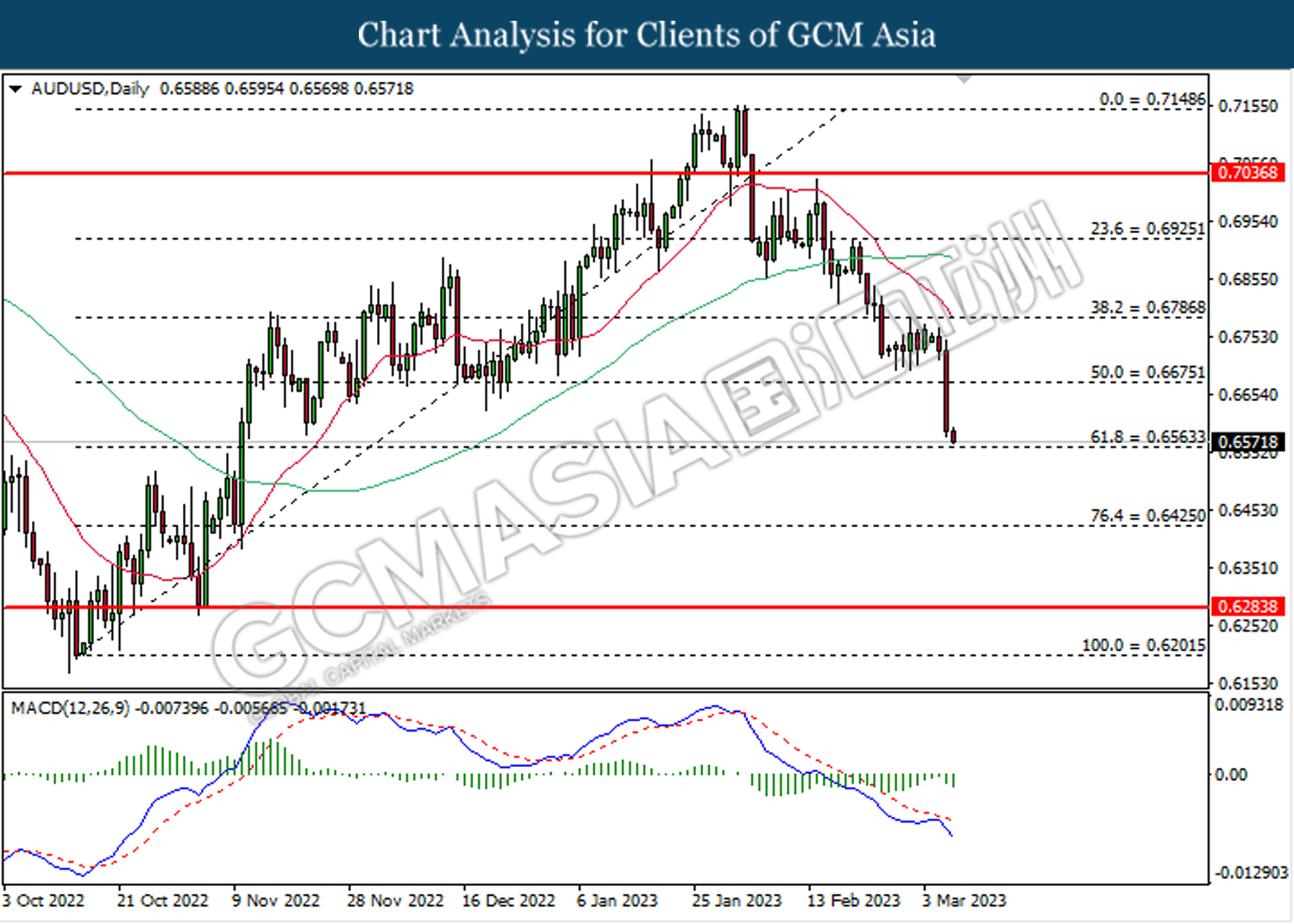

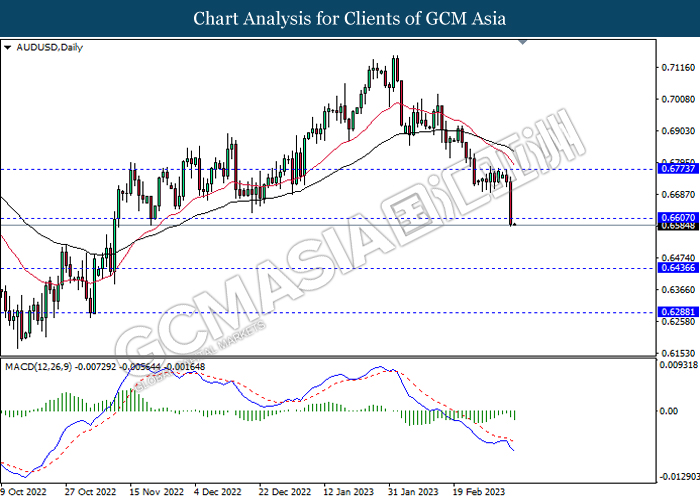

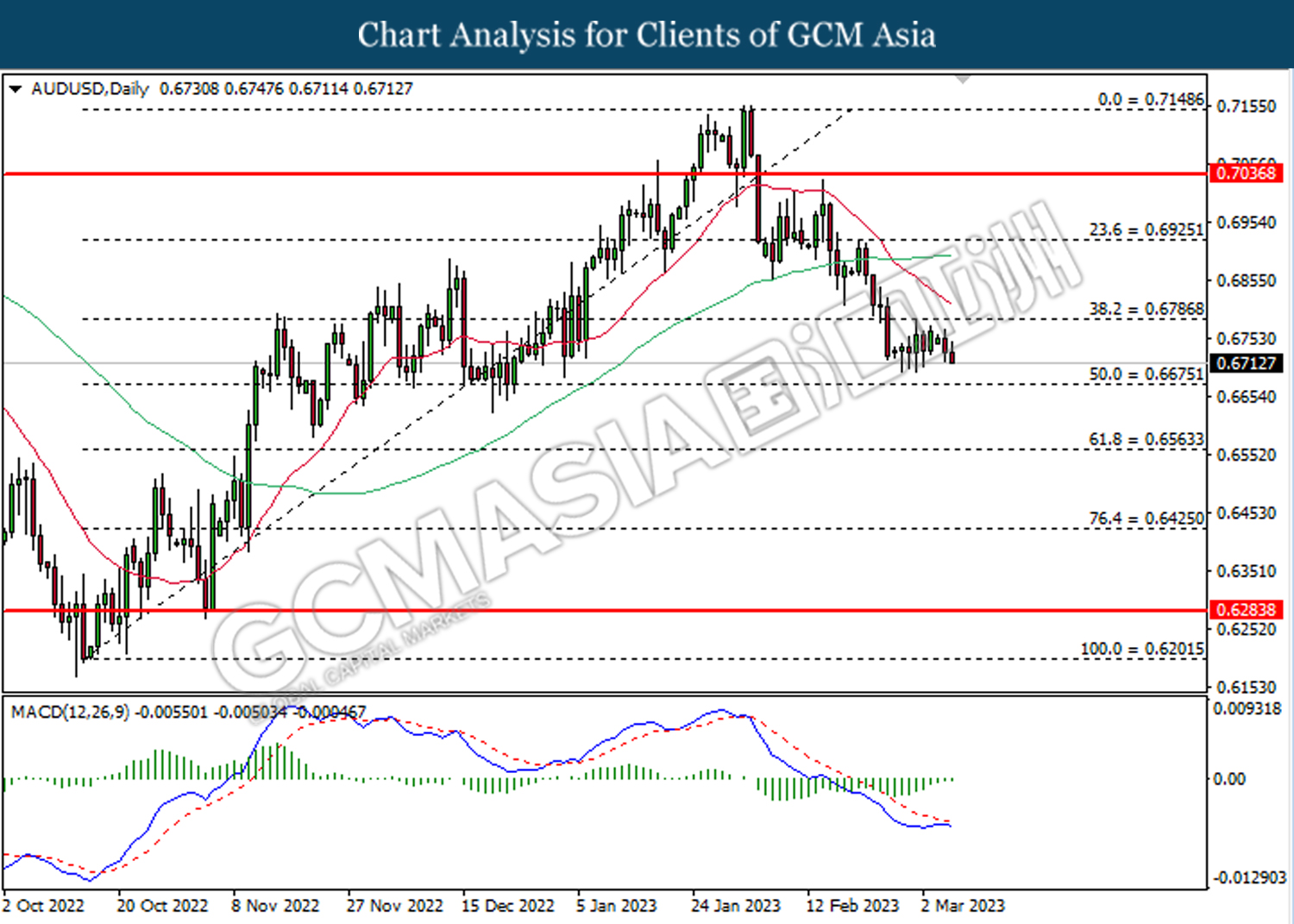

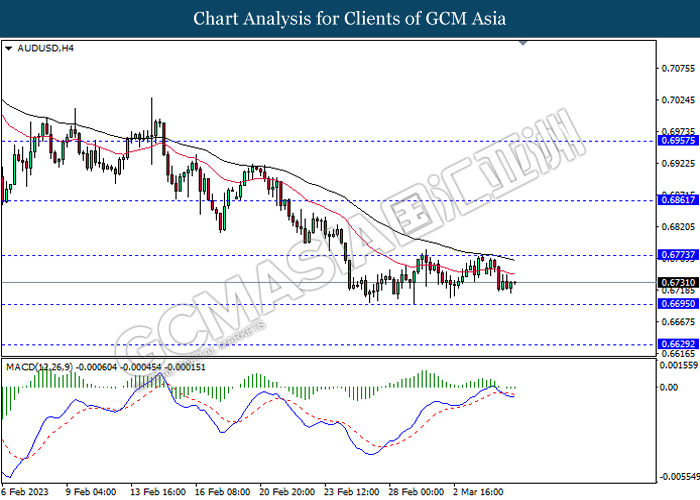

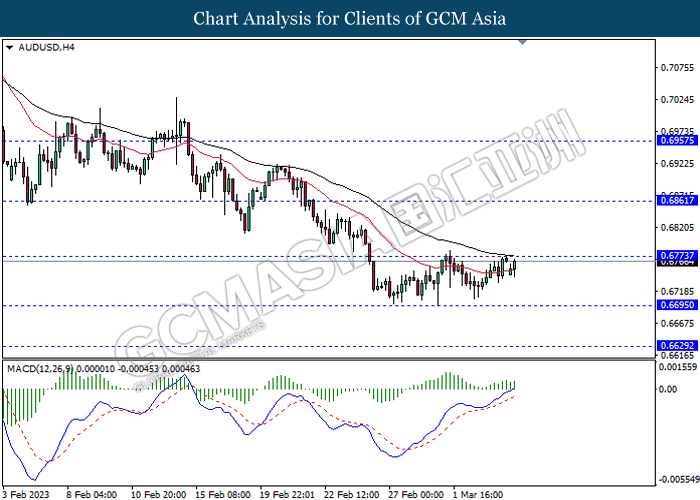

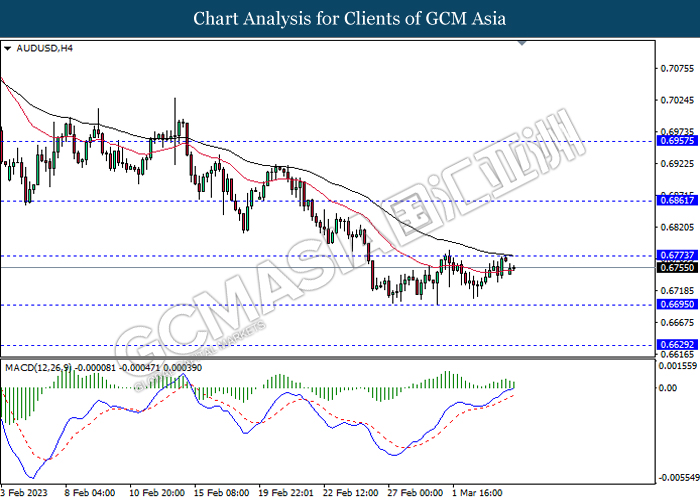

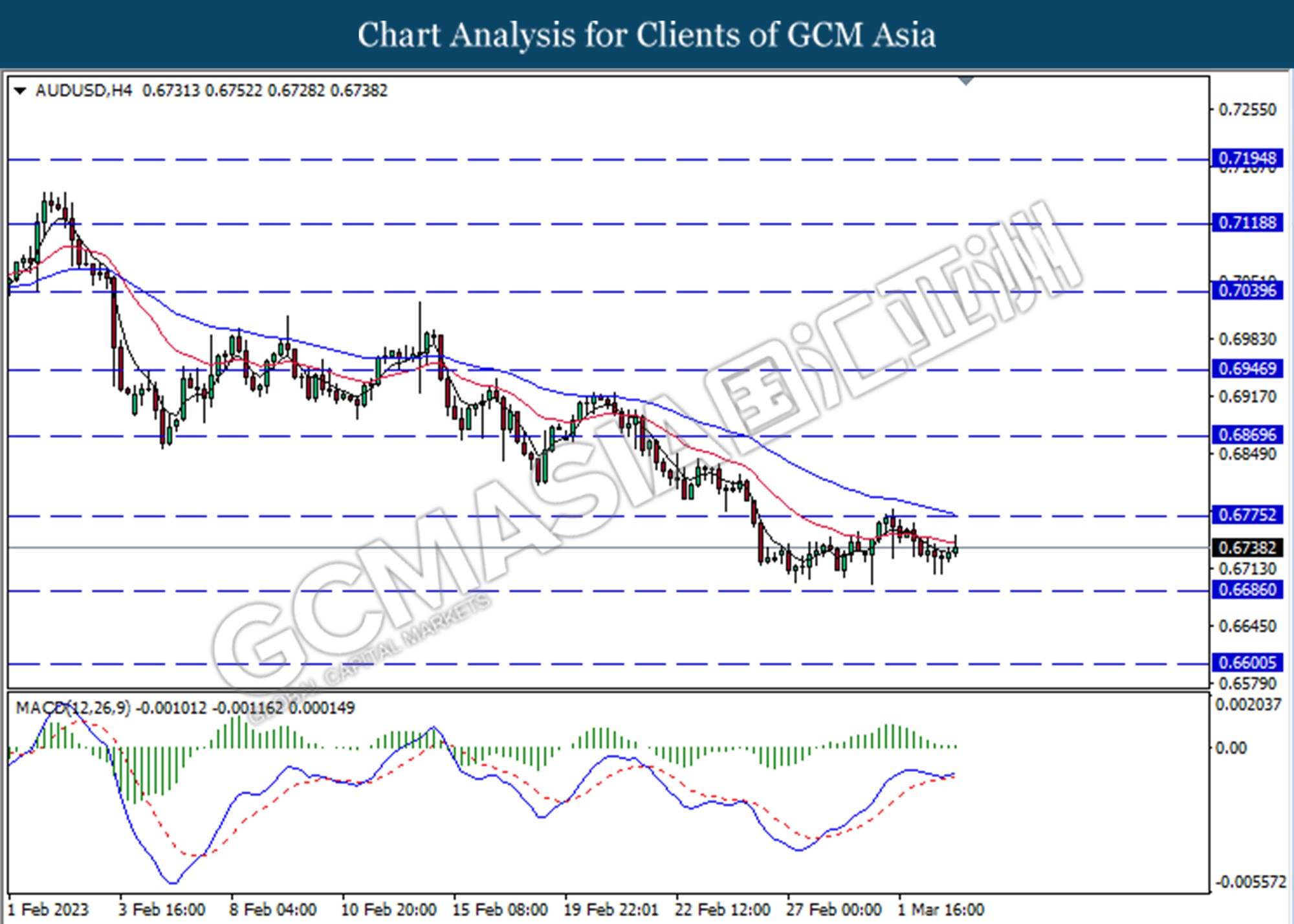

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the resistance level at 0.6685. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 0.6600.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

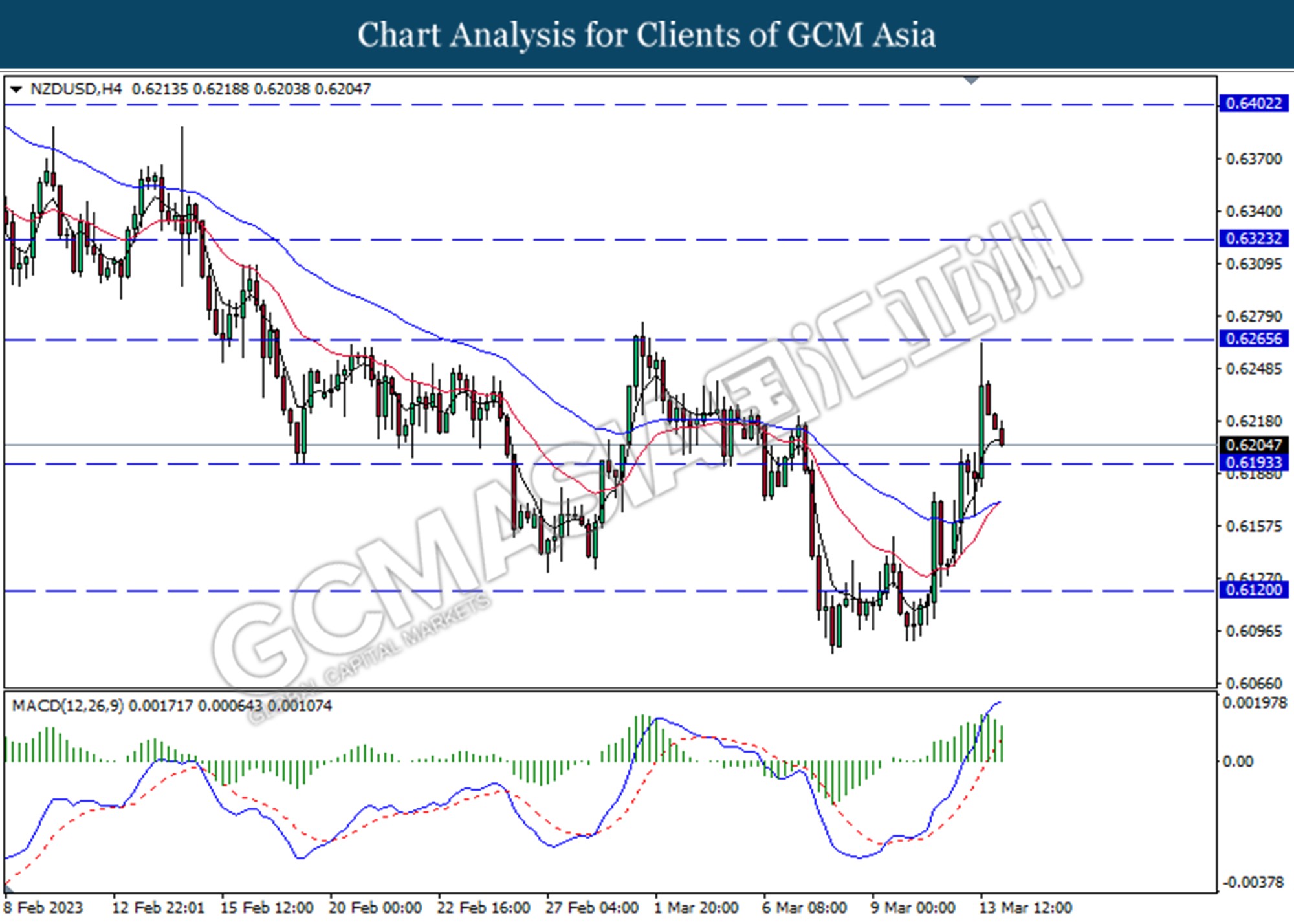

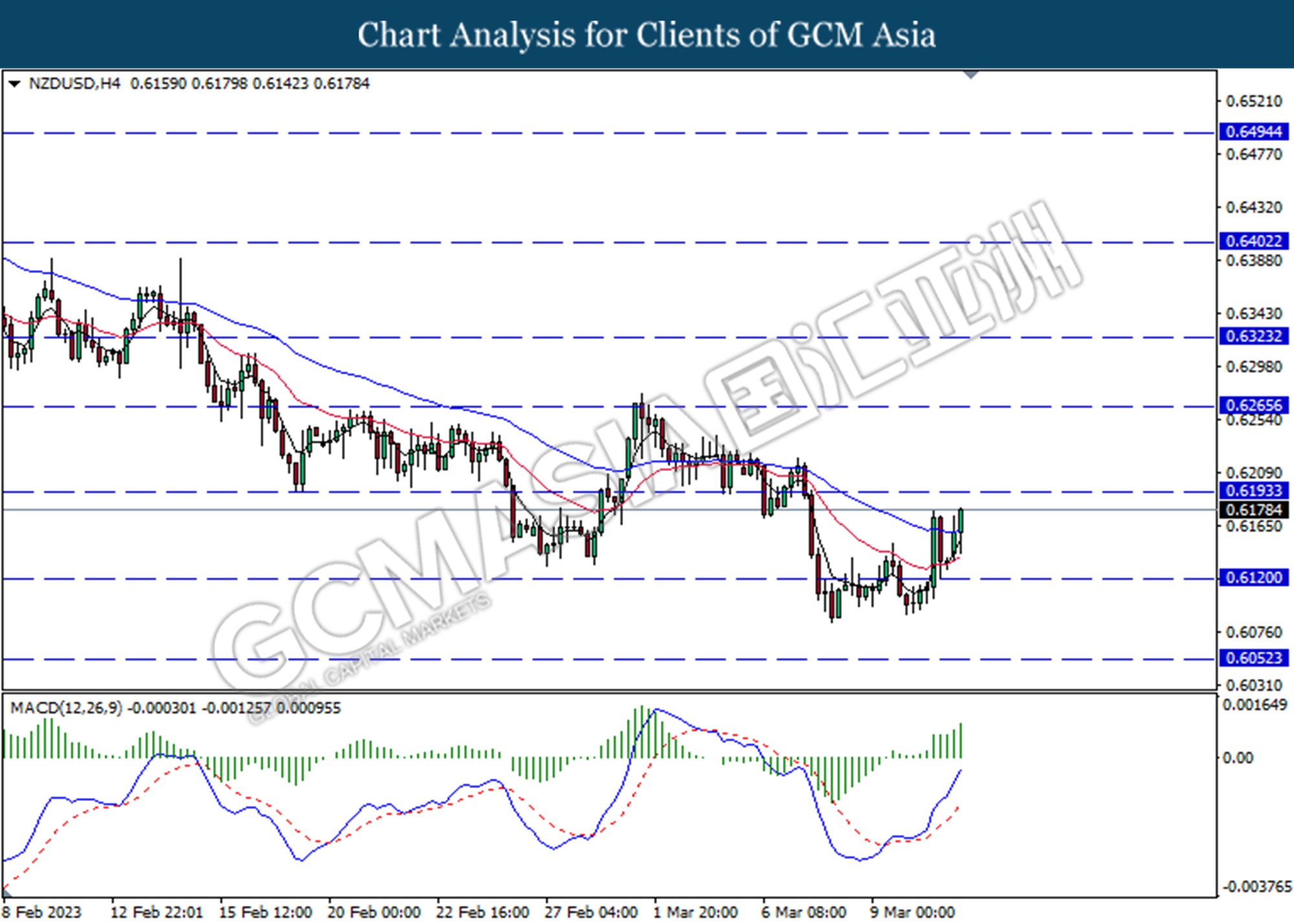

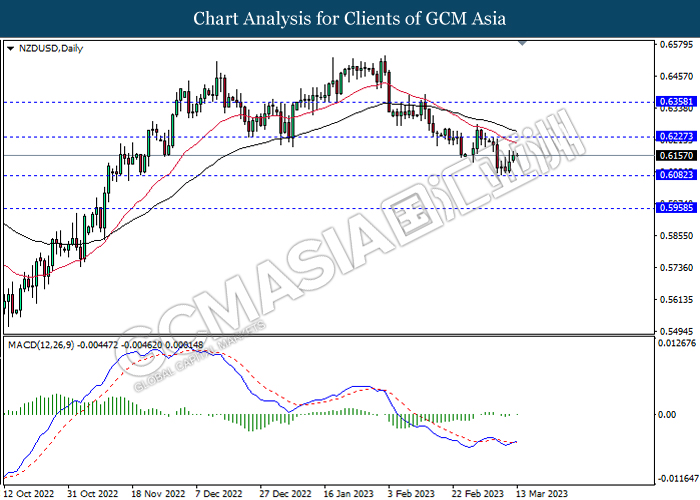

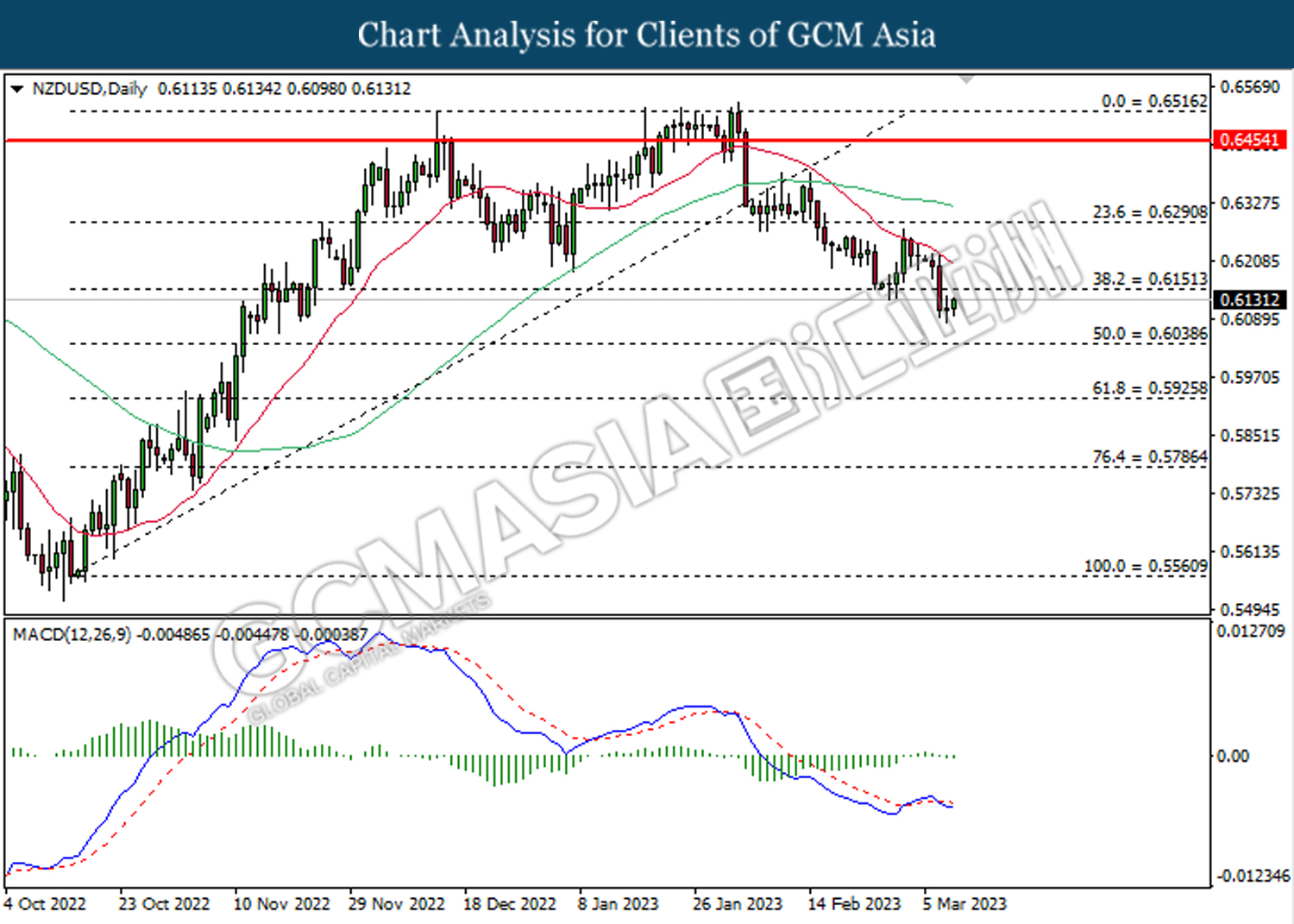

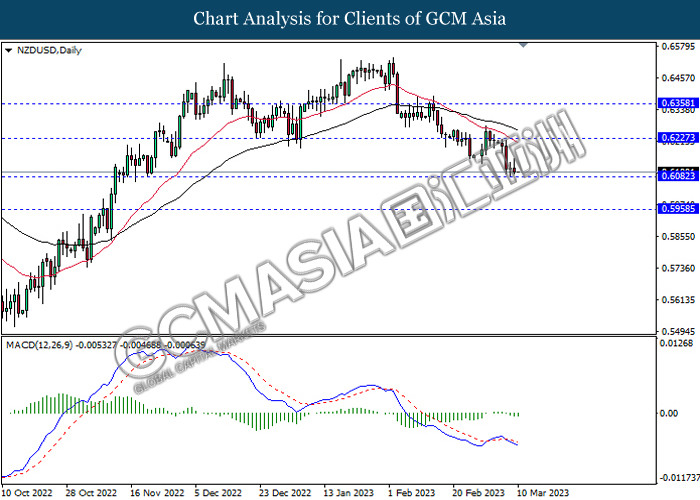

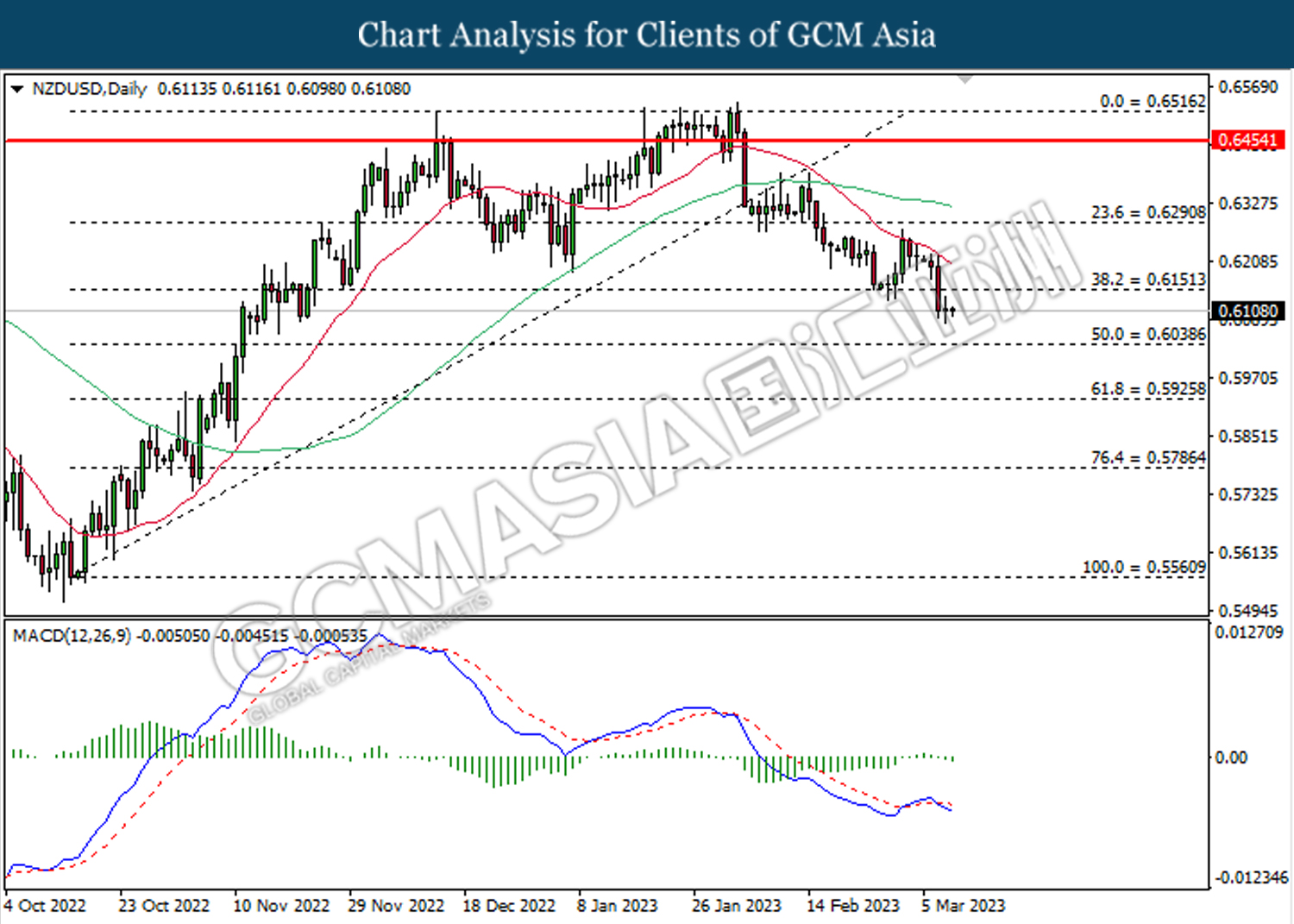

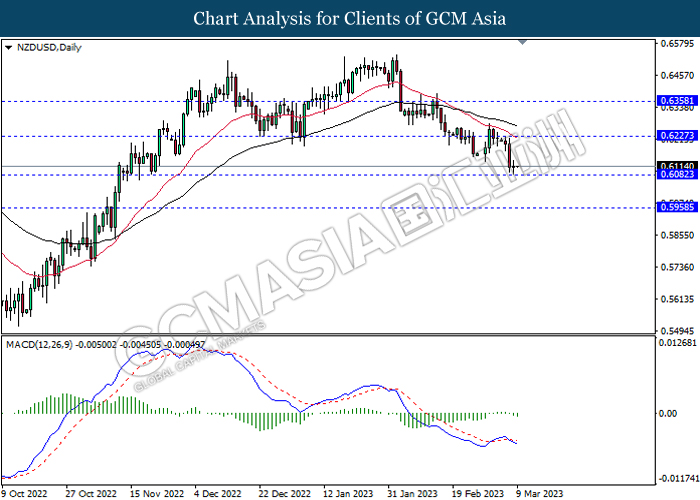

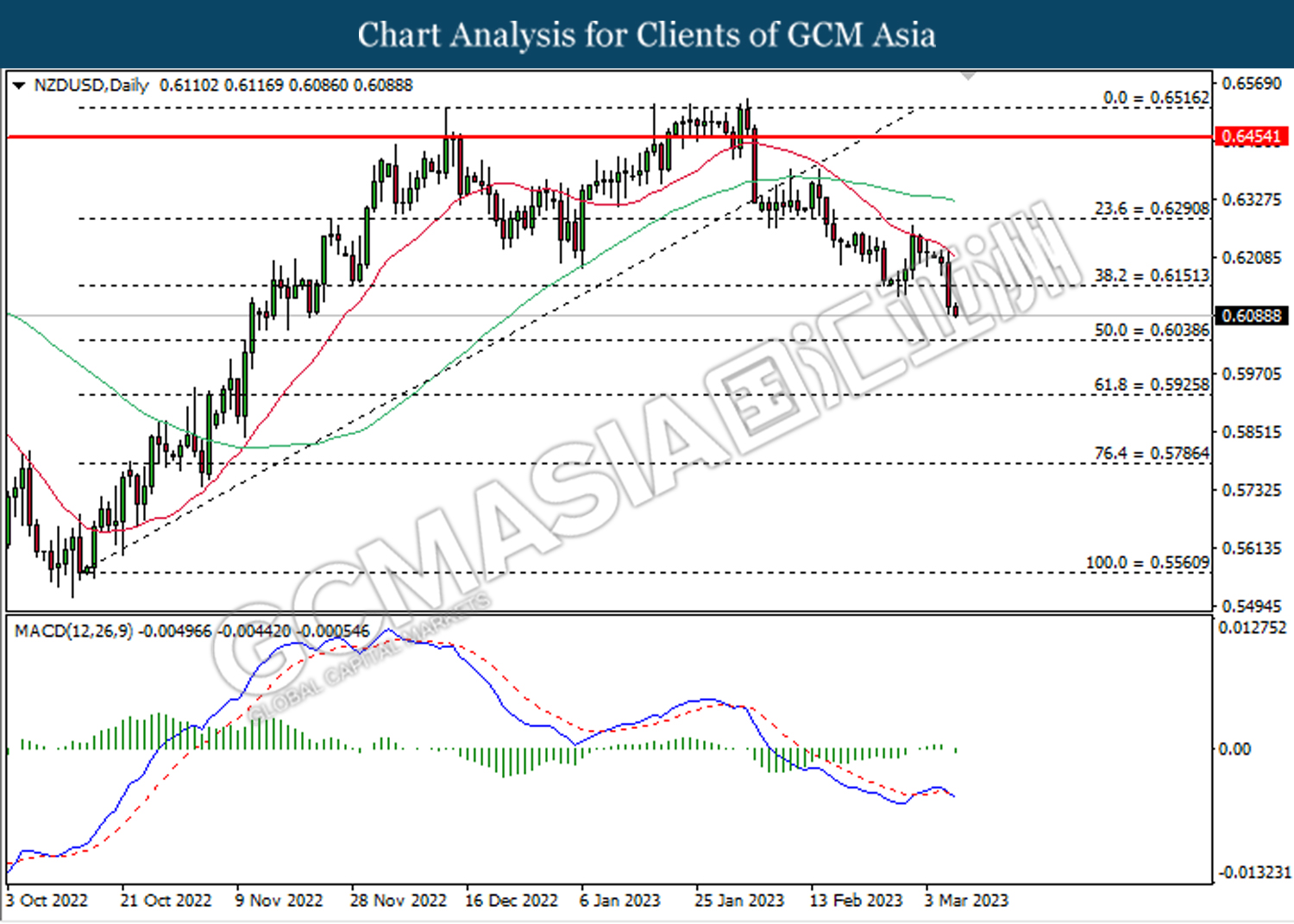

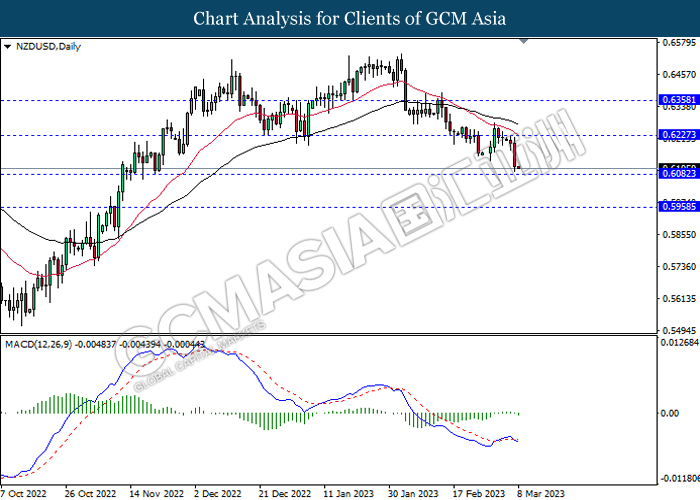

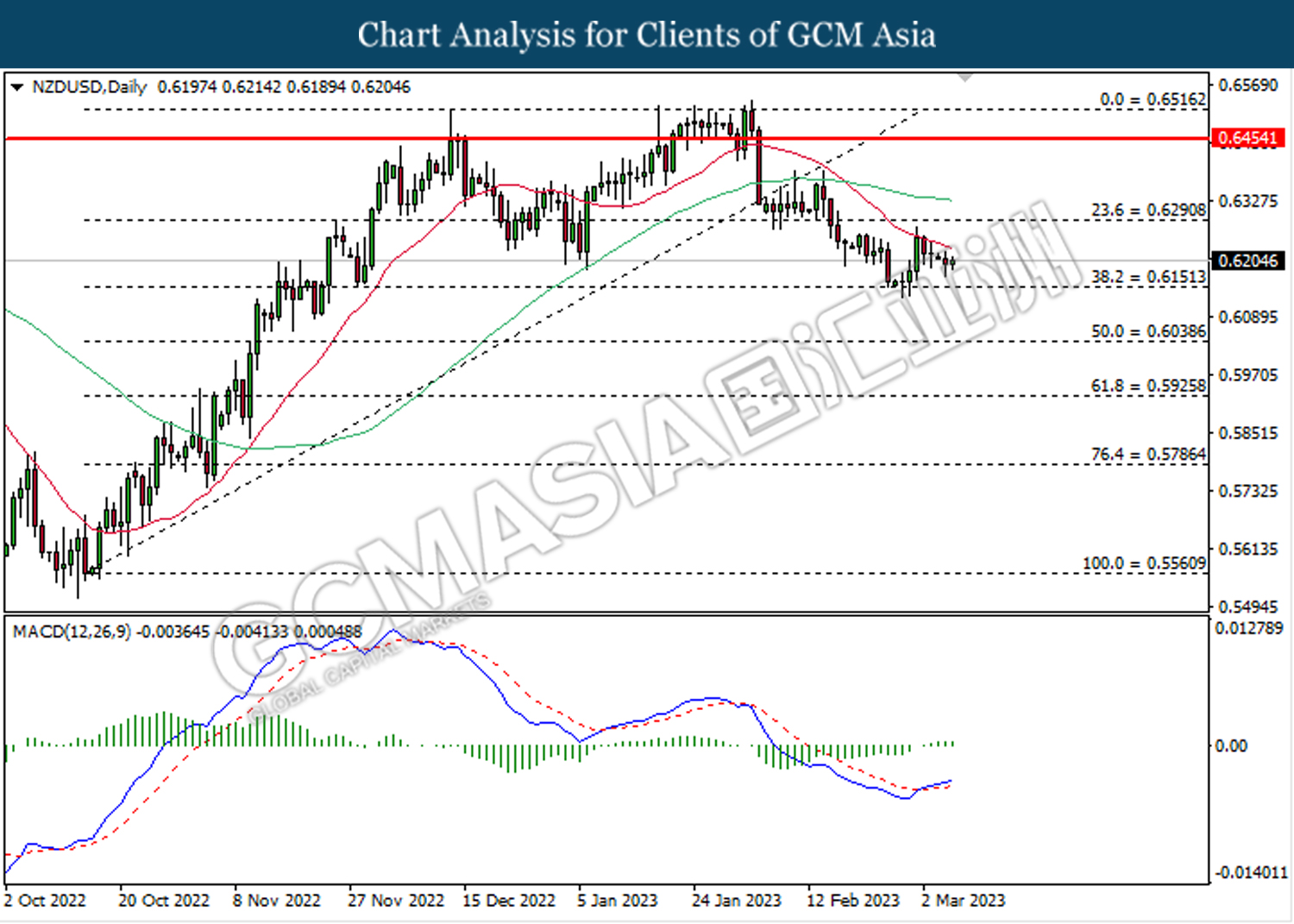

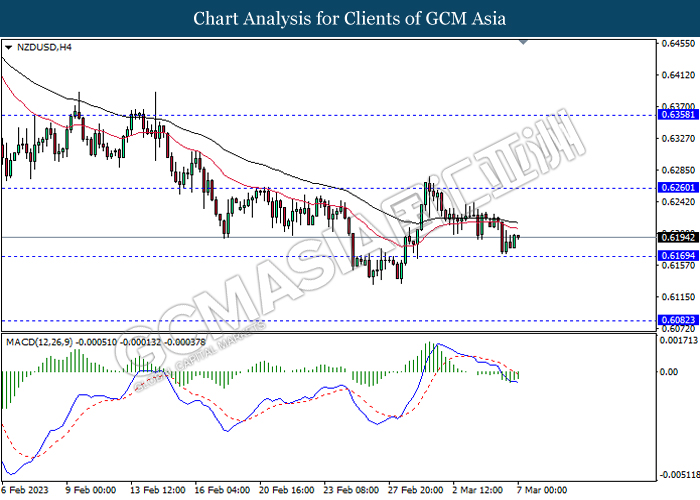

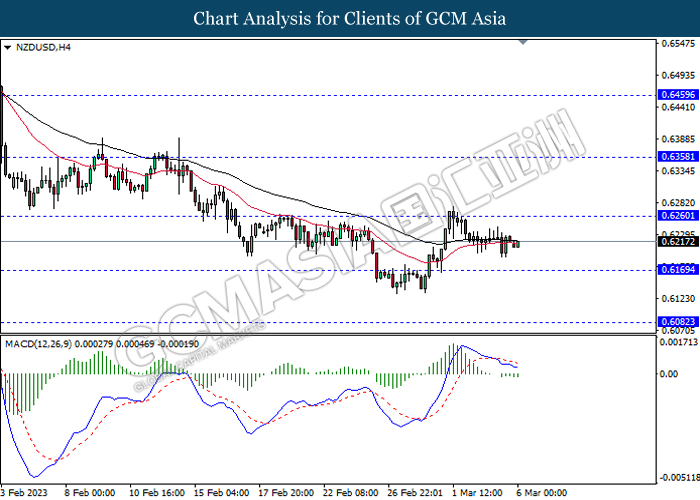

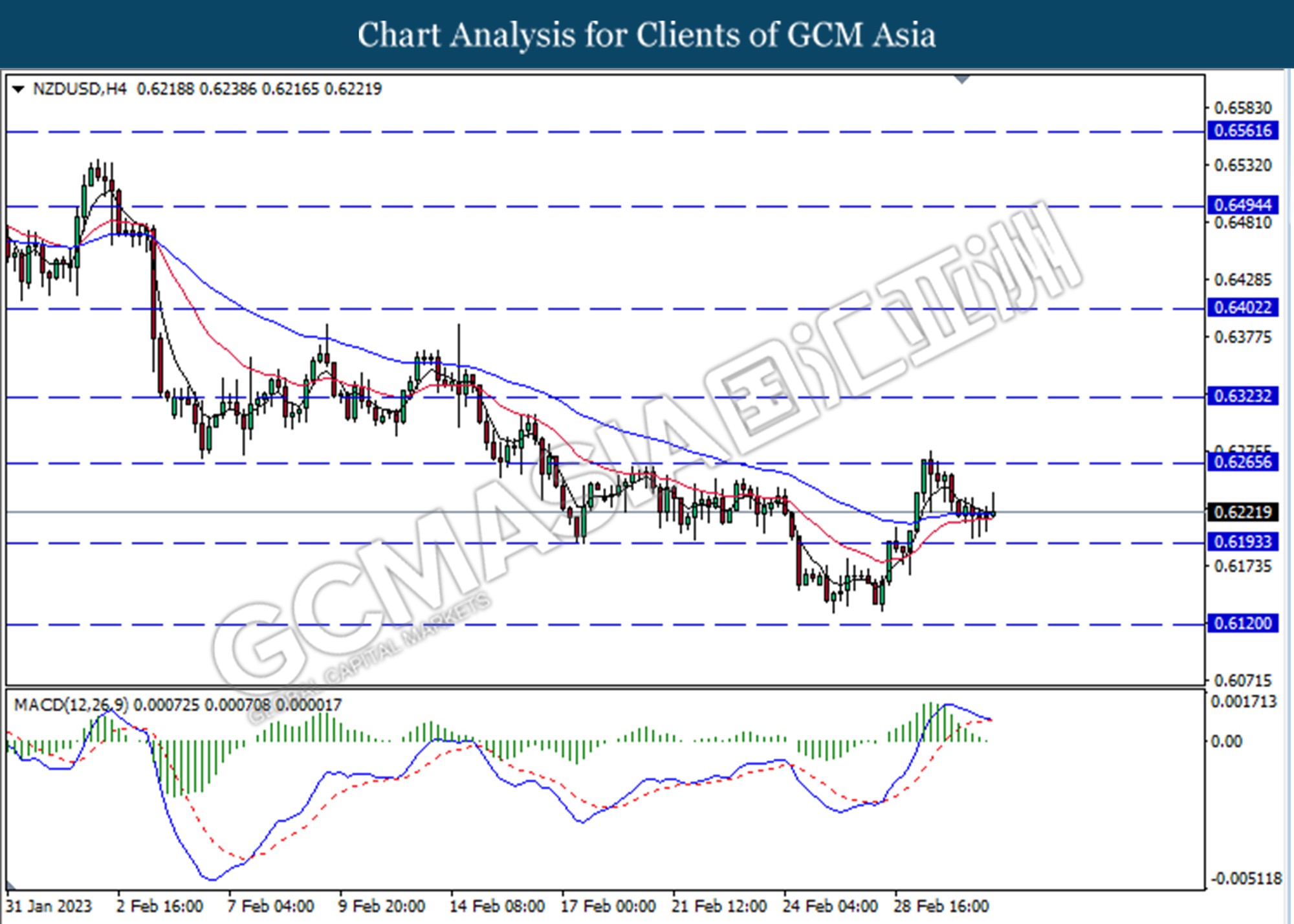

NZDUSD, H4: NZDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

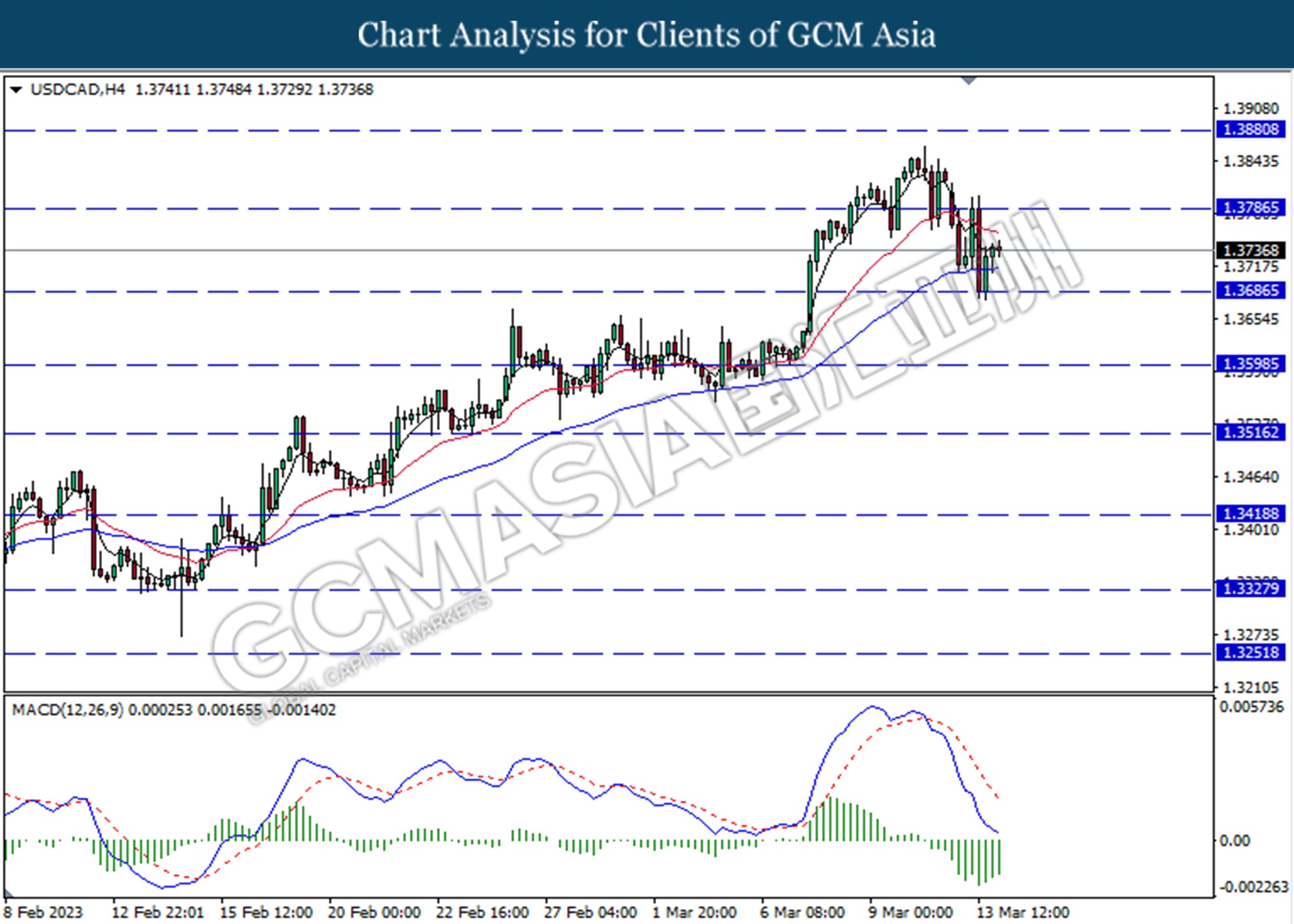

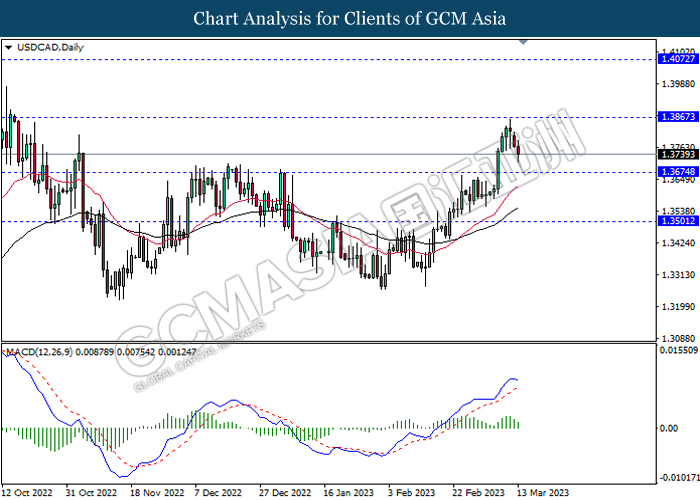

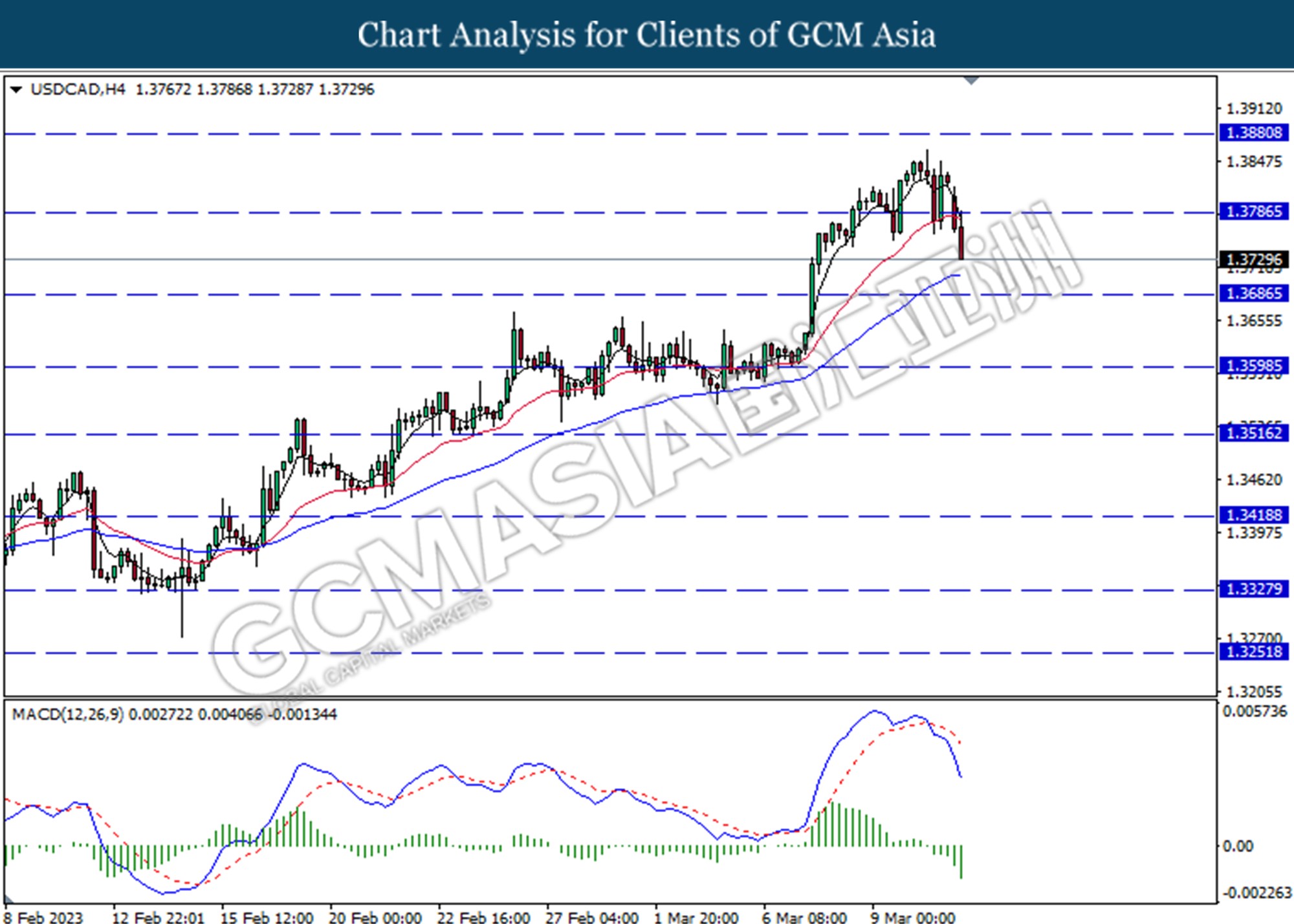

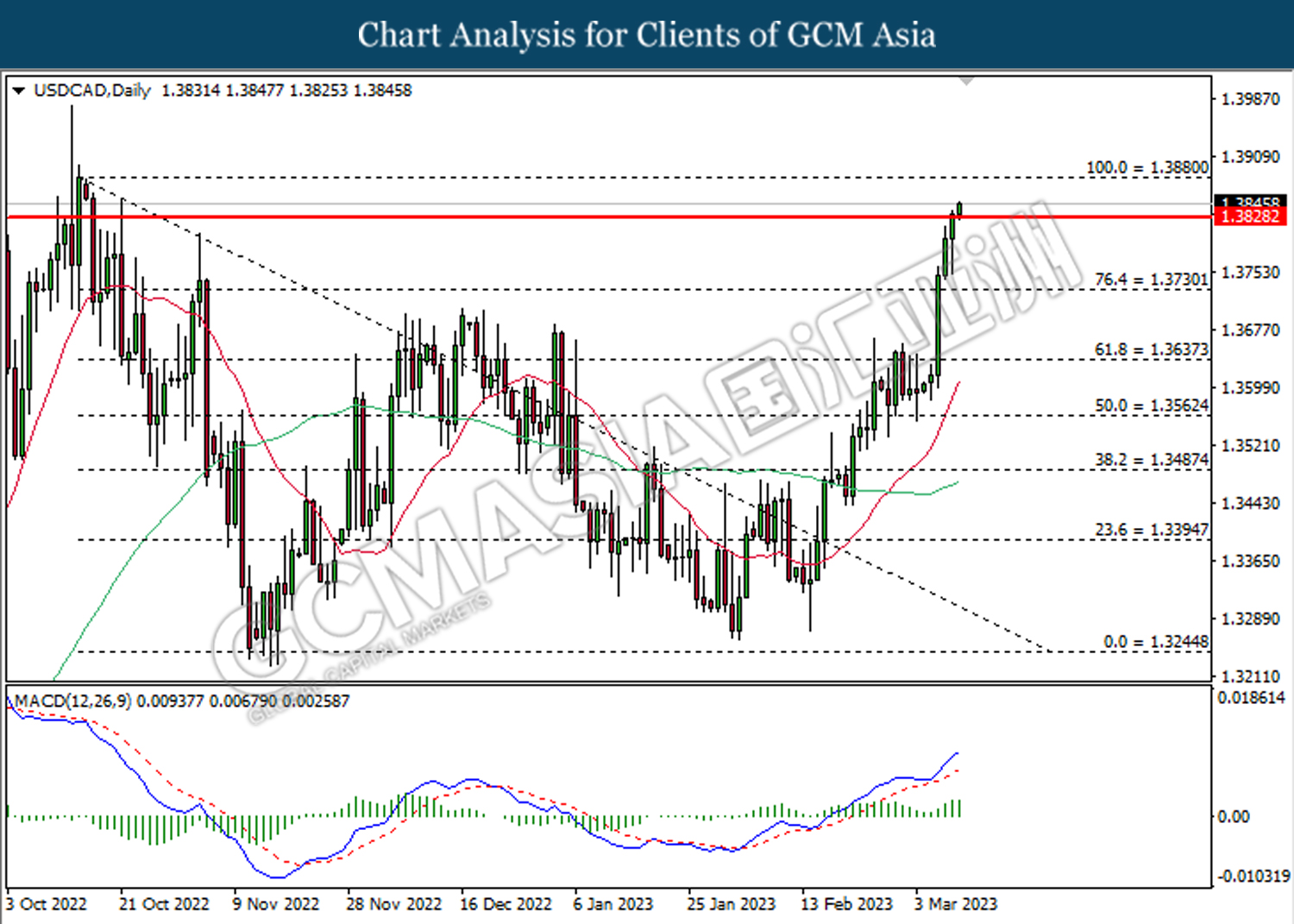

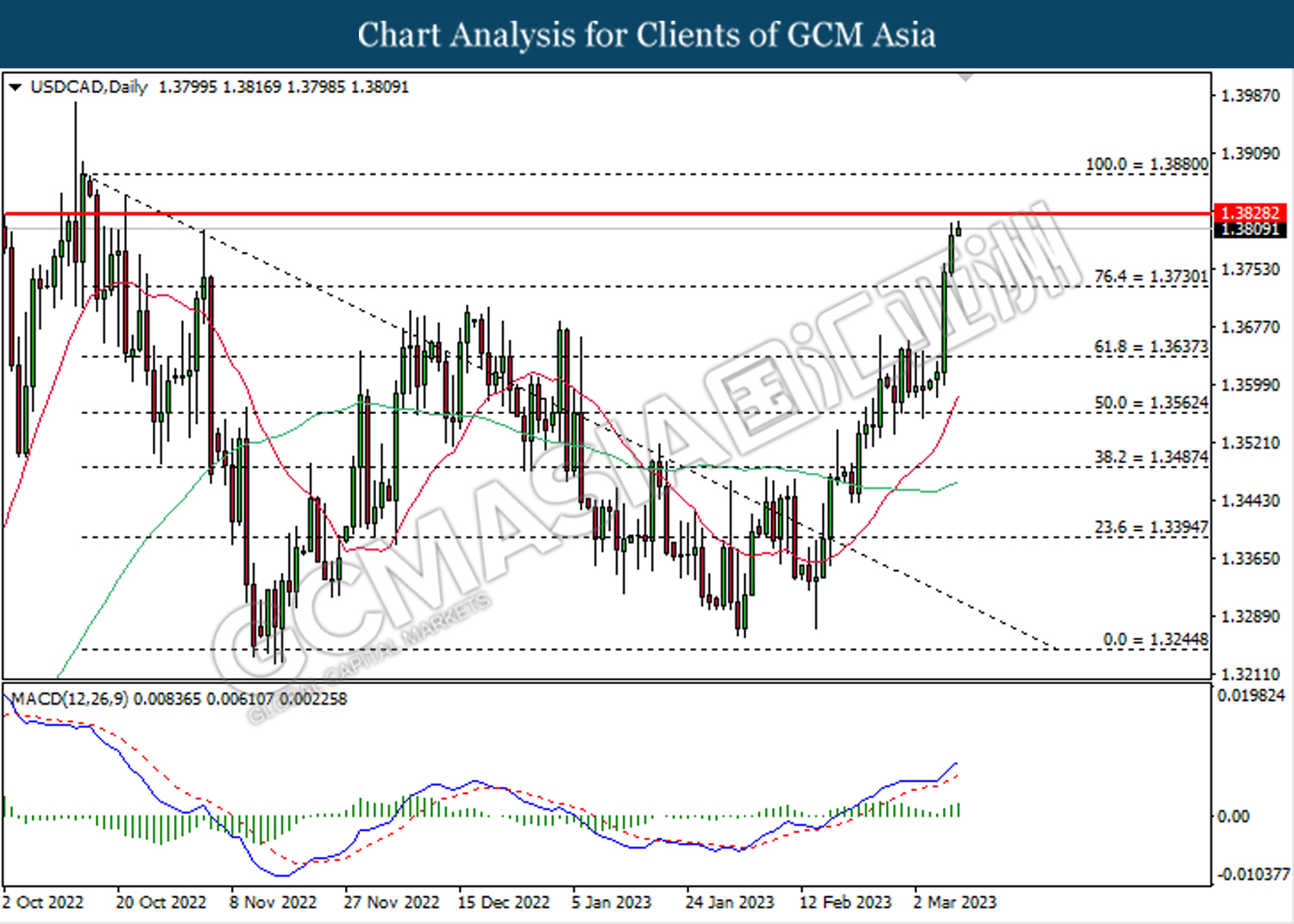

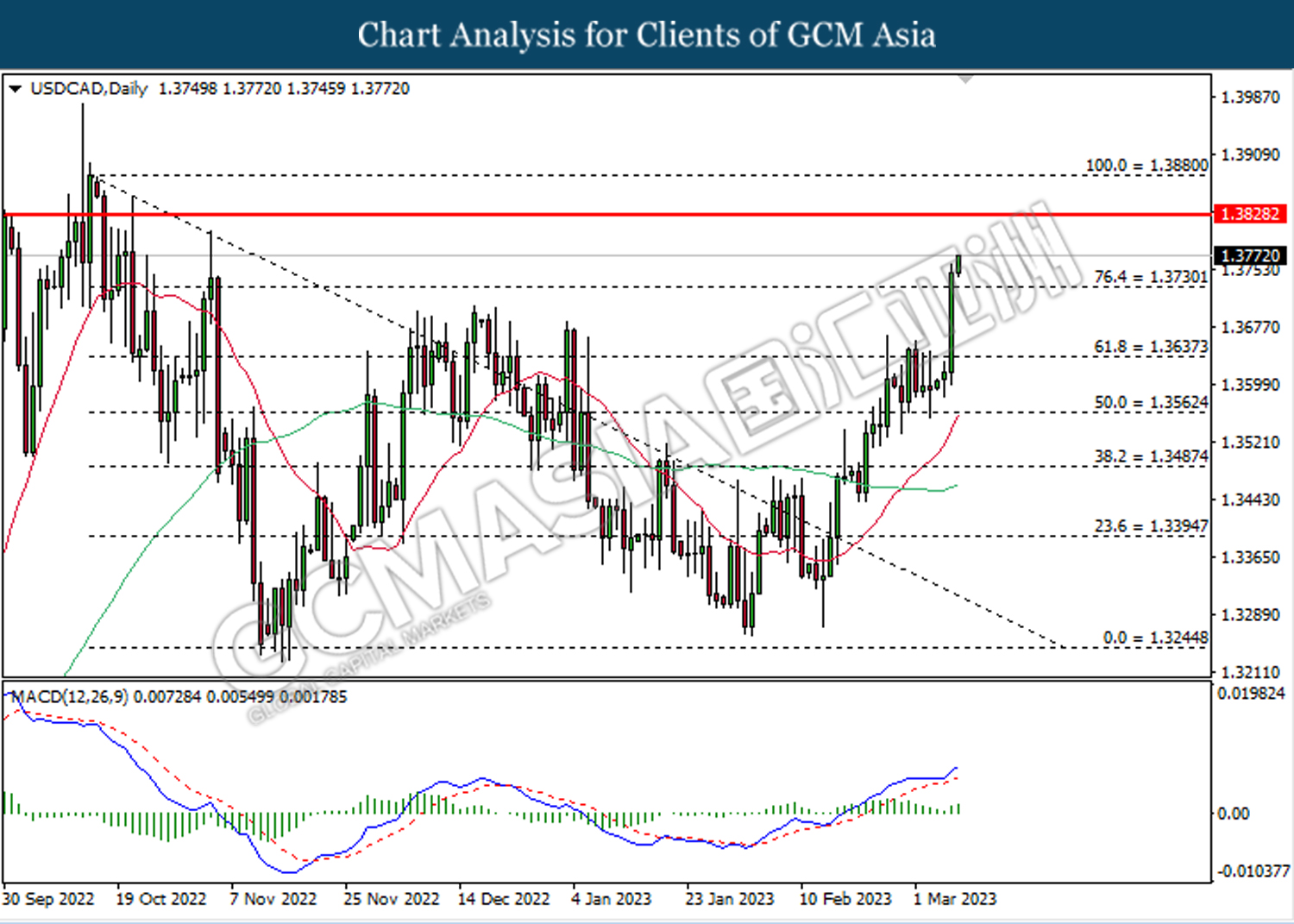

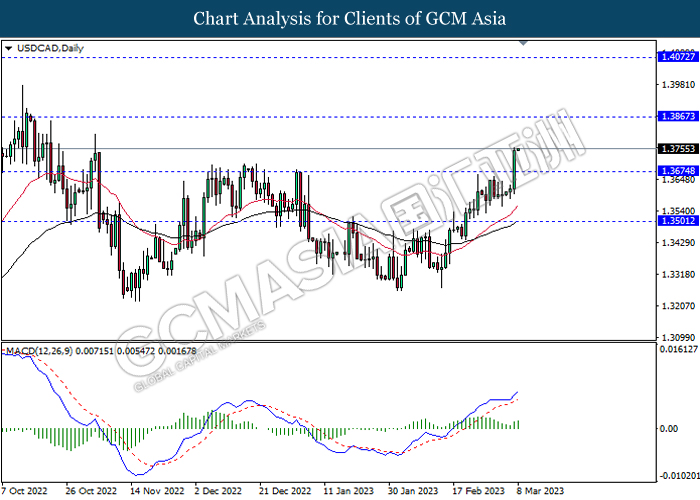

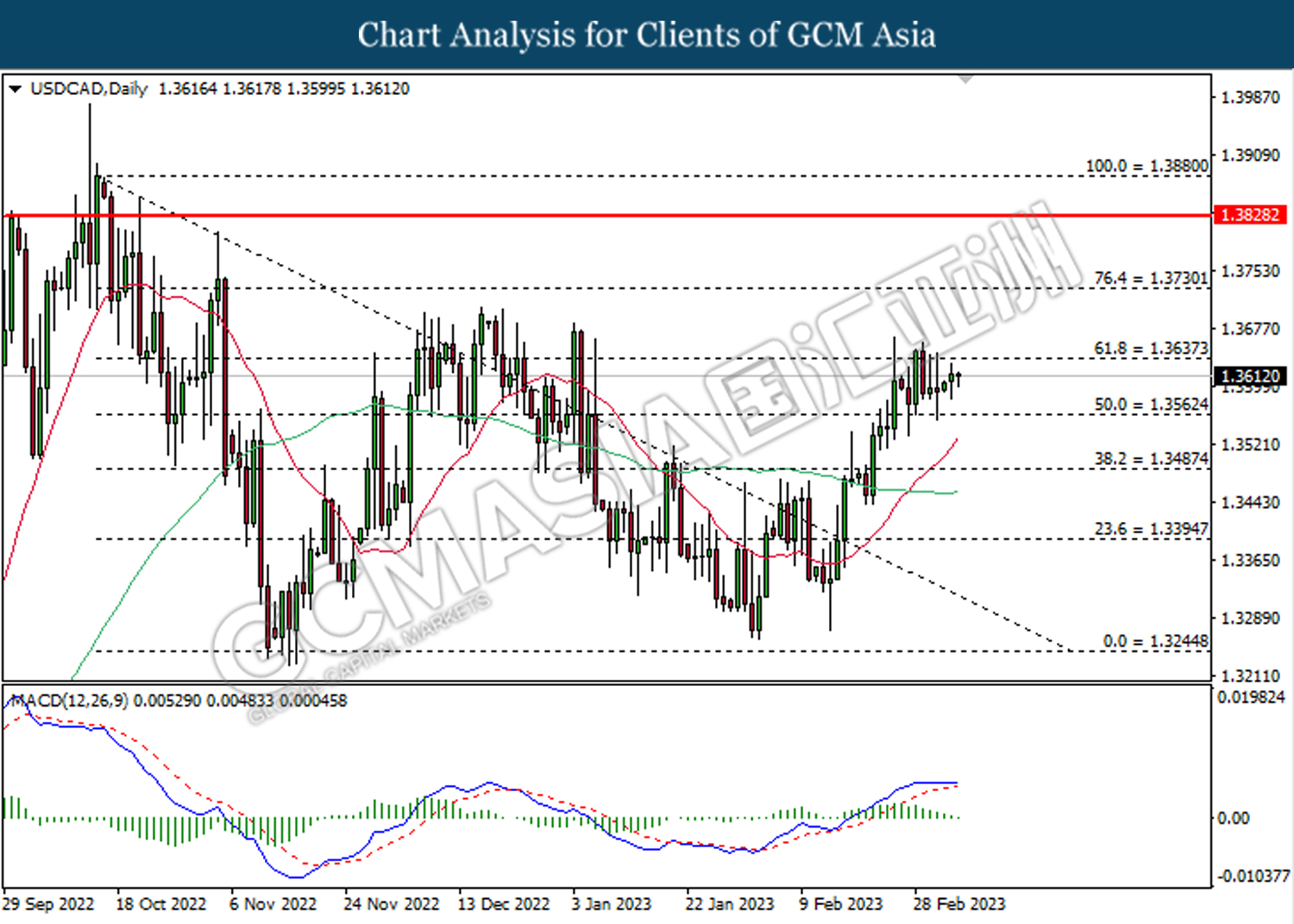

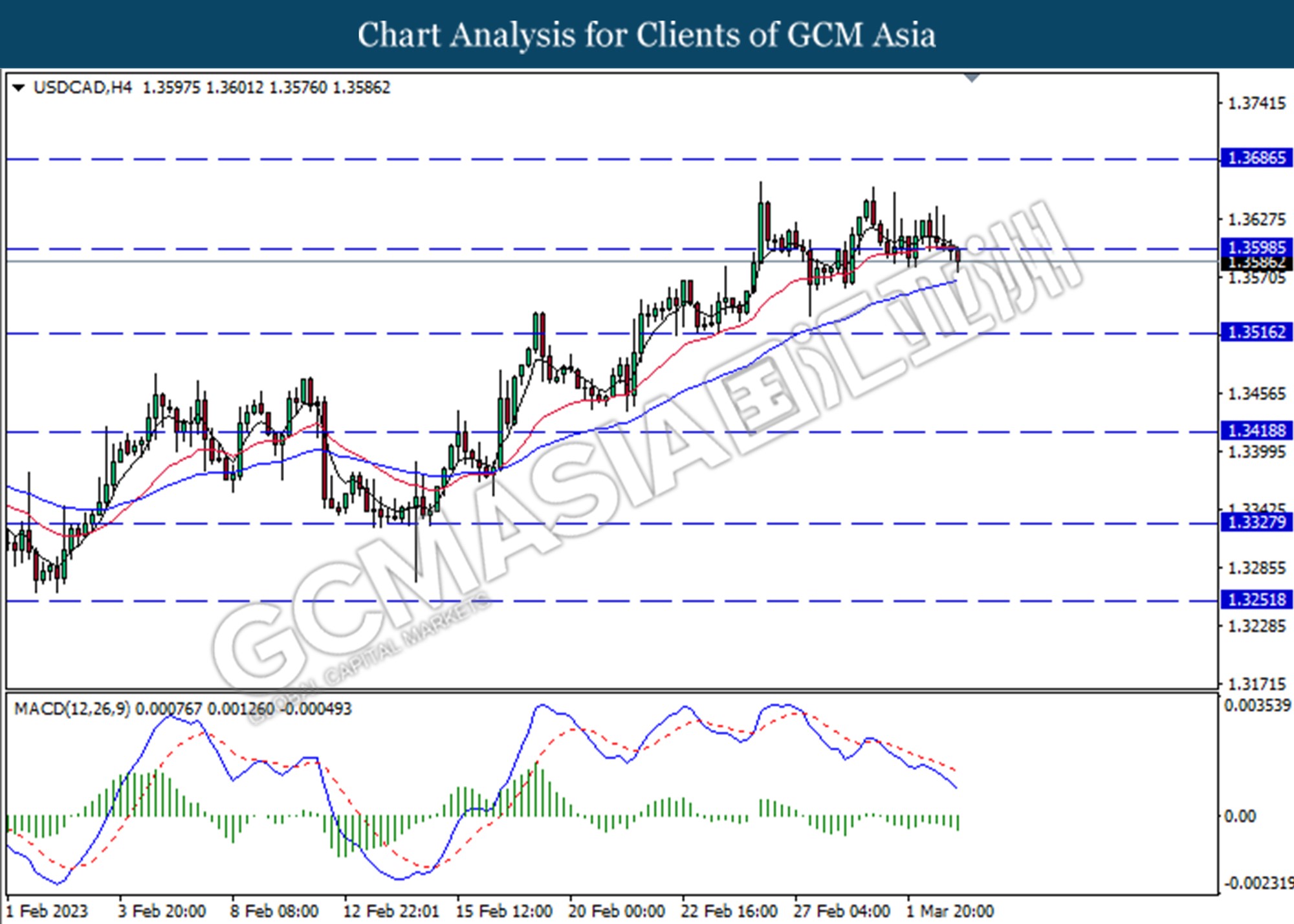

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3685. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3785.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

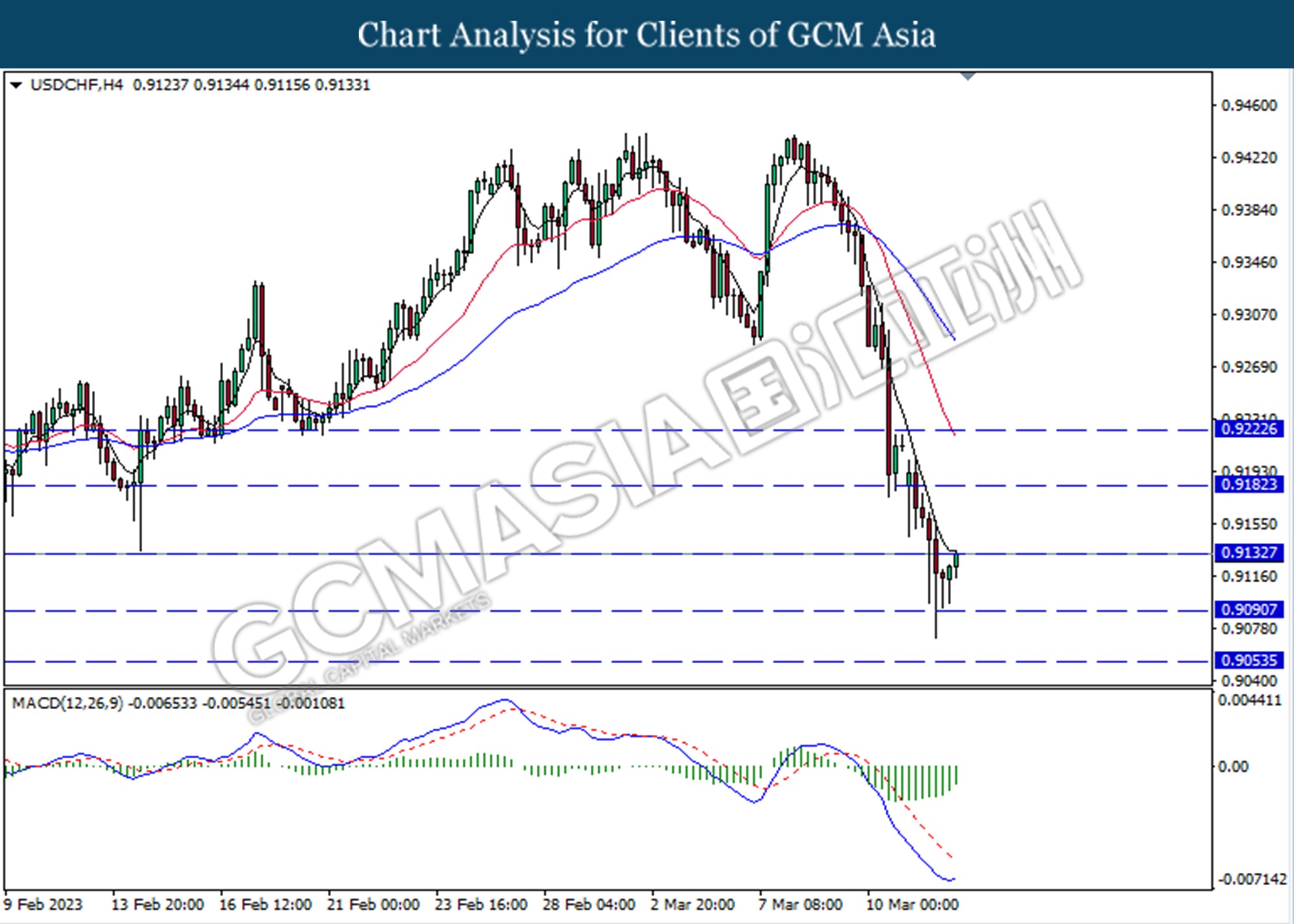

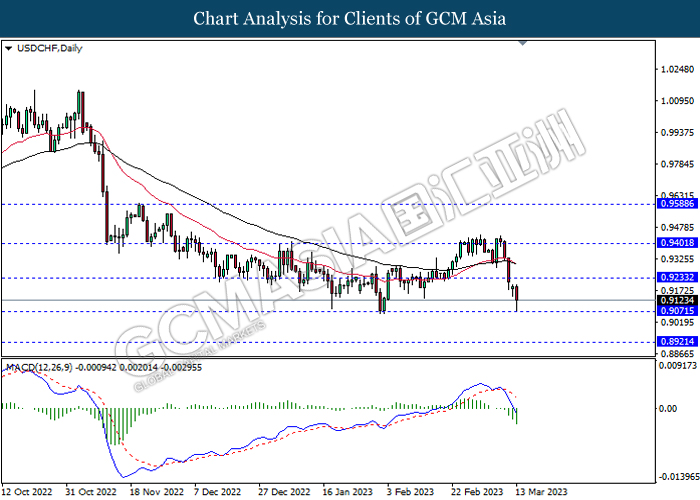

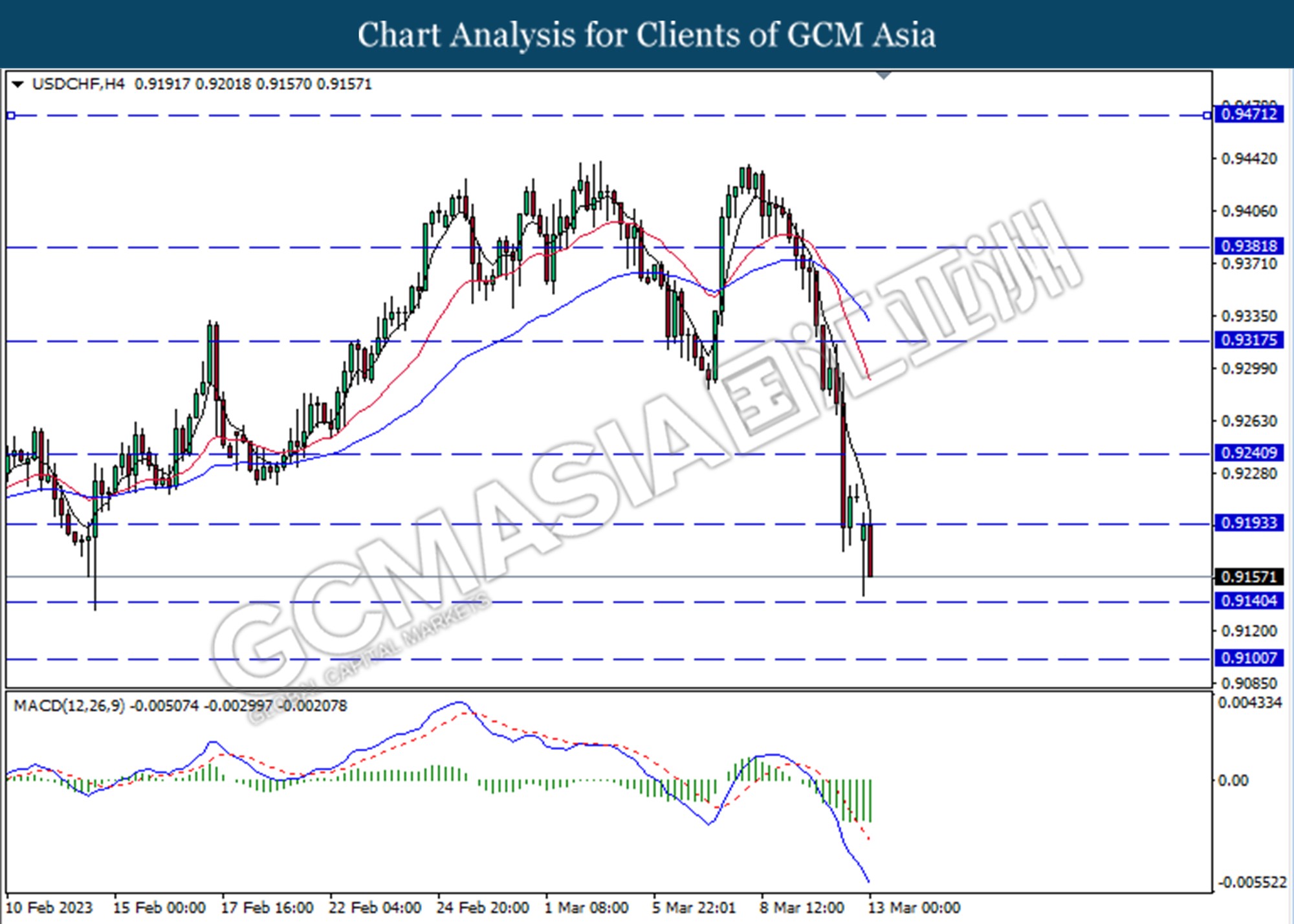

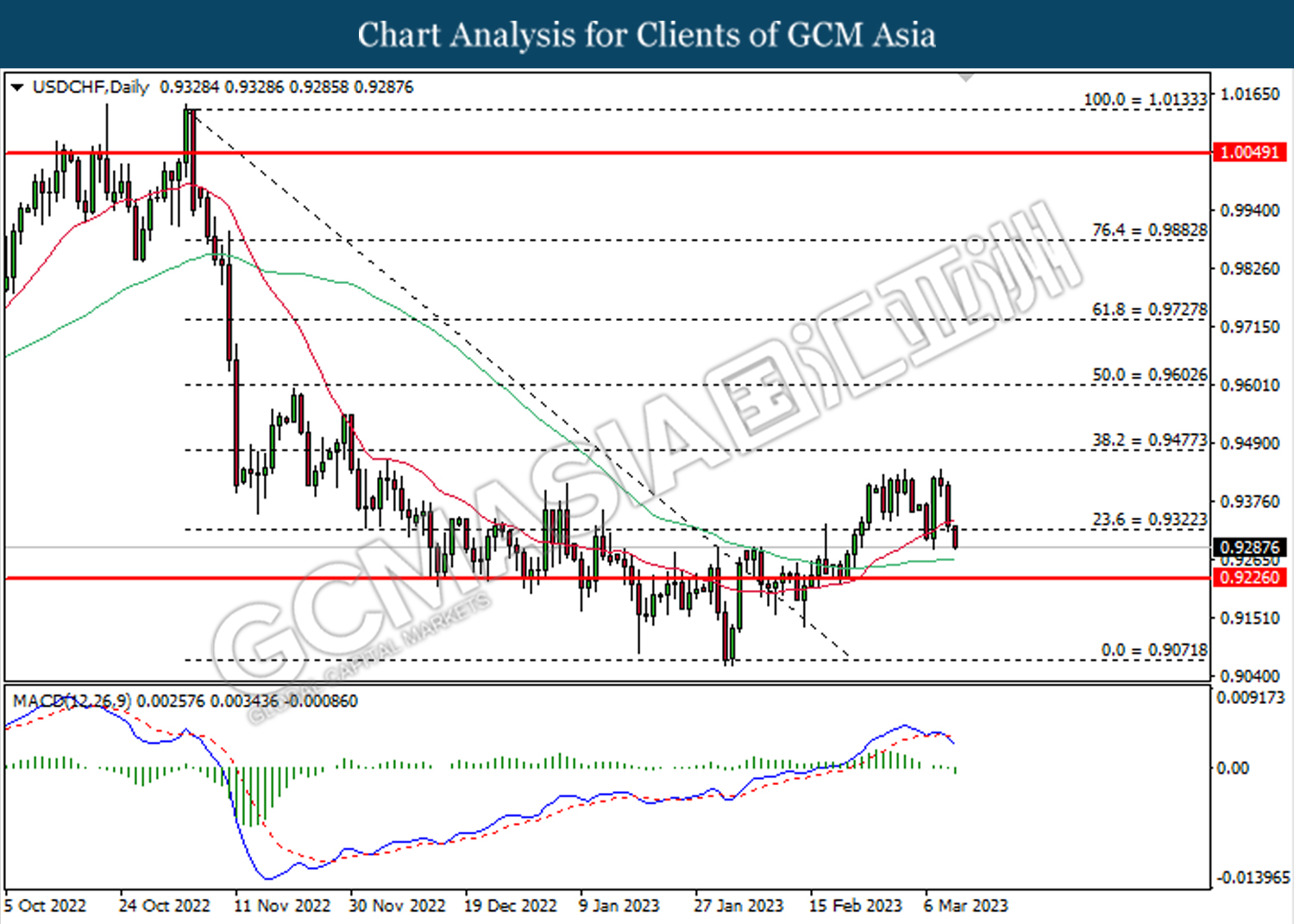

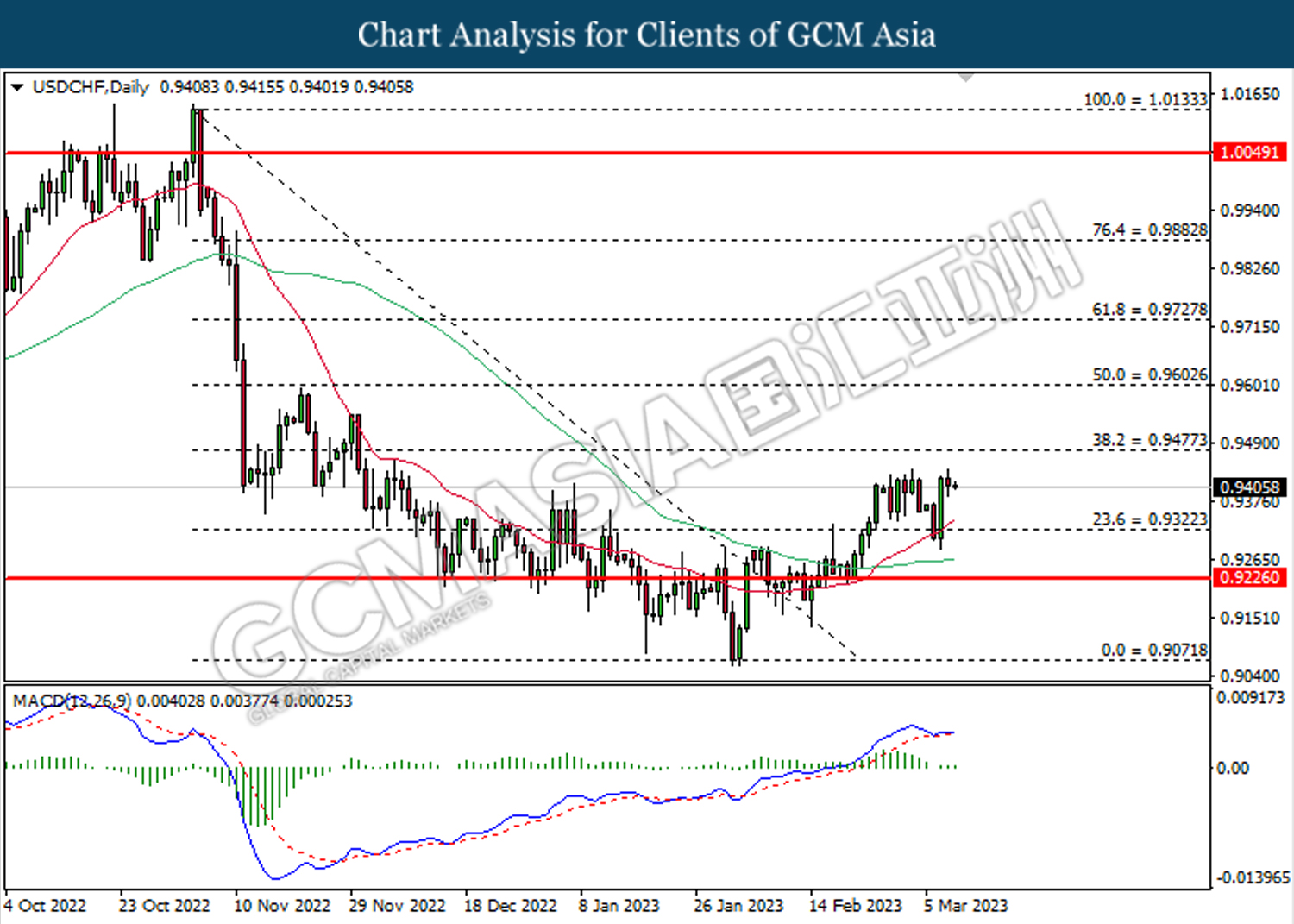

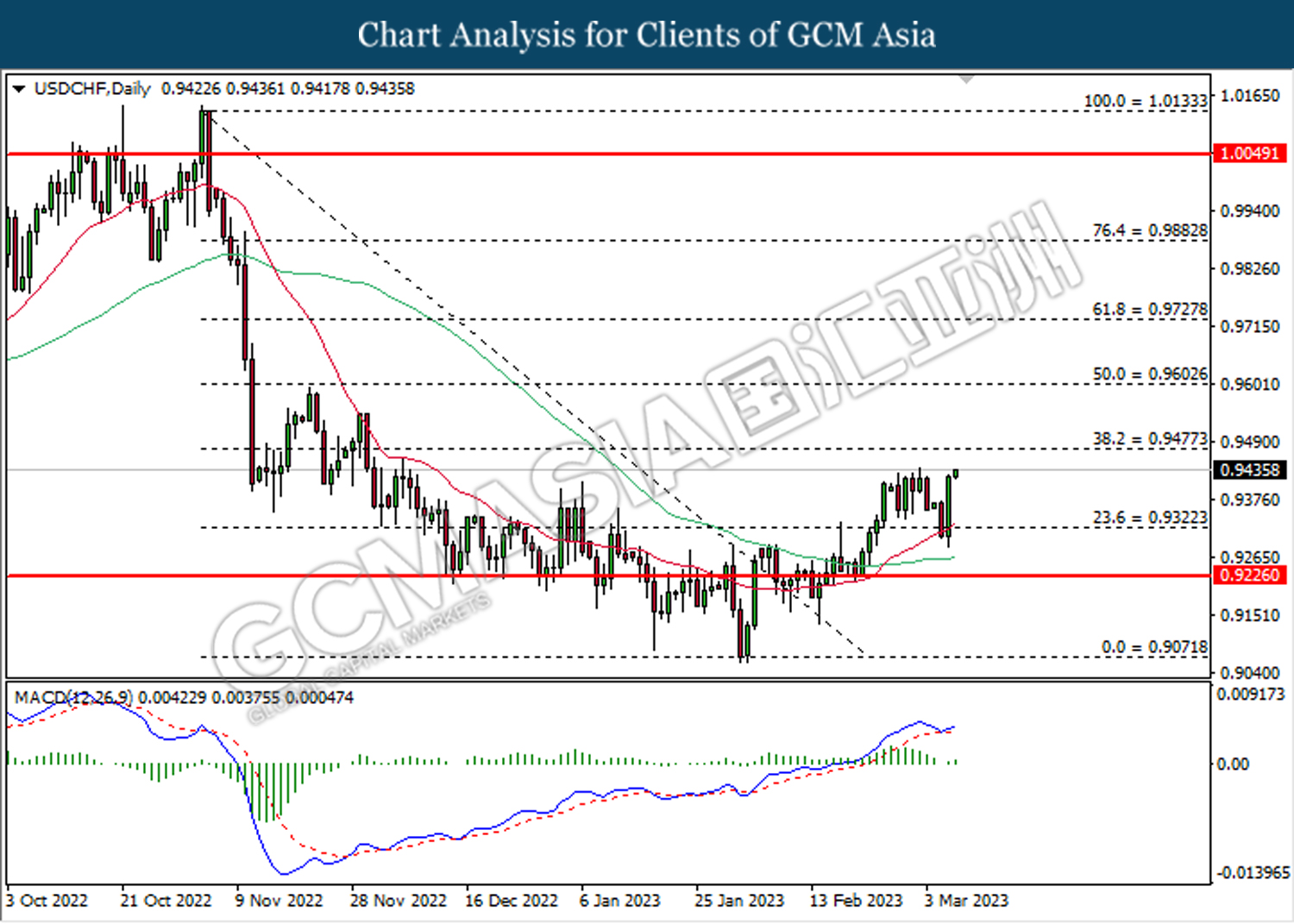

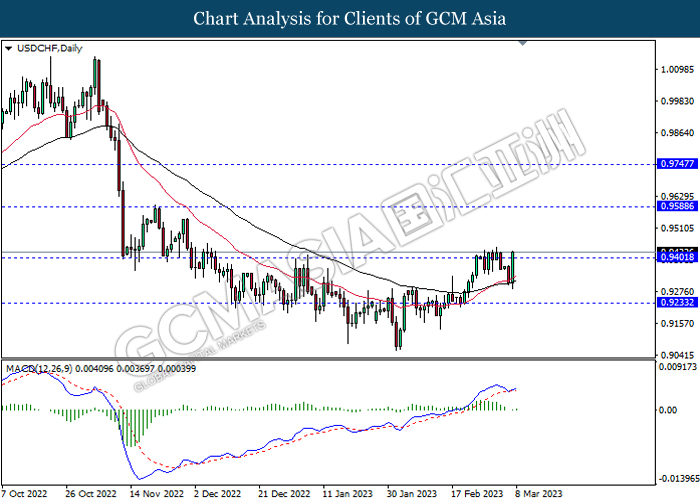

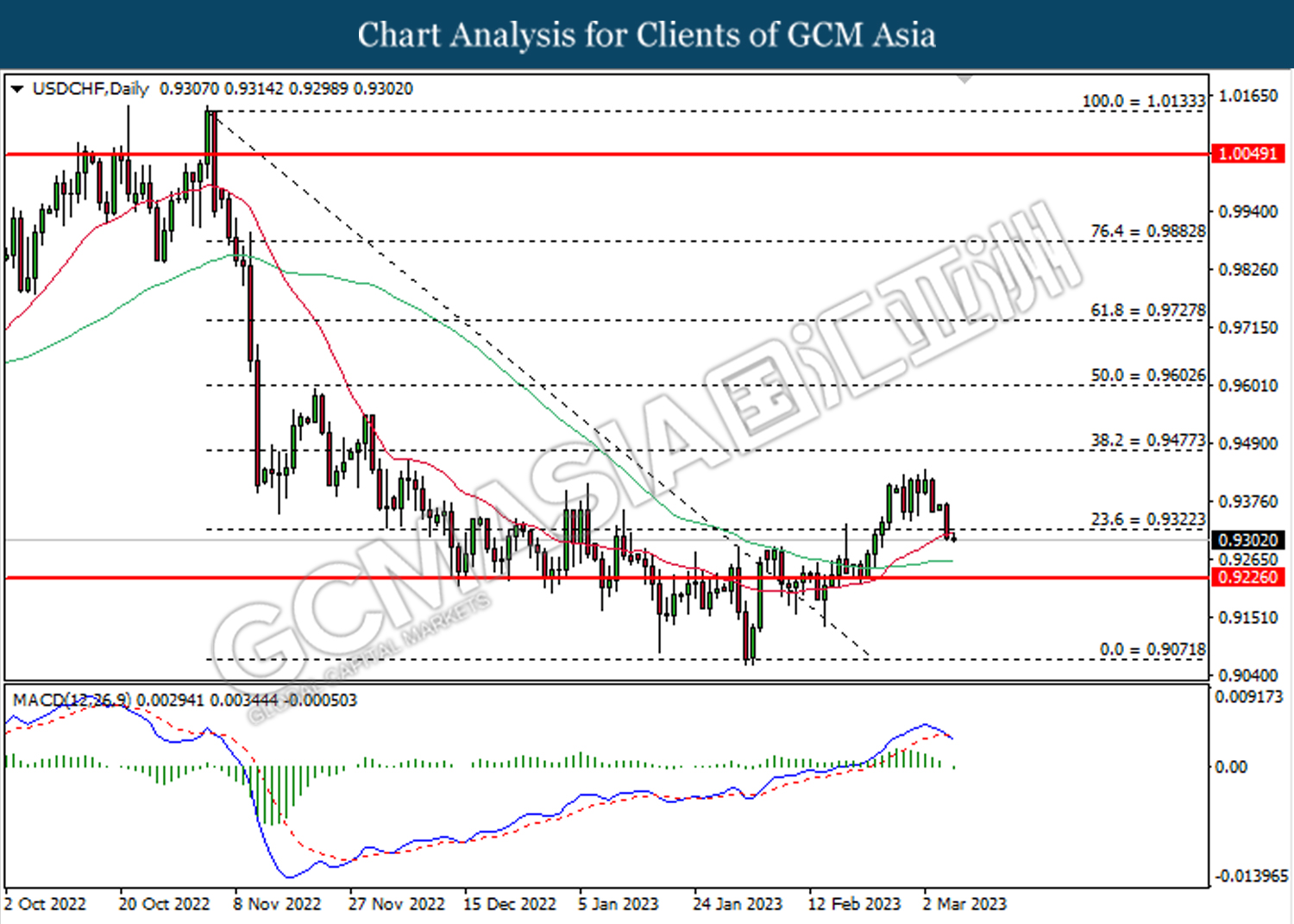

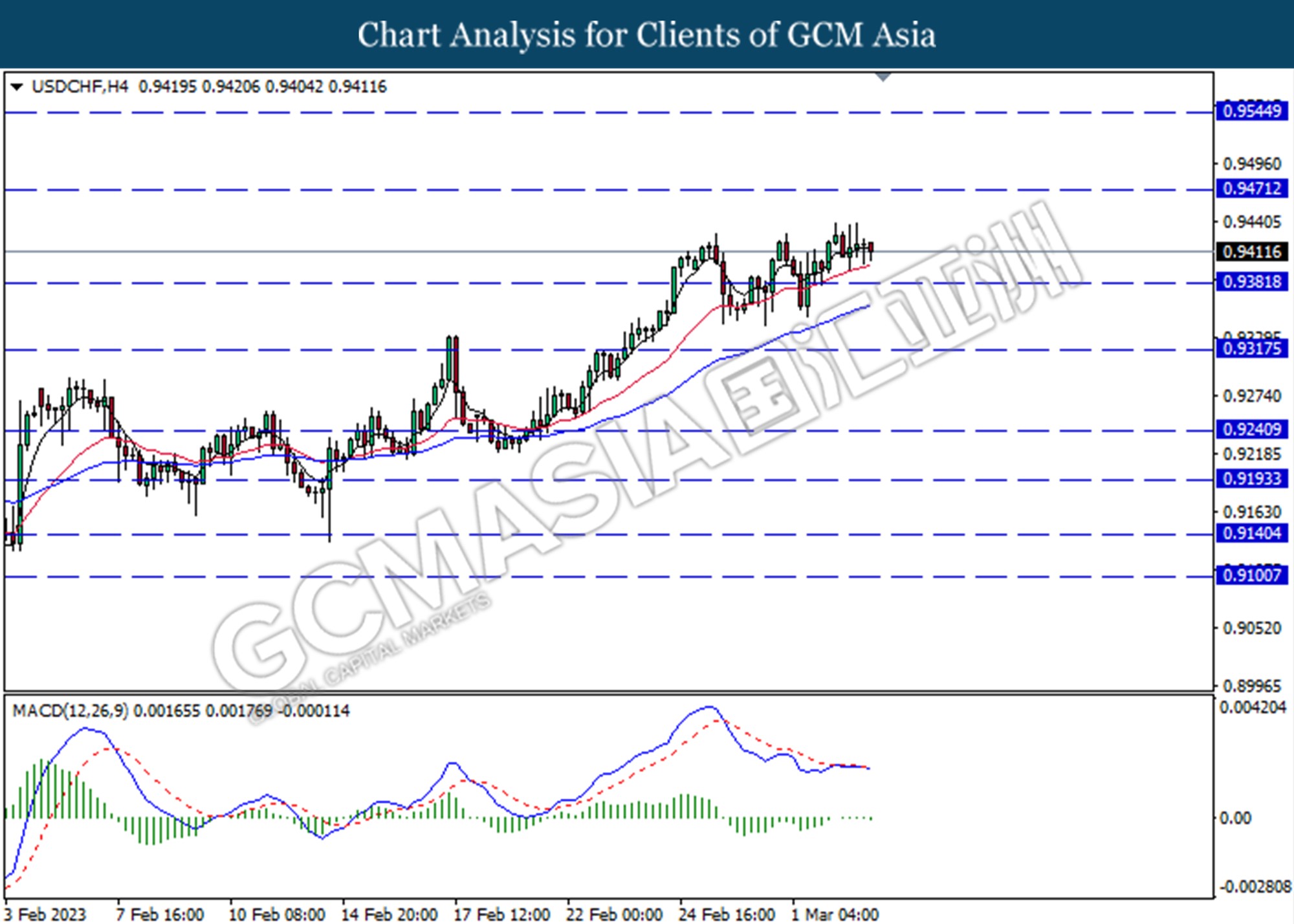

USDCHF, H4: USDCHF was traded higher while currently testing for the resistance level at 0.9135. MACD which illustrated decreasing bearish momentum suggests the pair to extend its gains if successfully break above the resistance level.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

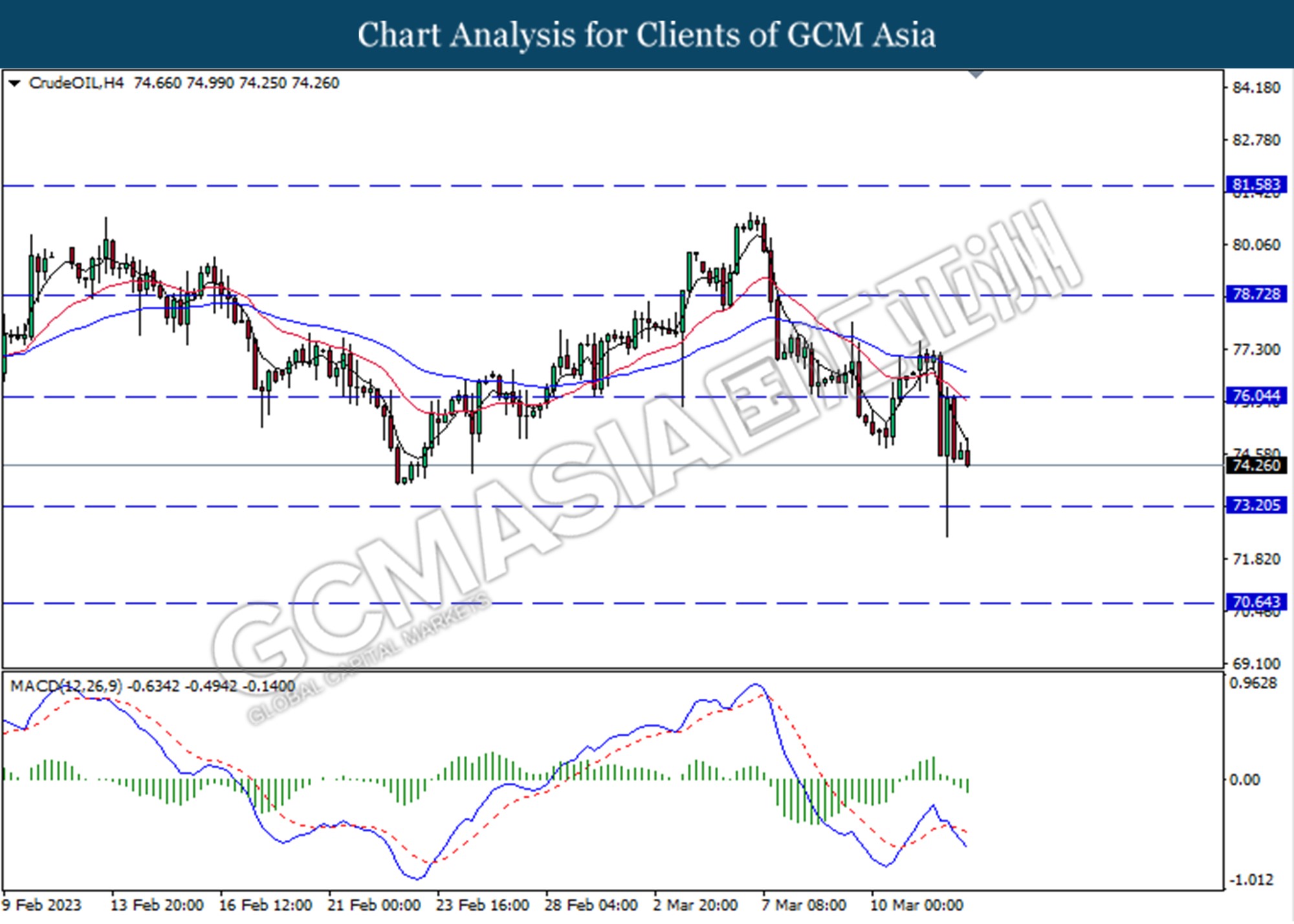

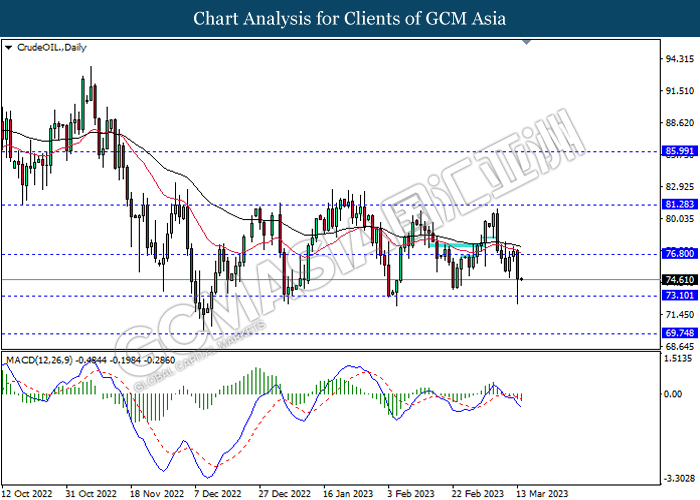

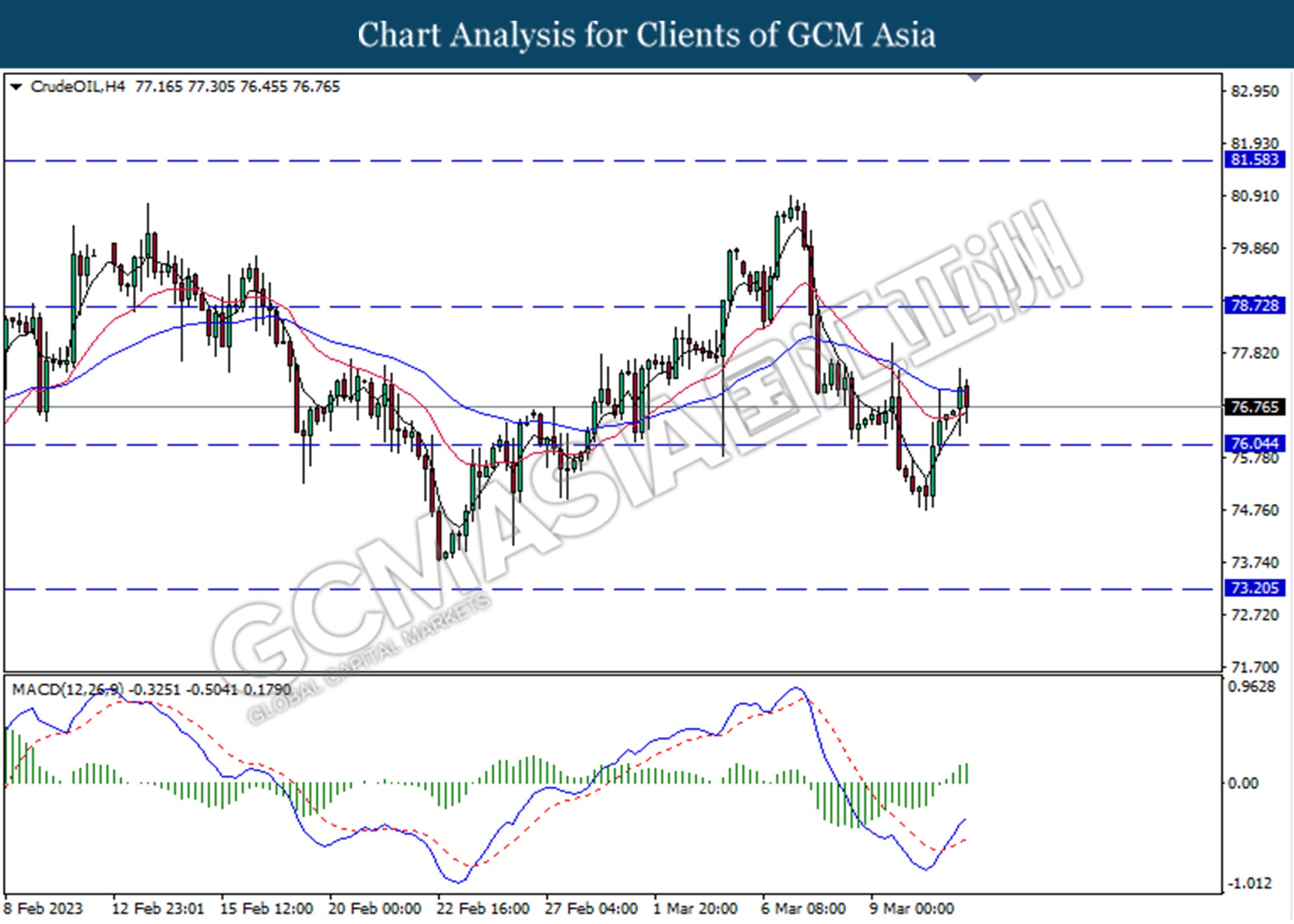

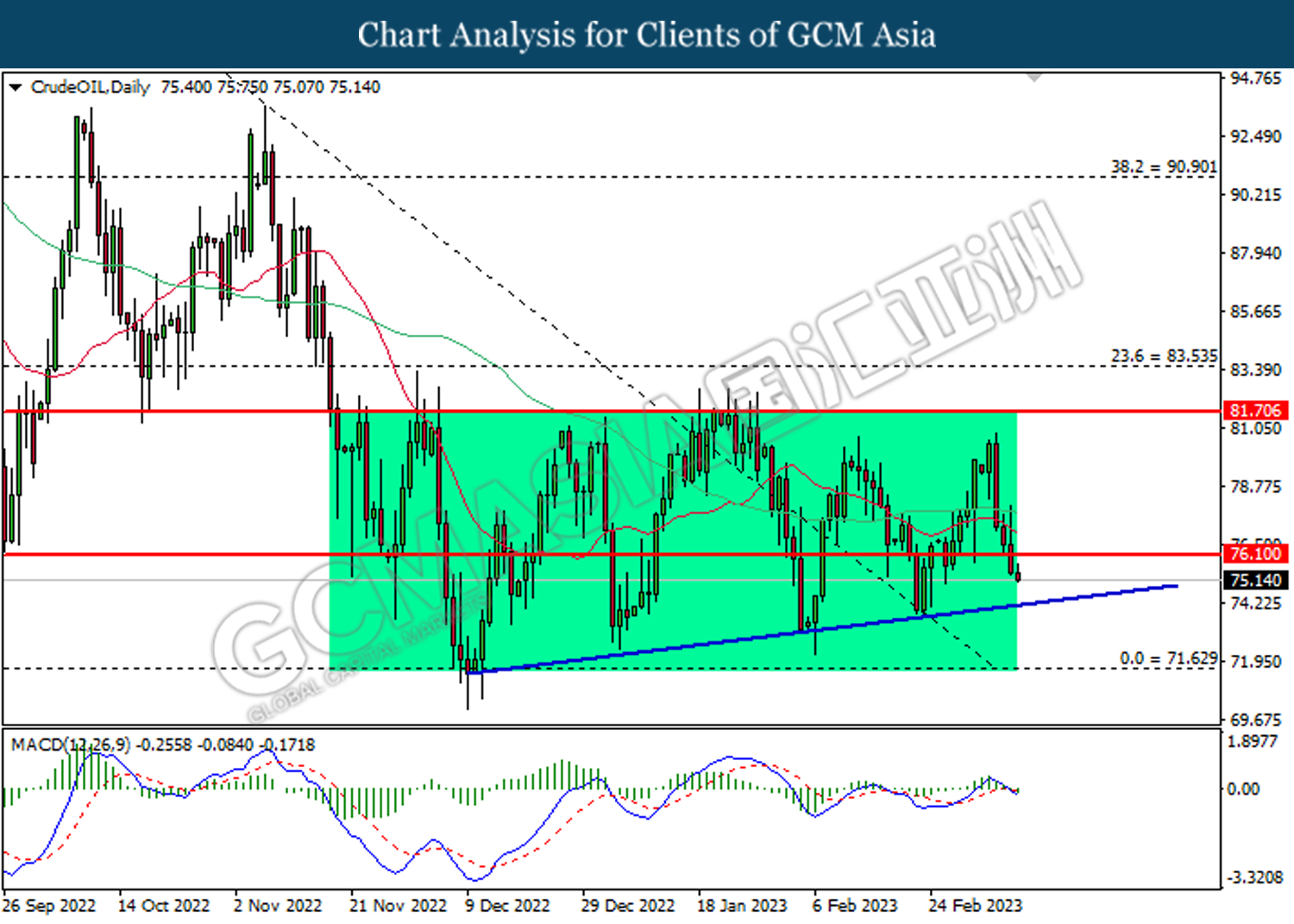

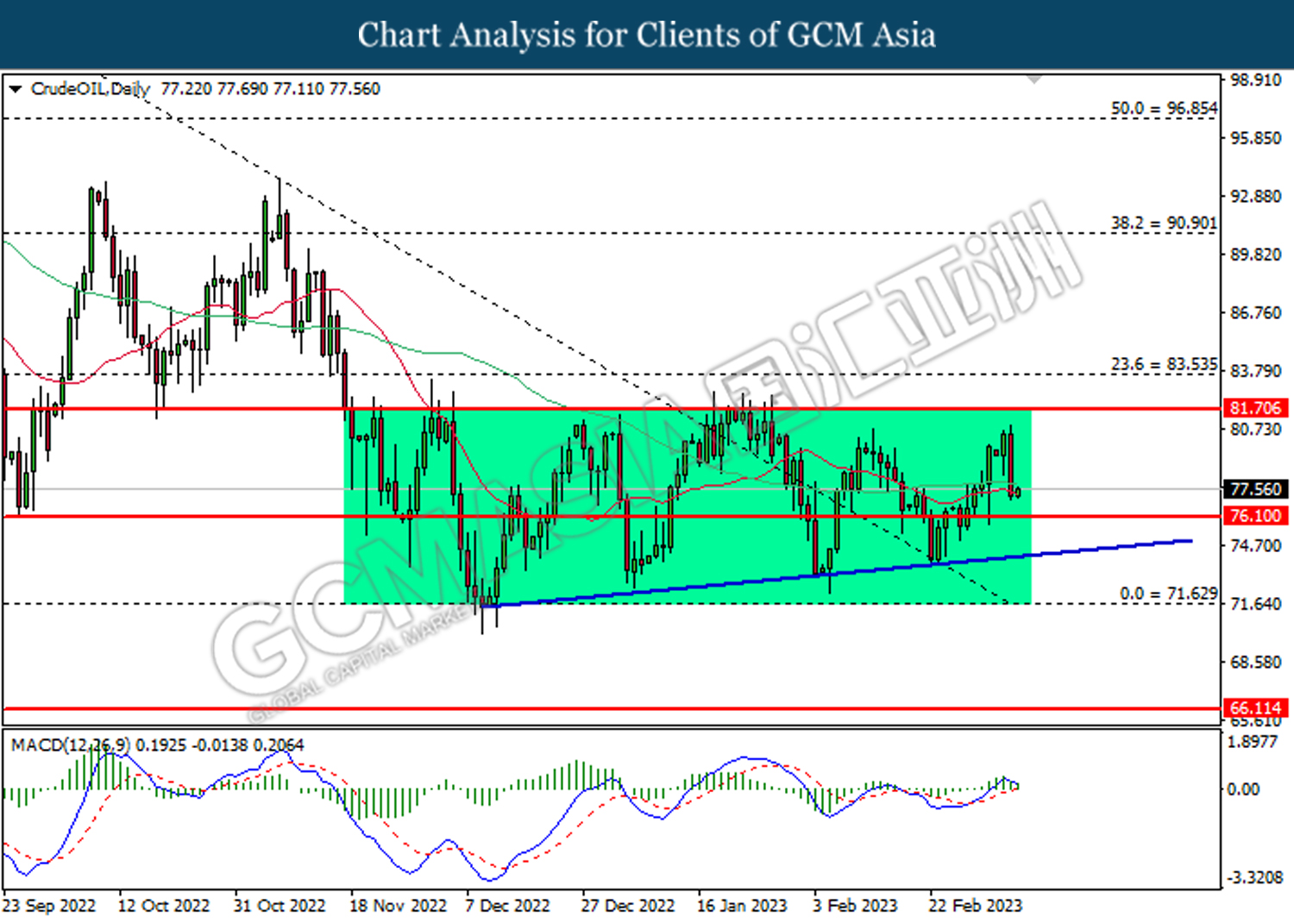

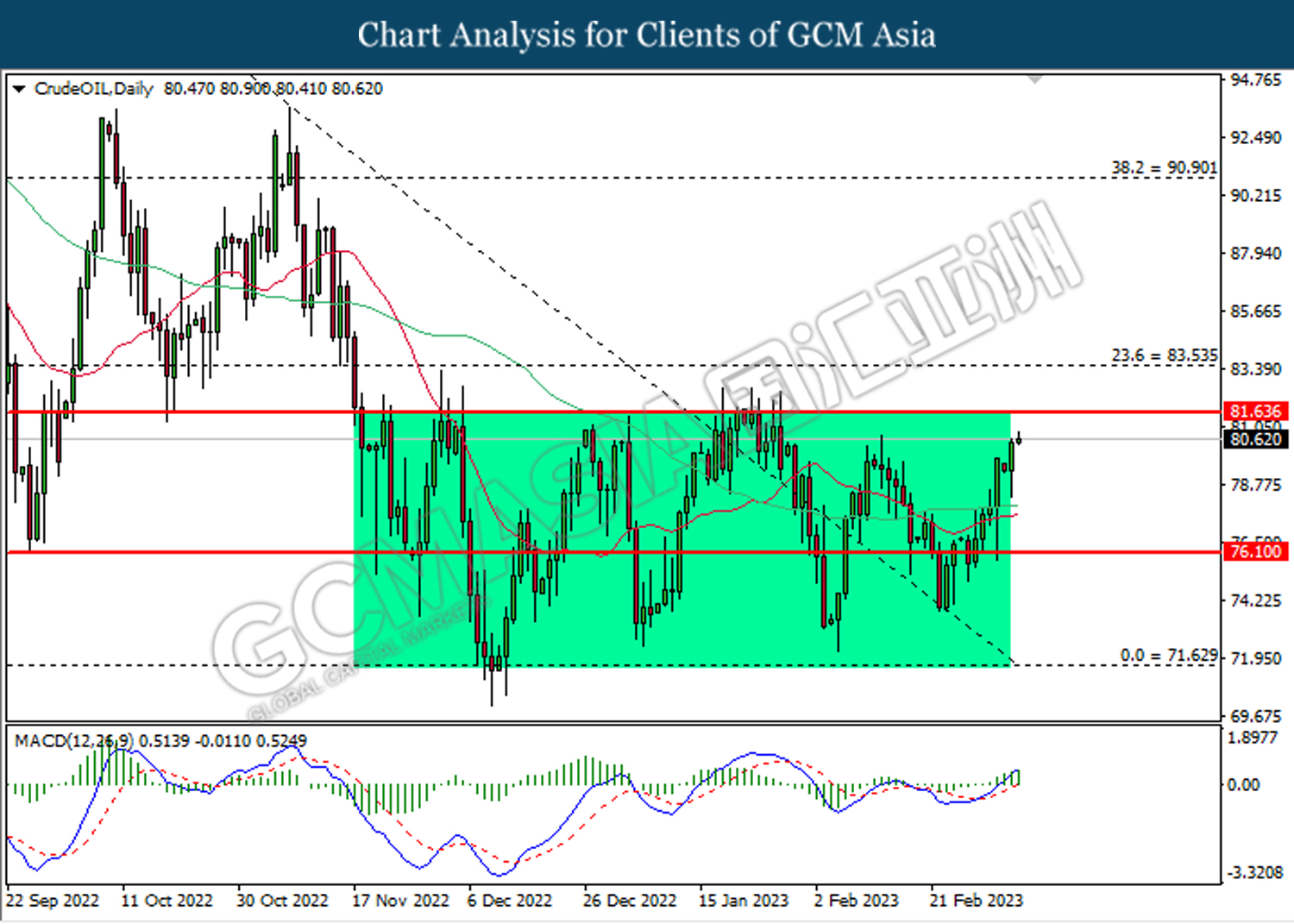

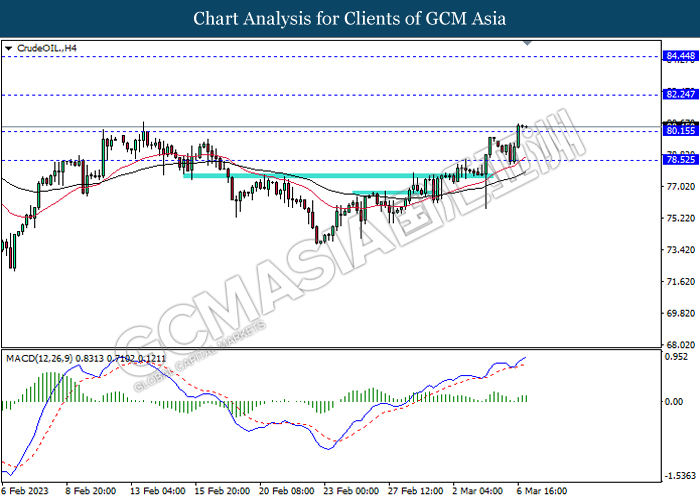

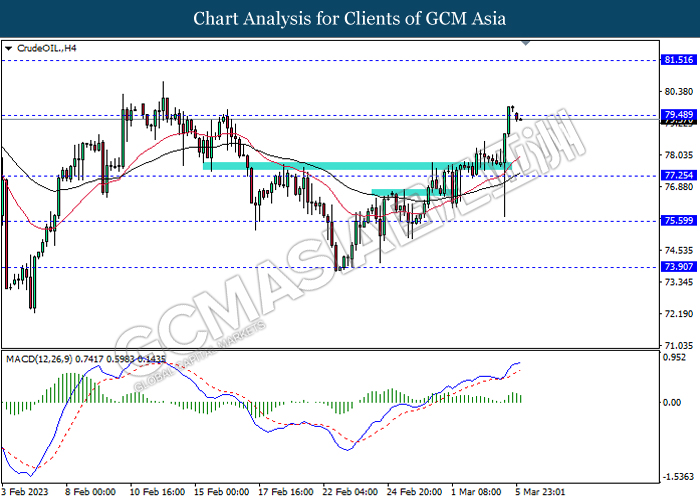

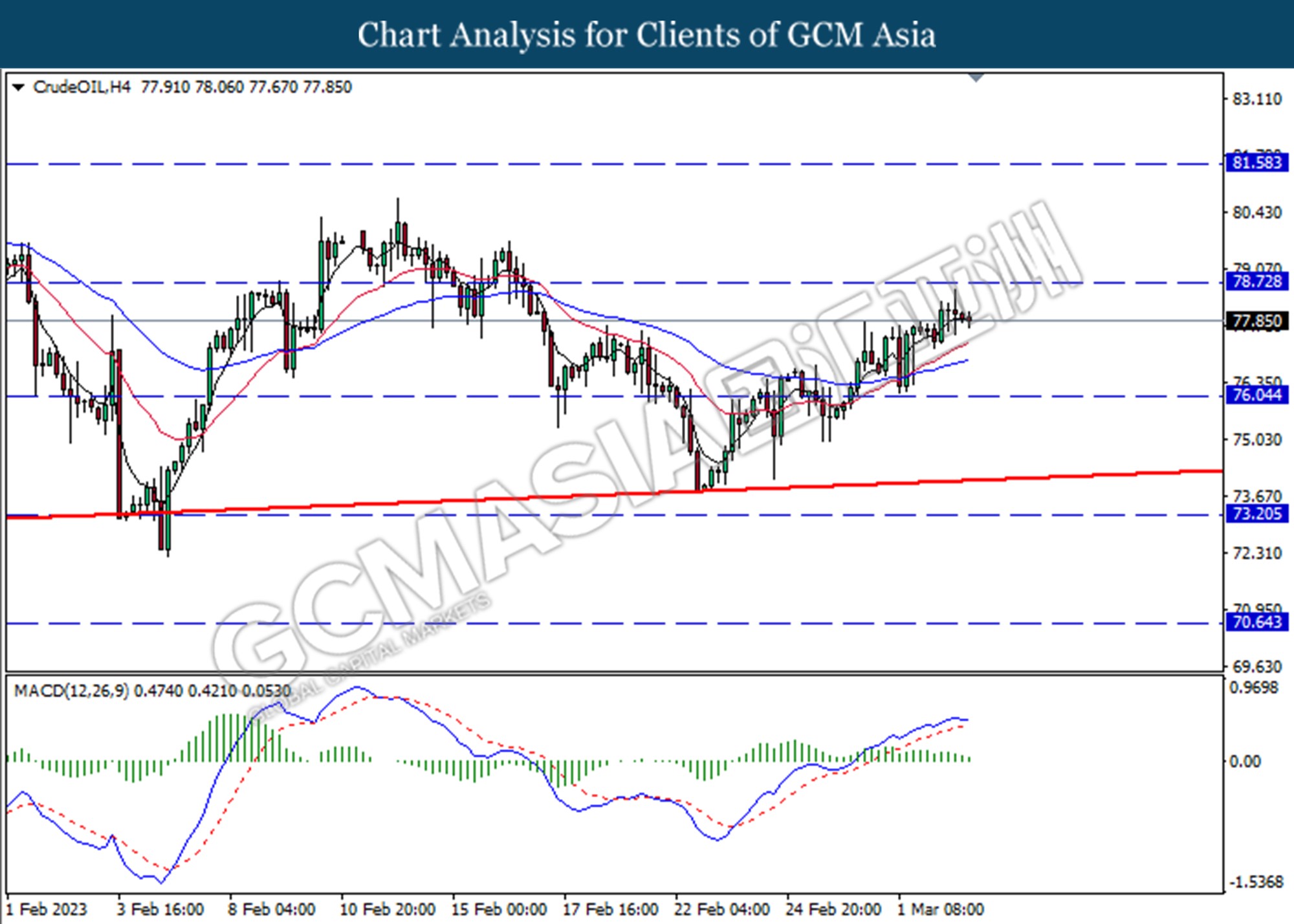

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 76.05. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 73.20.

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

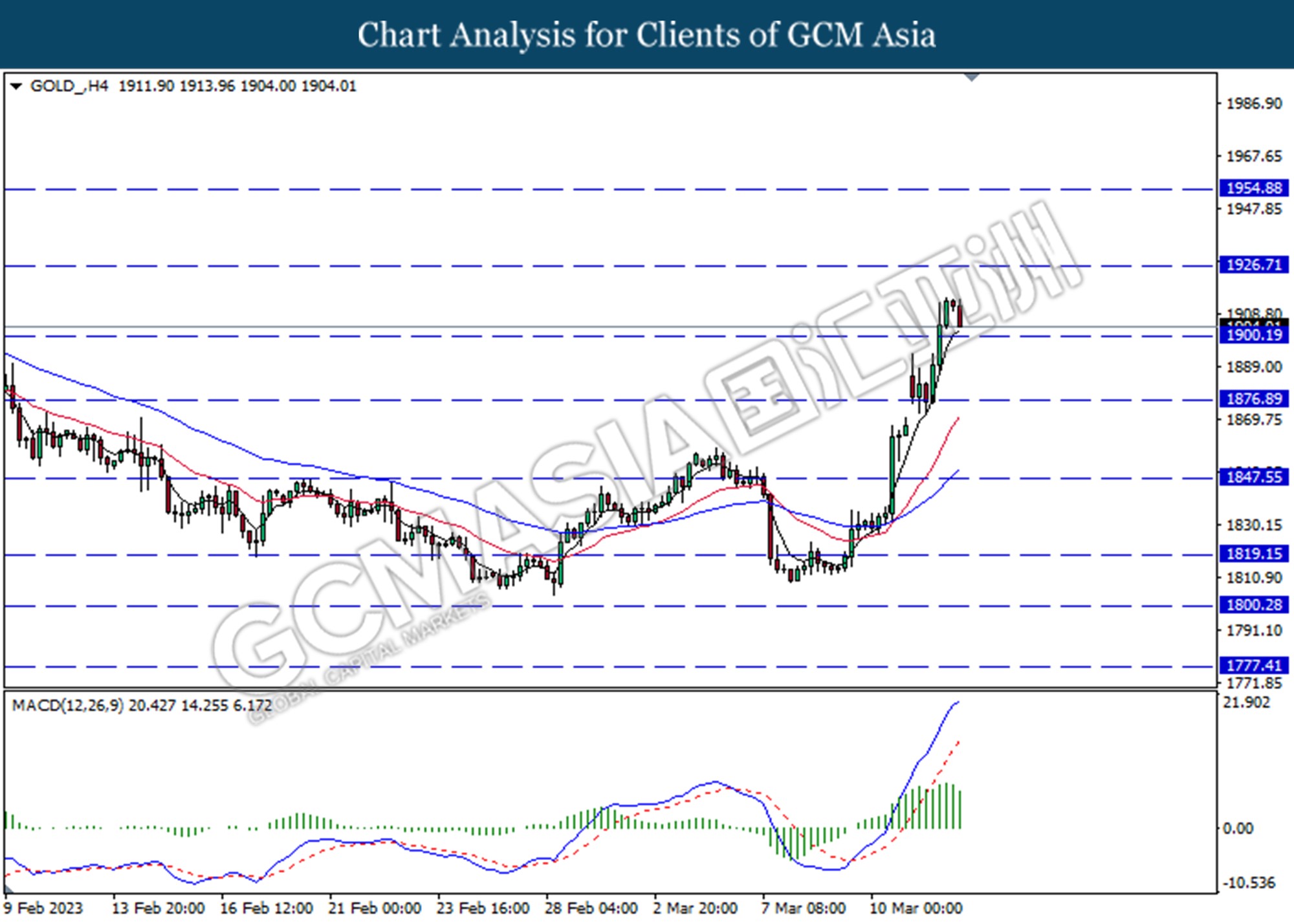

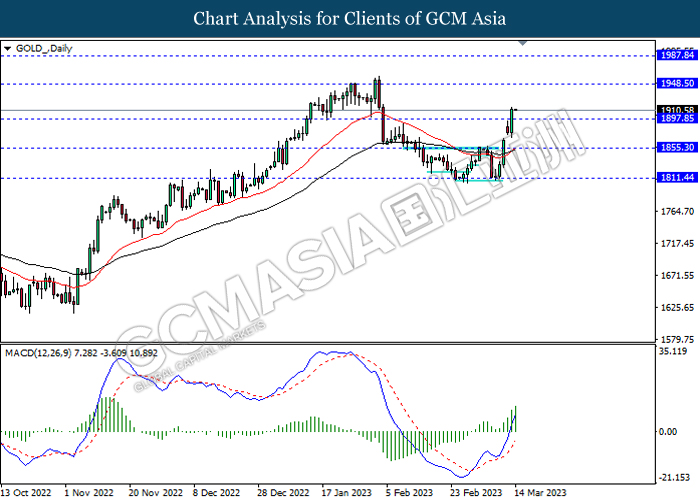

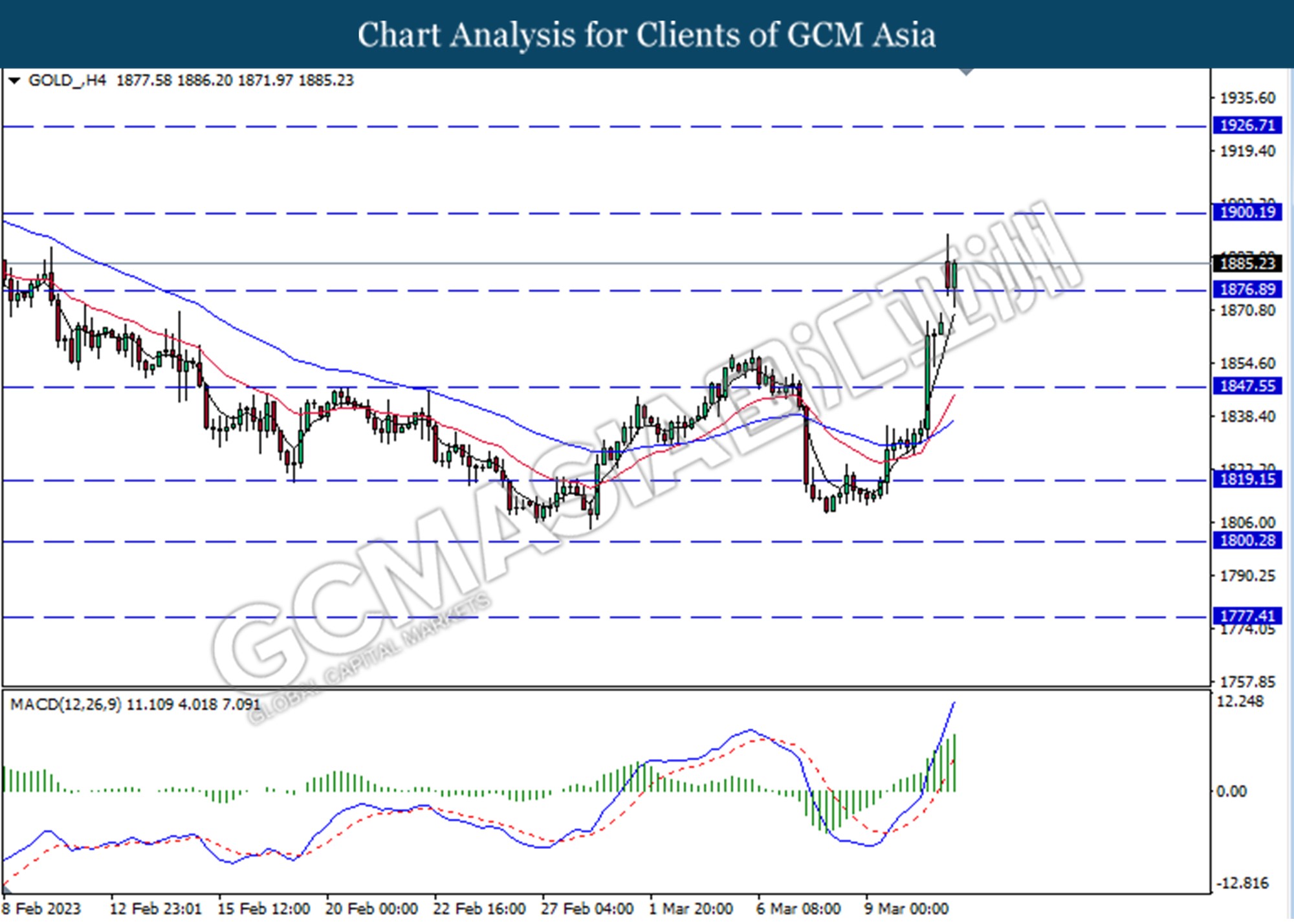

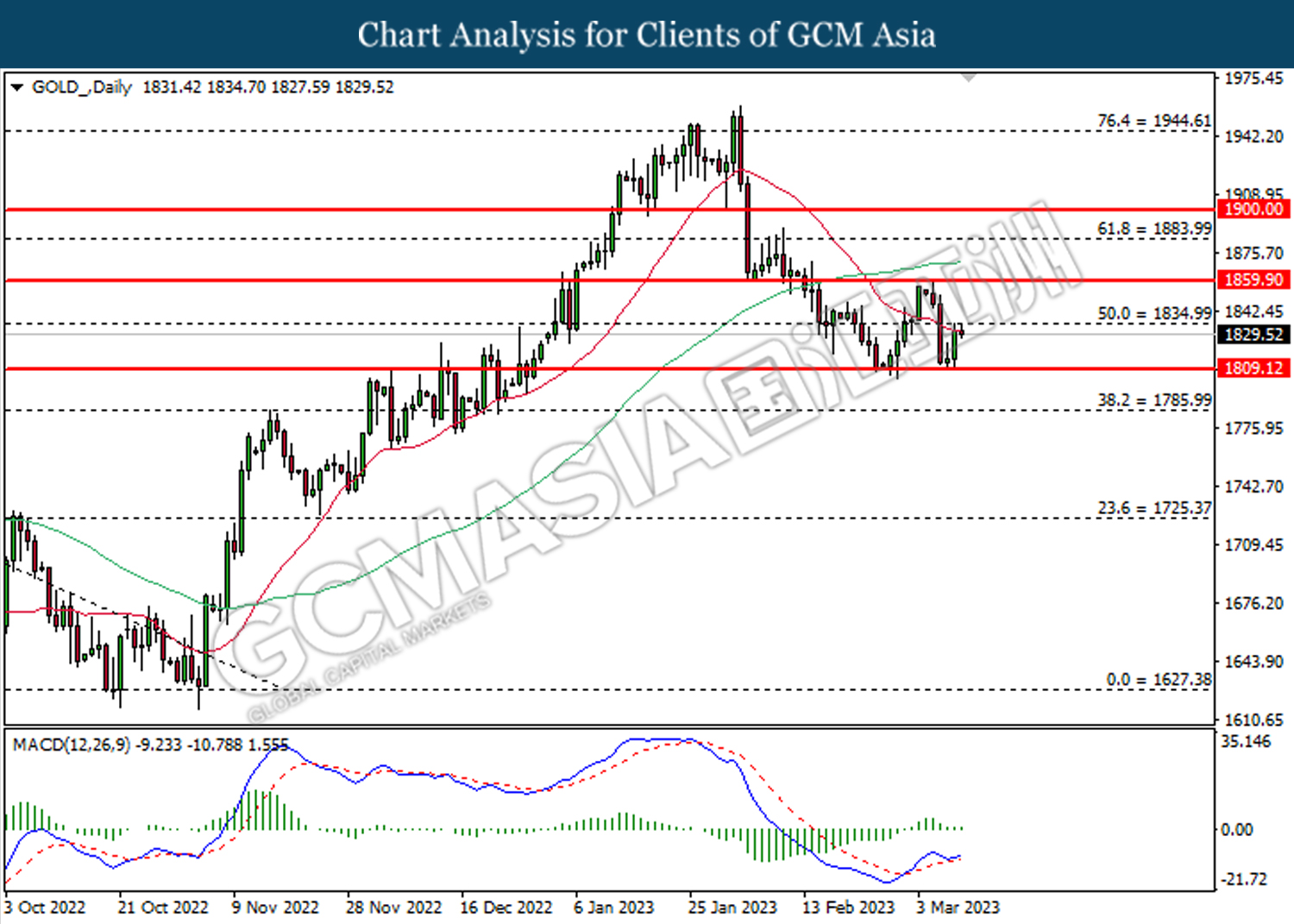

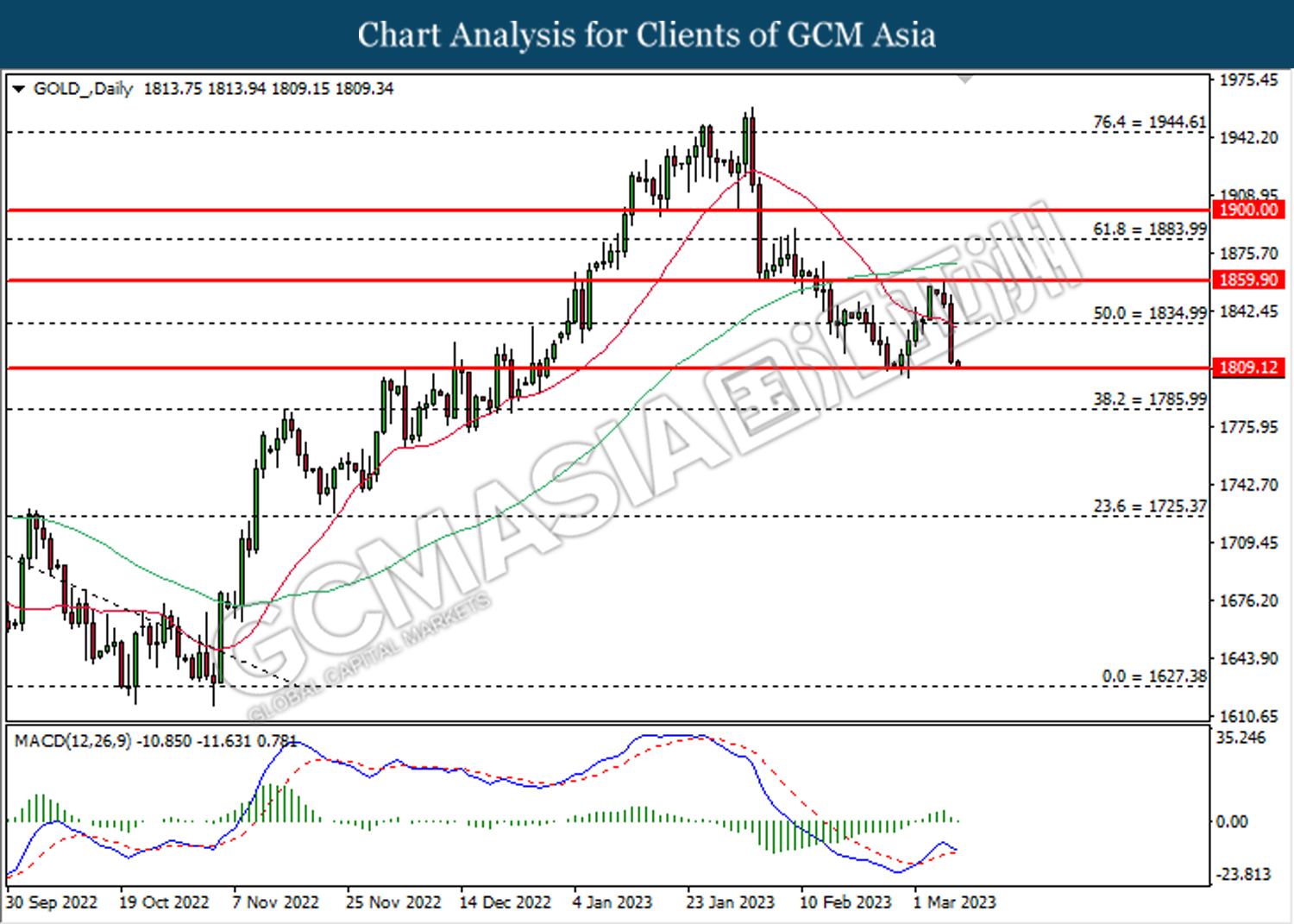

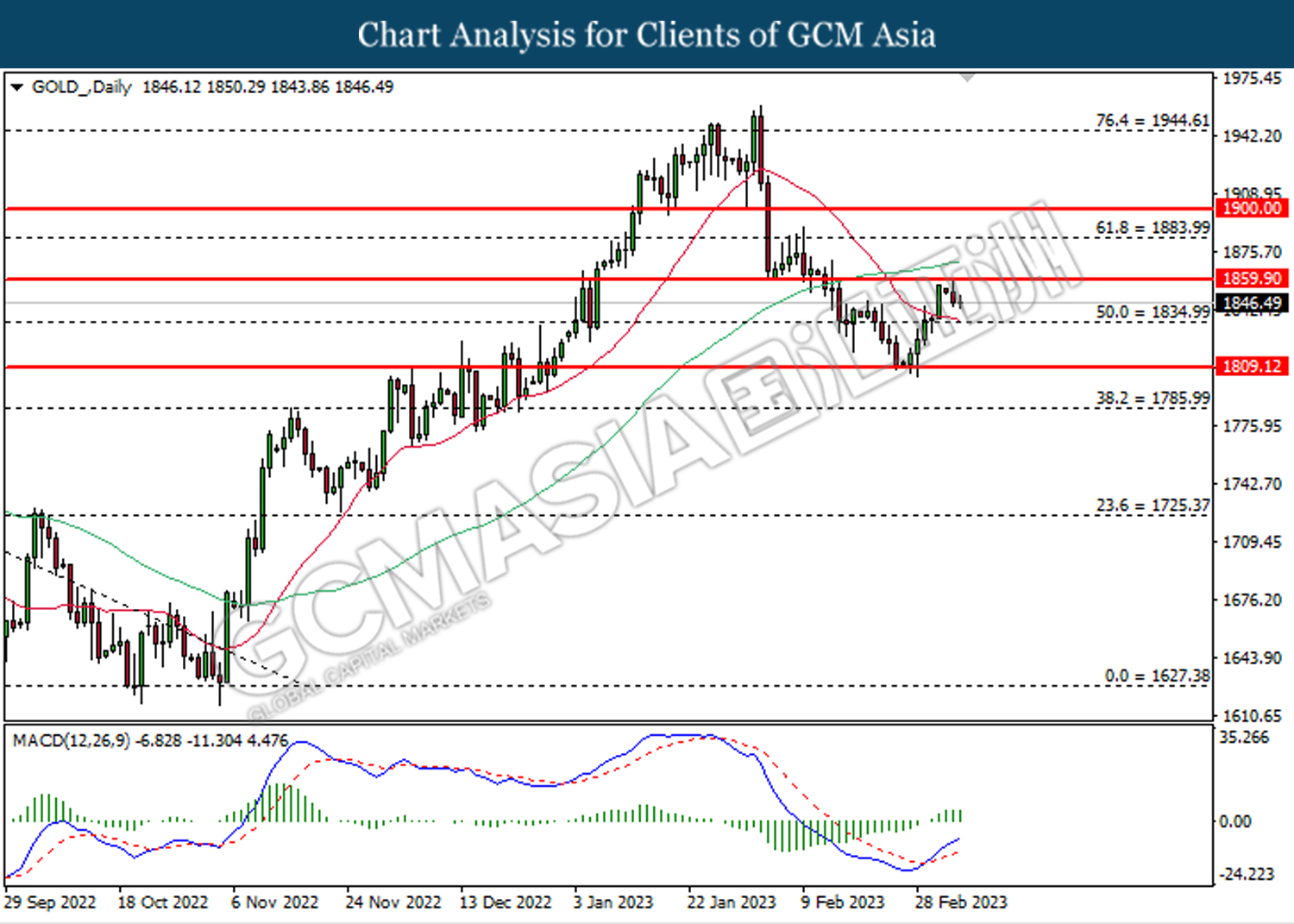

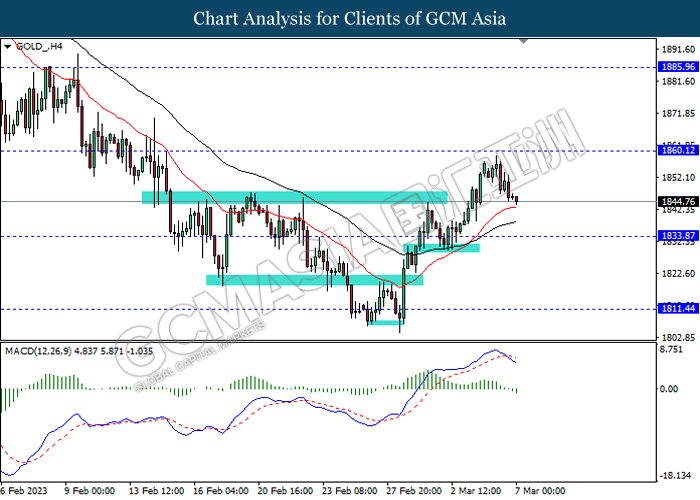

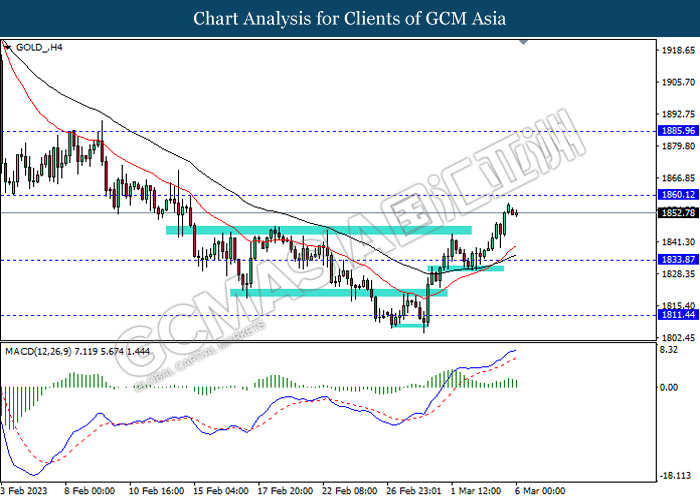

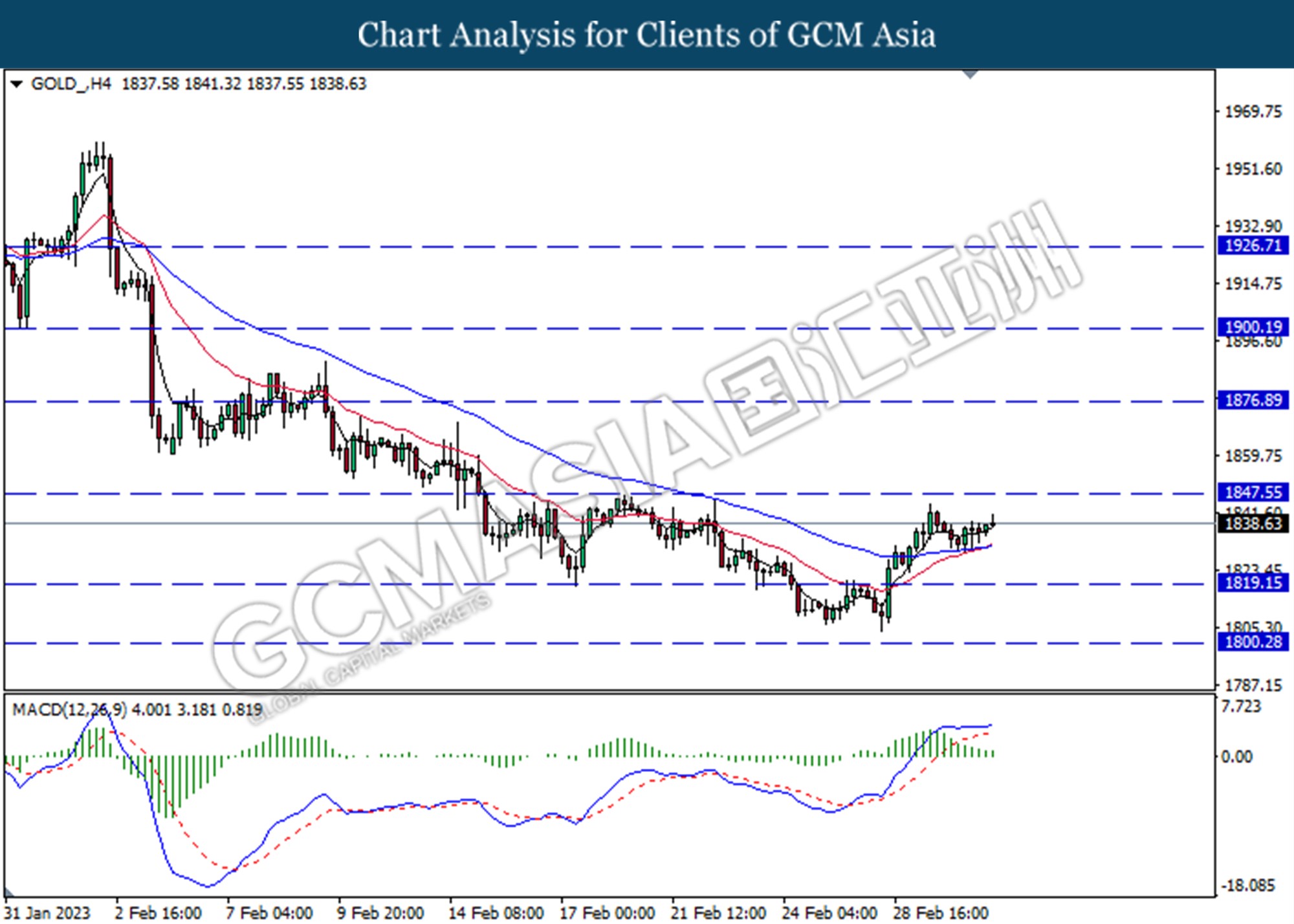

GOLD_, H4: Gold price was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses toward the support level at 1900.19.

Resistance level: 1926.70, 1954.90

Support level: 1900.19, 1876.90

140323 Morning Session Analysis

14 March 2023 Morning Session Analysis

US Dollar’s bear continued following the rate hike path might be stepped back.

The Dollar Index which traded against a basket of six major currencies continued its downward movement on Monday following the market participants afraid of happening of financial crisis. On Friday, the collapse of Silicon Valley Bank (SVB) was like dropping a stun bomb on the market, which indicating that the financial crisis driven by aggressive rate hike would likely to occur. Besides, the regulators also took control of SVB’s stricken peer Signature Bank. With that, investors would started to anticipate the likelihood of reducing rate hike by Fed in order to avoid economy hard-landing. However, it is note-worthy that the current situation has not stopped part of investors to expect a rate hike in the upcoming meeting, as the Fed Chairman Jerome Powell has reiterated the needs of inflation-fighting efforts. According to CME FedWatch Tool, the possibility of 25 basis point rate hike has reached 67.9%. Following to that, the announcement of CPI which scheduled tonight would highly gather the eyes of market participants. As of writing, the Dollar Index appreciated by 0.07% to 103.29.

In the commodity market, the crude oil price depreciated by 0.41% to $74.48 per barrel as of writing following the fresh concerns of SVB collapse still linger in the market. On the other hand, the gold price dropped by 0.04% to $1910.63 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Jan) | 5.90% | 5.70% | – |

| 15:00 | GBP – Claimant Count Change (Feb) | -12.9K | -12.4K | – |

| 20:30 | USD – Core CPI (MoM) (Feb) | 0.40% | 0.40% | – |

| 20:30 | USD – CPI (MoM) (Feb) | 0.50% | 0.40% | – |

| 20:30 | USD – CPI (YoY) (Feb) | 6.40% | 6.00% | – |

Technical Analysis

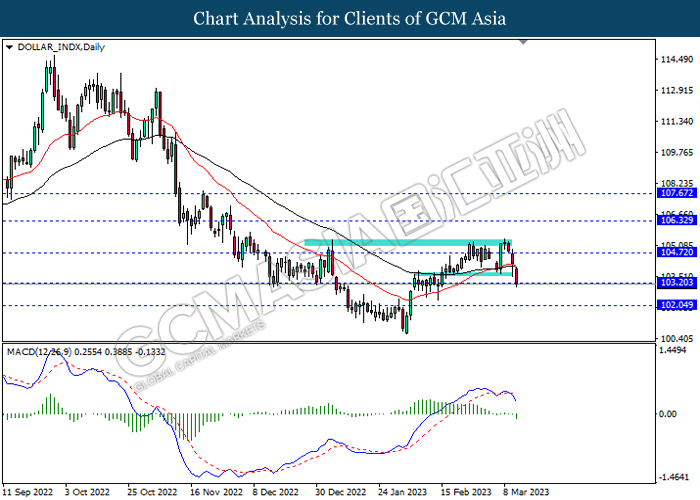

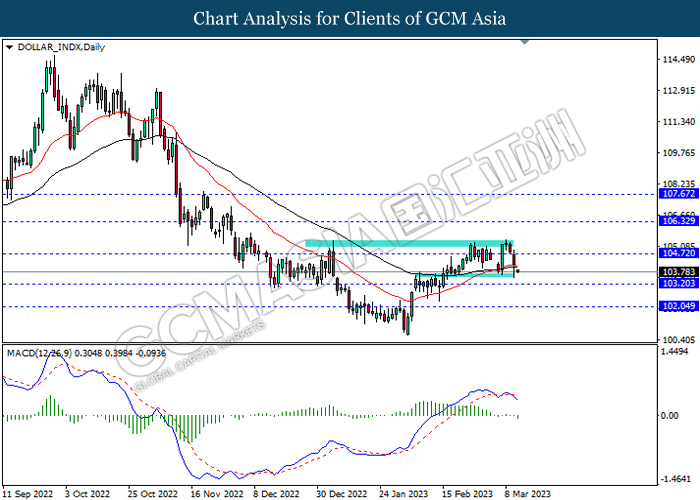

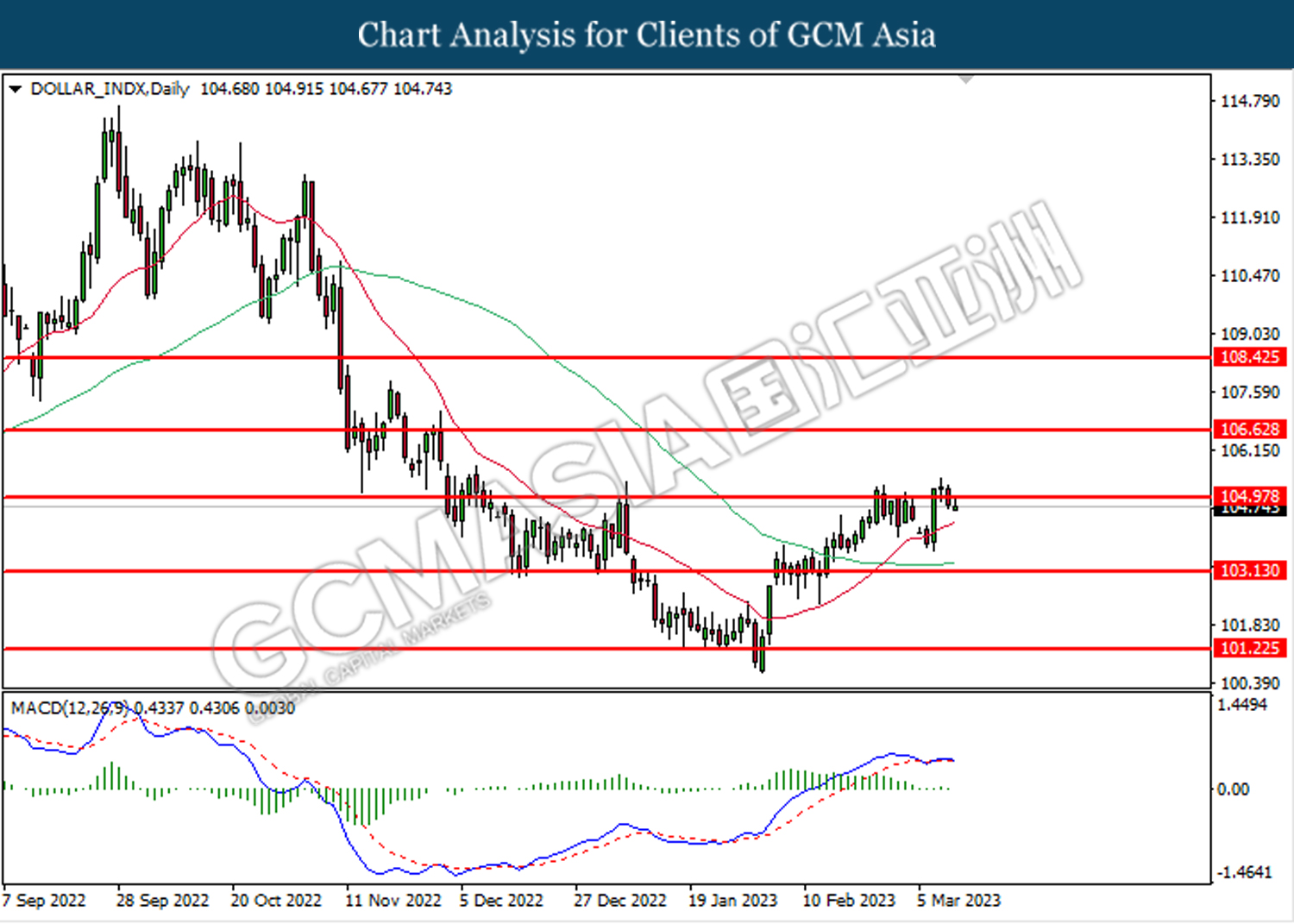

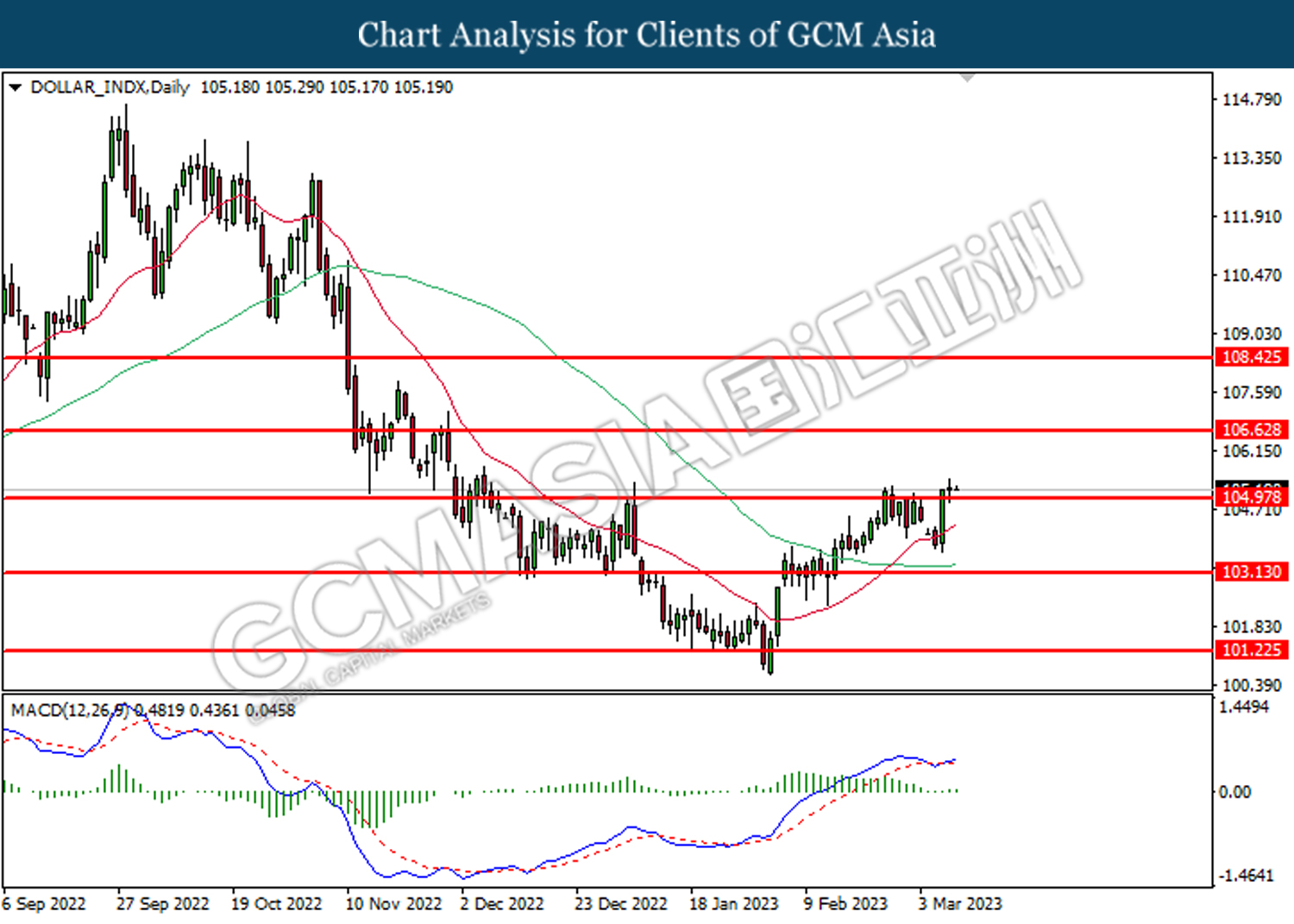

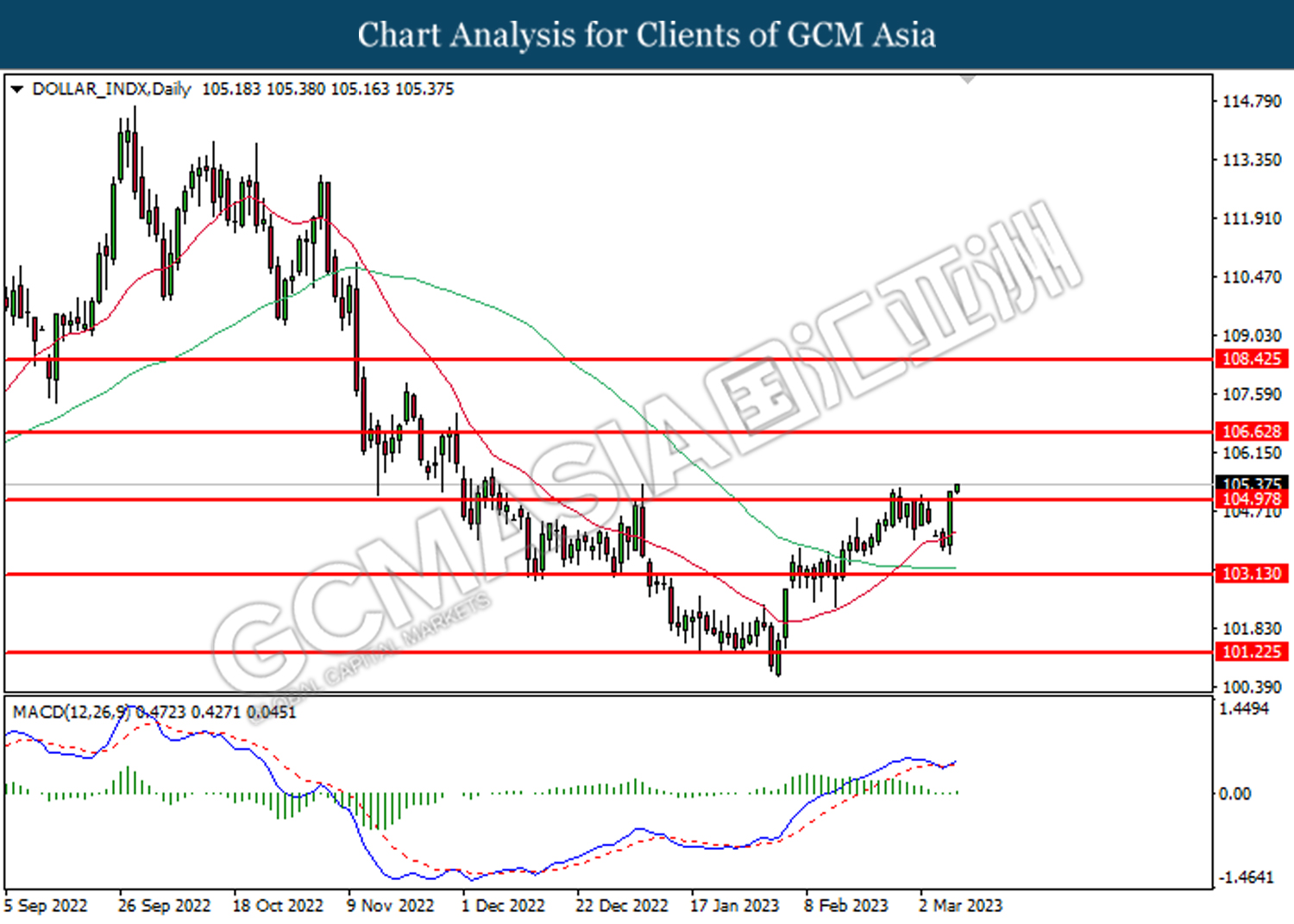

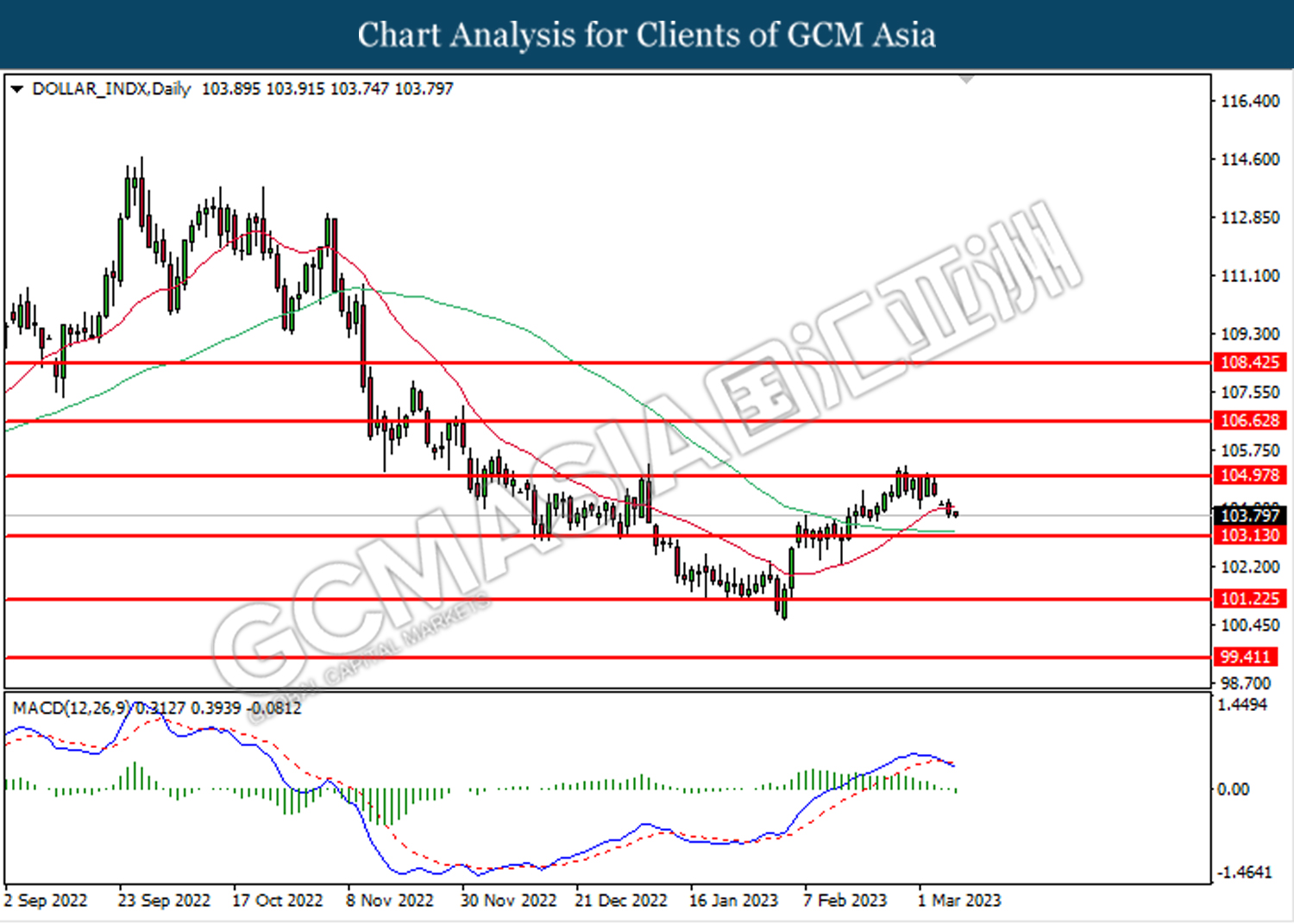

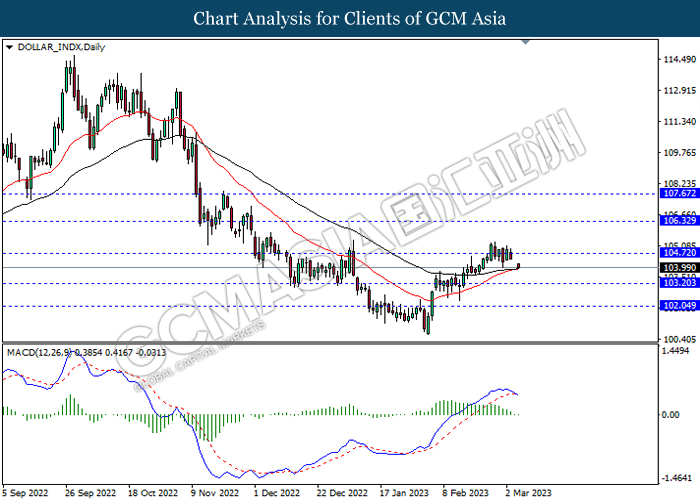

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses of successfully breakout the support level.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

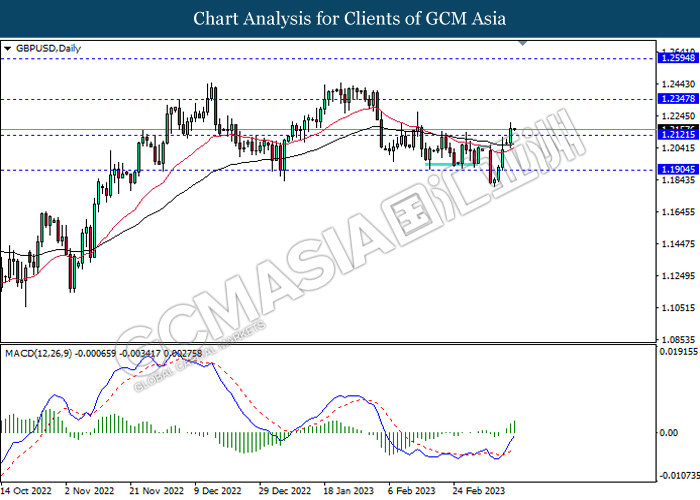

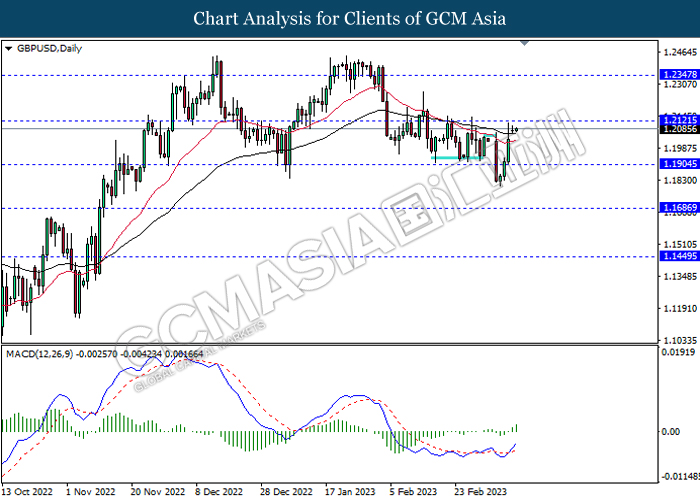

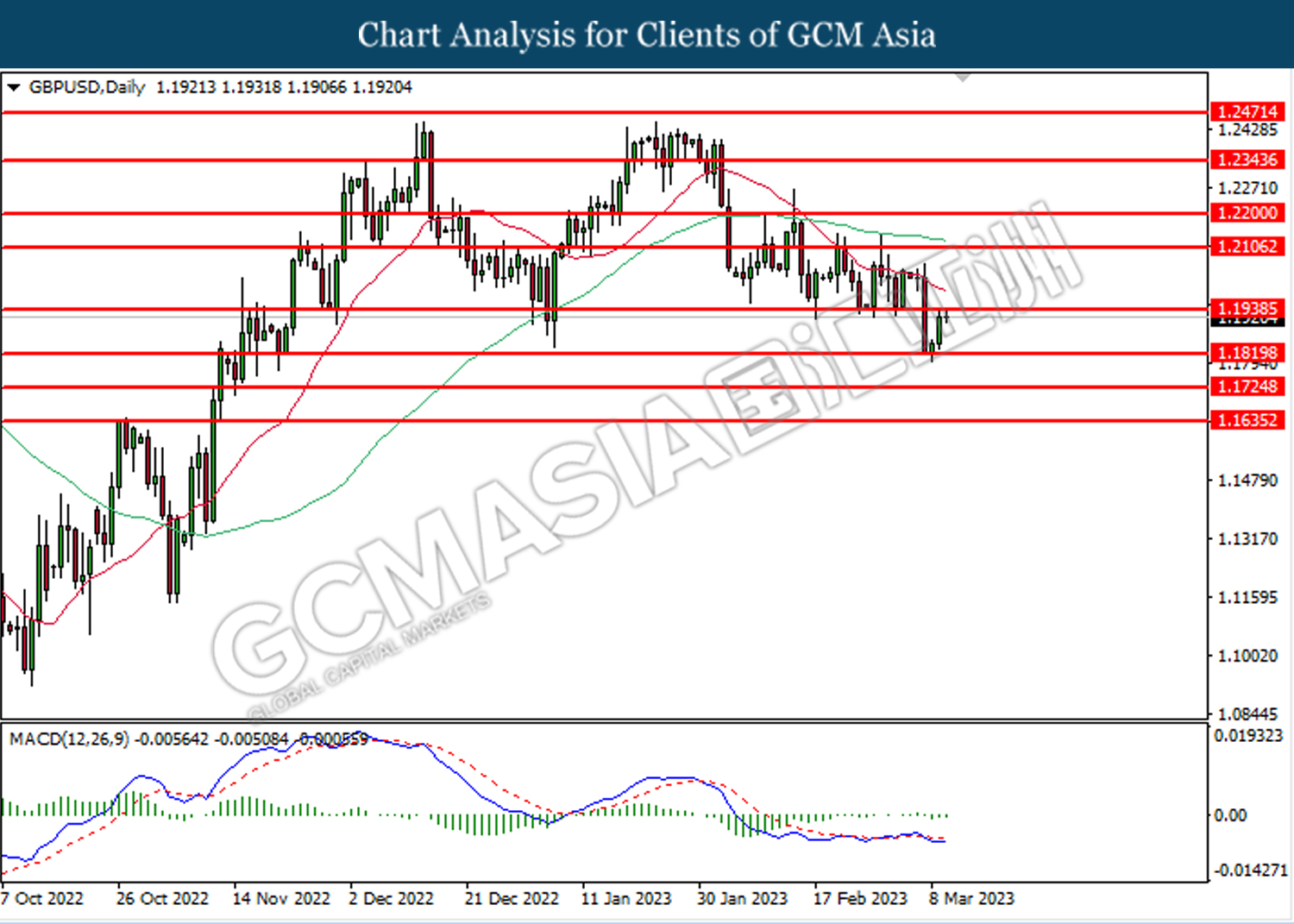

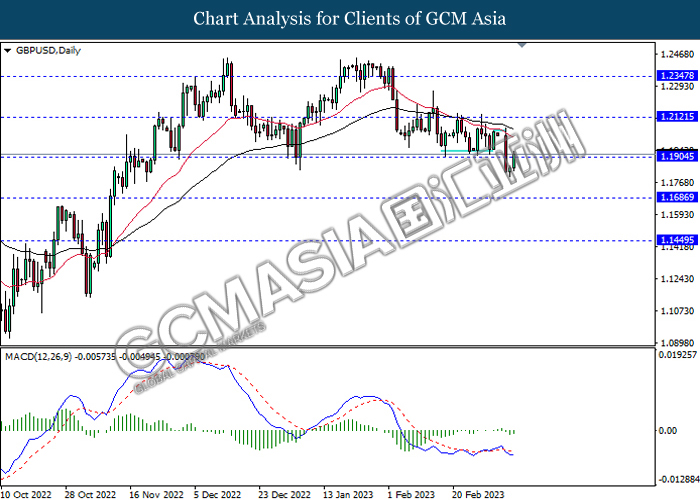

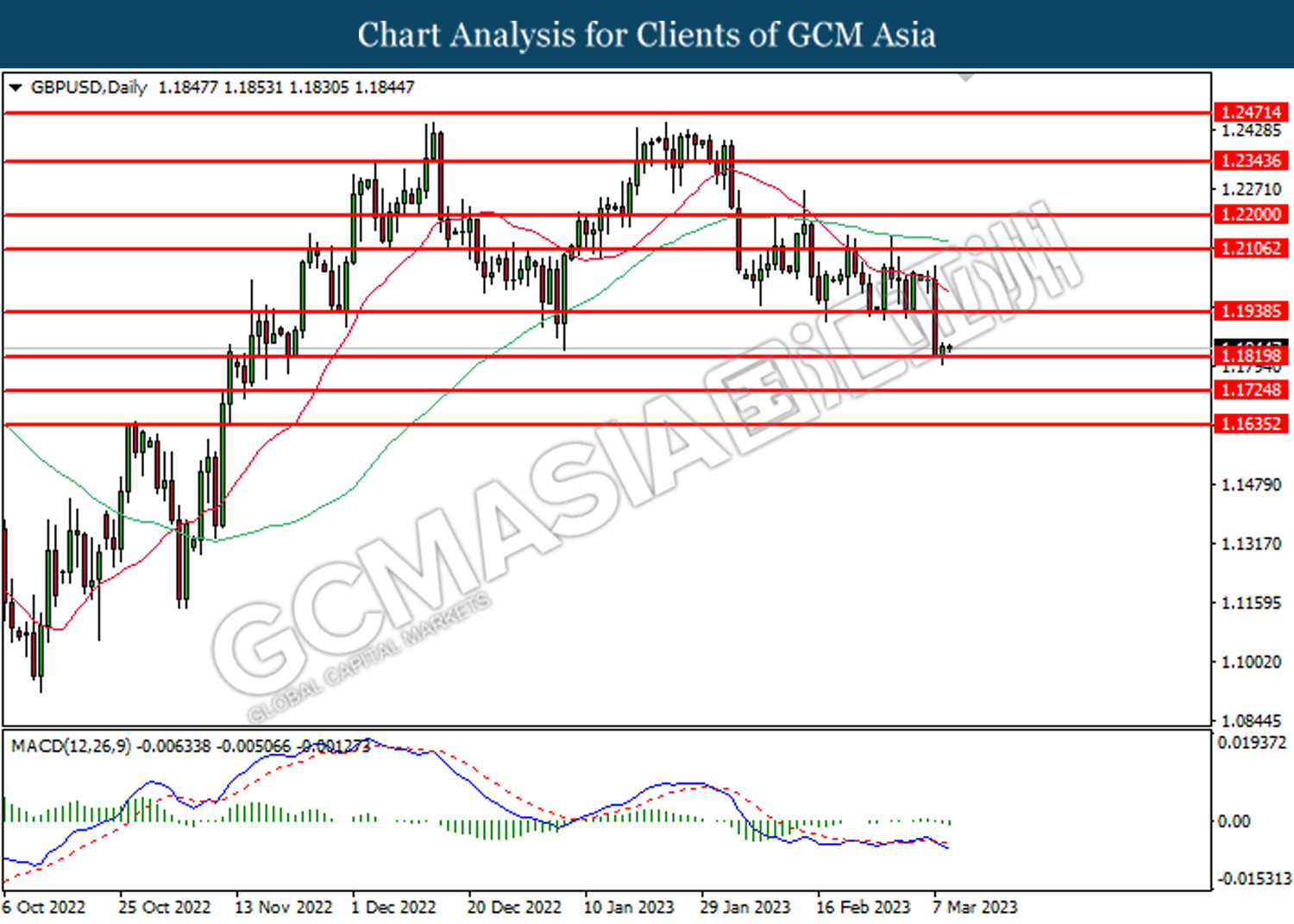

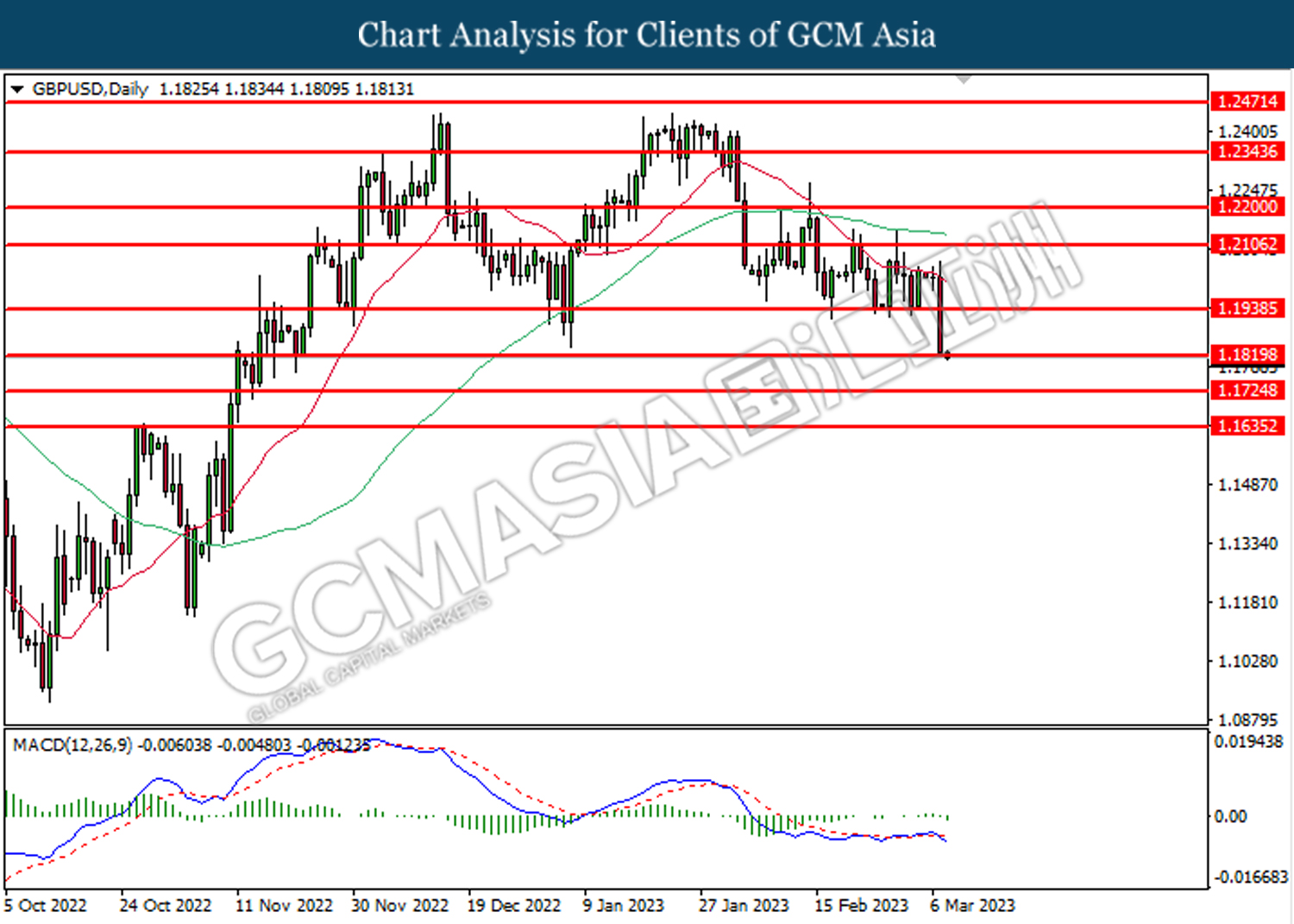

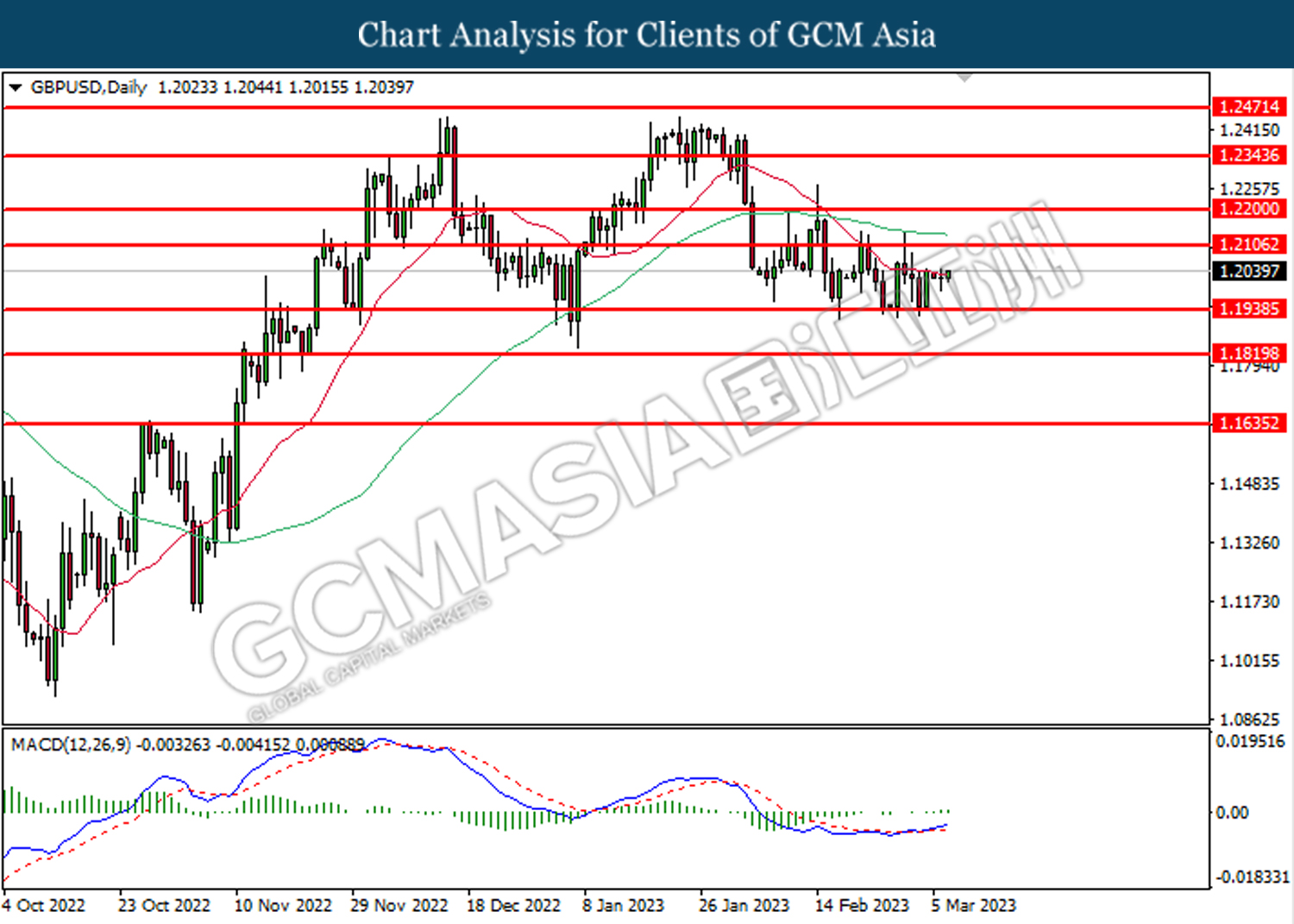

GBPUSD, Daily: GBPUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

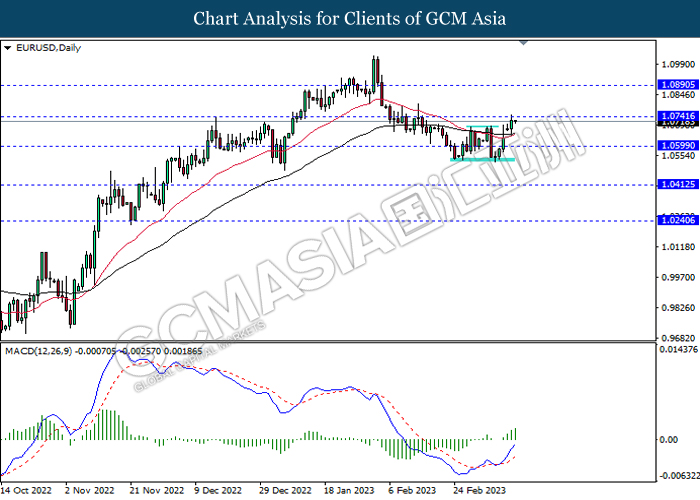

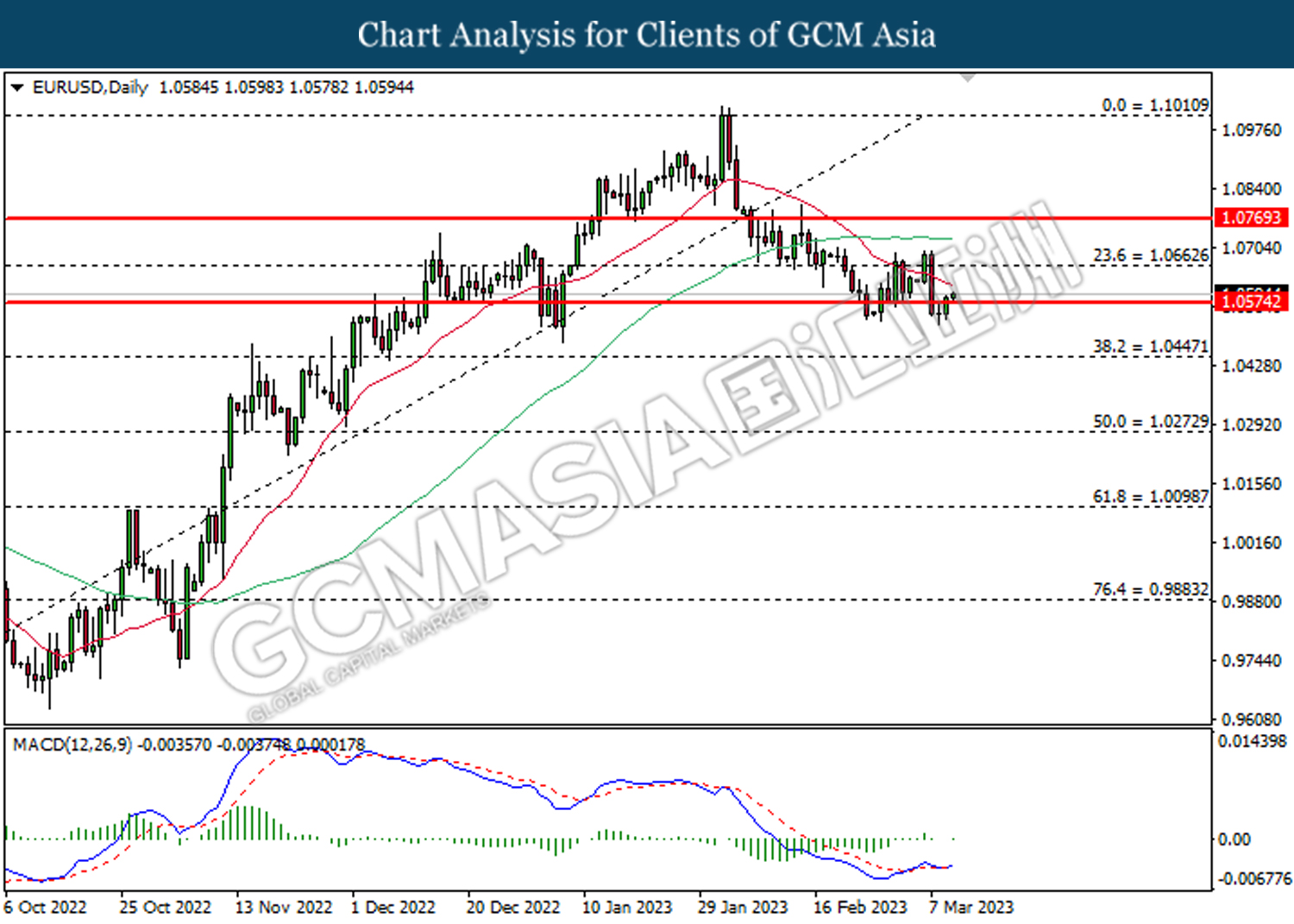

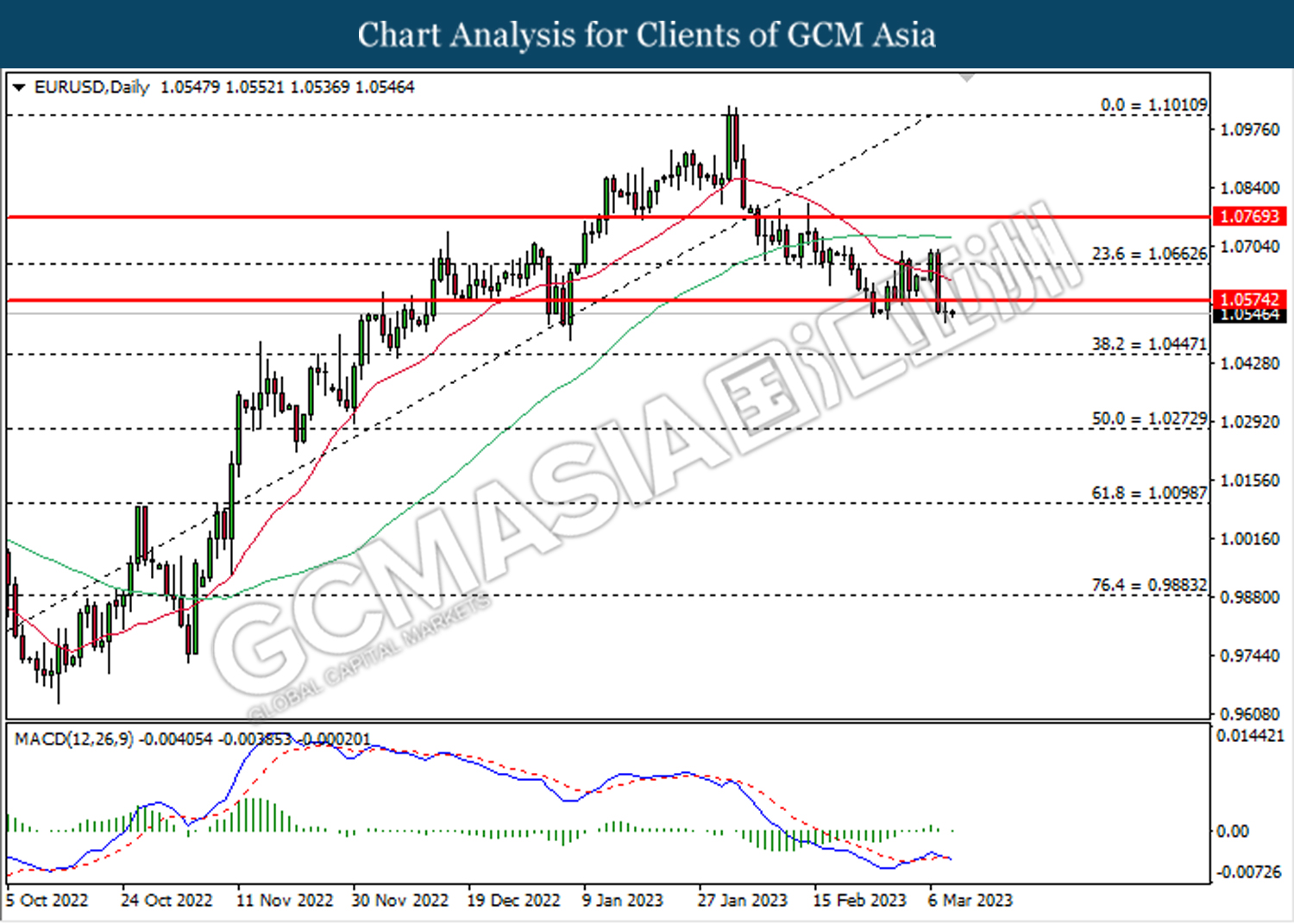

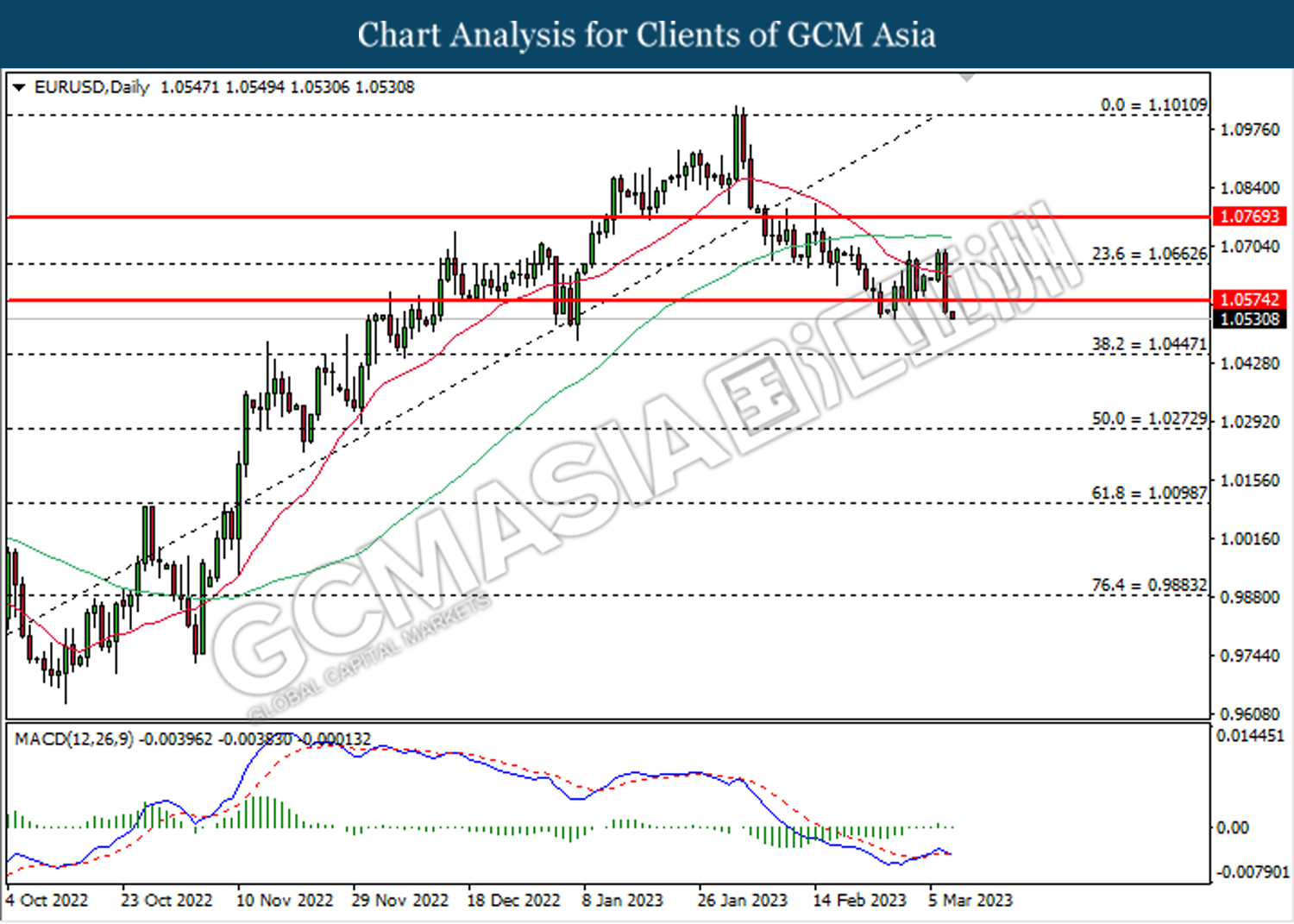

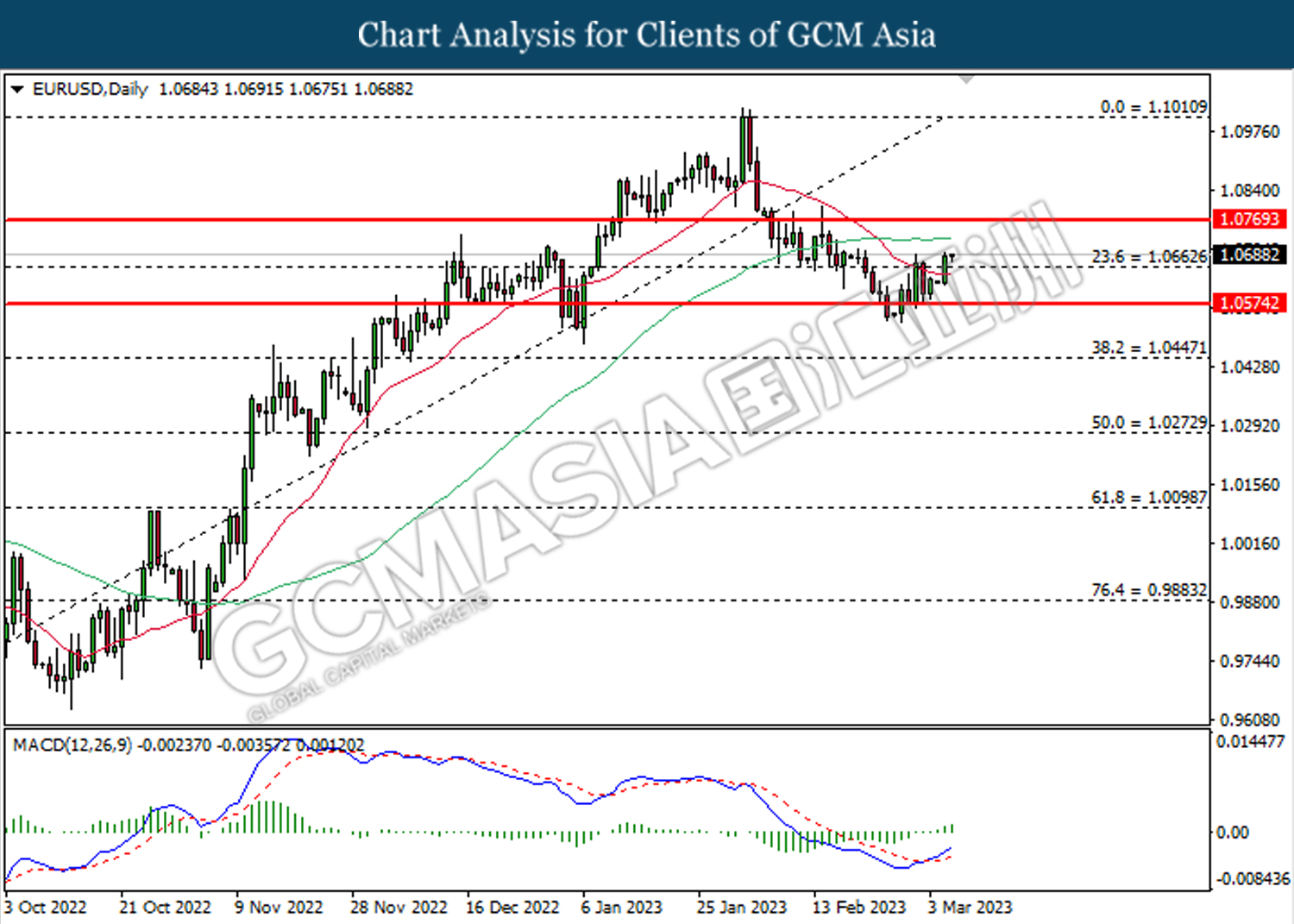

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

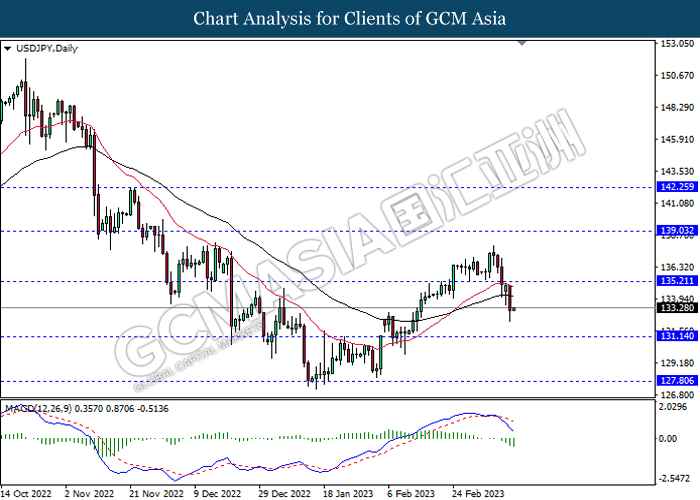

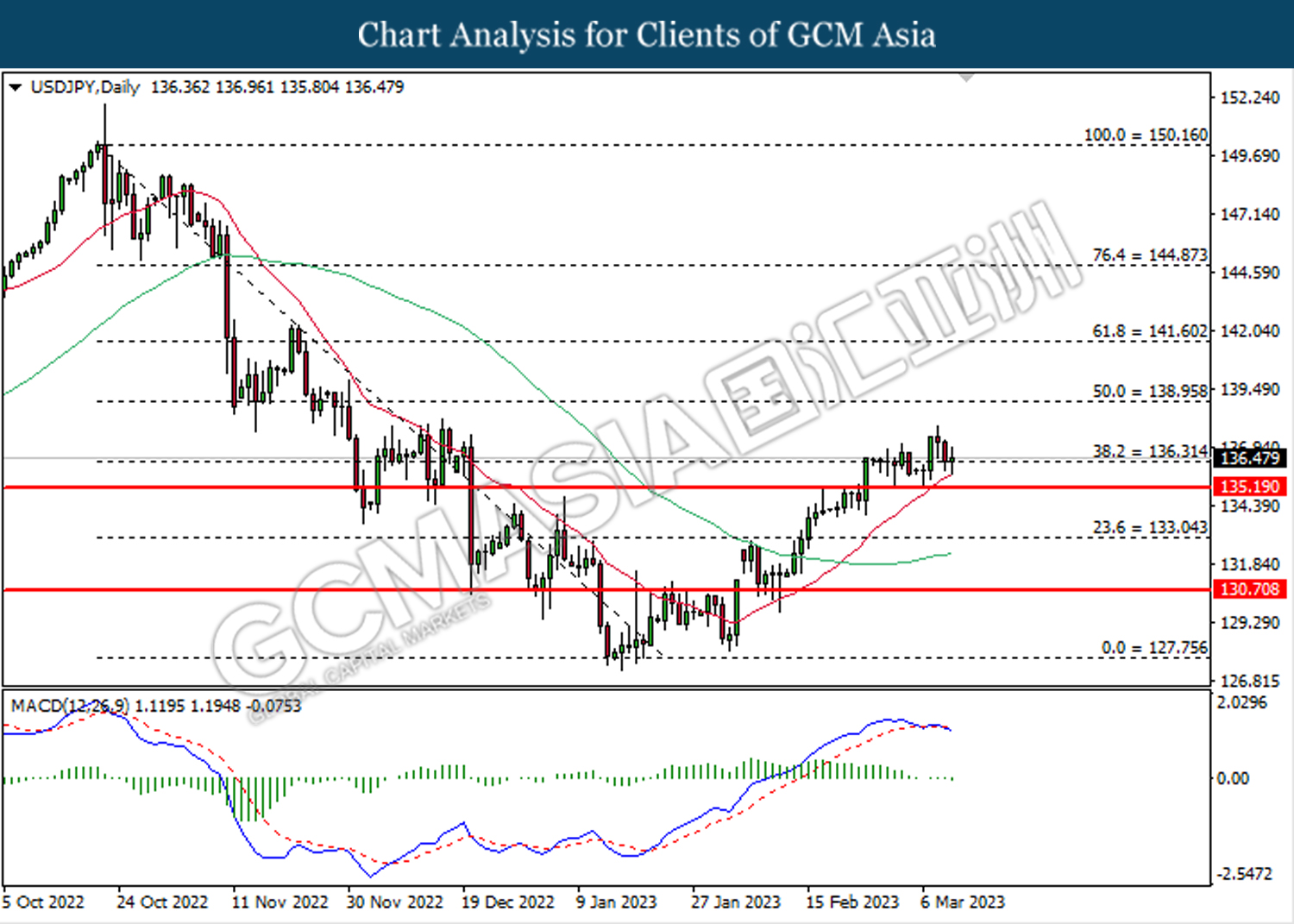

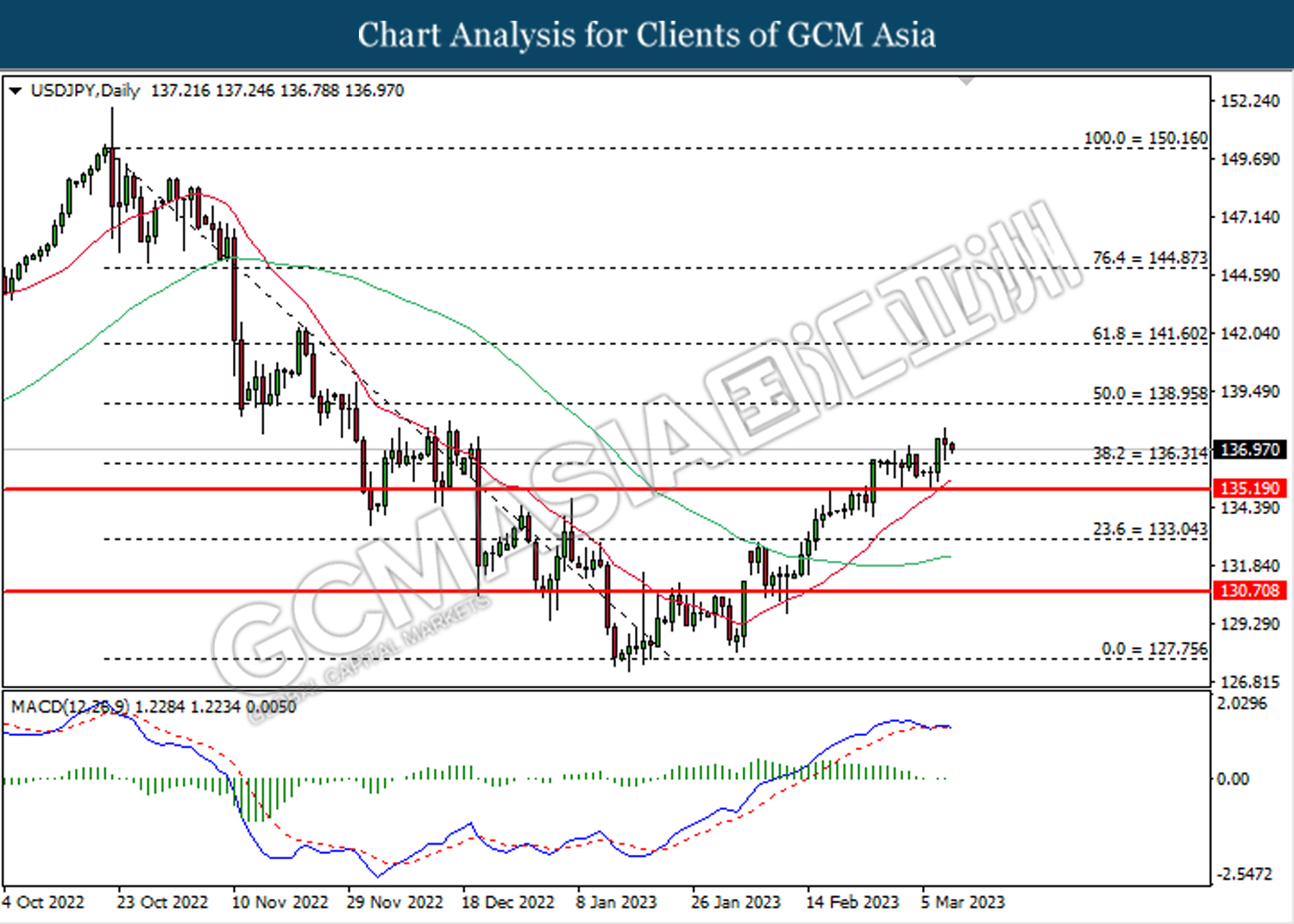

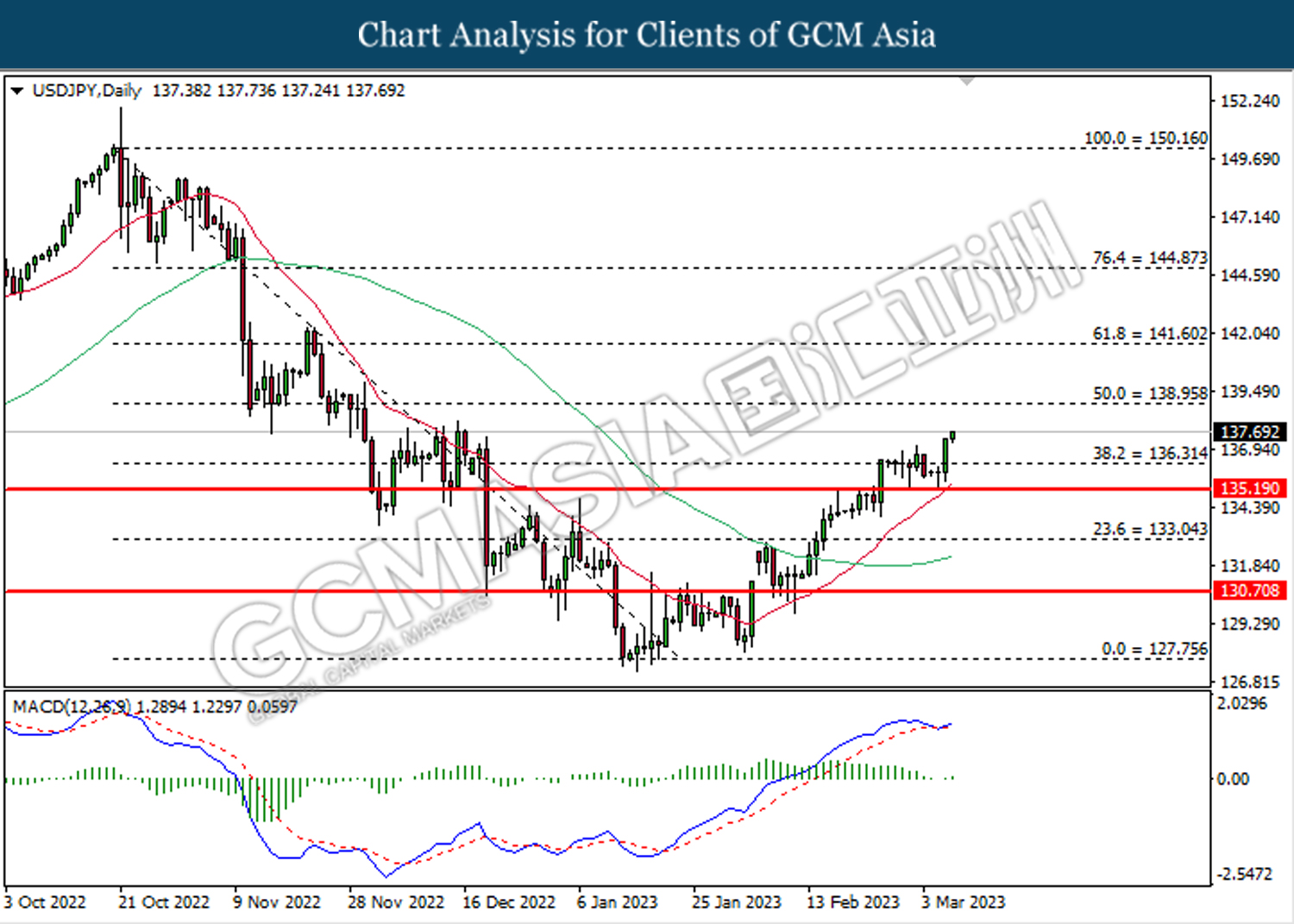

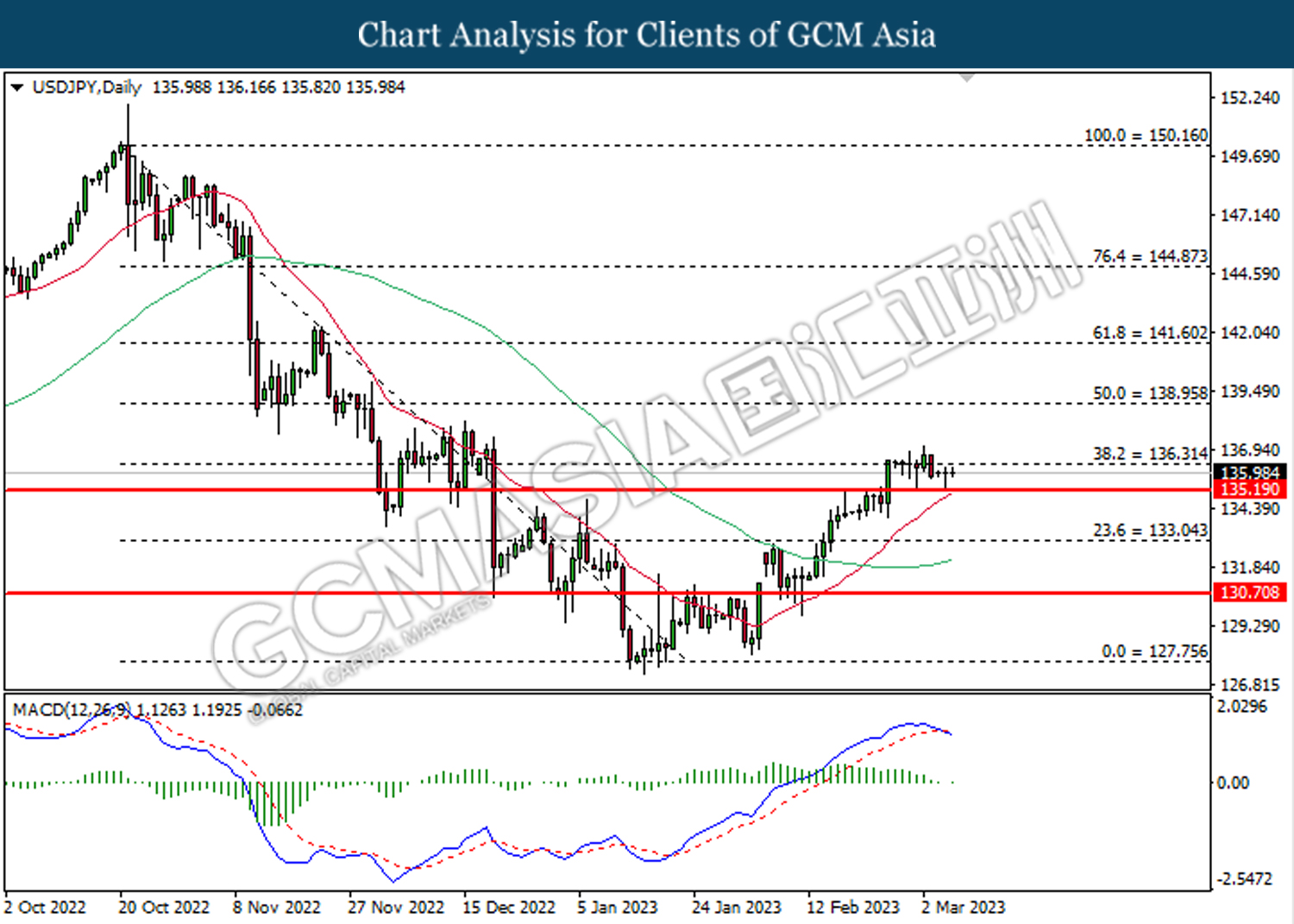

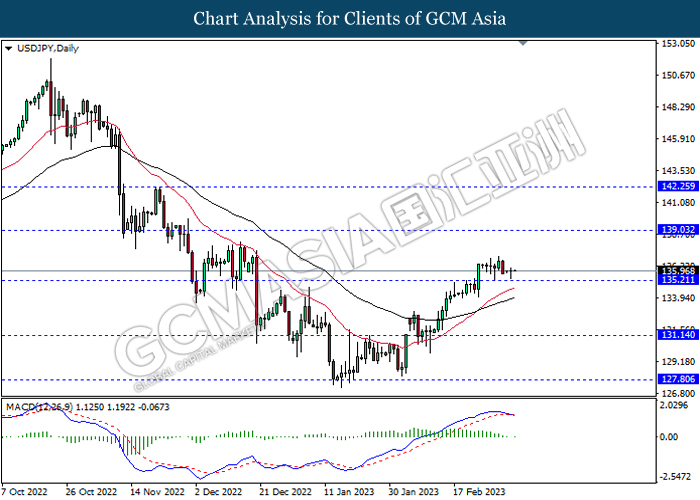

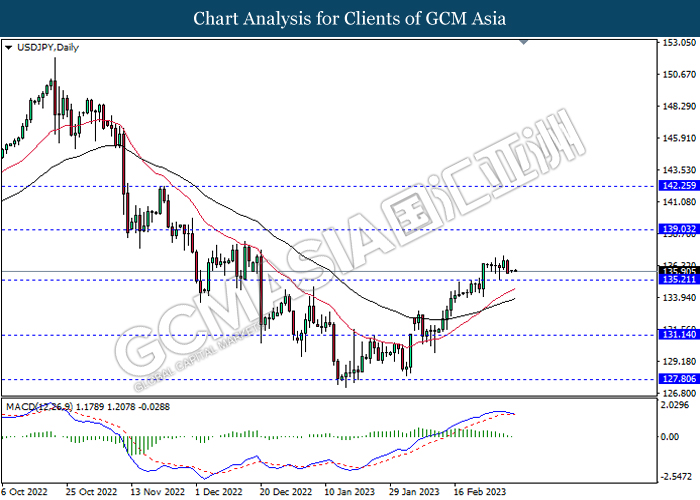

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

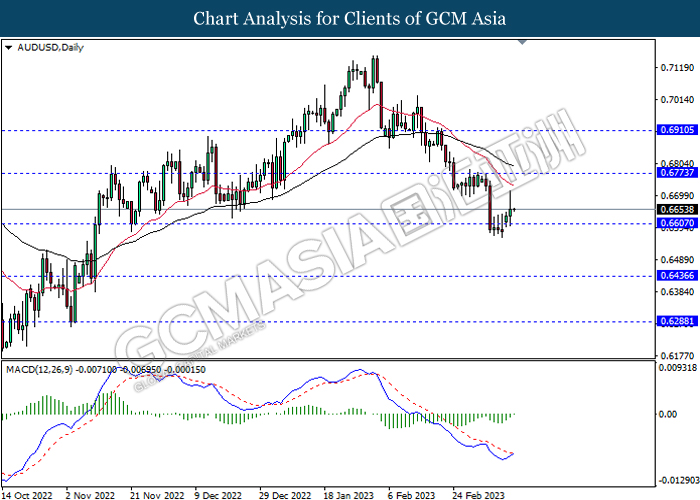

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

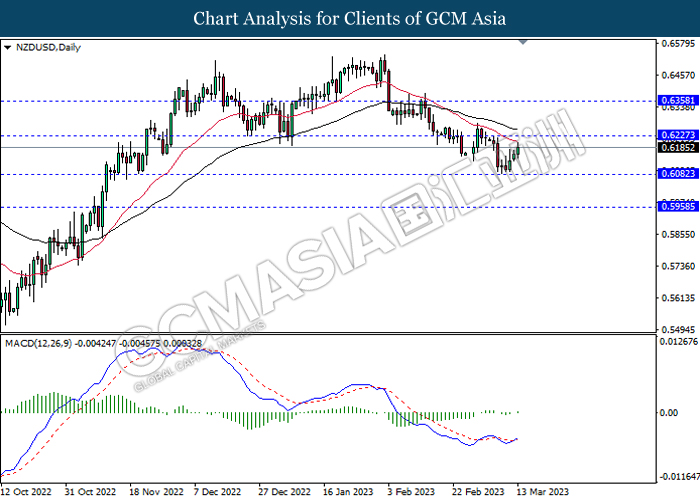

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

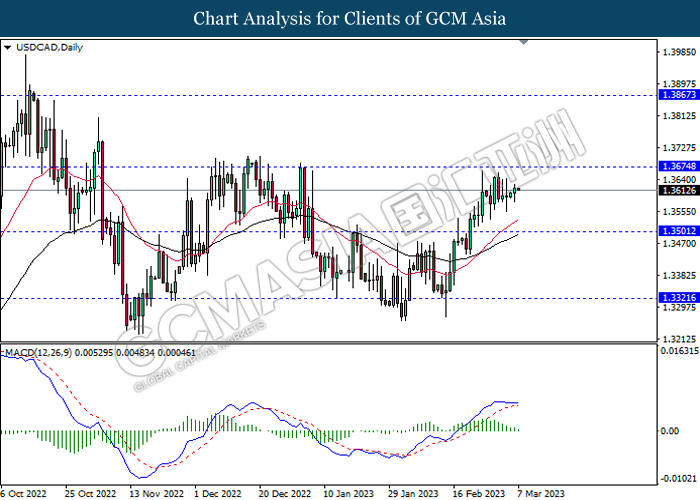

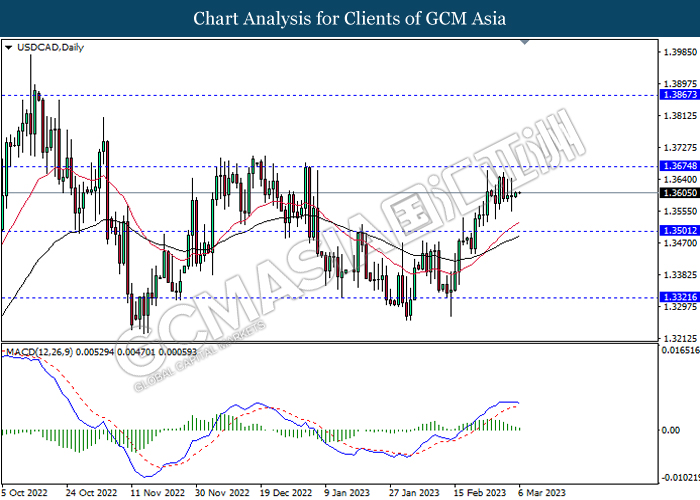

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

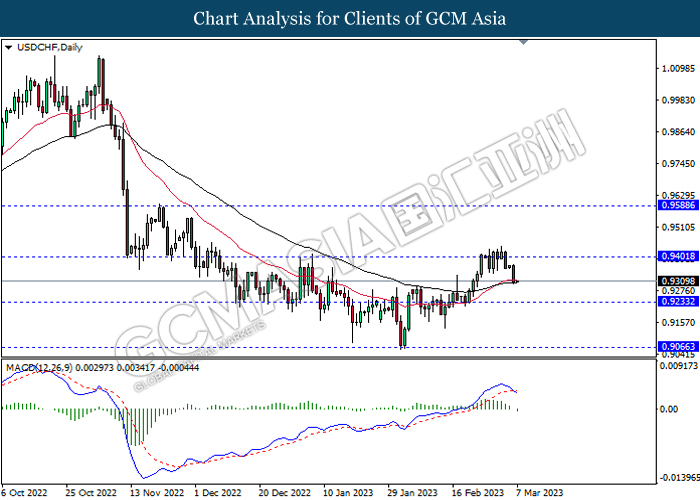

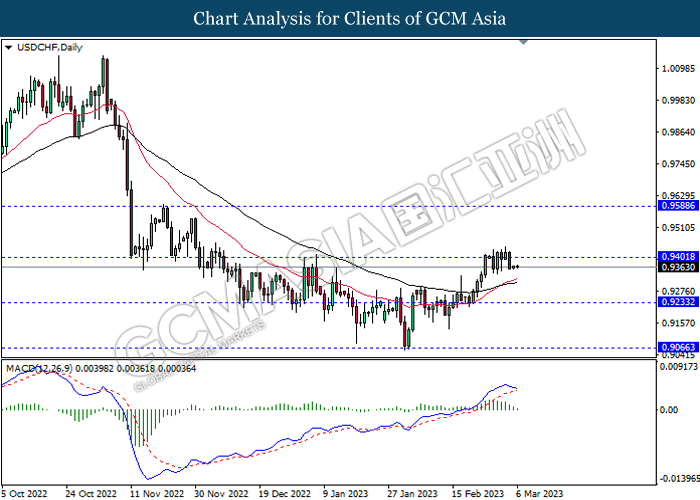

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 76.80, 81.30

Support level: 73.10, 69.75

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1948.50, 1987.85

Support level: 1897.85, 1855.30

130323 Afternoon Session Analysis

13 March 2023 Afternoon Session Analysis

Sterling rose after mixed economic data.

The Pound Sterling, one of the most traded currencies by global investors, rebounded from the November 2022 lows after mixed economic data was released. Data showed UK’s economy expanded 0.3% in January, out beat the market expectations of 0.1% growth. However, the manufacturing output in the UK showed contraction, where it came in at a reading lower than forecast, the Office for National Statistics announced. The gross domestic product growth of 0.3% was contributed by the start of the FIFA World Cup, which had supported consumption in the last quarter of 2022, but the manufacturing sector continues to shrink amid high inflation pressures and high energy prices. On the monetary policy front, the Bank of England (BoE) is expected to increase the cash rates by another 25 bps this month, an 11th consecutive rate hike, before the ending of tightening monetary policy. Besides, the reversal of the GBP/USD was also further boosted by the weakening position in the US dollar market after an unexpected increase in the US unemployment rate, and so increased the pressure on Fed to further tighten their monetary policy. As of writing, the GBP/USD edged up by 0.72% to $1.2117.

In the commodity market, the crude oil price appreciated by 0.44% to $77.03 per barrel as of writing following the banking crisis in the US has increased the expectation that Fed will soften its hawkish moves. On the other hand, the gold price rose by 1.01% to $1886.05 per troy ounce as of writing following the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following a prior breakout below the previous support level at 104.45. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward the support level at 103.00.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.2145.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.0635. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.0790

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following a prior breakout below the previous support level at 104.55. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 132.30

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the support level at 0.6600. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 0.6195.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded lower following prior following a prior break below the previous support level at 1.3785. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.3685.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

USDCHF, H4: USDCHF was traded lower following a prior breakout below the previous support level at 0.9195. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 0.9140.

Resistance level: 0.9195, 0.9240

Support level: 0.9140, 0.9100

CrudeOIL, H4: Crude oil price was traded higher following a prior breakout above the previous resistance level at 76.05. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains the resistance level at 78.70.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1876.90. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward the resistance level at 1900.20.

Resistance level: 1900.20, 1926.70

Support level: 1847.55, 1819.15

130323 Morning Session Analysis

13 March 2023 Morning Session Analysis

US Dollar dived after disappoint jobs data unleashed.

The Dollar Index which traded against a basket of six major currencies slumped on last Friday after the downbeat economic data has been released. According to Bureau of Labor Statistics, the US Nonfarm Payrolls posted at the reading of 311K, which is better than the consensus forecast of 205K. However, the US Dollar received significant bearish momentum after the unemployment rate has unexpectedly increased in February. The US Unemployment Rate has notched up from the previous reading of 3.4% to 3.6%, which signaling the recent labor market in the US had become fragile. Following to that, the anticipation of 50 basis point rate hike has been reduced. According to CME FedWatch Tool, the likelihood of half-percentage rate increase has dropped from the prior 40.2% to 39.5%. Though, the losses experienced by the Dollar Index was limited following the closing of SVB Financial Group, while it suggested that a serious economic crisis is brewing. As a safe-haven assets, the US Dollar has been put under the spotlight by investors. On the economic data front, investors would highly eye on the announcement of CPI data which scheduled on tomorrow in order to gauge the next step of Fed. As of writing, the Dollar Index depreciated by 0.27% to 103.87.

In the commodity market, the crude oil price appreciated by 0.57% to $77.13 per barrel as of writing following the fears of aggressive rate hike has reduced. On the other hand, the gold price rose by 0.91% to $1879.13 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded following prior breakout below the previous support level. MACD which illustrated increasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2120, 1.2345

Support level: 1.1905, 1.1685

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

USDCHF, Daily: USDCHF was traded lower following prior breakout above the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1898.50, 1948.50

Support level: 1855.30, 1811.45

100323 Afternoon Session Analysis

10 March 2023 Afternoon Session Analysis

Japanese Yen dive as interest rate remains unchanged.

The Japanese Yen, which is majorly traded by global investors, plummeted significantly after the Bank of Japan (BoJ) decided to hold its interest rate at the negative territory unchanged at -0.10%. In the early meeting, the board of members agreed to maintain its ultra-easing monetary policy while vowing to purchase the necessary amount of Japanese Government Bonds (JGBs) to support the economy. However, market participants see some light at the end of the tunnel as BoJ revealed that the Japan’s economy has started to picking up, and it is expected to recover strongly from the pandemic and constraints of supply. On top of that, BoJ also admitted that their expectations over the inflationary pressure are rising, while the Core CPI is hovering near the level at 4%. Nonetheless, the rising inflationary expectations did not triggered a large buying momentum in the Japanese Yen market as the majority investors are foreseeing the next BoJ Governor to have no major changes on the ultra-easing monetary policy. As of writing, the pair of USD/JPY rose 0.24% to 136.45.

In the commodities market, crude oil prices edged down -0.52% to $75.15 per barrel as the rising expectation over the aggressive rate hike plan in US trimmed the appeal of oil products. Besides, gold prices edged down -0.10% to $1829.15 per troy ounce following the release of downbeat Initial Jobless Claims.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (MoM) (Jan) | -0.50% | 0.10% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Jan) | 0.00% | -0.20% | – |

| 15:00 | GBP – Monthly GDP 3M/3M Change (Jan) | -0.30% | -0.10% | – |

| 15:00 | EUR – German CPI (YoY) (Feb) | 8.70% | 8.70% | – |

| 21:30 | USD – Nonfarm Payrolls (Feb) | 517K | 200K | – |

| 21:30 | USD – Unemployment Rate (Feb) | 3.40% | 3.40% | – |

| 21:30 | CAD – Employment Change (Feb) | 150.0K | 10.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 105.00. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1940. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1940, 1.2105

Support level: 1.1820, 1.1725

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0575. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0665.

Resistance level: 1.0665, 1.0770

Support level: 1.0575, 1.0445

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 136.30. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 138.95, 141.60

Support level: 136.30, 135.20

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3830. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3880.

Resistance level: 1.3880, 1.4000

Support level: 1.3830, 1.3730

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.9320. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9325, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.65.

Resistance level: 76.10, 81.70

Support level: 71.65, 66.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1835.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1835.00.

Resistance level: 1835.00, 1859.90

Support level: 1809.10, 1786.00

100323 Morning Session Analysis

10 March 2023 Morning Session Analysis

US Dollar slumped amid pessimistic labor market outlook.

The Dollar Index which traded against a basket of six major currencies dropped significantly after the economic data showed that the labor market in the US weakened. According to the US Department of Labor, the US Initial Jobless Claims notched up from the previous reading of 190K to 211K, exceeding the market expectation of 195K. With that, it had reduced the possibility of aggressive rate hike plan which might by implemented by Fed, as it hinted that the impact of higher interest rates may be starting to bite. The CME FedWatch Tool has shown that the likelihood of half-percentage rate hike has decreased to 63.1% from prior 78.6%. Though, it is note-worthy that the speech given by Fed Chair has changed the market anticipation over interest rate decision. Federal Reserve Chairman Jerome Powell said on Tuesday that the central bank’s terminal rate might be higher than market expectation in order to tame inflation more efficiently. As of now, investors would continue to scrutinize the announcement of NFP data as it could provide a clearer picture on Fed’s rate hike path. As of writing, the Dollar Index eased by 0.38% to 105.23.

In the commodity market, the crude oil price dropped by 0.22% to $75.50 per barrel as of writing following the worries among aggressive rate hike by Fed still lingering in the market. On the other hand, the gold price appreciated by 0.04% to $1831.29 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

13:00 JPY BoJ Press Conference

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (MoM) (Jan) | -0.50% | 0.10% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Jan) | 0.00% | -0.20% | – |

| 15:00 | GBP – Monthly GDP 3M/3M Change (Jan) | -0.30% | -0.10% | – |

| 15:00 | EUR – German CPI (YoY) (Feb) | 8.70% | 8.70% | – |

| 21:30 | USD – Nonfarm Payrolls (Feb) | 517K | 200K | – |

| 21:30 | USD – Unemployment Rate (Feb) | 3.40% | 3.40% | – |

| 21:30 | CAD – Employment Change (Feb) | 150.0K | 10.0K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 106.30, 107.65

Support level: 104.70, 103.20

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2120, 1.2345

Support level: 1.1905, 1.1685

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0600, 1.0740

Support level: 1.0410, 1.0240

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6605, 0.6775

Support level: 0.6435, 0.6290

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

USDCHF, Daily: USDCHF was traded lower following prior breakout above the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9070

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 76.80, 81.30

Support level: 73.10, 69.75

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1855.30, 1898.50

Support level: 1811.45, 1762.25

090323 Afternoon Session Analysis

09 March 2023 Afternoon Session Analysis

Canadian dollar plunged as BoC maintains its interest rate unchanged.

The Canadian dollar, which is majorly traded by the global investors, plummeted after the Bank of Canada (BoC) decided to hold its cash rate unchanged at the current level. In yesterday BoC meeting, the board of members unanimously agreed to hold its interest rate at 4.50%, in line with the consensus forecast despite the Fed’s cash rate has not seen any sign of pausing in anytime soon. After a series of rate hike since last year, the BoC has finally stop to hike its rate for the first time, citing the inflation figure is on the right pace of deceleration while heading toward their target of 2.0%. According to the Statistics Canada, the nation’s CPI printed a reading of 5.9%, weaker than the prior month reading’s 6.3%, while also far lower than the consensus forecast at 6.1%. With the backdrop of pausing rate hike, the market participants see an obvious policy’s divergence between the US and Canada, reacting to it accordingly by rushing into the pair of USD/CAD. As of writing, the pair of USD/CAD rose 0.04% to 1.3810.

In the commodities market, crude oil prices edged up 0.20% to $76.55 per barrel after extending its losses yesterday amid the further rally in US dollar market. Besides, gold prices edged down -0.04% to $1813.05 per troy ounce amid the dollar index strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 190K | 195K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 105.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 106.65.

Resistance level: 106.65, 108.45

Support level: 105.00, 103.15

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1820. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1940, 1.2105

Support level: 1.1820, 1.1725

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0575. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0445.

Resistance level: 1.0575, 1.0665

Support level: 1.0445, 1.0275

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 136.30. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 138.95, 141.60

Support level: 136.30, 135.20

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3730. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3830.

Resistance level: 1.3830, 1.3880

Support level: 1.3730, 1.3635

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.9320. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9475.

Resistance level: 0.9475, 0.9605

Support level: 0.9320, 0.9225

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 81.70. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.70, 83.55

Support level: 76.10, 71.65

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1809.10. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1835.00, 1859.90

Support level: 1809.10, 1786.00

090323 Morning Session Analysis

9 March 2023 Morning Session Analysis

US Dollar climbed as optimistic labor report unleashed.

The Dollar Index which traded against a basket of six major currencies retreated some gains on yesterday after a sharp rise on Tuesday following the hawkish statement from Fed Chairman Jerome Powell, due to investors were awaiting the announcement of employment data. After that, the Dollar Index extended its gains as the optimistic employment data has been unleashed. The US ADP Nonfarm Employment Change notched up from the previous reading of 119K to 242K, exceeding the consensus forecast of 200K. Besides, the US JOLTs Job Openings had also printed a better-than-expected result, which came in at the reading of 10.824M, higher than the 10.500M forecast. Both crucial data has shown a resilient labor market, while it provided more rooms for Fed to raise its rate higher. On the other hand, the Federal Reserve Chair Jerome Powell reiterated his speech on Wednesday that higher interest rate hikes would likely to be needed, but the size of hike was data-dependent. However, the gains in the dollar were modest on yesterday because the market had already got the message. As of writing, the Dollar Index appreciated by 0.06% to 105.66.

In the commodity market, the crude oil price rose by 0.09% to $76.56 per barrel as of writing following the crude oil inventories has decreased over the market expectation. In addition, the gold price appreciated by 0.05% to $1811.44 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 190K | 195K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 106.30, 107.65

Support level: 104.70, 103.20

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1905, 1.2120

Support level: 1.1685, 1.1450

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0600, 1.0740

Support level: 1.0410, 1.0240

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6605, 0.6775

Support level: 0.6435, 0.6290

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9590, 0.9745

Support level: 0.9400, 0.9235

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 76.80, 81.30

Support level: 73.10, 69.75

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1855.30, 1898.50

Support level: 1811.45, 1762.25

080323 Afternoon Session Analysis

08 March 2023 Afternoon Session Analysis

Aussie plummeted amid dovish comment from Philip Lowe.

The Australian dollar, which is widely known as Aussie, has been plunging since yesterday morning as a series of negative news weighs on the market. In Tuesday’s RBA meeting, the board of members agreed to increase the cash rate by 25 basis points to 3.60%, as widely expected. Although the outlook of the global economies remains cloudy, the CPI data suggested that the inflation rate in Australia has peaked, whereby the prices of goods and services are expected to moderate shortly. With such a backdrop, the Governor of RBA, Lowe revealed that the current cash rate is close to the appropriate level for curbing inflation going forward. Hence, it signaled that they might pause the rate hike plan anytime soon, provided that the inflation shows no sign of exacerbation in the future. The Aussie dollar slumped with the looming pause in rate hikes as it was against the plans of other major central banks, which still favor aggressive rate hike plans to tackle the high inflation. As of writing, the pair of AUD/USD dipped by -0.05% to 0.6580.

In the commodities market, crude oil prices jumped by 0.54% to $77.50 per barrel after plummeting by more than 3% during the previous trading session as the increase in dollar value urged the USD-denominated oil to become expensive. Besides, gold prices edged down -0.16% to $1810.25 per troy ounce following the hawkish statement from Jerome Powell.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR ECB President Lagarde Speaks

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:15 | USD – ADP Nonfarm Employment Change (Feb) | 106K | 195K | – |

| 23:00 | USD – JOLTs Job Openings (Jan) | 11.012M | 10.600M | – |

| 23:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 1.165M | 0.395M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 105.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 106.65.

Resistance level: 106.65, 108.45

Support level: 105.00, 103.15

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1820. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1940, 1.2105

Support level: 1.1820, 1.1725

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0575. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0445.

Resistance level: 1.0575, 1.0665

Support level: 1.0445, 1.0275

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 136.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 138.95.

Resistance level: 138.95, 141.60

Support level: 136.30, 135.20

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3730. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3830.

Resistance level: 1.3830, 1.3880

Support level: 1.3730, 1.3635

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.9320. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9475.

Resistance level: 0.9475, 0.9605

Support level: 0.9320, 0.9225

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 81.70. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.70, 83.55

Support level: 76.10, 71.65

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1809.10. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1835.00, 1859.90

Support level: 1809.10, 1786.00

080323 Morning Session Analysis

8 March 2023 Morning Session Analysis

US Dollar flied amid hawkish talk by Powell.

The Dollar Index which traded against a basket of six major currencies sky-rocketed on yesterday as Fed Chairman signaled further aggressive rate hike might be implemented. According to Reuters, Federal Reserve Chair Jerome Powell appeared a speech on his testimony which scheduled on Tuesday, that the terminal rate would likely to be raised over the market expectation in order to bring down inflation to long-term 2%. He claimed that the Fed’s decade-old 2% inflation target was the key factor for keeping a lower price pressures in the nation, as well as the officials should all-in their efforts to make it come true. With that, the US central banks has prepared to take a larger steps to reach the goal. Besides that, Jerome Powell reiterated that rate hike path might be continued if the incoming data presented a strong economy condition. Thus, investors has started to anticipate a 50 basis point increase in the March meeting. According to CME FedWatch Tool, the possibility of 50 basis point rate hike has rose significantly, which notched up from the previous 31.4% to 71.2%. As of writing, the Dollar Index surged by 1.23% to 105.60

In the commodity market, the crude oil price edged up by 0.01% to $77.22 per barrel as of writing after a sharp decline throughout the overnight trading session over the hawkish statement from Fed President. On the other hand, the gold price rose by 0.01% to $1813.82 per troy ounce as of writing following the slip of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR ECB President Lagarde Speaks

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:15 | USD – ADP Nonfarm Employment Change (Feb) | 106K | 195K | – |

| 23:00 | USD – JOLTs Job Openings (Jan) | 11.012M | 10.600M | – |

| 23:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 1.165M | 0.395M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 106.30, 107.65

Support level: 104.70, 103.20

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1905, 1.2120

Support level: 1.1685, 1.1450

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0600, 1.0740

Support level: 1.0410, 1.0240

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6605, 0.6775

Support level: 0.6435, 0.6290

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9590, 0.9745

Support level: 0.9400, 0.9235

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1854.65, 1898.50

Support level: 1811.45, 1762.25

070323 Afternoon Session Analysis

07 March 2023 Afternoon Session Analysis

Euro jumped amid ECB’s aggressive rate-hike comments.

The Euro, which is majorly traded by the global investors, extended its gains for the third consecutive days amid ECB members’ hawkish-titled monetary policy stance. Recently, the ECB Chief economist Philip Lane revealed that more rate hikes are needed at this point in time in order to tackle the still-high inflation. Besides, the Austria’s central bank governor, Robert Holzmann, stimulated the euro market by commenting that next week’s move will be just the first of four in 50 basis-point increments. The aggressive rate-hike comments came after Eurostat reported the CPI figure at 8.5%, missing the consensus forecast at 8.2%, showing that the nation’s economy is still beset by sky-high inflation. At this juncture, investors have priced in the possibility of 50 basis point of rate hike in the upcoming March meeting, however, the attention of the market is now focused on the rate hike beyond the next week’s meeting. With the aggressive rate-hike outlook in Eurozone, the pair of EUR/USD rose by 0.09% to 1.0688.

In the commodities market, crude oil prices jumped by 0.34% as the theme of China reopening and the Russia’s plan of production cut continued to play out in the market. Besides, gold prices edged up 0.07% to $1848.25 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Testifies

01:00 CrudeOIL EIA Short-Term Energy Outlook

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 105.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.1940. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2105.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0665. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.1010

Support level: 1.0665, 1.0575

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 135.20. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 136.30, 138.95

Support level: 135.20, 133.05

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6785. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3560. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.9320. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9325, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 81.65.

Resistance level: 81.65, 83.55

Support level: 76.10, 71.65

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1859.90. However, MACD which illustrated bullish bias momentum suggests the commodity to undergo technical rebound in short term.

Resistance level: 1859.90, 1884.00

Support level: 1835.00, 1809.10

070323 Morning Session Analysis

7 March 2023 Morning Session Analysis

US Dollar beaten down ahead Powell’s speech.

The Dollar Index, which gauge its value against a basket of six major currencies dropped significantly on yesterday as investors are awaiting the testimony from Federal Reserve Chair. Federal Reserve Chairman Jerome Powell would publish his testifies on Tuesday and Wednesday, whereas the market participants will be looking to the event for clues on the Fed’s interest rate decisions. Prior to that, the opinions among Fed members are simply divided. Most of the officials said that the aggressive rate hike path should be continued in order to quickly restore price stability. Though, part of member suggested the central bank to hike rates by 25 basis point in the next meeting for avoiding economy recession. Such situation has confused the market participants. On the other hand, investors would also eyeing on the announcement of NFP data for speculating the next step of Fed, which prompting investors to step back from the market. In addition, the Dollar Index has extended its losses after the ECB official called for more rate hikes. According to Reuters, the Austrian central bank chief Robert Holzmann claimed on Monday that the ECB should raise interest rates by 50 basis points at each of its next four meetings as inflation is proving to be stubborn. As of writing, the Dollar Index depreciated by 0.23% to 104.25.

In the commodity market, the crude oil price edged down by 0.01% to $80.50 per barrel as of writing following the China economic growth did not meet market forecast. Besides, the gold price dropped by 0.11% to $1844.73 per troy ounce as of writing following the market’s cautious mood ahead of the key data and events.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Mar) | 3.35% | 3.60% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6860

Support level: 0.6695, 0.6630

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 82.25, 84.45

Support level: 80.15, 78.50

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1860.10, 1885.95

Support level: 1833.85, 1811.45

060323 Afternoon Session Analysis

06 March 2023 Afternoon Session Analysis

Pound jumped amid upbeat economic data.

The Pound Sterling, which is majorly traded by global investors, took over the crown from other currencies last Friday following the release of a series of upbeat economic data. According to The Chartered Institute of Purchasing & Supply and the NTC Economics, UK Services PMI increased from the prior month’s reading of 48.7 to 53.5 in the month of February, slightly higher than the consensus forecast at 53.3. Besides, Markit Economics also posted UK Composite PMI data at 53.1, similarly higher than the consensus expectation of 53.0. With that, the investors finally see some light at the end of the tunnel, whereby the stronger business confidence and improved business outlook boosted the overall economic activity in the UK. Also, the market worries over the recession risk in the nation waned, despite the policymakers still holding pessimistic views against the economic outlook. On the other side, the less-hawkish comment from the Atlanta Fed President Raphael Bostic calmed down the bullish momentum in the US dollar market, lifting the pair of GBP/USD to a higher level. As of writing, the pair of GBP/USD rose 0.01% to 1.2041.

In the commodities market, crude oil prices plummeted by 1.04% this morning as China set a slightly lower annual GDP target at about 5.0%, while the last year’s target was about 5.5%. Besides, gold prices edged down 0.09% to $1855.15 per troy ounce amid a technical correction after a huge surge in the previous trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Feb) | 48.4 | 49.1 | – |

| 23:00 | CAD – Ivey PMI (Feb) | 60.1 | 55.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses of successfully breakout the support level.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6775, 0.6860

Support level: 0.6695, 0.6630

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 79.50, 81.50

Support level: 77.25, 75.60

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1860.10, 1885.95

Support level: 1833.85, 1811.45

060323 Morning Session Analysis

6 March 2023 Morning Session Analysis

US Dollar plunged despite of robust economic data.

The Dollar Index which traded against a basket of six major currencies slumped on last Friday, although the optimistic economic data has been released. According to Institute for Supply Management, the US ISM Non-Manufacturing Purchasing Managers Index (PMI) posted at the reading of 55.1, which exceeding the consensus forecast of 54.5. With such background, it spurred few of bullish momentum toward US Dollar. Though, the US Dollar has retreated its previous gains following the investors was awaiting for the announcement of crucial employment data — Nonfarm Payroll (NFP). Prior to that, one of the Fed member, Atlanta Federal Reserve President Raphael Bostic suggested that a “slow and steady” rate hike path might be a more proper way to ease inflation efficiently. On the other hand, part of Fed official stick to their hawkish stance. Since the members’ opinions diverged, investors decided to step away from the market in order to gauge the path for Federal Reserve policy. As of writing, the Dollar Index appreciated by 0.07% to 104.56.

In the commodity market, the crude oil price dropped by 0.34% to $79.41 per barrel as of writing after a sharp rise throughout the last trading session following Saudi Arabia increased oil price for Asia and Europe for April. In addition, the gold price rose by 0.25% to $1853.09 per barrel as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Feb) | 48.4 | 49.1 | – |

| 23:00 | CAD – Ivey PMI (Feb) | 60.1 | 55.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6860

Support level: 0.6695, 0.6630

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 79.50, 81.50

Support level: 77.25, 75.60

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1860.10, 1885.95

Support level: 1833.85, 1811.45

030323 Afternoon Session Analysis

03 March 2023 Afternoon Session Analysis

Headline inflation unable to keep euro from slipping.

The EUR/USD, as one of the most traded currencies by global investors, was penalized by the rising inflation and unemployment rate. Yesterday, the headline inflation of the eurozone slightly reduced by -0.1% to 8.5%, yet higher than the market expectation at 8.2%. At the same time, the core CPI of the Eurozone increased by 0.3% to 5.6% from 5.3%, well above the European Central Bank (ECB) target of 2%. With such a backdrop, an aggressive rate hike would likely be carried out in the upcoming meeting. On Thursday, ECB President Christine Lagarde warned that inflation in the Eurozone remained high, and another 50 basis points of interest rate hikes may be needed to take the inflation back to its target of 2%. Nevertheless, the expectation of an aggressive rate hike by the ECB is unable to keep the euro from slipping as investor expects the Europe economy to enter into stagflation in the future. The EU labor market remains vulnerable with an unemployment rate at 6.7%, pointing to a slowdown in the eurozone economy. As of writing, the EUR/USD was traded up by 0.07% to $1.0603 after a massive sell-off by investors in the previous trading session.

In the commodities market, crude oil prices depreciated by -0.37% to $77.87 per barrel as investors awaited for more cues from the US services PMI data. Besides, gold prices edged up by 0.21% to $1844.30 per troy ounce amid the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Feb) | 53.0 | 53.0 | – |

| 17:30 | GBP – Services PMI (Feb) | 53.3 | 53.3 | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Feb) | 55.2 | 54.5 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index extend its losses toward support level at 104.45

Resistance level: 105.85, 106.95

Support level: 104.45, 103.00

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2010

Resistance level: 1.2010, 1.2145

Support level: 1.1.1900, 1.1760

EURUSD, H4: EURUSD was traded higher following a prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair to undergo a technical rebound in the short term.

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair to traded lower as technical correction.

Resistance level: 138.15, 139.80

Support level: 136.30, 134.55

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo a technical correction in the short term.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo a technical rebound in short term.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded lower following the prior breakout below the previous support level at 1.3600. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3515.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.9380.

Resistance level: 0.9470, 0.9545

Support level: 0.0.9380, 0.9320

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the next support level.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its gains toward the resistance level at 1847.55.

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1800.30